The principal aim of this study is to analyze the effect of bankruptcy causes in its resolution. In furthering this purpose, a bankruptcy index is proposed, like a combination between the profitability and the leverage of bankrupt firms. This index tries to determine if the origin of the bankruptcy is mainly economic, financial or a combination. This study uses a sample of 1025 Spanish firms that went bankrupt in 2008 and obtained a resolution (reorganization or liquidation) by the end of 2012. The results reveal that a high bankruptcy index, which means low viability, reduces the reorganization probability of bankrupt firms. In addition, these results show that Spanish bankruptcy proceedings have a certain degree of efficiency, in such a way that the viable firms are reorganized and the nonviable firms are liquidated.

Several reasons support counting on legislation to regulate bankruptcy proceedings: the impossibility of creditors designing individual processes to recover from debtors (because the contracts are incomplete) (Hart, 2000); the reallocation of assets to better use (Jacobs et al., 2012); and the search for temporary protection by creditors from managers/shareholders with the aim of solving their liquidity problems or looking for a purchaser for the firm's assets (Baird and Rasmussen, 2002). In this sense, bankruptcy legislation should provide a framework that allows economically viable firms to reorganize and continue their business activities and simultaneously forces inefficient firms to be liquidated. Nevertheless, asymmetric information, such as conflicts of interest and inefficiencies in procedures, can result in two types of errors: liquidation of a viable firm and the survival of firms that should be liquidated.

The literature on bankruptcy resolution identifies two opposite types of systems that act as a function of the applied legislation: debtor-friendly systems (e.g., French “Redressement Judiciarie” or US Chapter 11) and creditor-oriented systems (e.g., British Administration or Voluntary Arrangement), and a wide debate exists about the efficiency of each one. In the first type, creditors try to maximize their credit recovery, while the second system focuses on the firm and, at the same time, safeguarding the interests of other agents, especially workers (Celentani et al., 2010). In the last few decades, many countries in Western Europe (e.g., Germany, France, Italy, and Spain) have reformed their bankruptcy legislation with the purpose of encouraging the survival of firms (Dewaelheyns and Van Hulle, 2009). The current Spanish legislation (2003 Bankruptcy Law)1 can be positioned as an intermediate one between both extremes. In fact, Spain received a score of two out of four in the creditor rights protection index prepared by La Porta et al. (1998) and Djankov et al. (2007). Nevertheless, Spanish Bankruptcy Law emphasizes creditors’ protection.

As has already been mentioned, there is a wide debate in the literature about the efficiency of bankruptcy legal proceedings. Thus, in debtor-friendly systems, it is unlikely that viable firms will be liquidated, but inefficiency rises in the continued existence of non-profitable firms. In this sense, some authors assert that debt-oriented systems (e.g., USA Chapter 11) have a bias toward the continuation of nonviable firms (Hotchkiss, 1995). In Spanish legislation, the 2003 Bankruptcy Law gives less protection to debtors than in the previous law, which raises some doubts about its efficiency (Fernández, 2004). On the other hand, Gennaioli and Rossi (2010) find that greater protection of creditors in the reorganization process provides judicial incentives to solve the bankruptcy in an efficient way, which prevents inefficient uses of judicial discretion. However, the efficiency of bankruptcy legislation is conditioned not only by the type of system but also by other factors linked to the institutional characteristics of the firm, such as the degree of ownership and debt dispersion and the mechanisms to discipline managerial activity (Thorburn, 2000; Fernández, 2004).

A way of evaluating the efficiency of the legislation is to analyze a situation in which only viable firms are reorganized, while the nonviable ones are liquidated. To do this, some authors suggest analyzing the causes of the bankruptcy, distinguishing between financial and economic bankruptcy (White, 1994; Hotchkiss, 1995; Andrade and Kaplan, 1998; Denis and Rodgers, 2007; Lemmon et al., 2009; Balcaen et al., 2011; Fischer and Wahrenburgh, 2012). Firms that face financial bankruptcy are economically viable, but they have greater leverage and problems repaying their debts. Firms that face economic bankruptcy can also have difficulties repaying their debts, but they are characterized by a very low or negative operative result, and for this reason, their continuation is doubtful, even when there is no leverage (Lemmon et al., 2009). These authors and Fischer and Wahrenburgh (2012) conclude that when the cause of the bankruptcy is financial, firms have a greater likelihood of reorganization, based on agreements with their creditors to repay their debts, because they have expectations of good results. However, when the cause of the bankruptcy is due to bad operative results, it is more likely that firms will be liquidated.

Along this line, it is necessary to point out that in Spain the use of the legal bankruptcy process is less common than in other similar countries. Nevertheless, during the period of the financial crisis, bankruptcy rates have increased from 2.6 to 14.6 bankruptcies per 10,000 firms. That level is similar in Canada, for example, but is significantly lower than the rates in the U.K or France (137 and 217, respectively) (García-Posada and Mora-Sanguinetti, 2012). This lower use of the legal process is a consequence of the firms’ preference to use alternative resolution mechanisms for bankruptcy, such as private renegotiation processes with creditors or the mortgage system. In fact, in Spain, the financial structure of the firms has a high proportion of mortgage debt, which allows avoiding the legal bankruptcy mechanism and negotiation through the mortgage system, which is less costly than the legal process (García-Posada and Mora-Sanguinetti, 2014). In this sense, “In Spain, the foreclosures could be a more attractive mechanism for creditors than the bankruptcy legal process…due to the lower length of the proceedings, the lower costs, and presumably, the higher rates of credit recovery” (García-Posada and Mora-Sanguinetti, 2012: 33). Additionally, the preference for those alternative resolution mechanisms contributes to an understanding of the level of damage in the firms that file for bankruptcy. Along this line, Van Hemmen (2009b) asserts that the firms file for bankruptcy with almost no possibilities of reaching an agreement, nine out of ten have clear signs of structural crisis, liquidation being the only feasible solution.

Lemmon et al. (2009) and Fischer and Wahrenburgh (2012) create an index to measure the type of bankruptcy through a combination of profitability and leverage. Following those studies, the aim of the present work is to analyze the efficiency of Spanish bankruptcy legislation by the relationship between the causes and resolution of bankruptcy. To do this, an index is created, called the “Bankruptcy index”, which is inspired by the aforementioned studies. The study uses a sample of 1025 non-financial, unlisted firms that went bankrupt in 2008 and obtained a resolution (reorganization or liquidation) by the end of 2012. The results of the present study show that less viable firms, especially those that present mixed causes of bankruptcy (financial and economic), are less likely to reorganize than firms that are exclusively financially bankrupt. The results also allow us to determine the importance of considering an index that relates profitability and leverage, instead of just considering individual factors.

The primary contributions of this study are that it is the first to analyze the causes of bankruptcy in Spanish bankrupt firms and, above all, it connects those causes with the bankruptcy resolution. In this sense, this study provides new outstanding empirical evidence to be considered in future studies, so that future studies about bankruptcy resolution must consider, at least as a control variable, some proxy of the viability of the firm. In fact, most of the studies consider this aspect indirectly when they include profitability and leverage.

The remainder of the study is structured as follows. Section 2 analyzes bankruptcy resolution proceedings under the framework of Spanish bankruptcy legislation. Theoretical arguments are then described concerning the position of bank creditors in bankruptcy resolution proceedings, and the hypotheses are presented in Section 3. Section 4 describes the methodological aspects, while Section 5 presents the results of the empirical study. The sixth and final section is dedicated to a discussion of the results and concluding remarks.

2Insolvency resolution under Spanish bankruptcy lawBankruptcy resolution is the stage of the proceeding in which it is decided whether the firm goes on in its activity with the approval of an agreement or is liquidated. Concretely, in Spanish Law, this moment is the end of the common phase and the beginning of the successive phase.

According to the preamble of the Spanish bankruptcy proceeding Law, reorganization is the normal solution from the proceedings, causing the Law to promote a series of measures whose purpose is to reach a satisfactory agreement with the creditors. That does not prevent the legislation from taking into account other groups in the firms, and in this sense, the preamble of the Law says: “Although the objective of the process is not the financial restructuring, an agreement of continuation can be an instrument to solve the total or partial viable firms, of benefit to not only the creditors, but also the debtor, the workers and other interest …” (VI, paragraph 7°).

In order to facilitate this solution, the admission of the “early proposal of agreement” stands out, allowing the debtor to present a proposed agreement in a volunteer bankruptcy or even in a necessary one.2 If an early proposal of agreement is not approved and the debtor does not choose liquidation of assets, the agreement phase is opened.

The Law is flexible with respect to the content of the proposed agreement. Thus, article 100 establishes that there can be propositions of reduction and moratorium on the debt or the accumulation of both; in the first version of the Law, debt reductions could not exceed half of the sum of each ordinary credit, and debt moratoriums could not continue for more than five years after the approval of the agreement. However, in RD 11/2014, those limits were eliminated.3 Moreover, alternative propositions may be admitted, such as a conversion of the debtor's credit into equity instruments or similar stakes. In addition, propositions of alienation can be included in the agreement. Those propositions can be over the set of goods and rights of the bankrupt firm, related to its corporate or professional activity or certain productive units, in favor of a natural person or a legal entity. The purchaser must continue with the corporate or professional activity.

Finally, the agreement needs judicial approval. The Law regulates the opposition to the approval, people who are legitimate objectors and the reasons for opposition, as well as the reasons for rejecting the admitted agreement by the judge. The approval of the agreement does not suppose the end of the bankruptcy, which is only obtained with its compliance. In fact, liquidation can be produced by breach of the agreement.

The last change in the legislation (RD 4/2014) included other measures which allow for refinancing agreements before filing in the legal bankruptcy process. The aim for that type of agreement allows viable firms, with an exceptional financial problem, to continue with its productive activity thanks to an adequate financial support which is agreeable to creditors.

Another possibility of the bankruptcy proceeding resolution is liquidation. Liquidation can occur at the request of the debtor at the moment the bankruptcy proceeding is filed or during the reorganization process if it is impossible to meet the promised payments.4 Likewise, if the debtor did not ask for the liquidation during the validity of the agreement, any creditor could request liquidation, confirming the existence of some of the facts that can determine the bankruptcy statement. It is noteworthy that firm management and possession of patrimony are suspended during the liquidation process. Moreover, the court resolution that initiates the liquidation process entails the dissolution of the firm and the substitution of managers by bankruptcy administrators.5

The objective of the liquidation procedure is to collect the assets of the firm, determine the outstanding debt, and pay the debt off in the way and order stated in the Law. The liquidation process can lead to a piecemeal or complete liquidation in which case the creditors can retain the synergies generated by the firm. Sometimes, the firm value is greater if it is sold or reorganized as a whole than when the assets are sold separately; in this case, creditors would receive more money if the firm were reorganized instead of liquidated (Succurro, 2012).

A remarkable aspect in the different legislation about bankruptcy proceedings, the Spanish one being among them, is the degree of protection provided to debtors and creditors. In this sense, different legislation in the international context is not at the extremes, either pro-debtor or pro-creditor, and it is possible to find several degrees of protection.

One of the most-used indicators in the international context to measure the degree of protection is the index created by La Porta et al. (1998) and updated by Djankov et al. (2007), which gives Spain a score of two out of four in the creditor rights protection index, while France has 0, the USA 1 and the UK 4.6 This fact places the Spanish bankruptcy legislation in an intermediate position between the extremes of the USA and France. Along the same line, Blazy et al. (2008), in a wider classification of bankruptcy legislation in 35 countries, classify Spain as a “pro secured creditors model”,7 which protects the interest of secured creditors and their greater bargaining power against the debtors. In sum, the protection degree will depend on the type of legislation and whether it is oriented to benefit the debtor or the creditor. These differences in the protection of the rights of creditors and debtors can explain the differences in reorganization percentages depending on the legal system (Brouwer, 2006).8

The allocation of the control rights of the firm during bankruptcy is one of the aspects covered in the resolution process. Thus, in pro-creditor systems (UK, Germany, and Japan), managers are automatically replaced by a team that will be responsible for controlling the firm until the conclusion of the proceeding. On the contrary, in pro-debtor systems (USA and Canada), managers can maintain the control of the firm (González and González, 2000). The current Spanish legislation shows two possibilities: if the debtor initiates a voluntary bankruptcy, the managers can remain in control, but if the bankruptcy is applied for by the creditors (necessary bankruptcy), the managers are replaced by the bankrupt administration. In this sense, the urgency in transferring the control of the firm to the creditors increases the likelihood of liquidation in viable firms, while the delay in that transfer of control allows managers to make suboptimal decisions (Myers, 1977; González and González, 2000).

3Ex-post efficiency: economic versus financial bankruptcy and resolutionAs mentioned previously, the way in which the bankruptcy is solved determines the efficiency of the legislation. That is, the system will be efficient if viable firms are reorganized and survive while the nonviable ones are liquidated. Along this line, there are three types of efficiency during the proceedings (White, 1994): ex-ante, intermediate and ex-post. With respect to the time horizon, ex-ante efficiency is produced before knowing if the firm is bankrupt or not. Intermediate efficiency is produced before the initiation of the bankruptcy process but when the firm is in a bankrupt situation. Finally, ex-post efficiency begins when the firm has filed in bankruptcy. Regarding the intermediate stage, it should be noted that the interest of managers in lengthening this stage and delaying the initiation of proceedings is harmful to the creditors because the firm's deterioration is greater and the survival opportunities are fewer.

Additionally, Hart (2000) asserts that ex-ante efficiency tries to avoid behaviors of the managers and shareholders of the debtor firm that are against the creditors’ interest, while ex-post efficiency is reached if the decision about the liquidation or the reorganization is supported on which resolution is the best for the firm. In this sense, “bankruptcy regime achieves ex ante efficiency if it creates good incentives for both creditors and debtors insofar as bankruptcy law affects entrepreneurs incentives to over invest and the terms on which lenders will lend … and achieves ex post efficiency when only efficient financially distressed firms are saved” (Blazy and Chopard, 2004: 448). Thus, in order to reach ex-ante efficiency, a creditor friendly bankruptcy system can increase the available funds and reduce the interest rates (Mora-Sanguinetti and Fuentes, 2012). However, according to those authors too, and related to ex-post efficiency, in this type of bankruptcy systems, the creditors can force the liquidation of viable firms because “creditors may not have incentives to coordinate or they are not obliged to so by the law” (p. 26). Therefore, both types of efficiency may be in conflict (Hart, 1995; Mora-Sanguinetti and Fuentes, 2012). For example, a higher protection of the creditors’ rights increases the ex-ante efficiency but at the same time, that protection can produce the liquidation of the viable firms, consequently reducing the ex-post efficiency. Thus, an optimal bankruptcy law must therefore strike a balance between two competing goals, the protection of creditors’ rights and the protection of the firm facing the liquidation (Mora-Sanguinetti and Fuentes, 2012). In this sense, bankruptcy regimes play an important role in determining liquidation values and chances of ex post firm survival (Cleasens and Kappler, 2005).

Ex-post efficiency, on the other hand, is related to judicial system efficiency. Cleasens and Klapper (2005) suggest that strong creditor rights are more necessary in countries with weak judicial systems to compensate for weaknesses in legal enforcement. In this sense, the Spanish judicial system is characterized by a great number of bureaucratic processes, which lengthens the time of resolution, and consequently the costs of the processes, and the efficiency is reduced (Mora-Sanguinetti and Fuentes, 2012).

Ex-post efficiency occurs when the bankruptcy is resolved and is therefore measured by the outcome. Thus, ex-post efficiency should require that the viable firms continue their activity and the nonviable ones are liquidated. In this sense, White (1996) distinguishes between “inefficient failing firms”, which are economically inefficient and have financial difficulties, and “efficient failing firms”, which would be economically efficient despite their financial difficulties. In other words, this author notes the need for considering the economic viability as well as the financial viability of bankrupt firms when it is necessary to determine the resolution of the process.

The problems of ex-post efficiency in bankruptcy are related to information asymmetries. In this way, with complete information, if a firm was declared insolvent, it would be liquidated, in the case of being nonviable, or it would be reorganized, in the case of being viable. More specifically, creditors would choose to liquidate firms that were economically nonviable, while they would be willing to make reductions in the debt of economically viable firms to avoid the problems of sub-investment. However, with information asymmetries, there are two types of ex-post inefficiency (White, 1994): Type I error occurs if nonviable (inefficient) firms are saved, while Type II error occurs if viable (efficient) firms are shut down. Specifically, White (1994) asserts that Type I error is more common in inefficient bankrupt firms, while Type II error is more common in efficient bankrupt firms.

Along the same line, Blazy and Chopard (2004: 448) assert: “Some economically inefficient failing firms (which should have been liquidated) mistakenly may be categorized as efficient and allowed to reorganize (type-I errors). Conversely, type-II errors occur when some economically efficient but failing firms may liquidate in bankruptcy…”. Those authors introduce the bankruptcy cause “economically inefficient/efficient”, which reveal that only financial distressed firms are likely to be organized.

Both types of ex-post inefficiency are related to the characteristics of the bankruptcy legal system (Fernández, 2004). In this sense, one of the main tasks of the judges and bankruptcy administrators in the process is to determine whether the firm value,9 as a going concern (with the same or different managers), is greater or lower than the value when the assets are sold separately. Depending on their capability, this task can be completed with a greater or lower likelihood of making errors, either Type I or Type II (Celentani et al., 2010). In this line, for Ayotte and Yun (2009), when the capacity of the judges to separate viable and nonviable firms is weak, the pro-creditor system is optimum.10 In addition, a pro-creditor bankruptcy system can be more suitable because it provides greater incentives for managerial effort. In this sense, Celentani et al. (2010) assert that Spain has a rather pro debtor bankruptcy system and the judges and bankruptcy administrators know the legislation, but they do not have the capacity in order to take decisions about the firm's continuity. Those authors, according to the model presented by Ayotte and Yun (2009), conclude that this fact makes contracts to be solved out of the legal bankruptcy process, and therefore, the use in Spain of that legal process is less common.

More recently, following the arguments of White (1994), several authors have also associated the efficiency of the bankruptcy process in insolvent firms with its causes, that is, with the previous viability of the firm. They have tried to identify whether bankruptcy has its origin only in financial problems (financial bankruptcy) or in the operative results (economic bankruptcy) (Hotchkiss, 1995; Andrade and Kaplan, 1998; Blazy and Chopard, 2004; Denis and Rodgers, 2007; Lemmon et al., 2009; Balcaen et al., 2011; Fischer and Wahrenburgh, 2012). Specifically, Blazy and Chopard (2004) assert that “economically inefficient” failing firms should be liquidated while only “financial distressed” firms should be organized. According to those authors, a firm is in economic distress if the net present value of assets is negative under any management team (it must be piecemeal liquidated) or positive under a different management team (it must be sold as a going concern). However, a firm is in “financial distress when the present value of cash flows is positive but it is lower than the value of claims” (Blazy and Chopard, 2004: 448).

Therefore, on the one hand, the firms facing financial bankruptcy can be economically viable, but they have high leverage and greater difficulties repaying their debts. On the other hand, firms facing economic bankruptcy also have problems in repaying their debts, but they are characterized by a low or negative operative result. For this reason, their continuation is doubtful, even without leverage (Lemmon et al., 2009; Balcaen et al., 2011).

Blazy and Chopard (2004), Lemmon et al. (2009) and Fischer and Wahrenburgh (2012) assert that if the bankruptcy is financial, firms have a greater likelihood of reorganization through an agreement with their creditors to repay their debts because the creditors have high expectations of results. However, firms in economic bankruptcy are more likely to be liquidated. This situation allows the assets to be reallocated to a more productive use (Balcaen et al., 2011). In sum, firms in financial bankruptcy can survive after restructuring their balance sheet, while the recovery of firms in economic bankruptcy requires restructuring their strategy and activity (Platt and Platt, 2006; Lemmon et al., 2009).

According to previous arguments, and with the aim of relating the bankruptcy causes (economic and/or financial) with the resolution of the process (liquidation versus reorganization), Lemmon et al. (2009) note that a combination of operative profitability and leverage provides a more suitable distinction between economic and financial bankruptcy than the individual consideration of each of those variables. Following those authors, firms mainly facing economic bankruptcy are characterized by low leverage and low economic profitability before the bankruptcy. Firms mainly facing financial bankruptcy are characterized by high leverage and relatively high economic profitability. Creating a combined index of profitability and leverage, those authors assert that firms with greater economic bankruptcy have a greater likelihood of being liquidated. Additionally, Fischer and Wahrenburgh (2012) also determine that the financial bankruptcy index is the main variable in explaining the resolution. They find that the greater value of the index, the greater is the likelihood of being reorganized.

Lastly, related to the legislation efficiency, several studies (Bulow and Shoven, 1978; White, 1989; Mooradian, 1994; Branch, 1998) show theoretical arguments and empirical evidence about how the bankruptcy process allows inefficient firms to remain operational. Gertner and Scharfstein (1991) note that one of the most critical aspects in US Chapter 11 is a possible moral hazard problem. This problem can cause imprudent investments that reduce the available assets for creditors and complicate the resolution of the bankruptcy. Hotchkiss (1995) finds that 40% of his sample of firms under Chapter 11 abandon the bankruptcy process with negative results, and 32% of the post-bankrupt firms are not financially stable. In this line, Lemmon et al. (2009) conclude that their results do not support the idea that Chapter 11 allows nonviable firms to solve the bankruptcy without making important changes in their assets.

Therefore, based on previous arguments, in the present study, we have tried to show in the Spanish bankruptcy legislation that if the bankruptcy is economic, the future viability of the firm and its likelihood of reorganization are reduced, while if the bankruptcy is financial, that likelihood is greater. Additionally, we expect that if the causes of bankruptcy are economic and financial, the likelihood of reorganization will be lower. In sum, the lower the viability of the firms, the lower the likelihood of reorganization. The results of our empirical analysis allow us to know to what extent the Spanish bankruptcy system, characterized by an intermediate position between pro-creditor and pro-debtor systems, is ex-post efficient or not.

4Methodological aspects: sample and variablesThe studies about bankruptcy resolution (e.g., White, 1984; Campbell, 1996; Bryan et al., 2002, 2010; Jacobs et al., 2012) analyze whether the accounting information before the initiation of bankruptcy is associated with the resolution. In this line, some authors (White, 1994; Blazy and Chopard, 2004; Lemmon et al., 2009; Fischer and Wahrenburgh, 2012) have tried to demonstrate whether the resolution of bankruptcy is related to its causes. For this reason, their studies are based on accounting information corresponding to the previous year of the entrance into the legal process. In the present study, in accordance with the work of those authors, an index is developed that approximates the type of bankruptcy (economic and/or financial), with the aim of analyzing its incidence in the resolution.

The selection of the sample starts from the published bankruptcies in the Boletín Oficial del Estado, obtained from webconcursal,11 which contains information on the different stages of the proceedings as well as the legal resolutions of bankruptcy filings by Spanish firms. The initial sample includes firms that went bankrupt in 2008. The selection of a unique year was due to the need of restricting the number of bankruptcies because their individual monitoring, in order to know the evolution of the bankruptcy process, is a huge task. In addition, the selection of the year 2008 responds to two reasons: (1) it is the first year of the crisis period and consequently the number of bankruptcies increase significantly, from 880 in 2007 to 2.528 in 2008 (an increase of 187%); (2) in 2008, the firms that file in bankruptcy, present differences regarding the previous years, concretely, better financial performance, lower percentage of firms with negative results and negative own funds (Van Hemmen, 2009a).

In addition, the need to have available financial information for the firms led to the consideration of bankruptcy filings only from the SABI database12 and was limited to firms with LLC (Limited Liability Company) or PLC (Public Liability Company)13 legal structures.14 This criterion reduces the sample from 2453 bankrupt firms to 1722 firms with available information. Afterwards, it is necessary to determine the firms that have reached a resolution. Concretely, following Van Hemmen (2009a), in the present work bankruptcy resolution is the stage of the proceeding in which it is decided whether the firm goes on in its activity with the approval of an agreement or is liquidated. In Spanish Law, this moment is the end of the common phase and the beginning of the successive phase. Therefore, from these 1722 firms, only 1025 have obtained a resolution (reorganization or liquidation), while for the rest of the firms, the process is incomplete or it is not possible to obtain the information. From those firms, 258 have begun the agreement phase with their creditors to postpone the repayment of their debts, and 767 have begun the liquidation phase, which is a rate of reorganization of 25.17%. This percentage can seem very high in comparison with 10% of Van Hemmen (2009a). The reason is that our rate is calculated over the number of firms that have reached the successive phase and with information in SABI in the previous years, and not over the total bankruptcies in the year.15

In addition, some firms are liquidated after reaching an agreement with their creditors. Until the final of 2012, in our sample, 101 firms are in that situation. Therefore, considering this subsample, the rate of reorganized firms is 17%. This subsample is considered in a subsequent robustness analysis.

The key variables in the analysis are related to the bankruptcy resolution and its causes, distinguishing between economic and financial bankruptcy. The explanatory variables try to approximate the cause of the bankruptcy, and two types of variables are considered: individual and mixed. The individual variables considered are economic profitability and leverage. As for the mixed variables, an index is created that reflects the type of bankruptcy (Lemmon et al., 2009; Fischer and Wahrenburgh, 2012) and, more concretely, the degree of the firm's viability. Additionally, a group of control variables that have been used in other empirical studies are considered, such as size, age, liquidity, the length of the process and the economic sector.

Resolution (reorganization versus liquidation). To distinguish among the firms that obtained a bankruptcy process resolution, the selection criteria used were whether the declaration of liquidation had been produced or whether the agreement of reorganization had been approved. To that end, a dummy variable was created that is equal to one if the resolution of the bankruptcy is reorganization and equal to zero if the company has begun liquidation (Tucker and Moore, 2000; Fisher and Martel, 1995, 2003; Wang, 2012).

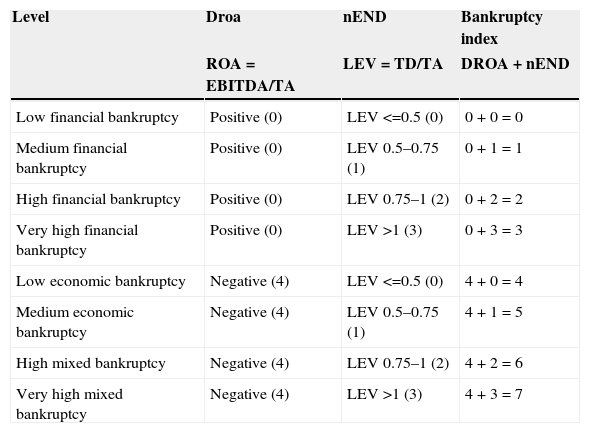

Economic profitability (NegativeROA, dROA). With the aim of isolating economic management and financial aspects, studies usually consider the economic profitability (ROA) (e.g., White, 1984; Bryan et al., 2002, 2010) calculated by the ratio EBITDA/TOTAL ASSETS. As a proxy of the economic bankruptcy, in the present study, a dummy variable is created (dROA). This variable presents a value of 4 if the ROA is negative and 0 otherwise. This approach is used by Naujoks (2012),16 who asserts that if firms have a low operative profitability, then the firms’ bankruptcy must be classified as economic, independent of the firms’ leverage. The allocated values of this variable have been selected with the aim of making easier the interpretation of the bankruptcy index, which has been created from a combination of profitability and leverage, as it is mentioned later.

Leverage (nLEV). Leverage (LEV) is used as an individual proxy of financial bankruptcy, which is calculated by dividing the total debt by the total assets (Denis and Rodgers, 2007; Lemmon et al., 2009; Leyman et al., 2011; Fischer and Wahrenburgh, 2012). According to Lemmon et al. (2009), once a firm goes bankrupt, all its debts are payable, and for this reason, it is better to consider the total debt instead of the short-term debt. The variable presents values between 0 and 3, and the greater the value of the variable, the greater is the leverage (nLEV).17 It is expected that the bankrupt firms with high leverage suffer a greater degree of financial bankruptcy. As in the dROA variable, the allocated values to this variable try to make easier the interpretation of the bankruptcy index.18

Bankruptcy index. According to Lemmon et al. (2009), firms facing mainly financial bankruptcy are characterized by a combination of low leverage and low economic profitability before the bankrupt situation. In contrast, firms facing financial bankruptcy are characterized by a combination of high leverage and their economic profitability is rather high. Following the proposal of Lemmon et al. (2009) and Fischer and Wahrenburgh (2012), an index is created by adding the value in variables dROA and nEND for each firm, according to the previous description. That index can reach values between 0 and 7: (1) the values between 0 and 3 belong to firms with ROA>0, although they are different in the level of leverage (low, medium, high and very high). Therefore, a value of 0 means that the firm has a positive profitability and low leverage (see Table A1 in the appendix). (2) The values between 4 and 7 belong to firms with ROA<0, so that the value 4 is for the firms with ROA<0 and low leverage, and the value 7 belongs to the firms with ROA<0 and very high leverage.

Therefore, the index interpretation is described as follows: a lower value of the index means financial bankruptcy because the firms have positive profitability, while a greater index value (at least 4) means economic bankruptcy. The values 4 and 5 can be considered economic bankruptcy because the firms present low or medium leverage. However, the values 6 and 7 may be explained as mixed bankruptcy because the firms present not only losses but also high or very high leverage. In these situations, the viability of the firms is further reduced. For this reason, the index must be interpreted in terms of viability, instead of a measure of economic versus financial bankruptcy.

In this line, a greater value of the index reflects a lower viability of the firm, and it is expected that a negative relationship will be found between the index and the likelihood of reorganization. It should be noted that due to the index configuration, a lower level means financial bankruptcy (pure), while the highest values implies economic and financial causes. This is one of the differences between our index and the index presented by Lemmon et al. (2009) and Fischer and Wahrenburgh (2012) because those authors consider firms with economic and financial problems to be situated in an undefined area, without considering either strictly economic or strictly financial bankruptcy. Nevertheless, those authors use the index in a continuous way in their models, which makes the interpretation more difficult.

Size.White (1984) argues that firm size increases the survival probability because its assets are more specific, and this situation reduces the number of purchasers that are interested in such firms. In addition, governments generally support the largest firms for strategic reasons. Furthermore, size is considered in the literature as a proxy for asymmetric information. Thus, it is possible that the largest firms, with fewer information asymmetries, have a greater probability of reaching an agreement than the smallest firms. The reason is that creditors will be more willing to trust information regarding the firm's viability, and the creditors’ probability of recovering the debt depends on that information. The size is estimated by the total assets logarithm (Ayotte and Morrison, 2009; Jacobs et al., 2012).

Age. The age is approximated by the logarithm of the number of years between the constitution of the firm and the date of the bankruptcy. This variable has been considered in different studies about bankruptcy resolution (e.g., Bergström et al., 2002; Kim et al., 2008) and is explained in the sense that greater accumulated experience is a sign of a good reputation and a guarantee for financial entities and creditors in general. Thus, a positive relationship between the age and the likelihood of reorganization is expected.

Liquidity. Liquidity problems are one of the primary reasons for bankruptcy filings. In fact, the Spanish Law notes that current or imminent liquidity problems, defined as the impossibility of fulfilling payments, are the objective requirement to declaring bankruptcy. Nevertheless, the degree of liquidity can be different in firms, which can affect the continuation of the firm. There are different forms of estimating liquidity. In the present study, liquidity is measured by the ratio of current assets to current liabilities (Kim et al., 2008; Leyman et al., 2011).

Duration. The length of the process can be important because it can affect the resolution (reorganization or liquidation) as well as the value of the assets (Dahiya et al., 2003). The longer the process, the greater are the costs. Therefore, the efficiency of the process is reflected in the time necessary to resolve the bankruptcy (Hotchkiss et al., 2012). An efficient system should be able to identify the firms for liquidating as soon as possible with the aim of minimizing the reorganization costs (Dewaelheyns and Van Hulle, 2009). Fischer and Wahrenburgh (2012) are among the authors who include the length of the process as an explanatory variable of the resolution.

Economic sector.Maksimovic and Phillips (1998) find that the incentives for reorganization depend on the characteristics of the economic sector of the firm. This variable attempts to summarize certain aspects that are more related to the sector activity rather than to the firm. Among the studies of bankruptcy resolution that consider sectors are those of Campbell (1996), Fisher and Martel (2012), Sundgren (1998), Ravid and Sundgren (1998), Bryan et al. (2002) and Bergström et al. (2002). In this study, eight dummy variables are considered: Agriculture and Fishing, Industry and Energy, Construction, Real Estate, Transport, Hotels, Commerce and Other Services.

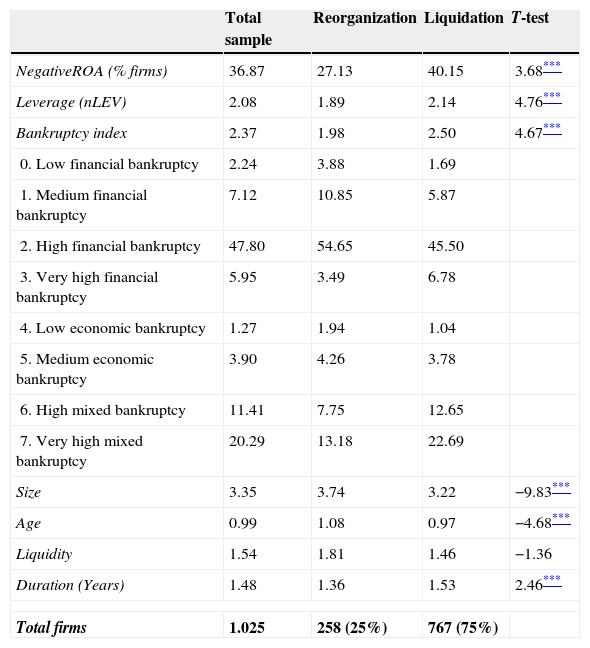

5Results5.1Descriptive analysisTable 1 lists the characteristics of the firms in the sample according to the resolution type (reorganization and liquidation). Approximately one quarter (25%) of the firms in the sample reached a restructuring agreement with their creditors. On the other hand, the average percentage of firms with losses is lower in the firms that are reorganized (27%) compared to the firms that are liquidated. In addition, the level of leverage is also very high in the last group. The average level of the bankruptcy index is 2.37 and is higher in the firms that were liquidated (2.50) compared to 1.98 in the reorganized firms. That means that a greater value of the index is associated with a lower reorganization likelihood.

Descriptive variables.

| Total sample | Reorganization | Liquidation | T-test | |

|---|---|---|---|---|

| NegativeROA (% firms) | 36.87 | 27.13 | 40.15 | 3.68*** |

| Leverage (nLEV) | 2.08 | 1.89 | 2.14 | 4.76*** |

| Bankruptcy index | 2.37 | 1.98 | 2.50 | 4.67*** |

| 0. Low financial bankruptcy | 2.24 | 3.88 | 1.69 | |

| 1. Medium financial bankruptcy | 7.12 | 10.85 | 5.87 | |

| 2. High financial bankruptcy | 47.80 | 54.65 | 45.50 | |

| 3. Very high financial bankruptcy | 5.95 | 3.49 | 6.78 | |

| 4. Low economic bankruptcy | 1.27 | 1.94 | 1.04 | |

| 5. Medium economic bankruptcy | 3.90 | 4.26 | 3.78 | |

| 6. High mixed bankruptcy | 11.41 | 7.75 | 12.65 | |

| 7. Very high mixed bankruptcy | 20.29 | 13.18 | 22.69 | |

| Size | 3.35 | 3.74 | 3.22 | −9.83*** |

| Age | 0.99 | 1.08 | 0.97 | −4.68*** |

| Liquidity | 1.54 | 1.81 | 1.46 | −1.36 |

| Duration (Years) | 1.48 | 1.36 | 1.53 | 2.46*** |

| Total firms | 1.025 | 258 (25%) | 767 (75%) | |

Variables: Bankruptcy Index, see Table A1 in the Appendix; NegativeROA if EBITDA/total assets <0; nLEV: Leverage, values from 0 to 3, see Table A1; Size: logarithm of total assets; Age: logarithm of the years from the creation of the firm and entrance into bankruptcy; Liquidity: current assets/current liabilities; Duration: years between the date of entrance into bankruptcy and the date of resolution.

*Significant at 10%.

**Significant at 5%.

With the aim of facilitating the interpretation of the results, the percentage distribution of the firms based on the level of the bankruptcy index is presented. These data show that among the reorganized firms, the percentage of firms with financial bankruptcy (levels 0–3) is 78.87%, compared to 55.47% of liquidated firms. On the contrary, the percentage of firms with economic bankruptcy (levels 4 and 5) is 6.20% in reorganized firms and 4.82% in liquidated firms. Lastly, the percentage of firms with mixed bankruptcy (levels 6 and 7) is 20.93% in reorganized firms and 35.34% in liquidated ones.

As a result, the reorganized firms present mainly financial bankruptcy, while the firms with economic or mixed bankruptcy are liquidated to a greater extent. Regarding the control variables, it seems that the reorganized firms are larger, older and the length of their proceedings is shorter.

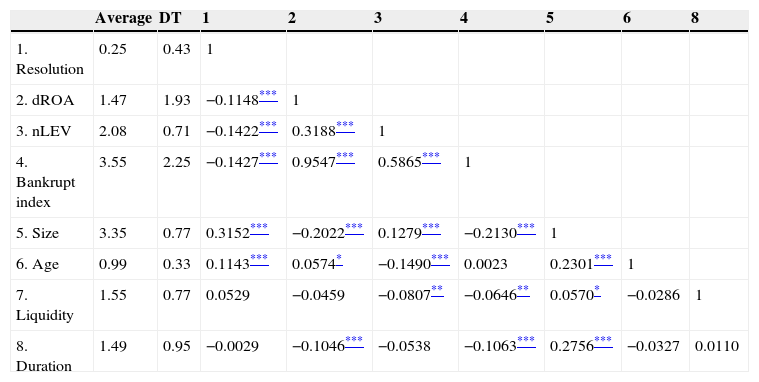

Table A2 in the Appendix shows the correlation matrix between the variables in the study. It should be noted that none of the variables presents a high correlation, with the exception of between the representative variables of ROA and leverage and the bankruptcy index because the index has been made based on the others.

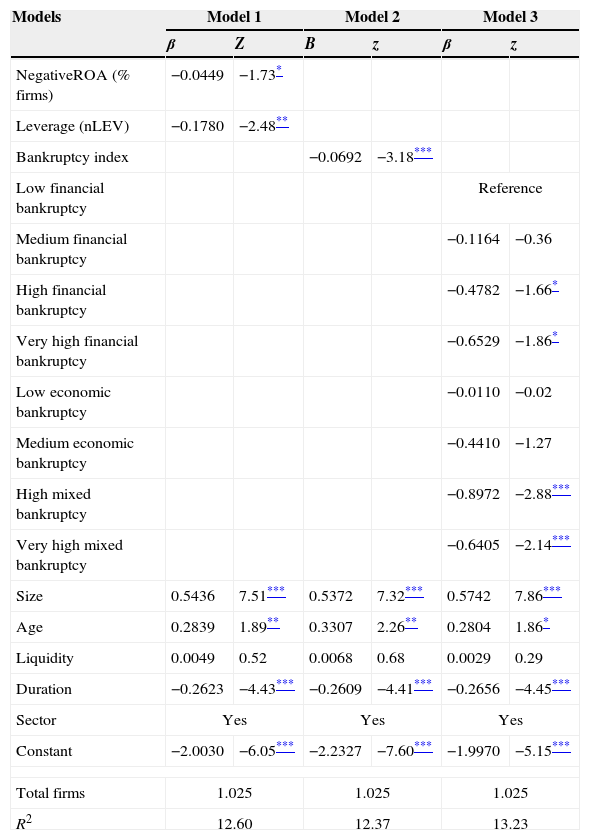

5.2Econometric analysisThe empirical testing of the proposed hypotheses was conducted using a probit model using Resolution (reorganization versus liquidation19 as the dependent variable and the proxies of profitability, leverage and the bankruptcy index as explanatory variables. The results of the estimated models are shown in Table 2.

Type of bankruptcy and resolution Dep. Var.: resolution (1 reorganization/0 liquidation).

| Models | Model 1 | Model 2 | Model 3 | |||

|---|---|---|---|---|---|---|

| β | Z | B | z | β | z | |

| NegativeROA (% firms) | −0.0449 | −1.73* | ||||

| Leverage (nLEV) | −0.1780 | −2.48** | ||||

| Bankruptcy index | −0.0692 | −3.18*** | ||||

| Low financial bankruptcy | Reference | |||||

| Medium financial bankruptcy | −0.1164 | −0.36 | ||||

| High financial bankruptcy | −0.4782 | −1.66* | ||||

| Very high financial bankruptcy | −0.6529 | −1.86* | ||||

| Low economic bankruptcy | −0.0110 | −0.02 | ||||

| Medium economic bankruptcy | −0.4410 | −1.27 | ||||

| High mixed bankruptcy | −0.8972 | −2.88*** | ||||

| Very high mixed bankruptcy | −0.6405 | −2.14*** | ||||

| Size | 0.5436 | 7.51*** | 0.5372 | 7.32*** | 0.5742 | 7.86*** |

| Age | 0.2839 | 1.89** | 0.3307 | 2.26** | 0.2804 | 1.86* |

| Liquidity | 0.0049 | 0.52 | 0.0068 | 0.68 | 0.0029 | 0.29 |

| Duration | −0.2623 | −4.43*** | −0.2609 | −4.41*** | −0.2656 | −4.45*** |

| Sector | Yes | Yes | Yes | |||

| Constant | −2.0030 | −6.05*** | −2.2327 | −7.60*** | −1.9970 | −5.15*** |

| Total firms | 1.025 | 1.025 | 1.025 | |||

| R2 | 12.60 | 12.37 | 13.23 | |||

Model 1 in Table 2 shows the effect of the profitability and leverage individually in the resolution. As noted, both variables are negative and significant, which means that the firms with losses in their economic activity and the firms with high leverage have a reduced likelihood of reorganization. These results are the same as those that were obtained by Fischer and Wahrenburgh (2012). Nevertheless, these individual variables do not allow us to analyze the influence of both variables simultaneously. For this reason, it is necessary to consider the bankruptcy index, which combines both variables.

To do this, in Model 2, the individual variables are replaced by the bankruptcy index, which is negative and significant. This means that a greater value of the index indicates a reduced likelihood of reorganization in the firms. These results support the considered hypothesis to the extent that a greater value of the index means lower viability of the firm that is motivated by economic or economic-financial causes, unlike the firms whose bankruptcy origin is mainly financial.

With the aim of going in depth into the influence of the types of bankruptcy on the likelihood of reorganization, Model 3 is presented. In this model, the bankruptcy index is replaced by dummy variables that represent the different values of the index, using as reference the lower level, that is, “low financial bankruptcy”. As noted, the levels of the index related to financial and mixed bankruptcy (high and very high in both cases) are significant. On the contrary, the levels related to economic bankruptcy are not significant. These results show that in both firms with losses and firms with profits, it is the high level of leverage (debt greater than 75% of its assets) that reduces the likelihood of reorganization. Additionally, it can be observed that the higher levels of the index (mixed bankruptcy) present more significance. This means that a lower viability of the firm reduces the likelihood of reorganization, which supports previous predictions.

Finally, with respect to the control variables, size and age have a positive influence on the probability of reorganization. On the other hand, a greater length of the process, which indicates more complexity, reduces the likelihood of reaching an agreement with the creditors.

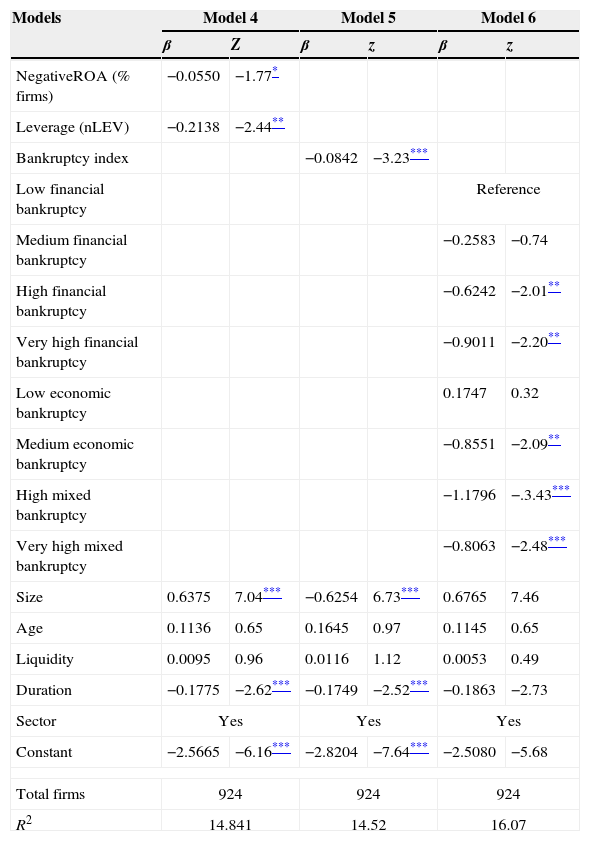

5.3Robustness analysisTo analyze the sensitivity of the obtained results, one robust analysis is shown. As it has been mentioned, 101 of the 257 firms, which have reached originally an agreement with their creditors, are liquidated later. This unsuccessful agreement can occur due to subsequent circumstances to the filing in bankruptcy. Consequently, following Casey et al. (1986), these firms have been eliminated, and 924 firms form the subsample. Among these firms, 157 have been reorganized and 767 have been liquidated, that is, a rate of reorganization of 16.88%. The results of the models are presented in Table 3. Following Casey et al. (1986), those firms that have entered into liquidation after having reached a reorganization agreement have been eliminated. The results of these models, with a sample of 924 firms, are presented in Table 3.

Type of bankruptcy and resolution. Robustness Dep. Var.: resolution (1 reorganization/0 liquidation).

| Models | Model 4 | Model 5 | Model 6 | |||

|---|---|---|---|---|---|---|

| β | Z | β | z | β | z | |

| NegativeROA (% firms) | −0.0550 | −1.77* | ||||

| Leverage (nLEV) | −0.2138 | −2.44** | ||||

| Bankruptcy index | −0.0842 | −3.23*** | ||||

| Low financial bankruptcy | Reference | |||||

| Medium financial bankruptcy | −0.2583 | −0.74 | ||||

| High financial bankruptcy | −0.6242 | −2.01** | ||||

| Very high financial bankruptcy | −0.9011 | −2.20** | ||||

| Low economic bankruptcy | 0.1747 | 0.32 | ||||

| Medium economic bankruptcy | −0.8551 | −2.09** | ||||

| High mixed bankruptcy | −1.1796 | −.3.43*** | ||||

| Very high mixed bankruptcy | −0.8063 | −2.48*** | ||||

| Size | 0.6375 | 7.04*** | −0.6254 | 6.73*** | 0.6765 | 7.46 |

| Age | 0.1136 | 0.65 | 0.1645 | 0.97 | 0.1145 | 0.65 |

| Liquidity | 0.0095 | 0.96 | 0.0116 | 1.12 | 0.0053 | 0.49 |

| Duration | −0.1775 | −2.62*** | −0.1749 | −2.52*** | −0.1863 | −2.73 |

| Sector | Yes | Yes | Yes | |||

| Constant | −2.5665 | −6.16*** | −2.8204 | −7.64*** | −2.5080 | −5.68 |

| Total firms | 924 | 924 | 924 | |||

| R2 | 14.841 | 14.52 | 16.07 | |||

See variable descriptions in Tables 1 and A1 (Appendix).

The results of Models 4 and 5 confirm the sign and statistical significance of Models 1 and 2, respectively. In Model 6, all of the representative variables of the different levels of bankruptcy are negative and significant with the exception of the levels that show low leverage (lower than 50% of the assets) in firms with negative and positive profitability. In addition, a greater explanatory capacity in the three models, specifically in Model 6, is observed. The reason can be the greater homogeneity of the firms in this sample.

6Discussion of results and conclusionsThe present study analyzes the relationship between the causes of bankruptcy and its resolution. Using the arguments in previous literature, we have distinguished between economic and financial bankruptcy. Thus, the hypothesis is that firms entering into bankruptcy due to financial causes present a likelihood of reorganization. Nevertheless, it is proper to add a third category called mixed bankruptcy, with a lower possibility that the firm is reorganized.

The obtained results for a sample of 1025 Spanish firms that filed for bankruptcy in 2008 and had finished the common phase by the end of 2012 show that a greater bankruptcy index reduces the likelihood of reorganization in bankrupt firms. These results agree with the results found by Lemmon et al. (2009) and Fischer and Wahrenburgh (2012), although our study is different in the construction and interpretation of the index. In this sense, those authors explain the index as economic versus financial bankruptcy, and therefore, they conclude that financial bankruptcy, more than economic, increases the likelihood of reorganization. In addition, the firms that present a mixed bankruptcy are situated in an undefined position. However, in our study, in the bankruptcy index, the mixed bankruptcy is situated in the upper zone, with the maximum values. In sum, the results allow us to conclude that more so than the type of bankruptcy, it is the viability of the firms that has an impact on the likelihood of reorganization. In this sense, it is demonstrated that a lower viability (a greater index of bankruptcy) reduces in a significant way the likelihood that the firm reaches an agreement with its creditors.

Finally, the results allow us to extract important implications related to the efficiency of the bankruptcy legislation. The fact that less viable firms present a lower likelihood of being reorganized reveals a high level of efficiency in the Spanish process. These conclusions are in line with the results of Lemmon et al. (2009) for USA legislation. These authors conclude that their results do not support the vision that Chapter 11 allows nonviable firms to solve the bankruptcy without making important changes in their assets. In the same line, Fischer and Wahrenburgh (2012) assert that Chapter 11 produces enough information to reach an optimum resolution, separating efficient and inefficient firms.

We thank “La Cátedra la Caixa in Banking and Financial Studies” from de ULPGC for its support.

Bankruptcy index.

| Level | Droa | nEND | Bankruptcy index |

|---|---|---|---|

| ROA=EBITDA/TA | LEV=TD/TA | DROA+nEND | |

| Low financial bankruptcy | Positive (0) | LEV <=0.5 (0) | 0+0=0 |

| Medium financial bankruptcy | Positive (0) | LEV 0.5–0.75 (1) | 0+1=1 |

| High financial bankruptcy | Positive (0) | LEV 0.75–1 (2) | 0+2=2 |

| Very high financial bankruptcy | Positive (0) | LEV >1 (3) | 0+3=3 |

| Low economic bankruptcy | Negative (4) | LEV <=0.5 (0) | 4+0=4 |

| Medium economic bankruptcy | Negative (4) | LEV 0.5–0.75 (1) | 4+1=5 |

| High mixed bankruptcy | Negative (4) | LEV 0.75–1 (2) | 4+2=6 |

| Very high mixed bankruptcy | Negative (4) | LEV >1 (3) | 4+3=7 |

Descriptive statistics and correlation matrix.

| Average | DT | 1 | 2 | 3 | 4 | 5 | 6 | 8 | |

|---|---|---|---|---|---|---|---|---|---|

| 1. Resolution | 0.25 | 0.43 | 1 | ||||||

| 2. dROA | 1.47 | 1.93 | −0.1148*** | 1 | |||||

| 3. nLEV | 2.08 | 0.71 | −0.1422*** | 0.3188*** | 1 | ||||

| 4. Bankrupt index | 3.55 | 2.25 | −0.1427*** | 0.9547*** | 0.5865*** | 1 | |||

| 5. Size | 3.35 | 0.77 | 0.3152*** | −0.2022*** | 0.1279*** | −0.2130*** | 1 | ||

| 6. Age | 0.99 | 0.33 | 0.1143*** | 0.0574* | −0.1490*** | 0.0023 | 0.2301*** | 1 | |

| 7. Liquidity | 1.55 | 0.77 | 0.0529 | −0.0459 | −0.0807** | −0.0646** | 0.0570* | −0.0286 | 1 |

| 8. Duration | 1.49 | 0.95 | −0.0029 | −0.1046*** | −0.0538 | −0.1063*** | 0.2756*** | −0.0327 | 0.0110 |

See variable descriptions in Table 1.

Law 22/2003, dated 22 July, bankruptcy proceeding law, LC hereinafter, which entered into effect on September 1, 2004. This regulation has been modified by, among others, the Royal Decree 3/2009, dated March 27, by Law 13/2009, dated November 3, in a reform of the procedural legislation, by law 38/2011 dated October 10 and by the Royal Decrees 4/2014 and 11/2014.

Until the end of the period of credits communication, with the condition that it is accompanied by the acts of adhesion of the creditors, in the proportion of the Law. The regulation of the early proposal of agreement even allows the judicial approval of the agreement during the common stage of the process, with an important reduction of time and costs regarding the current bankruptcy proceedings.

Royal Decree 11/2014.

See article 142 of the bankruptcy proceedings Law (LC).

See article 145 of the bankruptcy proceedings Law (LC).

The minimum punctuation points out a pro-debtor legislation, while the maximum punctuation points out a pro-creditor legislation.

Germany, Austria, Denmark and Belgium are in the same group.

More concretely, this author compares the importance of reorganization in the USA, Germany, France, the UK and Holland.

The role of the judges in the bankruptcy process is more relevant in Civil Law countries than the Common Law ones (Brouwer, 2006).

Those authors present a model where the quality of the legislation depends on the experience of the judges and on the quality of the contracts. Their model shows that bankruptcy legislation that tries to safeguard the firm value as a going concern (as Chapter 11) requires judicial experience to be effective.

Webconcursal, webpage with information about bankruptcy proceedings: www.webconcursal.com. Access February 2013. However, this web has changed and actually is not possible obtain the list of the filing firms. Only offers the information of the assets in liquidation.

SABI (Iberian Balance Analysis System; Bureau Van Dick database).

In Spanish legislation, a LLC is called S.L. (Sociedad Limitada) and PLC is called S.A. (Sociedad Anónima).

Cooperatives, foundations and other legal entities (not LLC and PLC) were excluded. We also eliminated sporting business corporations, as in Leyman et al. (2011).

In fact, the rate between the number of reorganized firms and the total number of bankruptcies in 2008 (258/2453) is 10.5%.

This author uses the operative result as a proxy for the ratio EBITDA/Adjusted Sales (with the sector median).