Micro-level analysis of innovation performance has become increasingly crucial to innovative policy in the context of innovation-driven economies. A micro-influence mechanism of human capital mismatch is presented in this paper and analysed. This research utilises a sample of 2510 high-tech enterprises in Zhejiang Province, China, for 2020. The research reveals that high-tech enterprises’ limited human capital is still severely mismatched, which significantly impedes innovation. The conclusion remains valid even after accounting for omitted variable bias and reverse causality. Considering the moderating effect of mismatch and innovation, the results of the study indicate that R&D investment, domestic and foreign talent are detrimental to innovation in the presence of human capital mismatch. Finally, the article concludes by pointing out that correcting human capital mismatch, clarifying relationships among factor structure, price mechanism, and innovation performance, as well as accumulating human capital, is crucial for stimulating the innovation vitality of high-tech enterprises.

Joseph Schumpeter used the term “innovation” for the first time in his “Theory of Economic Development,” stating that enterprise innovation refers to the introduction of a new or significantly improved production method (Carlsson, 2007). As a result of this study, five scenarios were developed: product development, technology introduction, the creation of a new market, resource acquisition, and organisational formation (Johannessen et al., 2001). Bernardin and Beatty (1984) provided an introduction to innovation from three angles: outcomes, innovation behaviour and innovation ability.

Innovation can be viewed from a narrow or broad perspective. In a narrow sense, it refers to the extent to which innovations are introduced within an enterprise. In a broad sense, innovation refers to the performance achieved through the process of generating innovative concepts and launching products to market (Ven & Poole, 1995). Due to its multiple senses, it is challenging to define innovation uniformly. Different perceptions of innovation require different metrics for measuring them.

The literature on innovation involves multiple innovation performance indicators that represent different concepts. Innovation performance indicators include the input, intermediate, and output indicators. Beneito (2006) defined innovation as the production of knowledge which can be proxied with such indicators as R&D investment, R&D workers (Du et al., 2019; Huang, 2023) or external technology acquisition (Brunswicker & Vanhaverbeke, 2015; Hervás-Oliver et al., 2021). Benito (2006) defined intermediate innovation, which can be measured by patents (Dang & Motohashi, 2015; Hegde et al., 2023) or trademarks (Flikkema et al., 2014; Block et al., 2022) obtained. Morris (2008) defined innovation as innovation-related outcomes with standard indicators, such as new products sales or the number of new products (Luzzini et al., 2015; Ramadani et al., 2019; Lianto et al., 2022). Carayannis et al. (2018) and Nuvolari et al. (2021) proposed composite indicators as a measure of innovation since there is no “one-fits-all” indicator. Overall, measuring innovation is a challenging task.

Furthermore, the influencing factors on innovation are an important area of research. The influencing factors of innovation performance can be summarised into four major categories: environmental, individual, structural, and organisational factors (Cole & Wayland, 1997; Li et al., 2017). Environmental factors refer to the macro-environment in which the enterprise operates, such as market-based development, government macro policy, and others (Wang et al., 2019; Yin et al., 2022). Individual factors consist primarily of the characteristics of enterprise executives, including their educational attainment, work experience, gender, etc. (Laguir & Den Besten, 2016; Afsar & Umrani, 2020; Yang et al., 2023). Structural factors refer to the introduction of technology or talent, which indicates the interaction between enterprises and external organisations (Veland et al., 2017; Xu et al., 2022). Organisational factors are the internal characteristics of the enterprise, such as its size, capital, or human resources, etc. (Garcia Martinez et al., 2019; Ramírez et al., 2020).

According to the literature, structural and organisational factors are more important than environmental and individual factors in exploring innovation performance. The relevant research has also gradually shifted from single-factor to multi-factor analysis, such as the cross-cutting study of human capital and R&D investment (Hsu et al., 2020; Chen & Kim, 2023), human capital and technology acquisition (Jimenez & Valle, 2020; Pradana et al., 2020).

In both the New-Kaldor Facts and the endogenous growth theory, human capital is recognised as a specific factor of production. Human capital is a combination of knowledge, technology, ability, and creativity that exhibits features of increasing returns to scale (Acemoglu, 1996). Therefore, human capital can promote innovation directly or indirectly by increasing consumption and output (Li et al., 2015; Vixathep et al., 2019; Timothy, 2022; Selivanovskikh, 2023).

According to the principle of marginal remuneration, Hsieh and Klenow (2009) argued that factors of comparative advantage are allocated inefficiently, preventing innovation from succeeding. Especially in the “New Kaldor Facts”, the mismatch between human capital and sustainable development becomes more pronounced (Gabardo et al., 2017; Ruggeri, Yu, 2023).

Human capital mismatch occurs when advanced human capital is treated as simple labour. Basically, it describes the involvement of human capital in the final goods sector with low skills in production activities (Marchante & Ortega, 2012; Marchiori & Franco, 2020). Human capital mismatch reflects labour allocation in enterprises. In addition, unemployment and job vacancies are external manifestations of human capital mismatch (Ruggeri & Yu, 2023).

Most research on human capital mismatch focuses on its internal mechanisms, typical forms, and effects. Economic development models and structural imbalances in the workforce are considered to be the primary mechanisms responsible for human capital mismatch (Anaduaka, 2014; Kuzminov et al., 2019; Wang et al., 2022).

Furthermore, the typical forms of human capital mismatch can be characterised in three ways. First, there may be a mismatch between different ownership systems, such as the government, competition, and monopoly sectors (Li & Yin, 2017; Mocetti & Orlando, 2019; Liu et al., 2023). Second, one may face a mismatch between different industries, primarily productive and non-productive (Yian, 2019; Liu et al., 2023). Third, a mismatch between different departments, particularly technology-intensive and end-product departments, may occur (Ge & Li, 2019).

The existing literature on the impact of human capital mismatch generally analyses from a macro perspective, such as industrial structure, economic growth, technological innovation etc. (Teixeira & Queirós, 2016; McGowan & Andrews, 2017; Burroni et al., 2019), whereas those with the latest analyses focus on enterprises from a micro perspective (Li et al., 2021; Jibir et al., 2023; Braunerhjelm & Lappi, 2023).

The research on the adjustment of human capital quality needs to be furthered as the questions related to the allocation of human capital remain important. Knowledge transfer and innovation are highly related to these issues. In particular, high-tech enterprises require explanation and motivation for actions surrounding human capital adjustment (Kim & Choi, 2018; Li et al., 2021, 2023).

Such emerging economies as China further stress the need for analysis of human capital quality and allocation. The Chinese government has put forward innovation-driven development strategies to increase enterprises’ self-innovation capacity, especially in high-end equipment production and novel metal development. However, innovation at companies, especially high-tech companies, remains unsatisfactory. It is well known that patent bubbles and innovation illusions are common phenomena that prevent innovation at companies from supporting sustained economic growth and upgrading the real economy in a sustainable manner (Staub et al., 2016; Sun & Li, 2022; Zhang et al., 2023a,b).

Against this backdrop, this research aims to identify the effects of human capital mismatch on innovation performance and to identify which approaches towards promoting innovation performance are most effective based on the cross-perspective of human capital mismatch and company innovation. This research is conducted from the following perspectives: first, Huzhou high-tech companies from 2019 to 2020 are taken as an example to investigate the link between human capital mismatch and innovation performance; second, based on Hsieh and Klenow (2009), this study introduces the concept of labour quality into a framework of the production function, as well as relaxing the assumption of constant returns to scale. Human capital mismatch can be calculated by determining the difference between the optimal and actual level of human capital. Third, the role of human capital mismatch as a mediator through which enterprise innovation is affected by domestic and foreign talents, R&D expenses and R&D personnel is analysed. These mechanisms prove that human capital mismatch inhibits enterprise innovation and development in the long run and can be used to identify more effective methods for improving this situation.

This paper offers several contributions to the analysis of the human capital–innovation nexus. First, this study introduces the concept of labour quality into a framework of the production function, as well as relaxes the assumption of constant returns to scale, thus providing an improved framework for the measurement of human capital mismatch. Second, the explanatory variables covered (R&D investment, R&D personnel, domestic talents and foreign talents) allow for a more comprehensive modelling of the innovation performance. Such a setting allows inferences to be made on the mediating role of the human capital mismatch in a more comprehensive manner.

The rest of this paper is organised as follows: Section 2 describes the theoretical framework of human capital mismatch and the regulation mechanism of human capital mismatch on innovation performance in high-tech enterprises. Section 3 analyses data from Huzhou City, Zhejiang Province and measures the mismatch degree of human capital. The actual impact of human capital mismatch on the innovation performance of high-tech enterprises is discussed in Section 4. Section 5 conducts a study on the moderating mechanism of human capital mismatch. The conclusions and implications of this paper are shown in Section 6.

Theoretical framework and mechanism analysisTheoretical framework of human capital mismatchThe literature on measuring human capital mismatch has received substantial interest with increasing interest on economic growth. However, there is no harmonised framework and methodology for measuring human capital mismatch. The measurement of factor allocation distortions can be categorised into direct and indirect methods (Restuccia & Rogerson, 2017). Among them, the direct measurement of the mismatch is in terms of the amount of subsidies or tax with multiple inputs from productive factors, while the indirect measurement of the mismatch is the efficiency gap between the optimal allocation and actual allocation of productive factors under profit-maximising conditions (Hsieh & Klenow, 2009; Restuccia & Rogerson, 2017). As a result of the obvious limitations of direct measurement, the most commonly used method of measuring human capital mismatch in the existing literature relies on improvements of the indirect method of Hsieh and Klenow (Yian, 2019; Yang et al., 2022; Hendricks & Schoellman, 2023).

Human resources flow freely amongst enterprises in a perfectly competitive labour market, while factor constraints can lead to distortions. Hence, some enterprises have excess human capital, and others face a lack of human capital (Neffke et al., 2017). This mismatch causes a deviation between the actual and optimal configuration of the firm in production and results in non-optimal final output (Fanti et al., 2021).

Traditional production systems consist of two main elements: capital and labour. Due to the difficulty of acquiring human capital in traditional producing firms, it is commonly regarded as homogeneous labour. However, the production function in high-tech firms should incorporate the integration of human capital, which includes both simple labour and labour quality (Li et al., 2015). Labour quality is defined broadly as education level, work skills, and work experience. Of these, education level is the most important variable and easy to measure (Van Tran et al., 2019; Hendricks & Schoellman, 2023).

This paper incorporates labour quality into a measurement framework of the production function based on a theoretical model by Hsieh and Klenow (2009). This approach relaxes the assumption of constant returns to scale. The difference between the optimal and actual scale of enterprises is further used to estimate a mismatch in human capital at the micro-enterprise level.

Based on the conventional Cobb-Douglas production function, the extended production function, which includes labour quality, is defined as:

where αs represents the capital elasticity of industry s, βs represents labour elasticity, γs represents labour quality elasticity, and Asi represents the total factor productivity of enterprise i.The product market is characterised by monopolistic competition, while the factor market is characterised by perfect competition, which results in distortions in factor price. In this paper, τKsi represents capital distortion, τLsi represents labour distortion, and τEsi represents labour quality distortion. The profit function for monopolistic enterprises is:

where R represents the capital price, ω represents the labour price, and μ represents the labour quality price.The demand function based on the enterprise-specific variables is governed by the equality between the marginal cost and the marginal revenue, that is YsiYs=(PsiPs)−σ, where σ is the elasticity of substitution between products in monopoly scenarios. According to the property of the constant elasticity of substitution, the price is: Ps=(∑Psi1−σ)11−σ. Combining the demand function and assumption of profit maximisation, the monopolistic price of products is given as:

Given the profit function and price data, the marginal revenue of production factors is:

Assuming profit maximisation, the marginal revenue of production factors is equal to the marginal factor cost:

The neoclassical economic theory implies that in the absence of trade barriers and frictions, each sector's marginal revenue and marginal cost are equal and equal to market prices. At this point, the factors should have been allocated under the Pareto optimality principle of the economic system (Levrero, 2014). In the event that various distortion factors are considered, the marginal revenue and marginal cost of factors may deviate and thus cannot ensure optimal allocation. In accordance with Eq. (5), we can obtain the degree of distortion of capital, labour, and labour quality as follows:

Thus, the relationship between the actual output with distortion and the optimal output can be obtained as:

The human capital mismatch of enterprises is based on the difference between their actual scale and the optimal scale as represented by Eq. (7):

Eq. (8) describes the degree of deviation between the enterprise's actual and optimal scale as a result of human capital mismatch. Mismatches are more serious the greater the degree of deviation.

The total factor productivity of enterprises can be calculated by substituting Eq. (8) into Eq. (3) as follows:

where H=YsPsσ(σ1−σ)−σ(KsiαsLsiβsEsiγs)σ−(σ+1)(αs+βs+γs)αs+βs+γs((1+τKsi)Rαs)−αsσαs+βs+γs(ωβs)−βsσαs+βs+γs(μγs)−γsσαs+βs+γs.To examine the mechanism of human capital mismatch on enterprise innovation, one may use the derivative of Eq. (9) with respect to human capital mismatch:

Given the expression in Eq. (10), we propose Hypothesis 1 which links the mismatch of human capital and total factor productivity:

H1 ∂Asi∂M<0, i.e., high-tech enterprises are less likely to innovate if there is a high degree of human capital mismatch.

Numerous studies have analysed the impact of human capital on innovation performance (Buenechea-Elberdin et al., 2017; Fonseca et al., 2019; Hanifah et al., 2022; Ali et al., 2023). Nevertheless, very few empirical studies have examined the relationship between human capital mismatch and innovation performance, particularly in high-tech firms. The intrinsic mechanism and moderating role of human capital mismatch on firms’ innovation performance have not been adequately explored. Moreover, Prokop and Stejskal (2019) noted that very few studies have considered such factors as ownership types, forms of cooperation in innovation activities, and investments into innovation in the light of innovation performance.

Human capital mismatch and R&DIn the resource-centred theory, human capital is the most valuable resource for ensuring competitiveness of firms (Zahra et al., 2006). It is also necessary for promoting innovative activities within firms (Wright & Snell, 2001). In high-tech firms, innovation is an essential operation activity due to the emerging market and aggressive competition. Therefore, the importance attached to human capital in making innovation-related decisions may differ. One can distinguish between the human capital of the executives and specialists. As for the executives, their human capital determines the overall planning of the processes (including those related innovations) within a company. With regard to the human capital of the specialists, it may be more or less successfully used for implementing the guidelines set by executives. Human capital can be expressed as a function:

where hc1 represents the top management's human capital measure, hc2 represents the technicians’ or researchers’ human capital measure, function E(·) defines a certain rule for combining the aforementioned two types of human capital. However, the inclusion of all the variables discussed in Eq. (11) may be cumbersome due to data availability. Thus, we restrict the focus to the executives’ human capital.One can assume that participating in innovative projects improves technical expertise and risk management qualities (Zhang et al., 2019; Shaikh & Randhawa, 2022). Possessing such traits may trigger further innovative activities (Trzeciak et al., 2022). Further, exposure to frontier technology can help develop open mindsets amongst top management. As a result, top management is able to absorb new information and accumulate knowledge reserves through scientific and technological exchange, knowledge service flow sharing, and spillover of knowledge in order to effectively promote enterprises to achieve innovation success (Scuotto et al., 2017; Deranek et al., 2019; Dahiyat et al., 2023).

The literature suggests that Chinese high-tech enterprises have not achieved industrial and technological progress in this manner because they have not reached the level of human capital required to take advantage of their R&D investments (Huang & Chen, 2020). Human capital mismatch is the most critical factor. History of career may also impact innovation performance. For instance, executives coming from less challenging positions involving repetitive tasks may also opt for risk avoidance when deciding on innovative activities and the associated investments (Goodall et al., 2004; Li, 2020; Li & Zhang, 2022).

Also, top managers may place technicians or researchers in low-producing and non-innovation-oriented departments. Thus, R&D investment is not effectively used, or even if sufficient R&D investments are made, they do not appear to achieve optimal efficiency, which cannot be externalised to a company's innovation. A recent study by Zhu et al. (2020) has shown that if R&D investment and structure deviate from the optimal scale of R&D subjects, even increasing R&D investments and R&D personnel will not increase the efficiency of enterprise innovation. This phenomenon is more common in high-tech enterprises (Zhao et al., 2019; Qi, 2020; Wan et al., 2023).

Based on the considerations above, this paper invokes an interaction term between human capital mismatch and R&D and proposes the following hypotheses.

H2 Under the moderating effect of human capital mismatch, the positive impact of R&D investment on the innovation performance of high-tech enterprises will be weakened or even turned into a negative effect.

H3 Under the moderating effect of human capital mismatch, the positive impact of R&D personnel on the innovation performance of high-tech enterprises will be weakened or even turned into a negative effect.

It follows from the knowledge-based approach to the functioning of a firm (Kogut & Zander, 1992) that proper use of knowledge in the underlying processes comprises the major means of achieving sustainable innovation. Indeed, human capital growth is mostly related to successful spread of knowledge. Therefore, human capital is usually defined as the accumulation of knowledge and its flow among managers and employees within a firm (Becker, 1962). Human capital, however, is not acquired or owned by organisations in the same manner as other types of capital, such as physical and technological. Human capital can be acquired with the introduction of talent (Marin-Garcia et al., 2011; Van den Broek et al., 2018).

The OECD indicated that there are two main types of talent mobility: external and internal. The first can be divided into geographical mobility (regional, national and foreign) and mobility from labour turnover. Internal mobility refers to movements within a company or occupation changes (Mahroum, 1999). This paper aims to examine only the first of these, namely, the geographical mobility of talent. With regards to the source of talents, human capital can be modelled as the function:

where hc3 represents domestic talent introduction, and hc4 represents foreign talent introduction. The literature highlights the importance of talent as a key component of firm innovation performance (Van den Broek et al., 2018; Huang et al., 2023; Liu et al., 2023). This is especially important when the know-how related to enterprise processes is prioritised against purely looking at the academic credentials.According to Subramaniam and Youndt (2005), a talent with proper knowledge may provide a competitive innovation advantage. Bornay-Barrachina et al. (2012) and Kianto et al. (2017) also pointed out that human capital's work experience and technical knowledge can bring innovative thinking and cutting-edge knowledge reserves to enterprises. Talent introduction is not a one-time transfer, but a complete enterprise knowledge structure, which can produce clear knowledge spillover effects and strengthen enterprise innovation.

Under the influence of human capital mismatch, however, imported talent cannot be rationally and scientifically allocated, and enterprises do not pay attention to their development and growth. Over time, the introduced talent will be restricted to the conception and implementation of enterprise innovation and, eventually, merge into the mediocre stream of enterprises or move to other enterprises to follow their dreams, thus, innovative creativity can be weakened by the departure of talent (Alves et al., 2019; Gu et al., 2022).

Accordingly, this paper considers the interaction between human capital mismatch and talent introduction and proposes the following hypotheses.

H4 Under the moderating effect of human capital mismatch, the positive impact of domestic talent introduction on the innovation performance of high-tech enterprises will be weakened or even turned into a negative effect.

H5 Under the moderating effect of human capital mismatch, the positive impact of foreign talent introduction on the innovation performance of high-tech enterprises will be weakened or even turned into a negative effect.

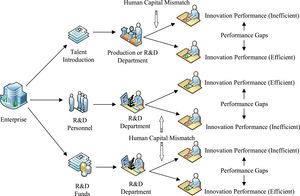

The theoretical assumptions underpinning this paper can be summarised within the mechanism through which human capital mismatch may affect innovation performance (Fig. 1).

Data description and model settingData descriptionThe certified high-tech enterprises in Zhejiang Province, China, were surveyed for the basic information, R&D investment, economic benefits, technical benefits and talent acquisition. The data were collected in 2020. According to a proportional stratified sampling, 2769 high-tech companies were surveyed. The sample is considered as a representative one as the sectors represented correspond to the overall distribution.

A total of 2510 enterprises complied with the data requirements, with a data efficiency rate of 91 %. In addition, the observations with negative values of key variables such as output value, operating income, profit and tax, and average monthly salary of staff were deleted. The outliers were identified as the 1 % highest and lowest values for the quantitative variables (for the patent data, the lower threshold was ignored).

The variables involved in the measurement of human capital mismatch include enterprise output, capital stock, labour input, employee salary and average education level of labour force. Enterprise output is measured as the output value of enterprise, labour input is the total number of staff and employee wages are measured as the average monthly salary. For the average number of years of education of the labour force, the proportion of employees with different educational backgrounds is multiplied by the relevant number of years of educational background.

In addition, in order to measure the mismatch degree of human capital, additional parameters are needed. The elasticity coefficient of substitution between products, according to Broda and Weinstein ((2006)), is within the range of 3–10. This paper refers to the setting of Hsieh and Klenow (2009) and uses σ=3. Cost of capital, according to Wen (2019), is set to 10 %. The output elasticities αs, βs and γs are obtained via the Ackerberg et al. (2015) approach with intermediate inputs taken as the proxy variable.

Variables’ selectionThe key question of this research is the nature of the linkage between human capital mismatch and enterprise innovation performance. Company-level data are used. The variables used were selected given the literature analysis and data availability.

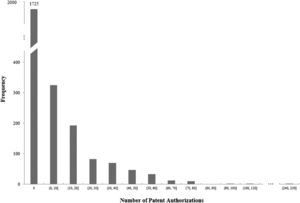

The dependent variable is the innovation performance of high-tech enterprises. The two main approaches are used to obtain proxies for the innovation performance viz., research output and innovation efficiency. Research output is defined as the results of scientific research, including patent applications, patent authorisations, and the value of new products. The ratio of the innovation output to R&D investment is used to measure the innovation efficiency (Hirshleifer et al., 2013). This study measures the innovation performance via the number of patent authorisations.

Human capital mismatch is one of the explanatory variables that may be used to test the research hypotheses. Other explanatory variables include R&D investment, R&D personnel, and foreign and domestic talent introduction. These factors will likely affect the performance of enterprise innovation.

The model includes control variables. It was necessary to account for firm characteristics when analysing the impact of human capital mismatch on firms’ innovation performance. According to Rafique Hashmi (2013), the most important characteristics are size, capital intensity, and profitability. Thus, we selected firm size, ownership type, industry type, profitability, capital intensity, and executive staff ratio as controlled variables. Table 1 presents the relevant definitions and descriptive statistics.

Variable definitions and descriptive statistics.

Note: Explanatory variables with zero values are not logged.

This paper constructs an econometric model to analyse the impact of human capital mismatch on high-tech enterprises’ innovation performance. Considering that the number of patent authorisations (INN) is a discrete variable that does not meet OLS assumptions, we adopt an enumeration model. According to the empirical distribution of the INN, the share of observations with zero value stands at 69 %. According to Fig. 2, there is a significant skewness in the distribution of INN due to the high proportion of zero values. Several reasons may account for this phenomenon. First, a number of enterprises have not applied for any patent authorisations and the corresponding value is actually zero. Second, the failed applications also contribute to zero values. Lastly, lack of accuracy in data may also render some zero-cases. According to Table 1, the mean value of the number of patent authorisations in the sample is 6.65, and the standard deviation is 22, i.e., the standard deviation is about three times the mean. It indicates that the distribution is over-dispersed and a potentially non-normal one. To ensure the credibility of empirical analysis, logistic zero-inflated models for both Poisson and binomial distributions are selected to minimise the estimation bias caused by the zero values in the sample.

In the zero-inflated count model, the mixed probability distribution is determined based on the probability of obtaining zero and non-zero values (Lemonte et al., 2020):

where yi is the number of patent authorisations of high-tech enterprises, pi represents the probability of zero events arising, subject to the Bernoulli distribution. In this process, the number of enterprise patent authorisations can only be zero, which explains the large number of zeros in the data, and g(yi) represents the probability of occurrence of events subject to Poisson or negative binomial distributions. As a result of this process, the number of enterprise patent authorisations may either be zero or positive.Thus, the zero patent authorisations come from enterprises that have not applied for patent authorisation, with probability pi and, with probability 1−pi, from enterprises that have applied but have not been granted authorisation. Therefore, the probability density function of Y=yi is as follows:

where g(0) denotes the probability of zero value in case any other outcome can be expected (i.e., patent authorisation was applied for). If the value of pi is affected by the independent variables, we have pi=F(Xiγ), F(·) is a zero-inflation connection function, logit and probit models mostly preferred, Xi is a vector of the independent variables, and γ is a vector of the associated parameters.The zero-inflation link function is designed as the logit model:

Using the zero-inflation connection function, we can transform Eq. (14) as follows:

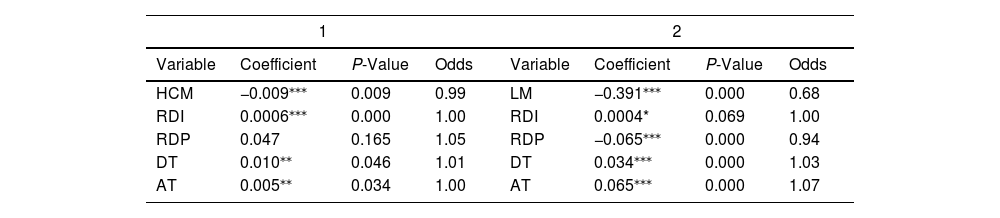

where the dependent variable INNi represents the number of patent authorisations of a high-tech enterprise, and the value is zero or a natural number; α0 is a constant term, HCMi is the core explanatory variable, β are the regression coefficients, Zi are the control variables, including size, ownership type, and εi is the random error term.Empirical resultsBaseline modelTo analyse the impact of human capital mismatch on the innovation performance of high-tech firms, an occurrence ratio—the change in the dependent variable due to a one-unit change in the independent variable when the other variables are held constant—is calculated based on the regression coefficients. In Table 2, we present the results of the baseline models.

Baseline models of human capital mismatch and enterprise innovation performance.

Note: NAT1, NAT2, NAT3 and NAT4 represent state-owned enterprises, private enterprises, jointly operated enterprises and foreign-funded enterprises, respectively; *, **, *** represent 10 %, 5 %, 1 % significance levels, respectively; the logit link is used.

The zero-inflated Poisson model to estimate innovation performance when a human capital mismatch exists is presented in Column 1 of Table 2. It has been estimated that the coefficient is significantly negative at the level of significance of 5 %. With a one-unit increase in human capital mismatch, enterprise innovation performance was reduced by 1 %. The zero-inflated negative binomial model, which supports the finding that a mismatch between human capital and enterprise innovation performance is adverse, is presented in Column 2. These results support Hypothesis H1. Human capital mismatch significantly inhibits enterprise innovation performance.

The introduction of domestic or foreign talent has a significant positive impact on the innovation performance of high-tech enterprises at the 1 % level of significance in terms of innovation measures. The effect on innovation of foreign talent introduction is 6 %, slightly higher than that of domestic talent introduction (1 % in Column 1 and 2 % in Column 2). As R&D personnel increases, innovation performance declines in enterprises, which is significant at 5 % and 1 % significance levels. With a one-unit increase in R&D personnel, innovation performance was reduced by 3 % to 5 %. In the context of a mismatch in human capital, improper allocation of R&D personnel is inevitable. Accordingly, blindly increasing R&D personnel not only fails to improve enterprises’ technical level but also increases R&D expenditures and reduces R&D efficiencies (Evangelista & Savona, 2003).

As for ownership types, state-owned and privately owned enterprises have the greatest impact on innovation performance (regression coefficients are 3.593 and 2.349, respectively). The reason is that compared with other ownership types, government subsidies can effectively stimulate state-owned enterprises’ innovation performance. While private enterprises are oriented towards profit maximisation, they have better flexibility and the input-output efficiency of innovation is higher. Furthermore, high-tech enterprises are highly knowledge-intensive, and R&D activities are their main source of sustainable development. As a result, these types of enterprises can play a significant role in innovation. Further, it is also imperative to remember that innovation performance will also be affected in highly knowledge-intensive enterprises, where there are a high proportion of top managers.

Enterprise size, capital intensity, and profitability have little impact on innovation performance. Note that these variables are insignificant in our case but may significantly affect innovation in other environments. In addition, the absence of complete data on capital intensity and profitability may also result in this variable failing the significance test.

Addressing endogeneityThere is a possibility that the basic regression results of human capital mismatch on innovation performance of high-tech enterprises may be subject to endogeneity problems. Despite the fact that control variables reduce the endogeneity of enterprise heterogeneity to some extent, estimation errors cannot be avoided entirely due to their combined effects. It is also possible that there is a reverse causal relationship between a mismatch in human capital and enterprise innovation performance. Therefore, this is addressed by (i) adding possible omitted variables and (ii) using instrumental variables.

Adding possibly omitted variablesEmployer learning theory, proposed by Murphy (1986), suggests that the productivity of top managers is largely dependent on their management skills. An effective allocation of managers and capital can promote enterprises’ technological innovation and maximise the enterprise's value. Accordingly, Column 1 of Table 3 incorporates the labour productivity of higher education (HLP). Following the inclusion of HLP, the coefficient of human capital mismatch is not significantly different from the basic regression coefficient. A significant negative impact has been observed on the labour productivity of higher education, showing that enterprise executives’ production efficiency is not able to positively impact the innovation performance of enterprises at present but rather needs to be allocated in an efficient manner. This is in accordance with the conclusions reached by Murphy (1986).

Regression estimates after adding possibly omitted variables (negative binomial model).

For enterprises to become more competitive, it is essential that they educate and train a more significant number of top managers. It is possible, for instance, to improve the innovation skills and management level of enterprise employees through systematic training (Dhiman & Arora, 2020). Compared with R&D investment to promote technological progress, this approach belongs to a broader sense of technological advancement. Column 2 of Table 3 provides information on employee education input (EDI), which indicates the level of training and education an employee has received. A positive correlation exists between employee education input and enterprise innovation performance at the 1 % significance level.

When the variables of higher education labour productivity and employee education input are added to Column 3, the enterprise innovation performance caused by human capital mismatch decreases by about 2 % compared with the baseline model, indicating that this part of the effect, which should be explained by higher education labour productivity and employee education input, is actually explained by human capital mismatch. Due to the missing variables, the estimated coefficient of a human capital mismatch for high-tech firms is biased upward.

Instrumental variablesSuppose the traditional instrumental variable method is used to find an exogenous variable that affects human capital mismatch but does not affect high-tech firms’ innovation performance. In that case, it is challenging to find such an exogenous variable. Based on Erickson's (2001) internal instrumental variable method, we establish a square of the mean difference between human capital mismatch in enterprises and industrial human capital mismatch as the instrumental variable. The paper adopts Hilbe's (2008) two-step approach to deal with endogeneity. The first step uses instrumental variables and other control variables to conduct OLS regression on the endogenous explanatory variables (human capital mismatch) and determine the residual; in the second step, zero-inflation negative binomial regression is performed using endogenous variables, residuals estimated in the first step, and other control variables (excluding instrumental variables). The results are displayed in column 2 of Table 4.

Instrumental variables regression.

An analysis of the first stage regression indicates that instrumental variables are significantly positively correlated with human capital mismatch. The quadratic of the mean difference between enterprise and industry human capital mismatch is the appropriate instrumental variable (IV), and the weak instrumental variable problem does not exist. As a result of the second stage of regression, we estimate that the coefficient of human capital mismatch is −0.014, which is different from zero at a significance level of 1 %. According to the regression results, unit human capital mismatch leads to approximately a 3 % reduction in enterprise innovation performance. Compared to the basic model, endogeneity overestimates the impact of human capital mismatch on firm innovation. In column 1, the instrumental variable is added to the baseline model as an explanatory variable, but the estimated coefficient does not pass the significance test. As a result, the instrumental variable is unlikely to directly affect high-tech enterprise innovation performance, except through the endogenous variable (human capital mismatch), further supporting the exogenous nature of the instrumental variable.

Robustness testThis study re-examined the effect of human capital mismatch on enterprise innovation performance by replacing the core explanatory variable and explained variable. First, it is necessary to replace the index used by high-tech companies to evaluate their innovation performance. The number of patent authorisations calculated through the unit R&D investment transformation in this paper is used to represent innovation efficiency, according to Hirshleifer et al. (2013). It is evident from column 1 of Table 5 that the estimated coefficient of human capital mismatch has a negative effect when the number of patent authorisations are replaced by the number of patent authorisations transformed by R&D investment. As a result, it remains valid to conclude that human capital mismatch negatively impacts enterprise innovation performance. Unlike the basic regression, the effect of R&D personnel changes from negative to non-significantly positive.

Robustness test of indicator substitution.

The second step is to replace the index for the enterprise's human capital mismatch. This paper investigates the human capital mismatch, which includes a comprehensive mismatch in the simple labour force and labour quality. However, an enterprise's innovation performance is more affected by a labour quality mismatch than by a simple labour mismatch (Li et al., 2015). Accordingly, this study replaces human capital mismatch with labour quality mismatch (LM) for analysis, as shown in column 2 of Table 5.

By contrast with the baseline model, the mismatch of unit labour quality can reduce the enterprise's innovation performance by nearly 32 %, which is evidently greater than the change in innovation performance caused by human capital mismatch. Nonetheless, both cases show a negative impact on enterprise innovation.

Regulation mechanism analysisRegulatory effect based on R&DAn increase in R&D investment and R&D personnel will positively impact high-technology enterprises’ innovation performance to a certain extent, as indicated by the above mechanism analysis. However, because of a mismatch in human capital, R&D investment, R&D personnel, and other related R&D indicators cannot effectively serve as catalysts. Therefore, it is necessary to explore whether human capital mismatch negatively moderates the process of R&D to promote the innovation performance of high-tech firms. According to the analysis of the moderating effect, an interaction term between human capital mismatch and R&D investment is included in the model. Test results are in Table 6.

Based on the estimated effect in column 1 of Table 6, after adding the interaction term of R&D investment and human capital mismatch, it has been determined that human capital mismatch, R&D indicators, and the interaction term are all significant at a 95 % confidence level. The result indicates a significant moderating effect of human capital mismatch. Considering the direction of action, R&D investment shows a positive coefficient, while the interaction term shows a negative coefficient. The mismatch between human capital and R&D investment impedes innovation.

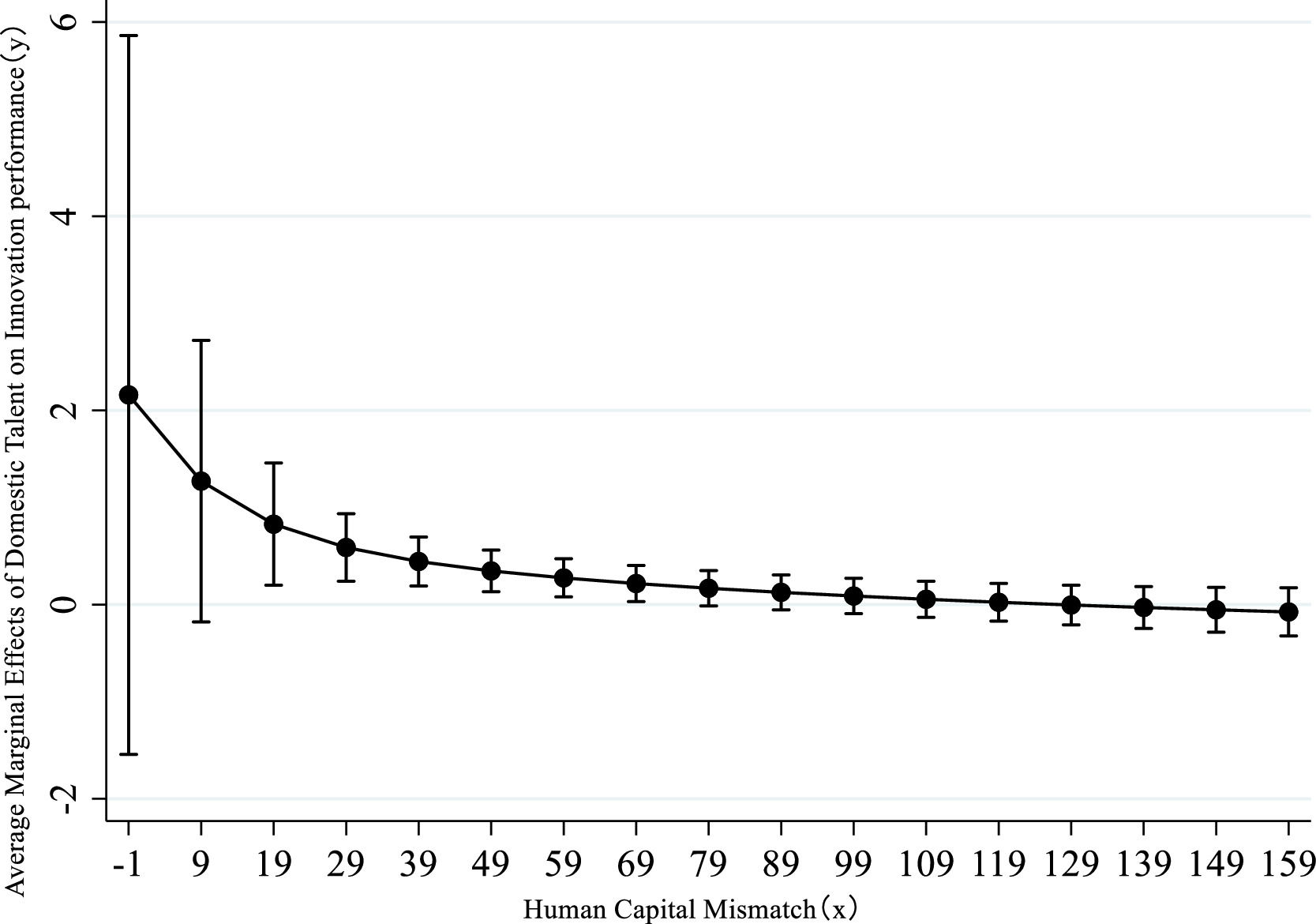

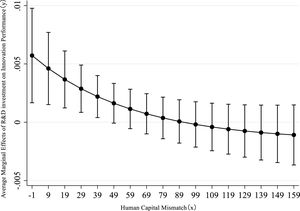

Note that the significance test results of the interaction term coefficients do not reflect the whole process of interaction effect testing but rather just a tiny part of it. As an important addition to interaction effect tests, the marginal effect graph can identify the moderating effects accurately. Based on Bowen's (2012) proposal, the regulatory effect diagram is used (see Fig. 3). In Fig. 3, the x-axis represents human capital mismatch, and the y-axis represents the average marginal effects of R&D investment on innovation performance. The response curve is established between 25 and 75 quantiles of the moderator variable. According to the figure, the average marginal effect of R&D investment on the innovation performance of high-tech enterprises decreases with increasing degrees of human capital mismatch. As soon as the value of human capital mismatch exceeds 99, the marginal effect of R&D investment becomes negative, which confirms hypothesis H2.

In column 2 of Table 6, the interaction term between R&D personnel and human capital mismatch is introduced, and the results show that both are significant at 1 % but that the interaction term is not significant. It appears that despite the human capital mismatch, the R&D personnel of high-tech companies will not negatively affect innovation performance. Thus, Hypothesis H3 cannot be validated.

Regulatory effect based on talent introductionBased on enterprise knowledge reserves, the research mechanism indicates that talent introduction can generate apparent knowledge spillovers that promote enterprise innovation. However, talent introduction does not achieve a rational allocation under human capital mismatch. Therefore, talent cannot play an innovative role for long periods. As a result, it is necessary to study how human capital mismatch affects the process of introducing talented individuals to high-tech firms in order to improve their innovation capabilities.

Based on the analysis structure of the moderating effect, this study constructs an interaction term between human capital mismatch and talent introduction to evaluate the validity of the moderating effect of mismatch. Test results are given in Table 7. Column 1 of Table 7 introduces the interaction term between domestic talent and human capital mismatch, while column 2 of Table 7 introduces the interaction term between foreign talent and human capital mismatch. At a significance level of 1 %, both variables of talent introduction are positively related to enterprise innovation, while interaction terms are significantly negative. Therefore, human capital mismatch weakens the positive impact of talent introduction on enterprise innovation.

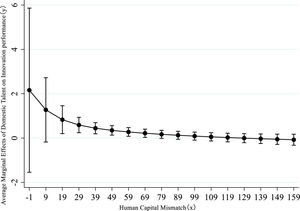

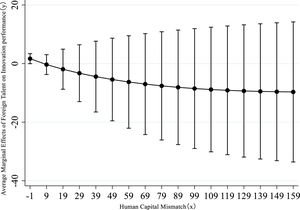

Figs. 4 and 5 illustrate the moderating effects of domestic and foreign talent introduction, respectively. In Figs. 4 and 5, the x-axis represents human capital mismatch, and the y-axis represents the average marginal effects of talent introduction on innovation performance. With the increase in human capital mismatch, the average marginal effect of the two types of talent introduction on innovation performance is gradually weakening. Preliminarily, this result confirms Hypotheses H3 and H4.

However, foreign talent is more vulnerable to human capital mismatch than domestic talent. In the case of a human capital mismatch index exceeding 129, the marginal effect of domestic talent introduction becomes negative. The human capital mismatch index is only 9 when foreign talent introduction has a negative marginal effect.

Discussion and implicationsDiscussion of resultsThis study has demonstrated that enterprises, particularly high-tech enterprises, suffer from human capital mismatch. The results of this study are consistent with those of Zhang et al. (2023a,b). A unique contribution to this study is the inclusion of labour quality (i.e., the education levels of labour) as a factor in measuring human capital mismatch. McGowan and Andrews (2017) and Zhang et al. (2023a,b) argue that companies should invest in a variety of forms of human capital, including highly educated employees and experienced managers. It is therefore necessary to take this indicator into account when measuring human capital mismatch.

Hypothesis H1, which states that human capital mismatch negatively impacts enterprise innovation performance, is supported by this research. A similar conclusion has also been reached by Capozza and Divella (2019), Li et al. (2021) and Su et al. (2023), who have found that human capital mismatch can result in an enterprise's “Crowding-Out Effect” and reduce the probability of innovation. Furthermore, Al-Jinini et al. (2019) also illustrate the importance of intellectual property and know-how as core components of innovation systems for enterprise innovation.

According to Hypotheses H2 and H3, R&D is critical to enterprise innovation, but a moderating mechanism framework based on a mismatch in human capital suggests that R&D negatively or insignificantly impacts enterprise innovation. In Hypotheses H2 and H3, R&D is defined primarily by two subdimensions, R&D investment and R&D personnel, under the job characteristics of top management. Zhu et al. (2020) and Li and Zhang (2022) both support this conclusion. As in previous studies, such as Afcha and Lucena (2022), human capital, as defined by education and skill, is believed to affect the innovation impacts of R&D subsidies or investments. Human capital mismatch, however, leads to a lower return on R&D investment than companies’ normal level, which affects the innovation performance of companies (Igna & Venturini, 2019), as demonstrated by the support of Hypothesis H2.

It Is proposed in Hypotheses H4 and H5 that human capital at the knowledge level of an enterprise consists of both domestic and foreign talent. According to Munjal and Kundu (2017), as well as Wei et al. (2020), talent plays a critical role in enabling innovation. A study conducted by Kohnová et al. (2020) emphasises the importance of talent-job fit for organisational effectiveness and demonstrates that mismatches in talent and job skills fundamentally reduce workforce participation and skill levels, resulting in a disincentive for firms to innovate.

Research contributionsBased on the results of this research, it can be concluded that human capital mismatch negatively impacts innovation performance. There are several important theoretical contributions to this study.

The first contribution is that it introduces labour quality to the production function framework, and it relaxes the assumption of constant returns to scale in order to provide a more effective framework for measuring human capital mismatch. The second contribution is that this study enriches the literature on enterprise innovation by providing an analysis of how human capital mismatch influences enterprise innovation. As a third contribution, through the exploration of R&D investment, R&D personnel, domestic talent and foreign talent introduction, four types of innovation elements have been identified as the key implementation paths for enterprise innovation in practice. Additionally, our empirical results provide important theoretical insights into the negative impact of human capital mismatch on innovation performance, as well as its negative moderating effect on R&D investment and foreign and domestic talent. In the existing literature, similar findings have been reported (Li et al., 2021; Afcha & Lucena, 2022).

Implications for policy-makersThe following policy suggestions are offered in light of the above conclusions. First, a market-oriented reform of the factor markets needs to be actively promoted, industry monopolies should be broken, and the market slowed to determine the flow and price of human capital. Meanwhile, government intervention should be reduced, and a market economic system established and improved to ensure that human capital flows to more efficient departments through the price and competition mechanism. Second, a mismatch in human capital should be minimised so that sound employment guidance can be provided. Human capital can be increased by encouraging households to invest more in it. Employment guidance services may reduce the asymmetry of information within the talent market. Third, companies should seek new ways of growing and improving their production efficiency and profit margins to relieve the pressure caused by excessive labour costs. Furthermore, enterprises should estimate production costs and recruit employees based on job requirements to ensure that human capital can be optimized (including reasonable allocations).

ConclusionSince factor resources are limited in their flow, human capital mismatch is inevitable in the current economic climate. It is very important to examine how imperfect factor markets affect enterprise innovation. Microscopically, human capital is closely related to enterprise development. It is crucial that enterprises allocate human capital in an efficient manner in order to improve their innovation capacity, and, ultimately, to ensure sustainable development.

Studying high-tech enterprises in Zhejiang Province, this study measured human capital mismatch at the micro-level as a means of interpreting innovation performance. As a result of the study, it was found that the majority of high-tech firms failed to allocate their human capital rationally and displayed a serious mismatch in human capital. High-tech firms are considerably hindered by a mismatch in human capital. Research has found that the more mismatches in human capital, the lower the innovation performance of a company. However, the conclusion remains robust even when endogenous variables as well as reverse causality are taken into account. Human capital mismatch adversely affects the process of R&D investment and the introduction of domestic and foreign talent to promote high-tech enterprises’ innovation, which weakens the average marginal effect of R&D investment and the introduction of domestic and foreign talent on enterprise innovation. It identifies the micro-mechanistic by which human capital mismatch hinders enterprise innovation.

This paper provides evidence that human capital mismatch impacts high-tech enterprises’ innovation performance using an econometric model and interaction term test, but certain limitations remain in the theoretical analysis. In this paper, we present a framework that incorporates human capital mismatch and which does not assume that returns to scale are constant but assumes that the production function of different enterprises is one and the same. Nevertheless, this is somewhat different from reality, and further studies may relax these assumptions. Furthermore, there are some design defects in the mechanism that regulates the impact of human capital mismatch on innovation performance in high-tech firms. This study focuses only on the adjustment mechanisms of R&D investments and the introduction of talent during the process of R&D. Aside from this, we need to take into account the moderating mechanisms between human capital mismatch and internal or external knowledge capital structures, as well as the substitution of production factors in the process.

This work was supported by the National Social Science Foundation of China (Nos. 19ZDA122, 20CTJ016, 21ATJ010).