The sharp rise in debt and the long fiscal consolidation process in some Eurozone countries has not always led to a reduction in debt-to-GDP ratios. As a result, some authors suggest that the primary balance may stop adjusting once debt has reached a certain limit. We show that the reaction of the primary balance to rising debt depends on the underlying growth and institutional dynamics. In particular, economic growth can have an exponential effect on the primary balance. Also, we show that rising debt, when accompanied by growth and a favorable political context may lead to an improvement in the primary balance.

La subida pronunciada de la deuda y el largo proceso de consolidación fiscal en ciertos países de la Eurozona no siempre ha conducido a una reducción de los ratios deuda-PIB. Como resultado, algunos autores apuntan a que la balanza primaria puede dejar de ajustarse una vez que la deuda haya alcanzado un cierto límite. Queremos reflejar que la reacción de la balanza primaria con respecto al crecimiento de la deuda depende del crecimiento subyacente y de la dinámica institucional. En particular, el crecimiento económico puede tener un efecto exponencial sobre la balanza primaria. De igual modo, queremos reflejar que el crecimiento de la deuda, cuando se ve acompañado de crecimiento y de un contexto político favorable, puede comportar una mejora de la balanza primaria.

The sharp rise in debt and long fiscal consolidation process in Eurozone countries has led some authors to consider the existence of fiscal fatigue. This happens when countries that face rising debt stop adjusting their primary balance once debt reaches a high level. This can be the case if long fiscal consolidation processes do not bear fruit.

Generally, the literature (see in particular Ghosh et al., 2013) considers that the relationship between the level of debt and the primary balance goes through three phases. In the first phase, when debt is low, the primary balance does not react to a rise in debt because increases in debt are considered irrelevant at those levels. Secondly, once rising debt reaches a level that, for instance, markets react and price in a higher probability of default, sovereigns will start a fiscal consolidation process aimed at stabilizing the debt-to-GDP ratio. Fiscal fatigue happens in the third phase of fiscal adjustment: when debt reaches a threshold in spite of the adjustment. The sovereign may stop adjusting, thus prompting further increases in the debt-to-GDP ratio.

This concept is related to the fiscal limit in the sense of Leeper (2013). The fiscal limit is reached when governments do not react to increases in debt with further adjustment. This can be either because markets do not deem further adjustment credible or, because the economic situation has deteriorated so much that further budget cuts are not revenue-generating. Ghosh et al. (2013) focus on the former phenomenon, and calculate the level of debt at which markets would stop financing the government, as debt would become unsustainable.

This paper tries to contribute to the literature by shedding light on how macroeconomic and institutional aspects may halt fiscal consolidation efforts. According to the narrative above, once a country reaches a certain level of debt, the government does not, ceteris paribus, react to the rise in debt, regardless of whether it is growing or not or the institutional circumstances at that point. These factors may change the level at which debt triggers a lack of adjustment, but they will not affect the policy reaction once the debt limit is reached.

Our hypothesis is that, in fact, whether a country stops adjusting when debt is at high levels depends on factors that pertain to the country's economic and institutional situation. When faced with large debt, if the government is strong or if the underlying growth momentum is improving, the primary balance is more likely to continue adjusting. These factors will have an impact on their own but also when they are interacted with growing debt.

To test this hypothesis, we introduce a series of interaction terms in the classic fiscal reaction function. In our equation, the level of debt is interacted with institutional and growth variables. For instance, we control for growth using a variety of specifications. If the output gap is positive, fiscal consolidation may be less costly for governments, if only because fiscal multipliers are lower (see Egert, 2014). In such a context, governments may be more willing to adjust than in recessions.

In order to properly capture the reaction to rising debt we consider the nonlinearities in the effect of the output gap on the primary balance. These nonlinearities may affect the fiscal fatigue result: Highly indebted countries tend to grow less (Herndon et al., 2014; Baum et al., 2013; Kempa and Khan, 2015) and have higher output gaps (in absolute value). Regardless of the direction of causality, that relationship alone can alter our results. The negative effect of growth on the primary balance may not be due to the reaction of the primary balance to rising debt, but rather, the effect of growth, which may not be captured correctly by a linear output gap term.

These nonlinearities arise for different reasons: for instance, they may be due to the fact that cutting spending in a downturn can be particularly damaging to the economy. Also, the asymmetry may stem from a government's myopia, which leads to the fiscal balance not being neutral over the cycle.

Finally, the asymmetry could be due to the fact that agents change their behavior at different points in the cycle. For instance, they may increase the proportion of expenditure allocated to basic goods in the downturn. To the extent that these goods are less heavily taxed than regular goods, the result could be a more procyclical fiscal balance. Also, tax compliance has a cyclical component (Sancak et al., 2010): in a downturn, there may be more incentives to evade taxes than in an upturn, when the marginal cost in terms of welfare of paying taxes may be lower.

There is reason to believe that government strength (in terms of political support in Parliament) may affect the primary balance reaction near the debt limit. Governments that are strong enough to carry out a fiscal adjustment may only be willing to do it when they do not have another option, as in general they want to avoid restrictive fiscal policies that may be electorally costly. Therefore, government strength may be particularly relevant when interacted with the level of debt.

Our main result is that growth and institutional factors are important determinants not only by themselves, but also when interacted with rising debt. We do find some evidence that there is fiscal fatigue, in the sense that the higher the level of debt, at the margin, fiscal adjustment will be lower. However, the reaction of the government to higher debt levels is greatly mitigated if the economy is growing and if the government has broad parliamentary support and does not have to worry about elections when the debt limit is reached.

Our sample is a panel of the Eurozone countries. From a policy perspective, the fiscal fatigue results are important for the subset of countries with high debt and that have gone through large fiscal adjustments, i.e. the periphery. In order to check the impact of our results on debt sustainability, we will test the effect of our results on debt forecasts in three peripheral European countries. In these scenarios, we will model the fiscal balance through the fiscal reaction function we estimate in the study. The estimated path of debt will be compared with the forecast from the IMF World Economic Outlook as of end 2014. This comparison will illustrate that the magnitude of the effects estimated is strong enough to alter substantially the expected path of the public debt-to-GDP ratio.

The rest of the paper is organized as follows. Section 2 reviews the relevant literature. Section 3 introduces the data and the model we use, while Section 4 analyzes the results. Section 5 shows the impact of the enhanced fiscal reaction function on debt sustainability. Finally, Section 6 offers some concluding remarks.

2Literature reviewThere are several strands of the literature that are relevant to this paper. First of all, the fiscal reaction function literature which usually models the primary balance as a function of growth, particularly of the output gap, provides the framework used in the empirical exercise.

The general framework used is based on Bohn's (1998) approach, which tests how the primary fiscal balance (i.e. fiscal balance excluding the interest payments on public debt) reacts to lagged sovereign debt. He considers fiscal policy can be deemed sustainable if the government reacts systematically to a change in public debt by adjusting the primary fiscal balance: if, ceteris paribus, the primary balance reacts positively to a shock to debt, then the government can be considered to act responsibly and guarantee that debt will be stabilized. If there is no such reaction, debt can become unsustainable.

Bohn (1998) analyzes the case of the US, finding significant response coefficients for the period 1916–1995 and different sub-periods and concludes that U.S. fiscal policy passed the sustainability test in that period. Semmler et al. (2007) investigate whether several Euro Area countries (Germany, France, Italy and Portugal) passed Bohn's test. They find that over the period 1960–2003 the response of the primary balance to debt was positive and robust, thus concluding that fiscal policy in these European countries follows a sustainable path.

However, the problem with these contributions is that by considering how the primary balance reacts over a whole period they do not consider the possibility that the nature of the reaction may change during the period, depending on how macroeconomic and institutional aspects evolve. One particular dynamic may be that when debt rises above a certain threshold, the primary balance may stop adjusting. Such is the idea of fiscal fatigue put forth by Ghosh et al. (2013). They find evidence of fiscal fatigue in highly indebted countries in the past few years in the Eurozone. The existence of a debt limit is consistent with the fact that countries lose market access quickly once they approach the debt limit (Flood and Marion, 2009).

Fatás and Mihov (2010), for an earlier period, had analyzed the same issue and find no evidence of fiscal fatigue in the Eurozone, as measured by changes in the impact of debt on the fiscal balance. However, they do not consider the crisis period in their analysis.

Our contribution will be to characterize the determinants of the primary balance reaction to debt. In particular, we will consider whether this reaction depends not just on the level of debt itself, but on the underlying growth and institutional characteristics of the country when debt is on the rise.

Another strand of the literature which our paper builds upon is that which analyzes the relationship between debt and growth. In the canonical fiscal reaction function, the output gap tends to affect the primary balance linearly. However, part of the literature has found that the reaction of the primary fiscal balance to the cycle does not behave this way. Sancak et al. (2010) show that tax evasion is countercyclical and that consumer habits tend to change in downturns, so that their consumption of primary goods, which tend to be taxed at a lower rate, is greater. Also, the mere progressivity of the tax code can lead tax revenue to decline more than proportionally in downturns.

Aside from the effect of growth on the fiscal balance, institutional factors can also play a role on the fiscal adjustment. There are two channels that are studied in this paper. First, the position on the electoral cycle and, secondly, the strength of the government. Both of these will have an impact on the primary balance at any given point in time, but should have more of an effect when accompanied by rising debt.

In general terms, the literature on the electoral cycle has searched for the effect of elections on spending. While the findings are mixed, most papers (Alesina et al., 1997 or Goeminne and Smolders, 2014) find that governments increase spending before elections. Similarly, weak governments will tend to be more prone to spending. One reason for this may be that governments have to avoid unpopular policies such as budget cuts in other to keep a weak coalition together (Roubini and Sachs, 1989).

The idea that government strength, electoral cycle considerations and growth conditions affect countries both over the whole sample but, particularly, when crises near is justified in Alesina and Drazen (1991). In their war of attrition model governments wait to carry out needed fiscal adjustment until a crisis nears because of the political process.

In their setting, governments only have an incentive to adjust when on the verge of a crisis. The result is the opposite of the fiscal fatigue result: when debt rises dangerously, instead of adjustment becoming less likely, governments may be prompted to act so as to avert a crisis. In the fiscal fatigue result, rising debt, after a certain level, actually lowers the appetite for additional adjustment.

This result emerges in Alesina and Drazen (1991) as the result of a war-of-attrition model, which concludes that stabilizations are more likely to happen in crisis periods with a “strong” government. In their setting, delays in the stabilization emerge from political conflict between two different groups in society which have different views on how to allocate the cost of the stabilization; each group would like the other to pay for the bulk of the fiscal adjustment.

Eventually, the more impatient sector of society will be willing to compromise, thus revealing that waiting is costlier for them. Each of the groups compares the marginal cost and the marginal benefit of waiting for the adjustment. The marginal cost is the cost of not having the stabilization for another period—that is, of living in an unstable economy for another period. The marginal benefit is the probability that in the next period the opponent group eventually concedes. Delaying a stabilization is costly for society as a whole, and it is Pareto inferior to immediate stabilization, but it is individually rational for each of the two groups.

Strong governments will be more capable of carrying out the fiscal adjustment when the result of the confrontation between the two groups points in this direction. However, weak governments may find that even when faced with rising debt, they do not have the ability to carry out the fiscal adjustment needed to avert a crisis.

Overall, therefore, we find evidence in the literature that the relationship between growth, institutions and the primary balance is complex. In our model we will test some the aspects put forth by the literature. First, we will analyze whether there are nonlinearities in the reaction of the primary balance to growth. Secondly, we will consider whether the state of the economy and the political institutions once the debt limit is reached has an effect on the reaction of the primary balance.

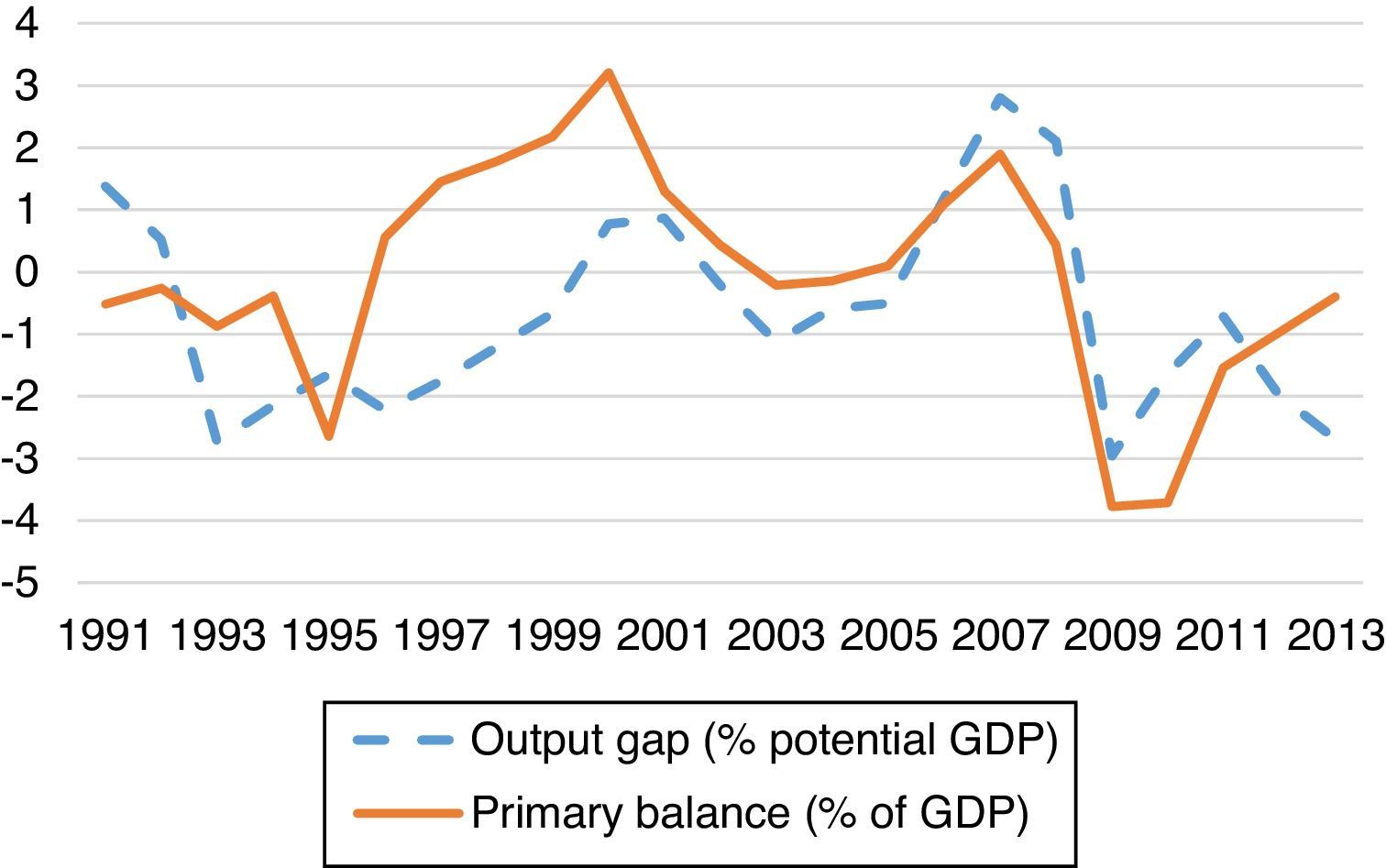

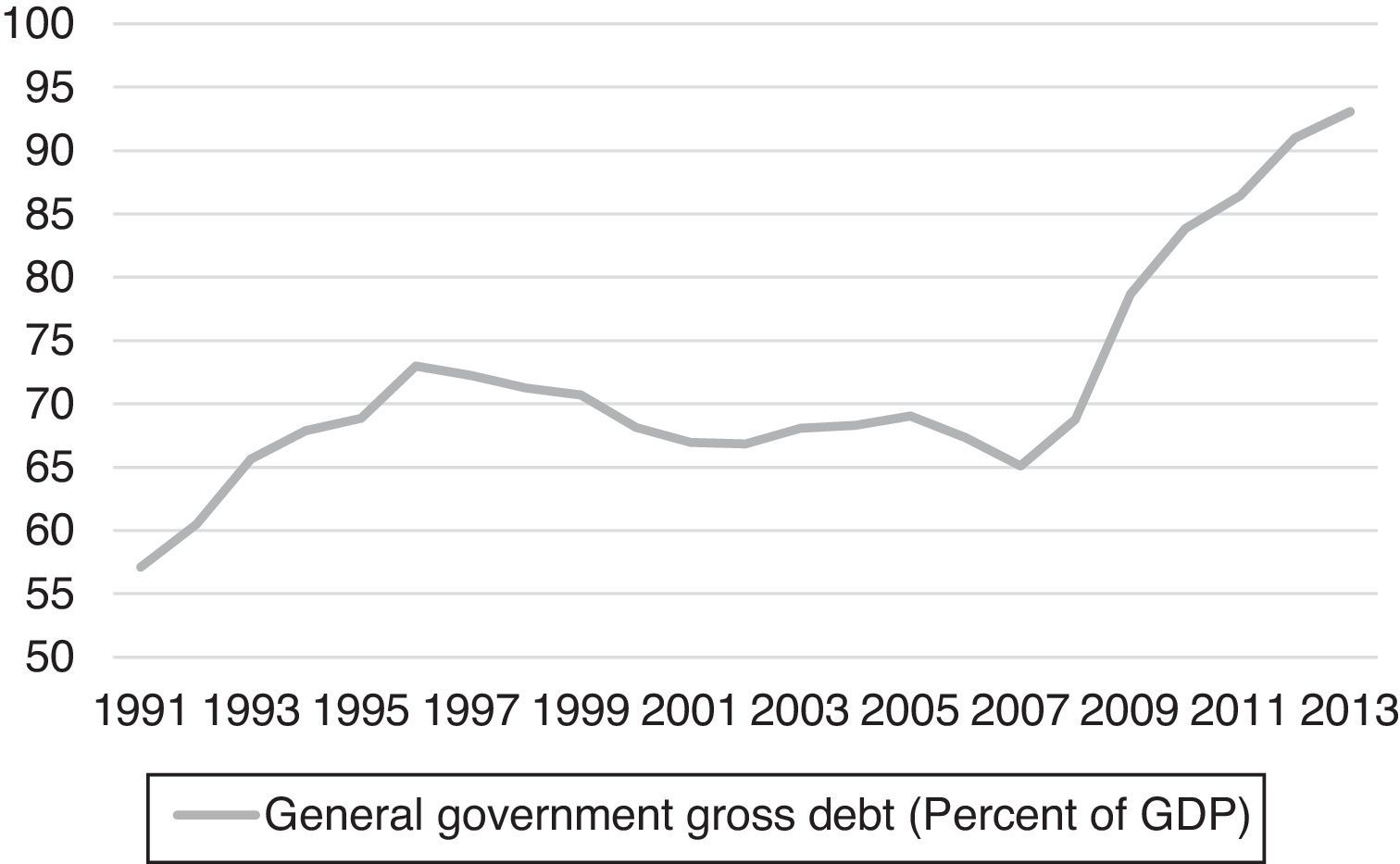

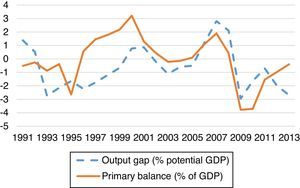

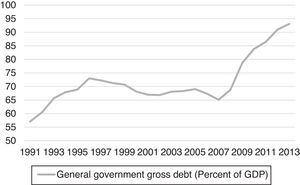

3Data and empirical model3.1DataOur model will use annual data, for the period 1980–2013 for the Eurozone member countries. The key macroeconomic variables considered are the output gap, debt to GDP ratio and the primary balance, which are taken from the International Monetary Fund's World Economic Outlook (WEO) database. As Figs. 1 and 2 show for the Eurozone as a whole, the recent period stands out as a time of large negative output gap and increasing government debt, in spite of the improvement in the primary balance. It is therefore natural to consider whether at some point fiscal adjustment will slow.

We will use as controls trade openness and the government expenditure gap. The former is calculated as the ratio of the sum of exports and imports to GDP. The government expenditure gap is the difference between government spending in a given year and smoothed government spending, calculated using a Hodrik Prescott filter. It is used to control for one off surges in government spending on a given year.

Secondly, we use the support that a government has as a measure of the ability to implement fiscal policy, in particular in reaction to rising debt. The variable is measured as the percentage of members of Parliament that have voted for a government in a given date, and is taken from the Bern University comparative political database. The literature tends to show a positive relationship between the primary balance and the degree of support for a government, which is explained by two aspects: first, the fact that governments with broad support may be able to afford being more farsighted, and, secondly, governments that have broad support do not need to please a wide variety of pressure groups through giveaways (Roubini and Sachs, 1989).

According to the political cycle theories (Alesina et al., 1997 or Goeminne and Smolders, 2014), governments tend to increase spending ahead of elections. The variable we use to capture this effect will be the number of government changes in a given year. The variable has a value of 0 if the government doesn’t change, takes a value of one if the government changes once in a given year, and can take a higher value if there is more than one government change in the same year. This indicator will enter the equation with a lead, to capture the forward looking effect described by the literature: governments increase spending right before an election. The source of the data will is also the comparative political data sets of Bern University.

We also consider the type of government ruling the country. In particular, we distinguish whether the governing party has a large stable majority or not. We introduce a dummy variable for the existence of a multiparty minority government, which, in the classification we use, the weakest type of government. This can be considered as an alternative measure of government strength.

3.2Model specificationIn the fiscal reaction function, the primary balance is a function of the level of debt the previous year, and then a series of controls covering economic and institutional variables as controls. Implicitly, the fiscal fatigue literature considers that the primary balance reacts linearly to changes in growth.

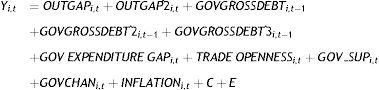

The canonical equation to be estimated is the following:

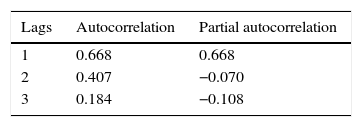

where y denotes the primary balance, GOVGROSSDEBT is the debt-GDP ratio, OUTGAP is the output gap (measured as the difference between actual and potential GDP1), INFLATION is the rate of change in the consumer price index and GOV_SUP is the variable government support. GOVCHAN indicates whether there has been a change in government in a given year. This is estimated as a panel of current Eurozone countries, using annual data for the period 1980–2013.The fact that debt depends on past values of the primary balance can be problematic for the estimation. As can be seen in Table 1, which shows the autocorrelation function of the residual, we do have reason to believe that there is autocorrelation. As a result, we model the error term as an AR(1) process, which corrects for the autocorrelation, and so for the endogeneity that arises from the persistence in the error term, which, in the presence of autocorrelation, arises even if debt is lagged. This is needed because lagged errors could be biasing our estimation of the primary balance (we introduce the debt variable with a lag of one period). We introduce the AR term to control for the persistence in lagged errors.

An additional issue arises from the fact that specific country characteristics may be captured by the impact of debt on the primary balance. These countries have heterogeneous institutional makeups, social welfare systems and tax systems, as a result, a given rise in debt may not have the same effect in all countries. While some of this may be captured by our institutional controls, we introduce fixed effects in the regression. This is supported by the Hausman test (see Table A1 in the Appendix). Table 2 reports the estimated fixed effects for each country.Finally, in order to check that the results are not driven by endogeneity problems, and as a robustness check, we employ the methodology developed by Bover and Arellano (1997), which uses orthogonal deviations and tends to give more robust results than the original estimation method proposed by Arellano and Bond (1991).We explore the impact of growth and the impact of the cyclical position: just like downturns will impact revenues more than proportionally, recoveries should be more revenue intensive, as the nonlinearities described earlier, during the recovery, become favorable to the primary balance.In order to capture this result, the output gap will enter both linearly and in quadratic form in our fiscal reaction function. We will also run the regression entering the output gap as a piecewise function, to test the difference in the coefficient when it is positive or negative. This piecewise approach implemented in the literature by Egert (2014) is an alternative way of correcting for the nonlinearities in the response of the fiscal balance to changes in the cycle.Our aim is to test whether there is evidence of fiscal fatigue in our sample. Secondly, we will test whether that result is robust to changes in the specification. Finally, we will test whether variables pertaining to the underlying macroeconomic and institutional dynamics have an effect on the primary balance when interacted with rising debt.

Fixed effects of the primary balance/GDP (%).

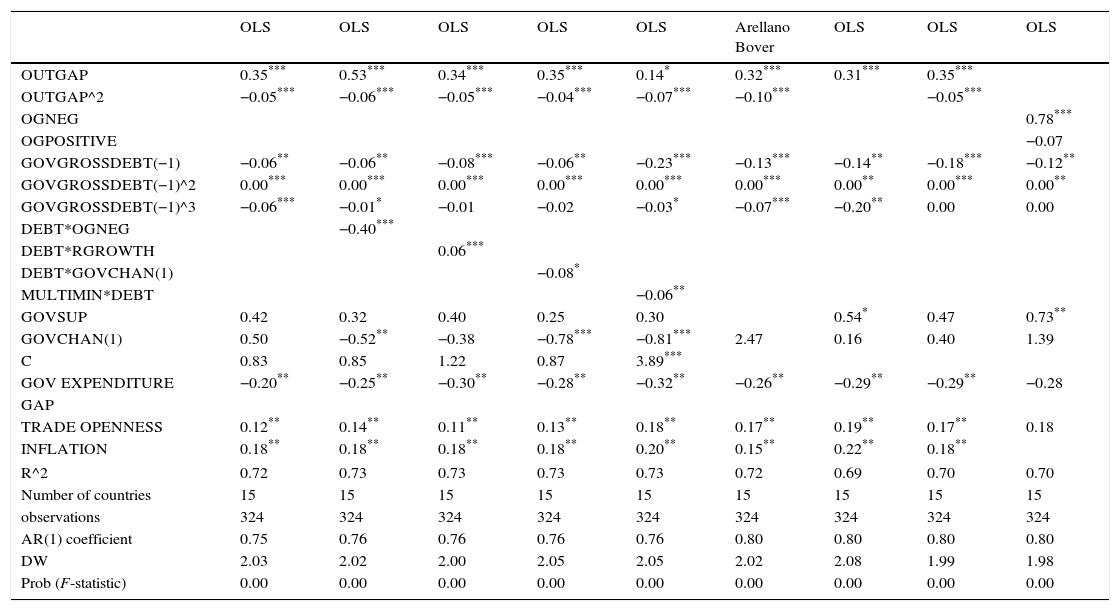

Table 3 reports the estimated coefficients and the associated p-values obtained from a fixed effects panel regression of the variables on the primary balance, for the current Eurozone countries in the period 1980–2013.

Empirical results.

| OLS | OLS | OLS | OLS | OLS | Arellano Bover | OLS | OLS | OLS | |

|---|---|---|---|---|---|---|---|---|---|

| OUTGAP | 0.35*** | 0.53*** | 0.34*** | 0.35*** | 0.14* | 0.32*** | 0.31*** | 0.35*** | |

| OUTGAP^2 | −0.05*** | −0.06*** | −0.05*** | −0.04*** | −0.07*** | −0.10*** | −0.05*** | ||

| OGNEG | 0.78*** | ||||||||

| OGPOSITIVE | −0.07 | ||||||||

| GOVGROSSDEBT(−1) | −0.06** | −0.06** | −0.08*** | −0.06** | −0.23*** | −0.13*** | −0.14** | −0.18*** | −0.12** |

| GOVGROSSDEBT(−1)^2 | 0.00*** | 0.00*** | 0.00*** | 0.00*** | 0.00*** | 0.00*** | 0.00** | 0.00*** | 0.00** |

| GOVGROSSDEBT(−1)^3 | −0.06*** | −0.01* | −0.01 | −0.02 | −0.03* | −0.07*** | −0.20** | 0.00 | 0.00 |

| DEBT*OGNEG | −0.40*** | ||||||||

| DEBT*RGROWTH | 0.06*** | ||||||||

| DEBT*GOVCHAN(1) | −0.08* | ||||||||

| MULTIMIN*DEBT | −0.06** | ||||||||

| GOVSUP | 0.42 | 0.32 | 0.40 | 0.25 | 0.30 | 0.54* | 0.47 | 0.73** | |

| GOVCHAN(1) | 0.50 | −0.52** | −0.38 | −0.78*** | −0.81*** | 2.47 | 0.16 | 0.40 | 1.39 |

| C | 0.83 | 0.85 | 1.22 | 0.87 | 3.89*** | ||||

| GOV EXPENDITURE | −0.20** | −0.25** | −0.30** | −0.28** | −0.32** | −0.26** | −0.29** | −0.29** | −0.28 |

| GAP | |||||||||

| TRADE OPENNESS | 0.12** | 0.14** | 0.11** | 0.13** | 0.18** | 0.17** | 0.19** | 0.17** | 0.18 |

| INFLATION | 0.18** | 0.18** | 0.18** | 0.18** | 0.20** | 0.15** | 0.22** | 0.18** | |

| R^2 | 0.72 | 0.73 | 0.73 | 0.73 | 0.73 | 0.72 | 0.69 | 0.70 | 0.70 |

| Number of countries | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 |

| observations | 324 | 324 | 324 | 324 | 324 | 324 | 324 | 324 | 324 |

| AR(1) coefficient | 0.75 | 0.76 | 0.76 | 0.76 | 0.76 | 0.80 | 0.80 | 0.80 | 0.80 |

| DW | 2.03 | 2.02 | 2.00 | 2.05 | 2.05 | 2.02 | 2.08 | 1.99 | 1.98 |

| Prob (F-statistic) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

The tables above show the results of the OLS regression. The dependent variable is the primary balance to GDP ratio. OGNEG and OGPOSITIVE are, respectively, the output gap when negative and positive. GOV_SUP is the variable of government support, GOVCHAN indicates the number of government changes in a given year, OUTGAP the output gap as a % of GDP, DEBTLIM the debt limit and MULTIMIN indicates the existence of a multi-party minority government.

As can be seen, our regression analysis shows that the relationship between the fiscal balance and debt is not as clear cut as the traditional fiscal fatigue result shows. In particular we present evidence that, first, there are nonlinearities on the impact of the cycle on the primary balance (as obtained, amongst others, by Lee, 1995), and, secondly, institutional aspects can have a significant impact on the primary balance.

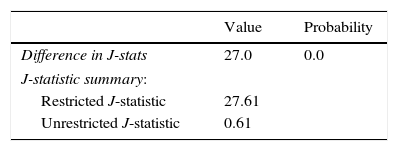

This result is robust to different specifications, such as the estimation using Bover and Arellano (1997). The results of this estimation can be found in the sixth column of Table 3, and are in line with the findings in the other specifications. For the estimation of this methodology, the panel is estimated using GMM, with the variables specified in orthogonal differences. The instruments used in the estimations are the lagged regressors. In order to check whether the use of these instruments is appropriate, we run the Durbin Wu Haussman test for endogeneity. In this version of the test, the null hypothesis is that the endogenous variables for which we use instruments are actually exogenous. The results suggest that this hypothesis can be rejected (Table 4).

Results of the Durbin Wu Haussman test.

| Value | Probability | |

|---|---|---|

| Difference in J-stats | 27.0 | 0.0 |

| J-statistic summary: | ||

| Restricted J-statistic | 27.61 | |

| Unrestricted J-statistic | 0.61 | |

The table above shows the results of the Durbin Wu Haussman test. Value shows the value of the statistic. Probability shows the p value of the test.

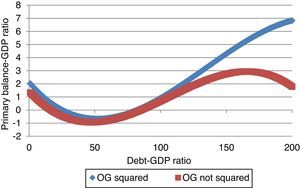

Furthermore, the results regarding the fiscal fatigue coefficient (i.e., the coefficient on the cubed term of government debt) depend crucially on the controls used. When growth is introduced linearly, the fiscal fatigue coefficient is significant, and all the other coefficients are similar to other results in the literature (see Ghosh et al., 2013). However, when we allow for nonlinearities on the effect of growth, that result no longer holds, and the coefficient becomes insignificant.

Regarding the reaction of the fiscal balance to the cycle, when using a piecewise explanatory variable, it turns out that the elasticity of the primary balance to the cycle is entirely driven by the observations with a negative output gap. When the output gap is positive, it does not have a significant impact on the primary balance.

This result is consistent with the asymmetric adjustment in the primary balance mentioned in the literature (Egert, 2014) and suggests that standard fiscal reaction functions will underestimate the impact that recessions have on the primary balance. If one does not separate the output gap into a positive and negative term, the resulting elasticity may be capturing some of the lack of impact from the positive output gap and so underestimating the effect of a negative output gap.

Similarly, the significance of the squared output gap term is evidence then that the primary balance will deteriorate more than expected when in recession. In addition, a subject of interest, particularly at this point in the Eurozone, is the reaction of the primary balance in recoveries. As we show by the squared term of the output gap, the improvement in the fiscal balance is even greater, which would be consistent with the elasticity of the fiscal balance increases in recoveries. This could be because countries tighten policy in the downturn (this would make fiscal policy procyclical, in line with the finding in Alesina et al., 2008) and then do not loosen when they are growing again, but rather wait until the output gap is positive. As a result, the inclusion of a squared output gap term both avoids the overestimation of the primary balance in the downturn and its underestimation in a recovery.

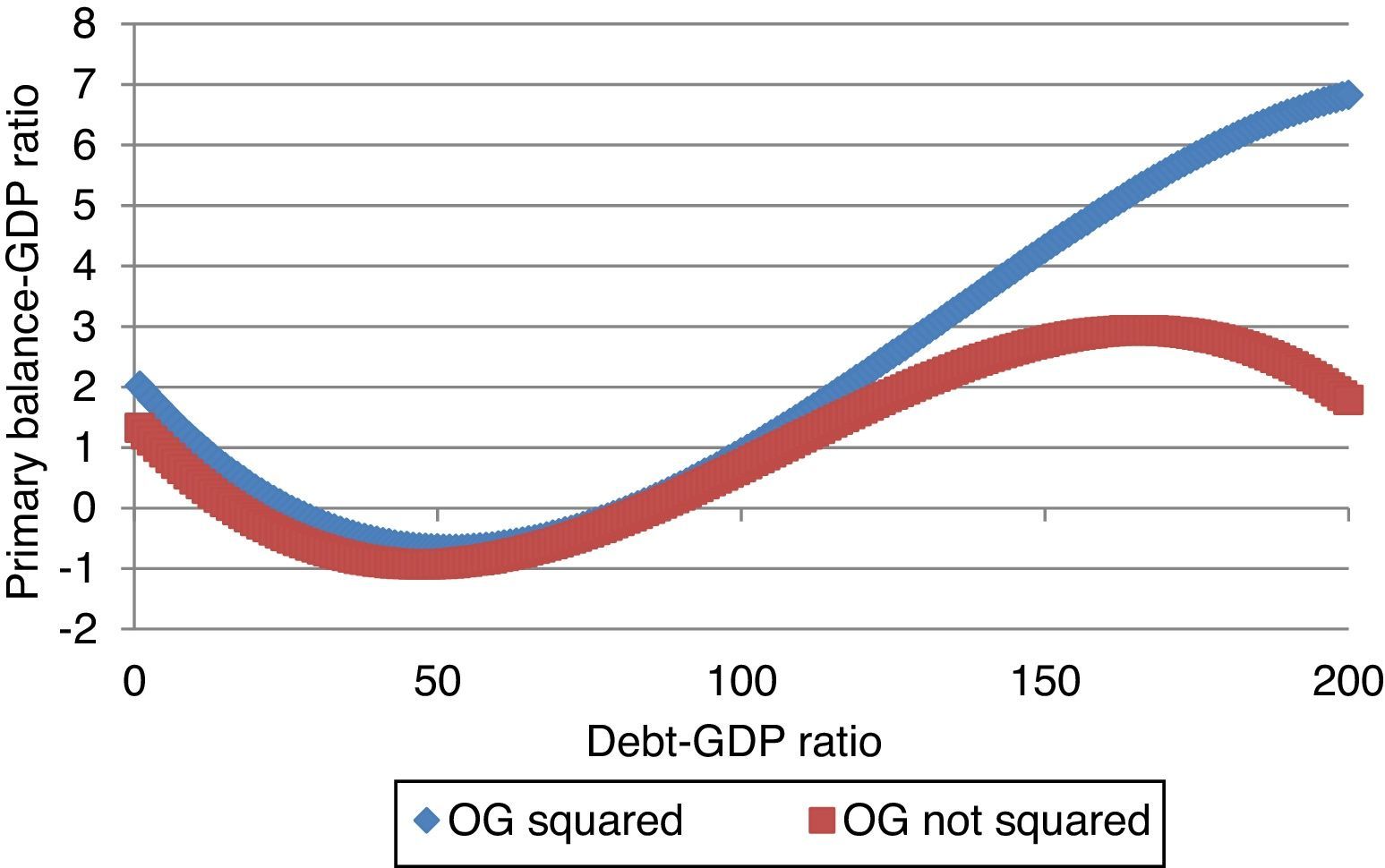

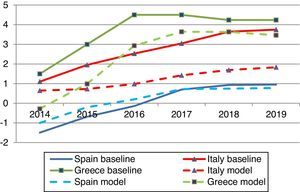

Further, in this case the coefficient on cubed debt becomes insignificant or very low, so that it only becomes relevant when growth is not taken into account (Fig. 3). As can be seen, when we take account of these nonlinearities, the fiscal fatigue result, which is present when growth is specified linearly, disappears. The fact that the cubed term on debt becomes insignificant when growth is allowed to have a nonlinear effect on the primary balance suggests that the initial fiscal fatigue result may, in fact, be driven by these effects. This is in line with the fact that the observations with large debt tend to be the ones with large output gaps.

Note that we do not distinguish explicitly the orientation of fiscal policy and automatic stabilizers (although the reaction of the fiscal balance to the output gap may be used as a proxy). As a result, the impact on growth may be due to the consumption habits discussed above and in general the asymmetric workings of automatic stabilizers, but also from the fact that in recessions, fiscal multipliers tend to be higher, so that a government that wants to stabilize output would have a bias to allow for higher deficits.

The results also provide evidence on whether institutional and growth aspects impact the primary balance when debt is rising. When debt is interacted with institutional strength or growth, this has a positive effect on the primary balance. Finally, when debt is interacted with a negative output gap, the impact on the primary balance is even more negative.

Some variables like government support are not significant determinants by themselves, only when interacted with debt. This result is in line with those of Alesina and Drazen (1991), who consider that factors like government strength are only relevant for the primary balance at times of stress.

We also show that when there is a weak government, as captured by the existence of a multiparty minority government, the interaction with debt worsens the primary balance. In other words, this factor is relevant throughout the sample, but is even more relevant when interacted with rising debt.

A key takeaway from our results is that while there is some evidence that rising debt has a negative effect on the primary balance, the effect can be mitigated by activating those factors that, when interacted with debt, lead to an improvement in the primary balance. Our results show that growth or an improvement in the political situation can be adequate counterbalances to the negative effect of rising debt. These factors must be taken into account when assessing the debt sustainability of a given country.

5Consequences for debt sustainabilityThe results described in the section above suggest that ceteris paribus, countries that grow faster will enjoy a particularly large dividend from such growth. The purpose of this section is to illustrate the magnitude of that effect. In particular, we show how the nonlinear effect of growth on the primary balance may be strong enough to alter debt dynamics substantially.

In order to illustrate these effects, we use the results of the equation above in a debt sustainability analysis. This can be interesting because the results will be different depending on which are the drivers of the debt sustainability dynamics: those countries that are growing rapidly can be expected to have more positive dynamics than those that are not growing as much. As shown in Section 4, this is all the more important in the case of countries with wide, negative output gaps.

The debt paths will be calculated as follows. We will start from the IMF forecasts for growth, the output gap and inflation. From those forecasts, we will use the results in the previous section to determine the path of the primary balance.

Once we have forecasts for growth, inflation and the primary balance, in order to calculate the future path of the debt-GDP ratio we calculate the future path of interest payments. These interest payments are based on the expected path of the risk free rate, taken from the bund futures curve, and the risk premium.

The latter is calculated to reflect the underlying probability of default of the countries, following Ghosh et al. (2013). This probability of default is defined as the probability that a given country will reach its debt limit, as calculated by Ghosh et al. (2013). While, as shown in Section 4, the level of the debt limit depends on other variables, we use the results from Ghosh et al. (2013) to have a standardized forecast of the interest rate on debt.

In order to calculate the probability that debt will reach its limit, the determinants of the dynamics of debt (the primary balance, interest payments, and growth) are shocked using Monte Carlo simulations. The distribution of the shocks is based on a normal distribution, using the historical mean and variance, and the contemporary covariance between all three determinants. As a result, we obtain different possible paths of the debt-to-GDP ratio. The risk premium is the probability that debt will reach the calculated debt limit as results from the Monte Carlo simulation. This probability of default is then applied to the loss given default, which we set at 90%, in line with Ghosh et al. (2013).

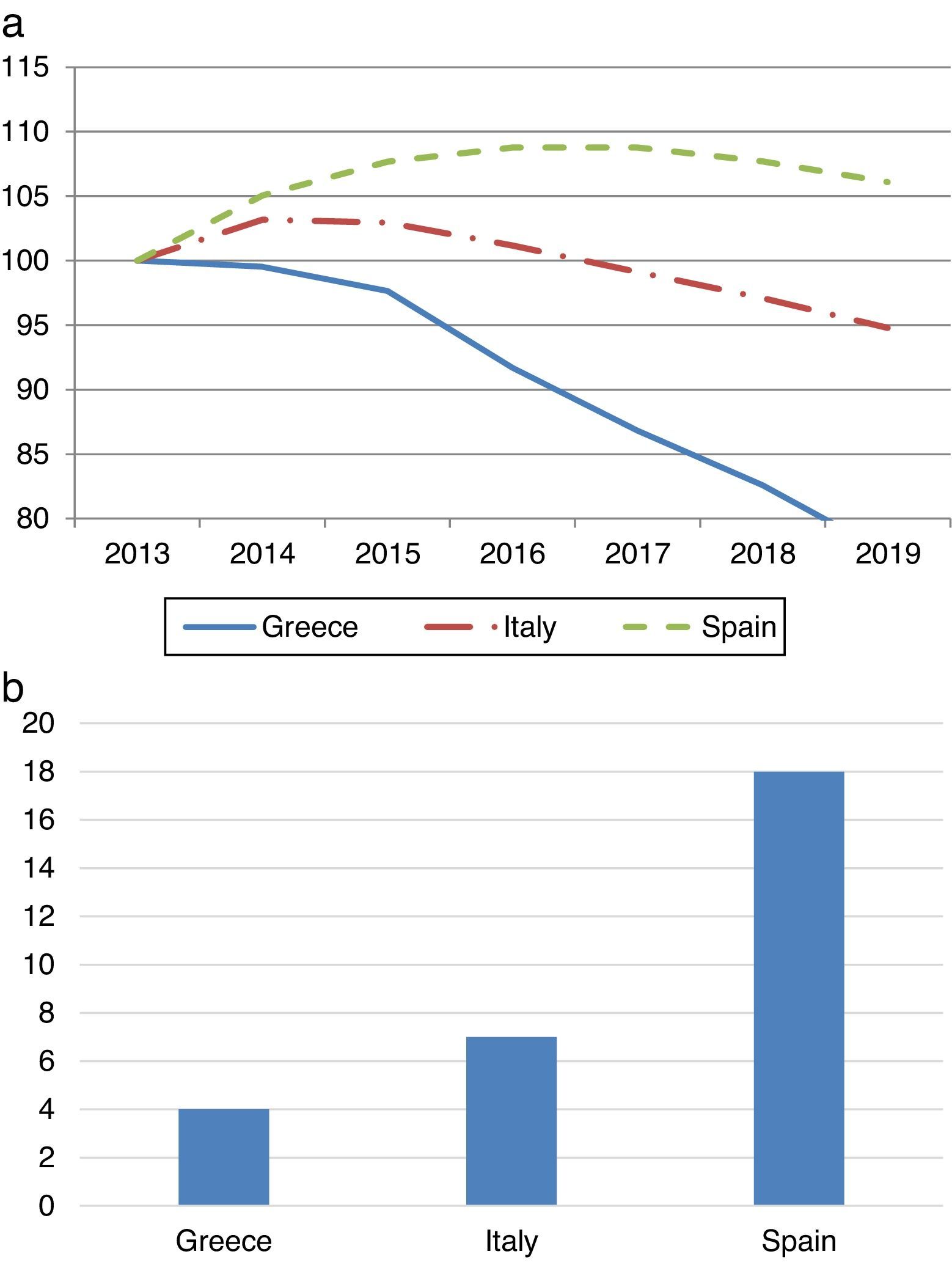

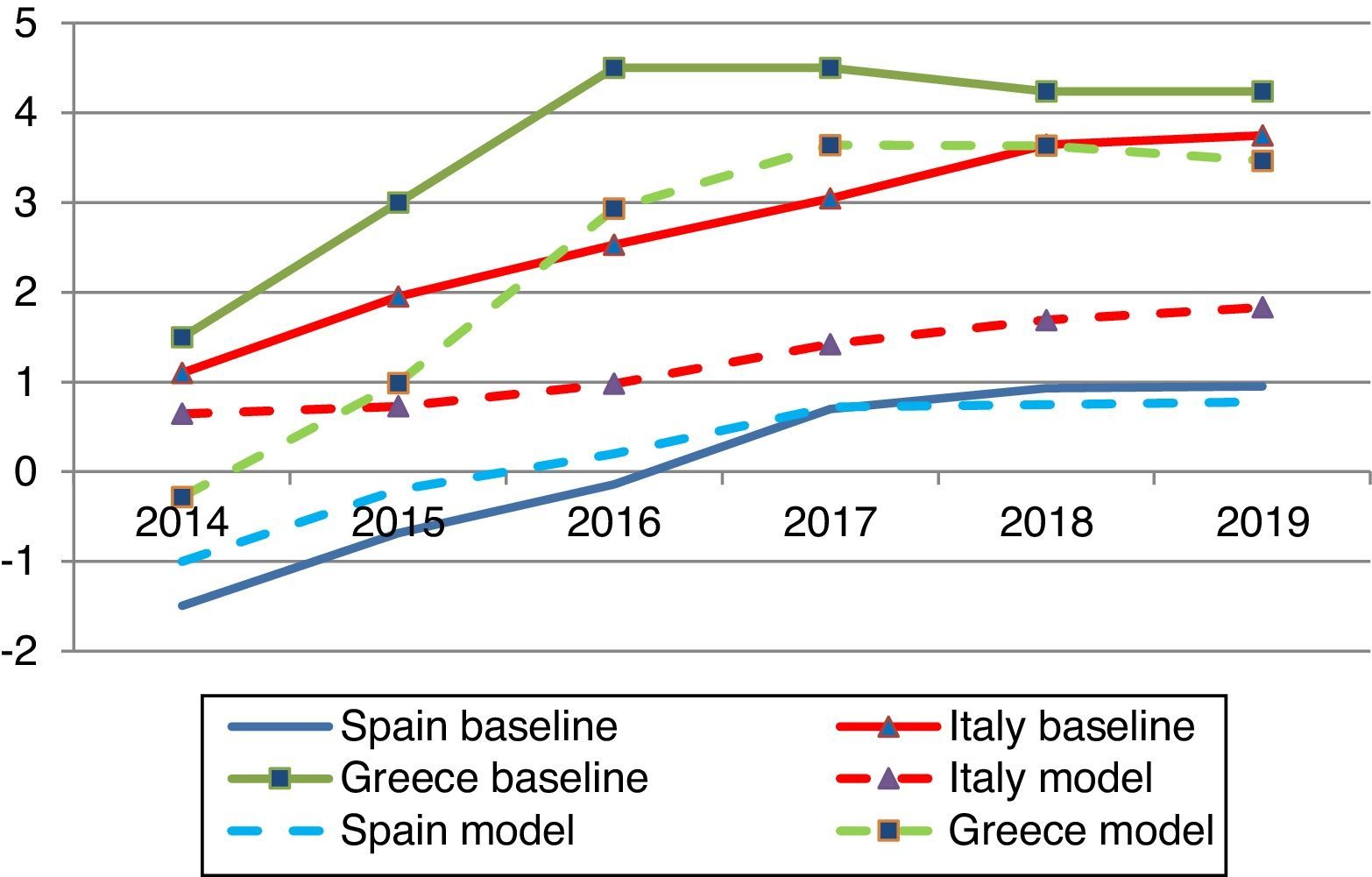

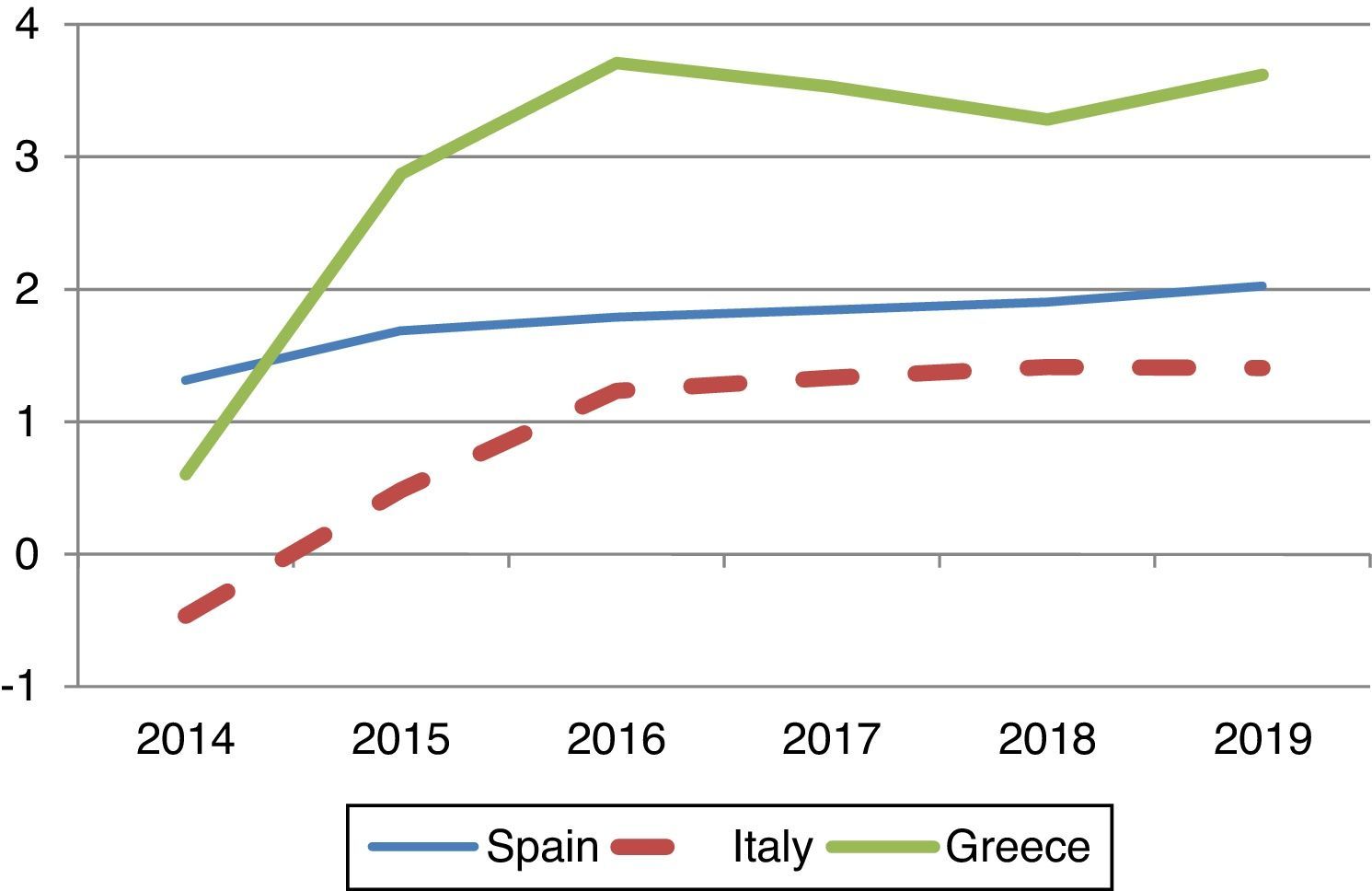

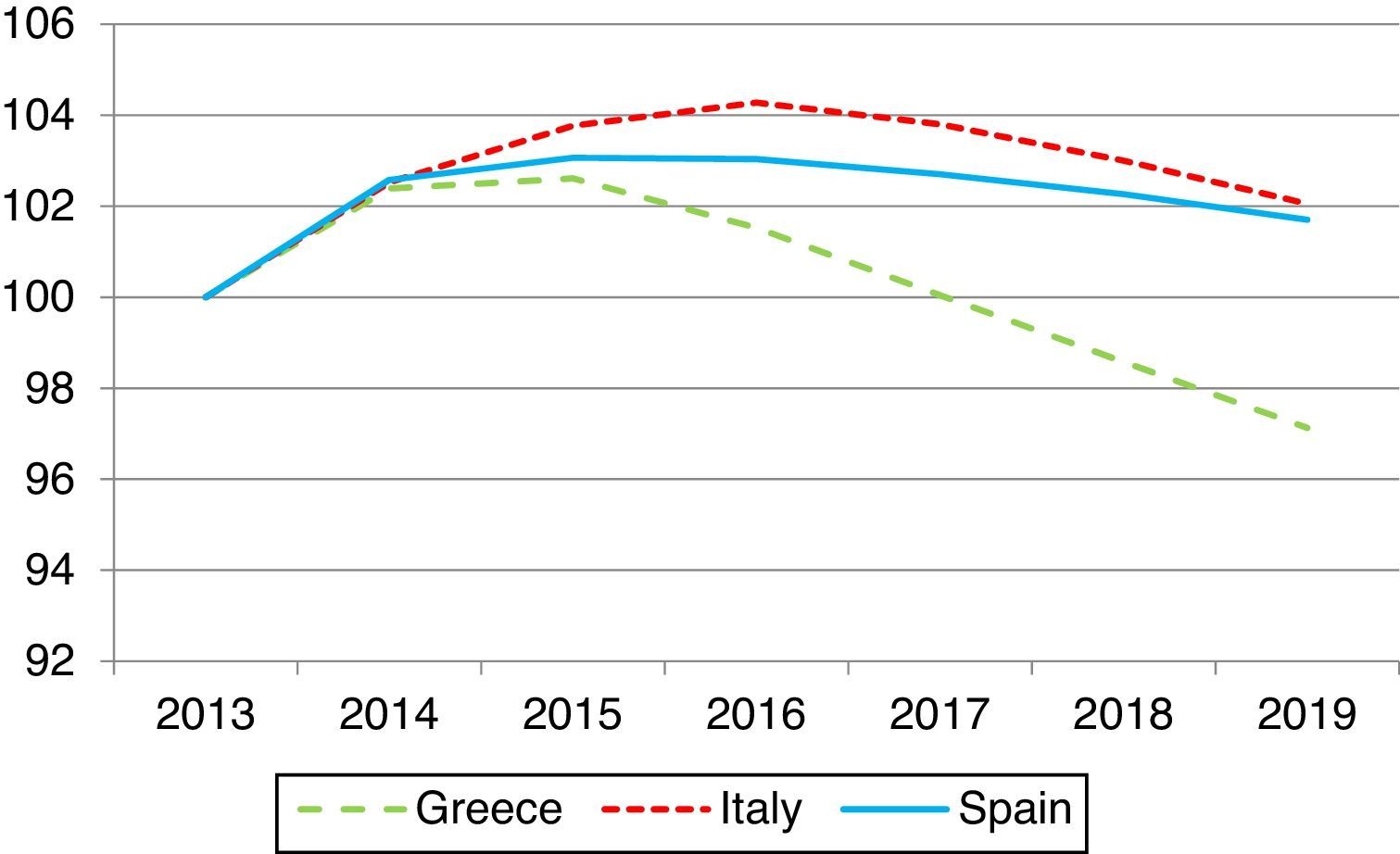

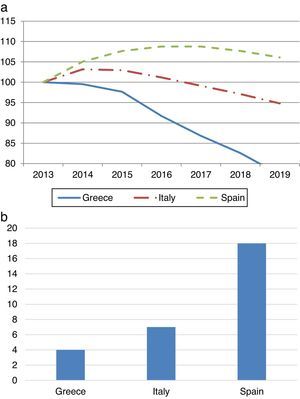

We illustrate this exercise for Spain, Italy and Greece. The comparison will allow us to understand the effects we are showing with respect to a baseline, which we consider to be the IMF's debt scenario.

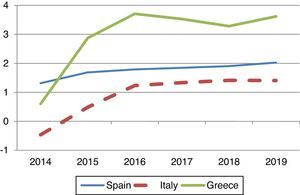

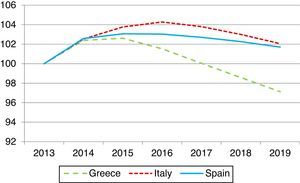

As shown in Fig. 4 the debt dynamics for Spain and Italy are similar in the baseline scenario: in all cases debt is expected to decline eventually. In each country, however, this is due to the different drivers of the debt path. While in Spain, growth will be favorable and provide a key input to reduce the debt ratio, its high primary deficit is the main driver of debt. In Italy, the key driver of better dynamics is the primary balance, while growth is expected to remain slow going forward, according to the IMF forecasts. Finally, the debt forecasts for Greece are extremely favorable, owing to the expected high growth and primary balances, combined with a low expected effective interest rate on its debt. The result is that in the baseline IMF scenario, debt declines substantially in Greece.

A probability of debt stabilization can be derived from the application of the Monte Carlo simulation to the forecasts of debt. Spain has the highest probability of not stabilizing debt in the period studied and Greece has the highest probability of stabilizing it.

However, when we adjust the debt forecasts to consider the determinants of the primary balance mentioned in the paper (in Eq. (1)), the results change. First, the endogenous primary balance forecasts change substantially from those in the IMF WEO. In particular, the endogenous forecasts penalize particularly Italy, given the low expected growth in the WEO forecasts. They also penalize Greece: the model based forecast suggest strong adjustment to the primary balance on the back of the strong growth that the IMF WEO expected. However, the WEO predicted an even stronger improvement in the primary balance (Figs. 5 and 6).

When these considerations are added to our debt equation, the resulting debt path shown in Fig. 7 changes the results of the three countries substantially. In particular, they point to a better behavior of Spain relative to the other countries, and a worse behavior of Greece, which is in part due to a worse primary balance than expected in the baseline WEO scenario.

While the difference between Spain and Italy reflects the importance of growth on the primary balance, this does not apply to Greece, which according to the WEO October 2014 forecasts was expected to post the highest growth. Our fiscal reaction function leads to a lower primary balance than expected and the level of debt to a higher interest rate burden. These effects worsen the debt dynamics in Greece, although the favorable growth forecasts mean that it is still the country where debt declines the most.

This section has shown that the results of the previous section when allowing for nonlinear effects of growth on the primary balance can have a substantial effect on the expected path of debt. This stems not only from the direct effect of growth the fiscal balance, but also from second round effects, by which the different paths of debt affect the risk premium, and so the expected path of interest payments.

6Concluding remarksThis paper has analyzed the determinants of the primary balance, and the impact of taking these determinants into account when analyzing debt sustainability. A key result from the paper is the significant role that growth plays in determining the fiscal balance, both in a downturn and in a recovery. Taking this into account can be essential when forecasting debt dynamics: a low growth economy is more likely to stop adjusting than an economy which, in spite of rising debt, keeps growing.

Secondly, and relatedly, downturns will be more damaging to debt sustainability that would be suggested by a linear relationship between the primary balance and growth. As has been shown above, growth has an exponential impact on the primary balance. Therefore, recessions could have a severe impact on debt dynamics.

Also, our results show that institutions play an important role in debt sustainability. We provide evidence that is in line with the Alesina and Drazen (1991) result that suggests that strong governments are more likely to adjust when countries are near a crisis. In general, our results hold policy lessons for both downturns and good times.

First, when output is growing above potential, governments would do well to have larger surpluses, as the primary balance is likely to overshoot in the downturn. Secondly, having appropriate political institutions that foster government stability can be of use.

This second result is particularly useful in times of distress. A government that has the power to implement a stabilization program in times of stress is more likely to implement the needed adjustment.

One avenue of research that stems from these results is the feedback loop between political results, fiscal fatigue, and the deterioration of fundamentals. In particular, if a government with a worse economic performance is more likely to be voted out, and replaced by a fragmented government, then the overall result can reinforce a vicious cycle: the worsening economic environment deteriorates a government's ability to implement an adjustment, and the worsening in economic times further limits the government's room for maneuver in stressful times (Coppedge, 1997).

In terms of policies to be implemented in a downturn, the key lesson is that the nonlinearities call for a pre-emptive approach to debt sustainability: these nonlinearities in the relationship between the output gap and the fiscal balance can lead to a rapid deterioration in the balance. When the market then incorporates this worsened balance into its analysis of debt sustainability, it is more likely to increase the cost of funding, which in itself can contribute to the unsustainability of debt.

These mechanisms call for swift action in downturns. Particularly, the promotion of growth can be effective in averting the negative debt spiral. Our study does not analyze which growth-enhancing measures are best, however, it does suggest that a strong, pre-emptive approach to a downturn is appropriate. Given that fiscal space will often be limited, demand is likely to have to be promoted through other instruments, like monetary policy.

Hausman test results.

| Correlated random effects – Hausman test |

| Equation: PRIMBAL |

| Test cross-section random effects |

| Test summary | Chi-Sq. statistic | Chi-Sq. d.f. | Prob. |

|---|---|---|---|

| Cross-section random | 7.915194 | 7 | 0.03 |

| Residual unit root test and correlogram |

| Panel unit root test: Summary |

| Series: RESID01 |

| Date: 08/23/15. Time: 13:14 |

| Sample: 1720 |

| Exogenous variables: individual effects |

| User-specified lags: 1 |

| Newey-West automatic bandwidth selection and Bartlett kernel |

| Method | Statistic | Prob.** | Cross-sections | Obs |

|---|---|---|---|---|

| Null: unit root (assumes common unit root process) | ||||

| Levin, Lin & Chu t | −3.92328 | 0.0000 | 18 | 422 |

| Null: unit root (assumes individual unit root process) | ||||

| Im, Pesaran and Shin W-stat | −4.74896 | 0.0000 | 18 | 422 |

| ADF – Fisher Chi-square | 82.9549 | 0.0000 | 18 | 422 |

| PP – Fisher Chi-square | 83.0413 | 0.0000 | 18 | 441 |

** Probabilities for Fisher tests are computed using an asymptotic Chi-square distribution. All other tests assume asymptotic normality.