The purpose of this article is to evaluate the quality of the services provided by the two most important banks that operate in Mexico, using as case study those branches that are located in the four main cities of the Isthmus of Tehuantepec: Ixtepec, Juchitán, Tehuantepec and Salina Cruz. The methodological strategy of this investigation resided in the application of a modified version of the SERVPERF model, one of the most important in this type of studies, which assesses the perception of the clients based on five criteria: reliability, responsiveness, safety, empathy and tangible elements. Strictly speaking, these criteria or dimensions jointly define the quality of the service received. The results found indicate that, in general terms, the assessment of the clients of both banks regarding their services is high, which could be explained by the establishment of very low expectations by the users according to the specific socioeconomic variables. Additionally, significant differences were found regarding the assessment between groups of people according to the different analyzed variables, such as occupation, level of education and age range.

El propósito de este artículo es evaluar la calidad de los servicios que prestan los dos bancos más importantes que operan en México, tomando como estudio de caso las sucursales asentadas en las cuatro principales ciudades del Istmo de Tehuantepec: Ixtepec, Juchitán, Tehuantepec y Salina Cruz. La estrategia metodológica de esta investigación consistió en la aplicación de una versión modificada del modelo SERVPERF, uno de los más importantes en este tipo de estudios, el cual valora las percepciones de los clientes con base en cinco criterios: fiabilidad, capacidad de respuesta, seguridad, empatía y elementos tangibles. En estricto sentido, estos criterios o dimensiones conjuntamente definen la calidad del servicio recibido. Los resultados encontrados señalan que, en términos generales, la valoración de los clientes de ambos bancos respecto a sus servicios es alta, lo que se podría explicar por el establecimiento de parte de los usuarios de expectativas muy bajas de acuerdo a variables socioeconómicas específicas. Adicionalmente, se encontraron diferencias significativas en la valoración entre grupos de personas de acuerdo a diversas variables analizadas, como ocupación, escolaridad y rangos de edad.

Quality constitutes one of the most relevant decision variables for buyers to select between goods and services in competitive markets. Thus, it in turn represents a strategic factor to place the companies in a favorable competitive position. However, as indicated by Montgomery (2010), it is frequent for there to be little attention to the client in the product design and for quality to be perceived as complying with the specifications, not caring if the product is adequate for its use by the consumer. This situation becomes more complex if we refer to the services area, the offer of which greatly defines our times (service society). Such complexity lies in the specific characteristics of the services, such as intangibility, heterogeneity and simultaneity, which hamper their control and the assessment of their results, for which indirect methods are normally used through the perception of the clients (Ruiz, 2006).

The foregoing, in addition to the fact that we all are, in one way or another, users of the services provided by banking institutions, and that there is practically no history regarding the assessment of this type of services in the Oaxaca portion of the Isthmus of Tehuantepec, drives the realization of this investigation, same which uses a quantitative approach with a cross-cutting nature (Hernández, Fernández, & Baptista, 2010). In that sense, this work analyzes the user quality perception of the services provided by the two biggest banks that operate in Mexico: Banco Nacional de México (Banamex) and Banco Bilbao Vizcaya Argentaria-Banco de Comercio (BBVA Bancomer),1 through their branches located in the most important cities of Oaxaca in the Isthmus of Tehuantepec: Ixtepec, Juchitán, Tehuantepec and Salina Cruz. To comply with said objective, the SERVPERF model will be used, which, among the available quality models to calibrate service quality, is the most advantageous by virtue that it focuses on measuring the perception of the clients regarding the quality of the service received.

The central question that inspires this investigation is expressed in the following manner: What is the assessment of the clients regarding the quality of the bank services in the Oaxaca region of the Isthmus of Tehuantepec? To address this, the following support questions will be answered: What is the quality level of the services that Banamex and Bancomer offer in the Isthmus of Tehuantepec-Oaxaca? What perception do the clients of Banamex and Bancomer have in the cities of Ixtepec, Juchitán, Tehuantepec, and Salina Cruz regarding the quality of the banking services?

Similarly, the main objective of this work is to know the perception of the users regarding the quality of the services offered by the banks in the Oaxaca portion of the Isthmus of Tehuantepec. The following specific objectives are presented as well: (a) identify the service quality offered by Banamex and Bancomer in the Isthmus of Tehuantepec-Oaxaca, (b) identify the service quality offered by Banamex and Bancomer in the cities of Ixtepec, Juchitán, Tehuantepec and Salina Cruz. Furthermore, the existing hypothesis is that the perception of the clients regarding the banking service quality of the Oaxaca portion of the Isthmus of Tehuantepec is positive at a general level and in each city.

For these reasons, this work first presents the theoretical framework regarding the concept of quality in the services, as well as the most important models for its evaluation, where SERVQUAL and SERVPERF stand out. Subsequently, the methodology used in the investigation is explained, followed by the presentation of the results. Lastly, the conclusions and final work reflections are presented.

Theoretical frameworkService qualityReferencing the research of the American National Standards Institute and the American Society for Quality (ASQ), Evans and Lindsay (2005, p. 16) indicate that quality is understood as “all the aspects and characteristics of a product or service that support its capacity to satisfy certain needs”. Said definition is completely aligned with the proposal by Juanes and Blanco (2001, p. 4), who indicate that quality is “the property or set of properties inherent to a product or service that has the capacity to satisfy the requirements of the user to which it is destined”. Nevertheless, since the 1980s, the business sector began using a simpler and more powerful description that still prevails, motivated by the client: “quality is covering or exceeding the expectations of the client” (Evans & Lindsay, 2005, p. 16). In that sense, it is important to remember that the premise of offering services that satisfy the clients is present in the different quality management models (Torres, 2011).

Even if its common in markets to find products that are complemented by services (as is the case of the automotive industry) and services with the material support of a product (such as telephone services), it is important to identify the three following characteristics inherent to services, which cause their management, adhered to high quality criteria, to become more complex than in the case of products. Firstly, services are intangible. This makes it more complicated to establish specifications regarding the way to generate their production and standardize their quality. Furthermore, the parameters that the clients use to evaluate them may be difficult to define and may vary from person to person. Secondly, the services are heterogeneous. Given the human nature of its participants—providers and consumers—the provision of a service can be different from one day to another and from one user to another. Thirdly, in the services, production and consumption are simultaneous, that is, no matter the nature of the service, its production happens at the same time it is consumed (Juanes & Blanco, 2001).

Based on the foregoing, the only legitimate criteria to evaluate the quality of a service are those determined by the very clients in function of their expectations for the service, their personal needs, the treatment they received, the time and effectiveness in the service, among other aspects. Such evaluation can only be made a posteriori, as it is impossible to do a quality control exercise prior to the specific perception of the service by the user (Jaráiz & Pereira, 2014). Therefore, for some authors, service quality can be understood as the difference made by the consumer between his expectations and the perception of the service that was received.

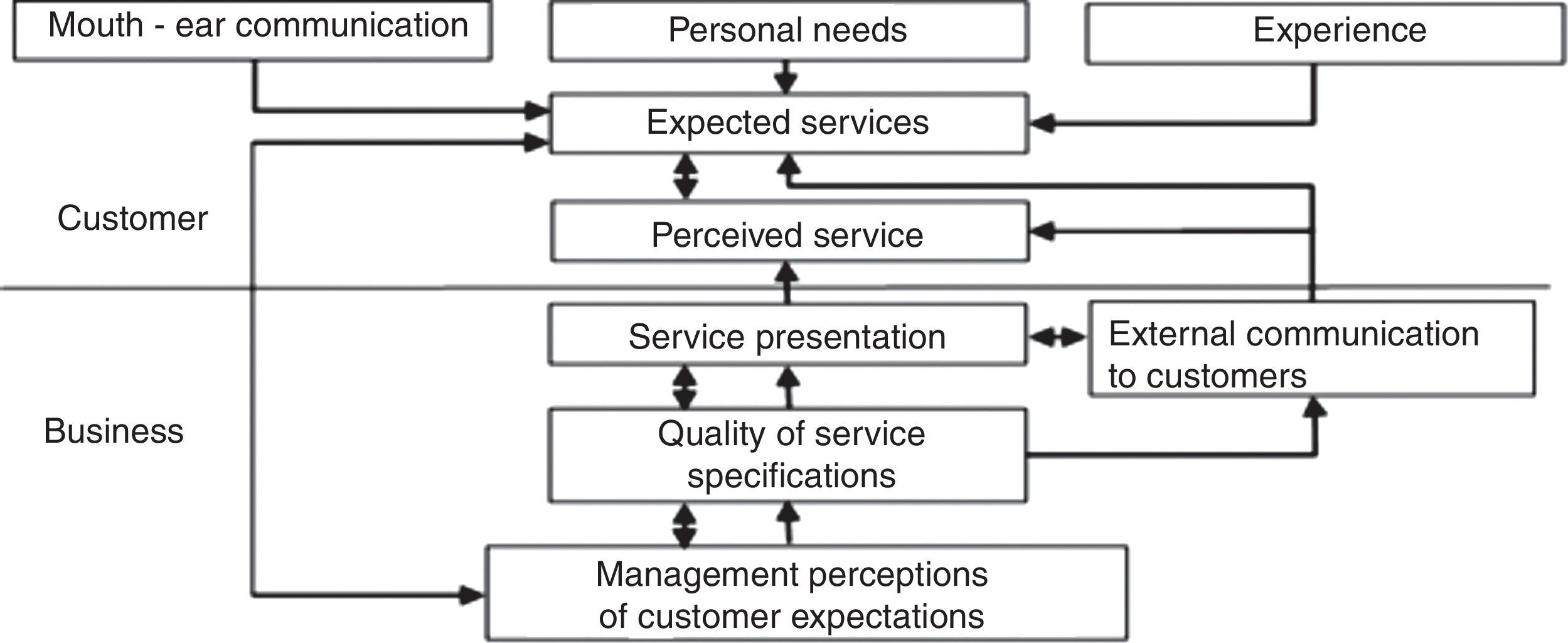

The SERVQUAL modelFor Parasuraman, Zeithaml, and Berry (1988) – who patented the SERVQUAL (SERVice QUALity) model, which is an obligatory reference in the study of quality service (Colmenares & Saavedra, 2007; Vázquez, 2015) – when referring to the service sector, quality must be understood as an integrated process. This process starts with the perceptions obtained through market studies and those that directives create regarding the expectations of clients, which in turn are formed through communication with other users of the service based on their needs and personal experiences, in addition to what the company conveys (Fig. 1). The perceptions of the senior management shall be materialized in the specifications that guarantee the quality of the service. Such specifications shall be followed precisely when providing the service, same which the client will assess or perceive based on their expectations.

Conceptual model of service quality.

Parasuraman et al. (1988) developed a model from the formulation of the following research questions: How does the client evaluate the quality of the service? Does the client do a direct global evaluation or do they first assess the specific stages of the service? If the client uses the latter, what are the different stages that they utilize to assess the service? To find the answers to these questions, these researchers carried out a comprehensive field study, finding ten common criteria, dimensions or attributes that the clients use when perceiving the quality of the service: (1) reliability, (2) professionalism, (3) accessibility, (4) safety, (5) responsiveness, (6) courtesy, (7) communication, (8) credibility, (9) understanding and knowledge of the client, and (10) tangible elements (Ruiz, 2006).

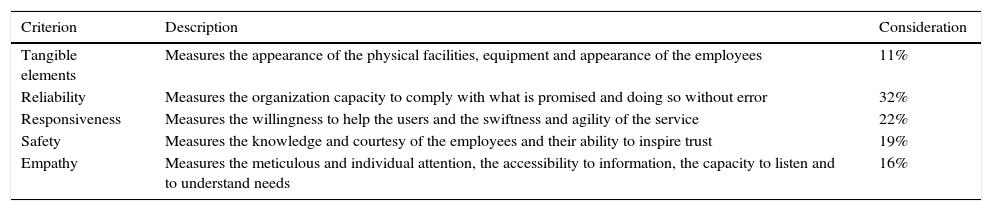

Given that the authors observed a strong correlation between several dimensions, they decided to integrate some into others, reaching the final proposal of a model with five criteria: (1) tangible elements, (2) reliability, (3) responsiveness, (4) safety (which comprised professionalism, courtesy, credibility and safety), and (5) empathy (which comprised accessibility, communication and understanding of the users). Even if these five dimensions are essential for the application of the model, not all of them are equally significant from the consumer perspective. Table 1 shows the description of each criteria and their corresponding weight.

SERVQUAL model criteria and their description.

| Criterion | Description | Consideration |

|---|---|---|

| Tangible elements | Measures the appearance of the physical facilities, equipment and appearance of the employees | 11% |

| Reliability | Measures the organization capacity to comply with what is promised and doing so without error | 32% |

| Responsiveness | Measures the willingness to help the users and the swiftness and agility of the service | 22% |

| Safety | Measures the knowledge and courtesy of the employees and their ability to inspire trust | 19% |

| Empathy | Measures the meticulous and individual attention, the accessibility to information, the capacity to listen and to understand needs | 16% |

The criteria that originated the formation of this model are similar to those identified by Fitzgerald, Johnston, Brignall, Silvestro, and Voss (1991) when defining the quality of the services that a bank offers: (1) access, (2) esthetic – appearance, (3) availability, (4) cleanliness and order, (5) convenience, (6) communication, (7) competence, (8) courtesy, (9) amicable treatment, (10) reliability, (11) attention to the demands, and (12) safety (Fitzgerald et al., 1991, cited by Peppard & Rowland, 1996).

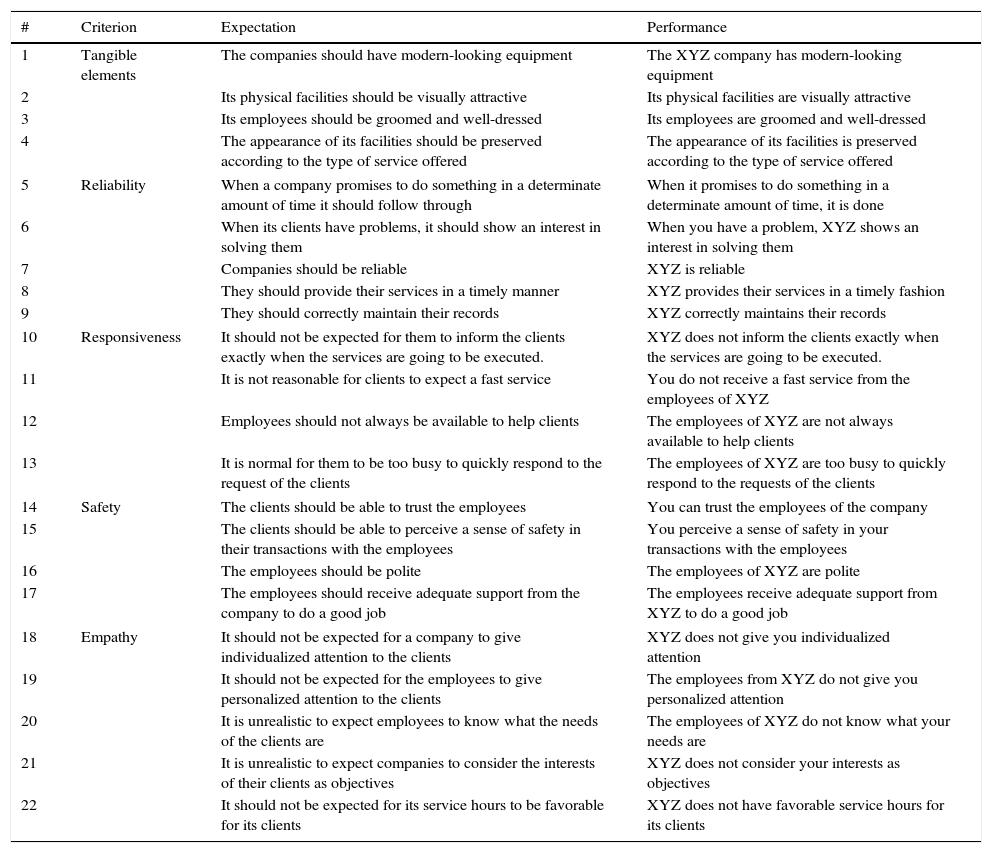

For its instrumentation, SERVQUAL utilizes a survey comprised by 22 items, which cover the five dimensions of the model to evaluate the expectations of the consumers regarding the service, in addition to applying the same 22 items, but adapted to a company in particular so that the client can assess their perception of the service (Table 2). In this manner, and regardless of their weight, tangible elements have four items; reliability has five; responsiveness has four; the safety criterion also has four items; and empathy has five. For its completion, a seven-point Likert scale is used, where 7 means the clients totally agree with the statement and 1 means they totally disagree.2

SERVQUAL survey.

| # | Criterion | Expectation | Performance |

|---|---|---|---|

| 1 | Tangible elements | The companies should have modern-looking equipment | The XYZ company has modern-looking equipment |

| 2 | Its physical facilities should be visually attractive | Its physical facilities are visually attractive | |

| 3 | Its employees should be groomed and well-dressed | Its employees are groomed and well-dressed | |

| 4 | The appearance of its facilities should be preserved according to the type of service offered | The appearance of its facilities is preserved according to the type of service offered | |

| 5 | Reliability | When a company promises to do something in a determinate amount of time it should follow through | When it promises to do something in a determinate amount of time, it is done |

| 6 | When its clients have problems, it should show an interest in solving them | When you have a problem, XYZ shows an interest in solving them | |

| 7 | Companies should be reliable | XYZ is reliable | |

| 8 | They should provide their services in a timely manner | XYZ provides their services in a timely fashion | |

| 9 | They should correctly maintain their records | XYZ correctly maintains their records | |

| 10 | Responsiveness | It should not be expected for them to inform the clients exactly when the services are going to be executed. | XYZ does not inform the clients exactly when the services are going to be executed. |

| 11 | It is not reasonable for clients to expect a fast service | You do not receive a fast service from the employees of XYZ | |

| 12 | Employees should not always be available to help clients | The employees of XYZ are not always available to help clients | |

| 13 | It is normal for them to be too busy to quickly respond to the request of the clients | The employees of XYZ are too busy to quickly respond to the requests of the clients | |

| 14 | Safety | The clients should be able to trust the employees | You can trust the employees of the company |

| 15 | The clients should be able to perceive a sense of safety in their transactions with the employees | You perceive a sense of safety in your transactions with the employees | |

| 16 | The employees should be polite | The employees of XYZ are polite | |

| 17 | The employees should receive adequate support from the company to do a good job | The employees receive adequate support from XYZ to do a good job | |

| 18 | Empathy | It should not be expected for a company to give individualized attention to the clients | XYZ does not give you individualized attention |

| 19 | It should not be expected for the employees to give personalized attention to the clients | The employees from XYZ do not give you personalized attention | |

| 20 | It is unrealistic to expect employees to know what the needs of the clients are | The employees of XYZ do not know what your needs are | |

| 21 | It is unrealistic to expect companies to consider the interests of their clients as objectives | XYZ does not consider your interests as objectives | |

| 22 | It should not be expected for its service hours to be favorable for its clients | XYZ does not have favorable service hours for its clients | |

Although for several years different studies such as that of Quevedo and Andalaft (2008) have attested to the use of SERVQUAL as a diagnosis tool that makes it possible to detect opportunity areas for the improvement of the quality of the services, Cabello and Chirinos (2012) conclude that the methodology of this model is somewhat complicated. This is due to the results being expressed in negative averages, which makes their interpretation difficult. They also detected problems to determine the expectations of the users. For their part, Rebolloso, Salvador, Fernández, and Cantón (2004) indicated that some of the SERVQUAL criteria show a particular weakness, as it is necessary to incorporate new items or new dimensions. Furthermore, based on a documentary review, Al-Ibrahim (2014) found that the methodology of this model is too complex to be handled with precision.

Other studies, in addition to approaching the phenomenon from a broader perspective, present a more optimistic appreciation of SERVQUAL and of other models, such as SERVPERF. Such is the case of the research by Salomi, Miguel, and Abackerli (2005), for whom, after applying an instrument of 18 items to analyze the quality of the internal services of a Brazilian industrial company, both SERVQUAL and SERVPERF are valid instruments. García and Díaz (2008) reached the same conclusion when they applied both models to calibrate the quality of the services in the Faculty of Economic Sciences of the Universidad de Málaga. Colmenares and Saavedra (2007) also approve such models from a theoretical and reflexive approach.

On the other hand, several works clearly point out the deficiencies in SERVQUAL and, at the same time, acknowledge the advantages of SERVPERF. Therefore, Salomi et al. (2005) stress that SERVPERF is more convenient since the clients that are evaluated with this model lose less time, given that they do not have to reflect regarding their expectations, which is what happens with SERVQUAL (making it become rather tedious), thus, it is more practical. To complement this, Alén (2006) demonstrates that the perception scale (used in SERVPERF) incorporates better psychometric properties than the one based on perceptions minus expectations (as is done in SERVQUAL).

Cronin and Taylor (1992, 1994) developed the SERVPERF model, which is based solely on the assessments (perceptions) of the client regarding the performance of the services (SERVice PERFormance). In it, the quality must not be measured through the differences between expectations and performance (Salomi et al., 2005). For its instrumentation, SERVPERF uses only the 22 sentences or statements regarding the perceptions on the performance of the service presented in the SERVQUAL, thus eliminating those that correspond to the assessment of expectations. This creates the following advantages for the SERVPERF model.

It requires less time for the implementation of the survey, as each item or characteristic of the service is addressed once; the assessment measures predict the satisfaction better than the measures of the difference (sic) and the interpretation work, and the corresponding analysis is easier to carry out given that they are based only on perceptions, eliminating the expectations and reducing with it 50% of the questions presented by the Servqual method (Ibarra & Casas, 2015, p. 234–235).

According to the above, the measurement of quality can be represented with the equation:

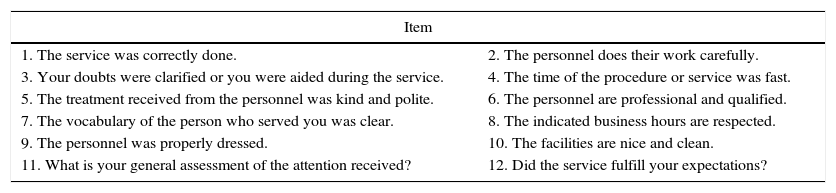

where Q is the global satisfaction index; wj is the importance of the dimension j=1,…,5 (Table 1), and pj is the average score of the satisfaction in dimension j (Jaráiz & Pereira, 2014).Methodology usedTo reach the objectives of the investigation, the SERVPERF model was used. It is more comfortable and precise to know the quality of a service through the assessment given by the client based on their experience; and in addition to being clearer, it is answered faster by the surveyed user. As previously explained, the SERVQUAL and SERVPERF models incorporate 22 items, though this number can be considered as the maximum number of attributes to introduce in the quality analysis to be carried out. According to the theory, it is advisable to use between 10 and 12 items, in addition to including a question regarding the general satisfaction with the service, and another one regarding the fulfillment of the client expectations (Jaráiz & Pereira, 2014).3

On this basis, an instrument with 12 items was designed to be applied to the study (Table 3).4 The first two questions measure the reliability criterion, the following two measure responsiveness, five and six measure the dimension of safety, seven and eight measure empathy, and nine and ten measure the tangible elements. Question eleven allows knowing the general perception of the client regarding the attention received, and 12 identifies if the service complied with their expectations. The age, sex, occupation and education level of the person surveyed were also documented. Moreover, each dimension variable was created with the average of the variables within each criterion.

Items of the perception survey regarding the quality of the banking services.

| Item | |

|---|---|

| 1. The service was correctly done. | 2. The personnel does their work carefully. |

| 3. Your doubts were clarified or you were aided during the service. | 4. The time of the procedure or service was fast. |

| 5. The treatment received from the personnel was kind and polite. | 6. The personnel are professional and qualified. |

| 7. The vocabulary of the person who served you was clear. | 8. The indicated business hours are respected. |

| 9. The personnel was properly dressed. | 10. The facilities are nice and clean. |

| 11. What is your general assessment of the attention received? | 12. Did the service fulfill your expectations? |

Regarding the numeric scale, the long one was used (0–10) as it has certain advantages that others do not, such as the Likert scale, which, though easy to understand, lacks precision regarding the grade assigned to each element. In the scale used, zero represents the lowest grade of assessment by the user of the banking services, and ten equals the highest grade of assessment. Furthermore, people easily associate this scale to the one used at school, where grades 6, 7, 8, 9 and 10 are considered passing grades, therefore, we will link them to the qualifiers: sufficient, regular, good, very good, and excellent, respectively. Among the scale advantages is the easy understanding by the people surveyed, which offers a broad spectrum of possibilities regarding the perception of quality, and the results allow applying a good number of statistical techniques (Jaráiz & Pereira, 2014).5

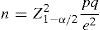

The number of clients to be surveyed was determined based on the simple random sampling for proportions, considering a maximum estimation error of 5% (e=0.05), a reliability of 95% (100(1−α)%=95%), and assuming an infinite population. The formula to calculate the sample size is:

where Z1−α/22 is quantile 1−α/2 of the standard normal distribution, e is the maximum permissible error, p is the probability of possessing the interest characteristic, and q=1−p. Given that probability p is unknown, it was decided to consider the maximum variance, which happens with p=q=0.5. For a 95% reliability, quantile Z1−α/22=1.96. Performing the calculations with Eq. (2), the minimum sample size to estimate the proportions is given; for example, the proportion that perceives the service as excellent is of 385 users. Moreover, due to the fact that four branches of each banking institution considered are located in the studied region (one branch in each of the cities of Ixtepec, Juchitán, Tehuantepec and Salina Cruz), the plan was to obtain at least 385/4≈96 surveys per branch, thus, ensuring representativeness per financial institution. The information gathering was done during business days and in both shifts, morning (8:30 a.m. to 12:00 p.m.) and afternoon (12:00–16:00 p.m.), between April 22nd, 2015, and May 8th, 2015. It is worth stressing that even though the information gathering was done according to the simple random sampling for proportions, given that the proportions of the different grades proportioned by the users to the banking service received would be estimated in the first instance, the analysis of the random sample collected was broader and included an study sub-demographic according to the bank branch, gender, occupation, level of education, and age.To evaluate the reliability of the instrument used (Table 3), the Cronbach alpha (Cronbach, 1951) was used, which is determined by the following expression:

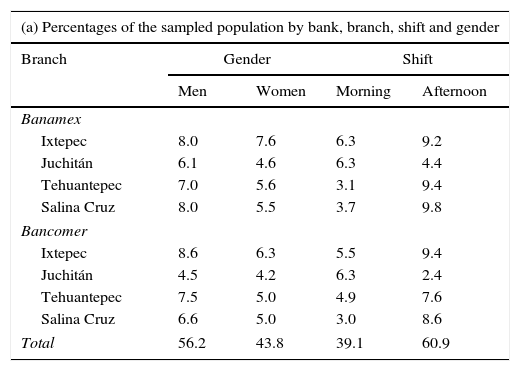

where Si2 is the variance of item i, St2 is the variance of the totals, and k is the number of items. If the items are additively combined and they measure the non-observable characteristic in the same direction, then the items are strongly correlated and, therefore, the instrument is reliable. In that case, coefficient α tends to be 1. Conversely, α tends to be zero if the items are independent or weakly correlated. This indicates that the instrument is not reliable, as it extracts information from unrelated questions, leading to erroneous conclusions. Lastly, the Mann–Whitney test was used to contrast the distributions of the dimensions by bank and gender, and the Kruskal–Wallis test was done to compare the distributions of the five attributes between branches, occupation categories, level of education, and five-year age group. The p-values that resulted from the corresponding hypothesis tests are reported in the results.ResultsGeneral characteristics of the sampleA total of 953 surveys were conducted, 498 of which corresponded to users of Banamex and 455 to users of Bancomer. Table 4a shows the characteristics of the people surveyed per bank, branch, gender and shift. Although previously it had been decided to apply at least 96 surveys per branch, in the Bancomer-Juchitán branch only 83 surveys were conducted. The remaining branches complied with the previously stipulated samples, with the two branches of Ixtepec standing out among the others as they had the highest user participation. It is worth noting that in all branches the ratio of men was higher to that of women. Furthermore, except for Banamex-Juchitán and Bancomer-Juchitán, the information obtained was mostly from the afternoon shift, as it is the time of day in which there is a higher influx of users in both banks.

General characteristics of the sampled population.

| (a) Percentages of the sampled population by bank, branch, shift and gender | ||||

|---|---|---|---|---|

| Branch | Gender | Shift | ||

| Men | Women | Morning | Afternoon | |

| Banamex | ||||

| Ixtepec | 8.0 | 7.6 | 6.3 | 9.2 |

| Juchitán | 6.1 | 4.6 | 6.3 | 4.4 |

| Tehuantepec | 7.0 | 5.6 | 3.1 | 9.4 |

| Salina Cruz | 8.0 | 5.5 | 3.7 | 9.8 |

| Bancomer | ||||

| Ixtepec | 8.6 | 6.3 | 5.5 | 9.4 |

| Juchitán | 4.5 | 4.2 | 6.3 | 2.4 |

| Tehuantepec | 7.5 | 5.0 | 4.9 | 7.6 |

| Salina Cruz | 6.6 | 5.0 | 3.0 | 8.6 |

| Total | 56.2 | 43.8 | 39.1 | 60.9 |

| (b) Distribution of the respondents according to their level of education | ||||||

|---|---|---|---|---|---|---|

| Level of education | No education | Primary | Secondary | Preparatory | University | Postgraduate studies |

| Percentage | 4.1 | 12.9 | 19.2 | 29.3 | 33.5 | 1.0 |

| (c) Structure of the sample by five-year age group | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Group | Percentage | Group | Percentage | Group | Percentage | Group | Percentage | Group | Percentage |

| [10–14] | 0.2 | [25–29] | 11.2 | [40–44] | 9.3 | [55–59] | 6.7 | [70–74] | 2.8 |

| [15–19] | 3.8 | [30–34] | 12.6 | [45–49] | 10.7 | [60–64] | 5.4 | 75 and more | 1.9 |

| [20–24] | 8.7 | [35–39] | 12.1 | [50–54] | 10.4 | [65–69] | 4.2 | ||

| (d) Distribution of the respondents according to their occupation | ||||||||

|---|---|---|---|---|---|---|---|---|

| Occupation | Housewife | Employee | Student | Entrepreneur | Does not work | Professional | Retired | Other |

| Percentage | 20.8 | 38.9 | 7.2 | 5.0 | 2.1 | 14.1 | 5.9 | 6.0 |

Regarding the level of education of the interviewees, those with higher education comprised most of the sample (33.5%). On the other hand, it was noted that only 1% of the users declared having postgraduate studies, and 4.1% stated not having education at all (Table 4b).

In relation to the age of the surveyed users, those who made a greater use of the banking services were between 20 and 59 years (81.7%). The number of clients significantly decreased in clients older than 59 years (14.3%). And the number of users younger than 20 years barely comprised 4% (Table 4c).

With regard to the occupation of those surveyed, the sample was comprised mainly by employees (38.9%), housewives (20.8%), and professionals (14.1%). The last group was mostly comprised by people with university or postgraduate degrees who offer their services in a specialized manner such as architects, doctors, dentists, engineers, stylists, but are not considered businessmen (Table 4d).

Instrument reliabilityWhen calculating the Cronbach alpha with the 12 items of the applied instrument, a value of 0.924 was obtained. This means that the designed instrument is globally reliable, as the items collect information consistently on the perception of the banking services. However, by dimension, Cronbach alpha was of 0.849, 0.670, 0.822, 0.611 and 0.662 for reliability, responsiveness, safety, empathy, and tangible elements, respectively. According to Hernández et al. (2010, p. 302), alpha values higher than 0.5 correspond to an instrument with a medium reliability (responsiveness, empathy and tangible elements) and values higher than 0.75 are pertinent to an acceptable reliability (reliability and safety). The decrease of the Cronbach alpha is due to each dimension having only two items and, as indicated by Cortina (1993), the alpha coefficient depends on the number of items: the more items in the instruments, the greater its reliability. To that effect, similar or lower alpha values to the ones obtained in this work when there are few items have been reported in the literature. Thus, for example, Kolko, Moser, Litz, and Hughes (1987) report alpha values of 0.77, 0.68, and 0.63 when evaluating the internal consistency of three dimensions, each one with three, two, and three items, respectively. Generally, the investigators report the alpha value calculated with all the items of the instrument, omitting their computation by dimension.

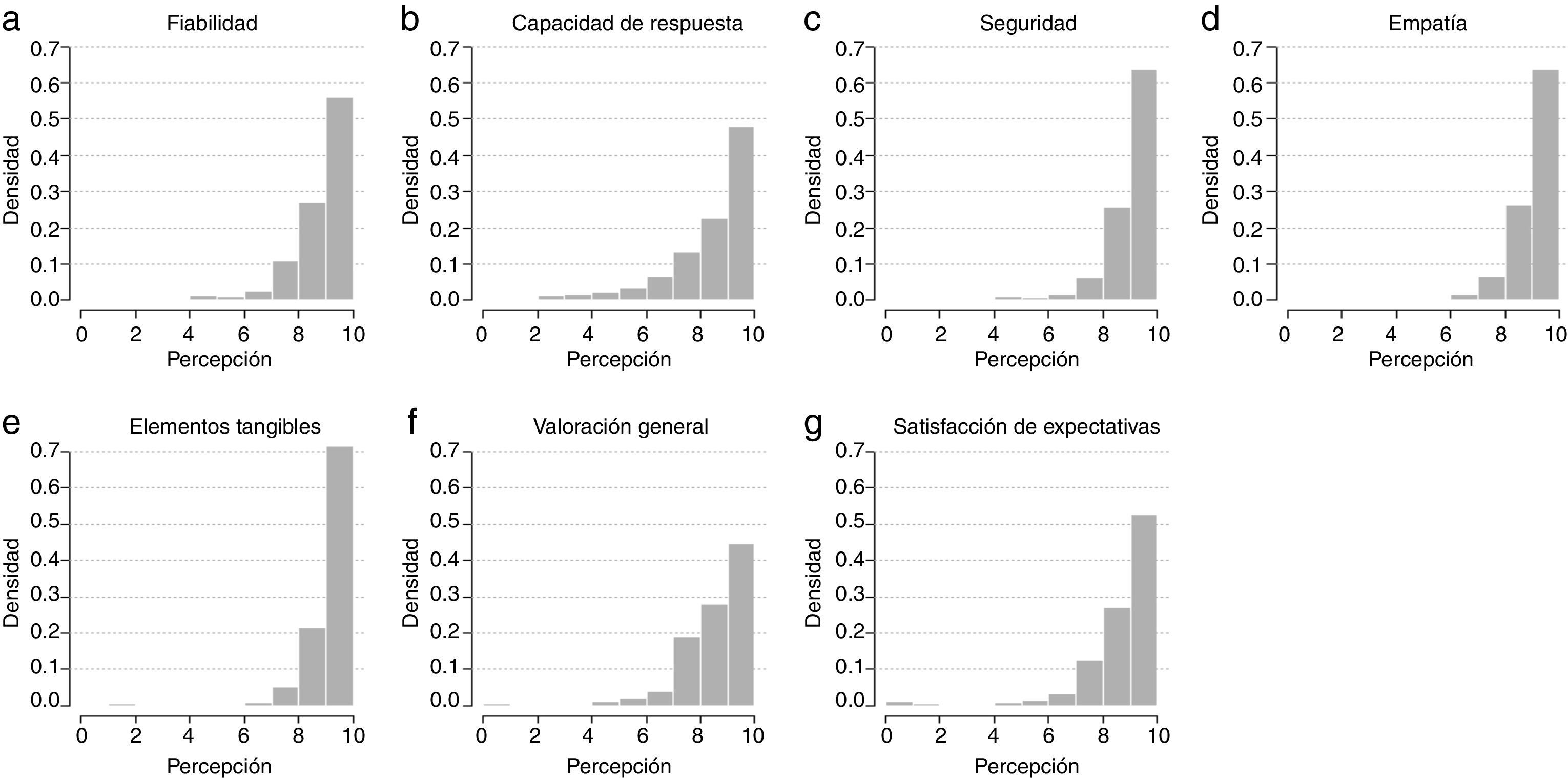

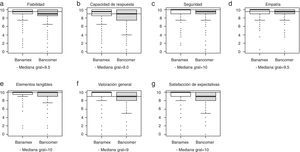

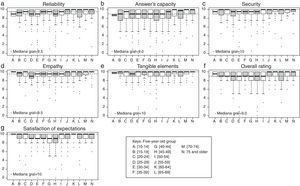

Dimensions of the quality of bank services at a global levelFig. 2 shows the histograms of global frequency (considering both banks) of the five dimensions of the quality of the banking services: (a) reliability, (b) responsiveness, (c) safety, (d) empathy, and (e) tangible elements. It should be noted that in each of the dimensions the assessment in the interval [9,10] prevailed, that is, most of the users graded the banking services offered by Banamex and Bancomer between very good and excellent. The criterion that received a higher grade between very good and excellent was the criterion of tangible elements; more than 70% of users gave this grade to that dimension (Fig. 2e). Furthermore, it should be stressed that 20% of the users appreciated this criterion as good. Therefore, the users consider the physical facilities to be visually attractive and that employees maintain an impeccable physical presentation (Fig. 2e).

On the other hand, the dimensions of safety and empathy recorded similar performances (Fig. 2c and d). For these two attributes, more than 90% of the users gave a grade between 8 and 10, meaning that the treatment received by the users from the personnel, the vocabulary used, their professional performance, and the compliance with the business hours were graded as very good by the users. Regarding the attribute of Reliability (Fig. 2a), 55% of bank users graded it between very good and excellent, therefore, the users consider that the personnel perform the service in a correct and careful manner. Concerning the responsiveness attribute, this criterion was the one graded the lowest by the users.6 The results show that a significant percentage of respondents gave a non-passing grade to this dimension, which can be seen in the thickness of the left portion of the empirical distribution tail (Fig. 2b). Therefore, it is inferred that it is the lack of support and the processing time during the service that are the weak points of the financial institutions evaluated. Generally speaking, it is important to highlight two points: (a) the discrepancy between the measures of the dimensions of tangible elements (9.5) and responsiveness (8.6); and (b) the high value that the global satisfaction index recorded (9.1).7 This last indicator makes it possible to deduce that the users are satisfied with the services offered by these two financial institutions, and this is corroborated with the General assessment and what is exposed in the portion of Expectation satisfaction (Fig. 2f and g). Regarding expectation satisfaction, more than 50% of the users gave a score of 10, meaning, excellent (Fig. 2g).

Quality dimensions by financial institutionThe distributions of each of the quality dimensions were presented above, globally. However, it is necessary to ponder on the performance of each attribute by bank. In this regard and utilizing the nonparametric Kruskal–Wallis test to compare k independent samples, statistical evidence is obtained to reject each of the hypotheses “The distribution of the Reliability dimension (responsiveness, safety, empathy, tangible elements) is the same in both banks, Banamex and Bancomer (p-values equal to 0.000, 0.000, 0.000, 0.001 and 0.001, respectively). Fig. 3 shows that in each of the five dimensions, Banamex had a greater median than Bancomer. It is important to stress that the medians of the safety, empathy, and tangible elements corresponding to Banamex (Fig. 3c–e) are equal to 10.0 or are valued as excellent. Additionally, regarding the service offered by Banamex, more than 50% of surveyed users graded the elements of General assessment and Expectation satisfaction as excellent (Fig. 3f and g). On the other hand, it is also worth mentioning that the global satisfaction index, calculated with Eq. (1), was of 8.9 for Bancomer and 9.2 for Banamex.

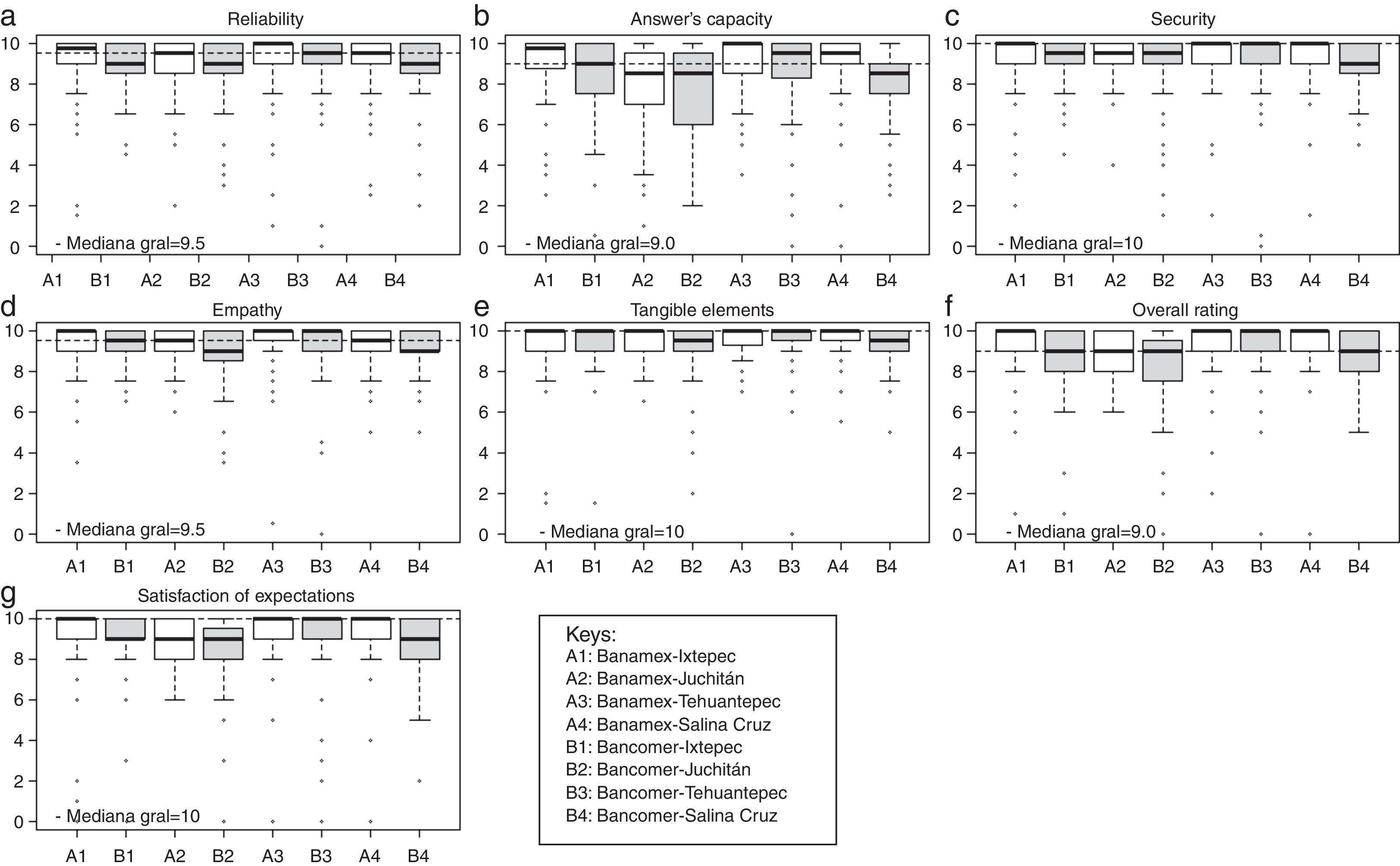

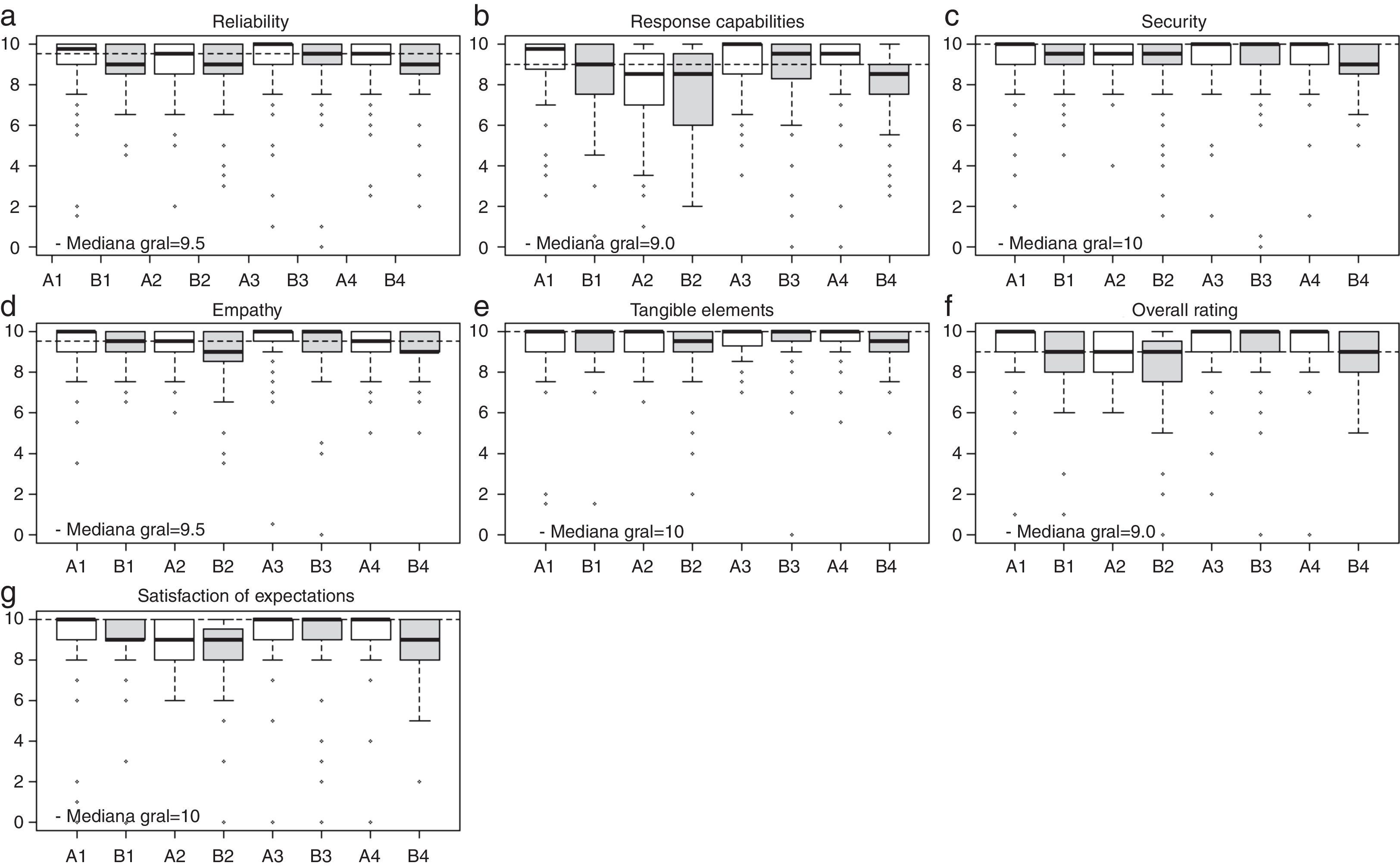

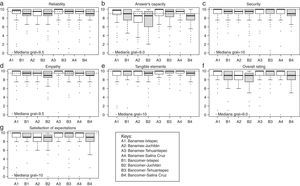

Quality dimensions by branchThe section above showed that Banamex had a better general assessment in the quality of its services according to the judgment of its clients; it is therefore expected for its branches to have higher scores than the branches of Bancomer. This is consistent with the results from the global satisfaction index, calculated with Eq. (1). The index shows that in Ixtepec, the Banamex branch received a grade of 9.3, whereas the Bancomer branch obtained a grade of 9.0; in Juchitán Banamex received 9.0, whereas Bancomer got a grade of 8.6; in Tehuantepec Banamex had a total grade of 9.4, with Bancomer having an average grade of 9.2; while in Salina Cruz Banamex summed 9.3 and Bancomer 8.8. This means that three of the four branches that had the highest grades belong to Banamex (Tehuantepec, Ixtepec and Salina Cruz) and one to Bancomer (Tehuantepec); conversely, four of the branches with the lowest grades belong to Bancomer (Juchitán, Salina Cruz and Ixtepec) and one to Banamex (Juchitán). This indicates that Tehuantepec has the best quality in banking services in the region, and Juchitán has the worst.

This is reinforced when rejecting the null hypothesis that states that the distribution of the Reliability attribute is the same in all branches (p-value equal to 0.000) with the Mann–Whitney statistical procedure. Another hypothesis that is also rejected is that of equal distribution in all branches for the dimensions of responsiveness, safety, empathy and tangible elements (p-values equal to 0.000, 0.000, 0.001 and 0.001, respectively). In the Reliability attribute (Fig. 4a), we explicitly obtained a general median of 9.5; all the Banamex branches reached or surpassed this record, with a grade of 10 in Tehuantepec, while all the Bancomer branches, except for the one in Tehuantepec, had a lower grade. Regarding responsiveness (Fig. 4b), the general median reached a grade of 9.0; three of the Banamex branches surpassed this number: Ixtepec, Tehuantepec (being once again the branch with the best grades, with 10.0) and Salina Cruz, in addition to Bancomer Tehuantepec which had a grade of 9.5. On the other hand, the offices of both banks in Juchitán and those of Bancomer Salina Cruz placed under the general median. Concerning safety, the general median is of 10.0, a figure reached by all the Banamex branches (Fig. 4c) except for Juchitán, in addition to Bancomer Tehuantepec; the rest of the Bancomer branches did not achieved this grade.

While in the Empathy dimension (Fig. 4d) a general median of 9.5 was reached, this score was obtained or surpassed by all the Banamex branches (among which the Ixtepec and Tehuantepec ones stand out with a grade of 10), along with Bancomer Ixtepec and Tehuantepec (this latter also receiving a grade of 10.0). Only Bancomer Juchitán and Salina Cruz had a median (9.0) that was lower than the general. As with safety, the tangible elements attribute (Fig. 5e) had a general median of 10.0, which was achieved in all Banamex branches, as well as in Bancomer Ixtepec and Tehuantepec. Conversely, the medians obtained in Bancomer Juchitán and Salina Cruz (also of 9.0) were lower to the general.

Regarding the general assessment of the service received, it can be observed (Fig. 4f) that the general median is of 9.0. It should be stressed that all the Banamex branches achieved a 10.0 with the exception of Juchitán, which had a grade of 9.0. As for Bancomer, only its branch in Tehuantepec achieved a 10.0, while the remaining ones had a median equal to the general. Concerning the compliance of the expectations for the service received, it should be noted that the general median was of 10.0, a figure obtained in all the Banamex branches except for, once again, Juchitán, which achieved a 9.0. This same number was observed in the branches of Bancomer, except for Tehuantepec, which achieved a 10.0.

Quality dimensions by gender, occupation, level of studies and ageAnalyzing the quality dimensions by gender through the Mann–Whitney test, we found that the hypothesis stating that the distribution of the Reliability attribute is the same for both men and women was not rejected (p-value=0.0892). The same equal distribution results were obtained for men and women in the remaining four dimensions, the item of General assessment and the one corresponding to Expectation satisfaction, where the p-values were equal to 0.902, 0.472, 0.920, 0.265, 0.976 and 0.612, respectively.

In other words, both men and women assessed each attribute that comprises the quality of the banking services with high parameters (with medians between 9.0 and 10). It is noteworthy that the median of the Expectation satisfaction item reached the level of excellence. These results coincide with those of Triadó, Aparicio, and Rimbau (1999) and with those of Ferraces, Andrade, and Arce (2000), but not with those of Sánchez (2005), Calabuig et al. (2008), Medina, Medina, and Vigueras (2011), and the Universidad de Almería (2015), where women give, more or less, higher grades than men with regard to the perception of the quality of different services.

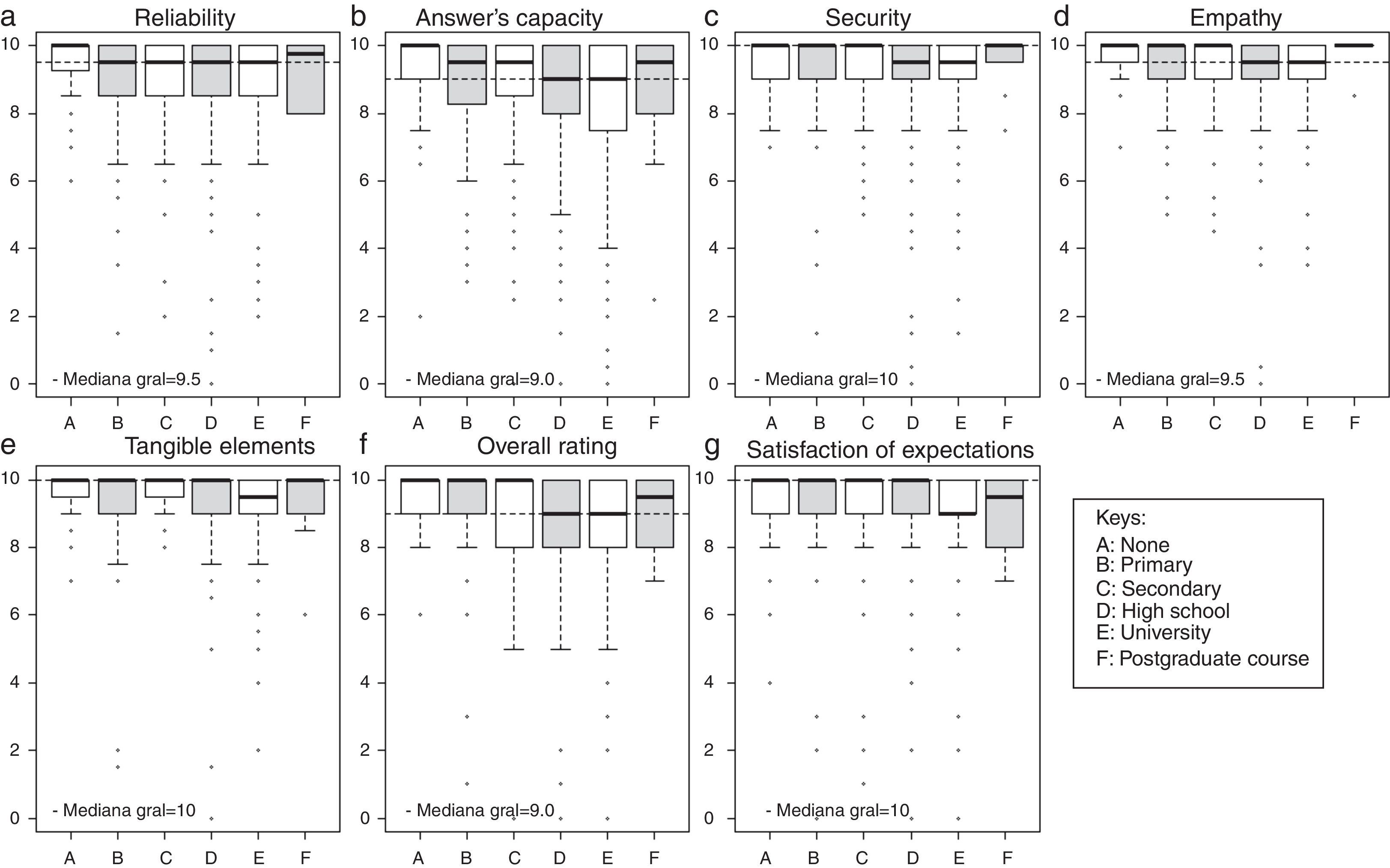

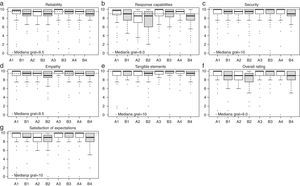

Regarding the assessment of the banking services by occupation, the results of the Kruskal–Wallis test indicate that the safety and empathy dimensions accept the hypothesis of equal distributions in each group (p-values equal to 0.595 and 0.066, respectively). Conversely, the assessments of reliability, responsiveness, tangible elements, general assessment, and expectation satisfaction depend on the occupation (p-values equal to 0.009, 0.000, 0.037, 0.045 and 0.013, respectively). The discrepancy in distributions is mainly due to the “professional” and “housewife” groups, because while professionals comprised the segment of the population with a grade median that was systematically inferior to the general, the median of the grades given by housewives was of 10 (Fig. 5). These results are aligned with those obtained by Ferraces et al. (2000) who, when evaluating the quality of the bus service, found that pensioners had a higher level of satisfaction than students and professionals. The education level variable had a similar behavior to the occupation variable. However, in this case, in the five quality dimensions, in general assessment and expectation satisfaction the null hypothesis of equal distributions (using the Kruskal–Wallis test, the p-values were: 0.048, 0.001, 0.041, 0.001, 0.006, 0.009 and 0.007, respectively) was rejected. The rejection of the null hypothesis is mainly due to the discrepancy in the assessment between the citizens with university studies and the remaining categories, as it is precisely those with a higher education that give a stricter assessment (Fig. 6). Sánchez (2005) reaches similar conclusions, whose study indicates that the higher the level of education, the lower the perception of the service quality.

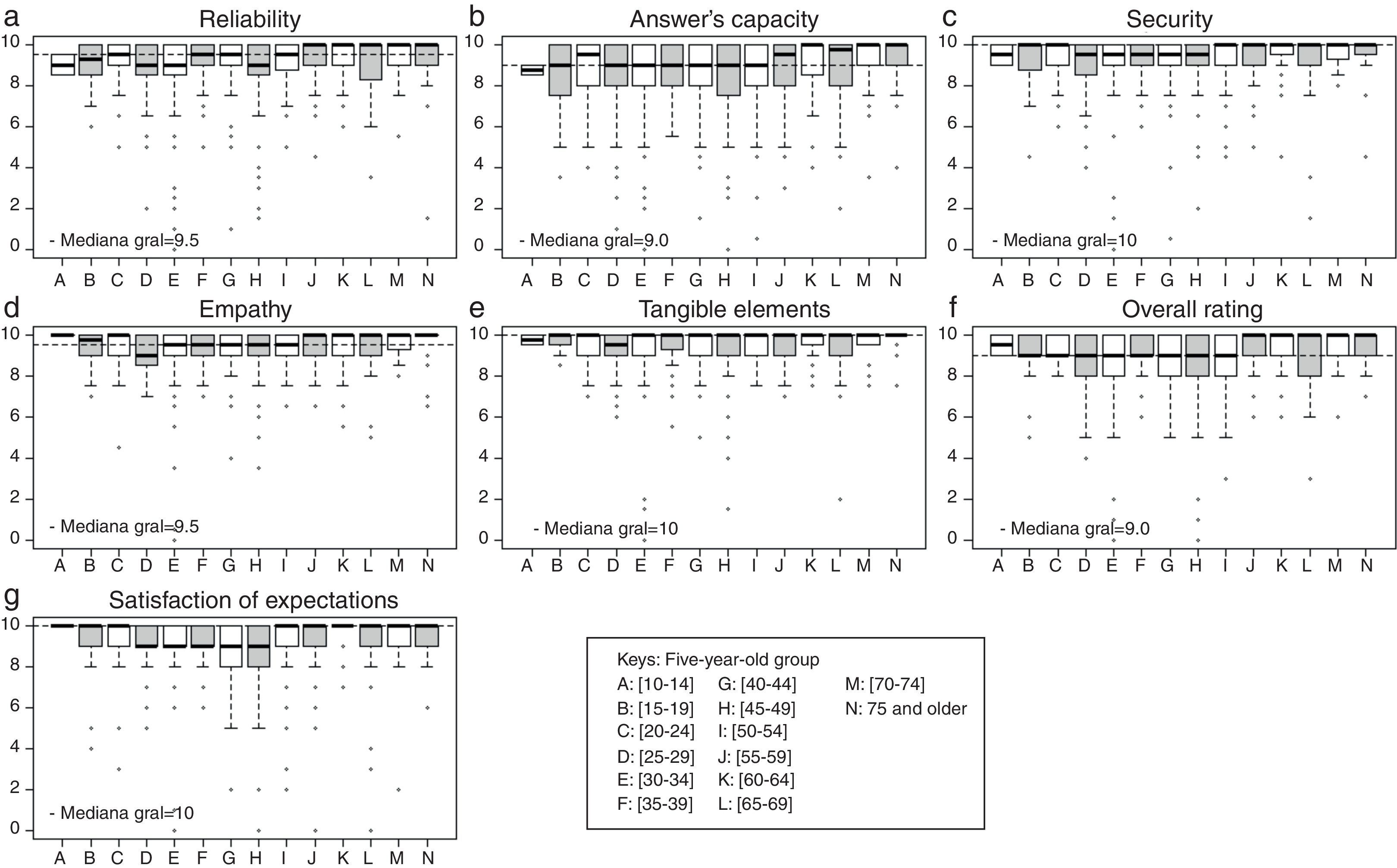

On the other hand, if the information is analyzed by age ranges, the Kruskal–Wallis test for equal distributions indicated that the same are different in the dimensions of reliability, responsiveness, empathy and in the two additional variables, general assessment and expectation satisfaction (p-values equal to 0.037, 0.001, 0.027, 0.049 and 0.007, respectively). As seen in Fig. 7, the population between 55 and 75 years of age or older, systematically grants the highest grades. Simultaneously, the one from 25 to 49 years of age was stricter when grading the services. These results are similar to those found in the studies by Triadó et al. (1999), Ferraces et al. (2000), Medina et al. (2011) and of the Universidad de Almería (2015); in them, older people gave higher grades than younger people. While in the work by Sánchez (2005), age did not influence quality perception.

ConclusionsThis investigation achieved its original objective, which was to know the perception of the clients in relation to the quality of the services offered by the main banks located in the Isthmus of Tehuantepec, particularly in the area corresponding to Oaxaca. Furthermore, the work hypothesis, which indicated that said perception was positive at a general level and by city, was confirmed. Furthermore, the results also indicate that the level of satisfaction with the services, based on a scale from 0 to 10, is elevated given that the assessment is slightly higher to 9. As it was already indicated, Banamex had a grade of 9.2 and Bancomer of 8.9.

The comparative analysis indicates that Bancomer will have to make additional efforts to increase the quality level of the customer service its systems, as two of its branches (Juchitán and Salina Cruz) did not achieve a grade of 9. At a city level, it is also necessary for Banamex and Bancomer to elevate the parameters of service in their offices in Juchitán – a municipality with festivals and traditions of the Zapotec civilization – as both are beneath the average for the region. Based on the statements by Robbins (1994), it is very probable that in this city, the regional culture is influencing the corporate culture of both banks. Furthermore, and according to Serrano and Segado (2015), it is natural for there to be differences in the measurement of quality perception in similar contexts, therefore, it is important to design models for specific investigation standards (as was done in this work).

Regarding the quality dimensions incorporated by the SERVPERF model, it is normal that, in connection to the aforementioned, 4 out of 5 Banamex branches have a better performance than Bancomer, though both organizations are rated at very acceptable levels. The clients appreciate the first-rate facilities, so the Tangible elements attribute got grades of 10 in both banks; the dimensions of safety and empathy are very close to this assessment. Therefore, this work detects an area of opportunity for improvement of both reliability and, in particularly, responsiveness; that is, the users expect to be more quickly assisted while keeping the service precise.

Nevertheless, the two special questions in the survey show that the general assessment of the service and the expectation satisfaction, in the case of Banamex, have a grade of 10, and a grade a little bit higher than 9 for Bancomer. These parameters can be considered as excellent. It is worth pointing out that the study of these dimension at a branch level shows similar results as the one presented above with relation to the total satisfaction behavior by branch. At first, it could be assumed that the fact that the clients generally and systematically give high grades to the services of the evaluated organizations is due to their low expectations.

According to the aforementioned, Calabuig et al. (2008) identify the existence of statistically significant differences for each country regarding the expectations that determine the service quality attributes. The same authors cite the work of Kim and Kim (1995), who have found relevant differences regarding the service quality expectations in accordance with gender, age, reasons for the use of the services, and type of organization. In this sense, this investigation confirms that, according to the socioeconomic variables considered, significant differences arise according to occupation, level of education, and age of the respondents. Regarding the level of education, those with university studies were slightly more demanding. Finally, it was observed that people 55 years of age or older were less strict concerning the services than the rest of the population.

In addition to these findings being consistent with other studies, as already noted, the aforementioned makes sense, as it could be expected for the professional population to have higher expectations regarding the service, given their experience and responsibilities. A similar situation occurs with the population segment that has university studies, given that with higher education it would be understood for expectations to growth. Similarly, it is understood that the older population segment, which includes a high percentage of retirees, becomes less demanding concerning dimensions such as responsiveness.

Another explanatory variable regarding the high assessment of the studied services has to do with the safety and empathy dimensions, which include aspects such as politeness, professionalism and the vocabulary used by the service provider. In this regard, Aparecida, Lopes, and Oliveira (2015) indicate that the disposition, behavior and expertise of the service providers affect the quality of the interaction, and this majorly influences the quality of the service. Castellano and González (2010) add that the quality perception of the service is linked to the treatment received. Moreover, Triadó et al. (1999) state that the most important factor in the provision of services is represented by human resources; complementary to this, in the studies by Calabuig et al. (2008), Cevallos (2011), and Medina et al. (2011) the personnel is positively assessed, particularly concerning politeness. This same situation occurs in this case study where, additionally, the characteristics of the context promote a very close interaction, almost familiar, between clients and service providers.

What is clear after this investigation is that there is an absolute need to permanently evaluate the quality of the most relevant services provided by public and private organizations in the Isthmus of Tehuantepec. Although this represents a first-order academic activity, by opening a new and thought-provoking line of investigation and establishing the corresponding communication and feedback channels, we will be helping generate a true quality philosophy and an improvement in public and business management in the region.

The market economy that defines present times, calls for companies – regardless of their sector of activities – to operate with criteria that adhere to efficiency, quality, competitiveness and innovation and that consider the global environment. In this regard, it is convenient to remember that, according to the Mexican Institute for Competitiveness (IMCO for its acronym in Spanish) (2012), Oaxaca is the least competitive state of the country (this estimation includes, within the area of innovation in the financial sectors, the growth of the GDP in the service sector) and that, according to the World Bank (2014), this state places 24th at a national level regarding the ease to start a business. Therefore, the reason to continue with this kind work is clear.

For practical purposes, it will be referred to as Bancomer in this work.

Peer Review under the responsibility of Universidad Nacional Autónoma de México.

The original design of the model stipulates that the statements that correspond to the responsiveness and empathy criteria were negatively formulated, so before being statistically processed, their grades are inverted.

As indicated by the authors, it is convenient for the number of items to adapt to the specific needs of each study (Jaráiz & Pereira, 2014).

As reference and as indicated by Calabuig, Quintanilla, and Mundina (2008) and Rodríguez, Agudo, García, and Herrero (2003), an adapted model of the 13-item SERVQUAL was applied to analyze football events.

It is worth mentioning that at the moment of the survey, the extreme positions are shown to the client. On the other hand, the suitability of using the numeric scale 0–10 instead of 1–10 lies on the fact that its middle point is number five. Furthermore, sometimes clients who are extremely unhappy with the service wish to rate the service with zero and this makes it possible to obtain direct percentages from the scale (Jaráiz & Pereira, 2014).

Other investigations that have used the SERVPERF methodology to evaluate service quality, such as those by Montaña, Ramírez, and Ramírez (2002), Cevallos (2011) and Alves et al. (2015) state that responsiveness is the worst evaluated dimension by the users. This is important because, as indicated by Sánchez (2005), the longer the waiting time, the lower the perception of satisfaction.

This figure coincides with the results of other investigations, thus, Vega (2008) reports a 98.2% of users satisfied with the quality of the health services; Medina et al. (2011) identify that a 98.2% of social service clients also grade their general satisfaction with high scores; whereas the Universidad de Almería (2015) states that the general average score of its administrative services achieved a score of 9.3 on a scale of 1–10.