Insurers are well versed in the litany of challenging conditions facing the sector. These challenges are economic, political, regulatory, legal, social, and technological. As a result of those pressures, the industry is experiencing increasing competition, muted growth, and an excess of capital. The increased connectivity among household and workplace devices, the development of autonomous vehicle and the rising threat of cyber attacks are transforming the way people live and risk they need to mitigate with insurance products. Insurers need to adopt their business models address the changes which can be threatening to the growth of the industry (Deloitte, 2017). Innovation is widely regarded as pinnacle success factor in highly competitive and global economy. An innovation perspective draws a clear picture of future opportunities that lie ahead. The main purpose of this paper is to explore the relationship among innovations capability, innovation type and on the different aspect of firm performance including innovation, market and financial performance based on an empirical study covering insurance industry in Sri Lanka. The research framework developed in this study was tested 379 senior managers of insurance companies. The empirical verification of assumption of this model has given evidence to confirm the relationship between innovation capabilities; innovation efforts and firm performance are significant and strong. The results of this study could lead effective management of innovation capability which helps to deliver more effective innovations outcomes to generate better performance and it would be benefits for management of the insurance companies.

During the past ten years insurance industry faced far border challenges. Demographic shift, financial reforms, emerging market, advancement of communication and information technology and changing customer behavior had a considerable impact to change the efficiency, productivity and the shape the structure of the industry. This would create very competitive threat and recast the whole insurance market. An insurer needs to carefully examine and confront how the various aspect of their business should be sourced to cost reduction, operational efficiency and enhance value. Some would say insurance industry is not known for innovative thinking. Innovation is already creating the significance challenge and pressure to the insurance industry. The potential market for insurance in developing economies significantly demanding for the range of insurance products from health and life; agriculture and property insurance to catastrophe cover. If the industry couldn’t respond changes rapidly and successfully, that will become extraneous. The insurance industry cannot maintain their image as a “smart follower”. Most academic and industry is widely recognized innovation as pinnacle factor for gaining competitive advantage and sustaining the competitiveness and growth. Awareness of the importance of innovation in the service sector as an engine for the economic growth is the latest phenomenon.

Traditionally insurance products were limited to the standard and stereotypic needs, the whole life endowment or type of life insurance and fire, marine, motor, health in a nonlife segment. There is a need to beyond the traditional products into the realm niches areas that cater to the special needs (Insurance Governance leadership network (IGLN 2015)). Therefore the importance of understanding the innovation competencies for integrated service is necessary and is becoming more relevant as an engine of economic growth under the global change (Ko & Lu, 2010). This concept has been investigated through different approaches ranging from product, process, market and organization (Toivenen & Tuominen, 2009). Growing attention to innovation inclines companies to differentiate the value of existing products and services (Nybakk & Jenssen, 2012).

Innovation is often happened using open technologies and high-quality open resource and relies on a different kind of knowledge and information system. Knowledge management is the most important part of the innovation, especially knowledge-intensive industry like insurance. Knowledge is a competitive advantage for underwriting and servicing in insurance companies. In the insurance industry trade secrets, confidential information and valuable ideas are part of the workforce knowledge. Therefore using knowledge management system to capture the internal expert will be crucial to the insurance companies (Plescan & Gavriletea, 2008). The firm's capability to innovate is the most crucial factor for competitive advantage in highly turbulent market condition. Innovation capability leads organization to develop innovations continuously to respond the changing market environment (Slater, Hult, & Olson, 2010) and its embedded with all the strategies, system and structure that support innovation in an organization (Gloet & Samson, 2016).

The insurance landscape in Sri Lanka is behaved as quite steady and confident industry. Due to the economic upturns in country, industry has been going through rough phase and especially increased price competition of motor insurance segment as a result of weakening technical performance which has created threatening competition in between rivals of the industry. On the other hand industry still maintain low insurance market penetration 1.3% of GDP compared with the Asian insurance market such as India 3.4%, Malaysia 4.8%, Thailand 5.8%, and China 3.0%. But Rapid economic development, population growth, and urbanization–combined with rapidly evolving insurance regulation–will lead to increasing insurance penetration. Therefore industry has to believe innovation is the major driver for creating confidence and growth.

The objective of this study is to investigate the relationship between innovation capability innovation strategies and innovation performance. Due to the lack of research related to the innovation and innovation performance of insurance industry in literature, there is a gap between factors affects innovation and influence to the overall performance of the insurance companies. Therefore the purpose of this paper is to fill the gap by developing a model to understand the factors which influence the innovation performance among the insurance companies in developing countries. Although there are numerous conceptual studies have been tested in extant literature studies are limited with numbers and depth of the analysis. Most of the studies have investigated the relationship between innovations typologies, innovation performance mainly linked with the manufacturing sector (Gunday, Ulusoy, Kilic, & Alpkan, 2011; Jin, Hewitt-Dundas, & Thompson, 2004; Kalay & Lynn, 2015; Rosil & Sidek, 2013). The studies related to the service sector have made the investigation linked with the company business strategies with the perspective of innovation (Lilly & Juma, 2014; Akman & Yilmaz, 2008). Especially innovation capability far less concerned and under-examined within the service sector. On the other hand, most of the research dealt with innovation capability and firm performance or innovation capability with innovation typologies (Huhtala, Sihvonen, Frösén, Jaakkola, & Tikkanen, 2014; Chang, Yen, Ng, & Chang, 2012; Taherparvar, Esmaeilpour, & Dostar, 2014). There are no studies intimately studies the relationship between innovation capability, innovation typologies and firm performances in the literature. Therefore the purpose of this paper is to establish more balance and empirically grounded picture of the innovation activities in service sector in developing country perspective, especially in insurance industry, that haven’t been fully tested in the literature.

Literature reviewResearch background and hypothesisInnovation literature claims that innovation is the most fundamental source for firm's success and survival (Abbing, 2010; Cho & Pucik, 2005) in such a competitive complex and intellectual environment. But the innovation in the service sector received relatively little attention. Research in the specific features and issues in the insurance sector is quite limited and untested until recently especially compared to the banking sector. A service business is often unique and it is widely regarded as services are not same to one another which cannot apply the same strategy when developing new product or services process or business model. For an example, they can be differentiated in terms of nature of service or act and on the degree of interaction between the service organization and the customers (Johne & Storey, 1998). A new way of business thinking which generate and reform unconventional and flexible operations (Kuo, Kuo, & Ho, 2014) that changes in the process of existing line as a example in insurance industry improvement in the risk assessment through changes of new policy conditions or new classification of existing risk in marketing and organization as well as primary product innovation (PPP) can be define as new product for new risks which together sometimes constitute new branches of the insurance industry in the way that fit instance employer liability and railway accident insurance formed branches of accident insurance (Pearson, 1997).

Many researchers agreed that innovation in service sectors different characteristic than the manufacturing sectors (Drejer, 2004) and often seen as non-technological (De Jong, Bruins, Dolfsma, & Meijaaed, 2003). Innovation in service sector generally considered two factors which are an introduction of a completely new product or service to the company or individuals and reconfiguration or improvement of existing services (Miles, 2008) either in a radical or incremental way. According to Veugelers (2008) in the manufacturing sector, this can be changed in the things such as products or goods which a company offers and changes the way which they created and deliver and he interpreted this as product and process innovation. But in services distinction between product and process tend to draw a quite unclear picture. Because of the in-service product and process innovation happens coincidently. However it depends on the industry which you are involved, some industries in service sector can apply this approach but this might be totally or slightly irrelevant for others (Bitran & Pedrosa, 1998), for an instance in insurance industry company can introduce new product with additional covers including extra bonus or some extra benefits such as foreign tours this can be called product innovation and on the other hand company can develop internal process of claim handling, underwriting and call center to speed up the delivery process. This can be justified as process innovation.

Innovation can only happen if the company has the capacity to innovate (Laforet, 2011). Innovation capability is considered as the valuable assets for the firms to provide and sustaining competitive advantage and in the implementation of the entire strategy. It is composed through the main process within the firm (Lawson & Samson, 2001) and cannot separate from the other practices. It is tacit and non-modifiable and closely correlated with the experimental acquirement and interior experiences (Guan & Ma, 2003). The capability of innovation facilitates firms to introduce new product quickly and adopt new systems rather it is important to factor for feeding the ongoing competition. Innovation performance can be explained as combination of assets and resources. Therefore it requires wide variety of resources, assets, and capabilities (Sen & Egelhoff, 2000) to drive through success in rapidly changing environment. According to the Adler and Shenbar (1990) innovation capability is defined as (1) the capacity of developing new products satisfying market needs; (2) the capacity of applying appropriate process technologies to produce these new products; (3) the capacity of developing and adopting new products and processing technologies to satisfy future needs; (4) and the capacity to respond the accidental technology activities and unexpected opportunities created by competitors.

Venkatraman and Ramanujam (1986) suggested that organizational performance is multiple hierarchical constructs which indicating financial performance and operational performance such as market share and quality. There are many research studies analyzed the impact of innovation and firm performance. The relationship between the innovation and organizational performance is predominant. Previous research has indicated that there are often mixed results. They fluctuate between the positive and negative results. Innovative performance act as a mediator role between types and performance aspects. Innovation has a strong and direct impact on the organization performance. Financial, market and production performance positively linked with innovation and innovative performance act as a mediator for their direct positive impact. Innovation strategy is the core indicator of the organizational performance.

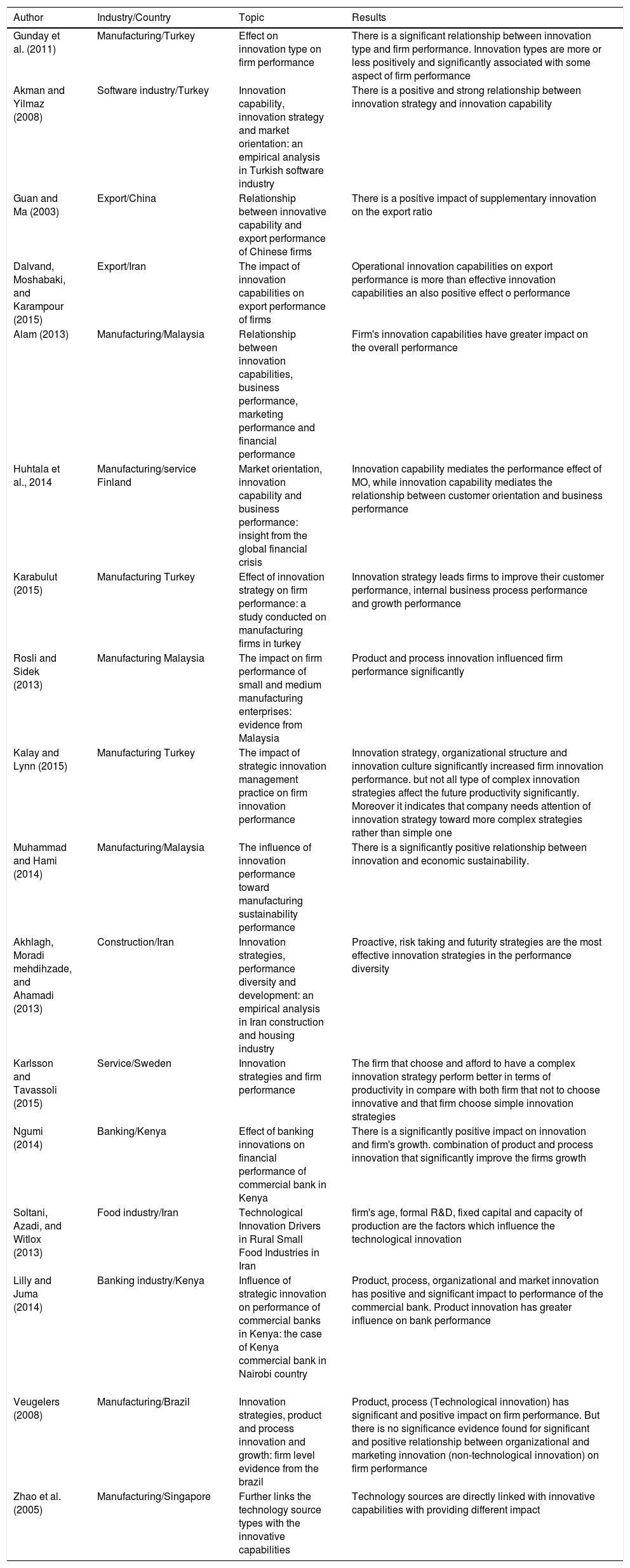

Studies in the literature related to the innovation capability, innovation typologies, and firm performance are summarized in Table 1

Summary of research studies of innovation capability, innovation typologies and firm performance.

| Author | Industry/Country | Topic | Results |

|---|---|---|---|

| Gunday et al. (2011) | Manufacturing/Turkey | Effect on innovation type on firm performance | There is a significant relationship between innovation type and firm performance. Innovation types are more or less positively and significantly associated with some aspect of firm performance |

| Akman and Yilmaz (2008) | Software industry/Turkey | Innovation capability, innovation strategy and market orientation: an empirical analysis in Turkish software industry | There is a positive and strong relationship between innovation strategy and innovation capability |

| Guan and Ma (2003) | Export/China | Relationship between innovative capability and export performance of Chinese firms | There is a positive impact of supplementary innovation on the export ratio |

| Dalvand, Moshabaki, and Karampour (2015) | Export/Iran | The impact of innovation capabilities on export performance of firms | Operational innovation capabilities on export performance is more than effective innovation capabilities an also positive effect o performance |

| Alam (2013) | Manufacturing/Malaysia | Relationship between innovation capabilities, business performance, marketing performance and financial performance | Firm's innovation capabilities have greater impact on the overall performance |

| Huhtala et al., 2014 | Manufacturing/service Finland | Market orientation, innovation capability and business performance: insight from the global financial crisis | Innovation capability mediates the performance effect of MO, while innovation capability mediates the relationship between customer orientation and business performance |

| Karabulut (2015) | Manufacturing Turkey | Effect of innovation strategy on firm performance: a study conducted on manufacturing firms in turkey | Innovation strategy leads firms to improve their customer performance, internal business process performance and growth performance |

| Rosli and Sidek (2013) | Manufacturing Malaysia | The impact on firm performance of small and medium manufacturing enterprises: evidence from Malaysia | Product and process innovation influenced firm performance significantly |

| Kalay and Lynn (2015) | Manufacturing Turkey | The impact of strategic innovation management practice on firm innovation performance | Innovation strategy, organizational structure and innovation culture significantly increased firm innovation performance. but not all type of complex innovation strategies affect the future productivity significantly. Moreover it indicates that company needs attention of innovation strategy toward more complex strategies rather than simple one |

| Muhammad and Hami (2014) | Manufacturing/Malaysia | The influence of innovation performance toward manufacturing sustainability performance | There is a significantly positive relationship between innovation and economic sustainability. |

| Akhlagh, Moradi mehdihzade, and Ahamadi (2013) | Construction/Iran | Innovation strategies, performance diversity and development: an empirical analysis in Iran construction and housing industry | Proactive, risk taking and futurity strategies are the most effective innovation strategies in the performance diversity |

| Karlsson and Tavassoli (2015) | Service/Sweden | Innovation strategies and firm performance | The firm that choose and afford to have a complex innovation strategy perform better in terms of productivity in compare with both firm that not to choose innovative and that firm choose simple innovation strategies |

| Ngumi (2014) | Banking/Kenya | Effect of banking innovations on financial performance of commercial bank in Kenya | There is a significantly positive impact on innovation and firm's growth. combination of product and process innovation that significantly improve the firms growth |

| Soltani, Azadi, and Witlox (2013) | Food industry/Iran | Technological Innovation Drivers in Rural Small Food Industries in Iran | firm's age, formal R&D, fixed capital and capacity of production are the factors which influence the technological innovation |

| Lilly and Juma (2014) | Banking industry/Kenya | Influence of strategic innovation on performance of commercial banks in Kenya: the case of Kenya commercial bank in Nairobi country | Product, process, organizational and market innovation has positive and significant impact to performance of the commercial bank. Product innovation has greater influence on bank performance |

| Veugelers (2008) | Manufacturing/Brazil | Innovation strategies, product and process innovation and growth: firm level evidence from the brazil | Product, process (Technological innovation) has significant and positive impact on firm performance. But there is no significance evidence found for significant and positive relationship between organizational and marketing innovation (non-technological innovation) on firm performance |

| Zhao et al. (2005) | Manufacturing/Singapore | Further links the technology source types with the innovative capabilities | Technology sources are directly linked with innovative capabilities with providing different impact |

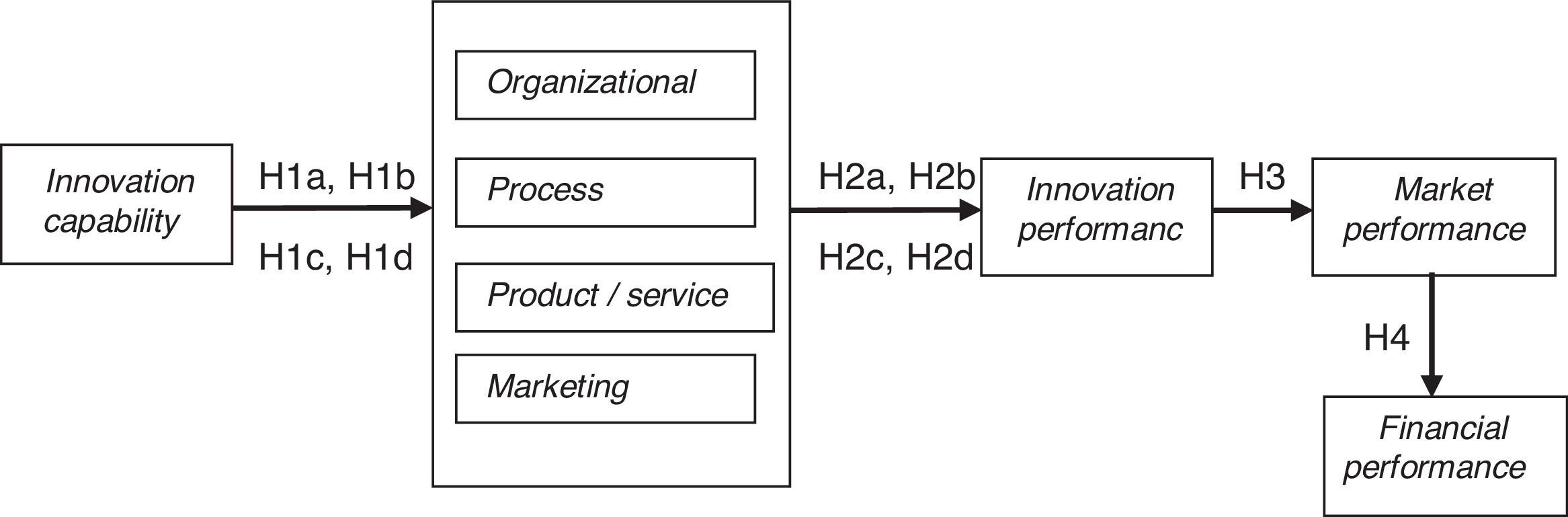

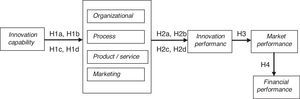

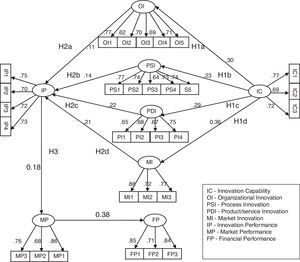

This study was aimed to investigate the relationship between innovation capability, innovation efforts and firm performance (Fig. 1). Innovation in the service sector is often seen as the technological innovation that they can be innovative to the extent which integrated with new technologies. But this is not the only way service innovation behaves in the innovative context; this was partly mentioned by Barras's (1986, 1990). Technology is the major driver of productivity growth in service firms. However non-technological aspects are also considered as very important in service innovation (Gallouj and Weinstein, 1997). According to the OECD Oslo Manual (2005) was introduced four types of innovations including product, process, organizational and market innovation. Product and process innovation closely related with technological improvements especially in the service industry term of technology might be considered as using high-tech plant and equipment. The definition of the Oslo Manual (2005) can also apply to the service innovation as well (Rothkopf & Wald, 2011). Innovation in insurance is related to the product, process market or structure (Deloitte, 2012, 2017; Schaerer & Wanner, 2011). According to our goals, this paper adopts the four-dimensional model of innovation related to the service sector, combining with insurance industry innovation, including two technological and two non-technological dimensions suggested by Den Hertog (2002); Howells et al. (2004); Kuusisto and Meyer (2002), OECD (2005), Oke (2007), and Tether et al. (2002). These four dimensions of innovation are service product innovation, process innovation, organizational innovation, and marketing innovation defined as follows, Product/service innovation is “introducing new product or service with the significantly improved performance characteristics such as technical specification, incorporated software to full fill the key customer needs better than the existing product” (OECD, 2005). The core attribute of the service products is intangible and development new service product is called service product innovation (Johne & Storey, 1998). Product/service innovation is a crucial performance factor which provides the capability to expansion into the new market and industries (Damanpour & Gopalakrishnan, 2001) and enables digging the opportunities to earn an abnormal profit and providing the route for the firms to earn profits (Nambisan, 2003). In response to the dramatic changes consumer – centric culture and increasingly technology – driven economy, it is important for insurers to continually upgrading their operating system, business model, and value proposition. They should also consider undertaking ongoing holistic transformation of product or services, legacy system and business process to drive revenue growth, financial stability improves customer experience and heads off emerging competition (Deloitte, 2017).

Process innovation is the “implementation of new or significantly improved production or delivery methods”. It may be considered changes in tools, human capital, and working methods or a combination of these such as install of new or improved software to speed up the claim settlement process and policy issuing (OECD, 2005) (Fig. 2). Josheph Schumpeter stressed that process innovation as the introduction of new tactics for the product or service or new way of commercializing the product or service. Process innovation may have influence on the productivity, productivity growth or profitability (Veugelers, 2008). The process is required in order to deliver product or services which customer does not directly pay for. Therefore process innovation should be a novel changes to the act of producing or delivering the products which allow significantly increase the value delivered to the stakeholders (Savitz, Kaluzny, & Kelly, 2000).

Marketing innovation is “introducing new marketing methods involving significant changes in product design, product placement, and product promotion or pricing (OECD, 2005). The main objective of the marketing innovation is better addressing of the customer needs, penetrate new market or new positioning a firm's product on the market with objective of increasing firm sales. Alsamydai, Alnawas and Yousif (2010) have examined the impact on marketing innovation in private commercial banks in Jordan. According to their findings proved that marketing innovation as positive effect on creating long-term competitive advantage and company growth. Furthermore, it is important that managers line with firms strategy and perception of marketing innovation for creating sustainable growth.

Organizational innovation is “implementation of a new organizational method in the firm's business practice, organization or external relations”. Organizational innovation can lead to improve the firm performance by reducing administrative and transaction cost, rather it intend to improve the workplace satisfaction. The activities oriented toward the organizational change can be consequently linked to the organizational innovation (Tether & Tajar, 2008). Thus organizational innovations are strongly connected with all the administrative efforts including renewing the organizational systems, procedures, routines to encourage the team cohesiveness, coordination, collaboration, information sharing practice and knowledge sharing and learning (Van der Aa & Elfring, 2002). According to the Samuelides (2001) organizational innovation will help absorb the evolution and exploit them into innovation in order to achieve rampant market growth. This also can apply any service industry which faced technological and regulatory evolution.

Adler and Shenbar (1990) stressed that innovation capability facilitates firm to apply appropriate process technologies develop new product meet the market needs and eliminate competitive threats. It helps to shape up and manages multiple capabilities of the firm for supporting to integrating capabilities and stimulus to innovation successfully (Lawson & Samson, 2001). Dadfar, Dahlgaard, Brege and Alamirhoor (2013) were identified that superior innovation capability tends to implement and develop a new product variety to the existing product portfolio. Dahlgaard-Park and Dahlgaard (2010) explained that firm must enhance the leadership, people, partnership and organizational capability before implementation of the original process of innovation and new product development. Vicente, Abrantes, and Teixeira (2015) have conceptualized that innovation capability is the firm capacity to develop new product through the combination of innovation behavior, strategic capability, and internal technological process. Thus we developed hypothesis as follows,H1 Innovation capability has positive impact on innovations. Innovation capability has positive impact on product/service innovation. Innovation capability has positive impact on process innovation. Innovation capability has positive impact on organizational innovation. Innovation capability has positive impact on marketing innovation.

The impact of innovation on business performance in service firms would be more complex and different than the manufacturing sector (Lin, 2011) due to the intangibility, perishable, inseparability, and variability. Over the past few decades’ scholars are dedicated to identifying the relationship between the innovation and firm performance. Researchers have used a different kind of financial and nonfinancial indicators to analyze the business performance; it may be subjective and objective indicators. Yıldız et al. (2014) suggested that innovation has a positive effect on business performance. According to the Oke (2007) innovations related to radical or incremental have given an interesting contribution to firm performance. It acts as an important determinant of the business performance in spite of the market upheaval in which the firm conducts (Hurley, Hult, & Knight, 2005). Innovation process can be viewed as effective drivers for enhancing the innovation and trade performance of the organization (Lendel & Varmus, 2014).

To expand the quality of new product or services, reliability, exceptionality, and newness from their competitors resulted in product/service innovation rather enhance the firm overall performance including marketing and financial (Langerak, Hultink, & Robben, 2004; Rosli & Sidek, 2014). (Wang and Hsu, 2014) was conducted research which related to High Tech industry in Taiwan to identify the relationship between the market orientation, service innovation, and innovation performance. Findings revealed that innovation as fully mediating effect on innovation performance. Furthermore, the study suggested that technology-based product quality which facilitates firms to generate superior innovation performance. Mabrouk and Mamoghli (2010) have investigated innovation in banking sector. Their study indicated that product innovation improves the profitability while process innovation improves the profitability and efficiency and also revealed that first mover of innovation both product and process has great effect on profitability. Implementation of product, process and institutional innovation makes firms to become more flexible in their operations and it drives company to improve the quality of products, expansions of network/acquired quality people and technology competitiveness (Githikawa, 2011).

On the other hand considerable amount of research has indicated that organizational innovation is positively associated with the innovation performance (Chiang & Hung, 2010; Reed, Storrud-Barnes, & Jessup, 2012) and helps to better understanding of which type of capabilities would affect for competitive advantage that can generate economic rent (Camison and Lopez, 2012). Yavarzadeh, Salamzade, and Dashtbozorg (2015) have investigated the relationship between organizational innovation and performance in tax affair general administration of Iran. The result of the study shows that innovation (product, process, administrative/organizational) as positive and significant effect on organizational performance in terms of financial, growth, customer and internal process. In addition to that product and process innovation play effective role on organizational performance. In general process, innovation is considered as a factor that can generate multiple benefits for the organization to achieve competitive advantage (Baer & Frese, 2003).

However, a considerable amount of business has adopted this practice without much success. In most cases companies indicated that moderate, very little or no results at all through their innovations for instance. Most of the research studies tended to focus on product and process innovation (Guan & Ma, 2003; Wolff & Pett, 2004) rather than given importance to the organizational and marketing innovation in the literature. Few types of research have adopted organizational innovation to identify the effect on firm performance among them Damanpour and Evan (1984) explored that adoption of administrative and technological innovations are more important for the organization to improve their performance level. Johne and Davies (2000) suggested that marketing innovation is given a decisive importance for the firms to increase their sales and enhance the profitability.

Past studies revealed that there is a positive relationship between innovation and firm performance (Matear, Gray, & Garrett, 2004; Pragogo & Ahmed, 2006; Wu, Mahajan, & Balasujbramanian, 2003). But some of them indicated that there is a negative relationship between the innovation and firm performance (Subramanian & Nilakanta, 1996). Innovation activities benefited for firms to augmented firm performance in different aspect. Past research has explored four types of performance (Antoncic & Hisrich, 2001; Hagedoorn & Cloodt, 2003) with consist of production performance, market performance, financial performance and innovative performance which accommodate to provide border explanation in terms of performance. Hence we hypothesized that,H2 Innovation has positive impact on innovation performance. Product/service innovation has positive impact on innovation performance. Process innovation has positive impact on innovation performance. Organizational innovation has positive impact on innovation performance. Marketing innovation has positive impact on innovation performance.

Market performance can be derived as the extent to which firms gain market-related outcomes than their rivals with respect to customer satisfaction, new customer acquisition, loyalty etc. (Oh, Cho, & Kim, 2014). Marketing concepts basically suggested that superior Judgmental performance (Quality, customer satisfaction, employee satisfaction) is the perquisite for superior performance of the market and financial (Subjective performance) of the company. Agrawal, Erramilli, and Dve (2003) study also imply that market and financial performance cannot be realized without the superior performance of judgmental/innovation. Innovation performance can facilitate firms to generate market performance in numerous ways through helping to identify technological possibilities with improving product and service quality and superior value product to the customer can help to gain new customers. Thus customer satisfaction improve the market position of the organization (Hogan & Coote, 2014).

Innovation performance is firstly affiliated with the non-financial aspects of corporate performance, for instance, customer facets, satisfaction and afterward it accelerated the higher financial performance (Gunday et al., 2011). Even though innovation in short time period might cause possible loss (Visnjic, Wiengarten, & Neely, 2016) during the long term that might expedite for positive effect to the production, market and financial performance (Damanpour & Evan, 1984). According to the (Han, Kim, & Srivastava, 1998) relationship between innovation and financial, market performances are not direct but mediated by innovation performance. Wei and Morgan (2004) were identified that innovation performance can lead sustainable competitive advantage through creating superior value to customer immensely which can turn greater market performance and profitability. However, in the literature, there are limited researches which have explained the positive relationship between the innovation performance market performance (Gök & Peker, 2017; Gunday et al., 2011; Stock & Reiferscheid, 2014) and also Cheng and Krumweide (2010) found a positive relationship which is related to the service industry. Following prior findings and rationale, we hypothesized thatH3 Innovation performance has positive impact on the market performance.

Recent evidence of the research revealed that positive relationship between innovation and financial performance (Lilly & Juma, 2014), in most cases given a proof which innovation statistically significant impact on the firm's profitability (Walker, 2004). On the other hand, Karabulut (2015) explained greater the market share, return on investment which resulted in greater the profit margin. Reichheld and Markey (2000) stressed that customer satisfaction and loyalty drive firms for the higher profitability and revenue growth. Therefore we hypothesized that,H4 Market performance has positive impact on the financial performance.

This research was conducted in the insurance industry because of the insurance industry is mature and knowledge base industry. Innovative solutions are absolutely essential for insurance players to remain in the competitive business environment (Deloitte, 2014). Insurance business can be categorized as life and non-life business and insurance products highly involve with intangible risk in long term and short term. Many insurance companies facing challenges due to highly increasing customer expectation toward personalized product and services, advanced technological improvement and macro shift of the economy (Deloitte, 2016) and industry facing disruption productive and innovative competitors from both inside and outside of the industry. Therefore given to the importance of innovation in insurance industry, research was conducted in insurance industry in Sri Lanka. Extant literature has asserted that innovation related to the service sector much more concentrated on organization dimension of innovation (Process, Marketing) with relative to the manufacturing sector (Van der Aa & Elfring, 2002). Therefore measurement of innovation activities should focus on the technological dimensions well as organizational dimensions. It is true that many don’t immediately think of the insurance industry when they think about product innovation. But among other things we are trying to change the stigma.

As we mentioned above conceptual framework of the study was used four dimensions for measure the innovation activities in the insurance companies. These four dimensions are insurance product innovation, process innovation, marketing innovation and organizational innovation. Innovation measures of the each type of innovation are designed based on the theoretical and operational definitions and aspects in the literature explain by OECD Oslo Manual (2005); CIS regarding four type of innovation and (Bilderbeek, Hertog, Marklund, & Miles, 1998) approach of measurement of service innovation activities. In the end, four indicators were generated to measure the innovation activities in insurance companies. Respondent were asked to rate the innovation activities currently available in their firms during the period of 2013–2016 with each scale of (5 point scale, 1 – not implemented, 2 – imitated from national market, 3 – imitated from international market, 4 – improved current product/process/marketing/organizational practice, 5 – original product/process/marketing/organizational practice were developed. In this research, a similar approach of Akman and Yilmaz, 2008 is followed in order to evaluate the innovation capability, adopt three questions contain main characters including organizational culture, characteristics of internal process. Respondents were answered by using each scale (5 point scale, 1 – strongly disagree, 2 – disagree, 3 – neither agree nor disagree, 4 – agree, 5 – strongly agree). Particularly three different type of performance measures were employed to measure the organizational performance. Innovation performances measurements consist with four criteria have been adopted from Cronin and Taylor (1994) and Rothkopf and Wald (2011). In the end, six indicators were generated to measure financial and market performance including return on sales, overall profitability, and return on investment, market share, total sales, and customer satisfaction. The six indicators have been adopted based on the existing literature mainly by research of Narver and Slater (1990) and Matear et al. (2004). Respondents were asked to rate the firm performance by indicating their strength of performance with each scale (5 point scale, 1 – extremely unsuccessful, 2 – unsuccessful, 3 – similar, 4 – successful, 5 – extremely successful).

Empirical data were obtained through the survey in 2016 within a period of 5 months. Survey questioner were distributed to the CEO, General Managers, Department Heads most of whom were senior managers who knows well about the present and past organizational practice related innovation aspects in the organization both life and general insurance business in different functions areas such as marketing, finance, human resource, sales, underwriting and claims in different class of insurance including life, motor, fire, marine, and miscellaneous. Individual questions designed to assess the innovation capability, innovation efforts, innovativeness, market condition and corporate performance. A total 393 managers were responded out of 550 questioners. We defined size of the organization based on the numbers of employees .73% employees who were working a firm with more than 300 employees or above and 6% respondents came from firm with 200 employees or less. After having the screen testing 379 questioners were considered as the valid for analyzing process. The final response rate was accounted for 68.9%. The respondents completed the questioners were from 48% top management and 52% were from middle management. After finishing the data collection process, questioners were evaluated by SPSS 16.0 statistical software package to measure the validity of the constructs.

Results and discussionCommon method biasThe study used Harmann's Single-Factor test to check the common method variance. This test was conducted using principal component analysis (PCA) and loading 30 items on one factor. The factor analysis indicates that (15%) less than 25% variance was extracted and half of the items suffered from poor factor loading well below 0.5. These results suggested that common method variance was not a significant problem in the data set.

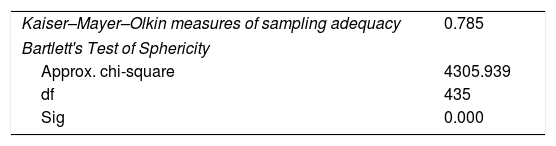

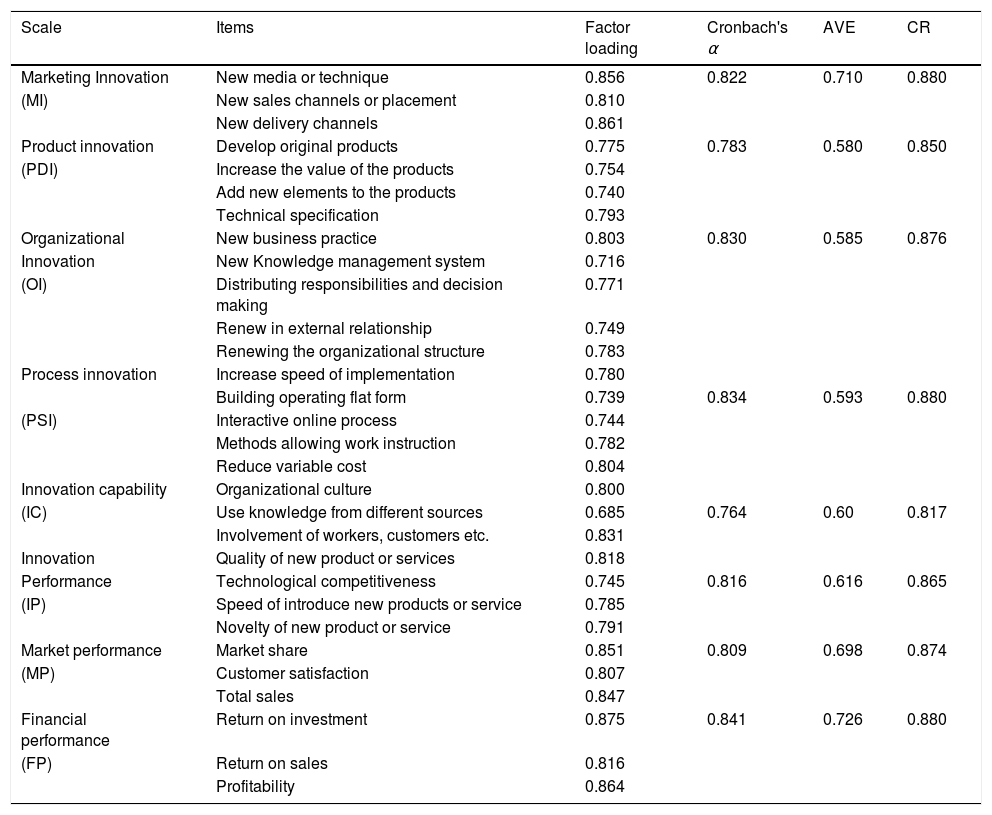

Reliability and validityData were first analyzed to ensure instrument quality by convergent and discriminant validity. Applying SPSS, the principal components analysis (PCA) was conducted to measure the underlying dimension associated with 32 items. The constructs validity was measured using Bartlett's test of Sphericity and Kaiser–Mayer–Olkin (KMO) measure of the sampling adequacy of individual variables. KMO overall should be 0.6 or over to perform factor analysis (Ozdamar, 2002). According to the results of Bartlett's test of Sphericity and KMO revealed that both are significant and suitable for the factor analysis (Table 2). The cumulative variance explained is 66.59% which exceeds the acceptable limit of 60% (Ozdamar, 2002). The value of Bartlett's test of Sphericity indicate sufficient correlation between the variables, it shows 4333.93 and significant (p>0.000). The factor loading of all items of each scale exceeds 0.5 (Hair, Black, Babin, Anderson, & Tatham, 1998). All the factors loaded above 0.6 and two items in innovation capability (IC4, IC5) were dropped out during the process (Table 3); thus these values constitute of evidence of convergent validity. This data analysis demonstrates that measurements possessed an acceptable convergent validity. The composite reliability of the measurements must reach 0.6 or above (Fornell & Larcker, 1981). The results indicated that all the latent variables reached (0.817–0.88) the standard or above.

Factors loading and reliability analysis.

| Scale | Items | Factor loading | Cronbach's α | AVE | CR |

|---|---|---|---|---|---|

| Marketing Innovation | New media or technique | 0.856 | 0.822 | 0.710 | 0.880 |

| (MI) | New sales channels or placement | 0.810 | |||

| New delivery channels | 0.861 | ||||

| Product innovation | Develop original products | 0.775 | 0.783 | 0.580 | 0.850 |

| (PDI) | Increase the value of the products | 0.754 | |||

| Add new elements to the products | 0.740 | ||||

| Technical specification | 0.793 | ||||

| Organizational | New business practice | 0.803 | 0.830 | 0.585 | 0.876 |

| Innovation | New Knowledge management system | 0.716 | |||

| (OI) | Distributing responsibilities and decision making | 0.771 | |||

| Renew in external relationship | 0.749 | ||||

| Renewing the organizational structure | 0.783 | ||||

| Process innovation | Increase speed of implementation | 0.780 | |||

| Building operating flat form | 0.739 | 0.834 | 0.593 | 0.880 | |

| (PSI) | Interactive online process | 0.744 | |||

| Methods allowing work instruction | 0.782 | ||||

| Reduce variable cost | 0.804 | ||||

| Innovation capability | Organizational culture | 0.800 | |||

| (IC) | Use knowledge from different sources | 0.685 | 0.764 | 0.60 | 0.817 |

| Involvement of workers, customers etc. | 0.831 | ||||

| Innovation | Quality of new product or services | 0.818 | |||

| Performance | Technological competitiveness | 0.745 | 0.816 | 0.616 | 0.865 |

| (IP) | Speed of introduce new products or service | 0.785 | |||

| Novelty of new product or service | 0.791 | ||||

| Market performance | Market share | 0.851 | 0.809 | 0.698 | 0.874 |

| (MP) | Customer satisfaction | 0.807 | |||

| Total sales | 0.847 | ||||

| Financial performance | Return on investment | 0.875 | 0.841 | 0.726 | 0.880 |

| (FP) | Return on sales | 0.816 | |||

| Profitability | 0.864 |

Then reliability coefficient was also tested by using Cronbach alpha (α) in order to measure the reliability for the set of two or more constructs. According to the Cronbach alpha test, the total scales of reliability varies from 0.78 to 0.843 (Table 3), which exceed the threshold point of 0.7 introduced by Nunnally (1978). The value of 0.7 or greater is indicated that good scale of reliability (O’Leary-Kelly & Vokurka, 1998). The Cronbach alpha of eight factors ranges 0.78–0.843 which indicated that they all are reliable.

Moreover, convergent and discriminant validities were measured using the average variance extracted. According to the Bagozzi, Baumgartner, and Youjae (1988) the basis test's criterion on each value of average variance extracted should be 0.5. All of the average variance extracted for measurements range 0.58–0.726, exceeds the threshold of 0.5 (Bagozzi & Yi, 1988) which indicate that study had adequate levels of convergent and discriminant validity

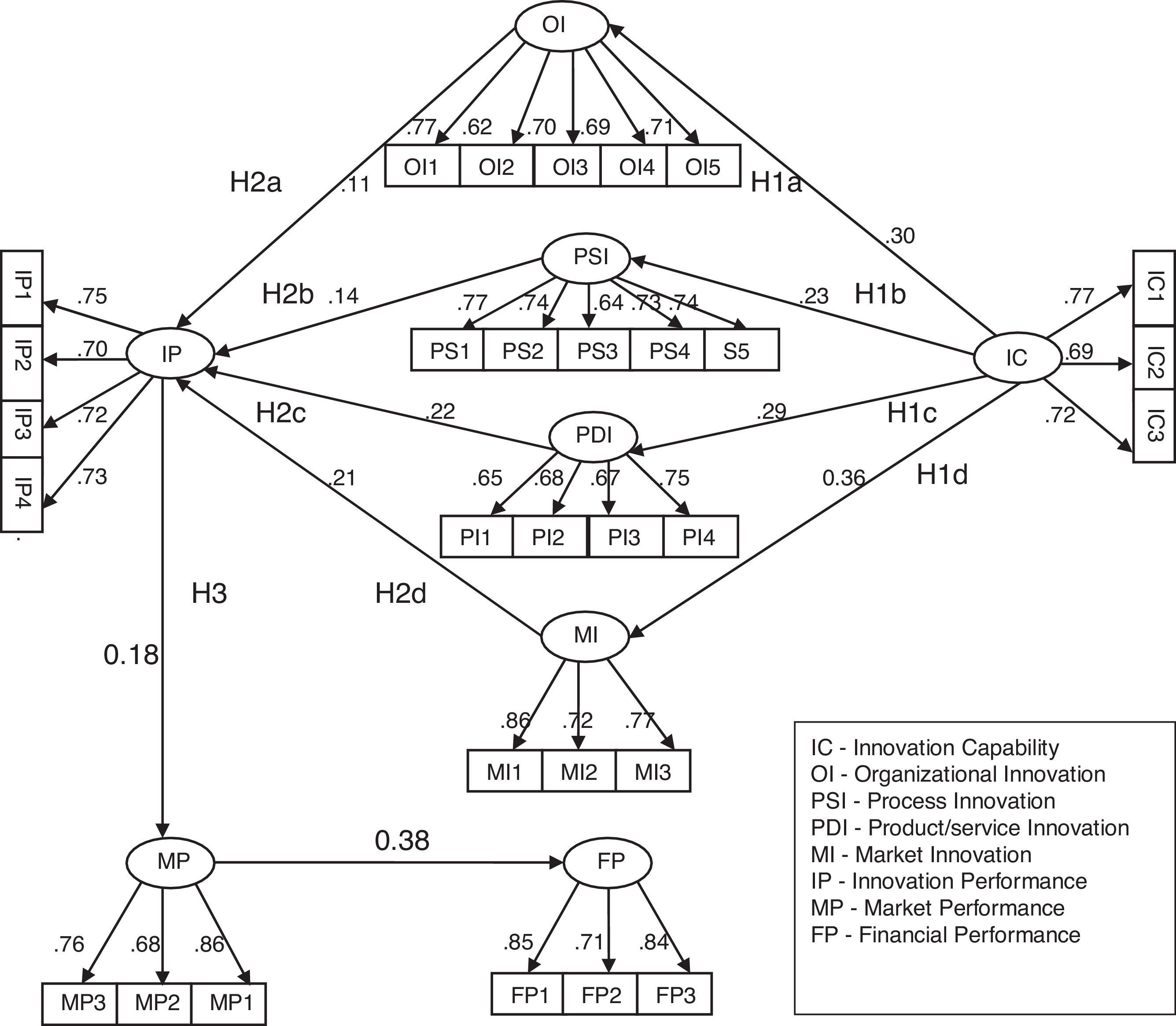

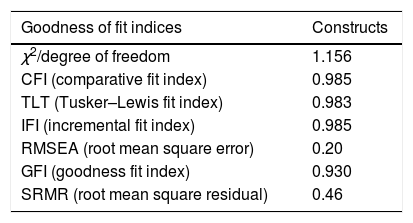

Hypothesis testingThe SEM model was employed to examine the relationship between constructs developed by study. Hence SEM analysis was performed by AMOS 24 version and analyses simultaneously goodness-of-fit indices. The results supported with Goodness fit indices. For the whole model statistical results shows that Chi-square/df=1.156, CFI=0.985, TLI=0.983, IFI=0.985, GFI=0.930, RMSEA=0.20, SRMR=0.46 (Table 4). Hu and Bentler (1999) mentioned that RMSEA, TLI, and CFI are necessary to value for the model fit. According to the study, we hypothesized four paths including eight sub-hypotheses.

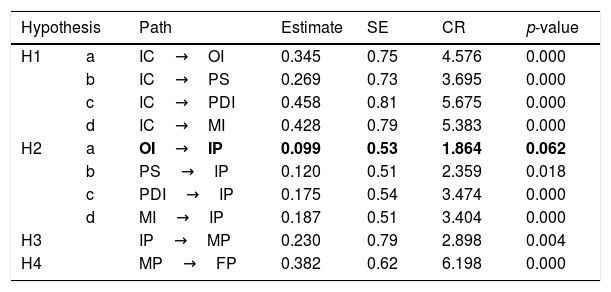

Using the SEM investigated that impact of innovation capability, innovation efforts and firm performance. Results exhibits all the paths are significant (p<0.05) except H2b (OI IP). A SEM model divulges the innovation capability is directly and positively affects the organizational, production, process and marketing innovation efforts. The entire paths were significant at p<0.000. Innovation capability directly effects to the organizational innovation in the insurance industry, the statistical findings revealed that innovation capability has a positive effect on organizational innovation activities. Therefore this hypothesis (H1a) accepted at p<0.000. The study showed that innovation capability positively influences to the process innovation activities. Therefore H1b hypothesis accepted as p<0.000. Regarding the H1c hypothesis which indicated innovation capability has direct effect on product innovation. Thus H1c hypothesis accepted where p<0.000. Results also indicated that for H1d (innovation capability affect marketing innovation) innovation capability has positive impact on marketing innovation. Hence H1d hypothesis is accepted at p<0.000 (Table 5).

Standard estimation of the main model.

| Hypothesis | Path | Estimate | SE | CR | p-value | |

|---|---|---|---|---|---|---|

| H1 | a | IC→OI | 0.345 | 0.75 | 4.576 | 0.000 |

| b | IC→PS | 0.269 | 0.73 | 3.695 | 0.000 | |

| c | IC→PDI | 0.458 | 0.81 | 5.675 | 0.000 | |

| d | IC→MI | 0.428 | 0.79 | 5.383 | 0.000 | |

| H2 | a | OI→IP | 0.099 | 0.53 | 1.864 | 0.062 |

| b | PS→IP | 0.120 | 0.51 | 2.359 | 0.018 | |

| c | PDI→IP | 0.175 | 0.54 | 3.474 | 0.000 | |

| d | MI→IP | 0.187 | 0.51 | 3.404 | 0.000 | |

| H3 | IP→MP | 0.230 | 0.79 | 2.898 | 0.004 | |

| H4 | MP→FP | 0.382 | 0.62 | 6.198 | 0.000 | |

Bold indicates not significant.

Furthermore, findings exposed that organizational, marketing and product performance has a significant and direct impact on the innovation performance through innovation capability. According to the structural relationship, the result shows that link between the process innovation and innovation performance reasonably strong (p<0.05) and supported hypothesis H2b. But the relationship between organizational innovation and innovation performance is statistically insignificant (p>0.01). Therefore H2a hypothesis is not accepted. Meanwhile, the results indicated marketing and product innovation performance has a significant and strong impact to the innovation performance. Hence H2c and H2d hypothesis also accepted where p<0.00. Moreover, the results were yielded that innovation performance which supported for the market performance eventually triggers direct impact to the financial performance. The results of the model confirmed innovation performance has significant positive impact on market performance p<0.01. Therefore H3 hypothesis is accepted. Finally, research showed that market performance has positive and direct impact to the financial performance. The statistical relationship between the market performance and financial performance is significant. Thus H4 is also accepted where p<0.000. The overall evidence of the results suggested that innovation capability has direct and positive impact to the product, process, marketing and organizational innovations, and directly stimulus to the innovation performance through innovation efforts, moreover innovation performance, which make toward the higher market performance, and ultimately higher the financial performance. Table 4 shows the standard path estimate and p-value of the SEM model.

DiscussionThe findings of the research supported to claim that innovation capability in insurance companies have a positive and strong impact on innovation efforts. Thus hypothesis H1a, H1b, H1c, and H1d are supported. Especially innovation capability has a strong and significant impact on the product, marketing, and organizational innovation activities. These findings are very important because innovation capability is one of the most influential factors for developing the innovation activities within the firm. Knowledge sharing, motivation, and creative thinking would lead to defining clear and effective innovation strategy. An organization with a culture that nurtures innovation and organization supported by right people, the process will provide the path to create a broad diverse set of ideas, especially converting them into the profitable business concepts. As well as effective scale of new business ideas supporting them with appropriate level and type of resources requires both creations of superior ideas and successfully commercialized them. Therefore innovation capability that provides insight for firm's innovation potential areas and assets, which leads to identifying strongest or weakest point, where firm should develop. For this reason, innovation capability is most required components for developing effective innovation outcomes within the firm to enable the application of resources and continuous transform of knowledge and skills into product, process, and system for the benefits of firms and stakeholders. Innovation capacity of the firm is subsequently responsible for generating highly creative innovation outcomes.

Another important result of this study is innovation activities have a positive and significant impact on innovation performance of the firms. The results revealed that product, process, and marketing less or more positively associated with firm performance. Therefore hypotheses H2b, H2c, H2d are supported. But the impact on organizational innovation on innovation performance is not found to be significant. Product and marketing innovation appeared to be the critical driver for innovation performance in insurance companies which also indicated that strong link with the innovation capability. This suggested that improving the innovation capacity of the firms which drives the better innovation performance. At the same time, the strong relationship between marketing innovation and innovation performance as proposed in the study suggested that through creating innovation supported organization culture which provides information on potential customers, customer expectations and needs to generate better marketing innovation activities enhance the innovation performance. For this reason, managers need to invest more in innovation capabilities support generating new efforts of innovation activities enhance the firm performance. On the other hand companies with successful process innovation efforts which facilitate develop better product and marketing activities within firm. Process innovation is all about reducing cycle time that results to reduce the work involved and the process becomes more – able. Proper new business recording system, addressing customer needs with tailor made decision with advanced technological infrastructure which drives effective performance. Focusing on process innovation activities through innovation culture that encourages employee to stretch and develop their capabilities. For that reason, insurers need to establish process, promote the cultivation of ideas toward the effective innovation solution. The evidence demonstrated our argument that managing innovation capabilities of insurance companies which leads more or less likely to produce performance results.

Another interesting finding of this research is relationship between innovation performances; financial performance and market performance. The results revealed that these relationships are positive and significant. Therefore H3 and H4 hypothesis are accepted. However certain amount of time lag needs to observe the exact performance of the firm in terms of innovation efforts. A time lag effect on innovation and financial performance explained in the literature (Teece, 1988). Overall findings of the study that can be summarized as follows; to achieve innovation performance insurance company first need to develop organizational culture that can motivate innovation behavior, internal coordination with employee to encourage the innovation driven mindset that pulls off ideas, concepts into successful product/service, process, business model or system. This provides sight for insurance companies to develop innovation capability and motivate and empower individuals within an organization to encourage innovative mindset. It is possible that organization to leverage technology and knowledge to deliver the better innovation outcomes and performance. Finally, the evidence from study suggested that if a firm has strong innovation capability innovation outcomes and performance might be very high. The findings of this study prescribe this is to be the most effective way for building innovation success.

ConclusionThis study was undertaken to investigate and understand the effect of innovation capability, innovation and innovation performance in the Sri Lankan insurance industry. The findings of the study supported that company with higher innovation capabilities has influenced positively and very strongly. In this way, it assists the improvement of innovation capability is core to the insurance companies to define successful innovations. But the lack of capabilities and skills is one of the top barriers to innovation in insurance industry particularly small and medium size organization (KPM). The insurance industry needs to pivot from a traditionally risk-averse culture to one that encourages experimentation while mitigating financial risk. To achieve this, insurers will need to tap into new sources of innovation, accessing fresh ideas from employees, customers, investors and partners, which, in turn, will require progressive leadership at the top of the organization.

In this study, we define innovation capability as an ability to understand and identify the future customer needs, expectations and potential customers promptly and responding appropriately, application of organizational internal including employees and external knowledge by developing an innovation support organizational culture to create new ideas and transform them into successful innovations. Considering the future customer needs and expectation is very critical to firms to be successful and it helps firms to notice opportunities in future generate new ideas and transform them into new ideas (Chandy & Tellis, 1998). The innovation ability of the whole insurance companies mainly depends on the employee's creativity, results of the study shows the creative employees and closely linked with the innovation support organization culture. The enterprise culture construction of innovative insurance is an important way to improve the innovation ability of insurance companies. The establishment of cultural innovation of insurance companies first needs to reach a consensus on leadership, on this basis, to take a scientific approach to design, and to consolidate. In the new business environment, the traditional organization structure of insurance enterprise pyramid due to inhibition of innovation and change. Insurance reform trend of the organization is the process; in the enterprise, design emphasizes the integrity and unity of the processes of the organization. Thus it influences innovation support organization culture which helps to improve the inter-functional coordination among the Department, it plays an important role to establish an organizational climate that encourages innovation through discovering innovation opportunities from the external environment to convert them into successful innovation. Therefore innovation capability is the one of most required factor for the managers to foster. This accommodates the catalysts that encourage and accredit individuals of organization to innovate. This will help organization to drive superior products, services, and business model. It given an indication like that, innovation capability drives stimulus for such activities.

The insurance industry is generally different from the other industries. Insurance is any type all about managing risk. Therefore insurance industry is highly involved with intangible risk. Today insurance industry becomes highly competitive. The gap between Insurances Company to another is usually not given a great picture. Therefore at present insurance more like commodity and areas which low-cost structure, greater efficiency, and better customer service would help firms to surpass the competitors. According to study claimed that product and market innovation has a greater impact on firm performance. Thus insurance company needs the variety of investment products try to lure in customers and focus on marketing related activities. At the present market scenario of the insurance industry, companies tend to focus on the consolidation rather than investing money in the market and advertising campaign. So industry needs to pay more attention especially Sri Lankan insurance industry due to the low penetration level, aware people of regarding insurance and insurance related product which may help to enhance the potential customers and sales. Especially property and casualty insurance it is harder to achieve more consistent and higher growth rate, to hard the market, increase the premium volume and investment income due to the risk outside their control. Instead of making changes in system, procedures, the company should think about transformational steps to boost their completion among the rivals and industry as a whole. Insurers need to lift all their boats considering how to transform the way they do business in more effectively to face the grim market competitions well as the differentiate their brands as a part of the leading edge (Deloitte, 2014).

Moreover, product innovation indicates as a critical instrument for innovation performance, due to this reasons company top management need to put attention regarding improving innovation capability because it is the most effective factor for innovation success (Meeus & Oerlemans, 2000) and introduce innovation in each type (product, process, organizational and marketing). On the other hand, innovation performance performs as the most important role in the model and this positive impact transfer to the market and financial performance. Finally, our results are painted a clear picture that innovation is the key strategic dimension for the firms to drive long-term growth and profitability as well absolutely necessary for the survival of the organization. This takes greater relevance for managers in a competitive context which given an importance to develop and execute innovation along with the firm's business strategy and to have a clear understanding about innovations imperative where deliberately explain themselves to implement through the strategic practice.

Similar to the other empirical research this study also has limitations which should be acknowledged. It will help for future studies and can make improvement of this area. First, this study measures the innovation capability as one dimension. But it should be considered as multi-dimensional concept. This is the limitation of this study. Future research needs to address different aspects which affect for the innovation capability such as customer orientation, market orientation, and technology orientation. These factors are increasingly developing factors for innovation capability. Therefore these factors should be investigated in future studies.

The second limitation of this research is qualitative data. We used qualitative data to measure the firm performance due to the firm restriction for giving original data. Therefore we have to limit with subjective data. However subjective data is widely used in the organizational research (Azaranga, Gonzalez, & Reavill, 1998; Dess & Robinson, 1984). The other limitation is answers of the respondent will be a bias which would affect results of the empirical study. Finally, we selected insurance industry to conduct the empirical research while other sectors are not included in this study. Some valuable findings of this research revealed that these can apply other service sector industries especially Banking Industry. The future research needs to be applied to different developing countries with different service sector industries to explore the impact on innovation with different economic growth and market level.