The purpose of this paper is to explore determinants of the debt financing of FinTech start-ups. Using a new hand-collected multisource database that maps FinTech start-ups incorporated in the UK from 2010 to 2015, this study examines how the characteristics of FinTech start-ups affect the types of financing used in the first three years after incorporation. The novelty of this study consists in the identification and analysis of the determinants that enable FinTech start-ups to obtain long-term debt and hence to finance their growth. The analysis is primarily conducted via a Tobit regression model. This paper contributes to the literature since we still have limited understanding of the financing of FinTech firms, even if academic literature examining the financing of start-ups has expanded in the last few years. The results from the empirical analysis demonstrate that unregulated FinTech start-ups are more likely to be financed with long-term debt. Asset structure, owner characteristics and the specific FinTech activity influence the funding source. Moreover, FinTech start-ups backed by equity investors receive less long-term debt funding than their peers. A better understanding of the debt financing of FinTech start-ups provides managers with valuable insights into ways of managing their firms. Furthermore, our results have relevant implications for the employment, competition and innovation, given the role that start-ups generally play in the economy. The study is limited to a sample of FinTech start-ups incorporated in an advanced economy, and thus the generalization of the presented results to developing economies will require caution.

Over the last decade, the digital revolution has led to new companies with a technological leaning—known as financial technology (fintech) start-ups—bursting onto the financial sector, unbundling the value chain by specializing in its different components. Currently, rarely a day goes by without one hearing a story about the success of a fintech start-up in the UK. These start-ups are evolving at a rapid speed, driven by their low-cost structure, technological advances and favourable regulations that allow them to offer financial services with more attractive terms than those of traditional financial providers. Unlike banks, fintech start-ups are often free of regulatory encumbrances and unburdened by obsolete legacy platform systems, branch networks with thousands of employees, or indeed the urge to defend their traditional existing businesses (McKinsey & Co, 2015).

Like all start-ups, fintech start-ups require financial capital to found their businesses and subsequently grow. Finding appropriate funding instruments is one of the factors that highly influences the success of a fintech start-up (Damian & Manea, 2019). However, access to funding is particularly challenging in the current turbulent financial landscape, especially for start-ups. Indeed, up to 50% of loan applications submitted by start-ups are rejected by banks in Great Britain (British Business Bank report, 2016). The promise of fintech start-ups is precisely to reshape the financial industry by filling these credit gaps (Buchak, Matvos, Piskorski & Seru, 2018) and creating a more diverse and stable financial landscape (The Economist, 2015).

Scholars have investigated several aspects related to start-up financing (e.g., Åstebro & Bernhardt, 2003; Cassar, 2004; Nofsinger & Wang, 2011). Capital decisions and the amount of debt and equity available to start-ups have been shown to have important implications for failure risk, firm performance, and the potential for business growth (Cassar, 2004).

Even if the academic literature examining the financing of start-ups has expanded, we still have limited understanding of the financing of fintech firms. To the best of our knowledge, this is the first empirical study that aims to specifically investigate the financing of such start-ups. How they are financed is a fundamental question because of the specific features of these types of companies.

To fill this gap, we hand-collect a new multisource dataset including data from Bureau van Dijk's Orbis and Zephyr databases for a sample of 285 fintech start-ups incorporated from 2010 to 2015 in the UK. Via multivariate analyses, we test how the characteristics of fintech start-ups impact different types of financing. The principal findings of this quantitative analysis are interesting in several respects. First, the results demonstrate that unregulated fintech start-ups are more likely to receive long-term debt financing than regulated firms in the sample. We also find evidence that the asset structure positively impacts the amount of long-term debt granted to fintech start-ups. Moreover, the ownership and the activity of fintech start-ups both impact financing. Finally, investor-backed fintech start-ups receive less long-term funding than their peers.

This study differs from previous empirical studies and contributes to several strands of the entrepreneurship and finance literatures. First, data on fintech companies are either scarce or non-existent due to its novelty and exponential development pace, making it difficult to investigate this observable phenomenon more deeply (Dapp, 2014). Previous studies draw on practical situations, issues, and experiences, e.g., participation in think tanks and roundtable discussions and/or in projects with fintech companies, rather than on (quasi)experimental designs (Anagnostopoulos, 2018). This study fills this gap, as it contributes to the emerging literature on fintech companies by creating a new dataset that maps the phenomenon and allows quantitative analyses to be run. Furthermore, this paper fits into the growing literature on innovation, entrepreneurship and knowledge, which have been acknowledged as the basis of economic competitiveness and growth (Piñeiro-Chousa, López-Cabarcos, Romero-Castro & Pérez-Pico, 2020).

Second, this paper contributes to the literature on credit financing for firm growth and development in general (e.g., Beck & Demirgüç-Kunt, 2006; Berger & Udell, 1998) and financing at the start-up stage in particular (e.g., Cerqueiro & Penas, 2016; Robb & Robinson, 2014; Schmalz, Sraer & Thesmar, 2017). The start-up setting also has the advantage of representing the benchmark case for problems of lending under asymmetric information given these firms’ lack of a track record (Cressy, 1996). This study also contributes to the literature on the debt financing of privately held firms (e.g., Ang, Cole & Lawson, 2010; Berger & Udell, 1998; Brav, 2009; Cole, 2013; Cole & Sokolyk, 2016; Mc Namara, Murro, & O'Donohoe, 2017) and to research in the field of digital entrepreneurship (Del Giudice & Straub, 2011; Florida, Adler & Mellander, 2016; Isenberg, 2011; Camisón-Haba, Clemente-Almendros, & Gonzales-Cruz, 2019). Most studies on start-up financing have focused on a single factor over a broad panorama of different start-ups rather than the impacts of several factors on a single type of company – the fintech start-up.

Finally, this paper covers a stage in the firm life cycle at which it is challenging for companies to seek funding and contributes to the literature on credit constraints. Furthermore, fintech start-ups can be competitors or allies for financiers; in this context, this study clarifies how lenders address this problem (Drasch, Schweizer & Urbach, 2018; Tornjanski, Marinković, Săvoiu & Čudanov, 2015).

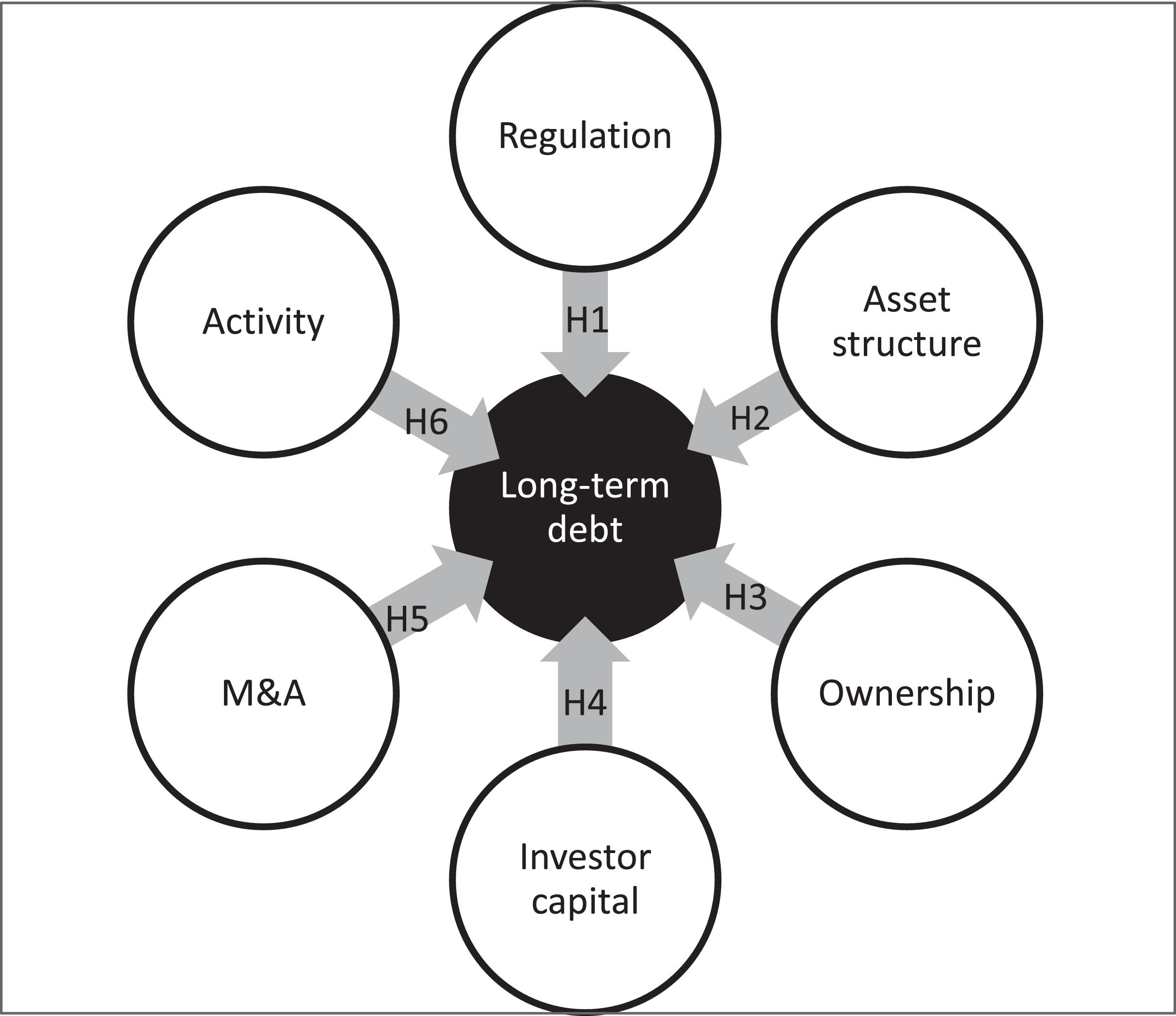

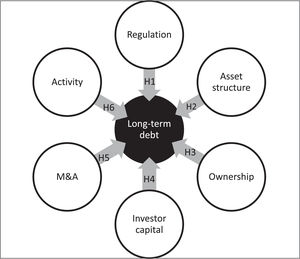

This research differentiates itself from previous studies by identifying and analysing the determinants (such as regulation, asset structure, ownership, investor capital, M&As and activity) that enable fintech start-ups to obtain long-term debt to finance their growth.

The study goes beyond mere description, as we provide testable implications derived from financial theory. There are also important implications for the economy, given the role that start-ups generally play in employment growth, competition and innovation.

The remainder of the study is organized as follows. The next section presents our literature review and hypotheses. Section 3 describes the data and research method used. Section 4 presents the results. Finally, Section 5 discusses the results, restates our main conclusions and describes the study's limitations and directions for further research.

Literature reviewFintech start-ups are firms that use technology for banking, payments, financial data analytics, capital markets or personal financial management (Huang, 2015). Through disruptive innovations,1 they have differentiated themselves from traditional financial firms with their innovative cultures, personalized niche services, data-driven solutions, and nimble organizational forms (Lee & Shin, 2018).

In short, fintech start-ups are new, fast-growing actors in the constantly changing financial services industry (Jagtiani & Lemieux, 2018), and as such, they are not well understood (Anagnostopoulos, 2018). There is a lack of consensus on the definition of fintech in the literature and on key research topics and trends (Milian, Spinola & de Carvalho, 2019). Indeed, Zavolokina, Dolata and Schwabe (2016) describe fintech as a living entity rather than a stable notion.

It is widely recognized that a key element of success for any start-up is adequate financing. Financing is an important enabler of rapid firm growth (Dobbs & Hamilton, 2007), allowing firms to invest in physical and human capital, develop new products/services and reach new international markets; the vast majority of high-growth SMEs rely strongly on debt-based financing for their funding rather than on equity financing (Brown & Lee, 2019).

Accessing external financing is a critical issue for start-ups due to their informational opacity (Berger & Udell, 1998; Cassar, 2004) and lack of collateral (Berger & Udell, 1998; Comeig, Fernández-Blanco & Ramírez, 2015) and the presence of information asymmetries (Petersen & Rajan, 1994). Hence, for start-ups, debt tends to be rationed (Stiglitz & Weiss, 1981). The use of debt, indeed, is associated with better performance prospects for start-ups. Compared to their unlevered peers, start-ups using debt are significantly more likely to survive (Cole & Sokolyk, 2018) and achieve faster growth in revenues and employment (Robb & Robinson, 2014).

The financial literature generally distinguishes between business bank debt—which consists of lending by financial institutions—and business trade debt—that is, lending from suppliers. Nevertheless, a number of studies in the literature (Marsh, 1982; Myers, 1977; Van Horne, 1977) highlight some distinctive characteristics of short‐ and long‐term debt.

According to the theory of bank loan demand (Cole & Sokolyk, 2018; Diamond, 1991), only the highest-quality start-ups are likely to obtain bank business debt financing (Berger & Udell, 1998). Therefore, self-selected start-ups choose to borrow business bank debt from informed banks to signal their quality, initiate their credit history and start to build their reputations (Cole & Sokolyk, 2016; Milde & Riley, 1988). In the meantime, informed banks select and finance only high-quality start-ups (Stiglitz & Weiss, 1981). Furthermore, monitoring by banks once credit has been granted allows start-ups to grow and perform better. In light of the above, there is a positive association between the use of bank debt financing in the first years after incorporation and a firm's future performance (Robb & Robinson, 2014).

Analogously, suppliers are informed lenders that obtain information about their borrowers through business relationships with the start-ups, mitigating the asymmetric information problem, just as banks obtain information about their borrowers through its financial relationships with such firms (Burkart & Ellingsen, 2004), although suppliers choose the firms to which they extend credit only from among their customer base in the same industry (Giannetti, Burkart & Ellingsen, 2011). Business trade debt usually involves short-term financing and is largely fixed at the industry level. As a result, start-ups typically depend on business bank debt for their long-term financing of assets, operations and growth (Ebiringa, 2011).

Regarding short- and long-term debt, the latter clearly requires more screening and monitoring (Cassar, 2004) and involves greater maturities and longer durations.

In light of the above, this paper does not distinguish between business trade debt and business bank debt, but we focus on long-term debt.

Starting from the assumption that the use of long-term debt should be associated with better prospects for (fintech) start-ups, we deeply investigate the characteristics of fintech start-ups to state our hypotheses on the impact of each firm characteristic on the level of long-term debt.

Our first hypothesis relates to the peculiar regulatory environment of fintech start-ups and the way that it should affect their long-term funding. The regulatory environment for fintech start-ups has been particularly favourable since the 2008 financial crisis (Holland fintech, 2015), as they are not subject to the same rigorous regulations and capital requirements as traditional financial institutions.

Some banks and traditional financial service providers have reacted fiercely to and formally voiced their concerns about attempts to apply the same regulatory standards to fintech start-ups (Anagnostopoulos, 2018; Bunea, Kogan & Stolin, 2016). For some fintech sectors, regulatory uncertainty has slowed their explosive growth (Domingo, Piñeiro-Chousa & López-Cabarcos, 2020). Currently, not all fintech start-ups are regulated, with many still flying under the regulatory radar. The looser regulatory requirements imposed on fintech start-ups allow them to provide more customized, less expensive, and more accessible financial services to consumers than traditional institutions (Lee & Shin, 2018). Put simply, they offer better services at lower costs (Anagnostopoulos, 2018). Consequently, in this paper, it is assumed that unregulated fintech start-ups are preferred by lenders and therefore able to obtain more long-term debt.

H1 Unregulated fintech start-ups are more likely to receive long-term debt financing.

Fintech start-ups may dramatically differ in size. In fact, similar to new firms in other industries, in the start-up phase, fintech firms may need few resources to operate, or they may require large sums of money to develop their businesses. As generally recognized by the academic literature, the size of a start-up should impact its capital structure. The reasons behind this theoretical view are related to the existence of diverse economies of scale that can shape information asymmetries, transaction costs, market access, and risk exposure (Harris & Raviv, 1991; González & González, 2011). In this regard, small start-ups may find it more expensive to resolve informational asymmetries with their potential financiers; this leads to small start-ups being offered less capital or the same amount of capital at higher rates than larger firms, discouraging the use of external debt (Berger & Udell, 1998). Furthermore, most starting entrepreneurs use their own money to start their businesses, and hence, external debt is collected only when the amount of capital needed exceeds the entrepreneur's financial resources. Consequently, the larger the (fintech) start-up is, the greater the fraction of long-term debt provided to the firm (Cassar, 2004).

As a result of this size heterogeneity among fintech start-ups, their asset structure is also heterogeneous. Fintech start-ups generally present great proportions of intangible assets linked to their specific characteristics, such as their high-tech investments or expenditures in innovation. They rely on innovative assets that are difficult to value, which may lead to problems in accessing financing (Lee & Brown, 2017). These features of fintech start-ups should have a significant effect on financing, given their increased information opaqueness in the first years of operations and the lack of other available options for financiers to reduce financial risk by examining current and future profitability. First, start-ups can reduce adverse selection and moral hazard costs by pledging their assets as collateral. This results in start-ups with greater fixed assets obtaining easier and cheaper access to financing, leading to these firms obtaining higher levels of debt or outside financing. Furthermore, the more tangible a firm's assets are, the greater its liquidation value is, reducing the financial loss incurred by lenders should the company default and the firm's assets be realized (Titman & Wessels, 1988; Harris & Raviv, 1991). Due to the preferred contracting mechanisms of banks, several authors suggest that debt financing depends on whether lending can be secured through tangible assets (Berger & Udell, 1998; Storey, 2016). Bank financing and long-term debt are positively related to the proportion of fixed assets, while firms with a relative lack of tangible assets appear to be financed through less formal means (e.g., personal bank debt) (Cassar, 2004) or not to be financed at all (Bigelli, Martín-Ugedo & Sánchez-Vidal, 2014). This leads to our second hypothesis.

H2 The fintech start-up asset structure is positively related to its level of long-term debt.

Fintech start-ups may provide ample opportunities for banks to gain competitive advantages. In fact, banks and financial service providers need to build capabilities to leverage and/or invest in innovative fintech to remain competitive. Hence, traditional financial institutions are investing in fintech in a variety of ways, including by acquiring/buying fintech firms (Drasch et al., 2018; Lee & Shin, 2018). In exchange for insights from these start-ups that allow banks to stay at the forefront of technology, they provide necessary funding (Yang, 2015). Consequently, the financing of fintech start-ups is influenced by the type of owner, which, if it is a financial institution, can grant more funding.

This assumption is in line with signaling theory, which states that owner characteristics explain the capital structure and financing characteristics of start-ups. As many of the mechanisms available to new firms and potential lenders to reduce information asymmetries and agency costs are not available to start-ups, the signals deriving from ownership through entrepreneur reputation affect lending decisions (Scholtens, 1999; Coleman, 2004). We thus posit the following hypothesis.

H3 Ownership characteristics significantly influence the financing of fintech start-ups.

The growth of investor capital (i.e., angel investments, venture capital, private equity and equity crowdfunding) in fintech firms has been phenomenal, globally reaching $5.3 billion in the first quarter of 2016 (Accenture, 2016).

The core function performed by capital investors is purchasing equity shares in the company and taking an active role in monitoring and guiding the portfolio company (Fenn, Liang & Prowse, 1996). The typical characteristic of investor capital is direct entry into the capital of unlisted high-growth companies through equity or equity-related investments (Gompers & Lerner, 2001). The specific instruments used by investors and not by banks make investor capital better able to finance innovative companies than capital from other investors (Schmidt, 2003). An important nonfinancial benefit of the presence of investors consists of improvements in the managerial culture and the introduction of new corporate governance rules (Sørensen, 2007; Acharya, Gottschalg, Hahn & Kehoe, 2012).

These resources open myriad new possibilities for start-ups, including the development of new technologies and products and the expansion of working capital and financial support for extraordinary finance operations. We hence posit the following hypothesis.

H4 Fintech start-ups that are backed by investors are more likely to receive equity instead of long-term debt financing.

Fintech start-ups may also be subject to M&As, corporate venturing and IPOs. All these forms of cooperation serve different objectives, such as developing complementary products/services, entering new international markets, exploiting production economies of scales, and, above all, sharing technological risks (Hellmann & Puri, 2002). These operations ease financial constraints for target firms, especially for smaller targets (Erel, Jang & Weisbach, 2015).

Usually, a start-up merges with another company to boost the growth of its own business or to fend off competition. These operations are conducive to high rates of innovation (Dushnitsky & Lenox, 2005), especially when targeting partners in related industries (Keil, Maula, Schildt & Zahra, 2008). If an M&A is successful, the company may present a better capital structure and future growth prospects, which can encourage debt financing. In particular, the specific professionalism of the corporate investor may act as a guarantee for other possible lenders, allowing the grafting of capital on less burdensome conditions than those imposed in the market (Megginson & Weiss, 1991).

Theoretical models predict that in response to takeover threats, managers of target firms increase leverage through both the issuance of debt and the use of debt capital to repurchase outstanding equity (e.g., Harris & Raviv, 1988; Stulz, 1988; Israel, 1992). The deductibility of interest expenses from the corporate tax base creates an incentive for acquiring companies to finance an M&A transaction with debt (Scheuering, 2014). Consequently, we test the following hypothesis.

H5 Fintech start-ups that are subject to M&A deals are more likely to receive long-term debt financing.

As with other highly technological start-ups, a plethora of firm types can fall under the fintech umbrella (Jagtiani & Lemieux, 2018). Alt and Puschmann (2012) find that fintech firms generally differ on the basis of (i) the sector in which they operate (insurance or banking), (ii) supported business processes (financial information, payments, investments, financing, or advisory and cross-process support), (iii) the targeted customer segment (retail, private or corporate banking), (iv) interactions (e.g., business-to-business, business-to-consumer, consumer-to-consumer), and (v) market positioning.

Fintech start-ups differ in their business models, value propositions, operating mechanisms and growth paths. If they expect very rapid growth, they require more long-term debt for different purposes than less rapidly growing firms. Slower-growing fintech start-ups may need financing to fund their day-to-day activities. Conversely, high-growth fintech start-ups are more likely to seek out funding for investment in research and development (R&D). Consequently, the activities in which fintech start-ups specialize should impact their financial structure, as suggested in the last hypothesis.

H6 Fintech activities influence the capital structure and financing of fintech start-ups.

In summary, this study explores how the features of fintech start-ups (regulation, asset structure, ownership, investor capital, M&A deals and activities) affect their debt financing. The research model (Fig. 1) reflects the effect of fintech characteristics on long-term debt as a linear function whose arguments include regulation, asset structure, ownership, investor capital, M&As and activities.

Research methodDataThis study covers fintech start-ups in the UK. We obtain information about the composition of debt on the balance sheet within three years of start-up. As the fintech revolution is a recent phenomenon, we select only companies incorporated during or after 2010 but before 2015. Therefore, we have complete and accurate data for all of the companies in the sample for the first years following incorporation.

Accounting data on fintech start-ups are collected from Bureau van Dijk's Orbis database (hereafter Orbis). From Orbis, we select companies that undertake financial service activities, except for insurance and pension funding (NACE Rev. 2 code 64). Our initial sample includes 58,754 companies incorporated from 2010 to 2015. We also require that a fintech start-up satisfy the following criteria to be included in our sample: 1) The company must have a website. We apply this condition because fintech services are still not popular, and as a result, users must search for these services through websites (Chuang, Liu & Kao, 2016). After removing 52,281 companies without websites from the sample, we retain 6473 companies to investigate individually. 2) The company's website must be working and not under construction or maintenance or for sale. After checking all of the websites, we are left with 5525 companies. 3) The company must provide an actual financial service. After checking the information on the individual websites, we remove from the sample all companies that, despite having NACE code 64, are not in the financial industry in practice (e.g., commercial holdings, real estate companies, accounting and payroll companies). We remove 2315 companies and are left with a final sample of 3210 companies. From this sample, after checking the information on their activities listed on their websites, we identify 2925 traditional financial companies and 285 fintech start-ups as defined by the European Banking Authority (EBA) fintech survey (2017).

Surprisingly, 200 fintech start-ups in the sample (70%) are regulated by at least one regulatory entity.2 Nearly all of the regulated fintech start-ups are supervised by at least one local (British) supervisory body, and just 6 regulated fintech start-ups are regulated only by foreign entities.

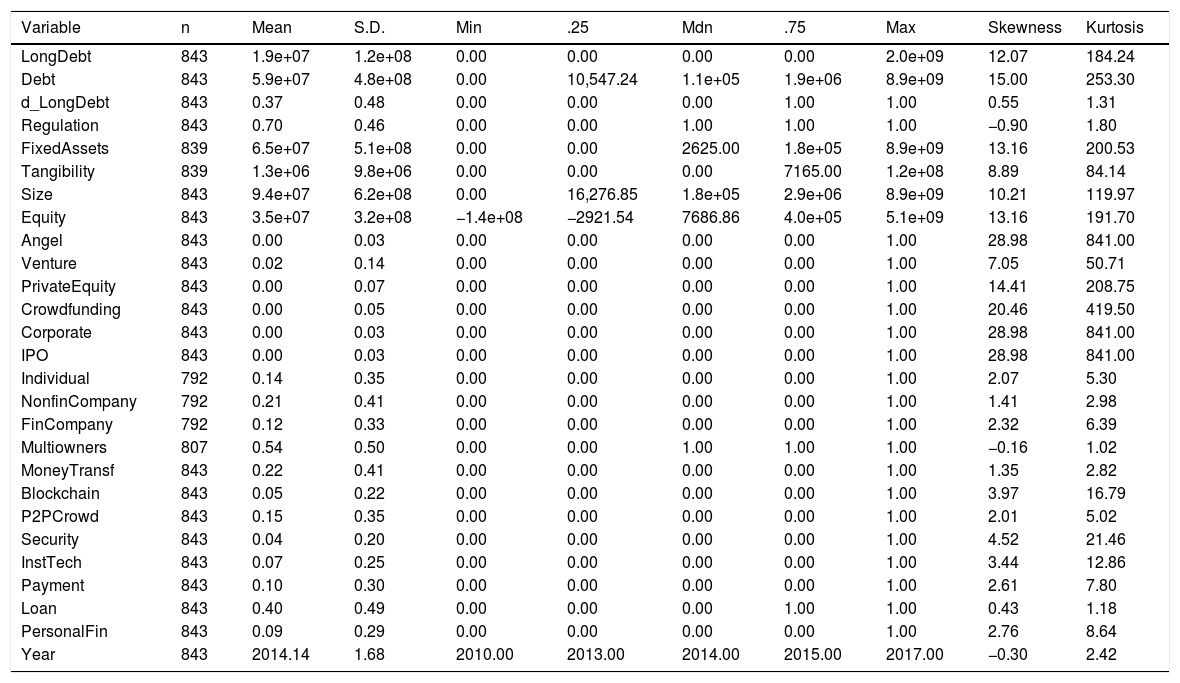

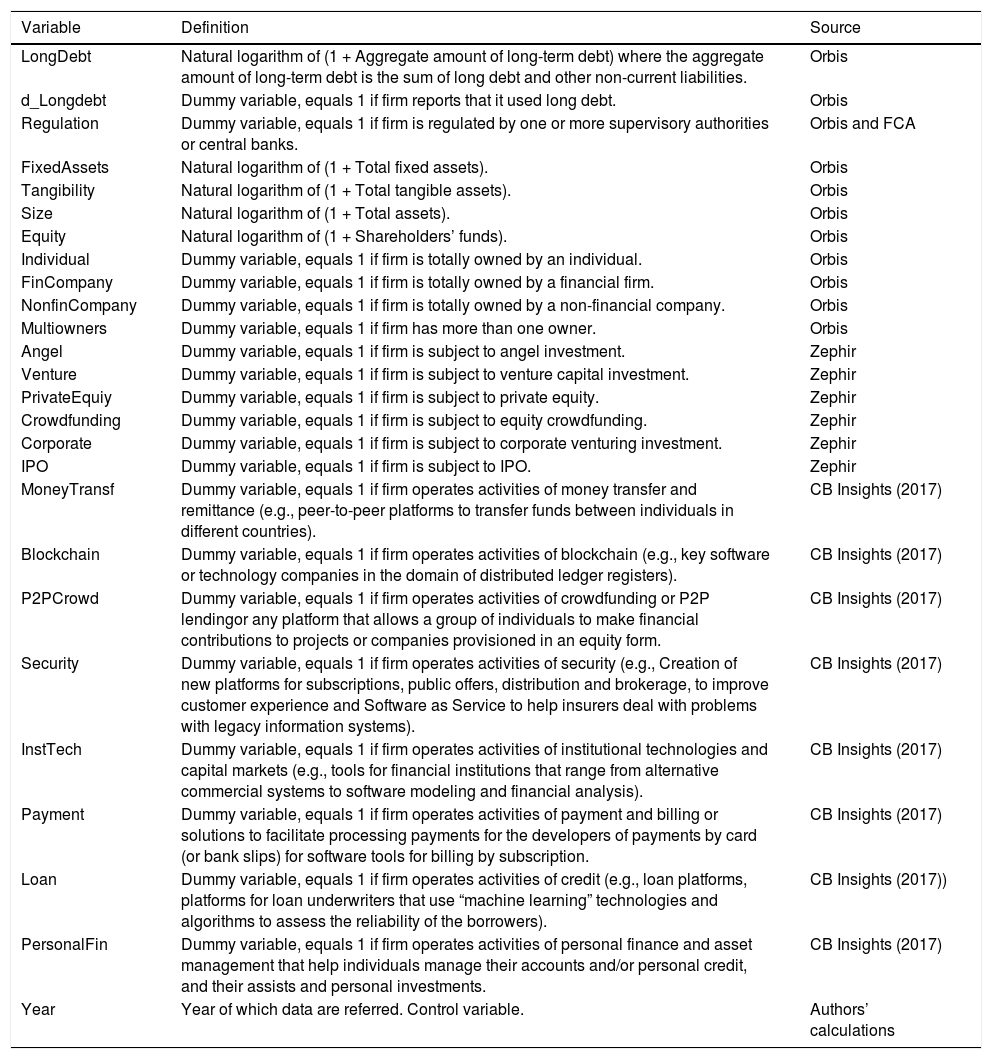

Table 1 presents descriptive statistics on the fintech start-ups. Data are collected from the year of incorporation (t) through the next two years (t + 2). Data sources and definitions are described in the Appendix.

Descriptive statistics.

Source: Orbis and Zephir databases.

On average, in the first three years of operations, the fintech start-ups had 94 million euros in total assets. The financial characteristics of the median firm, however, are quite different from the characteristics of the average fintech start-up. The median firm has 180 thousand euros in total assets. Fintech start-ups at the 75th percentile have asset values that are substantially smaller than the sample average (2900 thousand euros), which is indicative of the highly skewed distributions with the potential presence of significant outliers. To address the skewness of the distributions, we take the natural logarithms of the firm financial characteristic variables in our subsequent analysis. A logarithmic transformation is also recommended in the presence of variables with many values equal to zero; this enables zero values to be considered essentially equal to a very low value.

The average fintech start-up has 65,000 thousand euros of fixed assets and 1300 thousand euros of tangible assets. Furthermore, the average fintech start-up has 35 million euros of equity; this indicator ranges from a negative value—which means that the losses completely absorb the shareholders’ funds—to a maximum value of 5100 million euros.

Nearly 50% of fintech start-ups are owned by more than one entity, while 21% of the sample firms are owned by one nonfinancial company, 14% are wholly owned by an individual and 12% are wholly owned by a financial company. Only 3% of the sample firms have been subject to private equity investments, angel investments, corporate venturing or crowdfunding. Very few of the sample firms (2%) are backed by venture capitalists.

Regarding financing, the average (median) fintech start-up has 178,000.00 (111.62) thousand euros of debt, which includes 34,400.00 (0.00) thousand euros of long-term debt. The mass of points at zero for most of the long-term debt amounts and highly skewed distributions for firms with nonzero long-term debt amounts both require an analysis of the incidence of financing use. Our focus on the incidence of different types of financing allows us to analyze whether the form of a start-up's financing relates to successful outcomes, after we control for the total amount of debt financing.

Multivariate analysesTo test our hypotheses, we propose panel data models that enable us to assess the determinants of fintech start-ups’ growth in the sample over time by analysing observations from several consecutive years for the same firm.

We use a Tobit regression analysis because some fintech start-ups have no external financing, which abruptly shortens the left tail of the data distribution. Tobit models are better suited to manage this distributional property, and indeed, other studies of start-up financing adopt this type of modeling (Cassar, 2004; Nofsinger & Wang, 2011).

We use Eq. (1) to check the impact of fintech start-ups’ characteristics on the logarithmic transformation of long-term debt:

The variable Regulation is a dummy variable that takes the value of one for regulated fintech start-ups. AssetStructure is a vector of four firm-specific individual indexes related to the asset structure: size (Size), amount of fixed assets (FixedAssets), amount of tangible assets (Tangibility) and shareholder funds (Equity). Ownership is a vector of dummy variables that test the impact of the type of owner(s) (Individual, FinCompany, NonfinCompany, Multiowners). InvestorCapital is a vector of variables related to investments (Angel, Venture, PrivateEquity, Crowdfunding). M&As is a vector of dummy variables related to M&A transactions (Corporate, IPO). Activity is a vector of dummy variables for fintech activities (Loan, Payment, PersonalFin, MoneyTransf, Blockchain, InstTech, P2PCrowd and Security). Finally, dummies for the years to which data refer are included as controls (see Cole & Sokolyk, 2018). All these variables enter the model as explanatory variables of long-term debt (see the Appendix for more details).

All values are calculated for each fintech start-up i with i = 1–285 from incorporation through the following two years (in year t with t = 0–2). ¿ is a random residual.

To verify hypotheses H1-H6, vectors α1- α6 must be greater than zero.

The Tobit model simultaneously combines the effects of both the decision to be financed—or more appropriately the possibility of being financed—by a particular type of debt and the amount of debt collected. As a result, the model forces the dependent variables to have the same sign with respect to both the use and quantity of long-term debt, given the possibility of using this debt. As asserted by Cassar (2004), further empirical analyses are needed to validate this model assumption. Therefore, a series of logit and Arellano and Bond (1991) regressions are also undertaken. The logit model determines the influence of the independent variables on the possibility of using long-term debt, while the Arellano and Bond (1991) model describes the amount of long-term debt, given the firm's opportunities to use it. Consequently, our Eqs. (2) and (3) are as follows:

In particular, Eq. (2) is adopted to evaluate the influence of fintech start-ups’ characteristics on the decision to use long-term debt (i.e., the dummy for the presence of long-term debt), while Eq. (3) describes the impact of these characteristics on the amount of long-term debt, given the firm's opportunities to use it, with an Arellano and Bond (1991) regression model. For both models, the explanatory and control variables are the same as those used in Eq. (1).

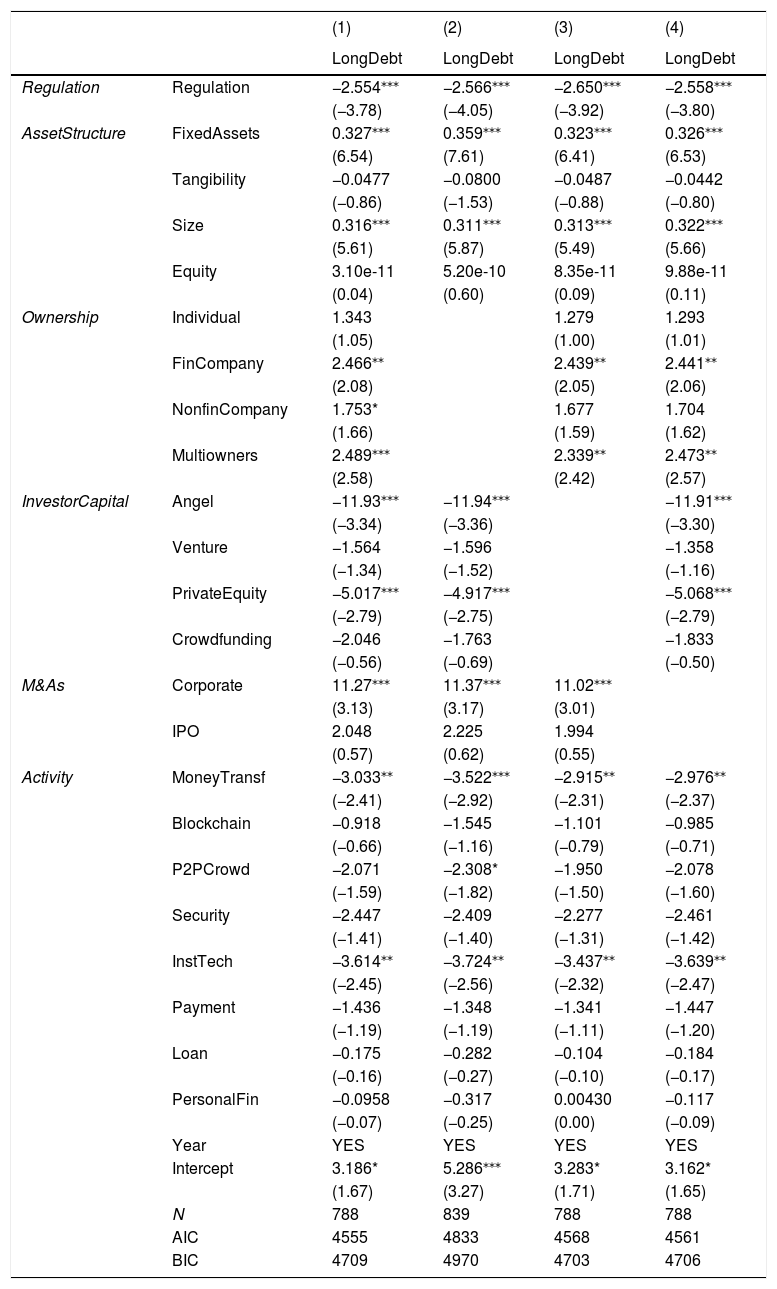

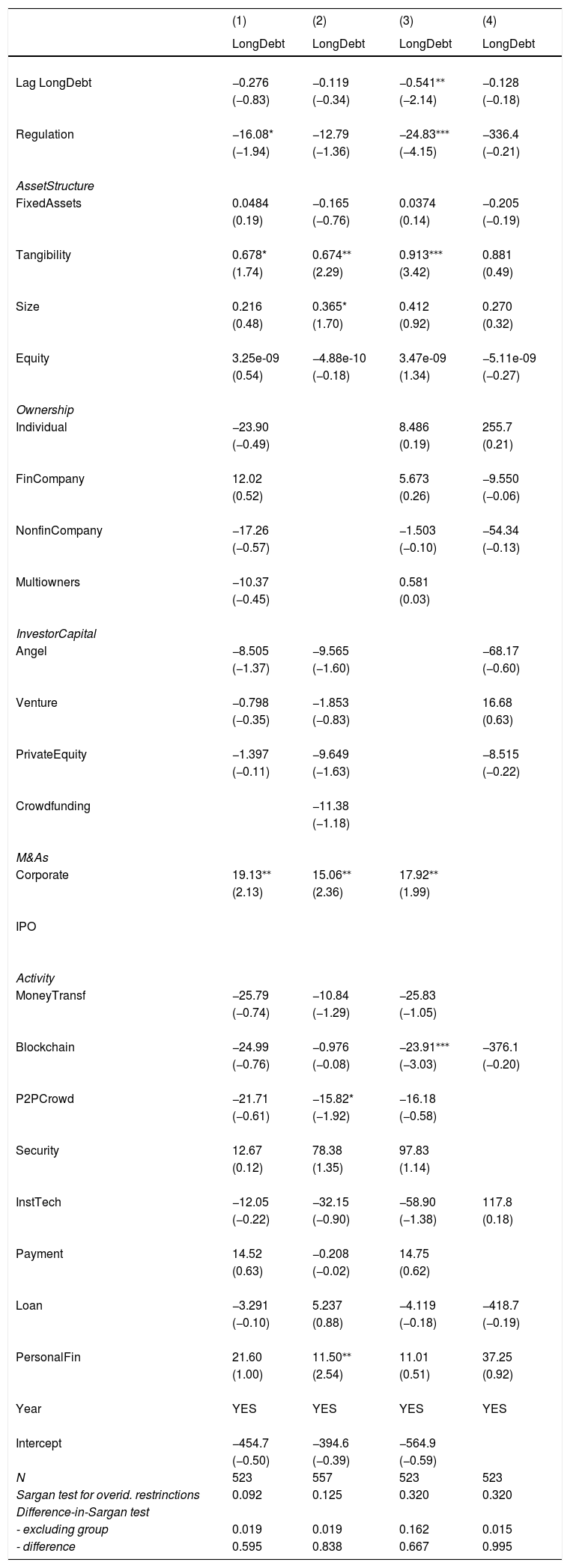

ResultsTable 2 presents the results of the Tobit regressions with all explanatory variables (first column), without the vector Ownership (second column), without the vector InvestorCapital (third column) and without the vector M&As (fourth column). The model is better specified with all the variables present, as shown by the slightly lower Akaike and Bayesian information criteria (AIC and BIC) values.

Results of the Tobit regression on Long-term debt (1) on the use of long-term debt financing among FinTech start-ups.

| (1) | (2) | (3) | (4) | ||

|---|---|---|---|---|---|

| LongDebt | LongDebt | LongDebt | LongDebt | ||

| Regulation | Regulation | −2.554⁎⁎⁎ | −2.566⁎⁎⁎ | −2.650⁎⁎⁎ | −2.558⁎⁎⁎ |

| (−3.78) | (−4.05) | (−3.92) | (−3.80) | ||

| AssetStructure | FixedAssets | 0.327⁎⁎⁎ | 0.359⁎⁎⁎ | 0.323⁎⁎⁎ | 0.326⁎⁎⁎ |

| (6.54) | (7.61) | (6.41) | (6.53) | ||

| Tangibility | −0.0477 | −0.0800 | −0.0487 | −0.0442 | |

| (−0.86) | (−1.53) | (−0.88) | (−0.80) | ||

| Size | 0.316⁎⁎⁎ | 0.311⁎⁎⁎ | 0.313⁎⁎⁎ | 0.322⁎⁎⁎ | |

| (5.61) | (5.87) | (5.49) | (5.66) | ||

| Equity | 3.10e-11 | 5.20e-10 | 8.35e-11 | 9.88e-11 | |

| (0.04) | (0.60) | (0.09) | (0.11) | ||

| Ownership | Individual | 1.343 | 1.279 | 1.293 | |

| (1.05) | (1.00) | (1.01) | |||

| FinCompany | 2.466⁎⁎ | 2.439⁎⁎ | 2.441⁎⁎ | ||

| (2.08) | (2.05) | (2.06) | |||

| NonfinCompany | 1.753* | 1.677 | 1.704 | ||

| (1.66) | (1.59) | (1.62) | |||

| Multiowners | 2.489⁎⁎⁎ | 2.339⁎⁎ | 2.473⁎⁎ | ||

| (2.58) | (2.42) | (2.57) | |||

| InvestorCapital | Angel | −11.93⁎⁎⁎ | −11.94⁎⁎⁎ | −11.91⁎⁎⁎ | |

| (−3.34) | (−3.36) | (−3.30) | |||

| Venture | −1.564 | −1.596 | −1.358 | ||

| (−1.34) | (−1.52) | (−1.16) | |||

| PrivateEquity | −5.017⁎⁎⁎ | −4.917⁎⁎⁎ | −5.068⁎⁎⁎ | ||

| (−2.79) | (−2.75) | (−2.79) | |||

| Crowdfunding | −2.046 | −1.763 | −1.833 | ||

| (−0.56) | (−0.69) | (−0.50) | |||

| M&As | Corporate | 11.27⁎⁎⁎ | 11.37⁎⁎⁎ | 11.02⁎⁎⁎ | |

| (3.13) | (3.17) | (3.01) | |||

| IPO | 2.048 | 2.225 | 1.994 | ||

| (0.57) | (0.62) | (0.55) | |||

| Activity | MoneyTransf | −3.033⁎⁎ | −3.522⁎⁎⁎ | −2.915⁎⁎ | −2.976⁎⁎ |

| (−2.41) | (−2.92) | (−2.31) | (−2.37) | ||

| Blockchain | −0.918 | −1.545 | −1.101 | −0.985 | |

| (−0.66) | (−1.16) | (−0.79) | (−0.71) | ||

| P2PCrowd | −2.071 | −2.308* | −1.950 | −2.078 | |

| (−1.59) | (−1.82) | (−1.50) | (−1.60) | ||

| Security | −2.447 | −2.409 | −2.277 | −2.461 | |

| (−1.41) | (−1.40) | (−1.31) | (−1.42) | ||

| InstTech | −3.614⁎⁎ | −3.724⁎⁎ | −3.437⁎⁎ | −3.639⁎⁎ | |

| (−2.45) | (−2.56) | (−2.32) | (−2.47) | ||

| Payment | −1.436 | −1.348 | −1.341 | −1.447 | |

| (−1.19) | (−1.19) | (−1.11) | (−1.20) | ||

| Loan | −0.175 | −0.282 | −0.104 | −0.184 | |

| (−0.16) | (−0.27) | (−0.10) | (−0.17) | ||

| PersonalFin | −0.0958 | −0.317 | 0.00430 | −0.117 | |

| (−0.07) | (−0.25) | (0.00) | (−0.09) | ||

| Year | YES | YES | YES | YES | |

| Intercept | 3.186* | 5.286⁎⁎⁎ | 3.283* | 3.162* | |

| (1.67) | (3.27) | (1.71) | (1.65) | ||

| N | 788 | 839 | 788 | 788 | |

| AIC | 4555 | 4833 | 4568 | 4561 | |

| BIC | 4709 | 4970 | 4703 | 4706 |

Notes: The model is conducted with all explanatory variables (first column), without information about ownership (second column), without information about investor capital (third column) and without the information about M&As (fourth column). See text and appendix for details.

For all four of the regression models, the influence of regulation on the use of a particular type of financing is strong, with all of the Tobit coefficients significant at P <0.001 and negatively related to long-term debt, consistent with H1.

AssetStructure appears to have a significant influence on the financing of fintech start-ups: size and fixed assets are positively related to long-term debt, with all the coefficients significant at P<0.001, confirming H2. Tangible assets are not significant, failing to confirm that the use of long-term debt is influenced by the tangibility of assets for fintech start-ups.

Ownership appears to have a significant influence on long-term debt, confirming H3. Fintech start-ups completely owned by a firm—whether by a financial firm or, to a lesser extent, by a firm in another industry—receive more long-term debt financing. Furthermore, ownership by more than one entity is strongly positively related to long-term debt financing, with at least P<0.01.

InvestorCapital appears to have a significant influence on the debt financing of fintech start-ups. Specifically, angel investments (Angel) and private equity investments (PrivateEquity) are negatively related to long-term debt, with all of the coefficients significant at P<0.001; hence, as posited by H4, investor-backed fintech start-ups receive less long-term debt financing than their peers because they receive equity financing. In contrast, corporate venturing is positively related to long-term debt, with all of the coefficients significant at P<0.001; start-ups backed by corporate venturing are more likely to obtain long-term debt financing, confirming H5.

Some activities of fintech start-ups have effects on long-term debt use, with money transfer/remittance, institutional technology/capital markets and (to a smaller extent) crowdfunding/P2P negatively related to the use of long-term debt. Hence, H6 is also confirmed.

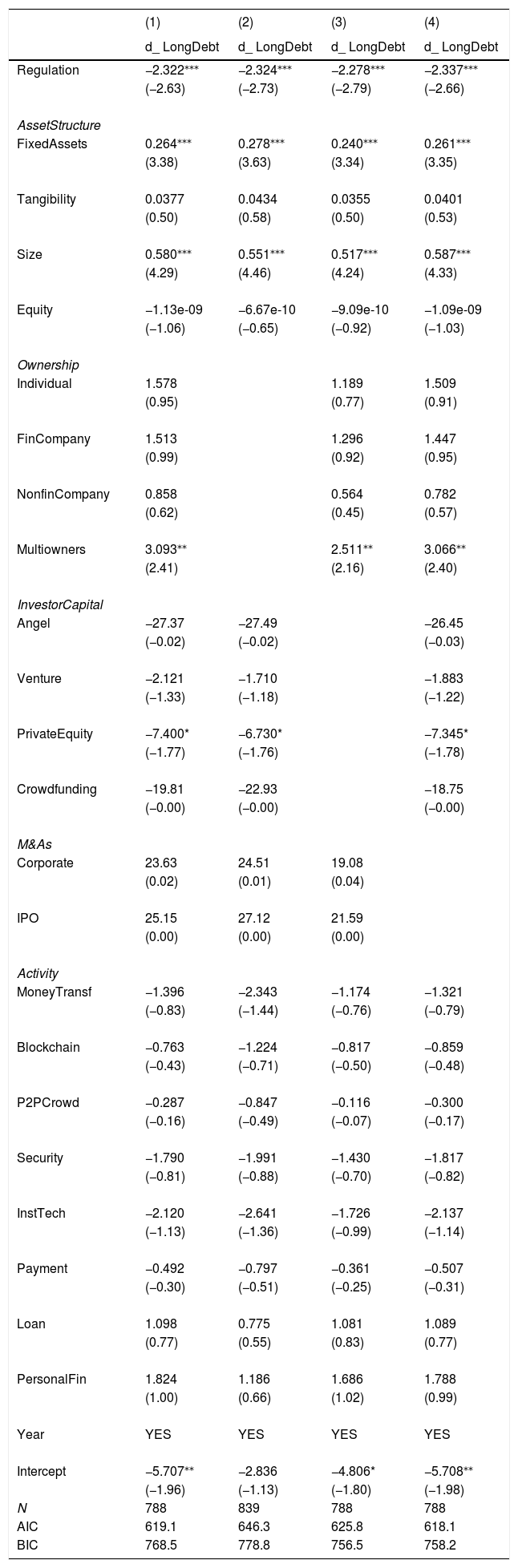

Table 3 presents the results of the separate logit analyses on the use of long-term debt financing among fintech start-ups with all explanatory variables (first column), without the vector Ownership (second column), without the vector InvestorCapital (third column) and without the vector M&As (fourth column). The model is better specified with all the variables present or without the vector M&As, as shown by the similar AIC and BIC values for the latter two specifications,which are slightly lower than those for the other two specifications.

Results of the Logit regression on Long-term debt (2) on the presence of long-term debt financing among FinTech start-ups.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| d_ LongDebt | d_ LongDebt | d_ LongDebt | d_ LongDebt | |

| Regulation | −2.322⁎⁎⁎ | −2.324⁎⁎⁎ | −2.278⁎⁎⁎ | −2.337⁎⁎⁎ |

| (−2.63) | (−2.73) | (−2.79) | (−2.66) | |

| AssetStructure | ||||

| FixedAssets | 0.264⁎⁎⁎ | 0.278⁎⁎⁎ | 0.240⁎⁎⁎ | 0.261⁎⁎⁎ |

| (3.38) | (3.63) | (3.34) | (3.35) | |

| Tangibility | 0.0377 | 0.0434 | 0.0355 | 0.0401 |

| (0.50) | (0.58) | (0.50) | (0.53) | |

| Size | 0.580⁎⁎⁎ | 0.551⁎⁎⁎ | 0.517⁎⁎⁎ | 0.587⁎⁎⁎ |

| (4.29) | (4.46) | (4.24) | (4.33) | |

| Equity | −1.13e-09 | −6.67e-10 | −9.09e-10 | −1.09e-09 |

| (−1.06) | (−0.65) | (−0.92) | (−1.03) | |

| Ownership | ||||

| Individual | 1.578 | 1.189 | 1.509 | |

| (0.95) | (0.77) | (0.91) | ||

| FinCompany | 1.513 | 1.296 | 1.447 | |

| (0.99) | (0.92) | (0.95) | ||

| NonfinCompany | 0.858 | 0.564 | 0.782 | |

| (0.62) | (0.45) | (0.57) | ||

| Multiowners | 3.093⁎⁎ | 2.511⁎⁎ | 3.066⁎⁎ | |

| (2.41) | (2.16) | (2.40) | ||

| InvestorCapital | ||||

| Angel | −27.37 | −27.49 | −26.45 | |

| (−0.02) | (−0.02) | (−0.03) | ||

| Venture | −2.121 | −1.710 | −1.883 | |

| (−1.33) | (−1.18) | (−1.22) | ||

| PrivateEquity | −7.400* | −6.730* | −7.345* | |

| (−1.77) | (−1.76) | (−1.78) | ||

| Crowdfunding | −19.81 | −22.93 | −18.75 | |

| (−0.00) | (−0.00) | (−0.00) | ||

| M&As | ||||

| Corporate | 23.63 | 24.51 | 19.08 | |

| (0.02) | (0.01) | (0.04) | ||

| IPO | 25.15 | 27.12 | 21.59 | |

| (0.00) | (0.00) | (0.00) | ||

| Activity | ||||

| MoneyTransf | −1.396 | −2.343 | −1.174 | −1.321 |

| (−0.83) | (−1.44) | (−0.76) | (−0.79) | |

| Blockchain | −0.763 | −1.224 | −0.817 | −0.859 |

| (−0.43) | (−0.71) | (−0.50) | (−0.48) | |

| P2PCrowd | −0.287 | −0.847 | −0.116 | −0.300 |

| (−0.16) | (−0.49) | (−0.07) | (−0.17) | |

| Security | −1.790 | −1.991 | −1.430 | −1.817 |

| (−0.81) | (−0.88) | (−0.70) | (−0.82) | |

| InstTech | −2.120 | −2.641 | −1.726 | −2.137 |

| (−1.13) | (−1.36) | (−0.99) | (−1.14) | |

| Payment | −0.492 | −0.797 | −0.361 | −0.507 |

| (−0.30) | (−0.51) | (−0.25) | (−0.31) | |

| Loan | 1.098 | 0.775 | 1.081 | 1.089 |

| (0.77) | (0.55) | (0.83) | (0.77) | |

| PersonalFin | 1.824 | 1.186 | 1.686 | 1.788 |

| (1.00) | (0.66) | (1.02) | (0.99) | |

| Year | YES | YES | YES | YES |

| Intercept | −5.707⁎⁎ | −2.836 | −4.806* | −5.708⁎⁎ |

| (−1.96) | (−1.13) | (−1.80) | (−1.98) | |

| N | 788 | 839 | 788 | 788 |

| AIC | 619.1 | 646.3 | 625.8 | 618.1 |

| BIC | 768.5 | 778.8 | 756.5 | 758.2 |

Notes: The model is conducted with all explanatory variables (first column), without information about ownership (second column), without information about investor capital (third column) and without the information about M&As (fourth column). See text and appendix for details.

The results obtained from the Tobit models are mainly confirmed by the logit regression. For all four of the regression models, regulation again appears to have a significant negative influence on long-term debt at P<0.001, consistent with H1.

For all four of the models, the influence of asset structure on the decision to use long-term debt financing is strong, with size and fixed assets significant at P <0.001. Again, size and fixed assets are positively related to long-term debt, confirming H2.

Ownership appears to have little influence on long-term debt, providing little evidence for H3. Only fintech start-ups owned by more than one entity are more likely to receive long-term debt financing.

Additionally, the influence of InvestorCapital is lower in the logit than in the Tobit model. Only private equity investments significantly impact the use of debt financing of fintech start-ups, with negative coefficients. M&As does not significantly impact the use of debt financing.

The activities of fintech start-ups have no effect on the use of long-term debt.

Table 4 reports the results of the Arellano and Bond (1991) regression model, which separately analyses the effects related to the magnitude of long-term debt financing for fintech start-ups. As before, the results from the regression with all of the explanatory variables are reported in the first column, while in the second column, the regression is conducted without information about ownership. In the third column, the regression is conducted without information about investor capital, and in the fourth column, the regression is conducted without information about M&As. The results of the Sargan test of overidentifying restrictions show that the models are not weakened by excessive instruments. Additionally, the results of the tests for exogeneity of instrument subsets show that the model is properly specified. Untabulated checks with data over a longer period show that there are no autocorrelation problems.

Results of the Arellano and Bond (1991) regression on Long-term debt (3) on the use of long-term debt financing among FinTech start-ups.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| LongDebt | LongDebt | LongDebt | LongDebt | |

| Lag LongDebt | −0.276 | −0.119 | −0.541⁎⁎ | −0.128 |

| (−0.83) | (−0.34) | (−2.14) | (−0.18) | |

| Regulation | −16.08* | −12.79 | −24.83⁎⁎⁎ | −336.4 |

| (−1.94) | (−1.36) | (−4.15) | (−0.21) | |

| AssetStructure | ||||

| FixedAssets | 0.0484 | −0.165 | 0.0374 | −0.205 |

| (0.19) | (−0.76) | (0.14) | (−0.19) | |

| Tangibility | 0.678* | 0.674⁎⁎ | 0.913⁎⁎⁎ | 0.881 |

| (1.74) | (2.29) | (3.42) | (0.49) | |

| Size | 0.216 | 0.365* | 0.412 | 0.270 |

| (0.48) | (1.70) | (0.92) | (0.32) | |

| Equity | 3.25e-09 | −4.88e-10 | 3.47e-09 | −5.11e-09 |

| (0.54) | (−0.18) | (1.34) | (−0.27) | |

| Ownership | ||||

| Individual | −23.90 | 8.486 | 255.7 | |

| (−0.49) | (0.19) | (0.21) | ||

| FinCompany | 12.02 | 5.673 | −9.550 | |

| (0.52) | (0.26) | (−0.06) | ||

| NonfinCompany | −17.26 | −1.503 | −54.34 | |

| (−0.57) | (−0.10) | (−0.13) | ||

| Multiowners | −10.37 | 0.581 | ||

| (−0.45) | (0.03) | |||

| InvestorCapital | ||||

| Angel | −8.505 | −9.565 | −68.17 | |

| (−1.37) | (−1.60) | (−0.60) | ||

| Venture | −0.798 | −1.853 | 16.68 | |

| (−0.35) | (−0.83) | (0.63) | ||

| PrivateEquity | −1.397 | −9.649 | −8.515 | |

| (−0.11) | (−1.63) | (−0.22) | ||

| Crowdfunding | −11.38 | |||

| (−1.18) | ||||

| M&As | ||||

| Corporate | 19.13⁎⁎ | 15.06⁎⁎ | 17.92⁎⁎ | |

| (2.13) | (2.36) | (1.99) | ||

| IPO | ||||

| Activity | ||||

| MoneyTransf | −25.79 | −10.84 | −25.83 | |

| (−0.74) | (−1.29) | (−1.05) | ||

| Blockchain | −24.99 | −0.976 | −23.91⁎⁎⁎ | −376.1 |

| (−0.76) | (−0.08) | (−3.03) | (−0.20) | |

| P2PCrowd | −21.71 | −15.82* | −16.18 | |

| (−0.61) | (−1.92) | (−0.58) | ||

| Security | 12.67 | 78.38 | 97.83 | |

| (0.12) | (1.35) | (1.14) | ||

| InstTech | −12.05 | −32.15 | −58.90 | 117.8 |

| (−0.22) | (−0.90) | (−1.38) | (0.18) | |

| Payment | 14.52 | −0.208 | 14.75 | |

| (0.63) | (−0.02) | (0.62) | ||

| Loan | −3.291 | 5.237 | −4.119 | −418.7 |

| (−0.10) | (0.88) | (−0.18) | (−0.19) | |

| PersonalFin | 21.60 | 11.50⁎⁎ | 11.01 | 37.25 |

| (1.00) | (2.54) | (0.51) | (0.92) | |

| Year | YES | YES | YES | YES |

| Intercept | −454.7 | −394.6 | −564.9 | |

| (−0.50) | (−0.39) | (−0.59) | ||

| N | 523 | 557 | 523 | 523 |

| Sargan test for overid. restrinctions | 0.092 | 0.125 | 0.320 | 0.320 |

| Difference-in-Sargan test | ||||

| - excluding group | 0.019 | 0.019 | 0.162 | 0.015 |

| - difference | 0.595 | 0.838 | 0.667 | 0.995 |

Notes: The model is conducted with all explanatory variables (first column), without information about ownership (second column), without information about investor capital (third column) and without the information about M&As (fourth column). See text and appendix for details.

The results partially confirm the findings of the Tobit model. In two out of the four regression models, regulation is significant and negatively related to long-term debt, providing more support for H1.

Asset structure appears to have a positive influence on the long-term debt financing of fintech start-ups, with tangibility and size both significantly related (albeit with modest effect sizes) to long-term debt, confirming H2. However, fixed assets are not significant, meaning that the magnitude of long-term debt is not influenced by the amount of fixed assets among fintech start-ups.

H3 on the ownership structure is not confirmed, as neither of the dummy variables in the vector Ownership are significant. Additionally, InvestorCapital appears to not have a significant influence on long-term debt. H4 is thus not confirmed. In contrast, fintech start-ups backed by corporate venturing are more likely to obtain long-term debt financing, confirming H5.

Furthermore, it appears that the activities of fintech start-ups have little effect on long-term debt use, with blockchain/cryptocurrency and crowdfunding/P2P activities negatively related to the use of long-term debt and personal finance/asset management positively related to the use of long-term debt in just one regression model. H6 hence is confirmed.

Discussion and conclusionThe financing of fintech start-ups remains a largely unexplored topic (Dapp, 2014; Anagnostopoulos, 2018). By applying multivariate analyses to a hand-collected dataset on fintech firms incorporated from 2010 to 2015, this paper examines the financing of 285 fintech start-ups by analysing the effects of their characteristics on long-term debt. The results are relevant because they clearly explain which characteristics help firms receive debt financing.

Fintech start-ups that are more likely to receive long-term debt financing are unregulated, larger, characterized by higher fixed assets, owned by more than one entity or wholly owned by a financial institution or corporation, or backed by a corporate venture capitalist. This study also elucidates the characteristics that negatively affect the financing of fintech start-ups: firms backed by investors receive less long-term debt financing than their peers. Finally, the results provide evidence that the type of fintech activities performed by a start-up impact its financing.

Some interesting concerns may be drawn considering together the results of the Tobit models (which test the effects on both the decision to use and the proportion of use of long-term debt financing), the logit models (which test the effects on only the decision to use long-term debt financing) and the Arellano and Bond (1991) models (which test the effects on the proportion of use of long-term debt financing). The effects of regulation appear to be stable across both the decision to use and the proportion of use of long-term debt financing. Overall, the influence of the asset structure on fintech start-up financing also appears to have an equal effect on the possibility and extent of use of a particular type of financing. In terms of ownership and investor capital, they appear to be more influential in explaining the decision/possibility of using long-term financing. Fintech activities have effects only on the magnitude of long-term debt and not on the decision/possibility of using this financing.

Our results provide overall evidence that fintech start-ups flying under the regulatory radar are more likely to obtain the financial resources needed for their businesses. While on the one hand, this result should not be surprising, since the absence of regulation enables fintech firms to offer personalized services at lower costs (Anagnostopoulos, 2018; Lee & Shin, 2018), this finding poses further problems for policy makers, as it offers an additional incentive for fintech start-ups to avoid being regulated. As supervision increases, business models based on avoiding regulatory demands will have to adapt.

In accordance with previous studies, the results provide support for the thesis that size is an important determinant of lending decisions (Harris & Raviv, 1991; González & González, 2011; Cowling, Liu & Ledger, 2012). Larger firms often represent safer investments, and size is sometimes used by banks as a proxy for risk. As a result, larger start-ups are more able to access financing. Furthermore, our work supports the importance of fixed assets for lending decisions (Cassar, 2004), as they can be treated as a guarantee in cases of failure. In contrast to the findings of previous papers on debt financing (Berger & Udell, 1998; Storey, 2016), our results show that asset tangibility does not impact the decision to use debt financing; this is likely linked to the very nature of fintech start-up assets, which are characterized by a strong component of intangibles. In fact, intangible assets are fundamental to these firms’ business and represent their main source of competitive advantage over competitors.

Our findings provide evidence that fintech start-ups that receive equity resources from financial investors seek less external debt funding (Gompers & Lerner, 2001).

Our further analyses show that a lack of regulation and the asset structure impact both the possibility of obtaining long-term debt financing and the amount of debt financing provided to fintech start-ups. In contrast, financing by corporate investors and the activities of fintech firms have no effects on the possibility of obtaining financing but do impact the amount of debt financing disbursed to them.

Fintech firms are a successful reality in the financial landscape that has changed or disrupted the financial industry (The Economist, 2015). The main benefits of the current study are twofold. First, even though the fintech phenomenon is growing, this work is one of the first quantitative studies to specifically map and analyze the financing of fintech start-ups. Second, this research argues that debt financing for fintech start-ups is determined by a combination of factors, such as regulation, asset structure, ownership, investor capital, M&As and activities.

Most studies on start-up financing have focused on a single factor within a broad panorama of different start-ups rather than analysing the impacts of several factors on a single type of company—the fintech start-up. This study therefore differentiates itself from previous studies by identifying and analysing the determinants (such as regulation, asset structure, ownership, investor capital, M&As and activities) that enable fintech start-ups to obtain long-term debt and hence finance their growth.

Even if our research is limited to a UK sample, we believe that this empirical study of fintech start-ups provides new insights for researchers and practitioners.

In terms of managerial implications, the causal factors identified in this study provide valuable insights regarding ways to increase the possibility of receiving long-term financing and the magnitude of such financing. This is very relevant from a managerial point of view because debt financing prevents the partial loss of control of the company that equity financing entails in terms of voting rights and participation in company decisions. With debt financing, the owners and managers of a start-up can freely run their business without the involvement of investors in their strategies.

Moreover, our findings are beneficial for banks and financial institutions, which should team up with and invest in the fintech start-ups that are ideal financing recipients in exchange for their technological advantages. The results are also useful to researchers because they pose new questions to be investigated. Finally, the results are of interest to policy makers because they highlight the benefits to fintech firms of being unregulated, implying that such firms should be treated appropriately and promptly by regulators.

We acknowledge some limitations of our study. Although our estimations control for many factors, others may be important; hence, further research could strive to improve the basic model proposed. First and foremost, our data do not identify firms that apply for business debt at start-up and are rejected. While it is possible that business debt is also backed by personal guarantees and personal collateral, the fact that most start-ups explicitly use personal debt while a large minority use business debt suggests that there are important differences between these firms and their capital structure decisions. Our database does not provide data on entrepreneurs' personal guarantees or wealth; thus, we are unable to incorporate these measures into our analysis. Our sample contains only a small number of unregulated fintech start-ups, finding that they are more likely to receive long-term financing; a larger number could permit a more in-depth analysis.

Furthermore, this paper focuses exclusively on an advanced rather than a developing economy. Extending this research to developing country contexts may have important implications for economic policy and development and extend the limited research on start-up financing in developing economies. It would also be interesting to explore whether the financing of fintech start-ups impacts their profitability and growth in subsequent years.

Nevertheless, our study provides new evidence of the importance of bank lending for firms with no record of business operations and very limited access to other types of financing.

See Table A1

Data source and definition.

| Variable | Definition | Source |

|---|---|---|

| LongDebt | Natural logarithm of (1 + Aggregate amount of long-term debt) where the aggregate amount of long-term debt is the sum of long debt and other non-current liabilities. | Orbis |

| d_Longdebt | Dummy variable, equals 1 if firm reports that it used long debt. | Orbis |

| Regulation | Dummy variable, equals 1 if firm is regulated by one or more supervisory authorities or central banks. | Orbis and FCA |

| FixedAssets | Natural logarithm of (1 + Total fixed assets). | Orbis |

| Tangibility | Natural logarithm of (1 + Total tangible assets). | Orbis |

| Size | Natural logarithm of (1 + Total assets). | Orbis |

| Equity | Natural logarithm of (1 + Shareholders’ funds). | Orbis |

| Individual | Dummy variable, equals 1 if firm is totally owned by an individual. | Orbis |

| FinCompany | Dummy variable, equals 1 if firm is totally owned by a financial firm. | Orbis |

| NonfinCompany | Dummy variable, equals 1 if firm is totally owned by a non-financial company. | Orbis |

| Multiowners | Dummy variable, equals 1 if firm has more than one owner. | Orbis |

| Angel | Dummy variable, equals 1 if firm is subject to angel investment. | Zephir |

| Venture | Dummy variable, equals 1 if firm is subject to venture capital investment. | Zephir |

| PrivateEquiy | Dummy variable, equals 1 if firm is subject to private equity. | Zephir |

| Crowdfunding | Dummy variable, equals 1 if firm is subject to equity crowdfunding. | Zephir |

| Corporate | Dummy variable, equals 1 if firm is subject to corporate venturing investment. | Zephir |

| IPO | Dummy variable, equals 1 if firm is subject to IPO. | Zephir |

| MoneyTransf | Dummy variable, equals 1 if firm operates activities of money transfer and remittance (e.g., peer-to-peer platforms to transfer funds between individuals in different countries). | CB Insights (2017) |

| Blockchain | Dummy variable, equals 1 if firm operates activities of blockchain (e.g., key software or technology companies in the domain of distributed ledger registers). | CB Insights (2017) |

| P2PCrowd | Dummy variable, equals 1 if firm operates activities of crowdfunding or P2P lendingor any platform that allows a group of individuals to make financial contributions to projects or companies provisioned in an equity form. | CB Insights (2017) |

| Security | Dummy variable, equals 1 if firm operates activities of security (e.g., Creation of new platforms for subscriptions, public offers, distribution and brokerage, to improve customer experience and Software as Service to help insurers deal with problems with legacy information systems). | CB Insights (2017) |

| InstTech | Dummy variable, equals 1 if firm operates activities of institutional technologies and capital markets (e.g., tools for financial institutions that range from alternative commercial systems to software modeling and financial analysis). | CB Insights (2017) |

| Payment | Dummy variable, equals 1 if firm operates activities of payment and billing or solutions to facilitate processing payments for the developers of payments by card (or bank slips) for software tools for billing by subscription. | CB Insights (2017) |

| Loan | Dummy variable, equals 1 if firm operates activities of credit (e.g., loan platforms, platforms for loan underwriters that use “machine learning” technologies and algorithms to assess the reliability of the borrowers). | CB Insights (2017)) |

| PersonalFin | Dummy variable, equals 1 if firm operates activities of personal finance and asset management that help individuals manage their accounts and/or personal credit, and their assists and personal investments. | CB Insights (2017) |

| Year | Year of which data are referred. Control variable. | Authors’ calculations |

Disruptive innovation can be defined as a process whereby a smaller company (usually a start-up/new entrant) with fewer resources is able to successfully challenge established incumbent businesses (Christensen, Raynor, & Mcdonald, 2015).

In total, 160 fintech start-ups are regulated by the Financial Conduct Authority (FCA); 39 are regulated by the Financial Supervisory Authority (FSA); 34 are regulated by the Financial and Capital Market Commission (FCMC); 32 are regulated by the Financial Services Commission (FSC); 28 are regulated by the Financial Markets Authority (FMA); 7 are regulated by the Financial Services and Markets Authority (FSMA); 1 is regulated by the European Banking Authority (EBA); and 50 are regulated by one or more foreign supervisory bodies or foreign central banks (Bank of Greece, Bank of Slovenia, Bank of Spain, Central Bank of Cyprus, Central Bank of Hungary, Central Bank of the Slovak Republic, Czech National Bank, De Nederlandsche Bank, French Prudential Supervision and Resolution Authority, Malta Financial Services Authority, National Bank of Belgium, National Bank of Romania, Polish Financial Supervision Authority, and the Financial Supervisory Authority of Norway).