The main purpose of this paper is to assess the simultaneous impact of regulatory pressures on banks’ capital and risk-taking behavior using a panel of 24 banks operating in the MENA region over the period 2004–2012. Using many panel data estimation techniques, we provide evidence that prudential regulations fail in reducing banks’ risk-taking incentives and in increasing capital. We find also that bank profitability is positively associated with capitalization level suggesting that the underdevelopment of financial markets in MENA countries leads banks to rely more on internal resources to build their capital buffer. Our findings reveal also a strong negative relationship between the bank size and risk suggesting that large banks have more experience in managing their risk levels through diversification.

The global banking sector has undergone significant structural and regulatory changes from the 1980s. Banks were taken in liberalization movement activities initiated by the rule of “3D1”, favored by the abolition of geographical boundaries.

Financial globalization and technological development have intensified competition among banks. This competition has encouraged financial innovation and the creation of new financial instruments. The absence of a risk management culture, the existence of a destructive competition and information asymmetry, all these factors represent the characteristics of a risky and constantly changing environment for banks. Thus, prudential regulations have been required to deal with this risky environment. The best-known regulatory instrument is the capital adequacy.

Despite their expansion, the impact of prudential standards on bank behavior remains a controversial issue. Traditional theories have failed to specify the nature of this relationship. Similarly, new theories have focused on the creation of conditions for proper operation of prudential instruments while taking into account the problem of moral hazard.

The issue of the impact of prudential capital regulation on bank behavior is one of the recurring topics of current events, especially after the last financial crisis. Thus, several empirical studies have focused on risk management and prudential regulation. However, those studies have been reserved to developed banking sectors by studying the experience of the US and European banks (see Shrieves and Dahl, 1992; Aggarwal and Jacques, 2001; Rime, 2001; Jokipii and Milne, 2008) and more recently developing countries such as Asian banks (see Awdeh et al., 2011; Lee and Hsieh, 2013; Zhang et al., 2008). The scarcity of studies on banks operating in the Middle East and North Africa (MENA) begs the question about their behavior concerning regulatory capital requirements.

In view of the crucial role played by banks in the economies of the MENA region, it is important to keep their soundness. Thus, MENA countries have done some serious preparations for the implementation of the regulatory measures. However, knowing if MENA banks obey the traditional assumptions of prudential regulation and adjust their capital in terms of risk is an empirical issue.

The purpose of this paper is to elucidate the relationship between regulatory capital and the risk level. Our findings suggest that prudential regulations fail in reducing the banks’ risk-taking incentives and in increasing capital. The rest of this article is organized as follows: Section 2 outlines the main previous studies on the topic, Section 3 presents data and methodology, Section 4 reports empirical results, and Section 5 concludes.

2Literature reviewThe first Basel accord, known as Basel I, issued in 1988, has induced the investigation of the impact of prudential capital regulation on banks’ behavior. Nevertheless, theoretical and empirical literature has led to controversial results.

Shrieves and Dahl (1992) investigate the relationship between capital and risk partial adjustments using a sample of U.S. commercial banks over the period 1984–1986. The three main variables employed to explain the relationship between bank capital and risk-taking behavior were the risk that is apprehended by the bank's assets weighted according to risk levels divided by the total banking assets (RWA), the capital, which is defined as the ratio of equity capital reported to total assets, and the quality of loans, which is approximated by the amount of non-performing loans. The estimates given by 3SLS techniques have shown the existence of a positive relationship between the changes in risk and capital suggesting that undercapitalized banks will increase their capital in response to additional risk exposure. This finding is mainly explained by the hypothesis of managerial risk aversion and bankruptcy cost. Shrieves and Dahl (1992) demonstrate that banks are unable to instantly adjust their capital and risk levels. They conclude that observed changes in both capital and risk have endogenous (discretionary) and exogenous components.

Aggarwal and Jacques (2001) estimate a 3SLS model to examine the impact of the Prompt Corrective Action (PCA) devised by the Federal Deposit Insurance Corporation Improvement Act (FDICIA) on both capital and risk levels using a sample of US banks over the period 1993–1997. Their findings indicate that the PCA standards had pushed banks to raise their capital levels and reduce their credit risks.

Similarly, Rime (2001) analyses adjustments in capital and risk in a sample of Swiss banks. Their results suggest that regulatory pressure has a positive impact on capital ratios but no significant effect on risk levels.

Jokipii and Milne (2008) show, through a sample of European banks, that the existence of capital adjustment costs induces banks to hold a large capital buffer and may explain the slow speed of adjustment toward target levels. Their findings reveal a negative co-movement of capital buffers with the economic cycle for the case of larger commercial and savings banks, i.e. rising in recession. In contrast, small banks and co-operative banks tend to raise their capital levels during the economic upturn. They conclude that the introduction of the Basel II accord will face some challenges given its potential “pro-cyclical” impact on bank capital adequacy.

Jokipii and Milne (2011) investigate the relationship between the changes in capital buffer and in credit risk using a sample of U.S. bank holding companies and commercial banks. A positive two-way relationship is found suggesting that banks raise their capital in response to an increase in risk and they tend to take more risk if their capitalization levels increase. They demonstrate that the buffer of capital hold by the bank is the key determinant of the adjustments in capital and risk.

Awdeh et al. (2011) assess the impact of regulatory capital on bank risk-taking using a panel of Lebanese commercial banks over the period 1996–2008. They use the Z-score indicator to assess the credit and two ratios to proxy for bank capitalization: equity to total asset ratio (CAR) and capital equity divided by total risk-weighted assets (CRWA). The estimates given by 3SLS techniques have shown that banks engaged in risky activities quickly adjust their capital ratios than those who are risk-averse.

Jacques and Nigro (1997) examine the impact of the risk-based capital standards on changes in bank capital and portfolio risk. Capitalization is measured by the ratio of total equity (Tier 1+Tier 2) to total risk-weighted assets (RWA); the risk level is measured by the RWA. Building on the techniques of 3SLS, they find that that the regulatory capital has a significant positive effect on capital ratios and a negative effect on portfolio risk of banks, which already met the new risk-based standards. In addition, they find a significant negative coordination between changes in capital and risk during the first year of the risk-based standards. They consider this result as expected because an undercapitalized bank can meet the risk-based requirement by raising capital, reducing portfolio risk, or both, while a bank with a ratio above the risk-based minimum may decrease capital or increase risk. By contrast, the risk has a negative but insignificant coefficient in the equation of capitalization.

Lee and Hsieh (2013) investigate the impact of bank capital on risk and profitability using a sample of Asian banks over the period 1994 to 2008. They find that increasing capital improves profitability and decreases risk. This evidence indicates that poorly capitalized banks generate less profitability and take more risk. They conclude that the negative relationship between capital and risk can be explained by the moral hazard hypothesis, while the positive association between capital and profitability can be understood under the structure-conduct-performance hypothesis.

Zhang et al. (2008) examine the effects of capital adequacy requirement on bank's risk-taking behavior in a sample of 12 Chinese commercial banks over the period 2004–2006. They find that changes in capital are negatively associated with the changes in portfolio risk.

Guidara et al. (2013) discuss the cyclical behavior of Canadian banks’ capital buffers and investigate its impact on the banks’ risk and performance throughout business cycles and in response to Canadian regulatory changes during various Basel regimes. Estimation results given by the two-step generalized method of moments (2SGMM) indicate the absence of a significant relationship between the variations of banks’ capital buffer and banks’ exposure to risks. They conclude that the well-capitalization of Canadian banks may be explained by market discipline considerations.

Similarly, Mongid et al. (2012) examine the relationship between capital, risk and inefficiency in a sample of 668 commercial banks operating in 8 countries of ASEAN over the period 2003–2008. Estimation results given by the 3SLS method reveal an inverse relationship between risk and capital suggesting that higher capitalized banks tend to reduce their risk exposure. By contrast, the risk turns out to have a negative but no significant impact on capital.

Agoraki et al. (2011) investigate the effect of competition and prudential regulation on the risk-taking for a sample of countries in Central Europe over the period 1998–2005. They find that capital requirements appear to be an effective tool as it is associated with a remarkable decrease in the risk level but has no significant effect on the probability of default.

Laeven and Levine (2009) find that the relation between risk-taking and capital regulations depends significantly on each bank's ownership structure. They demonstrate that the effect of the same regulation on a bank's risk-taking can be positive or negative depending on the bank's ownership structure.

Altunbas et al. (2007) analyze the relationship between capital, risk and efficiency for a large sample of European banks over the period 1992–2000. They find a positive relationship between bank capital and risk levels only for commercial and savings banks, and an inverse relationship for co-operative ones.

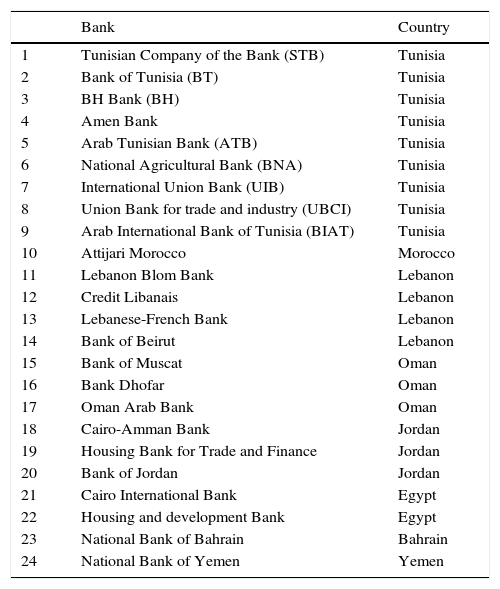

3Data and methodology3.1DataOur sample consists in 24 banks operating in MENA region (for more details see Appendix 1). The sample period ranges from 2004 to 2012, covering the period after the development of Basel II. The data are taken from the database provided by Tunisian Professional Association for Banks and Financial Institutions (APTBEF) and the annual reports of sample banks.

3.2Definition and measurement of the variables3.2.1Dependent variables- •

The risk: It is measured by the ratio of loan loss provisions to total assets. The loan loss provisions represent the funds set aside by the bank to cover unexpected losses caused by bad loans. An increase of the amount of doubtful loans results in an increase of the amount accumulated provisions. This measure was used by Aggarwal and Jacques (2001) to examine the asset quality.

- •

The capital: It is approximated by the ratio of equity to total assets used in Shrieves and Dahl (1992), Rime (2001), and Awdeh et al. (2011).

- •

Size: The bank size may influence capital and risk through economies of scale (Altunbas et al., 2007) or through its relationship with risk diversification, investment opportunities and access to equity capital (Rime, 2001). The natural logarithm of total assets is employed to proxy for bank size.

- •

Return on asset (ROA): ROA indicates the efficiency with which the bank manages its assets. The use of ROA seems more appropriate than the return on equity (ROE) because assets have a direct effect on expenses than income. However, ROA ignores off-balance sheet activities and gives the same importance to the various assets while some of them have higher risk than others. We predict a positive relationship between the capital level and ROA because banks rely more on internal resources given the underdevelopment of financial markets in the MENA. ROA is defined as net operating income reported to total assets.

- •

Liquidity: We use the ratio of loans to total assets to proxy for bank liquidity. A high value of this ratio indicates that liquidity is low since the bank is loaned up. Thus, a positive relationship between liquidity and risk is expected.

- •

Regulatory pressure: It is a dummy variable taking the value of unity in the years when a new regulatory framework is implemented (implementation of new capital requirements by The BCBS and the central banks of MENA countries) or when the bank holds a capital level less than the minimum required of 8% and equals to zero otherwise. We expect that an increase in regulatory pressure will positively (negatively) affect the level of capital (risk).

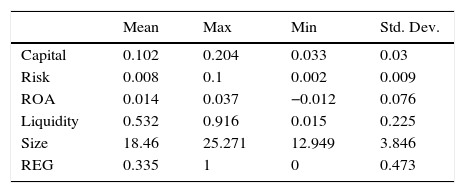

Table 1 displays the summary statistics for sample banks. As can be seen, the capitalization level ranges from a low of 3.3% to a high of 20.4% indicating that there is at least one bank in which capital ratio is largely lower than the minimum required. The mean of this variable equals 10.2% suggesting that our sample banks are on average “sufficiently” capitalized. The variable risk varies between 0.2% and 10%. The low value of this variable indicates that banks in MENA countries were very reluctant to deal with bad customers. The mean of the return on assets equals 1.4% suggesting that banks were not quite profitable. The mean of the variable liquidity equals 53.2% indicating that the activities of these banks were principally focused on providing loans. This evidence may be explained by the fact that MENA's financial systems are heavily bank-based and undiversified.

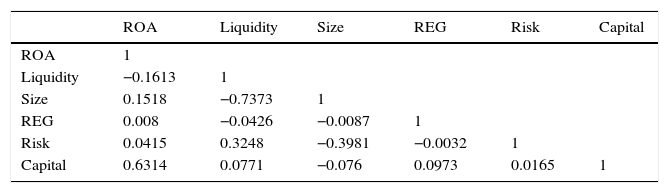

Table 2 shows that the correlations among the explanatory variables are weak indicating the absence of multicollinearity. Only one correlation coefficient is above 0.5, which makes us comfortable to employ them simultaneously in the models. Examining the signs of correlation coefficients, we point out a positive correlation between ROA, liquidity, regulatory pressures and capital. By contrast, these three explanatory variables are negatively related to the risk level.

To sufficiently study the relationship between these variables, we compute partial correlations. The results reported in Table 3 reveal a significant partial correlation between capitalization and bank profitability measured by ROA ratio. By contrast, there is no partial dependency between the capitalization level and the rest of the variables. Table 3 shows also that partial correlations between the risk level and other variables are not significant, except for the variable size, a negative and very significant correlation.

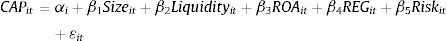

4Empirical analysis4.1The relationship between regulatory capital and riskWe are interested in the impact of prudential regulations on bank capital and the risk-taking. For this, we specify a model that links either the capitalization or the risk to explanatory variables such as size, liquidity, ROA, and regulatory pressure. Contrary to the assumptions of partial adjustment made in previous studies, in this paper, we assume that banks in the MENA region are able to instantly adjust their levels of risk and capital.

According to the regulatory hypothesis, a positive relationship must exist between the capital level and the risk-taking incentives. Indeed, capital acts as a buffer; so the banks have to increase their level of capital in response to any increase in risk. An alternative hypothesis is explained by the problem of moral hazard.

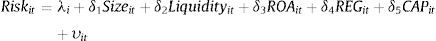

Following Shrieves and Dahl (1992), Rime (2001), and Altunbas et al. (2007), we specify a system of equations as follows:

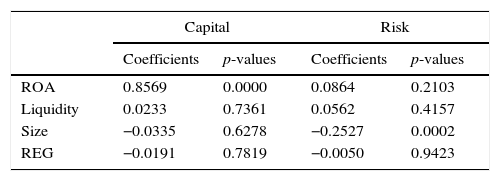

Table 4 displays estimate results using GLS technique. The specification tests show that the residues do not follow a normal distribution since Jarque–Bera statistics are significant for both relationships estimated by the GLS technique. Also, there is neither a heteroscedasticity problem nor an autocorrelation problem. Thus, we retain this estimate as an appropriate procedure to identify the direct benefits of prudential regulations in the capital increase and the reduction of risk.

Estimates by GLS technique.

| Capital | Risk | |||

|---|---|---|---|---|

| Coefficient | p-value | Coefficient | p-value | |

| ROA | 0.546*** | 0.000 | 0.157*** | 0.001 |

| Size | 0.279* | 0.081 | 0.918*** | 0.000 |

| Liquidity | 0.236 | 0.34 | 0.428* | 0.0624 |

| REG | −2.40 | 0.999 | −2.421 | 0.999 |

| Constant | 0.432 | 0.764 | 0.532 | 0.643 |

| Normality test of residuals | Chi-sq (2)=5.37 (0.068) | Chi-sq (2)=4.56 (0.052) | ||

| Heteroscedasticity | Chi-sq (1)=0.49 (0.483) | Chi-sq (1)=0.04 (0.837) | ||

| Autocorrelation | F(1,7)=1.519 (0.253) | F(1,7)=0.368 (0.561) | ||

Notes: *, *** represent significance levels at 10% and 1% respectively.

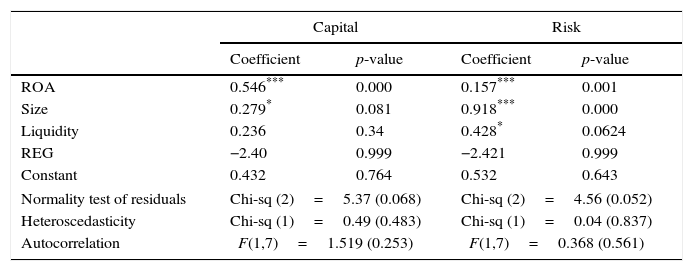

As can be seen in Table 4, ROA turns out to have a significantly positive effect in both equations suggesting that prudential regulation improves the bank profitability. Also, the bank size measured by the natural logarithm of total assets has a positive and significant sign for both the models. This evidence proves that these regulations lead some banks to increase their balance sheet. Liquidity is positively related to risk but it has no significant effect on capital. This result indicates that when the bank is loaned up, its liquidity becomes low and in turn its risk increases. Finally, regulatory pressures have no significant effect in both the models. Meanwhile, this result begs the question on the effectiveness of regulatory policies in improving the soundness of banks operating in MENA region.

4.2Interaction between regulatory capital and riskWe attempt to identify the interactions of prudential regulation on increasing bank capital and the reduction of credit risk. For this, we will use the simultaneous equations to capture the interrelation between changes in bank capital and risk. The strategy is that the endogenous variables (risk, capital) can be used as explanatory variables in our model. This model takes the following linear form:

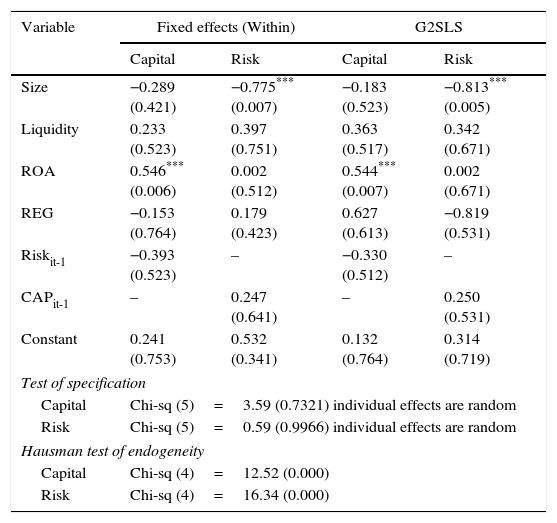

where, CAP and Risk are two endogenous variables representing respectively bank capital and credit risk. ¿it and υit are the error terms while αi and λi are the individual effects, fixed or random.4.2.1Instrumental variables approachThe two-stage least squares (2SLS) is used when some of the right-hand side variables are endogenous. The endogeneity is always explained by three main sources, namely, the errors of measurements on the explanatory variables, bivariate causality if the explanatory variable is the endogenous variable and vice versa, and finally, the bias of omitted variables when a variable not included in the model is correlated with at least one of the explanatory variables. In the present study, we consider capital and risk as endogenous variables. The use of 2SLS requires the specification of effective instruments that are correlated with explanatory variables but not with the disturbance terms. For this, we use the lagged capital and lagged risk as appropriate instruments. Estimate results using 2SLS are reported in Table 5. The Hausman test carried out suggests the presence of an endogeneity problem, since the Chi-square statistics are significant. Thus, the use of the one-lagged dependant variables seems necessary to resolve this problem. First, we have performed the estimation equation per equation using the fixed effects regression method (Within estimators) with instrumental variables. Then, we have re-estimated each equation by the Generalized Two-Stage Least Squares (2GLS) procedure. The specification test suggests that our model can be characterized as a random effects model.

Instrumental variable approach.

| Variable | Fixed effects (Within) | G2SLS | ||

|---|---|---|---|---|

| Capital | Risk | Capital | Risk | |

| Size | −0.289 (0.421) | −0.775*** (0.007) | −0.183 (0.523) | −0.813*** (0.005) |

| Liquidity | 0.233 (0.523) | 0.397 (0.751) | 0.363 (0.517) | 0.342 (0.671) |

| ROA | 0.546*** (0.006) | 0.002 (0.512) | 0.544*** (0.007) | 0.002 (0.671) |

| REG | −0.153 (0.764) | 0.179 (0.423) | 0.627 (0.613) | −0.819 (0.531) |

| Riskit-1 | −0.393 (0.523) | – | −0.330 (0.512) | – |

| CAPit-1 | – | 0.247 (0.641) | – | 0.250 (0.531) |

| Constant | 0.241 (0.753) | 0.532 (0.341) | 0.132 (0.764) | 0.314 (0.719) |

| Test of specification | ||||

| Capital | Chi-sq (5)=3.59 (0.7321) individual effects are random | |||

| Risk | Chi-sq (5)=0.59 (0.9966) individual effects are random | |||

| Hausman test of endogeneity | ||||

| Capital | Chi-sq (4)=12.52 (0.000) | |||

| Risk | Chi-sq (4)=16.34 (0.000) | |||

In the capital equation, the instrumental variable has a negative sign but statistically insignificant. The profitability (ROA) has the expected sign. By contrast, the size and liquidity exert negligible and insignificant effects on capital ratio.

In the second equation, the size seems to be the only determinants of risk level. Indeed, it turns out to have a negative and significant impact.

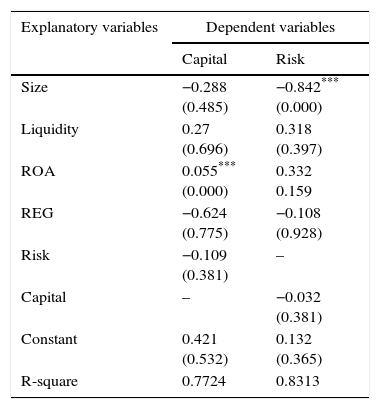

4.2.2Direct and interactive effect of regulatory capital and risk: simultaneous equationsTo detect the direct and indirect interrelations between regulatory capital and risk-taking in MENA banks, we adopt the method of simultaneous equations. The technique of Three-least squares (3SLS)2 has been employed to simultaneously estimate the system of equations. 3SLS is the 2SLS version of the Seemingly Unrelated Regression (SUR). The advantage of 3SLS is to estimate all model parameters simultaneously and consideration is given for possible correlation between error terms. The principle of this method is based on two levels of the 2SLS technique and adding a third step is to use the GLS method to simultaneously estimate all the coefficients of the model, and finally deduce overlapping effects of prudential regulation on bank capital and the risk level.

Table 6 shows that the interactions between capitalization and the level of risk is negative but not significant suggesting that capital requirements certainly increase the capital ratios but simultaneously push banks to lower their risk levels. An increase in the capitalization level is followed by a decrease in the risk. This result corroborates previous findings of Mongid et al. (2012) for the ASEAN countries, and Guidara et al. (2013) in their study of Canadian banks. However, it contradicts findings in Aggarwal at Jacques (2001) for the US context, Awdeh et al. (2011) for Lebanese banks and Rime (2001) for Swiss banks.

3SLS estimates results.

In the capital equation, the return on assets (ROA) is positively associated with the capital ratio. This positive relationship is highly significant (at 1%). Altunbas et al. (2007) showed that the ROA can lead to improvement in capital ratios; banks rely on asset returns to improve their capital instead of investing in other activities particularly securitization.

Size (SIZE) has no significant effect on capital. This evidence suggests that large banks do not take advantage from their easier access to capital markets in order to raise their capital (Aggarwal and Jacques, 2001). This situation may be due to the underdevelopment of capital markets in most MENA countries. In the risk equation, size turns out to have a negatively significant sign suggesting that large banks tend to reduce their risk levels. This result may be explained by the fact that large banks have more experience in managing their risk levels through diversification (Altunbas et al., 2007).

The variable regulatory pressure has no significant effect in both the equations reflecting the weakness of institutional and regulatory framework in MENA countries. This result corroborates findings in Awdeh et al. (2011) for Lebanese banks, unlike Zhang et al. (2008) who found that the regulatory constraint is statistically significant and positively correlated with the change in capital.

The coefficient of the variable liquidity turns out to be not significant in both the equations. This result contradicts finding in Altunbas et al. (2007). They found a significantly negative relationship between liquidity and the risk level. Regarding the relationship between liquidity and capital, they concluded that larger volume of loans is associated with greater capitalization (case of commercial banks and cooperative banks).

5ConclusionThis paper had as main goal the investigation of the effects of prudential regulation on the capital levels and risk-taking using a sample of 24 banks operating in 8 MENA countries during the period 2004–2012. We first began by the identification of the appropriate model. We found that our model can be specified as a panel with individual effects. The Hausman specification test shows that those individual effects are random. Thus, we retain the random effects model and GLS method as a good estimator of the direct effects of the prudential regulations on capital and risk. Then, we adopted the method of simultaneous equations to study the direct and indirect effects between the levels of capital and risk. We estimated each equation of the system by ordinary least squares with instrumental variables using lagged capital and risk as appropriate instruments. Finally, we estimated the two equations simultaneously by the method of Seemingly Unrelated Regressions (SUR).

Our findings revealed that prudential regulations have no significant effect on risk-taking behavior and the capital level. This result may be explained by the weakness of institutional and regulatory framework in MENA countries. We found also that the only variable that influences the risk level is the bank's size; larger banks are able to better manage their risk. Finally, banks principally rely on their profitability to build their capital buffer.

Overall, the failure of regulatory pressure in particular capital requirements may have several explanations. First, the stage of implementation of the Basel Accords differs across countries in the MENA region. For example, The Central Bank of Morocco raised the minimum capital requirement from 8% to 10% for all banks in 2008 while the Central Bank of Tunisia continues the preparation to adopt Basel II accord approaches (Financial Stability Institute Survey, 2013). Second, the majority of banks operating in the MENA region maintain capital levels above the minimum required and hence they may be not constrained by regulatory pressure. Third, the international standards have been set to reinforce the resilience and the soundness of financial systems around the world. However, they did not take into account the particularity of some countries. For instance, they did not differ between bank-based and market-based financial systems although banks’ behaviors may diverge between these two types of systems. In this sense, Naceur and Kandil (2013) find that the implementation of capital regulations of Basel I in five MENA countries (Egypt, Jordan, Lebanon, Morocco, and Tunisia), characterized by bank-based systems, has caused a credit growth instead of credit crunch.

| Bank | Country | |

|---|---|---|

| 1 | Tunisian Company of the Bank (STB) | Tunisia |

| 2 | Bank of Tunisia (BT) | Tunisia |

| 3 | BH Bank (BH) | Tunisia |

| 4 | Amen Bank | Tunisia |

| 5 | Arab Tunisian Bank (ATB) | Tunisia |

| 6 | National Agricultural Bank (BNA) | Tunisia |

| 7 | International Union Bank (UIB) | Tunisia |

| 8 | Union Bank for trade and industry (UBCI) | Tunisia |

| 9 | Arab International Bank of Tunisia (BIAT) | Tunisia |

| 10 | Attijari Morocco | Morocco |

| 11 | Lebanon Blom Bank | Lebanon |

| 12 | Credit Libanais | Lebanon |

| 13 | Lebanese-French Bank | Lebanon |

| 14 | Bank of Beirut | Lebanon |

| 15 | Bank of Muscat | Oman |

| 16 | Bank Dhofar | Oman |

| 17 | Oman Arab Bank | Oman |

| 18 | Cairo-Amman Bank | Jordan |

| 19 | Housing Bank for Trade and Finance | Jordan |

| 20 | Bank of Jordan | Jordan |

| 21 | Cairo International Bank | Egypt |

| 22 | Housing and development Bank | Egypt |

| 23 | National Bank of Bahrain | Bahrain |

| 24 | National Bank of Yemen | Yemen |