After the approval of Law 35/2015, the insurer is obliged to submit motivated offers in cases of traffic accidents and the possibility of requesting an extrajudicial expert advice from the Institutes of Legal Medicine in case of disagreement with the previous one.

ObjectiveThe objective of this paper is to describe the differences between the motivated offers of insurers and the forensic reports of the 409 extrajudicial expert advice requested to the Institute of Legal Medicine in Valladolid from 2021–2022 and to propose a methodology for comparing.

Material and methodsAll extrajudicial expert advice data from 2021 to 2022 was obtained, analysing the days of personal injury and sequelae and translating them into compensation variables.

ResultsForensic reports are more favourable for traffic injuries in about 81% of cases, granting on average an amount of almost €1400 more. This difference is mainly due to a greater consideration of sequelae, as well as a higher proportion of days of moderate particular damage in the forensic report. However, this difference is more or less accentuated, depending on the company that makes the motivated offer.

ConclusionTranslating the data from the forensic reports and motivated offers to compensation variables, allows us to make a comparison of the differences between both reports, observing that the forensic reports are more favourable than those issued by the insurers, at least in the province studied, and more studies are needed to have a more complete view.

Tras la aprobación de la Ley 35/2015, se obliga al asegurador a presentar una oferta motivada en casos de accidentes de tráfico y la posibilidad de solicitar una pericial extrajudicial a los Institutos de Medicina Legal y Ciencias Forenses en caso de disconformidad con la anterior.

ObjetivoEl objetivo de este trabajo es describir las diferencias entre las ofertas motivadas de las aseguradoras y los informes forenses de las 409 Periciales Extrajudiciales solicitadas al Instituto de Medicina Legal de Valladolid entre los años 2021–2022 y proponer una metodología para compararlas.

Material y métodosSe obtuvieron todos los datos de las Periciales Extrajudiciales de los años 2021–2022, analizando los días de perjuicio personal y las secuelas y traduciéndolos en variables de indemnización.

ResultadosLos informes forenses son más favorables para las lesiones de tráfico en aproximadamente el 81% de los casos, otorgando en promedio una cantidad de casi 1400 € más. Esta diferencia se debe principalmente a una mayor consideración de las secuelas, así como a una mayor proporción de días de daño particular moderado en el informe forense. Sin embargo, esta diferencia es más o menos acentuada, dependiendo de la aseguradora que realice la oferta motivada.

Conclusióntraducir los datos de las Periciales extrajudiciales y Ofertas Motivadas a variables de indemnización, nos permite hacer una comparativa de las diferencias entre ambos informes, observando que los informes forenses son más favorables que los emitidos por las aseguradoras en la provincia estudiada, siendo necesarios más estudios para tener una visión completa.

Organic Law 7/20151 of July 21, which modifies Organic Law 6/1985 of the Judiciary, included among the functions of forensic medical doctors, in art. 479.5.d “the issuance of reports and opinions, at the request of individuals under the conditions determined by regulation.” Thus, Law 35/2015,2 reforming the system for the assessment of damages and losses caused to people in traffic accidents, modified the consolidated text of the law on civil liability and insurance in the circulation of motor vehicles. It was approved by Royal Legislative Decree 8/20043 of October 29, and in its article 7, it obliged the insurer to present a “reasoned offer” (RO) of compensation or, in the case of non-presentation, a “reasoned response,” and regulated the possibility of requesting complementary expert reports in cases of disagreement by the injured party with the RO, “even from the Institute of Legal Medicine.”

The above was specified in Royal Decree 1148/20154 of December 18, which regulates the carrying out of expert reports at the request of individuals by the institutes of legal medicine and medical sciences, in extrajudicial claims for events related to the circulation of motor vehicles, which regulates the procedure for requesting these reports from the Institute of Legal Medicine and Forensice Sciences (ILMFS), and which have been called extrajudicial expert reports. It also establishes a common procedure for the preparation of these expert reports and sets a price as compensation for expert advice. Its article 2.2 specifies that this medical report (MR) must be adjusted to the rules of the system for assessing damages caused to people in traffic accidents, that is, to the content of title IV and the Annex introduced by the Law 35/2015.

Now that time has passed since the implementation of the practice of extrajudicial examinations for the resolution of discrepancies between the insured and the insurer in traffic accidents outside the jurisdictional area, it would be interesting to compare whether or not forensic doctors abide by what has been previously valued by the insurance company and whether there are any differences in the valuation. A methodological stumbling block occurs with the need to compare the different concepts introduced by the new Annex in Law 35/2015, such as damages, moral damages, various types of sequelae, and even diverse needs, in which sometimes compensation is not provided for a specific quantifiable amount, but for an interval, or on other occasions issues unrelated to medical–legal expertise are included, such as the adequacy of a home. In our opinion, the problem can be solved if a comparative methodology is used in which the compensation amount specified univocally in the scale prevails. Compensation for temporary injuries and sequelae are added, and the resulting amount is the one that is compared between the RO and the corresponding MR.

The main objective of this study is to describe the differences between the RO of the insurers and the MR of the extrajudicial expertise requested from the ILMFS. Another objective is to propose a methodology for comparing these differences.

Material and methodsA retrospective descriptive study was conducted of the extrajudicial expert reports registered from 1 January 2021 to 31 December 2022 in the Valladolid Directorate of the ILMFS of Palencia, Salamanca, and Valladolid. In other words, those presented for registration on those dates, but that may have correspond to accidents that occurred in other years. The study included data from extrajudicial investigations that generated a MR. Data from registered extrajudicial expert reports which were filed but did not generate a MR were excluded, due to withdrawal or denial, lack of documentation, etc.

A total of 409 extrajudicial cases are analysed.

The variables analysed in both the RO and the MR, considered as compensatory, are exclusively the following:

- −

Days of basic personal injury.

- −

Days of moderate personal harm.

- −

Days of serious personal injury.

- −

Days of very serious personal injury.

- −

Functional sequelae.

- −

Aesthetic sequelae.

Other data included were:

- −

Insurance entity.

- −

Date of birth.

- −

Sex.

- −

Date of the accident.

- −

Date of submission of the request for an extrajudicial expert report.

- −

Date of completion of the MR.

The compensation variables were translated into their amount with the criteria and rules of the system introduced by Law 35/2015, i.e., based on age and the sequelae score, and the amounts of compensation for the days of personal damage. To proceed with this calculation, the updates of the amounts established by the resolutions of the General Directorate of Insurance and Pension Funds for the corresponding year were used.5–9

The Microsoft Excel program was used to record the variables, their graphic description, and the arithmetic and statistical calculations. The chi-square statistic was performed on the data on sequelae, days of injury, and compensation to compare the data of the RO with those of the MR.

ResultsIn the period studied, a total of 439 requests for extrajudicial expert reports were received. Of these, 30 were filed. Therefore, a total of 409 193 registered in 2021 and 216 in 2022 were analysed.

Most of the expert reports analysed were from traffic accidents that had occurred in 2021 (53%), with the following being 2020 (27%) and 2022 (17%). Three per cent were from previous years.

The mean age of the injured at the time of the accident was 43 years SD (standard deviation)±14. The most represented age ranges were 36–45 years and 46–55 years, with 25.43% of cases in both age ranges, with 72.13% of victims between 26 and 55 years old. 11.25% were 25 years old or younger, 10.51% were between 56 and 65 years old, and the rest were 66 years old or older.

There was a slight predominance of female victims (52.07%) in the total period analysed, since, although in 2022 the predominance was of male victims (54.92%), in 2021, 59.07% of victims were female.

The average number of days that elapsed from the accident to the request from the ILMFS was 258 days.

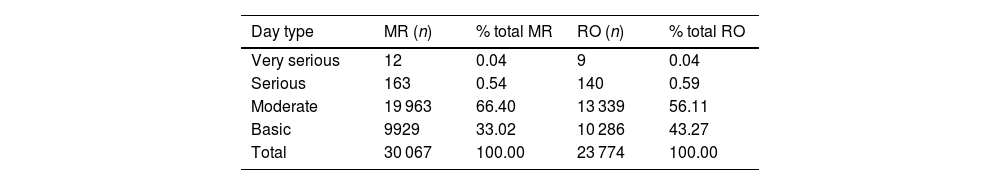

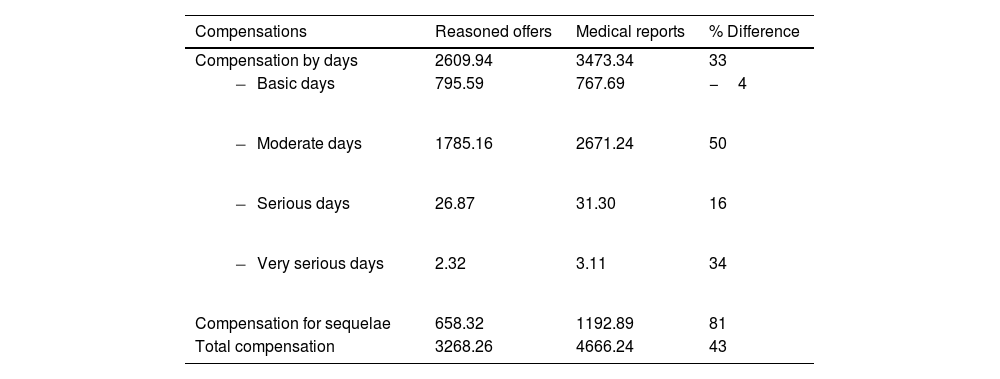

When analysing the days of personal harm (Table 1), a difference in the assessment of the days of moderate and basic harm between the RO and the MR was observed, which was not so accentuated in the case of the days of serious and totally residual harm in days of very serious damage. The higher percentage of evaluation of moderate type days in the MR compared to the RO stands out (66.4% vs. 56.1%) associated with a lower percentage in the basic type days (33% vs. 43.3%). The chi-square statistic was performed on the days of damage in all its degrees assessed in the RO and the MR, where a statistically significant difference (p<.05) was observed.

Total sum of the days of personal injury in the medical reports and reasoned offers and their percentage of the total days.

| Day type | MR (n) | % total MR | RO (n) | % total RO |

|---|---|---|---|---|

| Very serious | 12 | 0.04 | 9 | 0.04 |

| Serious | 163 | 0.54 | 140 | 0.59 |

| Moderate | 19 963 | 66.40 | 13 339 | 56.11 |

| Basic | 9929 | 33.02 | 10 286 | 43.27 |

| Total | 30 067 | 100.00 | 23 774 | 100.00 |

MR: medical report; RO: reasoned offer.

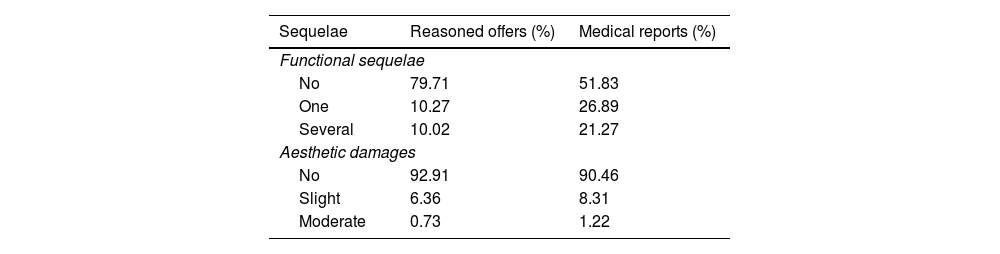

In the ROs, functional sequelae were considered in 20.29% of cases; In the MRs, the existence of sequelae was assessed in 48.16% (Table 2). The chi-square statistic was calculated on the functional sequelae, which resulted in a statistically significant difference (p<.05). Sequelae for aesthetic reasons were assessed in 7.09% of RO, compared to 9.54% of MR. Unlike the previous case, the application of the chi-square statistic in aesthetic sequelae resulted in a non-significant difference (p>.05). In the reports that assessed aesthetic damage, the majority of sequelae were due to slight aesthetic damage, 89% of the RO and 87% of the MR, compared to 10% and 12.8%, respectively, of moderate damage; no medium, important, very important or extremely important damages were reported in either the RO or the MR.

If we look at the compensation calculated by the amount of the compensation variables according to the method described, the calculation of the difference between the compensation of the MR and the RO amounts to a total of 80.93% of positive differences, that is, those, in which the medical–forensic assessment is greater than that of the RO. In 12.47% there is no difference and in 6.60% it is negative.

Table 3 shows that the average value of total compensation for the MRs is €4666.24, compared to €3268.26 for the ROs, which represents a difference of 43%. Analysing the differences in amounts by compensation variable, the largest are observed both in compensation for sequelae, which is 81% higher in the MR than in the RO, and in compensation for days of moderate particular harm, 50% higher in the MRs. The MRs value an average of €1192.89 in compensation for consequences compared to €658.32 for the ROs.

Average compensation (in Euros) from medical reports and reasoned offers and the percentage of their differences.

| Compensations | Reasoned offers | Medical reports | % Difference |

|---|---|---|---|

| Compensation by days | 2609.94 | 3473.34 | 33 |

| 795.59 | 767.69 | −4 |

| 1785.16 | 2671.24 | 50 |

| 26.87 | 31.30 | 16 |

| 2.32 | 3.11 | 34 |

| Compensation for sequelae | 658.32 | 1192.89 | 81 |

| Total compensation | 3268.26 | 4666.24 | 43 |

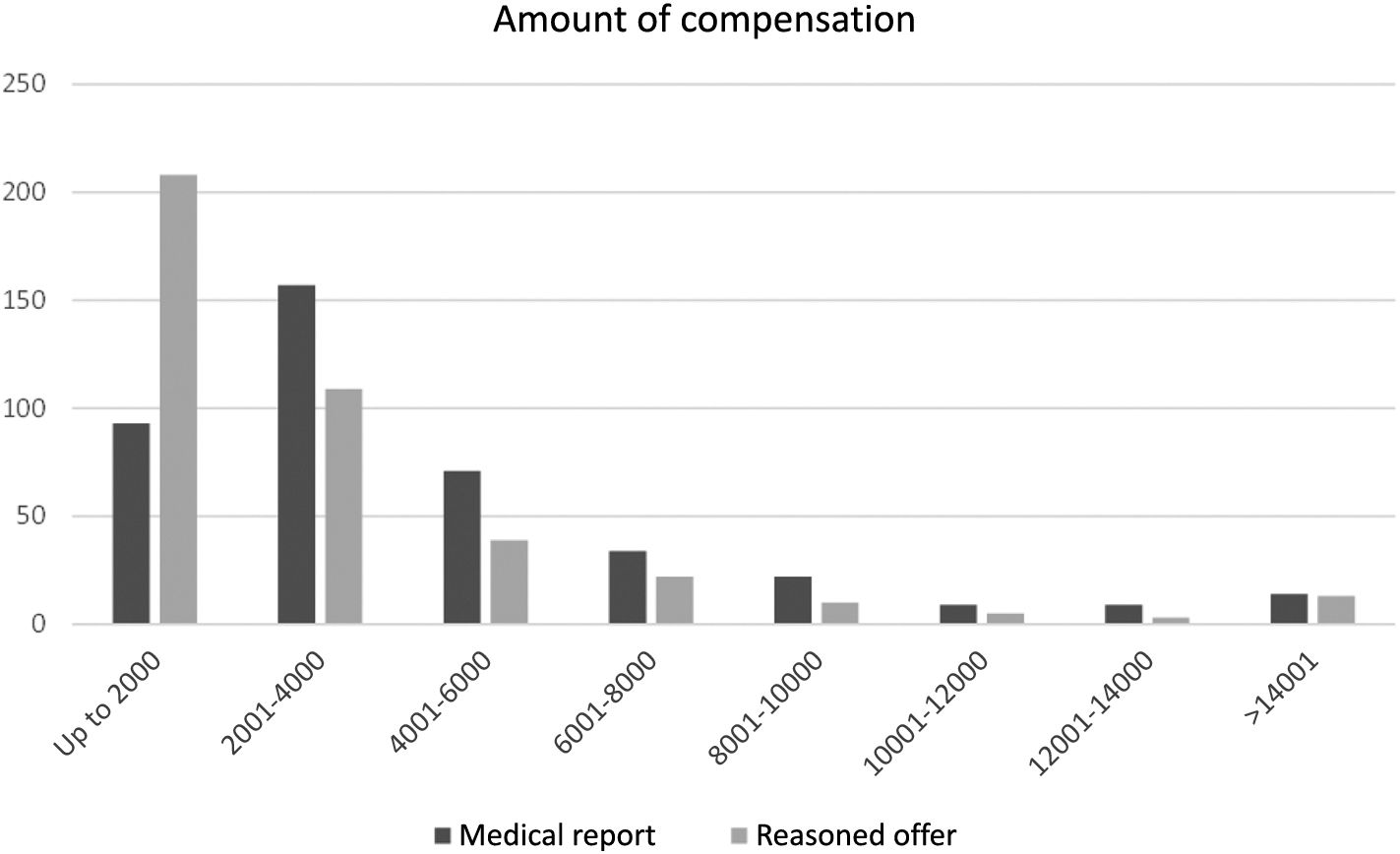

If compensation intervals of €2000 are established, it is observed that the compensation interval most frequently granted in the RO is less than €2000, with the most frequent interval for MRIs being between €2001 and €4000. The results are shown in Fig. 1.

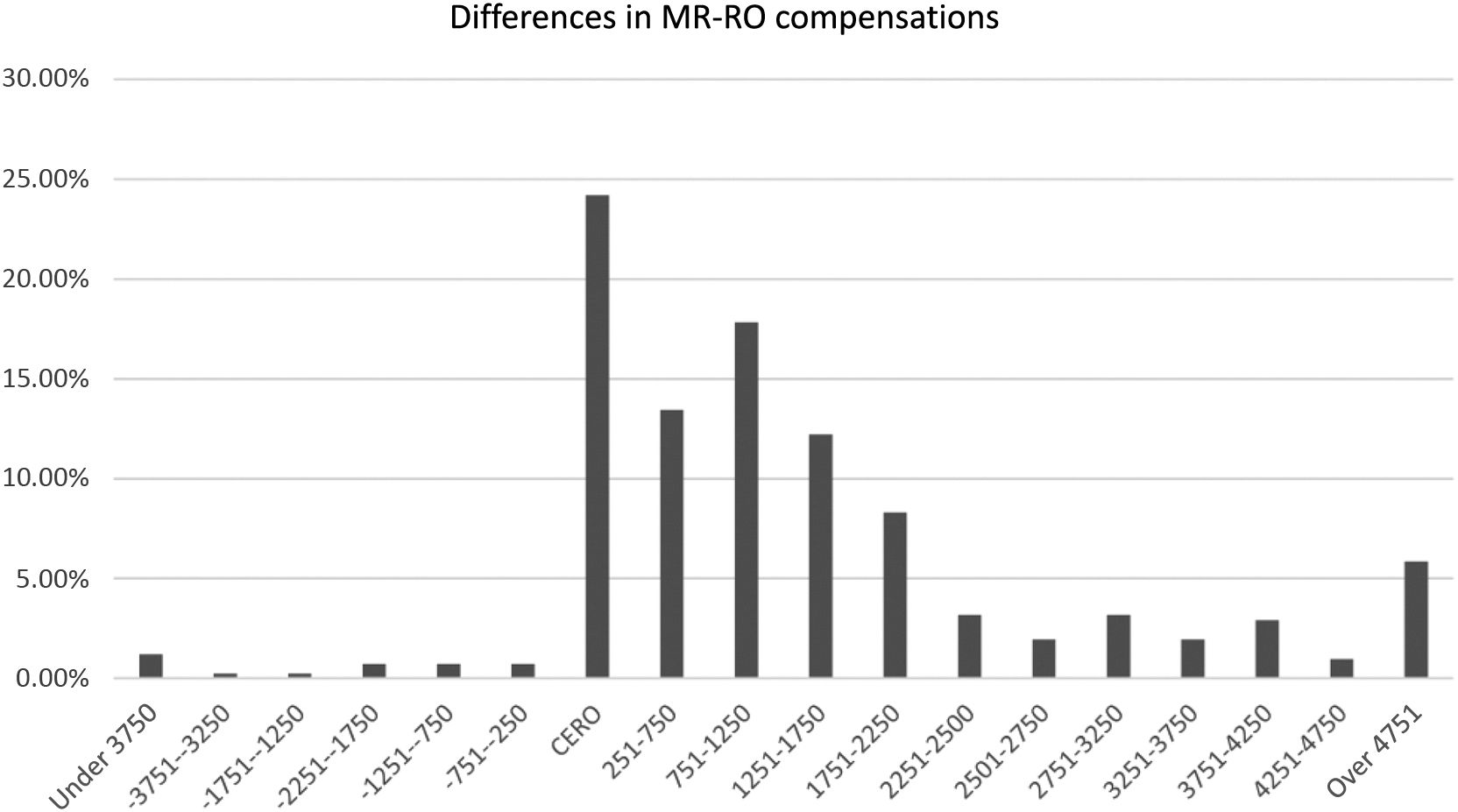

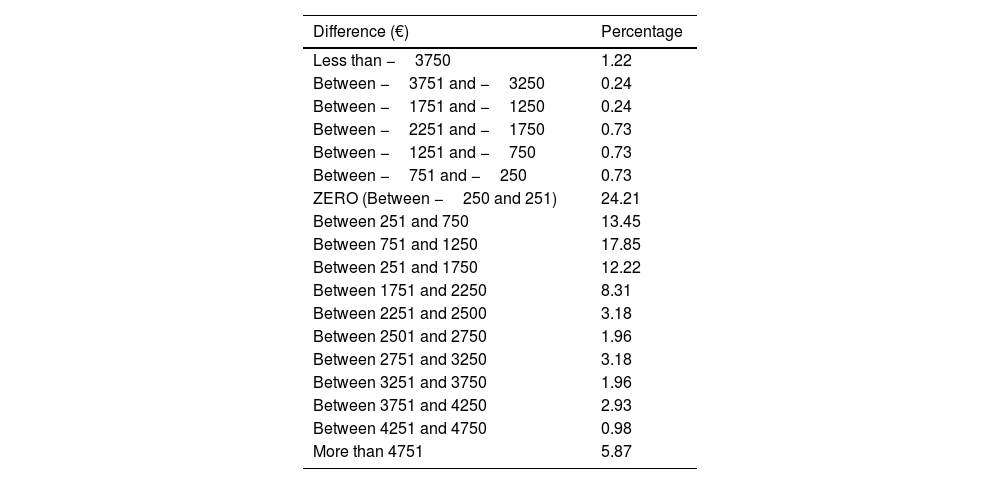

Table 4 analyses the difference between the total compensation amounts of the MRs and the ROs, which are described in intervals of €500. In this table, the interval between −250 and €250 has been considered as “zero”; 24.21% of values fall in this interval. 43.52% of the total medical expert reports have between €251 and €1750 more than the insurer's offer. The graphical representation is offered in Fig. 2.

Difference between the medical report and reasoned offer.

| Difference (€) | Percentage |

|---|---|

| Less than −3750 | 1.22 |

| Between −3751 and −3250 | 0.24 |

| Between −1751 and −1250 | 0.24 |

| Between −2251 and −1750 | 0.73 |

| Between −1251 and −750 | 0.73 |

| Between −751 and −250 | 0.73 |

| ZERO (Between −250 and 251) | 24.21 |

| Between 251 and 750 | 13.45 |

| Between 751 and 1250 | 17.85 |

| Between 251 and 1750 | 12.22 |

| Between 1751 and 2250 | 8.31 |

| Between 2251 and 2500 | 3.18 |

| Between 2501 and 2750 | 1.96 |

| Between 2751 and 3250 | 3.18 |

| Between 3251 and 3750 | 1.96 |

| Between 3751 and 4250 | 2.93 |

| Between 4251 and 4750 | 0.98 |

| More than 4751 | 5.87 |

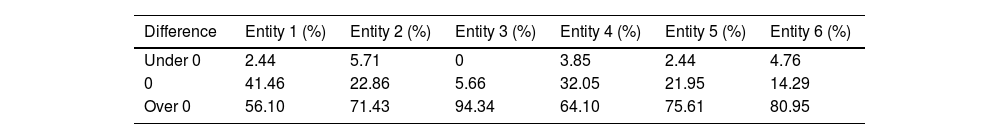

During the period studied, extrajudicial expert reports were requested in which 30 insurance entities were involved. Of them, the 6 with the most requests represent 65% of the ROs.

If the difference between the RO and the MR is analysed by an insurance entity, an evident variation between entities is observed; The broken down data for these 6 main ones are shown in Table 5. In this case, the interval between €-250 and €250 is considered “zero,” as before. The chi-square statistic is calculated, which results in a significant difference between the frequency of the different compensations offered depending on the company (p<.05).

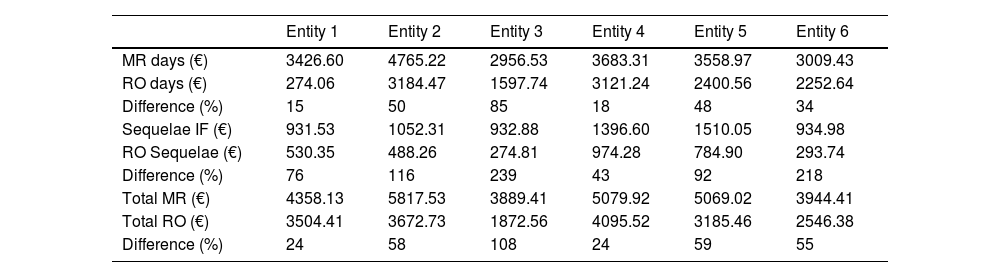

Further to this, the average of the compensations of all the ROs from each of these 6 main insurers was calculated and compared with the average of the compensations that were valued by the forensic doctors in those same extrajudicial expert reports (Table 6). If the amounts were separated by days of personal injury and sequelae, it was observed that these differences remained in both cases.

Average compensation (in Euros) from the medical report and reasoned offer by days of damage and sequelae and by insurers and their difference between the compensation from the medical report with respect to the reasoned offer in the overall cases of each entity.

| Entity 1 | Entity 2 | Entity 3 | Entity 4 | Entity 5 | Entity 6 | |

|---|---|---|---|---|---|---|

| MR days (€) | 3426.60 | 4765.22 | 2956.53 | 3683.31 | 3558.97 | 3009.43 |

| RO days (€) | 274.06 | 3184.47 | 1597.74 | 3121.24 | 2400.56 | 2252.64 |

| Difference (%) | 15 | 50 | 85 | 18 | 48 | 34 |

| Sequelae IF (€) | 931.53 | 1052.31 | 932.88 | 1396.60 | 1510.05 | 934.98 |

| RO Sequelae (€) | 530.35 | 488.26 | 274.81 | 974.28 | 784.90 | 293.74 |

| Difference (%) | 76 | 116 | 239 | 43 | 92 | 218 |

| Total MR (€) | 4358.13 | 5817.53 | 3889.41 | 5079.92 | 5069.02 | 3944.41 |

| Total RO (€) | 3504.41 | 3672.73 | 1872.56 | 4095.52 | 3185.46 | 2546.38 |

| Difference (%) | 24 | 58 | 108 | 24 | 59 | 55 |

MR: medical report; RO: reasoned offfer.

The request for an expert assessment of bodily injury at the ILMFS, by legal imperative, must be accompanied by an RO, with the result that this study has the advantage of being able to extract all the necessary data for case-by-case comparison and individually between the assessments carried out in the RO and those carried out by forensic doctors, within the same sample of extrajudicial expertise processed.

We have not found another study to compare our results to, other than the one carried out by Prió-Silvestre et al. in Catalonia.10 In ours, the time elapsed between the accident and the request from the ILMFS was 258 days, very close to the 268 days reflected in the Catalan study. The average age we found was 43 years, also very close to theirs. Regarding the difference between the extrajudicial expert reports carried out by forensic doctors and the RO, in our case, 80.93% are higher than those of insurance companies, somewhat less than the percentage observed in the Tarragona division, which was 91.5%. In our observation, 6.85% received less compensation than that of the company, compared to 2.83% of theirs.

In the reasoned report of the Monitoring Commission of the Bodily Harm Assessment System, the statements collected by the victims' lawyers and victims' associations were included, regarding “that often some forensic doctors, in application of Royal Decree 1148/2015, of December 18, establish lower valuations than those proposed by the actual insurance company and that the main purpose of such action is to prevent them from requesting further services.”11 We understand that the results of both studies contribute to refuting this hypothesis, at least in the areas studied, by comparing the assessments of insurance companies and those issued by forensic doctors.

For a better analysis of this difference, it is considered that the comparison of a single variable is clearer than the section-by-section comparison. It is proposed that this comparison variable be the sum of the compensation corresponding to the days of personal injury in its different degrees and for the sequelae, both functional and aesthetic. This calculation is carried out for the following reasons:

- −

One of the fundamental principles of the new valuation system establishes the full repair of damage, ensuring compensation for damages and losses. It is, therefore, consistent with the purposes of the law.

- −

It allows a clearer comparison of the difference in cases in which the total number of days is the same or similar, but the typology of days valued is different.

- −

A comparison of cases in which the total number of days is different, due to the inclusion of a prior stabilisation sequela is possible. Failure to do this would result in the paradox of including a lower than real expert valuation.

- −

The decision by the injured party and the company to request an extrajudicial expert opinion from the ILMFS is usually due to the presence of disagreements regarding the amount of compensation derived from the compensatory variables. Thus, the calculation in this study enables us to analyse the scope of said amount and its difference.

- −

Although it does not assess all the concepts introduced by the new annex included in Law 35/2015, since many of them depend on the sequelae score, it can be considered a good estimate of the real compensation amount.

When quantifying this difference, the medical–forensic reports grant on average an amount of €1398.25 more than the insurance companies. If the elements of this difference are analysed, it stands out that in 48.16% of the forensic expert reports the existence of sequelae has been considered, compared to 20.29% of the assessments by insurance entities. Forensic MRs value an average of 81% more compensation for sequelae than insurance companies. Consideration of personal injury days also contributes to the difference, mainly due to the greater proportion of cases in which moderate days are granted in the case of the MR, although the compensation for days of basic personal injury is somewhat lower in the MR.

Although biases may exist in the calculation of the average compensation due to substantial differences in the calculation of some it, the assessment of the differential between the RO and the MR through analysis of their intervals allows us to rule out that the differences detected are due solely to an excess of individual compensation in a specific case. We may also observe the distribution of the said difference. An interval of €500 has been considered appropriate for descriptive purposes, since €250 above or below the compensation amount calculated by the RO expresses that there are practically no differences between the medical–forensic reports and those of the insurance company. Out of the percentage without differences estimated with the reasoned offer, the highest is in the interval between €751 and €1250, followed by €251–750.

It has already been said that major expert variations are observed between the different insurers, which is consistent with the findings of Herrera Ligero et al. on interobserver variability.12 The name of the company was not included in this study, mainly due to impartiality, but also because the MRs on which the RO was based were made by different experts in different areas and it was not the object of this investigation to flag up specific professionals. The only intention was to show the variability that the forensic doctor faces when evaluating the elements offered by the RO, in which statistically significant differences were observed. It stands out that 41.46% of the expert reports from company 1, followed by 32.05% from company 4, are considered “zero,” that is, they present little difference with the expert reports carried out by forensic doctors. It contrasts with the “zero” interval of company 3, which represents only 5.66% of the expert reports.

When the difference between the average compensation by the forensic doctors and the offers of these 6 insurers is studied, both companies 1 and 4 maintain the minimum of differences, with compensations that differ by 24% from those of the doctors forensics, while for company 3, on average, a 108% higher compensation is recognised.

ConclusionsIn view of the above data, it can therefore be concluded that, during the years 2021 and 2022 in the province of Valladolid, the MRs were more favourable for those injured in traffic accidents in almost 81% of the cases, granting an average amount of approximatey €1400 more. This difference is fundamentally due to a greater consideration of sequelae, as well as a greater proportion of days of moderate personal damage in the MR. However, this difference is more or less accentuated, depending on the company that made the RO.

FundingThis research did not receive specific aid from public sector agencies, the commercial sector, or non-profit entities.

Out thanks to the director of the Institute, Dr. Victoria García Santos, for her reading and comments and to all the forensic doctors of the ILMFS of Palencia, Salamanca and Valladolid, Directorate of Valladolid, who undertook the assessment reports of the bodily harm assessed in this study.

Please cite this article as: Domínguez González C, Sánchez Pérez JD. Study of the difference between the assessment of bodily injury by insurance entities and by extrajudicial experts advice in Valladolid during the years 2021 and 2022. Presentation of a comparison methodology. Revista Española de Medicina Legal. 2024. https://doi.org/10.1016/j.remle.2023.11.005.