To my knowledge, this is the first paper that investigates the links between trust, the institutional setting (in terms of employment protection legislation (EPL) and investor rights) and studies the impact of all three on economic performance. In line with the previous literature (e.g. Knack and Keefer, 1997; Zak and Knack, 2001), we find that trust has a positive impact on GDP per capita growth. Our novel results are twofold. First, we find that EPL and investor rights have a negative relationship and that both (although the latter to a lesser extent) are substitutes for trust. Second, all three variables have a positive effect on economic growth.

La Porta et al. (1997a, p. 333) define trust as ‘[the] propensity of people in a society to cooperate to produce socially efficient outcomes and to avoid inefficient noncooperative traps such as that in the prisoner's dilemma’. This definition suggests that, contrary to the assertion of game theory that cooperation, fostered by trust, is not a rational strategy, people tend to trust others, including people they have never met, and expect them to cooperate even so they may never meet them again. The need for trust arises when there is asymmetric information, i.e. when the principal is unable to observe directly the actions of the agent. Trust is important when dealing with complete strangers or persons that one does not interact with on a regular basis. In contrast, regular dealings between parties are much less reliant on trust as such dealings enable each party to build up a reputation based on past interactions and also to punish each other for opportunistic behaviour. Hence, trust is more important in large organisations, such as large firms or bureaucracies, where dealings between people are less frequent and reputations cannot therefore be built up and punishments meted out.

Knack and Keefer (1997) argue that trust has economic benefits given that it reduces the costs of the principal dealing with an agent required to carry out some activities at a future date. Such dealings include the sale on credit of goods and services, investments that can be easily expropriated by the investee or the government and actions of a worker which cannot be easily monitored by the manager.

The existing literature suggests that trust increases economic growth and improves investment and institutional performance. It also suggests that particular societal and cultural characteristics, i.e. income inequality, ethnolinguistic and ethnic diversity as well as the percentage of a country's citizens following hierarchical religions, reduce trust. This paper goes beyond the analysis of the economic effects of trust and the determinants of the latter by analyzing how trust impacts on the institutional design, i.e. investor and employment rights. This paper finds strong evidence which suggests that it is important to analyse jointly shareholder rights and employment protection legislation. Indeed, while there is a negative relationship between the two, the regression results also suggest that they both affect the economic outcome in a positive way.

This paper has a companion paper (Goergen et al., 2013). While the present paper focuses on trust at the country level the companion paper also considers trust at the level of individual firms in each country. Although the inclusion of firm-level trust has certain advantages, it also makes the analysis, including the measurement of economic performance, firm performance to be more precise, more difficult. Indeed, the data required for the calculation of firm trust include sensitive data about employment practices that firms are not required to disclose. These data are sourced from the Cranet surveys. One of the limitations of the Cranet surveys is that firm performance is self-reported and not certified by third parties as this is the case with audited performance figures. As firms are anonymized in the Cranet surveys there is no way to remedy this. In contrast, the present paper uses GPD per capita growth, which is a less contentious measure of economic performance.

The rest of the paper is structured as follows. Section 2 reviews the literature on trust, investor rights and employment protection legislation. The following section focuses on the development of the hypotheses and discusses the methodology and data sources. Section 4 is on the empirical analysis. Finally, Section 5 concludes.

2Literature reviewThis section starts with a review of the literature on trust and economic performance, followed by a review of the literature on investor rights and economic efficiency. It then turns to the theory and the empirical evidence on the effect of employment protection legislation on economic performance.

2.1Trust and economic growthPutnam's (1993) study of the effects of the 1970 constitutional reform in Italy suggests that civic engagement, which creates trust, improves economic and institutional performance. This reform created local governments in charge of individual regions in Italy. While these local governments proved to be relatively efficient in the North, they failed in the South. Putnam argues that the reason why the new governments succeeded in the North is its long tradition of civic engagement. This civic engagement creates trust between the members of the civic community even though the members may not always have the same opinion on key issues. In particular, Putnam argues that flat or horizontal organisations create trust whereas hierarchical or vertical organisations, including hierarchical religions such as Catholicism, reduce trust.

Fukuyama (1995) studies the decline of sociability in the USA, i.e. the growing distrust among American citizens. He reports that, compared to other developed countries, the US spends significantly more on police protection and has a significantly higher proportion of its population locked up in prisons. The US also has a much more pronounced culture of litigation, with its citizens spending significantly more on lawyer fees than for example Europe or Japan. He argues that, similar to its savings deficit, the US has been living off its accumulated trust or social capital for a while without investing further in it. However, contrary to the ongoing political debate in a series of industrialised countries, he does not claim that a return to family values, which have been gradually eroded over the last decades, will improve sociability. He cites the examples of China and Italy where family ties are important. While strong family or blood ties (which Fukuyama refers to as familism) in themselves may not be detrimental to economic growth, they nevertheless put severe limits to the type and especially the size of firms that can proliferate under such circumstances and the sectors firms will operate in.

Zak and Knack (2001) study the impact of trust on economic performance. They first develop a theoretical model and then test the validity of its predictions on 44 countries. The model deals with transactions between investors and their investment brokers. Trust is the total amount of time economic actors spend on production rather than on monitoring others. The model predicts that rich investors will spend more time monitoring their brokers as they have more wealth to protect. However, taking time off work to monitor one's broker becomes a less attractive proposal as one's earnings from production increase. The level of monitoring is also reduced when formal and informal institutions are strong enough to reduce cheating. Wage inequality will result in more monitoring that is a less trusting society, as the effort the poor will spend on monitoring will be higher than the reduction in monitoring caused by the higher wages of the rich. To sum up, Zak and Knack predict that higher trust increases investment and economic growth. As to the determinants of trust, more societal homogeneity and less income inequality increase trust.

Zak and Knack (2001) main data source is the World Values Survey (WVS). They measure trust by the percentage of respondents in each country agreeing that ‘most people can be trusted’. They find the following:1 (i) investment is higher in countries where incomes are higher and where there is more trust; (ii) there is a positive relationship between growth and trust; (iii) there is relatively little variation of trust across time compared to the cross-country differences in trust; (iv) trust has a quadratic, U-shaped relationship with ethnic homogeneity suggesting that trust is lowest in countries where there are several sizeable groups2; (v) trust depends positively on the government's attitude towards property rights and negatively on income inequality and land inequality; and (vi) while growth is positively related to the strength of property rights trust remains significant. Zak and Knack explain the latter result by the fact that property rights proxy for the people's trust in their government whereas the trust index is a proxy for the level of trust between individuals.

While Zak and Knack (2001) argue that trust and property rights measure trust towards two different types of economic agents (individuals and the government, respectively), Knack and Keefer (1997) hypothesise that trust between citizens can be a substitute for property rights and law enforcement in countries where these are weak. They also predict that high-trust societies will have longer investment horizons than societies where trust is low. In the former, incentives will also be higher for employers to invest in their staff and for employees to acquire firm-specific skills. Citizens will be prevented from opportunistic behaviour by norms of civic cooperation and the sanctions imposed for breaking these. These sanctions are internal (such as guilt) and external (such as ostracism and shame). If civic norms manage to prevent opportunistic behaviour, economic actors will have more time to spend on producing rather than on monitoring other economic actors. Civic norms of cooperation also help citizens reduce expropriation by politicians and other government officials. Indeed, if civic norms are such that citizens are expected to be involved in politics, this will overcome the classical free-rider problem. Knack and Keefer investigate the impact of trust3 and civic norms4 on growth and investment. They find that economic growth – measured by the average annual growth in per capita income during 1980–92–and investment – measured as a proportion of GDP – are positively related to trust and the strength of civic norms. Further, the impact of trust is higher in poorer countries where formal institutions and the quality of law are likely to be weaker suggesting that trust does indeed act as a substitute for the latter two. They also find strong negative correlations between income inequality on one side and trust and civic norms on the other side. However, when income inequality is added as an independent variable to the regressions that explain economic growth, the coefficients on trust and civic norms remain significant in three out of four regressions.

Knack and Keefer (1997) also test the validity of Putnam's (1993) hypothesis that horizontal associational activity increases growth. This hypothesis is in direct contrast with Olson (1982) who claims that horizontal associations tend to be self-serving associations – such as lobbying groups – which divert economic resources into their own pockets at the detriment of the rest of society. Hence, according to Olson, associational activity is likely to hurt rather than to promote economic growth. Knack and Keefer measure associational activity by the average number of horizontal groups respondents from each country belong to. They find that associational activity is not significant in either the growth or investment regressions. They interpret this as evidence that the positive effect of horizontal networks (Putnam, 1993) is offset by their negative effect (Olson, 1982).

La Porta et al. (1997a) study the impact of trust on four measures of performance, i.e. the efficiency of government,5 participation,6 the performance of large firms (measured by the aggregate sales of the top 20 firms as a percentage of GNP) and social efficiency by trust.7 They find that trust increases all four measures of performance. They also test Fukuyama's (1995) hypothesis of the negative effect of familism on large firms: the share of the top 20 firms of the GNP is negatively related to the trust people put in their family.8 Hence, they find support for Fukuyama's hypothesis that strong family ties limit the development of large firms. Finally, they also test whether Putnam's (1993) hypothesis that the importance of vertical organisations, i.e. hierarchical religions, reduces trust. La Porta et al. consider that Catholicism, the Eastern Orthodox Church and Islam are such religions. They find evidence in favour of this hypothesis. In contrast, they do not find that ethnic heterogeneity measured by ethnolinguistic heterogeneity reduces trust.

2.2Investor rights and economic growthAlthough La Porta et al. (1997b, 2000a, 2000b) do not study the impact of investor protection on economic growth, a reading of their work nevertheless suggests that the former is a necessary and sufficient condition to achieve the latter. For example, La Porta et al. (1997b) find that equity and debt markets are more developed in countries with strong investor protection.9 In contrast, the varieties of capitalism (VOC) literature (see e.g. Amable (2003) and Hall and Soskice (2001)) do not claim that a single set of institutional arrangements is superior to all others. Central to this literature is the concept of complementarities (see e.g. Boyer, 2006) whereby an institution is more efficient or productive if it exists jointly with another institution. In other words, countries with weak investor rights may have similar economic performance to those with strong investor rights due to different sets of complementarities.

2.3Employment protection and economic performanceDeelen et al. (2006) define employment protection legislation (EPL) as ‘the institutions related to the dissolution of matches between firms and workers. Most notably, administrative and legal procedures including notice periods, severance pay and firing taxes. These arrangements may be the result of government legislation, collective labour agreements and/or individual contracts’ (p. 15). Their review of the theoretical literature suggests that the effect of EPL can be positive as well as negative. The positive effect stems from EPL insuring workers against loss of income via severance pay and notice periods (see e.g. Fella (2006) and Pissarides (2001, 2004)). In addition, Nagypál (2002) and others argue that EPL has a positive effect on productivity as it encourages firm-specific or job-specific investments in human capital. Nevertheless, this positive effect of EPL only applies to economies suffering from underinvestment by workers who are concerned that the gains from their investment will be ex post by their employers.

However, EPL also makes it more difficult for employers to fire employees as employees may become less productive given the lower likelihood of dismissal. Apart from such moral hazard, there are at least three other factors that may reduce the positive effect of EPL, i.e. its insurance role. First, the existence of unemployment insurance reduces the positive impact of severance pay. While severance pay is a one-off payment made when a worker is laid off, unemployment insurance is better at insuring the worker against the uncertain duration of the unemployment stage. Second, the existence of a working partner makes an individual less dependent on a single income. Finally, and most relevant for the context of this paper, better capital markets reduce the costs for workers to save and borrow in order to protect themselves against the risk of unemployment. Again, this reduces the positive, insurance role of EPL. All in all, this suggests that from a theoretical point of view the effect of EPL on productivity is not clear while the correlation between EPL and investor protection is likely to be negative.

Deelen et al. (2006) also review the empirical literature. They conclude that the effect of EPL on productivity is as yet not clear. Indeed, Nickell and Layard (1999) do not find a consistent effect, whether positive or negative, of EPL on productivity. In contrast, Bartelsman and Hinloopen (2005) find a consistent and significantly negative effect of EPL on investment. Finally, Belot et al. (2007) find a non-linear relationship between EPL and GDP growth for the case of 17 OECD countries. At first, an increase in EPL has a positive impact on economic performance, but once EPL exceeds a certain threshold its effect becomes negative.

2.4ConclusionThere is widespread consensus in the academic literature that trust has a positive effect on economic performance. At the extreme, a society where trust is absent may even suffer from economic backwardness, the so called low-trust poverty trap. Further, according to the finance and law literature, starting with the seminal work of La Porta et al. (1997b), there is a link between investor protection and the development of capital markets, and eventually economic growth. In other words, the finance and law literature prescribes a certain set of institutional arrangements, characterised by strong investor rights and developed capital markets. Given that shareholders’ investments in firms are essentially sunk funds, Shleifer and Vishny (1997) argue that investors should be better protected than workers. Hence, while there is a trade-off between investor rights and worker rights, the finance and law literature is fairly unanimous as to how this trade-off should be resolved: the optimal outcome consists of strong investor rights and weak (or a least, weaker) employment rights. Finally, there is no agreement, both from a theoretical as well as empirical point of view, as to the impact of EPL on productivity and economic growth.

While the focus of this paper is clearly on the impact of trust on a country's institutional settings, we feel that we provide at least a tentative answer as to the effect of EPL on economic growth. Given that we do not only concentrate on EPL in isolation, but also take into account the rights of investors, we feel that our study adopts a more holistic approach to studying the impact of EPL on economic efficiency.

3Hypotheses, data and methodologyThe aim of this paper is twofold. First, we attempt to explain cross-country differences in terms of the institutional setting, in particular employment protection legislation and investor rights, by the level of trust prevailing in each country. Second, we investigate the impact of the institutional framework and trust on economic performance.

Pagano and Volpin (2005) develop a model to explain differences in investor and worker rights across countries. Their model is based on three clearly delimited types of economic actors, i.e. managers, workers and so called rentiers. While the former two types do not hold shares in the companies they work for and their income is entirely generated from their human capital, rentiers are minority shareholders who live off their investment income and do not have paid jobs. Their model predicts that there will be a trade-off between strong investor rights and strong employee rights and that the outcome of this trade-off depends on the relative power of the three types of actors.10 Therefore, there should be a negative relationship between EPL and investor rights.

Similar to Zak and Knack (2001), we hypothesise that trust is a determinant of economic growth. However, while Zak and Knack did not consider such a link, we follow in the footsteps of La Porta et al. (1997b, 1998) and expect shareholder protection to increase economic performance. We also expect that there is a substitution effect between trust on one side and strong investor and worker rights on the other side.

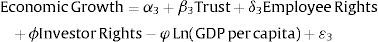

In detail, our empirical model consists of the following system of simultaneous equations:

where X is a vector of exogenous variables (see below for further information). Each of the equations in the system needs to be just-identified or over-identified. An equation will be just-identified (over-identified) if the number of predetermined or exogenous variables excluded in the equation is equal to (greater than) the number of endogenous variables – 1 included in the equation. In other words, equations (1)–(3) will be just-identified (over-identified) if there are (more than) 2, 2 and 3 exogenous variables, respectively, in Eq. (4). In turn, Eq. (4) does not need to exclude any exogenous variables to be just-identified as it includes only one endogenous variable. In order to ensure that all the equations within the system are at least identified, Eq. (4) will need to include a minimum of 3 exogenous variables.We expect both trust and investor rights to have a negative sign in Eq. (1). Similarly, trust and employment protection in Eq. (2) are expected to have negative signs. Finally, trust, employment protection and investor rights are predicted to have a positive effect on economic growth whereas richer nations (as measured by a higher GDP per capita) are expected to grow at a slower rate than poorer nations.

The model is estimated using the three-stage least-squares estimation method (3SLS) for a system of simultaneous linear equations with instrumental variables. 3SLS is asymptotically more efficient than 2SLS as it takes into account information on the error covariances as well as information contained in the endogenous variables included in the other equations (see Greene (2003) and Brooks (2008)). The instrumental variables we use are similar or identical to those from previous literature. In detail, these include the number of lawyers per population in millions, an index of ethnolinguistic diversity, the logarithm of GDP per capita, the percentage of the population belonging to a hierarchical religion and income inequality. Knack and Keefer (1997) use similar control variables11 for trust. However, they use the number of law students rather than the number of lawyers per population,12 and an ethnic homogeneity index rather than an ethnolinguistic index. In addition, Zak and Knack (2001) use the percentages of the population belonging to the Muslim, Catholic and Christian Orthodox churches as instruments for trust.13

We use the same measure for EPL as Pagano and Volpin (2005), i.e. the OECD index for the strictness of EPL. This index is measured in 2003 and is available for 28 of the 30 OECD member states.14 It ranges from 0 to 6, with higher values signifying more stringent EPL (see OECD, 2004 for further details). While this measure is only available for 28 OECD countries, most of the other variables are available for much larger samples. In the univariate analysis, we will also refer to the larger sample where applicable.

We use two different measures for investor protection: Djankov et al.’s (2008) anti-self-dealing index as well as the anti-directors-rights index from La Porta et al. (1997b, 1998). According to Djankov et al., the former index has a stronger theoretical basis than the latter one which was constructed in a fairly ‘ad hoc’ way (see La Porta et al. (1997b, 1998) for further details). The anti-self-dealing index counts the number of hurdles that the controlling shareholder will have to jump to engage in self-dealing transactions, i.e. transactions that result in minority shareholder expropriation.

Trust is measured in the same way as in the previous literature (e.g. La Porta et al. (1997a, 1997b), and Knack and Keefer (1997)). It is the percentage of respondents in each country sourced from the World Values Survey from the late 1990s who agree that “most people can be trusted”. As trust is measured during the late 1990s for most countries whereas all other variables are measured during the 2000s, this lag addresses at least to some extent the possible endogeneity of trust.15 In addition, La Porta et al. (1997a), among others, point out that trust does not vary substantially across time. They find that the correlation of the trust variable between the 1980s and 1990s is as high as 0.91. Hence, it is reasonable to assume that trust is mainly exogenous.

Economic growth is measured as the average percentage growth rate in GDP per capita (measured in constant year 2000 US dollars) over the period of 2000–2006 (as a robustness check we also use the longer period of 1990–2006). It is obtained from the World Development Indicators (April 2008) by the World Bank. The number of lawyers per millions of inhabitants is the ratio of the number of lawyers in each country (which is obtained from various sources including the Council of Bars and Law Societies of Europe (CCBE) and the American Bar Association) divided by that country's number of inhabitants (in millions) in 2004 (from the World Development Indicators). The number of lawyers per millions of inhabitants measures the litigious nature of a country's culture. In particular, Murphy et al. (1991) argue that there is a relationship between the number of lawyers in a country and the amount of rent-seeking and litigation. In line with their argument and their empirical evidence, Magee et al. (1989) find a negative link between economic growth and the number of lawyers.

Ethnolinguistic diversity is measured as in Gordon (2005). It is measured by the probability that two randomly chosen inhabitants of a country will have different mother tongues (Lieberson (1981)). It is an index which ranges from 0 (all inhabitants speak the same mother tongue and there is no diversity) to 1 (no two inhabitants have the same mother tongue and there is maximum diversity). The logarithm of GDP per capita is from the World Development Indicators (as used in Djankov et al. (2008)). It is measured in 1990 and 2000, respectively. The percentage of the population following a hierarchical religion is taken from La Porta et al. (1997a).16 Finally, similar to Zak and Knack (2001), we use the Gini coefficient as another instrument. The Gini coefficient, which measures income inequality, is from the World Development Indicators and is typically measured in 2000.17

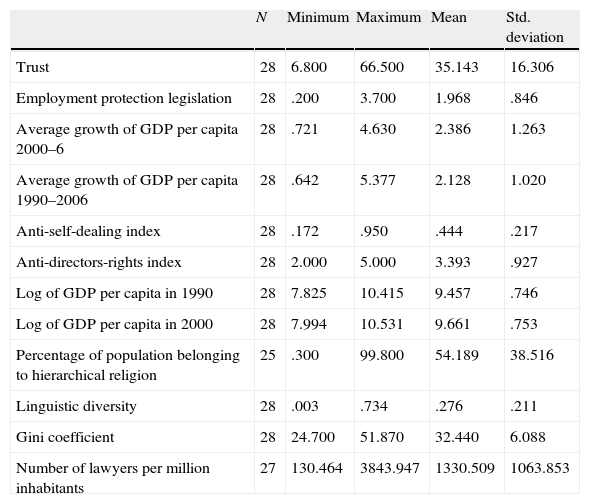

Table 1 contains the descriptive statistics on the variables and instruments. While our sample is fairly small compared to the sample size of a typical study in corporate finance, it is nevertheless comparable to other studies on trust. For example, Knack and Keefer (1997) and La Porta et al. (1997a) have a sample size of 26–28 and 27–40, respectively. Essentially, our sample size is conditioned by the availability of the measure on the strictness of employment protection legislation which is available for 28 (of the 30) OECD countries only.

Descriptive statistics.

| N | Minimum | Maximum | Mean | Std. deviation | |

| Trust | 28 | 6.800 | 66.500 | 35.143 | 16.306 |

| Employment protection legislation | 28 | .200 | 3.700 | 1.968 | .846 |

| Average growth of GDP per capita 2000–6 | 28 | .721 | 4.630 | 2.386 | 1.263 |

| Average growth of GDP per capita 1990–2006 | 28 | .642 | 5.377 | 2.128 | 1.020 |

| Anti-self-dealing index | 28 | .172 | .950 | .444 | .217 |

| Anti-directors-rights index | 28 | 2.000 | 5.000 | 3.393 | .927 |

| Log of GDP per capita in 1990 | 28 | 7.825 | 10.415 | 9.457 | .746 |

| Log of GDP per capita in 2000 | 28 | 7.994 | 10.531 | 9.661 | .753 |

| Percentage of population belonging to hierarchical religion | 25 | .300 | 99.800 | 54.189 | 38.516 |

| Linguistic diversity | 28 | .003 | .734 | .276 | .211 |

| Gini coefficient | 28 | 24.700 | 51.870 | 32.440 | 6.088 |

| Number of lawyers per million inhabitants | 27 | 130.464 | 3843.947 | 1330.509 | 1063.853 |

The variables are defined in Table A1.

Table 1 shows that the percentage of the population trusting strangers ranges from only 6.8% in Turkey to 66.5% in Denmark with a cross-country average of about 35%. Employment protection legislation is lowest in the USA and highest in Turkey. Over the period of 2000–2006, the average annual growth of GDP per capita was lowest in Portugal with 0.72% and highest in Hungary with 4.63%. For the period of 1990–2006, Switzerland grew at the slowest rate (0.64%) and Ireland at the highest rate (5.38%). The UK is the country that scores highest on the anti-self-dealing index whereas Mexico is at the bottom of the league table. A series of countries (e.g. Japan and the UK) achieve the observed maximum value of 5 for the anti-directors-rights index and the minimum value of 2 (e.g. Greece and Hungary). While Turkey has the lowest GDP per capita in both 1990 and 2000, it also has the highest percentage of the population which belong to a hierarchical religion. Japan is in exactly the opposite case with the highest GDP per capita in 1990 (Norway ranks at the top in 2000) and the lowest percentage of the population belonging to a hierarchical religion. Belgium ranges at one extreme of the spectrum in terms of linguistic diversity: two inhabitants selected at random from Belgium have a 73% chance of not having the same mother tongue. In contrast, in Korea the probability of bumping into a person with a different mother tongue is close to zero. Denmark not only has the highest level of trust, but it also has the lowest level of income inequality. Mexico has the most severe income inequality while its level of trust (21.8%) is below the cross-country average of 35%. This suggests that the negative relationship between trust and income inequality uncovered by the previous literature (e.g. Knack and Keefer (1997)) is also reflected in our data sample. Finally, the USA has the highest number of lawyers (3844) per million inhabitants whereas Korea has the lowest (130).

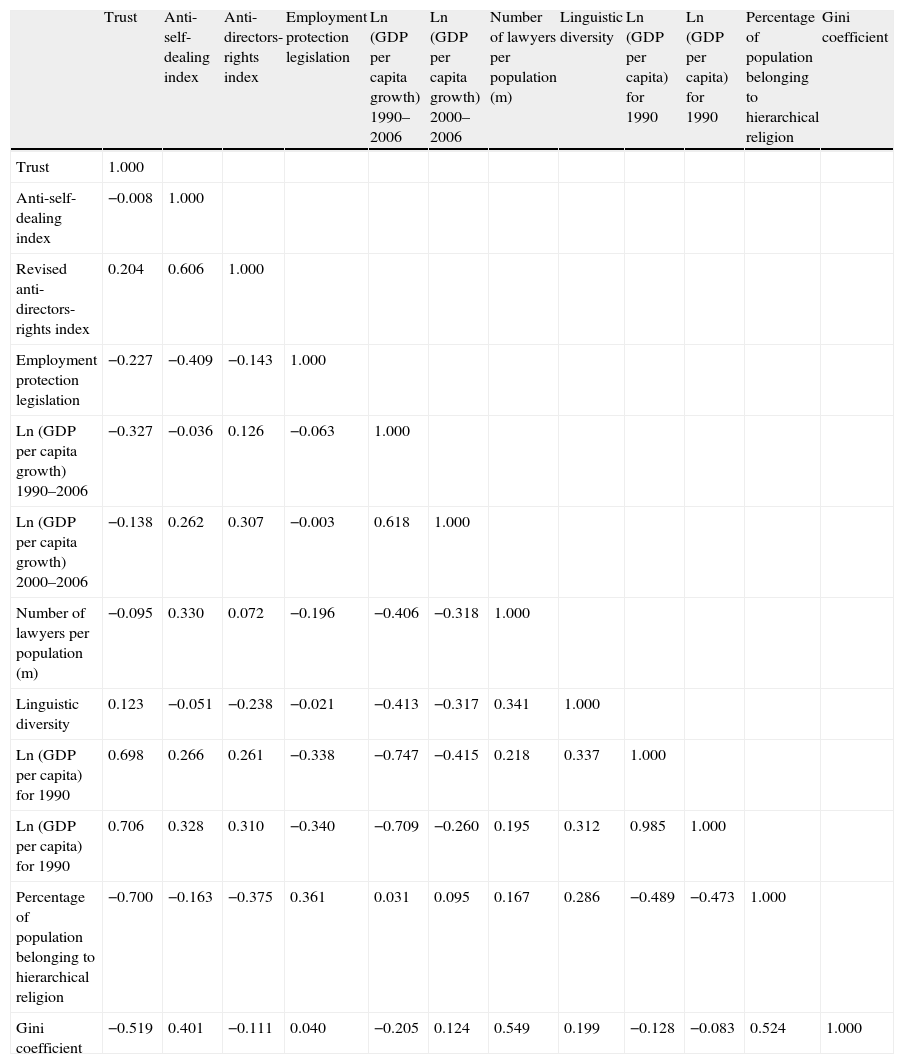

The Pearson correlation matrix for all the variables and instruments is reported in Table 2. As reported in the previous literature, trust is highly and negatively correlated with income inequality (as measured by the Gini coefficient) and the percentage of the population belonging to a hierarchical religion. There is a negative correlation between the strictness of employment protection legislation on one side and the anti-self-dealing index and the anti-directors-rights index on the other side.

Correlation matrix.

| Trust | Anti-self-dealing index | Anti-directors-rights index | Employment protection legislation | Ln (GDP per capita growth) 1990–2006 | Ln (GDP per capita growth) 2000–2006 | Number of lawyers per population (m) | Linguistic diversity | Ln (GDP per capita) for 1990 | Ln (GDP per capita) for 1990 | Percentage of population belonging to hierarchical religion | Gini coefficient | |

| Trust | 1.000 | |||||||||||

| Anti-self-dealing index | −0.008 | 1.000 | ||||||||||

| Revised anti-directors-rights index | 0.204 | 0.606 | 1.000 | |||||||||

| Employment protection legislation | −0.227 | −0.409 | −0.143 | 1.000 | ||||||||

| Ln (GDP per capita growth) 1990–2006 | −0.327 | −0.036 | 0.126 | −0.063 | 1.000 | |||||||

| Ln (GDP per capita growth) 2000–2006 | −0.138 | 0.262 | 0.307 | −0.003 | 0.618 | 1.000 | ||||||

| Number of lawyers per population (m) | −0.095 | 0.330 | 0.072 | −0.196 | −0.406 | −0.318 | 1.000 | |||||

| Linguistic diversity | 0.123 | −0.051 | −0.238 | −0.021 | −0.413 | −0.317 | 0.341 | 1.000 | ||||

| Ln (GDP per capita) for 1990 | 0.698 | 0.266 | 0.261 | −0.338 | −0.747 | −0.415 | 0.218 | 0.337 | 1.000 | |||

| Ln (GDP per capita) for 1990 | 0.706 | 0.328 | 0.310 | −0.340 | −0.709 | −0.260 | 0.195 | 0.312 | 0.985 | 1.000 | ||

| Percentage of population belonging to hierarchical religion | −0.700 | −0.163 | −0.375 | 0.361 | 0.031 | 0.095 | 0.167 | 0.286 | −0.489 | −0.473 | 1.000 | |

| Gini coefficient | −0.519 | 0.401 | −0.111 | 0.040 | −0.205 | 0.124 | 0.549 | 0.199 | −0.128 | −0.083 | 0.524 | 1.000 |

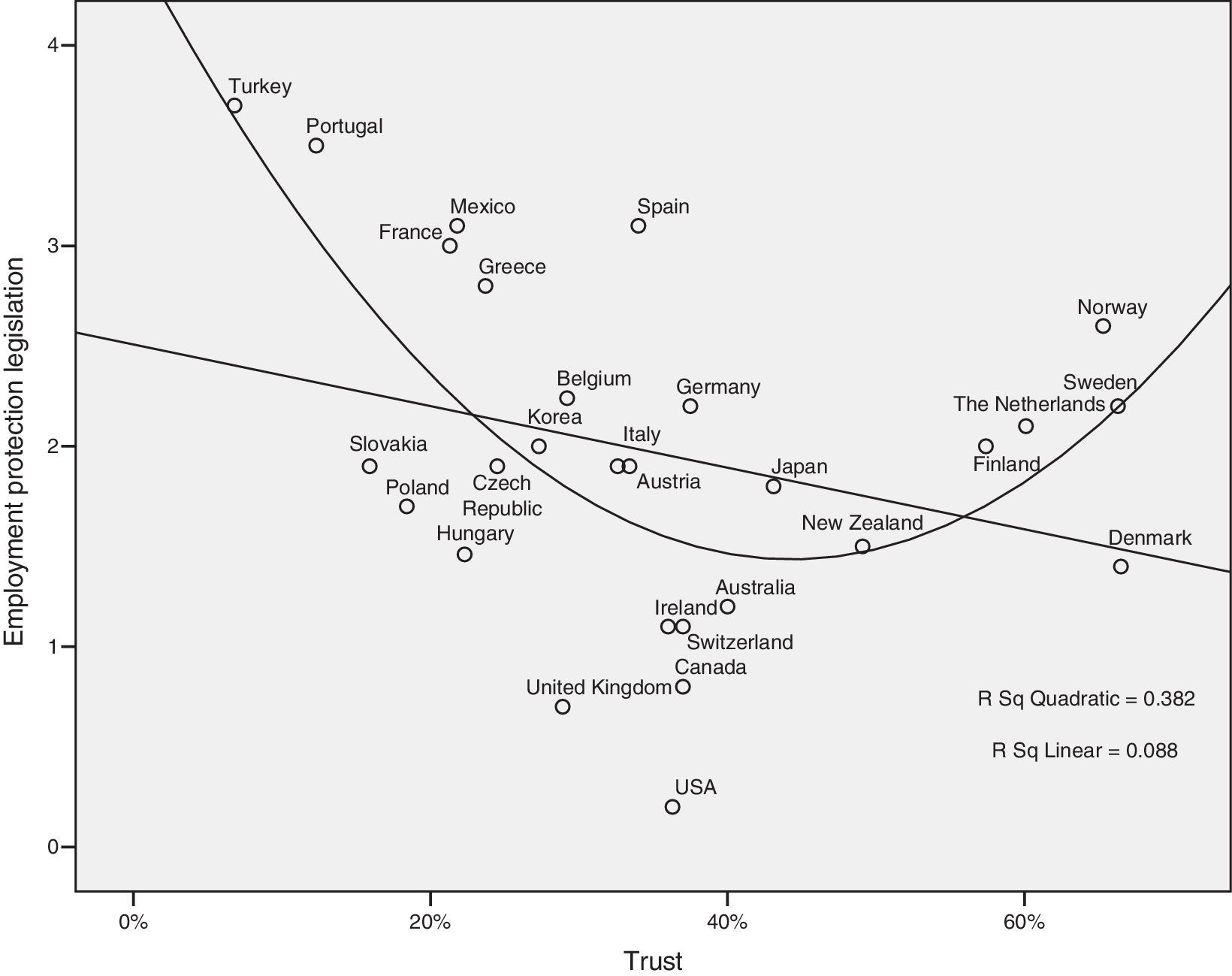

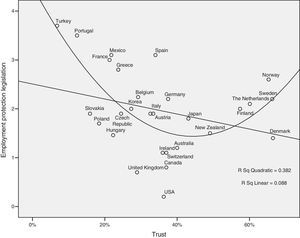

Before moving on to the discussion of the estimation results of the simultaneous-equations model, we investigate the relationship between the various variables with the help of diagrams and univariate regressions. Fig. 1 shows the relationship between the OECD measure of the strictness of employment protection legislation and trust. There is a negative linear relationship between the two variables (the coefficient on trust is significant at the 13% level) suggesting that countries with low levels of trust have better employment protection than those with high levels of trust. When the strictness of employment protection legislation is regressed in a quadratic equation on both the level of trust and the square of trust, the fit of the line increases from an R2 of 0.088 to about 0.38. Both the coefficient on the level of trust and that on the square of trust are significant at the 1% level of significance. The results from the quadratic equation suggest that, at low levels of trust, an increase in trust reduces the stringency of employment protection law to attain a minimum at about 40% of trust and to increase again thereafter.

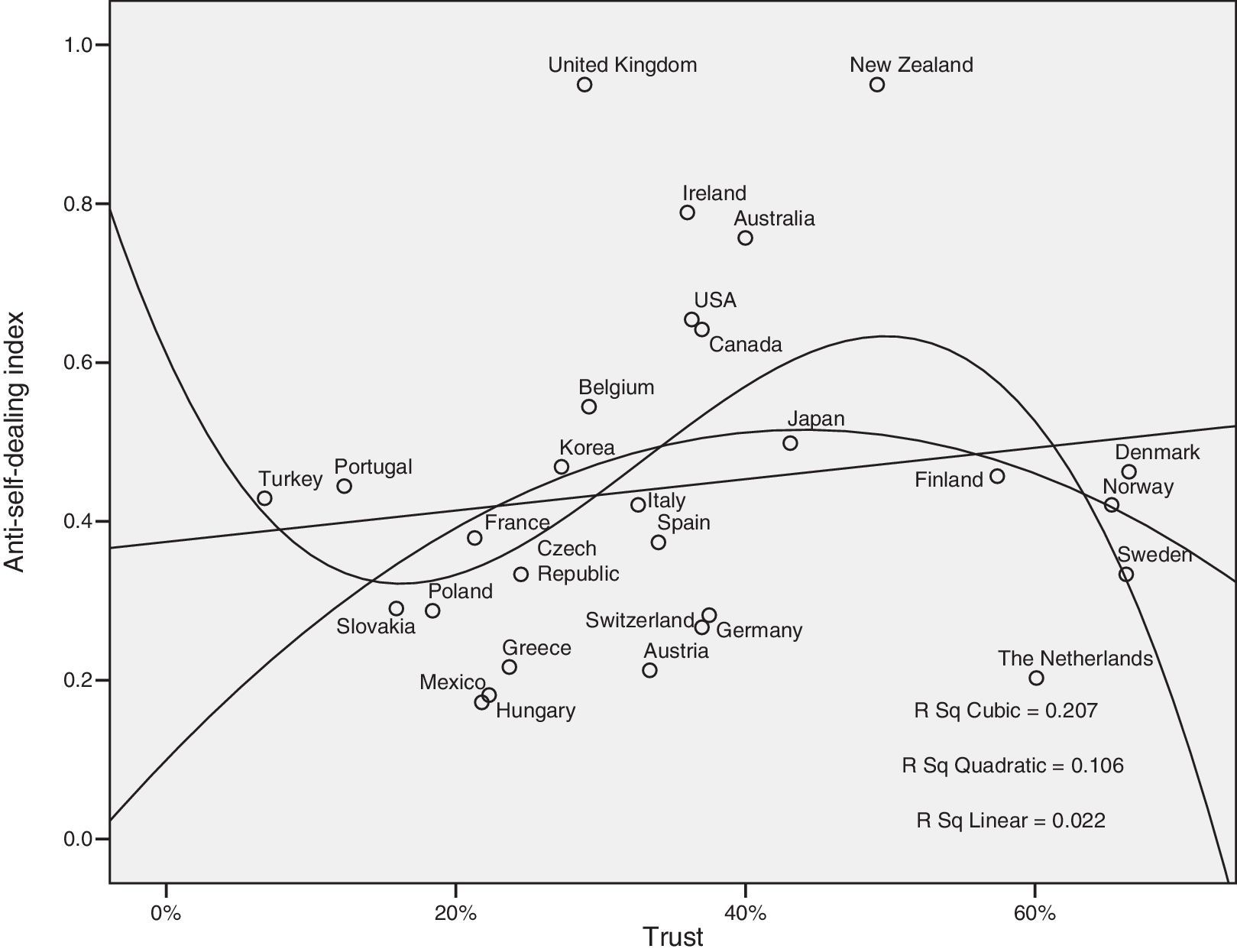

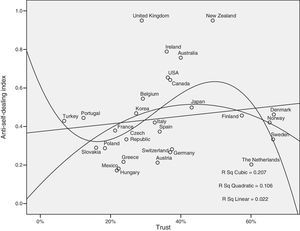

Compared to the strictness of employment protection legislation, the impact of trust on the anti-self-dealing index is much lower. As Fig. 2 suggests the goodness of fit of the various types of regressions (linear, quadratic and cubic) is much lower. In addition, it is only in the cubic regression that the coefficient on (the cube of) trust is significant at the 10% level of significance. When equivalent regressions are estimated for the augmented sample of 56 countries with data available on both the anti-self-dealing index and trust, the results are even worse. The at best weak relationship between the anti-self-dealing index and trust suggests that trust on its own cannot explain differences in investor protection. Obviously any univariate regression ignores the potential interaction between investor protection and employee rights.

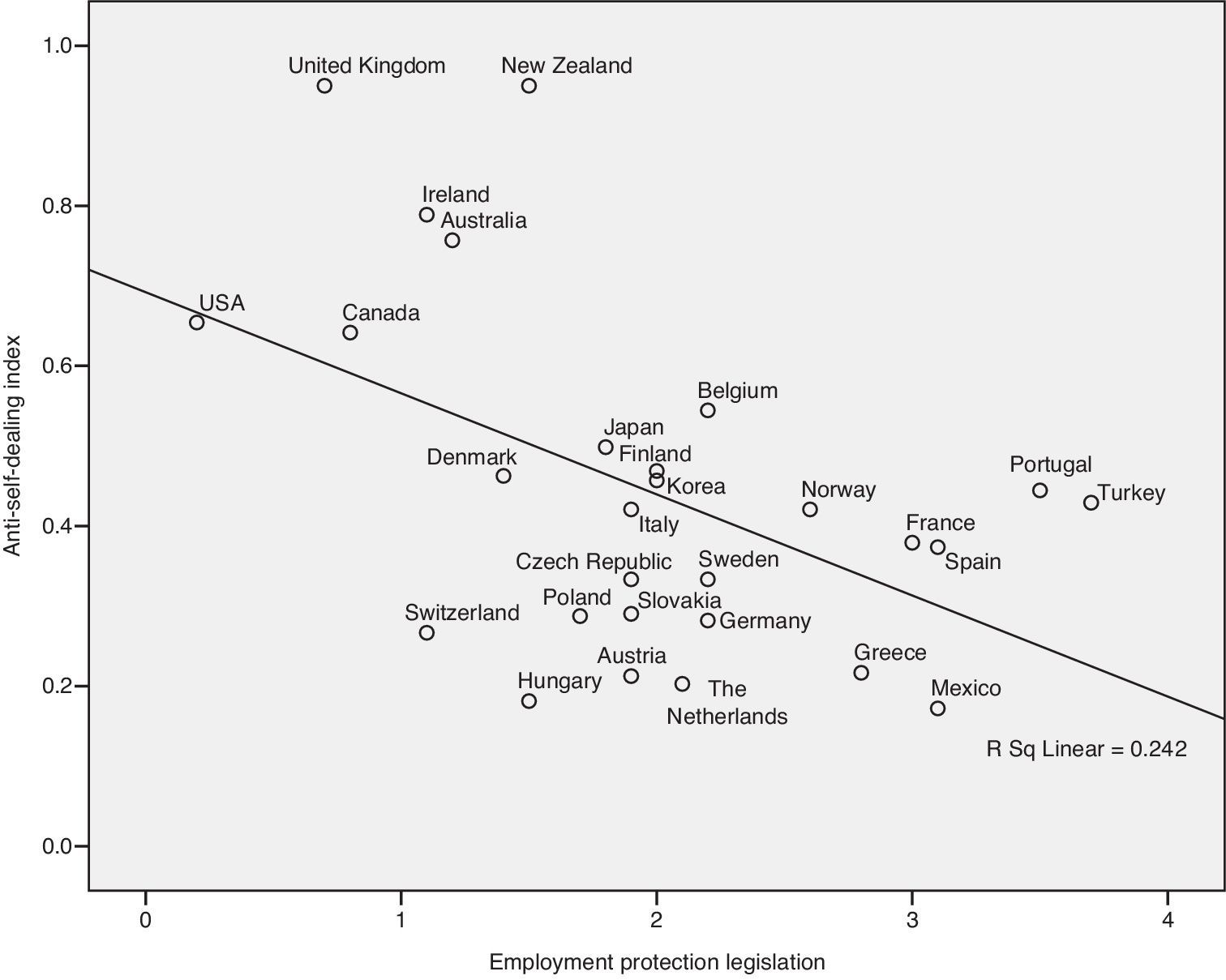

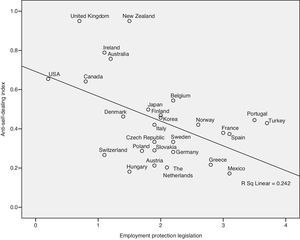

Fig. 3 investigates exactly that interaction. As the figure shows, there is a strong negative relationship between the two. The goodness of fit of the linear regression is relatively high with an R2 of 0.24 and the F-test and coefficient on the dependent variable are both significant at the 1% level. Given the existence of a strong negative relationship between the anti-self-dealing index and the level of employment protection legislation, it is essential to take into account this interaction when investigating the impact of trust and the institutional settings on economic growth.

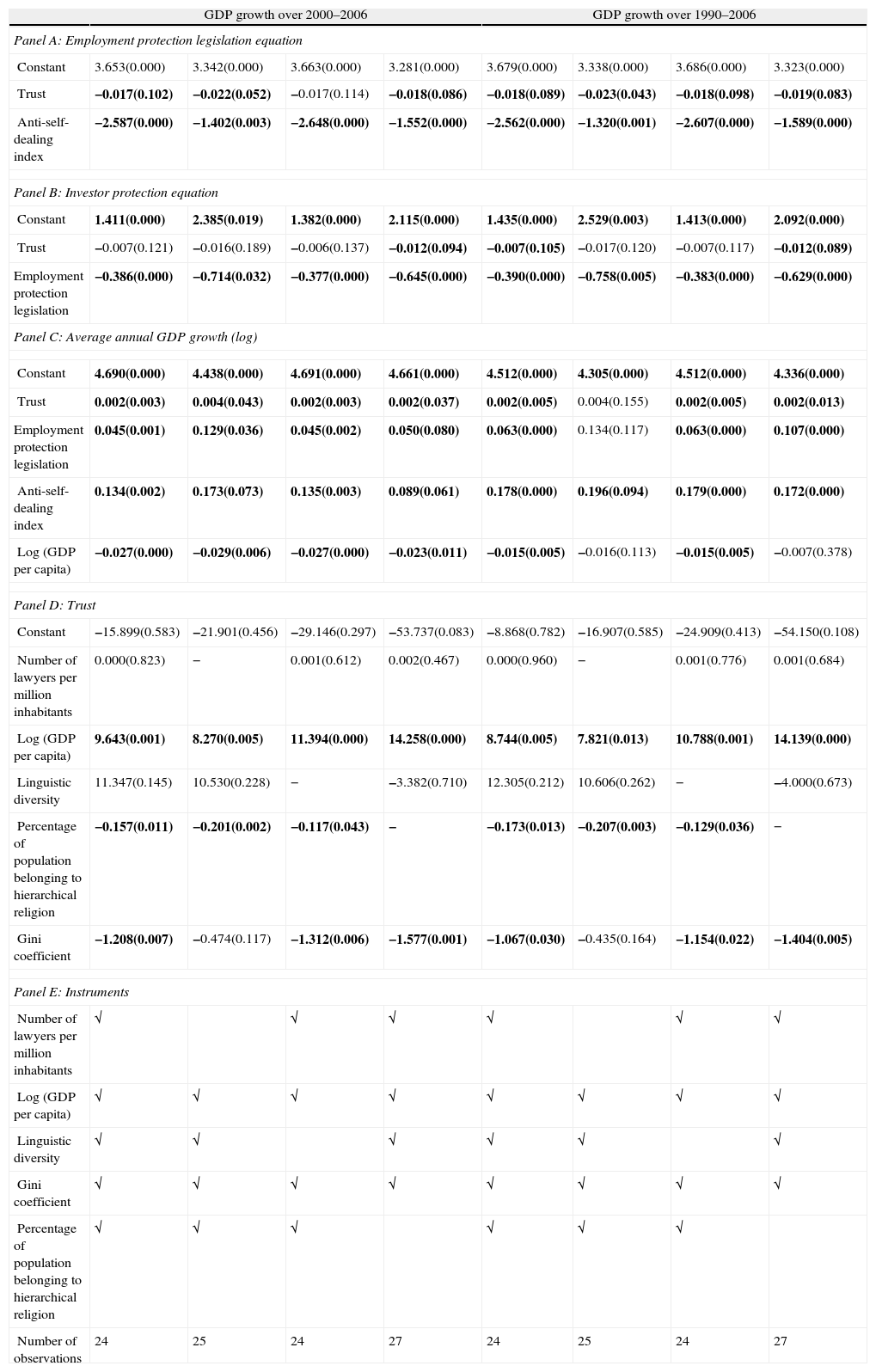

Table 3 reports the results from the estimation of the system of simultaneous equations. Each of the first four panels in the table contains the results for one of the four equations. Panel A contains the estimated coefficients for the equation explaining the strictness of employment protection regulation. Panel B reports the results for the investor protection equation, Panel C is on the economic growth equation and Panel D shows the results for the trust equation. The additional panel, Panel E, lists the instruments used for each system of equations. To check the robustness of our results, we experiment with various sets of instruments. The first four columns are based on the average annual GDP growth over the period of 2000–2006 while the last four columns are based on average annual GDP growth over the period of 1990–2006. As the latter four systems of equations are based on a longer period of economic activity, they may reflect long-term economic growth more accurately. However, they may suffer from an endogeneity problem as part of the 1990–2006 period precludes the date of measurement for the explanatory variables (e.g. trust which is measured in the late 1990s). Conversely, the former four systems do not suffer from this problem, but are based on a shorter period which may not adequately reflect long-term economic growth.

Estimation results from simultaneous-equations system based on average annual GDP growth over 2000–2006.

| GDP growth over 2000–2006 | GDP growth over 1990–2006 | |||||||

| Panel A: Employment protection legislation equation | ||||||||

| Constant | 3.653(0.000) | 3.342(0.000) | 3.663(0.000) | 3.281(0.000) | 3.679(0.000) | 3.338(0.000) | 3.686(0.000) | 3.323(0.000) |

| Trust | −0.017(0.102) | −0.022(0.052) | −0.017(0.114) | −0.018(0.086) | −0.018(0.089) | −0.023(0.043) | −0.018(0.098) | −0.019(0.083) |

| Anti-self-dealing index | −2.587(0.000) | −1.402(0.003) | −2.648(0.000) | −1.552(0.000) | −2.562(0.000) | −1.320(0.001) | −2.607(0.000) | −1.589(0.000) |

| Panel B: Investor protection equation | ||||||||

| Constant | 1.411(0.000) | 2.385(0.019) | 1.382(0.000) | 2.115(0.000) | 1.435(0.000) | 2.529(0.003) | 1.413(0.000) | 2.092(0.000) |

| Trust | −0.007(0.121) | −0.016(0.189) | −0.006(0.137) | −0.012(0.094) | −0.007(0.105) | −0.017(0.120) | −0.007(0.117) | −0.012(0.089) |

| Employment protection legislation | −0.386(0.000) | −0.714(0.032) | −0.377(0.000) | −0.645(0.000) | −0.390(0.000) | −0.758(0.005) | −0.383(0.000) | −0.629(0.000) |

| Panel C: Average annual GDP growth (log) | ||||||||

| Constant | 4.690(0.000) | 4.438(0.000) | 4.691(0.000) | 4.661(0.000) | 4.512(0.000) | 4.305(0.000) | 4.512(0.000) | 4.336(0.000) |

| Trust | 0.002(0.003) | 0.004(0.043) | 0.002(0.003) | 0.002(0.037) | 0.002(0.005) | 0.004(0.155) | 0.002(0.005) | 0.002(0.013) |

| Employment protection legislation | 0.045(0.001) | 0.129(0.036) | 0.045(0.002) | 0.050(0.080) | 0.063(0.000) | 0.134(0.117) | 0.063(0.000) | 0.107(0.000) |

| Anti-self-dealing index | 0.134(0.002) | 0.173(0.073) | 0.135(0.003) | 0.089(0.061) | 0.178(0.000) | 0.196(0.094) | 0.179(0.000) | 0.172(0.000) |

| Log (GDP per capita) | −0.027(0.000) | −0.029(0.006) | −0.027(0.000) | −0.023(0.011) | −0.015(0.005) | −0.016(0.113) | −0.015(0.005) | −0.007(0.378) |

| Panel D: Trust | ||||||||

| Constant | −15.899(0.583) | −21.901(0.456) | −29.146(0.297) | −53.737(0.083) | −8.868(0.782) | −16.907(0.585) | −24.909(0.413) | −54.150(0.108) |

| Number of lawyers per million inhabitants | 0.000(0.823) | − | 0.001(0.612) | 0.002(0.467) | 0.000(0.960) | − | 0.001(0.776) | 0.001(0.684) |

| Log (GDP per capita) | 9.643(0.001) | 8.270(0.005) | 11.394(0.000) | 14.258(0.000) | 8.744(0.005) | 7.821(0.013) | 10.788(0.001) | 14.139(0.000) |

| Linguistic diversity | 11.347(0.145) | 10.530(0.228) | − | −3.382(0.710) | 12.305(0.212) | 10.606(0.262) | − | −4.000(0.673) |

| Percentage of population belonging to hierarchical religion | −0.157(0.011) | −0.201(0.002) | −0.117(0.043) | − | −0.173(0.013) | −0.207(0.003) | −0.129(0.036) | − |

| Gini coefficient | −1.208(0.007) | −0.474(0.117) | −1.312(0.006) | −1.577(0.001) | −1.067(0.030) | −0.435(0.164) | −1.154(0.022) | −1.404(0.005) |

| Panel E: Instruments | ||||||||

| Number of lawyers per million inhabitants | √ | √ | √ | √ | √ | √ | ||

| Log (GDP per capita) | √ | √ | √ | √ | √ | √ | √ | √ |

| Linguistic diversity | √ | √ | √ | √ | √ | √ | ||

| Gini coefficient | √ | √ | √ | √ | √ | √ | √ | √ |

| Percentage of population belonging to hierarchical religion | √ | √ | √ | √ | √ | √ | ||

| Number of observations | 24 | 25 | 24 | 27 | 24 | 25 | 24 | 27 |

The first four systems of simultaneous equations are based on GDP growth over 2000–2006 and the last four on GDP growth over 1990–2006 Panel A, B, C and D display the results for the equation explaining EPL, investor protection, economic growth and trust, respectively. Panel E specifies the exogenous variables included in the equation explaining trust. The variables are defined in Table A1. The estimation technique is 3SLS.

The results are consistent across the two periods for measuring economic growth and the various sets of instruments. However, the coefficients tend to have higher significance levels when economic performance is measured over the 1990–2006 period, which is in line with what one would expect. The regression results (Panel A) confirm that there is a negative relationship between the strictness of employment protection regulation on one side and trust and the anti-self-dealing index on the other side. In turn, the anti-self-dealing index (Panel B) is affected negatively by the degree of worker rights and to a lesser extent trust. More importantly, economic growth (Panel C) is positively affected by trust, the strictness of employment protection legislation and investor protection as measured by the anti-self-dealing index. In five out of the ten regressions reported in Table 3, the coefficients on the latter two variables are significant at the 1% level. They are significant the 10% level or better in another four of the regressions.

Similar to the previous research (e.g. Knack and Keefer (1997)), we find that trust has a positive effect on economic growth: the coefficient on trust is significantly different from zero in all, but one of the regressions. Interestingly, the coefficient on trust is not the only significant one as the coefficients on EPL and the anti-self-dealing index are also significantly different from zero and positive. This suggests that trust explains economic growth over and above the degree of investment protection and the strictness of employment protection legislation. This suggests that differences in investor rights and EPL alone cannot explain differences in economic growth. In other words, trust explains not only differences in economic growth, but it also explains choices in terms of the institutional set up, in particular the levels of investor and employment rights. While Zak and Knack (2001) use somewhat different measures of the institutional settings (such as their property rights index which measures how well these rights are enforced by the government whereas we focus on the rights enjoyed by corporate stakeholders), our results are comparable to theirs: even after adjusting for the institutional setting trust still has a positive impact on economic growth.

In addition to the types of specifications and the sets of instruments reported in Table 3, we estimate a series of alternative specifications. For example, we test for the existence of an inverse U-shaped relationship between economic performance and EPL as found by Belot et al. (2007). When trust as well as EPL and its square are included in Eq. (3), all three of them end up being insignificant (Eqs. (1) and (2) are not affected). When either trust or EPL as well as its square are included in the regression, each of the coefficients is significant. Similar to Belot et al. (2007), we find a hump-shaped relationship between GDP per capita growth and EPL.

When we replace Djankov et al.’s (2008) anti-self-dealing index by La Porta et al.’s (1997a, 1997b, 1998) anti-director-rights index, we still find a negative relationship between EPL and investor rights. We also find that both EPL and the investor rights index, in addition to trust, have a positive effect on economic performance. However, contrary to the results in Table 3, we do find that trust explains the institutional setting. Given Djankov et al.’s (2008) own statement that their anti-self-dealing index has a stronger theoretical foundation than the old anti-director-rights index, we feel that we should attach more credence to the results from Table 3.

Finally, we also investigate whether there is a non-linear relationship between EPL or the anti-self-dealing index on one side and trust on the other side as Figs. 1 and 2 suggest. However, we do not find such a non-linear link. While the two figures clearly suggest a quadratic or cubic relationship, they obviously omit one important variable which is the level of rights enjoyed by the other class of stakeholders. Indeed, as the regression results in Table 3 show that it is important to adjust for the latter given the negative link between the rights conferred to workers and those conferred to investors. Hence, Figs. 1 and 2 only provide a partial picture of the story.

5ConclusionTo our knowledge, this is the first paper to investigate the links between trust, the institutional setting (in terms of employment protection legislation (EPL) and investor rights) and to study the impact of all three on economic performance. In line with the previous literature (e.g. Knack and Keefer (1997), and Zak and Knack (2001)), we find that trust has a positive impact on economic growth, as measured GDP per capita growth. We also find that EPL and investor rights are linked negatively and that both (although the latter to a lesser extent) are substitutes for trust. More interestingly, all three variables have a positive effect on economic growth.

While the rapidly expanding law and finance literature, launched by the seminal work of La Porta et al. (1997b, 1998), focuses on the rights of shareholders based on the premise that their investments in the firm are sunk funds, our results suggest that it is important not to ignore the rights of other stakeholders such as workers. Indeed, while our empirical results suggest a clear trade-off between the two, both investor rights and EPL have a positive impact on economic performance. This suggests that there is some credence to the strand of the literature on EPL which argues that there are net economic benefits generated by the latter. In addition, the results also provide support for varieties of capitalism literature (Amable (2003) and Hall and Soskice (2001)) which argues that, due to complementarities between various types of institutional arrangements, significantly different sets of institutions may nevertheless produce fairly similar levels of economic outcome. To sum up, while striking the balance between investor and worker rights is ultimately a political decision, this decision seems to be less straightforward than what is currently being argued in much of the law and finance literature.

See Table A1.

Definition of variables and data sources.

| Variable | Definition | Source |

| Employment protection legislation | Index measuring the strictness of employment protection legislation (index ranges from 0 to 6); measured in 2003 | OECD Employment Outlook (2004) |

| Anti-self-dealing index | Counts the number of hurdles that the controlling shareholder has to jump in order to engage in self-dealing; based on legal requirements in place in May 2003 | Djankov et al. (2008) |

| Anti-directors-rights index | The index is the sum of six mechanisms, each of which is assigned a value of 1 if the mechanism increasing shareholder protection exists, and zero otherwise. The mechanisms are: (1) the company law allows shareholders to mail their proxy votes to the firm; (2) shareholders are not required to deposit their shares prior to the general shareholders’ meeting; (3) cumulative voting for directors or proportional representation of minorities on the board of directors is allowed; (4) an oppressed-minorities mechanism is in place; (5) the minimum percentage of share capital that entitles a shareholder to call for an extraordinary shareholders’ meeting is less than the sample median of 10% and (6) shareholders have pre-emptive right to buy newly issued shares that can be waived only by a shareholders’ vote. This right protects the shareholders from an unwanted dilution of their stake | La Porta et al. (1997b, 1998) |

| Trust | Percentage of respondents for each country stating that ‘most people can be trusted’ versus the alternative that ‘you can’t be too careful in dealing with people’; measured during one of the years during the 1997–2001 period except for Australia (1995), Ireland and Portugal (1990), Taiwan (1994) and Uruguay (1996) | World Values Surveys (WVS) |

| GDP per capita | Measured in constant year 2000 US dollars | World Development Indicators – World Bank (2008) |

| Number of lawyers per million inhabitants | Number of lawyers divided by the population in millions | Population in millions in 2004 from World Development Indicators – World Bank (2008); number of lawyers is sourced from Council of Bars and Law Societies of Europe (CCBE) for the European countries (incl. Turkey), the American Bar Association for the USA, and various national and international organisations for the other countries |

| Ethnolinguistic diversity | The index is defined as the probability that any two randomly chosen inhabitants of a country will have different mother tongues (Lieberson (1981)); the index ranges from 0 to 1 | Gordon (2005) |

| Percentage of population belonging to a hierarchical religion | Percentage of population that are Roman Catholic, Eastern Orthodox or Muslim; measured during the early 1990s | La Porta et al. (1997a) |

| Percentage of population belonging to the Catholic religion | Percentage of population that are Roman Catholic; measured during the early 1990s | La Porta et al. (1997a) |

| Gini coefficient | This is a measure of income inequality; the index ranges from 0 (absolute equality) to 100 (absolute inequality); measured during the mid to late 1990s except for Nepal and Nigeria (2003), Jordan, Latvia and Pakistan (2002), Argentina, Brazil, Bulgaria and Israel (2001), Chile (2000), China and India (2004) | World Development Indicators – World Bank (2008) |

For the sake of brevity, all of these effects are statistically significant.

Zak and Knack (2001) state that this is e.g. the case in Fiji, Guyana and Trinidad. They also give the example of Tanzania which is a country with lots of small groups, but neither of these groups being large enough to dominate the political scene.

As in Zak and Knack (2001), trust is proxied by the percentage of respondents agreeing that ‘most people can be trusted’.

The strength of civic norms of cooperation is also taken from WVS and is measured by the respondents’ reply whether a series of actions ‘can always be justified, never be justified or something in between’. The actions are: ‘claiming government benefits which you are not entitled to’, ‘avoiding a fare on public transport’, ‘cheating on taxes if you have the chance’, ‘keeping money that you have found’, and ‘failing to report damage you’ve done accidentally to a parked vehicle’.

They employ four different measures of the efficiency of government: judiciary efficiency, the level of corruption, bureaucratic quality and tax compliance.

They distinguish between civic participation and participation in professional associations.

They use seven different measures of social efficiency: the quality of infrastructure, its adequacy, infant mortality, the percentage of the population with a high school education, the adequacy of the educational system, inflation and GDP growth.

As expected, it is positively related to the trust people put in strangers.

See Levine (1997) for an excellent overview of the literature on the link between financial systems and economic growth.

This outcome is essentially determined by the type of electoral system. Pagano and Volpin (2005) distinguish between two main types of electoral systems: the proportional system and the majoritarian system. Under the proportional system, a party has to obtain a majority of votes to win the elections. Therefore, it makes sense for parties to focus on homogeneous social groups such as the managers and workers. Under the majoritarian system, the party will have to win a majority of districts. Hence, the party will need to focus on the pivotal district which Pagano and Volpin equate to the district where the rentiers live. Pagano and Volpin predict that under the proportional voting system employee rights will be higher and investor rights will be lower. They find evidence of this based on data on OECD countries.

They use OLS regressions rather than 2SLS or 3SLS.

While, for most of their sample countries, Knack and Keefer (1997) measure trust in 1990–91, their data on the number of law students dates from 1962 to 64. We believe that our measure is not only more up-to-date, but it is also a more direct measure of the litigious character of a society.

They use 2SLS.

The measure is not available for Iceland and Luxembourg.

Indeed, it could very well be the case that trust within a country is increased by the past successful economic cooperation of its citizens. In other words, good past economic performance may have a positive effect on trust.

We also use La Porta et al.’s alternative measure which is the percentage of the population belonging to the Catholic religion.

It is measured in 2000 for most countries as this is the year which provides the best sample coverage. For all other countries it is measured in the year closest to 2000.