This study conducts a comprehensive bibliometric analysis and systematic review to investigate the moderating variables that influence the relationship between Environmental, Social, and Governance (ESG) measures, Corporate Social Responsibility (CSR) measures, and Corporate Financial Performance (CFP). Analyzing 108 articles from the Web of Science and Scopus databases published between 2019 and 2023, the study identifies key variables, influential studies, and methodological approaches within the ESG/CSR-CFP nexus. The findings reveal that moderating variables such as governance structures, cultural norms, technological readiness, market maturity, economic conditions, industry characteristics, firm strategy, and CSR engagement levels significantly impact the strength and direction of ESG and CSR effects on financial performance. However, the literature demonstrates considerable inconsistencies due to diverse research designs, varying definitions of ESG and CFP, and underrepresentation of moderating variables such as social and cultural factors, technological readiness, and firm-specific characteristics. The study highlights the need for more standardized variables, advanced research methodologies, and a broader exploration of these underexamined moderating variables to develop a more nuanced understanding of how ESG and CSR initiatives influence corporate financial outcomes. This work provides a framework for future research to address these gaps, enhancing the academic discourse on corporate sustainability and financial performance.

Sustainability has evolved from a peripheral concern to a pivotal element shaping corporate strategies in today's business landscape. Environmental, Social, and Governance (ESG) disclosures and Corporate Social Responsibility (CSR) engagement — now considered essential — play a critical role in ensuring transparency, enhancing financial performance, and securing long-term competitive advantages (Ellili, 2022; Sánchez García, 2018). Moreover, companies are increasingly adopting green finance to comply with regulatory requirements and boost their competitiveness and resilience in a rapidly changing global environment (Khan et al., 2024; Lyulyov et al., 2024). In tandem, sustainable business models enable firms to better adapt to market dynamics and global challenges, offering strategic advantages and fostering innovation (Bashir et al., 2022). As sustainability becomes embedded in core operations, improvements in operational efficiency, risk management, and stakeholder relationships drive long-term profitability and growth (Saini et al., 2023; Coelho et al., 2023).

The widespread adoption of ESG principles and CSR initiatives signifies a critical shift in how corporations address global challenges such as climate change, social inequality, and ethical governance. These frameworks, once considered optional, are now integral to corporate strategies, with firms recognizing their importance in building resilience, maintaining a competitive edge, and ensuring financial sustainability while addressing societal and environmental concerns (Sun et al., 2022). Research exploring the relationship between ESG/CSR initiatives and corporate financial performance (CFP), however, faces numerous challenges due to the inconsistencies and contradictory findings across studies. Some findings highlight the positive effects of ESG/CSR on financial outcomes, while others report neutral or even negative impacts (Barnett & Salomon, 2012; Friede et al., 2015).

One significant challenge in this research field is the lack of standardization in ESG/CSR metrics. Different data providers (e.g., MSCI and Sustainalytics) employ varying methodologies, making cross-comparisons difficult (Gillan et al., 2021). Compounding these challenges is the multi-dimensional nature of financial performance, which includes profitability, market performance, and risk management, each of which may be differently affected by sustainability efforts (Orlitzky et al., 2003; Alshehhi et al., 2018). Furthermore, the indirect benefits of ESG and CSR, such as improved stakeholder trust or corporate reputation, may take years to materialize and are difficult to quantify, complicating the assessment of the true value of these initiatives (Barnett & Salomon, 2012; Lins et al., 2017).

The underexplored role of moderating variables further complicates the analysis. Governance structures, industry characteristics, and regional factors can significantly influence the relationship between ESG/CSR and financial performance (Ye et al., 2021; Gillan et al., 2021). For example, companies with strong governance frameworks are more likely to successfully integrate sustainability into their core strategies, thereby, enhancing financial outcomes (Chen et al., 2024). Additionally, economic conditions play a critical role in shaping the financial impacts of ESG efforts, with varying results depending on whether firms operate in stable or volatile markets (Flammer, 2018; Lins et al., 2017). The interaction between these moderating factors and ESG/CSR initiatives highlights the need for more refined studies that consider context-specific conditions (Raman et al., 2024).

In addition, the lack of long-term studies and the over-reliance on cross-sectional data limit our understanding of the evolving impacts of ESG on financial performance (Orlitzky et al., 2003; Margolis et al., 2009). Consequently, longitudinal research is essential to capture the lasting effects of sustainability efforts and better understand how these initiatives influence firm resilience and financial outcomes over time (Eccles et al., 2014; Brammer et al., 2006; Gillan et al., 2021). Standardized metrics, advanced methodologies, and deeper exploration of moderating variables are crucial to overcoming these challenges and fully grasping the complexities of ESG/CSR's impact on financial performance.

The debate around ESG and CSR's financial effects is primarily anchored in theoretical frameworks such as Stakeholder Theory and Agency Theory, which provide insights into how companies balance competing interests (Freeman, 1984; Jensen & Meckling, 1976). While Stakeholder Theory underscores the importance of considering the interests of employees, customers, and communities, it falls short of fully explaining how cultural, social, and institutional factors moderate the relationship between ESG and financial performance (Laique et al., 2023). These complexities are further compounded by varying levels of regulation and public scrutiny across industries and regions (Lyulyov et al., 2024), which affect how firms prioritize sustainability.

The importance of financial sustainability must also be contextualized within broader discussions around innovation and technology. As global challenges such as climate change, social inequality, and resource depletion intensify, businesses are increasingly pressured to balance financial goals with their social and environmental responsibilities (Orlitzky et al., 2003). Firms that successfully integrate sustainability into their core business strategies, especially through technological innovations, are better positioned to create long-term value for both shareholders and stakeholders (Yang et al., 2024). This alignment between financial sustainability and social/environmental objectives is crucial for ensuring resilience and competitiveness in the face of global challenges (Raman et al., 2024).

While ESG and CSR frameworks offer substantial potential to enhance financial performance, their impact is shaped by a complex web of direct and indirect effects moderated by governance, industry, and market-specific factors (Ye et al., 2021). The full scope of these effects is further complicated by the lack of standardized ESG metrics, the underexplored role of moderating variables, and the multi-dimensional nature of financial performance. To address these challenges, this paper conducts a systematic review and bibliometric analysis, highlighting how ESG and CSR initiatives influence financial outcomes and identifying key research gaps.

Theoretical frameworkThe relationship between ESG and CSR factors converting into CFP is complex and multifaceted. Numerous empirical studies demonstrate varying positive, neutral, or negative outcomes depending on a range of moderating variables, including CEO characteristics, governance structures, industry type, and market conditions. Understanding the role of these moderating variables is essential to explain the conflicting results found in the literature This theoretical framework will explore several fundamental theories, such as Shareholder Theory, Stakeholder Theory, Agency Theory, Resource-Based View (RBV), and Institutional Theory, while emphasizing the critical role of moderating variables in shaping the impact of ESG and CSR initiatives on financial performance.

Shareholder theoryMilton Friedman's (1970) Shareholder Theory asserts that the foremost duty of a corporation is to maximize shareholder value, casting initiatives such as ESG and CSR as secondary unless they directly contribute to profitability. This perspective — rooted in prioritizing short-term financial gains — traditionally regards sustainability efforts with skepticism, suggesting they impose unnecessary costs. However, as the corporate landscape evolves, recent empirical studies offer a more nuanced view, revealing that under certain circumstances, ESG initiatives can align with the long-term interests of shareholders. The theory's interpretation is, therefore, shifting as moderating factors such as governance structures and market conditions redefine the potential value of ESG activities within this framework.

According to Shareholder Theory, ESG and CSR initiatives are often viewed as diversions from the core purpose of maximizing profit. Critics argue that such activities can impose unnecessary costs on firms, reducing their competitive edge. For instance, investing in costly sustainability projects can reduce short-term profits and create inefficiencies. Barnea and Rubin (2010)) argue that CSR initiatives are often driven by managerial motives such as reputation building rather than genuine financial incentives, leading to agency costs and misalignment between managers and shareholders. Additionally, Hart and Zingales (2017) suggest that in firms with concentrated ownership, major shareholders exert pressure to prioritize short-term profits over long-term sustainability goals, disincentivizing ESG initiatives unless they provide immediate financial returns.

Furthermore, evidence shows that ESG initiatives do not always align with financial performance. Albuquerque et al. (2020) have found that during periods of economic downturn, firms often deprioritize ESG activities to preserve financial performance, suggesting that in volatile markets, ESG may not be seen as a value-enhancing strategy. Similarly, Peloza and Shang (2010) argue that the effectiveness of CSR in creating value varies widely across different industries and stakeholder groups, with some firms seeing little to no financial return from these initiatives.

In certain cases, ESG and CSR activities may even reduce financial performance by increasing operational costs and diverting resources from core profit-generating activities. In highly competitive industries with low profit margins, the additional costs of ESG compliance can strain financial resources, leading to lower profitability. Companies with substantial environmental or social obligations may find themselves at a disadvantage compared to competitors that do not engage in such practices. This view is supported by empirical findings that suggest ESG's impact on financial performance is not universally positive (Khan et al., 2024), and in industries with low public visibility, the financial benefits of ESG are often minimal.

However, recent studies also provide evidence that ESG initiatives can align with shareholder interests under specific conditions. For example, Ghosh and Gupta (2023) demonstrated that decarbonization strategies, as part of broader ESG efforts, contribute positively to financial performance, particularly in industries under significant regulatory scrutiny. This suggests that ESG activities, when aligned with external pressures such as regulation or consumer expectations, can serve shareholder interests by mitigating risks and enhancing reputation. Similarly, Saini et al. (2023) argue that ESG practices can lead to lower capital costs, improved risk management, and enhanced operational efficiency, but these benefits vary significantly across industries and firm sizes, reinforcing the notion that the financial impact of ESG is context-dependent.

Ownership structure plays a crucial role in moderating the financial outcomes of ESG and CSR initiatives. In firms with dispersed ownership and stronger governance mechanisms, ESG initiatives are more likely to be embraced as part of a long-term strategy for value creation (Coelho et al., 2023). Such firms, driven by long-term institutional investors, may be more willing to invest in sustainability projects, recognizing that these initiatives can enhance reputation and build customer loyalty over time, thus, benefiting shareholder value in the long run.

Similarly, CEO characteristics play a significant role in shaping how ESG initiatives align with shareholder value. CEOs with a background in sustainability or those who personally champion long-term goals are more likely to integrate ESG practices into their firm's strategic vision, leading to better alignment with shareholder value over time (Shen et al., 2019). Rousseau et al. (2023) have found that firms with sustainability-oriented CEOs are better able to balance short-term profitability with long-term ESG benefits, suggesting that leadership commitment is essential for driving the success of ESG initiatives. In contrast, CEOs who prioritize immediate financial returns may resist ESG investments, viewing them as costly distractions from profit-maximizing activities.

While Shareholder Theory traditionally prioritizes profit maximization, conflicting evidence suggests that the relationship between ESG and financial performance is contingent on several moderating factors. Market conditions, for example, play a significant role in shaping this relationship. During periods of market growth, firms that invest in ESG may see positive returns as consumers and investors increasingly value sustainability. Conversely, in periods of economic downturn, ESG initiatives may be viewed as non-essential, leading to reduced financial commitment (Enciso-Alfaro & García-Sánchez, 2024).

Board diversity is another critical moderating factor. Enciso-Alfaro and García-Sánchez (2024) have found that firms with a higher proportion of female executive directors are more proactive in driving climate innovation, which can enhance financial performance. However, they also identified a threshold effect, where the positive impact of female representation diminishes after a certain point, suggesting that governance structures must be carefully balanced to optimize the financial returns from ESG activities.

Industry-specific dynamics further complicate the relationship between ESG and financial performance. Firms in industries with high public visibility and regulatory oversight, such as consumer goods or finance, are more likely to benefit from ESG activities (Ellili, 2022). In these sectors, ESG practices serve not only to mitigate risks but also to enhance legitimacy, aligning with shareholder interests by managing reputational risks and maintaining public trust. In contrast, firms in industries with less exposure to environmental or social risks may not experience the same financial benefits, as ESG activities may not be as integral to their strategic objectives (Khan et al., 2024).

While Shareholder Theory has traditionally been critical of ESG and CSR initiatives, empirical evidence presents a more nuanced view. Under certain conditions, such as strong governance, leadership commitment, and industry-specific pressures, ESG activities can align with shareholder interests and enhance financial performance. However, the financial benefits of ESG are highly contingent on contextual factors such as market conditions, ownership structure, and regulatory environment. These conflicting findings highlight the importance of understanding the moderating variables that shape the relationship between ESG initiatives and financial performance, suggesting that the success of such initiatives is far from universal and often depends on the broader market and governance context.

Stakeholder theoryStakeholder Theory, introduced by Freeman (1984), expands corporate responsibility beyond shareholders to include various stakeholders such as employees, customers, suppliers, communities, and the environment. This theory posits that creating value for all stakeholders, rather than focusing solely on shareholders, leads to long-term financial success. ESG and CSR initiatives naturally align with this framework as they seek to address the needs and concerns of a wide array of stakeholder groups. However, the financial impact of these initiatives is influenced by several moderating variables, leading to diverse outcomes across different contexts.

Recent empirical evidence supports the positive link between ESG practices and financial performance, particularly when addressing stakeholder needs. Saini et al. (2023) have found that ESG practices are associated with lower capital costs and improved risk management, especially in firms that actively engage with diverse stakeholder groups. This aligns with the idea that addressing stakeholder concerns can reduce risks and enhance operational efficiencies, leading to better financial outcomes. However, the study also highlights that these benefits are not uniform across all industries, suggesting that the influence of ESG on financial performance depends heavily on industry-specific dynamics.

Board composition is a critical moderating variable affecting the relationship between ESG activities and financial performance through Stakeholder Theory. Firms with more diverse boards — particularly those with higher levels of gender diversity — tend to manage stakeholder relationships more effectively, resulting in improved financial outcomes (Franco et al., 2020).

Enciso-Alfaro and García-Sánchez (2024) reinforce this view, finding that companies with higher female representation on boards are more proactive in addressing climate change and sustainability issues, strengthening stakeholder relationships and enhancing long-term financial performance. This mirrors earlier findings on the role of diversity such as those by EncisoAlfaro and García-Sánchez (2023), who argue that female leadership, particularly among executive directors, significantly enhances the transition toward circular business models. This transition not only drives environmental sustainability but also improves operational efficiency and financial outcomes. However, both studies note a diminishing return when board diversity exceeds certain thresholds, suggesting that diversity has limits in terms of its financial impact.

CEO leadership is another significant moderating variable. CEOs who are personally committed to sustainability and social responsibility are more likely to integrate ESG initiatives into the company's core strategies, ensuring that stakeholder needs are prioritized (Shen, 2019). For example, Rousseau et al. (2023) show that companies led by CEOs who actively champion sustainability tend to exhibit stronger alignment between ESG practices and financial performance. In contrast, CEOs who focus on short-term financial results may deprioritize ESG activities, potentially damaging stakeholder relationships and long-term profitability. Similarly, Yang et al. (2024) emphasize the importance of leadership in aligning CSR with technological innovation, noting that responsible leadership can enhance innovation while balancing stakeholder needs. However, excessive CSR can draw focus away from innovation by consuming limited resources, further complicating financial outcomes.

Stakeholder pressure also plays a crucial role in shaping the financial outcomes of CSR activities. Firms operating in consumer-facing industries, where customers and activist groups are vocal about sustainability issues, are likelier to adopt ESG practices to maintain their reputation and market share (Rangan et al., 2021). In such sectors, failing to meet stakeholder expectations regarding social and environmental responsibility can lead to reputational damage and revenue loss. Hossain et al. (2024) have highlighted that companies under high stakeholder pressure, whether from customers, investors, or regulators, tend to exhibit better financial outcomes when prioritizing ESG initiatives. This reinforces the argument that addressing stakeholder needs through ESG efforts can improve financial performance, especially in industries with high public visibility.

Ownership structure also influences the effectiveness of ESG practices in improving financial performance. Coelho et al. (2023) found that firms with dispersed ownership are more likely to prioritize ESG initiatives, as these firms tend to cater to a broader range of stakeholders, including institutional investors who often demand higher standards of sustainability and governance. In contrast, companies with concentrated ownership may face pressure to prioritize short-term financial gains, which can hinder the implementation of ESG initiatives that focus on long-term stakeholder value. Chen et al. (2024) also underscore the role of governance, showing that financial technology-driven sustainability efforts are more effective in firms with strong governance structures. These firms experience enhanced carbon emission reductions and improved financial performance, further proving the moderating role of governance in ESG success.

Additionally, industry-specific factors moderate the relationship between ESG practices and financial outcomes. For example, in industries with significant environmental impact, such as energy or manufacturing, firms that engage in proactive ESG initiatives are more likely to maintain legitimacy and manage risks effectively, thereby, ensuring long-term financial success (Khan et al., 2024). Conversely, companies in less-regulated industries may not experience the same benefits from ESG activities, as the pressure to address stakeholder concerns is less pronounced. Lyulyov et al. (2024) demonstrate how green branding within the context of Sustainable Development Goals (SDGs) enhances national competitiveness in the EU, suggesting that firms within more regulated environments are likely to see greater financial returns from their sustainability initiatives.

Despite the positive correlation between stakeholder engagement through ESG practices and financial performance, some studies report conflicting results. For instance, Peloza and Shang (2010) have found that while CSR activities can create value by influencing stakeholder perceptions and behaviors, their effectiveness varies depending on the type of activity and the stakeholder group targeted. Philanthropic efforts may yield less tangible financial benefits than product-related initiatives that directly impact consumer behavior. This suggests that the type of CSR activity and the stakeholder group being engaged serve as critical moderating variables in determining the financial impact of ESG practices.

In general, Stakeholder Theory provides a compelling rationale for adopting ESG and CSR activities, with the expectation that firms can achieve long-term financial success by creating value for all stakeholders. However, the financial outcomes of these initiatives are influenced by several moderating variables, including board composition, CEO leadership, stakeholder pressure, ownership structure, and industry-specific dynamics. Firms that successfully balance these factors are more likely to realize the financial benefits of ESG practices, while others may experience neutral or even negative financial impacts depending on their specific context. Integrating new insights from studies on gender diversity, digital integration, and national sustainability initiatives further highlights stakeholder engagement's complex but promising role in shaping long-term financial outcomes.

Agency theoryAgency Theory, developed by Jensen and Meckling (1976), focuses on the potential conflicts of interest between principals (shareholders) and agents (managers). Managers may pursue CSR and ESG activities for personal or reputational gains, even when these initiatives do not directly benefit shareholders, leading to agency costs. The presence of robust governance structures (e.g., performance-based executive compensation and independent boards) can mitigate these agency conflicts by aligning managerial actions with shareholder interests, ensuring that ESG initiatives contribute to long-term financial performance. The latest empirical evidence indicates that the correlation between ESG activities and financial outcomes, as per Agency Theory, is frequently influenced by various moderating factors.

One critical moderating variable is governance structure, particularly the presence of independent directors and the design of executive compensation schemes. Rousseau et al. (2023) demonstrate that firms with well-structured executive compensation schemes tied to ESG performance tend to outperform those without. These firms can align managerial incentives with shareholder interests by ensuring that executives are rewarded not just for short-term financial results but also for achieving long-term sustainability goals. In contrast, firms with weaker governance structures are more susceptible to agency problems, where managers may pursue ESG initiatives that enhance their personal reputation or social standing but fail to deliver financial returns for shareholders (Cohen et al., 2023).

Recent research from Sun et al. (2022) supports these findings, showing that board independence, CEO duality, and the adoption of integrated reporting standards significantly influence the integration of CSR disclosures. However, the study found that board independence and gender diversity did not directly impact CSR integration levels, highlighting that governance mechanisms must be specifically aligned with sustainability goals to mitigate agency conflicts effectively. EncisoAlfaro and García-Sánchez (2023) further argue that female executive directors, more so than independent directors, are more likely to drive meaningful ESG changes, emphasizing that governance structures must be carefully tailored to ensure that managerial ESG actions align with shareholder interests.

Ownership concentration also significantly determines how ESG activities align with shareholder interests. In firms with dispersed ownership, shareholders have less direct control over managerial decisions, which can exacerbate agency problems and lead to ESG initiatives that may not align with financial performance goals (Coelho et al., 2023). Conversely, in firms with concentrated ownership, large shareholders can exert greater influence over managerial decisions, ensuring that ESG initiatives are more closely aligned with the company's financial objectives. This dynamic is particularly evident in the study by Saini et al. (2023), which has found that concentrated ownership structures tend to lead to more focused ESG initiatives, improving operational efficiency and risk management.

Chen et al. (2024) also demonstrate that governance characteristics such as board independence and firm size moderate the impact of digital integration on corporate sustainability. Their findings align with Agency Theory, suggesting that firms with stronger governance structures are better positioned to ensure that digital sustainability efforts translate into financial benefits rather than becoming a source of agency costs.

CEO characteristics are another moderating factor that influences the effectiveness of ESG activities under Agency Theory. Shen (2019) argues that CEOs who are personally committed to sustainability and long-term value creation are more likely to integrate ESG practices into the firm's strategic vision. This can help reduce agency conflicts by aligning managerial actions with shareholder interests. For example, firms led by sustainability-oriented CEOs tend to balance short-term profitability with long-term ESG goals, as demonstrated in the findings of Rousseau et al. (2023). However, CEOs who prioritize short-term financial performance may resist ESG initiatives, viewing them as a distraction from immediate financial gains. Yang et al. (2024) further note that while responsible leadership enhances innovation in ESG practices, excessive focus on CSR can crowd out innovation by consuming limited resources, thereby, complicating the financial outcomes.

Recent empirical evidence also highlights the role of board diversity in mitigating agency problems. Enciso-Alfaro and García-Sánchez (2024) have found that firms with higher levels of gender diversity on their boards tend to adopt more comprehensive ESG initiatives, which not only enhance corporate governance but also align more closely with shareholder interests. This is particularly true for firms with female executive directors, who were found to play a stronger role in driving climate innovation and long-term sustainability strategies. However, the study also notes that the positive effects of gender diversity diminish after reaching a certain threshold, suggesting that there are limits to the governance benefits provided by diverse boards. EncisoAlfaro and García-Sánchez (2023) further highlight how female leadership drives the transition to circular economy models, suggesting that when aligned with governance, leadership characteristics play a critical role in the success of ESG initiatives.

The role of executive compensation in driving ESG performance is well-documented in the literature. Firms that tie managerial compensation to ESG outcomes are more likely to see improved financial performance, as managers are incentivized to focus on both short-term profitability and long-term sustainability goals (Rousseau et al., 2023). However, the effectiveness of this approach depends on the specific design of the compensation package. For instance, firms that offer long-term stock options linked to ESG performance tend to perform better financially, as managers are encouraged to adopt a longer-term perspective (Coelho et al., 2023). In contrast, firms with short-term bonuses tied only to financial results may experience weaker alignment between managerial decisions and shareholder value.

Market conditions also moderate the impact of ESG initiatives under Agency Theory. During market uncertainty or economic downturns, managers may deprioritize ESG activities to focus on short-term financial performance, exacerbating agency conflicts. Lins et al. (2017) and Flammer (2015) have found that firms facing financial instability are more likely to reduce ESG initiatives, which can lead to reputational risks and long-term value destruction. However, firms that maintain their ESG commitments during difficult market conditions tend to build stronger relationships with stakeholders, ultimately improving their financial performance in the long run. Chen et al. (2024) add that fintech-driven sustainability initiatives (e.g., carbon emission reductions) can help firms weather economic downturns by enhancing efficiency and resilience, further proving the role of market conditions in shaping the financial outcomes of ESG initiatives.

Despite the general alignment of ESG initiatives with shareholder interests when robust governance structures are in place, conflicting findings in the literature suggest that not all ESG activities lead to financial benefits. For example, Ye et al. (2021) have found that the effectiveness of ESG initiatives depends heavily on the presence of mediating and moderating variables, such as governance quality, CEO characteristics, and industry-specific dynamics. In some cases, ESG activities may create agency costs, particularly when managers pursue these initiatives for personal gain rather than shareholder value. Enciso-Alfaro and García-Sánchez (2024) also highlight the risks of over-investing in ESG activities without clear financial returns, noting that firms can experience diminishing financial benefits if ESG initiatives are not carefully aligned with core business strategies.

Agency Theory offers a more cautious perspective on ESG and CSR activities, highlighting the potential for agency costs when managerial actions do not align with shareholder interests. Managers may pursue ESG initiatives for personal or reputational reasons, leading to inefficiencies and potential conflicts of interest. Nonetheless, strong governance structures, such as independent boards and executive compensation schemes tied to ESG performance, can mitigate these agency problems. The effectiveness of ESG activities under Agency Theory is influenced by several moderating factors, including ownership concentration, board diversity, and market conditions. While firms with robust governance mechanisms tend to experience financial benefits from ESG efforts, those with weaker governance may face significant agency costs. Thus, the relationship between ESG activities and financial performance is contingent on the firm's ability to align managerial decisions with shareholder value through effective governance practices.

Resource-based viewThe Resource-Based View (RBV), as articulated by Barney (1991), posits that a firm's competitive advantage stems from its unique resources and capabilities. ESG and CSR initiatives, under this framework, can be viewed as strategic resources that help firms achieve long-term financial success. Through improved reputation, enhanced innovation, and operational efficiencies, ESG practices can differentiate firms in the marketplace. However, the ability to convert ESG activities into competitive advantage is heavily moderated by factors such as industry dynamics, R&D intensity, innovation capacity, and governance structures, leading to diverse financial outcomes across firms and sectors.

Empirical research strongly supports the notion that ESG activities, when integrated into a firm's resource base, can enhance financial performance by strengthening key capabilities. For instance, Ghosh and Gupta (2023) found that companies investing in decarbonization and sustainable innovation exhibit superior financial performance compared to those that do not. These firms leverage ESG initiatives as strategic resources, differentiating themselves and responding to consumer demand for environmentally responsible products. Similarly, Saini et al. (2023) demonstrated that ESG practices improve risk management and reduce capital costs, reinforcing the idea that ESG can act as a valuable resource for strengthening a firm's financial position.

However, the financial benefits of ESG practices are not uniform. Industry dynamics play a pivotal role in moderating the financial impact of ESG activities. Firms in industries with substantial environmental footprints, such as energy and manufacturing, are more likely to benefit from proactive ESG strategies, due to regulatory pressures and growing demand for sustainable practices (Khan et al., 2024). In contrast, firms in less-regulated sectors, where external pressures to adopt sustainability initiatives are lower, may not experience similar financial returns from ESG activities. This divergence underscores the importance of understanding the specific industry context when evaluating the financial impact of ESG initiatives.

R&D intensity and innovation capacity further influence how effectively firms can capitalize on ESG efforts. Bartolacci et al. (2019) have found that firms with strong R&D capabilities are better positioned to integrate ESG principles into their product development processes, which in turn improves their competitive advantage and financial outcomes. Companies with higher R&D intensity can innovate around sustainability challenges, developing new products that align with the growing demand for environmentally friendly solutions. Similarly, Chen et al. (2024) emphasized the role of fintech in reducing carbon emissions, particularly in high-carbon regions, highlighting how innovation capacity can translate ESG activities into financial gains. The ability of firms to harness technological innovation for environmental improvement underscores the importance of integrating ESG into the firm's innovation strategy.

In addition to innovation, governance structures play a critical role in the financial success of ESG initiatives. Saini et al. (2023) found that larger firms and those with strong governance frameworks are better able to turn ESG initiatives into financial gains. These firms typically have more resources to invest in comprehensive sustainability strategies and the governance mechanisms to ensure that ESG activities align with long-term financial goals. In contrast, smaller firms or those with weaker governance structures may struggle to achieve the same financial benefits, as they often lack the resources and oversight to manage sustainability initiatives effectively.

Despite the generally positive relationship between ESG activities and financial performance suggested by the RBV, some studies report mixed results. For instance, Verma and Mukhtaruddin (2023)) have highlighted that the financial impact of environmental responsibilities can vary significantly based on geographical and regulatory differences. Firms in developed markets tend to experience more positive financial outcomes from proactive environmental practices, while firms in emerging economies may face challenges in translating ESG activities into financial gains due to weaker regulatory frameworks and less demand for sustainability from consumers. This geographical variation underscores the role of institutional support in shaping the financial benefits of ESG activities.

Additionally, the long-term nature of ESG investments poses challenges for firms focused on short-term financial performance. While the RBV emphasizes that ESG activities contribute to long-term competitive advantage, the financial benefits may not always be immediate. Bos et al. (2017) have found that some firms, particularly in sectors such as healthcare, improved short-term financial performance through cost-cutting measures that negatively impacted ESG-related factors (e.g., employee well-being), suggesting a trade-off between short-term financial gains and long-term sustainability goals.

New evidence from Quttainah and Ayadi (2024) reinforces the role of digital integration as an enabler of ESG-driven competitive advantage. They have found that digital technologies significantly enhance emissions reduction, environmental innovation, and resource efficiency, particularly in firms with lower initial sustainability performance. This highlights how technology, as a unique resource, allows firms to achieve both environmental and financial goals, further supporting RBV's premise that valuable and rare resources (e.g., ESG-driven technological innovation) can lead to competitive advantage.

The RBV emphasizes the strategic value of unique resources and capabilities in generating competitive advantage. From this perspective, ESG initiatives can be seen as valuable intangible assets that enhance a firm's reputation, foster innovation, and improve operational efficiencies. Firms that invest in sustainable practices are better positioned to meet evolving market demands and regulatory standards, thereby, improving their financial performance in the long term. However, the financial benefits of ESG initiatives depend on a firm's ability to leverage these activities as strategic resources. Companies in industries with high environmental impact, such as energy or manufacturing, are more likely to benefit from sustainability efforts, while firms in less environmentally focused sectors may see fewer direct financial gains. The RBV underscores the importance of firm-specific capabilities in translating ESG initiatives into financial success, with industry-specific factors serving as critical moderators.

Legitimacy theoryLegitimacy Theory, as articulated by Suchman (1995), suggests that organizations seek to align their actions with societal norms and expectations to gain, maintain, or restore legitimacy in the eyes of stakeholders. In the context of ESG and CSR, firms engage in sustainability initiatives not only to secure financial returns but also to enhance their legitimacy, especially under public scrutiny or regulatory pressure. However, the financial outcomes of these actions are moderated by several factors, including regulatory environments, stakeholder scrutiny, and public visibility, leading to mixed empirical results in the literature.

Firms increasingly view ESG and CSR practices as mechanisms for aligning corporate behavior with societal expectations. Companies operating in highly scrutinized industries, such as consumer goods or pharmaceuticals, are particularly inclined to adopt ESG practices to avoid reputational damage and preserve stakeholder trust. For instance, Deegan (2002) emphasizes that firms in highly visible sectors are more likely to engage in CSR to maintain legitimacy in the eyes of the public. Additionally, firms facing adverse publicity or operating in regulated industries are under continuous pressure to demonstrate ethical behavior, further reinforcing the relevance of Legitimacy Theory in understanding the relationship between ESG and financial performance.

Moderating variables such as regulatory pressures, public visibility, and stakeholder scrutiny are critical in shaping how effectively firms maintain legitimacy through ESG and CSR initiatives. Companies in heavily regulated industries such as energy or finance often adopt ESG practices to comply with regulatory requirements and reduce legal risks (Khan et al., 2024). In these sectors, regulatory frameworks compel firms to align their operations with environmental and social standards, enhancing their legitimacy among stakeholders. Failing to meet regulatory expectations can result in penalties, reputational damage, and loss of market share, demonstrating the importance of legitimacy in these industries.

Public visibility is another significant moderating factor in the financial impact of ESG activities. Firms that operate in industries under constant public scrutiny, particularly consumer-facing businesses, are more likely to implement comprehensive ESG strategies to avoid negative publicity and maintain stakeholder confidence. Peloza and Shang (2010) have found that companies in highly visible industries are more inclined to engage in robust ESG efforts to prevent reputational damage, which can, in turn, lead to financial gains as consumers and investors increasingly favor businesses with strong sustainability profiles.

Stakeholder scrutiny is also crucial in moderating the financial outcomes of legitimacy-driven ESG activities. Companies closely monitored by investors, NGOs, or consumer groups are more likely to adopt transparent ESG strategies, which can lead to enhanced financial performance. Ellili et al. (2022) have found that firms with strong stakeholder engagement adopt ESG practices that not only meet societal expectations but also contribute to financial objectives. In industries with high stakeholder pressure, companies that fail to engage in ESG and CSR activities risk reputational damage and financial underperformance due to declining consumer trust and investor confidence.

While Legitimacy Theory offers a robust theoretical explanation for why firms adopt ESG and CSR practices, the empirical evidence is mixed. In highly visible industries, ESG practices often lead to positive financial outcomes. Saini et al. (2023) have demonstrated that ESG practices reduce capital costs and improve risk management, particularly in industries subject to stringent regulatory oversight. These firms benefit financially from their ESG efforts, as they are better positioned to meet regulatory and societal expectations.

However, the financial benefits of ESG initiatives are not equally distributed across industries. Firms in less visible sectors or those facing fewer regulatory pressures may not experience the same financial gains from adopting ESG practices. Verma and Mukhtaruddin (2023) have found that the financial impact of environmental responsibilities is mixed, particularly in industries with lower public scrutiny or weaker regulatory frameworks. Companies in these sectors may engage in ESG activities to maintain legitimacy but struggle to convert these actions into financial returns.

Additionally, the pursuit of legitimacy can sometimes lead to short-term, symbolic actions that fail to generate long-term financial benefits. Delmas and Montes-Sancho (2011) note that firms may adopt ESG initiatives in response to external pressures rather than integrating sustainability into their core business strategies. Such companies may engage in superficial activities, such as “greenwashing” to maintain legitimacy, which can harm long-term financial performance if stakeholders perceive these initiatives as insincere. This can lead to a loss of trust and undermine the firm's ability to achieve sustained financial success.

Legitimacy Theory suggests that firms engage in ESG and CSR activities to maintain or enhance their legitimacy in the eyes of stakeholders. These efforts are often driven by external pressures, such as regulatory requirements, societal expectations, and public scrutiny, rather than direct financial incentives. While ESG activities can help firms secure their legitimacy and manage reputational risks, their financial impact is less straightforward. Firms operating in industries with high public visibility are more likely to benefit financially from ESG efforts, as these activities help them maintain stakeholder trust and comply with regulatory standards. However, for firms in less scrutinized sectors, the financial returns on ESG initiatives may be minimal. Therefore, while Legitimacy Theory provides a strong rationale for adopting ESG practices, the financial outcomes depend heavily on the level of external pressure and stakeholder expectations.

Institutional theoryInstitutional Theory, as introduced by DiMaggio and Powell (1983), emphasizes both the formal and informal roles of external pressures in shaping corporate behavior. In the context of ESG and CSR, firms often adopt sustainable practices in response to institutional pressures such as regulatory requirements, industry standards, or normative societal expectations. With increasing demands to integrate sustainability, particularly through global initiatives such as the SDGs, Institutional Theory provides a framework to understand how these external factors influence corporate actions. However, the financial outcomes of ESG and CSR efforts vary based on the regulatory and normative environments in which companies operate.

Empirical evidence supports the significant influence of institutional pressures on ESG and CSR activities, particularly in regions with stringent regulatory frameworks or high normative expectations. For instance, Khan et al. (2024) have found that companies in areas with strong environmental regulations are more likely to implement robust ESG strategies, which, in turn, improve financial performance. These companies adopt ESG practices not only to comply with legal requirements but also to gain competitive advantages by aligning with societal expectations. Regulatory pressures, thus, act as a key moderating variable, ensuring that ESG practices contribute to both legitimacy and financial success.

Normative pressures, such as industry-specific sustainability standards, also shape corporate behavior. In industries such as energy, chemicals, and automotive, where sustainability norms are well-established, firms that adopt ESG initiatives often perform better financially. For example, Yu (2022) demonstrates that companies in such industries align their operations with both regulatory and market expectations, leading to improved financial outcomes. These normative pressures compel companies to exceed baseline regulatory requirements and adopt best practices, which enhance their competitiveness.

However, the effects of institutional pressures are not uniform across all industries or regions. Firms in less-regulated industries or emerging markets face weaker institutional pressures, resulting in less comprehensive ESG initiatives. Javed et al. (2016) highlight that companies in non-Western markets often experience fewer regulatory and normative pressures to adopt ESG practices, leading to inconsistent financial outcomes. While these firms may implement ESG initiatives to gain legitimacy in global markets, they often struggle to attain immediate financial benefits due to weaker institutional support in their domestic contexts.

Regional variations further complicate the relationship between institutional pressures and ESG performance. Firms in developed markets, such as the European Union, benefit from stronger institutional support for sustainability initiatives. For instance, Lyulyov et al. (2024) have found that European companies, especially in countries such as France, Germany, and Sweden, have been at the forefront of green branding and environmental performance, largely due to the alignment of national policies with SDGs. Conversely, firms in emerging markets such as Ukraine face challenges in achieving similar results, given weaker regulatory frameworks and less robust institutional support for sustainability.

Another important factor is mimetic pressure within industries. According to DiMaggio and Powell (1983), firms often imitate the practices of their peers to maintain legitimacy and competitive parity. This is particularly true in sectors where ESG practices have become the norm. For example, Enciso-Alfaro and García-Sánchez (2024) have found that firms with greater female representation on their boards are more proactive in climate change innovation, partly because of normative pressures to align with best practices in corporate governance. Such mimetic pressures push firms to adopt ESG strategies to maintain legitimacy and meet investor and stakeholder expectations.

Despite the strong theoretical foundation of Institutional Theory, empirical findings on the financial benefits of ESG practices remain mixed. Some studies, such as those by Quttainah and Ayadi (2024), show that digital integration and environmental innovation drive financial success, particularly for firms with low initial sustainability performance. However, other studies, such as Verma and Mukhtaruddin (2023), suggest that the financial benefits of environmental responsibilities are contingent on industry and regional factors, with firms in emerging markets facing more challenges in translating ESG activities into financial gains due to weaker institutional frameworks.

Institutional Theory emphasizes the role of external pressures such as regulations, norms, and societal expectations in shaping corporate behavior. Firms adopt ESG and CSR practices not necessarily for direct financial returns but to conform to these institutional demands and secure legitimacy. The financial outcomes of ESG activities under this theory are influenced by the strength of regulatory frameworks and normative pressures within specific industries or regions. Firms operating in markets with strong regulatory oversight or high societal expectations for sustainability tend to experience better financial outcomes from ESG initiatives. However, in regions with weaker regulatory environments, firms may find it more challenging to translate ESG activities into financial success. Institutional Theory highlights the importance of aligning ESG practices with external institutional demands to achieve both legitimacy and financial performance.

In summary, the theoretical perspectives of Shareholder Theory, Stakeholder Theory, Agency Theory, RBV, Legitimacy Theory, and Institutional Theory each provide unique lenses through which the relationship between ESG/CSR initiatives and CFP can be understood. These theories highlight the critical role of moderating variables such as governance structures, industry type, ownership concentration, market conditions, and institutional pressures in shaping the financial outcomes of ESG and CSR activities.

However, despite the extensive theoretical exploration of ESG/CSR and CFP relationships, significant research gaps remain, particularly regarding the nuanced role of moderating variables. The lack of consensus in empirical findings, driven by variations in these moderating variables, underscores the need for a more targeted analysis that synthesizes recent trends in the literature.

This study aims to address these gaps by exploring the role of moderating variables in the ESG/CSR-CFP relationship through a systematic review and bibliometric analysis of research published from 2019 to 2023. Specifically, it seeks to answer the following research questions:

- •

What are the most frequently studied moderating variables in the relationship between ESG/CSR and CFP in the literature from 2019 to 2023?

- •

How has the focus on specific moderating variables in the ESG/CSR and CFP literature evolved from 2019 to 2023?

- •

What primary theoretical frameworks are employed in recent ESG/CSR-CFP relationship studies?

- •

Are there any notable gaps or under-researched areas in the ESG/CSR and CFP literature regarding moderating variables?

- •

What are the most influential studies, journals, or authors in ESG/CSR and CFP research concerning moderating variables?

By addressing these questions, this study aims to provide a comprehensive overview of the evolving role of moderating variables in shaping the ESG/CSR-CFP relationship, identify trends and gaps in the current literature, and offer guidance for future research in this critical area.

To ensure a robust examination of the relationship between ESG/CSR initiatives and CFP, with a particular emphasis on moderating variables, it is essential to adopt a methodological approach synthesizing the wide range of existing research. In the following section, we will outline the methodology employed in this study, including the systematic review and bibliometric analysis. This approach allows for a comprehensive literature assessment, providing insights into the most frequently studied moderating variables, theoretical frameworks, and research trends from 2019 to 2023. The methodology will detail the steps taken to ensure the rigor and reliability of the analysis, guiding the investigation of the key research questions introduced above.

MethodologyBased on the vast number of articles that presented conflicting results, the justification for new research in ESG-CSR-CFP relationships, with a particular focus on moderating variables, is compelling. Addressing the inconsistencies and gaps identified in existing studies, exploring underrepresented moderating factors, and adopting more rigorous and standardized methodologies are essential for advancing our understanding of how ESG and CSR initiatives impact CFP. As the global business environment evolves, this new research will contribute to academic knowledge and provide valuable insights for practitioners seeking to navigate the complexities of sustainability and financial performance in diverse and dynamic contexts.

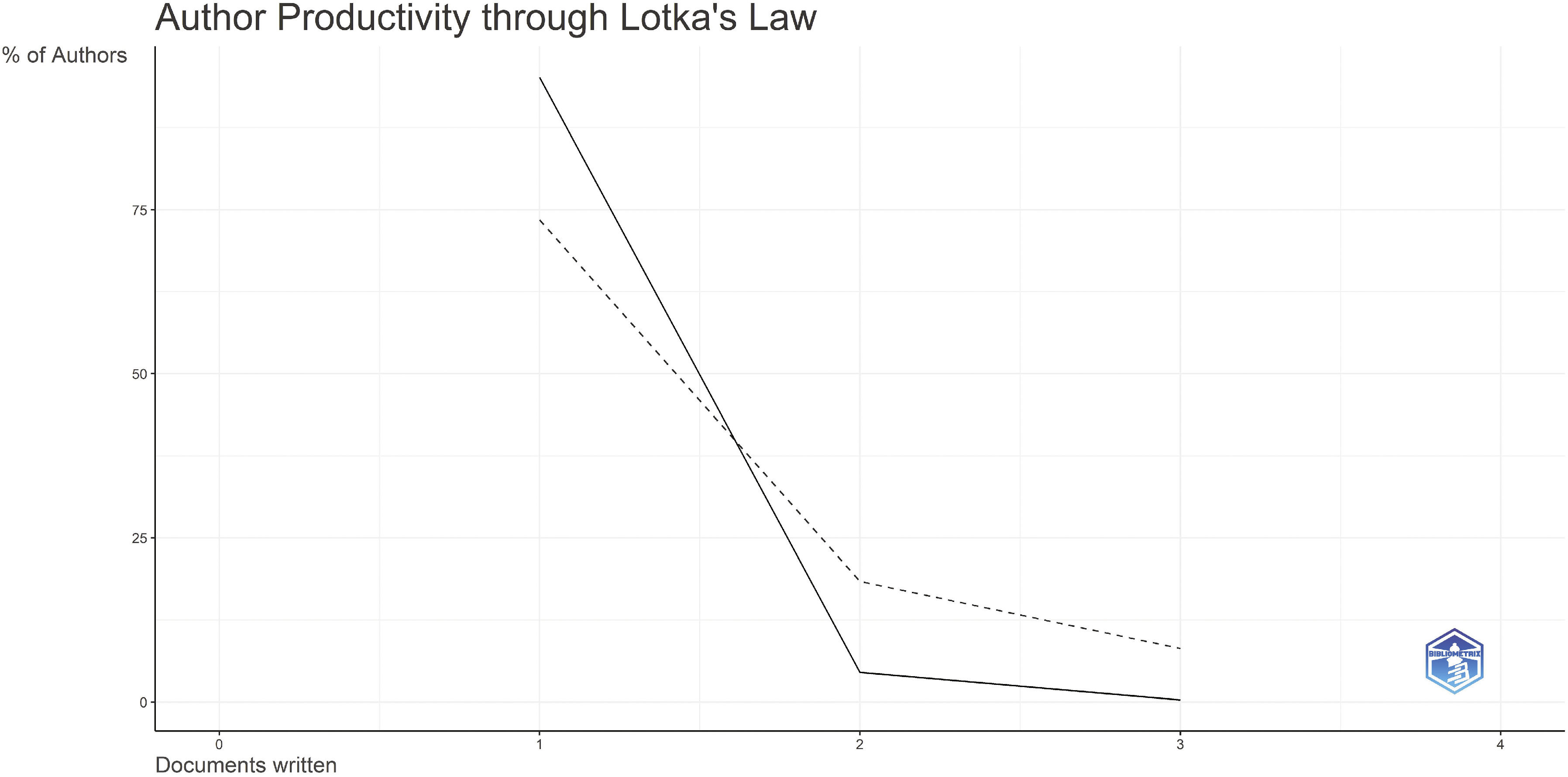

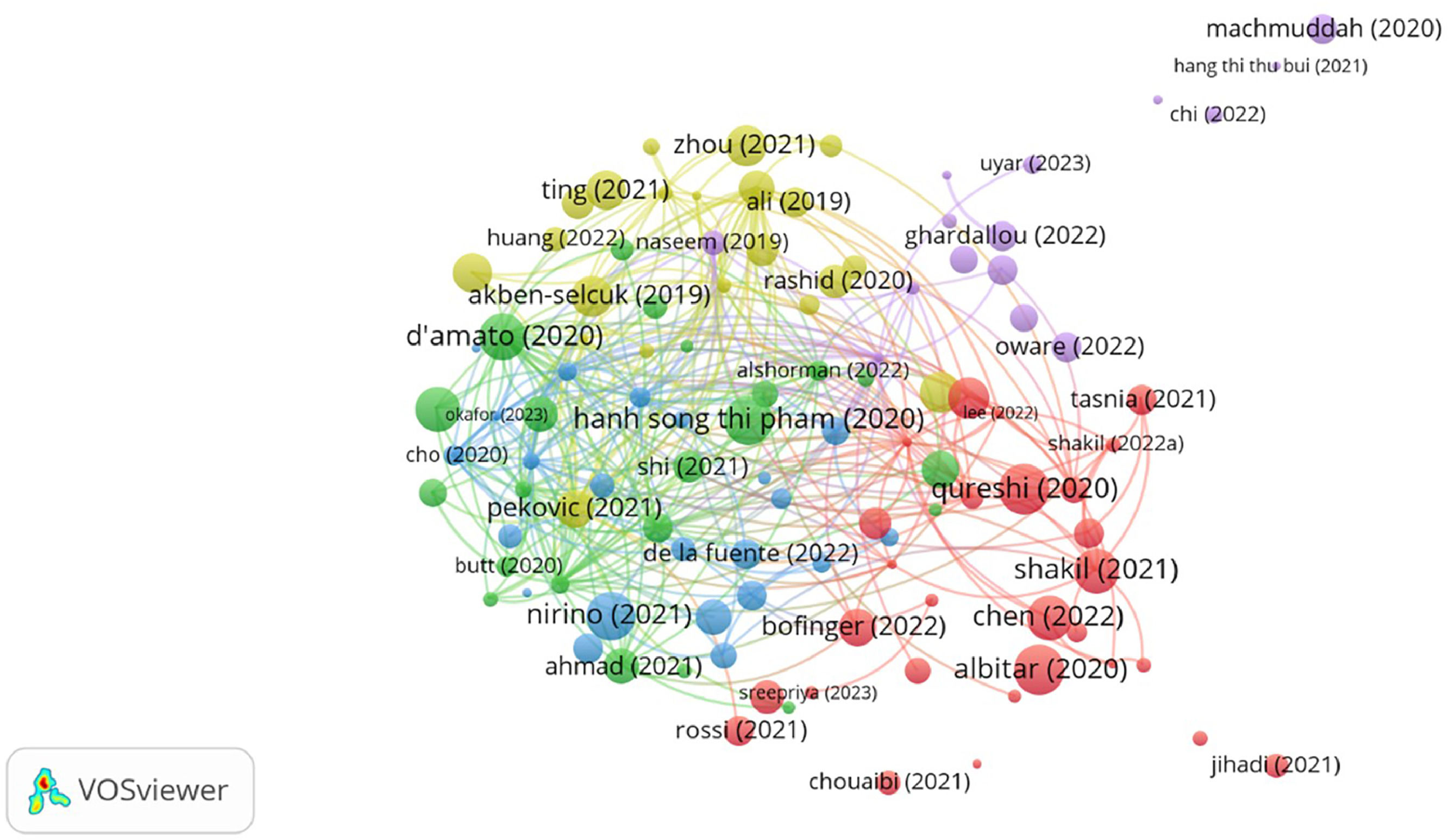

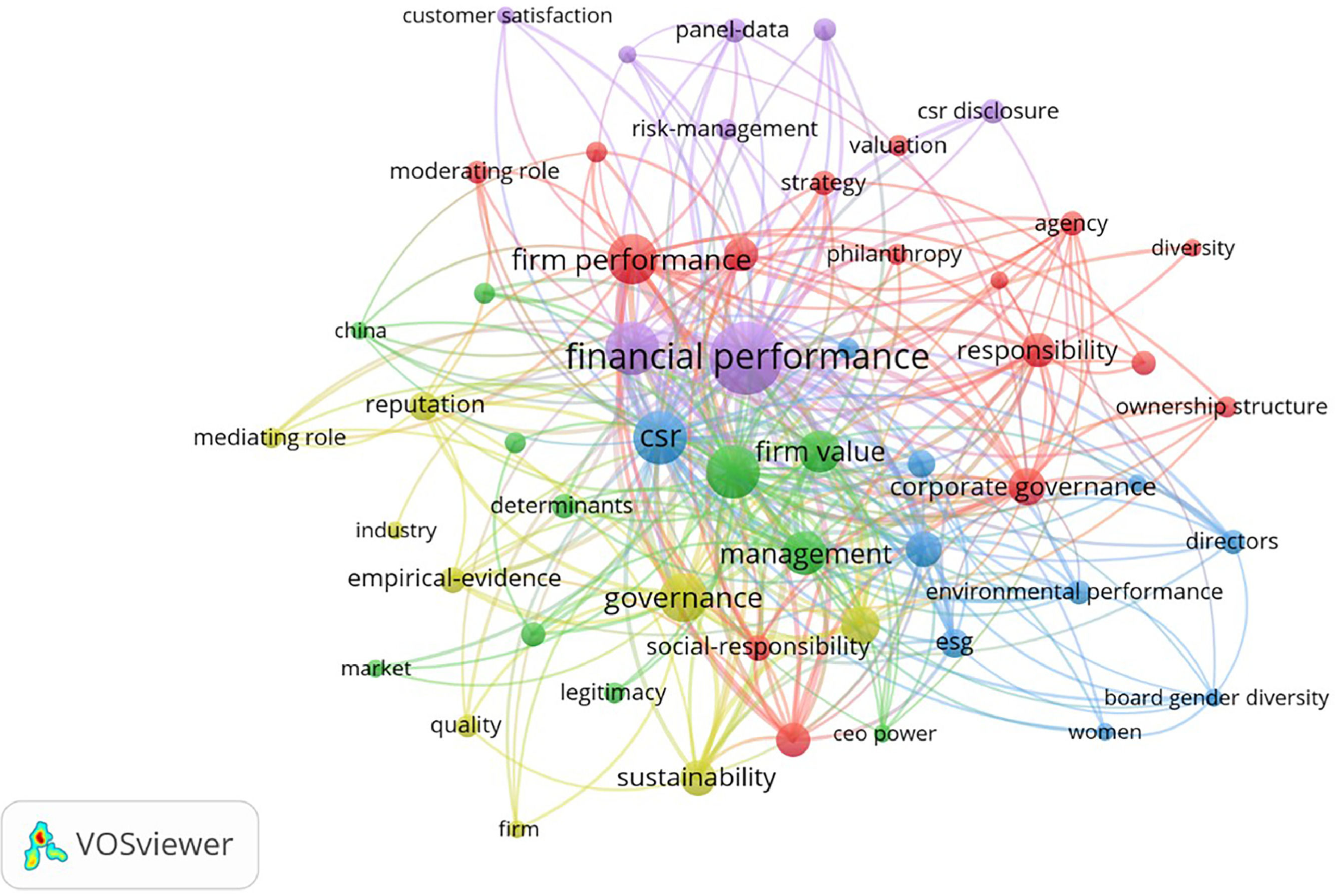

This study employs a combined methodology of bibliometric analysis and systematic review to address these research questions and provide a comprehensive overview of the current state of the literature. The bibliometric analysis starts by testing the bibliometric laws of Bradford and Lotka and follows techniques outlined by Ellili et al. (2022), including Trend Analysis, Bibliographic Coupling of Sources Analysis, Bibliographic Coupling of Articles Analysis, and Keyword Occurrence Analysis.

The systematic review follows the techniques of Junior and Godinho Filho (2010), Van Kampen et al. (2012), and Jabbour (2013), utilizing a codification system to identify gaps in the research field. The review systematically analyzes financial performance variables, ESG and CSR measures, assessment methods, theoretical foundations, and the role of database providers. It also explores the statistical modeling techniques employed and identifies key areas for future research, providing a roadmap for advancing knowledge in this domain.

The bibliometric analysis complements the systematic review by mapping the intellectual structure of the field and identifying key authors, influential studies, and journals. This dual approach offers a comprehensive and up-to-date overview of the existing literature while uncovering the underlying patterns and connections that have shaped academic discourse on ESG, CSR, and financial performance under the influence of moderating variables.

The article is organized as follows: Section 1 is the Introduction; Section 2 analyzes the Theoretical Framework and formulates the research questions; Section 3 presents the Methodology used in this article; Section 4 is structured to present the results and discussion relevant to the present literature review and bibliometric analysis. Finally, Section 5 presents the conclusions of this work, the practical applications, theoretical collaboration, limitations of this research, and guidelines for future research.

Sample selectionThe first step in this research involved carefully selecting articles, for which we utilized the Web of Science and Scopus databases. These databases are widely recognized in financial corporate research for their reliability and broad coverage. Scholars such as Aguinis et al. (2018) emphasize the importance of Web of Science and Scopus in conducting comprehensive literature reviews, particularly in the context of CSR.

The robustness of research findings is further reinforced by the use of Web of Science, as demonstrated by Orlitzky et al. (2003) in their meta-analysis of CSR and financial performance. Similarly, Peloza (2009) recognizes Scopus’ extensive coverage, making it a key resource for collecting data on CSR and financial outcomes. Friede et al. (2015) also advocate for the combined use of Web of Science and Scopus in examining ESG and CFP, acknowledging their value in sourcing reliable, peer-reviewed articles. These collective insights underline the essential role of Web of Science and Scopus in enhancing the rigor and depth of financial corporate research.

Beyond their extensive use in academic research, Web of Science and Scopus are valued for their comprehensive journal coverage, which includes a wide array of regional and non-English publications, especially within Scopus (Mongeon & Paul-Hus, 2016). Both databases maintain rigorous selection criteria to ensure that only high-quality, peer-reviewed journals are included, which is vital for producing credible research outcomes (Harzing & Alakangas, 2016). Their advanced search capabilities allow for precise and thorough literature reviews, facilitating systematic analyses that are integral to corporate financial research (Bramer et al., 2017). Moreover, the citation analysis tools provided by Web of Science and Scopus enable researchers to track the influence of their work and assess academic impact, offering valuable insights into research trends and collaboration networks (Bornmann & Daniel, 2008).

The global reach and interdisciplinary scope of Web of Science and Scopus make them indispensable for cross-disciplinary research, further establishing their reliability and broad adoption in various academic fields (Archambault et al., 2009). The consistent use of these databases in research processes not only enhances the credibility of the studies but also broadens their scope and relevance, solidifying Web of Science and Scopus as essential resources for conducting comprehensive and impactful financial corporate research.

We searched the Web of Science and Scopus databases using a search string encompassing many articles. The search string utilized: (“ESG” or “CSR”) and (“financial performance” or “firm value”) AND (“moderating” or “moderator” or “moderate”). The last systematic search was completed on December 18, 2023.

The sample initially comprised 610 articles from the Web of Science and Scopus databases from the 2019 to 2023 period, excluding the more recent studies such as Ye et al. (2021) and Lee and Suh (2022). We applied native filtering criteria Scopus (Subject Area: Business, Management, and Accounting; Social Sciences; Economics) and Web of Science (Categories: Business; Management). Subsequently, we imported a sample of 610 articles and filtered it to Ryann Systematic Review for a content selection analysis.

Rayyan is an increasingly popular tool for conducting systematic reviews, offering significant advantages in terms of efficiency, collaboration, and accuracy. Developed by Ouzzani et al. (2016), Rayyan is a web-based application specifically designed to streamline the screening and selection process in systematic reviews.

A key feature of Rayyan is its native PRISMA interface, which integrates seamlessly with the PRISMA (Preferred Reporting Items for Systematic Reviews and Meta-Analyses) guidelines. PRISMA is widely recognized for enhancing the transparency, reproducibility, and rigor of systematic reviews (Moher et al., 2009). By incorporating PRISMA's framework, Rayyan ensures that researchers can easily document and visualize the flow of studies through the different phases of the review process, adhering to best practices in transparency and reporting (Haddaway et al., 2022).

We apply the native PRISMA protocol selection in the Rayyan software to guarantee the reliability of the selection process.

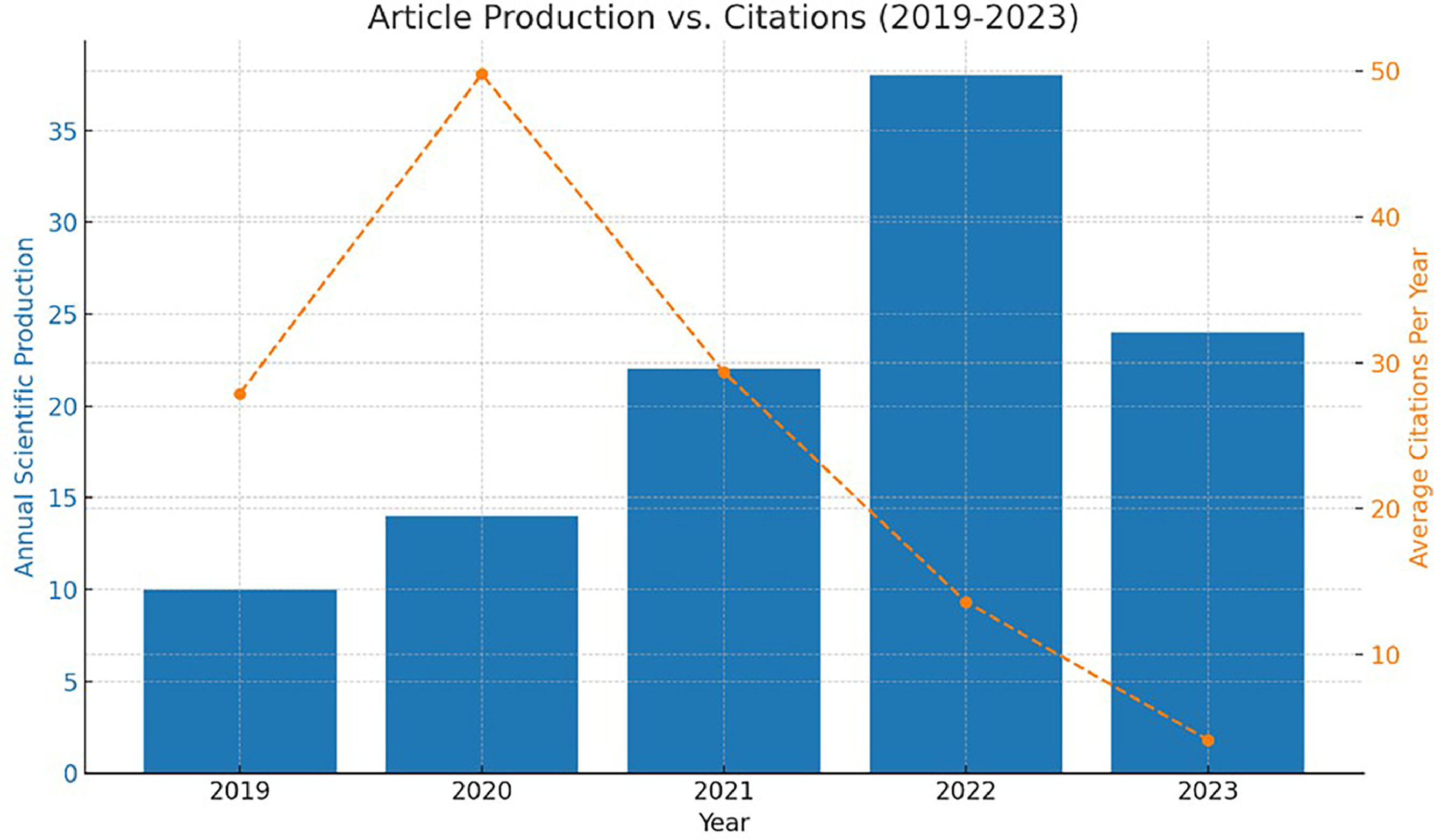

After selecting the articles, we start the analysis using the RStudio software with the Bibliometrics R package. This package allows us to use Biblioshiny, a web-based interface for bibliometric analysis. The sample includes 108 documents published between 2019 and 2023 by 320 authors from 76 academic sources. Fig. 1 presents the PRISMA flow diagram, generated using Rayyan, which visually summarizes the selection process from initial identification through final inclusion.

Bibliometric analysisBibliometric Analysis is a quantitative research method that allows scholars to systematically explore the landscape of academic literature by analyzing patterns in publication data and citations. It is particularly effective for identifying key authors, influential studies, and significant trends within a given field. The method has grown in popularity due to its ability to provide a structured and data-driven approach to understanding scholarly communication (Garfield, 1955; Price, 1963; Glänzel, 2003; Small, 2004; Van Raan, 2005; Aria & Cuccurullo, 2017; Bornmann & Daniel, 2008; Thelwall, 2008).

The origins of bibliometric analysis trace back to key figures such as Eugene Garfield, who pioneered the concept of citation indexing in the 1950s. His work, especially through the creation of the Science Citation Index, marked a breakthrough in the evaluation of academic impact and citation networks (Garfield, 1955).

Within this historical context, the application of foundational bibliometric laws — Bradford's Law and Lotka's Law — further refines our understanding of the structure and dynamics of academic literature.

Bradford's Law, introduced by Bradford (1934), identifies the core journals that publish the majority of significant articles, building on Garfield's concept of citation networks to reveal where research output is most concentrated (Aria & Cuccurullo, 2017).

Lotka's Law, formulated by Lotka (1926), examines author productivity, showing that a small number of authors produce most of the literature — a concept that aligns with Price's observations on the distribution of scientific productivity (Thelwall, 2008).

Researchers have applied these laws to identify key journals, authors, and themes within ESG and CSR research, particularly in business, demonstrating their utility in mapping the academic landscape (Chytis et al., 2024). Additionally, the comprehensive bibliometric methodologies developed by Maria Aria and Corrado Cuccurullo, including the use of the Bibliometrix package, integrate these laws to provide a structured and data-driven approach to understanding the impact of ESG and CSR on financial performance (Aria & Cuccurullo, 2017).

In modern research, tools such as VOSviewer and Biblioshiny have greatly enhanced bibliometric studies by offering sophisticated visualization capabilities for citation networks and large-scale data analysis. This has enabled a more in-depth examination of trends, research impact, and the evolution of academic fields (Donthu et al., 2021; Zupic & Čater, 2015). By leveraging techniques such as co-citation analysis, bibliographic coupling, and keyword mapping, researchers can explore the structure of academic disciplines and identify influential contributions over time.

Trend analysisIn conducting a trend analysis using Biblioshiny, linking the production of academic works over the years with the number of citations provides deeper insights into the impact and evolution of a research field. The software allows researchers to visualize the annual growth of publications, revealing how interest in topics such as ESG and CSR has expanded over time. This can be contrasted with citation data, highlighting which publications have had a lasting influence on the field. For example, a surge in publications might signal growing interest, but only highly cited works indicate significant contributions that shaped subsequent research.

By analyzing both production volume and citation trends, Biblioshiny enables a more nuanced understanding of how certain themes, such as sustainability integration or stakeholder engagement, have gained prominence and influenced CFP discussions. This dual approach helps researchers identify pivotal studies and periods of heightened scholarly attention, revealing key trends and gaps for further exploration.

Linking the article's production over the years with citation evolution is essential to understanding the relevance of the research field interest. While article production data reveal trends and periods of increased scholarly activity, citation analysis measures the lasting impact of these works, highlighting those that have significantly influenced subsequent research (Bornmann et al., 2008).

Bradford's law and bibliographic coupling analysisIn bibliometric research, Bradford's Law is a foundational principle that aids in understanding the distribution of scientific literature across journals. The law suggests that if journals are ranked according to the number of articles they publish on a specific topic, they can be categorized into a small core group followed by several broader groups, each containing a similar number of articles but spread over an increasing number of journals (Bradford, 1934). This distribution pattern highlights the concentration of crucial research outputs within a limited number of journals, while the remaining contributions are scattered across a broader range of publications.

The primary advantage of applying Bradford's Law in bibliometric analysis is its ability to identify the most influential journals within a specific field. By isolating the core journals, researchers can more efficiently target their literature reviews, focus on the most impactful publications, and strategically decide where to submit their work for publication (Egghe & Rousseau, 1990). Moreover, the law provides a clear visual representation of how research output is distributed across journals, which can reveal trends in publication activity over time (Ding et al., 2000).

The application of Bradford Law is relatively simple. The articles are, then, sorted by the journals in which they were published and ranked in descending order according to the number of articles each journal has contributed to the topic. Once the journals are ranked, the next step is dividing them into zones as Bradford's Law prescribes them.

The total number of articles N is divided into three groups, each containing one-third of the articles. The first group, known as the core zone, will typically include the fewest journals but publish the largest share of significant research articles. The remaining two zones will contain the same number of articles as the core zone but distributed across more journals (Egghe & Rousseau, 1990).

The general formula for Bradford's Law, while not as mathematically strict as other bibliometric laws, is often expressed in terms of the geometric progression of the number of journals in each zone:

Where:

R represents the multiplier that reflects the increasing number of journals needed in each subsequent zone to account for the same number of articles as in the core zone.

The process can be outlined as follows:

Total Articles (N): Determine the total number of articles in the dataset.

Articles per Zone: Divide N by 3 to find the number of articles in each zone:

Articles per Zone = N3

Zone Division: Assign journals to the first zone until the cumulative number of articles reaches one-third of N. Continue this process for the subsequent zones.

The application of Bradford's Law using Biblioshiny, a web interface for the R package Bibliometrix, facilitates the identification of core journals within research fields by automating the ranking and categorization of journals based on their publication frequency. The software's capabilities ensure that even in fields with widely dispersed research outputs, Bradford's Law can be applied with accuracy, providing a clear visualization of the most influential journals (Aria & Cuccurullo, 2017). Furthermore, Bibliophagy's intuitive interface enhances the accessibility of bibliometric analysis, allowing researchers to maintain a focused and strategic approach to literature reviews and resource allocation, as recommended by Egghe and Rousseau (1990).

While Bradford's Law is a valuable tool for identifying core journals in specific fields, its application in broad and interdisciplinary areas such as ESG and CSR presents challenges due to the dispersed nature of research outputs across numerous journals (Egghe & Rousseau, 1990).

This dispersion can blur the boundaries of core journals, making precise application difficult. Additionally, the dynamic nature of research fields means that core journals may shift over time, necessitating regular updates to maintain relevance. Furthermore, the overlap of journals across multiple disciplines complicates categorization, as journals might appear in more than one zone, further challenging the law's application (Li & Yin, 2017). To address these limitations, it is recommended that Bradford's Law be complemented with other bibliometric methods, such as Bibliographic Coupling, to achieve a more comprehensive understanding of the research landscape (Chiu & Ho, 2005).

Bibliographic coupling reveals connections between articles through shared references, highlighting clusters of related research that contribute to the same agenda. Together, these methods address the limitations of Bradford's Law by mapping the interconnected research streams and influential works that shape and advance the field.

By integrating Bradford's Law with bibliographic coupling, researchers can achieve a deeper, more structured view of the research landscape, enabling precise navigation of complex interdisciplinary fields such as ESG and CSR (Kessler, 1963; Small, 1973; Zupic & Čater, 2015).

This bibliographic coupling reveals the strength of connections between journals, with stronger links indicating a higher number of shared references. The software creates a visual map where journals are represented as nodes, and their connections are depicted as lines, highlighting clusters of journals that share similar research areas (Van Eck & Waltman, 2010). These clusters indicate closely related journals, while the size and centrality of nodes reflect the influence of particular journals within the academic landscape.

Lotka's lawLotka's Law, introduced by Alfred J. Lotka in 1926, is a critical bibliometric principle that describes the frequency of publication by authors within a given field. According to Lotka's Law, the number of authors producing n publications is inversely proportional to n²; that is, meaning that a small number of authors contribute a large portion of the total publications, and in contrast, the majority of authors publish only a few papers (Lotka, 1926).

The application of Lotka's Law in bibliometric analysis involves several steps. First, a comprehensive dataset of publications in the ESG and CSR fields is collected. Authors are then identified, and their contributions (i.e., the number of publications) are counted. The distribution of these contributions is, then, analyzed to determine if it follows the inverse square law described by Lotka. Mathematically, Lotka's Law can be expressed as:

where,y is the number of authors contributing x publications.

C is a constant representing the total number of authors.

n typically equals 2, representing the inverse square law.

To apply this in practice, the distribution of authorship is plotted on a logarithmic scale. If the data follow a straight line with a slope of approximately −2, it confirms the applicability of Lotka's Law to the dataset (Pao, 1985; Egghe & Rousseau, 1990).

Lotka's Law is a valuable tool in bibliometric analysis for identifying the most influential authors within a research field, offering insights into the key figures and groups driving scholarly advancements (Aksnes & Sivertsen, 2004).

It also helps understand the structure of scientific output by highlighting the disparity between highly productive and less active authors (Pao, 1985). Additionally, the rise of multi-author publications complicates the attribution of individual productivity, further challenging the application of Lotka's Law (Aksnes & Sivertsen, 2004). To address these limitations, using Lotka's Law alongside other bibliometric measures (e.g., Bibliographic Coupling Analysis) is recommended to comprehensively understand author influence (Pao, 1985).

Integrating Lotka's Law analysis with bibliographic coupling by article analysis provides a nuanced understanding of the research landscape in ESG/CSR and CFP under the effect of moderating variables. We perform bibliographic coupling by articles on VOSviewer.

Bibliographic coupling, which analyzes shared references between documents, is utilized in academic research to identify research trends, map intellectual structures, and trace the evolution of ideas within a field. This method helps to discover influential works, potential collaborations, and the impact of research by clustering studies with overlapping citations (Kessler, 1963; Boyack & Klavans, 2010). It is particularly useful in systematic reviews and meta-analyses for efficiently identifying related studies (Zupic & Čater, 2015).

Keyword analysisSimilar to the coupling analysis, the co-occurrence analysis is very often used. A co-occurrence map based on keyword analysis is utilized in academic research to visualize relationships between key concepts and identify major themes within a research area. Co-occurrence maps provide a visual representation of how different concepts are interconnected, which is valuable for understanding the intellectual structure of a field and guiding future research (Van Eck & Waltman, 2010; Donthu et al., 2021).

Systematic reviewThe systematic review in the article follows a five-step technique proposed by Jabbour (2013) and Lage Junior and Godinho Filho (2010), which has been successfully disseminated in various academic works. Several studies have utilized systematic literature reviews with categorization systems to advance research in different fields. Lee et al. (2021) employed a categorization system to review and classify sustainability-oriented applications of value stream mapping in manufacturing. Henrique et al. (2019) categorized machine learning techniques applied to financial market prediction, while Nazário et al. (2017) focused on categorizing studies related to technical analysis in stock markets. Pinto and Sobreiro (2022) provide a comprehensive literature review of anomaly detection approaches in digital business financial systems. It explores various methods used to identify irregularities within financial data, focusing on digital business environments, and evaluates their effectiveness in improving system security and performance.

In the field of environment and eco-innovation, Salim et al. (2019) systematically categorized internal capabilities for enhancing eco-innovation in manufacturing, and Masudin and Fernanda (2019) reviewed logistics performance using a structured approach to assess its impact on environmental outcomes. These studies illustrate the broad applicability of systematic reviews across diverse research fields, utilizing categorization to streamline complex data.

Systematic Search: The first step involved conducting a systematic search of available articles in a reliable database, specifically the Web of Science and Scopus databases. We improve the efficiency of the selection of the articles by using Rayyan and following the PRISMA's protocol.

Classification and Coding Framework Development: The second step involved developing a classification and coding framework to systematically categorize the identified articles. This framework was designed to capture various aspects of the studies, including the financial performance measures, ESG and CSR measures, moderating variable types, theoretical frameworks, statistical methods and common suggestions for research given by authors. The classification aimed to provide a comprehensive overview of the existing literature and identify research trends.

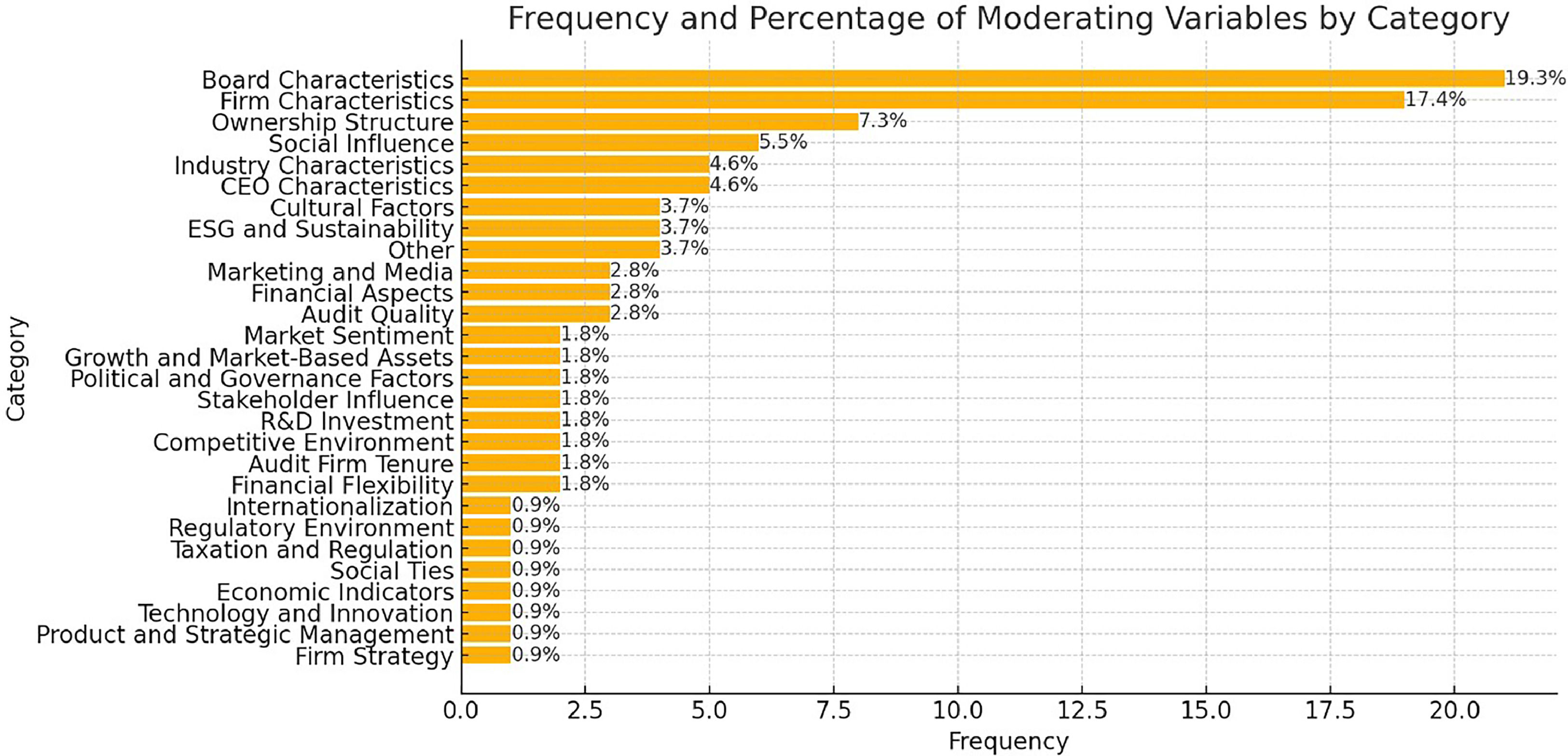

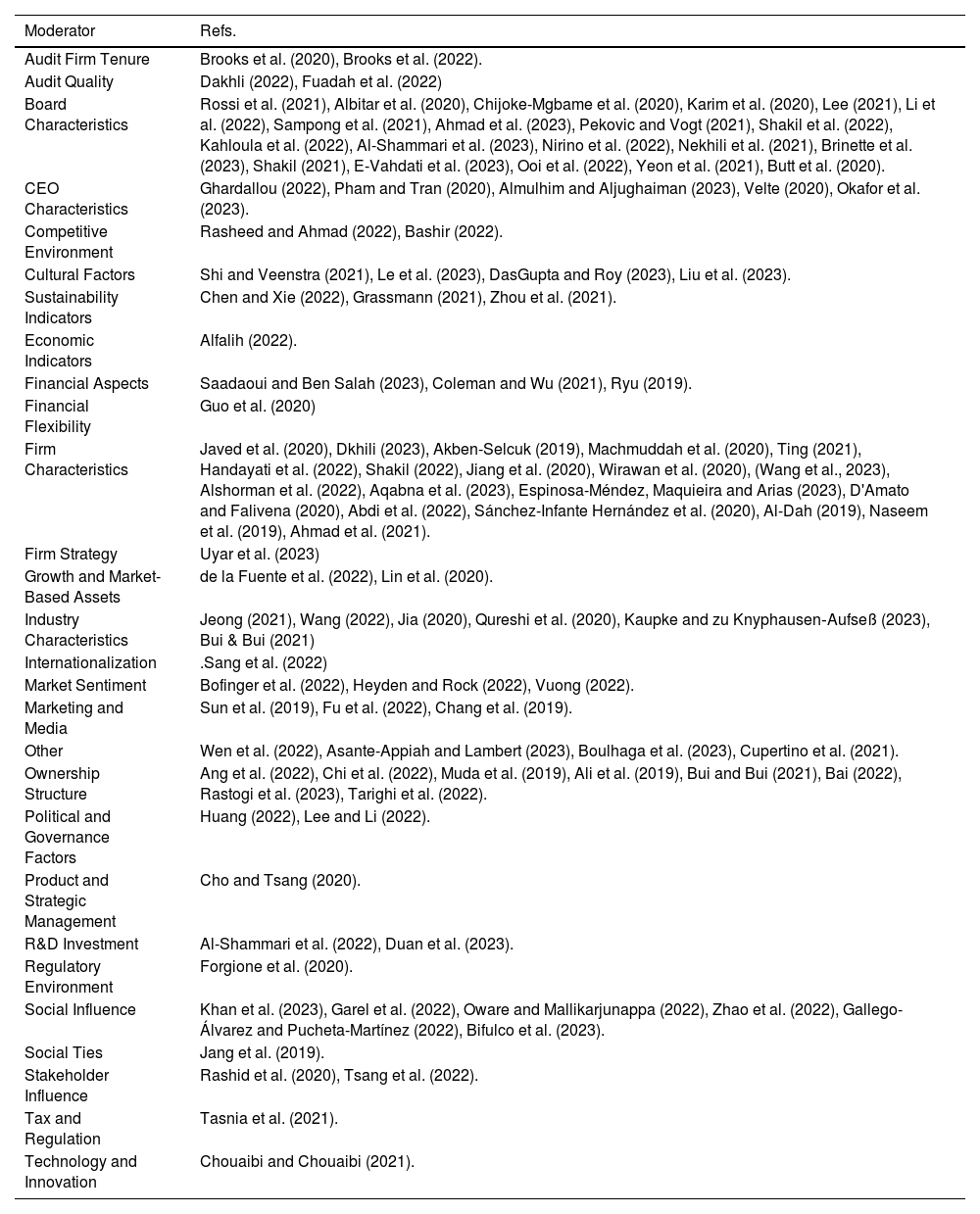

Application of Classification Framework: The third step entailed applying the classification framework to synthesize and present study trends on moderating variables and the ESG/CSR-CFP research field. Each article was classified according to the developed framework, allowing for a systematic analysis of the methodologies and findings.