This article analyzes termination in international joint ventures (IJVs) with a set theoretic approach and fuzzy set Qualitative Comparative Analysis (fsQCA) to show that parent contribution, ownership, managerial configuration and experience can lead to a successful end of a joint venture. The use of fsQCA provides the causal paths leading to termination. Termination by achieving the objectives and termination by corporate restructuring are the most common ways in IJVs to end the collaborative venture and are a consequence of the joint set of foreign contribution, ownership structure, managerial configuration and experience. The duration of terminated IJVs highlights the importance of managerial experience and local contribution.

Este artículo analiza la terminación en empresas conjuntas internacionales (IJV) con un enfoque teórico conjunto y un conjunto difuso de Análisis Comparativo Cualitativo (fsQCA) para mostrar que la contribución, propiedad, configuración administrativa y experiencia de los padres pueden conducir al final exitoso de una empresa conjunta. El uso de fsQCA proporciona los caminos causales que conducen a la terminación. La terminación mediante el logro de los objetivos y la rescisión mediante reestructuración corporativa son las formas más comunes en que las IJV ponen fin a la empresa de colaboración y son consecuencia del conjunto de contribución extranjera, estructura de propiedad, configuración gerencial y experiencia. La duración de las IJV terminadas destaca la importancia de la experiencia gerencial y la contribución local.

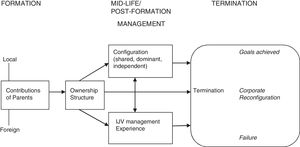

International joint venture (IJV) termination is a viable and dynamic research topic, particularly since many of the early IJVs from the 70s and 80s have matured and terminated. An IJV is depicted as a natural Venn diagram of a set theoretic relationship. Two or more companies in different countries set up a new legal entity with joint or shared management of the parents. This paper takes this unit of analysis into a set theoretic direction and considers joint sets of IJV causal conditions when it comes to the termination. It highlights the causal paths leading to termination in IJVs and provides a necessary conceptualization for a recent phenomenon in International Business (Beamish & Lupton, 2016).

Explaining the cause and effect of termination, the multiple definitions for IJV termination (Arino & Torre, 1998; Inkpen & Beamish, 1997; Ito, 2009; Luo, 2000; Makino, Chan, Takehiko, & Beamish, 2007; Shenkar & Yan, 2002) can decidedly alter the conclusions drawn, as the successfully planned termination of IJVs can be both successes and failures. There are at least two ways of ending an IJV relationship: as planned to end in favorable conditions when the partners have learnt what they intended to do, and as unplanned and/or acrimonious divorce of an IJV (Makino et al., 2007; Ott, 2000; Ott, Liu, & Buck, 2014; Reuer, 2000). The IJVs in the automotive industry have shown the duration and an important map of collaboration for decades. The insights of this industry and the termination scenarios during a highly uncertain time frame from 2004 to 2010 with the Global Financial Crisis offer the background of the empirical investigation.

This paper contributes to the literature in many ways. It analyzes the termination of IJVs of the automotive industry with its international collaborations lasting for many decades. Especially, equifinality, as strength of fuzzy set Qualitative Comparative Analysis (fsQCA), drives the investigation. Many theoretical lenses have been used so far but set theory with its configurational approach is a novel tool. This article benefits from an electronic database of IJVs across multinational companies (MNEs), countries and stages of IJVs. The findings give a configurational classification to termination scenarios which is new in international joint venture research. It shows how innovation in termination strategies can benefit the IJVs beyond their planned life cycle.

Theoretical underpinningTerminating IJVsThe literature asserts that IJVs are transitional entities (Park & Ungson, 1997; Porter, 1990; Sinha, 2008). They present a means of overcoming the obstacles and risks associated with entering unfamiliar and foreign markets. Once there has been a degree of market familiarization and a reduction in the ‘liability of foreignness’ (Zaheer & Mosakowski, 1997), an IJV provides parent firms with the possibility for acquisition, a progressive development for parents wishing to capture the full returns of a successful IJV. However, when the IJV follows the transitional path to a wholly owned subsidiary (WOS), the literature frequently refers to the venture as suffering from instability (Inkpen & Beamish, 1997; Parkhe, 1993;Yan & Zeng, 1999). Franko's (1971) early work regarded instability to heighten as a business undergoes an expansion of its global strategy, characterized by ‘shifts in organizational structure’ such as an ownership change whereby the foreign parent increases its ownership from minority or shared to a stake under 95%, the complete termination (planned or unplanned) of the IJV and the transition of an IJV into a WOS.

Contractor (1990) argues that when obstacles such as risk and government regulation are removed, the IJV will likely undergo a transition with a parent or third party to transform the IJV into a subsidiary. This transition of IJVs has been reported more frequently in economies that are themselves undergoing a transition to a more democratic and open state (Steensma et al., 2007; Steensma et al., 2007;Chung & Beamish, 2012). Despite IJV transition being what Porter (1990) describes as a natural progression within the IJV life cycle, the literature largely considers IJV transition synonymous for instability and poor performance (Gomes-Casseres, 1987; Reuer, 2000; Sinha, 2001 and 2008 ). Sinha (2008) and Geringer and Herbert (1991) propose that ‘changes in IJV ownership structure, seemed to have a much less direct relationship’ on performance than alternative factors. The influence of the parents on duration and termination was considered recently. Lu and Xu (2006) are the first to focus on the local parent, ‘de-compartmentalized’ local advantage and the local parent's age and size. Likewise, Ott et al. (2014) find that the longevity of IJVs in China is positively correlated to knowledge access given though Chinese senior managers in Sino-Foreign IJVs. The role of the parents is therefore an important factor in the termination.

There is support for the idea that termination is moderated by a cycle, where the IJV having operated for some time can greatly diminish the likelihood of termination (Park & Ungson, 1997). Kogut (1989) is one of the earliest proponents to suggest the longer an IJV has operated the greater its stability and moderating effect on termination. Whereas Lyles and Baird (1994) point out that where IJV longevity can be effectively linked with termination as a measure of success when a predetermined outcome of termination has been achieved. Kumar (2005) stipulates that the termination of an IJV does not always indicate failure but can be representative of success when planned for at the IJVs creation. The idea that termination can be a favorable option indicates that the IJV has been used as a transitional device, aimed at overcoming immediate shortfalls resources, abilities or market constraints (Demirbag, Apaydin, & Tatoglu, 2011; Kogut, 1989; Park & Ungson, 1997; Porter, 1990;Sinha, 2008).

Killing (1988) suggests IJVs are largely formed to overcome the ‘temporary problems’ faced by parents and that such obstacles overcome the termination of the IJV is the next evolutionary step. Consequently, the idea that longevity can reflect failure would be inaccurate and incorrect in such cases (Yan & Zeng, 1999). When IJV termination is a consequence of having achieved set objectives, it is in fact the inverse application of longevity that may determine how successful an IJV has been. The shortest possible time between the setting and completion of objectives would suggest the most successful IJV, since risk and costs have been kept to a minimum, partner opportunism has been avoided and subsequent operations may begin (Madhok, 2006; Mohr, 2006).

This research identifies a gap in the literature. The initial parent contributions, configurations and managerial experience of the IJV management have not been looked at from a set theoretic perspective to classify termination scenarios.

The termination framework – constructs of IJV terminationThe antecedent conditions of the IJV play an important role when considering the managerial process and the termination.

Contributions and Ownership. Consistent with the idea that the commitment of the parent firms is a major determinant of IJV performance (Beamish & Banks, 1987; Cavusgil & Zou, 1994; Cullen, Johnson, & Sakano, 1995; Isobe, Makino, & Montgomery, 2000; Newman, 1993), Hu and Chen (1996) find that successful IJVs attract a greater level of investment. For the managerial stage of an IJV, decision-making and autonomy between the partners and managers are relevant for survival. Makino et al. (2007) find that ownership structure has only a moderate effect on termination.

Control and Configuration.Luo (2000) argues transition brings single parent control which is easier to administrate than IJVs with multiple parents and therefore performance can be far easily monitored. Killing (1988) stresses that IJV management already suffers from complexity issues due to cultural and geographical distances, yet the shared management of an IJV will only exacerbate these existing issues attributable to the increased level of parent interaction required in the decision-making process. Yan and Child (2002) stress that partners rely more on legal ownership rights to retain an influence over IJV decision-making.

Managerial Experience.Datta, Musteen, and Herrmann (2009) emphasize the relevance of the board composition, insider equity ownership and compensation structures determine the choice of entry modes, and thus IJVs. Glaister, Husan, and Buckley (2003) stress that strategic and operational decisions in the IJVs are part of the relevance of managerial experience. Furthermore, Piaskowska and Trojanowski (2012) investigate the importance of a ‘global mindset’ in managers and the relevance of international experience. IJV's managerial experience needs to be considered as a condition for stability in addition to the partner selection criteria.

Termination Scenarios. The termination of the IJV must infer with the successful completion of an objective rather than any genuine form of failure. Gomes-Casseres (1987) was among the first to identify how the planned termination of IJVs can represent success in pertaining to the parents’ initial expectations. The distinction between a successfully planned termination and the termination of an IJV that has become unprofitable Geringer and Hebert (1991), has to be made. The latter is a casualty of external economic conditions or the consequence of the deterioration of the parent's relationship (Shenkar & Yan, 2002).

The implications for IJV data is relevant when unplanned terminated IJVs are combined with successfully planned IJV terminations. Yan and Gray (1994) consider termination by acquisition, dissolution and reorganization, whereas Reuer (2000, p. 5) views termination from five different angles such as: (1) the parent firm acquires the IJV, (2) the parent firm sells its equity position in the venture to its partner(s), (3) the parent firm sells its equity stake to an outside party, (4) the parent firm and its partner(s) sell the IJV in its entirety to an outsider, or (5) the parent firms liquidate the venture. Ott (2000) suggests that there is unplanned and planned termination with friendly and unfriendly behavior, such as cooperation and conflict at the center of termination. Makino et al. (2007) hypothesizes that international experience contributes to the longevity and termination in IJVs. This is relevant, since local and foreign parents play an important part in acquiring and providing experience and expertise. Based on the termination research, termination (intended or unintended) is a function of contribution, control and configuration in IJVs.

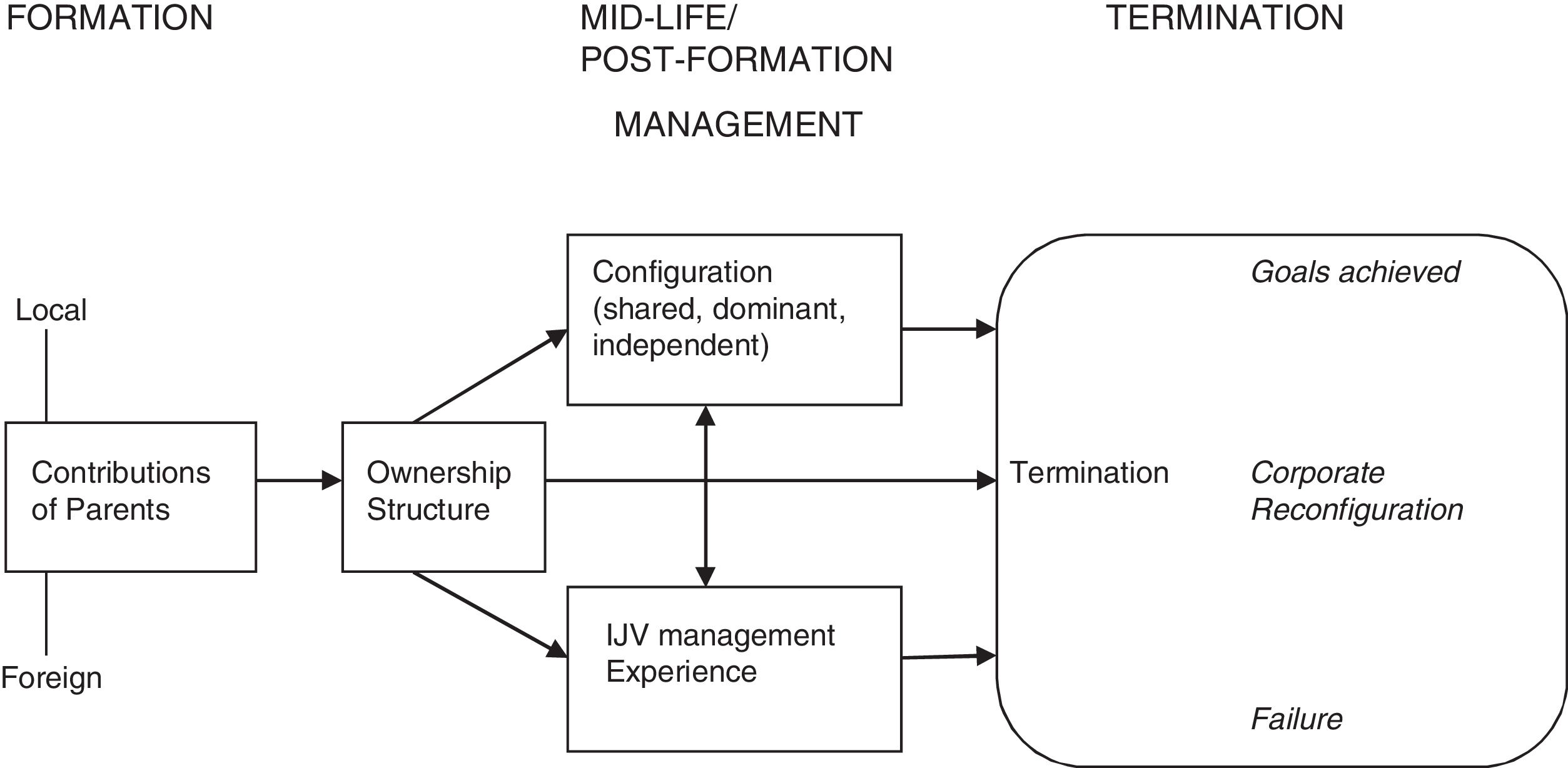

All these scenarios have in common that IJV termination is diverse and dependent on the parent relationships and the IJV management (Fig. 1).

The configurations between the contributions of the parents, managerial configurations, ownership structure and managerial experience lead to the following research questions: RQ 1: What configurations between parental contribution, ownership structure, managerial configuration and experience are necessary and/or sufficient for a termination by achieved objectives? RQ 2: What configurations between parental contribution, ownership structure, managerial configuration and experience are necessary and/or sufficient for a termination by corporate reconfiguration?

IJVs are naturally thought of as sets, the set of foreign parent firm, local firm and the joint venture. The transfer of the constructs into conditions is the next step leading to termination. When termination is the outcome condition Z, then the causal conditions are chosen in this second step (Ragin, 2000). Causal conditions can be ownership ratio A, configuration of the joint venture B, contributions of the parents C and managerial experience D. Below are some causal paths leading to termination.

Fiss (2007) highlights the use of set theory for the analysis of organizational configurations. He states that ‘at the center of set-theoretic approaches lies the idea that relationships among different variables are often best understood in terms of set membership. Consider the simple case that A is a member of the set Z (A is a subset of Z)’ (p. 1183). This information is useful to consider the IJV termination outcome as Z. The constructs of the framework are conditions A, B, C, D:

H1: The joint set of ownership, configuration, contribution and managerial experience is sufficient for termination by achieving the objectives. Both parents’ contributions are separately tested regarding its contribution to the outcome.

H2: The joint set of the contribution of the parents, the ownership, configuration and managerial experience is sufficient for the termination by corporate restructuring Both parents’ contribution are tested separately for their influence on the outcome.

H3: The joint set of the contribution of the parents, ownership structure, configurations and managerial experience are sufficient for the duration of the IJV.

H4: All configurations FOR∩LOC∩ OWN∩CONF∩ MEX→Termination

The joint set of the contributions of the foreign and local parent, ownership, configuration and management experience can lead to termination.

Focusing on the local or foreign parent's contribution, the joint set of ownership, configuration, and management experience can lead to termination. It is important to investigate the necessary condition for each side and its relevance for the end of the IJV.

To analyze the relationship between these causal conditions and the outcome, necessary (the outcome is a subset of the causal condition) and sufficient condition (causal condition is a subset of the outcome) are established (Ragin, 2000). The fuzzy set approach is a refinement to the crisp set approach of assigning memberships as either empty (0) or full (1) to these conditions. The fuzzy set approach allows to show the interval and is a much more precise and useful approach to apply to real-life situations.

Data analysis – frequency analysis and fsQCAData collectionTo test the hypotheses, the creation of an electronic database of automotive IJVs from published sources helps to target the necessary conditions for the analysis. The automotive industry as one of the most populated by IJVs lends itself to an investigation of termination due to the maturity of IJVs in this sector. The total number of IJVs identified in the industry was recorded at 200. The electronic IJV data base is derived from the global automotive industry with Ford, General Motors, Toyota, VW, Fiat, Honda and Renault constituting at least one of the parents. From the information collected, the following variables are quantified: Contribution of Local and Foreign Parents; Ownership Ratio; Configuration; Managerial Experience; Duration; Reason for Termination. The IJV data base has been reduced to the IJVs, which are terminated, and their information offers insights into the conditions of termination scenarios.

Interrogating the data base of 200 global automotive IJVs shows that between 2004–2010 an 8% termination rate rises to 24% if the parameters of termination include transitions to wholly owned subsidiaries (WOS). The time frame is important, since the Global Financial Crisis in 2008 falls into the investigation. Although the process of recording the IJVs spanned six years, many of them are set up many years before this investigation began and hence the duration variable identifies those IJVs, which have been set up as long as 40 years ago.

Whilst the IJV literature details the difficulties in entering an IJV and their high rate of failure (Buckley et al., 2007; Hennart et al., 1998; Luo, 2007; Nanda & Williamson, 1995; Puck, Holtbrugge, & Mohr, 2009), the database reports on total terminations, where the IJV no longer exists in any form, amounted to 8% and some form of structural alteration, as either transition or termination, 57% were transition to subsidiary. This suggests that with the transition to WOS both the foreign parent and the IJV have undergone a change that looks to benefit both parties. More than half of the cases represent IJVs located in China, India and the ASEAN region.

Reasons for IJV termination. The main reason for terminations seems to be corporate restructuring with 23 cases, followed by the continuation of the IJV was not viable. Only two cases suggested the deterioration of partner relationships. The failure to achieve objectives or targets was only identified in three cases. Termination also resulted in the same number of cases when objectives had been achieved.

Duration. Geringer and Hebert (1991) report the average duration of IJVs from a sample of US IJVs was ‘3.4 years for the terminated ventures and 6.0 years for the surviving IJVs’. Hu and Chen (1996) find that the average lifespan for all IJVs of a large data set was 13.7 years whilst those deemed ‘successful’ were longer at 15.9 years. This database shows that one third of the IJVs which lasted 0 to 5 years terminated. 11 IJVs which last 5–10 years and another 11 IJVs terminated between 10–15 years. In the ‘25–30 years duration’ category there is a 50% survival rate or termination rate. After this benchmark, more IJVs will survive and only a small number will terminate. The database reflects the common trend of a very short-lived duration of IJVs.

The data collection information specifies the conditions of termination and it becomes clear that the analysis needs to be transferred into a tool which shows the causal effect between the conditions of termination. Thus, in the next section the fuzzy set Qualitative Comparative Analysis uses the data set and transfers the factors of the database into conditions for the fsQCA.

Fuzzy set analysis – calibration of causal conditions and outcomeAs seen in the literature, the dynamics between the parents are often key factors for survival or termination. Thus, to investigate the conditions leading to termination the fsQCA deals with the complexity of causal consequences. This is in line with the set theoretic approach of the earlier literature review in which this approach is connected to IJV termination.

Ragin (1987, 1994, 2000, 2008) shows the capacity of set-theoretic analysis to strengthen the connection between the qualitative research's depth of knowledge into the cases and the quantitative research's elaboration into cross-case patterns. This innovative approach to empirical scientific work integrates the key strengths of qualitative (case-oriented) and quantitative (variable-oriented) methodology in the social sciences for ‘small-N’ and ‘large-N’ research. It shows the causal effects between the conditions (themes of the qualitative research) using Boolean Algebra to show the comparison between cases. In case of small-N, which range from 12–40 cases, their observations (called conditions) are across these cases. The knowledge of the qualitative researcher who has already identified these conditions will then lead to provide the calibration of the conditions into the breaking points of the sets.

The fsQCA approach builds on crisp sets csQCA [0,1] and moves then into the differences of fuzzy sets (as fully empty set 0, almost empty <, half/half 0.5, almost full >, to full set 1) which is the strength of fsQCA to provide the variance of the observations. The breakpoints of the 0 to 1 set will be determined by the researcher and their knowledge of the field and study. This tool provides necessary and sufficient conditions, a truth table, a truth table analysis, descriptive statistics, frequency analysis, a sub/superset analysis and the empirical importance of the data to strengthen the qualitative investigation. In management research, fsQCA was used to highlight configurations, classifications in organization theory (Fiss, 2007, 2011; Kvist, 2007), in consumer behavior (Woodside & Zhang, 2013; Woodside, Hsu, & Marshall, 2011), in international business (; Pajunen,2008;Schneider, Schulze-Bentrop, & Paunescu, 2009) of MNEs and governmental relationships. This is the first time that it is used for termination in IJVs.

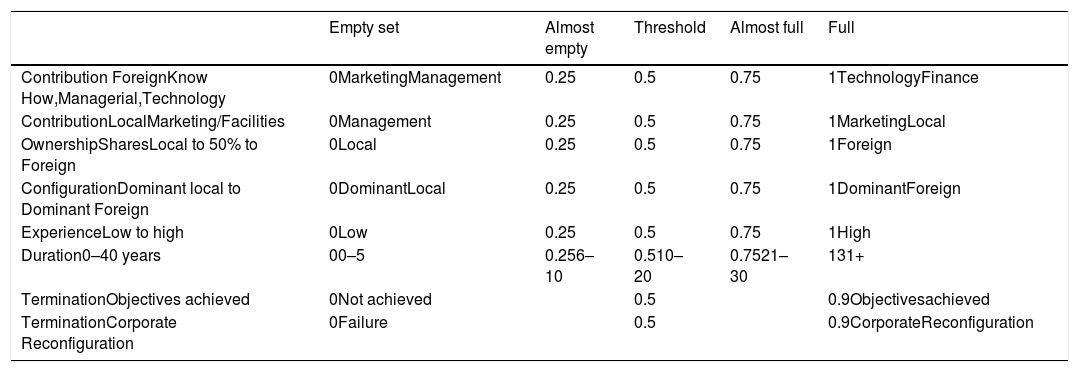

The conditions derived from the previous section transfer it into fuzzy set membership. The outcome condition will be termination. Termination can then be investigated to be a function of the chosen conditions (Table 1).

Calibration of break-points.

| Empty set | Almost empty | Threshold | Almost full | Full | |

|---|---|---|---|---|---|

| Contribution ForeignKnow How,Managerial,Technology | 0MarketingManagement | 0.25 | 0.5 | 0.75 | 1TechnologyFinance |

| ContributionLocalMarketing/Facilities | 0Management | 0.25 | 0.5 | 0.75 | 1MarketingLocal |

| OwnershipSharesLocal to 50% to Foreign | 0Local | 0.25 | 0.5 | 0.75 | 1Foreign |

| ConfigurationDominant local to Dominant Foreign | 0DominantLocal | 0.25 | 0.5 | 0.75 | 1DominantForeign |

| ExperienceLow to high | 0Low | 0.25 | 0.5 | 0.75 | 1High |

| Duration0–40 years | 00–5 | 0.256–10 | 0.510–20 | 0.7521–30 | 131+ |

| TerminationObjectives achieved | 0Not achieved | 0.5 | 0.9Objectivesachieved | ||

| TerminationCorporate Reconfiguration | 0Failure | 0.5 | 0.9CorporateReconfiguration |

The calibration of break-points shows the relevance of qualitative criteria as well. The choice of ownership is covered by giving the foreign ownership a full membership to indicate that it is a necessary condition for termination. If the ownership ratio is going in favor of the foreign ownership, termination will be more likely. The configuration of the IJV is related to the ownership ratio and goes toward dominant parent configuration. Shared management will be at the 0.5 threshold, whereas local dominated configuration seems to be rare and having more an empty set or almost empty set characterization. When it comes to contributions a full membership can be assigned to technology and finance for foreign contributions and marketing and local as the full membership for local contributions. An important condition is managerial experience which can reach from low to high dependent on the IJV management having been exposed to international experience before. Termination can be seen as objectives not reached in an empty membership and objectives achieved as a full membership, likewise we have corporate restructuring as full membership and failed IJVs as empty membership.

ResultsFuzzy set analysis – resultsBased on the analysis and calibration, the causal conditions (ownership, configuration, contribution local and foreign, managerial experience) are necessary conditions for the outcome ‘termination by achieving objectives’. The next step is the analysis of the truth tables and subset/supersets. In line with set theoretical analysis (Pajunen, 2008;Rihoux and Ragin, 2009;Schneider at al, 2009), the analysis considers the configurations of causal conditions for the outcome of IJV termination in the automotive industry. The comparison of the influence of three conditions (OWN, CONF, CONT, MANEX) on the outcome is only possible because of the fsQCA providing equifinality.

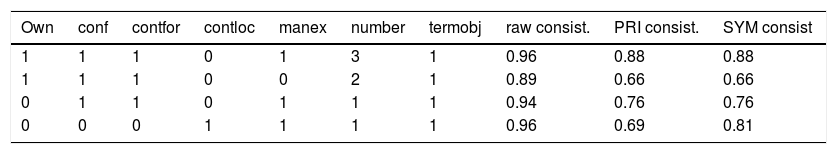

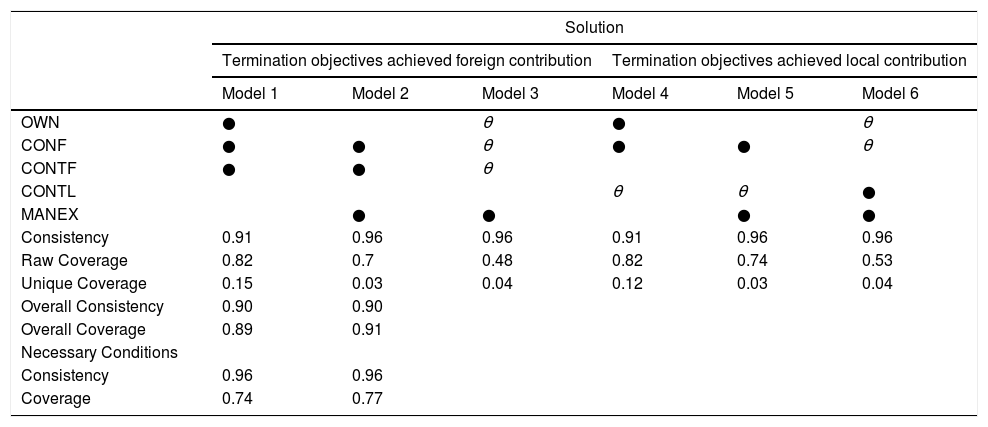

Truth table and Analysis. The truth table analysis for conditions (OWN, CONF, CONT MANEX) shows a consistency scores above of 0.9. This is the threshold suggested by Ragin (2006), whereas Schneider et al. (2010) would even consider a consistency above 0.85 as valid. In the latter case, the results hold for termination by achieving objectives and termination by corporate restructuring. To highlight the paths leading to a successful termination, the analysis provides insights into the relevance of contribution of the foreign parent, ownership structure, managerial configuration and experience. The strongest results are obtained for termination by achieving the objectives and the truth table below shows the cases and their paths of full membership with the consistency levels (Table 2).

The highest number of cases with the joint sets of foreign contribution, ownership, configuration and managerial experience shows the path to termination by achieving the objectives and termination by corporate restructuring to be a function of managerial experience. Analyzing the duration of the IJV in this context, it is striking that managerial experience and local contribution were the consistent conditions in the outcome (Table 3).

Analysis of Termination Scenarios.

| Solution | ||||||

|---|---|---|---|---|---|---|

| Termination objectives achieved foreign contribution | Termination objectives achieved local contribution | |||||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| OWN | ● | θ | ● | θ | ||

| CONF | ● | ● | θ | ● | ● | θ |

| CONTF | ● | ● | θ | |||

| CONTL | θ | θ | ● | |||

| MANEX | ● | ● | ● | ● | ||

| Consistency | 0.91 | 0.96 | 0.96 | 0.91 | 0.96 | 0.96 |

| Raw Coverage | 0.82 | 0.7 | 0.48 | 0.82 | 0.74 | 0.53 |

| Unique Coverage | 0.15 | 0.03 | 0.04 | 0.12 | 0.03 | 0.04 |

| Overall Consistency | 0.90 | 0.90 | ||||

| Overall Coverage | 0.89 | 0.91 | ||||

| Necessary Conditions | ||||||

| Consistency | 0.96 | 0.96 | ||||

| Coverage | 0.74 | 0.77 | ||||

| Termination corporate restructure foreign contribution | Termination corporate restructure local contribution | |||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| OWN | ● | θ | ● | θ | ||

| CONF | ● | ● | θ | ● | ● | θ |

| CONTF | ● | ● | θ | |||

| CONTL | θ | θ | ● | |||

| MANEX | ● | ● | ● | ● | ||

| Consistency | 0.92 | 0.96 | 0.97 | 0.92 | 0.96 | 0.96 |

| Raw Coverage | 0.64 | 0.54 | 0.37 | 0.64 | 0.56 | 0.41 |

| Unique Coverage | 0.12 | 0.02 | 0.04 | 0.10 | 0.03 | 0.04 |

| Overall Consistency | 0.81 | 0.81 | ||||

| Overall Coverage | 0.81 | 0.85 | ||||

| Necessary Conditions | ||||||

| Consistency | 0.96 | 0.96 | ||||

| Coverage | 0.74 | 0.77 | ||||

● Causal condition present.

θ Causal condition absent.

Termination by achieving objectives is a function of parental contribution, ownership structure, managerial IJV configuration and managerial experience with consistency levels above 0.9. The analysis found six consistent paths to termination by achieving objectives. The empirically dominant path is Model 1 with raw coverage .82 and unique coverage .15 for the combinations of foreign contribution, ownership and managerial configuration. However, when these three conditions are not fully present managerial experience has a consistency level of 0.96 with .48 raw and .004 unique coverage.

Termination by corporate restructuring has six consistent paths to the outcome. Like in the previous model, it is a function of foreign contribution, ownership structure, managerial IJV configuration with consistency .92, raw coverage .64 and .12 unique coverage as the highest overlap of the conditions. The model 1 is the empirically dominant path. However, the overall consistency levels for termination of corporate restructuring are below the threshold and therefore the hypotheses do not hold. The single combinations for the outcome can lead to a result that the outcome is present in the conditions (necessity). The necessary conditions for the combination of all conditions is .96. The truth table analysis highlights that the combination of the conditions in the cases is relatively low and that mainly managerial experience will lead to termination by corporate restructuring.

The duration of IJVs needs to be taken into account in this respect as well. Two paths are consistent in this result with terminated IJVs. Duration of terminated IJVs is not a function of parental contribution, ownership, managerial IJV configuration like in the previous observations, it is mainly a path of the lack of the three conditions, but with the presence of managerial experience with consistency levels of 0.91. The highest raw coverage and unique coverage levels are found in the combination with local contribution. Duration is a function of local contribution and managerial experience in successfully terminated IJVs.

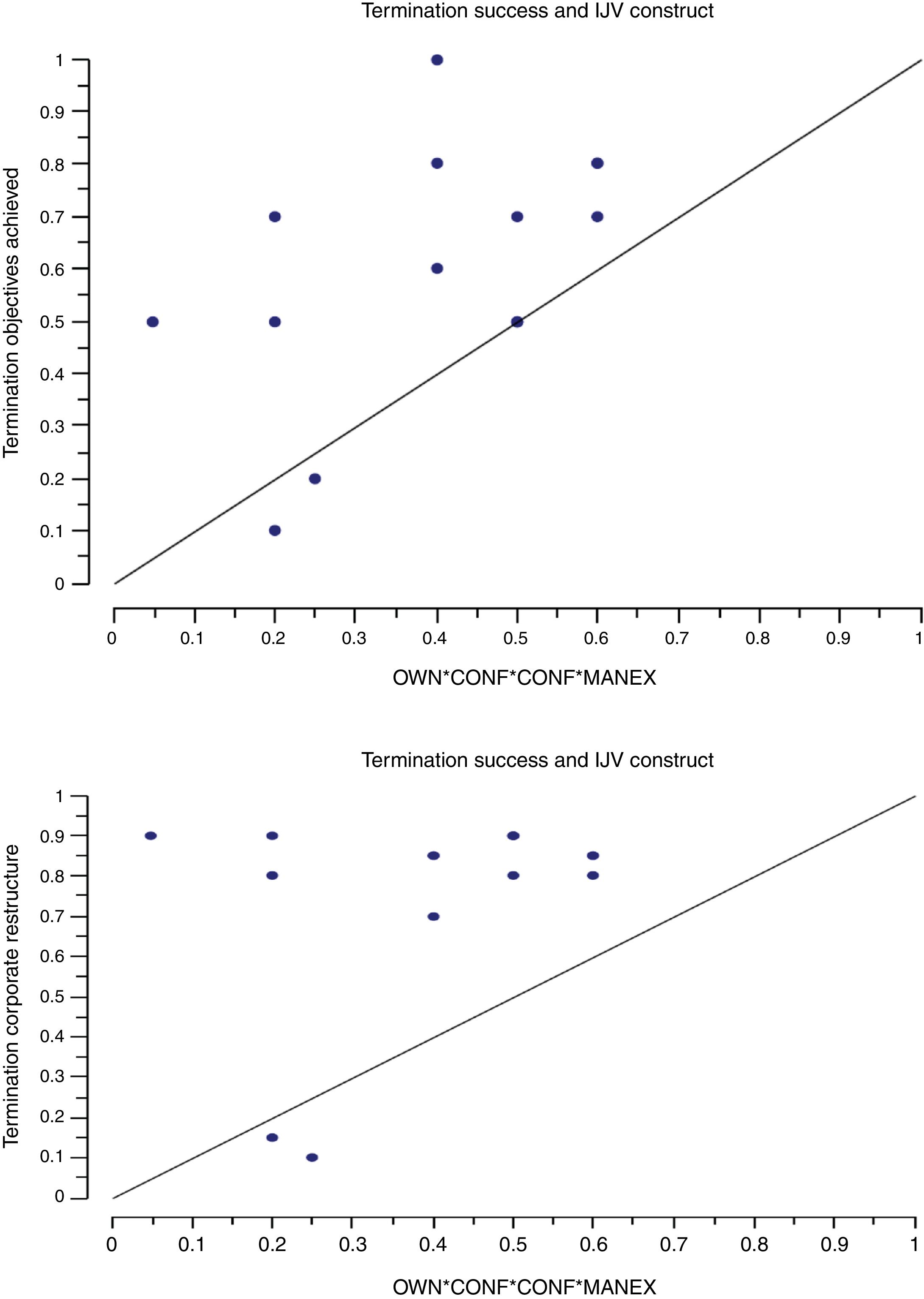

Asymmetric Relationships. Having identified the combination with the best results for termination by achieved objectives, we are now able to plot the joint sets for OWN∩CONF∩CONT∩MANEX in terms of consistency as necessary (y-axis) and coverage as sufficient conditions (x-axis) in Fig. 2 below. The highest consistency of joint sets can be found in the full combination with 0.96 for termination by objectives (x-axis) (1), then termination by corporate restructuring 0 (2) and duration (3). Fig. 2 with the XY plots (1), (2) and (3) of the hypotheses and the models identified above shows a representation of the relevance of fsQCA as equifinal results.

Fig. 2 below shows the consistency levels above 0.89 and the coverage levels which should be between 0.30–0.50 for sufficiency. It can therefore be seen that the necessary and sufficient conditions are holding for hypotheses H1.

Asymmetric relationships are stronger than the results generated from symmetric relationships. This supports the configurational approach and its robustness.

Limitations and future researchThe underlying data set of IJVs in the automotive industry is derived from company data and reports. The sample was in the range of small cases (fsQCA). The termination of IJVs can be analyzed in other industry or in a cross-sectional analysis. Future research could consider a large data set, the different stages in the termination of an IJV and a longitudinal approach toward termination.

Contributions and conclusionThe termination of IJVs in the automotive industry shows that it is a much more complex phenomenon than previous studies have suggested. The termination is a function of ownership, managerial configurations, contribution of both parents and managerial experience.

Theoretical implications – set theoretic conceptualizationIn previous studies the stability of IJVs has been discussed regarding partner selection, task relevance, contributions and managerial control. However, the strength between the parents, their contributions, and control rights is relevant in combination with managerial experience. On its own, the focus on partner contribution and control is less important than the actual managerial experience acting within the IJV. The joint set of ownership, contribution, configuration and managerial experience is the necessary condition for termination. Set theory can therefore be used as a lens to show causal effects and to provide equifinality. The logical paths combine more factors and their joint effect of the outcome of the investigation. The set theoretic analysis highlights a new theoretical underpinning for termination by combining the conditions for Termination by achieving the objectives and Termination by corporate reconstruction. The duration as a joint set of managerial experience and local contribution provides a strong result for IJV success and termination.

Empirical implicationsThe fsQCA tool is useful for the data base of IJV terminations in the automotive industry and offers a good analytical basis for understanding the joint sets. This study presents a good analytical basis for understanding the joint sets and their size in the endgame of IJVs. This contemporary database in one of the leading industrial sectors is ideal for fsQCA and the conditions derived are used in combinations such that it provides solutions for the termination problem. With careful deduction, this analysis offers advice for the termination of IJVs and stability of IJVs.

Managerial implicationsNot only theoretical and empirical implications can be drawn from this paper, but also managerial insights for the management of IJVs. The literature on partner criteria needs to be enlarged to focus on the actual managerial experience within the IJV management. The determining condition is managerial experience which brings failure or success to the termination story of a hybrid organization. If termination is considered as the goals achieved, then the joint set of ownership, foreign contribution and configuration is sufficient. If termination by corporate reconstruction is considered, then managerial experience and foreign contribution is sufficient.

The causal conditions and the outcome of termination in IJVs are linked to the necessary and sufficient condition of a set theoretic approach which was tested with fuzzy set Qualitative Comparative Analysis (fsQCA). This finding strengthens previous insights that managerial experience is beneficial for performance. The results support previous research that the host or local environment plays an important role in the type of termination and the longevity of IJVs (Ott et al., 2014). This paper supports but also enlarges previous findings toward a strong link and path between contributions of the partners, ownership, configuration and managerial experience of the IJV as key issues in termination and an avenue for future research.

Overall, conceptualizing termination with the necessary and sufficient conditions based on an electronic data base and a coherent theoretical and empirical analysis benefits rigor and relevance for the joint set of parental contribution, ownership structure, managerial configuration and experience in the termination and duration of IJVs.

The authors would like to thank the British Academy for funding the electronic database developed as well as funding from the Engineering and Physical Sciences Research Council into Success of International Joint Ventures in the Automotive Industry. The opinions presented are those of the authors and not of the funding bodies.