This work focused on analyzing whether the ownership structure has any effect on the dividend policy of companies in the Mexican market. The decision of dividend payment is one of the major elements in corporate policy, as this dividend policy influences the value of the company. Therefore, decisions such as adopting a company growth policy through the reinvestment of profits, or better yet allocating them to the payment of dividends, are going to be influenced by the type of ownership structure that dominates the company. The analysis was based on three types of ownership structures such as: families, institutions (mainly banks) and small blocks of shareholders. Our results show that the concentration of property in families negatively influences the payment of dividends, whereas the presence of institutional shareholders has an inverse effect on the payment of the same. This indicates that the presence of big shareholders foreign to the families has a different effect on the payment policy of dividends in the Mexican context. This work provides literature information about the context of emerging countries as is the case of Mexico, given that much of the existing investigations focus on European or North American contexts, where the markets are well regulated and property is broadly distributed.

En este trabajo nos enfocamos en analizar si la estructura de propiedad tiene algún efecto sobre la política de dividendos de las empresas en el mercado mexicano. La decisión de pago de dividendos es uno de los elementos primordiales dentro de la política corporativa, ya que esa política de dividendos tiene una influencia sobre el valor de la compañía. Por tanto, decisiones como adoptar una política de crecimiento de la empresa a través de la reinversión de utilidades o mejor destinarlo al pago de dividendos se verán influenciadas por el tipo de estructura de propiedad que predomine dentro de la empresa. Basamos nuestro análisis en tres tipos de estructura de propiedad: familias, instituciones (bancos principalmente) y pequeños bloques de accionistas. Nuestros resultados muestran que la concentración de propiedad en familias influye de forma negativa en el pago de dividendos, mientras que la presencia de accionistas institucionales tiene un efecto inverso sobre el pago de los mismos. Esto indica que la presencia de grandes accionistas distintos a las familias tiene un efecto diferente sobre la política de pago de dividendos en el entorno mexicano. Nuestro trabajo aporta a la literatura sobre el tema en el contexto de países emergentes como es el caso de México, ya que mucha de la investigación existente hasta ahora se ha centrado básicamente en entornos como el europeo o el norteamericano, donde los mercados están bien regulados y la propiedad, ampliamente distribuida.

The decision for the payment of dividends is one of the major elements in the corporate policy of a company; thus, it has become extremely relevant within the financial literature. Dividends are considered the payment made to the shareholders for their contribution in the provision of funds for a company and the compensation for supporting the inherent risks of the business. In this sense, the directive team of the company formulates a dividend policy to divide and distribute the earnings according to their contributions to the company. This dividend policy crucially influences the value of the company, as there should be a balance between the growth of the company and the payment policies of the dividends. For example, a low payment of dividends can lead to the dissatisfaction of the shareholders, however, a high payment of the same could hinder the growth of the company.

Therefore, the dividend policy is a sensitive subject, and its balance can be decisively influenced by the ownership structure of the company. On the one hand, the dividends can be used to mitigate the agency problems that could emerge in the company, as they are considered the control mechanisms of the directive (Easterbrook, 1984; Jensen, 1986; Rozeff, 1982). On the other hand, the big shareholders may use their majority power to expropriate resources for their own benefit at the expense of the minority, which could limit the payment of dividends and generate agency conflicts (Faccio & Lang, 2001). Consequently, there is a clear relation between the ownership structure and the payment policy of the dividends.

This work focuses on the relation between these variables, using a sample of companies in the Mexican market, taking as reference the period of 2005–2013. The objective is to answer questions such as: does the ownership structure affect the dividend policy of companies in the Mexican market? It is important to indicate that the Mexican market provides an interesting context to carry out studies like this, as the ownership structure is essentially highly concentrated in families. Furthermore, our work is also centered in the analysis of the effect that important shareholders – such as institutional shareholders (mainly banks) – could have on the decisions related to the payment of dividends. Many of the existing investigations have focused for the most part on the European or American environments, where the markets are well regulated and property is broadly distributed. However, there are few studies that have developed in emerging countries such as Mexico.

For this, the article is structured in the following manner: the following section presents a review of the literature on the impact of the ownership structure on the payment of dividends, this under the agency approach; and then, the hypotheses are formulated. In the third section, the methodology portion of the work is detailed. The fourth section presents the obtained results and, finally, the last section presents the conclusion of the work, its limitations and future lines of investigation.

Review of the literatureSeveral previous studies have shown a relation between dividend policy and ownership concentration (Rozeff, 1982). Nevertheless, it is also important to stress the structure of that ownership, considering both majority shareholders such as families or institutional investors (mainly banks), as well as small blocks of shareholders with “relevant” shareholdings in the company. The latter could, therefore, have great influence in the design of the dividend policy of companies, given that these majority shareholders or block-holders (investors with at least 5% of the shareholdings of the companies) are worried about controlling and supervising the performance of the directors, with the purpose of protecting their investments (Castrillo & San Martín, 2007).

This relation between ownership structure and dividend policy is analyzed based on the literature of Jensen and Meckling (1976). It is fundamentally focused in the agency theory, which suggests that the presence of big shareholders can alleviate or reduce agency conflicts. The concentration of ownership could reduce these conflicts, given that with the property and control being in the hands of the same person, they would have to assume a portion of the losses derived from their behavior (Jensen & Meckling, 1976; Morck, Shleifer, & Vishny, 1988). Therefore, big shareholders have a good incentive to maximize the wealth of the company (Shleifer & Vishny, 1997). However, the interest of the big shareholders could not necessarily coincide with the interest of the minority shareholders, which could lead to a possible expropriation by the former on the latter (Shleifer & Vishny, 1997).

The dividend payment policy plays an important role in the control of these possible conflicts between the big and small shareholders, because through the payment of dividends, it is possible to limit the extraction of wealth by the big shareholders. It is important to mention that some authors indicate that the dividends can also be used by the controlling shareholders to compensate the minority shareholders, aware that in the environment in which the latter are in, the presence of big shareholders dominates (Faccio & Lang, 2001). However, in the presence of big controlling shareholders, the payment of dividends does not always necessarily work as an agency control mechanism, but is actually considered a substitute mechanism of ownership concentration to mitigate the agency problems.

This relation has been an object of study for different authors such as: Gugler and Yurtoglu (2003), Maury and Pajuste (2002), Mancinelli and Aydin (2006), Renneboog and Szilagyi (2006), Renneboog and Trojanowski (2007), Setia-Atmaja (2009), Pindado, Requejo, and De la Torre (2012), Bradford, Chen, and Zhu (2013), Mori and Ikeda (2015), Vandemaele and Vancauteren (2015), Michiels, Voordeckers, Lybaert, and Steijvers (2015), among others. Jayesh (2003) and Warrad, Abed, Khriasat, and Al-Sheikh (2012), for example, analyze the relation between ownership structure, corporate government and dividend policy, and their results show a clear relation between the ownership structure and the dividend payment policy. López-Iturriaga and Lima (2014) analyze the relation between indebtedness, payment of dividends, and the concentration of ownership and their effect on the creation of value when there is a presence or absence of growth opportunities in Brazil. They found that the payment of dividends plays an important role as a disciplining mechanism on the management of companies with low growth opportunities, given that the payment of dividends reduces the cash flow available for management. For his part, Setia-Atmaja (2009) analyzes the relation between concentration of ownership and the independence of the management council and the audit committee in Australian companies. He also analyzes if having independent councils and audit committees has an effect on the creation of value and, in turn, if that effect is moderated by the concentration of ownership and payment of dividends. His results show that the concentration of ownership has a negative impact on the independence of the council, but does not have an impact on the audit committee. His results also suggest that the independence of the council increases the value of the company, and that the impact of the independence of the council on the creation of value is higher in companies with a low rate of payment of dividends. Ramli (2010) indicates that when the ownership structure is more concentrated, companies can manage a higher payment of dividends, given that the big shareholders have a greater influence on this type of policies. When analyzing the relation between ownership structure and dividend policy, Roy (2015) focuses on the effect that the adoption of corporate government practices has on the payment of dividends of the company. The main idea around which the work revolves is to know whether the presence of family blocks in the company has an effect on the dividend payment policy different to that in a company that is not family-owned. The results show that the presence of corporate government variables such as management council, independent counselors, and the rate of non-executive directors in the council, have a significant impact on the dividend policy. They also establish that the presence of growth opportunities in the company has a positive relation to the payment of dividends.

Mitton (2005) states that there is a positive relation between corporate government and the payment of dividends in emerging markets, establishing that the countries that have a strong protection for investors are capable of paying greater dividends. Pindado et al. (2012) analyze if family companies use the dividend policy as a corporate government mechanism to overcome agency problems among the controlling family and minority investors. Their results show that family companies have higher, more stable dividend payment rates to alleviate the expropriation concerns of the minority shareholders. Shabbir, Safdar, and Aziz (2013) analyze the relation between ownership structure, value creation and dividend policy. Their results show that the family ownership structure more significantly affects the dividend policy of the company and the creation of value. Their results also support the entrenchment theory, as they find a negative relation between the payment of dividends and the concentration of ownership. They state that the majority shareholders (families) benefit at the expense of the minority shareholders. Vandemaele and Vancauteren (2015) use behavioral economics to analyze the relation between dividend policy and family companies. Their results suggest that the payment of dividends is low when a member of the family is the general director, as well as when there is a strong presence of family members in the management council. According to the authors, this tendency is greater when talking about first-generation companies than for the case of subsequent generations.

On the other hand, Wei, Zhang, and Xiao (2003) analyze the relation between the payment of dividends and the ownership structure, finding a positive and significant relation between companies with a majority of ownership by the State. However, this relation becomes negative when the majority of the ownership is public. Bradford et al. (2013) analyze the pyramidal ownership structure, both public and private, and its relation to the dividend policies for companies in China. They find that the companies controlled by the State in China pay higher dividends when compared to those companies that are controlled by individuals. This is due to the fact that private companies have greater limitations regarding capital, income generation and indebtedness possibilities.

For their part, Renneboog and Trojanowski (2005) examine the dividend payment policies and argue that this policy, in countries such as the United Kingdom, is related to the ownership structure of the company, given that the presence of blocks of shareholders with high ownership percentages weakens the relation between the financial performance of the company and the dividend payment dynamics. González, Guzmán, Pombo, and Trujillo (2014) examine the effect of the participation of the family in the dividend policy in companies with few shareholders and which face agency problems that implicate majority and minority shareholders. The authors argue that the minority shareholders put pressure for the payment of dividends when they perceive situations related to the expropriation of wealth on behalf of the majority shareholders. Furthermore, the authors find that family participation in the management of companies does not affect the dividend policy; that family participation both in the property and control of the same negatively affects the payment of dividends; whereas the participation of family in the control through excessive representation in the council positively affects the dividend policy. Thus, the authors state that the influence of the family in the agency problems, and therefore in the dividend policy as a mitigation mechanism, varies according to the participation of the family.

When analyzing the relation between the dividend policy and ownership structure, Mancinelli and Aydin (2006) find that companies make fewer payments of dividends and concede less voting rights as ownership is concentrated. Kouki and Guizani (2009) argue that companies with a concentrated ownership structure distribute a greater percentage of dividends and show a positive relation between the concentration of ownership and the payment of dividends. Michiels et al. (2015) analyze if family companies use dividends as instruments to face conflicts of interest among the family shareholders, both active and passive, and how government practices moderate this relation. The results show that the existence of an intra-familial conflict of interest generates a greater propensity to pay dividends. Mori and Ikeda (2015) analyze the relation between the incentives to carry out a supervision by the different blocks of shareholders and the dividend policy. They argue that when individuals against the payment of dividends have a position of majority in companies with disperse ownership, the rest of the blocks of shareholders can be persuaded to impose a low dividend payment, this in accordance to the optimal in terms of taxes. Under these circumstances, the blockholders would be incentivized to stop doing an effective monitoring, as the saving benefits in terms of taxes are greater than the economic loss of the supervision activities.

Warrad et al. (2012) analyze the relation between the dividend payment policy and the different types of owners, finding that there is a positive relation between foreign ownership and the dividend payment policy. This is consistent with the works of Short, Zhang, and Keasey (2002) and Jayesh (2003). Mehrani, Moradi, and Eskandar (2011) found evidence of a negative relation between directive ownership and the dividend payment policy. Khan (2006) also analyzes the relation between dividends and ownership structure, arguing that there is a negative relation between the payment of dividends and the concentration of ownership; furthermore, the author finds that the composition of ownership is also a relevant variable.

Similarly, Gugler and Yurtoglu (2003) argue that companies with a high concentration of property tend to pay lower dividends. Maury and Pajuste (2002) indicate that the presence of big shareholders negatively affects the distribution of dividends. Meanwhile, Jain and Shao (2014), based on the agency and socioemotional wealth, evaluate the post-IPO investment options and their financial consequences, where they find that these are different for family companies in relation to non-family companies. Their results suggest that family companies invest little in post-IPO, and that the total expenses of investment, and in R+D, are lower when compared to companies that are not family owned. Feldstein and Green (1983) provide a market equilibrium model to explain why the companies that maximize the value of their shareholdings pay dividends. Miller and Modigliani (1961), in their pioneer work, analyze the effect of the dividend policy on the price of the shareholdings. They did not find any dividend policy to be superior to any other policy, and therefore it is not relevant for the value of the company and/or for the maximization of the shareholders wealth. Gordon (1959) proposes that, even in the presence of perfect capital markets, there is uncertainty regarding future cash flows, so the price of the company shares depends on the dividend policy. Rozeff (1982) argues that the payment of dividends subjects the companies to the scrutiny of the capital markets, as the dividend policy that the companies decide to use could play an informative role by allowing reliable information on the expectations of the company to reach the markets.

Different studies have analyzed the role of the family when it possesses the ownership majority. Different authors have observed that the presence of controlling families can align the interests between directives and shareholders, as it greatly reduces the possibility of having a conflict of interest when the company is not under the control of the same family. According to Crutchley and Hansen (1989), it is important to analyze the relation between family ownership and the dividend policy, as it can help reduce the conflict of interest between the management and the shareholders. Chen and Steiner (2005) analyze whether family ownership affects the payment of dividends. The results show a weak relation between family ownership and the dividend payment policy. However, there is a negative and significant relation between the payment of dividends and family ownership when the family owns up to 10% of the total shares of the company. Nevertheless, this relation is done in reverse when the family possesses between 10% and 35% of the ownership of the company. Eckbo and Verma (1994) argue that the dividends decrease as the participation in the ownership of the directors increases. Chen, Cheung, Stouraitis, and Wong (2005) also find a negative relation between the ownership of the directors and the dividend policy.

On the other hand, Short et al. (2002) argue that there is a negative relation between the ownership of the directors and the dividend payment policy, while Wen and Jingyi (2010) state that both the ownership of the directors and institutional ownership are negatively associated to the dividend payment policy. Moreover, Jensen, Solberg, and Zorn (1992) state that the ownership of the directors has a negative impact on the dividend payment policy and the company debt. Jensen (1986) argues that the directors prefer to retain the earnings generated instead of distributing them to the shareholders as dividends. Some other studies such as those by Gugler and Yurtoglu (2003), Maury and Pajuste (2002), Mancinelli and Ozkan (2006), Renneboog and Szilagyi (2006) and Renneboog and Trojanowski (2007), with samples from countries such as Germany, Finland, Italy, the Netherlands and the United Kingdom, have also found a negative relation between concentrated ownership structures and the dividend payment policy.

On the other hand, we can find different studies that analyze the effect of other big shareholders, such as institutional shareholders or blocks of shareholders with relevant shareholdings, also known as blockholders, and the effect that they can have on the dividend policy. In this sense, these other big shareholders could perform monitoring roles at the management level, which could limit the expropriation of the resources of the minority shareholders (Bolton & Von Thadden, 1998; Pagano & Röell, 1998). Waud (1966), Fama and Babiak (1968), and Short et al. (2002) suggest that there is a significant relation between the dividend policy and institutional ownership. Lalay (1982) finds a relation between both variables when analyzing a broad sample of bond issuance focused on the conflict between shareholders and bondholders when deciding the payment of dividends. Short et al. (2002) also find a positive relation between institutional ownership and dividend policy; on the other hand, they also find a negative relation between the directors ownership and the dividend policy. Chen et al. (2005) examine the relation between propensity to risk, indebtedness and dividends through an analysis with simultaneous equations. Their results show that the risk is positively associated to the level of the directors ownership, and that the management ownership is also a determinant for the risk level assumed in the company. These results support the statement that the management ownership helps resolve the agency conflicts between external shareholders and the management, but at the cost of increasing the agency conflict between shareholders and creditors.

However, there is another trend in the literature that argues that these other big shareholders could collude with the controlling shareholder in order to expropriate resources and share the benefits obtained (Faccio & Lang, 2001; Pagano & Röell, 1998). Nevertheless, the empirical evidence on the impact of these other big shareholders on the dividend policy has been limited. Faccio and Lang (2001), for example, find that the presence of big shareholders in the European market reduces the expropriation activity of the controlling shareholder to a minimum, which results in a higher payment of dividends, meanwhile, there is a lower repartition of dividends in Asia; the authors argue that the controlling shareholder collaborates with other big shareholders to expropriate the minority shareholders. In this sense, authors such as Han, Lee, and Suk (1999) argue that the dividend payment policy is positively related to institutional ownership, which is due to the fact that the dividend distribution contributes to the reinforcement of the directive control when incorporating the market as an instance for supervision. A company with a frequent dividend distribution policy is forced to capture resources to cover its profitable investment projects. In these cases, the company will be subject to the strong supervision of the capital markets where these resources are captured. In this way, said markets better monitor the use of said resources (Easterbrook, 1984).

As we can see, different studies have found a relation between different ownership structures and the dividend payment policy. Therefore, the hypotheses that we present are the following:H1

There is a negative relation between ownership concentration (in families) and the payment of dividends of the company.

H2There is a positive relation between companies with concentrated ownership structures in institutional investors (banks) and small blocks of shareholders on the payment of the dividends of the company.

MethodologyThe sample used for this work was obtained from companies in the Mexican Stock Exchange (BMV for its acronym in Spanish). The source of information used for the procurement of the financial statements of the companies is the “Economatica” database. The information concerning ownership structure, generational changes, and management of the companies in the sample used in the analysis was obtained from the annual reports of the companies that were published by the BMV in its website.1 The sample includes 88 companies of the 142 that are listed in the Mexican market. The data were obtained annually during a period of 8 years, from 2005 to 2013. The sample has 675 observations and comprises non-financial companies that belong to the different sectors, according to the classification of the Mexican Stock Exchange (Materials, Industrial, Service and Non-Basic Consumer Goods, Frequent Use Products, Health and Telecommunications).

Econometric modelIn this work, the panel data methodology was used. In the first model, the impact of owner structure on the payment of dividends was analyzed, as well as a series of control variables such as volatility, size of the company, available cash flow, and value creation. In models two and three, the estimation is done taking into consideration the ownership concentration in institutional shareholders (mainly banks), as well as those blocks of individual shareholders that do not correspond to the controlling family (we considered individual and institutional shareholders, such as those that have ownership of five percent or more of the company). The resulting model is the following:

Definition of the variablesThe family ownership is determined as the percentage of ownership of a family. Authors such as Anderson and Reeb (2003) state that for a company to be considered a family-owned company, the percentage of ownership at the hands of the family needs to be analyzed, as well as the weight of the family in the management council. For their part, McConaughy, Matthews, and Fialko (2001) consider a company as family-owned when the CEO is part of the controlling family. Institutional ownership is determined as the percentage of shares at the hands of institutions such as banks. Ownership by this type of institutions is relevant because by possessing a significant portion of shares, they are incentivized to follow the performance of the company more thoroughly due to the investment made on the company by themselves. Ownership by individual shareholders refers to the percentage of ownership at the hands of investors that do not belong to the controlling family group or to any financial institution, but that possess a significant share package within the company (greater than five percent). According to authors such as Chai (2010) and Baba (2009), the ownership of individual investors has a significant impact on the dividend policy of the company.

The size of the company was also included, given that according to authors such as Redding (1997), big companies have a greater probability for dividend payment. Moreover, Titman and Wessels (1988) indicate that big companies tend to be more diverse, generate greater income and, consequently, have a lower probability of bankruptcy, which could cause the payment of dividends to shareholders. The size of the company is determined as the natural logarithm of the total assets of the company. Following Ullah, Fida, and Khan (2012), we have included the volatility of the earnings before interests, taxes, and depreciation as a control variable, as well as the level of indebtedness of the company, which is determined by the relation between the total liability and the total assets, measured as the carrying value of the debt divided by the carrying amount of the total assets. In this sense, authors such as Bradley, Jarrell, and Kim (1984) argue that the volatility of the earnings is a determinant factor, to a certain degree, in the capital structure of the company. Therefore, this volatility and the indebtedness of the company will have an effect in the dividend policy.

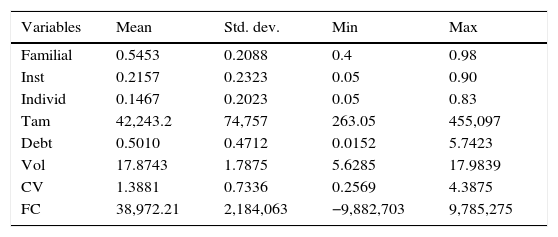

The cash flow variable is also included, as well as the value creation variable, measured through the Q of Tobin as control variables. These two variables have been included because they have a clear relation to the payment of dividends; in the case of the former, if the available cash flow of a company increases, then it means there is a surplus of cash after the company obligations have been met, thus, this money can be used for the payment of dividends to the shareholders. A greater distribution of dividends reduces the free cash flow (Lang & Litzenberger, 1989; Dewenter & Warther, 1998). While in the case of the latter, the greater the creation of value generated in the company, the greater the probability of carrying out the payment of dividends. Table 1 shows the descriptive statistic of the different variables used in our analysis.

Descriptive statistics.

| Variables | Mean | Std. dev. | Min | Max |

|---|---|---|---|---|

| Familial | 0.5453 | 0.2088 | 0.4 | 0.98 |

| Inst | 0.2157 | 0.2323 | 0.05 | 0.90 |

| Individ | 0.1467 | 0.2023 | 0.05 | 0.83 |

| Tam | 42,243.2 | 74,757 | 263.05 | 455,097 |

| Debt | 0.5010 | 0.4712 | 0.0152 | 5.7423 |

| Vol | 17.8743 | 1.7875 | 5.6285 | 17.9839 |

| CV | 1.3881 | 0.7336 | 0.2569 | 4.3875 |

| FC | 38,972.21 | 2,184,063 | −9,882,703 | 9,785,275 |

Table shows the ownership variables, such as Familial, which is the ownership of shares at the hands of the controlling family; Inst represents the institutional ownership; Individ determines the possession of shares of individual investors; Vol is the volatility of the earnings; FC are the free cash flows; Debt is the level of leverage of the company; Tam is the size of the company; and CV represents the value creation of the company, which is calculated through the Q of Tobin.

The results of the estimation are shown in Tables 2–4. The three models are included in these tables, that is, the effect on the payment of dividends under family, institutional and individual ownership structures. It is important to mention that our sample has the characteristic of combining temporary series and cross-section cuts, which allows us to make use of the panel data, especially, if the unobserved heterogeneity is controlled (Arellano, 1993). The panel data part from the idea that each individual has specific inherent issues, which makes it possible to differentiate them from the others, and these specific issues are maintained throughout time. Therefore, being a sample of companies, these can have certain characteristics that are different to the rest of the sample and that can prevail throughout time. In this manner, carrying out estimations without taking these individual considerations into account could create biases in the estimation. Therefore, it is important to differentiate the relation between the element of individual effect and the rest of the explicative variables, because if there is correlation between both of them, then the fixed effects must be eliminated (López-Iturriaga & Saona, 2007). This correlation can be detected through the Hausman test, as it makes it possible to contrast the hypothesis of absence/presence of correlation between the individual effects term and the independent variables. It is, therefore, necessary to carry out the estimations in this manner within the estimation method in order to be able to deal with the unobserved heterogeneity.

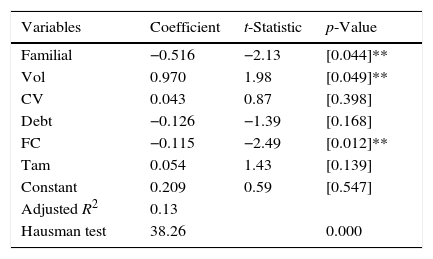

Results of the estimation considering a family ownership structure.

| Variables | Coefficient | t-Statistic | p-Value |

|---|---|---|---|

| Familial | −0.516 | −2.13 | [0.044]** |

| Vol | 0.970 | 1.98 | [0.049]** |

| CV | 0.043 | 0.87 | [0.398] |

| Debt | −0.126 | −1.39 | [0.168] |

| FC | −0.115 | −2.49 | [0.012]** |

| Tam | 0.054 | 1.43 | [0.139] |

| Constant | 0.209 | 0.59 | [0.547] |

| Adjusted R2 | 0.13 | ||

| Hausman test | 38.26 | 0.000 |

Table of the estimated coefficients, t-statistic and the p-value, where: *significant to 0.10, **significant to 0.05, and ***significant to 0.01. The payment of dividends is the dependent variable. Familial is the ownership of shares at the hands of the controlling family; Vol is the volatility in the earnings, determined by the earnings before interests, taxes and depreciation; FC are the free cash flows; Debt is the leverage level of the company, measured by the total liability divided by the total asset; Tam is the size of the company, determined by the natural logarithm of the total assets; and CV represents the value of the company which has been calculated through the Q of Tobin, determined by the market value of the assets plus the carrying value of the debt on the total assets. The Hausman test allows demonstrating the hypothesis of fixed effects vs random effects in the estimation. This test has a distribution of χ2.

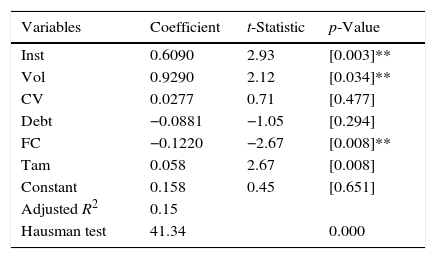

Results of the estimation considering an institutional ownership structure.

| Variables | Coefficient | t-Statistic | p-Value |

|---|---|---|---|

| Inst | 0.6090 | 2.93 | [0.003]** |

| Vol | 0.9290 | 2.12 | [0.034]** |

| CV | 0.0277 | 0.71 | [0.477] |

| Debt | −0.0881 | −1.05 | [0.294] |

| FC | −0.1220 | −2.67 | [0.008]** |

| Tam | 0.058 | 2.67 | [0.008] |

| Constant | 0.158 | 0.45 | [0.651] |

| Adjusted R2 | 0.15 | ||

| Hausman test | 41.34 | 0.000 |

Table of the estimated coefficients, t-statistic and the p-value, where: *significant to 0.10, **significant to 0.05 and ***significant to 0.01. The payment of dividends is the dependent variable. Inst is the ownership of shares at the hands of institutional investors (banks); Vol is the volatility in the earnings, determined by the earnings before interests, taxes and depreciation; FC are the free cash flows; Debt is the leverage level of the company, measured by the total liabilities divided by the total asset; Tam is the size of the company, determined by the natural logarithm of the total assets; and CV represents the value of the company which has been calculated through the Q of Tobin, determined by the market value of the assets plus the carrying value of the debt on the total assets. The Hausman test allows demonstrating the hypothesis of fixed effects vs random effects in the estimation. This test has a distribution of χ2.

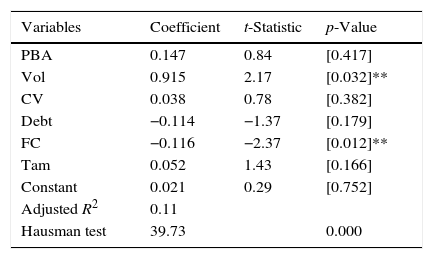

Results of the estimation considering an ownership structure of small blockholders.

| Variables | Coefficient | t-Statistic | p-Value |

|---|---|---|---|

| PBA | 0.147 | 0.84 | [0.417] |

| Vol | 0.915 | 2.17 | [0.032]** |

| CV | 0.038 | 0.78 | [0.382] |

| Debt | −0.114 | −1.37 | [0.179] |

| FC | −0.116 | −2.37 | [0.012]** |

| Tam | 0.052 | 1.43 | [0.166] |

| Constant | 0.021 | 0.29 | [0.752] |

| Adjusted R2 | 0.11 | ||

| Hausman test | 39.73 | 0.000 |

Table of the estimated coefficients, t-statistic and the p-value, where: *significant to 0.10, **significant to 0.05 and ***significant to 0.01. The payment of dividends is the dependent variable. PBA is the ownership of shares at the hands of small groups of shareholders; Vol is the volatility in the earnings, determined by the earnings before interests, taxes and depreciation; FC are the free cash flows; Debt is the leverage level of the company, measured by the total liability divided by the total asset; Tam is the size of the company, determined by the natural logarithm of the total assets; and CV represents the value of the company which has been calculated through the Q of Tobin, determined by the market value of the assets plus the carrying value of the debt on the total assets. The Hausman test allows demonstrating the hypothesis of fixed effects vs random effects in the estimation. This test has a distribution of χ2.

As can be appreciated in Table 2, our results show a negative and significant relation between the dividend policy and the concentration of ownership at the hands of families, while we execute control through factors such as: cash flow, indebtedness, value creation, volatility and the size of the company. Therefore, we obtain evidence that the magnitude of the payment of dividends is lesser when there is the presence of controlling family groups within the company. This means that companies with a higher concentration of ownership in families tend to pay less dividends. A reason for this could be that, according to the agency theory, these dividends are not necessary as control mechanisms, given that they can be considered a substitute of another mechanism, such as the concentration of ownership to mitigate agency conflicts. In the case of Mexico, we observe a significant concentration of ownership, which, according to Jensen (1986), facilitates the supervision of the activities of the company by the main shareholders (families), and thus reduce the agency conflict.

In this manner, we differentiate between two types of internal mechanisms that the company may use to align the interests of the management level to those of the shareholders: the concentration of ownership and the payment of dividends. A substitution effect is created between both mechanisms, so that the companies that use the concentration of ownership – in families, for example – will need to put less emphasis on mechanisms such as the payment of dividends.

On the other hand, control variables such as indebtedness and cash flow are negatively related to the payment of dividends, with only the latter being significant. Therefore, our results indicate that the higher the payment of dividends, the less the cash flow. The size of the company is positively related to the payment of dividends, though this is not very significant. Moreover, the creation of value, measured through the Q of Tobin, has a positive relation to the payment of dividends, which could be related to the Mexican market, given that due to the uncertainty of the environment, it is possible that the investors prefer a greater distribution of dividends. The results, however, are not significant.2

Tables 3 and 4 show the results obtained, considering ownership structures different to the familial ones, such as institutional ownership (banks) and small blockholders. Regarding the former, in the Mexican market, after family groups, the main control groups within public companies are the financial entities, so we included this variable to analyze what is the effect that the presence of institutional shareholders has on the dividend policy of companies. As can be seen in Table 3, our results show a positive relation to the payment of dividends, and in this way, we obtain evidence that with a greater ownership of institutional shareholders, the greater the payment of dividends by the same. These results are consistent with those of Zeckhouser and Pound (1990), who suggest that institutional investors do not directly supervise the functioning of the company, but that they do pressure the directive to distribute the available cash flow when there is no project that will contribute to the generation of value for the company. On the other hand, with the exception of indebtedness and value creation, the rest of the control variables are statistically significant. Moreover, Table 4 shows the analysis considering another type of ownership structure, such as the small blockholders and their effect on the dividend policy. As can be appreciated in the table, the results are not significant in our estimations, which is no surprise, as it is not common in Mexico for small blockholders to own significant shares that will allow them to influence the dividend policy of a company.

ConclusionsThis work analyzes one of most important business decisions that directly impact the spirit of any investor, such as the dividend policy assumed by a company. Thus, our work focuses on investigating, under the context of the agency theory, the effects on the dividend policies of Mexican companies that the ownership structure could have, be it familial, institutional or that of blockholders, all the while we control the level of indebtedness and available cash flow through aspects such as the volatility of earnings, the size of the company, and its market value. Mexico is a good scenario to investigate this relation, as the ownership structure in this country is characterized by its high concentration. For this, we used a series of data from companies listed in the Mexican Stock Exchange for a period of 8 years spanning from 2005 to 2013. The results obtained show that the concentration of ownership in families negatively influences the payment of dividends by the company. However, the presence of institutional shareholders with significant ownership percentages has a significant and positive effect on the payment of dividends. This indicates that the presence of other big shareholders has a different effect on the dividend payment policy in the Mexican environment.

Therefore, ownership structure plays an important role when defining the dividend policy of the company, acting as a substitute government mechanism when dealing with agency problems. This means that the payment of dividends has been used as a discipline mechanism to control the behavior of the management by reducing the available cash flow. However, when there is a concentration of ownership at the hands of families, this problem is alleviated, and thus the payment of dividends is reduced as the familial ownership increases. On the other hand, institutional ownership has a positive impact in the payment of dividends, and an increase in the ownership of this type of shareholders leads to an increase in the payment of these. The reason for considering this is that institutional investors interfere less when supervising the directive role; their concern is for their investment, thus, they prefer to recover it through the payment of dividends, which in turn helps them control and reduce the possible opportunistic behavior of the management. In emerging economies, such as the Mexican economy, the legal protection for investors is low, which, on several occasions, leads to this type of investors not being able to directly control the company. Furthermore, there is a very strong familial content in these companies, and so the ownership of the institutional shareholders, though important, is less so when compared to the ownership of the families, and as such it represents a smaller payment of dividends. Additionally, it is important to mention that according to our results, the minority shareholders are not significant in the process for the payment of dividends. It would be interesting, as a future line of research, to broaden this work by delving into the problematic between majority and minority shareholders, as well as the analysis that includes other type of main shareholders, such as the government or foreign corporations. This would be done with the objective of analyzing whether the impact in the payment of dividends is divergent to the findings, or matters such as whether the legal aspects have some effect or cause any type of variation in the results, in addition to extending the study to other emerging countries and see if there are differences in relatively similar markets that are distant from the English context where most of the investigation in this regard is carried out.

See http://www.bmv.com.mx.

Peer Review under the responsibility of Universidad Nacional Autónoma de México.