The main aim of this paper is to study the convergence between micro and macro systems of government accounting information, looking to contribute to the analysis of accounting harmonization process in the EU, as a tool to improve the comparability of financial, budgetary, and aggregated statistical reports, in order to improve social, political and economic decision-making and accountability. All this is obviously located in the current context of the EU, with a high degree of harmonization of accounting standards between the International Public Sector Accounting Standards (IPSAS), and those applied for the preparation of national accounts, ruled by European System of National and Regional Accounts (ESA 2010).

We have carried out different analytical methodologies to study the convergence of public accounting systems in the EU for 2014 and 2015, considering that the new European System of National Accounts came in force since September 2014. First, for each country, we calculate a global index and partial indexes for central and local governments. Secondly, we apply an alternative model based on the distance between the adjustments of each country and the extreme situation, that would imply null adjustments. As a supplementary, we focus on the relative weight of adjustments by country and for each level of government.

The study concludes, among other findings, that the importance of adjustments differs between countries and areas of government. Adjustments connected to recognition criteria (accrual or others), particularly significant from the point of view of the approach to GAAP, rank first in importance at the central government level, but are less significant at the local level.

El objetivo principal de este trabajo es analizar la convergencia entre los sistemas de información contable públicos tanto a nivel micro como a nivel macro con el objetivo de contribuir al análisis del proceso de armonización contable en la UE, como herramienta para mejorar la comparabilidad de los informes financieros, presupuestarios y las estadísticas agregadas, con el fin de mejorar el proceso de toma de decisiones a nivel social, político y económico, así como la rendición de cuentas. Todo ello, obviamente, en el contexto actual de la UE, con un alto grado de armonización de las normas contables entre las Normas Internacionales de Contabilidad para el Sector Público (IPSAS) y las aplicadas para la elaboración de las cuentas nacionales, regidas por el Sistema Europeo de Cuentas Regionales (SEC-2010).

Hemos utilizado diferentes metodologías analíticas para estudiar la convergencia de los sistemas de contabilidad pública en la UE durante 2014 y 2015, teniendo en cuenta que el nuevo Sistema de Cuentas Nacionales Europeo entró en vigor en septiembre de 2014. En primer lugar, para cada país, hemos calculado un índice global y unos índices parciales para los niveles gubernamentales central y local. En segundo lugar, hemos aplicado un modelo alternativo basado en la distancia entre los ajustes de cada país y la situación extrema, que implicaría ajustes nulos. Complementariamente, hemos analizado el peso relativo de los ajustes por país y por nivel de gobierno.

El estudio concluye, entre otros hallazgos, que la importancia de los ajustes difiere entre los países y las áreas de gobierno. Los ajustes relacionados con los criterios de reconocimiento (devengo u otros), particularmente importantes desde el punto de vista del enfoque de los GAAP, ocupan el primer lugar en importancia en cuanto al gobierno central, pero son menos importantes a nivel local.

The analysis of the convergence of public accounting systems in the EU is a dynamic research that needs to be updated depending on statistical, methodological and regulatory changes that are occurring in the EU. Therefore, we consider that the introduction of the new ESA 2010 requires a review of the state of convergence of accounting systems. The main justification of this study comes from a continuous research work on this field, in order to have a “permanent picture” of the process of convergence between systems, focused on the transition to accrual criteria.

After a review of the main differences between macro and micro governmental accounting systems in the EU countries, we will focus this paper on the methodological analysis of the differences listed in Excessive Deficit Procedure (EDP) Notification Tables developed by the Statistical Office of the European Union (EUROSTAT), studying the differences between the budgetary accounting and Government Financial Statistics (GFS) in different EU MSs at central and local governments. Specifically, this study attempts to answer the following research questions:

- (a)

What are the most relevant features of the adjustments for differences between national accounts and budgetary accounts of each country in determining the deficit with the new methodology at the two government levels?

- (b)

What is the global convergence between both accounting information systems at central and local government?

- (c)

What is the partial convergence showed by the differences associated with classification of transactions, recognition criteria, delimitation of the sectors or other differences between both accounting information systems at central and local government?

The research is focused on accrual criteria and analyses both, central and local government levels.

Three public accounting systems: the necessary harmonizationThe EU governments produce two main types of financial data on their activities, obtained from three public systems of accounting information:

- (1)

Government finance statistics (GFS) for the purpose of fiscal policy, based on national accounting system (macro system),

- (2)

Accounting and

- (3)

budgetary reports for accountability and decision-making purposes, relating to individual entities or groups of entities (micro system).

For macro system, GFS reporting guidelines are set out in the United Nations System of National Accounts (SNA) (United Nations, 2008) and in the new ESA 2010. On the other hand, concerning micro system, the International Public Sector Accounting Standards (IPSASs) are developed specifically to address the financial reporting needs of public sector entities around the world and development of adapted European Public Sector Accounting Standards (EPSASs) is currently being discussed.

The relationship between both types of reporting systems is important, with respect to transparency (explaining to users the differences between the data in the respective reports) and efficiency, since public accounting systems are generally the fundamental source of data for compiling GFS aggregated data. Also, aggregated magnitudes included in national accounts and the compilation of statistics on public finances calculated on an accrual basis are based on budgetary reports presented on a cash basis in most MSs.

Harmonization of public accounting systems would allow policymakers and other stakeholders to be able to analyze the financial position and performance of governments and the long-term sustainability of public finances, as highlighted by the European Commission (EC) in March 2013 (EC, 2013). The key question for the development of high quality GFS is the availability of a robust public accounting system based on accrual basis. As Barton (2011) says, cash, accrual and budgeting accounting systems can be integrated in a single comprehensive financial management information and reporting system useful for governments, parliaments, taxpayers and other interested users.

This context explains the importance of the interaction between the application of the rules of micro-accounting, such as IPSASs, or future EPSAS, and GFS-based macro-accounting information, because both systems will have to coexist. Under this scenario, it is particularly relevant to the EU the new ESA 2010, adopted by Regulation (EU) N° 549/2013 of the European Parliament and the Council on 21 May 2013 (EU, 2013), to be applied first to the data to be transmitted to Eurostat as of September 1, 2014.

The need for transparency and the importance of GFS in the EU is reflected in the inclusion of a chapter in the new ESA 2010 that analyzes its development and the reconciliation of the magnitudes of income, expenditure and net lending/borrowing. Given the important policy need for accurate figures on government deficit and debt in Europe, and the experience of the implementation of ESA 95 in the determination of reliable estimates, it is necessary to point out the significant increase of the regulation concerned with these issues in the ESA 2010 with respect to its predecessor. The changes include, among other features, more extensive guidance on sector boundaries between government, public corporations and private companies, which may imply an associated change in the recorded government deficit and debt.

In the following sections we first analyze the main differences between accounting standards and GFS and secondly the differences between the latter and the budgetary system, with a particular consideration of innovation in ESA 2010.

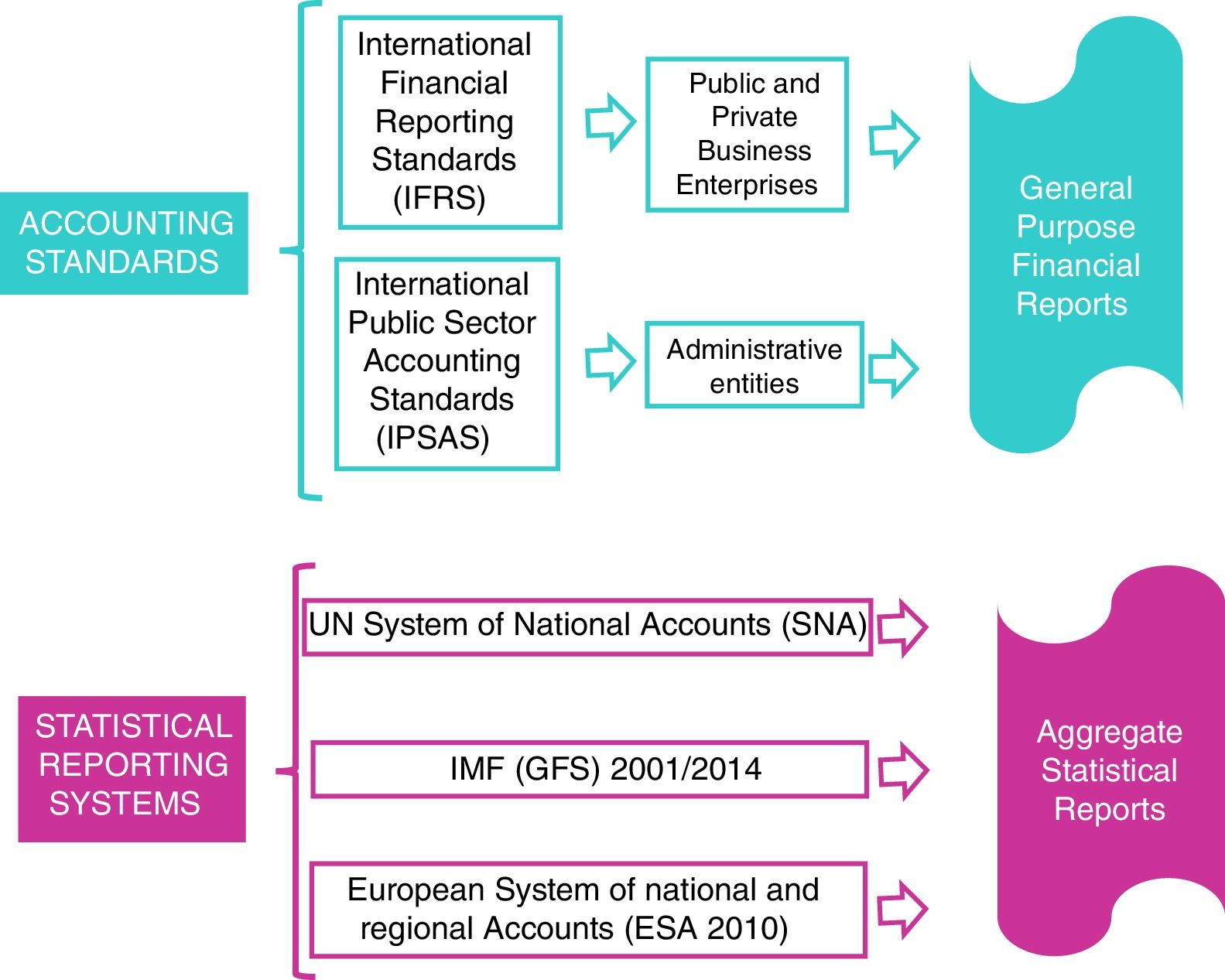

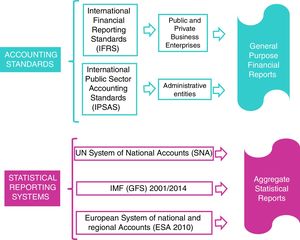

The relationship between the financial reporting and statistical systemsThere are two sets of international accounting standards for entities’ financial reporting and three for statistical financial reporting (Fig. 1).

The relationship between accounting standards and statistical reporting systems.

Accounting Standards are used for financial reporting in the case of General Purpose Financial Reports (GPFRs): IPSASs by all governmental entities, except government business enterprises and IFRSs for public and private business enterprises.

On the other hand, Statistical Reporting Systems have been introduced by international bodies to gather information on countries in order to provide cross-country comparisons on a standardized basis. The International Monetary Fund (IMF) GFS is concerned exclusively with financial information on the General Government Sector, while the coverage of the United Nations (UN) SNA and ESA 2010 extends financial information on the governments to national economic data.

EU GFS are based on the methodological rules of the ESA 2010, based in turn on the worldwide SNA 2008, supplemented by further Eurostat decisions and guidance, most notably the ESA 2010 Manual on Government Deficit and Debt. It is also important to note that EU MSs also prepare GFS for reporting to IMF and the IMF's GFS Manual is based on the SNA.

The International Public Sector Accounting Standards Board (IPSASB) has developed a work program on the convergence of IPSASs with national accounting systems, and in 2005 a research report identified systematically the similarities and differences between the two reporting frameworks (IPSASB, 2005). In 2011, the IPSASB approved a new project (IPSASB, 2011), oriented to perform a further reduction of the differences between IPSASs and public sector GFS reporting guidelines.

Recently, the IPSASB Conceptual Framework for General Purpose Financial Reporting (GPFRs) by Public Sector Entities (IPSASB, 2014), points out that the information provided by GPFRs may be useful for compiling national accounts, as an input to prepare statistical financial reporting models, although IPSASB acknowledges that GPFS are not developed specifically to respond to the needs of national accounting systems.

However, as IPSASB (2012) emphasizes, significant benefits can be obtained from using a single integrated financial information system to generate both, IPSAS financial statements and GFS reports. This will reduce GFS report preparation time, costs, and effort, while improvements can be expected in the source data for these reports, with flow-on benefits in terms of report quality, including timeliness. Improvements to the understandability and credibility of both types of reports are also reasonably expected.

It is important to note, according to the aim of this paper, that IPSAS financial statements and GFS reports have much in common, especially considering that both allow to report on:

- •

financial, accrual-based information

- •

government's assets, liabilities, revenue, and expenses

- •

comprehensive information on cash flows

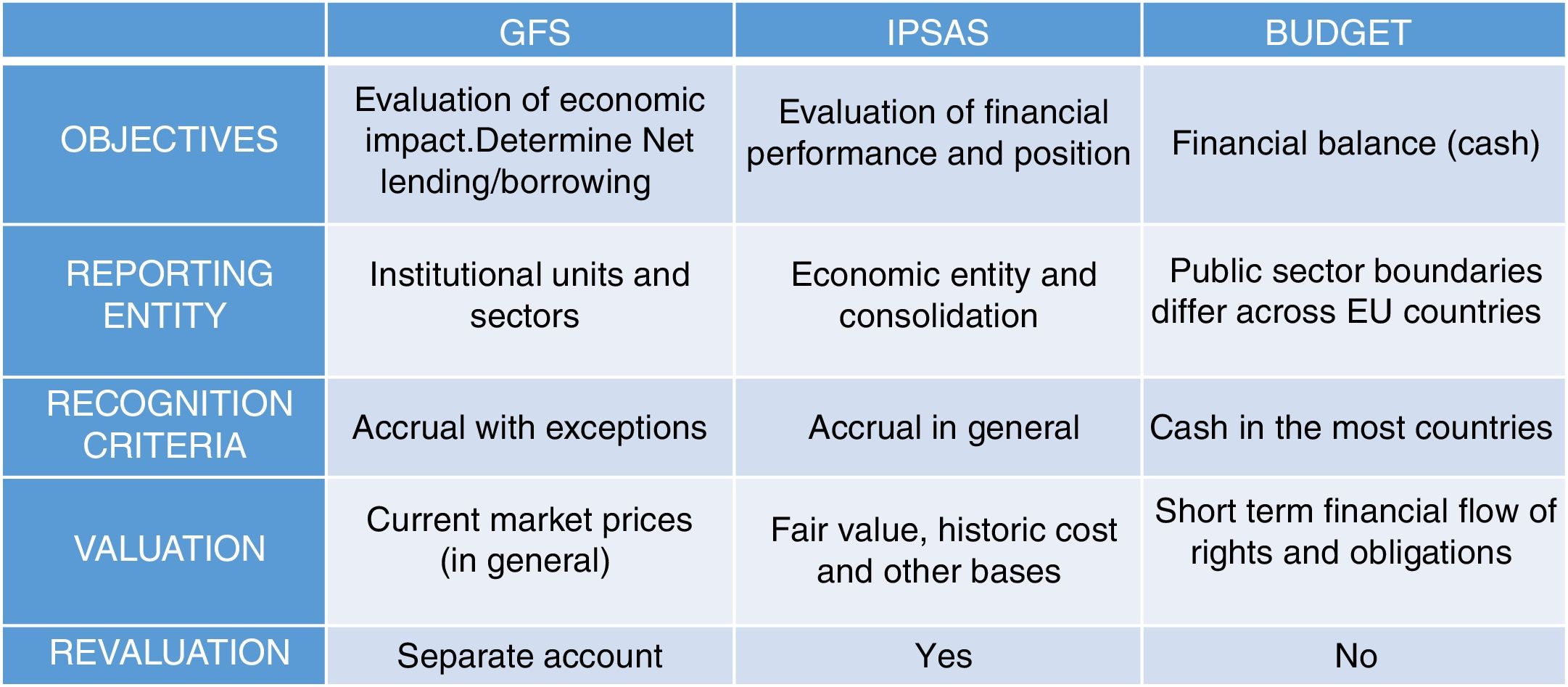

But the fact is that a considerable gap still exists between those two reporting frameworks. IPSASs and GFS reporting guidelines still present some important differences, as a result of their different objectives and separate development (EC, 2013; IMF, 2014; IPSASB, 2012) collected in Fig. 3.

Relationship between the budgetary and statistical systemsEuropean GFS are produced in accordance with the ESA rules, and differ from budgets standards, which are specific in every country member in terms of its entities scope and the principles applied for transactions recording purposes. At national level, statistical authorities are responsible for ensuring that reported data comply with legal provisions. At European level, Eurostat is responsible for providing the statistical methodology on which EDP statistics are compiled, and for assessing the quality of data reported by MSs for EDP purposes

Moreover, in line with its proposal for a Council Directive on requirements for budgetary frameworks of the MSs,1 the Commission will support the implementation of public accounting standards providing the information needed to compile ESA-based data for all sub-sectors of general government. Eurostat intends to play an active role within the framework of the IPSASs, which promote accrual-based public accounting close to ESA-based principles.

As noted, the ESA is the conceptual framework of the national accounts for the evaluation and control of the requirements of the EU Treaty for the assessment and control of MSs budgetary discipline. The source of these data is the micro-level budgetary accounting, therefore, it is necessary to clarify the relationship between the two systems and establish a certain alignment, at least on the basic principles. Furthermore, the differences between the two systems of accounting information can question the reliability and comparability of the aggregate financial decisions that sustain EU (Bastida & Benito, 2007; Benito & Bastida, 2009; Benito, Brusca, & Montesinos, 2007; Jesús, Jorge, & Laureano, 2014; Luder, 2000).

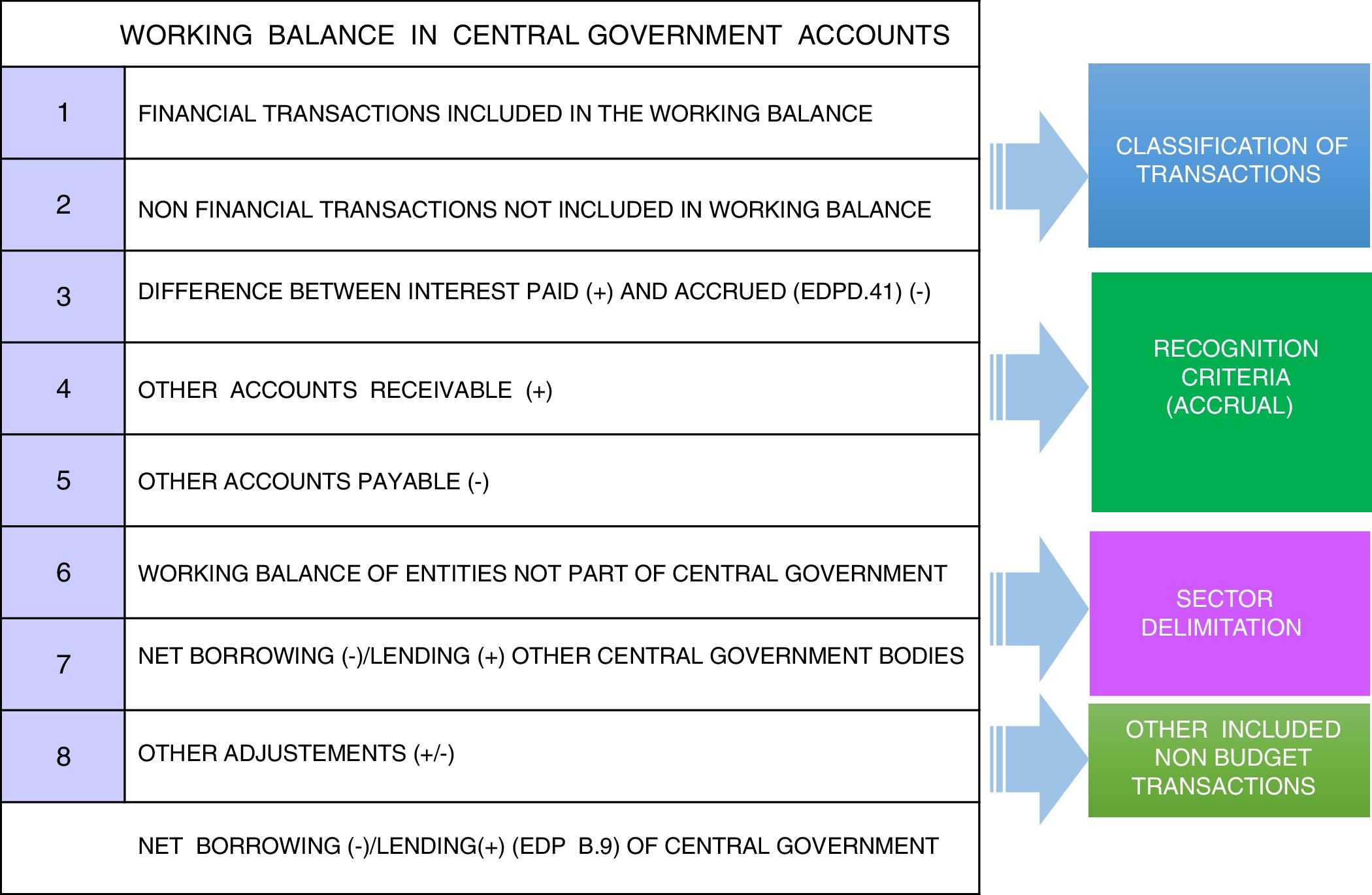

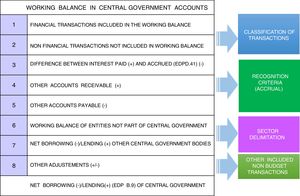

The EDP Tables, presented by MSs for monitoring deficits and government debt, reflects the differences between public budgetary accounting and national accounts for the net lending/borrowing and allows to study the differences between the two systems through appropriate adjustments. Also indicate in each case the recognition criteria of the working balance (budgetary balance): cash, accrual, mixed or other.

The “working balance” should be adjusted for net lending/borrowing. As shown in Fig. 2, these adjustments can be classified into eight groups and four categories, that are related to the conceptual differences between the two information systems (Dasí, Montesinos, & Murgui, 2013; Eurostat, 2002, 2014a, 2014b, 2014c).

In Fig. 3 we summarize the main conceptual differences between the three public accounting systems.

Main conceptual differences between the three public accounting systems.

The information provided by national accounts in Europe since September 2014 is prepared in accordance with new ESA 2010. It is necessary to know the gap between the information provided in the national accounts and that derived from microeconomic accounting systems used by MSs. This is particularly relevant when it is considered that EU authorities are implementing policies and developing projects to reduce the gap between the microeconomic accounting systems and information prepared according to SNA criteria, as in the case of EPSAS.

An empirical analysis of these relevant issues is presented in “Empirical study of the differences between budgetary and national accounting in the EU countries at central and local governments” section, in order to give a reasoned response to the research questions raised in the Introduction section to this paper.

Previous literature had mainly focused in the determinants of divergences at central government level (Dasí et al., 2013; Dasí, Montesinos, & Murgui, 2014; Dasí, Montesinos, & Murgui, 2016; Jesús and Jorge, 2012, 2016; Sforza & Cimini, 2017a), so it is of interest to enrich the analysis by widening the spectrum of investigation at local government level.

Empirical study of the differences between budgetary and national accounting in the EU countries at central and local governmentsInformation on stability and fiscal balance of MSs’ public finances. Study of the complete universe dataThe information obtained corresponds to the EDP Notifications Tables of 28 countries of the EU provided by EUROSTAT.

At the time of this study, with respect to its temporal dimension, data for 2014 and 2015 in terms of ESA 2010 were only available, considering that the new system of national accounts came in force since September 2014.

On the other hand, our study has focused on information from Central Government subsector (sector S.1311) and Local Government subsector (sector S. 1313).

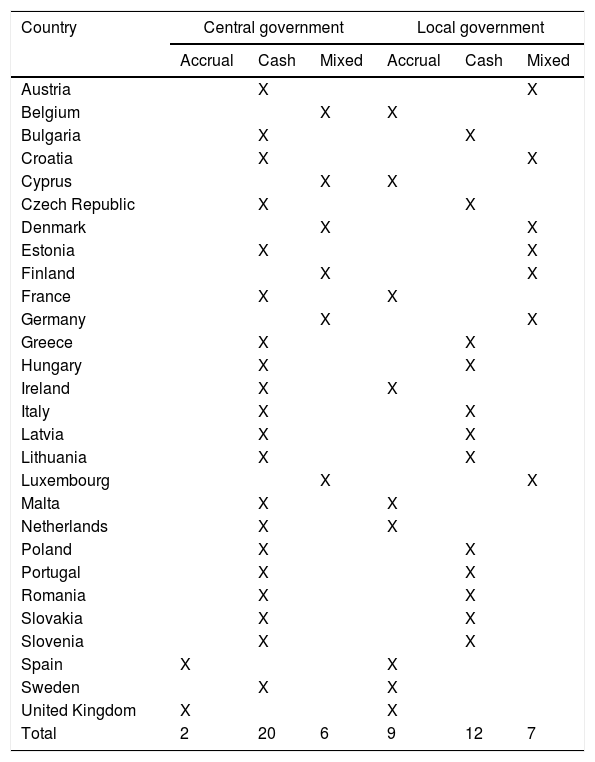

As we can see in Table 1, in Central Governments, only Spain and United Kingdom declare accrual as the accounting basis for the working balance calculation, while Belgium, Denmark, Germany, Cyprus, Luxembourg, Hungary and Finland declare to use mixed bases and the rest of countries a cash basis. In Local Governments, nine countries declare accrual, seven countries declare mixed bases and 12 countries cash basis. It must be noted that 10 countries declare different accounting bases in their central and local governments.

EU member states by basis of accounting of working balance measure for EDP reporting and by government subsectors (October 2016).

| Country | Central government | Local government | ||||

|---|---|---|---|---|---|---|

| Accrual | Cash | Mixed | Accrual | Cash | Mixed | |

| Austria | X | X | ||||

| Belgium | X | X | ||||

| Bulgaria | X | X | ||||

| Croatia | X | X | ||||

| Cyprus | X | X | ||||

| Czech Republic | X | X | ||||

| Denmark | X | X | ||||

| Estonia | X | X | ||||

| Finland | X | X | ||||

| France | X | X | ||||

| Germany | X | X | ||||

| Greece | X | X | ||||

| Hungary | X | X | ||||

| Ireland | X | X | ||||

| Italy | X | X | ||||

| Latvia | X | X | ||||

| Lithuania | X | X | ||||

| Luxembourg | X | X | ||||

| Malta | X | X | ||||

| Netherlands | X | X | ||||

| Poland | X | X | ||||

| Portugal | X | X | ||||

| Romania | X | X | ||||

| Slovakia | X | X | ||||

| Slovenia | X | X | ||||

| Spain | X | X | ||||

| Sweden | X | X | ||||

| United Kingdom | X | X | ||||

| Total | 2 | 20 | 6 | 9 | 12 | 7 |

As Dabbicco (2015) says, it should be mentioned that although in some countries accrual accounting is used, there is a tendency in some areas to operate off-budget (or balance sheet) transactions, and this should be also taken into account in the assessment of accrual adoption.

Objectives and methodology of the empirical analysisThe main objective of this paper is to analyze the link between macro and micro public sector accounting systems in the EU countries at central and local level, searching for answer the research questions set out in the Introduction to this paper. We will thus deepen in the differences and the necessary adjustments between data, in order to improve the comparability, support the harmonization process and provide a better understanding of the relationship between budget information and statistical bases of financial reporting. To avoid the potential impact of interannual changes, we will use aggregate data for each country for 2014 and 2015 fiscal years, the only ones fully elaborated according to the ESA 2010 new methodology.

In order to determinate the aggregate values of the data that will measure the overall impact of the adjustments, some corrections were necessary so as to facilitate the consistency and comparability of the proposed aggregations. First, due to the great heterogeneity in the data, we have considered that it is necessary to standardize it, dividing the data by the total general government revenue (non-financial resources) as done by Anessi Pessina and Steccolini (2007) and Brusca and Montesinos (2014). In addition, since the adjustments show discrepancies between two different information systems, all data have been processed in absolute values, so the aggregates correspond to accumulated absolute values.

Moreover, to facilitate the manipulation and interpretation of the results, the value of the standardized data has been multiplied by 10,000. This data transformation has no impact on the empirical study and has been done to facilitate the reading and interpretation of the data.

We analyze the convergence from two different perspectives, partial and global, and for central and local governments. For each country we calculate a global index and partial indexes for both, central and local governments.

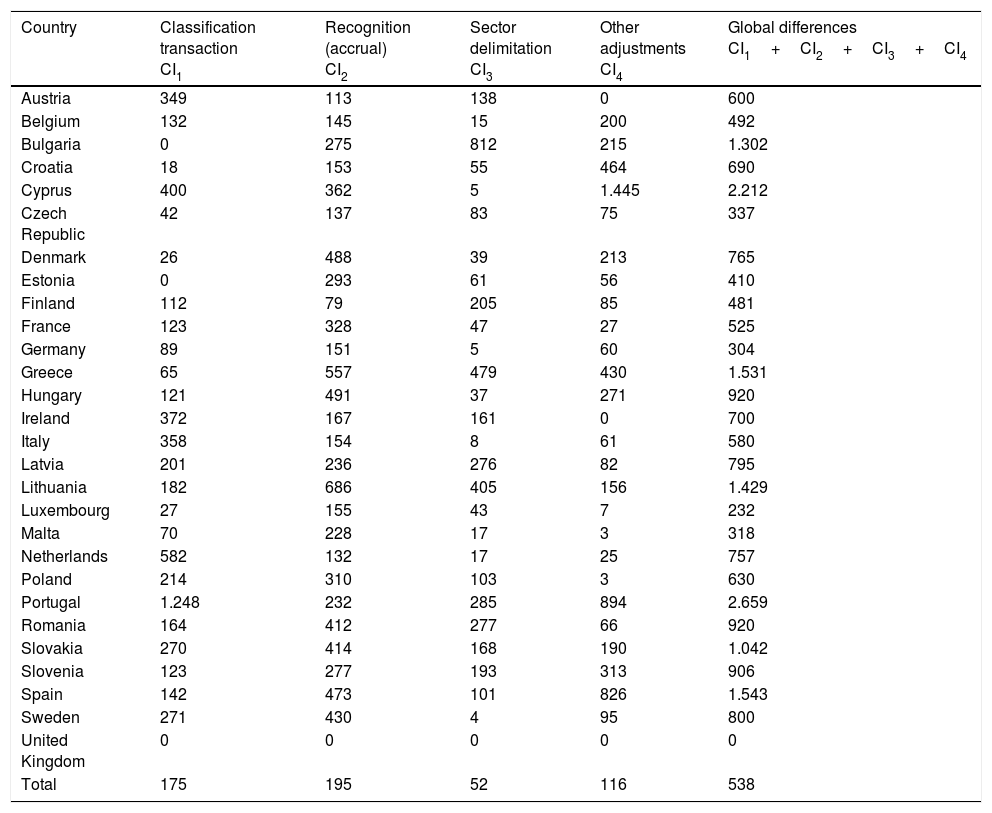

Regarding the global adjustment, with the aim of achieving an overall view, all of the adjustments have been integrated into a single aggregated index, that provides an overview of adjustment magnitude for the period 2014–2015 for both levels of government (Tables 2 and 3).

Global convergence index and partial convergence indexes by categories of adjustments for central government (2014–2015).

| Country | Classification transaction CI1 | Recognition (accrual) CI2 | Sector delimitation CI3 | Other adjustments CI4 | Global differences CI1+CI2+CI3+CI4 |

|---|---|---|---|---|---|

| Austria | 349 | 113 | 138 | 0 | 600 |

| Belgium | 132 | 145 | 15 | 200 | 492 |

| Bulgaria | 0 | 275 | 812 | 215 | 1.302 |

| Croatia | 18 | 153 | 55 | 464 | 690 |

| Cyprus | 400 | 362 | 5 | 1.445 | 2.212 |

| Czech Republic | 42 | 137 | 83 | 75 | 337 |

| Denmark | 26 | 488 | 39 | 213 | 765 |

| Estonia | 0 | 293 | 61 | 56 | 410 |

| Finland | 112 | 79 | 205 | 85 | 481 |

| France | 123 | 328 | 47 | 27 | 525 |

| Germany | 89 | 151 | 5 | 60 | 304 |

| Greece | 65 | 557 | 479 | 430 | 1.531 |

| Hungary | 121 | 491 | 37 | 271 | 920 |

| Ireland | 372 | 167 | 161 | 0 | 700 |

| Italy | 358 | 154 | 8 | 61 | 580 |

| Latvia | 201 | 236 | 276 | 82 | 795 |

| Lithuania | 182 | 686 | 405 | 156 | 1.429 |

| Luxembourg | 27 | 155 | 43 | 7 | 232 |

| Malta | 70 | 228 | 17 | 3 | 318 |

| Netherlands | 582 | 132 | 17 | 25 | 757 |

| Poland | 214 | 310 | 103 | 3 | 630 |

| Portugal | 1.248 | 232 | 285 | 894 | 2.659 |

| Romania | 164 | 412 | 277 | 66 | 920 |

| Slovakia | 270 | 414 | 168 | 190 | 1.042 |

| Slovenia | 123 | 277 | 193 | 313 | 906 |

| Spain | 142 | 473 | 101 | 826 | 1.543 |

| Sweden | 271 | 430 | 4 | 95 | 800 |

| United Kingdom | 0 | 0 | 0 | 0 | 0 |

| Total | 175 | 195 | 52 | 116 | 538 |

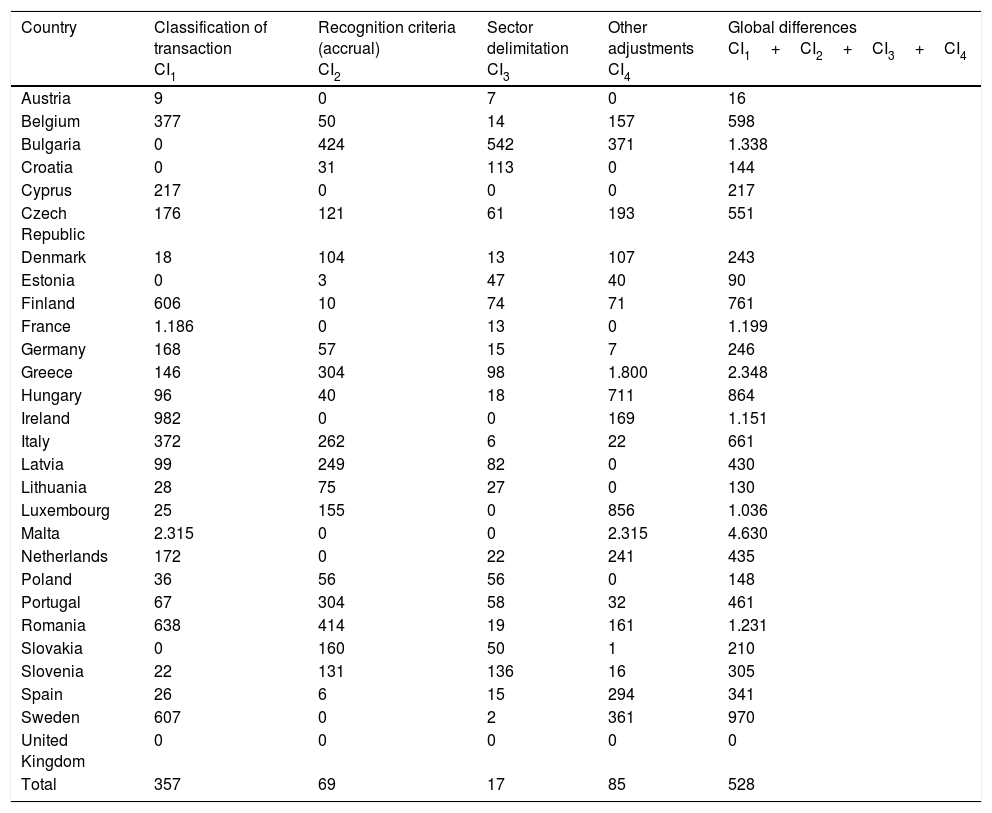

Global convergence index and partial convergence indexes by categories of adjustments for local government (2014–2015).

| Country | Classification of transaction CI1 | Recognition criteria (accrual) CI2 | Sector delimitation CI3 | Other adjustments CI4 | Global differences CI1+CI2+CI3+CI4 |

|---|---|---|---|---|---|

| Austria | 9 | 0 | 7 | 0 | 16 |

| Belgium | 377 | 50 | 14 | 157 | 598 |

| Bulgaria | 0 | 424 | 542 | 371 | 1.338 |

| Croatia | 0 | 31 | 113 | 0 | 144 |

| Cyprus | 217 | 0 | 0 | 0 | 217 |

| Czech Republic | 176 | 121 | 61 | 193 | 551 |

| Denmark | 18 | 104 | 13 | 107 | 243 |

| Estonia | 0 | 3 | 47 | 40 | 90 |

| Finland | 606 | 10 | 74 | 71 | 761 |

| France | 1.186 | 0 | 13 | 0 | 1.199 |

| Germany | 168 | 57 | 15 | 7 | 246 |

| Greece | 146 | 304 | 98 | 1.800 | 2.348 |

| Hungary | 96 | 40 | 18 | 711 | 864 |

| Ireland | 982 | 0 | 0 | 169 | 1.151 |

| Italy | 372 | 262 | 6 | 22 | 661 |

| Latvia | 99 | 249 | 82 | 0 | 430 |

| Lithuania | 28 | 75 | 27 | 0 | 130 |

| Luxembourg | 25 | 155 | 0 | 856 | 1.036 |

| Malta | 2.315 | 0 | 0 | 2.315 | 4.630 |

| Netherlands | 172 | 0 | 22 | 241 | 435 |

| Poland | 36 | 56 | 56 | 0 | 148 |

| Portugal | 67 | 304 | 58 | 32 | 461 |

| Romania | 638 | 414 | 19 | 161 | 1.231 |

| Slovakia | 0 | 160 | 50 | 1 | 210 |

| Slovenia | 22 | 131 | 136 | 16 | 305 |

| Spain | 26 | 6 | 15 | 294 | 341 |

| Sweden | 607 | 0 | 2 | 361 | 970 |

| United Kingdom | 0 | 0 | 0 | 0 | 0 |

| Total | 357 | 69 | 17 | 85 | 528 |

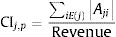

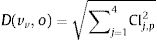

The global convergence index (CI) for each country was proposed by Dasí et al. (2014). The variable Ai denotes the eight specific adjustments listed in EDP Notification in Table 2, and the equation of CI is given by:

This CI is a relative indicator of divergence between the two accounting systems and measures the convergence/divergence between budget and GFS information. With increasing convergence decreases the indicator, expressing zero maximum convergence.

Partial convergence indexes (CIj,p) for each category are defined by denoting (j) each of the four adjustment categories listed in EDP Notification in Table 2 and Aji adjustment i in category (j):

we will call CIj,p, the value of the accumulated adjustments category “j” in country “p”.Results of the studyMagnitude of the convergence indexes at central and local levelsWe have looked at convergence from different perspectives, partial and global, for both, central and local governments, and Tables 2 and 3 incorporate these dual perspectives, taking into account that the “global differences” in these tables are the aggregation of the previous categories.

Global convergence indexAs it has been said, this is a relative indicator of divergence between the two accounting systems and with increasing convergence decreases the indicator, expressing zero maximum convergence.

For central government some relevant results can be highlighted in Table 2:

- -

UK presents maximum convergence.

- -

Some of the countries with lowest global adjustment value at central level – which indicates greater convergence, such as UK, Germany, Belgium, France and Italy, have highest governmental revenues.

- -

Those countries with a higher index value – which indicates lower convergence, belong to Eastern Europe, such as Hungary, Romania, Slovakia, Bulgaria and Lithuania, or have had budget and financial problems, such as Greece, Spain, Cyprus and Portugal.

For local government (Table 3), some results are completely different to those indicated for central level:

- -

UK presents maximum convergence too.

- -

Among the countries with the lowest index value are the UK, Germany, some Eastern countries such as Estonia, Lithuania, Croatia or Poland, as well as Cyprus and Spain, which had minimal convergence at central level.

- -

Among the countries that have the greatest value of the global adjustment at local level are countries such as France, Italy, Belgium, Luxembourg and Malta that showed maximum convergence at the central level.

Once the four categories of adjustments (classification of transactions, recognition criteria, sector delimitation and others adjustments) have been established, and assuming that each one of them represents a source of divergence between the two information systems, we have proceeded to analyze how many divergences are identifiable among the different countries at central as well as at local level.

By countries, at central level, UK presents the maximum convergence. Austria, Bulgaria, Estonia and Ireland have an in intermediate convergence, with 3 adjustments; and from the remaining 23 countries, with 4 categories of adjustments, the majority present minimum convergence.

As for local level, by countries, UK presents also maximum convergence. Cyprus, Croatia, France, Ireland, Malta, Austria, Bulgaria, Estonia, Latvia, Lithuania, Luxembourg, Netherlands, Slovakia and Sweden have Intermediate Convergence, with 1, 2 or 3 adjustments; and finally the remaining 14 countries present minimal convergence, as in the case of central governments for these countries.

As it can be noted, at local level a smaller number of countries present the four categories of adjustments vis-à-vis the central government.

On the other hand, by categories of adjustments, for central government some relevant results can be highlighted from Table 2:

- –

United Kingdom presents zero value in all adjustments.

- –

The most important adjustments are accrual-related adjustments (195) for which only UK has zero value. Thus, differences in application of accrual basis results in a remarkable difference in quantitative terms across all European MSs when calculating the gap between accounting information systems.

- –

The adjustments related to the delimitation of the sector (52) are the least important, although for Bulgaria that presents the most important value (812).

- –

The adjustments related to the classification of the operations occupy the second place in importance, even when the high value of Portugal and the value zero for some countries of the east like Bulgaria and Estonia should be emphasized.

Finally, as a result of the analysis by categories of adjustments for local government, some relevant facts can be highlighted (see Table 3):

- -

Looking at total amount, it can be noted the low value of accruals adjustments (69), going down from being the most important adjustment to occupy the third place in importance. This circumstance is related to the fact that nine countries declare the accrual criteria as a basis of recognition at the local level vis-à-vis only two countries at the central level (see Table 1).

- -

The most important adjustments are those related to the classification of operations (357), highlighting the high value of France and Malta.

- -

It also stands the low value of the adjustments related to the delimitation of the sector, that occupy the last place in importance. Bulgaria presents a very high value for this adjustment, also at local level.

As a supplementary analytical methodology, we apply an alternative model based on the distance between the adjustments of each country and the extreme situation, that would imply null adjustments. To do this, the distances between the vector of adjustments and the null vector will be defined and determined. The null vector identifies the non-existence of any kind of adjustment.

For each country p we define the vector of its specific adjustments by vp=(CI1p, CI2p, CI3p, CI4p), and CIj,p as the value of the accumulated adjustments of the category “j” in country “p”.

The relative position of each country with respect to the ideal position represented by the null vector, using the Euclidean distance, is determined by the following expression:

The analysis of these distances, ranging from a minimum of 0 for UK at the two levels of government, to a maximum of 1.579 for Portugal at the central level and 3.274 for Malta at the local level, allows to establish the groups presented in Table 4, according to their level of high, intermediate, or reduced convergence between budgetary and national accounting.

Groups of countries with maximum, high, intermediate or low convergence between the budgetary and national accounts at central and local governments.

| Central government | Local government | |

|---|---|---|

| Maximum convergence | UK | UK |

| High convergence | Austria, Belgium, Czech Republic, Estonia, Finland, France, Germany, Italy, Luxembourg, Malta, Poland | Austria, Croatia, Denmark, Estonia, Germany, Lithuania, Poland, Slovakia, Slovenia |

| Intermediate convergence | Croatia, Denmark, Hungary, Ireland, Latvia, Netherlands, Romania, Slovakia, Slovenia, Sweden | Belgium, Cyprus, Czech Republic, Finland, Italy, Latvia, Netherlands, Portugal, Spain |

| Low convergence | Bulgaria, Cyprus, Greece, Lithuania, Portugal, Spain | Bulgaria, France, Greece, Hungary, Ireland, Luxembourg, Malta, Romania, Sweden |

Some relevant results coming from Table 4 are:

- 1.

It is noteworthy that countries adopting accruals in EDP Tables (Table 1) show intermediate and minimum convergence at both levels of government, with the exception of the UK. This indicates that the countries that present an accrual budget maintain other divergences with the national accounts and that, even though accrual basis is a very important difference between the two accounting information systems, it is not the determining adjustment of the convergence or divergence between budget and national accounts. As Sforza and Cimini (2017b) say, adjustments do not depend solely on the basis used to account the Working Balance but also on other factors that involve the accounting practices followed at micro-level.

As pointed out by Dasí et al. (2016), we can realize that, in spite of a first glance resulting from mean values, ESA 95 and ESA 2010 have a similar quantitative convergence regarding accrual basis and therefore both methodologies are similarly demanding on that subject.

- 2.

The United Kingdom appears alone in a cluster as it can be appreciated when considering the distance from the adjustment vector to zero adjustment in both sub-sectors of the administration, which shows the maximum convergence between budgetary accounting and national accounts.

- 3.

Most countries have the same convergence at both levels of government, although there are significant differences in classification.

- 4.

Among these differences, it is noteworthy that some of the countries with minimal convergence at local level (France, Hungary, Ireland, Luxembourg, Malta, Romania, Sweden) have a high or intermediate convergence for central level governments.

- 5.

In addition, Cyprus, Portugal and Spain, with minimal convergence at central level, present intermediate convergence at local level.

- 6.

If we look at the classification of countries according to the cultural and administrative traditions in the EU (Anglo-Saxon, Continental, Nordic and Eastern European), we can conclude that in all levels of convergence, countries belonging to all these different traditions are included. It is therefore correct to interpret that, with ESA 2010, although accounting tradition has a clear incidence on the degree of convergence or divergence between the two information systems, it is not the only explanatory element for them.

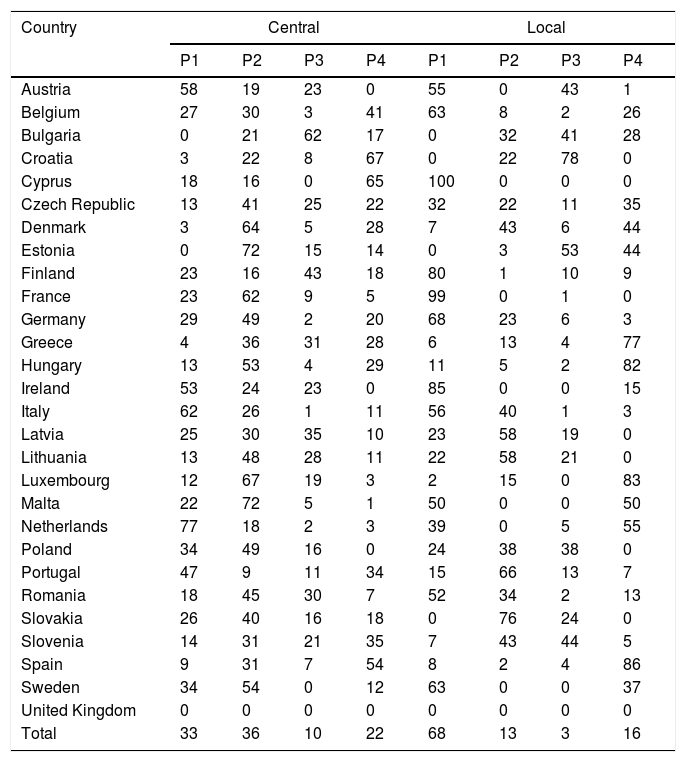

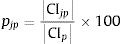

In this section, the focus is on the effect of all the adjustments categories, with an emphasis on the vector determined by the weight corresponding to each one. Therefore, we will focus on the relative weight of adjustments by country and for each level of government.

For our purposes, for a country p, the relative weight of the adjustment j is identified through the expression pjp, which is defined by the ratio of the global convergence index and the partial indexes for each country.

This is formally defined as:

verifying that:

Results for central and local government are shown in Table 5.

Relative weight of the adjustment in central and local government.

| Country | Central | Local | ||||||

|---|---|---|---|---|---|---|---|---|

| P1 | P2 | P3 | P4 | P1 | P2 | P3 | P4 | |

| Austria | 58 | 19 | 23 | 0 | 55 | 0 | 43 | 1 |

| Belgium | 27 | 30 | 3 | 41 | 63 | 8 | 2 | 26 |

| Bulgaria | 0 | 21 | 62 | 17 | 0 | 32 | 41 | 28 |

| Croatia | 3 | 22 | 8 | 67 | 0 | 22 | 78 | 0 |

| Cyprus | 18 | 16 | 0 | 65 | 100 | 0 | 0 | 0 |

| Czech Republic | 13 | 41 | 25 | 22 | 32 | 22 | 11 | 35 |

| Denmark | 3 | 64 | 5 | 28 | 7 | 43 | 6 | 44 |

| Estonia | 0 | 72 | 15 | 14 | 0 | 3 | 53 | 44 |

| Finland | 23 | 16 | 43 | 18 | 80 | 1 | 10 | 9 |

| France | 23 | 62 | 9 | 5 | 99 | 0 | 1 | 0 |

| Germany | 29 | 49 | 2 | 20 | 68 | 23 | 6 | 3 |

| Greece | 4 | 36 | 31 | 28 | 6 | 13 | 4 | 77 |

| Hungary | 13 | 53 | 4 | 29 | 11 | 5 | 2 | 82 |

| Ireland | 53 | 24 | 23 | 0 | 85 | 0 | 0 | 15 |

| Italy | 62 | 26 | 1 | 11 | 56 | 40 | 1 | 3 |

| Latvia | 25 | 30 | 35 | 10 | 23 | 58 | 19 | 0 |

| Lithuania | 13 | 48 | 28 | 11 | 22 | 58 | 21 | 0 |

| Luxembourg | 12 | 67 | 19 | 3 | 2 | 15 | 0 | 83 |

| Malta | 22 | 72 | 5 | 1 | 50 | 0 | 0 | 50 |

| Netherlands | 77 | 18 | 2 | 3 | 39 | 0 | 5 | 55 |

| Poland | 34 | 49 | 16 | 0 | 24 | 38 | 38 | 0 |

| Portugal | 47 | 9 | 11 | 34 | 15 | 66 | 13 | 7 |

| Romania | 18 | 45 | 30 | 7 | 52 | 34 | 2 | 13 |

| Slovakia | 26 | 40 | 16 | 18 | 0 | 76 | 24 | 0 |

| Slovenia | 14 | 31 | 21 | 35 | 7 | 43 | 44 | 5 |

| Spain | 9 | 31 | 7 | 54 | 8 | 2 | 4 | 86 |

| Sweden | 34 | 54 | 0 | 12 | 63 | 0 | 0 | 37 |

| United Kingdom | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 33 | 36 | 10 | 22 | 68 | 13 | 3 | 16 |

In order to facilitate the analysis of the structure of the adjustments in each country, we have calculated the Euclidean distance between the structures of the adjustments of the central and local governments.

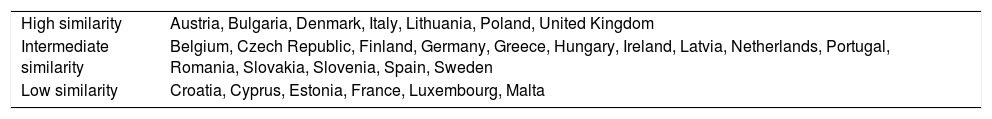

We can distinguish three groups of countries according to the results of the analysis, based on the similarity in the structure of the adjustments between the two levels of government.

From Table 6 some relevant results are:

- -

Only six UE countries have a low similarity in the structure of the adjustments between the two levels of government.

- -

The ten countries that declare different accounting bases in central and local governments according to Table 1, present a low and an intermediate similarity in the structure of the adjustments between the two levels of government. This situation highlights the importance of adjustments related to accrual.

- -

Bulgaria and Greece have a low convergence at central and local level (Table 4), however, they show high and intermediate similarity in the structures of their adjustments to the two levels of government.

- -

Ireland, Lithuania, Hungary, Portugal, Romania, Spain and Sweden have an intermediate similarity, although they have low convergence (Table 4) in one of the two levels of government.

Similarity by countries in the structure of the adjustments between central and local governments.

| High similarity | Austria, Bulgaria, Denmark, Italy, Lithuania, Poland, United Kingdom |

| Intermediate similarity | Belgium, Czech Republic, Finland, Germany, Greece, Hungary, Ireland, Latvia, Netherlands, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden |

| Low similarity | Croatia, Cyprus, Estonia, France, Luxembourg, Malta |

In EU countries three systems of public accounting information operate: the budgetary system, accrual-based financial accounting and macroeconomic accounts. The comparison between the figures derived from national budgetary systems and information based on accrual of macroeconomic aggregates is specified in the tables that regularly publishes EUROSTAT. This comparison, which presents different categories of adjustments for each country, is no doubt an effective indicator of the distance or gap between both information systems.

Since September 2014 the new ESA10 has come into force and this fact raises the important task of reviewing the state of convergence of accounting systems at central and local governments.

We have carried out different analytical methodologies to study the convergence of public accounting systems in the EU. First we have analyzed the convergence from two different perspectives, global, (for eight specific adjustments listed in EDP Notification Tables) and partial (for each adjustments categories) and for central and local governments. For each country we calculate a global index and partial indexes for both, central and local governments. Secondly, we apply an alternative model based on the distance between the adjustments of each country and the extreme situation, that would imply null adjustments. As a supplementary, we focus on the relative weight of adjustments by country and for each level of government.

By the analysis of the data available after the entry into force of the new ESA10, 2014 and 2015, the research presented in this paper can conclude the following:

- -

The only country with maximum convergence between budget and national accounts is the UK, both at central and local levels.

- -

At central level, the most important adjustments are accrual-related adjustments. Nevertheless, at local level, it can be noted the low value of accruals adjustments, going down from being the most important adjustment to occupy the third place in importance. This circumstance is related to the fact that nine countries declare the accrual criteria as a basis of recognition at the local level vis-à-vis only two countries at the central level.

- -

Bulgaria and Greece are in the group of smaller convergence, both at central government level and at local level.

- -

Austria and Germany have high convergence rates at the central and local levels, while the remaining countries have different levels of convergence at central and local levels.

- -

A clear link between the convergence of public accounting systems and cultural and administrative traditions in the EU (Anglo-Saxon, Continental, Nordic and Eastern European) has not been found, highlighting a significant diversity in this regard within the EU.

- -

The importance of adjustments differs between countries and areas of government. Adjustments connected to recognition criteria (accrual or others), particularly significant from the point of view of the approach to GAAP, rank first in importance at the central government level, but are less significant at the local level.

- -

Finally, it can be concluded that the application of the 2010 ESA criteria in the period under review does not contribute significantly to the approximation of the information presented by the two public accounting systems considered, with respect to ESA 95, according to the findings of this paper and other empirical studies carried out by the authors previously.

The authors declare no conflicts of interest.