Speculative price bubbles are defined as a significant deviation between an asset's intrinsic value and its market value and in this paper it refers to stock values. Literature about the theme has noted the existence of bubbles in various types of markets and their respective assets. A great deal of effort has been directed toward identifying bubbles in stock price indices. However, few research endeavors focus on assets as the unit of analysis. Studies about stocks in Brazil have identified the presence of bubbles in IBOVESPA (São Paulo Stock Exchange Index). Given this context and assuming that the speculative bubbles are present in the Brazilian stock market, this research is focused on the following question: Is there evidence of the existence of speculative bubbles in stock prices traded on the São Paulo Stock Exchange? Econometric tests were performed on twenty-seven stocks, based upon their positions each semester, for the period between the first semesters of 1990 until the first semester of 2010. The nominal values of the selected stocks were adjusted for inflation by the IPCA (Brazilian Consumer Price Index). In order to identify the presence of bubbles, we applied the Johansen non-cointegration test and/or the Granger non-causality test between the intrinsic value, dividends and interest on equity capital, and the market value (semester closing price) of the stocks. The primary findings reveal a presence of bubbles in twenty of the twenty-seven stocks, at a 5% significance level. Of the seven stocks not showing evidence of bubbles, six are financial institutions. In five stocks the tests reveal Granger causality stemming from the market value toward the intrinsic value. The study findings are consistent and contribute with previous research in the literature and, are useful for investors, financial institutions, academics, government agents, and traders.

Las burbujas de precios especulativas se definen como una desviación significativa entre el valor intrínseco de un activo y su valor de mercado y en este articulo se refiere a los valores de las acciones. La literatura sobre el tema ha señalado la existencia de burbujas en diversos tipos de mercados y sus respectivos activos. Un gran esfuerzo se ha dirigido hacia la identificación de burbujas en los índices de precios de las acciones. Sin embargo, pocos esfuerzos de investigación se centran en los activos como la unidad de análisis. Los estudios sobre existencias en Brasil han identificado la presencia de burbujas en IBOVESPA (Índice de Bolsa de São Paulo). Dado este contexto y suponiendo que las burbujas especulativas están presentes en el mercado de valores brasileño, esta investigación se centra en la siguiente pregunta: ¿Existe evidencia de la existencia de burbujas especulativas en los precios de las acciones cotizadas en la Bolsa de Valores de São Paulo? Las pruebas econométricas se realizaron en veintisiete acciones, con base en sus posiciones cada semestre, para el período comprendido entre los primeros semestres de 1990 hasta el primer semestre de 2010. Los valores nominales de las acciones seleccionadas fueron ajustados por inflación por el IPCA (Índice de precio). Para identificar la presencia de burbujas, se aplicó la prueba de no cointegración de Johansen y / o la prueba de no causalidad de Granger entre el valor intrínseco, los dividendos y los intereses sobre el capital social, y el valor de mercado (precio de cierre semestral). Los hallazgos primarios revelan una presencia de burbujas en veinte de las veintisiete poblaciones con UN nivel de significación del 5%. De las siete acciones que no muestran evidencia de burbujas, seis son instituciones financieras. En cinco poblaciones las pruebas revelan la causalidad de Granger, derivada del valor de mercado hacia el valor intrínseco. Los resultados del estudio son consistentes y contribuyen con investigaciones previas en la literatura y son útiles para inversionistas, instituciones financieras, académicos, agentes gubernamentales y comerciantes.

The possibility for the existence of speculative bubbles in assets, especially in stock markets, always exists in the business world (Al-Anaswah & Wilfling, 2011; Almudhaf, 2016; Driffill & Sola, 1998; Evans, 1991; Madrid & Hierro, 2015; Shleifer, 2000). The existence of bubbles primarily affects those who invest in stocks, and also results in consequences that are almost always disastrous for the economy as a whole. According to Almudhaf (2016), Blanchard and Watson (1982) a speculative bubble can be defined as a deviation between the intrinsic value and the market value of an asset. In stock transactions the important values are: (i) the intrinsic value [IV] of the stock as a function of the present value of a series of expected dividends (Dividend Valuation Model, or DVM); the Market Value of the stock as traded between parties in a stock exchange (Dezhbakhsh & Demirgue-Kunt, 1990; Evans, 1991; Madrid & Hierro, 2015; Xie & Chen, 2015). Thus, the challenge for researchers, investors and the formulators of economic policy is to understand how speculative bubbles occur; especially, what causes deviation between Market Value and Intrinsic Value and at what point in time does deviation occur. A complete understanding of this phenomenon can be decisive in a country's economic stability, seeing that stock markets have such important roles, especially as a locus for companies to obtain financial resources. On the other hand, monetary authorities and regulatory agencies, so long as they understand the phenomenon, can anticipate the effects and implement measures to prevent the formation of bubbles. In this way, they can minimize or avoid the adverse effects that would otherwise occur (Tran, 2016).

One of the more striking examples about the effect bubbles can have on an economy, in this case the USA, is the “dot com” crisis of the year 2000, and more recently in the “subprime mortgage” debacle. Another historical incident studied as a classic case of economic bubbles was the Dutch tulip episode that happened in the 17th century. From Sornette's (2004) perspective, the history of bubbles has been repeated numerous times throughout the centuries. There have been few changes in their characteristics and all have borne a resemblance to the Dutch tulip scenario. The bubble theme, in general, has been approached from the perspective of historical analysis (Garber, 1990, 2000; Madrid & Hierro, 2015) and empirically using quantitative models with the intent of identifying their occurrence (Asako & Liu, 2013; Balcilar, Gupta, Jooste, & Wohar, 2016; Dezhbakhsh & Demirgue-Kunt, 1990; Dufwenberg, Lindqvist, & Moore, 2005; Leverton, 2002). Studies about bubbles, concerning various types of assets found in the economy over time, have occupied researchers from various literature areas. Understanding why a change in market asset prices in relation to their intrinsic values is of utmost importance, because until now, a methodology has not been developed that is capable of predicting such fluctuation of prices (Chang, Gil-Alana, Aye, & Ranjbar, 2016; Taylor, 2016).

Research into verifying the existence of such bubbles in Brazil, specifically in assets traded on BOVESPA (São Paulo Stock Exchange) in comparison with other exchanges, is still in its beginning stages. The results of existing research, such as Martin, Kayo, Kimura, & Nakamura (2004), De Medeiros and Daher (2008), Fernandes and De Medeiros (2009), Gomide (2009), Nunes and Da Silva (2009), Taylor (2016), suggest that there is evidence for the presence of bubbles in the São Paulo Stock Exchange Index – IBOVESPA (BOVESPA, 2004).

The studies making use of IBOVESPA data targeted their efforts at empirically verifying the occurrence of bubbles at an aggregated level, expressed by an index, instead of isolating the companies or their stocks. It is therefore appropriate that a new direction be taken in research, focusing instead on stocks of publicly traded companies, independent of the level at which they are classified on BOVESPA. Hence, we believe that it is logical to investigate the occurrence of speculative bubbles in stocks of companies that compose the BOVESPA Index (IBOVESPA). Given this frame of reference, the research question that guides this study is: Is there evidence for the existence of speculative bubbles in the prices of stocks that are traded on the São Paulo Stock Exchange?

The general objective is to investigate the existence of speculative bubbles in prices of stocks that are traded in the São Paulo Stock Exchange. An important justification for this research, one that offers motivation, is that there have been few works concerning this theme, especially in regards to companies traded on BOVESPA. Results of this type of study may be most useful to agents acting in the stock market (Martin & Edward, 2009), to regulatory agencies, the government, the Central Bank, financial and research institutions, by expanding the scope of analysis due to the great number of stocks that compose the Brazilian stock market. Following this introduction, the article is composed of: (i) a second section, which lays out the theoretical background discussing intrinsic value and market value, speculative bubble definitions, and main evidence found in studies about bubbles in BOVESPA; (ii) a third section detailing the methodology; (iii) the results and discussion; and (iv) final considerations.

Theoretical–empirical reviewIntrinsic value and market valueDiscussion concerning bubbles in stock prices requires an understanding of the two basic concepts: Intrinsic Value (IV) and Market Value (MV) (Evans, 1991; Kasser & Ryan, 1993, 1996; Malinovskii, 2014; Singh & Yerramilli, 2014; Sun & Liu, 2016; Tiwari, 2016; Xie & Chen, 2015). Determination of the intrinsic value, from the perspective of capital market operatives, assumes the premise that the intrinsic value of an asset is the result of evaluating various fundamental financial variables, including: profit, dividends, financial structure, market perspectives, and management quality. The formation of an asset's intrinsic value is based upon the assumptions that the economic agents hold rational expectations, behaving according to the Muth (1961) model, and that the expected returns for the asset will occur over time.

Literature about speculative bubbles (Al-Anaswah & Wilfling, 2011; Anderson & Brooks, 2014; Madrid & Hierro, 2015) has mostly used the present value of dividends as a representative variable for the intrinsic value of stocks. For Smith, Suchanek, and Williams (1988), the actual value of a specific stock converges with a value equivalent to the flow of expected dividends for that stock, as adjusted by a risk factor related to the business and brought to the present value. However, since the present value of the expected dividends depends upon the relative risk factor adjusting the stock, it can suffer from deviations according to investors’ expectations. Expressing a conflicting perspective, Aglietta (2004) argues that dividends are not the best variable for determining the returns expected by investors.

Aglietta justifies this by explaining that many of the elements that compose the calculation of the current net present value (NPV) for a company are rarely known in their entirety beforehand. For Stiglitz (1990) there are three factors that impede the correct evaluation of an asset according to its intrinsic value:

- i.

The estimation of returns expected over time;

- ii.

The difficulty in correctly evaluating the asset's end value;

- iii.

The difficulty in correctly determining the discount rate that should be used in estimating the present value of future income.

Aligned with the operational practices employed in previous studies, this study adopts the amount of dividends paid in cash, and due to the specifics of the Brazilian market, the interest on equity (IOE) as the representative variables used to calculate a stock's intrinsic value. Interest on equity capital represents a way of profit distribution and is calculated by multiplying the Long-term Interest Rate (LTIR) for the period by the company's net present value (adjusted by the deduction of the unrealized revaluation reserve). The resulting value is the sum of IOE and payments to shareholders (Teles & Nagatsuka, 2002).

The market values of stocks traded on BOVESPA are represented by their quotes as listed on the Stock Exchange. The stock prices, according to BOVESPA (2004, p. 4) “…are formed on the trading floor, according to the dynamics of the forces of supply and demand for each stock, and which makes the listing quote a reliable indicator of the value that the market has attributed to different stocks”. For Luquet and Rocco (2005), Coslor (2016), the market quote, price, or value represents a data that reflects the average expectation between buyers and sellers. A quote's recurrence period is verified according to investors’ interests, and can be observed in frequencies that encompass observations within a single trading day (minutes or hours), multiple days, weeks, months, and reaching periods of more than a year.

Bubble definitionsThe theoretical basis for understanding the phenomenon of speculative bubbles can be traced to Keynes (1936) perspective that compares the stock market to a beauty pageant. As in a beauty pageant, in the stock market there are speculators seeking to anticipate what will be the market's opinion in the near future, trying to predict the opinion of the average investor, looking to gain profits by taking advantage of sudden increases or losses in values of stocks and bonds (Al-Anaswah & Wilfling, 2011; Anderson & Brooks, 2014; Tran, 2016).

Blanchard and Watson (1983) demonstrated, in pioneering research, a perspective for approaching bubbles that affirms fundamentals are only one part of determining stock prices. They define two types of bubbles: (i) deterministic and (ii) stochastic. In the first case, bubbles grow exponentially, which signifies that negative bubbles are not possible, and implicates the possibility of the existence of a negative future price. In the second case, bubbles emerge with a probability of π of continuing or a probability of 1−π of collapsing. The authors also describe bubbles as a type of Ponzi mechanism, suggesting that they can only emerge if the market consists of successive generations of participants. The authors’ primary argument is that bubbles have a higher probability of emerging in markets where the fundamentals are difficult to access, such as the gold market.

Tirole (1985) and Tran (2016) concluded that the presence of bubbles occurs due to the existence of infinite, overlapping generations of investors that acquire assets with a finite planning scope, while the rate of the economy's growth is greater than or equal to the existing rate of return. In the opinion of Diba and Grossman (1987) a rational bubble in a stock market starts “on day zero” (the first day of business) and should be continuously overvalued in relation to its market fundamentals; once collapsed, it cannot reappear. According to Shiller (2000: XIV), a bubble comes from “…a situation in which temporarily high prices are sustained in part by the enthusiasm of the investors, and not by an estimation that is consistent with real value.” The author explains that this type of behavior on the part of investors is similar to amplifier mechanisms or feedback loops. Replicating these mechanisms, the initial increase in price is caused by a precipitating effect, such as a fall in inflation. This initial price increase results in higher investor demand; beginning an escalating cycle of increases in demand and price.

The second round of price increases generates the third, the fourth, and so on. In this way, the initial impact of precipitating factors is amplified in much higher price increases than that which the factors themselves should elicit. Investors observing the movement of stock prices in the same direction over a long period of time believe that the tendency is representative and capable of provoking changes in the stock fundamentals.

Sornette (2004, pp. 282–283), based upon various bubbles in emerging markets between 1990 and 2000, enumerates five possible stages during the formation of bubbles, which demonstrate the link with Shiller's (2000) feedback loop:

- i.

The bubble starts slowly with some increase in production or sales (or demand for a specific commodity) in a relatively optimistic market;

- ii.

The attraction of investments with high profit potential leads to increased investments, possibly from new sources; frequently international investors, inflating the prices;

- iii.

This in turn attracts less sophisticated investors, and additionally, lowers the profit margins, which increase the demand for stocks more rapidly than the market's real interest rate;

- iv.

In this stage, market behavior is far removed from the reality of the service and industrial production;

- v.

As the prices increase substantially, the number of new investors entering into the speculative market diminishes and the market dives into a phase of great anxiety, until the point at which the instability is revealed and the market collapses.

The author concludes that the robustness of this scenario is rooted in investors’ psychology and involves a combination of imitative behavior and greed, in addition to an overreaction to bad news in a period of instability.

Primary evidence in bubble researchResearch about speculative bubbles encompasses the most diverse types of markets and respective assets; among them real estate markets, the currency exchange markets, and stock markets. Noussair, Robin, and Ruffieux (2001) and Taylor (2016) created an experimental stock market with fundamental values that were kept constant, in order to verify the presence of bubbles. The primary result indicated that the constant disbursement of dividends increases the probability of bubbles occurring.

Brooks and Katsaris (2003) investigated the presence of bubbles in the London Stock Exchange (LSE) in the 1990s by employing three distinct metrics: (i) variance bounds tests; (ii) bubble specification tests; (iii) cointegration tests based upon ex ante and ex post data. The results revealed that prices diverged significantly from their fundamentals, indicating the presence of bubbles. Bohl (2003) verified the presence of bubbles that burst periodically in the American stock market. Dividing the data into two sub-samples (1871–1995 and 1871–2001), the author found the presence of bubbles only in the second sub-sample. Chan and Woo (2006) studied the presence of inflationary bubbles in the period between wars (1920–1923) in Germany, Hungary, Poland, and Russia. The authors found evidence of a stationary process of regime change in the dynamic demand for money and no inflationary bubbles for the countries studied.

Investigating the Internet (dot com) bubble, Hong, Scheinkman, and Xiong (2008) developed a model for working with the hypotheses: (i) asset price bubbles occur in periods of hesitation about new technologies; (ii) after the final internet bubble, the media and regulatory agencies placed most of the blame on the biased opinions of the analysts who manipulated the opinions of inexperienced investors. Based upon their findings, the authors point out the existence of two types of analysts: conservatives and tech-savvies. The former were described as not being knowledgeable about new technologies and consequently did not gain market share. The latter possessed significant knowledge about new technologies, and were therefore listened to by investors. The conservative analysts, according to the study, in order to maintain market share published erroneous analyses and predictions with strong bias for overestimation of returns on investments.

Data on mutual funds operating during the Internet bubble were the basis of a study by Greenwood and Nagel (2009), which investigated the hypothesis that inexperienced investors have an important role in the formation of stock price bubbles. The age of investors served as a proxy for the amount of investment experience. The results revealed that funds controlled by younger managers had greater investments in technology stocks than funds controlled by older managers; showing this type of behavior did align with less-experienced individual investors.

Xiao and Park (2009) examined the role of rational speculative bubbles in the formation of the price index for apartments in Seoul, South Korea, between the years 1998–2006. The results revealed that rational bubbles as a proxy are significant price drivers. However, neither latent information nor rational bubbles are sufficient enough to explain the increase in prices, even in conjunction with the fundamentals observed. Ferreira (2009) investigated the presence of bubbles in exchange rates of industrialized countries, through means of Markov regime models. The results revealed that these mechanisms are not sufficient for identifying bubbles driving exchange rate behavior, besides the existence of non-linearity and various other regimes, suggesting that the linear monetary models are not adequate for examining movements in exchange rates.

Anderson, Brooks, and Katsaris (2010) tested for the presence of bubbles that partially collapse, using the Standard and Poor's (S & P 500) sector indices through means of a regime change approach. They used monthly data from the period of January 1973 to June 2004. The authors employed an augmented regime change model, which included business volume as a technical indicator to improve the model's ability to capture the temporal variations of the returns. It was discovered that more than half of the indices of market capitalization and seven of the ten sector indices exhibit some bubble behavior during the studied period. In the context of the study, for the authors, the abnormal business volume is significant as a predictor of returns.

Primary evidence in BOVESPAResearch into speculative bubbles in the Brazilian stock market, in comparison with the other centers, is in its initial stages (Taylor, 2016). We encountered seven studies on this specific topic. The results of the investigations suggest that there is evidence of speculative bubbles in the Brazilian stock market. Martin et al. (2004) studied the presence of rational speculative bubbles, beginning with the identification of regime change in the process of generating returns in the Brazilian stock markets after implementation of the Real Plan (a fiscal, financial and economic plan initiated in 1994). It used Markov regime-switching models. The main results suggested the dynamics of the returns generating process as a function of “bull market” and “bear market” regimes. The regimes were separated into: (i) initial and final phases of the growth cycle (bull market); and (ii) the growth phase (bear market). The separation was able to more coherently demonstrate the concept of a speculative bubble, because there was a non-linear relationship between stock prices and their fundamentals.

De Medeiros and Daher (2008) investigated if the volatility verified in the Brazilian stock market during the period from 1999 to 2006 could be attributed to the presence of speculative bubbles. The results, obtained by applying unit-root and cointegration tests, suggest that there is evidence for the presence of bubbles during that period. Covering the period from 1994 to 2007, a study conducted by Fernandes and De Medeiros (2009) investigated if there was evidence of bubbles in BOVESPA. They used the data portfolios from BOVESPA and 17 activity sectors as conforms to the classification found in the Economatica database. To enact the study, they employed IBOVESPA as a proxy for the average stock price and developed a dividends index based upon the stock portfolio that composed IBOVESPA. They used Engle-Granger and Johansen cointegration tests on the data to verify if the indices (IBOVESPA and the dividends index) maintained a balanced relationship over time. The test results indicate cointegration non-existence between IBOVESPA and the dividends index. The same result was obtained with the sector tests. The test results (IBOVESPA, dividends index, and 17 Economatica database sectors) suggest the possibility of bubble occurrence for the studied period of time.

In order to test the hypothesis for the existence of bubbles in the BOVESPA Index (IBOVESPA), Gomide (2009) developed a model that used a variable interest rate to calculate the present value of the stocks that comprised the index. The author also used a structural change model for two separate periods (1995 and 2008) in order to test for the existence or absence of bubbles. The results of the test suggest bubbles existed in the first period. However, the results of the second period test did not offer a good fit, which prevented making any inference about the existence of bubbles during it. Research conducted by Martin & Edward (2009) investigated the existence of rational speculative bubbles in nine stocks, using a present-value model to estimate prices and dividends with a variable discount rate. Company stock prices were used as a reference for company selection as research objects. The quantitative model used was a panel data techniques with unit roots and cointegration for the period from 1994 to 2008. The findings allowed for a partial validation of the present-value model.

The existence of rational bubbles in the monthly series of the BOVESPA index was investigated by Nunes and Da Silva (2009). The results indicated, for the analyzed period, the existence of both explosive bubbles and bubbles which burst periodically. The occurrence of the bubbles which burst periodically was identified by applying the consistent Threshold Autoregressive (TAR) and Momentum Threshold Autoregressive (M-TAR) models. The consistent M-TAR showed the best fit, validating the present-value model only in the long-term, while the fit from short to long-term was asymmetric. In the short-term the stock prices tended to deviate from their fundamentals (flow of paid dividends) forming bubbles that ended in crashes. Therefore, it means that bubbles tend to be generated by extrinsic factors and not just by a non-linear intrinsic relationship between stock prices and dividends.

The existence of bubbles in the stock market, the object of a study conducted by Silva (2009) was divided into two parts. The first part used event study methodology to analyze 106 IPO's (Initial Public Offerings) that occurred in BOVESPA during the years 2004–2007. The second part applied four statistical tests, using the BOVESPA index from 1999 to 2008 as a source of secondary data. The research findings of the event study showed evidence of overvaluation of stock prices on the first days of trading. On the other hand, the results of the four statistical tests showed evidence for the presence of bubbles in the formation of the BOVESPA index for the period 1999–2008.

MethodologyPopulation, sample and data collectionIn order to carry out this investigation, we used secondary data available from the Economatica database, from a period starting the first semester of 1990 until the first semester of 2010. During the period of this research, the Economática database had active information on six hundred and twenty-nine (629) shares of companies listed on the São Paulo Stock Exchange, these data being related to domestic and foreign companies. Of these actions, thirty paid their investors more than eighteen years, a period necessary for the formation of a database with sufficient information to perform the econometric tests. Of these thirty shares, only twenty-seven (27) paid their investors regularly during the period considered, with no intervals exceeding four semesters without paying dividends to its shareholders. This criterion was used so that there were no distortions in the results of the econometric tests, since a high number of null observations could lead, for example, the existence of cointegration vectors without the existence of causality among the variables, which, as observed In the literature, would be an inconsistent result in econometric and empirical terms. However, only 27 shares of companies provided information sufficient enough to conduct the tests for bubble identification.

Intrinsic value (IV), for the purpose of this research, was determined as the sum of the amount of dividends paid combined with the total payments and interest on equity capital in each semester. Dividend values and interest on equity capital were adjusted according to the variation found in the Brazilian Consumer Price Index (IPCA); a procedure automatically performed by Economatica. Market value (MV), as used in this research, was the closing quote on the last trading day of June for the first semester, and the last day of December for the second semester. Adoption of these criteria resulted in 41 observations for each variable (IV and MV), meeting the requirements demanded for the application of Johansen cointegration and Granger causality tests.

Data treatmentThe techniques used to verify the existence of stock bubbles consisted of the Johansen cointegration and Granger causality tests. Evidence of bubble phenomenon in a specific stock occurs when the Johansen test verifies no cointegration between the IV and MV (Diba & Grossman, 1988), and the Granger test results in non-causality (De Medeiros & Daher, 2008).

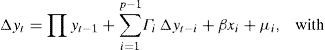

Johansen cointegration testThe Johansen cointegration test allows verification if two or more variables are synchronized. When it happens that time series are cointegrated, it means that the parameters resulting from the regressions are not spurious and that a long-term equilibrium does exist between them (Johansen, 1991, 1995). Verification of the existence of cointegration between stock prices and dividends requires that the tests are applied in the proscribed steps, as follows. Initially, an ADF (Augmented Dickey–Fuller) test is applied, in order to verify if the time series IV and MV of a stock are I(1), meaning integrated of order 1, and thus meet the requirements for cointegration (Gujarati, 2006). If so, then the method proposed by Johansen (1988) and Johansen and Juselius (1990) is applied, based upon the procedure for maximum likelihood estimation. This is briefly elaborated here: If there is a Vector Auto-Regression (VAR) of order p, such that:

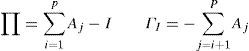

where Yt is the vector k×1 of non-stationary variable I(1), xt is a vector of deterministic variables, and ut is a vector of random errors. This VAR (p) can be rewritten as:According to the Granger representation theory, if the matrix of the coefficients Π has a reduced rank where r<k, then there exist the k×r matrices α and β, both with rank r, such that Π=αβ′ and β′yt∼I(0), where there are r number of cointegrating relations (the cointegration rank) and each column of β is a cointegrating vector. The elements of α are known as adjustment parameters in the vector error correction model. The Johansen test consists of estimating the matrix Π based upon an unrestricted VAR and testing if it is possible to reject the restrictions implied by a reduced rank for Π (QMS, 2004). Additionally, as proposed by Johansen and Juselius (1990) and Johansen (1991), it tests for verifying the number of characteristic roots for the matrix Π statistically different from zero that have their distributions asymptotically derived; with one of them converging with the matrix trace and the other the matrix's maximum eigenvalue. Thus, the statistics for the test of maximum likelihood, in order to verify the null hypothesis “there exists a maximum of k cointegrating vectors” against the alternative “the number of these vectors is greater than k” are given by the trace statistic designated in (4):

In Eq. (4), λˆi is the estimation of the characteristic roots (or autovalues) obtained by the matrix Π, and T is the number of observations. The statistic of the test for maximum likelihood used to verify the null hypothesis “there exist exactly k cointegrating vectors” against the alternative “the number of these vectors is equal to k+1” is given by the maximum autovalue statistic, as can be seen in (5):

Johansen and Juselius (1990) supplied critical values for (4) and (5) in three distinct situations, depending upon the deterministic terms that appear in (2).

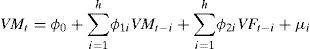

The Granger causality testThe Granger causality test, when given two time series Xt and yt, assumes for the prediction of the respective variables that the relevant information is only contained within their relevant time series. Thus, one stationary time series Xt necessarily causes, according to Granger, another stationary time series Yt, if the best statistically significant predictors for Yt, can be obtained by including the lagged values of Xt with the lagged values of Yt (Carneiro, 1997). At the moment in which the IV and MV time series of a stock, for example, a share of a given class for a specific company, are stationary series, they are meeting the fundamental requirement of the Granger causality test. The causality test, in the Granger sense, of the IV for the MV of a stock, conforms to the following expression:

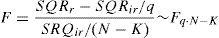

In Eq. (6), ϕ1i and ϕ2i are, respectively, the coefficients of the lagged variables VMt−i and VFt−i, while μi is the white noise error term. We define the number of lags to be included (h and j) in the Granger causality test pattern according to the criteria defined by Akaike (1974) and Schwarz (1978) which are obtained by estimating an unrestricted VAR between the variables in question. The null hypothesis is that the IV does not cause the MV, in the Granger sense, to be rejected, if the coefficients ϕ2i are jointly different from zero. The statistic for this test is given by:

In Eq. (7), N is the number of observations, SQRr is the sum of the squared residuals for the restricted model, SQRir is the sum of the squared residuals for the unrestricted model, k is the number of estimated parameters in the unrestricted regression, and q is the number of restrictions. If Fcalculated>Fcritical is at α % level of significance, rejects the null hypothesis; in the opposite instance, it is accepted. In order to test the contrary hypothesis, that IV does not cause MV in the Granger sense, it is sufficient to estimate an equation similar to (7), using MV as the dependent variable and verifying if the coefficients of VFt−i are jointly significant.

Results and discussionThis section presents the results and analysis of the quantitative tests. The initial purpose is to identify the presence of unit roots by means of the Augmented Dickey–Fuller (ADF) hypothesis test (1979, 1981). Thereafter, the goal is to identify the existence or absence of speculative bubbles in the prices of stocks traded on BOVESPA, by applying the Johansen cointegration and/or Granger causality tests.

Dickey–Fuller unit root hypothesis testsThe starting point for an econometric analysis is to verify if the time series for the stocks (MV and IV) are stationary. In order to obtain a consistent result of stationarity in the time series analyzed, we used the ADF test (Dickey & Fuller, 1979, 1981) in order to determine the number of unit roots. Therefore, we individually tested each of the following hypotheses for each stock:

- i.

H0: IV has one unit root; i.e., the series is non-stationary (it shows a tendency in its series history);

- ii.

H1: IV does not have a unit root; i.e., the series is stationary (it does not show a tendency in its series history);

- iii.

H0: MV has one unit root; i.e., the series is non-stationary (it shows a tendency in its series history);

- iv.

H1: MV does not have a unit root; i.e., the series is stationary (it does not show a tendency in its series history).

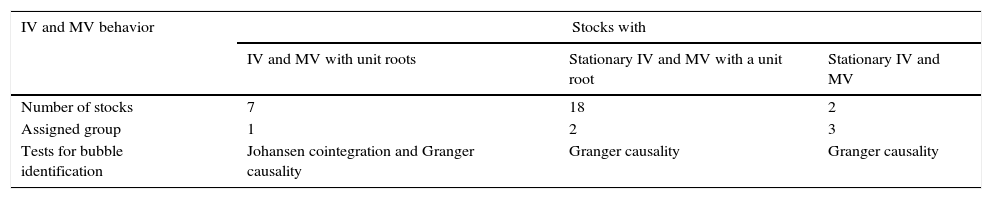

Table 1 displays the details of the test results, under the null-hypothesis of the presence of unit roots, with a distribution according to Fuller (1976) for the critical statistical values ADF at 5%, for the variables IV and MV:

ADF test results.

| IV and MV behavior | Stocks with | ||

|---|---|---|---|

| IV and MV with unit roots | Stationary IV and MV with a unit root | Stationary IV and MV | |

| Number of stocks | 7 | 18 | 2 |

| Assigned group | 1 | 2 | 3 |

| Tests for bubble identification | Johansen cointegration and Granger causality | Granger causality | Granger causality |

Table 1 shows the three groups of stocks that came out of the tests identifying the bubbles: (1) 7 stocks where the IV and MV had a unit root; (2) 18 stocks with a stationary IV and a MV with a unit root; (3) two stocks with stationary IV and MV. The groups are: Group 1 (Johansen cointegration and Granger causality); and Groups 2 and 3 (Granger causality).

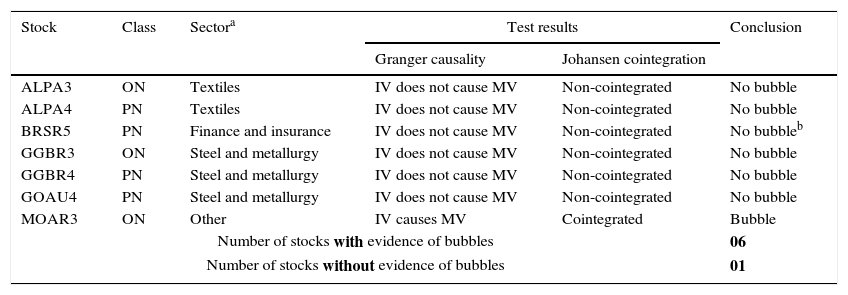

Analysis of Group 1Group 1 is comprised of stocks with IV and MV having unit roots, allowing for the use of both Johansen cointegration and Granger causality tests. Table 2 details the stocks and the results of the test at 5% significance.

Test results for the detection of bubbles in Group 1.

| Stock | Class | Sectora | Test results | Conclusion | |

|---|---|---|---|---|---|

| Granger causality | Johansen cointegration | ||||

| ALPA3 | ON | Textiles | IV does not cause MV | Non-cointegrated | No bubble |

| ALPA4 | PN | Textiles | IV does not cause MV | Non-cointegrated | No bubble |

| BRSR5 | PN | Finance and insurance | IV does not cause MV | Non-cointegrated | No bubbleb |

| GGBR3 | ON | Steel and metallurgy | IV does not cause MV | Non-cointegrated | No bubble |

| GGBR4 | PN | Steel and metallurgy | IV does not cause MV | Non-cointegrated | No bubble |

| GOAU4 | PN | Steel and metallurgy | IV does not cause MV | Non-cointegrated | No bubble |

| MOAR3 | ON | Other | IV causes MV | Cointegrated | Bubble |

| Number of stocks with evidence of bubbles | 06 | ||||

| Number of stocks without evidence of bubbles | 01 | ||||

The details from Table 2 display that Group 1 is composed of Ordinary stocks (ON) and Preferential stocks (PN) belonging to companies acting in the following Economatica sectors: textiles, finance and insurance, steel and metallurgy, and other. De Medeiros and Daher (2008) argue that the Granger non-causality in the direction of Intrinsic Value (IV) toward Market Value (MV) indicates evidence of the existence of bubbles in the prices of a specific stock; which is verified at 5% significance in six of the seven stocks, as can be seen in Table 1. Only the stock “MOAR3” shows causality in the contrary direction, from Intrinsic Value to Market Value, suggesting that this stock does not show evidence of any bubbles in its prices.

A greater robustness in the analyses was obtained by using the Johansen test, guided by Diba and Grossman's (1988) proposal, for whom the non-cointegration between the IV and the MV is evidence of the presence of bubbles in a stock's price. Adopting a 5% level of significance, the statistics results (Trace Test and Maximum Likelihood Test) do not indicate the existence of cointegration vectors between the variables. This suggests that in six of the seven stocks there was no long-term relationship between the IV and the MV. The results obtained also gave evidence of the existence of bubbles in the analyzed stocks. The stock “MOAR3” showed at least 11 cointegration vectors between IV and MV, confirming the Granger test results: i.e., this stock did not show evidence of bubbles in its prices. The test identified at a 5% level of significance causality in the direction from Market Value to Intrinsic Value for the stock “BRSR5”. One possible explanation for this result is “Income Smoothing”, a method used by companies to maintain their profits at an average level in order to assure that they do not suffer from too much oscillation in their stock's market price.

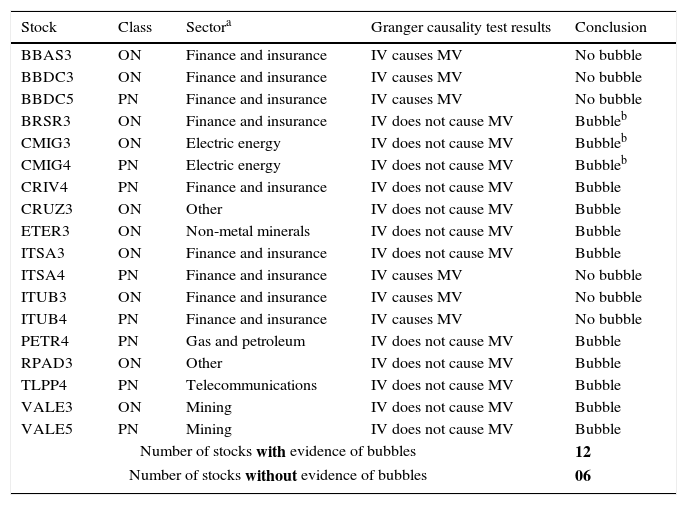

Analysis of Group 2The stocks in Group 2 have stationary IV and MV with a unit root, allowing only the application of the Granger causality test. Table 3 details the stocks and the results of these tests at a 5% level of significance.

Test results for the detection of bubbles in Group 2.

| Stock | Class | Sectora | Granger causality test results | Conclusion |

|---|---|---|---|---|

| BBAS3 | ON | Finance and insurance | IV causes MV | No bubble |

| BBDC3 | ON | Finance and insurance | IV causes MV | No bubble |

| BBDC5 | PN | Finance and insurance | IV causes MV | No bubble |

| BRSR3 | ON | Finance and insurance | IV does not cause MV | Bubbleb |

| CMIG3 | ON | Electric energy | IV does not cause MV | Bubbleb |

| CMIG4 | PN | Electric energy | IV does not cause MV | Bubbleb |

| CRIV4 | PN | Finance and insurance | IV does not cause MV | Bubble |

| CRUZ3 | ON | Other | IV does not cause MV | Bubble |

| ETER3 | ON | Non-metal minerals | IV does not cause MV | Bubble |

| ITSA3 | ON | Finance and insurance | IV does not cause MV | Bubble |

| ITSA4 | PN | Finance and insurance | IV causes MV | No bubble |

| ITUB3 | ON | Finance and insurance | IV causes MV | No bubble |

| ITUB4 | PN | Finance and insurance | IV causes MV | No bubble |

| PETR4 | PN | Gas and petroleum | IV does not cause MV | Bubble |

| RPAD3 | ON | Other | IV does not cause MV | Bubble |

| TLPP4 | PN | Telecommunications | IV does not cause MV | Bubble |

| VALE3 | ON | Mining | IV does not cause MV | Bubble |

| VALE5 | PN | Mining | IV does not cause MV | Bubble |

| Number of stocks with evidence of bubbles | 12 | |||

| Number of stocks without evidence of bubbles | 06 | |||

Table 3 details that Group 2 is composed of Ordinary stocks (ON) and Preferential stocks (PN) that belong to companies from the following Economatica sectors: finance and insurance, electric energy, non-metal minerals, gas and petroleum, telecommunications, mining, and other. Guided by De Medeiros and Daher (2008), who state that Granger non-causality in the direction of Intrinsic Value toward Market Value indicates evidence for the existence of bubbles in a stock's price, we verified at a 5% significance that 12 of the 18 stocks in Group 2 did not present Granger causality in this direction. This suggests that there is evidence of bubbles for the prices of the stocks analyzed.

The tests suggest that in 6 stocks from Group 2 there is Granger causality in the direction from Intrinsic Value toward Market Value, which means that there is no evidence of bubbles in the prices of these stocks. All of these stocks belong to the same sector, finance and insurance, in particular banks. By using the payment of proceeds from these stocks, we discovered that these companies pay their investors more often than the other companies researched. For example, the companies with stocks BBDC3, BBDC5, ITSA4, ITUB3 and ITUB4, paid monthly dividends since 1997, and stock BBAS3 paid quarterly since 2000. There are two distinct perspectives that can be taken to understand this.

The first, found in Blanchard and Wilson (1982), where the authors assert that in markets where it is more difficult to determine the true intrinsic value of a stock, there is a greater probability for bubbles to occur. The fact that these companies pay their shareholders more frequently helps gauge the intrinsic value of their stocks, lowering the probability of a bubble in their prices. The second, on the other hand, proposed by Noussair et al. (2001), is that constant payment of dividends is the primary causality for price bubbles in stocks. However, this position does not seem to fit the results of our research as well as the ideas from Blanchard and Wilson (1982). Similar to the one stock in Group 1, three stocks in Group 2 had a 5% level of significance for Granger causality in the direction from Market Value toward Intrinsic Value of their stocks.

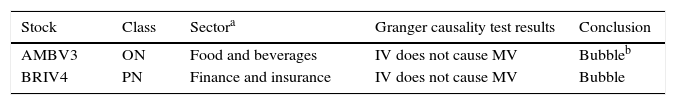

Analysis of Group 3The stocks that composed Group 3 showed both stationary Intrinsic Values and Market Values. This only allowed for the application of the Granger causality test for each. Table 4 details the stocks and the results at a 5% significance.

The details presented in Table 4 show that Group 3 is composed of Ordinary stocks and Preferential stocks, belonging to the two Economatica sectors: food and beverages, and finance and insurance. Similarly to Groups 1 and 2, the proposal from De Medeiros and Daher (2008) concerning how Granger non-causality in the direction from Intrinsic Value toward Market Value indicates the evidence of the existence of bubbles in a stock's price. This was verified at a 5% significance for both stocks in Group 3, demonstrating that these stocks have evidence of bubbles in their stock prices, as shown in Table 4. Finally, another stock showing Granger causality at 5% significance in the direction from Market Value toward Intrinsic Value appeared: AMBV3.

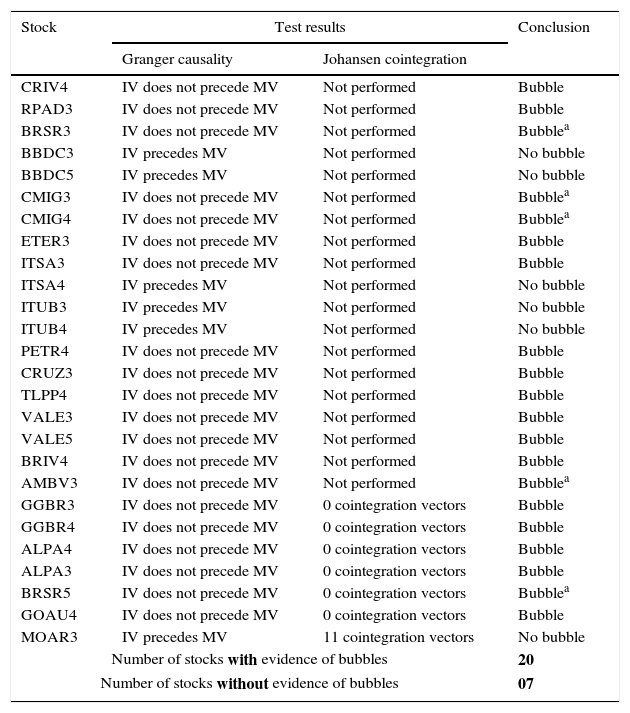

Results summaryIn order to present an overall vision of the results encountered in the 27 stocks that were analyzed for this research, Table 5 consolidates the results of the tests for identification of bubbles based upon the variables Market Value (MV) and Intrinsic Value (IV).

Summary of the results of tests performed on the 27 stocks in the sample.

| Stock | Test results | Conclusion | |

|---|---|---|---|

| Granger causality | Johansen cointegration | ||

| CRIV4 | IV does not precede MV | Not performed | Bubble |

| RPAD3 | IV does not precede MV | Not performed | Bubble |

| BRSR3 | IV does not precede MV | Not performed | Bubblea |

| BBDC3 | IV precedes MV | Not performed | No bubble |

| BBDC5 | IV precedes MV | Not performed | No bubble |

| CMIG3 | IV does not precede MV | Not performed | Bubblea |

| CMIG4 | IV does not precede MV | Not performed | Bubblea |

| ETER3 | IV does not precede MV | Not performed | Bubble |

| ITSA3 | IV does not precede MV | Not performed | Bubble |

| ITSA4 | IV precedes MV | Not performed | No bubble |

| ITUB3 | IV precedes MV | Not performed | No bubble |

| ITUB4 | IV precedes MV | Not performed | No bubble |

| PETR4 | IV does not precede MV | Not performed | Bubble |

| CRUZ3 | IV does not precede MV | Not performed | Bubble |

| TLPP4 | IV does not precede MV | Not performed | Bubble |

| VALE3 | IV does not precede MV | Not performed | Bubble |

| VALE5 | IV does not precede MV | Not performed | Bubble |

| BRIV4 | IV does not precede MV | Not performed | Bubble |

| AMBV3 | IV does not precede MV | Not performed | Bubblea |

| GGBR3 | IV does not precede MV | 0 cointegration vectors | Bubble |

| GGBR4 | IV does not precede MV | 0 cointegration vectors | Bubble |

| ALPA4 | IV does not precede MV | 0 cointegration vectors | Bubble |

| ALPA3 | IV does not precede MV | 0 cointegration vectors | Bubble |

| BRSR5 | IV does not precede MV | 0 cointegration vectors | Bubblea |

| GOAU4 | IV does not precede MV | 0 cointegration vectors | Bubble |

| MOAR3 | IV precedes MV | 11 cointegration vectors | No bubble |

| Number of stocks with evidence of bubbles | 20 | ||

| Number of stocks without evidence of bubbles | 07 | ||

As shown in Table 5, of the 27 stocks analyzed, 20 showed evidence of bubbles in their prices and only 7 did not. These conclusions were obtained based upon the results of Granger causality tests and/or Johansen cointegration tests, with the assumption that non-causality between the Intrinsic Value and the Market Value (De Medeiros & Daher, 2008) and non-cointegration between Intrinsic Value and Market Value (Diba & Grossman, 1988), are indicative of the presence of bubbles in stock prices.

ConclusionsStudies about stocks in Brazil have identified the presence of bubbles in IBOVESPA. Given this context and assuming that the speculative bubbles are present in the Brazilian stock market, this research sought to answer on the following question: Is there evidence of the existence of speculative bubbles in stock prices traded on the São Paulo Stock Exchange? The primary findings reveal a presence of bubbles in twenty of the twenty-seven stocks, at a 5% significance level. Of the seven stocks not showing evidence of bubbles, six are financial institutions. In five stocks the tests reveal Granger causality stemming from the market value toward the intrinsic value. Granger non-causality in the direction from Intrinsic Value toward Market Value encountered in some of the analyzed stocks indicates that the fundamentals, dividends paid and interest on equity capital, of the stocks do not guide (precede) the market value for these stocks at any moment during the period they were studied. In this context, there is strong evidence that non-rational behavior in the market and/or cognitive lapses on the part of investors became ever stronger, resulting in what literature calls speculative bubbles, a type of behavior in which stocks’ market values deviate from their intrinsic values. On the other hand, the findings of this research align with previous works which studied the primary index for the Brazilian stock market: IBOVESPA. As the research contribution, the units of analysis studied in this research were the stocks which make up this market, those of individual companies. The study findings are consistent and contribute with previous research in the literature and, are useful for investors, financial institutions, academics, government agents, and traders.

For managerial and academic implications, the use of stocks of individual companies broadens the horizons for research concerning speculative bubbles and opening new areas for studies into the theme. The primary managerial implications stemming from the results will depend upon the need for additional studies that seek to explain why stocks from financial companies do not show evidence of price bubbles during the period from January 1990 until June of 2010. Such results, if achieved, will enable a much more clear vision for regulatory agents, such as the Brazilian Securities and Exchange Commission and even for Bovespa itself and other agents operating in the market, of how bubbles can occur in the Brazilian economy. On the other hand, for academic implications, it is necessary that future research seek to develop alternative ways of measuring Intrinsic Value for stocks traded on BOVESPA. This needs to be done in such a way that enables a larger sample of stocks, which will allow a better generalization of future results. We also recommend using Dividend Yield as representative of the Intrinsic Value variable. The limitations of the findings of this research, the results of this research cannot be generalized for all stocks of individual companies listed on BOVESPA for the analyzed period. The main limitation of this study is a function of the number of stocks analyzed; seeing that the Brazilian stock market is still young when compared to those in the USA or Europe, and also that there are only a small n

Peer review under the responsibility of Universidad Nacional Autónoma de México.