This study aims to identify to what extent certain factors perceived by internal decision-makers (politicians and financial officials) influence the usefulness they consider the information presented in the financial reports of municipalities has for decision-making purposes.

It follows a quantitative research approach at a first stage, using a questionnaire. At a second and complementary stage, it uses a qualitative research perspective, with interviews in a small group of municipalities, which might be seen as case studies, in order to explore and understand the (external and internal) contextual factors that determine the usefulness of the financial report in decision-making by internal decision-makers.

The main findings show that the pressure of professional organizations and of a national problem (external factors), as well as the lack of knowledge and training on the accounting information system (internal organizational factor) are factors that most influence the usefulness of the financial report for internal decision-making. Qualitative analysis confirms these results, reinforcing a factor relating to a work overload.

Two important implications of this study are the following: first, professional bodies and the financial situation in the country; while stimulating informational needs by internal users in the public sector they determine the usefulness they offer to financial reporting for decision-making. Second, the lack of knowledge of the accounting information system, especially by local politicians, is a hindering factor of the usefulness given to financial reporting for internal decision-making. Nowadays, when many countries are considering reforms of public sector accounting in line with the International Public Sector Accounting Standards (IPSAS), supposedly increasing the sophistication, the level of information and usefulness of financial reporting, such factors must be taken into account.

Este estudio busca identificar hasta qué punto algunos factores percibidos por los decisores internos (políticos y técnicos) influyen en la utilidad que ellos conceden a la información presentada en el informe financiero de los ayuntamientos para los propósitos de toma de decisión.

Sigue primeramente un enfoque cuantitativo, con un cuestionario. En una segunda fase complementaria, se emplea una perspectiva de investigación cualitativa, con entrevistas a un pequeño grupo de ayuntamientos que se pueden considerar estudios de caso, de modo que exploran y entienden los factores contextuales (externos e internos) que determinan la utilidad del informe financiero para la toma de decisiones por los decisores internos.

Los principales resultados muestran que la presión de organizaciones profesionales y de un problema nacional (factores externos), así como la falta de conocimiento sobre el sistema de información contable (factor interno organizacional), son los factores que más influyen en la utilidad del informe financiero para las decisiones internas. El análisis cualitativo confirma estos resultados, reforzando otro factor relacionado con la sobrecarga de trabajo.

Dos importantes implicaciones de este estudio son las siguientes. En primer lugar, los organismos profesionales y la situación financiera del país, mientras estimulan necesidades informativas en los decisores internos en el sector público, determinan la utilidad que ellos consideran para el informe financiero para el propósito de toma de decisiones. En segundo lugar, la falta de conocimiento sobre el sistema de información contable, particularmente de los decisores políticos, es un factor inhibidor de la utilidad del informe financiero para la toma de decisiones. Actualmente, cuando muchos países se plantean reformas de la contabilidad pública para aproximarse a las IPSAS, supuestamente para aumentar la sofisticación, el nivel de información y la utilidad del informe financiero, tales factores deben ser atendidos.

The decision-making process tends to be similar in all organizations, even if the decisions concern particular issues either in the public or private sectors. The effectiveness of decision models depends on the circumstances that shape the organization (Tarter & Hoy, 1998).

The reforms introduced in the management and accounting structures of public sector entities, in response to New Public Management requirements, reinforce the role of accountability as a means to improve economy, efficiency and effectiveness in Public Administration. Accountability is no longer conceived as merely reporting about complying with norms and procedures, but as the need to report on the allocation and use of public resources and the results attained, in order to allow assessing public officials’ responsibilities (Brusca, 2010; Hookana, 2008; Lapsley, 1999, 2001, 2009; Mir & Rahaman, 2007; Neilson & Gregor, 2007; Ter Bogt & Van Helden, 2000; Ter Bogt, 2008). Consequently, the leaders of public sector organizations, namely in Local Administration, nowadays need useful information to be able to make better decisions.

In this context, the paradigm of information users and their needs is of chief importance while reforming the accounting and financial reporting systems.

Organizational changes (in management and accounting) can potentially be affected by a set of external and internal factors that should be taken into account in the decision-making process, namely concerning the preparation and dissemination of useful information for decisions (Haldma & Lääts, 2002). In this sphere, complementing the paradigm of the information usefulness, contingency and institutional theories can be used to support the analysis of (internal and external) explanatory factors of the usefulness of the financial reporting for decision-making, in the context of Local Government.

Relevant literature indicates that the usefulness of the financial reporting information for the purpose of decision-making depends on various factors in the entities’ context. Several authors (e.g., Cohen, Kaimenakis, & Zorgios, 2007; Grossi & Reichard, 2009; Mack & Ryan, 2006; Mack, 2004) concluded that the degree of use of financial information for decision-making varies as a function of its usefulness for that purpose. Grossi and Reichard (2009) found that the use of financial information depends also on various organizational factors, such as the lack of appropriate knowledge and training regarding the accounting and reporting system.

This study aims to identify the (external and internal) explanatory factors of the financial reporting usefulness for internal decision-making through an empirical analysis of the 308 Portuguese municipalities. To fulfill this purpose, a quantitative analysis was firstly developed (by applying a survey), complemented by qualitative exploratory case studies (resorting to interviews). The option of case studies of this nature is justified by the intention to explore and understand which internal and contextual factors of local authorities might determine the usefulness of financial information for internal decision-making by internal decision-makers.

The investigation contributes to the relevant debate on which factors determine the usefulness of the information presented in the financial reporting, particularly that prepared by local authorities. As far as we know, this is the first investigation carried out to this effect in the context of Portuguese municipalities.

Additionally, the results of the study are intended to stimulate interest in the identification of factors that possibly affect the usefulness of financial reporting in several public sector realities at international level. In the current context where many countries are considering or in the process of adapting their public sector accounting systems to IPSAS, supposedly increasing the sophistication, level of information and usefulness of financial reporting, such factors must be attended in the reforming processes.

The paper follows structured in three main sections. “Literature review” section presents the theoretical framework, addressing explanatory theories of reforms in public sector accounting and relevant literature on factors possible of determining the usefulness of financial reporting, particularly for decision-making. “Determinant factors of the usefulness of financial reporting for internal decision-making in Local Government” presents the empirical study, starting by briefly describing the objectives, methodology and hypotheses, data collection and analysis techniques, and finally, presenting and discussing the results. “Conclusions and policy implications” summarizes the main conclusions and policy implications.

Literature reviewExplanatory theories of reforms in public sector accountingIn recent years there has been a proliferation of empirical studies based on social science theories, namely on the organizational theory, seeking to explain organizational change and reforms adopted in the public sector, including those of financial management and accounting systems (Brignall & Modell, 2000; Burns & Scapens, 2000; Caccia & Steccolini, 2006; Lapsley & Pallot, 2000; Scapens, 1990, 1994; Ter Bogt, 2008; Ter Bogt & Van Helden, 2000). More precisely, the authors have attempted to understand the reasons for the existing gap between regulations and accounting practices adopted by organizations, aiming to understand whether the reforms in the scope of the New Public Financial Management (NPFM) were introduced in order to overcome the real limitations of accounting information and reporting systems or simply to comply with legislative requirements.

The decision-making process tends to be similar in all organizations, even if decisions concern particular issues of organizations either in the public or in the private sector. The effectiveness of decision models depends on the circumstances that shape the organization (Tarter & Hoy, 1998). Organizational changes in public entities, faced with the new demands of NPM/NPFM, triggered new information needs for decision-making. Decision-makers now need useful and opportune information to be able to make the most suitable decisions, highlighting the importance of the paradigm of information users and their needs. Nevertheless, organizational changes can potentially be affected by a series of external and internal factors that should be considered in the decision-making process (Haldma & Lääts, 2002).

Here, contingency and institutional theories can be used to explain the reforms in public sector accounting, particularly to explore factors possibly affecting information usefulness in the decision-making process in the context of public sector entities, namely local authorities.

Contingency theoryThe contingency theory is a theoretical perspective of organizational behavior that emphasizes the way contingencies or restrictions, such as size, environmental uncertainties, technology and environmental pressures, affect organizations’ development and functioning (Chenhall, 2003; Thomas, 1991). It tries to identify the relationships between an organization's internal and external characteristics and its management capacity (Ryan, Trevor, & Nelson, 2002).

According to this framework, contingencies or restrictions influence organizations’ structure in terms of training, specialization, differentiation and bureaucratization (Covaleski, Dirsmith, & Samuel, 1996).

Regarding accounting and financial reporting systems, the contingency theory is “based on the premise that there is no universally appropriate accounting system which applies equally to all organizations in all circumstances” (Otley, 1980:413). Therefore, there is not a universal model of a control and accounting system suitable for and applicable to all organizations and circumstances (Anessi-Pessina, Nasi, & Steccolini, 2008). Organizations will have to adopt new accounting practices seeking a better adjustment between their administrative systems and contingency factors (Anessi-Pessina et al., 2008; Woods, 2009). The design of a new accounting system will depend on the organization's capacity to recognize and adapt to changes as a function of external and internal factors.

Although the contingency theory has been developed in the private sector, and greatly used in the scope of management accounting, some studies have used the contingency perspective in explaining reforms in public sector management and accounting, investigating particularly the introduction of new systems for measuring and managing performance, as well new accounting and reporting systems (Anessi-Pessina et al., 2008; Lüder, 1992, 2002; Pollitt & Bouckaert, 2004; Woods, 2009).

Institutional theoryWithin the literature of organizational theory, the institutional theory considers that expectations and values, both inside and outside organizations, as well as the rules of society, can also play a role in the decision to introduce organizational changes, namely concerning the accounting system. It supports that organizations acquire legitimacy if they adapt to external expectations, i.e., there is pressure to introduce certain accounting practices without due consideration of whether these will bring benefit (Geiger & Ittner, 1996).

This institutional approach differs from other theories of a rationalist nature, by understanding that economic, social, political and cultural phenomena make up the institutional environment, forming the meaning of concepts such as individual, social action, State and society (Carpenter & Feroz, 2001; Carpenter, Cheng, & Feroz, 2007; DiMaggio & Powell, 1991; Meyer & Rowan, 1991; Modell, 2004; Ryan et al., 2002).

Within the scope of the public sector, in recent years, the institutional theory (namely the New Institutional Sociology stream) has been frequently used by various researchers who seek to understand organizational change in this context (Brignall & Modell, 2000; Grossi & Reichard, 2009; Lapsley & Pallot, 2000; Ter Bogt, 2008; Ter Bogt & Van Helden, 2000).

The institutional theory has been used to explain how organizations respond to the pressures of their institutional environments (Carpenter & Feroz, 2001; Carpenter et al., 2007; Chapman, Cooper, & Miller, 2009). It seeks to identify a series of external factors that can pressurize or induce the process of internal change in order to gain external legitimacy (DiMaggio & Powell, 1991; Lapsley & Pallot, 2000; Meyer & Rowan, 1991). Organizations’ tendency towards uniformity in relation to their institutional environment was called by DiMaggio and Powell (1991) as “isomorphism”. The process by which organizations tend to adopt the same practices and structures over time, in response to institutional pressures (so as to self-defence when facing problems for which they do not yet have their own solutions), is named institutional isomorphism.

Isomorphic change can occur according to three mechanisms (DiMaggio & Powell, 1991): coercive (resulting of formal and informal pressure exerted on organizations by other organizations and society's expectations, in a shared legal, economic and political context, as well as formal and informal pressure exerted by the State, which leads organizations to make a decision to adopt a certain practice); normative (arising from the professionalization which forms a set of delimited norms and procedures for a specific occupation or activity; this type of isomorphism occurs as the result of shared values and ideas about suitable behavior, often spread through professional and academic groups); and imitative (occurring in conditions of uncertainty and diminished stability, when organizations imitate practices already tested and successful in other similar organizations).

Factors affecting the internal usefulness of financial reportingThe literature on public sector accounting and the above-referred theoretical frameworks, support that the usefulness of financial reporting for the decision-making process of internal users/decision-makers depends on factors inside and outside public sector organizations, including local authorities (Askim, 2008; Cohen, 2009; Cohen et al., 2007; Grossi & Reichard, 2009; Guthrie, 1998; Lee, 2008; Mack & Ryan, 2006; Pallot, 1997; Paulsson, 2006; Taylor, 2009; Yamamoto, 2008).

The traditional literature suggests that reasons of economic nature (to improve efficiency and effectiveness) have been the main motivation for organizational change, namely the usefulness of the financial reporting for decision-making. However, in the light of the organizational theory, institutional (external) factors – competitiveness, government, professional groups, technology and customers – and cultural (internal) factors – need for efficiency, professionalism, change in the dynamics of autonomy, size and complexity of the organization, and the search for organizational strategies – have a prominent role in explaining organizational change, including that of accounting systems (Benito, Bastida, & Muñoz, 2010; Burns & Scapens, 2000; Deegan, 2002; Scapens, 1994).

Regarding changes in the accounting and reporting systems and financial information usefulness, overall, such studies mention as influencing factors (Buylen & Christiaens, 2013): institutional and legal pressures, lack of understanding about the new information prepared according to the accrual basis, lack of human resources and resistance to change, among others. Some factors are directly related to the individual characteristics and attitudes of decision-makers, others are the result of certain institutional standards of the respective organizations and others concern outside circumstances.

Factors associated with the decision-makers’ individual characteristics – such as skills, knowledge and experience of concepts and tools of financial management (familiarity) – seem to be particularly relevant in determining the degree of usefulness they give to financial information (Askim, 2008; Paulsson, 2006; Yamamoto, 2008).

The degree of financial reporting data usage for decision-making is also depending on the “decision-usefulness” of the data (see Mack & Ryan, 2006, for this concept), which concerns the potential benefit of data for the user (relevance, congruence with expectations, etc.) but it is also a question of readability and understandability of the financial information. Grossi and Reichard (2009) explain that the demand for certain sets of financial reporting data depends very much on various individual and institutional factors, like knowledge or culture. Generally, the use of financial information is a result of the interplay of several supply-side and demand-side related influence factors.

Considering the literature review and the conclusions of the studies referred to, generally, external factors are assumed to have a positive effect on the use of financial information, while internal factors have a negative effect (Askim, 2008; Grossi & Reichard, 2009; Yamamoto, 2008). In fact, external (institutional) pressures or contingencies may increase financial reporting usefulness, even generating further (new and different) information needs, given that decision-makers tend to resort to financial reporting so as to show how they and the organizations they run, decide to react to those circumstances. Internal organizational factors and individual characteristics and attitudes may, on the other hand, resist against the external pressures and limit the usefulness of the financial information.

Determinant factors of the usefulness of financial reporting for internal decision-making in Local GovernmentObjective, methodology and hypothesesFollowing the approaches of contingency and institutional theories, this study aims to identify to what extent the factors perceived by respondents influence the usefulness they attribute to the information presented in local authorities’ financial reporting, for internal decision-making, considering that those factors can also affect their information requirements.

Given the proposed objective, the study looks for answering the question “Which external and internal factors influence the usefulness of the municipal financial reporting for decision-making by internal decision-makers (politicians and financial officials)?”.

The study adopts a mixed research methodology. At a first stage, it follows a quantitative research approach, using a questionnaire; at a second and complementary stage, it uses a qualitative research perspective, resorting to the explanatory and exploratory case study method. The choice of case studies of this nature is justified by the fact that one intends to explore and understand the (external and internal) contextual factors of local authorities that determine the financial reporting usefulness. The option for a qualitative research methodology to complement the quantitative approach is also justified by the fact that the former allows for a better comprehension of the social context the phenomenon studied is part of, additionally complementing aspects not possible to obtain through a survey.

For the quantitative part of the study, the following research hypotheses were defined, based on the literature and theoretical framework presented in the previous section:H1 Factors external to local authorities positively influence the usefulness of financial reporting for internal decision-making by municipal decision-makers. Factors internal to local authorities negatively influence the usefulness of financial reporting for internal decision-making by municipal decision-makers.

Regarding the quantitative dimension of the study, a questionnaire was applied to all Portuguese local authorities (308), directed to internal decision-makers (politicians – member of the Executive responsible for the finance department; and officials – head of the local authority's financial department1). The questionnaire was essentially drawn upon evidence from the literature review.2 Therefore, questions (in an ordinal scale from 1 to 5, where 1 is Not at all useful and 5 is Very useful) were intended to ascertain the usefulness, for internal decision making, of obligatory budgetary and financial statements presented in municipalities’ financial reporting, according to what is established in the Local Government accounting regulation currently in practice in Portugal,3 as well as of other economic and financial information voluntarily reported. So as to find out the degree of influence of factors, both external and internal to local authorities, in the usefulness attributed to financial reporting for internal decision-making by politicians and financial officials as municipal decision-makers, two questions were asked while listing a varied set of factors (in an ordinal scale of 1–5, where 1 is Does not Influence and 5 is Influences Greatly).

Respondents were selected according to their predominant role as municipal internal decision-makers, hence principal internal users of the local authority's financial reporting. The option for internal users as the subject for survey was due to the fact that this group has a major role in using financial information produced by the local authority, following NPM principles. The response rate was approximately 49%, with the final sample being made up of 302 valid responses (94 responses from politicians and 208 from financial officials).4

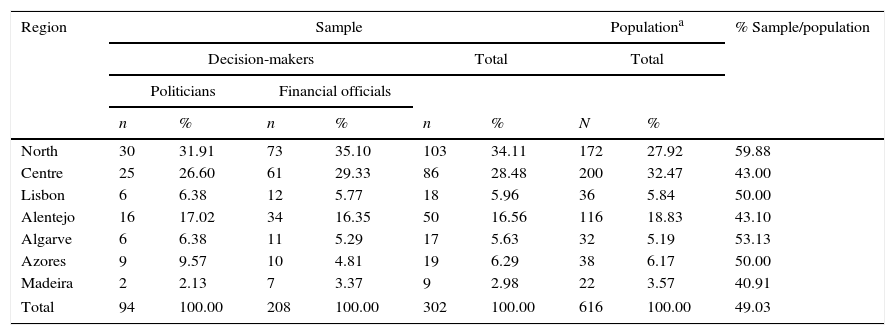

Table 1 presents a brief characterization of the respondents, by region, showing that more than one-third of the respondents in the sample (34.11%) comes from municipalities in the North region, followed by those of the Centre region (28.48%). The least represented is the Autonomous Region of Madeira, with only 2.98% of valid responses.

Characterization of respondents by region.

| Region | Sample | Populationa | % Sample/population | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Decision-makers | Total | Total | |||||||

| Politicians | Financial officials | ||||||||

| n | % | n | % | n | % | N | % | ||

| North | 30 | 31.91 | 73 | 35.10 | 103 | 34.11 | 172 | 27.92 | 59.88 |

| Centre | 25 | 26.60 | 61 | 29.33 | 86 | 28.48 | 200 | 32.47 | 43.00 |

| Lisbon | 6 | 6.38 | 12 | 5.77 | 18 | 5.96 | 36 | 5.84 | 50.00 |

| Alentejo | 16 | 17.02 | 34 | 16.35 | 50 | 16.56 | 116 | 18.83 | 43.10 |

| Algarve | 6 | 6.38 | 11 | 5.29 | 17 | 5.63 | 32 | 5.19 | 53.13 |

| Azores | 9 | 9.57 | 10 | 4.81 | 19 | 6.29 | 38 | 6.17 | 50.00 |

| Madeira | 2 | 2.13 | 7 | 3.37 | 9 | 2.98 | 22 | 3.57 | 40.91 |

| Total | 94 | 100.00 | 208 | 100.00 | 302 | 100.00 | 616 | 100.00 | 49.03 |

As to the respondent groups in municipalities by region, the most representative group in the sample is that of financial officials from the North region (35.10%), while the least represented group is that of politicians in the Autonomous Region of Madeira (2.13%). It is also observed that in all regions of Continental Portugal and in Madeira the number of financial officials as respondents is twice or more the number of politicians. In Azores, however, the number of politicians and financial officials responding to the survey approximates.

Finally, the weight of the respondents in the sample compared to the population, ranges from 41% in Madeira to 60% in the North, so it might be said that the representation of each region in the sample does not diverge considerably.

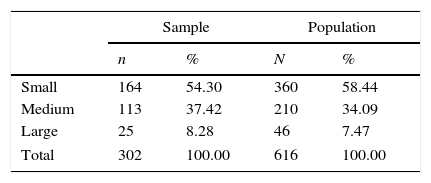

Concerning the size of municipalities,5Table 2 shows that this study had greater collaboration from respondents belonging to small municipalities (54.30%), the percentage of participation diminishing as the municipalities’ size increases. Given the configuration of Portuguese municipalities, large municipalities are less represented in the sample, accounting for only 8.28%. Still, the distribution of municipalities in the sample, according to their size, approximates that of the population.

As for the qualitative part of the study, semi-structured interviews were made, following a previously elaborated script containing the main questions, as suggested by Yin (2009). As in the questionnaire, the script covered a varied set of questions. Those relevant for the purpose of this paper are: In your opinion, what are the internal organizational factors influencing the greater/lesser usefulness/use of the financial information presented in the local authority's financial reporting for your decision-making? Why?

Given the fundamental purpose of the qualitative analysis – supplementing the primary data obtained in the quantitative research – a theoretical or purposeful sample was considered, according to pre-established criteria (Patton, 2002; Strauss & Corbin, 1990). From the beginning, the selection of the cases took into account the fact that a questionnaire had been previously applied and the respondents had replied contrasting answers regarding the overall usefulness of financial reporting for internal decision-making – either very useful or not at all useful. Additionally, the (contrasting) case studies were chosen in order to have representativeness for different sizes and geographical locations6 of municipalities.

The theoretical sample was also guided by the saturation principle, ending when information from additional cases adds nothing to the initial basis (Creswell, 2009; Stake, 1995).

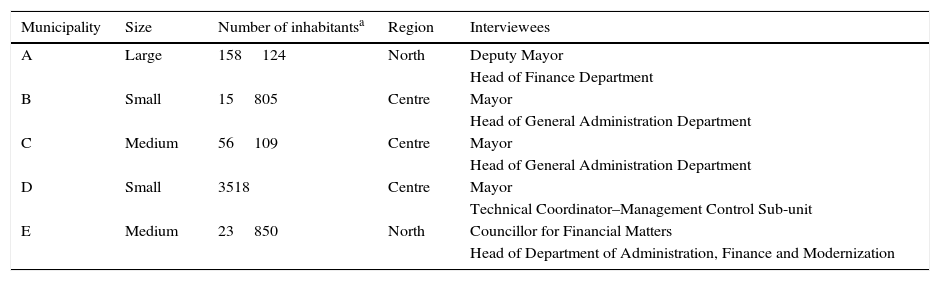

Bearing in mind these principles, five local authorities were chosen to form the case studies: two situated in the Northern and three in the Central region of Portugal. As for size according to number of inhabitants, one large, two medium-sized and two small local authorities were selected.

Contact with local authorities belonging to different regions and various sizes was found very important to enhance comparison of the various contexts inherent to the entities, for example, regarding the process of decision-making and/or action in the area of service provision to citizens.

Creswell (2009), Eisenhardt (1989), and Quivy and Campenhoudt (2003) state that the position of interviewees should be at the basis of their selection, plus the fact of them being directly involved in action or responsibilities, besides having good knowledge of the subject, being able to explain their actions and justify them. Considering that the qualitative research intended to complement the quantitative one, it was understood that the interviewees should be the same as those who answered the questionnaire – politicians and financial officials.

For the cases considered, 10 face-to-face interviews were performed, taking place in the premises of the respective local authorities. Each interview lasted 1h on average, although sometimes longer, in order to take advantage of the interviewee's interest and in the attempt to obtain more information. As recommended by several authors (Ryan et al., 2002; Scapens, 2004; Yin, 2009), the interviews were recorded and later transcribed.

The reporting of the interviews is made without any element of identification of the municipality at stake, for reasons of anonymity and confidentiality. Therefore, in the case studies, all names were replaced by letters A to E, as in Table 3.

Interviews for the case studies.

| Municipality | Size | Number of inhabitantsa | Region | Interviewees |

|---|---|---|---|---|

| A | Large | 158124 | North | Deputy Mayor |

| Head of Finance Department | ||||

| B | Small | 15805 | Centre | Mayor |

| Head of General Administration Department | ||||

| C | Medium | 56109 | Centre | Mayor |

| Head of General Administration Department | ||||

| D | Small | 3518 | Centre | Mayor |

| Technical Coordinator–Management Control Sub-unit | ||||

| E | Medium | 23850 | North | Councillor for Financial Matters |

| Head of Department of Administration, Finance and Modernization |

Concerning the technique of analysing the data from the interviews performed in the case studies, content analysis was used as it is an instrument combining a varied set of methodological techniques (Eisenhardt, 1989; Stake, 1995). The work was not limited to analysing the individual interviews; it was also necessary to carry out a synthesis in order to obtain a single discourse and so induce the answers to what is intended in this part of the study. To this end, the method followed to analyze, in general, the case studies was based simultaneously on a vertical analysis (synthesis of the main research questions of each case study) and on a horizontal analysis (comparative analysis of all cases, highlighting the main differences and similarities). In this study, only the results of the horizontal analysis are presented.

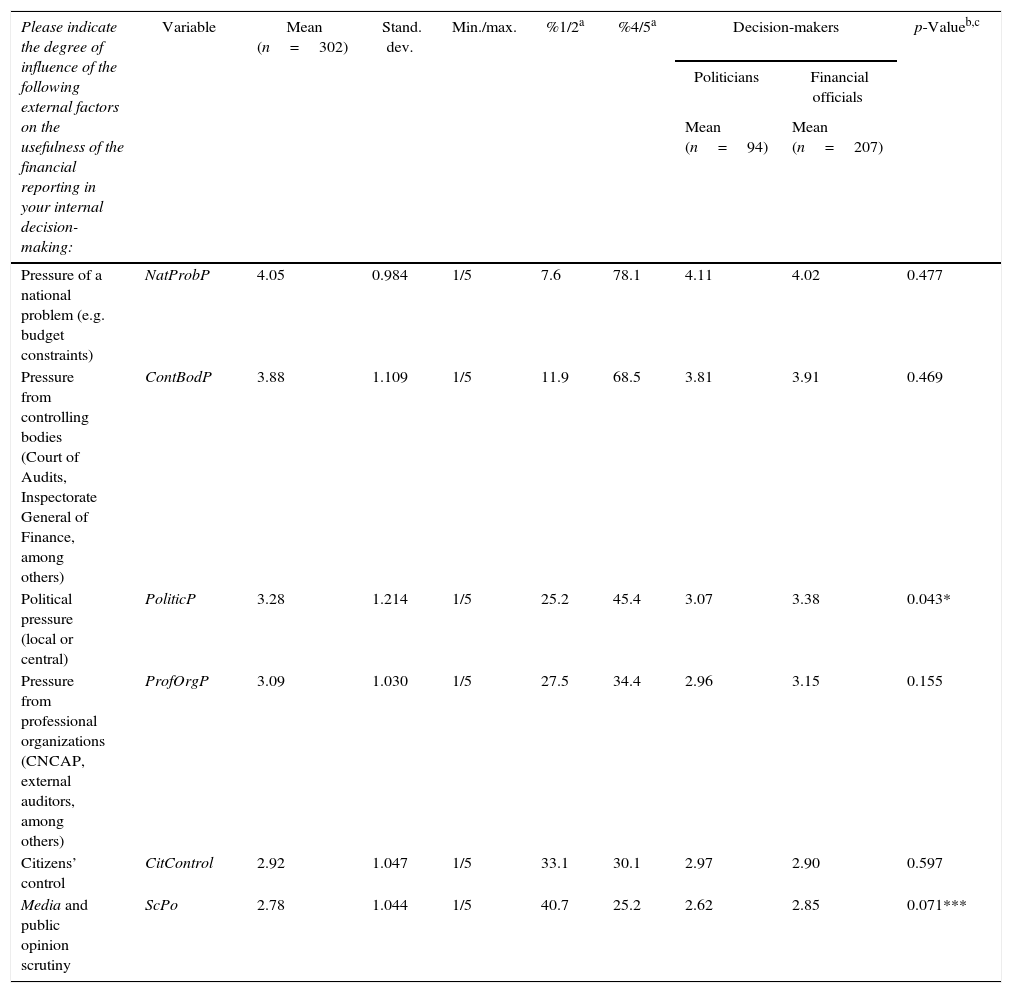

Presentation, analysis and discussion of the resultsQuantitative analysisUnivariate analysisIn a first descriptive analysis of the data obtained through the questionnaire (Table 4), the pressure of a national problem (for example, the case of budget constraints) and the pressure of controlling bodies (Court of Audits, Inspectorate General of Finance, among others) were found to be the main factors external to local authorities that potentially influence the usefulness of the information disclosed in the financial reporting for internal decision-making. Control by citizens and media and public opinion scrutiny are the external factors that potentially have least influence, according to the respondents (mean under the intermediate value on the scale).

Descriptive statistics of external factors.

| Please indicate the degree of influence of the following external factors on the usefulness of the financial reporting in your internal decision-making: | Variable | Mean (n=302) | Stand. dev. | Min./max. | %1/2a | %4/5a | Decision-makers | p-Valueb,c | |

|---|---|---|---|---|---|---|---|---|---|

| Politicians | Financial officials | ||||||||

| Mean (n=94) | Mean (n=207) | ||||||||

| Pressure of a national problem (e.g. budget constraints) | NatProbP | 4.05 | 0.984 | 1/5 | 7.6 | 78.1 | 4.11 | 4.02 | 0.477 |

| Pressure from controlling bodies (Court of Audits, Inspectorate General of Finance, among others) | ContBodP | 3.88 | 1.109 | 1/5 | 11.9 | 68.5 | 3.81 | 3.91 | 0.469 |

| Political pressure (local or central) | PoliticP | 3.28 | 1.214 | 1/5 | 25.2 | 45.4 | 3.07 | 3.38 | 0.043* |

| Pressure from professional organizations (CNCAP, external auditors, among others) | ProfOrgP | 3.09 | 1.030 | 1/5 | 27.5 | 34.4 | 2.96 | 3.15 | 0.155 |

| Citizens’ control | CitControl | 2.92 | 1.047 | 1/5 | 33.1 | 30.1 | 2.97 | 2.90 | 0.597 |

| Media and public opinion scrutiny | ScPo | 2.78 | 1.044 | 1/5 | 40.7 | 25.2 | 2.62 | 2.85 | 0.071*** |

Financial officials consider that the political pressure has potentially more influence on the usefulness of the financial information for decision-making, compared to the group of politicians (p<0.05). The differences are also statistically significant between the decision-making groups (p<0.1), in the case of the potential influence exerted by media and public opinion scrutiny. It stands out that, also in this case, the higher mean of potential influence of the factor on the usefulness of the financial reporting is attributed by the group of financial officials (2.85).

Interesting is to notice that politicians, although more linked to national problems and citizens’ scrutiny through the political commitment taken on, while attributing greater potential influence to those factors in the usefulness of the financial reporting than financial officials, the differences are found not to be statistically significant.

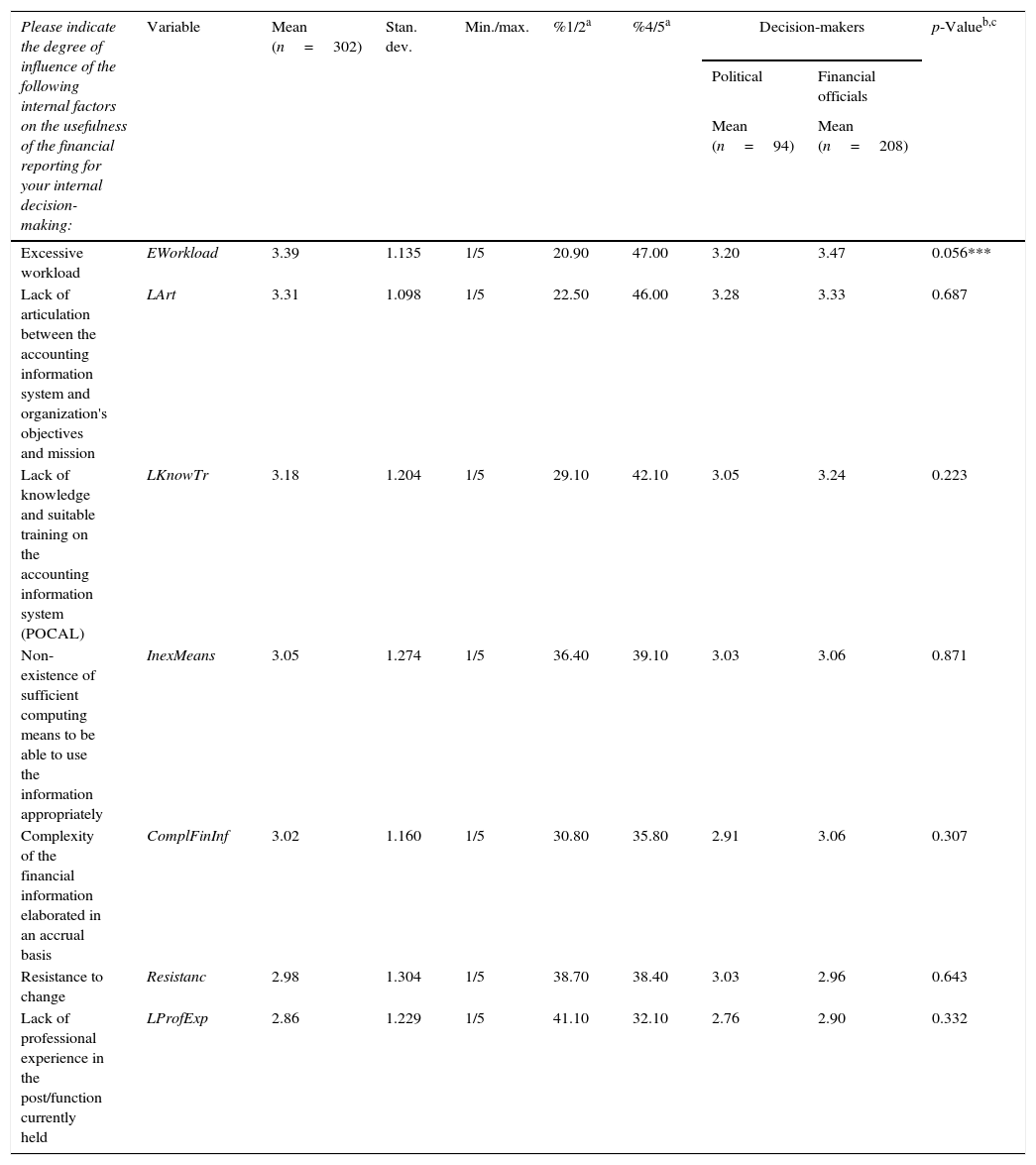

Regarding the degree of influence of local authorities’ internal factors (Table 5) on the usefulness of the financial reporting for internal decision-making, respondents consider excessive workload and the lack of articulation between the accounting information system and the organization's objectives and mission to be the factors with the greatest potential to influence that usefulness. Resistance to change and the lack of professional experience in the post or function performed are the factors considered with least potential influence.

Descriptive statistics of internal factors.

| Please indicate the degree of influence of the following internal factors on the usefulness of the financial reporting for your internal decision-making: | Variable | Mean (n=302) | Stan. dev. | Min./max. | %1/2a | %4/5a | Decision-makers | p-Valueb,c | |

|---|---|---|---|---|---|---|---|---|---|

| Political | Financial officials | ||||||||

| Mean (n=94) | Mean (n=208) | ||||||||

| Excessive workload | EWorkload | 3.39 | 1.135 | 1/5 | 20.90 | 47.00 | 3.20 | 3.47 | 0.056*** |

| Lack of articulation between the accounting information system and organization's objectives and mission | LArt | 3.31 | 1.098 | 1/5 | 22.50 | 46.00 | 3.28 | 3.33 | 0.687 |

| Lack of knowledge and suitable training on the accounting information system (POCAL) | LKnowTr | 3.18 | 1.204 | 1/5 | 29.10 | 42.10 | 3.05 | 3.24 | 0.223 |

| Non-existence of sufficient computing means to be able to use the information appropriately | InexMeans | 3.05 | 1.274 | 1/5 | 36.40 | 39.10 | 3.03 | 3.06 | 0.871 |

| Complexity of the financial information elaborated in an accrual basis | ComplFinInf | 3.02 | 1.160 | 1/5 | 30.80 | 35.80 | 2.91 | 3.06 | 0.307 |

| Resistance to change | Resistanc | 2.98 | 1.304 | 1/5 | 38.70 | 38.40 | 3.03 | 2.96 | 0.643 |

| Lack of professional experience in the post/function currently held | LProfExp | 2.86 | 1.229 | 1/5 | 41.10 | 32.10 | 2.76 | 2.90 | 0.332 |

It is of note that, in the set of local authorities’ internal factors, answers are, on average, very close to the intermediate value in the scale, being more scattered for the case of external factors. In the majority of local authorities’ external and internal factors, the mean of the degree of influence on the usefulness of financial information disclosed in the financial reporting, for internal decision-making, is overall higher in the group of financial officials.

In relation to organizational factors inside local authorities, excessive workload is the only internal factor with statistically significant differences (p-value<0.1) between groups of decision-makers.

Although not statistically significant, politicians, more than financial officials, consider resistance to change as having potentially greater influence on the usefulness of the financial reporting for their decision-making. This seems to indicate that politicians are not as receptive to changes in the accounting information system as financial officials. This situation might be justified by the fact that politicians do not have an immediate need to adapt to new systems, inasmuch as they are generally supported by specialized personnel, preparing and providing the financial information they require.

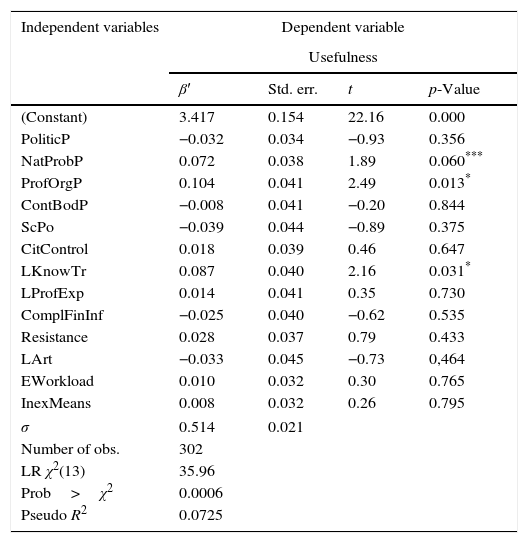

Multivariate analysisThe analysis continues identifying the factors explaining the usefulness of the financial reporting for decision-making by internal decision-makers (politicians and financial officials) using an explanatory regression model. Three variables were considered: “INTERNAL FACTORS” and “EXTERNAL FACTORS” (independent variables), and “USEFULNESS” (dependent variable).

Independent variablesThe variables ‘INTERNAL FACTORS’ and ‘EXTERNAL FACTORS’ were constructed on the basis of the simple average of items as part of each factor extracted from the factorial analysis in principal components of the scale, as suggested by Pestana and Gageiro (2008). The results of the factorial analysis reveal the formation of two factors that explain 52.35% and 60.75% of the total variance of the responses, respectively. The factors identified were designated ‘EXTERNAL FACTORS’ and ‘INTERNAL FACTORS’ (independent variables). The results of Cronbach's Alpha showed a good internal consistency – Cronbach's Alpha equal to 0.853 for ‘EXTERNAL FACTORS’ and 0.900 for ‘INTERNAL FACTORS’. Considering that the factorial analysis generated one single factor for each variable, all items within each variable were included.

Dependent variableThe variable ‘USEFULNESS’ is a global variable formed from five factors arising from the factor analysis. The results of Cronbach's Alpha showed a reasonable internal consistency – Cronbach's Alpha equal to 0.755 (Pestana & Gageiro, 2008). The perception of the respondents on the usefulness of municipal financial reporting for internal decision-making indicates that it is quite useful, with an average of 4.12. Thus, for the variable ‘usefulness of municipal financial reporting’, results of the KMO test (equal to 0.911) indicate that the quality of the correlations between variables is very good (Marôco, 2010; Pestana & Gageiro, 2008). Furthermore, results of Bartlett's test (p<0.05, α=0.000) demonstrate that there is a positive correlation between the variables (χ2(351)=80.077.504).

To analyze the relationship between variables, non-parametric statistic was used, namely, by calculating Spearman's (rho) coefficients.

Results show that the ‘EXTERNAL FACTORS’ are mutually related, in this way confirming the results of the factor analysis. The correlation coefficients with the ‘USEFULNESS’ variable show that external factors are positively correlated, although the results show weak correlations (rho(302) varies between 0.099 and 0.249).

Regarding the independent variable, ‘INTERNAL FACTORS’, results show the existence of a moderate to strong correlation, for a level of significance of 0.01, also confirming the results obtained in the factorial analysis. The correlation coefficients with the ‘USEFULNESS’ variable show, unexpectedly and contrarily to the literature, that internal factors are positively correlated, although the results show very weak correlations (the correlation coefficient rho(302) varies between 0.129 and 0.249).

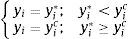

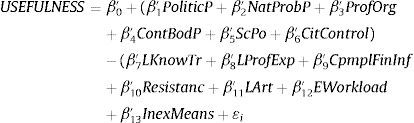

Regression analysisTo analyze the factors explaining the usefulness of the financial reporting for decision-making by internal decision-makers (politicians and financial officials), a regression of explanatory variables is proposed (to test H1 and H2). Given that the dependent variable is censored and truncated, with the value oscillating between 1 and 5, the adequate technique consists of estimating a Tobit model7 (Tobin, 1958), such as:

where yi* is the dependent variable to be estimated (‘USEFULNESS’); β′ is a k-dimensional vector of unknown parameters; xi is a vector that contains all explanatory variables of ‘INTERNAL FACTORS’ and ‘EXTERNAL FACTORS’ (independent variables); and ¿i represents the residual errors.The variable yi, which refers to the observed usefulness scores, is thus defined as follows:

yic represents the value of censorship and, as the purposes of this research, its value is the minimum and maximum scores that the variable ‘USEFULNESS’ can obtain (1–5 points).The standard Tobit model assumes homoscedasticity and normality in the residual distribution, obtaining consistent estimators when both assumptions are met.

H1 and H2 were then tested estimating the following Tobit regression model:

where ‘USEFULNESS’ represents the dependent variable; and the variables PoliticP, NatProbP, ProfOrgP, ContBodP, ScPo, CitControl (representing the variables of ‘EXTERNAL FACTORS’), and LKnowTr, LProfExp, ComplFinInf, Resistanc, LArt, EWorkload, InexMeans (representing the variables of ‘INTERNAL FACTORS’), represent the independent variables explaining the usefulness of the financial report for internal decision-making; and ¿i represents the estimated errors.Table 6 displays the statistics from the estimation.

Regression estimates.

| Independent variables | Dependent variable | |||

|---|---|---|---|---|

| Usefulness | ||||

| β′ | Std. err. | t | p-Value | |

| (Constant) | 3.417 | 0.154 | 22.16 | 0.000 |

| PoliticP | −0.032 | 0.034 | −0.93 | 0.356 |

| NatProbP | 0.072 | 0.038 | 1.89 | 0.060*** |

| ProfOrgP | 0.104 | 0.041 | 2.49 | 0.013* |

| ContBodP | −0.008 | 0.041 | −0.20 | 0.844 |

| ScPo | −0.039 | 0.044 | −0.89 | 0.375 |

| CitControl | 0.018 | 0.039 | 0.46 | 0.647 |

| LKnowTr | 0.087 | 0.040 | 2.16 | 0.031* |

| LProfExp | 0.014 | 0.041 | 0.35 | 0.730 |

| ComplFinInf | −0.025 | 0.040 | −0.62 | 0.535 |

| Resistance | 0.028 | 0.037 | 0.79 | 0.433 |

| LArt | −0.033 | 0.045 | −0.73 | 0,464 |

| EWorkload | 0.010 | 0.032 | 0.30 | 0.765 |

| InexMeans | 0.008 | 0.032 | 0.26 | 0.795 |

| σ | 0.514 | 0.021 | ||

| Number of obs. | 302 | |||

| LR χ2(13) | 35.96 | |||

| Prob>χ2 | 0.0006 | |||

| Pseudo R2 | 0.0725 | |||

Tobit model.

The results show that the dependent or explained variable is only significantly influenced by three variables. These findings were somehow expected given the weak correlations obtained between the variables in the above-performed analysis. The model estimated presents a determination coefficient of 0.0725 (Pseudo R2), which means the independent variables analyzed (factors) explain only about 7.25% of the variation observed in the usefulness variable, so the model estimated might be said as not so robust (Marôco, 2010).

Nevertheless, the χ2 statistic with a value of 35.96 associated with a p-value equal to 0.0006 (α=0.05) allows concluding that the model is statistically significant, i.e., it is suitable to explain the relationship between the usefulness of the financial reporting for internal decision-making by local authorities’ decision-makers, and some external and internal organizational factors. The usefulness of the financial reporting is positively influenced only by the pressure from professional organizations (ProfOrgP) and the pressure of a national problem (NatProbP), both external factors, and by the lack of knowledge and suitable training on the accounting information system – POCAL (LKnowTr), an organizational factor internal to the local authority. Therefore, the regression coefficients are statistically significant only for the variables ProfOrgP (α=0.05) and NatProbP (α=0.1), both external factors, and for LKnowTr (α=0.05; internal factor). From these findings, the following regression model is established:

Reflecting on the results of the regression model, one can conclude that H1 is only partially corroborated, and H2 cannot be corroborated.

In effect, the usefulness considered to financial information in supporting internal decision-making in Portuguese local authorities is positively affected only by two out of the six external factors considered (ProfOrgP and NatProbP). As to internal factors, financial reporting usefulness is affected only by one out of the seven factors considered (LKnowTr); in addition, the positive sign of this effect was opposite to what was initially expected. This means that, in the case of Portuguese local authorities, the lack of knowledge and suitable training on the accounting information system (POCAL) seems to have a rather unexpected positive effect on the usefulness of the financial reporting for internal decision-making. In other words, this finding suggests that internal decision-makers in local authorities, who have less knowledge and do not have suitable training on the accounting information system (regardless whether they are politicians or financial officials), use and attribute greater usefulness to the financial information disclosed in the financial reporting. Considering that the correlations between the variables ‘USEFULNESS’ of financial reporting and local authorities’ internal organizational factors were weak, further research was needed to clarify this finding, which one tried to complement in the qualitative part of this study.

Taking those weak correlations into consideration, these findings seem to mean that the respondents/decision-makers (either politicians or financial officials) do not consider most of the internal organizational factors analyzed as possible of affecting the usefulness they give to financial information for decision-internal making. This was another matter requiring further discussion on the qualitative analysis.

Finally, most factors were found as statistically non-significant in the regression model, as in the case of the excessive workload while processing the information; these were unexpected results given that in the descriptive/univariate analysis this factor had been ranked as having high influence on internal decision-making.

Overall, these results seem to indicate that the adoption of private sector accounting practices in the Local Government accounting system (which resulted in the preparation and presentation of new accrual-based information for decision-making) occurred as a response to institutional pressures exerted on local entities. Professionals, but also fiscal constraints requiring constant monitoring of the decisions outputs, seem indeed to pressure positively for the usefulness of financial reporting for internal decision-making. Therefore, the institutional theory seems indeed to have a significant role in explaining the accounting reforms adopted in the public sector, specifically in Local Administration in Portugal, which ultimately have had positive impact in the usefulness of the financial information for internal decision-making.

If on the one hand, from the outputs of the univariate analysis, it seems that both external and internal organizational factors have a potential influence on use and usefulness of the information disclosed in the local authority financial reporting for internal decision-making, on the other hand, the results of the regression model show that the factors considered generally explain a very low percentage of the variation observed. Nevertheless, considering the results of the variables correlations, such conclusions do not come as a surprise.

Only three factors – pressure from professional organizations, pressure from a national problem (both external factors) and the lack of knowledge and suitable training on the accounting information system (internal organizational factor) – show statistical significance, albeit weak, in explaining usefulness of financial reporting for internal decision-making, allowing only partial support for the hypotheses formulated. Still, these findings seem to be somehow convergent with others in the literature, e.g. corroborating the conclusions in the studies by Askim (2008), Cohen (2009), Cohen et al. (2007), Grossi and Reichard (2009), Guthrie (1998), and Pallot (1997). To a certain extent, there is some evidence that finds support in some assumptions of contingency and institutional theories about the relationships between aspects of the internal and external contexts of a public sector organization and its management capacity, specifically in the usefulness of the information presented in the financial reporting to support the process of internal decision-making in local authorities.

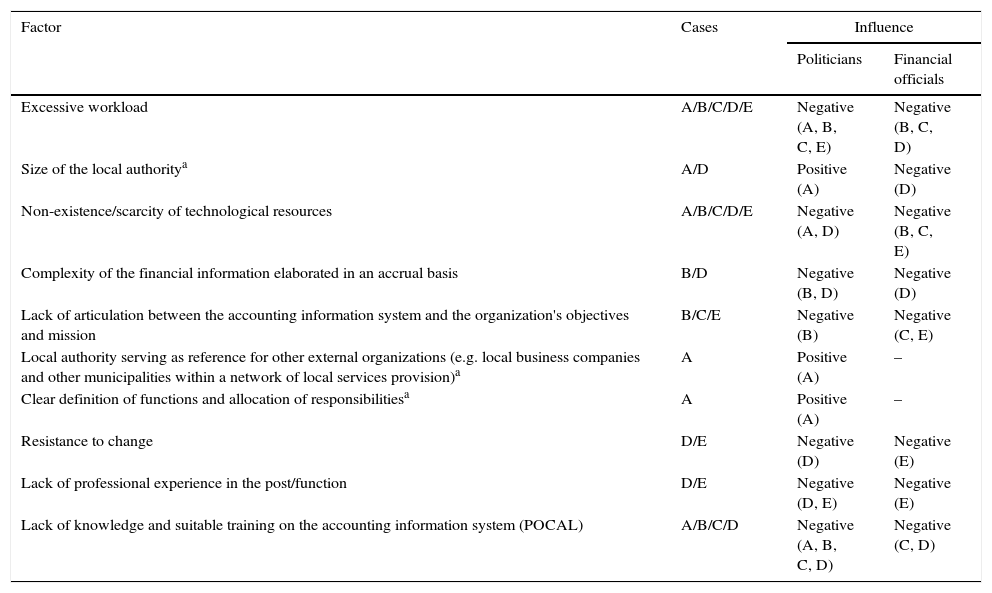

Qualitative analysisIn the light of the institutional theory, the qualitative analysis sought, in general, to reinforce the identification of internal organizational factors that can influence greater or lesser usefulness/use of the financial information in the local authorities’ financial reporting in support internal decision-making, with a view to extending the results obtained with the questionnaires. This analysis also aimed to attempt to establish a closer relationship with some theoretical explanations for reforms in public sector accounting, namely for the changes in order to elaborate more useful information for accountability and decision-making. The complementarity of the information gathered also allowed covering the non-responses to the survey.

As in the quantitative analysis, in the qualitative one the intention was to compare the perspectives of politicians and financial officials as decision-makers, by local authority.

In general, the results of the interviews regarding internal organizational factors confirmed the results described in the univariate analysis, but new factors possibly influencing greater or lesser usefulness of the municipal financial reporting in supporting the decision process were also identified. Table 7 shows the internal factors highlighted by the interviewees, the cases in which they were referred to and the signal for each factor of influence, distinguished by politicians and financial officials as decision-makers.

Results of interviews – internal factors influence on usefulness of financial information.

| Factor | Cases | Influence | |

|---|---|---|---|

| Politicians | Financial officials | ||

| Excessive workload | A/B/C/D/E | Negative (A, B, C, E) | Negative (B, C, D) |

| Size of the local authoritya | A/D | Positive (A) | Negative (D) |

| Non-existence/scarcity of technological resources | A/B/C/D/E | Negative (A, D) | Negative (B, C, E) |

| Complexity of the financial information elaborated in an accrual basis | B/D | Negative (B, D) | Negative (D) |

| Lack of articulation between the accounting information system and the organization's objectives and mission | B/C/E | Negative (B) | Negative (C, E) |

| Local authority serving as reference for other external organizations (e.g. local business companies and other municipalities within a network of local services provision)a | A | Positive (A) | – |

| Clear definition of functions and allocation of responsibilitiesa | A | Positive (A) | – |

| Resistance to change | D/E | Negative (D) | Negative (E) |

| Lack of professional experience in the post/function | D/E | Negative (D, E) | Negative (E) |

| Lack of knowledge and suitable training on the accounting information system (POCAL) | A/B/C/D | Negative (A, B, C, D) | Negative (C, D) |

As already stated, these findings for internal organizational factors and their influence on the usefulness of financial reporting for decision-making, allow an overall confirmation of those of the univariate analysis of data gathered from the questionnaire. They also validate the negative signal expected for the influence of these factors, even for the ‘Lack of knowledge and suitable training on the accounting information system (POCAL)’, which had found a positive inexplicable influence in the regression analysis.

It should be remembered that this factor appears in the literature with a negative sign and that in above testing of H2 the opposite result was obtained, raising the need for further clarification in the interviews. For this factor, all interviewees shared an opinion coherent with the international literature, hence contradicting the statistical analysis and suggesting that internal decision-makers with a lack of knowledge and suitable training on the accounting information system (POCAL) make less use of the financial information to support decision-making in Portuguese local authorities, regardless whether they are politicians or financial officials.

The factor ‘Excessive workload’ continues to be the potentially most influencing one.

Therefore, while findings in the quantitative analysis did not allow to corroborate H2, the qualitative analysis reassures that this hypothesis might be accepted.

Furthermore, the information gathered at the quantitative stage was complemented, by identifying new internal factors such as: the size of the local authority; the fact that the local authority serves as reference for other external organizations in terms of efficient, effective and economic management of the resources, increases its financial information needs, so increasing financial information usefulness for decision-making; and the clear definition of functions and allocation of responsibilities. While the two latter internal factors were identified only by a politician (in a large municipality in the North region) as positively affecting the usefulness of financial reporting for internal decision-making, the former (size of the local authority) was identified by a politician in a large municipality as having a positive influence and by a financial official in a small municipality as having negative influence. Consequently, there is a slight indication that size might be an issue when considering the usefulness of financial reporting for internal decision-making in municipalities. This is a matter that deserves attention in the future of this research.

The interviews in general also indicate that political decision-makers are those who appear to be less receptive to changes resulting from the reform of Local Government accounting in Portugal.

Conclusions and policy implicationsThe literature indicates that the usefulness of the financial information presented in the financial reporting of public bodies depends on various factors in the organizational (internal and external) context. These conclusions were somehow corroborated in this study in the context of local authorities. The empirical results for Portuguese municipalities show that pressure from professional organizations as well as the pressure of a national problem (both external factors with positive influence) and the lack of knowledge and suitable training on the accounting information system – POCAL (internal organizational factor with negative influence) are factors with great influence on the usefulness of the municipal financial reporting for decision-making by the main internal decision-makers – politicians and financial officials. These findings are validated in the complementary qualitative analysis, which additionally strengthens the ‘excessive workload’ factor as possible of hindering the usefulness of financial reporting for internal decision-making. Although this factor has not obtained a significant value in the hypothesis tested from the questionnaire data, it is noted that the results of the descriptive (univariate) analysis of the quantitative part of the study seemed to point to it as being somehow important in determining the usefulness for internal decision-making of local authorities’ financial information in Portugal (respondents/decision-makers gave the highest average punctuation).

In general, these conclusions find support in the contingency theory, and especially in the institutional theory, which sustain that external pressures and organizational factors determine changes in public sector accounting systems, hence affecting the way the financial information they produce is used for internal decision-making.

Overall, one may say that the results showed the usefulness of the financial reporting for internal decision-making in Portuguese local authorities derives from external pressures. A new system for public sector accounting in Portugal, including for Local Government, is currently under development,8 implying a more sophisticated accounting and reporting system, closer to international standards (IPSAS). According to the discussion in this paper, the future (as the current) regulation and standards on the subject, as well as the usefulness acknowledged to such information for internal decision-making purposes in public sector entities, will derive from coercive and normative isomorphism (institutional theory). It will result, respectively, on the one hand, from external pressures (e.g. lenders such as the ECB and the IMF) to the adoption of new accounting practices by public sector bodies, including local authorities, and, on the other hand, from pressures of professionals pushing an approximation of the public sector accounting into the business accounting system.

Consequently, similarly to what has happened in the business sector, one can expect that also for Public Administration, the new model of financial reporting to be adopted, adapted from the IPSAS, will on the one hand be more flexible in the information to report, and on the other, more rigorous and transparent in presenting the information to its users. The main aim of adopting a new model of financial reporting, through external pressures, will therefore lead to increasing its usefulness. However, it is questionable whether the usefulness intended will be truly recognized by its users, namely to support internal decision-making. Will decision-makers come to use the information available in the new financial reporting in their decision-making for better financial management of public resources or will they find it just a useless work overload? Another question arising concerns, for example, the knowledge of those who will use the new financial report internally – will they be ready for it and have the appropriate knowledge? This seems to be a critical issue highlighted in the study as possible to hinder the use/usefulness attributed to such information.

All in all, this study allows deriving the following implications:

- -

Pressures from professional organizations (e.g. the certified accountants institute) and a national fiscal problem are of major importance when considering the usefulness of financial reporting for internal decision-making, especially in local authorities, meaning that professional bodies and the financial conjuncture seem to stimulate informational needs by internal decision-makers in public sector entities.

- -

The lack of knowledge and suitable training on the accounting information system by decision-makers, especially by local politicians, is a hindering factor of the usefulness given to financial reporting for internal decision-making, which allows concluding that the background, and possibly the training, of decision-makers on the accounting and financial reporting system will increase its usefulness as subsequently the quality of the decisions taken.

Countries and international standard-setters (e.g. IPSASB for IPSAS, Eurostat for EPSAS), while reforming public sector accounting, must consider these issues, if they wish accounting to be an information system to truly support decision-making.

Conflict of interestThe authors declare that there are no conflicts of interest.

Sponsored by FCT (UID/CPO/00758/2013).

Finance Department or Finance Division or Accounting Section, according to the local authority's model of organizational structure.

The questions dealt with in this paper are just a part of a more wide-ranging questionnaire.

Law-decree n. 54-A/99, 22 February – Official Plan of Accounts for Local Authorities (POCAL).

Politicians in the sample are 30% of the population, while financial officials are 67.5% of the population. The global rate of response (49%) was quite good and for this was crucial the process followed to apply the questionnaire, in order to get as much answers as possible. Firstly a letter was sent directly addressed to all 308 Mayors, presenting the survey with a link were the questionnaire could be filled in, and asking, when applied, for his/her direct collaboration in the survey or, as in most cases, for authorization for other respondents (both the alderman for the financial area and the relevant financial official). Support for the survey was also got from the National Association of Portuguese Municipalities (ANMP) as well as from Medidata.net – Sistemas de Informação para as Autarquias S.A., a company that produces accounting software for most municipalities in the northern Portugal. The former sent a memo to all associates (addressing the Mayors) and the latter an e-mail, appealing for their collaboration in this survey, highlighting the importance of the study to the Portuguese municipalities. This support, namely from the ANMP, was crucial to increase the response rate.

A second round of contacts was made about two months after the first letter, both via e-mail and telephone, with those that up to then had not replied the questionnaire, seeking for the reasons of non-reply and again appealing for collaboration.

Meanwhile, other contacts were made replying to clarification requests by the respondents.

For the analysis by size, the methodology defined by Carvalho, Fernandes, Camões and Jorge (2008) was followed, which categorizes Portuguese municipalities according to the number of inhabitants: (1) small municipalities – population no greater than 20000 inhabitants; (2) medium-sized municipalities – population over 20000 inhabitants and no greater than 100000 inhabitants; and (3) large municipalities – population above 100000 inhabitants.

Following the Nomenclature of Territorial Units for Statistical Purposes (NUTS), level II. NUTS II comprises seven regions, five of which are in the mainland Portugal (North, Centre, Lisbon and Tejo Vale, Alentejo and Algarve) and two correspond to the Autonomous Regions of Madeira and Azores (Law-decree n. 244/2002, 5 November).

The use of the OLS technique is not adequate, as demonstrated by Chou and Cebula (1996) and Greene (2002), since it would obtain inconsistent estimators. Adds to the low and high limits of the dependent variable, the fact that it is discrete.

The development of the new accounting system – SNC-AP (Accounting Standards System for Public Administrations) – started with the Project 6 of the Portuguese Accounting Standard-setting Committee (Comissão de Normalização Contabilística – CNC), subsequently to its re-establishment in 2013. Article 2 of Law-decree n. 134/2012, June 29, which set the operationalization of CNC, defined that its main forthcoming activities should involve developing a new system for public sector accounting, approaching IPSASs. For this, a subcommittee for public sector accounting was created (CNCP), which has been working in the project since March 2013.

The main features of SNC-AP can be found in the document with guidelines titled “Linhas Orientadoras para o Sistema de Normalização Contabilística – Administrações Públicas (SNC-AP)”, published by CNC in July 2013. Past developments and current state of the work can be consulted in CNC's activities plans and reports, all available at http://www.cnc.min-financas.pt/atividades.html.