Some firms have successfully harnessed artificial intelligence (AI) to create unparalleled wealth, while most around them have failed to do so. This managerial challenge has led to recent calls for research to answer the question of how firms can use AI to create and appropriate economic value. This paper answers that question. The paper reviews the existing research and discusses its merits. This review highlights the need for subsequent conceptual reconfigurations of business model theory, the theory of data network effects, and the theory of situated AI for competitive advantage. The integration of these three theories leads to a novel theory: AI-enabled business models for competitive advantage. This paper contributes to the broad literature on technology management, and more specifically to literature on technology-enabled business models and the use of AI. Several important managerial implications are outlined to help firms ensure successful AI use.

Some of the largest firms in the world by market capitalization use artificial intelligence (AI) to create and appropriate value (Chui et al., 2018; Parker et al., 2016). For example, Apple's mobile devices use AI for face recognition in user logins, Spotify employs AI to create personalized music playlists, and Uber deploys AI to estimate ride arrival times. A growing number of firms are investing in the use of AI technologies (Brynjolfsson & McAfee, 2014). Global spending on AI surpassed $100 billion in 2022, and it is projected to reach $300 bn in 2026 (Shirer, 2022). Firms’ uses of AI can deliver a range of business benefits such as a reduction in operating costs (Brynjolfsson et al., 2019; Loske & Klumpp, 2021), higher-quality service provision (Chen et al., 2022; Guo et al., 2023), and overall strategic repositioning (Collins et al., 2021). However, as noted by The Economist, businesses find AI hard to adopt (The Economist, 2020). Even renowned technology firms struggle to create value from their AI investments. For example, IBM had to scale down its Watson initiative, and Amazon rolled back its AI-enabled recruitment process (Jeans, 2020). Indeed, studies suggest that the overwhelming majority of AI investments fail (Ransbotham et al., 2019; Tse et al., 2020).

These business challenges are reflected in the recent research guidepost noting that “it has become increasingly important to understand how organizations can use AI tools to create and capture value” (Berg et al., 2023, p. 2). Unfortunately, the existing research offers inconclusive answers to that question (Åström et al., 2022; Cao, 2021; Haftor et al., 2021; Enholm et al., 2022; Mele et al., 2018; Milkau, 2019; Shollo, Hopf, Thiess & Müller, 2022). Therefore, the present study seeks to answer the question: How can firms use AI to create and appropriate economic value? More specifically, the focus is on firms’ uses of AI to establish competitive advantage rather than mere cost efficiency with short-term benefits (Porter, 1985). Although the scholarly objective of this study is to provide a plausible answer to this question, the managerial aim is to inform how firms should invest in AI use and thereby help them realize strategic benefits from such investments. To address this research question and the underlying managerial challenge, a novel theory is formulated: AI-enabled business models for competitive advantage.

This paper first reviews the existing research on value creation and appropriation from the use of digital technologies in general and then turns its focus specifically to uses of AI. That review identifies both strengths and limitations in the theory and thereby a key knowledge gap, which is targeted by this paper. Using narrative modeling (Alvarez & Sachs, 2023), several bodies of theory are examined and then employed to formulate a new theory (Dubin, 1978). Thus, a conceptual extension of business model theory is proposed. This proposal integrates business model theory with the theory of data network effects and the theory of situated AI. This theoretical development provides a novel answer to the research question posed in this paper.

In summary, the proposed theory explains that a firm's competitive advantage, and thereby its sustained high performance, is conditioned by its evolutionary activation of business model themes as sources of value creation and appropriation. The firm first activates the novelty and efficiency business model themes. As a response to imitating firms, it then evolves to activate the lock-in and complementarity business model themes. As a response to peers’ further imitations, the firm attempts another activation of novelty and efficiency, iterating the evolutionary cycle of business model theme activation (Costa Climent & Haftor, 2021). In doing so, the firm's business model architecture is based on the use of AI, which is positioned where it can realize data network effects. These effects enable the activation of the lock-in business model theme, which enables the firm to create and appropriate economic value. The firm thus discourages customers, suppliers, and other actors from migrating from its business model to that of competitors, while generating a unique database that allows it to use AI and thereby produce unique services. This privileged ability will raise entry barriers for new competitors, while locking in current actors and attracting new customers. Finally, the embedding process of AI use within the firm's business model architecture is guided by grounding and bounding, while reconfiguration adapts the firm's business model and its AI use to changing contexts.

The literature: value creation from the use of artificial intelligenceIn broad terms, for the purposes of this research, AI is understood as a machine that completes cognitive tasks that were previously conducted only by humans (Davenport, 2018; Raisch & Fomina, 2023). AI is now distinguished by its ability to learn from large sets of data that can inform a machine's decision making and thereby produce digital agency (Faraj et al., 2018; Kemp, 2023). Conventional digital technologies conduct their operations following prior instructions such as if-then statements from a human programmer. The behavior of such a machine is thus a direct reflection of the instructions of a programmer (Alpaydin, 2016). AI-enabled systems, in contrast, are given a problem or task along with algorithms that identify patterns in the data sets that are provided, which are used to instruct the machine. Hence, the machine's behavior is not a direct reflection of the human programmer. Instead, it is conditioned by patterns identified in the data (Castelvecchi, 2016; Kemp, 2023; Murray, Rhymer & Sirmon 2021). The literature offers various distinctions between types of AI. One is between discriminative AI and generative AI (e.g., Jebara, 2004). Another distinction is between predictive AI and generative AI (Raisch & Fomina, 2023). In this paper, it is assumed that discriminative models are also predictive models because the former classify data into predefined categories, whereas the latter also offer regression or prediction of continuous values. This paper focuses on the use of predictive AI.

Finally, in this paper, value creation refers to situations where an actor, such as a firm, provides a value proposition to another actor. Such a situation leads to the exchange of value propositions between actors that lowers costs or raises performance at the receiving actor's end (Porter, 1985). Value appropriation then occurs when the providing actor receives in return a value proposition from the initial receiver (Amit & Schoemaker, 1993).

The productivity paradox of digital technologiesThe quest for understanding how the use of digital technologies can enable a firm to create and appropriate economic value is by no means new. It existed long before the recent growth in AI adoption. Following a decade of unparalleled industrial investment in the uses of digital technologies in the United States, the Noble Laureate R. Solow (1987, p. 36) noted the following: “You can see the computer age everywhere but in the productivity statistics.” This observation can be regarded as the seed for a comprehensive research program into how firms can use digital technologies to create and appropriate economic value (Brynjolfsson, 1993; Brynjolfsson & Saunders, 2009). The key research findings from that program are summarized in the next paragraph.

A firm's acquisition and use of digital technology do not necessary lead to the creation and appropriation of economic value (Brynjolfsson & Hitt, 2003). A specific digital technology must be used in a particular manner to contribute to value creation and appropriation. A particular manner of digital technology use refers to the alignment between digital technology's functionality and usability and the firm's operations and technology users (Coltman et al., 2015; Gerow et al., 2014; Wu & Chen, 2017). It also depends on the fit between the technology-enabled operation and the firm's context (Amit & Zott, 2001). An example is when a particular e-commerce solution makes it easier for customers to access a product. To achieve these two types of alignment, studies have shown that a number of factors must be deliberately synchronized (Brynjolfsson & Milgrom, 2013). An adopted digital technology application must be aligned with customized work processes, workers’ knowledge, skills, and motivation, and decision-making authority (Brynjolfsson & Saunders, 2009).

The business model as a means of harnessing value from digital technology useStudies have further shown that there are four generic types of configuration of firm factors and digital technology use that lead to economic value creation and appropriation (Amit & Zott, 2001; Zott & Amit, 2008). These four configurations are conceived as a firm's business model. A business model has an underlying business model architecture that may or may not activate one or more business model themes. A business model architecture is understood as a firm's specific activity system, executed by a firm's internal and external actors. These actors interact in a dedicated order, exchanging value by creating exchangeables, thereby giving rise to economic value creation and appropriation (Amit & Zott, 2015; Teece, 2010; Zott & Amit, 2010; Zott et al., 2011). The four generic types of business model configurations are viewed as four distinct business model themes. A firm may use one or more themes in its competitive market engagements (Amit & Zott, 2001; Leppänen et al., 2023). The four business model themes are novelty, efficiency, complementarity, and lock-in Amiy and Zott (2001); Zott and Amit (2007), 2008.

The novelty business model theme means that the firm uses digital technology to conduct business in a way like no other firm in the marketplace. This novelty may lead to disruption of the market, as in the case of e-Bay with the auctions market (Comberg & Velamuri, 2017). The efficiency business model theme means that the firm uses digital technology to conduct business in a manner that requires fewer resources within the firm's business model architecture than competitors. This theme is illustrated by Amazon's initial online book-selling business model compared to all brick-and-mortar businesses (Ritala et al., 2014). The complementarity business model theme refers to a firm's ability to bundle any combination of offerings, activities, and resources to create synergies. This theme is exemplified by Amazon's consumer business model, which offers a large portfolio of consumer goods and thereby enables cross-selling to capitalize on established customer relations (Ritala et al., 2014). The lock-in business model theme refers to a firm's ability to discourage actors (customers, suppliers, forwarders, etc.) from migrating away from its business model to that of another firm. There are several ways for a firm to establish lock-in effects. One is through sunk costs (Schmalensee, 1992). There are also three kinds of network effects: direct network effects, indirect network effects (Katz & Shapiro, 1985; Economides, 1996), and, recently, data network effects (Gregory et al., 2021).

Crucially, empirical studies have shown that a firm's ability to use digital technology to activate a certain combination of business model themes contributes to its high performance (Zott & Amit, 2007; Kulins et al., 2016; Leppänen, George & Alexy, 2023) Studies have also shown that a firm's business model accounts for economic performance, complementing performance factors (Amit & Zott, 2001; Sohl et al., 2020; Zott & Amit, 2007) such as country, industry, corporate structure, corporate focus, and products (Hawawini et al., 2003; McGahan & Porter, 2002; Porter, 1985; Rumelt, 1991; Sohl et al., 2020). Hence, given two firms with a similar corporate structure and focus, similar products that target the same customer base, and the same industry and country, one of the two firms may outperform the other because of its use of a different business model, even if the two firms use similar digital technologies. Such a case is illustrated by the head-to-head competition between Zara and H&M in the fast-fashion industry (Lanzolla & Markides, 2021).

Even though business model theory has advanced the overall understanding of how the use of digital technologies can give rise to a firm's economic value creation and appropriation (Furr et al., 2022; Snihur & Eisenhardt, 2022), it also has certain limitations. First, the theory explains that a firm must configure its business model architecture in terms of activities, actors, actor interactions, governance, offerings or exchangeables, and technology uses (Amit & Zott, 2001, 2015; Haftor & Costa, 2023; Teece, 2010; Zott & Amit, 2010) to activate one or more business model themes (Zott & Amit, 2007, 2008). However, it does not explain how a firm should configure its business model architecture to activate these business model themes. More specifically, the theory is also silent on how to align technology with the remaining parts of the business model architecture. This gap is unfortunate because it means that the theory informs managers of what they should seek to establish (i.e., activation of certain business model themes) but does not inform them about how to do it, leaving it up to the managers’ experimentation.

A second limitation of business model theory is that it regards digital technologies as a monolithic concept (Amit & Zoot, 2001). This view is a feature of much of the technology management research, which black-boxes technology and thereby disregards its unique characteristics and hence its unique capabilities (Orlikowski & Iacono, 2001). This limitation is particularly worrying in the case of AI technologies because they have unique characteristics that other digital technologies do not. AI technologies are the first to offer an unparalleled capability for learning from data sets (Meyer et al., 2014). Again, this limitation of business model theory is unfortunate because it is not enough for managers to decide to invest in using AI. Instead, the question should be how to harness the unique capabilities of AI for successful value creation and appropriation.

These two limitations—knowledge gaps in research terms—are related. Answering the first gap also requires responding to the second one and vice versa. It is essential to understand both how to configure a business model architecture and how to synchronize it with AI's unique capability to learn in order to achieve deliberate activation of one or more business model themes that give rise to superior business performance. The present study offers proposals to fill these gaps and overcome these limitations of business model theory.

As explained, business model theory ignores the unique learning capability of AI technology. Therefore, attention must turn to two recent theoretical contributions. Each, in its own manner, accounts for AI's learning capability. These theoretical contributions are the theory of data network effects and the theory of situated AI for competitive advantage.

Data network effectsUnlike business model theory, the theory of data network effects accounts for AI's unique learning capability (Gregory et al., 2021, 2022; Clough & Wu, 2022). According to this theory, a user of an AI-enabled service (e.g., road navigation) will perceive increasing user value from such a service depending on how much it is used by other users. The more people use an AI-enabled service, the more data will be generated. In the road navigation example, these data might relate to past, current, and future traffic situations. This increase in data improves the learning capability of the AI-enabled service because it means that more specific data patterns will be identified. Such patterns then enable more accurate predictions (e.g., about traffic delays). These better predictions provide a higher quality service to users, for example identifying the fastest routes at any given time, which may not be the shortest. This service increases perceived user value compared to a service with smaller data sets. With data network effects, a user's perceived value is driven by the AI's speed and accuracy of predictions (Hagiu & Wright, 2023; Karhu, Heiskala, Ritala & Thomas, 2024).

This relationship is moderated by data ownership, legitimacy, and user-centric design. Data ownership refers to the quality and quantity of data needed for the specific service. Legitimacy refers to personal data use and prediction explainability. If the AI-enabled service uses personal data in an illegitimate manner, users will likely react negatively. Likewise, if predictions can be explained in a reasonable manner to users, when requested, then they will be more likely to accept the service. The converse is also true. Inexplicable predictions are likely to alienate users. User-centric design refers to a user's performance expectancy and effort expectancy. If the user expects high performance from a service for little effort, then the user will be more likely to use that service and will thereby generate new data to feed the data network effects. Again, the converse is true. An expectation that a service will perform poorly and will require considerable effort is likely to discourage users.

In sum, data network effects account for AI's unique learning capability. The more an AI-enabled service is used, the more data are generated and hence the better the service becomes. This outstanding service further increases users’ perceived value, which incentivizes users to use the service again, thereby generating even more data. The loop then iterates (Gregory et al., 2021).

Although the theory of data network effects offers an ingenious account of AI's unique learning capacity, it only focuses on an individual's perceived value creation. It does not account for economic value creation from AI at the firm level (Costa-Climent et al., 2023). This economic value creation is the focus of the present paper. This focus on individual user value does not mean that this theory cannot help answer the question of how a firm can use AI to create and appropriate value. Indeed, AI must in some sense have the potential to contribute to a firm's value creation and appropriation. Anticipating the second part of this study, the theory of data network effects and business model theory both offer insights in order to answer that question. At this point another theory should be introduced to provide another part of the answer to the overarching research question.

Situated artificial intelligence for competitive advantageThe theory of situated artificial intelligence for competitive advantage focuses on how firms use AI to build competitive advantage (Kemp, 2023). The theory explains that a firm's competitive advantage will be achieved from its AI-enabled organizational capabilities. These capabilities must have the right specificity, development costs, and environmental fit to give rise to competitive advantage and enable value creation and appropriation. Accordingly, the theory proposes that a firm must pursue three kinds of organizational activities: grounding, bounding, and recasting. Grounding refers to a firm's “allocation of strategic attention and organizational resources to the process of selectively endowing AI with historical sensibility” (Kemp, 2023, p. 6). In this sense, grounding provides AI with deliberate experiences that shape its perspective on task performance. Grounding activities are designed to transform a generic AI technology, such as ChatGPT, into a unique AI customized for its intended task. Second, bounding refers to “anchoring AI in a nexus of contracts” (Kemp, 2023, p. 8) and thereby attempting to hinder expropriation hazards that benefit competitors. Third, recasting refers to “the adaptation of internal technologies and routines to contextualize AI in a firm's system of tasks, relational and strategic interdependencies” (Kemp, 2023, p. 9). It is necessary because a firm's environment is dynamic, and changes in the environment make an established AI use less relevant in the marketplace. In sum, the key hypothesis of this theory is that the “greater the use of grounding, bounding and recasting during capability development and deployment, the greater the likelihood of establishing a competitive advantage with an AI-driven capability” (Kemp, 2023, p. 9). This relationship is moderated by the characteristics of the specific AI (i.e., supervised vs. unsupervised learning and degree of explainability of AI-made decisions), as well as by the firm's environmental dynamism.

Although this theory of situated AI for competitive advantage makes a major contribution to the understanding of how a firm can use AI for value creation and appropriation, it has several potential limitations. First, the grounding of AI technology can also “undermine core capabilities and values” (Moser et al., 2023, p. 2) of a firm through the mechanization of a firm's centrally held values. AI's mechanical nature means that it seeks an optimal solution to a given problem. However, complex business tasks seldom have a single optimum solution but instead require a balance between divergent objectives and underlying values (Mintzberg et al., 1976). This challenge is illustrated by Facebook's drive to maximize the number of views to please advertisers. However, this drive negatively affected its core task of connecting communities of people, which made them stop using Facebook (Bucher, 2017). Therefore, grounding can cause a misfit with the context. Another criticism relates to the theory's proposal that supervised learning techniques and explainable AI will enable situated AI capability because human participation in grounding and bounding will give rise to a unique capability. Moser et al. (2023) noted that there is no reason why unsupervised learning AI with a unique data set could not produce unique insights and thus capabilities. Also, supervised learning and explainable AI may give rise to algorithmic inertia (Glaser et al., 2023), which may hinder accurate recasting and thereby adaptation to environmental dynamics.

Another set of criticisms of this theory suggests that it does not clearly distinguish between a firm's ability to establish competitive advantage by using AI and its ability to use AI to create and appropriate value (Li et al., 2024). A firm without an AI-enabled competitive advantage can use AI to create and appropriate economic value in parity with its competitors (Li et al., 2024). However, the argument is that a firm that has established an AI-enabled competitive advantage will necessarily create and appropriate economic value. Furthermore, the theory of situated AI is built on an intra-firm view of AI use (i.e., firm-internal capabilities). It thereby ignores the fact that a firm's economic value creation and appropriation often involve firm boundary spanning activities and actors linked by technologies, as illustrated by firms such as Amazon, Airbnb, and Uber. Hence, in its current state, the theory of situated AI offers a limited account of a firm's use of AI to create and appropriate economic value.

The position defended in this paper is that, although the theory of situated AI for competitive advantage is useful for answering how firms can use AI to create and appropriate economic value, it offers only partial insight and disregards other insights from the existing research. For example, business model theory provides a more comprehensive understanding of a firm's value creation and appropriation than organizational capability theory, which underpins the theory of situated AI for competitive advantage (Amit & Zott, 2001; Furr et al., 2022; Snihur & Eisenhardt, 2022). In contrast, business model theory is founded on a synthesis of the theory of a firm's value chain Porter, (1985), strategic capabilities (Barney, 1991), innovation (Schumpeter, 1934, 1942), transaction costs (Williamson, 1975, 1979, 1983), strategic networks (Doz & Hamel, 1998; Gulati et al., 2000), and externalities or network effects (Arthur, 1990; Katz & Shapiro, 1985). This theoretical foundation allows the firm's business model to account for the firm's boundary spanning business model architecture (Amit & Zott, 2001; Zott et al., 2011). This boundary spanning conception admits that value creation and appropriation do not originate only within a firm but can arise within a firm's ecosystem of actors linked together in a specific manner to form an activity system where they exchange value in a specific way (Amit & Zott, 2015; Zott & Amit, 2010). For example, Apple's App Store requires multiple actors and exchanges to create value. It requires the iPhone hardware and its operating system iOS, one or more telecommunication network operators, and firms that supply telecommunication systems. It also requires firms that develop apps to be downloaded from the App Store for customers, who may pay a fee and who provide user data. From this perspective, multiple actors must be coordinated within a business model architecture and fit with each other to create a business model where business model themes emerge and where all actors create and appropriate value in some way or else cease to participate (Brandenburger & Stuart, 1996). Therefore, whereas organizational capabilities account for value creation from the supply side only (Winter, 2003), the business model accounts for value creation from both the supply side and the demand side, recognizing a firm's potential network externalities (Amit & Zott, 2001; Massa et al., 2017).

Increased computing power, data communications capabilities, and algorithmic advances in recent decades have enabled development of a variety of novel business model architectures (Furr et al., 2022), sometimes generating wealth at a pace and scale never before seen (Van Alstyne et al., 2016). It has broadened the understanding of firms’ value creation and appropriation from products to platforms, from firms to ecosystems, and from people to algorithms (Furr et al., 2022). Such changes are often associated with a shift in the profit logic from variable costs to scale-free economics of information (Furr et al., 2022). The more comprehensive notion of a firm's business model is based on a dynamic and systemic understanding of value creation and appropriation, unlike the more limited notion of traditional strategic positioning of a firm based on its internal capabilities. As Snihur & Eisenhardt (2022), p. 758 explain, “the business model is rapidly replacing strategy as the most significant source of competitive advantage.”

Therefore, this paper argues that the business model is more appropriate as a conceptual foundation for understanding how a firm can use AI to create and appropriate value than the notion of organizational capabilities that underpins the theory of situated AI for competitive advantage. Therefore, business model theory is adopted to provide the theoretical foundations of this research. However, the valuable insights of the theory of situated AI for competitive advantage are not disregarded. In the next section, these insights are employed, together with the insights of the theory of data network effects, to develop a new theory to answer the research question at hand.

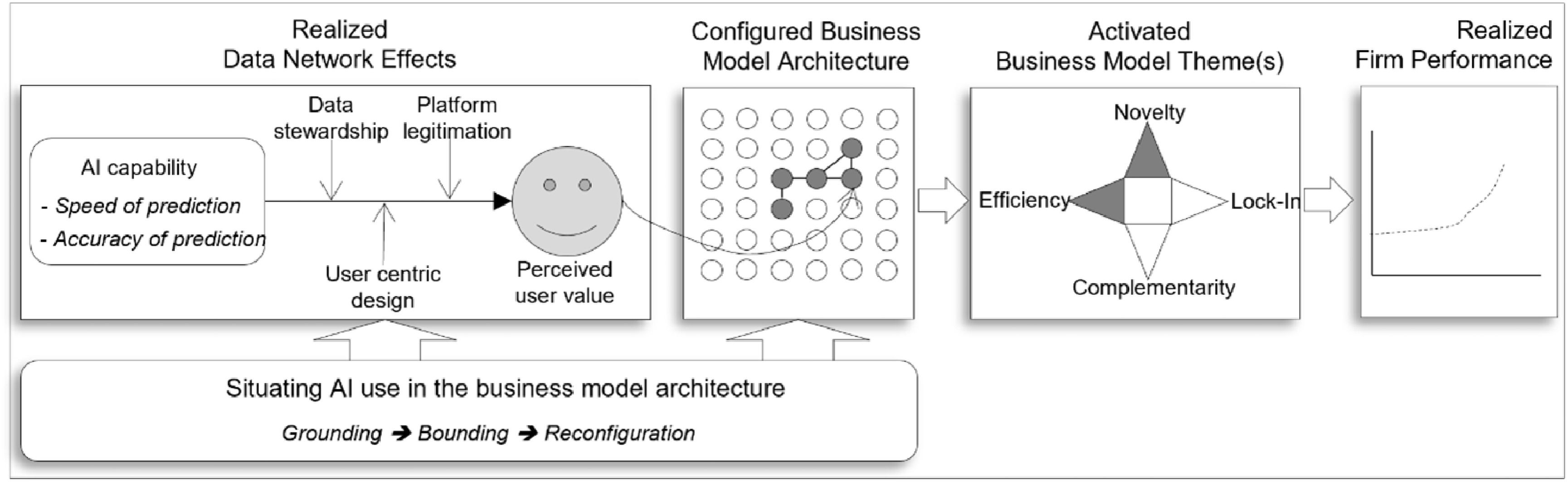

Strategic use of AI for firms’ value creation and appropriationFig. 1 gives an overview of the proposed theory of AI-enabled business models for competitive advantage. To start with, as a firm makes large investments in the development, deployment, and use of AI, it often aims at major business benefits in terms of economic value creation (Porter, 1985). This aim is referred to as a firm's business performance gain, which can be measured by various indicators, depending on the specific firm and its situation (Franco‐Santos et al., 2007). Examples of such indicators include market share, revenues, net profit margin, return on investment, and return on assets (Arifeen et al., 2014). Another example is Tobin's Q (Brainard & Tobin, 1968; Tobin, 1969), which is calculated as the ratio of a firm's market value to its total assets (Visnjic, Wiengarten & Neely, 2016). The question addressed in this paper is: How can a firm use AI to create and appropriate value? This value is manifested as business performance. The proposed theory offers an answer, as depicted in Fig. 1.

From right to left: Realized firm performance is conditioned by the activated business model themes, which emerge from the configured business model architecture. Within that architecture, AI use is embedded to realize data network effects. This realization is based on grounding and bounding to ensure that the AI is aligned with the business model architecture and its socioeconomic context.

Evolutionary activation of business model themesTo achieve superior business performance to competitors, business model theory states that a firm must activate one or more of the four available business model themes of novelty, efficiency, complementarity, and lock-in Amit and Zott, (2001). More specifically, recent empirical studies have shown that, to achieve very high performance, a firm must combine the novelty and efficiency business model themes (Leppänen et al., 2023). This finding confirms the theoretical argument that, to realize sustained superior performance, a firm must start with the novelty and efficiency business model themes (Costa Climent & Haftor, 2021). In such cases, a firm's success will most likely attract imitators (Lieberman & Asaba, 2006). Hence, the firm will need to evolve by activating the lock-in business model theme. Lock-in activation discourages actors in the firm's business model (most notably customers and key suppliers) from migrating to other firms. To defend against imitating competitors, the firm must then activate complementarity to retain the current actors in its business model and attract new customers. If the firm successfully activates complementarity, competing firms will probably imitate it again Lieberman and Asaba (2006). Successfully activating lock-in will stop the current customer base from migrating to competitors and will thus constitute an entry barrier. At that point, the firm has two options to protect its superior performance. One is to activate further lock-in Haftor et al. (2023). The other is to attempt to introduce another novelty in the business model, thereby repeating the evolutionary cycle of business model theme activation (Balboni et al., 2019; Costa Climent & Haftor, 2021). As explained earlier, studies have shown that the use of digital technologies may be a key enabler for this business model evolution (Haftor & Costa Climent, 2023; Leppänen et al., 2023). However, studies do not indicate how to configure a business model to use AI technology so that the firm can create and appropriate economic value. This explanation is the next step of the theory proposed in this paper.

Positioning AI use within the business model architectureThe business model architecture is understood as the configuration of internal and external actors, which are both individuals and organizations, that interact in specific sequences and means of transactions. This architecture gives rise to a firm boundary spanning activity system, which may activate one or more business model themes, depending on the configuration of the architecture (Amit & Zott, 2015; Teece, 2010; Zott & Amit, 2010). A business model architecture enables partaking actors to exchange offerings (e.g., products, production factors, and compensation), thereby creating and appropriating value for all.

For example, Uber develops and operates smartphone software that matches riders with drivers (Boshuijzen-van Burken & Haftor, 2017; Kim et al., 2018). Accordingly, external actors, car drivers, car owners, and passengers all partake in Uber's business model. Initially, this model activated novelty and efficiency (Garud et al., 2022). However, there are also other actors in this business model. For instance, investors and owners of Uber, employees, and numerous suppliers also partake. These and other actors exchange offerings, hence creating and appropriating multiple forms of value. If they do not, they will ultimately leave that business model architecture, which will potentially modify the activation of the business model themes.

A firm can thus configure its business model architecture to activate the lock-in business model theme. Lock-in can be activated by realizing the three kinds of network effects: direct or single-side network effects, indirect or multi-side network effects (Church et al., 2008; Katz & Shapiro, 1992), and data network effects (Gregory et al., 2022). This last type of effects is what enables value creation from the use of AI. Uber offers an effective illustration of activation of lock-in by realizing indirect network effects and data network effects (Van Alstyne et al., 2016). The more drivers that Uber can make available for riders in a given time and place, the shorter the pick-up time will be. Hence, more riders will be attracted because they need to wait for less. Likewise, the more riders that Uber forwards to drivers, the lower idle time drivers will have and the higher their revenues (and profitability) will be. Thus, Uber can lower its fees, attract even more riders, and hence attract even more drivers. The spiral will continue until saturation is reached. It can be maintained until the established demand or supply levels are disrupted for any reason (Boshuijzen-van Burken & Haftor, 2017). Accordingly, Uber activates lock-in on both the drivers and the riders. Riders are dissuaded from leaving Uber's business model because it offers the best revenues, whereas riders have no reason to leave Uber, because of its lower fees and faster pick-up times than competitors. If all else remains the same, there is no reason for a driver or a rider to migrate to a competitor that has not realized indirect network effects.

As noted earlier, the business model literature has only started to explore the link between AI use and business model architecture (Costa-Climent et al., 2023; Haftor et al., 2021). The existing literature suggests (a) that a firm must use AI to activate data network effects (Gregory et al., 2021) and (b) that such an activation must occupy a certain position within the business model architecture to create strategic benefits (Haftor et al., 2023). In the case of Uber, AI technology is used to predict demand for how many cars will be needed in a certain time and place. For this purpose, Uber uses real-time data and a large set of historical data that its operations have generated (Boshuijzen-van Burken & Haftor, 2017). The more data that Uber's operations generate for a given time and place (e.g., Friday afternoon from a certain office to a residential area), the faster and more accurate demand prediction will be. This insight is important because it allows Uber to influence drivers by signaling where the growing demand will be and adjust the fare price (and thus drivers’ revenue), which is also based on AI-generated predictions of what customers will be willing to pay at a given time and place and what price levels will make the fare attractive to drivers. Such use of AI generates operational efficiency that is not possible to achieve without large sets of data and the use of AI. This AI-enabled operational efficiency constitutes an entry barrier for new firms (Porter, 1985). If a new firm wishes to compete with a similar service, Uber has the key advantage of matching varying demand with supply more optimally because it has generated a unique data set from actual operations. This optimal matching is not possible without such data. It hence constitutes a source for superior performance and acts as a deterrent to potential entrants. Thus, Uber has positioned its realization of data network effects in a strategic place within its business model architecture. This positioning activates the novelty and efficiency business model themes by determining, in a novel manner, the balance between supply and demand and thus the success or failure of Uber's business. Crucially, such a positioning of AI use within the business model architecture also activates lock-in, which discourages drivers and riders from migrating and constitutes an entry barrier for newcomers. Conversely, without the use of AI in that position within the business model architecture, Uber will face an increasing risk that, under growing demand for cars that the firm fails to match, riders will switch to another provider, which will also demotivate drivers. Alternatively, Uber could have positioned the use of AI in another place within its business model architecture such as to obtain optimal advertising of services. Although such an AI use could certainly create some value by optimizing marketing resources, it would have no strategic impact for Uber's business success in terms of dissuading drivers and riders from leaving and raising entry barriers to protect against new competitors. In summary, a firm's use of AI requires deliberate positioning within the business model architecture so as to realize powerful data network effects that can activate lock-in, attract a customer base, hinder migration to competitors, generate a unique database, and raise entry barriers.

Grounding of AI useThe previous discussion shows the need for a firm to position AI use correctly within its business model architecture (architectural positioning) to realize data network effects that generate a strategic advantage. A subsequent question is: How should the firm do so?

The theory of situated AI for competitive advantage provides a way of answering that question. Situating AI is understood as “the process of contextualizing AI's agency in a firm by collectively anchoring AI in the firm's experiential, relational, and strategic systems” by means of a “purposeful and concerted action across an organization” (Kemp, 2023, p. 6). However, as explained earlier, this proposal assumes that firms’ value creation and appropriation is rooted in internal capabilities (Barney, 1991) that are valuable, unique, difficult to imitate, and aligned with the external environment (Sirmon et al., 2007). It has already been shown that the business model notion of value creation and appropriation extends the firm-internal notion of value creation and appropriation to a firm boundary spanning activity system operated by deliberately linked internal and external actors. Therefore, the proposal is to modify the notion of “contextualizing AI's agency” (Kemp, 2023, p. 6), shifting it from being limited to the confines of a firm's internal capabilities to being able to extend to a firm's boundary spanning business model architecture.

Kemp proposed three key activities for successful AI contextualization: grounding, bounding, and recasting. The first, grounding, accounts for the “allocation of strategic attention and organizational resources to the process of selectively endowing AI with historical sensibility” (Kemp, 2023, p. 6). It thereby refers to shaping and steering the use of AI technology for a selected operational task such as Uber's predictions of rider demand. Grounding is crucial to counter the generic nature of AI. Failure to provide the right grounding may produce suboptimal AI behavior. For example, if Uber's predictions for rider demand on Friday afternoons at Heathrow airport outside London disregard a Friday public holiday, then the AI-enabled demand operation may operate based on average Friday afternoon numbers. Consequently, it might incentivize a larger rider fleet than necessary to go to the airport, even on a Friday public holiday with only, say, 20 % of the usual number of travelers and thus much lower demand for rides. Many Uber drivers would therefore have to return empty back to the city, potentially motivating them to leave Uber's business model.

To prevent such situations, careful grounding may include selecting data structures and types from the firm's internal and external databases that must be fed to the AI for identification of patterns and hence predictions. Grounding may further include surveys of customers, customers’ customers, and the public, as well as vendors and other actors partaking in the firm's business model. It may also include supervised AI learning (Murphy, 2012) with both internal and external actors. The notion of grounding in this paper is thus derived from a broader view, moving from firm-internal capabilities (Barney, 1991) to a firm boundary spanning business model architecture (Amit & Zott, 2001; Teece, 2010).

An example of Uber's failure to establish successful grounding relates to the tragic events on June 3, 2017, when a terrorist attack took place near London Bridge in the UK (The Guardian, 2017). It resulted in eight deaths and 48 injuries. People in the surrounding area wanted to flee the site of the attack, and many ordered an Uber. This situation created massive local demand for rides, which made Uber's AI automatically raise the price dramatically. Uber's staff eventually intervened and adapted the price surge, but this unethical behavior caused a massive public outcry, challenging the legitimacy (Gregory et al., 2021) of Uber's use of AI and thus its operations and business. It even caused some riders to abandon the company (Boshuijzen-van Burken & Haftor, 2017). To prevent such situations of suboptimal AI behavior, AI grounding must account for a firm's entire business model, including its external actors. It must not be limited to a firm's internal capabilities only.

Bounding of AI useKemp proposed that a firm's use of AI should be developed by “anchoring AI in a nexus of contracts” (Kemp, 2023, p. 8) so that “a firm can overcome internal expropriation hazards and can influence which AI-driven capabilities competitors can develop” (Kemp, 2023, p. 9). This goal can be achieved by measures such as encrypting data, cybersecurity, and non-disclosure agreements with employees and vendors. Such bounding may certainly prevent competitors from imitating AI use and thus has major benefits. However, it is focused on the defense of a firm's internal capabilities. Such defensive measures tend to be slow, costly, and imperfect in terms of legal contracts (Giat & Subramanian, 2013). The notion of bounding proposed in this paper broadens the concept from firm-internal capabilities to a firm boundary spanning business model architecture and from defensive penalties to incentives for mutual benefit (Corsaro & Snehota, 2011). Hence, through the strategic positioning of AI use in the business model architecture and then the grounding of AI use, the actors that partake in establishing and operating a firm's AI may be both internal and external to the firm. These actors partake in the firm's business model architecture for value creation and appropriation. Because the use of AI in the firm's business model architecture is inherently linked to the actors that partake in this architecture, then bounding a firm's AI use is inherently related to bounding actors that partake in the firm's business model architecture. For example, as AI engineers develop and deploy the AI uses for Uber's demand predictions, these engineers can be not only prevented from disclosing their work but also incentivized not to do so through options and bonus programs.

Configuration of AI-enabled business modelsAs the third AI-situating activity, Kemp proposes recasting, defined as “the adaptation of internal technologies and routines to contextualize AI in a firms’ system of task, relational and strategic interdependencies” (Kemp, 2023, p. 9). Recasting “involves the orchestration of activities such as customizing AI, restructuring links between different AI algorithms within a single conjoined routine, and promoting or demoting algorithms based on previously demonstrating alignment (or misalignment) with firm's capabilities” (Kemp, 2023, p. 9). Recasting accounts for situations where an AI-enabled operation is optimal for a given task, routine, or capability but incompatible with other interrelated tasks, routines, or capabilities. The need to align a local use of AI with its context is illustrated by Uber's price surge during the London Bridge terrorist attack.

Although recasting may be central to ensure that a firm's use of AI is aligned with its immediate context, it is again based on a firm-internal assumption, which is restrictive. The proposal in this paper is to assume a business model notion of recasting instead. Such a notion accounts for the firm's boundary spanning business model architecture (Amit & Zott, 2001). Because adjusting the use of AI is closely related, and often inherent, to the actors involved in its use, such adjustments should account for the entire business model reconfiguration, not just local technology use changes. For example, Uber reconfigured its business model when it entered various European Union markets, at which point its original business model became illegitimate for legal or sociocultural reasons (Niemimaa et al., 2019). Uber reconfigured its original business model to adapt to the local context by, for example, switching from transporting people to food delivery in Barcelona (Gilibert et al., 2019). Hence, Uber changed the actors that partake in its local business model and adjusted the use of AI to fit with those actors’ needs. In this regard, the reconfiguration of AI use proposed in this paper resembles the notion of dynamic capabilities of a business model (Heider et al., 2021; Teece, 2014).

DiscussionSome firms succeed in creating and appropriating high economic value from their use of AI (Parker et al., 2016). However, most fail (Ransbotham et al., 2019; The Economist, 2020; Tse et al., 2020). This challenge is reflected in the recent call for research on how firms can use AI to create and appropriate economic value (Berg et al., 2023). In response to this call by focusing on sustainable economic value creation from a firm's AI use, this paper develops a theory to answer this question.

This paper's message can be explained in several steps. First, a firm's sustained high performance is conditioned by its evolutionary activation of business model themes of value creation and appropriation. A firm can disrupt a marketplace by jointly activating the novelty and efficiency business model themes. If this activation is successful, then imitating firms will probably adopt similar business model configurations. The firm must then respond by activating the lock-in theme, and, if possible, the complementarity theme. Rivals will probably attempt to imitate the firm again. Therefore, the firm must reactivate novelty and efficiency, repeating this cycle of business model theme activation.

Second, in this evolutionary activation of business model themes, the firm must position the AI use within its business model architecture in such a way that the realized data network effects help activate these business model themes, particularly novelty and lock-in. These two themes should discourage customers, suppliers, and other actors from migrating to competitors. They will also provide a unique database that will create entry barriers for newcomers, which lack such data. Meanwhile, current actors are locked in to the business model, and new customers are attracted. Correctly positioning AI use in the business model architecture refers to a situation where the realized data network effects activate one or more business model themes to an extent that substantial economic value is created. Depending on which business model themes are activated and to what extent, different kinds and amounts of value creation and appropriation will be achieved.

Third, in order to embed AI use in the firm's business model architecture, the firm must conduct grounding and bounding of this AI use within its business model architecture. However, market conditions will almost certainly change sooner or later. Therefore, the firm will have to manage these dynamics by reconfiguring its use of AI and reconstituting its business model architecture, given that these two aspects are highly interdependent. Accordingly, a firm's value creation and appropriation from its use of AI depends heavily on its activation of business model themes and whether this activation is enabled by its use of AI. This AI use must be embedded appropriately within the firm's business model architecture. This idea is aligned with the general message of the productivity paradox research, namely that technology per se has no economic value. Instead, it is the kind of technology use that can potentially create value (Brynjolfsson & Saunders, 2009).

Contributions to theoryThis research offers several contributions to theory. The first is that it unpacks in detail the notion of the business model. Business models are often referred to only in terms of the business model per se (Osterwalder et al., 2005). Based on careful reading of the business model literature, this paper distinguishes between a firm's (a) performance, (b) activated business model themes that contribute to performance, and (c) the underlying business model architecture that enables the activation of one or more business model themes. For example, the popular managerial tool Business Model Canvas tends to focus on the configuration of a business model architecture only (Osterwalder & Pigneur, 2010; Sparviero, 2019). This unpacking of the notion of the business model is a necessary condition to answer the question of how a firm can use AI to create and appropriate value because such an AI use must be positioned within the business model architecture.

A second contribution to business model theory is the explicit allocation of a firm's AI use within the firm's business model architecture. Within that architecture, AI constitutes an actor with a unique learning capability that interacts with other actors, namely users. This situation gives rise to interactions between the AI services produced and the AI services consumed, whether by firm-internal or firm-external actors. These interactions are crucial because they highlight another contribution, namely the articulation of the possible realization of data network effects from this AI use within the business model architecture (i.e., AI-user interactions). Previous conceptualizations of data network effects tend to ignore the business model context (Gregory et al., 2021;2022; Hagiu & Wright, 2023; Karhu et., 2024; Kemp, 2023).

A third contribution is the elucidation of the crucial function of where a firm's use of AI is positioned within a given business model architecture. Only certain ways of positioning AI uses within the business model architecture can realize meaningful data network effects. Specifically, such meaningful data network effects should be realized in a manner that (a) activates strong lock-in, so the firm can dissuade actors in its business model architecture from migrating to competing firms, and (b) thereby creates substantial economic value. Such strategic positioning of AI use also attracts new customers and builds entry barriers against new competitors.

A fourth contribution is to reconceive the theory of situated AI for competitive advantage (Kemp, 2023). In its original version, this theory describes AI's value creation as an organizational capability within a firm. In contrast, the current proposal brings such value creation out of the internal organizational capabilities, placing it in a business model architecture context that spans a firm's boundaries (Amit & Zott, 2001; Snihur & Eisenhardt, 2022). Thus, the activities that ground and bound a given firm's use of AI are conducted within the boundary spanning business model architecture rather than within the firm as a purely internal capability. This relocation of the firm's AI use is to ensure that it has the potential to activate business model themes and thereby realize economies on the supply and demand sides of the business model (Massa et al., 2017; Zott et al., 2011).

A final contribution is that business models and data network effects tend to be regarded in static terms (Costa Climent & Haftor, 2021). This view is unfortunate because business model success and AI use success are in fact conditioned by contextual fit, which changes over time (Leppänen et al., 2023). Although the theory of situated AI for competitive advantage explicitly recognizes this dynamism, it focuses only on the fit of the firm's internal capabilities. In contrast, the proposed theory recognizes that the use of AI must be reconfigured together with the underlying business model architecture to reestablish contextual fit.

Limitations and opportunities for future researchThis paper describes a process of theoretical reconstruction of business model theory, the theory of data network effects, and the theory of situated AI for competitive use. This process offers a new plausible answer to the question of how firms can use AI for economic value creation and appropriation. Whereas business model theory has received considerable empirical support (Massa et al., 2017; Zott et al., 2011), the theory of data network effects has only started to receive some empirical support (Haftor et al., 2021), and the theory of situated AI for competitive advantage is still awaiting empirical support. Therefore, opportunities are there to empirically test the theory proposed in this paper. Empirical testing is important to contribute to answering the question addressed in this research.

The second limitation is related to the first. The theory built in this paper accounts for how to adopt the use of AI within a firm's business model architecture, namely through grounding and bounding. However, these activities do not account for the cold-start problem, which refers to being able to kickstart data network effects (Vomberg et al., 2023). A theorization of a successful kickstart of data network effects should thus be added to the proposed theory.

A third avenue for research has to do with the recent debate on the shift of the conception of a firm's value creation for shareholders to a firm's value creation for its stakeholders (Amis et al. 2020; Barney, 2018; Barney & Harrison, 2020; Harrison et al. 2019; Harrison & Wicks, A. 2013). As the genericity of AI technologies offers opportunity for a nearly endless multiplicity of uses, such uses can potentially target any firm stakeholder. This in turn will ask managers to priorities, which may be challenging because of the interconnect-ness of digital technology. For example, information generated from interaction can be used for customer services and the other way around, which makes the question of where to position AI uses complex to answer.

Managerial implicationsThis study has several key messages for managers considering investment in AI use. The first is the reconfirmation of the insight that acquiring AI per se will not necessarily generate value for a firm. The key question is not whether to have AI technology but how to use it.

The second message is that AI use can be either strategic or operational. An operational approach implies that AI is used in operational processes of the business model to optimize existing processes such as recruitment, production, or marketing. Although such initiatives are important for firms to keep up with the constant efficiency increases in most industries, these initiatives will be imitated by most peers and will thus fail to create strategic benefits for the firm. A strategic use of AI, in contrast, means that managers must reflect on which positions within a business model architecture they should select for AI use to realize data network effects and thereby activate the lock-in business model theme. Such activation will be strategic if it attracts customers, generates large sets of new data, and thereby improves AI-generated services, discouraging customers from migrating to competitors and creating high entry barriers. Firms capable of doing so will be likely to achieve sustained superior performance.

ConclusionsSome firms are able to use AI to generate unparalleled wealth, but many firms fail. A firm's acquisition of AI technology does not in itself create value. Successful value creation and appropriation from the use of AI requires a deliberate use of AI. This deliberate use can be understood (a) in terms of where to position the AI use within the firm's business model architecture and (b) in terms of how to position it with regard to the grounding and bounding of AI use. These two dimensions of a firm's AI use, where and how, are not eternal. Any firm's context is dynamic, so the firm's business model and its use of AI must be regularly reconfigured to realign the AI use with the firm's business model architecture.

CRediT authorship contribution statementRicardo Costa Climent: . Darek M. Haftor: Validation, Supervision, Project administration, Formal analysis, Conceptualization. Marcin W. Staniewski: Visualization, Investigation, Data curation.