This study proposes a model to explain the effect of digital capabilities on firm performance in the “new normal” context from a firm-level perspective. Moreover, it analyzes the mediating role of technological capabilities and the Human Development Index (HDI) in explaining firm performance. Our study used data from the World Bank's Enterprise Surveys 2020, which included 999 firms from 27 countries. We applied the methodological approach, partial least square structural equation modeling (PLS-SEM), to test the hypothetical model. The results show that digital capabilities positively influence firm performance only through technological capabilities. We also empirically demonstrate that digital skills in low HDI economies have a more significant indirect effect on firm performance than in high HDI countries. Finally, some promising avenues for future research and implications for managers and policymakers are suggested based on these findings.

Companies are increasingly becoming aware of adapting to “new normal” challenges through their activities, strategies, and routines (Loureiro, Ferreira & Simões, 2021). Firms have begun to optimize and improve their processes’ efficiency through digital tools to ensure business continuity. Thus, digital capabilities are gaining popularity due to a changing and turbulent environment (Zhen, Yousaf, Radulescu & Yasir, 2021).

However, our literature review indicates no consensus on the relationship between digital capabilities and firm performance (Martínez-Caro, Cegarra-Navarro and Alfonso-Ruiz, 2020). Some studies argue that digital capabilities positively affect a firm through reduced costs and increased flexibility (Drnevich & Croson, 2013). The more a firm is equipped with these resources and the more effectively it can use them, the more likely it is to develop a more complex and advantageous strategy (Wang, 2007). However, there is evidence that digital capabilities have little or no effect on firm performance Usai et al. (2021). argue that a firm's innovative performance is not the result of digital capabilities but creativity and constant efforts in research and development activities. It appears that recent research is “hard-pressed” to present evidence for a positive relationship between digitization and firm performance (Tan, Pan & Hackney, 2010). This shows that digital capabilities alone are insufficient for achieving a successful innovative performance.

The lack of evidence to establish a positive relationship between digital capabilities and firm performance is due to the limitations of the studies to explain their mechanisms. Similarly, previous research does not explain the internal mechanism of reconfiguration from a firm's perspective to increase innovation and firm performance (Salomo, Talke & Strecker, 2008). Therefore, our study seeks to fill this gap by analyzing companies’ success in this “new normal” by increasing firm performance and digital transformation. In addition, in a manner similar to motivation, this study seeks to understand how digital transformation affects firm performance.

Therefore, this study proposes that technological capabilities play an essential role. Recent studies have endeavored to understand the relationship between technological and digital capabilities Zhen et al. (2021). explain how management capabilities influence digital capabilities and firm performance. Similarly, David-West, Iheanachor and Umukoro (2020) observed digital capabilities’ failure in Nigeria and suggested that these technologies need other capabilities to achieve organizational goals. In this regard, in the present environment of constant change due to digitization, technological capabilities require adaptation at the same pace as digital capabilities (Lee & Trimi, 2018).

Due to the spectacular increase in digital technology in this “new normality” (Soto-Acosta, 2020), the concept of collaborative economy allows a greater adoption of digitization in companies by reducing costs and increasing firm performance.

Additionally, the effects of the COVID-19 pandemic vary from country to country. In countries with a low human development index (HDI), firms faced recovery problems during the pandemic due to inadequate infrastructure, scarce public health resources to vaccinate, and the development of informal work, which made them use massive digital platforms through mobile applications (gig economy) to overcome these institutional voids. However, countries with a high HDI responded rapidly during the pandemic using the more efficient capacity, which was built before the onset of COVID-19 (Caballero-Morales, 2021Egger et al., 2021;).

Therefore, such countries reinforce the idea that digital capabilities play a vital role in new normality. Thus, these questions arise: (i) What is the mechanism by which digital capabilities can affect firm performance in accelerated digital transformation in the context of the new normal? More specifically, what are the mediating factors in the effect of digital capabilities on a firm's performance in the context of accelerated digital transformation by the new normal? (ii) Does the impact of digital capabilities get mediated more significantly by technological capabilities in countries with a low level of development (HDI)? We extended the dynamic capabilities theory and used a partial least squares structural equation model (PLS-SEM). In addition, this study used a sample of 999 private companies from 27 countries. We obtained the data from the World Bank Enterprise Surveys, 2020.

Our study presents several significant results and conclusions. First, technological capabilities mediate between digital capabilities and firm performance. In other words, technological capabilities complement digital capabilities to operationalize a firm's value proposition (Wang, 2007). Second, we moved forward in including the context in our relationship. We employed the HDI as a moderating variable. This study considers HDI by country (PNUD, 2020). The HDI measures each country's level of development based on variables, such as life expectancy, education, and income per capita (UNDP). Surprisingly, we found that the impact of digital capabilities on innovation and technology in countries with a low HDI is much more significant than that in countries with a high HDI.

Following our results and conclusions, we propose a new model that emphasizes the interaction between digital and technological capabilities in the “new normal” context. It also analyzes the moderating effect of the HDI to distinguish between high and low HDI economies.

Theoretical framework and development of hypothesesThe “new normal” is considered the great accelerator for the existing global trend toward adopting modern emerging technologies that set the tone for transformations in lifestyle, work patterns, and business strategies (Amankwah-Amoah, Khan, Wood & Knight, 2021). Therefore, it represents a significant change in the environment and the building of new technological innovation capabilities (Zhou et al., 2021).

Previous studies have found the use of specific capabilities of a firm and its reconfiguring role of other capabilities and resources, such as information technology (IT) (Grewal, Comer & Mehta, 2001), artificial intelligence, machine learning (Gordini & Veglio, 2017), the use of virtual reality (Boyd & Koles, 2019), videoconferencing (Hardwick & Anderson, 2019), and internet (Avlonitis & Karayanni, 2000), among others.

This study employed the dynamic capabilities theory (Teece, 2007), developed as an extension of the resource-based view (RBV) (Burisch & Wohlgemuth, 2016). Thus, the definition depended on how firms reconfigure and renew their resources and capabilities over time in turbulent environments (Teece, Pisano & Shuen, 1997). However, recent literature on dynamic capabilities still has a long way to go before constituting a solid integrated framework. In addition, despite the great efforts previously made (Eisenhardt & Martin, 2000a Teece, 2007; Zollo & Winter, 2002;), still present an incipient measurement (Loureiro et al., 2021).

Therefore, our study aims to analyze digital capabilities as a third-order capability that allows the activation of technological capabilities, ensuring an exemplary implementation of a company's value proposition. Indeed, dynamic third-order capabilities emphasize a firm's constant search for reconfiguration and recreation of resources and core capabilities to cope with a changing environment (Wang, 2007).

However, there is still not enough empirical evidence that seeks to explain the relationship between dynamic capabilities and firm performance (Baía & Ferreira, 2019) in the “new normal” context. Thus, a study argues that dynamic capabilities are necessary but insufficient to achieve firm performance ((Baia, Ferreira and Rodrigues, 2020).

In this sense, we consider that an empirical study on dynamic capabilities still needs to be conducted. The review establishes that most studies discuss the relationship between dynamic capabilities and firm performance (Loureiro, Ferreira and Simões, 2021).Ferreira and Fernandes (2017) argue that a good combination of resources and capabilities allows firms to achieve a competitive advantage that generates high performance Wilden and Gudergan (2015). argue that dynamic capabilities (precisely, technological capabilities) have a positive impact on firm performance. However, previous studies have found a negative relationship between digital capabilities and firm performance (Usai et al., 2021). This is because a firm's innovative performance results from creativity and constant research and development activities. It follows that digital capabilities are not the central axis for achieving success in firm performance (Usai et al., 2021).

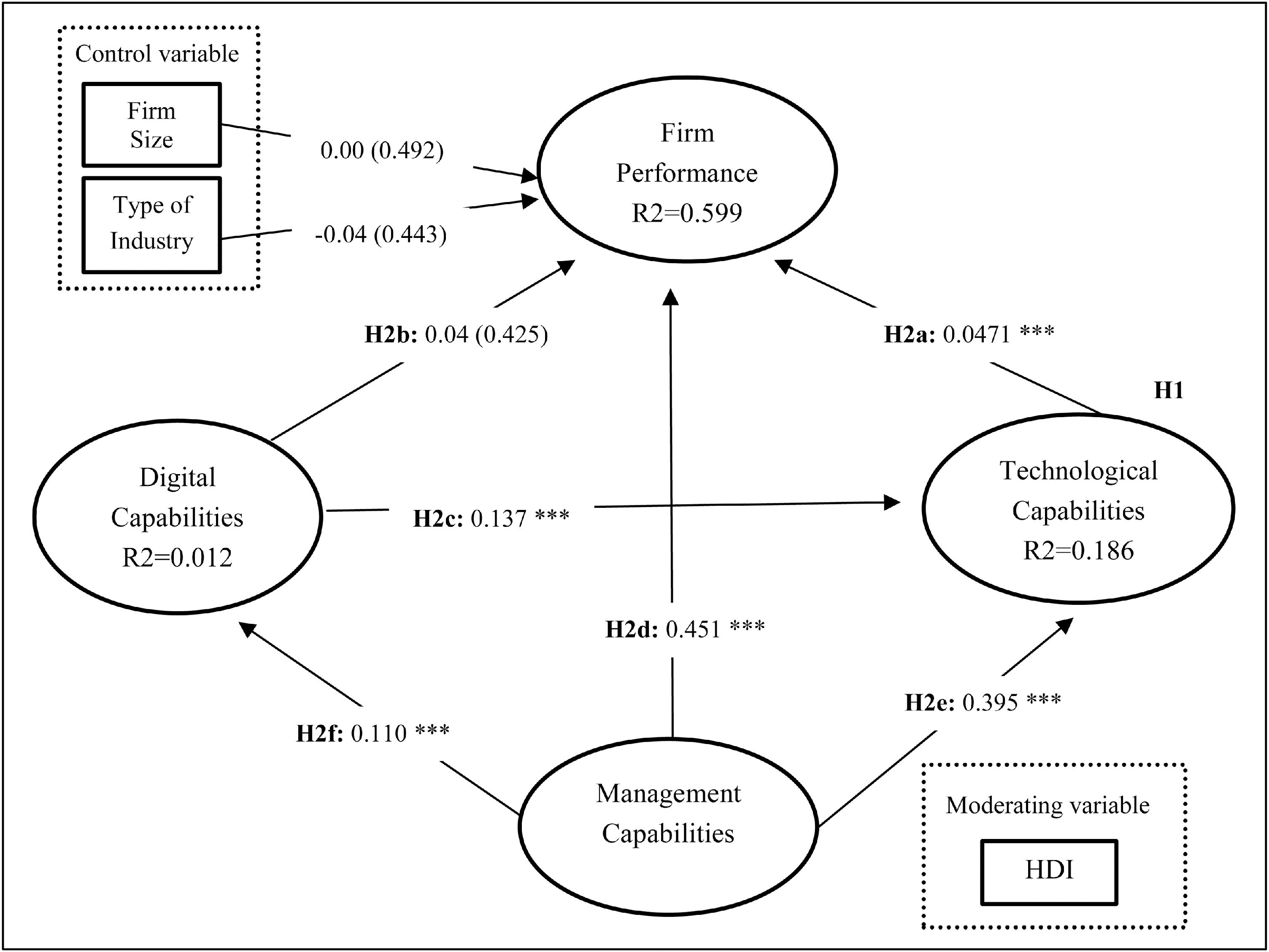

Based on these antecedents, we present a theoretical model for this study, as shown in Fig. 1.

Technological capabilities refer to a firm's ability to develop new products and services by aligning its strategy with innovative processes (Wang, 2007). Such capabilities involve knowledge and skills in acquiring, using, absorbing, adapting, improving, and generating new technologies (Bell & Pavitt, 1995Malhotra, Mathur, Diddi & Sagar, 2021;). These capabilities have enabled the development of new products and technologies, improving manufacturing processes and quality control skills, and predicting technological changes in the industry (DeSarbo, 2005).

Similarly, as a system, digital capabilities are provided through another supplier-user interaction that creates value, also defined as a digital output or service (Srivastava & Shainesh, 2015). Kohli and Grover (2008) defines it as the internal capability to provide customer information at the required instant. According to Lyytinen, Yoo and Boland (2016), digital capabilities are digital systems that generate new outcomes and structures without uncoordinated participation of third-party actors and without deliberate planning by the system creator. Consistent with Yoo, Boland, Lyytinen and Majchrzak (2012), multiple products or subsystems can be designed and controlled using the same digital tools.

Technological capabilities have enabled organizations to create opportunities to support their competitive advantage. In this regard, understanding the dynamics that influence the adoption of digital technologies becomes critical to their success El-Haddadeh (2020). examines the specific aspects of digitization that affect technology adoption in organizations Karimi and Walter (2015). analyze the impact of dynamic capabilities on digital disruption in firm performance. Digital disruption reduces intermediation costs (Sutherland, 2018) and incorporates technology more efficiently (Karimi & Walter, 2015).

In this sense, recent empirical studies have left the relationship between digital capabilities and firm performance ambiguous Torres, Sidorova and Jones (2018). highlight the role of business intelligence and analytics (BI&A) and its positive connection with firm performance from the perspective of dynamic capabilities. However, Usai et al. (2021) and Chen, Lin, Chen, Chao and Pandia (2021) propose that companies reshape their capabilities to meet new market demands by adopting digital transformation as their primary organizational strategy. This environment can also be presented to IT capabilities (Grewal, Comer and Mehta, 2001), artificial intelligence and machine learning (Gordini & Veglio, 2017), use of virtual reality (Boyd & Koles, 2019), video conferencing (Hardwick & Anderson, 2019), and the internet (Avlonitis & Karayanni, 2000), among others, that act as reconfiguring capabilities and resources within an organization. Given the reconfiguring role of digital capabilities in other capabilities, we proposed that digital capabilities, as third-order capabilities, do not positively affect firm performance; instead, this relationship can be harmful.

Thus far, there is evidence that digital dynamic capabilities, which complement other capabilities, have a positive relationship with firm performance Soluk, Miroshnychenko, Kammerlander and De Massis (2021). studied the role of dynamic capabilities as mediators in the relationship between family influence and digital business model innovation (BMI) and the moderating role of environmental dynamism. Similarly, Khin and Ho (2019) examined the effect of digital orientation and capability on digital innovation and their mediating impact on the link between firm performance, digital direction, and digital capability. However, the present study includes new variables such as management and digital capabilities. Additionally, the interaction of HDI (moderating variable) with digital capabilities, technological capabilities, and firm performance has emerged in response to the “new normal.”

The fundamentals of ensuring a successful adoption process depend on how organizations can identify the need to adopt such technological innovations (Kim, 2015). Hence, there is a need to adopt digital tools to improve the effectiveness of organizational functions and processes (Osmonbekov, Bello & Gilliland, 2002). Digital capabilities allow us to take advantage of a large amount of information from the environment and incorporate the technology more efficiently according to an organization's value proposition (Gobble, 2018).

In this “new normal,” Almeida, Santos and Monteiro (2020); propose indications of the impact of digital capabilities in three business areas in the new normality: labor and social relations, marketing capabilities, and technological capabilities. Based on the above, digital technology combines technological capabilities to meet an organization's objectives.

Digital tools have allowed companies to permanently capture significant volumes of information regarding consumers in recent years. In this sense, the development of digital capabilities acquires relevance in organizations, allowing the use of information to reduce the cost structure and redesign their processes. Consequently, technological capabilities are activated by digital ones, improving the quality of products and services provided and, therefore, improving firm performance (Ciampi, Demi, Magrini, Marzi & Papa, 2021).

This study considered that digital capabilities enable the identification of signals from the environment and as the main complement to other capabilities. Likewise, third-order capabilities allow for the activation of resources and inferior capabilities. Thus, the following hypothesis is proposed:

H1: Technological capabilities have a mediating effect between digital capabilities and firm performance.

Collaborative economies, the level of development of countries, and digital capabilitiesCollaborative economies are emerging and growing through the possibility of developing or transforming new activities in emerging economies. Collaborative economies help to reconfigure capabilities and resources through digital technologies (Malik, 2020). Similarly, developing new capabilities in companies can lead to disruptive opportunities Fainshmidt, Pezeshkan, Lance Frazier, Nair and Markowski (2016). argue that new capabilities contribute more significantly to firm performance in emerging economies than in developed ones. Institutional factors such as informality and institutional gaps promote collaborative economies in emerging markets (Boateng, Kosiba & Okoe, 2019Heredia, Geldes, Kunc & Flores, 2019;).

Therefore, collaborative economies have more significant advantages in emerging economies because of their lower levels of investment and more straightforward implementation (Dokko, 2015). Thus, in economies with a low level of development, the use of collaborative economies significantly reduces intermediation costs (Dokko, 2015).

Thus, it can be said that emerging economies have a low HDI. The initial premise of this index was that national development should include both life expectancy and literacy. Amartya Sen is the pioneer of this approach, and it is a widely known concept of human welfare or development. Emerging economies with a low level of HDI present high levels of creativity, and collaborative economies are growing in emerging economies (Vega-Muñoz, Bustamante-Pavez and Salazar-Sepúlveda, 2019). The development of a collaborative economy in emerging economies requires less complexity in the design of these tools than in developed economies. HDI represents the level of public health infrastructure (Ross & Wu, 1996), inequality, and poverty (Leung, Sharma, Adithipyangkul & Hosie, 2020).

During the pandemic, the term “gig economy” became popular due to the growth of digital platforms and apps. In this sense, the rapid spread of digital technology has generated new economic activities. A study argues that the pandemic positively impacted the “gig economy” (Umar, Xu & Mirza, 2021). In addition, communication technologies, digital platforms, and apps have allowed people with a computer, cell phone, and internet connection to perform jobs from anywhere in the world (Anwar & Graham, 2021). Therefore, intensification of the gig economy in emerging countries with a low HDI generates new employment opportunities (PNUD, 2020). An essential aspect of the “gig economy” is that it offers non-traditional forms of work because there is no employer-employee relationship, achieving greater flexibility, as workers decide the hours and days they work.

The rapid growth of the “gig economy” in emerging economies (low HDI) is because there is a greater supply of informal workers in these economies as well as a greater adoption of temporary work by mobile applications driven businesses. In this sense, companies’ digital capabilities increase, reducing business costs and increasing firm performance. Thus, we propose the following hypothesis:

H2: In countries with low HDI, the impact of digital skills on technological capabilities is more significant than in countries with high HDI.

MethodologyThe data were obtained from the “Enterprise Survey – Covid19: Impact on firms” conducted by the World Bank 2020. We extracted data from a sample of 999 private companies that had participated in the survey. The sample is according to the adequate number of responses in the variables included in the study.

The countries considered in the sample are Guatemala, Bulgaria, Latvia, Moldova, Romania, El Salvador, Mongolia, Morocco, Honduras, Nicaragua, Czech Republic, Poland, Georgia, Estonia, Hungary, Slovak Republic, Italy, Croatia, Slovenia, Greece, North Macedonia, Portugal, Lithuania, Cyprus, Malta, Zimbabwe, and Zambia. We considered 27 countries to overcome the limitations of previous studies, which had considered a single country for analysis. Our research focused on studying a large group of countries to ensure adequate variability and robustness. This group of countries has one thing in common, that is, they have not produced vaccines for the pandemic.

In addition, the R-squared value improves when country effects are considered (Olczyk & Kuc-Czarnecka, 2021). Rocha (2021). indicates that it is necessary to consider a set of countries to understand the heterogeneous effects and improve the robustness of a model. Hence, we highlight that the selected sample was previously considered a missing data treatment of up to 50% missing values in the variables for each analyzed firm (Hair, Sarstedt, Ringle & Gudergan, 2017). Consequently, the companies that presented more than half of the variables as missing had to withdraw from the study. Note that the companies that participated in the survey belonged to manufacturing, retail, and other sectors.

We used the HDI (as a moderation variable), and the values corresponding to each country are shown in Table 7. We eliminated the possibility of heterogeneity bias in the sample (Motiwalla, Albashrawi & Kartal, 2019), using HDI as a moderating variable. We proposed HDI in 2020 as a moderating variable because it captures the actual effect of the pandemic, as HDI is an indicator of the previous level of preparedness of the countries. We also considered it a key variable because it allowed us to analyze the heterogeneity of countries. In this way, we tested our model in two clusters of countries, with lower and higher HDI, to better understand the intensity of pandemic damage (COVID-19) at the firm level; countries with lower HDI have suffered more due to the pandemic because they do not have sufficient financial resources, and vice versa (Caballero-Morales, 2021Egger et al., 2021;). Therefore, the HDI is the only indicator that considers people's capacity to be affected by the COVID-19 pandemic (Mithani, 2020).

Definition of variablesThe present study considered four variables through internal factors (resources and capabilities) and external factors (moderating HDI) that are relevant to firm performance in this “new normal.”

The independent variable of the model was management capability. The mediating variables of the model were digital and technological capabilities. Finally, the dependent variable was firm performance. We emphasize that all the variables are constructs in which a series of indicators have been formed Table 1. shows descriptions of these variables.

Definition of constructs and indicators.

| Constructs | Indicators | Description | Variables and Scale | References | |||

|---|---|---|---|---|---|---|---|

| Management capabilities | Liquidity | Since the COVID-19 outbreak, has the liquidity or cash flow of this facility increased? | Dichotomous. “No” | 1 | “Yes” | 0 | Wernerfelt (1984)Westhead, Wright and Ucbasaran (2001)) DeSarbo (2005); |

| Technological capacity | Supply Variation | Comparing the supply of inputs, raw materials, or finished goods and materials purchased for resale from this establishment [insert last completed month] to the same month in 2019, did it increase (did they increase)? | Dichotomous. “No” | 1 | “Yes” | 0 | Bell and Pavitt (1995)DeSarbo, 2005; |

| Variation hours of operating | Comparing the total hours of operation of this facility per week [insert last full month] to the same month in 2019, did it increase (did they increase)? | Dichotomous. “No” | 1 | “Yes” | 0 | (Feng, Sun, Chen and Gao, 2020) DeSarbo (2005); | |

| Digital capability | Online activity | Did this facility experience initiating or increased online business activity in response to the COVID-19 outbreak? | Dichotomous. “No” | 1 | “Yes” | 0 | Zhou and Wu (2010) |

| Delivery | Did this facility experience an increase in the delivery or provision of goods or services in response to the COVID-19 outbreak? | Dichotomous. “No” | 1 | “Yes” | 0 | ||

| Remote work | Did this facility experience initiation or increased telecommuting of staff in response to the outbreak of COVID-19? | Dichotomous. “No” | 1 | “Yes” | 0 | ||

| Firm performance | Demand variation | Comparing the demand for this establishment's products and services for [insert last completed month] to the same month in 2019, did it increase? | Dichotomous. “No” | 1 | “Yes” | 0 | Rolstadås (1998) |

| Change in sales | Comparing this establishment's sales for [insert last completed month] to the same month in 2019, did the sales increase? | Dichotomous. “No” | 1 | “Yes” | 0 | ||

| Control variable | Type of industry | To which industry does the company belong: manufacturing, retail, or services? | ManufacturingRetail = 2Services = 3 | =1 | Medase and Abdul-Basit (2020)Moretti and Biancardi (2020); | ||

| Firm Size | At the end of December 2019, how many permanent, full-time employees did this establishment employ? | Continuous variable | Höflinger, Nagel and Sandner (2018)Clauss et al., 2021; | ||||

Source: Own elaboration.

We used the “Enterprise Survey – Covid19: Impact on firms.” The World Bank designed this study to measure the effect of the virus on the countries considered in the sample. The measures used for each variable in the study were dichotomous. The constructs used were management capabilities, technological capacity, digital capabilities, and firm performance. The liquidity variable represents management capability. The measure of technological capabilities is the variation in operating hours and supplies—digital capabilities measured by online activity, delivery, and the adoption of remote work. Finally, firm performance refers to two items: change in sales and demand for goods and services (see Table 1).

All constructs were measured as mode A composites (Henseler & Schuberth, 2020). We analyzed the standard method to assess the quality of the information, which could improve the relationships between variables when collected from the same source. The analysis applying Harman's single-factor test (Podsakoff & Organ, 1986) did not reveal that the variables were grouped into a single factor, thus presenting no problems (Twigg, Kutzer, Jacob & Seaman, 2019).

We included the following control measures to eliminate the possible endogeneity of the omitted variable bias (Hamilton & Nickerson, 2003), which has been shown in the literature to impact firm performance. Size is measured using the number of employees in a firm (Clauss et al., 2021Medase & Abdul-Basit, 2020; Moretti & Biancardi, 2020;). We also included industry-type dummy variables to represent the selected subsectors (manufacturing, retail, and services) (Clauss et al., 2021Höflinger, Nagel & Sandner, 2018;). To detect and overcome the possible existence of unobserved heterogeneity bias due to unknown factors, we followed the proposal of Motiwalla, Albashrawi and Kartal (2019) and segmented the sample into different groups according to countries with high or low HDI.

Data analysisWe tested our research model using partial least squares (PLS) and the SmartPLS package (v.3.3.3) (Ringle & Sarstedt, 2016). We used PLS for the following reasons.

(1) The research model is complex, depending on the type of hypothesized relationships (direct, mediation, and moderation); (2) It has the advantage of not imposing distributional assumptions for the indicators, and (3) The constructs included are composite (Chin, 2010Sarstedt, Henseler & Ringle, 2011;). This model is also widely used to test theories using the dynamic capabilities approach (Ali, Javed & Danish, 2021Ebrahimi, Hamza, Gorgenyi-Hegyes, Zarea & Fekete-Farkas, 2021; Frempong, Mu, Adu-Yeboah, Hossin & Adu-Gyamfi, 2021;).

The application of the PLS technique involves several steps, including model fitting, applying a bootstrapping process (10,000 subsamples), following bootstrap-based exact fit tests for the estimated model (Henseler, Ringle and Sarstedt, 2016). Further, we evaluated the measurement model by analyzing the fit of the saturated model (Müller, Schuberth and Henseler, 2018). Finally, the algebraic sign, magnitude, and statistical significance of the path coefficients were assessed and coefficients of determination (R2) were evaluated (Ali, Rasoolimanesh, Sarstedt, Ringle & Ryu, 2018).

We tested the moderating hypothesis, H2, using multi-group analysis (Henseler & Fassott, 2010). We divided the sample into two groups: countries with a high or low HDI. Before comparing the path estimates between groups, it was necessary to ensure measurement invariance of the composites. Then, it was possible to ensure that the effect of HDI as a moderating variable in the model was due to the path coefficients of the structural model and not because of the parameters of the external model. A three-step procedure for analyzing the measurement invariance of composite models (MICOM) was used (Henseler, Ringle and Sarstedt, 2016).

ResultsMeasurement modelThe indicator loadings of each construct were generally above 0.707, except for the online activity indicator, whose value was 0.664, which was slightly below the threshold. We retained to improve the explanation of the construct (Henseler & Schuberth, 2020). The composite reliability of the constructs was above 0.7, and AVE was above 0.5. Cronbach's alpha and rhoA values for the technological and digital capabilities constructs were slightly below the cutoff. However, we kept these indicators considering that a value above 0.5 may be sufficient (Taherdoost, 2016). We evaluated discriminant validity according to the Fornell-Larcker criterion (Fornell & Larcker, 1981) and heterotrait-monotrait ratio (HTMT) value (Henseler, Ringle and Sarstedt, 2016). These values are listed in Table 2.

Measurement model - Discriminant validity.

| Fornell–Larcker Criterion | Heterotrait–Monotrait Ratio (HTMT) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 1 | 2 | 3 | 4 | 5 | 6 | |

| 1. Firm Performance | 0,935 | |||||||||||

| 2. Technological Cap. | 0,654 | 0,850 | 0,898 | |||||||||

| 3. Digital Cap. | 0,137 | 0,169 | 0,709 | 0,203 | 0,285 | |||||||

| 4. Management Cap. | 0,645 | 0,411 | 0,105 | 1000 | 0,697 | 0,524 | 0,145 | |||||

| 5. Size | 0,083 | 0,096 | 0,106 | 0,092 | 1000 | 0,090 | 0,121 | 0,143 | 0,092 | |||

| 7. Sector | 0,000 | −0,001 | 0,075 | −0,004 | −0,102 | 1000 | 0,006 | 0,048 | 0,105 | 0,004 | 0,102 | |

Fornell–Larcker Criterion: Diagonal elements (bold) are the square roots of the variance shared between the constructs and their measures (average variance extracted). Off-diagonal elements are the correlations among the constructs. For discriminant validity, diagonal elements should be more significant than off-diagonal elements. AVE: Average variance extracted.

Source: Own elaboration.

Following Hair, Sarstedt, Ringle and Gudergan (2017), to assess the statistical significance of the path coefficients, we used bootstrapping (10,000 resamples) to generate t-statistics, along with confidence intervals. The R2 values for firm performance and technological capability were significant Fig. 1. shows the results of this model. In total, only one of the direct effects was non-significant, whereas the other five were significant.

Finally, we followed the proposed measures to assess the goodness-of-fit of the estimated model (Dijkstra & Henseler, 2015). The standardized root mean square residual (SRMR) of the model was less than 0.10, as proposed in other studies (Ringle, Sarstedt & Straub, 2012Williams, Vandenberg & Edwards, 2009;) Table 3. shows that the variances were not significant because the 99 percent bootstrap quantiles of the value of the three measures (SRMR, the unweighted least squares discrepancy dULS, and the geodesic discrepancy dG) were higher than the original values (Henseler, Ringle and Sarstedt, 2016), making the model explanatory.

Global model fit.

| Estimated model | Original value | HI95-HI99 |

|---|---|---|

| SRMR | 0.030 | 0.026–0.030 |

| Duls | 0.050 | 0.037–0.049 |

| Dg | 0.012 | 0.012–0.015 |

Notes: SRMR: standardized root mean squared residual (SRMR); dULS: unweighted least squares discrepancy; dG: geodesic discrepancy; HI95: bootstrap-based 95% percentiles; HI99: bootstrap-based 99% percentiles; HI99: bootstrap-based 99% percentiles.

Source: Own elaboration.

To test the mediation hypothesis, H1, we applied the analytical approach described by Nitzl, Roldan and Cepeda (2016). We specified the indirect effect of digital capabilities on firm performance through technological capabilities. As shown in Table 4, digital capabilities do not directly affect firm performance. As (Usai et al., 2021) mentioned, we identified complete mediation by introducing technological capabilities, supporting the idea of Wang (2007) that technological capabilities complement digital capabilities. In addition, the results did not reveal heterogeneity bias for any of the controlled variables. Thus, Hypothesis 1 is accepted.

Summary mediation effect.

| Percentile | |||||

|---|---|---|---|---|---|

| Direct Effects | Coefficient | Lower (2.5%) | Upper (95%) | Sig. | t-value |

| c’ (Dig–>Perf) | 0.004 | −0.029 | 0.042 | No sig. | 0.175 |

| a (Dig–>Tecn) | 0.137 | 0.082 | 0.193 | Sig. | 4.076 |

| b (Tecn –> Perf) | 0.471 | 0.392 | 0.548 | Sig. | 9.91 |

| Indirect effects | Point estimate | ||||

| a*b | 0.064 | 0.037 | 0.096 | Sig. | 3.621 |

p<.001 (based on t (4999), one-tailed test.

Source: Own elaboration.

To test the moderating hypothesis, H2, concerning multi-group analysis, we used a measurement model invariance of composite models (MICOM) (Henseler, Ringle and Sarstedt, 2016). This approach involved three steps: (i) configuration invariance, (ii) compositional invariance, and (iii) full-measurement model invariance (Henseler, Ringle and Sarstedt, 2016; Sarstedt, Henseler and Ringle, 2011). We used the MICOM procedure by running a two-tailed permutation test for the moderating variable (HDI) at a 5% significance level and 10,000 permutations. The results of the MICOM procedure are shown in Table 5. The results of the permutation-based multigroup analysis are shown in Table 6, indicating the hypothesis tested for each group as H2a, H2b, H2c, H2d, H2e, and H2f. According to the HDI, three relationships show differences between countries: the effect of technological capabilities on firm performance, the impact of digital capabilities on technological capabilities, and the effect of liquidity on firm performance.

MICOM results.

| Composite | Original Correlation | 95% confidence interval | p-value | Compositional invariance? | |

|---|---|---|---|---|---|

| 1. Firm Performance | 0,989 | [0,970;1000] | 0,223 | Yes | |

| 2. Technological Capabilities | 0,992 | [0,942;1000] | 0,472 | Yes | |

| 3. Digital Capabilities | 0,673 | [0,566;1000] | 0,131 | Yes | |

| 4. Management Capabilities | 1 | [1000;1000] | 0,683 | Yes | |

| 5. Size | 1 | [1000;1000] | |||

| 6. Sector | 1 | [1000;1000] | 0,040 | No | |

| Composite | Difference of mean value | 95% confidence interval | p-value | Equal mean values? | |

| 1. Firm Performance | 0,058 | [−0,131;0,135] | 0,416 | Yes | |

| 2. Technological Capabilities | 0,092 | [−0,129;0,139] | 0,166 | Yes | |

| 3. Digital Capabilities | 0,377 | [−0,134;0,134] | No | ||

| 4. Management Capabilities | −0,079 | [−0,132;0,132] | 0,301 | Yes | |

| 5. Size | 0,209 | [−0,119;0,139] | 0,001 | No | |

| 6. Sector | 0,271 | [−0,123;0,126] | No | ||

| Composite | Difference of variances ratio | 95% confidence interval | p-value | Equal variances? | |

| 1. Firm Performance | 0,009 | [−0,346;0,311] | 0,953 | Yes | |

| 2. Technological Capabilities | 0,247 | [−0,421;0,389] | 0,235 | Yes | |

| 3. Digital Capabilities | 0,465 | [−0,165;0,156] | No | ||

| 4. Management Capabilities | −0,279 | [−0,491;0,408] | 0,236 | Yes | |

| 5. Size | 0,382 | [−1138;1102] | 0,635 | Yes | |

| 6. Sector | 0,034 | [−0,085;0,078] | 0,432 | Yes | |

Source: Own elaboration.

Permutation-based multi-group analysis for path coefficients and indirect effects.

| Hypothesis | Path | Path Coefficients (IDH=0) | Path Coefficients (IDH=1) | Path Coefficients Difference IDH | Permutation p-value | Hypothesis Supported |

|---|---|---|---|---|---|---|

| H2a | Technological capacity–>Firm Performance | 0,656 | 0,373 | 0,283 | 0,007 | Yes |

| H2b | Digital Caps. –> Firm Performance | −0,037 | 0,001 | −0,038 | 0,392 | No |

| H2c | Digital Caps. –> Technological Caps. | 0,245 | 0,050 | 0,195 | 0,006 | Yes |

| H2d | Management Caps. –> Firm Performance | 0,179 | 0,579 | −0,400 | 0,001 | Yes |

| H2e | Management Caps.–>Technological Caps | 0,350 | 0,424 | −0,075 | 0,481 | No |

| H2f | Management Caps.–> Digital Caps. | 0,142 | 0,138 | 0,004 | 0,939 | No |

| Size–> Firm Performance | 0,039 | −0,008 | 0,047 | 0,466 | No | |

| Sector–> Firm Performance | 0,057 | 0,057 | 0,072 | 0,086 | No |

Source: Own elaboration.

Construction of HDI as a moderating variable.

| Countries | HDIcontinuous | HDI dichotomous (moderating) |

|---|---|---|

| Guatemala | 0.663 | 0 |

| Bulgaria | 0.816 | 1 |

| Latvia | 0.866 | 1 |

| Moldova | 0.750 | 0 |

| Romania | 0.828 | 1 |

| El Salvador | 0.673 | 0 |

| Mongolia | 0.737 | 0 |

| Morocco | 0.686 | 0 |

| Honduras | 0.634 | 0 |

| Nicaragua | 0.660 | 0 |

| Czech Republic | 0.900 | 1 |

| Poland | 0.880 | 1 |

| Georgia | 0.812 | 1 |

| Estonia | 0.892 | 1 |

| Hungary | 0.854 | 1 |

| Slovak Republic | 0.860 | 1 |

| Italy | 0.892 | 1 |

| Croatia | 0.851 | 1 |

| Slovenia | 0.917 | 1 |

| Greece | 0.888 | 1 |

| North Macedonia | 0.774 | 0 |

| Portugal | 0.864 | 1 |

| Lithuania | 0.882 | 1 |

| Cyprus | 0.887 | 1 |

| Malta | 0.895 | 1 |

| Zimbabwe | 0.571 | 0 |

| Zambia | 0.584 | 0 |

| Mean | 0.797 |

Source: Own elaboration.

Finally, technological capabilities have a mediating effect between digital capabilities and firm performance at 100% because this study shows that the relationship between digital capabilities and firm performance is not significant. Similarly, through an analysis of impacts comparing countries with low HDI with countries with high HDI, we can affirm that in countries where the HDI is low, the impact of digital capabilities is more significant on firm performance than in countries where the HDI is high. The results do not indicate an unobserved level of heterogeneous bias because the model results did not change when analyzing groups with control variables. Thus, Hypothesis 2 is accepted.

DiscussionTo evaluate the goodness-of-fit of the estimated model, we followed the measures proposed by Dijkstra and Henseler (2015). The SRMR for the model was less than 0.10, as suggested by Ringle, Sarstedt and Straub (2012)Table 3. shows that the deviations were not significant because the 99 percent bootstrap quantiles of the three measures (SRMR, the unweighted least squares discrepancy dULS, and the geodetic discrepancy dG) were more significant than the original values (Henseler, 2017; Henseler, Ringle and Sarstedt, 2016). Therefore, based on the analysis performed and the results obtained, it is stated that the present study is confirmatory.

We also identified that technological capabilities fully mediate digital capabilities. Therefore, the development of digital capabilities influences technological capabilities to improve firm performance. Digital capabilities enable digital activities, which impact the use of information to improve processes because it is an activity with internal origins.

The impact of digital technology on technological capabilities is more significant in countries with a low HDI than in those with a high HDI. Two complementary factors explain the high incidence of collaborative economies in low HDI economies. The first is the low cost of digital platforms’ implementation. The second factor is the increase in creativity in low-HDI economies due to the scarcity of resources and the need to adapt. In response, low-cost digital tools have been adopted and employed in such economies (Vega-Muñoz, Bustamante-Pavez and Salazar-Sepúlveda, 2019).

ConclusionsAlthough we know that digital capabilities are related to firm performance, we know very little about the mechanism of this relationship and the role of HDI as a moderating variable to allow us to explain this phenomenon. Based on this, we believe it is necessary to address this “gap” through a structural model (PLS-SEM) that demonstrates a firm's performance in this “new normal.” For this reason, the authors analyzed 999 firms in the World Bank, 2020 study, based on data from 27 countries.

This study shows that digital capabilities do not directly affect firm performance. Moreover, technological capabilities function as mediators between digital capabilities and firm performance. In addition, this study observes that in countries with low HDI levels, the effects of digital capabilities on technological capabilities are more significant than in countries with high HDI levels. In this sense, digital infrastructure such as digital marketing has allowed companies to survive in this “new normal” (Ghorbani et al., 2021). Moreover, in emerging economies with low HDI during the pandemic outbreak, the use of digital platforms and apps (gig economy) intensified, allowing companies to improve their performance.

Furthermore, the development of digital capabilities is essential to generate innovation and to take advantage of the mediating effect of technological capabilities to improve firm performance. This is even more critical in less developed economies because the implementation of digital platforms has a disruptive impact owing to reduced costs and ease of implementation.

RecommendationsThe results show that in countries with a low level of development, collaborative economies have a greater impact because of low costs in these economies. Therefore, we recommend taking advantage of the returns of collaborative economies in developing countries and the increasing demand for activities related to e-commerce because the effect on them is disruptive. Likewise, the context of informality (Boateng, Kosiba and Okoe, 2019;Pérez, Yang, Bai, Flores & Heredia, 2019;) is ideal for developing collaborative economies, expanding products and services, improving market access, and income generation.

Digital transformation can be a critical tool for companies to accelerate technological innovation (Troise, Corvello, Ghobadian & O'Regan, 2022). Our study emphasizes that digital capabilities can generate technological innovation faster than traditional capabilities (long-term resource investment and funding constraints). Thus, companies must digitize as quickly as possible to become more efficient. Additionally, the government should provide facilities for companies to develop technologies more quickly (Heredia, Rubiños, Vega, Heredia & Flores, 2022).

Future research directionsThe analysis conducted in our research collected cross-sectional information at a specific point within the context of the “new normal.” In the future, we can analyze firm dynamics and the influence of technology collaboration networks, and how they are affected by macroeconomic cycles, industry life cycles, and firm age (Ramírez-Alesón & Fernández-Olmos, 2021). Also, we propose to analyze the interaction of digital capabilities with other types of capabilities and resources in organizations (such as labor and social relations, marketing capabilities, and technological capabilities) (Almeida, Santos and Monteiro, 2020). Future research should focus on a longitudinal study or conduct analyses using a non-recursive structural model, which shows that a firm's performance influences its resources and capabilities. We propose new moderating variables, such as the globalization index (KOF) and the global competitiveness index (GCI), as suggested by Skare and Soriano (2021). Likewise, another line of future research is on the dynamic perspective of the model, which would allow us to contrast our results and make significant contributions in the light of the appearance of new variants of the COVID-19 virus.

Finally, future research should focus on replicating this study in developed and vaccine-producing countries, given that our study only considered a segment of vaccine-receiving countries to monitor the effects of the pandemic (Dinleyici, Borrow, Safadi, van Damme & Munoz, 2021).

ImplicationsThis study provides relevant management implications for leadership in the pursuit of improving firm performance through digital capabilities. First, digital capabilities are a sufficient, but not necessary, condition. Second, the positive impact of technological capabilities (mediating variable) on the relationship between digital capabilities and firm performance. Third, during the pandemic, the sustainable growth of “gig economy” activities, especially in countries with a low HDI.

In terms of societal implications, we recognize the role of firms’ digital capabilities during the COVID-19 pandemic and in achieving a “new normal.” Furthermore, this study argues for the positive impact of digital capabilities in low HDI countries (Kryzhanovskij, Baburina & Ljovkina, 2021); which indicates that digitalization (firm-level perspective) can provide sufficient opportunities to generate growth, help improve people's quality of life, and promote human development.

Acknowledge

Special acknowledge to the Center of research at Universidad del Pacífico for supporting this research and the assistant research Oscar Andree Flores Leon for support on data processing.