This study aims to explore the relationship between social capital and the innovation performance of digital firms. In addition, we examine the mediation effect of cross-border knowledge search on this relationship and investigate the serial mediation effect of cross-border knowledge search and absorptive capacity between social capital and innovation performance. Using data collected from 217 Chinese digital companies, we tested the proposed hypotheses by constructing structural equation models through SPSS 22.0 and AMOS 24.0. Based on the results of theoretical deductions and empirical tests, some conclusions can be drawn. First, for digital firms, social capital remains significantly and positively associated with innovation performance during the COVID-19 pandemic. Meanwhile, digital firms with higher social capital are likely to generate higher innovation performance even if they experience a more severe impact of the COVID-19 pandemic. Second, cross-border knowledge search effectively mediates the relationship between social structural capital, social relational capital, and innovation performance, whereas this mediation effect is not significant between social cognitive capital and innovation performance. Finally, the serial mediation effect of cross-border knowledge search and absorptive capacity on the relationship between social capital and innovation performance is confirmed. Some managerial implications are summarized based on our findings. On the one hand, digital firms should still actively build social capital to enhance innovation performance during the pandemic. On the other hand, social capital can help digital firms implement cross-border knowledge search and develop absorptive capacity. Thus, digital firms can effectively utilize heterogeneous knowledge to enhance their innovation performance.

During the COVID-19 pandemic, firms in almost all industries are developing digital technologies or attempting digital transformation to face the multiple pressures of constrained resources, communication difficulties, and lack of innovation. Digital transformation presents a long cycle time, high risk, and high investment for digital firms, which greatly exacerbates the pressure on their resources. Under multiple pressures, internal resources can no longer meet the needs of corporate innovation. Consequently, many digital firms are beginning to leverage social capital to access external resources. Corporate social capital is typically regarded as an effective guarantee for firms to acquire knowledge, stimulate innovation, and improve performance (Ortiz, Donate, & Guadamillas, 2018; Sheng & Hartmann, 2019; Q. Zhang, Pan, Jiang, & Feng, 2020). Firms with superior social capital can obtain heterogeneous knowledge by establishing tight connections or reaching a consensus with cooperative subjects (Tsai & Hsu, 2019). In turn, the acquisition of heterogeneous knowledge can stimulate firms to innovate and enhance their innovation performance. However, the COVID-19 pandemic exacerbates the level of change in the business environment, which makes it difficult for firms to build social capital. Therefore, Priyono, Moin and Putri (2020) recommend that small and medium enterprises (SMEs) undergo digital transformation to cope with the changes during the pandemic. Nevertheless, it is undeniable that the lack of resources has become a major obstacle for firms to build social capital (Crupi, Liu, & Liu, 2021) and undergo digital transformation (Chen & Tian, 2022). Specifically, digital firms need to continuously innovate the processes of production, R&D, and sales to achieve digital transformation, which consumes considerable resources. Meanwhile, building social capital also requires the depletion of corporate resources. Unfortunately, the outbreak of the pandemic has left digital firms with an extraordinary lack of resources, making it extremely difficult to establish connections among firms. Consequently, it remains ambiguous whether digital firms can improve innovation performance by building social capital during the pandemic.

Earlier studies have analyzed and discussed the effects of organizational boundaries in relatively stable environments (Fennell & Alexander, 1987). However, the ever-changing business environment has made such stability demands progressively inappropriate; therefore, firms attempt to conduct cross-border organizational activities. In this context, Sheng & Hartmann (2019) find that cross-border tacit knowledge sharing and social capital can influence the development of a firm's ambidextrous innovation capabilities. Similarly, Duan, Huang, Cheng, Yang & Ren (2021) discover that cross-border knowledge management can improve the quality of innovation in multinational firms, in which cultural distance plays a moderating role. Hence, it is not difficult to speculate that close connections exist between cross-border knowledge management activities and corporate innovation. In terms of cross-border knowledge search, knowledge search across organizational boundaries may bring heterogeneous knowledge to firms, which is conducive to the generation of new ideas (An, Huang, Liu, & Wu, 2022). However, firms are not independent individuals but nodes in intricate networks of interests. In such networks, all nodes are interdependent and interact with each other. Social capital, as a bond formed by the joint action of all parties in the interest network, helps stakeholders exchange knowledge, information, and value. Therefore, close relationships potentially exist between social capital, cross-border knowledge search, and innovation performance. Nevertheless, to the best of our knowledge, only few studies have explored this topic in depth.

For corporate innovation, the acquisition of heterogeneous knowledge is insufficient for innovation. Firms also need to have the absorptive capacity to absorb and utilize heterogeneous knowledge. Santoro, Bresciani & Papa (2020) find that heterogeneous sources of knowledge and absorptive capacity can optimize inter-firm collaboration patterns to enhance innovation performance. Similarly, Yu (2013) reveals that absorptive capacity plays a mediating effect on the relationship between social capital and firm innovation. However, considering the current situation of resource-constrained firms, it is not yet known whether absorptive capacity can still mediate the relationship between social capital and innovation performance. Meanwhile, cross-border knowledge search is an effective means for firms to obtain heterogeneous knowledge. According to Moeen & Agarwal (2017), the acquisition of heterogeneous knowledge stimulates knowledge creation within firms, which enhances their capacity to absorb and export knowledge. Therefore, the intermediary chain between cross-border knowledge search and absorptive capacity potentially plays a serial mediating role between social capital and innovation performance.

Although the topics explored in this study have been initially discussed in earlier studies, research gaps remain in existing studies, which need to be filled. First, previous studies have argued that social capital enables firms to build social networks (Akintimehin, Eniola, Alabi, Eluyela, Okere, & Ozordi, 2019) and strengthen inter-firm ties, so that knowledge, information, and other factors can flow freely among firms and ultimately improve innovation performance (Maurer, Bartsch, & Ebers, 2011). While the pandemic has intensified resource pressures, digital transformation remains the key to corporate innovation (Soto-Acosta, 2020). However, under the combined pressures of resource constraints and digital transformation, it is not yet known whether digital firms can enhance their innovation performance by building social capital. Second, corporate connections based on social capital promote the free flow of knowledge among firms and make cross-border knowledge search available. In addition, cross-border knowledge search brings heterogeneous knowledge to firms to increase innovation performance. However, existing studies have failed to clarify the relationship between these three factors. Finally, the processes of knowledge search and absorption are inextricably intertwined. Social capital provides paths for firms to search for heterogeneous knowledge across borders, and the heterogeneous knowledge gained from cross-border knowledge search can promote firms’ absorptive capacity and ultimately enhance their innovation performance. Unfortunately, no extant study analyzes the serial mediation effect of cross-border knowledge search and absorptive capacity between social capital and innovation performance.

In fact, in the new digital transformation environment, digital firms’ social capital is still supposed to play an important role in the acquisition of external knowledge. This is because social capital lays the foundation for cross-border knowledge search and digital firms can effectively cross inter-firm boundaries to access external heterogeneous knowledge through social capital networks. Meanwhile, the acquisition of heterogeneous knowledge can enhance digital firms’ knowledge absorptive capacity, which helps them transform acquired knowledge into new products or services. Thus, digital firms’ innovation performance can be improved. Therefore, we address the following three research questions based on the results of our theoretical review and empirical tests.

RO1. Does the social capital of digital firms still enhance innovation performance under the combined pressures of resource constraints and digital transformation?

RQ2. Does cross-border knowledge search mediate the relationship between social capital and innovation performance in digital firms?

RQ3. Do cross-border knowledge search and absorptive capacity have a serial mediation effect between social capital and innovation performance in digital firms?

To answer the aforementioned research questions, our study is divided into four sections to discuss them. In the first section, the relevant literature on social capital, cross-border knowledge search, absorptive capacity, and innovation performance is reviewed, and research hypotheses are presented from the perspective of theoretical analysis. In the second section, we explain the research methodology used in our study, including the data collection and measurement of variables. In the third section, the proposed hypotheses are tested from the perspective of empirical tests, and the results of the empirical tests are briefly analyzed. In the final section, based on the theoretical review and empirical test results, we summarize the findings, including the conclusions, theoretical contributions, management implications, limitations, and future research directions.

Literature review and research hypothesesSocial capital and innovation performanceSocial capital describes the interactions between firms and stakeholders. The establishment, maintenance, or breakage of these interactions can affect the exchange of information and resources between firms (Yang, Cozzarin, Peng, & Xu, 2021). In general, social capital is studied mainly through three dimensions: social structural capital, social relational capital, and social cognitive capital (Nahapiet & Ghoshal, 1998; Q. Zhang et al., 2020). Social structural capital refers to the state of connections between different subjects, including the existence, frequency, and nature of the connections. Social relational capital indicates behavioral relations between different subjects, and these relations are similar to human relationships, such as trust, concern, and exclusion. Moreover, the generation, maintenance, and breakdown of these relationships can affect the flow of information, knowledge, value, and other elements in relational networks. Social cognitive capital refers to the degree of common acceptance among different subjects in terms of their perception, recognition, and understanding of the same things. Due to different positions of interest and cognitive constructs, there are numerous differences between different subjects, which may form barriers to communication or cause different judgments. Consequently, these differences can only be communicated, understood, and eventually accepted by all parties if consensus (a high degree of common acceptance by all parties) exists.

Social structural capital identifies stakeholders connected to firms and reflects the extent of such connections. These connections are essential channels for firms to acquire heterogeneous knowledge (Tsai & Hsu, 2019). Meanwhile, heterogeneous knowledge flowing through these connections is considered the key element for corporate innovation. When these connections are strong, firms can obtain a wealth of knowledge with innovative value. There are many ways to establish connections among firms, such as forming alliances and signing cooperation agreements. These initiatives have shortened the time and cost of knowledge flow among firms and decreased the risks associated with information asymmetry, thus making it easier for firms to improve innovation performance.

Social relational capital refers to the quality and closeness of the interactions between the two (or several) parties in a business. Deep interactions among firms are predicated on trust, respect, and mutual benefit. Therefore, good social relational capital means that a firm is perceived by other partners as reliable, honest, and trustworthy. Based on trust, the interactions among firms are smooth and low-cost. At the same time, such interactions can facilitate establishing long-term and stable relationships among firms. Strong social relational capital guarantees equal quality and efficiency of knowledge flow. Meanwhile, it is stable for firms to operate their innovation activities without worrying about the risks of short-term technological fluctuations. This is because they can receive continuous support for innovation through these strong interactions. Moreover, trust-based corporate interactions are agile and unhindered, which is critical to the transfer and manifestation of tacit knowledge (Ganguly, Talukdar, & Chatterjee, 2019). Given that knowledge (especially tacit knowledge) is generally embedded within firms, obtaining such knowledge through interactions becomes the aspiration of other collaborators. Fortunately, the interactions among firms help them break down the limitations of knowledge search and renew their knowledge base, which provides a high-quality source of motivation for innovation.

Social cognitive capital is a cognitive paradigm that firms construct in their social networks. This cognitive paradigm refers to the interpretations and value orientations shared by all parties on social networks. The cognitive dimension belongs to the collective subconscious level. From this perspective, social cognitive capital can be abstractly defined as the extent to which a firm recognizes the consensus and shared values of its various partners in the social network. Moreover, social cognitive capital can be figuratively understood as an interactive agreement or a value community between firms. Communication tends to be intensive and productive, based on common or similar cognitive patterns (consensuses) and values. Consensuses are derived from the integration of the differences between parties and games with partners. In the process of reaching consensus, the other party's cognitive model strikes the existing cognition of the firm and shatters its original cognitive boundary Peng (2013). Immediately afterward, a firm with a new cognitive model can search for heterogeneous knowledge in the interaction process, which becomes the innovation diffusion point in the interaction process and stimulates corporate innovation (Yong & Yang, 2014). In addition, corporate social cognitive capital is formed from long-term common statements, goals, and values among firms (Yoshida, Gordon, & James, 2021). Therefore, as a corporate principle transcending corporate interests and viewpoints, social cognitive capital is critical for overcoming conflicts of interest and barriers among firms (Nahapiet & Ghoshal, 1998). In parallel, social cognitive capital facilitates the exchange and combination of resources and information, application of new knowledge, and formation of a favorable climate for innovation, thereby promoting innovation.

Admittedly, the pandemic has put many digital firms in difficult situations. Difficulties such as plummeting profits, constrained resources, and blocked communication add to the operational pressures of digital firms. From this perspective, when digital firms are less affected by the pandemic, they are more likely to obtain more resources to innovate and improve their innovation performance. However, even when firms are affected by the pandemic to the same extent, their innovation performance still varies. In general, digital firms with high social capital tend to create higher innovation performance during the pandemic than those with low social capital. This is because digital firms with high social capital have solid social networks that guarantee the free flow of resources (such as heterogeneous knowledge) among firms. In turn, the acquisition of heterogeneous knowledge can effectively stimulate firm innovation, and thus enhance innovation performance.

Based on the above analysis, the following hypotheses are proposed.

H1a: Social structural capital significantly contributes to innovation performance.

H1b: Social relational capital significantly contributes to innovation performance.

H1c: Social cognitive capital significantly contributes to innovation performance.

H1d: When firms have similar social capital, there is an opposite trend between their innovation performance and the degree to which they are affected by the pandemic.

H1e: Digital firms with high social capital can achieve more innovative performance than those with low social capital when affected by the pandemic to the same extent.

Mediating role of cross-border knowledge search between social capital and innovation performanceCross-border knowledge search refers to the actions of firms to acquire heterogeneous knowledge from external subjects across their organizational boundaries. It is the premise of cross-border knowledge search that organizations are clearly conscious of their organizational boundaries (Xiangyang Wang, Xi, Xie, & Zhao, 2017). Organizational boundaries enable firms to find their positions in the social division of labor as well as to architect their approaches to internal value creation. The original goal of establishing organizational boundaries is the effective achievement of organizational goals (Tripathi, Popli, Ghulyani, Desai, & Gaur, 2021). As the subjects of economic practice, firms should constantly adjust their boundaries according to their practical experiences or cognitive structures. However, the existence of boundaries weakens knowledge acquisition and makes it extremely difficult for firms to obtain heterogeneous knowledge. Thankfully, cross-border knowledge search can transcend the boundaries of firms and bring new perspectives and ideas that are distinct from the firms’ existing knowledge base. Meanwhile, the development of firms requires an open attitude (Zhou & Wu, 2018), which means that stagnation and seclusion are not the best choices. Therefore, firms should actively conduct cross-border knowledge search activities to acquire new knowledge and ideas. Scholars tend to divide cross-border knowledge search into two main dimensions: cross-border technological knowledge search and cross-border market knowledge search (Gao, He, Teng, Wan, & Zhao, 2021). The former refers to the cross-border search for skills and knowledge related to products, processes, procedures, and methods in the industry from suppliers, research institutions, among others. The latter refers to the cross-border search for knowledge related to market demand, product design, distribution channels from customers, channel providers, among others. Cross-border knowledge search accommodates the perceptions and opinions of different stakeholders, which allows brainstorming and opens up multiple paths to innovation.

Social capital explains the interaction of firms in their social networks where they are located and provides platforms for the flow of information and knowledge. Firms with high social capital frequently have extensive and high-quality knowledge-search channels. For example, firms with high social structural capital are extensively connected to various stakeholders, such as the government, suppliers, customers, and universities. Most existing studies on social structural capital focus on government-enterprise relationship research (Setiaji & Setyawan, 2015), cluster effect (Pucci, Brumana, Minola, & Zanni, 2020), consumer value co-creation (H. Zhang, Gupta, Sun, & Zou, 2020), and industry-academia-research collaborative innovation. Based on prior studies, these connections allow firms to learn about technological knowledge, such as the frontiers of technology development, product design processes, and the competitive landscape of technology, as well as relevant market knowledge including consumer preferences and market demand. As far as social relational capital is concerned, firms with good social relational capital are empowered to accumulate deep-rooted trust and cooperative relationships. Efficient interactions with other market players lead to higher quality and reliable knowledge searched across borders. For example, firms with superior social relational capital are likely to search for technological and market knowledge by forming strategic alliances and forging technological co-development agreements. Such approaches allow them to complement and mutually reinforce resources with their partners. Based on the definition of social cognitive capital discussed in this study, firms with excellent social cognitive capital can rapidly obtain and absorb heterogeneous knowledge from their partners. This is because the establishment of the cross-border knowledge search mechanism breaks the limited cognition of firms’ existing technological and market knowledge. Meanwhile, with consensus (formed based on similar behaviors or shared values), the closer the cooperation between the participating firms, the more in-depth discussions can be held at different, stages such as products, processes, procedures, market demand, and sales channels.

Corporate social capital transcends the limitations of firms that rely on their resources for development and provides substantial opportunities to acquire heterogeneous knowledge for corporate innovation. Cross-border knowledge search, as a means for firms to proactively implement knowledge management, can acquire valuable technological and market knowledge (including information and resources) from the social networks in which the firms are located. Moreover, based on cross-border technological and market knowledge search, firms can utilize the new knowledge searched to optimize their own knowledge base and develop innovative products with promising technological reliability and market acceptability. Therefore, we speculate that cross-border knowledge search mediates the relationship between social capital and innovation performance. Based on the above analysis, the following hypotheses are proposed.

H2a: Cross-border technological knowledge search mediates the relationship between social structural capital and innovation performance.

H2b: Cross-border technological knowledge search mediates the relationship between social relational capital and innovation performance.

H2c: Cross-border technological knowledge search mediates the relationship between social cognitive capital and innovation performance.

H3a: Cross-border market knowledge search mediates the relationship between social structural capital and innovation performance.

H3b: Cross-border market knowledge search mediates the relationship between social relational capital and innovation performance.

H3c: Cross-border market knowledge search mediates the relationship between social cognitive capital and innovation performance.

The mediating role of absorptive capacity between social capital and innovation performanceSearching for knowledge is merely the initial stage in the construction of a firm's knowledge system. Digital firms should also develop their capacity to absorb, transform, and export knowledge. Cohen & Levinthal (1990) argue that absorptive capacity refers to a firm's ability to identify and evaluate new external knowledge and then digest and apply it (Chichkanov, 2021). Zahra & George (2002) categorize absorptive capacity into potential and actual absorptive capacity. The former is a firm's capacity to evaluate and digest external knowledge (Ahmed, Guozhu, Mubarik, Khan, & Khan, 2020), whereas the latter is a firm's capacity to transform and apply the digested knowledge (Kale, Aknar, & Başar, 2019). Firms with high social structural capital tend to be recognized and accepted by most participating parties, which helps them gain additional resources and seek opportunities for cooperation. Good social structural capital contributes to the establishment of formal and legitimate inter-firm connections for the free flow of resources and information, which facilitates the identification and acquisition of knowledge (Jinghua & Jisheng, 2017). Firms with excellent social relational capital can acquire high-quality heterogeneous knowledge based on mutual trust. At the same time, they are capable of developing products and co-creating value from digested and integrated knowledge. As firms with favorable social cognitive capital frequently share consensus with their partners, they can effectively utilize, absorb, and export knowledge based on consensus. This is because knowledge exchange among firms under consensus is generally considered safe, comfortable, and smooth Peng (2013). In contrast, powerful absorptive capacity means a lower cost of knowledge acquisition, transformation, and output, which contributes to the effective expansion of the knowledge stock owned by firms. Through the absorption of knowledge, firms can generate new ideas for the optimization of existing processes, such as product design, production, and marketing. In addition, firms can also design and develop completely new products based on the newly absorbed knowledge. In summary, optimizing existing processes and developing new products are external manifestations of corporate innovation. Therefore, corporate innovation performance increases. Based on the above analysis, the following hypotheses are proposed.

H4a: Absorptive capacity mediates the relationship between social structural capital and innovation performance.

H4b: Absorptive capacity mediates the relationship between social relational capital and innovation performance.

H4c: Absorptive capacity mediates the relationship between social cognitive capital and innovation performance.

The serial mediation roles of cross-border knowledge search and absorptive capacity between social capital and innovation performanceAccording to Balle, Oliveira & Curado (2020), the basis for the development of absorptive capacity is a firm's large knowledge base. Establishing an effective knowledge search channel facilitates the expansion of the knowledge base. Cross-border knowledge search has become an essential means for firms to increase their absorptive capacity. This is because the knowledge searchers can understand, assimilate, and transform new knowledge through interactions with knowledge sources (Xiangyu Wang, Wang, & Zhang, 2019). Additionally, firms stimulated by new knowledge may develop new ideas for their existing knowledge, which helps them refine their existing knowledge. Briefly, cross-border knowledge search is an effective channel for firms to expand their knowledge base, and the expansion of knowledge base, in turn, can enhance their absorptive capacities to a certain extent.

In this context, it is not sufficient to discuss the mediating role of cross-border knowledge search and absorptive capacity separately in the process of influencing innovation performance through social capital. Especially for digital firms, cross-border knowledge search and absorptive capacity have demonstrated equal importance in this process. Digital firms with good social structural capital can construct suitable knowledge circulation channels by establishing alliances or signing cooperative agreements so that resources and knowledge can flow smoothly among firms. Through these channels, firms can quickly and effectively implement cross-border knowledge search activities to expand their knowledge bases. After that, the expanded knowledge base can increase the firms’ capacities for knowledge assimilation, transformation, and output, and thus, the firms’ absorptive capacity is correspondingly enhanced. Firms with high absorptive capacity can output and utilize adequate knowledge to optimize existing products, processes, or design new products, thereby improving their innovation performance. Similar to social structural capital, social relational capital and social cognitive capital can facilitate cross-border knowledge search by building relational networks and establishing a consensus. Ultimately, cross-border knowledge search enhances corporate innovation performance by improving the corporate absorptive capacity. Based on the above analysis, the following hypotheses are proposed.

H5a: Cross-border technological knowledge search and absorptive capacity play serial mediating roles in the relationship between social structural capital and innovation performance.

H5b: Cross-border technological knowledge search and absorptive capacity play serial mediating roles in the relationship between social relational capital and innovation performance.

H5c: Cross-border technological knowledge search and absorptive capacity play serial mediating roles in the relationship between social cognitive capital and innovation performance.

H6a: Cross-border market knowledge search and absorptive capacity play serial mediating roles in the relationship between social structural capital and innovation performance.

H6b: Cross-border market knowledge search and absorptive capacity play serial mediating roles in the relationship between social relational capital and innovation performance.

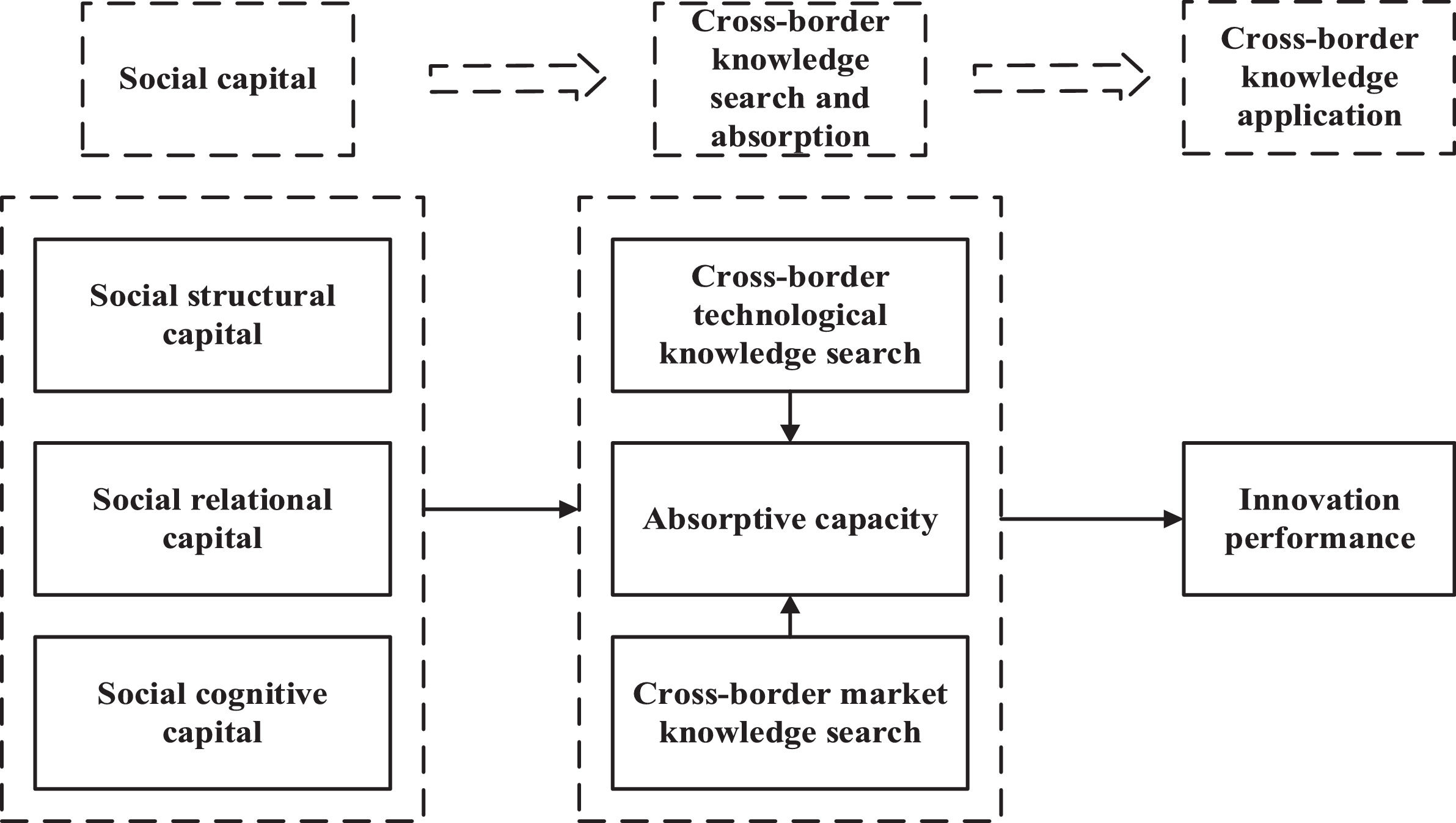

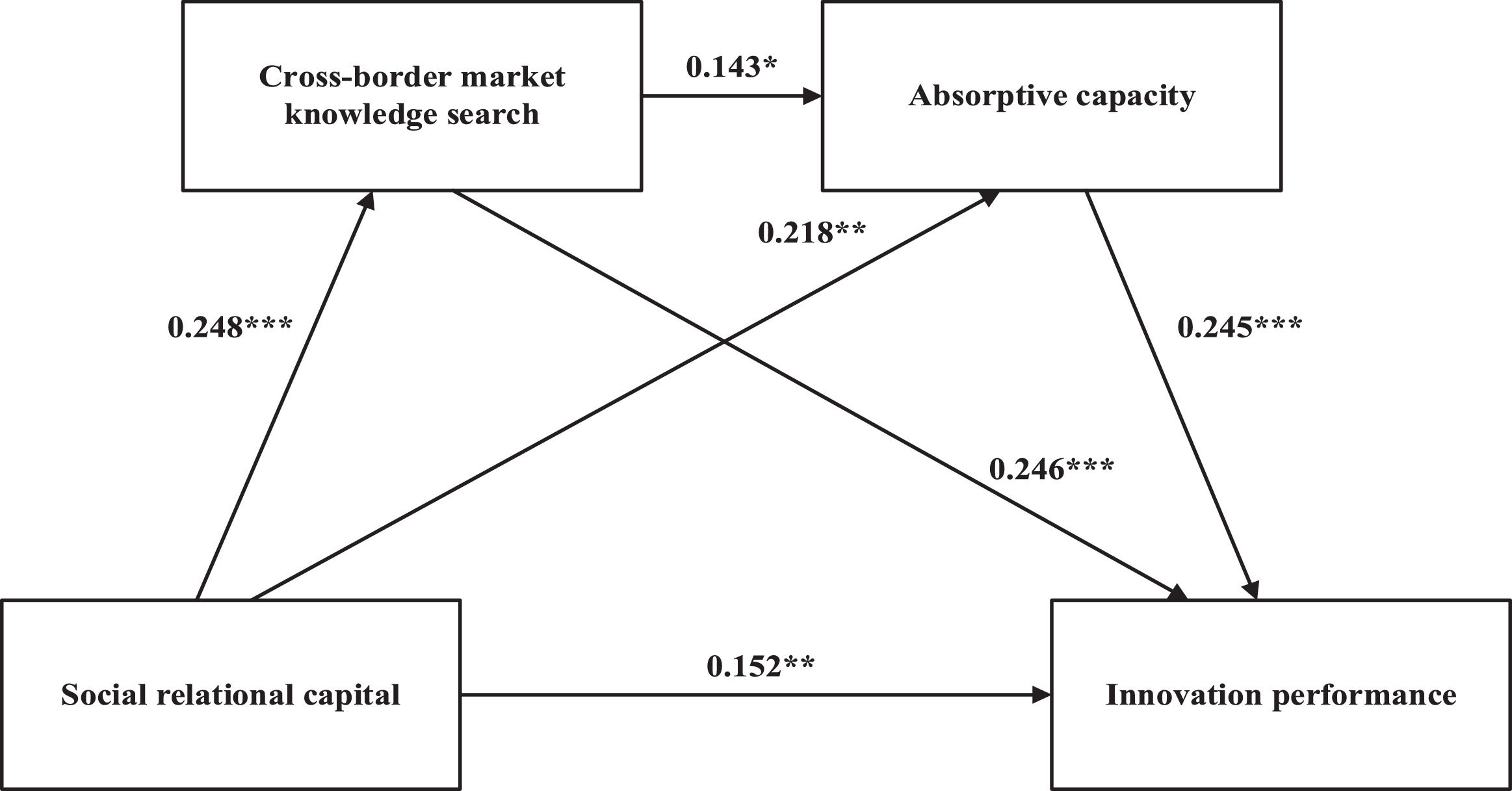

H6c: Cross-border market knowledge search and absorptive capacity play serial mediating roles in the relationship between social cognitive capital and innovation performance. The theoretical framework of this study is shown in Fig 1.

MethodologyData collectionThe data for this study was obtained from 217 leaders of digital firms in China. The survey was conducted over a period of eight months from January to September 2021. Based on Donnelly & Stapleton (2021), digital firms can be defined as firms that rely on an information (knowledge) management system to obtain information on business operations, product design, and sales through digital technology, and thus realize the combination of digital technology and business management. Considering the blurred boundaries of digital firms, we first position our sample selection for high-tech firms. This is because high-tech firms tend to have strong knowledge bases and knowledge accumulations. These firms typically demonstrate strengths in the development of digital technologies and transformation. We then randomly selected 600 high-tech firms from the list issued by the Ministry of Science and Technology of Jiangsu Province in China.

Given that the scales used in our study are mainly English scales, we focus on the effect of language differences when translating the scales into Chinese. On the one hand, we compared a large amount of Chinese and English literature to accurately translate specialized vocabulary. On the other hand, we discussed and modified the translated Chinese scales with business leaders and experts to make these scales more suitable for the Chinese context.

The questionnaires were distributed mainly on-site and via email. Given that this study primarily aims to explore the relationship between social capital and innovation performance in digital firms, we conducted a pre-survey before distributing the questionnaires. Following the study of Sousa & Rocha (2019)on the characteristics of digital firms, we investigated the digital characteristics of the surveyed firms during the pre-survey. For example, “Does your firm develop technology based on big data?” After the pre-survey, we found that 421 of these 600 high-tech firms are developing digital technologies or in the process of digital transformation. Subsequently, we requested the leaders of these 421 firms for permission to conduct follow-up surveys and obtained permission from the leaders of 392 firms. Due to the pandemic, leaders of 364 firms chose to complete the questionnaires by email, while leaders of the remaining 28 firms chose to complete the questionnaires onsite. After eliminating invalid responses, 217 valid responses were obtained. In addition, considering that this study aims to explore the relationship between digital firms’ social capital and innovation performance during the pandemic, we investigated the extent to which digital firms were affected by the pandemic. Specifically, in the pre-survey, we invited each leader to evaluate the extent to which the firm was affected by the pandemic. For example, “To what extent do you think your firm has been affected by the pandemic?” The answers were measured on a 3-point scale (1= slight effect, 2 = moderate effect, and 3 = severe effect).

The results of the descriptive statistical analysis are presented in Table 1. Most of the surveyed firms are privately owned (112, 51.6%). Regarding the firm size, most firms (80, 36.9%) had 100 to 300 employees. Regarding firm age, most firms (82, 37.8%) in our survey are between 5 and 10 years old. In terms of the extent to which digital firms have been affected by the pandemic, 51 leaders (23.5%) believe that their firms have been slightly affected. In all, 89 leaders (41.0%) believe that their firms have been moderately affected. In addition, 77 firms (35.5%) have been severely affected by the pandemic.

Results of descriptive statistical analysis.

Note: N = 217

Considering that the focus of our study is to investigate the contribution of connections among firms established based on social capital to innovation performance, we follow the suggestion of Nahapiet & Ghoshal (1998) to measure social capital in three dimensions (e.g., social structural capital, social relational capital, and social cognitive capital). Measuring social capital in terms of these three dimensions has been recognized by many scholars (S. W. Jeong, Ha, & Lee, 2021; Wu & Chiu, 2018). In terms of social structural capital, we draw on the scale used by Kim & Shim (2018) and measure social structural capital with three items. Given that we are primarily measuring the social capital of digital firms, we followed the suggestion of S. W. Jeong et al. (2021) to measure social relational capital using three items. Meanwhile, according to S. W. Jeong et al. (2021) and Nahapiet & Ghoshal (1998), shared language, shared narratives, and shared visions are equally important for measuring social cognitive capital. Therefore, we choose to measure social cognitive capital using three items. Cross-border knowledge search is measured in two dimensions: cross-border technological knowledge search and cross-border market knowledge search. The measurement scale is mainly drawn from Sidhu, Commandeur & Volberda (2007) and W.-H. Zhang, Chen & Zhao (2013), which contains 12 question items. The measurement of innovation performance is based mainly on the scales of Alpkan, Bulut, Gunday, Ulusoy & Kilic (2010) and Hagedoorn & Cloodt (2003). The scale contains five question items. The measurement of absorptive capacity is drawn mainly from the scales of Lau & Lo (2015) and Zahra & George (2002). The scale contains six question items. In addition, all scales used in this study follow a five-point Likert scale (1 = total disagreement and 5 = total agreement).

According to Nasr, Kilgour & Noori (2015), firm type can affect firm innovation by influencing knowledge exchange. Furthermore, firm size and firm age are all considered factors that may influence firm innovation and knowledge search to some extent (Luo, Lui, & Kim, 2017; Short, Ketchen, Bennett, & du Toit,2006). Therefore, we set firm type, size, and age as the control variables for our study.

Empirical analysis and resultsReliability and validity testsIn our study, the reliability and validity of the scales were analyzed using SPSS 22.0. Table 2 presents the results. As shown in Table 2, Cronbach's α for each scale is greater than 0.7, which implies good reliability for each scale. In addition, the AVE values of all variables are greater than 0.5, and the CR values are higher than 0.7, indicating that the scales used have good convergent validity.

Results of reliability and validity tests.

We then conducted confirmatory factor analysis (CFA) on different factor models using AMOS 24.0. The CFA results are presented in Table 3. In particular, the values of all indicators reveal that the seven-factor model is superior to the other factor models (χ2/df=1.162<3; GFI=0.911>0.9; CFI=0.983>0.9; RSMEA=0.027<0.08), which also indicates that the seven-factor model is statistically significant. Therefore, the scales used in this study have good discriminant validity.

To predict the relationships between the variables, we conducted a correlation analysis using SPSS 22.0. Table 4 presents the results of the correlation analysis. Table 4 shows that the main variables are all correlated to a certain degree, which initially supports the hypotheses proposed in our study; therefore, subsequent tests of the hypotheses can be conducted. Moreover, the square root of the AVE of each variable on the diagonal is greater than its correlation coefficients with the other variables, which reconfirms the good discriminant validity of the scales.

Common method variance testCommon method variance is a systematic bias due to the adoption of a common method in a study (Steenkamp & Maydeu-Olivares, 2021). The data in our study were obtained using questionnaires, which could potentially lead to the results of the empirical tests being affected by common method variance. Therefore, we tested the common method variance using the Harman single-factor test. In our study, the question items of all variables were subjected to factor analysis using SPSS 22.0. Seven characteristic roots greater than one are obtained without rotation. Meanwhile, the amount of variance explained by the first factor is 35.081% (<40%), which implies that the effect of the common method variance is acceptable. The results of the confirmatory factor analysis (CFA) in Table 3 indicate that the seven-factor model has a superior fit compared to the single-factor model. This also suggests that the impact of common method variance in our study is within an acceptable range.

Results of confirmatory factor analysis.

Notes: Model a: SSC, SRC, SCC, CBTKS+CBMKS, AC, IP; Model b: SSC, SRC, SCC, CBTKS+CBMKS+AC, IP; Model c: SSC, SRC, SCC+CBTKS+CBMKS+AC, IP; Model d: SSC, SRC+SCC+CBTKS+CBMKS+AC, IP; Model e: SSC+SRC+SCC+CBTKS+CBMKS+AC, IP; Model f: SSC+SRC+SCC+CBTKS+CBMKS+AC+IP

Mean, standard deviation and results of correlation analysis.

| Variables | Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.Type | 2.055 | 0.882 | ||||||||||

| 2.SIZE | 3.081 | 1.036 | 0.121 | |||||||||

| 3.AGE | 3.222 | 1.044 | 0.114 | 0.198 | ||||||||

| 4.SSC | 3.141 | 1.389 | 0.021 | -0.059 | 0.039 | 0.792 | ||||||

| 5.SRC | 3.563 | 0.812 | 0.054 | -0.027 | 0.157 | 0.404⁎⁎ | 0.778 | |||||

| 6.SCC | 3.544 | 0.831 | 0.047 | -0.012 | 0.004 | 0.510⁎⁎ | 0.457⁎⁎ | 0.819 | ||||

| 7.CBTKS | 3.315 | 0.762 | 0.012 | -0.124 | 0.110 | 0.293⁎⁎ | 0.394⁎⁎ | 0.287⁎⁎ | 0.773 | |||

| 8.CBMKS | 3.436 | 0.731 | 0.056 | 0.045 | 0.027 | 0.328⁎⁎ | 0.340⁎⁎ | 0.273* | 0.206⁎⁎ | 0.773 | ||

| 9.AP | 3.536 | 0.721 | 0.101 | 0.108 | 0.037 | 0.350⁎⁎ | 0.402⁎⁎ | 0.318⁎⁎ | 0.341⁎⁎ | 0.307⁎⁎ | 0.772 | |

| 10.IP | 3.476 | 0.852 | 0.009 | -0.034 | 0.064 | 0.548⁎⁎ | 0.563⁎⁎ | 0.538⁎⁎ | 0.498⁎⁎ | 0.517⁎⁎ | 0.565⁎⁎ | 0.840 |

To examine the differences in the innovation performance of digital firms in different situations, we adopted an analysis of variance (ANOVA) approach using SPSS 22.0 (Kapoutsis, Papalexandris, & Thanos, 2019). First, we divided the surveyed firms into six groups (A–F) according to the extent to which they were affected by the pandemic and their social capital. Firms were classified into three types according to the extent of being affected by the pandemic (slight, moderate, and severe). Meanwhile, firms’ social capital is classified into two types (high and low social capital) based on the principle of median cut-off (He & Wong, 2004). The specific groups are listed in Table 5. Second, we performed a test for the homogeneity of variance across groups. The results indicate that the variances of all groups are not significantly different from each other (Levene statistic = 0.731, p = 0.458>0.05). Therefore, following the suggestion of Han, Luo & Zhong (2016), we used LSD variance analysis to compare the differences between the groups. The results of LSD variance analysis for the six groups are shown in Table 6.

As shown in Table 6, group A has the highest mean value of innovation performance, which implies that both pandemic and social capital affect the innovation performance of digital firms (A>C>B>E>D>F). When digital firms have high social capital, their innovation performance shows an opposite trend to the degree of being affected by the pandemic (A>C>E), and vice versa (B>D>F). Thus, Hypothesis 1d is supported. When digital firms experience the same level of pandemic impact, the innovation performance of digital firms with high social capital is higher than that of firms with low social capital (A>B; C>D; E>F). Thus, Hypothesis 1e is supported. In addition, we observed an interesting phenomenon. Digital firms with high social capital are likely to create higher innovation performance, even if they suffer from the more severe effects of the pandemic (C>B; E>D).

Direct effect analysisStructural equation model (SEM) allows for convenient and visual display of the path coefficients, which facilitates model revision and hypothesis tests (Durdyev, Ismail, & Kandymov, 2018). Considering the complex relationships between variables and the large number of hypotheses proposed, we chose to analyze the direct effect between variables by constructing a structural equation model using AMOS24.0.

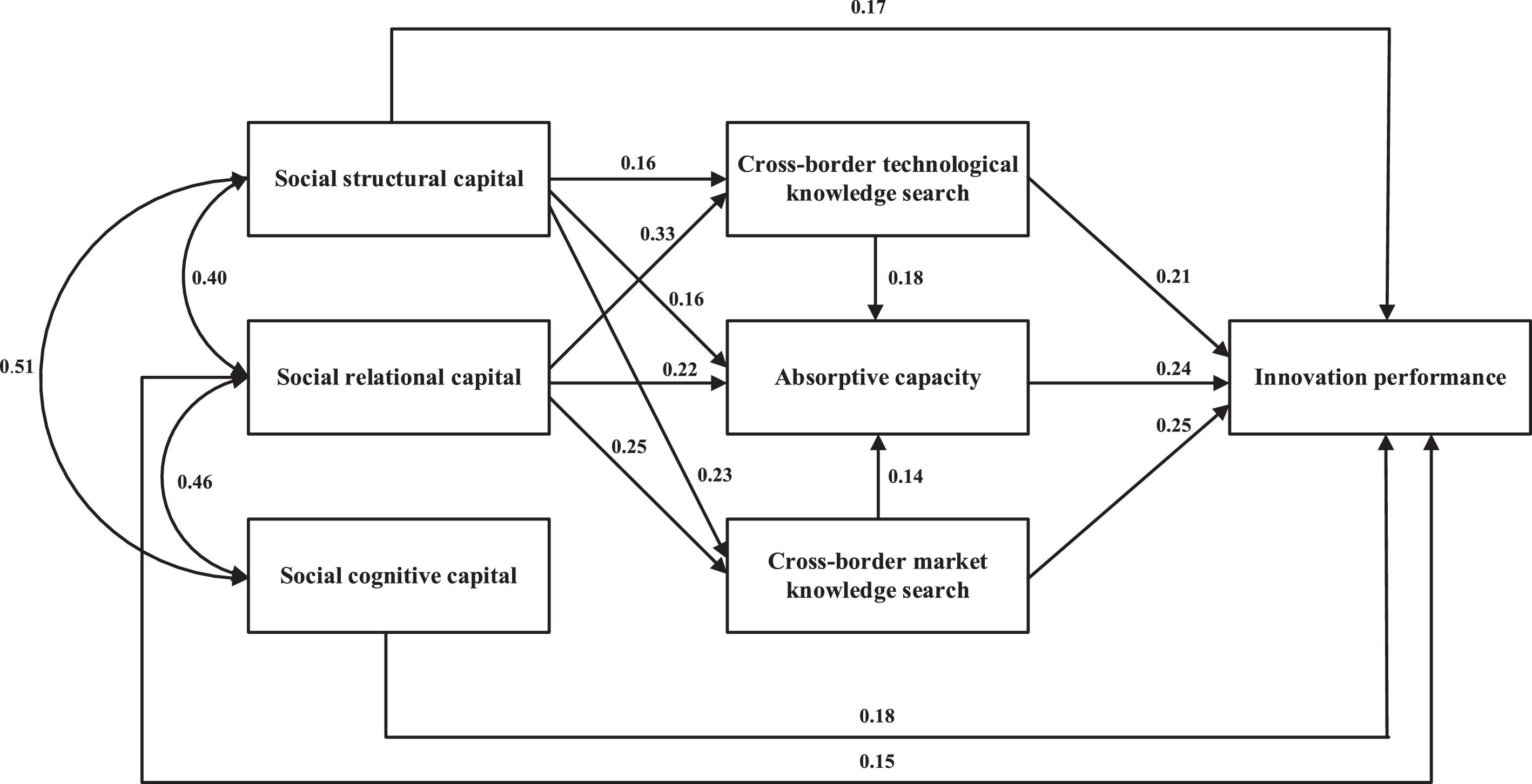

Specifically, we constructed an initial structural equation model based on a theoretical model and tested the significance of the paths. Then, we modified the constructed paths according to the CR values and obtained a modified structural equation model, as shown in Fig. 2. The test results for the path coefficients are summarized in Table 7. As shown in Fig. 2 and Table 7, all three dimensions of social capital have significant paths to innovation performance, and the path coefficients are greater than zero, indicating that all three dimensions of social capital are significantly and positively related to innovation performance. Thus, Hypotheses 1a, 1b, and 1c are supported.

Results of path coefficient test.

| Direct path | SC | NSC | SE | CR |

|---|---|---|---|---|

| Social structural capital→cross-border technological knowledge search | 0.160* | 0.136 | 0.058 | 2.368 |

| Social structural capital→cross-border market knowledge search | 0.228⁎⁎⁎ | 0.200 | 0.060 | 3.344 |

| Social structural capital→absorptive capacity | 0.164⁎⁎ | 0.143 | 0.058 | 2.445 |

| Social structural capital→innovation performance | 0.173⁎⁎⁎ | 0.175 | 0.052 | 3.364 |

| Social relational capital→cross-border technological knowledge search | 0.329⁎⁎⁎ | 0.278 | 0.057 | 4.882 |

| Social relational capital→cross-border market knowledge search | 0.248⁎⁎⁎ | 0.215 | 0.059 | 3.632 |

| Social relational capital→absorptive capacity | 0.218⁎⁎ | 0.187 | 0.060 | 3.116 |

| Social relational capital→innovation performance | 0.152⁎⁎ | 0.152 | 0.052 | 2.922 |

| Social cognitive capital→innovation performance | 0.181⁎⁎⁎ | 0.168 | 0.047 | 3.588 |

| cross-border technological knowledge search→absorptive capacity | 0.178⁎⁎ | 0.181 | 0.066 | 2.732 |

| cross-border technological knowledge search→innovation performance | 0.206⁎⁎⁎ | 0.245 | 0.055 | 4.463 |

| cross-border market knowledge search→absorptive capacity | 0.143* | 0.142 | 0.064 | 2.218 |

| cross-border market knowledge search→innovation performance | 0.246⁎⁎⁎ | 0.283 | 0.052 | 5.409 |

| absorptive capacity→innovation performance | 0.245⁎⁎⁎ | 0.285 | 0.055 | 5.157 |

Notes: SC means standardized coefficient. NSC means non-standardized coefficient.

Due to space limitations, only those path coefficients that passed the test are listed in this table.

In terms of cross-border technological knowledge search, Fig. 2 and Table 7 show that both social structural capital and social relational capital are significantly and positively related to cross-border technological knowledge search (β=0.160, P<0.05; β=0.329, P < 0.001). Furthermore, cross-border technological knowledge search is significantly and positively associated with innovation performance (β=0.206, P < 0.001). However, the path from social cognitive capital to cross-border technological knowledge search is not significant, and hypothesis 2c is not supported. To further test the mediation effect of cross-border technological knowledge search, we used the bootstrap method. Following the suggestion of Hayes (2018), we first set social structural capital as the independent variable, cross-border technological knowledge search as the mediating variable, and innovation performance as the dependent variable and conducted a bootstrap test with 5000 samples using the PROCESS program in SPSS 22.0. The results of the test for the mediation effect of cross-border technological knowledge search from social structural capital on innovation performance are presented in Table 8. The criterion for a significant mediation effect is that the 95% confidence interval (0.05 level of significance) does not include 0. From Table 8, it is clear that the 95% confidence interval for the path constructed based on social structural capital, cross-border technological knowledge search, and innovation performance does not include 0. Therefore, cross-border technological knowledge search mediates the relationship between social structural capital and innovation performance. Thus, Hypothesis 2a is supported. Similarly, we replace the independent variable with social relational capital and conduct a bootstrap test with 5000 samples. The results of the bootstrap test are presented in Table 9. The 95% confidence interval for the path constructed by social relational capital, cross-border technological knowledge search, and innovation performance does not include 0. Clearly, cross-border technological knowledge search mediates the relationship between social relational capital and innovation performance. Thus, Hypothesis 2b is supported.

Results of the bootstrap test for mediation effect of cross-border knowledge search and absorptive capacity between social structural capital and absorptive capacity.

Note:5000 bootstrap samples.

Results of the bootstrap test for mediation effect of cross-border knowledge search and absorptive capacity between social relational capital and absorptive capacity.

Note:5000 bootstrap samples

For cross-border market knowledge search, Fig. 2 and Table 7 show that both social structural capital and social relational capital have significant positive correlations with cross-border market knowledge search (β=0.228, P < 0.001; β=0.248, P < 0.001). Concurrently, cross-border market knowledge search is significantly and positively associated with innovation performance (β=0.246, P < 0.001). On this basis, it can be observed from Table 8 that the 95% confidence interval for the path consisting of social structural capital, cross-border market knowledge search, and innovation performance does not include 0. Thus, cross-border market knowledge search mediates the relationship between social structural capital and innovation performance. Thus, Hypothesis 3a is supported. Similarly, the 95% confidence interval for the path consisting of social relational capital, cross-border market knowledge search, and innovation performance does not include 0. This means that cross-border market knowledge search mediates the relationship between social relational capital and innovation performance. Hypothesis 3b is also confirmed. However, Hypothesis 3c is not confirmed because the path from social cognitive capital to cross-border market knowledge search is not significant.

Analysis of the mediation effect of absorptive capacityAs shown in Fig. 2 and Table 7, both social structural capital and social relational capital can influence absorptive capacity significantly and positively (β=0.164, P<0.01; β=0.218, P < 0.01). Meanwhile, absorptive capacity can also positively influence innovation performance (β=0.245, P < 0.001). However, the relationship between social cognitive capital and absorptive capacity is not significant, implying that hypothesis 4c is not supported. Furthermore, Table 8 shows that the 95% confidence interval for the path constructed by social structural capital, absorptive capacity, and innovation performance does not include 0. Thus, absorptive capacity mediates the relationship between social structural capital and innovation performance. Thus, Hypothesis 4a is supported. Similarly, Table 9 shows that the 95% confidence interval for the path construed by social relational capital, absorptive capacity, and innovation performance does not include 0. Thus, absorptive capacity mediates the relationship between social relational capital and innovation performance. Thus, Hypothesis 4b is supported.

Analysis of the serial mediation effect of cross-border knowledge search and absorptive capacityBased on the modified structural equation model, we examined the serial mediation effect using the bootstrap method through the PROCESS program in SPSS 20.0 Hayes (2018). From the results of the path coefficient test presented in Table 7, we find that only the mediation paths from social structural capital to innovation performance and social relational capital to innovation performance are complete and significant. Neither cross-border knowledge search nor absorptive capacity mediates the relationship between social cognitive capital and innovation performance. Hypotheses 5c and 6c are not supported. Therefore, this section examines the serial mediation effect of cross-border knowledge search and absorptive capacity between social structural capital, social relational capital, and innovation performance.

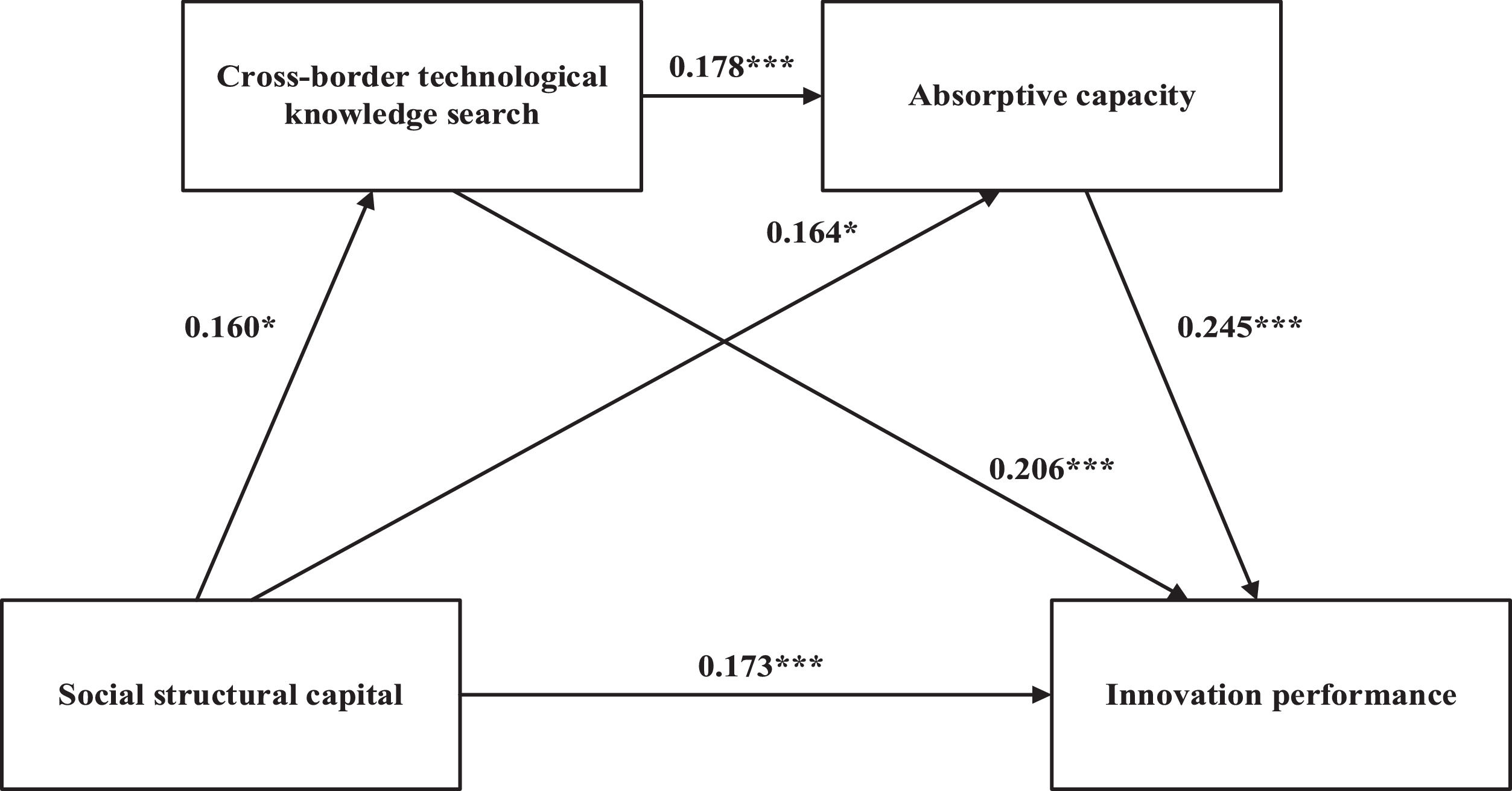

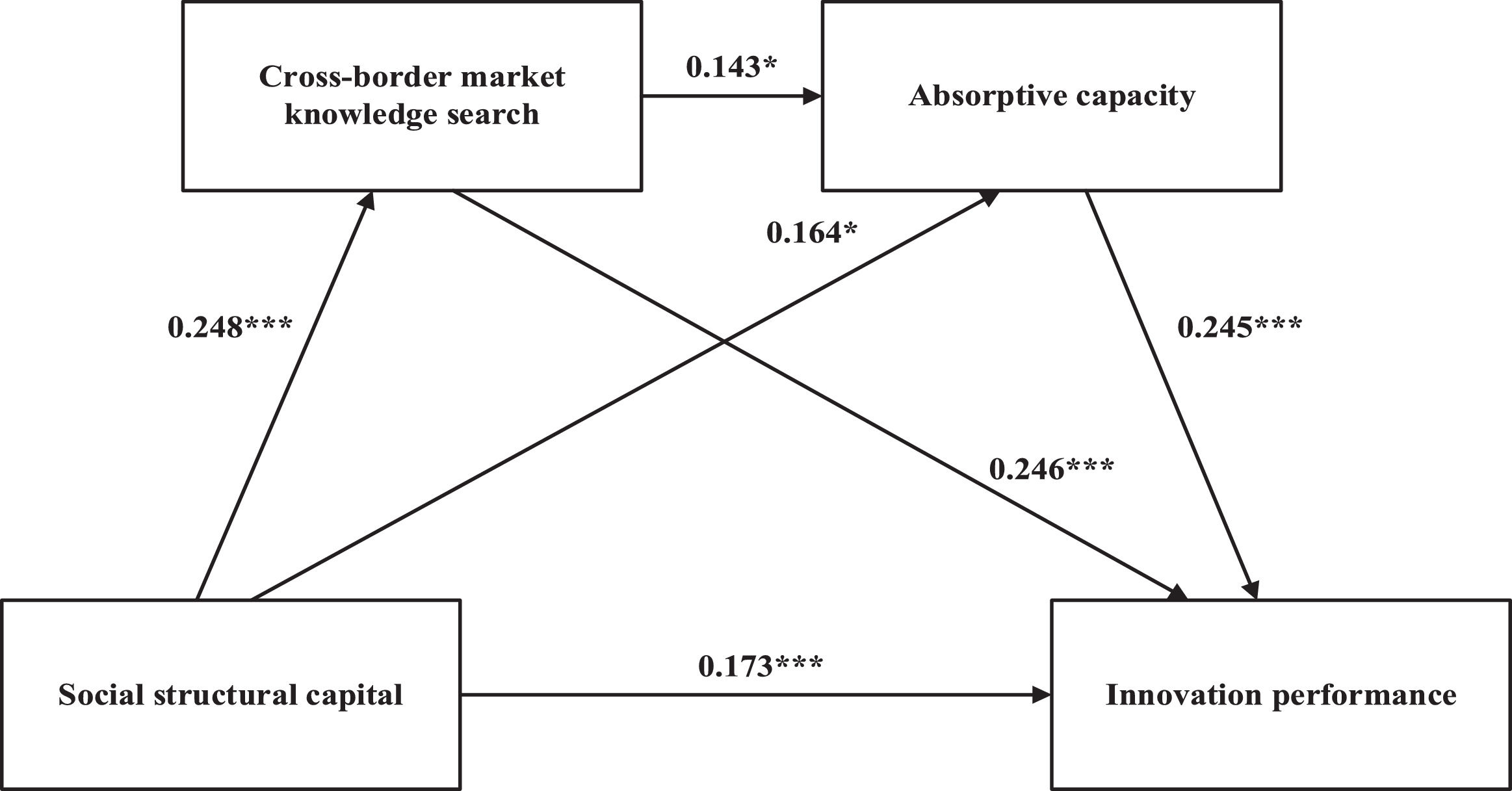

To examine the serial mediation effect of cross-border knowledge search and absorptive capacity between social structural capital and innovation performance, we first examine the mediation effect of cross-border knowledge search and absorptive capacity between social structural capital and innovation performance. The results in Tables 7 and 8 show that both cross-border knowledge search and absorptive capacity mediate the relationship between social structural capital and innovation performance. We then constructed paths containing social structural capital, cross-border knowledge search, absorptive capacity, and innovation performance and conducted 5000-sample bootstrap tests. The test results are presented in Table 8, which shows that the 95% confidence interval (SSC→CBTKS→AC→IP) does not contain 0. Therefore, the serial mediation effect of cross-border technological knowledge search and absorptive capacity between social structural capital and innovation performance is present and significant. The 95% confidence interval (SSC→CBMKS→AC→IP) does not contain 0. This also means that the serial mediation effect of cross-border market knowledge search and absorptive capacity between social structural capital and innovation performance is also present and significant. Thus, Hypotheses 5a and 6a are supported. Specific diagrams of the serial mediation effect are illustrated in Figs. 3 and 4.

As far as social relational capital is concerned, it is evident from the aforementioned test results that both cross-border knowledge search and absorptive capacity mediate the relationship between social relational capital and innovation performance. From the results of the bootstrap test in Table 9, the 95% confidence interval (SRC→CBTKS→AC→IP) does not contain 0. Thus, the serial mediation effect of cross-border technological knowledge search and absorptive capacity between social relational capital and innovation performance is present and significant. At the same time, the 95% confidence interval (SRC→CBMKS→AC→IP) also does not contain 0, which means that the serial mediation effect of cross-border market knowledge search and absorptive capacity between social relational capital and innovation performance is also present and significant. Therefore, hypotheses 5b and 6b are supported. The corresponding serial mediation effect diagrams are presented in Figs. 5 and 6.

Considering the large number of hypotheses formulated and tested in our study, the results of the hypotheses testing are summarized in Table 10.

Results of hypotheses tests.

Guided by the three proposed research questions, we examine the relationship between social capital and the innovation performance of digital firms during the pandemic and attempt to analyze the serial mediation effect of cross-border knowledge search and absorptive capacity in this relationship. Based on the results of the theoretical review and empirical tests, we arrived at the following conclusions.

First, the social capital of digital firms still significantly and positively affects innovation performance during the pandemic. According to Maurer et al. (2011), organizational members’ social capital can effectively facilitate intra-organizational knowledge transfers to enhance innovation performance. On this basis, we again validate the relationship between corporate social capital and innovation performance, considering the combined pressure of resource scarcity and digital transformation by digital firms during the pandemic. The findings suggest that building social capital can be effective in improving the innovation performance of digital firms even though it consumes firms’ resources. Connections between firms based on social capital guarantee the free flow of knowledge, information, and other resources across firms (Horng & Wu, 2020), which also brings heterogeneous knowledge and information for the development of digital technologies (Forman & van Zeebroeck, 2019). Thus, building social capital and realizing digital transformation may seem superficially contradictory, but they complement each other. In addition, we find that digital firms with high social capital are more likely to be effective in creating innovation performance than those with low social capital, even if digital firms with high social capital suffer from a more severe pandemic. Admittedly, scarce resources, communication barriers, and plummeting profits caused by the pandemic can result in tremendous operational pressure on digital firms. Thus, constructing social capital may be a luxury for digital firms. However, our findings do not support this view. Instead, we believe that digital firms should build social capital proactively even under the pressure of a pandemic. Superior social capital can facilitate the flow and sharing of resources (e.g., knowledge) among firms, thus allowing limited resources to create additional value (e.g., innovation performance) (Maurer et al., 2011; Nahapiet & Ghoshal, 1998). Therefore, constructing social capital is crucial for digital firms to improve their innovation performance during the pandemic.

Second, cross-border knowledge search mediates the relationship between social structural capital and innovation performance, as well as the relationship between social relational capital and innovation performance. However, the mediation effect of cross-border knowledge search on the relationship between social cognitive capital and innovation performance is not significant. One of the difficulties in cross-border knowledge search is the construction of knowledge search paths between firms and stakeholders (Sheng & Hartmann, 2019). Fortunately, firms with superior social capital can effectively overcome this difficulty and realize cross-border knowledge search by signing contracts and establishing alliances with partners. In addition, the heterogeneous knowledge brought about by cross-border knowledge search (Duan et al., 2021) breathes new life into firm innovation and expands the original knowledge base of firms. This is the key to improving firms’ innovation performance.

Finally, cross-border knowledge search and absorptive capacity can play a serial mediation effect between social capital and innovation performance. According to knowledge creation theory, the input of heterogeneous knowledge can stimulate knowledge creation in the firm to expand the knowledge base (Fabiano, Marcellusi, & Favato, 2021). This expanded knowledge base enables firms to understand, transform, and export additional knowledge, which is effective in stimulating innovation (Davids & Frenken, 2018). Therefore, cross-border knowledge search, as an effective way to acquire heterogeneous knowledge, can have a serial mediation effect between social capital and innovation performance, together with absorptive capacity. However, regarding social cognitive capital (one of the dimensions of social capital), such a serial mediation role is not significant. Although this result is unexpected, it seems logical after considering it thoroughly. Regarding the relationship between social cognitive capital and innovation performance, inter-firm ties constituted by consensus or shared values (Q. Zhang et al., 2020) can facilitate the flow of knowledge and information; thus, social cognitive capital can enhance innovation performance. However, when these ties are loosened by unexpected events (e.g., the COVID-19 pandemic), the heterogeneous knowledge derived from cross-border knowledge search may be reduced. This may mean that the heterogeneous knowledge brought through cross-border knowledge search is not sufficient to significantly enhance the absorptive capacity and innovation performance of digital firms. In view of this, we consider the result of the insignificant serial mediation effect of cross-border knowledge search and absorptive capacity between social cognitive capital and innovation performance to be acceptable.

Theoretical contributionsThrough the findings of the theoretical analysis and empirical tests, we answer the proposed research questions and attempt to make theoretical contributions to the existing literature.

First, guided by the first research question, we theoretically and empirically examine the relationship between social capital and innovation performance of digital firms. Our study contributes to the research on digital firms’ innovation performance by examining the positive relationship between social capital and the innovation performance of digital firms during the pandemic. Previous studies have argued that social capital is an enabler of firm innovation in a relatively stable environment (Pucci et al., 2020; Singh, Mazzucchelli, Vessal, & Solidoro, 2021). However, considering that numerous firms have tried to develop digital technologies and undergo digital transformation (Teece & Linden, 2017), we explore the relationship between social capital and the innovation performance of digital firms. Moreover, our findings reveal that digital firms with high social capital can create higher innovation performance during the pandemic than those with low social capital. This finding also complements the existing literature on social capital and innovation performance (Yanni Liu, Chen, Ren, & Jin, 2021; Maurer et al., 2011). At the same time, our study also finds that digital firms with high social capital can generate higher innovation performance than those with low social capital, even if digital firms with high social capital experience more severe pandemic effects. This helps us better understand how the innovation performance of digital firms during the pandemic differs according to different levels of social capital.

Second, guided by the second research question, we theoretically and empirically examine the mediating role of cross-border knowledge search between social capital and digital firms’ innovation performance. Although different studies have affirmed the importance of social capital for corporate knowledge management and innovation (e.g., corporate innovation (Hasan, Hoi, Wu, & Zhang, 2020), collaborative knowledge creation (Al-Omoush, Simón-Moya, & Sendra-García, 2020), and innovation capability), few studies have explored the impact of social capital on innovation performance from the perspective of cross-border knowledge search. To address this gap, we examine the mediating effect of cross-border knowledge search between social capital and digital firms’ innovation performance. Through theoretical analysis and empirical tests, we find that cross-border knowledge search (including cross-border technological knowledge search and cross-border market knowledge search) can mediate the relationship between social capital and the innovation performance of digital firms. This finding suggests that social capital lays the foundation for firms to construct cross-border knowledge search paths and facilitates the process of searching for heterogeneous knowledge across firm boundaries. On this basis, heterogeneous knowledge acquired through cross-border knowledge search helps digital firms improve their innovation performance. In summary, our study contributes to the clarification and enrichment of research on the mechanisms underlying digital firms’ social capital to enhance innovation performance through cross-border knowledge search.

Finally, guided by the third research question, we theoretically and empirically examine the serial mediation effect of cross-border knowledge search and absorptive capacity on the relationship between social capital and digital firms’ innovation performance. Based on our study's results, we confirm that cross-border knowledge search and absorptive capacity can play serial mediating roles between social capital and innovation performance, which provides new ideas for future research. Previous studies have acknowledged the importance of the knowledge acquisition and knowledge absorption processes between social capital and innovation, but they have tended to investigate the two processes separately. For example, Huang & Liu (2019) find that social capital can stimulate service innovation through external knowledge acquisition. Gölgeci & Kuivalainen (2020) argue that social capital affects firm absorptive capacity, whereas Yu (2013)suggests that firm absorptive capacity can stimulate firm innovation. However, to the best of our knowledge, no study combines the processes of knowledge search and knowledge absorption to analyze their roles in the relationship between social capital and innovation performance of digital firms. To address this gap, we investigate the serial mediation effect of cross-border knowledge search and absorptive capacity between social capital and digital firms’ innovation performance. In summary, our study complements studies in related fields and provides a new research perspective for subsequent studies.

Managerial ImplicationsWe have obtained some conclusions by exploring the effect of cross-border knowledge search and absorptive capacity on the relationship between social capital and innovation performance and attempt to summarize the following managerial implications based on our findings.

First, digital firms, especially when developing digital technologies or undergoing digital transformation, need to pay special attention to the contribution of social capital to innovation performance. Even though the pressures caused by the pandemic, such as resource constraints and communication obstacles, restrict the construction of social networks by firms, these social networks built on social capital can still dramatically improve innovation performance. Simultaneously, we confirm that all three dimensions of social capital in digital firms can contribute to innovation performance; although, under the pandemic, it could be more difficult for digital firms to build social capital. However, considering that digital firms are uniquely positioned to develop online platforms (e.g., software and applications) (Miric, Boudreau, & Jeppesen, 2019), we still believe that digital firms can build social capital by establishing B2B online platforms. For social structural capital, the number of inter-firm connections determines the level of a digital firm's social structural capital. Hence, it seems that the establishment of cooperative relationships is quite essential for the social structural capital of digital firms (Hafner, Diepold, & Fottner, 2021). Therefore, we recommend that digital firms establish open B2B online platforms to share collaborative information. Unlike general online B2B cooperation platforms (Yi Liu, Chen, & Gao, 2020), we emphasize the openness of these platforms. This means that digital firms with collaboration needs are free to post their collaboration information on these platforms. Consequently, digital firms can establish collaborative relationships to consolidate social structural capital. However, new collaborative relationships can bring heterogeneous knowledge to digital firms to enhance their innovation performance. In terms of social relational capital, Li, Zhao & Wu (2017) note that trust is fundamental to the construction of social capital among firms. For digital firms during the pandemic, in-person communication has become increasingly difficult, which has hindered the maintenance of trust between firms. Therefore, we suggest that digital firms establish online B2B feedback platforms for after-sales information. On the one hand, B2B online feedback platforms can help digital firms promptly understand and meet the needs of their partners to maintain trust (critical for building social relational capital). On the other hand, digital firms can improve their services or processes based on feedback to enhance innovation performance. For social cognitive capital, firms need to share their values, norms, and goals with their partners in appropriate and effective ways, which depends on their knowledge background and knowledge base (Ghinoi, Steiner, & Makkonen, 2021). Therefore, we suggest that digital firms build online B2B platforms for knowledge sharing. Thus, on the one hand, the online B2B platform for knowledge sharing can help digital firms share knowledge and build similar knowledge backgrounds (G.-Y. Jeong, Chae, & Park, 2017). On the other hand, the online B2B knowledge sharing platform can expand the knowledge bases of both digital firms and thereby stimulate corporate innovation.

Second, cross-border knowledge search is a bridge between social capital and innovation performance. Digital firms with superior social capital have tremendous advantages in terms of building partnerships and forming alliances. Such advantages facilitate the construction of channels for cross-border knowledge search, which permits digital firms to search for heterogeneous knowledge expediently and freely. Heterogeneous knowledge acquired through cross-border knowledge search can accelerate knowledge creation within digital firms, which facilitates the improvement of their innovation performance. Moreover, the mediation chain, consisting of cross-border knowledge search and absorptive capacity, plays a mediating role between social capital and innovation performance, which means that digital firms should pay attention to the processes of heterogeneous knowledge search and absorption. It is not sufficient for digital firms to conduct cross-border knowledge search activities or develop absorptive capacity separately for enhancing innovation performance through social capital. Digital firms should attach importance to the processes of both heterogeneous knowledge search and absorption, which implies that they should not only actively engage in cross-border knowledge search but also cultivate their absorptive capacity simultaneously.

Although we attempt to make theoretical contributions and obtain managerial implications of our findings, some questions remain for subsequent research to address. First, considering the current situation in which most firms pursue digital transformation (Teece & Linden, 2017), we choose to use digital firms as the research sample to explore the related issues. However, the difficulty of digital transformation differs for firms in different industries. For example, in contrast to industries with a superior technological base, the digital transformation of traditional industries faces extremely difficult obstacles. Therefore, subsequent research could subdivide the research sample by industry to provide more targeted recommendations. Second, we argue that knowledge and absorptive capacity are extremely crucial for digital firms to enhance their innovation performance through social capital. Therefore, we analyzed the serial mediation effect of cross-border knowledge search and absorptive capacity. However, the effect of various capabilities of firms cannot be underestimated for the processes of knowledge search and knowledge absorption. Therefore, subsequent research could examine the effect of a firm's other capabilities in the aforementioned process. Finally, our study initially aimed to explore the relationship between social capital and the innovation performance of digital firms during the pandemic. Therefore, we used cross-sectional data to test our hypotheses. However, given the persistence and recurrence of the pandemic, the information reflected in cross-sectional data might be relatively limited. Hence, we suggest that subsequent studies use other methods to compare the change in innovation performance of digital firms before and after the pandemic, such as case studies.

FundingThis work was supported by the National Social Science Fund of China (Grant number: 21BJL101) and National Natural Science Foundation of China (Grant number: 72032002; 72102112).