Banking union is the most ambitious European project undertaken since the introduction of the single currency. It was launched in the summer of 2012, in order to send the markets a strong signal of unity against a looming financial fragmentation problem that was putting the euro on the ropes. The main goal of banking union is to resume progress towards the single market for financial services and, more broadly, to preserve the single market by restoring the proper functioning of monetary policy in the eurozone through restoring confidence in the European banking sector. This will be achieved through new harmonised banking rules and stronger systems for both banking supervision and resolution that will be managed at the European level. The EU leaders and co-legislators have been working against the clock to put in place a credible and effective set-up in record time, amid intense negotiations (with final deals often closed at the last minute) and very significant concessions by all parties involved (most of which would have been simply unthinkable just a few years ago). Despite the fact that the final set-up does not provide for the optimal banking union, we still hold to its extraordinary political value and see its huge potential. By putting Europe back on the right integration path, banking union will restore the momentum towards a genuine economic and monetary union. Nevertheless, in order to put an end to the sovereign/banking loop, further progress in integration is needed including key fiscal, economic and political elements.

The outbreak of the financial crisis in early 2007 showed that the European institutional architecture was weak to properly address the new structural risks. The lack of predictable and harmonised rules to handle the banking crisis together with defensive ring fencing supervisory practices resulted in an increasing financial market fragmentation whereby the bank's funding cost became highly dependent on the strength of their sovereign, thus reinforcing a feedback loop between banks and sovereigns. A widely used way to explain this process was that banks were “European in life but national in death”.

Deficiencies in the European governance are not new. There is vast literature stating that the European Monetary Union was flawed. Perhaps, it would have rather been qualified as a union of banknotes. The euro is the mean to ensure that we can pay with the same currency all over the 19 Member States of the monetary union. However, this crisis has revealed that there are differences between the “euros” of each Member State. The lack of perfect money's fungibility reflects financial fragmentation. Those differences appear because two assets which should be completely fungible and interchangeable within the monetary union are not perceived as of the same quality. Instead of assessing the asset quality by taking into account individual entity's risk considerations, a purely country risk prevails and this is in essence contrary to the spirit of integration. Therefore, until the money is truly fungible, we will not be indifferent having deposits in one country or another, and we will not live in a true monetary union.

Against this background, banking union emerges as another step forward towards financial integration and towards the perfection of the euro construction. It can be qualified as a major milestone as it implies moving well beyond the harmonisation of rules, which already applies to the European Union of 28 Member States. Indeed, it involves a significant transfer of sovereignty from countries sharing a common currency to new supranational authorities, thus enhancing the Economic and Monetary Union (EMU) governance. All with a big component of private-sector solidarity, never before seen in Europe. It is worth noting that this project is forward looking, designed to solve not the problems of the past but rather to prevent and address those that may arise in the future.

In this paper we explain why banking union emerged as the definitive solution to the European crisis conundrum, what type of banking union was finally politically possible and how it was built up in record time. Even if not fully fledged and complete, the agreed banking union 1.0 is fit for purpose at this stage and will deliver significant benefits already in the short-term, by helping mitigate the two biggest threats to the EMU at this moment: financial fragmentation, which still remains at unacceptably high levels (European Central Bank, 2014) and the vicious circle between sovereigns and their banks. Born out of necessity, the banking union 1.0 that the leaders have recently agreed upon had been politically unfeasible for many years and would had been simply a dream for many EMU fathers. Even if it will not suffice to fully solve these two problems, and will therefore require further development (a banking union 2.0 with a common safety net) and some other complementary measures (Sicilia et al., 2013) it still represents the biggest cession of national sovereignty since the creation of the euro, and thereby stands as a true breakthrough in the quest towards a fully integrated Europe.

2Preamble: the necessity and the virtueThe creation of the European Monetary Union (EMU) and the introduction of its single currency in 1999 symbolised a crowning of the Single Market project and marked the starting point for the most impressive financial integration process ever undertaken in Europe (Padoa-Schioppa, 2002). In the first nine years of the euro, integration indicators showed an extraordinary improvement, especially in the wholesale domain, assisted by enhanced pan-European market infrastructures and a significant regulatory convergence promoted under the Financial Services Action Plan (2001–05). Between 2000 and 2008 total intra-EU foreign exposures grew over 200%, and by 2007 40% of the euro area's interbank claims stood against non-domestic EU banks. Although a genuine integration process remained elusive for the retail market (mainly due to regulatory, fiscal and institutional barriers across Member States), the strong convergence registered in banks’ funding costs translated into reduced spreads in deposit and loan rates across the euro area. There was probably an overshooting in the convergence of sovereign spreads that prevented market discipline from working properly during the boom years and exacerbated the subsequent correction (as shown by the case of Greece), but overall the convergence process was healthy and consistent with a single currency in a single, integrated, financial market (Fig. 1).

But a significant part of the integration achieved between 2000 and 2008 was lost in a flash with the outbreak of the crisis. By the time it had fully spread over to Europe, spurring a deep sovereign debt crisis in 2011, integration levels were back to those seen before the introduction of the euro, putting at risk its achievements as well as those of the internal market. Between 2007 and 2011, the average exposure of core European Union banks to periphery banks dropped by 55% and the percentage of cross-border collateral used for Eurosystem credit operations dropped by one third (returning to 2003 levels). It is important to note that part of this fragmentation was the result of supervisory actions tending to ring fence the core banking systems and protect them from potential contagion from the periphery. These actions, although rational from a purely domestic financial stability mandate, validated market concerns at that moment and put at risk the euro itself. They created a financial stability problem far larger than the one they intended to avoid. These supervisory measures even triggered a query by the Commission on possible (and illegal) limits to capital follows.

In the summer of 2012 the situation was so critical for certain sovereigns that only the European Central Bank (ECB) strong determination and supporting action eased the rumours of a break-up of the euro. This was instrumental in stopping financial fragmentation, together with the announcement of a common strategy towards a genuine economic and monetary union, which included as the key first step the creation of a banking union (Abascal et al., 2013).

By September 2012 the European Commission (the Commission) had already tabled its proposal for the first master pillar of banking union: a Single Supervisory Mechanism. As for the other master pillar, a Single Resolution Mechanism, the proposal would be tabled at a later stage, in July 2013. These two pillars have already been passed by legislators, with a speed of action which constitutes an absolute record by any EU legislative standards. The single supervisor became fully operational in November 2014 after the identification of the legacy assets of the European banking industry, a key precondition for a safe and credible banking union. Moreover, the ECB gains not only microprudential powers but also some macroprudential tools to address any financial stability concern at the eurozone level, which would contribute to address financial fragmentation problems. The Single Resolution Board was set up in January 2015 but it will not undertake any resolution action until January 2016, when a single fund will also be constituted. Both pillars are built over the foundations of EU-wide harmonised micro-prudential rules embedded under a new single rulebook for the EU. And in the mid-term, banking union should with all likelihood be underpinned by a third pillar of single deposit protection, a common safety net that, although not yet in the roadmap, will be made possible once advances towards fiscal union are materialised (Box 1).

The European miracle

| The European Union dream was born in the aftermath of World War II, under the shared ideals of a varied group of people including visionary statesmen such as Jean Monnet, Robert Schuman, Konrad Adenauer or Alcide de Gasperi. These “founding fathers” devoted their lives to persuading their peers about the benefits of achieving a full economic and political integration in Europe one day. Sixty years on we are not there yet but Europe has undeniably come a long way by constructing the most advanced form of supranational integration achieved to date. |

| This singular metamorphosis is the result of an evolutionary process that was always guided by the rule of law and, admittedly, too often dictated by one crisis after another. All the steps towards further integration were costly and took time as they had to be founded on new Treaties that had to be democratically ratified by all Member States. From the seminal Paris Treaty (signed in 1951 by the “six founders” of the European Coal and Steel Community) and the Treaty of Rome (which constituted the Common Market in 1957) until the latest Lisbon Treaty (ratified in 2009 by 27 Member States), more than 50 treaty revisions have taken place to enhance the EU's governance and widen its functional and geographical scope.a |

| For more than thirty years (1957–1992) the European Economic Community and its Common Market established under the Treaty of Rome facilitated the free movement of people, goods and services across national borders. But Member States could still control capital exchanges, so the free movement of capital was indeed limited. This impasse was broken in 1986 by the Single European Act (SEA), which revised the Treaty of Rome to add momentum towards European integration and to complete the internal market. Among other things, the SEA reformed the European institutions and created new Community competencies: it established the European Council, enhanced the powers of both the Parliament and the Commission, and streamlined decision-making at the Council of Ministers. In the financial domain, this facilitated, among other things, the adoption of the Capital Liberalisation Directive (1988),b which introduced the principle of full liberalisation of capital movements between Member States as of July 1990. Moreover, in 1989 the Second Banking Directivec introduced the principles of a single banking license, home country control on solvency and mutual recognition. |

| In 1993, the ratification of the Maastricht Treaty completed the Single Market and created the European Union, marking a new and decisive turning point in the European integration project. The new EU consisted of three pillars: the European Community, a Common Foreign and Security Policy, and police and judicial cooperation in criminal matters. This opened the way to political integration: the concept of European citizenship was introduced and the powers of the European Parliament reinforced. In the economic/financial domain, the freedom of capital principle was definitively enshrined through a general ban on any direct or indirect restriction to the free movement of capital and payments, and it was directly applicable (with a few temporary exemptions) under the broadest scope of all the Treaty's fundamental freedoms, as it also covered the movement of capital between Member States and third countries. |

| Moreover, clear rules were defined for the creation of a single currency under a new European Monetary Union, with the main purpose of solving the “inconsistent quartet” dilemma,d which referred to the impossibility for the EU to combine a Single Market (with free trade and free capital) with independent domestic monetary policies and fixed exchange rates. |

These successive treaties did not simply amend the original text but also gave rise to other texts that were combined with it. In 2004 the existing European treaties were consolidated into a single text known as the Treaty of Functioning of the European Union (TFEU).

This idea was characterised, in 1982, by Tommaso Padoa-Schioppa, a father of the euro and considered by many as the one who provided the main intellectual impetus behind the single currency.

With the outbreak of the global crisis financial integration in the EU started to reverse at a steady pace. Fragmentation appeared first in the banking industry and then spread to the sovereign markets (Abascal et al., 2013). The fragile conditions of banks translated into a squeeze in the unsecured interbank market and then into a financial fragmentation problem with contagion to the domestic fiscal sector. As the most distressed sovereigns struggled to access primary markets, banks’ repo prices became extremely dependent on the nationality of the counterparties and the collaterals, initiating a vicious circle between banks and sovereigns that would become the worst nightmare of European leaders.

The immediate reaction of most EU Member States fell short, taking into account that the foundations of the euro were tumbling: they first denied the European dimension of the problem and, then, unable to agree on a coordinated response, they only half-admitted its seriousness. Many EU countries started to bail-out their failing banks under a purely nationalistic approach, which exacerbated fragmentation and ultimately placed a huge burden on their fiscal budgets. Between October 2008 and December 2012 the Commission (DG COMP) took more than 400 decisions authorising State Aid measures to the financial sector in the form of recapitalisations or asset relief measures amounting to €592bn (4.6% of EU 2012 GDP).1 Between 2009 and 2013 the Commission also adapted its temporary State Aid rules for assessing such public support to banks through six new communications.2 But the titanic efforts of the Commission to rein in protectionist stances via State Aid rules proved insufficient to mitigate the absence of EU-wide coordination. Nationality was once again mattering to the markets. As macroeconomic and financial conditions deteriorated further, the vicious circle between banks and sovereigns was perpetuated, putting some peripheral economies in an impossible position (Fig. 2).

Until then, the ECB's accommodative monetary policy and generous liquidity assistance seemed to be sufficient to keep control of the problem; but during the first half of 2012 it became clear that mere coordination was not sufficient to sustain the monetary union. In the European summit of 28–29 June 2012, the European Council announced a plan to construct a more genuine EU, encompassing a banking union, a fiscal union, and also economic and even political union. The first step of this ambitious plan would be the construction of a banking union to repair the euro's institutional deficiencies, in particular the lack of unified systems for banking supervision and resolution. That same day, the Eurogroup asked the Commission to urgently bring forward a proposal to establish its first pillar, a Single Supervisory Mechanism (SSM), and called on the Member States to reach an agreement on this proposal before the end of 2012. In addition, in order to break the vicious circle between sovereigns and banks, the Eurogroup set out the possibility of direct recapitalisations of banks by the European Stability Mechanism (ESM) without involving increasing national deficits, once the single supervisor was established.

The banking union announcement (and the associated possibility of a direct ESM recapitalisation of ailing banks in this context) represented a clear sign of the political will to advance towards a stronger and more integrated Europe, but it proved insufficient to calm the markets. There was suspicion that it would simply remain a declaration of interest by the EU leaders, and the lack of a formal proposal was perceived as a sign of immaturity. Meanwhile, market stress seemed to have reached a point of no return amid escalating financial tension and rumours about a disintegration of the euro. On 26 July the situation had become so critical that the ECB's President, Mario Draghi, came forward publicly to commit to do whatever it takes to preserve the integrity of the euro. This public commitment of unconditional support by the ECB, underpinned by the announcement of the launch of the Outright Monetary Transactions programme in September, was enough to silence rumours about the end of the euro and to ease financial tensions. The markets turned their attention back to the banking union project with renewed optimism and have since remained extremely vigilant on the development of the process, always on the lookout for possible delays in the roadmap agreed in June 2012 to create a banking union based on two main pillars: single supervision and single resolution. But, as we shall see, the roadmap has, for the most part, been kept largely on track.

The Commission tabled its proposal for the SSM in September 2012, and only three months later, in December, the Member States reached an agreement on the proposal at an extraordinary ECOFIN. The following day, the final version of the report “Toward a Genuine Economic and Monetary Union” was endorsed by the European Council (see Box 2), giving a definitive official impulse to banking union.

The “Four Presidents’ Report” towards a Genuine Economic and Monetary Union

See Fig. 3.

| The EU strategy to advance towards more integration by completing the Single Market and the Economic and Monetary Union (EMU) was established in late 2012 in a report, “Towards a Genuine Economic and Monetary Union”, whose final version was endorsed by the European Council in December 2012. The report (known as the “Four Presidents’ Report”), was produced by the President of the European Council, Herman Van Rompuy, in collaboration with the Presidents of the ECB, the Commission and the Eurogroup. Van Rompuy presented a first vision of the report's roadmap in June 2012, in an attempt to calm the markets by giving signals about the strong determination of the EU leaders to advance towards ‘more Europe’, not less. The report envisaged the creation of a banking union, a fiscal union and an economic union, all of them underpinned by stronger democratic legitimacy, as the way to get out of the crisis by building a stronger, more integrated Europe. The strategy, endorsed that December, proposed the following time-bound roadmap: |

| Building block 1. A more integrated financial framework (banking union): The European Council foresaw agreement on the main legislations of the single rulebook (Capital Requirements CRDIV-CRR package, Bank Recovery and Resolution Directive and the Directive on Deposit Guarantee Schemes) and the operational rules for the direct recapitalisation of banks by the European Stability Mechanism (ESM) by 2013, as well as the establishment of the Single Supervisory Mechanism (SSM). According to the text, a single resolution authority and a single private resolution fund (now Single Resolution Fund – SRF-) should be set up in 2014, with the same scope than the SSM. The ESM would be able to provide a credit line to the single resolution authority as a public, but fiscally neutral, backstop. There is no mention of the Single Deposit Guarantee Scheme, only a call for a quick adoption of the new (harmonising) Deposit Guarantee Scheme (DGS) Directive. This roadmap covers a 18–24-month period and is clearly designed to address the urgency of the situation while taking into account the legal constraints set by the current EU Treaty. This explains, for example, why the single DGS was finally dropped from the official roadmap, despite having been included at earlier stages as a key pillar of banking union. With the exception of the role to be played by the ESM in providing a public backstop to the SRF, the rest of the banking union roadmap has so far been met on time. |

| Building blocks 2 and 3. Integrated economic policy and budgetary frameworks (economic and fiscal unions): These two building-blocks are interlinked as fiscal integration lies at the core of economic integration. The report foresaw that the “Two Pack” and the “Six Pack”, as well as a framework for ex-ante coordination of economic policies, should be implemented before 2014. In a second stage, the economic coordination of structural reforms should be reinforced by giving the arrangements a mandatory contractual nature for all euro area countries. These contractual arrangements would be supported with temporary financial assistance, using funds independent from the multiannual financial framework. At a final third stage, after 2014, the text foresees giving the EMU a formal fiscal capacity through a centralised shock-absorbing fund (“euro area budget”) and common decision-making powers on economic policy issues. Much progress is expected in the development of these building blocks in October 2014 when the European Council will discuss the main elements of the system of mutually agreed contractual arrangements and associated solidarity mechanisms. |

| Building block 4. Legitimacy (political union): The Report of the Four Presidents ends by concluding that all these three building blocks will have to be accompanied by stronger legitimacy and accountability at the level at which the decisions are to be taken. With regard to financial integration, as policy-making will gather mostly at the European level, the parallel involvement of the European Parliament should be increased. With regard to the fiscal and economic integration blocks, appropriate mechanisms will be established for close cooperation between the national Parliaments and the European Parliament. |

| According to the roadmap set in this highly strategic document, banking union marks the point of departure of a new European journey towards higher forms of integration. In its current version, the banking union 1.0 will deliver a more complete euro, an EMU 2.0. We hope that a Single Deposit Guarantee Scheme will be introduced within a few years, delivering a fully stable banking union 2.0. An EMU 3.0 would include the banking union 2.0 as well as a fiscal union and some form of economic and political union as well. Along the way, the rule of law will be guiding this breakthrough process, imposing the need for one or several Treaty revisions that might prove challenging and take time, but the target seems clear. |

In late 2008 the G-20 embarked on a financial regulatory overhaul to address the main regulatory and supervisory weaknesses that had been identified along the crisis. From a policy perspective, the main objective of the reform was threefold: (1) reducing the probability of banks’ failure (by increasing their solvency and liquidity and realigning their risk-taking strategies with the social goal of financial stability), (2) reducing the costs of bank failures (by providing good resolution frameworks in which the threat of no bail-out is credible), and (3) ensuring financial stability by reducing the complexity and opacity of financial markets, while monitoring and mitigating systemic risk through a more explicit and active macro-prudential set-up.

In Europe this resulted in a frantic legislative activity. Between 2009 and 2013, the Commission tabled close to 40 proposals, of which almost 30 have already been adopted by co-legislators (Fig. 4).3

The main purpose of the EU regulatory reform was to introduce a new framework with harmonised rules, a new single rulebook aligned with the principles agreed at the G-20 level and applicable to all the financial institutions operating in the EU. Such harmonisation of rules across the EU-28, which is key to preserve the integrity of the Single Market, is ensured by (i) making a wider use of directly applicable EU Regulations instead of Directives,4 and (ii) leaving the technical development of many provisions of these Directives and Regulations, to rules with a lower rank in the legislative hierarchy (Levels 2 and 3) but which are generally applicable to Member States.5 By mitigating national discretions through mostly directly applicable rules this approach reduces compliance costs and ring fencing practices, thereby preserving the level playing-field in the EU banking sector and mitigating the scope for regulatory arbitrage (IMF, 2013) (Fig. 5).

By providing harmonised rules the single rulebook offers a solid foundation from which to achieve the unification of rules and policies that are required by a banking union. These new harmonised rules seek to: (1) increase the EU banks’ strength and resilience through enhanced prudential requirements and supervision, (2) reduce the costs of bank failures by providing an effective resolution framework that seeks both to avoid bank bail-outs and to improve deposit protection; and (3) manage systemic risk through a more explicit and active macro-prudential policy framework. In the areas of relevance for banking union the reference regulatory pieces are:

- 1.

The Capital Requirements CRDIV-CRR package, which includes the latest revision of the Capital Requirements Directive (CRD) and a new, directly transposable, Capital Requirements Regulation (the CRR). Both pieces implement the new global standards on bank capital (the Basel III framework) into the EU legal framework and entail tougher capital requirements and new requirements on liquidity and leverage with the purpose of reducing the probability of failure of banks. The CRDIV-CRR package entered into force in January 2014 (including national transpositions of the Directive) and is now undergoing and extensive technical development process, mainly carried out by the European Banking Authority (EBA).

- 2.

The Bank Recovery and Resolution Directive (BRRD),6 which makes possible the orderly resolution of ailing banks at the minimum cost to the tax-payer. In the first instance banks will have to activate their recovery plans when financial weaknesses appear in the entity. Moreover, supervisors will have powers to intervene early to manage them (early intervention). Resolution authorities will also prepare resolution plans that ensure the continuity of critical functions of banks that cannot be recovered in the early intervention phase. These resolution authorities would take control of the institution and resolve it through the use of any of these tools: (i) sale of business, (ii) bridge bank, (iii) asset separation and (iv) bail-in (debt conversion or write down). As a private backstop, there will be a resolution fund built up with banks’ contributions (with a total capacity of at least 1% of the covered deposits of the Member State). The resolution fund will be used to cover resolution costs up to 5% of the bank liabilities and only after a minimum 8% bail-in has been applied over such liabilities. Bail-in will be applied according to the following hierarchy of claims: (i) shares, (ii) subordinated debt, (iii) senior debt and uncovered corporate deposits (i.e. over €100,000), and (iv) uncovered Small and Medium Enterprise deposits as well as uncovered retail deposits (both over €100,000). Deposits below €100,000 are guaranteed by the Deposit Guarantee Scheme. Public aid is allowed as a backstop in cases of systemic risk or financial stability risks and after a minimum 8% bail-in has been applied with very limited exceptions related to financial stability concerns. The BRRD entered into force in January 2015 (the bail-in tool will apply since January 2016).

- 3.

A recast version of the Directive on Deposit Guarantee Schemes (DGSD), which seeks to harmonise the funding and coverage of DGS arrangements across the EU,7 with effect since January 2015. Bank deposits will continue to be guaranteed up to €100,000 per depositor per bank if the bank fails. Moreover, it improves the 2009 DGSD by (i) simplifying and harmonising the scope of coverage (type of covered deposits) and pay-out procedures (with gradual reduction in the pay-out period from the current 20 days to 7 working days by 2024), (ii) clarifying responsibilities to improve insurance payments for cross-border banks, (iii) allowing the use of the DGS for early intervention and resolution purposes and (iv) introducing common rules to ensure a strong financing of the DGS. Regarding this last point, the Directive requires Member States to collect from banks, within ten years starting from 2015, risk-based contributions to build up an ex-ante funding capacity equal to at least 0.8% of the system's covered deposits. If ex-ante funds are insufficient the DGS will collect immediate ex-post contributions from banks, and, as a last resort, will also have access to alternative funding arrangements such as loans from public or private third parties. The Directive also introduces voluntary loans between DGS from different EU countries (Box 3).

Box 3.The EU legislative maze

Most of the EU Directives and Regulations are approved through the “ordinary legislative procedure”, which covers 85 areas of activity and involves the participation of the Commission and the two EU co-legislators: the European Parliament and the Council of the EU (Council). The process starts upon a Commission proposal, which is then scrutinised by both co-legislators. Once they define their internal positions (which might take months) they embark on a negotiation process called “trilogues” which involves the Parliament, the Council and the Commission and which ends up once a common final text has been agreed. The whole process can be rather lengthy and extend over several months or years. When things go well the text is passed after the first round of negotiations (first reading) or “early” second reading (after trilogues), but even in this case the process can be extremely lengthy, due to the need to get 28 Member States in the Council, several different Parliamentary groups (which in turn are composed of different political parties coming from different States) and the EU authorities themselves, all of them with potentially divergent interests, to agree democratically on difficult and strategic issues.a As can be seen, in the fields related to banking union the process was relatively quick. The CRDIV-CRR package (the backbone of EU banking prudential regulation and a particularly thick regulatory piece) was passed two years after the Commission had made its proposal (July 2011–July 2013). A similar timescale applied for the BRRD (it took one and a half year, June 2012–April 2014). However, for the Single Supervisory Mechanism (SSM) Regulation, the Council managed to define its position in just three months (Sept 2012–Dec 2012) but then it took until September 2013 to get the Parliament on board (see section on SSM). Finally, on the Single Resolution Mechanism it only took nine months for co-legislators’ to reach agreement (July 2013–March 2014), which represents an absolute record given the extremely sensitive nature of the mutualisation aspects involved. aIn the 6th legislature (2004–2009) 72% of Level 1 texts were adopted at first reading, after an average 15-month period, and another 9% at the early second reading, with an average of 27 months to be passed. Files that went into the second and third reading (generally involving the participation of a formal Conciliation) could take 30–40 months to be passed. However, a significant improvement was recorded in the 7th legislature (2009–14), with more than 84% of procedures being adopted at first reading and 92% before a formal second reading.

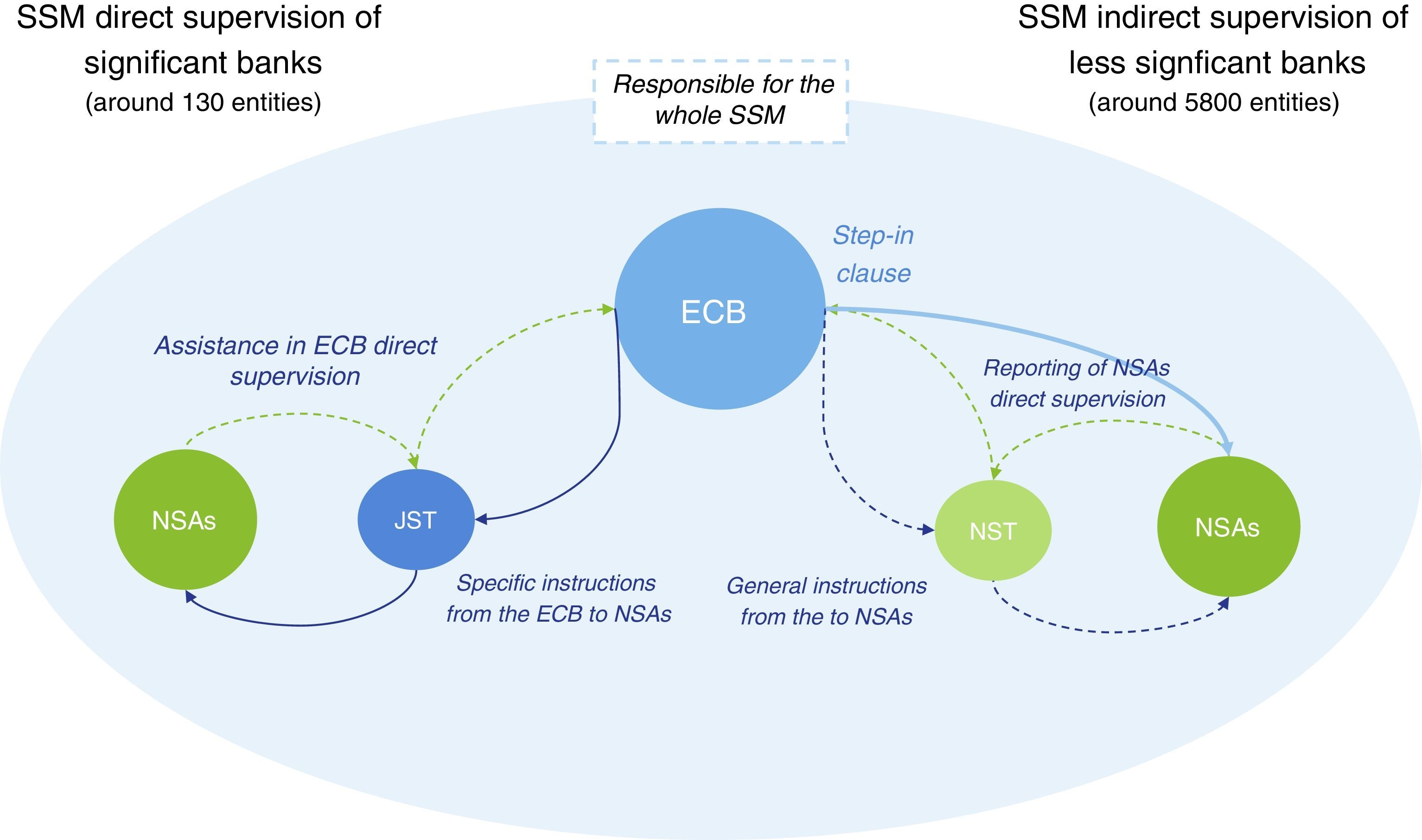

The Single Supervisory Mechanism (SSM) is the first master pillar of banking union. It is a game changer for banking supervision as it involves creating, at last, a European centralised system which encompasses both ECB and the National Supervisory Authorities (NSAs) of the participating Member States. The main purpose of the SSM is to ensure the safety and soundness of the European banking system by putting an end to national ring-fencing and forbearance in supervisory practices. The ECB supervises directly only the “significant credit institutions”, but it works closely with the NSAs to supervise all other credit institutions and may decide, at any time, to take responsibility for a less-significant bank in order to ensure the overall functioning of the SSM. Since the ultimate decision powers remain within the ECB, a unified interpretation and application of supervisory practices across the EMU is ensured. The ECB applies the CRDIV pack (and more generally the single rulebook) under unified criteria, allowing for a better comparability across banks.

5.1Why a single supervisor for the eurozone and why the ECB?The founding fathers of the euro were well aware of the imperfect nature of the original EMU, in particular of the lack of consistency between the unified monetary policy and the fragmentation of banking rules and supervision along national lines. This institutional weakness was amplified by the fact that, in the EMU, the banking sector provides the most important channel for the transmission of monetary policy. Some experts were concerned about the unprecedented nature of this “experiment” and knew that, in the absence of common bank rules and supervision, the increased financial integration spurred by the euro could turn the financial instability in any Member State into a threat for the whole EMU (Padoa-Schioppa, 1999). One of the most active participants in this debate was Tommaso Padoa-Schioppa, an eminent expert in the European economic and monetary integration who had been co-rapporteur of the Jacques Delors committee on the Monetary Union (1989) and also held important responsibilities at the Commission and the ECB. Due to his insistence, the Maastricht Treaty (1993) had indeed left the door open for a possible expansion of supervisory responsibilities of the ECB following a simplified procedure to be activated by the Council.8 Still, the use of this “enabling clause” was seen as a last resort in case the interaction between the Eurosystem and national supervisory authorities turned out not to work effectively. Later on, when the European System of Central Banks (ESCB) was being designed (1998), bank supervision was included as the fifth basic task in its draft statute.9 But the idea was fiercely opposed by Germany (and other countries) for fear that it could interfere with the ECB's primary goal of price stability, so, in the end the relevant legal texts only mentioned prudential supervision as a non-basic task of the ECB (Lastra, 2001).

Although the potential negative implications of a misalignment between a European monetary policy and national supervisory mandates were “known unknowns”, it was thought that enhanced cooperation at the EU level in national bank supervisory practices would suffice to ensure the financial stability of the region, at least in the absence of a severe crisis. But when the global financial crisis broke out, Padoa-Schioppa was among the first to anticipate the damaging consequences for the stability of a euro zone which, by 2008, already had highly interdependent banking sectors. As an Italian Finance Minister, he started to call for a unified regulatory and supervisory framework for euro zone banks, a banking union to complete and support the EMU (Angeloni, 2012). Although some ECB directors shared his concerns, he did not get support from his peers in the different Member States.

Later on the EU leaders decided to consult a high-level group of experts, which still declined the idea of giving the ECB direct supervisory competences due, inter alia, to implementation difficulties and potential conflicts of interest with the ECB's primary mandate of price stability (de Larosière et al., 2009). Instead, they proposed to tighten financial supervision and make it more EU-wide by creating a European System of Financial Supervision (ESFS). This new system would reinforce the mechanisms for enhanced coordination at the EU level in prudential supervision, while broadly maintaining national supervisory mandates (see Box 4). It would also include new elements of an EU macro-prudential supervision.

The European System of Financial Supervision (ESFS)

See Fig. 6.

| The ESFS was established in 2010 to improve co-operation in prudential regulation and supervision by enhancing and upgrading the existing Lamfalussy Committees. It reinforces the delegation of supervisory powers to the lead home/consolidating supervisors and gives new European agencies specific coordination powers. |

| It has a micro-prudential pillar which is composed of the National Supervisory Authorities (NSAs) and three new European Supervisory Authorities (ESAs). Namely, the European Banking Authority (EBA), European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority (EIOPA). The three ESAs work together with the NSAs to ensure harmonisation in the rules and their application. It also has a macro-prudential pillar which includes a new European Systemic Risk Board (ESRB), hosted by the ECB, whose main role is to prevent and mitigate systemic risks in the EU by means of ex ante warnings and recommendations.a |

| The ESFS has been in operation since January 2011 and is now undergoing its first periodic review by the Commission (as mandated by law). Among the elements that could be the object of revision there is the limited role of the ESAs in (i) addressing cases of breach of EU law, (ii) helping ensure a higher consistency in primary regulation; (iii) addressing consumer protection. The limited democratic legitimacy and accountability of ESA decisions before the EU and national parliaments has also been pointed by experts as a weakness of the EFSF. |

| By introducing new elements of centralisation the ESFS represents a big step towards a more effective EU supervision. However, it fails to provide a genuinely centralised EU supervisory system since national authorities continue to retain competence for most of the decisions, with the ESAs/ESRB having quite limited powers and resources in the end. While enhanced cooperation might work well in normal times, in crisis situations national authorities have incentives towards national bias and to engage in non-cooperative strategies that are not aligned with the overall EU interest (Chiodin et al., 2012). |

For a detailed analysis about the ESFS structure see Financial regulation and Supervision. A post-crisis analysis (Oxford Press, 2012).

In the summer of 2012, on the verge of the euro's disintegration, the EU leaders finally saw the limits of enhanced cooperation in banking supervision to overcome the crisis and recognised the need to have a single bank supervisor with a eurozone-wide mandate of financial stability.

The significant cession of sovereignty implied by a single supervisor required it to have a solid legal basis. Although it was clear that an ex-novo entity was the optimum in terms of teeth and independence, there was no time to wait for the lengthy process implied by the required Treaty revision. In this context, the aforementioned “enabling clause” proved instrumental in making the single supervisor possible. This clause pointed directly to the ECB, but there were also practical reasons supporting the ECB “candidacy” as the single supervisor, including its knowledge about the functioning of the financial system (due to its lender-of-last-resort role and its mandate on financial stability), the fact that most national supervisors are already part of the Eurosystem, and its institutional prestige based on proven independence and credibility. On the other hand, the main risks associated with having the ECB as the single supervisor had to do with the potential conflicts of interest in the conduct of monetary policy and banking supervision and the potential loss of the ECB's overall credibility and independence.

Article 127.610 of the Treaty on the Functioning of the EU (TFEU) imposed two additional constraints on the design of the SSM. First, it states that the ECB can assume specific (i.e. not all) prudential supervisory functions over banks and other financial institutions, except for insurance firms. This automatically limited the scope of potential action of the ECB in banking supervision, in both the functional and the institutional dimensions. For this reason the activities and firms that could fall under the remit of the ECB were limited to those considered to be indispensable to ensuring a coherent and effective application of the EU's prudential rules. Second, the article establishes that only the Council could confer the new supervisory mandate on the ECB, which explains why the SSM Regulation did not go through the ordinary legislative procedure and is, in fact, a Council regulation (i.e. the Parliament has not an actual say in the legislative process).

5.2How is the SSM structured and what were the main elements driving negotiations?On 12 September 2012 the Commission made a legislative proposal to establish a Single Supervisory Mechanism in the eurozone (with voluntary adhesion by non euro Member States). The proposal included two legal texts, one Council Regulation to confer, in application of the article 127.6 of the TFEU, a range of financial supervisory powers to the ECB; and one Council and Parliament Regulation to change the voting rules at the EBA in order to avoid an excessive power of the SSM countries in the decision-making process of this institution.

Negotiations on the SSM Council Regulation11 were relatively quick. They mainly focused on (i) potential conflicts of interest between the ECB's supervisory and monetary policy functions, and (ii) the institutional scope (i.e. the scope of entities under the direct supervision of the ECB). Even if unanimity among all Member States was required, these issues were addressed with relative speed and a final Council agreement was closed in December 2012. But, unexpectedly, the Regulation concerning the change in the EBA voting rules would prove much more problematic, all the more since the Parliament decided to use it as a bargaining chip to indirectly influence some aspects related to the SSM Council Regulation (notably to ensure appropriate accountability of the ECB before the Parliament). For this reason the Parliament's green light to the SSM regulatory package was postponed until September 2013, once it had signed an Inter-institutional Agreement with the ECB on accountability matters.12 After that it was immediately passed by the Council and the SSM Regulation entered into force in November 2013.

The final SSM framework can be described along three main dimensions: geographical, institutional and functional (Angeloni, 2012). Regarding the geographical scope, the Commission had proposed a mandatory participation of all EMU Member States and a voluntary participation of the rest of the EU Member States (under a “close cooperation” formula) with a view to safeguarding the internal market. This proposal was kept mostly unchanged, although some aspects of the governance were adapted in order to provide non-eurozone countries (which are not represented in the Governing Council of the ECB) with a say in SSM matters.

Regarding the institutional scope, the Commission wanted the ECB to supervise directly all banks in the SSM, with the assistance of NSAs. This prompted a hot debate, due to the reluctance of some countries (notably Germany) to accept such a broad institutional scope. Germany found this approach neither practical (there are over 6000 banks in the eurozone) nor politically palatable and wanted to restrict the ECB's remit to the biggest (systemic) entities. But France, Spain and other countries feared that such a “two-tier” system would jeopardise the level playing-field and would not prove effective in breaking the vicious circle between banks and sovereigns. Finally a “differentiated approach” was agreed, by which the ECB would directly supervise the “significant” eurozone banks (around 130 entities representing about 85% of the European banking assets) whereas the NSAs would directly supervise the rest. The approach incorporates some key safeguards to ensure that the SSM was sufficiently European, in particular the ECB's power to step-in at any non-significant bank, at any time and on its own discretion, in order to ensure the overall efficient functioning of the SSM.13 This ensures that, ultimately, the SSM is not a “two tier system”.

The SSM Regulation establishes that the banks directly supervised by the ECB are those which have requested or received EU funds and those which are deemed “significant” by fulfilling any of the following conditions: (i) having total assets over €30bn, or (ii) having total assets representing over 20% of domestic GDP, unless total assets are below €5bn; or (iii) having significant cross-border activity; or (iv) are considered as systemic by national supervisor. Apart from these thresholds, at least the most significant three banks in each country had to fall under the remit of the ECB. The status of “significant bank” will be periodically reviewed. The last list was published in September 2014, two months before the ECB took over its supervisory powers, and included 123 banks (Fig. 7).

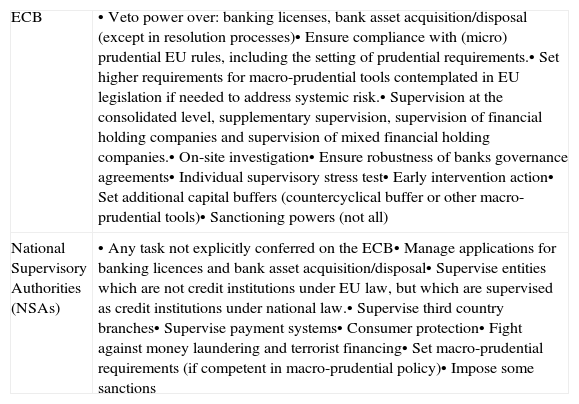

Regarding the functional scope, a clear division of tasks between the ECB and the NSAs has been established (see Table 1). Basically the ECB is considered as the supervisory competent authority in prudential matters, and therefore has all the powers available to competent authorities under the Capital Requirements Directive package. The NSAs keep some competences (such as supervision of payments system, consumer protection or anti-money laundering control) that are not directly related to prudential issues, and which are therefore not conferred to the ECB in the SSM Regulation. The NSAs are also bound to assist the ECB it its day-to-day prudential supervisory functions. Finally, national competent authorities retain most powers related to macro-prudential supervision and regulation, although the ECB is given binding powers to impose higher requirements for those macro-prudential tools that are in the CRDIV/CRR packs if necessary. In this sense, it is the national authority that must act in the first instance, but the ECB may decide to add additional requirements (capital buffer or any other macro-prudential measure) when deemed necessary, or when asked to do so by the national authority itself. If it decides to act autonomously (over the national authority), it must duly notify the relevant national authorities of this and shall explain the reasons for its actions if the national competent authority objects. The following table shows the division of tasks between the ECB and the national authorities in relation to the institutions that are directly supervised by the ECB.

Division of tasks between the ECB and the National Supervisory Authorities.

| ECB | • Veto power over: banking licenses, bank asset acquisition/disposal (except in resolution processes)• Ensure compliance with (micro) prudential EU rules, including the setting of prudential requirements.• Set higher requirements for macro-prudential tools contemplated in EU legislation if needed to address systemic risk.• Supervision at the consolidated level, supplementary supervision, supervision of financial holding companies and supervision of mixed financial holding companies.• On-site investigation• Ensure robustness of banks governance agreements• Individual supervisory stress test• Early intervention action• Set additional capital buffers (countercyclical buffer or other macro-prudential tools)• Sanctioning powers (not all) |

| National Supervisory Authorities (NSAs) | • Any task not explicitly conferred on the ECB• Manage applications for banking licences and bank asset acquisition/disposal• Supervise entities which are not credit institutions under EU law, but which are supervised as credit institutions under national law.• Supervise third country branches• Supervise payment systems• Consumer protection• Fight against money laundering and terrorist financing• Set macro-prudential requirements (if competent in macro-prudential policy)• Impose some sanctions |

The SSM governance resembles that of the Eurosystem. A new Supervisory Board was set up within the ECB in January 2014 to plan and carry out the ECB's supervisory tasks, undertake preparatory work and prepare draft decisions that will be adopted by the ECB Governing Council (Fig. 9). The Supervisory Board is separated from the ECB Executive Board (with a separate budget funded with supervisory fees) and is composed of a Chair (appointed for a non-renewable term of five years), a Vice-chair (chosen from among the members of the ECB's Executive Board, to which it shall report on the Supervisory Board's activities), four ECB representatives and one representative from the national supervisory authorities from the participating countries. All these members have one vote (the Chair has a casting vote). Additionally, the Board will be able to invite as observers (without vote) the Chair of the new Single Resolution Board, a representative from the Commission and the EBA.

The Supervisory Board is assisted in its daily work by a Steering Committee composed of eight members (Chair, Vice-chair, an ECB representative and five rotating members representing the participating member states). There is a Secretariat Division and four Directorates General (DG). Two of them (DG Micro-Prudential supervision I and II) conduct the direct supervision of the significant banks, with DG I dealing with those banking groups that have a higher risk profile (measured in terms of risk exposure, complexity and business model) and DG II overseeing the other significant banks. The DG Micro-Prudential supervision III hosts the conduct of indirect supervision over less significant banks, for which direct supervision still is carried out by national supervisors, but with regular reporting to the ECB. Finally, the DG Micro-Prudential supervision IV performs horizontal supervision and specialised functions such as developing methodologies and standards (including on-site inspections), model validation, enforcement and sanctions, crisis management and control of supervisory quality, among others (Fig. 8).

Regarding the decision-making process, it is worth mentioning that, according to the EU Treaty and ECB Statute, the Governing Council is the only ECB body that can take final decisions in the name of the ECB. For this reason the Commission's proposal foresaw the Governing Council explicit approval of any decision taken by the Supervisory Board. However, a group of countries (led by Germany) found that the proposal provided for an insufficient separation between the monetary and supervisory roles within the ECB, and called for further guarantees on this front in order to avoid negative effects on the ECB's credibility. As a result, it was finally agreed that the Supervisory Board's decisions would follow a positive silence procedure, under which they would get automatically adopted unless the Governing Council explicitly rejected them within a defined (short) period and after due (public) reasoning. This positive silence procedure, which mitigates the role of the Governing Council to the maximum extent possible, also seeks to address non-eurozone countries’ concerns about their lack of representation on the Governing Council.

In order to further ensure the separation between supervisory and monetary policy decisions, the Governing Council holds separate meetings (with separate agendas) to take monetary and supervisory decisions. Moreover, a mediation panel (composed of one member per participating EU Member State, chosen from among the members of the Governing Council and the Supervisory Board) will consider appeals against rejections by the Governing Council of decisions by the Supervisory Board.

Apart from the German claims regarding the Supervisory Board independence and the reduced institutional scope, a group of countries, led by the United Kingdom, were concerned about a possible domination of the SSM interests in the decisions taken at the EBA, given that more than half of the EBA members would be under the SSM scope. In September 2012, along with the SSM Regulation the Commission had also tabled a proposal for a Regulation to align the existing Regulation (1093/2010) on the establishment of the EBA to the SSM, in particular to modify the voting modalities at the EBA for decisions requiring a simple majority (those concerning breach of EU law and settlement of disagreements). The idea was to adapt the voting procedure in this case so as to avoid SSM members, which together would have a simple majority, having an overwhelming influence on the final decision. But the Commission proposal did not satisfy non-eurozone countries, and in the end a double majority system prevailed (i.e. at both the SSM group and the non-SSM group) for all decisions taken at the EBA, not only those requiring simple majority but also for those requiring a qualified majority (technical standards, guidelines, recommendations and EBA's budget decisions) except for emergency situations. This implies that no decision can be taken without having the support of at least a simple majority within the non-SSM group, greatly increasing the power of this group. These new voting arrangements will hold as long as the number of non-SSM voting members at the EBA board remains above four. If, due to the establishment of close cooperation with the SSM or by adopting the common currency, the number of non-SSM members falls under this threshold, the requirement of having a simple majority of both groups would be relaxed to a simple majority of SSM members and at least one vote from the non-SSM group.

The ECB will have to introduce a new supervisory culture. For that purpose, it has developed new single supervisory templates and a common Supervisory Manual that comprises (i) principles and procedures of supervision, (ii) the process of supervisory review and the evaluation (SREP), (iii) a system of quantitative and qualitative indicators for risk assessment (RAS) and (iv) the details and objectives of on-site inspections. Along the process of the construction of this new supervisory culture, it will be necessary to guarantee a full transmission of the know–how of national supervisors, take into consideration the particularities of the different geographies and maintain a good relationship with third countries (host) supervisors, in order to maximise the benefits of the mechanism. The costs of this new supervisory framework will be covered by annual fees on banks, based on the risk profile and importance of each entity.

The national supervisory authorities and the ECB, have a mandate with respect to the less and the more significant banks. An ECB Regulation defines the methodology for the identification of the banks that will be directly supervised by the ECB as well as the rules that will govern cooperation between the ECB and the national supervisors within the SSM:

The roles of the ECB and the NSAs are clearly separated with regard to supervision:

- •

Direct supervision of significant banks is carried out by the ECB with the assistance of the NSAs through the Joint Supervisory Teams (JST). Each bank will be supervised by one JST. Under the lead of an ECB coordinator, each JST is composed of several experts from the different NSAs involved (in proportion to the structure of the cross-border banking group in the EU). The JST have responsibility for the day-to-day supervision and are in charge of implementing the ECB and the Supervisory Board decisions with regard to significant banks. Their input will be the basis for the elaboration of draft decisions by the Supervisory board. They will propose inspections, prepare the associated recommendations and lead their follow-up. As a general principle, on-site inspections will be done, on a yearly basis, by staff from the National supervisor, under the lead of a Head of Mission to be nominated by the ECB (DG IV).

- •

Direct supervision of non-significant banks is carried out by the respective National Supervisory Teams in accordance to the ECB's supervisory manual. For the sake of having a more integrated mechanism, the ECB may involve staff from other national supervisory authorities in these teams, which will have to report to the ECB on a regular basis. In this case, unless the ECB decides to take over the supervision of the concerned less significant banks, the supervisory decisions will be taken by the national authorities and reported to the ECB. The SSM Regulation gives the ECB several powers to execute this responsibility: (i) addressing general instructions to NSAs; (ii) requesting information and reporting and (iii) general investigations and on-site inspections, led by on-site inspections teams whose leader would be chosen by the ECB.

But in any case, as already said, the ECB is ultimately responsible for ensuring the well functioning of the SSM, and hence for the supervision of all entities in participating Member States. As such, it is exclusively in charge of assessing authorisations of new banks (and their withdrawals) and acquisitions of participations regardless of the significance of the bank concerned. Any entity willing to obtain banking authorisation or any bank wishing to acquire new holdings shall notify its NSA, which in turn will submit a draft proposal to the ECB to obtain its approval. A different procedure has been settled for the establishment of new branches. In this case, the decision would be taken by the ECB or the NSA depending on the status of the bank.

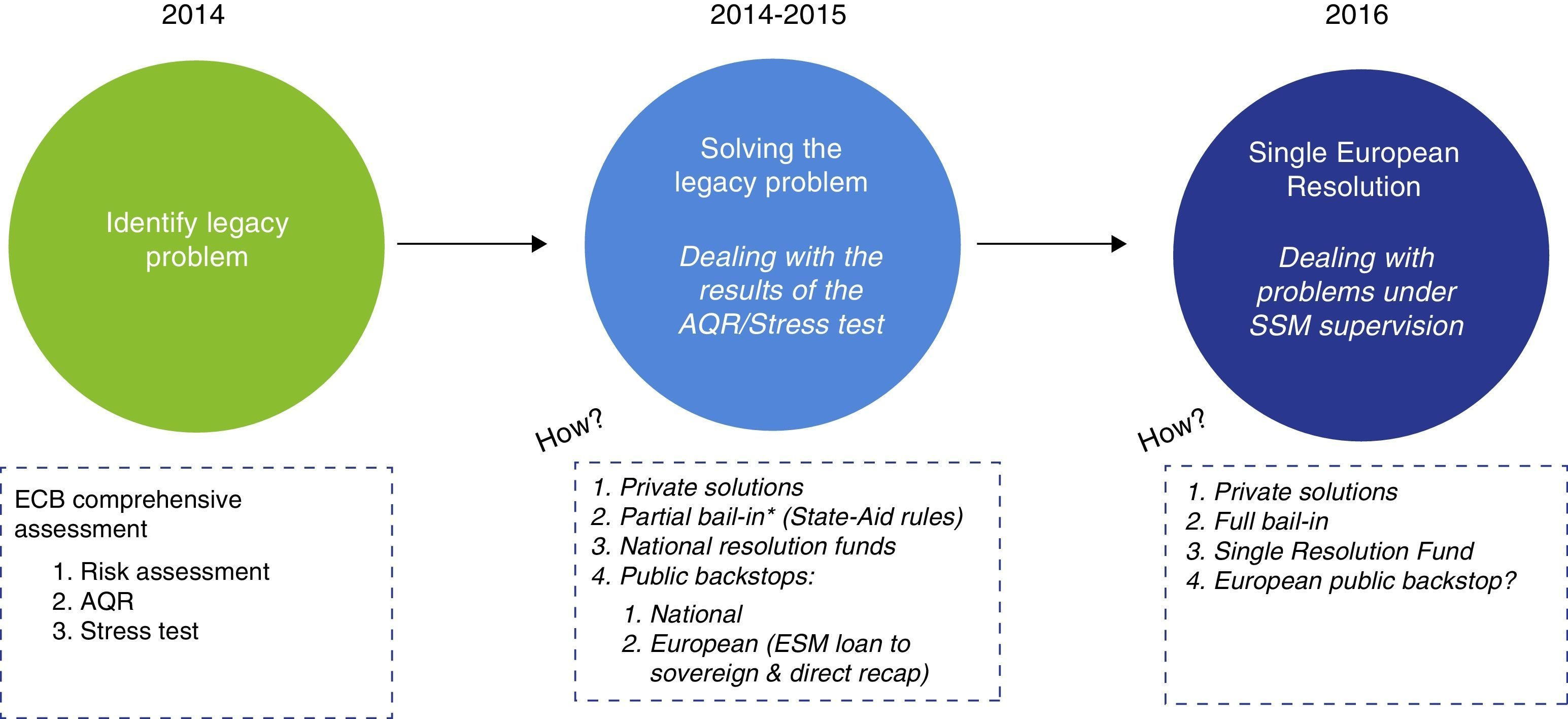

6Intermission II: solving the legacy problemThe ECB, was responsible for conducting, along 2014, a comprehensive assessment of the balance sheets of the most significant eurozone banks. This comprehensive exercise, included a Supervisory Risk Assessment, a Balance-sheet Assessment (including an Asset Quality Review, or AQR) and a Stress Test (jointly with EBA).

The importance of this comprehensive assessment shall not be understated. To some extent the AQR/stress test can be seen as a one shot game which has a certain parallelism with the SCAP exercise undertaken by the US authorities back in 2009 and which definitively restored the confidence in the banking sector of that country. In this sense, the AQR/stress test was instrumental in drawing a line between the past problems of the European banking sector (legacy issues) and a future under which mutualisation of bank resolution costs could be envisaged (if needed) (Fig. 9).

The ECB published the results of the comprehensive assessment on 26 October 2014 https://www.bankingsupervision.europa.eu/banking/comprehensive/html/index.en.html. According to the ECB guidelines any capital shortfall identified as a result of the AQR and/or the baseline scenario of the stress test will have to be covered within 6 months (around May 2015) and using Common Equity Tier 1 (CET1) capital instruments, whereas for those associated to the adverse scenario of the stress test the deadline covers 9 months (August 2015) and suitable strong convertibles will also be accepted.14

As a general principle, capital shortfalls will have to be absorbed through private means in the first instance. Only when private means prove insufficient could a public backstop be activated at the national level. No European mutualisation or financial solidarity should be expected at this stage, except as a very last resort measure in the form of direct or indirect ESM assistance.

In November 2013 the ECOFIN had agreed the following sequence for loss absorption in the context of the recapitalisations aimed at solving the legacy issue:

- 1.

Raise capital from the markets. New issuance of common equity or suitable strong contingent capital.

- 2.

Banks’ balance sheet management. Banks could retain earnings, disinvest from non-strategic assets or adjust their pay-back policy, for example.

- 3.

Partial bail-in. In application of the new State Aid rules (see Box 4), a bail-in would be applied over shareholders and junior creditors prior to any use of public funds. Senior creditors would not be affected. While the rules foresee exemptions on a case-by-case basis, they are confined to addressing concerns of financial stability or lack of proportionality.

- 4.

Public national backstops. State Aid will only come onto the scene as a last resort measure as public support may be needed to ensure an adequate backstop if private sources prove insufficient. These national public backstops will be there to close the loop, and their existence is essential to bring credibility to the AQR/stress test exercise.

- 5.

European assistance. Notwithstanding their primary national dimension, public backstops would be ultimately backed by the ESM, through a credit line to the sovereign (similar to the Spanish programme) which will require applying conditionality on certain financial policies in the perceiving countries. A direct recapitalisation by the ESM would be available as a last resort for viable entities located in countries lacking fiscal room upon more stringent conditionality than in the previous instrument.15

On 10 June 2014 the Eurogroup reached political agreement on the final proposal to confer on the ESM the faculty to directly recapitalise ailing (significant) banks in stressed countries. The final agreement is similar to the preliminary text agreed in June 2013 but it includes a tightening of the preconditions set for the use of the recapitalisation tool. While in 2013 only shareholders and junior bondholders had been formally required to support a bail-in, the final framework sets that, before any ESM direct recapitalisation take place during 2015 (Box 5):

- •

At least an 8% of all liabilities of the bank will have to be bailed-in (including senior debt and uncovered deposits), fully front-loading from 2016 to 2015 the bail-in tool introduced by the BRRD.

- •

A contribution from the national resolution fund of the concerned Member State will be disbursed up to the 2015 target level set up by the BRRD.

The partial bail-in for precautionary recapitalisations

| In the context of the recapitalisations that would take place in order to cover the capital shortfalls identified following the ECB comprehensive assessment between November 2014 and May 2015, it must be noted that the bail-in tool introduced by the BRRD will not be used, as it will not enter into force until January 2016, except for the use of direct recapitalisation by the ESM. |

| However, the revised State Aid rules in force since August 2013 require a burden-sharing by shareholders and subordinated creditors before a Member State can give any state-aid to an ailing bank (senior debt holders are not affected by this principle). This principle will apply in the context of the precautionary recapitalisations. Any exemptions to this general principle will be analysed on a case-by-case basis, and with the sole purpose of preserving financial stability and/or avoiding disproportionate results (for example when the amount of public support is small compared to the risk-weighted assets of the bank and the equity gap has already been significantly reduced via private sources). |

| According to the general burden-sharing principle, for banks having a capital ratio above the regulatory minimum marked by the CRDIV, subordinated debt must be converted into capital before any State Aid. For banks having a capital ratio below the regulatory minimum marked by the CRDIV, subordinated debt must be either converted or written down before any State Aid. However, it is unclear whether a waiver could apply, for example, to a mandatory conversion of subordinated debt of banks whose capital ratio is above the regulatory minimum, but which still need capital to achieve the level required in the forthcoming ECB/EBA stress test exercise, as initially hinted by the ECB on the grounds of three key concerns: (i) that these banks are not technically under resolution (and hence it would not be appropriate to apply the bail-in rule by analogy to the BRRD), (ii) that these banks might not get the capital they need from private sources, due to a crowding-out effect (and not because they are not perceived as solvent and sound), and (iii) possible negative effects of mandatory conversion on the European junior bond markets and on financial stability (investors’ flight due to a non-resolution probability of forced conversion). For the time being, the Commission has been against modifying the rules, but a possible refinement of the wording of the State Aid rules in due time cannot be discounted, given the importance of the issue. |

The ESM Board adopted the direct recapitalization tool on 8 December 2014. The tool has a cap of €60bn, which can be increased only under exceptional circumstances. It is intended to be used for systemically important institutions in stressed countries that are unable to provide the necessary financial assistance to restore the viability of the bank. A burden-sharing system is foreseen, with two different scenarios:

- a.

Scenario 1: bank has a capital ratio under 4.5% CET1. Member States should cover all capital needed up to 4.5%, and the ESM would provide the rest until reaching the 8% ratio required by the ECB under CRDIV phase in definition.

- b.

Scenario 2: bank has a capital ratio at/above 4.5% CET1 but below the ECB's required level. Member States should contribute a 20% (10% from 2017 on) share to cover the gap and the ESM should cover the rest. Under exceptional circumstances, the ESM Board could decide to suspend the Member State contribution but unanimity is required.

The ESM's assistance must be formally requested by Member States, and would involve the signature of a Memorandum of Understanding (MoU). We understand that the approval of assistance by the ESM would take place under the same general rules that apply to current ESM sovereign assistance programmes (where 85% of the votes are required, and which grants Germany a de facto veto power). The associated MoU might include conditionality clauses, both for the recapitalised banks and also concerning the general economic policies of the Member State. Banks would be recapitalised through an ESM fully owned subsidiary with no decision-making powers.

The agreed framework is consistent with both (i) the new crisis management framework (BRRD) as it gives priority to private solutions before using any public funds and (ii) the banking union approach whereby the comprehensive ECB assessment will draw a dividing line between past problems (to be solved mainly at a national level) and future problems (which will be dealt with partially on a mutualised basis). From a short-term standpoint, having this backstop implemented on time is critical to underpin the credibility of the whole AQR/stress test exercise, as it will provide an essential complement of the national backstops that have already been implemented in compliance with the ECOFIN requirements agreed in November 2013.

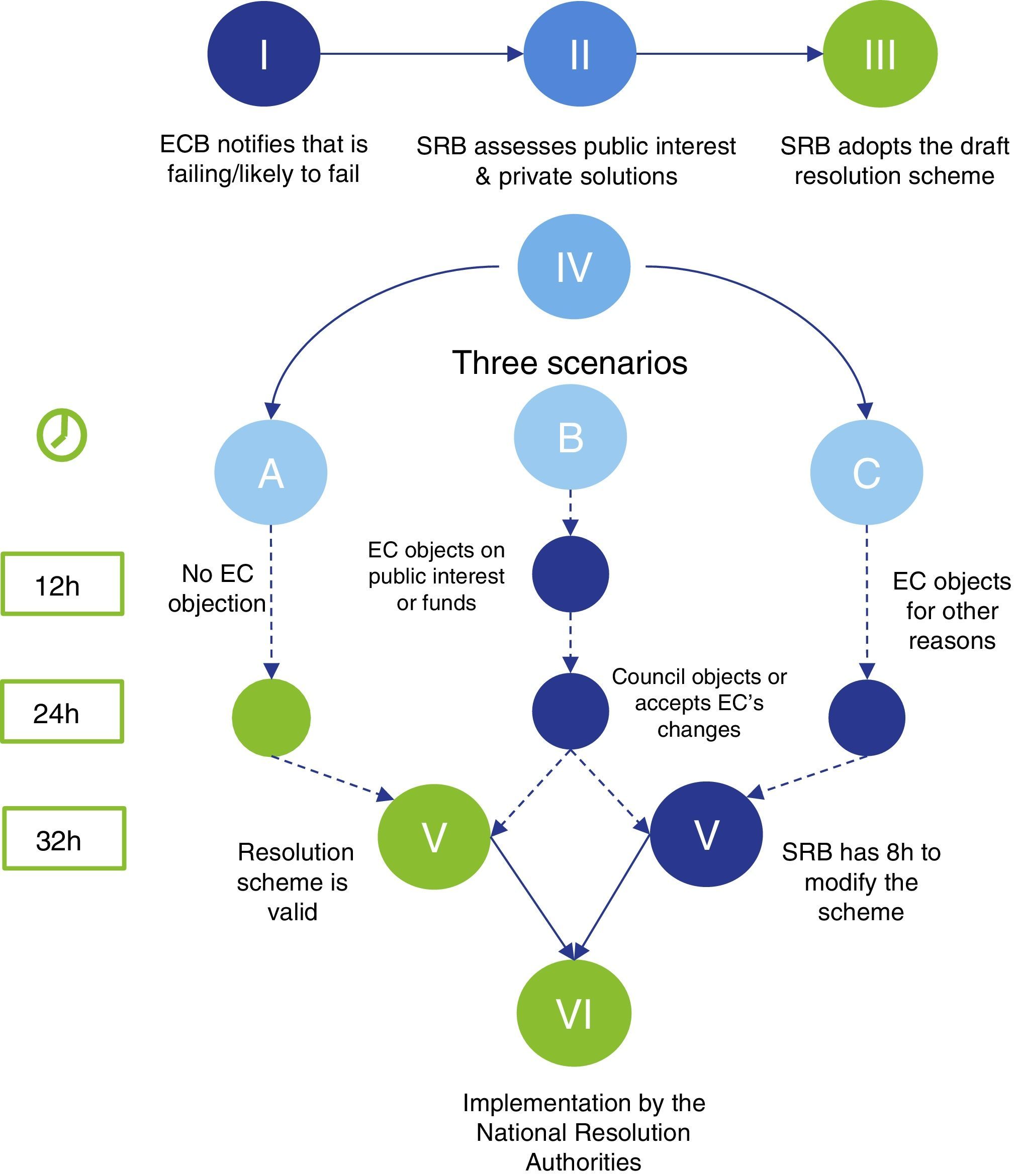

7Act III: the Single Resolution Mechanism (SRM)The Single Resolution Mechanism (SRM) is the second master pillar of banking union. It is operational as of 1 January 2015 but will not have full resolutin powers until one year later. Its main purpose is to put bank resolution decisions and actions at the same centralised level as supervision and to make possible the orderly resolution of a failing bank over a weekend, following unified criteria and with the possibility to resort to common (mutualised) private funds in those cases in which the bank's own private resources prove insufficient to cover the costs of the resolution process. To do that the SRM will encompass a centralised system for bank resolution across the eurozone, composed of the National Resolution Authorities (NRAs), a new Single Resolution Authority (which will have the ultimate decision-making power), a Single Resolution Fund and a single set of resolution rules (that will be fully aligned with the BRRD).

Political negotiations to close a deal on the SRM design were particularly tough, given the extremely sensitive nature of cost mutualisation. The final SRM agreed represents a great step forward vis-à-vis the initial positions of some Member States (notably Germany) which advocated for a decentralised resolution mechanism as the first step.

7.1Why a Single Resolution Mechanism for the eurozone?The Single Resolution Authority will directly resolve significant banks, cross-border EU banks and all banks whose resolution requires the use of the Single Resolution Fund. The remaining banks will be resolved by the NRAs, but the Single Resolution Authority will be able to step in at any time and Member States will always have the option to decide to make the Single Authority responsible for all the banks based in their territory. Resolution processes will be guided by the BRRD (which the Single Resolution Authority shall apply uniformly across the eurozone) and there will be recourse to a Single Resolution Fund which will reach an overall target level of €55bn in eight and in which the mutualisation of costs will be at least 40% already in the first year (2016), reaching 100% by 2023.

Banking union needs such a centralised SRM for three main reasons:

- 1.

To provide the SSM with a credible counterpart on the resolution side. The Single Supervisor cannot by itself break the vicious circle between sovereign and bank risks. Moreover, having a single supervisor operating along with 19 national resolution authorities involves high risks. The SRM will avoid inconsistent situations where the ECB adopts a decision concerning a European bank with potential resolution implications to be borne by a national resolution authority and ultimately by national backstops.

- 2.

To preserve the level playing-field by ensuring a uniform implementation of the EU bank resolution rules (BRRD) across the SSM-area. The wide discretionality allowed in the BRRD does not sit well with the uniformity of rules that is required at the eurozone level. The SRM will bring certainty and predictability to the application of the BRRD and the DGSD within the SSM, avoiding gaps arising from divergent national positions.

- 3.

To enhance cross-border resolution processes in the EU. The Single Market needs to rely on an effective cross border resolution framework to ensure financial stability and avoid competitive distortions. In the SSM, the Single Resolution Authority would act in the interests of the whole area, facilitating the signature of cross-border resolution agreements wherever needed.

On 10 July 2013 the Commission made a proposal to set up a centralised SRM based on the article 114 of the TFEU.16 This proposal included both a Single Resolution Authority and a Single Resolution Fund. As for the Single Resolution Authority, the Commission proposed to create a new body, the Single Resolution Board (SRB) in charge of preparing the bank resolution decisions in the eurozone. For legal reasons, the ultimate decision power was given to the Commission. All resolution decisions taken by the SRB will need the Commission green light. As for the Single Resolution Fund, a €55bn private Fund would be created in 10 years from individual banks’ contributions, and would be used as a private backstop after an 8% bail-in over the bank's liabilities.

During the second half of 2013 the Commission proposal was discussed and reviewed by the EU Parliament and the Council, following the ordinary legislative process. The Parliament issued its report on 25 September, which mostly supported the Commission proposal, with a few relevant amendments. The Parliament wanted to make sure that both the ECB and the Single Resolution Board would have the opportunity to give their assessment and recommendation to the Commission before it could take any action. The Parliament also asked for the Fund to be used to protect all uncovered deposits from any bail-in but conditioned its use to the establishment of a loan facility, preferably a European public one.

The Council agreed its position in December 2013. In this case several changes and amendments to the Commission approach were introduced in order to make it much less ambitious. Nevertheless, despite the initial opposition from Germany (which was not persuaded about the legality of using Article 114 to provide for a centralised SRM), the centralised approach prevailed. For months Germany had been advocating a two-stage approach, with a first stage in which a network of national resolution authorities and funds would be set up, and a second stage in which a centralised SRM would be eventually established after the due Treaty revision. However, the legal services of the Council, the Commission and the ECB confirmed the legality of Article 114 to build up a centralised SRM, and so finally Germany had to give in.

The Council's December position reflected important concessions towards the centralised approach but, in the end it did not provide for a sufficiently European SRM. The general feeling was that it would not help banking union deliver the desired outcome in terms of reduced fragmentation and break of the vicious circle. First of all, it was the Council, instead of the Commission, which was proposed as the ultimate resolution authority; this rendered the decision-making process less streamlined, more complex and vulnerable to political interferences as it involved too many stakeholders. There was a risk that the system would not work properly if the new Authority was unable to take swift decisions on time. Ideally the Single Resolution Authority should have been a newly created European institution, but this required a revision of the EU Treaty which would be extremely difficult to achieve within a reasonable timeframe. This is the reason why the European Council opted for a second-best solution. But the solution agreed was too complex and having the Council as the ultimate resolution authority (instead of the Commission) raised significant concerns and the 24-h deadline given for any opposition to a decision by the Single Resolution Board appeared insufficient to avoid political deadlocks (Fig. 10).

Second, although a Single Fund was to be established from the beginning, the transition towards full mutualisation was too long and uncertain. There was increasing mutualisation in the loss absorption process but with a rather limited scope, whereas the Commission proposal proposed full mutualisation from the beginning. The Fund would be able to borrow money from third parties in case of need, but no explicit loan facility was provided for. As for public backstops, there would be a national bridge financing system in operation until 2024, to be succeeded by a European public backstop, but no details were provided in relation to these two elements. There were more unknowns than knowns regarding the role to be played by these public backstops, which are key to bringing credibility to the Single Fund. Moreover, the key details of the Single Fund were ruled through an Inter-governmental Agreement (IGA) which was not part of the acquis communautaire (the EU legislation) and which therefore faced strong opposition from the Parliament.

Overall, the Council's position clearly fell short of the ambition of both the Commission and the Parliament blueprints and when the trialogues started, in January 2014, a timely final agreement between co-legislators seemed highly unlikely (Alonso, 2014). Indeed, trialogue negotiations remained deadlocked for two months, given the wide disparity in the positions (Abascal et al., 2014a). But on 12 March co-legislators attended negotiations with new formal positions that incorporated important concessions from both sides.17 At that point, three main issues still blocked the final agreement:

- 1.

Ultimate Resolution Authority and decision making at the Board. Parliament insisted that it should be the Commission which triggered resolution, whereas the Council wanted to keep a decisive role in the process (with the possibility of vetoing or amending any Board decision within 24h at the request of the Commission).

- 2.

Build-up and mutualisation of the Single Resolution Fund. Parliament still wanted to build up the €55bn Fund over ten years (2016–2026) but could accept postponing full mutualisation to 2019 (that means, in three years). The Council remained reluctant to significantly accelerate the transition path towards full mutualisation but started to consider a shortening of the path to eight years in exchange for a similar shortening in the build-up path.

- 3.

Boosting the liquidity of the Single Resolution Fund. Parliament insisted on putting in place a loan facility, preferably a public and European one, as a backstop to reinforce the strength and credibility of the Single Fund. The Council had strong reservations at that stage. The uncertainty was exacerbated by the lack of agreement on the final rules for the ESM direct bank recapitalisation tool.