This paper shows that women are more likely than men to employ the fair allocation that most benefits their financial payoff. The experimental evidence is gleaned from a dictator game with production, in which subjects first solve a quiz to accumulate earnings and then divide the surplus by choosing one over five different allocations, some of which represent a fairness ideal. The data also suggest that women are more sensitive to the context as their allocation choices depend on whether they have accumulated more or less money than their counterparts. This is not the case for the men's allocation choices.

Este artículo muestra que las mujeres eligen con mayor frecuencia la asignación justa que les resulta más beneficiosa a su rentabilidad financiera. La evidencia experimental proviene de un juego del dictador con la producción, en el que los sujetos primero resuelven un cuestionario para acumular ganancias, y luego dividen estas ganancias eligiendo una de las 5 posibles asignaciones propuestas, algunas de las cuales se fundamentan en ideales de justicia. Los datos muestran también que las mujeres son más sensibles al contexto, dado que sus elecciones dependen de si han acumulado más o menos dinero que sus oponentes. Esto no ocurre en el caso de los hombres.

“Equity is merely a word that hypocritical people use to cloak self-interest” H. Peyton Young (1994)

Given the assumption that economic actors are largely motivated by self-interest, arguments about fairness pervade the literature on behavioral economics and are frequently used to explain departures from equilibrium predictions. Recent findings in the experimental literature, however, suggest that individuals in a distributional problem such as the dictator game might apply principles of fairness in a self-interested manner (Rutstrom and Williams, 2000; Rodriguez-Lara and Moreno-Garrido, 2012). Further experimental evidence suggests that the underlying motivation for much fair behavior might be self-interest, albeit coupled with a desire to maintain the illusion of not being selfish (Dana et al., 2007; Larson and Capra, 2009). Along these lines, some authors argue that giving in the dictator's game might be explained by subjects wanting to be perceived as fair (Andreoni and Bernheim, 2009), because they want to avoid the “greedy” tag (Bolton et al., 1998), or simply because fairness imposes a constraint on self-interested behavior (Kahneman et al., 1986).

If self-interest may combine with principles of fairness to generate a behavioral pattern that suggests the importance of both, an issue remaining to be investigated is how subjects vary in this respect along observable dimensions (e.g., gender). The insights gleaned from this analysis might be important for both economists and policymakers in approaching the problem of distributive justice, or for agents understanding the implication of economic policies.2

This paper is an attempt to study gender differences in social preferences by eliciting women's and men's preferences over redistribution in a dictator game with production. Although there is a considerable literature on gender differences in preferences (e.g., Eckel and Grossman, 1998; Croson and Gneezy, 2009; Cooper and Kagel, 2009) the current paper departs from the bulk of the literature as participants in the experiment contribute to the surplus that is being distributed. This feature is important, as it generates entitlement and disentangles the effect of fairness concerns from property rights in the final distribution. As noted by Cherry et al. (2002) if there is no production stage, then dictators might give money away because they are fair-minded, or simply because the surplus to be divided is “manna from heaven”, and dictators do not feel any right to keep the entire surplus for themselves.

The dictator game with production presented in the current paper consists of two different phases. In the first phase, subjects earn money by completing a multiple-choice test that pays a fixed and a random reward for each correct answer. In the second phase, dictators allocate the earned surplus after being informed as to the reward levels (which might differ across individuals) and both members contribute to the surplus. In particular, dictators are offered five different allocations for dividing the surplus, some of which represent a fairness ideal.3

The experiment is designed to test three hypotheses. First, we want to test if some of the behavioral patterns that have been identified in the literature (e.g., women being more likely to equalize payoffs) remain when there is a production stage that precedes the dictator's decision. Second, we wish to investigate the hypothesis advanced by Croson and Gneezy (2009) that suggests that women might be more sensitive to the experimental design. This is done by studying whether women and men behave in the same manner when they allocate, after contributing more or less money than their counterparts. Finally, the data are used to shed light on how gender interacts with self-interest when dictators have to choose a division of the generated surplus. In particular, we examine whether men and/or women show any tendency to choose fairness principles in a self-serving manner by selecting the principle that is most convenient to them (i.e., the fair allocation that brings them the highest payoff).

The results support the hypothesis of heterogeneity in the use of fair allocations for both men and women with roughly 70% of subjects choosing a fair allocation and no significant differences in the way that women and men allocate the surplus (i.e., the unconditional distribution of allocation choices when subject's production is disregarded is fairly close). Despite these similarities in women's and men's allocation choices, some striking results emerge. Interestingly, women do not behave in the same manner when they allocate the surplus after contributing more or less money than their counterparts, whereas men's allocation choices are invariant to their relative position with regard to the accumulated surplus (thus, the distribution of allocation choices when relative production is accounted for is different). The same results hold when considering effort levels. Women do not behave in the same manner when they allocate the surplus after being paid more or less than their counterpart, whereas men do. These findings provide support to the hypothesis in Croson and Gneezy (2009) suggesting that women are more sensitive to the experimental design.

The existence of gender differences toward the use of the most convenient allocation represents one of the main contributions of the paper. We find that roughly 50% of women (23% of men) divided the surplus according to the fair allocation that yields them the highest payoff. When looking at those dictators who are not selfish, 66% of women who chose a fair allocation chose the payoff-maximizing one, whereas only 40% of men who chose the fair allocation chose it. To isolate the possible effects of women and men's different contributions to the surplus, a logit model is used that controls this feature. It was found that women (ceteris paribus) are 27% more likely to choose the fair allocation that is most convenient to them. This behavior is consistent with the recent finding in Miller and Ubeda (2011), who show that (in a repeated context) women are more likely to switch between fairness principles, choosing the most convenient one across rounds.

The remainder of the paper is organized as follows: in the next section, the relevant literature is briefly discussed and the intended contribution of the paper set in context. Section 3 presents the experimental design. The research questionnaire is described in Section 4. Section 5 contains the results. The final section concludes. The appendix contains supplementary material, including the experimental instructions and data analysis for robustness checks.

2Literature reviewSince Rapoport and Chammah (1965) economists have explored the existence of gender differences in behavior by means of controlled laboratory experiments. The main findings of controlled laboratory experiments. The main findings of the literature indicate that women are more risk averse than men, have a lower preference for competitive environments and give more weight to others payoffs or utilities (see Croson and Gneezy, 2009 for a revision). In the field of other-regarding preferences, the results of the dictator game suggest that women are more likely to be socially oriented, whereas men are more likely to be selfish. These differences in social preferences are expected by subjects (Aguiar et al., 2009), and are found to be significant in some studies (Eckel and Grossman, 1998; Andreoni and Vesterlund, 2001) but not in others (Bolton and Katok, 1995; Dufwenberg and Muren, 2006). As Croson and Gneezy (2009) argue, the lack of a clear-cut result might be explained because women are more sensitive to the experimental design. The extent to which subjects are exposed to risk can also determine whether the observed differences are significant or not (Eckel and Grossman, 2008). However, the magnitude and the direction of the gender differences are still far from being thoroughly understood (see Cox and Deck, 2006).

The chief issue addressed in this paper is whether gender differences in distributive justice occur when a production stage precedes the dictator's decision. Although the study of distributive justice in experiments goes back at least to Hoffman and Spitzer (1985), the majority of experiments used to investigate social preferences consider a dictator game in which the surplus to be divided was provided by the experimenter rather than earned by participants (see Cooper and Kangel, 2009 for a revision of the results). Although economists have long discussed the effect of the origin of wealth on individual behavior (e.g., Friedman, 1957), the idea of incorporating the earned surplus into the dictator game was not considered until Konow (2000) and Cherry et al. (2002), where it is shown that 95% of dictators transferred no money at all to recipients, if dictator's identities were anonymous and their effort levels determined the size of the surplus. The results in Cherry et al. (2002) align with the theoretical prediction for selfish dictators that has favored the use of the production stage to elicit fairness attitudes toward redistribution. Some recent studies in this area are by Frohlich et al. (2004), Cappelen et al. (2007), Oxoby and Spraggon (2008) and Rodriguez-Lara and Moreno-Garrido (2012), which argue for the importance of the earned surplus to explain subject's preferences for fairness, although none of these studies investigate the existence of gender differences in allocation choices. As a result, we lack experimental evidence for how gender interacts with self-interest when dictators have to choose a division of the generated surplus. One remarkable exception is Miller and Ubeda (2011), who consider a dictator game with production played during twenty periods. In each period, subjects are paid depending on their performance in a real-effort task that consists of unscrambling as many puzzles as possible. The authors show that when subjects have to divide the earned surplus, men are more likely to be selfish, but consistent across rounds, whereas women are more likely to be fair but have a tendency to switch between fairness principles, choosing the most convenient one across rounds. Importantly, the scope of Miller and Ubeda (2011) (and therefore their experimental design) is slightly different from the one presented in the current paper, as they are interested in testing the hypothesis in Croson and Gneezy (2009) by means of a within-subject design that analyze the consistency of fairness principles, whereas the current paper relies on a between-subject analysis with no repetition.4

Lastly, the data in this paper also shed light on fairness as a context-specific phenomenon (Walzer, 1983; Young, 1994). In the field of empirical social choice and psychology, some studies (mostly questionnaires) attempt to evaluate several distribution mechanisms and show that context matters, as subjects choose different solutions for the same distribution problems depending on the prevalence of tastes or needs in the story underlying each question (Yaari and Bar-Hillel, 1984; Young, 1994; Scott et al., 2001). The present contribution to this literature is to show (by means of an experiment) how men and women behave when they contribute to the surplus more or less than their counterparts.

3Experimental designA total of 144 students (77 women and 67 men) were recruited among the undergraduate population of the University of Alicante. The experiment was run in May 2008 and November 2008 in the Laboratory for Theoretical and Experimental Economics (LaTEx). Each of the six sessions had 24 subjects and lasted around 1h.

The experiment was implemented using the z-Tree software (Fischbacher, 2007). Subjects had to complete a test during the first stage of the experiment. The test contained twenty multiple-choice questions with a time constraint of 35min. There was only one correct answer out of five possibilities. At the conclusion of the test, subjects were randomly matched in pairs and assigned a role that did not depend on their performance on the test or any individual characteristic. Subjects received a random reward level (pi) for each of their correct answers. The realization of pi occurred after subjects were informed about their role. Dictators (37 women, 35 men) were rewarded pd=150 pesetas5 per each correct answer. To investigate how dictators were held responsible for their outcomes (Cappelen et al., 2007, 2010) and introduce variability in the data, recipients received pr∈{100, 150, 200} pesetas per each correct answer. The number of observations is balanced by having 24 dictators in each situation. Thus, there are 24 observations in which dictators were rewarded more than recipients (DM: pd=150, pr=100) and 24 in which there were rewarded less than recipients (DL: pd=150, pr=200). In the remaining cases, dictators and recipients were rewarded the same (pd=pr=150).6

When subjects were informed about their reward levels and their contribution to the surplus, the total surplus was divided according to the dictator's decision. Dictators had to decide between five allocation choices to divide the surplus: (1) keeping the entire surplus, (2) giving the entire surplus to the other subject, (3) dividing the surplus in two identical parts (the egalitarian allocation), (4) dividing the surplus according to the subject's contribution in terms of correct answers (the accountability allocation), and (5) dividing the surplus according to the subject's monetary contribution (the libertarian allocation).7

This set of allocation choices allows dictators to keep the entire surplus as would be predicted by the Nash equilibrium for selfish subjects. Likewise, the “fair allocations” (i.e., the egalitarian, the accountability, and the libertarian allocation) can be used to categorize the subject's preferences for fairness, as it is illustrated in Cappelen et al. (2007). The egalitarian allocation corresponds to the idea of equality (Fehr and Schmidt, 1999) whereas the accountability and libertarian principles consider that entitlements to the available surplus are determined by the subject's performance in the questionnaire. In particular, the accountability allocation is based on the effort exerted (i.e., the number of correct answers) and corresponds to the idea of equity in the sense that those factors that cannot be controlled by subjects are not considered by dictators when they are making their choice (Konow, 1996; Roemer, 1998). The libertarian allocation, on the other hand, takes into account the reward levels and states that subjects ought to receive as much as their (monetary) contribution to the surplus (Nozick, 1974).

To see how fairness ideals apply in a dictator game with production, consider that the case where the total surplus to be divided is denoted by y¯≥0. We assume that the size of the surplus depends on the dictator and the recipient's monetary contributions, which are denoted by yd≥0 and yr≥0, respectively. In particular, yi=piqi where qi≥0 represents subject i's performance in the test and pi>0 is the reward for each correct answer, for i∈{d,r}. If the dictator chooses the egalitarian allocation, then the dictator will divide the surplus in two identical parts, so that each subject will receive y¯/2, regardless of his/her performance and the reward levels. The accountability allocation implies that each subject will receive the part that corresponds to his/her performance on the test y¯qi/(qd+qr)), whereas the libertarian allocation held subjects responsible for the reward levels and pays yd to each of the subjects.8

4Research questionsThe main questions to be addressed concern the existence of gender differences in allocation choices and the possibility that women and men behave differently depending on context (i.e., when they contribute to the surplus more or less than recipients). We also want to investigate whether subjects choose the fair allocation that is most convenient (i.e., the one that yields the highest payoff) and the extent to which this choice can be determined by the dictator's gender, the performance in the test (pi) and the reward levels (qi). We now present the research questions in detail and relate them with previous findings in the literature on gender differences. Q1: In the dictator game with production, do men and women differ in their allocation choices? Are men and/or women inclined toward choosing a unique allocation?

Some evidence from previous studies that investigate gender differences highlight that women are more socially oriented than men (e.g., Eckel and Grossman, 1998), and are more concerned with equalizing payoffs (e.g., Andreoni and Vesterlund, 2001; Dickinson and Tiefenthaler, 2002). In that regard, it will be worth analyzing whether men (women) are more likely to choose the selfish (egalitarian) allocation.9

The data in Croson and Gneezy (2009) suggest that women are neither more nor less socially oriented but their preferences seem to be more malleable. The second question is then related to the idea of women's decisions being more context-specific than men's (Cox and Deck, 2006; Croson and Gneezy, 2009) and the possibility of behavior varying with the “price of giving” (Andreoni and Vesterlund, 2001). This is the main focus on Miller and Ubeda (2011). Q2: Do men and women choose the same allocation choices regardless of their contribution to the surplus? Does their behavior depend on the external factors (e.g., the reward levels)?

The final question is in line with recent findings suggesting that dictators are likely to choose fairness principles in a self-interested manner (Rutstrom and Williams, 2000; Rodriguez-Lara and Moreno-Garrido, 2012). Q3: Do men and women choose the fair allocation that brings them the highest payoff?

The objective is to shed light on the (possible) interaction between gender and the self-serving choices of fairness allocations.10 Hereafter we consider that the dictator chooses the most convenient allocation whenever he/she chooses the fairness ideal (egalitarian, accountability or libertarian allocation) that brings him/her the highest payoff.

5ResultsIn this section, I analyze the data gathered during the experimental sessions. First, I outline the subjects’ performance in the first-stage quiz. On average, women had 8.64 questions correctly when they were dictators, whereas men had 11.77 questions correctly (standard deviations are 2.27 and 2.77 respectively). Women faced recipients who had on average 11.32 questions correctly, whereas men's counterparts had 10.4 questions correctly. A simple t-test rejects the null hypothesis that women and men had the same number of questions correctly when they were dictators (t=5.23, p-value<0.000). In addition, the t-test rejects the null hypotheses that women and men had the same questions correctly than their counterparts (for women, t=4.03, p-value<0.003; for men t=2.10, p-value<0.043). We therefore conclude that women's and men's performance in the first-stage quiz is significantly different.11

The dictators’ decisions are summarized in Fig. 1, which plots the frequency of choosing each possible allocation by considering women and men separately. Since no dictator chose to give the entire surplus away, such an allocation is not listed (Fig. 1).

We see in Fig. 1 that roughly 70% of dictators chose one of the fair allocations. If we look at the choice of fairness allocations, we observe that there is no unique fairness ideal that can be used to describe the dictator's behavior. Instead, there is heterogeneity in the use of fair allocations, which is consistent with Cappelen et al. (2007).12Result 1 Women and men do not choose a unique allocation when they divide the surplus but exhibit heterogeneous behavior concerning redistribution.

In Fig. 1, we observe that women are less likely to choose the selfish allocation and more likely to choose the egalitarian allocation. The test of proportion, however, suggests no significant difference between the proportion of women choosing the selfish option and the proportion of men doing so (Z=1.16, p-value=0.123). The same result holds when testing for the proportion of women and men choosing the egalitarian principle13 (Z=1.33, p-value=0.183) and there is not any significant correlation between the dictator's gender and the possibility of choosing a fair allocation (p-value=0.148). Comparing the distribution of allocations that women and men chose, the Fisher exact probability tests cannot reject the null hypothesis that these allocation choices come from the same distribution (Fisher's exact=0.351). These results are consistent with the idea in Croson and Gneezy (2009) of women being neither more nor less socially oriented.Result 2 Women and men's allocation choices cannot be rejected to come from the same distribution.

To see whether decisions are context-dependent or not, the dictator's relative position with regard to the accumulated surplus as a reference point is considered. In Table 1, we report the p-values of the Fisher exact probability test that compare the distribution of allocation choices when dictators contribute to the surplus more than recipients (yd≥yr) and when they contribute less (yd<yr). Dictator's behavior is compared when they are paid more (pd≥pr) or less (pd<pr than recipients for each correct answer.

The Fisher exact test rejects the null hypothesis that the distribution of women's allocation choices when yd≥yr is the same as the distribution of women's allocation choices when yd<yr. The test does not reject this hypothesis for men, who seem to behave in the same manner when they are in an advantageous position and when they are in a disadvantageous position with regard to the accumulated surplus. The same conclusion holds when considering differences in the reward levels.14Result 3 Women's allocation choices are sensitive to the context since choices depend on whether women have accumulated more or less money than recipients. Women's allocation choices do also depend on the reward levels.

The third research question presented in Section 4 concerns the extent to which dictators choose a convenient allocation. To approach this issue, we compared the final distribution of payoffs (that result from dictator's choices in Fig. 1) with the (hypothetical) distribution of payoffs that would correspond to dictators following the fair allocation that is most-convenient to them (i.e., the payoff maximizing one).15 The Wilcoxon signed-rank test cannot reject the null hypothesis that these distributions are the same for women (W=0.75, p-value=0.449), but it rejects the same null hypothesis for men's allocation choices (W=2.36, p-value=0.018).

At the individual level, 8 out of the 35 men (i.e., roughly 23%) chose to allocate the surplus according to the fair allocation that gave them the highest payoff, whereas 18 of the 37 women (i.e., 49%) did so. The test of proportion indicates that this difference in the proportion of men and women allocating the surplus according to the most convenient allocation is significant (Z=2.28, p-value=0.023). When the analysis focuses on dictators who were not selfish, it was found that 27 women chose to give money away, and 18 of them (i.e., roughly 66%) chose the most convenient allocation. There are 20 men who chose to give money away, and 8 of them (i.e., 40%), chose the most convenient allocation. Again, the test of proportion indicates that the difference is significant (Z=1.52, p-value=0.063).

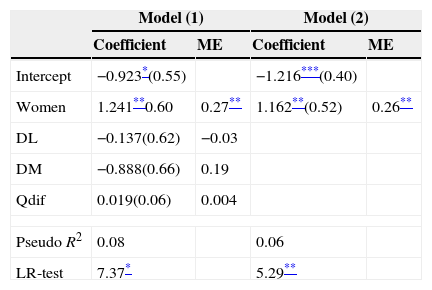

Overall, it seems that women and men's behavior is fairly close when the production of the surplus is disregarded, but women are somehow inclined toward choosing the fair allocation that is most convenient to them. This finding can be affected by subject's performance in the test. Assume that women and men do have exactly the same preferences over redistribution so that they would choose the same allocations. If women do contribute to the surplus less than men but choose the same allocations, women would appear as being more convenient than men (even though they both have exactly the same preferences). Thus, the fact that women appear to be more likely to choose the convenient allocation could be explained by their gender or simply by their relative performance in the quiz (e.g., Qdif=qd−qr). This is particularly important in our experiment given that women contribute significantly less to the surplus. The treatment conditions (i.e., the reward levels) could also affect the frequency of choosing the most convenient allocation, since dictators may feel good or bad for being paid more or less than recipients. To disentangle the effect of these variables, a logit regression was estimated in which the dependent variable is the probability of choosing the fair allocation that gives the dictator the highest payoff. The explanatory variables are the dictator's gender (i.e., a dummy variable WOMEN that takes the value 1 if the dictator is a woman), the treatment conditions (i.e., the dummy variables DM and DL take the value 1 if dictators are paid more or less than recipients) and the difference in subject's correct answers (Qdif=qd−qr). The estimates and the marginal effects (ME) of this specification are presented in the first columns of Table 2 (Model (1)). The second specification (Model (2)) is based on a stepwise model in which the choice of the independent variables is carried out by backward elimination; i.e., those variables that are not significant according to the t-test are deleted in each step. The standard errors of both models are presented in brackets.16

Neither the treatment conditions nor the difference in correct answers seems to have a statistically significant effect on the frequency of choosing the biased allocation. The dictator's gender, however, has a significant effect as women are 27% more likely to choose the biased allocation than men (ceteris paribus). In fact, if we perform a stepwise regression, we will conclude that the dictator's gender is the only significant variable in explaining the frequency of choosing the most convenient allocation.17Result 4 Women are more likely than men to employ the fair allocation that most benefits their financial payoff.

Although the regression analysis suggests that there is no effect of the relative performance on the probability of being self-serving, recent evidence suggest that disadvantaged individuals might have a tendency to overcome their disadvantage by cheating (e.g., Schwieren and Weichselbaumer, 2010; Gino et al., 2013). This, in turn, could explain why women are more likely to be self-serving in the experiment. As they contribute to the surplus less than their counterparts, they might feel entitled to take a larger part of the surplus, showing then a tendency to appear self-interested. If this were the case, we should observe that women who have accumulated more money than their counterparts should forgo using the most convenient allocation. In Table 3 we report the p-values of a Wilcoxon signed-rank test to see if the distribution of payoffs associated to dictators’ allocation choices (Fig. 1) is the one that yields them the highest payoff. Men and women are considered separately and perform the test for cases in which dictators are in disadvantage (advantage) position with regard to the accumulated surplus, yd<yr (yd≥yr).

Biased behavior and earnings in the production stage.

| Women | Men | |

|---|---|---|

| If yd<yr dictators divide the surplus choosing the most convenient allocation | 0.962 | 0.332 |

| If yd≥yr dictators divide the surplus choosing the most convenient allocation | 0.230 | 0.017** |

p-Values for the Wilcoxon signed-rank test.

*Significance at 10% level.

Interestingly, there exists a tendency for dictators to be self-serving when they have accumulated less than their counterparts. This occurs both for men and women.18 Strikingly enough, women who accumulated more than their counterparts still show this tendency to be self-serving, whereas men do not.

6ConclusionsThis paper studies gender differences in distributive justice by means of a controlled laboratory experiment. In the first phase, subjects solve a questionnaire to earn money. In the second phase, dictators divide the surplus according to five different allocations, some of which represents a fairness ideal.

There is evidence that women are more likely than men to employ the fair allocation that most benefits their financial payoff. The data also suggest that women are more sensitive to the context as their allocation choices depend on whether they have accumulated more or less money than their counterparts. This is not the case for men's allocation choices.

Overall, these findings suggest a subtle but significant change in our understanding of what other studies have found with respect to the effect of gender on problems of distributive justice. The existence of the production stage has probably contributed these new findings on gender differences. Although this feature of the experimental design has been shown to be a key component to study fairness (Cherry et al., 2002; Konow, 2000; Cappelen et al., 2007) it has been widely ignored in papers that investigate gender differences in behavior.

Still, there are some things to be done. Although this paper provides a correlation between the dictator's gender and the self-serving use of justice principles, the sample size (72 dictators) is relatively small given that there are three different treatment conditions. In that regard, it would be beneficial to replicate the current study with more observations. Turning to a discussion of a rationale for the main result, one possible explanation might be offered by the dual interest theory (Lynne, 1999; Czap et al., 2012). This suggests that there is a natural, inherent cognitive dissonance in the brain, which is reflected in the egoistic–hedonistic based self-interest. This tendency needs to be tempered by the tendency to empathy-sympathy based on other interests which refers to the subject's capacity to step into someone else's shoes (empathy) and his/her concern for others’ welfare (sympathy). The idea of designing an experiment that investigates the extent to which women and men differ in these dimensions would be an excellent area for future research.19 The possibility of considering the dictator's behavior as a third-party view (i.e., comparing their choices when they are involved in the problem and their choices for other subjects) or extending the game to the possibility of taking (List, 2007; Bardsley, 2008; Cappelen et al., 2013) seem also fruitful areas for future research into gender differences in distributive justice.

FundingFinancial support from the Spanish Ministry of Science and Innovation (ECO2011-29230) is gratefully acknowledged.

He is also Research Fellow at LUISS Guido Carli University (Rome).

As pointed out by Debbie Walsh, the director of the Center for American Women and Politics at Rutgers University, understanding of gender differences might be particularly important nowadays since “women may be the change [voters are] looking for”.

Technically speaking, this is a mini-dictator game because dictators are not allowed to choose any division of the surplus, but have to choose from a set of allocations. In such a set, the allocations that represent a fairness ideal are the egalitarian, the accountability and the libertarian allocation. The interested reader can see Cappelen et al. (2007), Konow (2000), Miller and Ubeda (2011) and Rodriguez-Lara and Moreno-Garrido (2012) for the application and the rationale of these fairness allocations in a “traditional” dictator game in which dictators are allowed to choose any distribution of the surplus. Konow (2003) is an excellent revision of the different fairness ideals.

Another recent paper in this literature on social preferences that uses a dictator game with production to investigate gender differences is Heinz et al. (2012), who consider the case in which dictators have to divide a surplus that only depends on the recipients’ performance.

It is standard practice for all experiments run in the University of Alicante to use Spanish pesetas as experimental currency. Exchange rate: 1Euro=166,386 pesetas.

The information on gender was collected at the end of the experiment. Since roles did not depend on any individual characteristic, we cannot control for having exactly the same number of women and men in each role. This procedure was chosen so as to guarantee equality of opportunities, what is important to avoid compensation and control for responsibility (Fleurbaey and Maniquet, 2009). The fact that roles were not revealed in the experiment is also important because dictators’ behavior was not conditioned (e.g., Aguiar et al., 2009) and gender stereotypes were not activated (Fryer et al., 2008).

See Appendix A for the experimental instruction and Rodriguez-Lara and Moreno-Garrido (2012) for further details in the procedures. I note that the current paper differs from Rodriguez-Lara and Moreno-Garrido (2012) because dictators have to choose from a set of allocation choices instead of choosing any division of the surplus. Besides, Rodriguez-Lara and Moreno-Garrido (2012) do not analyze the impact of gender differences on behavior, which is the main focus of the current study.

For further discussion on the relationship between responsibility or control over outputs and fairness principles see Fleurbaey and Maniquet (2009) and Cappelen et al. (2010) among others. Of course, there exist cases in which the fair allocations overlap. This is discussed in the supplementary material (Appendix B).

Bolton and Katok (1995) is one of the studies that do not find significant differences.

Rodriguez-Lara and Moreno-Garrido (2012) provide evidence for self-serving choices of fairness ideals. This is related to the dictator's gender in Miller and Ubeda (2011) in a within-subject analysis. I note that the use of the most convenient allocation might be related to the existence of what Croson and Konow (2009) call “moral bias" (i.e., behavior biased away from impartial standards). Other concepts in the literature of distributive justice that might be related to the choice of the most convenient allocation are “self-serving bias" and “egocentric bias" (e.g., Messick and Sentis, 1983; Babcock et al., 1995; Konow, 2000), but these concepts require to compare the dictators’ allocation choices with their choices as impartial judges who divide the surplus for two other subjects.

This gender difference in performance is consistent with previous findings (e.g., Brown and Josephs, 1999; Gino et al., 2013) and is particularly important for understanding the main results of the paper (Result 4). Although it is found that men and women choose the same allocation choices (Result 2), we will see that women's behavior is sensitive to the context and women are inclined toward choosing a convenient allocation.

Cappelen et al. (2007) show that dictators exhibit heterogeneous behavior and do not allocate the surplus according to a unique fairness ideal. However, the role of gender is disregarded in their analysis.

If I compute the women's and men's deviations from equality, the Kolmogorov–Smirnov test cannot reject the hull hypothesis that women's and men's allocation choices come from the same distribution (KS=0.250, p-value=0.15). I should acknowledge that gender differences in the use of the selfish and egalitarian allocation might not be significant because of the small sample size. Thus if the sample size were larger, I would expect men to be (significantly) more selfish as it occurs in Miller and Ubeda (2011).

The interested reader can see the distribution of allocation choices depending on the context in Appendix C. In line with Croson and Gneezy (2009) and Cox and Deck (2006), the data suggest that women might be more sensitive to the context than men. It seems that women are more likely to equalize payoffs when they contribute to the surplus less than recipients; e.g., the test of proportion rejects the null hypothesis that women are equally likely to choose the egalitarian principle when yd≥yr and when yd<yr, in favor of the alternative that the egalitarian principle is chosen more frequently when yd<yr (p-value=0.056).

I am not aware of any statistical test that compares distributions of categorical data when more than two outcomes are possible and observations are not independent. For that reason, I decided to use the distribution of payoffs. To control for the effect of different reward levels (that would yield a higher size of the surplus in the DM treatment even if performance were unaffected), I transform the data and consider the proportion of the surplus that dictators decided to keep so as to compare it with the proportion of the surplus they would keep if they used fairness allocations in a self-serving manner.

The regression results are robust to a number of other specifications. In particular, the marginal effects do not change qualitatively if rather than using Qdif I consider a dummy variable DQdif that takes the value 1 if Qdif≥0, or if I include in the model the product of the dummy variables “Women” and Qdif as explanatory variable. The interested reader can find these regressions in Appendix C. One limitation of the data is that women do allocate a smaller surplus than men (p-value=0.017), but controlling for the size of the surplus (y¯≥0) could be problematic, especially once I control for the relative performance and the reward levels. As a referee pointed out, it could be the case that results are due to a wealth effect, with subjects who divide a smaller surplus (women) being more likely to be self-serving. Although I find that this is a plausible assumption, the pairwise correlation coefficient suggests no relationship between the size of the surplus and the use of the most-convenient allocation (correlation coefficient=−0.152, p-value=0.204).

In Appendix D, the interested reader can see a robustness check of this result using the data in Rodriguez-Lara and Moreno-Garrido (2012).

This finding is in line with the interpretation of Gino et al. (2013), who find that women tend to misreport in a competitive environments (i.e., a problem-solving task) in which they perform worse than men but do misreport their score in non-competitive environments (i.e., rolling a dice and inform the experimenter about the result). In the authors’ opinion, it is not the case that women cheat more in competitive tasks, but that disadvantaged individuals tend to overcome their disadvantage by cheating in competitive tasks (see also Schwieren and Weichselbaumer, 2010 for a similar interpretation).

The evidence gleaned from this experiment would also be useful to reconcile the data in dictator games with and without production. For example, Andreoni and Vesterlund (2001) or Dickinson and Tiefenthaler (2002) find that women are more likely to equalize payoffs, whereas the current paper suggests that this only occurs if women contribute to the surplus less than their counterpart. Maybe the egoistic-hedonistic based self-interest and the empathy–sympathy based other-interest are related to the relative position with regard to the accumulated surplus or to the dictator's gender.

- Descargar PDF

- Bibliografía

- Material adicional