Firm’ ability to effectively allocate capital and manage risks is the essence of their production and performance. This study investigated the relationship between capital structure, portfolio risk levels and firm performance using a large sample of U.S. banks from 2001 to 2016. Stochastic frontier analysis (SFA) was used to construct a frontier to measure the firm's cost efficiency as a proxy for firm performance. We further look at their relationship by dividing the sample into different size and ownership classes, as well as the most and least efficient banks. The empirical evidence suggests that more efficient banks increase capital holdings and take on greater credit risk while reducing risk-weighted assets. Moreover, it appears that increasing the capital buffer impacts risk-taking by banks depending on their level of cost efficiency, which is a placeholder for how productive their intermediation services are performed. An additional finding, is that the direction of the relationship between risk-taking and capital buffers differs depending on what measure of risk is used.

The measurement of firm performance is central to management research. Traditional techniques such as financial ratio analysis summarizing firm performance in a single statistic are widely used. Despite the appealing simplicity, this approach have been heavily criticized as it fails to control for product mix or input prices (Berger et al., 1993), is susceptible to changes of external prices that are beyond the control of the management (De Young, 1997), and also the comparison of the firm-specific performance without peer groups is meaningless.

The structural approach on firm performance focuses especially on the frontier efficiency, a concept motivated by the theory of production that firms cannot operate above the ideal “frontier” and the deviations from the “frontier” represent the individual inefficiencies. The frontier efficiency measures how efficient the firm is compared to the “best practice” firm in the market. Frontier efficiency models have wide applications in many industries across the world, such as evaluating the outcomes of market reforms, and establishing performance benchmarks.

Efficiency study is specially relevant in the financial sector. The 2007 global financial crisis had a significant impact on the performance of financial institutions and the stability in the financial system. The crisis not only revealed that the existing regulatory frameworks were still inadequate for preventing financial institutions from taking excessive risks, but also highlighted the importance of the interdependence and spillover effects within the financial markets. Therefore, from a management perspective, these events have prompted a need in understanding the key components of firm technology and production to better prevent risks and improve performance.

Literature recognizes that a firm's choices of risk-taking and capital allocation influence its production decisions, and so, in turn, affects its cost and profitability. Hughes et al. (1995) link risk-taking and firm's operational efficiency together and argue that higher loan quality is associated with greater inefficiencies. Kwan and Eisenbeis (1997) link firm risk, capitalization and measured inefficiencies in a simultaneous equation framework. Their study confirms the belief that these three variables are jointly determined. Taken together, empirical literature on banking business practices imply that capital, risk and efficiency are all related.

Understanding the relationship between capital structure, efficiency and risk decisions is therefore fundamental in management, and the underlying mechanisms should be fully understood by managers to improve firm performance and prevent any hazardous behavior. The aim of the paper is to gain a better understanding of the effects of capital structure, risk and efficiency among each other. To reach this objective, we use empirical data in a sector of great interest, the U.S. banking sector. The sampling period includes banks that report their balance sheet data according to both the original Basel I Accord and the Basel II revisions (effective from 2007 in the U.S.), and up to the most available date 2016-Q3. More precisely, this paper addresses the following questions: How does a firm's risk-taking, capital and efficiency relate to each other? To what extent are firm's risk-taking behavior and efficiency levels sensitive to capital regulation? Do firms behave differently depending on the size, efficiency or ownership classes?

This study makes several contributions to the discussion on capital, risk and efficiency and has important implications. First, this analysis provides the the first empirical investigation, which links capital regulation on bank risk taking, capital buffer and efficiency while accounting for the simultaneous relationship between them. Second, this study employs a significantly larger and more recent data set compared to previous studies that used data only up to 2010. In addition, the findings of this study will offer useful insights for regulators and managers in the rapidly changing institutional environment.

This paper is organized as follows. We begin by introducing the fundamentals of the frontier efficiency methods. We then review the hypothesis between capital, risk and efficiency. This is followed by our model and estimation strategies. We then illustrate our methodologies using panel data on U.S. banks and present our findings.

Frontier efficiency: conceptual backgroundThe basic idea of efficiency analysis is to measure firm's performance of the extent to which inputs are well used for outputs (products or services.) The non-structural approach to measure efficiency uses simple financial ratios from accounting statements such as return-on-equity or the ratio of operating costs to total assets.

The structural approach relies on theoretical models of production and the concept of optimization. Generally, there are two approaches to measure the frontier efficiency: the parametric and the non-parametric approach. Parametric methods, like Stochastic Frontier Analysis (SFA), Thick Frontier Approach (TFA) and Distribution Free Approach (DFA), are used to estimate a pre-specified functional form and inefficiency is modeled as an additional stochastic term. On the other hand, non-parametric methods, including Data Envelopment Analysis (DEA) and Free Disposal Hull (FDH) approach, use linear programming to calculate an efficient deterministic frontier against which units are compared.

Stochastic frontier analysis (SFA)The most widely implemented technique is stochastic frontier analysis (SFA) proposed by Aigner et al. (1977), Meeusen and Van den Broeck (1977). SFA is often referred to as a composed error model where one part represents statistical noise with symmetric distribution and the other part, representing inefficiency, follows a particular one-sided distribution. The availability of a panel data enables the use of standard models of fixed and random effects without the need to make any distributional assumption for the inefficiency term (Schmidt and Sickles, 1984). This is the Distribution Free Approach (DFA). The model has the general form:

where xit is a vector of input variables, yit is the output variable, f(xit;β) is a log-linear production function (e.g. Cobb-Douglas, translog or fourier flexible form) and α is the frontier intercept. vit is the statistical noise, and is assumed to be independently and identically distributed, and ui is the one-sided inefficiency term that represents technical inefficiency of firm i. ui is assumed to have half-normal, truncated normal, exponential, or gamma distribution.The fundamental idea of stochastic frontier technical efficiency can be formalized as the ratio of realized output, given a specific set of inputs, to maximum attainable output:

with yit* is the maximum attainable output for unit i given xit.Later, Cornwell et al. (1990) (CSS) extended the standard panel data stochastic frontier model in (1) to allow for heterogeneity in slopes as well as intercepts. The intercept is specified as:

where the parameters δi1, δi2, δi3 are firm specific and t is the time trend variable.Following a slightly different strategy, Lee and Schmidt (1993) specifies uit as the form of g(t)ui in which

where dt is a time dummy variable and one of the coefficients is set equal to one.Numerous similarly motivated specifications have been proposed for uit. Two that have been proved useful in applications are Kumbhakar (1990)'s model,

and Battese and Coelli (1992)'s “time decay model”,where Ti is the last period in the ith panel, and η is the decay parameter. The decay parameter gives information on the evolution of the inefficiency. When η> 0, the degree of inefficiency decreases over time; when η<0, the degree of inefficiency increases over time. If η tends to 0, then the time-varying decay model reduces to a time-invariant model.Non-parametric approachData envelopment analysis (DEA), introduced by Charnes et al. (1979), provides a nonparametric methodology to evaluate the relative efficiency of each of a set of comparable decision making units (DMUs) relative to one another. DEA assumes that there is a frontier technology (in the same spirit as the stochastic frontier production model) that can be described by a piece-wise linear convex hull that envelopes the observed outcomes. In contrast to SFA, DEA is purely deterministic and creates virtual units that serve as benchmarks for measuring DMUs’ comparative efficiency. Free disposal hull (FDH) analysis is similar to DEA, but relaxes the convexity assumption of DEA models. Therefore, compared to DEA frontier, data is enveloped more tightly in the FDH, which has a staircase shape.

Main hypothesis between capital, risk and efficiencyThe manager's role is vital in making decisions about their capital structure and the amount of risk to assume. Modern banking theory emphasizes managers’ contrasting incentives. On the one hand, managers are obliged to fulfill shareholders’ objectives especially to maximize the value of equity shares. On the other hand, managers are restrained their attempts to take excessive risk by means of a restrictive regulatory system. The prevalence of a minimum capital requirement is primarily based on the assumption that banks are prone to engage in moral hazard behavior. The moral hazard hypothesis is the classical problem of excessive risk-taking when another party is bearing part of the risk and cannot easily charge for that risk. Due to asymmetric information and a fixed-rate deposit insurance scheme, the theory of moral hazard predicts that banks with low levels of capital have incentives to increase risk-taking in order to exploit the value of their deposit insurance (Kane, 1995). The moral hazard problem is particularly relevant when banks have high leverage and large assets. According to the too-big-to-fail argument, large banks, knowing that they are so systemically important and connected that their failure would be disastrous to the economy, might count on a public bailout in case of financial distress. Thus, they have incentives to take excessive risks and exploit the implicit government guarantee. In addition, the moral hazard hypothesis predicts that inefficiency is positively related to higher risks because inefficient banks are more likely to extract larger deposit insurance subsidies from the FDIC to offset part of their operating inefficiencies (Kwan and Eisenbeis, 1996).

With regard to the relationship between cost efficiency and risks, Berger and DeYoung (1997) outline and test the “bad luck”, “bad management”, and “skimping” hypotheses using Granger causality test. Under the bad luck hypothesis, external exogenous events lead to increases in problem loans for the banks. The increases in risk incur additional costs and managerial efforts. Thus cost efficiency is expected to fall after the increase in problem loans. Under the bad management hypothesis, managers fail to control costs, resulting in a low cost efficiency, and they also perform poorly at loan underwriting and monitoring. These underwriting and monitoring problems eventually lead to high numbers of nonperforming loans as borrowers fall behind in their loan repayments. Therefore, the bad management hypothesis implies that lower cost efficiency leads to an increase in problem loans. On the other hand, the skimping hypothesis implies a positive Granger-causation from measured efficiency to problem loans. Under the skimping hypothesis, banks skimp on the resources devoted to underwriting and monitoring loans, reducing operating costs and increasing cost efficiency in the short run. But in the long run, nonperforming loans increase as poorly monitored borrowers fall behind in loan repayments.

Model and identification strategyMeasuring efficiencyHow one measures performance depends on whether one views the firm as cost minimizing, profit maximizing or managerial utility maximizing. The cost efficiency is the most widely used efficiency criterion in the literature, and measures the distance of a firm's cost relative to the cost of the best practice firm when both of them produce the same output under the same conditions. A firm's production function uses labor and physical capital to attract deposits. The deposits are used to fund loans and other earning assets. We specify inputs and outputs according to the intermediation model (Sealey and Lindley, 1977).

Following Altunbas et al. (2007), we specify a cost frontier model with two-output three-input, and a translog specification of the cost function:

where TC represents the total cost, y are outputs, w are input prices, and t is a time trend to account for technological change, using both linear and quadratic terms. Inputs are borrowed funds, labor, and capital. Outputs are securities and loans. The inclusion of quadratic time trend and time interaction with outputs and input prices enables the measurement of time-dependent effects in costs, such as the pure technical change and non-neutral technological shifts of the cost frontier. The term v is a random error that incorporates both measurement error and luck. u measures the distance of an individual bank to the efficient cost frontier and represents the bank's inefficiency level. A description of input and output variables are shown in Table 4.1.Input and output description.

| Variable | Symbol | Description |

|---|---|---|

| Total cost | TC | Interest+non-interest expenses |

| Outputs | ||

| Total securities | Y1 | Securities held to maturity+securities held for sale |

| Total loans | Y2 | Net loans (gross loans−reserve for loan loss provisions) |

| Inputs prices | ||

| Price of physical capital | W1 | Expenditures on premises and fixed assets/premises and fixed assets |

| Price of labor | W2 | Salaries/full-time equivalent employees |

| Price of borrowed funds | W3 | Interest expenses paid on deposits/total deposits |

Eq. (2) is estimated using several methods. We first estimate cost efficiency using Battese and Coelli (1992) time-decay model with time-varying efficiency which is the model of choice in many applications. We then estimate firms’ relative efficiency follow (Cornwell et al., 1990) model using within transformation. Since CSS estimators are vulnerable to outliers and measurement error, we also incorporate a TFA and order-α type of estimation technique with CSS within estimator to estimate average efficiency of each quartile and compare across groups. Within the banking literature, size has often been found to be a key factor driving variations in efficiency across banks. It is interesting to note that there is no consensus in previous empirical studies about the relationship between bank size and banking efficiency. The modified estimations of relative cost efficiency are as follows:

- 1.

We first sort the data of banks by asset size, from small to large, and the sorted sample is divided into quartiles. Firms in the first quartile are the smallest firms and are assumed to be the most cost efficient group of firms.

- 2.

Use a procedure similar to Cornwell et al. (1990) to get the inefficiency and efficiency scores for each quartile separately.

- 3.

Choose [100−α]th(where α=90) percentile among banks in each quartile, i.e. trim 10% of the super efficient banks from the sample.

- 4.

Repeat Step 2 to get relative inefficiency and efficiency scores of each bank in each quartile.

Taken all together, these studies and the models on which they are based imply that bank capital, risk and efficiency are simultaneously determined and can be expressed in general terms as follows:

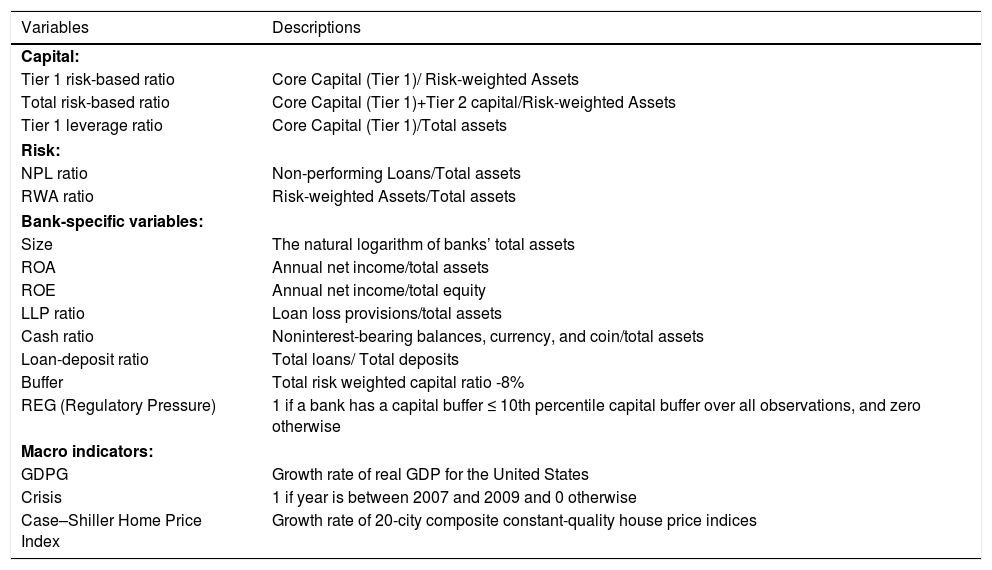

where Xit are bank-specific variables.Measures of capital and riskGiven the regulatory capital requirements associated with Basel I, II and III, capital ratios are measured in three ways: Tier 1 risk-based ratio, total risk-based ratio and Tier 1 leverage ratio. Tier 1 risk-based capital ratio is the proportion of core capital to risk-weighted assets where core capital basically consists of common stock and disclosed reserves or retained earnings. Tier 2 capital includes revaluation reserves, hybrid capital instruments and subordinated term debt, general loan-loss reserves, and undisclosed reserves. Total risk-based ratio is the percentage of Tier 1 and Tier 2 capital of risk-weighted assets. Tier 1 leverage ratio is the ratio of Tier 1 capital to total assets. The higher the ratio is, the higher the capital adequacy.

The literature suggests a number of alternatives for measuring bank risk. The most popular measures of bank risk are the ratio of risk-weighted assets to total assets (RWA) and the ratio of non-performing loans to total loans (NPL). The ratio of risk-weighted assets is the regulatory measure of bank portfolio risk, and was used by Shrieves and Dahl (1992), Jacques and Nigro (1997), Rime (2001), Aggarwal and Jacques (2001), Stolz et al. (2004) and many others. The standardized approach to calculating risk-weighted assets involves multiplying the amount of an asset or exposure by the standardized risk weight associated with that type of asset or exposure. Typically, a high proportion of RWA indicates a higher share of riskier assets. Since its inception, risk weighting methodology has been criticized because it can be manipulated (for example, via securitization), NPL is thus used as a complementary risk measure as it might contain information on risk differences between banks not caught by RWA. Non-performing loans is measured by loans past due 90 days or more and non-accrual loans and reflect the ex-post outcome of lending decisions. Higher values of the NPL ratio indicate that banks ex-ante took higher lending risk and, as a result, have accumulated ex-post higher bad loans.

Determinants of capital structureThe optimal capital structure is not observable and typically depends on some set of observable bank-specific variables. We do so as well in our analysis. Loan loss provisions (LLP) as a percentage of assets are included as a proxy for asset quality. A higher level of loan loss provisions indicates an expectation of more trouble in the banks’ portfolios and a resulting greater need for capital, and thus might capture ex-ante credit risk or expected losses.

The loan-to-deposit ratio (LTD) is a commonly used measure for assessing a bank's liquidity. If the ratio is too high, it means that the bank may not have enough liquidity to cover any unforeseen fund requirements, and conversely, if the ratio is too low, the bank may not be earning as much as it otherwise earns.

Size will likely impact a bank's capital ratios, efficiency and level of portfolio risk, because larger banks are inclined to have larger investment opportunity sets and are granted easier access to capital markets. For these reasons, they have been found to hold less capital ratios than their smaller counterparts (Aggarwal and Jacques, 2001). We include the natural log of total assets as the proxy for bank size. Bank profitability is expected to have a positive effect on bank capital if the bank prefers to increase capital through retained earnings. An indicator of profitability is measured by return on assets (ROA) and return on equity (ROE).

The regulatory pressure variable describes the behavior of banks close to or below the regulatory minimum capital requirements. Capital buffer theory predicts that an institution approaching the regulatory minimum capital ratio may have incentives to boost capital and reduce risk to avoid the regulatory cost triggered by a violation of the capital requirement. We compute the capital buffer as the difference between the total risk-weighted capital ratio and the regulatory minimum of 8%. Consistent with previous work, we use a dummy variable REG to signify the degree of regulatory pressure that a bank is under. Since most banks hold a positive capital buffer, we use the 10th percentile of the capital buffer over all observations as the cutoff point. The dummy REG is set equal to 1 if the bank's capital buffer is less than the cutoff value and zero otherwise. To test the predictions outlined above, we interact the dummy REG with variables of interest. For example, in order to capture differences in the speeds of adjustment of low and high buffer banks, we interact REG with the lagged dependent variables Capt−1 and Riskt−1. In addition, to assess differences in short term adjustments of capital and risk that depend on the degree of capitalization, we interact the dummy REG with ΔRisk and ΔCap in the capital and risk equations respectively.

Macroeconomic shocks such as a recession and falling housing prices can also affect capital ratios and portfolios of banks. In order to capture the effect of common macroeconomic shocks that may have affected capital, efficiency and risk during the period of study, the annual growth rate of real U.S. GDP and Case–Shiller Home Price Index are included as controls. We also include a dummy variable Crisis that takes the value of 1 if the year is 2007, 2008 or 2009. A summary of variable description is presented in Table 4.2 below.

Description of variables used in the study.

| Variables | Descriptions |

|---|---|

| Capital: | |

| Tier 1 risk-based ratio | Core Capital (Tier 1)/ Risk-weighted Assets |

| Total risk-based ratio | Core Capital (Tier 1)+Tier 2 capital/Risk-weighted Assets |

| Tier 1 leverage ratio | Core Capital (Tier 1)/Total assets |

| Risk: | |

| NPL ratio | Non-performing Loans/Total assets |

| RWA ratio | Risk-weighted Assets/Total assets |

| Bank-specific variables: | |

| Size | The natural logarithm of banks’ total assets |

| ROA | Annual net income/total assets |

| ROE | Annual net income/total equity |

| LLP ratio | Loan loss provisions/total assets |

| Cash ratio | Noninterest-bearing balances, currency, and coin/total assets |

| Loan-deposit ratio | Total loans/ Total deposits |

| Buffer | Total risk weighted capital ratio -8% |

| REG (Regulatory Pressure) | 1 if a bank has a capital buffer ≤ 10th percentile capital buffer over all observations, and zero otherwise |

| Macro indicators: | |

| GDPG | Growth rate of real GDP for the United States |

| Crisis | 1 if year is between 2007 and 2009 and 0 otherwise |

| Case–Shiller Home Price Index | Growth rate of 20-city composite constant-quality house price indices |

Given the discussion above, Eq. (3) can be written as:

DataAll bank-level data is constructed from the Consolidated Report of Condition and Income (referred to as the quarterly Call Reports) provided by the Federal Deposit Insurance Corporation (FDIC). The sample includes all banks in the Call Report covering the period from 2001:Q1 to 2016:Q3. Complete data of period 2001–2010 is available from the website of the Federal Reserve Bank of Chicago1 and data after 2011 is available from the FFIEC Central Data Repository's Public Data Distribution site (PDD).2 We also collected data on U.S. Gross Domestic Product (GDP) and Case–Shiller Home Price Index from Federal Reserve Bank of St. Louis. We end up with an unbalanced panel data on 8055 distinct banks, yielding 330,970 bank-quarter observations over the whole sample period.

Tables 5.1 and 5.2 presents a descriptive summary of key variables in the full sample (panel A) and compares the sample mean for 3 periods: pre-crisis, crisis and post-crisis (panel B). All variables are averaged by banks from 2001 to 2016. Fig. 1 shows the time series plots of bank risks, capital ratios, assets, profits, liquidity, and average capital and interest costs for the average bank over 2001–2016.

Summary Statistics of the portfolios of U.S. banks.

| Mean | Std. dev. | Min | Max | |

|---|---|---|---|---|

| Panel A: Descriptive statistics of key variables for the full sample period | ||||

| Stochastic frontier arguments | ||||

| Cost of physical capital | 0.20 | 0.21 | 0.02 | 1.97 |

| Cost of labor | 35.05 | 18.46 | 8.33 | 102.43 |

| Cost of borrowed funds | 0.01 | 0.01 | 0.00 | 0.04 |

| Total securities ($million) | 51.19 | 74.95 | 0.41 | 770 |

| Total loans($million) | 160.17 | 212.36 | 7.61 | 1726 |

| Total Cost($million) | 6.30 | 8.94 | 0.25 | 167 |

| Regression arguments | ||||

| Assets($million) | 239.4 | 301.6 | 9.6 | 3540 |

| Equity($million) | 24.6 | 32.5 | 0.7 | 577 |

| Deposit($million) | 196.0 | 240.2 | 7.5 | 2666 |

| Net income ($million) | 1.3 | 2.9 | −261.6 | 109 |

| Return on assets (%) | 0.54 | 0.64 | −27.48 | 9.16 |

| Return on equity (%) | 5.32 | 6.56 | −304.34 | 83.21 |

| Risk weighted assets (%) | 68.05 | 11.80 | 36.43 | 95.78 |

| NPL ratio (%) | 2.73 | 2.73 | 0.00 | 51.27 |

| Loan loss provision (%) | 0.24 | 0.54 | −20.92 | 44.54 |

| Tier1 capital ratio (%) | 15.30 | 5.38 | 7.23 | 43.09 |

| Risk-based capital ratio (%) | 16.43 | 5.37 | 9.91 | 43.48 |

| Tier1 leverage ratio (%) | 10.02 | 2.46 | 6.08 | 20.64 |

| Capital buffer (%) | 8.43 | 5.37 | 1.91 | 35.48 |

Summary statistics of the portfolios of U.S. banks.

| Pre-crisis | Crisis | Post-crisis | |

|---|---|---|---|

| 2001q1-2007q2 | 2007q3-2009q4 | 2010q1-2016q3 | |

| Panel B: Sample mean of key variables for pre-crisis, crisis and post-crisis period | |||

| Stochastic frontier arguments | |||

| Cost of physical capital | 0.201 | 0.192 | 0.192 |

| Cost of labor | 30.365 | 35.505 | 40.053 |

| Cost of borrowed funds | 0.014 | 0.016 | 0.004 |

| Total securities ($million) | 42.819 | 46.613 | 62.849 |

| Total loans ($million) | 128.651 | 171.229 | 189.787 |

| Total Cost ($million) | 5.747 | 7.702 | 6.205 |

| Regression arguments | |||

| Assets ($million) | 192.100 | 244.572 | 289.565 |

| Equity ($million) | 18.815 | 24.544 | 31.085 |

| Net income ($million) | 1.342 | 0.899 | 1.451 |

| Deposit ($million) | 155.824 | 196.543 | 240.498 |

| Return on assets (%) | 0.652 | 0.404 | 0.477 |

| Return on equity (%) | 6.720 | 3.989 | 4.440 |

| Risk weighted assets (%) | 68.244 | 71.086 | 66.302 |

| NPL ratio (%) | 2.216 | 3.328 | 2.994 |

| Loan loss provision (%) | 0.193 | 0.356 | 0.246 |

| Loan-deposit ratio (%) | 78.125 | 81.887 | 74.809 |

| Tier1 capital ratio (%) | 14.882 | 14.573 | 16.125 |

| Risk-based capital ratio (%) | 16.015 | 15.674 | 17.276 |

| Tier1 leverage ratio (%) | 9.752 | 9.955 | 10.354 |

| Capital buffer (%) | 8.015 | 7.674 | 9.276 |

In general, the majority of banks in the sample have been well capitalized throughout the sample period. The average bank has exceeded the minimum required capital ratio by a comfortable margin. In our sample, the mean capital buffer above capital requirements is 8.43 %. The average Tier 1 capital ratio is 15.26% and the average risk-based capital ratio is 16.43% during 2001–2016. The findings show that banks tend to hold considerable buffer capital.

Comparing average bank portfolios during the pre-crisis, crisis and post-crisis period, it is evident that an average bank was hit hard by the financial turmoil. The average ROE (ROA) dropped from its highest level (7%/0.7%) in 2005 to its lowest (2%/0.2%) in 2009. The time trend of capital ratios shows a steady movement until a drop in 2008 and then picked up after 2010. The time series plots of two measures of bank risks show a similar trend. Liquidity here is measured by cash ratio and LTD. The average LTD ratio increased steadily until the financial crisis hit and reached the peak of almost 100% in 2009, then fell precipitously until 2012 and have been rising again. The high LTD during crisis period suggests insufficient liquidity to cover any unforeseen risks. This sharp drop in LTD since 2010 could be attributed to the tightened credit management by banks after the financial crisis, the contraction in lending demand due to the sluggishness of the economy, and the measures undertaken by the government to curb excessive lending.

Empirical resultsEstimates of bank cost efficiency are reported in Tables 6.2 and 6.1. The results of the two-step GMM estimation for the full sample are reported in Table 6.5. We also did GMM estimation separately for each size and ownership class, as well as the most and least efficient banks. The estimation results for the subsamples are presented in Table A.1–A.3, respectively. Capital ratios here are measured by Tier 1 leverage ratio. We also did additional tests that used two other measures of capital ratios, and none of these cause material changes to the results reported in the tables.

Efficiency estimates based on the translog cost functions.

| Estimated inefficienciesuˆit | |

|---|---|

| Mean | 0.508 |

| SD | 0.243 |

| Min | 0.006 |

| Max | 1.290 |

| Estimated cost efficiencyCEˆit | |

| Mean | 0.619 |

| SD | 0.149 |

| Min | 0.275 |

| Max | 0.994 |

| Observations | 330,790 |

Note: The top and bottom 5% of inefficiencies scores are trimmed to remove the effects of outliers.

Cost efficiency scores by size and type of banks over years.

| Commercial banks | Cooperative banks | Savings banks | Large banks | Small banks | Full sample | |

|---|---|---|---|---|---|---|

| 2001 | 0.667 | 0.740 | 0.642 | 0.581 | 0.668 | 0.667 |

| 2002 | 0.661 | 0.734 | 0.636 | 0.575 | 0.662 | 0.661 |

| 2003 | 0.653 | 0.729 | 0.625 | 0.558 | 0.655 | 0.653 |

| 2004 | 0.646 | 0.718 | 0.616 | 0.549 | 0.648 | 0.645 |

| 2005 | 0.638 | 0.712 | 0.607 | 0.539 | 0.640 | 0.638 |

| 2006 | 0.630 | 0.703 | 0.598 | 0.527 | 0.633 | 0.630 |

| 2007 | 0.624 | 0.684 | 0.588 | 0.513 | 0.626 | 0.623 |

| 2008 | 0.620 | 0.680 | 0.584 | 0.504 | 0.623 | 0.619 |

| 2009 | 0.615 | 0.671 | 0.576 | 0.492 | 0.619 | 0.614 |

| 2010 | 0.608 | 0.665 | 0.567 | 0.479 | 0.612 | 0.606 |

| 2011 | 0.600 | 0.651 | 0.556 | 0.465 | 0.604 | 0.599 |

| 2012 | 0.597 | 0.650 | 0.547 | 0.469 | 0.601 | 0.595 |

| 2013 | 0.588 | 0.648 | 0.542 | 0.469 | 0.592 | 0.587 |

| 2014 | 0.578 | 0.646 | 0.529 | 0.459 | 0.583 | 0.576 |

| 2015 | 0.569 | 0.642 | 0.515 | 0.451 | 0.574 | 0.567 |

| 2016 | 0.564 | 0.639 | 0.508 | 0.455 | 0.569 | 0.561 |

Notes: Large banks are banks with assets greater than 1 billion and small banks are banks with assets less than 1 billion.

We estimate cost efficiency specifications in Eq. (2) using Battese and Coelli (1992)'s method. Table 6.1 shows average cost inefficiency at U.S. banks to be around 0.508 and mean cost efficiency to be 0.619. That is, given its particular output level and mix, on average, the minimum cost is about 61.9% of the actual cost. Alternatively, if a bank were to use its inputs as efficiently as possible, it could reduce its production cost by roughly 50.8%.

Table 6.2 presents the level of cost efficiency for the entire sample and for different ownership and size classes during 2001–2016. Cooperative banks have higher costs efficiency than commercial and savings banks. The results are in line with Altunbas et al. (2003)'s findings, who showed that cooperative banks have higher cost efficiency as compared to the commercial banks. Also, smaller banks are more cost efficient than are the larger banks during all periods.

We also computed relative efficiency scores as outlined in the model section for all banks to assess individual bank performance relative to the expected performance of peer banks; regulators, managers and shareholders, including prospective acquirers, might also find this information useful. The columns labeled “Q1”, “Q2”, “Q3”, and “Q4” give the estimated average efficiency levels for the first, second, third and forth size quartiles of banks (Table 6.3).

Cost efficiency scores over years (banks are divided into quartiles according to their size.)

| YEAR | Full sample | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|---|

| 2001 | 0.5224 | 0.6565 | 0.5024 | 0.3882 | 0.3026 |

| 2002 | 0.4473 | 0.5694 | 0.4403 | 0.3478 | 0.2666 |

| 2003 | 0.4161 | 0.5358 | 0.4208 | 0.3309 | 0.2553 |

| 2004 | 0.4060 | 0.5281 | 0.4160 | 0.3310 | 0.2536 |

| 2005 | 0.4149 | 0.5425 | 0.4327 | 0.3469 | 0.2631 |

| 2006 | 0.4772 | 0.6309 | 0.5083 | 0.4059 | 0.3047 |

| 2007 | 0.4488 | 0.6016 | 0.4886 | 0.3868 | 0.2904 |

| 2008 | 0.4611 | 0.6243 | 0.5163 | 0.4051 | 0.2990 |

| 2009 | 0.4394 | 0.6017 | 0.5041 | 0.3907 | 0.2881 |

| 2010 | 0.4260 | 0.5886 | 0.4977 | 0.3854 | 0.2822 |

| 2011 | 0.3809 | 0.5326 | 0.4525 | 0.3504 | 0.2557 |

| 2012 | 0.4220 | 0.5948 | 0.5111 | 0.3948 | 0.2868 |

| 2013 | 0.4394 | 0.6198 | 0.5393 | 0.4173 | 0.2996 |

| 2014 | 0.4093 | 0.5823 | 0.5138 | 0.3911 | 0.2814 |

| 2015 | 0.3968 | 0.5647 | 0.5087 | 0.3833 | 0.2771 |

| 2016 | 0.3542 | 0.5044 | 0.4544 | 0.3481 | 0.2502 |

| Total | 0.4301 | 0.5834 | 0.4805 | 0.3773 | 0.2789 |

Note: Estimated using CSS within estimator.

Two-step GMM estimations (FE) for the relationships between bank capital, cost efficiency and risk-taking

| Model where risk= NPL | Model where risk= RWA | |||||

|---|---|---|---|---|---|---|

| Variables | Y = ΔNPL | Y = ΔTier1 ratio | Y = Efficiency | Y = ΔRWA | Y= ΔTier1 ratio | Y= Efficiency |

| ΔCapital | 0.0243* | 0.0517* | −0.987* | 0.0378* | ||

| (0.00313) | (0.00612) | (0.00615) | (0.00694) | |||

| ΔRisk | 0.00686* | −0.00509 | −0.00866* | −0.00967* | ||

| (0.00246) | (0.00456) | (0.000192) | (0.00236) | |||

| Efficiency | 0.00439* | 0.00117* | −0.114* | 0.000474* | ||

| (0.00103) | (0.000214) | (0.00192) | (0.000174) | |||

| RISKt−1 | −0.263* | −0.320* | ||||

| (0.00139) | (0.00122) | |||||

| Capt−1 | −0.947* | −0.934* | ||||

| (0.00129) | (0.000497) | |||||

| Buffer | 0.00139 | 0.937* | −0.266* | −0.223* | 0.925* | −0.265* |

| (0.00126) | (0.00136) | (0.00243) | (0.00263) | (0.000494) | (0.00244) | |

| Size | 0.124* | −0.00482 | −8.505* | −1.099* | −0.0156* | −8.507* |

| (0.0124) | (0.00318) | (0.0175) | (0.0232) | (0.00210) | (0.0175) | |

| ROA | −0.175* | 0.0184* | 0.761* | 0.0972* | 0.0175* | 0.760* |

| (0.00545) | (0.00111) | (0.0106) | (0.0100) | (0.000910) | (0.0106) | |

| LLP ratio | 0.323* | −0.0451* | 0.275* | −0.400* | −0.0477* | 0.270* |

| (0.00583) | (0.00122) | (0.0111) | (0.0105) | (0.000955) | (0.0112) | |

| LTD | −0.000540*** | −0.00145* | 0.0150* | 0.163* | −0.000988* | 0.0155* |

| (0.000305) | (5.88e−05) | (0.000605) | (0.000683) | (5.29e−05) | (0.000620) | |

| REG | −0.111* | −0.298* | 0.773* | 2.000* | −0.234* | 0.773* |

| (0.0143) | (0.0413) | (0.0217) | (0.214) | (0.0229) | (0.0217) | |

| Crisis | 0.0300* | 0.0313* | 1.474* | 0.293* | 0.0322* | 1.473* |

| (0.00886) | (0.00144) | (0.0173) | (0.0166) | (0.00150) | (0.0173) | |

| REG*RISKt−1 | 0.0344* | −0.0223* | ||||

| (0.00387) | (0.00268) | |||||

| REG*Δ CAP | 0.00301 | −0.151* | ||||

| (0.0154) | (0.0290) | |||||

| REG*Capt−1 | 0.0357* | 0.0286* | ||||

| (0.00418) | (0.00232) | |||||

| REG*Δ Risk | −0.0122* | 0.00731* | ||||

| (0.00273) | (0.000520) | |||||

| GDP growth | −11.81* | −0.316* | 11.99* | 25.04* | 0.0444 | 12.32* |

| (0.476) | (0.0838) | (0.946) | (0.888) | (0.0808) | (0.947) | |

| Spcs growth | −2.418* | −0.108* | 23.31* | 3.186* | −0.0779* | 23.34* |

| (0.142) | (0.0229) | (0.277) | (0.264) | (0.0240) | (0.277) | |

| Hansen J statistic | 0.063 | 0.097 | 0.217 | 1.403 | 0.92 | 0.233 |

| (0.8019) | (0.7553) | (0.6414) | (0.1084) | (0.3374) | (0.6295) | |

| No. of observations | 265,905 | 265,905 | 265,985 | 265,905 | 265,905 | 265,985 |

| Number of banks | 7644 | 7644 | 7725 | 7644 | 7644 | 7725 |

Notes: Standard errors in parentheses.

Specifically, we divided banks into quartiles according to total assets for 3 sample periods: 2001Q1, 2008Q4 and 2016Q3. Table 6.4 shows results for estimation of cost efficiency at these 3 periods and the estimated average efficiency levels for the first, second, third and forth quartiles of banks.

Fig. 2 are scatterplots of averaged efficiency scores computed using the CSS within method for each size quartile at 3 different periods. The analysis shows that cost efficiencies are the highest in the small-sized group, and that the firms with the lowest cost efficiency are largest firms in all 3 periods.

Our results find a significant negative relationship between size and banking efficiency, suggesting that small banks may possess operational advantages that bring about higher cost efficiencies.

GMM results for the full sampleRelationships between capital, risk and efficiencyTable 6.5 shows the GMM fixed effect estimates of risk, capital, and efficiency equation for the full sample using two different measures of risk. Fixed effects are used to account for the possible bank-specific effects and provide consistent estimates. The Hansen statistics are also presented. The non-significance of the Hansen J-statistics indicates that the null hypothesis of valid instruments cannot be rejected for each model, confirming the validity of the instruments used.

The empirical results show that there is a strong positive two-way relationship between changes in NPL and changes in capital. This means banks’ NPL holdings increase when capital increases and vice versa. This finding is consistent with Shrieves and Dahl (1992), suggesting the unintended effects of higher capital requirements on credit risk. However, when risk is measured by risk-weighted assets, the relationships become negative, contrary to the findings by Shrieves and Dahl (1992) but consistent with Jacques and Nigro (1997). This together suggests that when capital ratio increases, banks reduce ex-ante investments in risk-weighted assets but, but at the same time, can have ex-post higher non-performing loans. The different signs on NPL and RWA raise concern whether risk-weighted assets are a credible measure of risk. It might be the case that banks “optimize” their capital by under-reporting RWA in an attempt to minimize regulatory burdens. Banks have two ways to boost their capital adequacy ratios: (i) by increasing the amount of regulatory capital held or (ii) by decreasing risk-weighted assets. Therefore, if banks capital adequacy ratios fall, banks’ can immediately reduce risk-weighted assets to increase the capital ratio to meet the regulatory requirement. However, non-performing loans will still stay on the balance sheets and increase over time due to compounded unpaid interests. The high non-performing loans can erode bank's financial health despite having lower rates of risk-weighted assets.

With regard to efficiency, the results show a positive relationship between efficiency and change in NPL as well as change in capital, suggesting more efficient banks increase capital holdings and take on greater credit risk (NPL), supporting the “skimping hypothesis”. This finding is contrary to the results by Kwan and Eisenbeis (1996) but consistent with Altunbas et al. (2007). While when risk is measured by RWA, efficiency and change in RWA are negatively related, implying that less efficient banks take on greater overall risk, supporting the moral hazard hypothesis.

Further, the results show the parameter estimates of lagged capital and risk are negative and highly significant. The coefficients show the expected negative sign and lie in the required interval [0,-1]. The can be interpreted as the speed of capital and risk adjustment towards banks’ target level (Stolz et al., 2004). The speed of risk adjustment is significantly slower than the capital adjustment, which is in line with findings by Stolz et al. (2004).

Regarding buffers, capital buffers are negatively related to adjustment in RWA. This finding is consistent with Vallascas and Hagendorff (2013) and according to them it might be a sign that banks under-report their portfolio risk.

Impact of regulatory pressures on changes in capital and riskOne important goal of this study is to assess what impact the risk-based capital standards had on changes in bank capital ratios, portfolio risk, and efficiency levels. To answer this question, an examination of the dummy REG and its interaction term provides some interesting insights. The negative coefficients of REG on both capital equations suggest that banks with low capital buffers increase capital by less than banks with large capital buffers. This result reflects the desire of very-well capitalized banks to maintain a large buffer stock of capital, and the regulatory capital requirement was effective in raising capital ratios among banks which were already in compliance with the minimum risk-based standards. The parameter estimates of REG are negative and significant on ΔNPL but positive and significant on ΔRWA, suggesting that banks with low capital buffers reduce their level of nonperforming loans by more but decrease overall risk-weighted assets by less than banks with high capital buffer. The dummy REG has a positive sign on both efficiency equations, implying banks with lower capital buffer has higher cost efficiency than banks with high capital buffer.

The interaction terms REG×Riskt−1 and REG×Capt−1 shed further light on how the speed of adjustment towards the target level depends on the size of the capital buffer. The coefficients on REG×Capt−1 are significant and positive, indicating that banks with low capital buffer adjust capital toward their targets faster than better capitalized banks. This is in line with the study by Berger et al. (2008) in which they find that poorly capitalized and merely adequately capitalized banks adjust toward their capital targets at a faster speed than do already well capitalized banks. With respect to risk, we find that the coefficient of REG×Riskt−1 has the negative sign when risk is measured by RWA but becomes positive when risk is measured by NPL. The results suggest that banks with low capital buffer adjust NPL faster but adjust RWA slower than banks with high capital buffers.

The interaction terms of REGi,t×ΔCapi,t and REGi,t×ΔRiski,t represent the impact of capital buffer on the management of short term risk and capital adjustments. We find that the coefficient on REGi,t×ΔCapi,t is insignificant when risk is measured by NPL but is significant and negative when risk is measured RWA. This finding indicates that banks with low capital buffer reduce overall risk-taking when capital is increased. We also find the coefficient on REGi,t×ΔRiski,t is significant and negative when risk is measured by NPL but is significant and positive when risk is measured RWA, suggesting that banks with low capital buffer reduce capital holding when NPL is increased but increase capital holding when RWA is increased.

Variables affecting optimal capital structure and efficiency levelsWith regards to the bank specific variables, we find that larger banks (in terms of total assets) tend to be less cost efficient, implying dis-economies of scale for banks. This results are contrary to previous studies where they find large institutions tend to exhibit greater efficiency associated with higher scale economies (Wheelock and Wilson, 2012; Hughes and Mester, 2013). Bank size (SIZE) has a significant and negative effect on changes in capital and RWA but positive effect on changes in NPL. The finding is consistent with literature that larger banks generally have lower degrees of capitalization (Shrieves and Dahl, 1992; Aggarwal and Jacques, 2001; Rime, 2001; Stolz et al., 2004 and etc.). Larger banks have larger investment opportunity sets and are granted easier access to capital markets (Ahmad et al., 2008), which renders their target capital level smaller than the target capital levels of smaller banks. The negative relationship between size and change in RWA can be explained as larger banks are believed to be more diversified and could contribute to a reduction of their overall risk exposure (Lindquist, 2004). The results also show that size has a positive impact on change in NPL, suggesting larger banks tend to increase credit risk (NPL) more than smaller banks. This can be attributed to their Too-Big-To-Fail position, whereby larger banks believe any distress will be bailed out by government assistance.

In addition, the results support the findings of Stolz et al. (2004) and Altunbas et al. (2007) that profitability (measured by ROA) and capital are strongly positively related. Hence, banks seem to rely strongly on retained earnings in order to increase capital. The coefficient of loan loss provision ratio on ΔNPL ratio is positive but negative on ΔRWA ratio. The results are contrary to the finding of Aggarwal and Jacques (2001) where they find U.S. banks with higher loan loss provision have higher risk-weighted assets. Liquidity (measured by loan-deposit ratio) appears to be negatively related to change in capital and positively related to efficiency. There is a strong significant positive relationship between liquidity and change in RWA. Banks with more liquid assets need less insurance against a possible breach of the minimum capital requirements. Therefore banks with higher liquidity generally have smaller target capital levels and may also be willing to take on more risk.

Subsample estimationBanking type characteristics may lead to different business strategies regarding bank lending and capital or cost management, which can result in differences in profitability and risk (Camara et al., 2013). Thus we consider three types of banks: commercial, cooperative and savings banks. Profit maximization is the traditional objective of commercial banks. However, mutual & cooperative banks are owned by their customers and might thus put their interests first (Altunbas et al., 2001). Their core business is often lending and taking deposits from individuals and small business. Savings banks, on the other hand, are generally held by stakeholders such as local or regional authorities and mainly depend on deposit. Moreover, mutual & cooperative and savings banks might experience difficulties in raising capital as much as they would like. We test the robustness of the results by running specifications on each type of banks separately.

Size is also a key factor determining the way credit and market risk, and capitalization levels affect efficiency. Therefore we investigate whether capital strategies differ for large and small banks. We also report estimates derived by using samples of the most and least cost efficient banks defined as the top quartile or bottom quartile cost efficient banks. The aim here is to see if the relationships differ if we look only at relatively cost efficient or inefficient banks.

Overall, estimates on sub-samples are largely consistent with full sample estimates. Table A.1 reports the results for equation where ΔRisk is used as the dependent variable. The results suggest that cooperative banks decrease risk (RWA) more than commercial banks and savings banks do when capital increases. With respect to the impact of capital buffer on the management of short term risk and capital adjustments, we find that the coefficient on REGi,t×ΔCapi,t is significantly negative for commercial banks, insignificant for cooperative banks and significantly positive for commercial banks when risk is measured by RWA. This finding indicates that commercial banks with low capital buffer reduce overall risk taking when capital is increased while savings banks with low capital buffer increase overall risk taking when capital is increased. The table also shows that for large banks with low capital buffers, capital and risk adjustments are positively related while for small banks with low capital buffers, the relationship is negative.

The capital equation in Table A.2 shows that bank size has a significant and negative effect on changes in capital for the most efficient banks but positive effect for the least efficient banks. The efficiency equation indicates that increase in capital increase cost efficiency of commercial banks while adjustments in capital do not appear to have any significant impact on efficiency levels for cooperative and savings banks.

ConclusionFirm’ ability to effectively allocate capital and manage risks is the essence of their production and performance. This paper has provided an understanding on the frontier methodology as a tool for performance measurement. Specifically, we assess the relationships between firm efficiency, capital allocation and risk, using data on a large sample of U.S. banks over the period of 2001–2016. We further look at their relationship by dividing the sample into different size and ownership classes, as well as the most and least efficient banks. Efficiency analysis is conducted using distance functions to model the technology and obtain X-efficiency measures as the distance from the efficient frontier.

The empirical evidence suggests that more efficient banks increase capital holdings and take on greater credit risk (NPL) while reduce overall risk (RWA). This study also finds evidence that capital buffer has an impact on capital and risk adjustments as well as cost efficiency. Moreover, it appears that increasing the capital buffer impacts risk-taking by banks depending on their level of cost efficiency, which is a placeholder for how productive their intermediation services are performed. More cost efficient banks that are well-capitalized tend to maintain relatively large capital buffers versus banks that are not. An additional finding, which is quite important, is that the direction of the relationship between risk-taking and capital buffers differs depending on what measure of risk is used.

This study accounts for the endogeneity of risk and capital decisions in firm production and would provide useful insights to managers on firm performance and important implications for banks as well as other organizations. It will be useful to consider in future research the relevance of the proposed methodology in other industries or across countries. This will also help to assess how different industries and institutional characteristics may impact on firm capital structure and risk decisions and how in turn these choices may affect firm performance.

Estimation for different subsamples: risk equation.

| Commercial banks | Cooperative banks | Savings banks | Large banks | Small banks | Most efficient | Least efficient | |

|---|---|---|---|---|---|---|---|

| Model where risk= RWA Equation 1: DEP = ΔRWA | |||||||

| ΔCapital | −0.962*** | −2.161*** | −1.113*** | −0.800*** | −0.984*** | −0.973*** | −0.994*** |

| Efficiency | −0.119*** | −0.0998*** | −0.102*** | −0.295*** | −0.114*** | −0.233*** | −0.129*** |

| RISKt−1 | −0.337*** | −0.130*** | −0.164*** | −0.337*** | −0.325*** | −0.397*** | −0.328*** |

| Buffer | −0.232*** | −0.147*** | −0.117*** | −0.362*** | −0.226*** | −0.260*** | −0.271*** |

| Size | −1.122*** | −0.602** | −0.927*** | −2.947*** | −1.161*** | −1.635*** | −1.420*** |

| ROA | 0.0742*** | 1.373*** | 0.494*** | 0.0427 | 0.0995*** | 0.000887 | 0.105*** |

| LLP ratio | −0.408*** | 0.0533 | −0.230*** | −0.377*** | −0.397*** | −0.396*** | −0.347*** |

| LTD | 0.177*** | 0.0203*** | 0.0498*** | 0.152*** | 0.166*** | 0.201*** | 0.167*** |

| REG | 1.883*** | 7.824** | 3.786*** | −0.460 | 2.211*** | 3.626*** | 0.519 |

| Crisis | 0.305*** | 0.209* | 0.235*** | 0.0228 | 0.302*** | 0.224*** | 0.310*** |

| REG*RISKt−1 | −0.0209*** | −0.111** | −0.0460*** | 0.00941 | −0.0249*** | −0.0413*** | −0.00387 |

| REG*Δ CAP | −0.172*** | −0.110 | 0.355** | 0.442*** | −0.183*** | −0.0995 | −0.147*** |

| GDP growth | 24.96*** | 14.70** | 19.00*** | 23.20*** | 24.86*** | 24.39*** | 23.15*** |

| Home index growth | 2.951*** | 3.182* | 4.194*** | 4.401*** | 2.993*** | 2.503*** | 3.353*** |

| Observations | 249,647 | 2804 | 13,348 | 9245 | 256,619 | 61,604 | 72,114 |

| Number of banks | 7209 | 68 | 372 | 565 | 7495 | 2448 | 2781 |

| Model where risk= NPL Equation 1: DEP = ΔNPL | |||||||

| ΔCapital | 0.0235*** | 0.0138 | 0.0348*** | 0.0639*** | 0.0237*** | 0.0269*** | 0.0167*** |

| Efficiency | 0.00552*** | −0.0234** | −0.00615* | 0.0181*** | 0.00304*** | 0.0273*** | 0.00832*** |

| RISKt−1 | −0.264*** | −0.306*** | −0.239*** | −0.143*** | −0.268*** | −0.391*** | −0.222*** |

| Buffer | 0.00232* | −0.00345 | −0.00487 | −0.0174*** | 0.000901 | −0.00359 | −0.000199 |

| Size | 0.135*** | −0.0327 | −0.0142 | 0.273*** | 0.108*** | 0.138*** | 0.196*** |

| ROA | −0.180*** | −0.0498 | −0.0137 | −0.112*** | −0.177*** | −0.238*** | −0.120*** |

| LLP ratio | 0.318*** | 0.883*** | 0.512*** | 0.154*** | 0.327*** | 0.232*** | 0.332*** |

| LTD | −0.000380 | −0.00565*** | −0.00249*** | 0.00124 | −0.000605* | −0.00242*** | −2.69e−05 |

| REG | −0.114*** | −0.191 | −0.0798 | −0.0817** | −0.106*** | −0.180*** | −0.0608** |

| Crisis | 0.0343*** | 0.0947 | −0.0342 | −0.00641 | 0.0318*** | 0.0531*** | 0.0174 |

| REG*RISKt−1 | 0.0353*** | 0.141*** | 0.00200 | 0.00681 | 0.0325*** | 0.0868*** | 0.00637 |

| REG*Δ CAP | 0.00436 | 0.402* | −0.0973 | −0.120*** | 0.00767 | 0.0535 | −0.0566** |

| GDP growth | −12.00*** | −11.81*** | −8.948*** | −14.46*** | −11.66*** | −11.92*** | −11.15*** |

| Home index growth | −2.321*** | −3.555*** | −4.081*** | −2.377*** | −2.379*** | −1.912*** | −2.548*** |

| Observations | 249,646 | 2804 | 13,348 | 9245 | 256,618 | 61,604 | 72,114 |

| Number of banks | 7209 | 68 | 372 | 565 | 7495 | 2448 | 2781 |

Notes:

1. Large banks are banks with assets greater than 1 billion and small banks are banks with assets less than 1 billion.

2. Most efficient banks are banks in the top quartile of cost efficiency. Least efficient banks are banks in the bottom quartile of cost efficiency.

Estimation for different subsamples: capital equation.

| Commercial banks | Cooperative banks | Savings banks | Large banks | Small banks | Most efficient | Least efficient | |

|---|---|---|---|---|---|---|---|

| Model where risk= RWA Equation 2: DEP = ΔCAP(Tier 1 ratio) | |||||||

| ΔRisk(RWA) | −0.00705*** | −0.0567*** | −0.0268*** | −0.00727*** | −0.00769*** | −0.00477*** | −0.00767*** |

| Efficiency | 0.000432** | 0.0151*** | 0.00423*** | −0.00103 | 0.000693*** | −0.00366*** | 0.000991*** |

| Capt−1 | −0.941*** | −0.732*** | −0.847*** | −0.916*** | −0.937*** | −0.961*** | −0.934*** |

| Buffer | 0.932*** | 0.713*** | 0.832*** | 0.905*** | 0.928*** | 0.950*** | 0.924*** |

| Size | −0.0195*** | 0.0285 | 0.131*** | 0.0289 | −0.0180*** | −0.0201*** | 0.00728* |

| ROA | 0.0181*** | 0.0316 | 0.0524*** | 0.0155*** | 0.0173*** | 0.0104*** | 0.0211*** |

| LLP ratio | −0.0453*** | −0.161*** | −0.0972*** | −0.0447*** | −0.0468*** | −0.0376*** | −0.0511*** |

| LTD | −0.00109*** | −0.000950 | −0.000425 | 0.000505 | −0.00108*** | −0.00122*** | −0.000504*** |

| REG | −0.332*** | 1.271** | 0.00729 | −0.166* | −0.301*** | −0.316*** | −0.425*** |

| Crisis | 0.0326*** | 0.0493** | 0.0179* | 0.0234*** | 0.0330*** | 0.0246*** | 0.0366*** |

| REG*Capt−1 | 0.0394*** | −0.129** | −0.00164 | 0.0212** | 0.0357*** | 0.0361*** | 0.0477*** |

| REG*Δ Risk | −0.00592*** | −0.00486 | 0.00437 | −0.0104* | −0.00521*** | −0.00128 | −0.00981*** |

| GDP growth | 0.0757 | 2.234** | −0.487 | 0.112 | 0.0336 | −0.0450 | 0.286** |

| Home index growth | −0.0548** | −0.480 | −0.558*** | 0.169 | −0.112*** | −0.183*** | 0.0620 |

| Observations | 249,646 | 2804 | 13,348 | 9245 | 256,618 | 61,604 | 72,114 |

| Number of banks | 7209 | 68 | 372 | 565 | 7495 | 2448 | 2781 |

| Model where risk= NPL Equation 2: DEP = ΔCAP(Tier 1 ratio) | |||||||

| ΔRisk(NPL) | 0.0390*** | 0.0501*** | −0.00800 | 0.110*** | 0.0372*** | 0.0261*** | 0.0453*** |

| Efficiency | 0.000498*** | 0.0212*** | 0.00531*** | −0.00167 | 0.000790*** | −0.00354*** | 0.00110*** |

| Capt−1 | −0.949*** | −0.839*** | −0.878*** | −0.917*** | −0.946*** | −0.967*** | −0.944*** |

| Buffer | 0.940*** | 0.816*** | 0.860*** | 0.909*** | 0.937*** | 0.955*** | 0.933*** |

| Size | −0.0182*** | 0.0731 | 0.148*** | 0.0249 | −0.0159*** | −0.0182*** | 0.00949** |

| ROA | 0.0189*** | −0.0583** | 0.0442*** | 0.0142*** | 0.0179*** | 0.0138*** | 0.0195*** |

| LLP ratio | −0.0431*** | −0.196*** | −0.0929*** | −0.0376*** | −0.0445*** | −0.0328*** | −0.0511*** |

| LTD | −0.00173*** | −0.00161** | −0.000975*** | −0.000475 | −0.00172*** | −0.00164*** | −0.00124*** |

| REG | −0.305*** | 1.630** | −0.0566 | −0.130 | −0.271*** | −0.296*** | −0.405*** |

| Crisis | 0.0294*** | 0.0391* | 0.0156 | 0.0174** | 0.0300*** | 0.0234*** | 0.0321*** |

| REG*Capt−1 | 0.0369*** | −0.162** | 0.00428 | 0.0191** | 0.0329*** | 0.0342*** | 0.0461*** |

| REG*Δ Risk | −0.0444*** | −0.0644 | 0.0175 | −0.118*** | −0.0419*** | −0.0269*** | −0.0546*** |

| GDP growth | 0.279*** | 1.947* | −1.134** | 1.058** | 0.194** | 0.137 | 0.449*** |

| Home index growth | −0.0869*** | −0.746** | −0.708*** | 0.183 | −0.146*** | −0.220*** | 0.0445 |

| Observations | 249,644 | 2804 | 13,348 | 9245 | 256,616 | 61,604 | 72,114 |

| Number of banks | 7209 | 68 | 372 | 565 | 7495 | 2448 | 2781 |

Notes:

1. Large banks are banks with assets greater than 1 billion and small banks are banks with assets less than 1 billion.

2. Most efficient banks are banks in the top quartile of cost efficiency. Least efficient banks are banks in the bottom quartile of cost efficiency.

Estimation for different subsamples: cost efficiency equation.

| Commercial banks | Cooperative banks | Savings banks | Large banks | Small banks | Most efficient | Least efficient | |

|---|---|---|---|---|---|---|---|

| Model where risk= RWA Equation 3: DEP = Efficiency | |||||||

| ΔRisk(RWA) | −0.0105*** | −0.0464* | −0.0140 | −0.0177* | −0.0108*** | −0.00672*** | −0.0122** |

| ΔCapital | 0.0396*** | −0.0984 | 0.00266 | 0.0719** | 0.0361*** | −0.00161 | 0.0561*** |

| Buffer | −0.273*** | −0.125*** | −0.185*** | −0.489*** | −0.267*** | −0.0875*** | −0.360*** |

| Size | −8.339*** | −11.83*** | −12.67*** | −12.02*** | −8.829*** | −4.774*** | −9.159*** |

| ROA | 0.728*** | 1.306*** | 1.262*** | 0.278*** | 0.766*** | 0.284*** | 0.624*** |

| LLP ratio | 0.268*** | −0.0933 | −0.0849 | 0.186*** | 0.263*** | 0.0929*** | 0.299*** |

| LTD | 0.0225*** | 0.00387 | −0.0477*** | −0.00412 | 0.0157*** | 0.00164*** | 0.0245*** |

| REG | 0.749*** | 0.364 | 1.321*** | 0.370*** | 0.776*** | 0.302*** | 0.772*** |

| Crisis | 1.392*** | 1.299*** | 2.397*** | 0.841*** | 1.430*** | 0.399*** | 1.672*** |

| GDP growth | 11.62*** | 12.49* | 17.48*** | 6.407* | 11.87*** | 1.024 | 16.75*** |

| Home index growth | 23.08*** | 16.59*** | 22.31*** | 4.504*** | 22.69*** | 12.00*** | 11.71*** |

| Observations | 249,647 | 2804 | 13,348 | 9245 | 256,619 | 61,604 | 72,114 |

| Number of banks | 7209 | 68 | 372 | 565 | 7495 | 2448 | 2781 |

| Model where risk= NPL Equation 3: DEP = Efficiency | |||||||

| ΔRisk(NPL) | 0.157*** | 1.124*** | 1.440*** | −0.111 | 0.237*** | 0.00737 | 0.0885*** |

| ΔCapital | 0.0496*** | −0.00577 | −0.0243 | 0.0974*** | 0.0441*** | 0.00839 | 0.0731*** |

| Buffer | −0.273*** | −0.130*** | −0.180*** | −0.495*** | −0.266*** | −0.0882*** | −0.361*** |

| Size | −8.344*** | −11.73*** | −12.58*** | −12.02*** | −8.835*** | −4.773*** | −9.161*** |

| ROA | 0.730*** | 1.059*** | 0.990*** | 0.277*** | 0.767*** | 0.287*** | 0.621*** |

| LLP ratio | 0.268*** | −0.470* | −0.277*** | 0.195*** | 0.260*** | 0.0976*** | 0.298*** |

| LTD | 0.0211*** | 0.00111 | −0.0511*** | −0.00478 | 0.0141*** | 0.00110* | 0.0232*** |

| REG | 0.746*** | 0.249 | 1.324*** | 0.371*** | 0.770*** | 0.301*** | 0.771*** |

| Crisis | 1.375*** | 1.110*** | 2.268*** | 0.854*** | 1.404*** | 0.399*** | 1.661*** |

| GDP growth | 13.23*** | 21.94*** | 28.85*** | 4.327 | 14.36*** | 0.917 | 17.32*** |

| Home index growth | 23.01*** | 16.04*** | 24.47*** | 4.393*** | 22.62*** | 11.97*** | 11.70*** |

| Observations | 249,646 | 2804 | 13,348 | 9245 | 256,618 | 61,604 | 72,114 |

| Number of banks | 7209 | 68 | 372 | 565 | 7495 | 2448 | 2781 |

Notes:

1. Large banks are banks with assets greater than 1 billion and small banks are banks with assets less than 1 billion.

2. Most efficient banks are banks in the top quartile of cost efficiency. Least efficient banks are banks in the bottom quartile of cost efficiency.