Business model innovation is an important field in enterprise innovation, both as a necessary tool as well as a source of innovation. This study analyzes two business model innovations of Suning and their effects, and finds that enterprises will also face the innovator's dilemma when they carry out business model innovations. By introducing environmental variables into the decision interval model, this study explores the conduction path and mechanism to explain the innovator's dilemma from a new perspective, and calls on the academic to strengthen research on environmental variables to adapt to the VUCA era. The S-curve analysis implies that when enterprises encounter the innovator's dilemma the key lies in whether they can cross the discontinuity gap and successfully open the second S-curve. To deal with this, enterprises can form a closed loop of feedback iteration through insight problems, seeking solutions, and verifying solutions to explore the direction of business model transformation, and promote business model innovation in an orderly manner by implanting a “central control system” and commissioning a “radar system”.

A business model (BM) is defined as the “design or architecture of the value creation, delivery, and capture mechanisms” of a firm and has become an indispensable part of economics (Teece, 2010). BMs effectively answer the question of ancient businesses as raised by Peter Drucker (Magretta, 2002). More recently, BM innovation (BMI) has become influential in management research, which is seen as “designed, novel, and nontrivial changes to the key elements of a firm's BM and/or the architecture linking these elements” (Foss & Saebi, 2017). Research on BM and BMI originates from transaction cost economics, enterprise resource view, system theory, and strategic network theory (Amit & Zott, 2001; Hedman & Kalling, 2001; Morris, Schindehutte & Allen, 2005), and they usually focus on business activities to solve social and sustainability problems (David-West, Iheanachor & Umukoro, 2020; Geissdoerfer, Vladimirova & Evans, 2018; Yunus, Moingeon & Lehmann-Ortega, 2010). The business world (Johnson, Christensen & Kagermann, 2008; Massa, Tucci & Afuah, 2017; Smith, Gonin & Besharov, 2013) and academia (DaSilva & Trkman, 2014; Spieth, Schneckenberg, & Ricart, 2014; Teece, 2018) both advocate that BMI plays a key role in the success of an enterprise, and the criterion for judging the success of an enterprise's BMI is its efficiency in creating value (Wei, Yang, Sun & Gu, 2014; Zott, Amit & Massa, 2011).

Current research on the ability of BMI to create value for enterprises primarily begins with its impact on organizational performance (Foss et al., 2017), but there has been no consistent conclusion yet. On the one hand, scholars have found that BMI can improve organizational performance (Mitchell & Coles, 2003; Foss et al., 2017, Clauss, Abebe, Tangpong & Hock, 2019; Pucihar, Lenart, Kljajić Borštnar, Vidmar & Marolt, 2019). They believe that BMI can help companies develop new products, optimize processes, enter new markets, and reduce costs, thereby creating value for companies and improving organizational performance. Some studies propose that even the same BMI will have different impacts on different enterprises because of their differing resources (Kastalli & Van Looy, 2013; Miroshnychenko, Strobl, Matzler & De Massis, 2021). On the other hand, some studies have found that BMI reduces organizational performance. They claim that BMI may produce high human, material, and financial costs, and make it difficult to improve organizational performance in the short term (Guo, Pang & Li, 2018).

The second facet corresponds to the innovator's dilemma. Based on cases of innovation failure in leading enterprises in hard disk, excavator, steel, and other industries, Christensen (1997) finds that “in the face of new technologies and new markets, the cause of failure is precisely the flawless management,” thus putting forward “the innovator's dilemma”. For incumbent enterprises, the disruptive innovation brought by new entrants is an important aspect of creating and obtaining value, but it is often overlooked by them (Ansari, Garud & Kumaraswamy, 2016; Klenner, Hüsig & Dowling, 2013). Correspondingly, BM plays an important role in the sustainability of disruptive innovation projects (Alberti-Alhtaybat, Al-Htaybat & Hutaibat, 2019; Cozzolino, Verona & Rothaermel, 2018; Sandström, 2011; Snihur, Thomas & Burgelman, 2018). Although it is convincing that BMI has an impact on enterprises success (Cortimiglia, Ghezzi & Frank, 2016), a nuanced understanding of firms’ BMI behavior and strategies in the context of multi-regime interactions is largely missing from the literature (Ruggiero, Kangas, Annala & Lazarevic, 2021). Thus, it is of unique value to study whether there is an innovator's dilemma in BM to explore the sustainability of BMI and understand how enterprises may carry out BMI under conditions of environmental uncertainty.

SUNING.COMCO.LTD. (Hereinafter referred to as Suning) is a leading enterprise in the field of household appliance circulation in China. It enjoys the dividends of market-oriented reform and the opening up of the economy, and encounters the impact of the e-commerce environment. During these two environmental changes, the two corresponding BMIs of Suning reached various results. The first BMI benefited from the reform of the Chinese economic system, showing that Suning is an excellent enterprise with a strong ability to grasp opportunities. However, in the face of the Internet technology revolution, Suning missed the opportunity for innovation and development corresponding to its second BMI, which is consistent with the innovator's dilemma. Therefore, taking Suning as a case, we explore whether BM also encounters the innovator's dilemma, what are the characteristics and the internal reasons for it, and how the enterprise deals with it. This study makes four major contributions. First, based on typical case studies, we validate that BM encounters the innovator's dilemma. Second, we use the S-curve to analyze the reason why BM encounters the innovator's dilemma. Third, we introduce environmental variables into the decision interval model to analyze the mechanism of the BM innovator's dilemma; Fourth, we use the lean method to explore the path for entrepreneurs to scientifically carry out BMI.

The remainder of this paper is organized as follows. First, we provide a structured literature overview. Then, we introduce the main methods used, including the decision interval model, S-curve theory, and the innovator's method. Next, we introduce the two BMIs of Suning and their effects, and provide comparative analysis; based on this, we explore the mechanism of the BM innovator's dilemma and give the solution path. Finally, we present the conclusions, contributions, and limitations of the study.

Literature reviewLife cycle theory and S-curveSince Mueller (1972) introduced the life cycle model in organizations, which conceptualized organizations as having stages of birth, growth, maturity, and decline, the organizational life cycle method has been used to describe the changes and characteristics of different life cycle stages (Barbieri & Santos, 2020), and explain the evolutionary process of organizational growth and development (Fisher, Kotha & Lahiri, 2016; Rahimi & Fallah, 2015). From start-ups to mature companies, the life cycle theory of products, innovation, and businesses is based on biology (Henry, Bauwens, Hekkert & Kirchherr, 2020; Jurgens-Kowal, 2012; Lichtenstein & Lyons, 2008).

Sahal (1981) proposed the S-curve theory of technology. According to this theory, in the early stage, the rate of progress of technological performance is relatively slow, and as the technology is better understood, controlled, and disseminated in subsequent stages, the rate of technological improvement increases. The S-curve theory explains the life cycle of innovation, technology, and organization and has been verified in various studies, including the natural sciences (Lichtenstein et al., 2008; Rogers, 2010), innovation (Christensen, 1992; Priestley, Sluckin & Tiropanis, 2020), and entrepreneurship (Gans, Kearney, Scott & Stern, 2021). The technological S-curve becomes the core of technological strategy, and innovations to existing technologies can create a new S-curve. Companies will usually lose their industry-leading position if they fail to jump the S-curve to the next innovation (Christensen, 1992). Organizations can avoid decline by releasing new technologies to the market if they adjust their strategy in time (Jurgens-Kowal, 2012). Organizations can also maintain long-term performance objectives through continuous innovation (Lyon & Ferrier, 2002; Priestley et al., 2020). To “jump out of the S-curve”, organizations need to constantly generate new ideas, backlog various ideas, and establish a “funnel” to allow multiple ideas to enter the market continuously (Bosch, Olsson, Björk & Ljungblad, 2013).

BM and BMIThe concept of the BM is gaining momentum in academia and the business world (Massa et al., 2017; Zott et al., 2011). While BMs’ theoretical roots have been firmly embedded within the fields of strategic management, economics, and innovation (Foss et al., 2017; Lanzolla & Markides, 2021; Miller, McAdam, Spieth & Brady, 2021), prior research is fragmented because of the variety of disciplinary and theoretical foundations through which BM is examined (Ramdani, Binsaif & Boukrami, 2019). Scholars have explored BM from multiple disciplines beyond the ones mentioned and often in intersections with the same, such as financial accounting (Nielsen & Roslender, 2015), or international business (Child et al., 2017). Furthermore, since the concept of BM is not specific to a particular industry, it can be applied in a vast range of settings (Hock-Doepgen, Clauss, Kraus & Cheng, 2021), such as healthcare (Villani, Greco & Phillips, 2017), social enterprises (Best, Miller, McAdam & Moffett, 2021; Spieth, Schneider, Clauß & Eichenberg, 2019), and corporate sustainability (Bocken & Geradts, 2020).

Importantly, BM is seen as a potential unit of innovation (Zott et al., 2011). The idea that managers can innovate their BM was first explicitly discussed in 2003 by Mitchell and Coles. Since then, many researchers have focused on the innovation dimension of BM and examined BMI from a variety of angles (Carayannis, Sindakis & Walter, 2015; Cortimiglia et al., 2016; Spieth, Schneckenberg, & Ricart, 2014; Trimi & Berbegal-Mirabent, 2012; Foss et al., 2017; Kraus, Palmer, Kailer, Kallinger & Spitzer, 2018). Furthermore, most studies describe BMI as a dynamic process, by: emphasizing the different stages of the BMI process (De Reuver, Bouwman & Haaker, 2013; Frankenberger, Weiblen, Csik & Gassmann, 2013; Girotra & Netessine, 2013, 2014), identifying the different organizational capabilities and processes required to support this change process (Demil & Lecocq, 2010; Doz & Kosonen, 2010), citing the importance of learning and experiments (Andries & Debackere, 2013; Cavalcante, 2014; Eppler, Hoffmann & Bresciani, 2011; Günzel & Holm, 2013; Sosna, Trevinyo-Rodríguez & Velamuri, 2010; Yunus et al., 2010), and proposing practitioner-oriented tools to manage the process (Deshler & Smith, 2011; Evans & Johnson, 2013).

Both the business world (Johnson et al., 2008; Massa et al., 2017; Smith et al., 2013) and academia (DaSilva et al., 2014; Spieth, Schneckenberg, & Ricart, 2014; Teece, 2018) alike have indicated that BMI is indispensable for a company's success. As the core purpose of BMI is to create value for enterprises, the criterion for judging its success is its efficiency in creating value (Wei et al., 2014; Zott et al., 2011). On the one hand, scholars believe that BMI can improve organizational performance by developing new products, optimizing processes, entering new markets, and reducing costs (Mitchell et al., 2003; Foss et al., 2017). In contrast to enterprise technology or product innovation, BMI needs to effectively satisfy the diversified individual needs and create new value growth points by restructuring the industrial chain, and helping the enterprise gain a competitive advantage in the market to improve organizational performance (Casadesus‐Masanell & Zhu, 2013; Teece, 2010; Zott et al., 2011). However, some scholars have found that not all enterprises can obtain new value growth points from BMI even when they match their resources. Therefore, even the same BMI has different impacts on the performance of different enterprises (Kastalli et al., 2013).

On the other hand, some studies have shown that BMI reduces organizational performance. These studies believe that enterprises need to invest more resources in the process of BMI, which will hurt organizational performance Guo et al. (2018). point out that enterprises need to implement radically innovative operating mechanisms and build new strategic positioning when they carry out BMI, which will produce high human, material, and financial costs; thus, making it difficult to improve organizational performance rapidly.

The innovator's dilemma and disruptive innovationIn the book “The Innovator's Dilemma”, Christensen (1997) points out that the key to the failure of well-managed enterprises is that the management methods that helped them to be the leading enterprises will also seriously hinder them from developing destructive technologies, eventually swallowing their markets. Based on this, scholars have begun to explore how best to eliminate the innovator's dilemma for incumbent enterprises. Incumbent enterprises often overlook disruptive innovations brought by new entrants (Ansari et al., 2016; Klenner et al., 2013). Existing research explores how incumbent enterprises handle disruptive innovation from new entrants and summarize the main factors, including two aspects: organization and strategy.

Organizationally, Henderson (2006) proposes that the organizational competence of the company may be more critical to the failure of the incumbents facing disruptive innovation than is generally recognized Roy and Cohen (2015). find that differences among incumbents affect their responses to disruptive changes. Research results indicate that incumbents who use internal knowledge to help them understand “what to develop and design” and “how to do it” are more likely to be market leaders that match the performance characteristics of disruptive products. Similarly, Wan, Williamson and Yin (2015)) show that the industrialization of R&D processes, the design of modular product development processes, and the adoption of pragmatic and rapid processes for R&D decisions appeared to underpin and facilitate disruptive innovation. Specifically, to make and implement strategic decisions that successfully respond to disruptive innovations, incumbents need to predict disruptive innovations and assess their impact on the industry, diversify by developing disruptive, sustaining, and new technological capabilities, and transform the organization to adapt to new business conditions created by disruptive innovation while maintaining organizational continuity (Ho & Chen, 2018).

Strategically, although new entrants have disadvantages in terms of technological capability and market resources, they can successfully introduce disruptive technologies from advanced economies to emerging economies through secondary BMI (Wu, Ma & Shi, 2010). Specifically, the entrant's innovation will gain a foothold in a niche market, then continuously improve the innovation's performance, unaffected by the incumbent, and eventually launch on the mainstream market, eroding the incumbent's market share (Christensen, Raynor & McDonald, 2013) Kim and Min (2015)). claim that what is critical to changes in the performance of an incumbent is not only the resources per se, but also management choices. The key is to ensure consistency between the assets and management choices of incumbents.

The BM plays a key role in the sustainability of disruptive innovation projects, because it is critical to successfully commercialize the innovation outcome (Alberti-Alhtaybat et al., 2019; Cozzolino et al., 2018; Sandström, 2011; Snihur et al., 2018). Disruptive innovation often uses new technologies or BMs and replaces archaic ways of doing business, creating new demands, new competitors, and new ways of doing business, further redefining the meaning of value creation and capture (Cozzolino et al., 2018; Suseno, 2018).

From the existing literature, the new BM may be the root of disruptive innovation and will become the standard for the next round of competition. However, few studies have explored whether the BM will encounter the innovator's dilemma. Based on a typical case study, this study verifies that BM encounters the innovator's dilemma and provides a path for entrepreneurs to carry out BMI scientifically through the lean method.

MethodTo verify whether enterprises face the BM innovator's dilemma, explore its mechanism, and analyze the countermeasures to the dilemma, this study adopts the decision interval model, life cycle S-curve theory, and innovator's method, respectively.

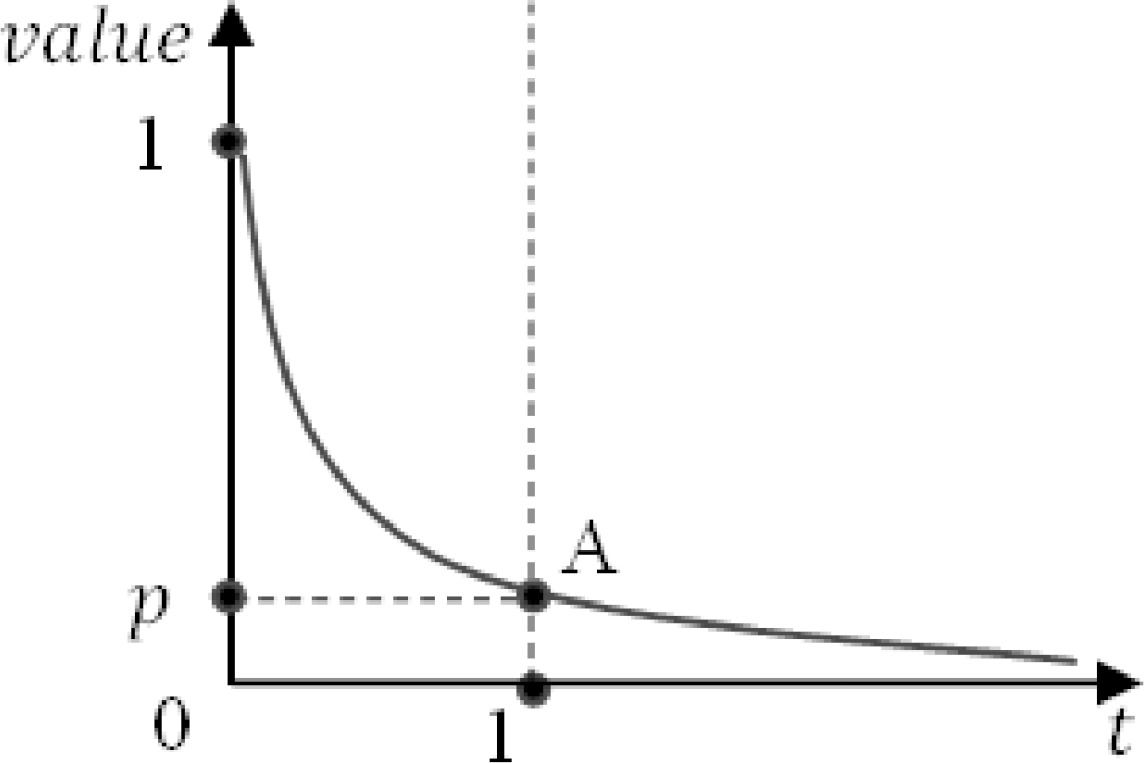

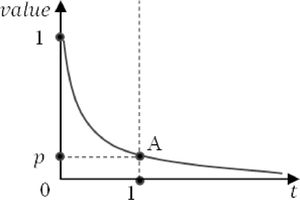

Decision interval modelFacing a rapidly changing external environment, the traditional concept and method of “decision + execution” are difficult to execute. Let PLC be the product life cycle, and IRC be the investment return cycle. Both innovation and investment decisions become difficult when entrepreneurs cannot clearly see the trend of environmental changes. Let x=PLC/IRC, which we will call the “decision interval”. Then, we obtain the decision risk model: y=f(x). Suppose that the IRC is relatively stable at a reasonable fixed value.

If PLC→∞, x→∞, the decision risk y→0. That is, when the PLC becomes sufficiently long, the decision interval is relatively large. Entrepreneurs improve their decisions with complete information; thus, the decision risk is very low, close to 0.

If PLC→0, x→0, the decision risk y→1. That is, when the PLC becomes infinitely short and the decision interval is close to 0, the investment decision risk is very high, close to 1.

Based on the above analysis, we can obtain a decision interval model (Fig. 1).

Next, we discuss three situations:

First, if PLC≫IRC, product upgrade is very slow. Entrepreneurs have enough time to make investment decisions and choose the best time to invest. The risk of decision-making is very low.

Second, if PLC>IRC, entrepreneurs have the opportunity to choose the right time to invest through project evaluation, and the decision risk is within an acceptable range.

Third, if PLC≤IRC, to recover the investment, the entrepreneur's decision needs to span multiple projects successfully. At this time, the entrepreneur's investment decision has gone beyond simple project evaluation. It is necessary to accurately predict and evaluate the innovation ability of the project team, and the decision risk has crossed the critical point p, and the difficulty of decision-making has increased significantly.

Thus, with PLC shortening, the innovator's dilemma is becoming increasingly prominent and common.

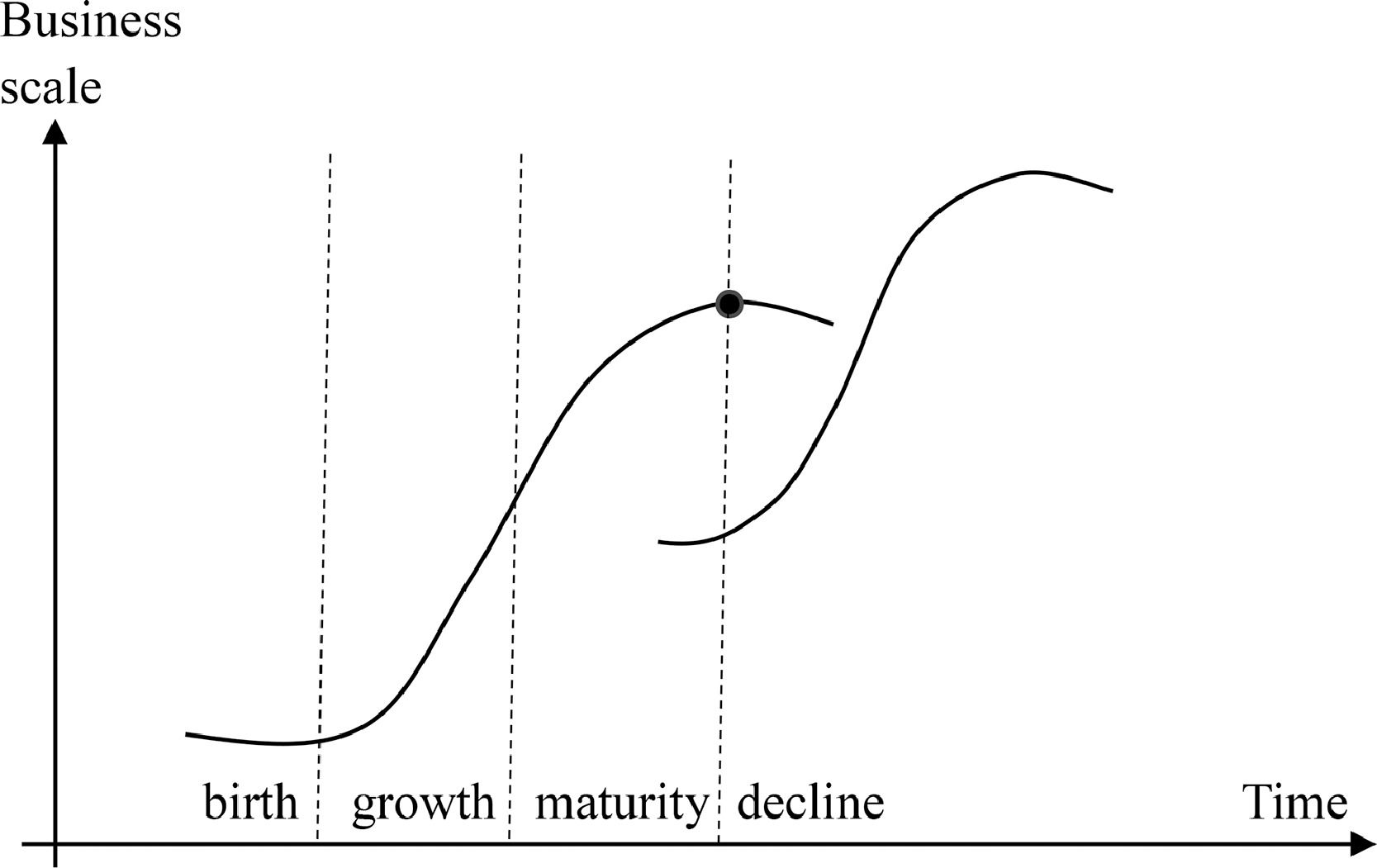

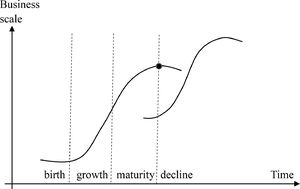

S-curve of BMThe product-based S-curve theory still applies to BMs. As the product gradually matures, the company's BM goes through four stages: birth, growth, maturity, and decline (Fig. 2) (Couto et al., 2021; Fisher et al., 2016).

The birth period corresponds to the concept stage of a product, which can last from one month to 10 years (Reynolds & Miller, 1992), and there are great differences between different industries and products. In the early stage of commercialization of products corresponding to the growth period, the company has been established (Katz & Gartner, 1988), and the founder has organized a product development team (Kazanjian, 1988) to find product-market fit (Ries, 2011) based on user iteration, aiming to continuously optimize products to meet specific user needs (Blank, 2013). The maturity phase corresponds to the late commercialization and growth phase of the product, where the product has achieved market success and may require a substantial capital injection to expand its business (Martens, Jennings & Jennings, 2007). The decline period corresponds to the product stabilization period, reaching a tipping point when a company's business growth is in line with market growth (Fisher et al., 2016).

The S-curve of the business model is a continuous evolutionary process. Companies need to plan and cultivate new products (or new businesses) in advance to ensure that they can smoothly switch to the new S-curve before the previous S-curve approaches the decline period. As the new product (or new business) is not a continuation of the original product (or business), there is a discontinuity between the two S-curves. Companies encounter the innovator's dilemma if they fail to build a new S-curve.

Innovator's methodFacing the innovator's dilemma, Furr and Dyer (2014) proposed an innovator's method in which entrepreneurs can reduce uncertainty through four steps: insight, problem, solution, and BM. The first is insight. Cherish unexpected discoveries. Enterprises can widely seek insights into problems worth solving through behavioral skills, such as questioning, observation, communication, and experimentation (Dyer, Gregersen & Christensen, 2019). The second is the problem. Clarify the work to be completed. Look for functional, social, and emotional work to be done by exploring customers’ needs or problems rather than solutions. The third is the solution. Develop a minimum excellent product. Propose theoretical or virtual models from multiple solution dimensions instead of developing complete products. Then, entrepreneurs should develop the minimum viable product model according to each solution and finally develop the minimum excellent product. Fourth is the BM. Verify the market entry strategy. After determining the solution, we start to verify other parts of the BM, such as pricing strategy, customer acquisition strategy, and cost structure strategy. Each step in this method is crucial and involves a “hypothesis, test, learning” closed-loop (Ries, 2011). We will expand the innovator's method and establish a BMI method for enterprises in highly uncertain environments.

BMIs of suningSuning was founded on December 26, 1990, and is located in Nanjing. Suning is a leading company among Chinese commercial enterprises, whose products include traditional household appliances, consumer electronics, department stores, daily necessities, books, virtual products, and other comprehensive products. Suning has experienced two major BMIs since its establishment. The first BMI occurred in the early stage of entrepreneurship, when they seized the opportunity for Chinese reform and opening up, and became the largest commercial retail enterprise in China, which we call the “Suning Electric Appliance” mode. Facing the impact of e-commerce on real business, Suning changed its name to “Suning cloud business” and carried out the second BMI, which we call “Suning cloud business” mode. However, two BMIs have brought different organizational performances; whether there is an innovator's dilemma in BM has become a focus issue.

“Suning electric appliance” modeChinese reform and the opening up of the economy have created entrepreneurial opportunities for the development of the current home industry. Zhang Jindong, the founder of Suning, seized the business opportunity and successfully founded the “Suning Electric Appliance”. Based on the successful opening of “air conditioning” franchise stores, Suning has established the “Suning Electric Appliance” mode through category expansion and chain operation.

First, it has keenly grasped business opportunities. In 1990, Zhang Jindong seized the opportunity for the Chinese transition from a planned economy to a market economy, and established “Suning pay electricity company” (the predecessor of Suning) in Nanjing and successfully opened “the first air conditioning franchise store” in China. Second, it has enriched the categories of household appliances in a timely fashion. In 1999, Suning expanded its business scope from “air conditioning” to “comprehensive electrical appliances,” and operated household appliances of multiple brands, specifications, and models, such as air conditioning, color TVs, refrigerators, washing machines, small household appliances, computers, mobile phones and other digital products. The company operates a full range of comprehensive appliances and has become the preferred place for consumers to buy household appliances. Third, it took the lead to explore the chain operations. In 2000, to adapt to market changes, Suning began to explore the chain operations of comprehensive household appliances. In three years, Suning has 41 direct chain stores in Nanjing, Beijing, Shanghai, Guangzhou, Zhejiang, Xi'an, Shenzhen, Yangzhou, Nantong, Xuzhou, Huai'an, Changzhou, Wuxi, and Suzhou, with a sales scale of 6.034 billion yuan in 2003.

“Suning Electric Appliance” mode has achieved excellent commercial value. First, it is a leading enterprise. Suning has become the sales champion of the air conditioning industry in China (1994), the 3C leading home appliance chain enterprise in China (1999), and the largest commercial circulation enterprise in China (2009). Second, it successfully creates business value.

“Suning cloud business” modeSince 2009, offline entity chain operations have faced challenges and pressure from the rapid rise of e-commerce enterprises, such as Alibaba and JD Mall. Suning has passively carried out BMI and explored the “Suning cloud business” mode since 2013.

Suning launched “Suning Tesco” to strengthen mergers and acquisitions (M&A) and explore the establishment of BM, integrating the online and the offline. First, they changed their business philosophy. Suning decided to change its name to “Suning cloud business” (2013) and implement “Omnichannel sales reform”. Based on the customer experience, Suning decided to change its name to “Suning Tesco” (2018). Renaming strongly reflects the management's willingness to change its business philosophy. Second, focusing on mergers and acquisitions, Suning mainly carries out BMI through M&A. In 2018, Suning invested 9.5 billion yuan to acquire “Wanda Department Store” and 4.8 billion yuan to acquire 80% equity of Carrefour China, with an annual M&A amount of 26.7 billion yuan. Third, imitating the leading enterprises. Taking JD Mall,1 Alibaba,2 PDD,3 and other leading e-commerce platforms as benchmarks, Suning began to organize the implementation of Project M&A (Table 1).

Project characteristics of Suning's M&A and operation.

The “Suning cloud business” mode did not achieve the expected results, bringing continuous losses and operating pressure to Suning. As a result, they are in heavy debt. The debt scale of Suning expanded from 56.1 billion yuan to 136.1 billion yuan from 2015 to 2020, a sharp increase of 80 billion yuan. With the maturity of various bonds, the Suning group mortgaged its shares to Taobao many times to raise short-term working capital. Moreover, there were serious losses. After deducting non-operating profits and losses, Suning has suffered continuous losses, and the losses have continued to expand since 2014 (Table 2). The loss in 2019 was as high as 5.711 billion yuan. Compared with the M&A process, it can be seen that the increasing M&A efforts in 2018 directly led to huge losses in the last two years.

Case analysisSuning has created two BMIs and achieved two different organizational performances. Next, we analyze the key factors and differences of the two BMIs through the discussion of the success of “Suning Electric Appliance” and the failure of “Suning cloud business”.

Why did “Suning electric appliance” succeed?Suning successfully seized the market opportunity presented by Chinese market reforms and the opening up of the economy, and created the “Suning Electric Appliance” mode. According to the innovator's method, Suning has found the problems created by the original circulation channels, innovated the circulation mode of household appliances, quickly copied the same to Chinese first-and second-tier cities based on a successful experiment in the Nanjing market, and successfully created the “Suning Electric Appliance” mode. The innovative value is reflected in three aspects.

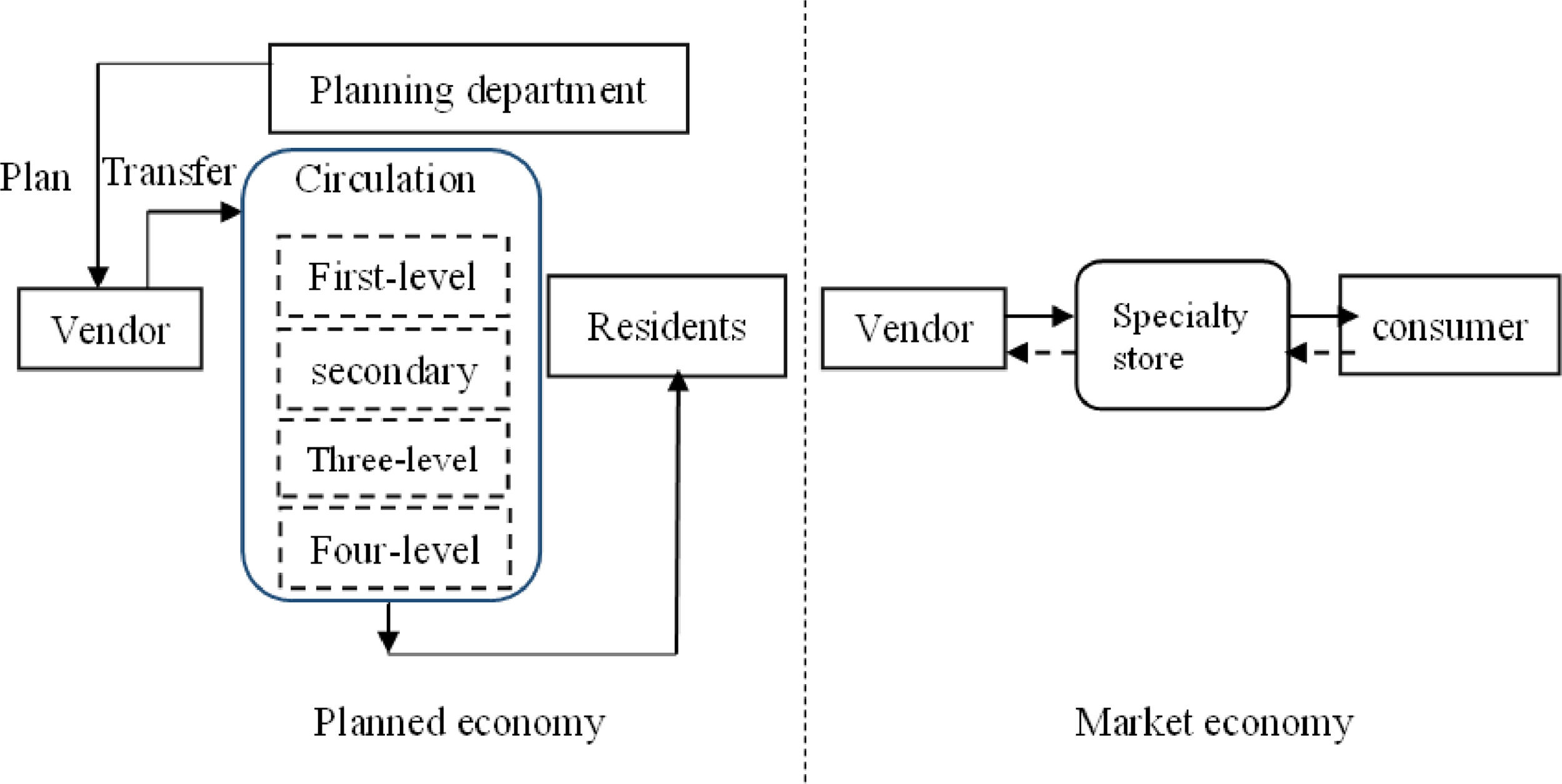

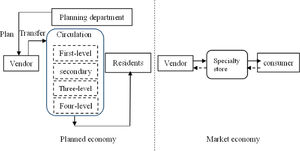

The first is improving circulation efficiency. Before the reforms, China organized production, distributed materials, and products according to the planned economy model. The industrial products produced by manufacturers had to be transferred to the residents (Fig. 3). With the “state-owned enterprise reform” comprehensively promoted, according to the principle of hierarchical management of state-owned assets, the four-level allocation system of the planned economy was quickly separated, bringing great obstacles to the circulation of industrial products of manufacturers.

Suning directly built a platform for vendors to sell industrial products through “specialty stores,” which greatly improved circulation efficiency. Meanwhile, the store has established a consumer information feedback loop to build an effective business feedback loop for vendors.

The second is realizing the scope of the economy. Suning summarized the successful experience of “air conditioning” stores, rapidly expanded the categories of other household appliances, created the brand image of “Suning Electric Appliance,” occupied the commanding height of the industry, and became the leading enterprise in electrical sales in China.

The third is realizing economies of scale. Suning quickly copied and promoted the successful model of “chain operation,” and became the largest commercial circulation enterprise at that time in China with 941 stores and 117 billion yuan of sales until 2009. The scale economy offers advantages to the company's resource integration and regional expansion.

The “Suning Electric Appliance” mode benefits from the institutional environment of Chinese reforms, and it is suitable for countries or regions with similar institutional changes.

Why did “Suning cloud business” fail?Compared with the first BMI, the second BMI of Suning, the “Suning cloud business” mode faces the BM innovator's dilemma and has brought huge losses. The reasons for this failure are as follows. The first is the lagging environmental cognition. Alibaba and JD Mall have risen rapidly since 2009 because of the destructive innovative technology of e-commerce, which is subverting the traditional business circulation industry. Suning realized the impact of e-commerce on offline business as early as 2013, but started BMI passively, significantly lagging behind environmental changes as a result.

The second is strategic decision failure. Taking JD Mall, Alibaba, and other leading e-commerce enterprises as a benchmark, Suning hurriedly started BMI with the help of M&A projects, which resulted in serious strategic decision failure. JD Mall and Alibaba are e-commerce service platforms that have successfully built their ecosystems. JD Logistics forms the core competitiveness and infrastructure of the JD Mall. Alibaba can easily obtain and monetize traffic based on Youku and Ant Financial. However, it is difficult for Suning to effectively integrate and achieve synergy by directly imitating the platform and promoting BMI through splicing M&A.

Third, we have the deviation in customer logic. As a large chain enterprise, Suning's consumers and manufacturers are important bilateral customers. Suning has no insight into customer needs and lacks in-depth insight from customers, which results in a serious deviation in customer positioning.

Imitating PDD's approach, Suning runs counter to the core customer base. PDD advocates the concept of low prices and has achieved great success in the rural market. “DD buys” and sinking markets are consistent with the customer's positioning. Simply imitating PDD's measures and launching “Suning buy together” and “Suning small group purchase” have poor compatibility with the original customer base and cause business confusion.

The “Suning cloud business” mode is based on the BMI under the changes of the “e-commerce” environment. With the rapid application of technologies, such as the internet and mobile internet, changes in the business environment are universal. It is suitable for the BMI of commercial enterprises in the volatility, uncertainty, complexity and ambiguity (VUCA) era.

Comparative analyses of two BMIsSuning carried out two BMIs, but the results were quite opposite. Comparing the two BMIs, there were significant differences in the external environment, market competition, corporate status, and organizational status (Table 3).

The first is the different external environments. Suning's first BMI was in the early stages of Chinese reforms. Although the external environment is changing, it can be predicted. To reduce the “uncertainty’ of Chinese reform, Deng Xiaoping promised the world that “it will remain unchanged for 100 years”, indicating that Chinese institutional change is predictable. The second BMI is at the stage of the rapid development of e-commerce. Internet technology has rapidly changed consumers’ shopping habits. New formats and species emerge endlessly, and the external environment is difficult to predict accurately. Facing new environmental changes, Suning is unable to judge the environment and its development trend, which is reflected in the lag in decision-making.

The second is the different market competition. The market environment transitioned from a planned economy to a market economy in Suning's first BMI. Market transaction dominance can effectively compensate for deficiencies in the planned economy model. The transformation of the Chinese economic system brought great business opportunities to Suning; market competition was not fierce, which is equivalent to entering the blue ocean market (Kim, 2005). Thus, Suning took the lead in entering the circulation field and obtained the first-mover advantage.

During Suning's second BMI, Alibaba, JD Mall, and other leading enterprises occupied the commanding heights of e-commerce. E-commerce follows the network effect and appears in the situation of “winner takes all”. New entrants face greater challenges in the e-commerce field, which is a typical red ocean market (Kim, 2005). It is difficult for Suning to realize BMI only through the transformation from an offline entity chain to an online platform.

The third is a different corporate status. In the first BMI, whether starting in Nanjing or operating across provinces, Suning is the market leader. Category expansion upgraded “specialty stores” to “hypermarkets”, which bring consumers an excellent consumption experience. The national chain operation achieves a scale economy and provides manufacturers with efficient industrial product sales channels. The second BMI was a passive response after experiencing the serious impact of e-commerce on offline physical stores. Suning has no deep insight into the internal logic of customers, channels, and traffic, but hastily imitates the e-commerce benchmarking platform to achieve BMI through projects M&A. This result is often counterproductive.

The fourth is a different organizational status. Suning is a new enterprise with the first BMI. The company has unique advantages in terms of business opportunities, innovation vitality, and resource organization. Suning is a mature enterprise with a second BMI. The company already has a mature organizational structure and normative system. They will face conflicts in ideas, systems, and culture, forming a large internal resistance when they carry out BMI. Project M&A and its integration will accelerate the triggering of internal contradictions and conflicts.

The limitations of insight opportunities and cognitive problems affect the external factors of Suning's BMI. The management mode of mature companies hindered the BMI of Suning, which is completely consistent with the innovator's dilemma. Thus, the “Suning cloud business” mode faces a typical innovator's dilemma.

ResultsBased on the above case analysis, we use the S-curve to further analyze whether Suning faces the BM innovator's dilemma and its mechanism.

Introduce environment variablesIn IT innovation, enterprises face a VUCA environment (Bennett & Lemoine, 2014). Drastic changes in the external environment have subverted traditional BM and brought about discontinuous changes. Moore's law (Moore, 1965) opens the way for the exponential improvement of semiconductors (DeBenedictis, 2019), which results in an endless stream of disruptive innovations in the hardware and software industry. The two industries complement and promote each other, which provides a basis for the Internet, big data, cloud computing, Internet of Things, and blockchain. Furthermore, it brought an unpredictable external environment and led to a change in economic structure (Greenstein, 2017).

Moore's law compresses the life cycles of IT products. The IT industry has been developing rapidly following Moore's law, accelerating the speed of product renewal, and the product life cycle (PLC) is less than 1.5 years. Although the density of semiconductors approaches the physical limit, this does not necessarily mean the end of Moore's law (Edwards, 2021). Disruptive innovation in the IT industry is rapidly promoting cross-industry transfers through technology, channels, and relationships. Taking the Internet as an example, e-commerce has completely subverted the traditional business circulation industry. The popularity and application of smartphones have changed people's social networks, information channels, and consumption habits, which invalidates traditional sales channels and methods. The ultrashort PLC subverts the investment decision-making mode. In the capital market, the P/E ratio of most industries exceeds 20, that is, the average investment return cycle (IRC) is greater than 20 years. Currently, PLC in many industries is less than 1 / 10 of the IRC, which subverts the traditional investment decision-making mode.

The mechanism of BM innovator's dilemmaWe use the S-curve theory and decision interval model to explore the mechanism of the BM innovator's dilemma.

Decision interval modelChinese Internet technology has been rapidly applied in the commercial field since 2009. It switched from the PC Internet to the mobile Internet in 2013. Users have experienced changes from search to push, then to streaming media, which changes consumers’ shopping habits, and it is difficult for enterprises to quickly adapt to changes in the business environment.

It can be seen that the two BMIs of Suning are matched to the second and third cases of the decision interval model, respectively.

Due to the rapid changes in new business formats such as e-commerce and online transactions, Suning faces the decision-making dilemma of whether, when, and how to implement business transformation. First, rapid changes in the external environment shorten the business life cycle and compress the first S-curve. The evolution of traditional business formats is a continuous and lengthy process. E-commerce is changing rapidly with the change in communication channels, new formats emerge one after another, and the model replacement speed is very fast. Entrepreneurs face a third decision interval model. The risk of decision-making increases rapidly, resulting in the dilemma of choosing a new model. Second, execution is an important skill in traditional management. If there is uncertainty in the decision itself, the stronger the execution, the less likely it is to correct the error, and the greater the loss. Decision risk depends on the project team's ability to innovate and manage uncertainty.

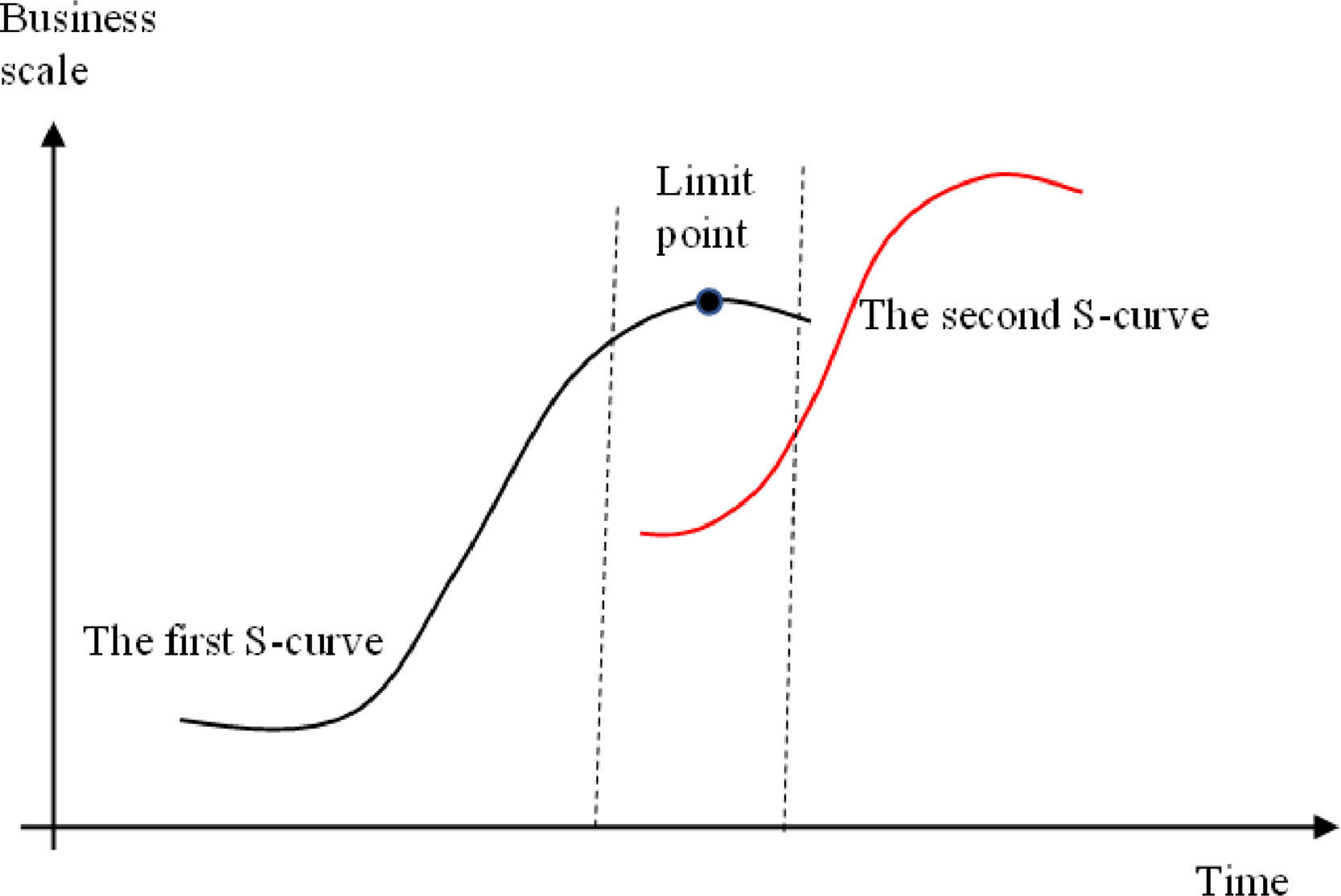

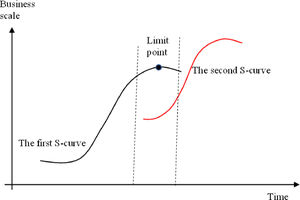

S-curve theoryAccording to the S-curve theory, the operating conditions of a company will show an S-curve growth as its business expands. When an enterprise approaches the late stage of maturity, it encounters the limit of development, and the original business will face stagnation. When the company reaches the limit of growth, 70% of the leading companies will be replaced, and only 4% of the companies can restart the growth engine (Olson & Van Bever, 2008). The original business will stall when the company encounters a limit point. Olson & Van Bever, (2008) tracked Fortune Global 500 companies and showed that only 5% maintained a growth rate exceeding the inflation rate from 1955 to 1995. This means that companies need to open the second S-curve before the original business encounters the stall point (Fig. 4).

With Chinese reforms, residents’ income has continued to increase, and Suning's offline retail business has achieved steady and sustained growth along the first S-curve. However, customer habits and the business environment had undergone drastic changes with the switch from PC Internet to mobile Internet since 2013, and as a result, Suning's offline retail business reached the “limit point”.

E-commerce has been affecting the traditional offline retail business since 2009, while Suning only started to explore online business in 2013. Due to the discontinuity between the two S-curves, Christensen called it “disruptive innovation,” and overcoming this discontinuity has become the Achilles heel of enterprises.

Facing a rapidly changing external environment, traditional “decision + execution” concepts and methods are facing challenges. We conduct a mechanism analysis by establishing a decision interval model.

Countermeasures for the BM innovator's dilemmaCorporate failures can be divided into three categories: simple, complex, and catastrophic. Organizational learning can address simple failures, organizational planning can address complex failures, and catastrophic failures require building organizational agility (McMillan & Overall, 2017). The enterprise faces the risk of catastrophic failure when it encounters the innovator's dilemma. We draw on the innovator's method (Dyer et al., 2019) to improve the agility of the enterprise and cope with the highly uncertain external environment from insight problems, seeking solutions, and verifying solutions.

Insight problemsBMI needs to return to the underlying logic of business, focus on specific customer groups based on the classification and stratification of customer groups, gain insight into customers, and find problems worth solving through association, questioning, and observation (Dyer et al., 2019). Give priority to insight into the customer's motivation and behavior, clarify the work that the customer needs to complete, explore the pain points affecting the customer's work, and the expected benefits for the customer (Furr et al., 2014).

Based on customer insight and empathy, observe how products and services help customers complete their work, overcome extreme pain points and create surprising benefits from a customer perspective, then establish an iterative closed-loop of product service with the most important customer group, gain insight into the optimization and improvement space of product service, and improve the fit between product and market. On this basis, improve the channel, relationship, value creation, and business sustainability logic in BM to further explore the problems and deficiencies of BM.

Combined with the insights above, a list of problems related to enterprise BMI is summarized and formed.

Seeking solutionsThe enterprise team needs to prioritize the insight BM problem list according to the importance and difficulty of its solution. Focus on solving the three problems, while the remaining problems are included in the alternative problem pool. Based on the logic of enterprise growth, the BMI team should focus on demand creation and design solutions catering to customer acquisition, activation, and retention to better meet customers’ value expectations (Ellis & Brown, 2017). According to the problem types of BM, formulate multiple solutions one by one, and enter the commercial experiment after evaluation and ranking to scientifically obtain the basis for the effectiveness of the scheme.

Verifying solutionsAfter determining the solution, a series of commercial experiments are designed to verify the effectiveness of the solution and continuously iterate the BM. For a product service optimization scheme, the BMI team should be good at using the minimum available products (Ries, 2011), obtain customer feedback through multiple rounds of commercial experiments, continue iterative optimization, and shape the minimum excellent products (Furr et al., 2014). Excellent products are a prerequisite for a successful BMI. The BMI team should use the “Sean test” to verify whether products are indispensable to customers. If the critical value of 40% cannot be satisfied, the BMI team should continue to optimize the products (Ellis et al., 2017). In the test experiment, the BMI team should transform all fixed costs into variable costs as much as possible, and use the asset-light strategy to borrow resources, delay the purchase of resources, or simulate resources (Furr et al., 2014). It is not recommended that the BMI team forcibly embeds destructive innovation solutions into existing BM because BMI plates interact and influence each other.

Process to deal with the BM innovator's dilemmaPromoting a BMI for a mature enterprise is equivalent to driving in the fog. Based on the analysis of environmental uncertainty, this fog climate is normal. Mature enterprises need to skillfully use the lean method, refit the traditional “functional vehicle” into a “smart vehicle,” establish a scientific trial-and-error mechanism, and scientifically determine a path out of the fog range.

Implant “central control system”Enterprise management needs to reach a high consensus on BMI and firmly implant the “central control system” in the organization. The BMI process will derive a series of conflicts of ideas and cultures without the strong “central control system,” and make the BMI unsustainable. Based on years of lean transformation experience of the firm General Electric (GE), Ries (2017) shows that mature enterprises face many internal obstacles to carrying out BMI.

Commissioning “radar system”The enterprise should establish a BMI investigation team and build a new “investigation department” under the direct leadership of enterprise executives. According to the enterprise BMI goal, the investigation team should start from the bottom logic of business and focus on the most important customer groups and core businesses. Based on extensive “customer exploration,” they should see the key problems, put forward solutions, scientifically verify the effectiveness of the solutions, and find an effective path for BMI.

Promote BMI in an orderly mannerEnterprise management needs to personally participate in the entire process of “radar system” installation and commissioning. Combined with GE's lean transformation experience, BMI exploration should be promoted in an orderly fashion and in stages: first, start with a single project pilot to test the effectiveness of lean BMI. Second, rapidly expand and fully deploy and unswervingly promote lean BMI. Third, cultural innovation and institutional change can be used to solve deep-seated problems of lean BMI (Ries, 2017). The business philosophy needs to change from the traditional “rational prediction” to “scientific trial-and-error,” and the gene of “trial, error tolerance, error correction” needs to be implanted in the corporate culture.

Concluding remarks, contributions and limitationsConcluding remarksBased on the analysis of successful and failed cases of BMI in Suning, we have four main conclusions. First, the changed environment exacerbates the BM innovator's dilemma. In the process of rapid cross-border integration of the current IT technology revolution into traditional industries, the operating environment of traditional industries has become unpredictable, and traditional enterprises will generally face the BM innovator's dilemma. Second, the decision-making dilemma affects decision risk. The results of the decision interval model show that the IT technology revolution has seriously compressed the decision interval and severely challenged the traditional “decision + execution” management mode. Enterprises generally face a decision-making dilemma, which is the root of the BM innovator's dilemma and the key factor of “the innovator's dilemma” proposed by Christensen (1997). In addition, due to the decision-making dilemma, the better the execution, the greater the risk. Third, the key to BMI is opening the second S-curve of innovation. The analysis shows that there is a discontinuous gap between the first and second S-curves. Discontinuity is the main factor restricting the smooth opening of the second S-curve. The lean method can help deal with the BM innovator's dilemma. In reference to the innovator's method, the business world can use the lean method to establish and improve the scientific trial-and-error mechanism, and find the path of BMI through insight problems, seeking solutions, and verifying solutions.

ContributionsThis study makes two main academic contributions. One is to supplement the insight of the innovator's dilemma in the field of business. Taking Suning as a case that belongs to the commercial circulation industry, we indicate that there still exists the innovator's dilemma proposed by Christensen in the commercial field.

The other is to analyze the internal mechanism leading to the innovator's dilemma in BM. First, by introducing environmental variables into the research framework, we analyze the causes of the innovator's dilemma from a new perspective. Especially in the VUCA era, the highly uncertain external environment brings great challenges to the business community, and the academic needs to increase the research intensity of environmental variables. Second, by constructing a decision interval model, we explore the conduction mechanism of environmental variables. Rapid changes in the environment have shortened product life cycles and challenged traditional decision-making models in the corporate world. In particular, when the product life cycle is shorter than the investment return cycle, the traditional decision-making model fails. Third, we use the S-curve theory to explore the key to the innovator's dilemma. The study found that the key to the innovator's dilemma in the business world lies in whether the second S-curve can be successfully opened. Well-managed companies are good at operating within the first S curve, but struggle to successfully cross the second S curve, which creates a discontinuity.

This study also puts forward policies and suggestions for the business community, which are specifically reflected in the following. The first is to use the lean entrepreneurship method to solve the dilemma. The innovator method (Furr et al., 2014) is a model applied by the lean entrepreneurial method in the field of business models. The enterprises can form a closed loop of feedback iteration through insight problems, seeking solutions, and verifying solutions to explore the direction of business model transformation.

The second is to use the lean method to provide a process to deal with the BMI dilemma. Enterprises can establish a scientific trial-and-error process to deal with the BMI dilemma by implanting a “central control system,” debugging “radar system” and orderly promoting “BM innovation”.

LimitationsThe limitation of this study is that it only studies the BM innovator's dilemma through a single case. The conclusion of this study needs to be widely practiced in business to verify its effectiveness. The BMI innovator's dilemma is an integral part of the innovator's dilemma. This study attempts to introduce “decision intervals” and establish a decision interval model to analyze the causes of the innovator's dilemma. The decision interval model needs to be refined; in particular, indicators such as innovation resources and innovation teams need to be introduced to further study the internal mechanism leading to the innovator's dilemma. In addition, entrepreneurs need to widely apply the lean method to carry out BMI, track successful cases, and further verify the effectiveness of the lean method in solving the innovator's dilemma.

This work was supported by National Social Science Foundation of China [grant numbers 20BTJ025].

JD Mall is a comprehensive online retailer in China and a popular and influential e-commerce platform in China's e-commerce field.

Paper prepared for Journal of Innovation and Knowledge

Alibaba is a China's leading e-commerce service platform. Its businesses include Taobao, Tmall, Juhuasuan, AliExpress, 1688, Alibaba, Alibaba Cloud, Ant Financial, and Cainiao.com.

PDD is a new e-commerce pioneer in China and a third-party social e-commerce platform focusing on C2M group shopping.