A study is presented on production, consumption, and the investment of profit in a closed economy over a two-week period. Bernard Schmitt's analysis of production and capital formation was applied to numerical and theoretical examples. The broad objective of this inquiry is to detect apparent formal coincidences between Nicholas Kaldor's (1956) formalization of the General Theory (1936) and the analytical formulation of the theory of the monetary circuit. Kaldor's (1956) model is considered as a special case among those contemplated by Schmitt's monetary theory.

Proponemos un estudio de la producción, el consumo y la inversión de la ganancia en una economía cerrada en dos periodos de tiempo. Aplicamos el análisis de la producción y de la formación del capital de Bernard Schmitt a ejemplos teoréticos y numéricos. Nos proponemos detectar coincidencias formales entre la formalización de la Teoría General (1936) propuesta por Nicholas Kaldor (1956) y la formulación analítica de la teoría del circuito monetario. Subsumimos el modelo de Kaldor (1956) bajo los casos contemplados por la teoría monetaria de Schmitt.

At the end of the 1950s, Bernard Schmitt became acquainted with the Keynesian economists at the University of Cambridge, England. It was then that Schmitt started developing his own dialectical analysis of the production of wage-goods and capital-goods in monetary and capitalist economies. It was the time of the academic controversy between the United Kingdom and the United States on the mathematical functions of economic production and technical progress: in 1956, Robert M. Solow had published his famous neoclassical model of economic growth in the Quarterly Journal of Economics; in the same year, Nicholas Kaldor proposed his Keynesian model of growth in The Review of Economic Studies and, in 1957, he went onto write on that topic in The Economic Journal. What we now call the monetary theory of production, that is to say, an integrated approach to money and output, dates back to that time. Indeed, money is “paramount” for proponents of the so-called “monetary analysis”, including “post-Keynesians, but also supporters of the monetary circuit approach as well as a number of Sraffians, Institutionalists and Marxian scholars” (Rochon and Rossi, 2013: 211). In this paper, we will merely recall the conception of money advocated by these economists (on this matter, see Schmitt, 1975; Graziani, 2003; Cencini, 2005; Lavoie, 2006; Rossi, 2007). Nevertheless, the logic of their reasoning is functional to the analysis that follows. This paper aims in fact to propose a study of profit and capital formation according to our interpretation of Schmitt, one among the major proponents of the theory of the monetary circuit, which has been developed independently also by Parguez (1975, 1996, 2001), Barrére (1979, 1990a, 1990b), and Graziani (1989, 2003), among others, drawing on Keynes's monetary theory of production (Gnos, 2013: 23). We will argue that Kaldor's formulation of Keynes's 1936 General Theory can be reconsidered as a special case among others contemplated by the monetary circuit approach. Our ultimate goal is to analyze Kaldor's (1956) analysis of profits in terms of Schmitt's monetary analysis. Through the use of analytical and accounting schemes, we will argue that in modern economies national output is equal to the sum of wages paid to workers inclusive of the profit effectively invested in capital goods.

It has been shown (Gnos, 2013: 31) that some of the concepts advanced by the theorists of the monetary circuit can be found in a number of classical writings, but the true renewal of this circuit dates back to Keynes's (1930 [1979]) ideas on money. Among the authors referring to these ideas, there is common agreement on what money is not: that is to say, it is not a commodity (see for instance Schmitt, 1975, and Graziani, 2003). As Rossi (2007: 18) points out,“[m]oney does not need to be reified into a precious metal in order for it to be a means of payment: it would be enough that a government keeps a double-entry book by means of which its economic transactions are recorded and settled with a mere book-entry device”. Even in our economies, where money is often identified with notes and coins, “we can assert that all money – including metallic money – is credit money” (Realfonzo, 1998: 36).

But the question at issue regards the nature of money, to wit, what money is, if not a physical asset.

The underlying theme of the circuit theory is that, at a first glance, money is of a numerical nature, with no intrinsic value: “a money-unit is by definition number 1, ‘made concrete’ in a bank's balance sheet” (Schmitt, 1998: 38, our translation), or, again, money is “a pure symbol, a stroke of the pen in the bank's balance sheet” (Realfonzo, 1998: 43). It is thanks to double-entry bookkeeping that an analysis of money can be made. As Rochon and Rossi (2013: 218) point out, based on Cencini (2005: 299), such accounting tool was “developed […] – in the thirteen century – by Italian traders, who took advantage both of Arabic numerals and of the Indian conception of zero”, and its usage gave rise to banking activities. It is indisputable that Schmitt's conception of money originates from the study of double-entry bookkeeping (see Schmitt, 1972, 1975, 1998): he firmly believes that two kinds of “money” are at the heart of the economy, namely, money-as-a-flow and money-as-a-stock. “Money cannot be stocked, since payments themselves cannot be stocked; however, the objects of payments can perfectly convert to stocks” (Schmitt, 1998: 5, our translation). Further, “‘money-as-flow’ does exist only in payments, at the instants when they take place; […] the other money, money-as-stock, is the definition of deposits constituted within banks” (Schmitt, 1998: 7, our translation). Though both of them are interesting, we are here concerned with money-as-stock, since it is the result of the point of departure of our analysis, that is, the monetization of production.

The monetary theory of production examined here is built around three categories of agents: firms, banks, and workers, or wage-earners. Both Graziani and Schmitt emphasize the role of banks and firms in the functioning of capitalist economies. Where they concur is on the idea of a mutual relationship between firms and banks, present in Keynes already (Graziani, 2003: 68): according to Graziani, since the banking system and firms “share the same expectations about the level of aggregate demand”, it follows that, “if a firm has decided upon a given volume of production, there will also be a bank prepared to grant the required finance”. Following Graziani's theory of the monetary circuit, the role of banks is to finance firms “to carry out the production process” (Graziani, 2003: 69). The next proposition clarifies such a role: “Firms produce commodities and make use of banks in order to make the payments they need to; the banks provide means of payment and act as clearing houses between the contracting agents” (Graziani, 2003: 65). According to Schmitt (1998: 16, our translation),“by working ‘hand in hand’, the firm and the bank substitute a creation of money for the real production of workers. It is a matter of substitution and not of two simultaneous productions, as if money creation were to be added to the production of goods”.

The monetization of production rests on this basic idea. A firm requests a bank to credit workers’ deposits with wages, relying on a line of credit that the firm has previously obtained and backed by securities (Rossi, 2007: 25). At the instant wages are paid out, the bank payment creates money (Rochon and Rossi, 2013: 214). Money-as-stock designates bank deposits, while income is the result of such a payment (Cencini, 2001: 66), where production is the real content of money, and money the unit of account of real output. “At the instant of receiving 100 francs as payment for his productive activity, agent B acquires his product, not in nature, but in money” (Schmitt, 1998: 16, our translation).

The remainder is structured with the aim to (i) study the equations of output and investment according to post-Keynesian and circuit theorists and (ii) detect possible coincidences between the outcome of such theories. In the next section we sketch a simple example of the formation of capital following Schmitt's reasoning. Section 3 is devoted to the review of Kaldor's (1956) paper, which paved the way to major post-Keynesian studies. This exposition, together with the previous section, will be the point of departure of our analytical investigation. In Section 4, by means of numerical examples, we propose a study of Schmitt's analysis of output, profit and its investment in capital-goods. We study the dynamics of profit creation – through the payment of wages to workers in exchange for their production of wage-goods – and its first investment (complete or partial) in the production of capital-goods.1 A final consideration follows on the similarity – incidental or not – between post-Keynesian and circuit approaches, and on their implications on employment policies.

2A monetary theory of production: new suggestionsSchmitt aims to develop an analysis of money “that is not at odds with itself (first criterion of truth) and that is not contradicted by reality (complementary criterion of truth)” (1998: 38, our translation). The next example of his monetary theory of production meets Keynes's (1936 [1964]) attempt to push “monetary theory back to becoming a theory of output as a whole” (vi) by studying money within “the economic scheme in an essential and peculiar manner” (vii).

Consider a closed economy without capital-goods.2 In this economy, initially (period one), goods and services of different types3 are produced by the only existing company (we will call it E for enterprise, or French entreprise). At the beginning of the first period, E obtains the opening of a line of credit by the bank (or the national banking system), B, for the payment of wages to workers.4 The people whose accounts are credited with wages (“wage-earners”) include all kinds of workers, without any social class distinction: for instance, workmen, employees, employers, managers, consultants, and so on. In this sense, workers include shareholders of one or more companies. Further, some shareholders do not work: they either receive a share of wages from their families or expect to receive a share of future profits. When physical production is completed and ready to be sold, the bank accounts of workers are credited: this event triggers, so to speak, the formation of income, and physical production becomes economic production. The value of wage-goods is equal to wages paid in period one, W1. According to Schmitt (1998: 46, our translation), “wages are the sole production cost in a macroeconomic sense”. This kind of reasoning, following Keynes (1936 [1964]: 20), is typically classical: “The conclusion that the costs of output are always covered in the aggregate by the sale-proceeds resulting from demand, has great plausibility, because it is difficult to distinguish it from another, similar-looking proposition which is indubitable, namely that the income derived in the aggregate by all the elements in the community in a productive activity necessarily has a value exactly equal to the value of the output.”

Now, suppose that income-earners spend the totality of their wages in consuming produced wage-goods, that is sw=0. Two cases must be introduced: (i) an “economy with wage-income” (Schmitt, 1998: 42, our translation), that is, where the selling price is equal to the value of production, namely, in our example, 100 money units (m.u.), and (ii) an “economy where the final purchases are devoted to consumption or investment” (Schmitt, 1998: 72, our translation), that is, where wage-goods are completely purchased by income-earners, and where, the selling price being higher than the value of production, profit is created and invested in the production of capital-goods.

In the first case, wage-earners purchase the totality of wage-goods (they have themselves produced) by spending the totality of income. No wage-goods are left in the company's warehouse. It is worth noting that economic consumption gives rise to the destruction of income, in line with Jean-Baptiste Say's (1803 [1843]: 178–179) intuition5: “For the same reason, that the creation of a new product is the opening of a new vent for other products, the consumption or destruction of a product is the stoppage of a vent for them.”

The resulting accounting entries show this process (Table 1).

Following Schmitt (1998: 32, our translation), we infer that “when investment is null, no positive macroeconomic saving will arise”.

In the second case, the firm sells a percentage of production and stocks the remaining part. That is to say, E makes a profit: “[t]he profits formed at p0 [period 1 in our case] are […] the monetary aspect of the circulating capital corresponding to this real stock of consumption goods” that remains unsold (Cencini, 2005: 140). The following example will clarify this statement. Consider the wages paid at the end of the first period, W1=100m.u., a selling price p=125m.u., the value of sold production equal to 80m.u. and the profit equal to 20m.u.

This case is represented in Table 2. We call: (i) W1 the total wages; (ii) p the selling price; (iii) α the ratio W1/p; (iv) π the rate of profit of this economy (where π=1−α); (v) P1 total profits.

Table 3 shows the bookkeeping representation of this case, from wage payment to profit creation.

Now, suppose that, subsequently (period 2), the managing board of E invests its profits in the production of capital-goods, and that, through the spending of profit, E finances the new payment of wages.6 Moreover, suppose that workers (wage-earners) spend the new wages in the consumption of wage-goods that were stocked in E at the end of the first period. The selling price is equal to the value of production of wage-goods (that is, at a price of 20m.u.: no new profit is generated), and production is entirely destroyed by economic consumption.

This fact is corroborated by double-entry book-keeping: no income survives in banking accounts. The bookkeeping representation of this situation is shown in Table 4.

The consumption of profit in the payment of wages and the consumption of previously unsold goods: current banking bookkeeping.

(i) The payment of wages; (ii) the consumption of unsold goods.

In this case, and contrary to the previous case, the investment of profit gives rise to what Schmitt calls macroeconomic investment or saving. Nevertheless, notice that not a trace of it is left in bank accounts.

Now, the case of a null saving rate from wages and of a saving rate from profit equal to unity, as the one described above, was also contemplated by Marx in 1887 and Kalecki in 1935 (on this subject, see for instance Ahmad, 1991). A question comes straightforward: what are the dynamics of consumption and investment when saving rates from wages and from profit are respectively other than zero and unity? Keynes (1936 [1964]), formalized by Kaldor (1956), and, implicitly, Schmitt, investigate this interesting topic. We will briefly analyze the two approaches, and we will possibly detect coincidences among them.

3Output and investment: early studiesAccording to Keynes (1936 [1964]: v) the “fault” of orthodox economics lies not so much in the “superstructure”, but in “a lack of clearness and of generality in the premises”. The General Theory arose as an alternative to classical and neoclassical economics aiming to investigate the concept of “output as a whole” (Keynes, 1936 [1964]: vi). The most notable of the early works developed on this assumption is Nicholas Kaldor's (1956) paper on “alternative theories of distribution”, where he investigates the relation between profit, output, wages, and saving rates out of wages, sw, and of profits, sp. His intention is to improve economic analysis starting from what he was later to define the “[c]osy world of Harrod, Domar and Solow, where there is only a single saving propensity applicable to the economy – where in other words, sY=swY” (Kaldor, 1966: 311).

The first observation worth mentioning is that Kaldor's analysis is based on the conceptual distinction between two types of income (wages and profits) rather than two types of social classes. Kaldor's and Schmitt's approaches to income and to “social classes” are similar. Both authors base their analysis on income(s) and make no “social classes” distinction (on “social classes” analysis see for instance Pasinetti, 1962).

Nevertheless, contrary to Schmitt, Kaldor proposes an analytical formulation of Keynes's (1936 [1964]) monetary theory, presumably starting from Keynes's definition of total income. According to Keynes (1936 [1964]: 23), “two kinds of expense” are to be detected in an economy: the “factor cost of the employment in question” and the “user cost”. “The excess of the value of the resulting output over the sum of its factor cost and its user cost is the profit or, as we shall call it, the income of the entrepreneur. Factor cost and the entrepreneur's profit make up […] total income” (Keynes, 1936 [1964]: 23).

Kaldor (1956) develops the following mathematical formulation of Keynes's reasoning:

andbeing investment defined as the sum of saving from wages and saving from profit:and where Y is economic output; P stands for profit, and W for wages; I and S are supposed to be equal to saving from wages plus saving from profit. Observe that “the wage-category comprises not only manual labour but salaries as well, and Profits the income of property owners generally, and not only of entrepreneurs” (Kaldor, 1956: 95).7Now, hundreds of studies followed what has gone down in history as Kaldor and Pasinetti's, or post-Keynesian, theory of growth and distribution in the 1960s.8 On the contrary, Schmitt's dialectical analysis of distribution and capital accumulation is less well known. This is the reason why, in the next section, we propose the analytical applications of the special example studied in Section 2, and of another, general case. Our ultimate goal is to (i) study output and investment equations and (ii) find possible points of convergence between the outcome of post-Keynesian and circuit theory works.

4Output and investment: a generalizationWe call sw the saving rate from wages, and sp the saving rate from profit. Their numerical values will be given arbitrarily.

4.1Output and the investment of profit: a special caseSuppose sw=0 and sp=1.9 At the end of the first period, being W1 the wages paid starting from a line of credit (100m.u. in our example), and given the selling price, p (here assumed to be equal to 125m.u.), economic output (the value of sold and unsold wage-goods) can be written as10:

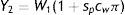

In other words, economic output produced in the first period is equal to the sum of real wages, W1α (that is, the value of wage-goods that can be purchased by wage-earners given initial wages and selling price) and real profit (equal to the value of wage-goods that cannot be purchased by wage-earners at the end of the first period owing to the positive difference between the selling price and the value of production). Arguably, profit is not to be added to nominal wages, since it derives from them: profit, as we will see, is a share of wages distributed and then spent in the final purchase of goods or in the investment for the production of capital-goods. Note also that Eq. (4) is equal to Y1=W1, which means that nominal wages define both real output and nominal output.Now, total output (of the first and the second periods), Y2, is equal to the sum of the value of wage-goods produced in period 1 and the value of capital-goods produced in period 2, namely the sum of wages paid at the end of period 1 and wages paid at the end of period 211:

Output at the end of the second period is equal to nominal wages paid at the end of the first period, W1, multiplied by (1+π), where π is the rate of profit of the economy (given wages and prices).12Observe that this way to compute the value of total output is equal to Eq. (1), i.e. Kaldor's equation of output according to Keynes's definition of income. Bear in mind, however, that, according to Schmitt, profit originates from wages (see Eq. (4)), which are the only macroeconomic income from which profit-goods, interest-goods, and rent-goods arise, thanks to the positive divergence between the selling price and the wages paid to workers that is set by the capitalists (or shareholders). On the other hand, in Kaldor's (1956) analysis the origin of profit is to be attributed to capitalists’ (or shareholders’) spending decisions.

Now, we ask whether this last observation on the coincidence of Eqs. (1) and (5) can be extended to another, general case, or is to be relegated to this special case of a saving rate from wages equal to zero and a saving rate from profit equal to one. Further, is there a coincidence between Kaldor's and Schmitt's definitions of output and investment? In pursuing this line of inquiry, we will extend our analysis to another, general case. We will comment on such case in Section 4.3.

4.2Output and the investment of profit: a general caseSuppose that sw=0.3 and sp=0.6.13 This is the most general case among those to be studied. Therefore, formulas and conclusions on this case hold true also for all the others.

As in the first case, the value of output produced in the first period is equal to the wages paid in the first period,14 and we compute output at the end of the second period as the sum of wages paid in periods 1 and 2. Otherwise, total output is equal to the value of wage-goods produced in period 1 plus the value of capital-goods produced in period 2. We obtain that total output is15:

Now, generalizing our previous reasoning, we obtain the equation of total output:being (i) macroeconomic investment or saving equal to profit invested:and (ii) the value of wage-goods unsold16:Let us resume our previous analysis and consider what happens after the formation of capital-goods and the payment of new wages, W2, in period 2. Let us briefly introduce infinite situations. If workers and shareholders spent the totality of their savings and of wages of period 2, wage-goods left unsold in period 1 would be purchased entirely at a price equal to their value. In this case, no new profits would be generated, and, consequently, no new capital-goods would be created. Further, economic production would be entirely destroyed by economic consumption. This fact would be corroborated by double-entry book-keeping: no income would survive in bank accounts. In this case, when workers’ and shareholders’ savings were spent in the purchase of all wage-goods unsold in the first period (that is, at a selling price equal to their value), profit invested would be identical to the economy's saving. However, after the payment of wages in period 2, workers and shareholders could also spend new wages (completely or not) to purchase wage-goods unsold in period 1 at a selling price higher than their value. New profits would be generated, and new capital-goods could be created. This process, or sequence, could be repeated once, or more times.17 At a certain point in time, workers and shareholders would decide to spend the totality of their savings held in bank accounts to purchase all the goods unsold in the previous periods, at a selling price equal to their value. In this case, as before, when all workers’ and shareholders’ savings were spent on purchasing all wage-goods unsold in the previous periods, production would be entirely destroyed by economic consumption, and profit invested would be identical to the economy's saving.4.3A final considerationA final consideration is in order, on a parallel between Keynes's General Theory and Schmitt's circuit theory. With regard to the post-Keynesian assumption of output being equal to profit plus wages, we suggest that it could be restated, to reach the following conclusion. In an economy where profit formed in a first period has been invested in the production of capital-goods, and wage-goods have been completely sold – that is, the consumption of wage-goods has been completely realized – output is equal to the sum of the value of wage-goods and the value of capital formed (that is, profit invested):

which is tantamount to asserting that the value of output is identical to the value of consumption plus the value of investment.Now, if shareholders or company managers spend the totality of profit to produce capital-goods (i.e. when sp=1), Kaldor's equation of output (Eq. (1) in this paper) will coincide with Eq. (7), and, further, Kaldor's equation of investment (Eq. (3) in this paper) will coincide with Eq. (9). Equations of investment (3) and (8) will coincide when the saving rate of wages is null (i.e. sw=0): namely, following Kaldor (1956: 96), “the amounts of profits is equal to the sum of investment and capitalist consumption”, being this proposition satisfied, under Schmitt's reasoning, whatever the value of the saving rate of wages.

Hence, despite Keynes's (1936 [1964]: 3) “emphasis on the prefix general”, as he conceived of his theory, in order “to contrast the character of [his] arguments and conclusions with those of the classical theory”, we argue that post-Keynesian equations of income and investment can be revisited as a special case among many possible ones according to the theory of the monetary circuit.18 Here is the novelty of Schmitt's analysis of output. It is a general macroeconomic theory through which Keynes's analysis can be interpreted from a new perspective. Pasinetti (2007: 358) calls for the ‘resumption’ of Keynes's economic theory. In this sense, studies integrating old Keynesian and monetary circuit theories may well have to address employment policies in the near future.19 What we infer from our previous analysis is the need of a functional relationship between banks and firms for the creation of net value. In an economy where wage-goods and capital-goods are created, the population is provided with the income necessary to purchase the totality of production. The tool of double-entry bookkeeping triggered the development, after the Renaissance, of industry. The role of industry and banks is to guarantee the division of labor and the monetization of production without which production would be of a purely physical nature. Economic relations would rest on the system of bartering. We endorse the idea (see for instance Pasinetti, 1981: 2) that the phase of industry presupposes trade, but it more than anything presupposes banking activities. The advanced phase of trade is no exception. The analysis conducted above implicitly confirms that firms’ access to bank credit is crucial for sustainable economic growth.

However, things are not as easy as they may appear. In regard to unemployment, Schmitt attributes it not to being conceivable in an economy where consumption- and capital-goods are the only types of goods produced, i.e. the economy analyzed in this paper. Yet, Say's Law seems to be wavering, with mass unemployment a recurring burden in capitalist societies. To a certain extent, the crux of the matter is the idea, shared also by Keynes, that demand temporarily falls short of supply. Keynes (1936 [1964]: 32)20 notices that Malthus was among the first scientists opposing “Ricardo's doctrine that it was impossible for effective demand to be deficient; but vainly. […] Malthus was unable to explain clearly […] how and why effective demand could be deficient […].” From then onwards no definitive explanation to that phenomenon, which is at the origin of ‘involuntary unemployment’, has been given. The theory of the monetary circuit embraces the Keynesian idea that “involuntary unemployment can only result from the breaking of the causal link between the demand for goods and the supply of labour” (Bradley, 2003: 405). Nevertheless, it would be worth studying, in future academic works, the explanations of the divergence between demand and supply in modern economies given by the General Theory and the circuit theory, namely Keynes's “psychological arguments like the excessive thriftiness of income-earners or the timorous attitude of investors” (Bradley, 2003: 405) versus the role played in Schmitt's analysis by amortization. According to Keynes (1932 [1979]: 52), “[t]here is a half-way house, which permits the existence of unemployment in the short period”. Following Solow (2012: 268), Keynes also argues that “a modern economy could be in equilibrium with unemployment, meaning that there were no internal forces at all tending to move it out of that state”, although “[m]ost modern economists […] think that Keynes did not quite make good” on that assertion (Solow, 2012: 268). The monetary analysis of amortization possibly shuffles off any doubts about. In fact, according to Schmitt, monetary disorders are likely to emerge when the replacement of capital-goods takes place: as Bradley (2003: 405) puts it, this “process causes a reduction in the rate of profit that will in its turn lead to the decline of productive investment in favor of purely financial operations, this tendency being accompanied by soaring unemployment”. Hence, a future line of inquiry should deal with a meticulous investigation into the formation of amortization-goods and its implications on the real and nominal aspects of aggregate demand and aggregate supply.

5ConclusionAccording to the theories of the monetary circuit, authored preeminently by Schmitt (1972, 1975, 1984, 1998), Parguez (1975, 1996), Barrére (1979), and Graziani (1989, 2003), bank money – broadly speaking, money in general – is not of physical nature, but a pure symbol, a number without intrinsic value. These authors show that it is thanks to the numerical attribute of money that goods and services produced in modern economies are made homogeneous from an economic point of view. Namely, the monetization of production is made possible by the interaction between workers, firms, and banks: workers’ bank accounts are credited with wages by banks upon request of a firm, in exchange for the production of consumption-goods or capital-goods due to human labor. Given this reasoning as ascertained, in this paper we analyzed the dynamics of consumption and investment when saving rates from wages and from profit are respectively other than zero and unity. With such an aim, we analyzed Kaldor's (1956) formalization of Keynes's (1936) General Theory, and Schmitt's monetary analysis of production. We shared Kaldor's (1966: 311) aim to go beyond Harrod, Domar and Solow's conception of a “single saving propensity applicable to the economy”.

Starting from Keynes's (1936 [1964]: 23) definition of total income as the sum of the “factor cost” and profit, Kaldor (1956) analytically defined national output as the sum of wages and profit, being investment the sum of saving of wages and saving of profit. It is worth noting that further studies followed Kaldor's (1956) economic model (see for instance Pasinetti, 1962). We made an attempt to compare Kaldor's original model to Schmitt's economic theory, in order to (i) detect possible analytical coincidences between both theories, and (ii) verify whether Kaldor's (1956) equation, where output is equal to the sum of wages and profits, is applicable in real fact.

Following Schmitt, we supposed that (i) consumption-goods are produced in period 1, (ii) capital-goods are produced in period 2, and (iii) all consumption-goods have been purchased by income-earners at the end of the two periods. We defined the value of consumption-goods produced in a period as equal to wages paid to workers, and the value of capital-goods produced in the following period as equal to profit which has been spent to pay new wages in exchange for the production of capital. We found out that wages paid in period two are equal to profit only if the managing board of the company decides to invest – and effectively does – the entirety of profit formed in period 1 into the production of capital-goods. Otherwise, in period two, only a share of profit will be used to pay wages to workers producing capital; the remaining share of profit will be devoted to shareholders’ consumption of previously unsold goods.

In this respect light is thrown on Keynes's “truisms” resulting “from the equality between aggregate Income (Y) […] and aggregate Disbursement (D) which is the sum of Consumption-expenditure (C) and Investment (I)” (1933 [1979]: 68–69): that is to say that national output, identical to income, can be defined as the value of wage-goods plus the value of capital-goods, namely the sum of wages and profit invested. Further, macroeconomic investment or saving is always equal to saving from profit.

Hence, referring to Kaldor's and Schmitt's reasonings, equations of output coincide when the saving rate of profit is equal to unity, and investment equations coincide when the saving rate of wages is equal to zero. Further, when the saving rate of profit is equal to unity, Kaldor's investment equation coincides with our equation to be used to compute the value of wage-goods left unsold at the end of period 1. Consequently, from such analytical comparison we inferred that Kaldor's (1956) formalization of Keynes's (1936) General Theory can be subsumed as a special case among those contemplated by Schmitt's monetary theory.

Now, as Keynes (1936 [1964]: 18) puts it: “[C]lassical economists have thought that supply creates its own demand; – meaning by this […] that the whole of the costs of production must necessarily be spent in the aggregate […] on purchasing the product”. Schmitt's analysis of profit and capital formation proves the veracity of this classical conception. Yet, in modern capitalist economies, Say's law (1803 [1843]) seems to be wavering, being mass unemployment a recurring burden in capitalist societies: “[t]here are machines, and there are workers able to man them, but they all remain idle for lack of effective demand” (Pasinetti, 1974: 33). It follows that future academic research should be focused on digging deeper into the economic factors which lead to the “breaking of the causal link between the demand for goods and the supply of labor” (Bradley, 2003: 405). We suggest that such lines of inquiry shall address Keynes's (1936) “psychological arguments” (Bradley, 2003: 405) versus Schmitt's analysis of capital amortization.

FundingThis article was written during my assistantship to the Chair of Monetary Economics at the Università della Svizzera italiana (Switzerland).

We acknowledge Alvaro Cencini and Sergio Rossi for helpful comments, Mauro L. Baranzini and Luigi L. Pasinetti for recommending useful Keynesian literature. We are also grateful to Simona Cain-Polli, for her careful linguistic review of the draft of this paper. Complete responsibility for the content and argumentation remains with the author.

Consider the case where the saving rate of wages is positive (for instance, equal to 0.3 as in our general case). We compute output at the end of the first period as the value of sold and unsold goods. Our reasoning leads us to compute economic output as the sum of:

- (a)

the value of wage-goods sold;

- (b)

the value of wage-goods unsold owing to the saving of wages (these goods could have been sold if workers had spent the totality of wages paid to them);

- (c)

profit formed by the positive difference between selling price and the value of production (it is not known yet whether this profit will be invested or not in the production of capital-goods); and

- (d)

profit unformed owing to the saving rate of wages (profit that would have been formed if workers had also spent that share of wages that they have saved)2121

The sum of what we defined as the value of wage-goods unsold owing to the saving of wages and profit unformed owing to the saving rate of wages is workers’ saving of wages (in our general case, 30m.u.). Observe also that (a)+(b) equals W1α, that is, real wages (or the value of wage-goods that could have been sold if the totality of wages paid at the end of period 1 had been spent by workers); observe also that (c)+(d) is equal to πW1, that is, profit that could have been generated if the totality of wages paid at the end of period 1 had been spent (it is also equal to the value of goods unsold in the case that all wages paid at the end of the first period are spent). Notice also that (b)+(c)+(d) is the value of wage-goods unsold in period 1, WGU1:Recall that (a) is the value of wage-goods sold in period 1, C1, while (b)+(d) is saving of wages in period 1, Sw1, and (c) is profit formed, P1, that can be invested (capital-time by using Schmitt's terminology) in the production of capital-goods:In our numerical general example: Y1=(56+24+14+6)m.u.=100m.u.

:

In the matter of neoclassical economics, we share Kaldor's (1966: 310) idea – but this is not the proper context to discuss it – that Walrasian economists should “evolve a system of non-Euclidean economics which starts from a non-prefect, non-profit maximizing economy where […] abstractions are initially unnecessary”. For this reason and to avoid further digressions, we do not analyze here major neoclassical contributions to the capital theoretical debate.

These are examples applied to Schmitt's analysis relative to profit and capital formation. In what follows, all the explanations of the theory of the monetary circuit refer to Schmitt (1972, 1975, 1984, 1998) and Cencini (2001, 2005). Remember that physical production becomes economic production at the very instant of the payment of wages, and, under Schmitt's reasoning, every single economic production is a macroeconomic magnitude, insofar as it increases national income. It is for this reason that we consider a single company, E, representative of the system of production in our study of macroeconomic dynamics of production, consumption, and capital formation. Further, in the examples studied in this article, we will follow a periodic analysis, assuming that consumption goods are produced in period 1, whereas capital goods are produced in period 2. This is an assumption made here for didactical sake; nevertheless, the same reasoning can be applied to a one-period setting as well as an infinite-periods one. Moreover, another assumption will be made here: that is to say, all consumption goods are fully sold by the end of period 2. As observed in Section 4.2, we might realistically assume that not all consumption-goods are sold by the end of that period: in which case our study would imply the use of geometrical series. However, we find such assumption to be superfluous here, because the logic of that reasoning would be the same as the one presented in a two-periods setting.

Following Solow (2012: 271), “goods and services are both examples of economic goods […].”

For the sake of simplicity, suppose that only bank money is used. Neither coins nor banknotes exist.

This phenomenon has been explained as the law of purchases-sales (see Cencini, 2001, 2005). Nevertheless, it can be shown (see Schmitt, 1984, 1998) that, when amortization-goods are introduced into economic analysis, Say's law seems to be wavering, in support of the old fear in economic theory that the society “might not be able to develop sufficient demand to absorb the increasing production” brought about by technical progress (Pasinetti, 1981: 240).

Notice that neither a new line of credit nor the use of other sources external to the system is necessary in order to produce, in the second period, capital-goods ex novo.

According to Kaldor, the rate of profit turns out to be: PY=1sp−sw⋅IY−swsp−sw. We also stress the fundamental restriction in Kaldor's model: 0≤sw≤sp≤1, that is, the saving rate of wages is lower than the saving rate of profits and their value less than one, zero and one included. Kaldor (1956: 95) justifies this restriction by stating that “if sp<sw, a fall in prices would cause a fall in demand and thus generate a further fall in prices, and equally, a rise in prices would be cumulative.”

It must be observed that Kaldor's (1956) equation became the focus of critical attention in the 1960s. Pasinetti (1962: 270) rewrites the equation, which he identifies as “the equilibrium condition”, as:

being Y “net income” (Pasinetti, 1962: 268), being I “the amount of investment necessary to cope with population growth and technical progress” (Pasinetti, 1962: 268), and “where Pc and Pw stand for profits which accrue to the capitalists and profits which accrue to the workers”, and where sc and sw are the propensities to save of capitalists and workers respectively (Pasinetti, 1962: 270). Observe, hence, that Pasinetti bases his analysis on two classes –workers and capitalists – and on political implications – for instance “[t]he case of a socialist system” (Pasinetti, 1962: 277). On this subject, see, for instance, Harcourt (1969, 1972) and Baranzini and Harcourt (1994).

We develop analytically the case studied in Section 2.

Y1=W1α+W1(1−α), where W(1−α) is equal to profit, P1.

Y1=W1+W2; Y2=(1+α)W1.

In our numerical example: Y2=[(1+0.2)100]m.u.=120m.u.

Assume the same data of the first case relative to wages (100m.u.) and total selling price (125m.u.). If sw=30%, workers spend 70m.u. (being their saving, sw, equal to 30m.u.). Therefore, they purchase 70/125 of wages, i.e. wage-goods worth 56m.u., but priced 70m.u. The firm, E, gains a profit of 14m.u. If sp=0.6, at the end of the second period capital-goods produced have a value of 8.4m.u. (to wit, 60% of profit), and the remaining 5.4m.u. (40% of profit) are distributed as dividends.

Nevertheless, a careful study on this point is to be found in our Appendix.

Y2=W1+W2; Y2=W1+spcwπW1; Y2=W1(1+spcwπ). In our numerical example: Y2=W1(1+cwspπ)=100⋅(1+0.7⋅0.6⋅0.2) m.u.=108.4 m.u.

A careful explanation of this equation can be found in our Appendix. Interestingly, after calculation, we obtain that profit is equal to: P1=WGU111−spsw−Y2sw1−spsw. Note that Kaldor's (1956) assumption of a saving rate of profit higher than the saving rate of income (see the previous section on this point) is not necessary. Namely, in this economy, where only wage-goods and capital-goods have been created (to wit, no other types of goods, like interest-goods or amortization-goods exist), the demand for money turns out to be always identical to the supply of money. Let us explain this concept by quoting Keynes's own words: “From the time of Say and Ricardo the classical economists have taught that supply creates its own demand; – meaning by this in some significant, but not clearly defined, sense that the whole of the costs of production must necessarily be spent in the aggregate, directly or indirectly, on purchasing the product” (Keynes, 1936 [1964]: 18). This applies to Schmitt's monetary theory, whatever value the saving rates from wages and from profit may have.

A complete study case consists in analysing the dynamics of capital accumulation in an infinite temporal setting, and assuming different saving rates from wages and from profit, this meaning that α may be changing from period to period, as it effectively does in real economies. Such a study implies using geometrical convergent series, with n→∞ and ratio q (−1<q<1). It must be clear that such a study is based on Schmitt's analysis and not on others’, like Samuelson and Modigliani's (1966) attempt to build a neoclassical formulation of Pasinetti's (1962) model of economic growth, which Pasinetti started developing from Kaldor (1956). Namely, Samuelson and Modigliani (1966: 295–296) build a “one-sector neoclassical model with two classes of savers, a class who forever save a constant proportion sc of their income that comes wholly from profits, and a class who forever save a constant proportion sw of their income from wages and profits.”

This not meaning that Keynes's and Schmitt's reasonings are identical or to be taken as nailed. The coincidence detected here is likely to be incidental. We may argue, however, that Keynes's (1936 [1964]) intuitions were similar to, or even influenced, Schmitt's thinking. In this sense, it is worth noting that Schmitt (1972: 113), we may argue, criticizes the General Theory approach developed from “Chapter III” (1936 [1964]): it seems to us that Schmitt implicitly shares Keynes's intuitions to be found in the first two chapters. Further, Keynes himself left the door open to exchanges of opinions on the ‘revolution’ started by his work, which was far from being clear and accomplished (see for instance Moggridge, 1992: Chapter 23, and Pasinetti, 2007), being it, at the time of publishing, radically different from his previous economic ideas which we find as being, presumably and to some extent, still ramified, in 1936, into his mind. Nevertheless, a debate on this subject will only be based on mere conjectures.

Following Pasinetti (1981: 6) Smith “points out how ‘the savage nations of hunters and fishers [where] every individual who is able to work is more or less employed in a useful labour […] are so miserably poor […] [while] among civilized and thriving nations, though a great number of people do not labour at all […] the produce of the whole labour of the society is so great that all are often abundantly supplied’.” The implication of Smith's reasoning is straightforward: considerations on employment policies (i) should be done on the basis of the wealth created in an economy and distributed to the population, and (ii) attribute less importance to demographic magnitudes.

See also Keynes (1933 [1979]: 67); Pasinetti, 1981: 240–241.