The disclosure of the minutes of the Boards of Directors of central banks (procedural transparency within the inflation targeting (IT) literature) implies the challenge of sending a clear message. Regardless of whether the document released is a brief, moderate, or highly detailed (verbatim) account of a Board's discussion, its contents often align expectations and define an effective monetary policy to curb inflation. This paper provides a quantitative perspective of procedural transparency by performing a text analysis of the minutes of Board meetings in the central banks of Brazil, Chile, Colombia, Mexico, and Peru. The study examined the lengths of the minutes, their frequent vocabulary (including its association with a predefined central-bank terminology), and their readability (through a reading ease index).

La divulgación de las actas de las juntas directivas de los bancos centrales (transparencia procedimental dentro de la literatura de inflación objetivo) supone el reto de enviar un mensaje claro. Independientemente de si el documento publicado es un resumen breve, moderado o muy detallado (literal) de una reunión de la junta, los contenidos suelen converger las expectativas y definir una política económica eficaz para contener la inflación. El presente ensayo arroja una perspectiva cuantitativa de la transparencia en los procedimientos por medio de un análisis textual de las actas de las reuniones de las juntas en los bancos centrales de Brasil, Chile, Colombia, México y Perú. El estudio examinó la longitud de las actas, el vocabulario más frecuente (entre el que se incluye la asociación a una terminología predefinida del banco central) y su comprensión (a través de un índice de legibiligad).

In the 1990s, the central banks of several developing countries carried out deep reforms to control inflation (Mishkin & Savastano, 2000). Most of them were within the IT scheme. While there is no conclusive empirical evidence of the IT scheme's causal effect upon inflation, it is regarded as a chief strategy to reduce inflation and bring about price stability in many economies (IMF, 2005; Lin & Ye, 2009; Mishkin & Schmidt-Hebbel, 2007).1

Mishkin (2000) describes five basic elements for a successful IT strategy: (1) a public announcement of the inflation target, (2) an institutional commitment to price stability, (3) increased amount of information to guide policy decisions, (4) transparency through communication with the public, and (5) accountability. While the public announcement of an inflation target, the institutional arrangements (including constitutional or those related to the banks’ independence), and accountability received great attention and academic scrutiny in the early stages of the IT scheme implementation,2 the policy and research agendas have been focusing on increased information and transparency in more recent times.3 In general, the compliance with information and transparency requirements has been assessed by the number of background studies, reports to the media, Senate hearings, minute releases, and other printed materials employed in the policy decision-making and dissemination processes. Such evidence has been used to determine to what extent central banks are complying or not with an IT approach.

Beyond the above-described framework, Geraats (2002) breaks down the concept of central-bank transparency into five facets: (1) political, (2) economic, (3) procedural, (4) policy, and (5) operational transparency. This author shows how transparency influences and integrates all IT elements, further inquiring whether these elements reduce uncertainty or not, and affect the incentives for reputation building. From this perspective, procedural transparency deals with how monetary policy decisions are taken, including policy deliberations crystallized in minutes and voting records.

This paper focuses on procedural transparency by examining the release of the minutes of central-bank Board meetings. This is not, by any means, a trivial task. It implies a commitment to an effective public communication, so that the citizens’ expectations are aligned, and the anti-inflationary policies may succeed. However, the contents of the minutes often remain unchecked with respect to their conveying the desired message. In other words, beyond the publishing of the minutes, little is said about what is in them. Therefore, there is a possible imbalance between the freedom of information (procedural transparency) and the contents of these communications (clarity). This paper examines such a potential asymmetry within the central banks of Brazil, Chile, Colombia, Mexico, and Peru. By performing a text analysis of the minutes of the Board meetings of these banks, it offers a quantitative view of their procedural transparency.

The potential effects of a lack of transparency seem to be more pervasive in developing countries. Blinder et al. (2008) discuss how central banks that announce the implementation of IT strategies in those countries, usually do it in a rather circumstantial way instead of following a set of rules or a pre-established mechanism. This stresses the need and importance of high-quality communication tools (minutes, reports, press conferences, etc.) to convey their rationale and decisions.

The empirical literature on IT implementation and central-bank transparency regards the release of the minutes as a step toward IT success. No matter its contents, a release itself demonstrates purpose and enhances transparency. However, the mere release of the minutes (whether or not they record the deliberation process verbatim, present voting records, or scrutinize a Board member's view) might not achieve two leading IT goals: establishing a clear communication with the public (Mishkin, 2000); and attaining a coherent management of their expectations (Blinder et al., 2008). If the minutes (and their timely release) are a core element of procedural transparency, their clarity or the lack of it, their proper or improper wording, their verbose or succinct treatment of specific events, may have desirable or undesirable effects upon policy outcomes.

This paper explores these potential procedural-transparency misalignments involving clarity and the need to manage expectations. And it does so by performing a text analysis of the minutes of the Board meetings of the central banks of Brazil, Chile, Colombia, Mexico, and Peru.4 This empirical strategy permits to count the appearance of a word within a document; to assess what type of word it is (verb, subject, noun); to identify the most frequent words; and to isolate a predefined set of keywords related to the basic concerns of central banks acting under the IT scheme. This information renders numerical syntheses of the texts, which facilitate their comparison between countries. And such a comparative analysis of the usage of words or expressions and their closeness (via cluster analysis) reveals differences between the central banks, and the contents and emphases of their communications to the public in regard to the economic environment, and the banks’ views and policies.

Furthermore, a standard readability index was applied to the text of each of the minutes of the central banks to assess the banks’ progress in terms of the clarity of their communications. This approach, which comes from a body of educational and linguistics research, offers another alternative to analyze the contents of the minutes systematically.

Text analysis has the advantage over other methodologies of not assigning any subjective measure to the contents of a document. It is simply an account of words, whose recorded frequency per document becomes a random variable subject to scrutiny via statistical methods. The replicability and scalability of these analyses are a second advantage (once the text analysis is “modeled”, it can be extended to a large number and variety of documents; for this study, 557minutes and Board communications were analyzed). Nonetheless, text analysis has a shortcoming: word frequency and readability indexes cannot be taken at face value of proper or improper communication; put otherwise, having more or less words on a phenomenon does not imply its high (or low) importance within the text.

The transparency literature features several works that scrutinize the minutes (and other communication tools) of central banks through automated means, and assess various transparency criteria by analyzing the contents (beyond the mere distribution of words) of minutes, press releases, background materials, and other information pieces.5de Haan and Jansen (2007) examined the keyword ‘vigilance’ in the communications of the European central bank to determine the effect of communication on inflation expectations. Lucca and Trebbi (2009) constructed a semantic-orientation measure for news headlines concerning the Federal Reserve communications and meetings. Their measure was based on the relative frequency of words occurring together in a sentence. Its impact was analyzed with regard to short- and long-term treasury yields, revealing that communications had a higher effect on long-term treasuries. In their analysis of the introductory statement of the European Central Bank, Berger, de Haan, and Sturm (2011) identified a larger share of words related to the monetary sector than to other subjects, but they also observed a smaller monetary coverage during the second half of the period. Born, Ehrmann, and Fratzscher (2014) used automatic coding for the contents of the financial stability reports, speeches, and interviews of 37 central banks. They further classified these documents as optimistic or pessimistic, finding that the former had a positive effect upon market returns. Hansen, McMahon, and Prat (2014), taking advantage of further clarity in processing the minutes of the Federal Open Market Committee (FOMC),6 examine the increasing transparency effect upon the deliberating process of the committee. In particular they established a career effect between new and existing members of the committee in terms of discipline and conformity effect. Bulíř, Čihák, and Jansen (2013) performed human coding on text fragments containing central-bank assessments of IT matters, and they evaluated the clarity of those texts through the Flesch–Kincaid Grade Level. The authors found enhanced communications readability in Chile, lesser readability in Thailand, and an even level in the Czech Republic, Poland, Sweden, and the European central banks. A second finding was the idiosyncratic nature of the communications of central banks. Overall, there is a growing body of literature relying on non-human coding approaches to summarize the features of the banks’ information pieces.

This paper adds to the literature in several ways. First, it focuses on some central banks of Latin America, which is a region where IT has been heralded as an effective alternative to control inflation. Second, methodologically, this work refrains from human intervention in codifying the content of the minutes. Third, the findings reveal word-usage and clarity patterns that are useful to improve the communication strategies of the central banks studied.

Section 2 summarizes the experience of Latin America concerning IT implementation and transparency. Section 3 describes the basic concepts of text analysis and the tools used in this study. Sections 4–6 display the results, and complete the analysis. Section 7 provides some conclusions.

2Inflation targeting and the minutes of central banksTable 1 summarizes the basic features of the IT scheme in Latin America. The adoption dates reflect, as some observers and academic analysts have agreed, not only the announcement of IT as the monetary framework, but also the actual implementation of some minimum IT elements. Among them are the publications of a comprehensive inflation report, the establishment of a mid-term inflation target, and an improved communication with the public (including the legislative and executive branches of government). However, the inception of the IT scheme has not been a straightforward process with immediate results, and authors like Steiner et al. (2014) have described the accommodating path towards its full application. Hence, in most Latin American countries, this has been a slow-paced transition – each country dealing with its own economic and political challenges. Out of the countries of our study, Brazil is the only one to have announced and put in place a full IT scheme; the remaining ones considered IT for years, but did not undertake committed actions until the early 2000s.

Inflation targeting in Latin America.

| Country | Adoption date | Information release channels |

|---|---|---|

| Brazil | June – 1999 | • Inflation reports (quarterly) |

| • Board's minutes | ||

| • Parliament hearings. | ||

| • Press releases | ||

| Chile | September – 1999 | • Inflation reports (monthly) |

| • Board's minutes | ||

| • Parliament hearings | ||

| • Press releases | ||

| • Financial sector reports | ||

| Colombia | September – 1999 | • Inflation reports (quarterly) |

| • Board's minutes | ||

| • Parliament hearings | ||

| • Press releases | ||

| • Financial sector reports | ||

| Mexico | January – 1999 | • Inflation reports (quarterly) |

| • Board's minutes | ||

| • Press releases | ||

| • Financial sector reports | ||

| Peru | June – 2002 | • Inflation reports (quarterly) |

| • Press releases | ||

Note: The adoption date does not necessarily reflect the inception of the IT approach, which differs from country to country. For instance, although Chile is considered to be the second world country to have adopted IT (after New Zealand) in September 1990, it was not until September of 1999, when it dropped the exchange-rate anchor, that its monetary strategy fitted the IT scheme (Hammond, 2012). Mexico announced its IT adoption in 1995, but only by 1999 did it publish its official targets. Peru introduced IT in 1994; however, it was by 2002 that it implemented a detailed IT framework.

In 1999, Brazil established a monetary policy in line with the IT scheme after moving to a floating exchange rate. The central bank began to publish an inflation report and strengthened its independence. Currently, the National Monetary Council sets the inflation target annually, with a tolerance range for the upcoming two years. Since January of 2000, the central bank has been publishing the minutes of its Board meetings in Portuguese and English. For the purposes of this study, 133 such minutes were collected from the bank's web page. The structure of those minutes is rather static, in the sense that they typically review recent economic developments, inflation trends, labor market issues, foreign trade and world economy matters, and the behavior of the money markets (among others). Very seldom does their length exceed 12 pages, and they feature a section describing the monetary policy decision after the meeting.

Chile is Latin America's IT pioneer, having announced price stability as a primary objective in 1991, right upon introducing the central bank's independence. However, it was not until 1999 that a full IT scheme was in place, when a multi-year inflation target was announced, and inflation reports were issued with the corresponding inflation forecast. The central bank has published its Board minutes since March of 1997. For this study, 172min were collected from the bank's web page. Each of them has an approximate length of seven pages.7 Since their text structure does not follow a template (by contrast with the Brazilian case), throughout most of this period, they summarized Board discussions in several sections: background (“antecedentes”), scenarios (“opciones”), monetary policy and decisions (“acuerdo”).

Colombia sanctioned an independent central bank in 1991, fully committed to control inflation, including its setting of an annual inflation target. However, the bank's dual task of managing also the exchange rate did not expedite the fall of inflation. It was not until 1999, when the country abandoned the exchange-rate band mechanism that the IT scheme brought down inflation to a single digit. The central bank has made available the Board minutes since June of 2007. 80 such minutes were collected from the bank's web page for this study. The number of pages of these minutes grew steadily from about five pages in early 2008, to about nine pages by 2012. Similar to the Brazilian model, the Colombian central bank publishes a quite standard report with one section on recent inflation developments, economic growth, financial sector and foreign trade matters, and the world economy; a second section summarizing the points discussed throughout the meeting, and a third section featuring the monetary policy decision.

Mexico announced its IT implementation right after the 1995 financial crisis; however, the country was also using a monetary growth target as an anchor within its policy. It was only by 1999, when the Mexicans regained confidence, that the central bank could refocus on inflation control and publish official targets and inflation reports. Nevertheless, the bank began releasing its Board minutes as late as January of 2011. Consequently, only 24min were available from its web page. These are the lengthiest minutes, ranging from 13 to 23 pages. Their text covers thoroughly the information shared throughout a meeting. It begins with a background section featuring recent economic and financial developments (related to the world's economy, the emerging markets, inflation). A second section contains the Board's debate on policy decisions based on the background information. And a third and closing section provides the monetary policy conclusions.

Peru announced its adoption of the IT scheme while still being a “dollarized” economy. Although by the year 2000 the country's inflation had fallen to one-digit levels, only by 2002 was the IT scheme fully implemented, with announcements of multi-year inflation targets, increased communication via inflation reports, and an independent central bank. Peru does not release the Board minutes. Instead, it publishes an Informative Note from the Monetary Program (Nota informativa del programa monetario) after the Board meetings. These Notes are a synthesis of those meetings, and as such, the documents closest in contents and timing to the minutes released by the other four central banks under study. 150 such Notes were collected from the bank's web page. Their structure and wording are quite static, as will be discussed later in our text analyses. However, this is a useful trait for the purposes of our research. The central bank of Peru conveys information in a rather succinct manner, with respect to its regional counterparts. Its Notes rarely exceed two pages, and there seems to be a minimum-wording guideline in force. Such a compact text usually begins with the policy decision on the intervention interest rate, accompanied by one or two paragraphs on recent inflation and economic developments. These Notes feature no Board discussions, arguments, or considerations whatsoever. Clearly, they function more as press releases than as Board minutes. This distinction is borne in mind in the analyses.

The set of documents studied are those that each central bank released as the official account of its Board meetings; it did not matter whether they were called “minutes” or not, whether they provided summaries or lengthy accounts, whether they were drastically edited or remained a verbatim version of the deliberation process. These documents are primary channels of communication with the public, together with other economic reports, press releases, or public hearings. They contain what each central bank wishes to share with the markets and their agents. They are not random documents likely to be manipulated by fortuitous agents at each central bank. Therefore, although they might not offer a highly detailed account of the deliberative process (its arguments, dissents and agreements), this study regards them as the right pieces of information.

Overall, the primary communication tool of five Latin American central banks under the IT scheme has been briefly described, that is, the Brazilian, Chilean, Colombian, and Mexican official minutes as well as the Peruvian Informative Notes. A visual inspection reveals that Brazil, Colombia, and Mexico employ a rather stable treatment and format, with steady sections and subjects. Mexico has increased the length of its minutes, while the other countries have not. The minutes of Chile seem to be the less rigid, while the Notes of Peru are the most succinct. King (2000), as quoted by Blinder et al. (2008), suggests that a central bank should be “boring”, in the sense that the markets should not react to its releases or actions, but based on the economic outlook. In this vein, this short review confirms that Latin America has indeed “boring” central banks, which release quite static texts, meeting after meeting, with no intention to disrupt the markets. This description would suffice if the analysis had been limited to a binary variable (release or not, communicate or not). However, there is more to our analysis than reports, sections, and number of pages. In the following sections, the contents of these communications tools is further examined.

3Text analysisText analysis8 converts a text, or a set of texts (corpus), into numerical information for further study. For this research purposes, the minutes of the central bank of each country form a corpus, which will undergo a series of operations to extract its characteristics (Fagan & Gencay, 2011; Francis & Flynn, 2010). These operations include: determining the format and the length of the text (or corpus); eliminating spaces, punctuation, and non-informative words; collapsing in a single word the plurals and variants of words that convey the same meaning, and tokenizing.9 In Section 3.1, the preprocessing performed on the research corpus is presented. These procedures prepare and transform words into a data structure where words or tokens become (random) variables subject to statistical and semantic analyses. In Section 3.2, the methods used after processing the corpus are described. In Sections 4 and 5, the results of the study are offered.

3.1Preprocessing and corpus descriptionThis section describes the preprocessing performed on the corpora. Every corpus includes each minute, and Note issued after the Board meetings of the central banks (as published on the banks’ web sites) until December of 2013; however, they varied in their dates and number or issuances. A total of 564 text pieces were processed: 133 from Brazil (dating back to January of 2000); 172 from Chile (dating back to April of 1997); 80 from Colombia (dating back to January of 2007); 24 from Mexico (dating back to January of 2001), and 155 from Peru (dating back to February of 2001). Brazil publishes its minutes in Portuguese and English; the other countries do so only in Spanish. The English version of the Brazilian minutes was used for the study. The preprocessing and word count described below in the original language the texts were performed; however, the words were translated into English to have a homogeneous account.

The first preprocessing step employed the tm:Text Mining Package (Feinerer, 2011; Feinerer, Hornik, & Meyer, 2008) of the R statistics software package (R Development Core Team, 2011). It involved:

- 1.

Converting text into lower case.

- 2.

Removing white spaces, numeric characters and punctuation.

- 3.

Collapsing words with similar meanings into a single expression word. For the Spanish-language documents:

- •

asiáticas, asiático, asiáticos ⇒ asia.

- •

brasilera, brasilero, brasileña, brasileñas, brasileño, brasileños ⇒ brasil.

- •

chilena, chileno, chilenos ⇒ chile.

- •

colombiana, colombiano, colombianos ⇒ colombia.

- •

mexicana, mexicano, mexicanos ⇒ méxico.

- •

peruana ⇒ perú.

- •

crecimiento económico, crecimiento de la economía ⇒ crecimiento_económico.

- •

crisis financiera ⇒ crisis_financiera.

- •

comercio internacional ⇒ comercio_internacional.

- •

internacionales, internacional, mundial, mundiales ⇒ mundo.

- •

déficit fiscal, déficit público ⇒ déficit_fiscal.

- •

Dólares ⇒ dólar.

- •

empresarial, empresariales, empresarios, empresas, empresariado, firmas, firma ⇒ empresa.

- •

estados unidos ⇒ estados_unidos.

- •

estabilidad financiera ⇒ estabilidad_financiera.

- •

europea, europeas, europeo, europeos ⇒ europa.

- •

euros ⇒ euro.

- •

expectativas ⇒ expectativa.

- •

industrias, industrial ⇒ industria.

- •

inflación objetivo ⇒ inflación_objetivo.

- •

mercados financieros, mercado financiero, sistema financiero, sector financiero ⇒ mercado_financiero.

- •

negativas, negativos, negativa, negativo ⇒ negativo.

- •

petroleras, petroleros, petrolera, petrolero ⇒ petróleo.

- •

política fiscal, políticas fiscales ⇒ política_fiscal.

- •

política monetaria, políticas monetarias ⇒ política_monetaria.

- •

positivas, positivos, positiva ⇒ positivo.

- •

salarial, salariales, salario ⇒ salarios.

- •

tasa de cambio nominal ⇒ tasa_de_cambio_nominal.

- •

tasa de cambio real ⇒ tasa_de_cambio_real.

- •

tasa de cambio ⇒ tasa_de_cambio.

- •

tasa de interés ⇒ tasa_de_interés.

- •

- 4.

Collapsing words with similar meanings into a single expression/word. For the English-language documents:

- •

asian ⇒ asia.

- •

brasil, brazilian ⇒ brazil.

- •

chilean ⇒ chile.

- •

colombian ⇒ colombia.

- •

mexican ⇒ méxico.

- •

peruvian, perú ⇒ perú.

- •

economic growth ⇒ economic_growth.

- •

dollars ⇒ dollar.

- •

international trade ⇒ international_trade.

- •

international ⇒ world.

- •

fiscal deficit, public deficit ⇒ fiscal_deficit.

- •

financial crisis ⇒ financial_crisis.

- •

entrepreneurs, entrepreneur, entrepreneurial, firms ⇒ firm.

- •

european ⇒ europe.

- •

euros ⇒ euro.

- •

inflation targeting ⇒ inflation_targeting.

- •

industries, industrial ⇒ industry.

- •

financial markets, financial market, financial system, financial sector ⇒ financial_market.

- •

financial stability ⇒ financial_stability.

- •

financial stability ⇒ financial_stability.

- •

negatively ⇒ negative.

- •

fiscal policy, fiscal policies ⇒ fiscal_policy.

- •

monetary policy, monetary policies ⇒ monetary_policy.

- •

positively ⇒ positive.

- •

salaried, salaries, salary, wage ⇒ wages.

- •

united states ⇒ united_states.

- •

nominal exchange rate ⇒ nominal_exchange_rate.

- •

real exchange rate ⇒ real_exchange_rate.

- •

exchange rate ⇒ exchange_rate.

- •

interest rate ⇒ interest_rate.

- •

- 5.

Removing stop words in Spanish (for instance: el, lo, los, las) and English (for instance: the, a).

After this preprocessing, a DTM was built. This is a matrix whose rows index the documents (ordered chronologically), and whose columns list the words. Therefore, the DTM systematizes all the words (or predefined word sets) of every minute, for further analysis.

Tokenizing the texts is a second preprocessing step. Tokenizing is identifying paragraphs, sentences, words, syllables, numbers, and punctuation marks within the texts, in order to apply readability indexes to them. It is done through the koRpus Package (Michalke, 2014a, 2014b), which is part of the R statistics software package. Therefore, tokenizing uncovers the structure of texts, and permits to run readability indexes on them in order to assess their clarity.

3.2MethodsThree sets of information can be extracted out of the DTM. First, there is the total number of words of every document. The time series of the sizes of the documents are an initial quantitative measure of procedural transparency; the relative extended or short length of documents implies a difference in terms of public communication. In this regard, there are two patterns worth investigating: (a) whether there is a long-term trend in the size of the communications (or there have been changes). A given long-term trend may be interpreted as a permanent need to deliver more (or less) information to the public. A change in the trend may suggest that a central bank modified its communication strategy so dramatically that the size of its releases changed. And (b) whether there are any short-term variations in the size of texts, and they could be associated to exogenous events. The use of longer or shorter pieces of text by the central banks is expected to reflect their need of expanding (or not) their presentations of current affairs.

Second, a list of the Most Frequent Terms (MFT) within the corpora may be developed, in order to determine what is “important” in the texts. This is done by extracting the top 30 MFT in each document. For instance, in regard to our research purpose, it was expected that central banks be highly and permanently concerned about the “inflation target”; therefore, the words “target” or “inflation target” were expected to rank high on the list. This second measure of procedural transparency reveals what the central banks continuously talk about. While there is always a risk of finding non-economics vocabulary on the MFT list, the analysis focuses on economics terminology.

The two measures described above are interrelated, and they can only be analyzed with respect to a given central bank and not between banks. The choice of length and words may be regarded as a matter of idiomatic idiosyncrasy. The third type of information that a DTM may provide is an inter-bank measure of procedural transparency. Based on a set of predefined words, a reduced DTM may be defined. By performing a cluster analysis, and particularly a single linkage with a correlation measure, this DTM is summarized through a dendrogram or tree diagram (Johnson & Wichern, 2002), displaying the association of the set of words along the corpus. Since all of our study's central banks share the same set of words, the clustering pattern provides a picture of their own given treatment of economic issues. Hence, this stage of the analysis permits to compare procedural transparency between the banks, and determine any particular patterns.

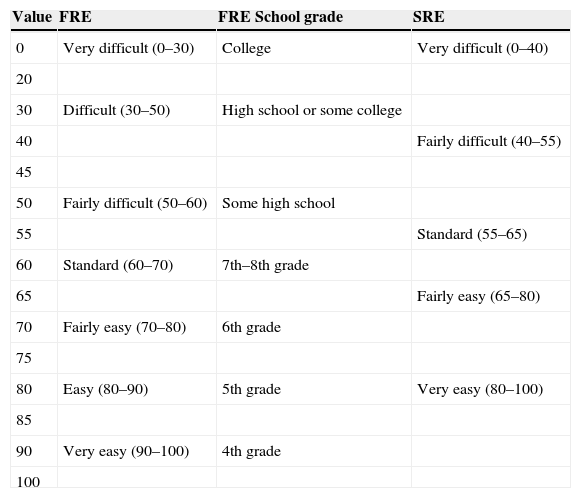

The analysis of readability comes after the above-described DTM estimations. By readability, we understand the typographical and linguistic characteristics that make a text comprehensible. This is indeed a very broad definition. However, readability analyses focus mostly on linguistic traits, that is, on the grammatical and lexical elements that enhance understanding. The study of grammatical readability has developed several measures that rely on the assumption that a text is easier to read if it features shorter words and phrases. This approach belongs to what DuBay (2004) classifies as classic readability studies, which apply readability measures such as the Flesch Reading Ease (FRE), SMOG, Flesch–Kincaid, Gunning FOG, and Fry readability graph.

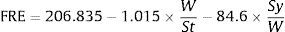

For this study, the FRE measure (Flesch, 1948) was chosen. The FRE computes the total number of words, the number of syllables, and the full number of sentences within a text. These parameters are combined in the formula:

that comprises the average sentence length (W/St) and the average word length (Sy/W), where (W) stand for words, (St) for sentence and (Sy) for syllable. The FRE was developed for texts written in English, and scaled from 1 to 100 (the higher the score, the easier the text). In addition, the measure was mapped in terms of the age or the formal-education years of average US citizens by the time of its publication (see Table 2). Since then, for reliability purposes, the FRE measure has been modified for several languages. In Spanish, Fernández-Huerta (1959) made the first attempt, which was later improved by Szigriszt (1992) (hereinafter, the Szigriszt Reading Ease (SRE)):Comparability of the FRE and SRE measures.

| Value | FRE | FRE School grade | SRE |

|---|---|---|---|

| 0 | Very difficult (0–30) | College | Very difficult (0–40) |

| 20 | |||

| 30 | Difficult (30–50) | High school or some college | |

| 40 | Fairly difficult (40–55) | ||

| 45 | |||

| 50 | Fairly difficult (50–60) | Some high school | |

| 55 | Standard (55–65) | ||

| 60 | Standard (60–70) | 7th–8th grade | |

| 65 | Fairly easy (65–80) | ||

| 70 | Fairly easy (70–80) | 6th grade | |

| 75 | |||

| 80 | Easy (80–90) | 5th grade | Very easy (80–100) |

| 85 | |||

| 90 | Very easy (90–100) | 4th grade | |

| 100 |

Note: Flesch Reading Ease (FRE) and Szigriszt Reading Ease (SRE).

All measures of readability are language and reader-specific formulas, which hinders their comparability. Flesch (1948) sets seven brackets for his measure, namely: very easy (comics), easy (pulp fiction), fairly easy (slick fiction), standard (digests), fairly difficult (quality), difficult (academic), very difficult (scientific). In an effort to replicate this mapping, Barrio-Cantalejo et al. (2008) estimated a similar SRE distribution for a range of Spanish-language manuscripts (scientific journals, local news, national news, sports news, popular literature, school textbooks, magazines, comics), and proposed comparable reading-ease ranges (Table 2).

Because the documents under study were published in Spanish (in Chile, Colombia, Mexico, and Peru) and in English (in Brazil), the respective readability measures (FRE and SRE) were calculated. The readability measures obtained from these analyses were in direct relation with the procedural transparency expected from the central banks. Although the release of minutes is generally regarded as a step toward procedural transparency, and therefore, toward IT success, this study examined the contents and clarity of these documents as crucial transparency elements in the Latin American context, in a way that had not been done thus far.

Bulíř et al. (2013) carried out a related analysis of the clarity of the communication tools of central banks. Their study focused on inflation reports, monetary policy reports, and press releases in seven countries implementing IT. They included documents aimed at specialists and at the general public. This study, however, narrows down the analysis to the above-described minutes and Notes.

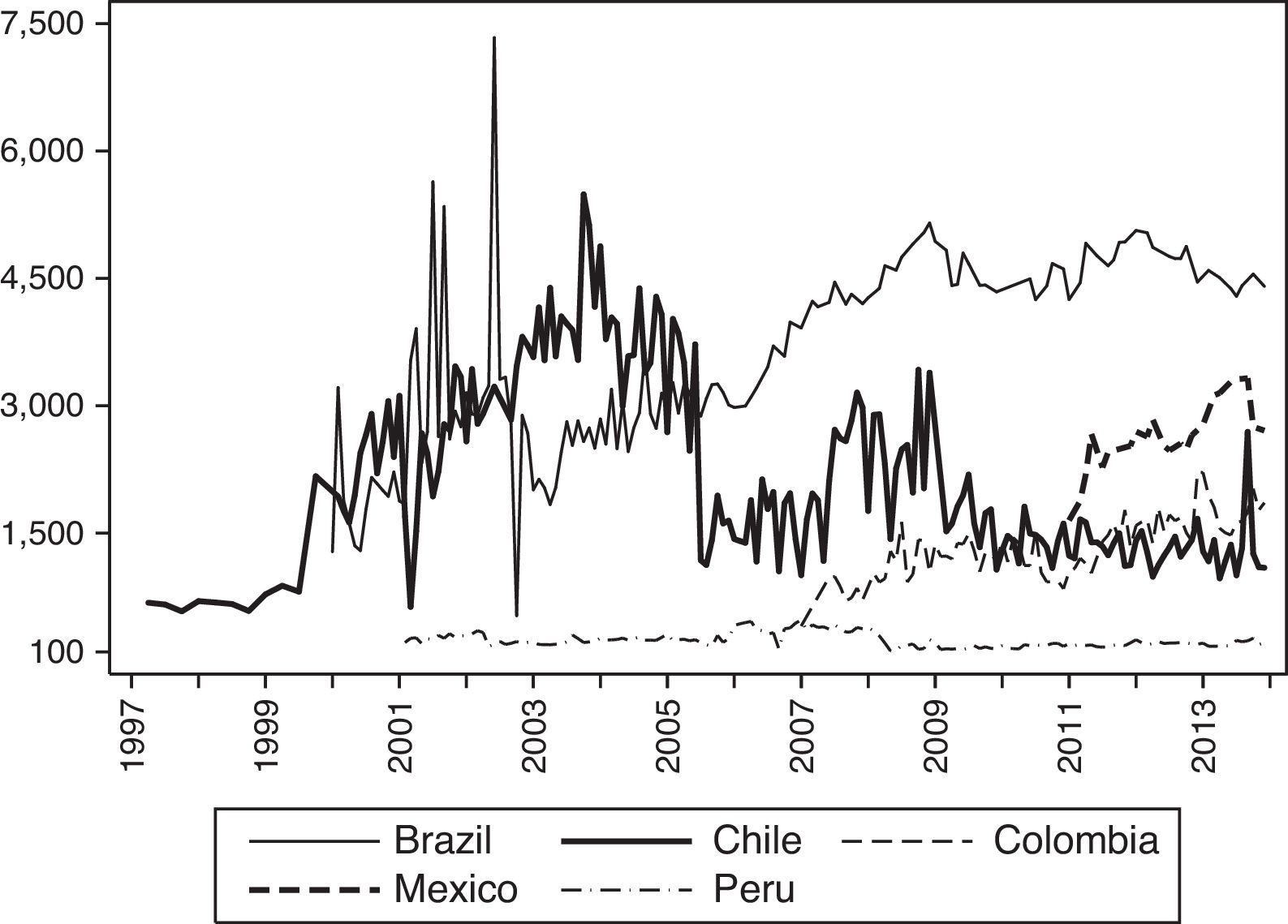

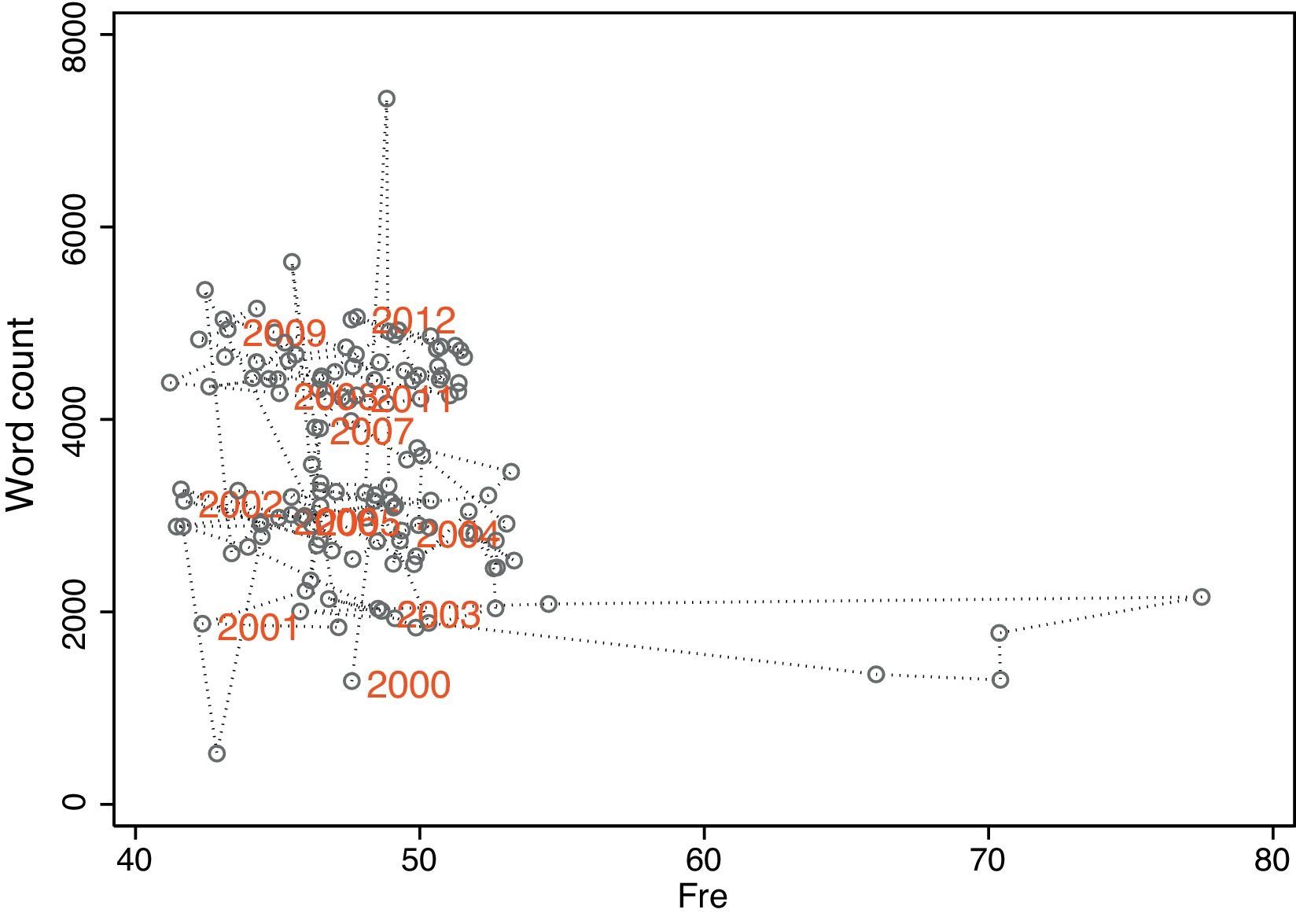

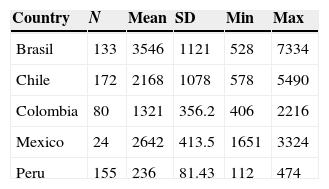

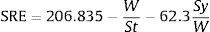

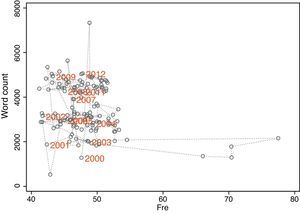

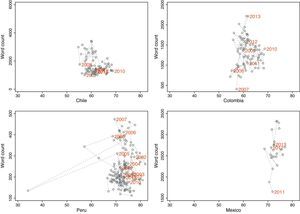

4Unstructured analysis4.1Text lengthExamining the length of the texts provides a first insight on the communication of central banks through their minutes. Fig. 1 displays the time series of the total word counts of each of the minutes of the central banks, and Table 3 features some descriptive statistics. While Peru has the shortest minutes (236 words on average), Brazil displays the longest (3546 words on average). Interestingly, Mexico has the largest minimum length of all countries (1651 words).

Minutes – word count. Descriptive statistics.

| Country | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| Brasil | 133 | 3546 | 1121 | 528 | 7334 |

| Chile | 172 | 2168 | 1078 | 578 | 5490 |

| Colombia | 80 | 1321 | 356.2 | 406 | 2216 |

| Mexico | 24 | 2642 | 413.5 | 1651 | 3324 |

| Peru | 155 | 236 | 81.43 | 112 | 474 |

Note: The table shows the number of documents per country (N), the average number of words (mean), the standard deviation (SD), the shortest document (min), and the longest one (max).

Brazil, Colombia, and Mexico display a long-term increasing trend in the length of their documents. However, such a trend was not stable in Brazil, where by mid-2002, the minute word count decreased to 2000, after reaching an average of 3000 words in 2001. By contrast, in Chile, the word count increased between late 1999 and mid-2005, to an average of 3000 words per minute, and thereafter registered a steady length average of 1500 words. Peru does not display any trend; the length of its Informative Notes after Board meetings remains constant over time.

Reflecting upon procedural transparency as evidenced by the length of the minutes, the central bank of Peru seemed to be the less informative of all. The steadiness of its Notes is so remarkable that not even in the aftermath of the 2008 global economic crisis did the bank increase its flow of public communication. In terms of Blinder et al. (2008), it is indeed a “boring” central bank. The remaining four countries of this study display an opposite attitude through their patterns of response and their ability to adjust their communication strategies.

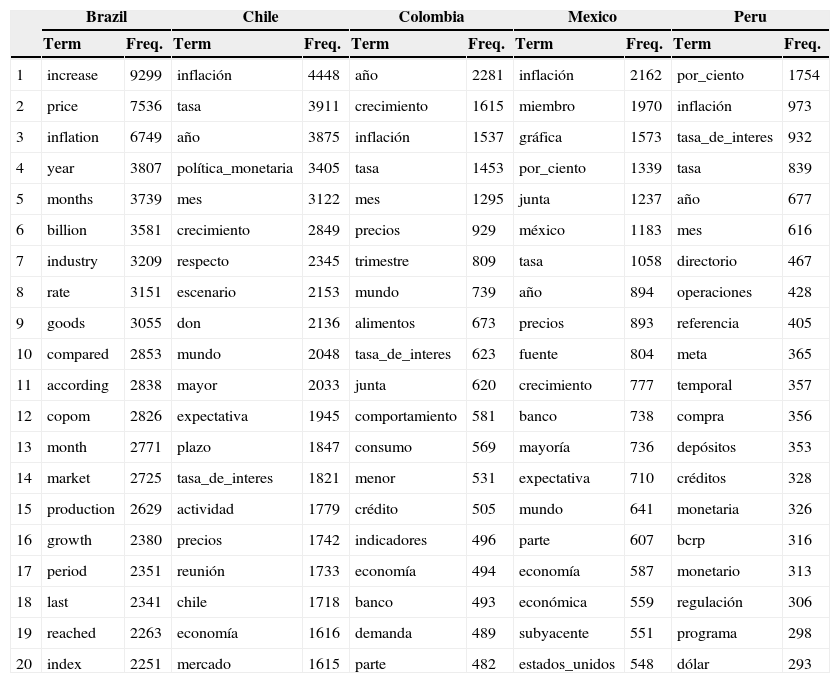

4.2Most Frequent Terms (MFT)In this section, the MFT used by every central bank were examined. First, we identified and listed the top 20 words10 (see Table 4). Second, a cluster analysis upon a Term-Document matrix (TDM) was performed, which is the transpose of a DTM, incorporating the top 30 words. Specifically, the words’ frequency correlation per document (summarized in the TDM) is used to obtain a similarity measure based on the cluster analysis. The outcome of this procedure is displayed in a dendrogram or tree diagram.

Most Frequent Terms – top 20.

| Brazil | Chile | Colombia | Mexico | Peru | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Term | Freq. | Term | Freq. | Term | Freq. | Term | Freq. | Term | Freq. | |

| 1 | increase | 9299 | inflación | 4448 | año | 2281 | inflación | 2162 | por_ciento | 1754 |

| 2 | price | 7536 | tasa | 3911 | crecimiento | 1615 | miembro | 1970 | inflación | 973 |

| 3 | inflation | 6749 | año | 3875 | inflación | 1537 | gráfica | 1573 | tasa_de_interes | 932 |

| 4 | year | 3807 | política_monetaria | 3405 | tasa | 1453 | por_ciento | 1339 | tasa | 839 |

| 5 | months | 3739 | mes | 3122 | mes | 1295 | junta | 1237 | año | 677 |

| 6 | billion | 3581 | crecimiento | 2849 | precios | 929 | méxico | 1183 | mes | 616 |

| 7 | industry | 3209 | respecto | 2345 | trimestre | 809 | tasa | 1058 | directorio | 467 |

| 8 | rate | 3151 | escenario | 2153 | mundo | 739 | año | 894 | operaciones | 428 |

| 9 | goods | 3055 | don | 2136 | alimentos | 673 | precios | 893 | referencia | 405 |

| 10 | compared | 2853 | mundo | 2048 | tasa_de_interes | 623 | fuente | 804 | meta | 365 |

| 11 | according | 2838 | mayor | 2033 | junta | 620 | crecimiento | 777 | temporal | 357 |

| 12 | copom | 2826 | expectativa | 1945 | comportamiento | 581 | banco | 738 | compra | 356 |

| 13 | month | 2771 | plazo | 1847 | consumo | 569 | mayoría | 736 | depósitos | 353 |

| 14 | market | 2725 | tasa_de_interes | 1821 | menor | 531 | expectativa | 710 | créditos | 328 |

| 15 | production | 2629 | actividad | 1779 | crédito | 505 | mundo | 641 | monetaria | 326 |

| 16 | growth | 2380 | precios | 1742 | indicadores | 496 | parte | 607 | bcrp | 316 |

| 17 | period | 2351 | reunión | 1733 | economía | 494 | economía | 587 | monetario | 313 |

| 18 | last | 2341 | chile | 1718 | banco | 493 | económica | 559 | regulación | 306 |

| 19 | reached | 2263 | economía | 1616 | demanda | 489 | subyacente | 551 | programa | 298 |

| 20 | index | 2251 | mercado | 1615 | parte | 482 | estados_unidos | 548 | dólar | 293 |

Note: The table shows the top 20 words and their frequency for the minutes of each central bank.

Hereinafter, the analysis will attempt to distinguish between economics or economy-related words, and those used in common speech that might be specific to a central bank or country. Words like “inflation”, “economic growth”, “monetary policy”, “consumption”, “investment”, and “demand” are regarded as economics terms. Calendar words (January, February, etc.), or references to Board members, or central-bank acronyms are considered to be country specific.

As foreseeable for central banks developing policy under the IT scheme, the words “inflation” (inflación) and “prices” (precios) are top words for all countries (Table 4). Consequently, they would be expected to bring along words like: “target”, “targeting”, “monetary policy”, “interest rate”, and “expectations.” However, most of these words are not on the top 20 list for all countries. For Chile, “monetary policy” (política monetaria) comes in the second place; “expectations” (expectativa) ranks 11th and 13th for Chile and Mexico, respectively; Peru is the only country for which “target” (meta) is a top 20 word. The focus on world-wide economic events can be captured by the appearance of the term “world” (mundo) on the lists of Chile, Colombia, and Mexico.

Some specific economics words on the top 20 lists are: “industry” for Brazil, “consumption” (consumo) for Colombia, and “credit” (crédito) for Colombia and Peru. The importance of the US economy for Mexico is evidenced by the presence of the word “United States” (estados_unidos) on its top 20 list. The rest of the words on those lists may be regarded to be there for speech or writing-style reasons. Words like “growth” (crecimiento), “month(s)” (mes, meses), and “rate” (tasa) exemplify expressions used frequently in this type of documents. They are no less important for assessing communication; however, this study focuses on IT-related terminology.

The relative importance of the top 20 words is not trivial, and even more so considering the great variation observed in the number of minutes and their lengths (see Table 3). This aspect may be further analyzed by measuring the average frequency of the first and twentieth words in every document. Thereafter, a second measure takes this average frequency and defines the ratio between it (the average number of times the word appears in each document) and the average length of the document (measured in words × 1000). This measure results in the average number of times that a word appeared in each document with respect to its average length per thousand words (see both measures in Table 5). Thus, for instance, it is observed that Mexico used the word “inflation” (inflación) 90 times per document on average; Brazil used it 50 times (per document on average), and Chile used it 25 times. This meant that while Mexico used the word “inflation” 34 times per thousand words, Brazil used it 14 times per thousand words and Chile, 11 times. This suggested that Mexico made longer analyses and a stronger emphasis on inflation than its two counterparts. In addition, the relative strength of the use of the word “inflation”, both within minutes and between them, was estimated and found that Mexico was the heaviest user of the word, followed by Brazil and Chile, by a large margin.

Most Frequent Terms – first and twentieth. Relative to corpus size and average minute size.

| Country | Corpus size (N) | Average minute size (words) | Word | Rank | Frequency | Frequency w.r.t. corpus size | Frequency w.r.t. minute size × 1000 |

|---|---|---|---|---|---|---|---|

| (a) | (b) | (c) | (d) | (e) | |||

| Brasil | 133 | 3546 | inflation | 1st | 6749 | 50.74 | 14.31 |

| reached | 20th | 2263 | 17.02 | 4.80 | |||

| Chile | 172 | 2168 | inflacion | 1st | 4448 | 25.86 | 11.93 |

| mercado | 20th | 1615 | 9.39 | 4.33 | |||

| Colombia | 80 | 1321 | crecimiento | 1st | 1615 | 20.19 | 15.28 |

| banco | 20th | 493 | 6.16 | 4.67 | |||

| Mexico | 24 | 2642 | inflacion | 1st | 2162 | 90.08 | 34.10 |

| estados_unidos | 20th | 548 | 22.83 | 8.64 | |||

| Peru | 155 | 236 | ciento | 1st | 1939 | 12.51 | 53.01 |

| regulacion | 20th | 306 | 1.97 | 8.37 |

Note: Frequency w.r.t. corpus size shows the ratio between word frequency (c) and corpus size (a). Frequency w.r.t. minute size shows the ratio between word frequency (c) average frequency per document (d) × 1000.

The above-described analysis developed understanding on procedural transparency by examining the content of the minutes in a systematic way. The most frequent words were extracted and found the expected focus on inflation. However, we observed that the documents studied made no high emphasis on any other words related to the IT scheme.

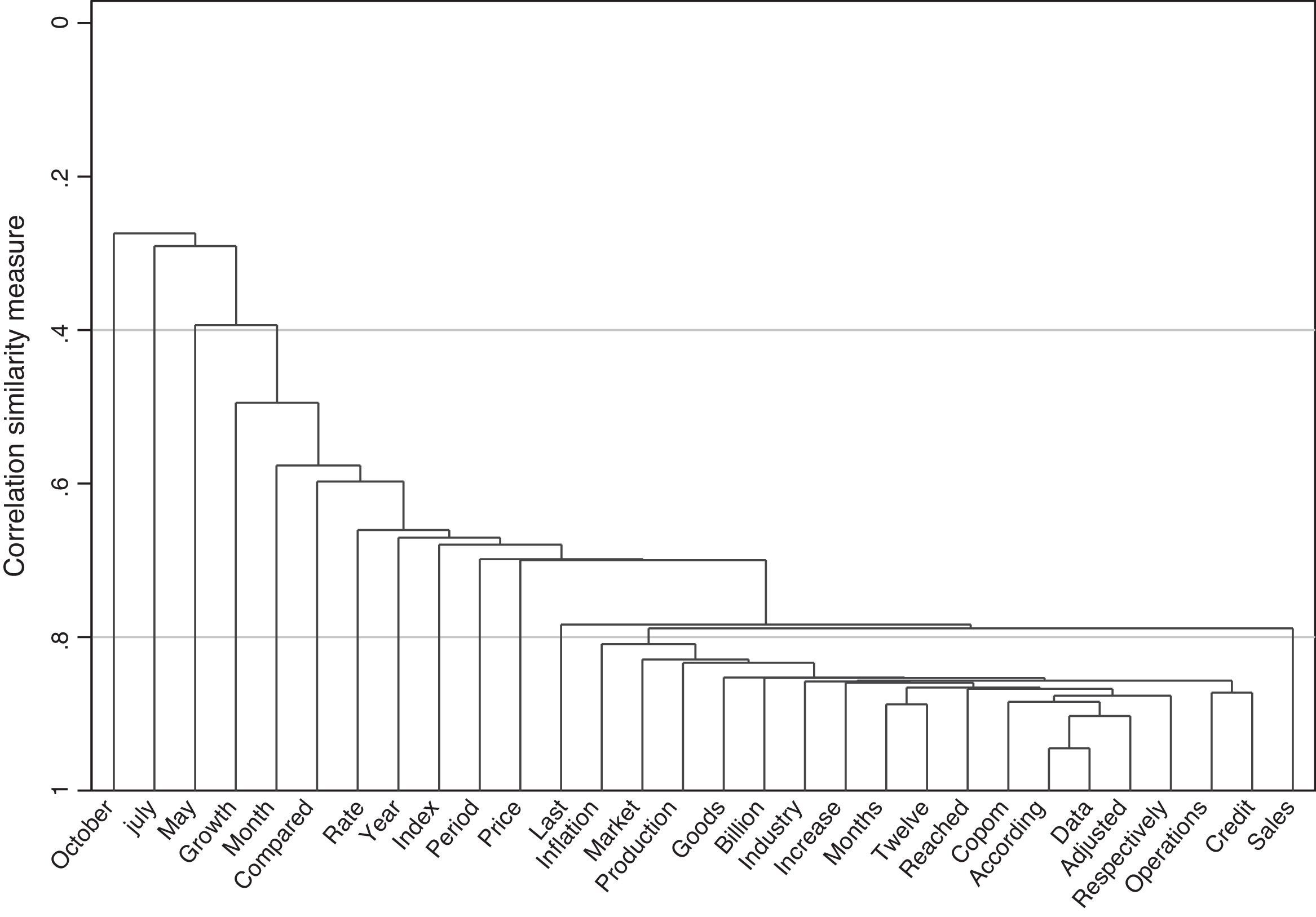

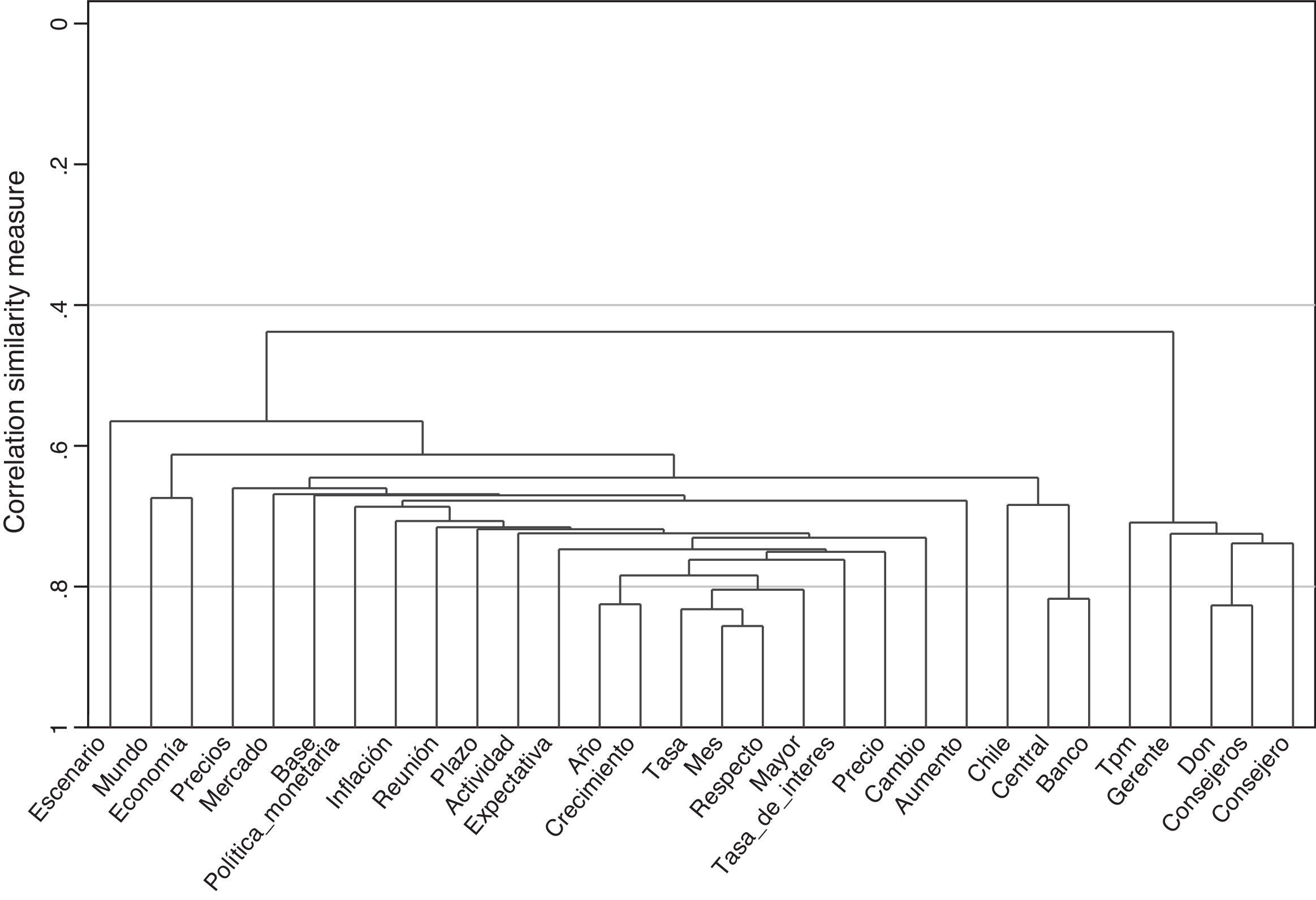

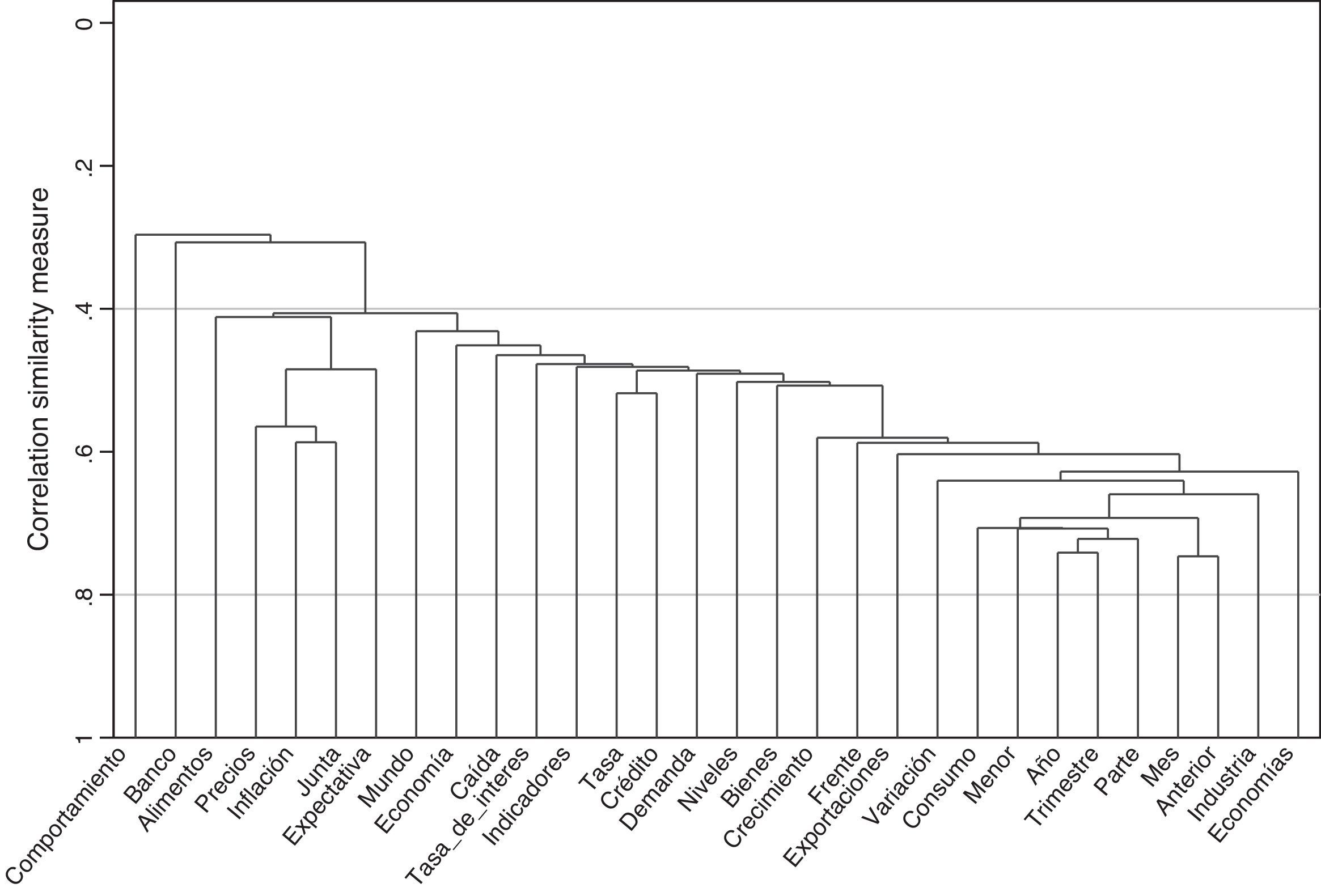

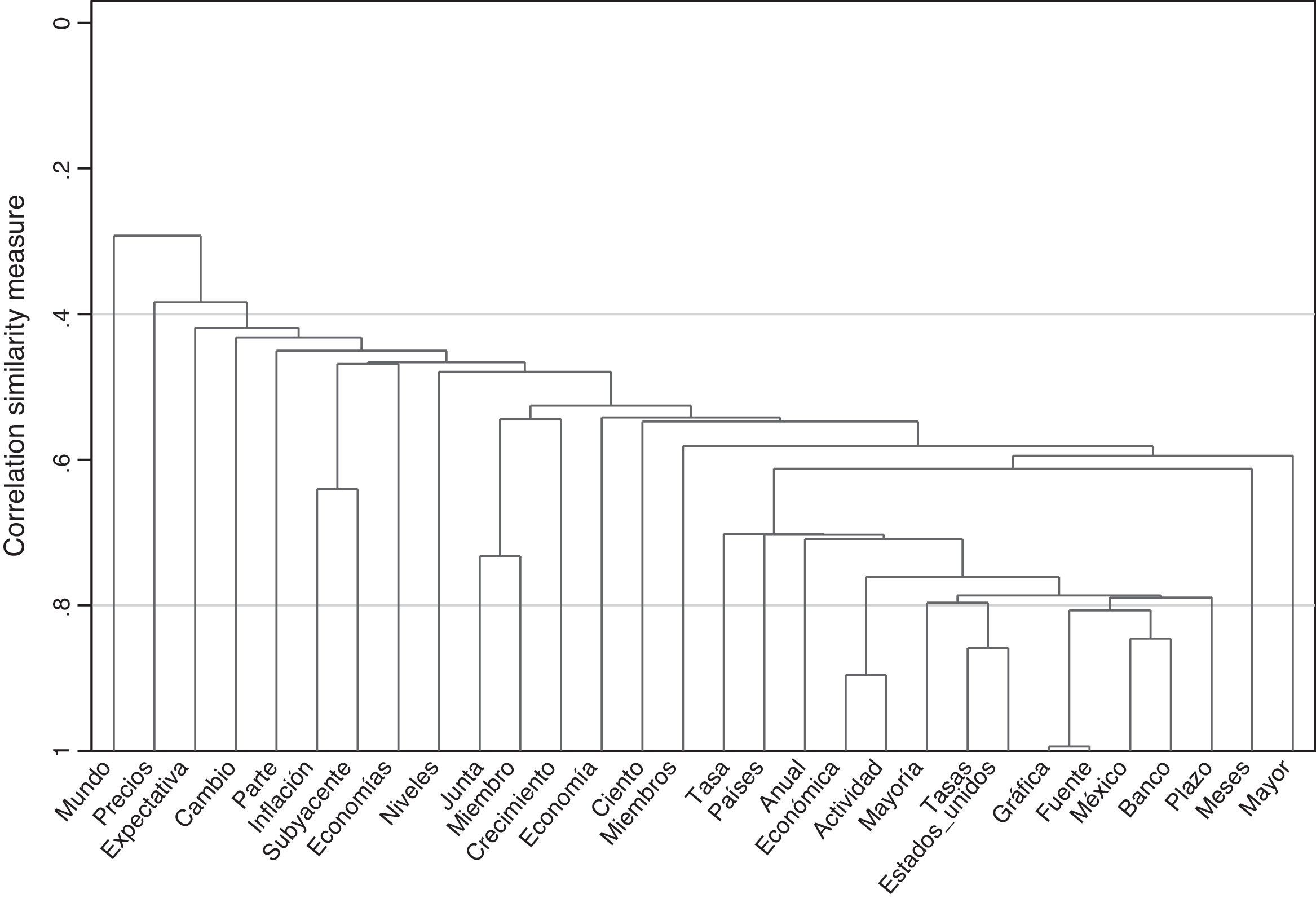

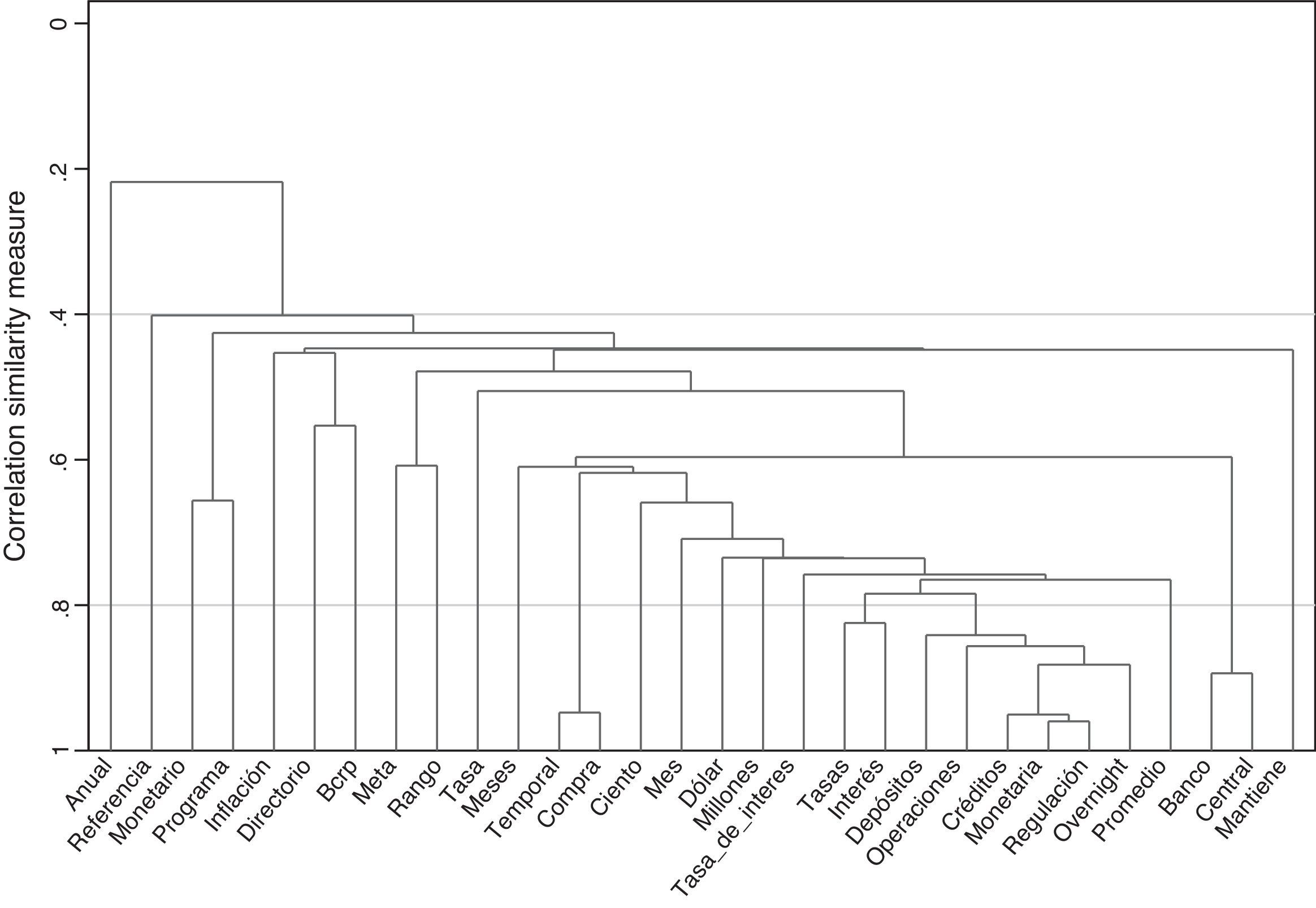

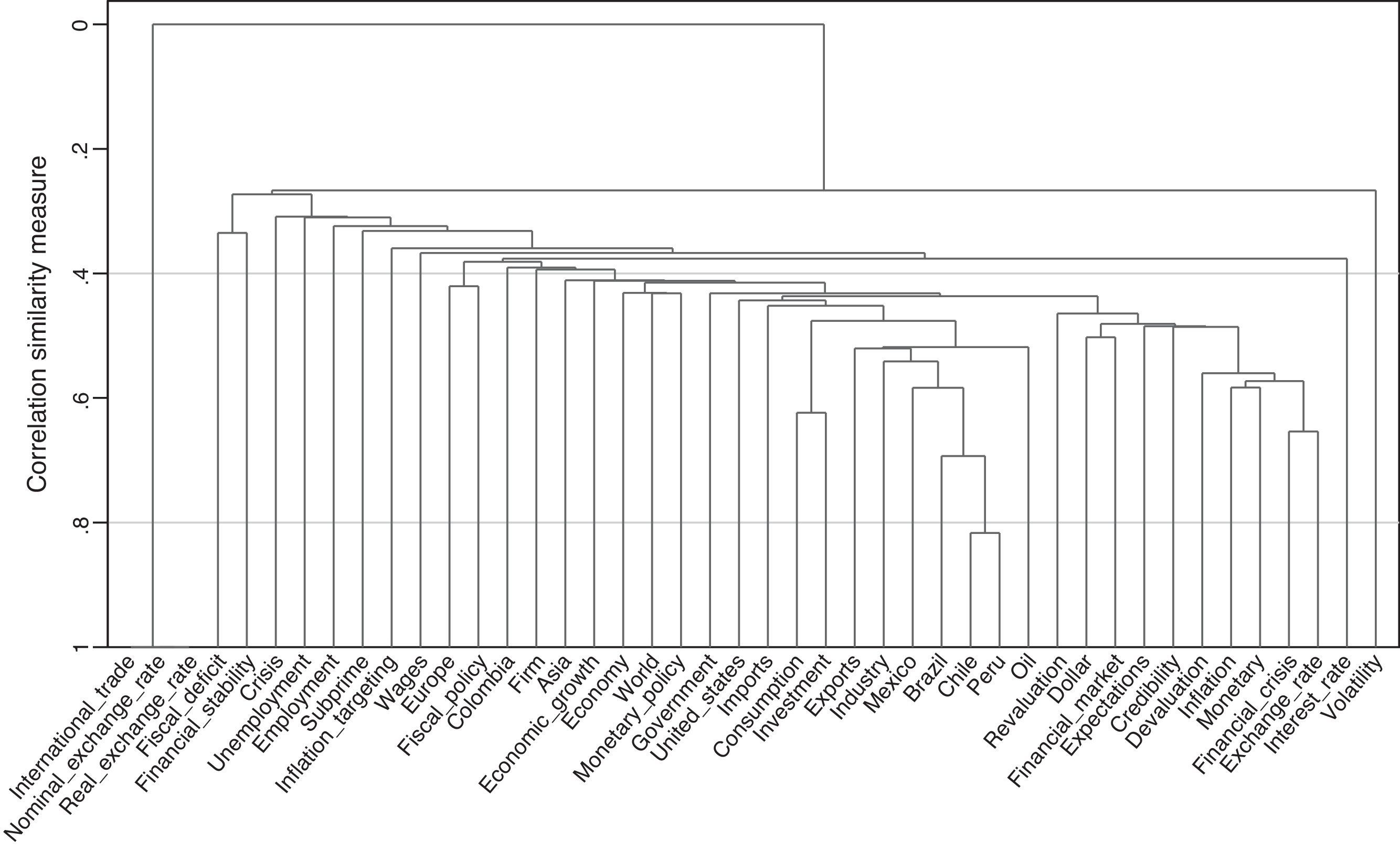

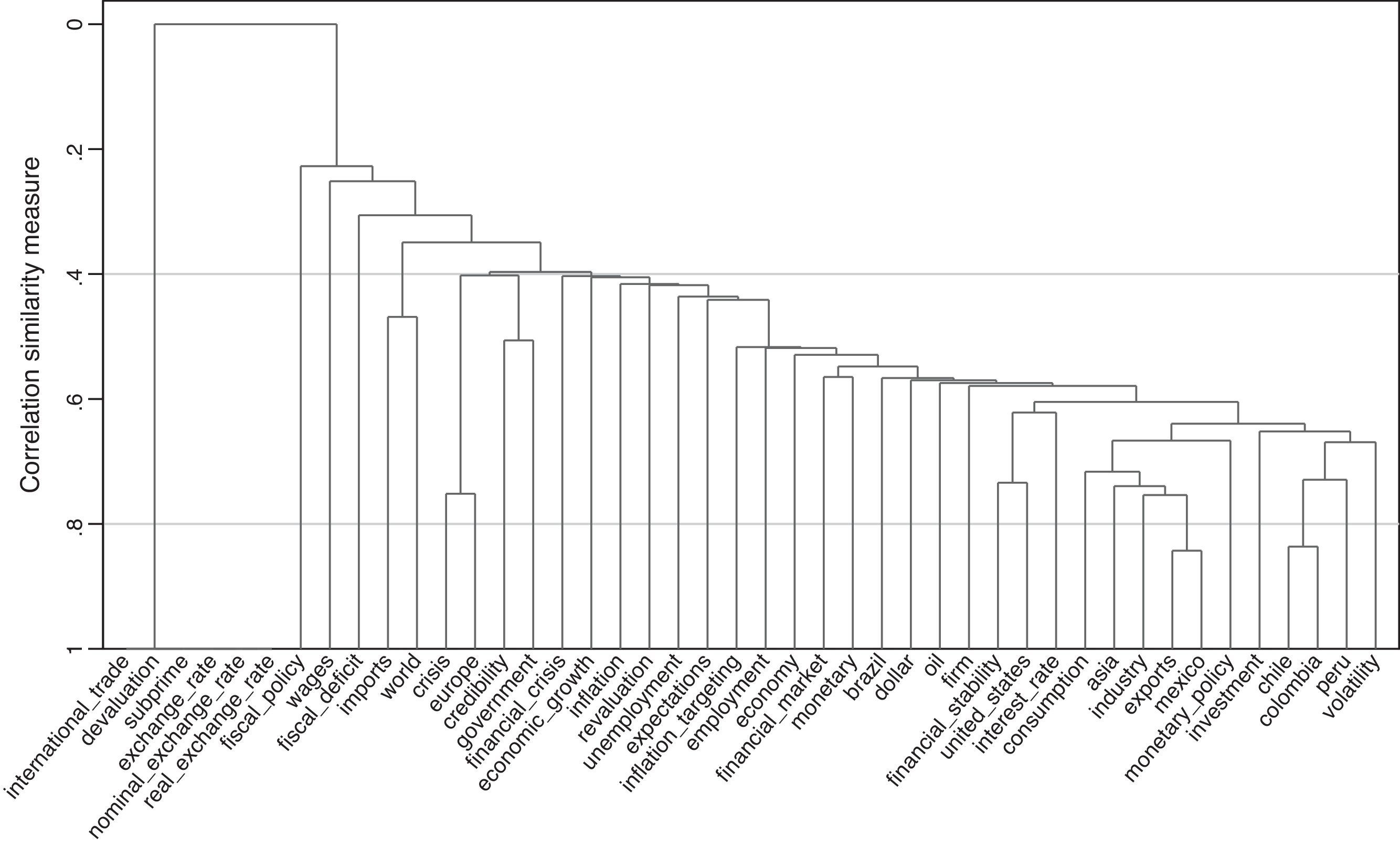

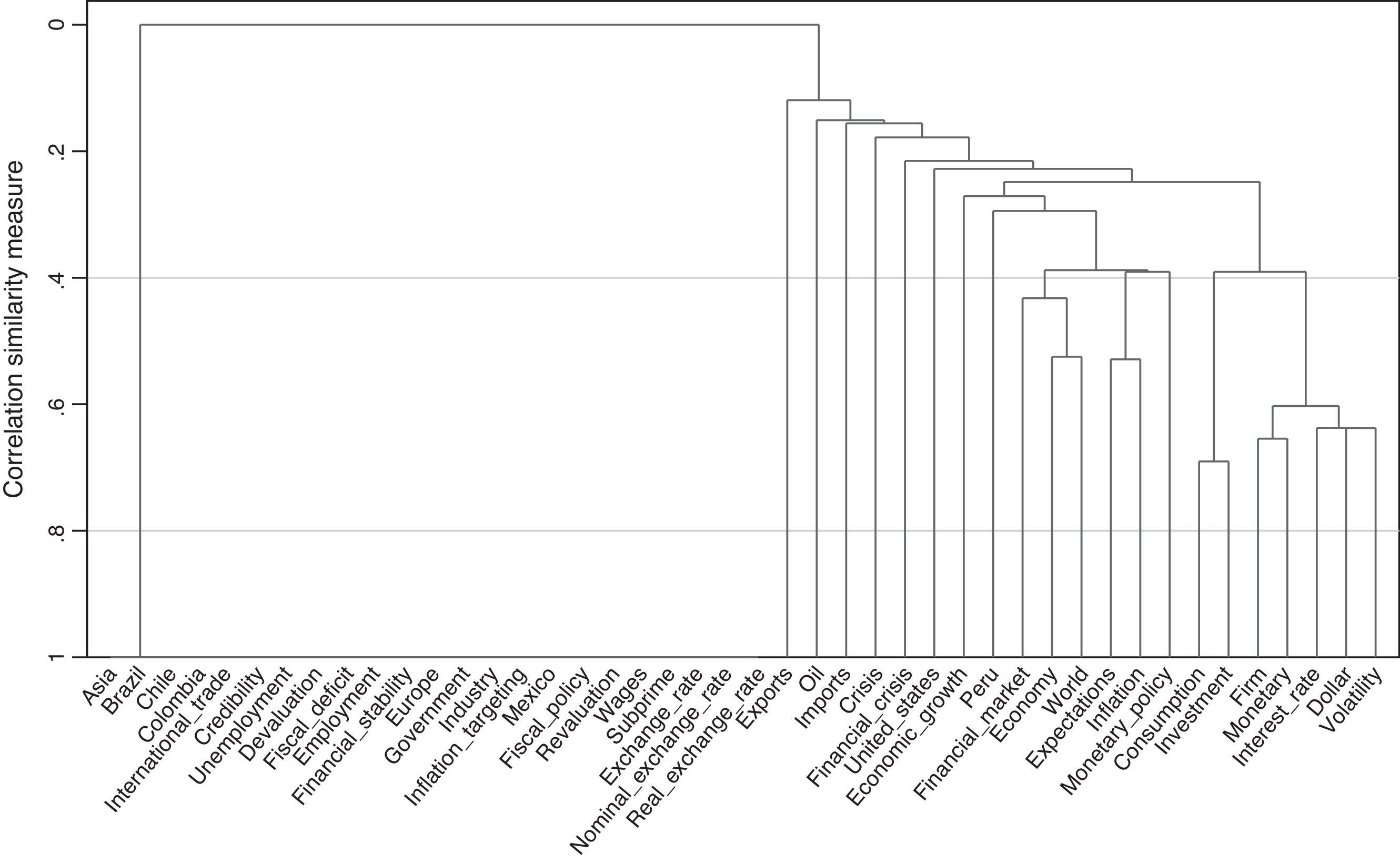

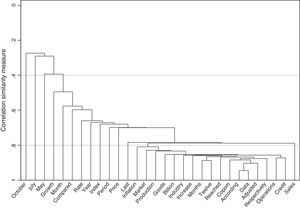

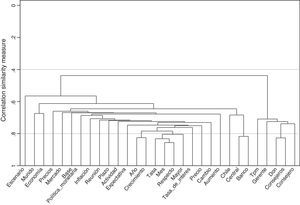

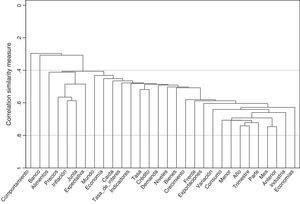

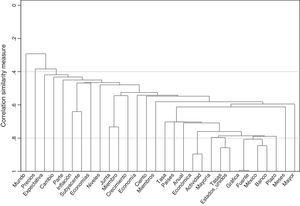

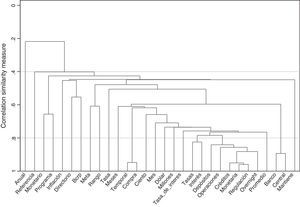

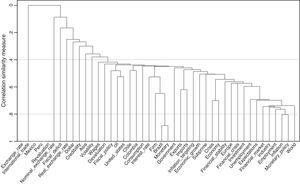

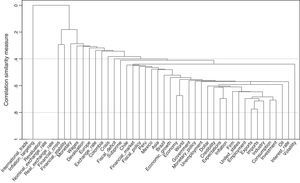

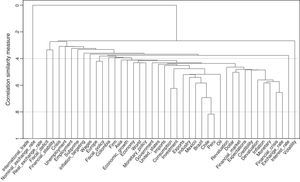

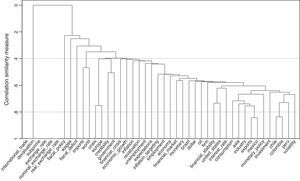

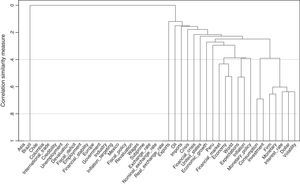

The rest of this section describes one final aspect of the MFT analysis through which the minutes of the central banks were dissected. Based on the top 30 most frequent words per country, cluster analyses summarize the relationships between those words. The clusters were formed through the single linkage method using the correlation as a measure of similarity. The results are displayed in dendrograms or tree analyses (Figs. 2–6). The vertical axes of the dendrograms show the correlation similarity measure between the clusters of words formed on the horizontal axes. The words highly correlated (given their frequency per minute/document) will form a cluster grouped in a branch. To illustrate our points, the results for Brazil are discussed first. The month words on the far left (“October”, “July”, and “May”) are part of the top 30 list for the Brazilian corpus. They are relatively poorly correlated with the remaining words, and therefore, stand apart from them; however, they are together on the horizontal axis because they appear jointly in the minutes. It is plausible that these three words appear repeatedly in different minutes within descriptive passages on price growth. That is why the next three words on the horizontal axis are “price”, “growth”, and “month.”

The term “expectativas” (expectations) is part of the top 30 words of Colombia and Mexico, and it is nicely clustered in their dendrograms with words like “inflación” (inflation), “precios” (prices), “alimentos” (food), and “junta directiva” (Board of Directors). In both cases, the message revealed is one of a strong association between inflation and expectations, in what is typical of central banks under the IT scheme. In the Chilean dendrogram, the word “expectativas” follows the term “inflación”, although as part of a much broader cluster whose several words suggest a wider message. Meanwhile, Peru stands on an opposite shore. The term “expectativas” is not in its top 30 words, which suggest (together with their clusters) the bank's mere description of its position on the interest rate, deposits, credit, and monetary operations.

Overall, these MFT analyses provide a partial but novel view of the contents of the minutes of some Latin American central banks, and the given emphases that they make. The corpora suggest that two of the banks under study are relatively talkative: Brazil, whose minutes rank first in length on a long-term perspective (and have not ceased to grow in the last eleven years); and Mexico, whose shortest minute is almost three times larger than the briefest minutes of its counterparts. By contrast, the Peruvian central bank releases a very succinct Informative Note, which contains no analysis or description of the bank's economic insight. Consequently, its Notes reduce the communication to highly concise capsules on monetary matters that are quite far from the ambitions of an IT strategy involving the public and aligning their expectations. As for Chile, by mid-2005, the central bank reversed the growing trend of its minutes and defined a very clear average of around 1500 words per document. Colombia stands right in the middle of these patterns with minutes of average length (compared to those of its counterparts) and a seemingly stable trend.

Consequently, a focus on inflation and prices is clear in every corpus, as evidenced by the top 20, and top 30 MFT analyses. This is, indeed, a group of central banks highly concerned about inflation and price-related matters. However, in terms of an open ambition to shape expectations and conduct a monetary policy based on the intervention of the interest rate, the Peruvian central bank lags behind with an Informative Note that does discuss “expectativas” (expectations) explicitly. The opposite is true for the remaining countries, whose minutes employ the terms “expectations”, “inflation”, or “prices” to convey and clarify the IT purposes of their central banks.

These preliminary results help us to discern the type of IT strategy followed by the central banks within our inquiry on procedural transparency. Brazil, Chile, Colombia, and Mexico have central banks highly concerned about the relationship between inflation and expectations; therefore, they implement a communications strategy through the Board minutes. This is not the case of Peru, as reflected by the analyses of the inner structure of the documents released by all of these banks. It is worth mentioning that these documents are the same as used by analysts and market agents in the real economy.

The discussion moves now to what we call structured analysis. It goes along the same lines of the current section; however, it narrows the scrutiny to a reduced set of words, or glossary, set forth by the researchers.

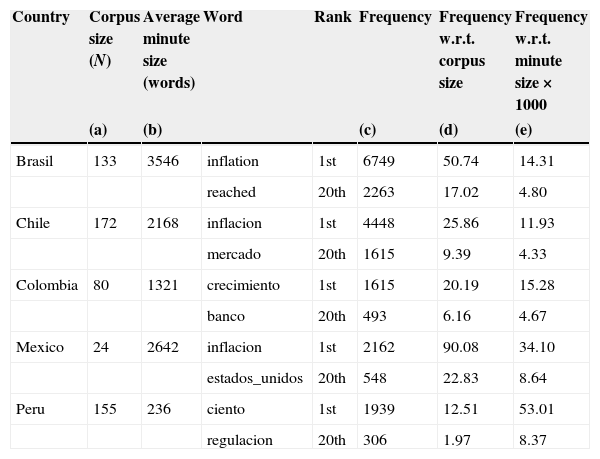

5Structured analysisThis section explores the frequency of a set of preselected terms. Table 6 lists them, along with their frequency figures, and their respective corpus statistics (extracted from Table 3). These words were chosen in order to examine, in greater detail, the central banks’ interest to address relevant issues, and classified into the following categories:

- •

Finance: financial crisis, financial market, financial stability, subprime.

- •

Geography (regions or countries): Asia, Brazil, Chile, Colombia, Europe, Mexico, Perú, Unites States, World.

- •

Macroeconomy: consumption, economic growth, economy, employment, fiscal deficit, fiscal policy, government, investment, unemployment, wages.

- •

Monetary policy: credibility, expectations, inflation, inflation targeting, interest rate, monetary, monetary policy.

- •

Trade and exchange rate: devaluation, dollar, exchange rate, exports, imports, international trade, nominal exchange rate, real exchange rate, revaluation.

- •

Other: crisis, firm, industry, oil, volatility.

Frequency for a subset of words.

| Brasil | Chile | Colombia | Mexico | Peru | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Corpus characteristics | ||||||||||

| Corpus size | 133 | 172 | 80 | 24 | 155 | |||||

| Avrg. min. length (words) | 3546 | 2168 | 1321 | 2642 | 236 | |||||

| Word | Freq. Abs. | Freq. Rel. | Freq. Abs. | Freq. Rel. | Freq. Abs. | Freq. Rel. | Freq. Abs. | Freq. Rel. | Freq. Abs. | Freq. Rel. |

| Finance | ||||||||||

| financial_crisis | 38 | (1.07) | 16 | (0.74) | 32 | (2.42) | 6 | (0.23) | 2 | (0.85) |

| financial_market | 462 | (13.03) | 471 | (21.73) | 170 | (12.87) | 258 | (9.77) | 126 | (53.39) |

| financial_stability | 31 | (0.87) | 39 | (1.80) | 7 | (0.53) | 10 | (0.38) | 0 | (0.00) |

| subprime | 17 | (0.48) | 23 | (1.06) | 1 | (0.08) | 0 | (0.00) | 0 | (0.00) |

| Geography | ||||||||||

| asia | 74 | (2.09) | 76 | (3.51) | 67 | (5.07) | 35 | (1.32) | 0 | (0.00) |

| brazil | 1434 | (40.44) | 160 | (7.38) | 76 | (5.75) | 93 | (3.52) | 0 | (0.00) |

| chile | 25 | (0.71) | 1718 | (79.24) | 54 | (4.09) | 39 | (1.48) | 0 | (0.00) |

| colombia | 17 | (0.48) | 2 | (0.09) | 284 | (21.50) | 41 | (1.55) | 0 | (0.00) |

| europe | 287 | (8.09) | 230 | (10.61) | 169 | (12.79) | 288 | (10.90) | 0 | (0.00) |

| mexico | 0 | (0.00) | 35 | (1.61) | 35 | (2.65) | 1183 | (44.78) | 0 | (0.00) |

| peru | 0 | (0.00) | 4 | (0.18) | 42 | (3.18) | 29 | (1.10) | 139 | (58.90) |

| united_states | 127 | (3.58) | 533 | (24.58) | 233 | (17.64) | 548 | (20.74) | 6 | (2.54) |

| world | 1519 | (42.84) | 2048 | (94.46) | 739 | (55.94) | 641 | (24.26) | 148 | (62.71) |

| Macroeconomy | ||||||||||

| consumption | 353 | (9.95) | 919 | (42.39) | 569 | (43.07) | 190 | (7.19) | 15 | (6.36) |

| economic_growth | 197 | (5.56) | 127 | (5.86) | 275 | (20.82) | 156 | (5.90) | 29 | (12.29) |

| economy | 948 | (26.73) | 1616 | (74.54) | 494 | (37.40) | 587 | (22.22) | 89 | (37.71) |

| employment | 925 | (26.09) | 728 | (33.58) | 112 | (8.48) | 119 | (4.50) | 0 | (0.00) |

| fiscal_deficit | 9 | (0.25) | 23 | (1.06) | 4 | (0.30) | 6 | (0.23) | 0 | (0.00) |

| fiscal_policy | 148 | (4.17) | 116 | (5.35) | 4 | (0.30) | 15 | (0.57) | 0 | (0.00) |

| government | 314 | (8.86) | 101 | (4.66) | 50 | (3.79) | 338 | (12.79) | 0 | (0.00) |

| investment | 551 | (15.54) | 588 | (27.12) | 260 | (19.68) | 156 | (5.90) | 17 | (7.20) |

| unemployment | 619 | (17.46) | 247 | (11.39) | 77 | (5.83) | 110 | (4.16) | 0 | (0.00) |

| wages | 103 | (2.90) | 13 | (0.60) | 4 | (0.30) | 17 | (0.64) | 0 | (0.00) |

| Monetary policy | ||||||||||

| credibility | 5 | (0.14) | 93 | (4.29) | 50 | (3.79) | 21 | (0.79) | 0 | (0.00) |

| expectations | 1593 | (44.92) | 1945 | (89.71) | 479 | (36.26) | 710 | (26.87) | 94 | (39.83) |

| inflation | 6749 | (190.33) | 4448 | (205.17) | 1537 | (116.35) | 2162 | (81.83) | 973 | (412.29) |

| inflation_targeting | 46 | (1.30) | 0 | (0.00) | 1 | (0.08) | 4 | (0.15) | 0 | (0.00) |

| interest_rate | 629 | (17.74) | 669 | (30.86) | 183 | (13.85) | 82 | (3.10) | 589 | (249.58) |

| monetary | 979 | (27.61) | 445 | (20.53) | 84 | (6.36) | 218 | (8.25) | 326 | (138.14) |

| monetary_policy | 1831 | (51.64) | 3405 | (157.06) | 357 | (27.02) | 379 | (14.35) | 204 | (86.44) |

| Trade and exchange rate | ||||||||||

| devaluation | 23 | (0.65) | 17 | (0.78) | 21 | (1.59) | 0 | (0.00) | 0 | (0.00) |

| dollar | 136 | (3.84) | 641 | (29.57) | 187 | (14.16) | 248 | (9.39) | 293 | (124.15) |

| exchange_rate | 0 | (0.00) | 1 | (0.05) | 99 | (7.49) | 0 | (0.00) | 0 | (0.00) |

| exports | 939 | (26.48) | 248 | (11.44) | 409 | (30.96) | 168 | (6.36) | 7 | (2.97) |

| imports | 805 | (22.70) | 435 | (20.06) | 218 | (16.50) | 31 | (1.17) | 5 | (2.12) |

| international_trade | 0 | (0.00) | 0 | (0.00) | 0 | (0.00) | 0 | (0.00) | 0 | (0.00) |

| nominal_exchange_rate | 1 | (0.03) | 0 | (0.00) | 0 | (0.00) | 0 | (0.00) | 0 | (0.00) |

| real_exchange_rate | 3 | (0.08) | 0 | (0.00) | 0 | (0.00) | 0 | (0.00) | 0 | (0.00) |

| revaluation | 0 | (0.00) | 0 | (0.00) | 17 | (1.29) | 1 | (0.04) | 0 | (0.00) |

| Other | ||||||||||

| crisis | 245 | (6.91) | 142 | (6.55) | 70 | (5.30) | 96 | (3.63) | 4 | (1.69) |

| firm | 46 | (1.30) | 372 | (17.16) | 151 | (11.43) | 116 | (4.39) | 98 | (41.53) |

| industry | 3209 | (90.50) | 374 | (17.25) | 400 | (30.28) | 246 | (9.31) | 0 | (0.00) |

| oil | 98 | (2.76) | 818 | (37.73) | 196 | (14.84) | 77 | (2.91) | 5 | (2.12) |

| volatility | 341 | (9.62) | 256 | (11.81) | 56 | (4.24) | 223 | (8.44) | 31 | (13.14) |

Note: Corpus size is the number of minutes per central bank. Average minute length is the average number of words per document. Freq. Abs. is the absolute frequency of each word in the entire corpus. Freq. Rel. is the relative frequency of each word, estimated as (Freq. Abs. / Avrg. min. length (words))×100.

Two points further clarify our purposes. First, the use of words like “crisis” indicates whether a given central bank is aware of their presence (before, during or after; whether they are local, regional or international-like that of October of 2008). Second (and closely related to this paper's main purpose), it is important to examine the minutes in regard to the IT strategy, and the attention that central banks pay to short-term measures within it. Therefore, terms like “inflation targeting” and “expectations” must be scrutinized with respect to their given texts. Clearly, central banks under IT schemes may not focus exclusively in reducing and controlling inflation; therefore, by measuring the frequency and relationships of any other economic variables within the minutes, any emphases made on them may be observed, beyond any speculation or circumstantial evidence.

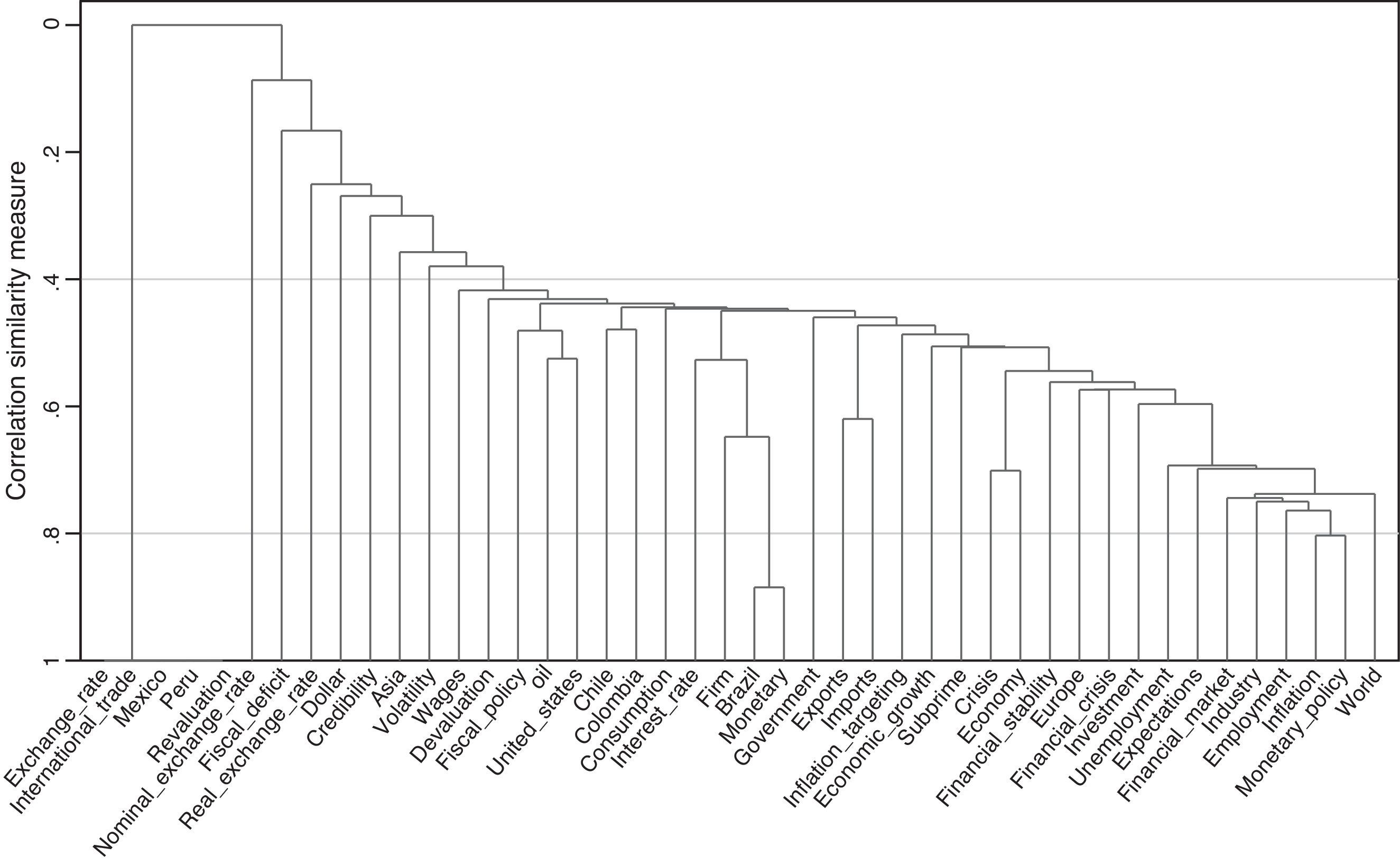

In the case of Brazil, the dendrogram and frequency figures indicate the emphasis of its central bank on the relationships between the financial markets, inflation, monetary policy, and expectations (far-right cluster). However, the term “inflation targeting” does not seem to show a strong association with any cluster, since it stands as a separate branch with other regular terms. Moreover, this central bank shows some interest in the labor market, given that employment and unemployment are frequent words, which cluster in the tree diagram. Conversely, the minutes do not display concern on international trade or exchange rate matters (Fig. 7).

Brazil – cluster analysis. Dendrogram. Note: Dendrogram using a subset of predefined terms (listed in Table 6).

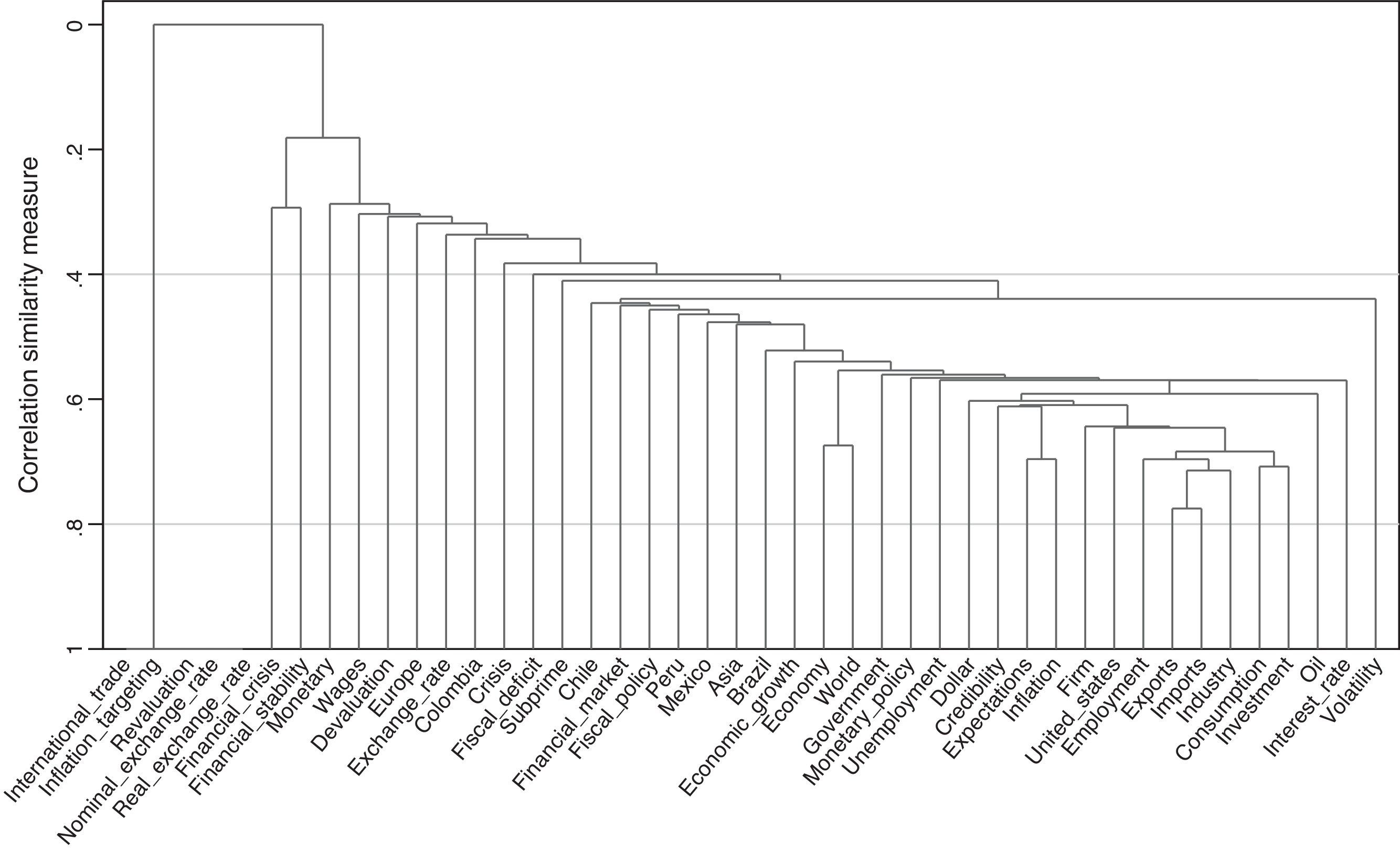

The Chilean dendrogram displays a set of words closely related throughout the corpus; these are: “employment”, “exports”, “imports”, “industry”, “consumption”, and “investment.” This subset indicates that its central bank often includes analysis of these macroeconomic variables in its minutes. The tree diagram further reveals how the words “credibility”, “expectations”, and “inflation” cluster, thus revealing the central bank's IT-strategy efforts. On the far left, Fig. 8 shows again how words related to international trade and to the nominal and real exchange rates group together due to their very low frequency (Table 6, third column).

Chile – cluster analysis. Dendrogram. Note: Dendrogram using a subset of predefined terms (listed in Table 6).

Like all of its counterparts, Colombia seldom uses international trade words in its minutes. And yet, it is the only country that employs the term “exchange rate” heavily (99 times). This means that such a term is used, on average, at least once in every minute. Within the IT framework, this exchange rate concern is unique for Colombia.11 Moreover, in the dendrogram (Fig. 9) the term is closely associated with words like “inflation”, “devaluation”, “financial crisis”, “expectations”, and “credibility”, which are all IT-related words.

Colombia – cluster analysis. Dendrogram. Note: Dendrogram using a subset of predefined terms (listed in Table 6).

The word frequency and cluster measures for Mexico do not reveal any distinctive patterns. A close relationship between the terms “crisis” and “europe” indicates that, at some point, its central bank paid a special attention to the evolution of the European crisis. However, this branch is away from other branches, which suggests an isolated occurrence within the corpus.

Peru's Informative Notes, being the shortest communications of the corpora, display the lowest preselected-word frequencies. Clearly, all the words with cero counts are linked, and the remaining terms are clustered with relatively low correlations (Figs. 10 and 11).

Mexico – cluster analysis. Dendrogram. Note: Dendrogram using a subset of predefined terms (listed in Table 6).

Peru – cluster analysis. Dendrogram. Note: Dendrogram using a subset of predefined terms (listed in Table 6).

As for the frequency of the words and their respective category, monetary policy terms were the leading vocabulary (adding up to 31,290 appearances in total), followed by geography words (13,178 appearances), macroeconomic expressions (12,338 appearances), other terms (7670 appearances), trade and exchange-rate words (4953 appearances), and finance vocabulary (1709 appearances). This was not a surprising result, given the central banks’ interest in discussing inflation and monetary policy, and shaping expectations. Interestingly enough, the expression “inflation targeting” is seldom used in the minutes, although the banks are acting under such a policy arrangement. For the subset of macroeconomic terms, the frequency of the words “consumption”, “employment”, and “investment” is noteworthy, while “fiscal issues” received a relative low attention. For the trade and exchange-rate group, the Most Frequent Terms are those related to international trade (exports and imports), with a minimal use of the terms “nominal” or “real exchange rate.” The terms pertaining to the finance category ranked last. This result is coherent with the central banks’ almost exclusive attention to monetary policy issues; however, since the health of the financial sector is a key factor for a successful monetary policy (particularly in the aftermath of the 2008 financial crisis) some discussion of these issues was expected.12

In recent years, conducting monetary policy, whether it is under the IT framework or not, cannot be done in isolation from the behavior of the financial markets. Such a fact can be traced by examining the use of three of the preselected terms: “financial crisis”, “financial market”, and “financial stability.” All three appear in branches of the dendrograms well integrated with the rest of terms. “Financial market”, in particular, is the expression most used, and it is linked to the expression “monetary policy.” The Colombian, Mexican, and Peruvian central banks shared this trend, which reflects their concern about communicating the relevance of the financial market to the public, while implementing their monetary policy.

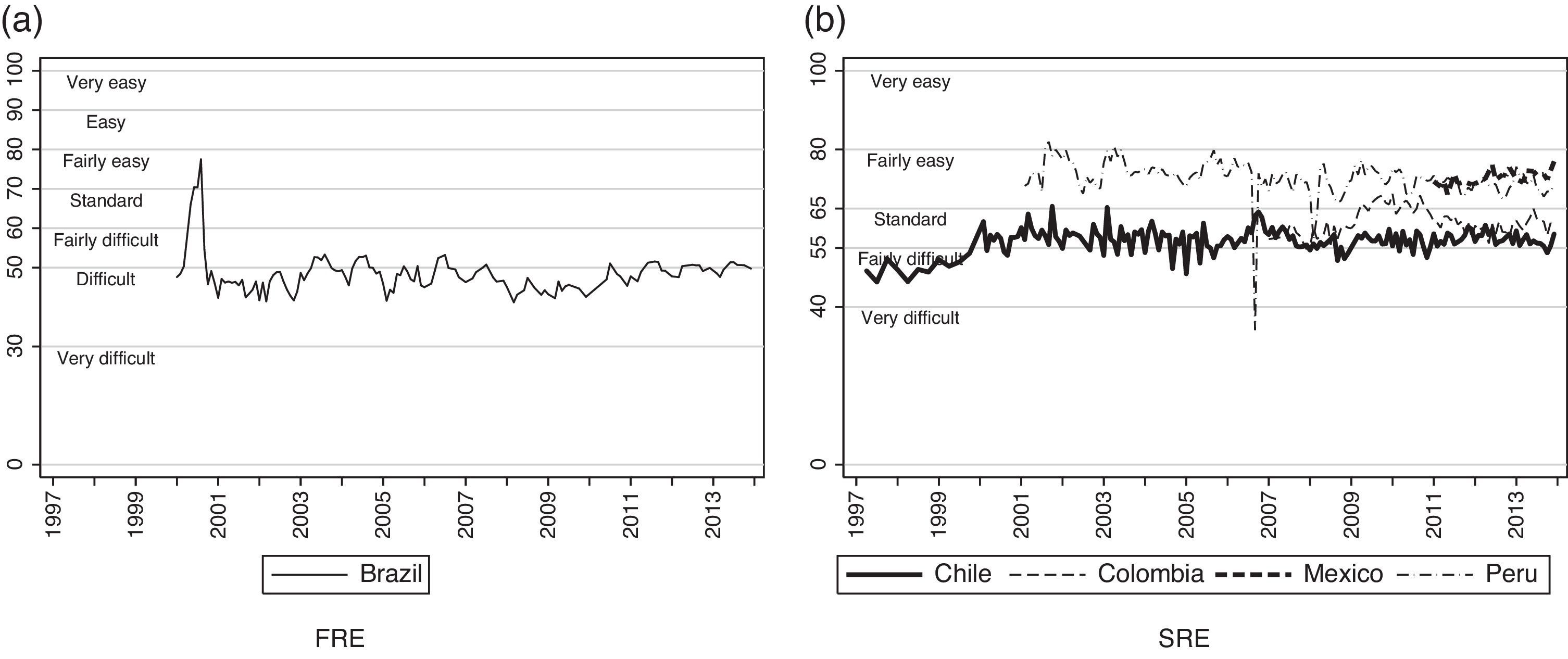

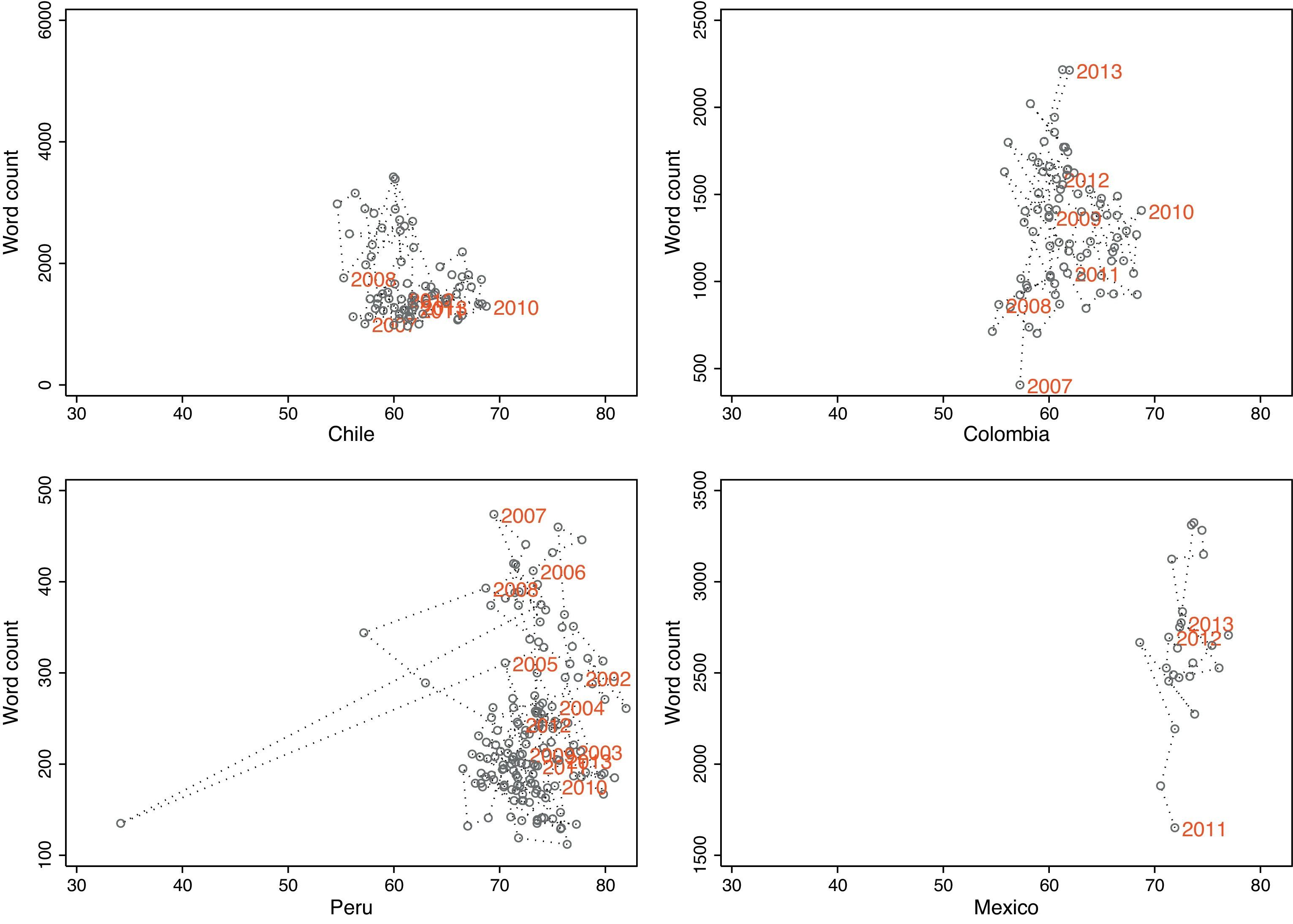

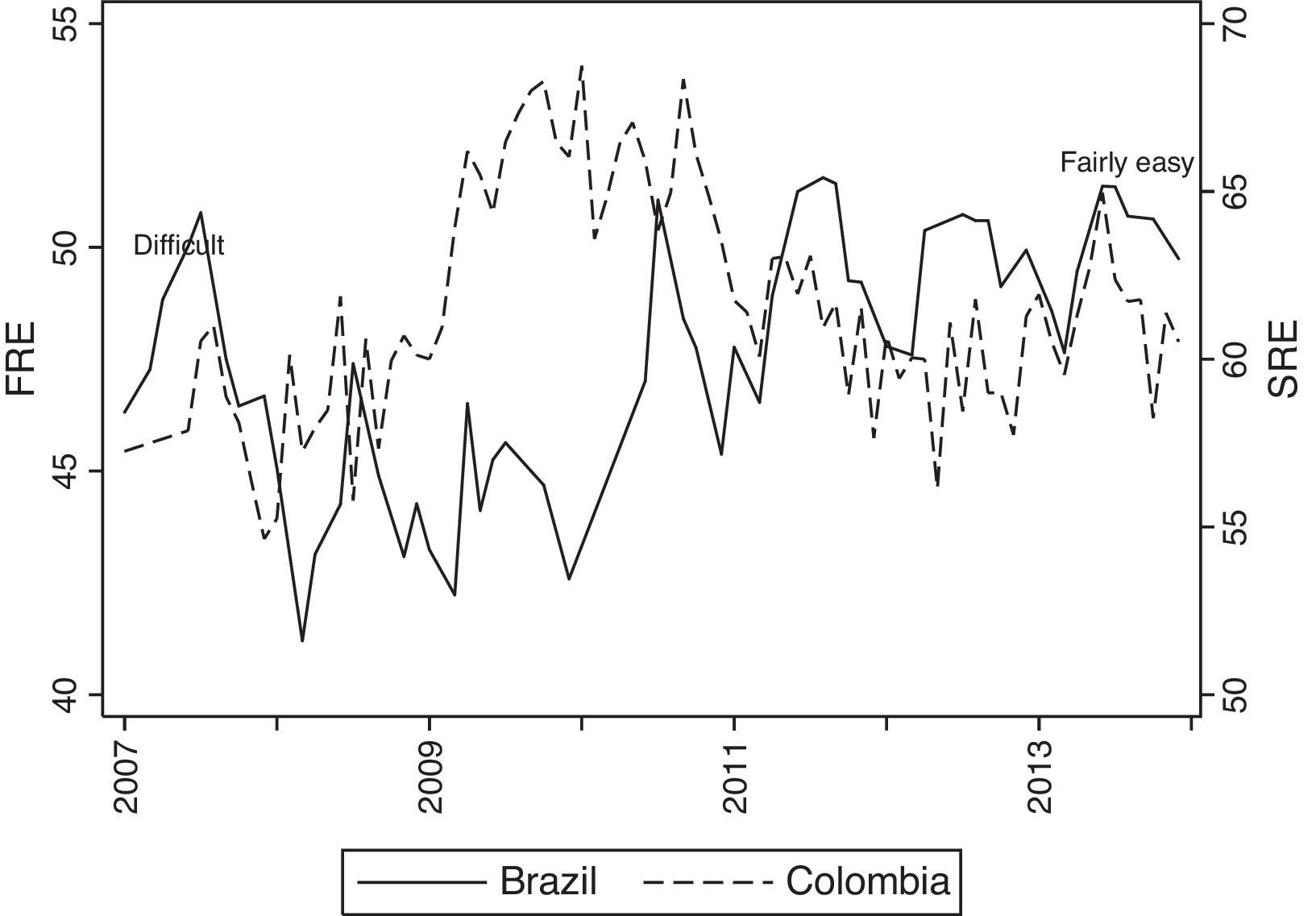

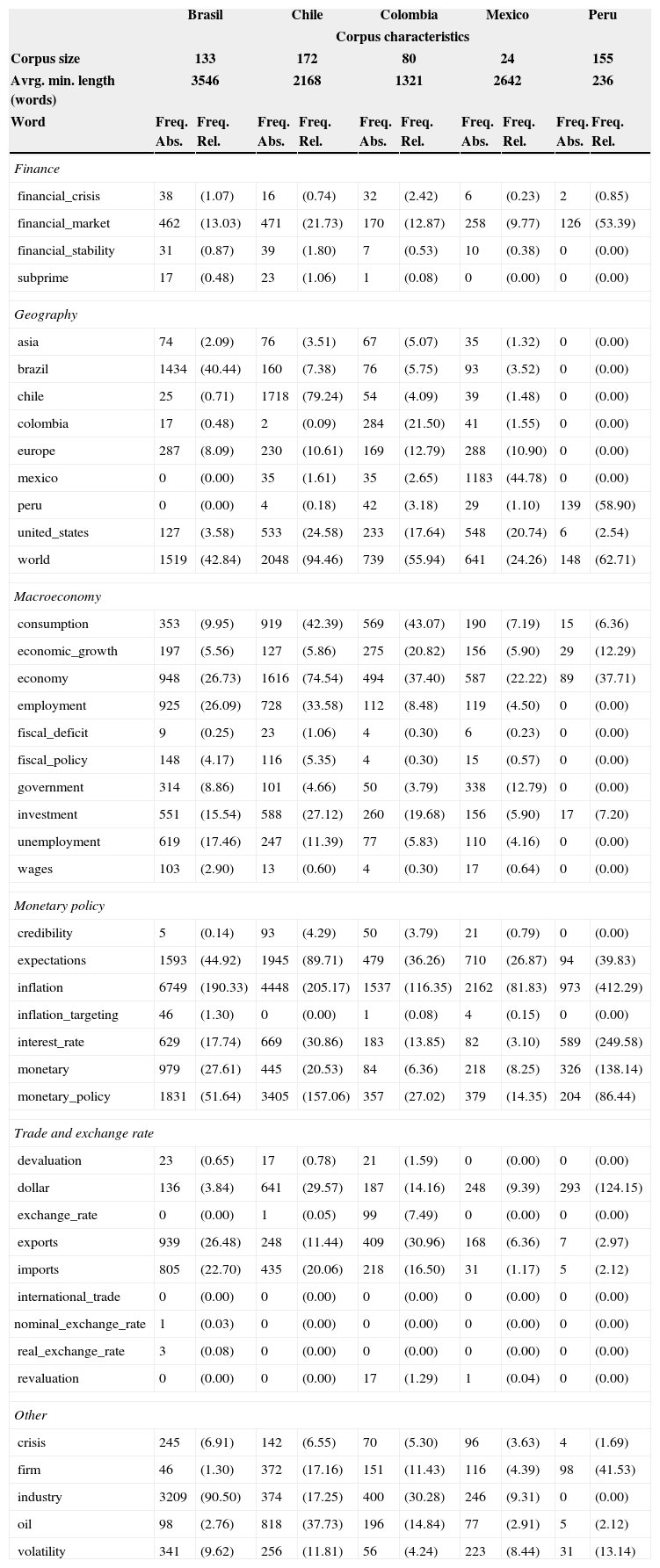

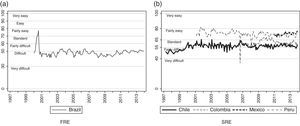

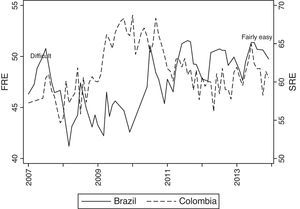

6ReadabilityUpon completion of the frequency analyses, the readability of the minutes of the central banks is now examined. Through the methodology described in Section 3.2, the FRE and SRE scores are now examined (Fig. 12). As already discussed, these measures are language specific (adjusted); the FRE for English, and the SRE, for Spanish. They do not account for the nature of the speech, i.e. whether it addresses economic or financial issues; therefore, they only provide a general interpretation of what can be considered as good or readable central-bank communication.13

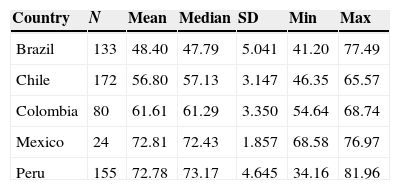

Fig. 12a shows that, except for four months in 2000, the readability of the minutes of the Brazilian central bank remains at a rather stable mean value for the period of time analyzed. Its FRE does not go beyond a score of 50. Fig. 12b describes the readability indexes for the remaining countries. The index for the Chilean minutes increased from 1997 to 2000, and thereafter it remained even. Peru and Mexico recorded constant indexes as well, probably related to their very specific communication styles. From 2009 to 2011, the readability index for Colombia reached the “fairly easy” category, and thereafter it displayed standard levels.

Although the readability indexes remain fairly constant for all countries over time (Table 7), there are two cases worth reviewing to corroborate the power of this metric to determine the reading difficulty of the minutes. First, there is a sharp fall in the Peruvian SRE by mid-2006, which corresponds to its September Informative Note. This particular piece has one page and two paragraphs, each of them formed by two sentences. In SRE terms (Eq. (2)), this text has very few and long phrases; therefore, it is “hard” to read. Some subsequent human inspection confirmed that the Note was indeed poorly drafted. Despite their short nature, the remaining Peruvian Notes were written better. Nonetheless, the SRE identified the “very difficult” report adequately.

FRE and SRE – descriptive statistics.

| Country | N | Mean | Median | SD | Min | Max |

|---|---|---|---|---|---|---|

| Brazil | 133 | 48.40 | 47.79 | 5.041 | 41.20 | 77.49 |

| Chile | 172 | 56.80 | 57.13 | 3.147 | 46.35 | 65.57 |

| Colombia | 80 | 61.61 | 61.29 | 3.350 | 54.64 | 68.74 |

| Mexico | 24 | 72.81 | 72.43 | 1.857 | 68.58 | 76.97 |

| Peru | 155 | 72.78 | 73.17 | 4.645 | 34.16 | 81.96 |

Note: The table features the descriptive statistics for the English FRE (Brazil's central bank), and the Spanish SRE (Chile, Colombia, Mexico, and Peru's central banks) indexes.

The readability spike of the Brazilian minutes between May and August of 2000 is a second case in point. Interestingly, these minutes are not particularly larger than usual, keeping in mind that the length of Brazil's communications is higher and has been increasing since 2003 (Fig. 1). A human review of these materials revealed that they were easier to read than the subsequent documents. Their phrases were shorter, nicely drafted, and gathered together in concise paragraphs, which are features that score high on the FRE index. These two examples support the methodological choice of using readability indexes to assess the readability of the central-bank minutes systematically and without human scoring.

Associating the length of the minutes with readability indexes permits to explore whether increased readability may be achieved by modifying the extension of the texts. Central banks might need to increase their public communication, and might choose to do so by expanding their minutes’ length. However, more and better information must be coupled with clarity. Fig. 1 describes how all central banks have increased the size of their minutes within the time frame of this study. Nevertheless, when plotting their word count against readability measures, to assess whether clarity has increased as well, the outcome is not conclusive. A trend or a statistical relationship between readability indexes and text length does not seem to exist (Figs. 13 and 14).

Both figures reveal how the size of the minutes is not related to their readability scores. The evolution of readability does not match any changes in the minutes’ length. An enhanced readability is neither paralleled by the size-expansion trend of the minutes of Brazil, Colombia, Mexico, and Peru, nor evidenced by the minute size-contraction observed in Chile.

The Chilean minutes displayed an enhanced readability in the initial 18 months; however, in the following 14 years, there was no evolution in this regard. The same was true for Peru, with little change in the quality of its communications over time. The central bank of Mexico also recorded few SRE changes, probably because of the small number of minutes released (Table 7).

A closer look at the readability scores for Brazil and Colombia (Fig. 15) revealed a decrease in the Brazilian index from 2007 to 2011, and an improvement in the Colombian index from 2009 to 2011. Both trends remained at the 2011 level until 2013.

Consequently, by reviewing the relative readability of the communications of some Latin American central banks, modest evolution in the clarity of these materials is uncovered. Such a finding echoed the central argument of this discussion, according to which, if the central banks do not improve the quality of their releases, they may produce scant and obscure information pieces, fully inadequate for their IT purposes.

7ConclusionThrough the content analyses of the Board minutes of five Latin American central banks, their procedural transparency has been explored. The existing literature on the communications of central banks under the IT scheme has traditionally focused on their freedom of information, and the types of reports that they release (inflationary, financial, addressed to Congress or to the markets, etc.). This research goes beyond these aspects to dissect the information contained in their chief central-bank communications tool.

The unstructured analyses (Section 4) revealed that the size of the texts and their MFTs suggest the trends and emphases of the central banks in their minutes. Concerning size (word counts), Brazil, Colombia and Mexico share a growing tendency; Chile has a steady size since mid-2005, and Peru features the most succinct communications of the region. Regarding the emphases made, words like “inflation”, “prices”, and “interest rate” are on the top 20 word lists, which is not surprising given the nature of the documents. Other terms on these lists suggest certain interests for given central banks. That is the case of the word “industry” for Brazil, the term “alimentos” (food) for Colombia, and the expression “mundo” (world) for Chile and Mexico. These words exemplify how these central banks pay particular attention to international developments, or how important the industries or the prices of food are for their respective economies. Interestingly, except for Chile, the expression “inflación objetivo” (inflation targeting), which is strongly related to the policy strategy, is not used at all. Cluster analyses done to assess associations between the documents’ top 30 words uncovered some interesting trends. In the case of Colombia, there was a cluster revealing a strong association between “inflación” (inflation), “junta” (Board), “precios” (prices), and “expectativas” (expectations).

For the structured analyses, several economics terms were selected to review their frequency and associations, in order to reach a deeper understanding of the central-bank communications. For instance, focusing the analysis on monetary policy matters let us compare their relevance between countries. Hence, although the term “expectations” was not on the list of top 20 words for several countries, isolating its correlation with other related terms allowed us to make country comparisons. Conversely, the linguistic, cultural and economic differences observed through the unstructured analyses allow no such comparisons. The structured analyses revealed a cluster for “inflation”, “monetary policy”, “employment”, and “industry” in Brazil. In the case of Chile, its focus on macroeconomic variables was evident, once “exports”, “imports”, “industry”, “investment”, and “consumption” became a cluster. Interestingly, this type of analysis revealed that, in general, the terms related to international finance and trade, including the exchange rate vocabulary, were scantly used and showed a low association with other terms.

As for the readability index analyses, they revealed the validity of using the FRE and SRE measures for this type of communications.14 While the readability of the central-bank minutes has not evolved noticeably in Latin America, it has not worsened either. The banks might simply be unaware of this aspect and its value when addressing their markets’ agents.

We would like to end by suggesting that the central banks under the IT scheme in the region could improve their overall communication strategies, beyond the release of minutes or other information materials. First is being explicit about their desire to shape expectations or educate external agents on given policy mechanisms, objectives and results. And second is improving their readability standards, which is always possible and desirable. The research findings certainly confirm that there is room for progress.

Conflict of interestThe author declares no conflict of interest.

DTM Document-Term matrix Flesch Reading Ease inflation targeting Federal Open Market Committee Most Frequent Terms Szigriszt Reading Ease Term-Document matrix

I would like to express my gratitude to Volker Nitsch, Hernán Rincón, and the participants of the 11th Annual Conference for the Special Edition of the ESPE Journal “Changes in monetary policy and central Banking over the past two decades” and particularly, to the invited editor Julian Parra, and the two anonymous referees for their helpful comments to the previous version of this document. My gratefulness goes also to Eduardo Soto for his valuable research assistance, and to María Angélica Samper C. (www.transcrear.com) for her English proofreading and editing services. Last, I would like to acknowledge and appreciate the support of Universidad de Los Andes and its Facultad de Administración for the development of this study under the “Proyecto de Profesores Asistentes (FAPA)”.

Broto (2008) examines the volatility effects of IT in Latin America. Steiner, Barajas, Pabón, and Villar (2014) review the IT and inflation-control experience within the region.

The vast literature on the independence and accountability of central banks is an example, see Walsh (2008).

See Eijffinger and Geraats (2006), Geraats (2002) and the review of Blinder, Ehrmann, Fratzscher, Haan, and Jansen (2008).

Text analysis converts text into data for quantitative analysis. It involves information retrieval, lexical analysis to study word frequency distributions, pattern recognition, tagging/annotation, information extraction, and data mining techniques, including link and association analysis, visualization, and predictive analysis.

There is also abundant literature examining clarity in communication in a non-automated way, via human coding and evaluators, Bailey and Schonhardt-Bailey (2008), Balke and Petersen (2002), Fracasso, Genberg, and Wyplosz (2003) and Bulíř, Šmídková, Kotlán, & Navrátil, 2008 are examples of such approach, Blinder et al. (2008) reviewed some works employing these methodologies as well.

In 1993 the members of the FOMC discovered that the meetings were recorded and decided that this material could be used to increase transparency.

Not including front and back matter.

It is also known as statistical analysis of text, or text mining.

This is a procedure by which a text is sliced in semantic parts for language processing.

The words “words”, “terms” and “tokens” are used interchangeably in the text analysis literature.

Taborda (2013) explains the exchange rate emphasis of the Colombian central bank as a response to the external pressure of interest groups.

The category “other”, is not discussed, although it ranked third in the analysis; half of its frequency is explained by the use of the word “industry” by the Brazilian central bank, slanting the results without significance for the rest of countries.

As a research area, the readability of economics and financial texts lacks any specific methodologies. For our purposes, these measures were the best approach available; furthermore, developing or discussing readability measures for economics texts goes beyond the objectives of this study.

However, many other information pieces released by central banks could also be scrutinized to assess their clarity in regard to their purpose.