Currently, most traditional banks provide digital services and the government encourages people to use cashless payments in their everyday life, particularly during the pandemic when the demand for avoiding physical encounters is getting higher. There is a growing trend in the development of digital-only banks, a fully virtual bank without individual physical branches where all banking activities operate through mobile applications. Fully virtual operations change how individuals experience the service, and subsequently, their consumption and financial habits. This research explores the experiential factors affecting digital-only banking services among the generation Y and Z. A mixed-method approach was applied using semi-structured interviews and empirical surveys. We interviewed 20 respondents to explore customers' experiences, followed by a survey to test the hypotheses developed from the proposed factors to 402 respondents aged 17–35 who used digital banking in the past six months. We analyzed the relationship of eight variables when using digital-only banking: economic value, ease of use, social influence, firm reputation, promotion, features, curiosity, and reward. Results show that all variables except curiosity and sales promotion significantly impact intention to use digital-only banking. Creating an attractive and simple digital banking interface is important to support an ease-of-use experience for customers. However, to ensure positive customer experiences, other factors must be applied, such as rewards, unique features, and positive word-of-mouth.

The new technology wave sweeping through the financial industry has changed many traditional banking structures. Factors such as online banking, self-service machines, financial integration, and 24-hour access have changed the outlook regarding the need for digital banking (Chauhan, 2018). Digital banking is the frontier innovation of banking activities and financial services, historically only available to customers in the physical bank branch.

Recently, banking services have developed more advanced applications in digital-only banking (also known as virtual banking and internet-only banking). Unlike other technology-enabled banking services, digital-only banking is branchless, with no physical banks offering a wider variety of services yet, such as more flexible savings and investments, and virtual credit cards (Sha & Mohammed, 2017). Furthermore, digital-only banking is different from mobile and Internet banking because it provides banking services and a digital wallet (Shaikh & Karjaluoto, 2016). Therefore, a digital-only bank has advantages for banks and customers, as it provides more convenient and faster banking services. Additionally, it fulfills some tasks of physical wallets, such as holding personal information, facilitating cash and credit payments, and storing temporary tokens (vouchers, transportation tickets, etc.) (Ebringer, Thorne, & Zheng, 2000).

The digital-only bank movement shows significant growth in Asian regions. Several new virtual bank brands have been launched. Currently, Hong Kong has eight virtual banks, followed by Taiwan, China, Singapore, Japan, Korea, Malaysia, and Indonesia, who launched virtual banks after their government approved the virtual system in the banking industry (Mckinsey and Company, 2021).

After the outbreak of the COVID-19 pandemic, governments have raised regulations to adapt to the "New Normal." One of the protocols is to maintain social distance and limit physical interactions. The Indonesian government also boosted the cashless payment process for society to support the “New Normal”. As a result, the absence of physical interactions on service encounters has received higher customer demands, including banking and financial services (Aji, Berakon, & Husin, 2020). Therefore, financial sectors should innovate by fully digitizing their products and services to embrace this new normal. Accordingly, customers can utilize the financial product over their smartphone with no brick-and-mortar and physical contact needed. In addition, mobile adoption spreads at a higher rate than financial inclusion. Therefore, the existence of digital-only banking can increase accessibility to a larger population, especially in developing and emerging economies (Ozili, 2018).

The development of digital banking also enriches the customer experience PwC (2018). found three main reasons banks go fully digital in Indonesia: customer/employee experience, revenue growth, and cost reduction. Approximately 44% of PwC research respondents choose customer experience as their top reason because they want to put customers at the heart of operations to obtain sustainable revenue and loyalty. Digital banks increase customer experience by offering simplicity of usage (Mbama & Ezepue, 2018). Virtual validations by biometric and online account verification are presented as an alternative to the physical verification process, saving customers' time that previously required in-person interactions (Alhothaily et al., 2017). Several features that were previously limited to financial transactions by mobile and internet banking are now enhanced by digital banking through investment-related services without requiring human contact.

Despite its convenience and benefits, digital banking faces risk-benefit calculations for its customers. The downside of digital banking is that customers might feel more hesitant to adopt the service due to the absence of physical financial institutions. Financial decision-making is critical for every individual due to trust, privacy, and other perceived risks posed by bank customers (Alkhowaiter, 2020). Digital banks should convince their customers that they will experience the same level of service and reliability, even if the service is delivered digitally. Further, it should also promote more incentives, financial or emotional, to compensate new users for switching and adapting.

Prior research on technology-enabled banking services shows that customer experiences are determined by service quality, functional quality, perceived value, employee-customer engagement, perceived usability, and perceived risk (Mbama & Ezepue, 2018; Mbama, Ezepue, Alboul, & Beer, 2018). In addition, prior research focuses heavily on customer loyalty and bank performance (Larsson & Viitaoja, 2017; Mbama & Ezepue, 2018) in well-established settings in developed countries.

This research aims to fill this gap by uncovering empirical insights of digital-only banking usage from customer experience factors. This study focuses on young customers; Gen Y and Gen Z (Gen Y is represented by 17 - 25 years old users, and 26 - 35 year-old users are presenting Gen Z. In Indonesia, the minimum age of digital banking users is 17 years old), both generations considered a tech-savvy generation and are the main target segment of digital banking services (Lipton, Shrier, & Pentland, 2016). Generations Y and Z are predicted to have different consumption behavior, especially through digital platforms compared to the older generation (Eastman, Iyer, & Thomas, 2013; Obal & Kunz, 2013). This study was conducted in Indonesia since the monthly user growth of digital banking has risen twice over the past three years, and 55% of non-digital customers intend to use a digital bank in the next six months (Mckinsey and Company, 2019). This indicates that the digital banking industry is attractive. This success has led to curiosity on the factors driving the success of digital banking, particularly in emerging economies.

The remainder of this paper is organized as follows. First, we present the current state of digital banking and how customers experience digital banking services. Second, we discuss a preliminary qualitative study conducted to explore the experiential and motivational factors affecting customer usage of digital banking among Gen Y and Gen Z. Third, we discuss the empirical survey we designed to test customer intention to use digital banking on a larger scale. Finally, we propose the implications of our findings and explore future research directions.

Literature reviewDigital-only bankingDigital-only banks have been used interchangeably with virtual banking, digital banking, or internet banking, making it difficult to distinguish them from digital services provided by traditional banking. However, the fundamental difference is the existence of the physical branches where digital-only banks rely solely on the digital infrastructure to cover all types of transactions. They offer neither brick-and-mortar offices, nor face-to-face tellers and customer services, and operate fully virtually (Fathima, 2020; Sha & Mohammed, 2017). As a result, it cuts the service costs, particularly all services traditionally carried out in a branch (Fathima, 2020; Sha & Mohammed, 2017).

Literature on banking and financial services shows that digitalization and customer acceptance of services have already been embraced for decades, such as through self-service kiosks, mobile banking, and Internet banking (Kaushik & Rahman, 2015) Table 1. compares the features provided by digital-only banks and the mobile and internet banking services provided by traditional banks (BTPN, 2021; DBS, 2021; Otoritas Jasa Keuangan, 2021a)

Differences between digital banking with mobile and internet banking.

| Factors | Digital Banking | Mobile and Internet Banking |

|---|---|---|

| Registration | Fully online through pre-downloaded app; cards are sent directly to the customer (no contact with the bank employee) | Register through the bank and download the app |

| Physical Form | Branchless, has no physical bank | Has physical bank and branches |

| Account Verification | Digital sign, online and biometric verification | Physical and in-person verification by coming to the bank |

| Features (financial service) offered | Including investment account opening (i.e. mutual funds, bonds, time deposit, etc.); e-wallet with NFC top-up | Limited to day-to-day transactions |

| Financial advisory | Provided in the app | Provided in the branch office |

Source: BTPN (2021), DBS (2021); Otoritas Jasa Keuangan (2021a)

According to the Indonesian government, digital-only banking provides and carries activities through electronic channels; they have a head office without having any or limited physical offices (Otoritas Jasa Keuangan, 2021b). The Hong Kong government also has a similar definition of digital-only banks as Indonesia, which defines virtual-only banks as banks that primarily deliver retail banking services through the Internet or other forms of electronic channels instead of physical branches (Hong Kong Monetary Authority, 2021).

Research on digital-only banking mostly discusses regulatory, financial inclusion, and business-related perspectives (Boskov, 2019; Fathima, 2020; Lau & Leimer, 2019; Tosun, 2020). Digital-only banks are revolutionary fintech applications that break away from conventional banking norms, completely paperless, signature-less, and branchless banks. Thus, it changes the financial ecosystem landscape and how businesses operate, which improves operational efficiency while also facing security and privacy challenges (Dharamshi, 2019). However, despite its massive adoption, limited empirical studies have been published in peer-reviewed journals regarding digital-only/virtual/internet-only banking from the perspective of customer and customer experiences.

Customer experiences in digital bankingIt is common for customers to open accounts in several banks. Younger customers easily compare the services provided by banks and switch banks (Clemes, Gan, & Zhang, 2010). This drives banks to provide unique and exceptional services through Internet technology.

The use of technology such as digital banking in service innovation to meet clients' needs is best understood through its relationship with service users and how they perceive the service (Ababa, 2018). Customers expect to utilize digital banking similar to social media, and they can use the services anytime, anywhere, and under any conditions (Dootson, Beatson, & Drennan, 2016). However, the bank's digitalization also has implications for users, such as privacy, security, time, and performance risk, and other associated risks (Mbama & Esepue, 2018; Alkhowaiter, 2020).

Besides convenience, digital banks offer more financial and psychological benefits than traditional banks do. For example, the two main digital banking players in Indonesia, Jenius, and Digibank offer monetary advantages that traditional banks have never provided, such as free transfers to other banks, no initial account fees, high-interest deposits, and free withdrawals from any ATM. In addition, they offer non-monetary benefits such as virtual customer services, expenditure tracking and allocation, splitting bills, etc. The study explored whether or not these features are attractive enough to lure customers into using this service.

Customer experience is an important factor that marketers must analyze to generate a marketing strategy (Sorofman, Virzi, & Genovese, 2015). Meanwhile, advanced technology enables the banking industry to deliver its services in many forms, leading to positive or negative experiences for customers and affecting how a bank outperforms the competition. Customer experience is defined as the customer's cognitive and affective assessment of all direct and indirect encounters with the firm relating to their purchasing behavior (Klaus & Maklan, 2013). Digital banking experiences include service quality, functional quality, perceived value, service customization, service speed, employee-customer engagement, brand trust, digital banking innovation, perceived usability, and perceived risk (Mbama & Esepue, 2018).

In particular, there are some differences in experiencing digital services for younger customers. Young (vs. older) consumers are more likely to rely less on heuristic processing (Yoon, 1997). As consumers move through their life cycle, their needs and responses to marketing programs tend to shift to be more benefit-oriented (Akturan & Tezcan, 2012; Khan, Fatma, Shamim, Joshi, & Rahman, 2020). Customer experience develops younger customers’ affective commitment but not older customers’. For younger (vs. older) customers, a stronger effect of customer experience on affective commitment confirms that consumers with different age profiles experience brand-related stimuli differently. The development of experiential value-laden interactions seems most promising for young customers (Khan, Hollebeek, Fatma, Islam, & Riivits-Arkonsuo, 2020).

Previous studies discuss digital banking. However, only a few have focused on customer user experience. There are many theories on the new technology adoption used in prior studies, such as the technology acceptance model (TAM) by Davis (1989), theory of reasoned action (TRA) by Fishbein and Ajzen (1975), theory of planned behavior (TPB) by Ajzen (1985), diffusion of innovation (DOI) by Rogers (1962), and unified theory of acceptance (UTAUT and UTAUT 2) (Venkatesh, Morris, Davis, & Davis, 2003; Venkatesh, Thong, & Xu, 2012). However, these adoption theories cannot be directly applied to customer experience research because they do not capture customers' overall experience (e.g., rational, emotional, sensorial, physical, and spiritual) between a customer, product, and company. These types of experiences could be triggered by various stimuli that subsequently affect how they make financial choices. Therefore, we must elaborate on other factors through exploratory studies with specific contexts on digital-only banks and to younger customer.

Mbama and Ezepue (2018) study on customer experience in digital banking confirmed that perceived value, functional quality, service quality, employee-customer engagement, perceived risk, and perceived usability positively affect customer experience. However, Cruz, Salo, Munoz-Gallego, and Laukkanen (2010) stated that customer experience in digital banking is focused on utilitarian goals. Still, they found that hedonic consumption has a role in customer experience and elaborated that it was as necessary as utilitarian consumption. Meanwhile, other studies on online customer experiences have identified ease of use as a proxy of the quality of online banking services (Bilgihan, Kandampully, & Zhang, 2016; Jun & Cai, 2001; Rose, Hair, & Clark, 2011). Therefore, this study combines several theories of customer adoption and customer experience in digital banking. In addition, we conducted interviews to gain information about the fit dimensions, as research carried out in Gen Y and Gen Z customers and in developing countries (Indonesia) could possess different characteristics compared to prior research.

MethodologyWe utilized a sequential mixed-methods approach (Creswell, 2009). We started with qualitative semi-structured interviews (Study 1) to explore the motivating factors and customers' experiences when using digital banks. A qualitative-exploratory approach is necessary for this context because of the limitations of the literature regarding experiential factors impacting digital-only banking. In addition, due to its special characteristics that operate fully virtual, this context differs from other studies on digital services operated by traditional banks. Further, our study focuses on young customers aged 17–35, who are digital natives and have different behavior and characteristics in using financial services, which were not covered by previous studies.

The factors obtained from (Study 1) were then analyzed to formulate hypotheses, and based on this, a second quantitative phase (Study 2) was carried out. Finally, we used a quantitative survey (Study 2) to validate the elements and obtain more generalizable results. The study wants to know whether the intention to use can be explained by economic value, ease of use, social influence, firm reputation, promotion, features, curiosity, and reward. Multiple linear regression is the best data analysis for bivariate regression context (Malhotra, 2019). The multiple linear regression model was used to determine the relationship between the variables and the level of significance of each independent variable (Hair, Black, Babin and Anderson, 2009).

Study 1: exploratory studyQualitative exploratory research was conducted using in-depth semi-structured interviews. A convenience sampling method was used in this study to uncover customer motivational factors and their experiences when using digital banking. Therefore, participants were selected based on their experiences in using digital banking (i.e., having at least one active digital bank account). Twenty participants were chosen: ten participants aged 17–25 years and ten aged 26–35 depicting the proportion of actual users targeted by digital banks. The numbers of male and female participants were balanced to avoid gender bias.

The initial questions covered two essential phases: 1) customer motivation to sign up to a digital banking service (including their decision-making process and influencing factors) and 2) customer experience while using the digital banking service (difficulties faced, benefits encountered during usage, willingness to recommend, and continued usage intention).

The primary data collection process ended after data saturation was reached. Data saturation was reached when additional sampling was unnecessary because no new information related to the research question was obtained after the additional interviews. The open and manual coding is feasible for the code with a few interviews (Basit, 2003), and this study only has twenty interviewees. Data were analyzed using open and manual coding to ensure comprehensive analysis and interpretation (Saldana, 2015). After finding the keywords, the results were interpreted and proposed as factors for Study 2.

Study 1: resultsThe eight factors identified during the interviews were economic value, perceived ease of use, social influence, firm reputation, sales promotions, product features, curiosity, and rewards. The categorization results from open coding are shown in Table 2.

Interview results.

| Code | Description | Sample Quotations | Listing Key Phrases |

|---|---|---|---|

| Economic Value | In the aspect of Digital Banking, the component of economic value that is considered by users is cost reduction and time savings (Kenney, 1999). | “The reason I use Jenius because free transaction and withdraw in anywhere ATM that make minimize my time” S, 19 | Free transactionSaving timeFinancial solutionAffordable |

| Ease of Use | Easy to Use refers to the level of one's freedom from the effort or easy of use of a system (Davis, 1989). | “Because in my opinion it is not complex and easy to use for any transaction” R, 26 | SimpleConvenientUsability |

| Social Influence | Social Influence is a way for someone to do a new activity because it is influenced by others. | “Get a recommendation from a friend to use DBS” I, 21“From the ads on Instagram, the first time I saw it from there, I was really interested in trying to use it” S, 19 | RecommendationSuggestion |

| Firm Reputation | A good reputation guarantees the ability, integrity and goodwill of the company, thereby helping to increase trust even when users do not have direct knowledge of service companies (Lohse & Spiller, 1998). | “Jenius is a product development from BTPN so I think it's guaranteed” A, 25“Because BTPN is a national bank, it is more certain” L, 28 | Product developmentSafely |

| Promotion | Promotion is the value of every discount or promotion offered by digital banks generated in dynamically generated advertising messages. The promotion referred to in this study is incentives provided through third parties. (Example: M-Tix balance charging discount using Digital Bank) | “I like the one get one every Thursday premiere at XXI, that is one factor why I use DBS” I,21 | Lowering costBenefit and advantages |

| Features | The definition of a product (service) according to Kotler and Armstrong (2010) is a competition tool to differentiate company products from similar products that are competitors. With a variety of product features offered by producers, users will be increasingly satisfied with products that suit their needs to differentiate products produced by the company. | Eventually I prefer because the fit is Cashtag, in my opinion it's really interesting because the only one in Indonesia is rich like that. Then the second save it is because you can save money so you can save money” S, 19 | Value-addedSimplify |

| Curiosity | Curiosity is the desire to learn and learn something to gain new knowledge. | “Initially because I wanted to try digital banks with the latest technology” E, 26 | Digital paymentTransformationInnovation |

| Reward | Reward is a strategy or policy used to appreciate someone's contribution in the form of financial and non-financial purposes in order to gain profits. The bonus referred to in this study is incentives provided directly from the digital bank. (Example: Cashback transfers every Monday to other banks). | “I like to use Jenius because there is cashback when transferring from another bank” Fi, 21 | CashbackLowering cost |

The participants described economic value in terms of additional benefits or cost reduction as a value-adding characteristic. Customer perceived value has been shown to predict the intention to use in mobile service settings (Wang, Lin, & Luarn, 2006).

Perceived ease of use and social influence were described as factors that motivated them to use digital banking. Ease of use reduces customer mistakes when using a novel technology or product. As for social influence, gen Y and gen Z rely on social proof to guide their decision-making, including financial decisions (Mun, Khalid, & Nadarajah, 2017). Further, perceived ease of use and social influence have been discussed widely as affecting customer intention to use technology in TAM and UTAUT, respectively.

Firm reputation is essential because customers need to trust the company before using the product. Credible conventional banks support the digital banks in Indonesia (Jenius and Digibank). Jenius was developed by BTPN, a well-known public bank under the control of the government, and Digibank is run with support from DBS Indonesia, an international bank based in Singapore that is known globally. Firm reputation affects customer trust, reliability, and perceived assurance, and the firm's reputation might always be a big consideration for the customer, particularly for financial services (Walker, 2010). Firm reputation can assist in overcoming perceived risk, which subsequently affects customers' purchase intentions (Kim & Lennon, 2013).

The interviewees enthusiastically described sales promotions. The essential services offered by digital banks are similar to those offered by conventional banks. Digital banks must therefore create different promotion strategies to gain the attention of target markets. For this study, sales promotions are limited to incentives provided by third parties or partnered organizations to promote the immediate use of the payment. An example of digital banking promotions includes discounts on selected third-party items if paid using digital banking, additional points from partnered merchants, cashback, vouchers, and coupons. These short-term incentives have been particularly effective among younger customers who prefer monetary incentives (Smith, 2012).

The product features indicate customer interest in the special characteristics of digital banking technology, which provides them with financial solutions. As consumer experiences are increasingly important in the digital service context, it is critical to develop superior product features to convince customers. The features must be unique and different from those of Internet and mobile banking. For example, Jenius offers unique features, like bill sharing and reminders, to pay back the money. Some customers feel that these useful features help them manage their money. This variable is mentioned because of the advanced technology present in the current era, which is expected to lead to valuable service, efficiency, and convenience.

As the respondents were young generations, curiosity appeared in the initial findings. As our participant age starts from 17 years old, which is the legal year to have their first own bank account, they might do several trials and experience new banking service. Young customers are likely to have high curiosity and low uncertainty avoidance and like to experience new things.

Customers believe rewards influence their use intention. As mentioned before, the only visible difference between traditional and digital banks is the physical form of the bank, while the differences in the services offered remain unclear. Thus, a reward system is essential to attract customers' attention. Unlike sales promotions, which are supported by third parties and restricted to partnered merchants, rewards are direct actions taken by a company to show appreciation for customers' use of their product, for instance, cashback after fund transfers. Customers might prefer rewards above sales promotions because the incentives are not tied to and do not depend on their usage of other parties or merchants.

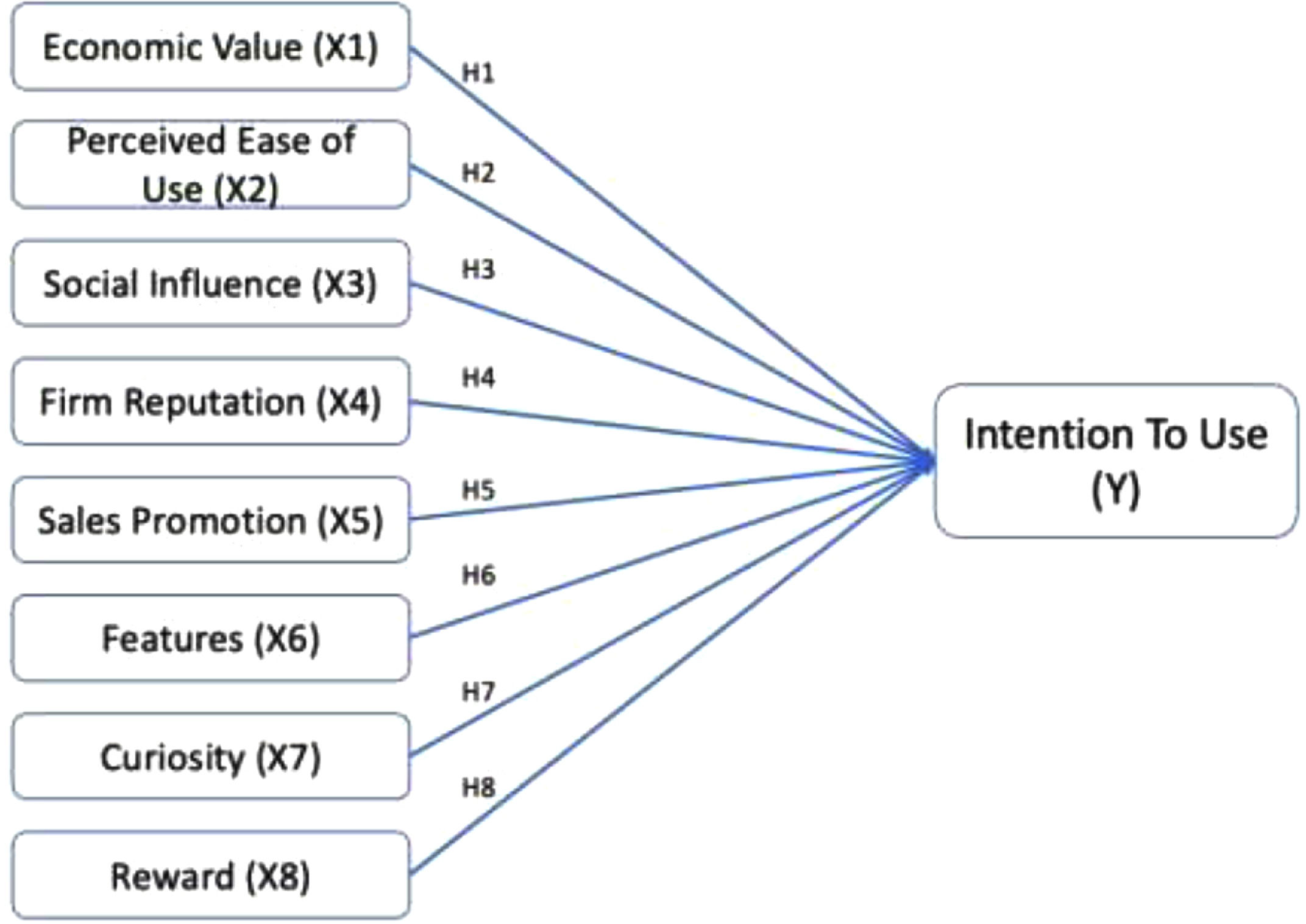

Hypotheses developmentEight hypotheses were proposed in this study based on the eight factors obtained from Study I. In market research, monetary cost/value is typically conceptualized along with the quality of products or services to determine the perceived worth (Zeithaml, 1988). However, the economic value of using technology appears to be larger than the monetary value, and such a price value has a positive impact on intention (Venkatesh, Thong, & Xu, 2012). Therefore, the first hypothesis is as follows:

H1

Economic value positively affects the intention to use digital banking.

Many studies of users' intentions have found that individuals minimize behavior efforts. Therefore, the more comfortable the system's usability is, the more customers view it as useful. Previous studies have supported the theory that there is a positive relationship between perceived ease of use and intention to use (Oh, Cruickshank, & Anderson, 2009; Schierz, Schilke, & Wirtz, 2010; Zhang & Mao, 2008). Furthermore, Danurdoro and Wulandari (2016) also researched the intention to use internet banking in Indonesia. Their results indicated that the perceived ease of use is related to the intention to use Internet banking. Therefore, the second hypothesis is as follows.

H2

Perceived ease of use positively affects the intention to use digital banking.

According to Marr and Prendergast (1993), a lack of human interaction considerably inhibits the adoption of new technologies. Social influence (SI) results from environmental factors, such as the opinions of a user's friends and relatives (Venkatesh, Morris, Davis, & Davis, 2003) Yaseen and Qirem (2018). also found that social influence has a positive relationship with the intention to use digital banking services. Therefore, the third hypothesis is as follows.

H3

Social influence positively affects the intention to use digital banking.

The service provider's reputation is also one of the main factors influencing customer choice in services enabled by technology (Aladwani, 2001). A good reputation guarantees the company's ability, integrity, and goodwill, thereby helping to increase trust, even when consumers do not have direct knowledge of service companies (Lohse & Spiller, 1998). Therefore, the fourth hypothesis is as follows:

H4

Firm reputation positively affects the intention to use digital banking.

Promotion is the value of every discount or promotion offered by digital banks generated through dynamically generated advertising messages. The promotions referred to in this study are incentives provided through third parties (for example, M-Tix balance discounts when paying using a digital bank account) Teck Weng & Cyril de Run (2013). posited that promotions positively affect behavioral intention. Its effect lies in monetary value and extrinsic motivation, leading to stronger customer preferences. Therefore, the fifth hypothesis is as follows.

H5

Promotion positively affects the intention to use digital banking.

Service features are a competitive tool to differentiate a company's products from comparable products by competitors (Kotler & Armstrong, 2010). With various product features offered by producers, consumers will be satisfied with products that suit their current needs. For example, in digital banking, features such as splitting bills with friends, flexible savings, and virtual credit cards are unique financial service offerings that have never been available through conventional banking. Therefore, the sixth hypothesis is as follows.

H6

Features positively affect the intention to use digital banking.

There are four types of curiosity: interpersonal, epistemic, sensory, and perceptual (Litman, 2008). Epistemic curiosity is defined as the desire to motivate individuals to eliminate information gaps and when people learn about new things, including new types of banking service (Fang, 2014). Therefore, many prospective users become curious and want to learn about technological developments, as digital banks are new technologies in Indonesia. In their study of online shopping, Koo and Ju (2010) showed that curiosity influences shopping intentions. Therefore, the proposed seventh hypothesis is

H7

Curiosity positively affects the intention to use digital banking.

A reward is a strategy or policy used to appreciate an individual's contribution, in financial or non-financial forms. The bonuses referred to in this study are incentives provided directly by the digital bank (for example, cashback rewards every Monday, if transferring money to other banks). A reward is a reinforcement that triggers motivation (Lepper and Greene, 2015). Therefore, the final hypothesis proposed is

H8

Reward positively affects the intention to use digital banking.

Study 2: surveyConceptual frameworkBased on the concepts discussed in the previous section, we developed a conceptual framework to identify the factors leading to the use of digital banks in Indonesia (Fig. 1).

In Study 2, an online questionnaire was designed based on Study 1 to test the hypotheses. The eligibility criteria were similar to those of Study 1, namely people from the Indonesian population who have a digital bank account, male and female, aged 17–35 years. Purposive sampling was used to assess the eligibility of the sample by confirming participants' ownership and experiences in using digital bank accounts daily within the last six months. The questionnaires were distributed to 450 respondents, and 402 valid questionnaires were received for further processing. Among the 402 respondents, 37.3% were men, and 62.7% were women.

The questionnaire was arranged in two sections. The first section dealt with the sociodemographic characteristics of the respondents, including digital bank possession, gender, age, domicile, education level, monthly expenditure and savings per month, and occupation. The second section consisted of questions related to the eight factors identified in Study 1 and the intention to use digital banks. The questionnaire used a Likert scale with a range of 1–7, 1 as strongly disagree, and 7 as strongly agree. The scale was adopted from several sources: the economic value scale from Lee, Pi, Kwok, and Huynh (2003), the perceived ease of use, social influence, and intention to use scales from (Thakur & Srivastava, 2014), the firm reputation scale from Jin, Park, and Kim (2008), and the curiosity scale from Kashdan et al. (2009). We used self-developed scales from the interview results for the other variables (promotion, features, and rewards). Detailed operational variables are listed in Table 3. The surveys were distributed online and spread across major cities in Indonesia.

Operational variable.

| No | Variable | Label | Indicator | References |

|---|---|---|---|---|

| 1 | Economic Value | EV1 | The digital bank that I use minimises queue time. | Lee, Pi, Kwok and Huynh (2003) |

| EV2 | The digital bank that I use minimises the cost of payments. | |||

| EV3 | The digital bank that I use minimises the time required to do payments. | |||

| 2 | Perceived Ease of Use | PEU1 | I expect the digital banking system to be easy to use. | Thakur and Srivastava, (2014) |

| PEU2 | I expect it will be easy for me to become skillful at using digital bank services. | |||

| PEU3 | Learning to use digital banking will be easy. | |||

| 3 | Social Influence | SI1 | People in my environment who use mobile payment services have more prestige than those who do not. | |

| SI2 | In general, the bank has supported the use of digital banking. | |||

| SI3 | People who are important to me think that I should use digital banking. | |||

| 4 | Firm Reputation | FR1 | The conventional bank that supports the digital bank that I use has a good reputation. | Jin et al. (2008) |

| FR2 | The conventional bank that supports the digital bank that I use is recognised widely. | |||

| FR3 | The conventional bank that supports the digital bank that I use offers good services. | |||

| 5 | Promotions | P1 | I feel that I have saved money. | Self-developed |

| P2 | The promotions help me make faster purchase decisions. | |||

| P3 | The promotions give me new ideas of things to buy. | |||

| 6 | Features | F1 | I like to use digital banking because it provides many useful features. | Self-developed |

| F2 | My digital bank provides features that I need. | |||

| F3 | The digital bank that I use provides features that ease my personal financial management. | |||

| 7 | Curiosity | C1 | I use digital banking because I want to learn new things. | Kashdan et al., (2009) |

| C2 | I like to learn about new technology. | |||

| C3 | I like finding out why people use digital banking. | |||

| 8 | Reward | R1 | I like to use digital banking because it gives me many rewards. | Self-developed |

| R2 | I like to use digital banking because I feel that I have save money from the rewards. | |||

| R3 | Using digital banking is very profitable for me. | |||

| 9 | Intention to Use | IU1 | I will use/continue using digital banking services in the future. | Thakur and Srivastava (2014) |

| IU2 | During the next six (6) months, I intend to use digital banking. | |||

| IU3 | Five (5) years from now, I intend to be using digital banking. | |||

| IU4 | I encourage others to use digital banking. |

First, the model was confirmed through validity and reliability tests before the hypothesis measurement. Cronbach's alpha was used to test the reliability and Pearson's correlation for the validity test. The construct can be claimed to be reliable when Cronbach's alpha scores are above 0.6. Table 4 presents the reliability score, and it can be seen that all variables have passed 0.6. Meanwhile, the Pearson correlation compares the r-table and r-statistic for the validity test. Each indicator from the construct must present the r-table < r-statistic, and the r-table for 402 respondents was 0.082. In Table 4, the r-statistic for all the indicators is higher than 0.082. Based on the above criteria, our data results are valid and reliable.

Reliability and validity.

| Construct | Indicator | Cronbach's Alfa | R-Statistic |

|---|---|---|---|

| Economic Value | EV1 | 0.707 | 0.6384 |

| EV2 | 0.5848 | ||

| EV3 | 0.6250 | ||

| Perceived Ease of Use | PEU1 | 0.857 | 0.6944 |

| PEU2 | 0.6385 | ||

| PEU3 | 0.6078 | ||

| Social Influence | SI1 | 0.700 | 0.5312 |

| SI2 | 0.5838 | ||

| SI3 | 0.4973 | ||

| Firm Reputation | FR1 | 0.858 | 0.6443 |

| FR2 | 0.6356 | ||

| FR3 | 0.7144 | ||

| Promotion | P1 | 0.897 | 0.7193 |

| P2 | 0.7174 | ||

| P3 | 0.6745 | ||

| Feature | F1 | 0.825 | 0.7342 |

| F2 | 0.6917 | ||

| F3 | 0.6834 | ||

| Curiosity | C1 | 0.729 | 0.6138 |

| C2 | 0.5563 | ||

| C3 | 0.5047 | ||

| Reward | R1 | 0.868 | 0.6479 |

| R2 | 0.6246 | ||

| R3 | 0.7854 | ||

| Intention to Use | IU1 | 0.884 | 0.7320 |

| IU2 | 0.6338 | ||

| IU3 | 0.6022 | ||

| IU4 | 0.7413 |

Correlation analysis.

| Mean | SD | Economic Value | Ease of Use | Social Influence | Firm Reputation | Promotion | Features | Curiosity | Reward | Intention to Use | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Economic Value | 5,9867 | 0,9303 | 1000 | ||||||||

| Ease of Use | 6,3226 | 0,8135 | 0,596 | 1000 | |||||||

| Social Influence | 5,1269 | 1,1043 | 0,442 | 0,389 | 1000 | ||||||

| Firm Reputation | 5,8184 | 0,9760 | 0,548 | 0,560 | 0,551 | 1000 | |||||

| Promotion | 5,5937 | 1,2462 | 0,527 | 0,473 | 0,449 | 0,501 | 1000 | ||||

| Features | 6,0274 | 0,9704 | 0,654 | 0,625 | 0,404 | 0,561 | 0,564 | 1000 | |||

| Curiosity | 5,5506 | 1,0970 | 0,457 | 0,414 | 0,456 | 0,412 | 0,470 | 0,502 | 1000 | ||

| Reward | 5,5108 | 1,1749 | 0,470 | 0,438 | 0,387 | 0,460 | 0,667 | 0,591 | 0,472 | 1000 | |

| Intention to Use | 5,9950 | 0,9648 | 0,562 | 0,599 | 0,435 | 0,544 | 0,474 | 0,635 | 0,413 | 0,569 | 1000 |

⁎⁎⁎all of them p<0.001.

We performed data analysis using multiple linear regression (MLR). First, the model summary was checked to determine the goodness of the regression model. Our adjusted R-square value is 0.532, which means that 53.2% of the intention to use is explained by the eight independent variables, which indicates a good regression model. Second, our results show that F (8393) = 58.139 and p-value <0.005 (the significant value is 0.00000), indicating that the regression model is a good fit with the data. Finally, we conducted hypothesis testing to consider whether the relationships proposed in our model are significant (p-value must be below 0.05). From Table 6, it can be seen that six of the eight hypotheses are accepted. Economic value, perceived ease of use, social influence, firm reputation, features, and rewards significantly influence the intention to use, while promotion and curiosity do not.

Hypothesis result.

| Hypotheses | Hypothesis | Coefficients | p-value | Significant |

|---|---|---|---|---|

| H1 | Economic Value → Intention to Use | 0.110 | 0.034* | Accepted |

| H2 | Perceived Ease of Use → Intention to Use | 0.272 | 0.000*** | Accepted |

| H3 | Social Influence → Intention to Use | 0.079 | 0.038* | Accepted |

| H4 | Firm Reputation → Intention to Use | 0.106 | 0.027* | Accepted |

| H5 | Sales Promotion → Intention to Use | -0.061 | 0.116 (n/s) | Rejected |

| H6 | Features → Intention to Use | 0.221 | 0.000*** | Accepted |

| H7 | Curiosity → Intention to Use | -0.012 | 0.742 (n/s) | Rejected |

| H8 | Rewards → Intention to Use | 0.216 | 0.000*** | Accepted |

Note: *p < 0.1; **p < 0.05; ***p < 0.01.

Economic value is a significant predictor of intention to use digital banking. This result is consistent with Yuen, Wang, Ng, and Wong (2018), who established that economic value and its relative advantages are significant antecedents of intention to use in various technology-enabled service applications. Particularly for financial services, customers prefer a service that gives them monetary advantages to grow their funds. The interviewees supported this argument. They argued that digital-only bank products must provide additional value for particular monetary features. For instance, the concept that customers can withdraw their money from many traditional banks' ATMs is convenient for Gen Y and Gen Z because they are mobile and active generations who move from one place to another; therefore, this feature saves time.

The findings show that the perceived ease of using digital-only banking applications (apps) positively affects customer intention to use a digital-only bank. If digital banking is simple, convenient, and easy to navigate, it is also easier for customers to become familiar with it and be willing to use it. The perceived ease of use variable has been discussed in the TAM and its extended theories (Davis, 1989; Venkatesh & Bala, 2008; Venkatesh & Davis, 2000). TAM theory states that perceived ease of use influences a customer's intention to use. Gen Y and Gen Z are technology-savvy individuals; however, this does not mean they like complexity when operating the technology. The interviewees said they are productive people who did not want to spend too much time learning how to operate the digital bank features; they prefer brief guidelines. Sometimes, the long instruction leads to failed transactions because of misinterpretation. Therefore, simple, convenient, and easy to navigate applications are better for these generations.

Social influence was also a positive predictor of the intention to use digital banking among young customers. Social influence has been mentioned several times in the technology adoption literature, such as in the UTAUT (Venkatesh et al., 2003). Further, when digital banks target young customers, social influence becomes more significant in affecting customer use intention. Gen Y and Gen Z are more connected to peers, have a strong social conscience, and consider opinions from friends and fellow consumers as a more reliable basis for adoption decisions (Purani, Kumar, & Sahadev, 2019). In line with interview respondents' arguments, they considered using digital-only banking when recommended by their friends. Since digital-only banks have a very low physical presence, external confirmation is needed to prove the reliability of the service. Potential users might barely know about the digital-only bank, so opinions from significant others could enhance customer trust and confidence in using a digital-only bank.

Firm reputation is also shown to significantly affect intention to use. Reputation is more important for purely online service providers (such as digital banking) than multichannel service providers. Multichannel consumers form service expectations based on their offline channel experiences or knowledge (Jin, Park, & Kim, 2009). It is not easy to gain customer trust as a new brand, especially for banks that do not have brick-and-mortar offices. In this study, both Jenius and Digibank are known to be backed up by conventional banks. The interviewees said they were willing to use the digital bank because credible traditional banks guaranteed them. Thus, customers do not hesitate to use the derivative products of these banks.

The novel findings of this study include the positive effects of product features and rewards. Product features are measured by three items: whether it is valuable, good fit of customer needs, and provide solutions for financial management problems. Product features cover the basic financial solution and additional valuable solutions that meet customer demands and are considered value-added. Individual perceptions about the value that meets and exceeds expectations will subsequently affect customer use behavior (Hong, Lin, & Hsieh, 2017). Therefore, the digital-only bank must offer unique features to traditional banks to make them more attractive. One of the features of digital-only banks is the cashtag; in this feature, the user can replace the bank account number with a nickname. For instance, if the bank account number is 12,345, it is replaced by the nickname "@deliciouscake" and the other users can easily remember the bank account. The respondents said that a feature cashtag had attracted her intention because of its simplicity. In addition, the attainment of extrinsic rewards, such as cashback and other monetary benefits, directly from the service provider lead to customer satisfaction and behavioral intention (Tussyadiah, 2016).

Finally, surprising results come from sales promotions and curiosity, as they are not significant predictors of the intention to use digital banking. These results contradict Smith (2012), who endorse short-term incentives for the younger generation. Sales promotions and curiosity have similar characteristics that promote short-term actions. A strategy to increase sales promotion and induce customer curiosity might work for temporal behavior, such as willingness to try (Santini, Vieira, Sampaio, & Perin, 2016). However, a longer commitment is required for intention to use. Commitment is strongly linked to purchase intention in financial services (Bloemer & Odekerken-Schroder, 2003). Digital banks and financial services are considered high-involvement products that inherently possess a higher perceived risk, especially in the context of online or digital transactions (Sanchez-Franco, 2009). Even though millennials exhibit lower loyalty in terms of products or services (Purani et al., 2019), financial decision-making requires careful consideration. The customer must be committed before using a product. Therefore, short-term induced strategies may not predict digital bank customers' use intentions.

ConclusionTheoretical implicationsThe emergence of digital banking has disrupted the banking industry in emerging countries. Predictions show that opportunities in this industry are growing yearly, making them more attractive. Even though customers have become familiar with Internet banking and mobile banking in their daily lives, fully digital-only banking is still new for many of them. The fact that digital-only banks do not have official offices, and that all services are delivered through virtual platforms, creates unique customer experiences. Thus, experiential factors influencing customers' usage of this technology have become essential.

This new phenomenon of digital-only banking is new, while at the same time, the number of young-adult banking customers is rising. However, studies on digital banking and how customers behave towards its service are still limited. Therefore, this study aimed to specifically determine the intention to use a digital bank by focusing on the young-adult customer experience.

The gap in the literature regarding digital banking led us to apply a qualitative method to gather information on the essential factors of customer intention to use. Through a qualitative study, we found eight variables affecting Gen Y and Gen Z customers of digital banking: economic value, perceived ease of use, social influence, firm reputation, sales promotions, product features, curiosity, and reward. Our qualitative study confirmed that not all of the variables on technology adoption theories (e.g., TAM, TAM 2, TAM 3, UTAUT, UTAUT2, etc.) were mentioned and considered important by Gen Y and Gen Z digital-only banking customers in Indonesia. The new variables that emerged from the qualitative research were firm reputation, promotions, features, curiosity, and rewards. These variables have not been discussed in digital banking adoption research. Our nationwide quantitative survey validated that all aforementioned variables except sales promotion and curiosity, have become significant factors for Gen Y and Gen Z users to experience digital-only banks. This shows that promoting curiosity and offering promotions as a gimmick and short-term strategies that endorse impulsive behavior do not always lead to usage intention and commitments, especially for highly utilitarian products like financial service.

Practical implicationsThe findings of this study are relevant to companies that intend to enter the digital banking industry. This industry is promising, as evidenced by the annual growth of digital bank providers. This could increase financial access for the unbanked population across counties. The Middle East and Africa have half of their population with no access to bank services, followed by South and Central America with a 38% unbanked population. Meanwhile, one-third of the people in Eastern Europe and the CIS have no bank accounts. The Asia Pacific and North America present 24% and 21% unbanked populations, respectively, and also in Western and Central Europe, only 6 percent of the population is unbanked (Merchant Machine, 2021). Outside of economic conditions, the unbanked people's motives to not have a bank account are expensive bank costs and less accessibility to the bank office. The adoption of digital-only banking by Gen Y and Gen Z can help solve this issue since digital-only banks are affordable, convenient, and easily accessible through mobile applications.

The six variables that were found to have a significant influence on the intention to use (i.e. economic value, perceived ease of use, social influence, firm reputation, product features, and rewards) can be used by companies to create strategies. Companies must focus on interaction-enabling features, such as emphasizing the ease of use and familiarity of navigating the technology and creating features to connect customers to their peers (i.e., split bill features). Companies should also focus on reward attributes and beneficial features that foster engagement and avoid short-term strategies (i.e., sales or viral promotions) that promote impulsivity. Thus, creating simple, attractive, and rewarding applications with economic, social, and emotional value to customers can be major strategies for developing a digital bank.

Limitations and recommendations for future researchOur study has several limitations, and we propose several future research agendas. The first limitation of this study is its methodology. Although we already started from exploratory research to obtain the factors and validate them through nationwide quantitative surveys, the study of customer experience might be more captivating using an experimental approach in collecting real-time customer data. Therefore, future studies could utilize service design methods (e.g., customer journey mapping, cultural probes, persona research, etc.) to better explore the customer needs of digital banking interfaces and features. Furthermore, these can be tested using experimental methods to examine how they fulfill customers' utilitarian and hedonic consumption.

Second, since this study is limited to examining customer experiences, another possible area of future research is measuring customer engagement and enhancing customer lifetime value. These variables can generate positive customer relationships and increase bank performance. Future studies should focus on user decisions to determine which digital bank features have a greater effect on the experience to retain customers' continued use. Future research can expand and compare different customer profiles, such as psychographic and financial behavior.

Finally, the competition in digital-only banking will be fiercer in the future. Therefore, companies must find a competitive advantage to win customer attention on the usage of digital-only banking service. As digital-only banking is performed on mobile platforms only, future agendas should elaborate on digital user experience (UX) and user interface (UI) to drive users' positive financial behaviors, such as using the Nudge concept (Thaler & Sunstein, 2008) and gamification (Huotari & Hamari, 2012). Further, it is worth exploring the advancement of AI, such as developing smart recommendation systems based on predictive analytics, virtual assistants, API, and location-based platforms to improve loyalty reward programs.

The first and second authors were responsible for writing the manuscript and supervised the research. The third author conducted data analysis, and the fourth author collected the data and literature review. This study was supported by School of Business and Management, Institut Teknologi Bandung with grant number 057/I1.C12/SK/PP/2019.