This paper examines the measurement and identification of tax policy shocks using novel multi-country databases on tax rates. On the measurement front, we argue that there is no substitute for using tax rates, a true policy instrument, as opposed to the much more popular revenue-based measures, such as cyclically adjusted revenues.

On the identification front, we argue that the narrative approach (whereby changes in tax rates are classified into exogenous or endogenous to the business cycle based on contemporaneous economic records) is the most accurate method. When properly measured and identified, tax multipliers for both industrial and developing countries are, on average, about -2. Further, we find important non-linearities with multipliers becoming bigger (in absolute value) as both the level of initial taxes and the size of tax changes become larger.

Este artículo estudia la medición e identificación de los choques de política tributaria por medio de bases novedosas de datos multinacionales de tasas de impuestos. Desde el punto de vista de la medición, se argumenta que no existe un sustituto para las tasas de impuestos, un verdadero instrumento de política, en contraposición a las mediciones basadas en la renta mucho más populares, como la de renta ajustada por el ciclo.

En cuanto a la identificación, se argumenta que el enfoque narrativo (donde los cambios en las tasas fiscales se clasifican en exógenos o endógenos al ciclo coyuntural en función de los registros económicos contemporáneos) es el método más preciso. Cuando se miden e identifican adecuadamente, los multiplicadores fiscales para los países industriales y en desarrollo están, en promedio, en torno a -2. Asimismo, se encuentran no linealidades importantes al incrementar los multiplicadores (en valor absoluto) a medida que tanto el nivel de los impuestos iniciales como el tamaño de los cambios en los impuestos es mayor.

In the aftermath of the global financial crisis of 2008-2009 and ensuing recession, many governments across the world enacted aggressive countercyclical fiscal policies. More recently, and in the midst of sovereign debt crises in many Eurozone countries and the end of high commodity prices for many emerging markets, fiscal consolidation (the euphemism in vogue for fiscal contraction) has become the order of the day. Not surprisingly, this sequence of fiscal expansion followed by fiscal retrenchment has triggered a large academic literature on fiscal policy and, particularly, on fiscal multipliers.1

Interestingly enough, most of the work has focused on the spending side of fiscal policy (as opposed to the revenue, or tax, side). The main reason behind this is probably the measurement problems that arise on the revenue side. While, in principle, data on government spending (the policy instrument) is easy to come by, the same is not true of tax policy. The readily available data covers tax revenues, a crude, at best, measure of policymakers’ tax policy given that revenues are greatly influenced by the fluctuations of the tax base over the business cycle. While alternative measures have been used as a proxy for tax policy – particularly cyclically adjusted revenues – their validity remains in question. In other words, how to measure tax policy has been, in and of itself, a major research challenge.

Yet another critical research challenge has been how to identify in the data tax shocks that are exogenous to the business cycle. Failure to do so will, of course, invalidate any estimate of the effects of tax policy on output. As the workhorse of empirical work in this area – the Blanchard and Perotti (2002) identification method – has been repeatedly called into question, new identification techniques – most notably the narrative approach pioneered by Romer and Romer – have become more common. The big drawback of the Romer-Romer methodology, however, is the enormous demands in terms of time, effort, and data sources that it imposes on the researcher.

Based on our own work, this paper reviews the main problems and solutions related to measurement and identification of tax shocks.2 Perhaps even more importantly, it will show how measurement and identification are much more than obscure technicalities that academics obsess over. In fact, correct measurement and identification of tax shocks critically affect the conclusions that one may draw regarding the cyclical properties of tax policy, the size of tax multipliers, and the presence of non-linearities in the effects of tax changes on output.

The paper proceeds as follows. Section 2 focuses on different measures that have been used in the literature to capture tax policy, in particular cyclically adjusted revenues. It argues, however, that there is really no good substitute for using tax rates which are, after all, the main tax policy instrument. Section 3 turns to the two main identification techniques that have been used to identify exogenous tax shocks (Blanchard–Perotti and the narrative approach) and argues that the narrative approach is the best one. Section 4 puts our machinery to use and estimates tax multipliers for a sample of 35 countries (18 industrial and 17 developing), showing the biases that would arise if the Blanchard–Perotti technique were used and illustrating the presence of important non-linearities. Specifically, the initial level of taxes and the size of the tax rate changes thus critically matter for the size of tax multipliers. Section 5 concludes.

2MeasurementAn obvious, yet critical, observation is that policymakers’ main policy instrument on the tax side is the tax rate. However, the most common measure of tax policy in multi-country databases is tax revenues. By definition,

While the tax rate is the policy instrument, tax revenues are a policy outcome since the tax base is heavily influenced by the business cycle and many other non-policy factors. The lack of easily available multi-country data on tax rates have led researchers to look for alternative measures of tax policy. Arguably, though, most measures are seriously flawed. We now take a look at the most common measures.

2.1Inflation taxSince it is very easy to compute, the inflation tax has often been used as a proxy for the overall stance of tax policy.3 The idea is, of course, not without merit since viewing inflation as “just another tax” can be traced all the way back to Phelps (1973) and has been greatly refined ever since (see, for example, Chari and Kehoe (1999)). There is, however, little empirical support for this idea.4 Perhaps at best, the inflation tax can be though of as “just another tax” only when central bank independence is low, as argued by Delhy Nolivos and Vuletin (2014).

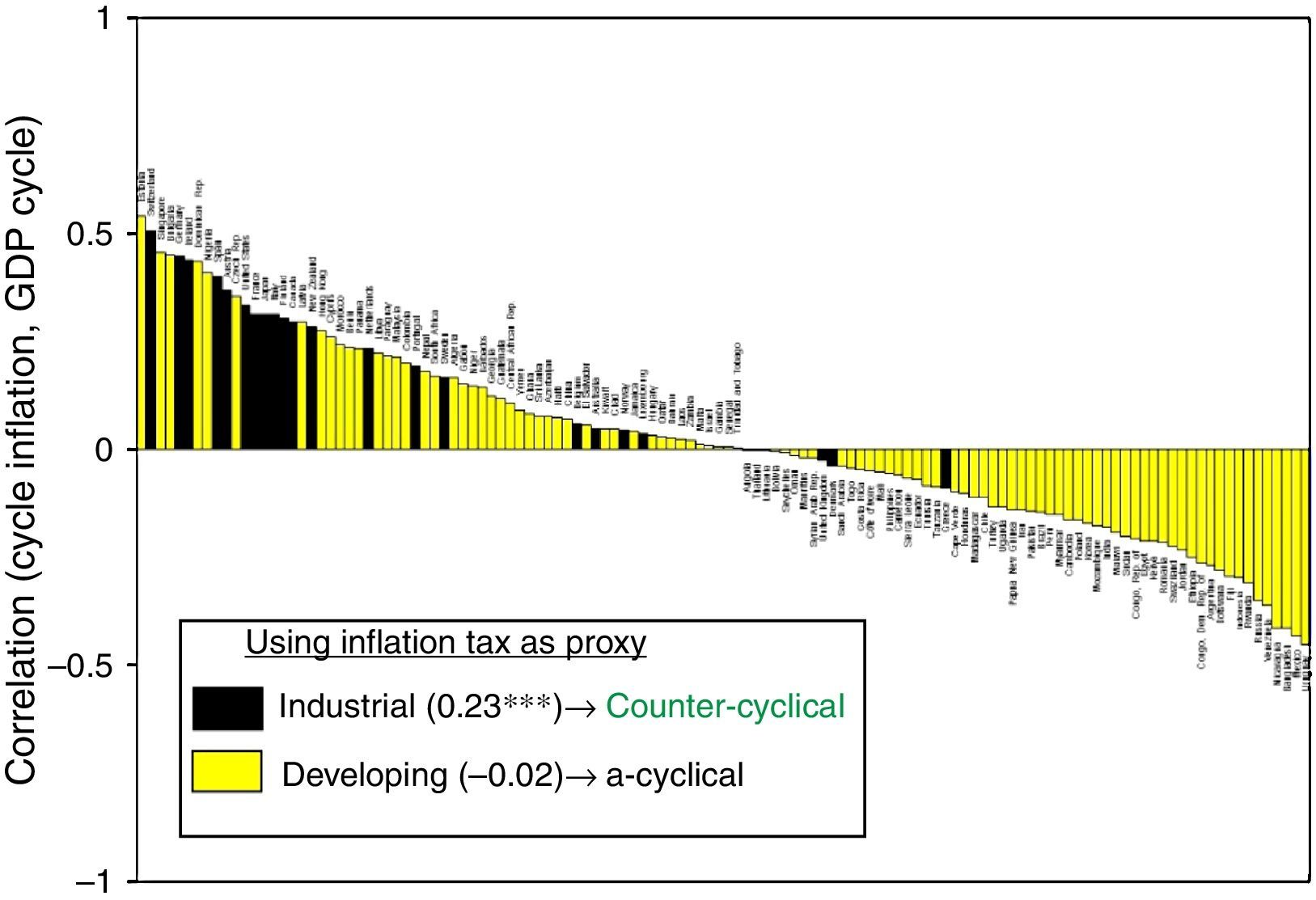

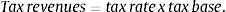

Fig. 1 shows the correlation between the cyclical components of the inflation tax and real GDP for 124 countries.5 Black (dark) bars denote industrial countries while yellow (light) bars indicate developing countries. The average correlation for industrial countries is 0.23 and significantly different from zero at the one percent level, indicating, in principle, countercyclical tax policy.6 In contrast, the average correlation for developing countries is not significantly different from zero, indicating an acyclical policy. As will be shown below, this result for developing countries is simply not right since when a tax rate index is used, developing countries will turn out to be procyclical.7

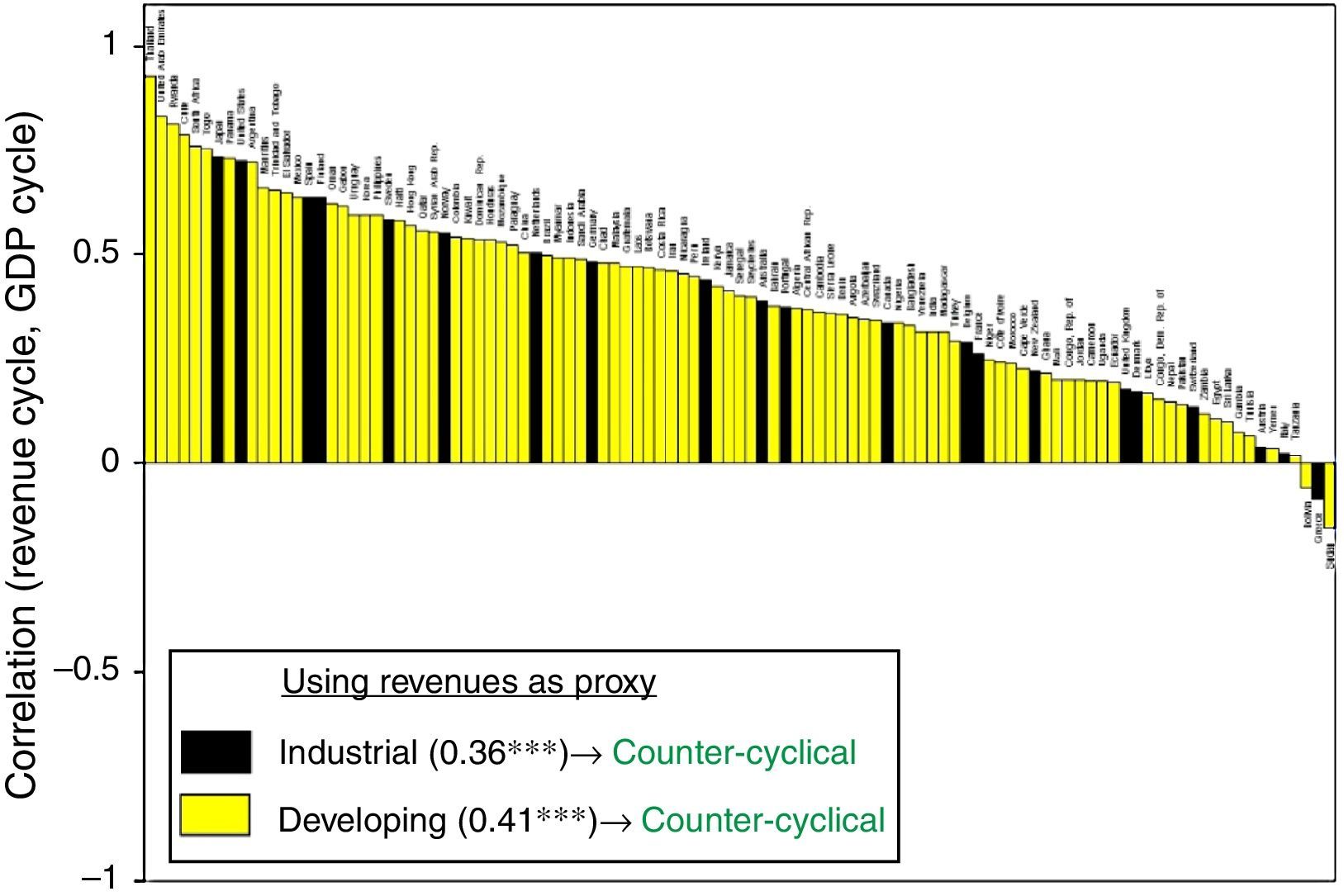

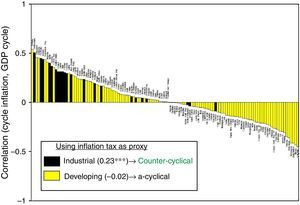

2.2Tax revenuesAs mentioned above, tax revenues are heavily influenced by the business cycle, with the tax base responding very elastically to fluctuations in GDP. Hence – and as illustrated in Fig. 2 – the cyclical components of tax revenues and real GDP are positively correlated for all countries in our sample except three. In fact, the average correlations are 0.36 and 0.41 for industrial and developing countries, respectively, and both significantly different from zero. Based on this measure, therefore, one would (erroneously) conclude that tax policy is countercyclical in both industrial and developing countries. The reality, in fact, is that many developing countries are actually procyclical (increasing tax rates in bad times for instance) but the behavior of the tax base simply dwarfs changes in tax rates.

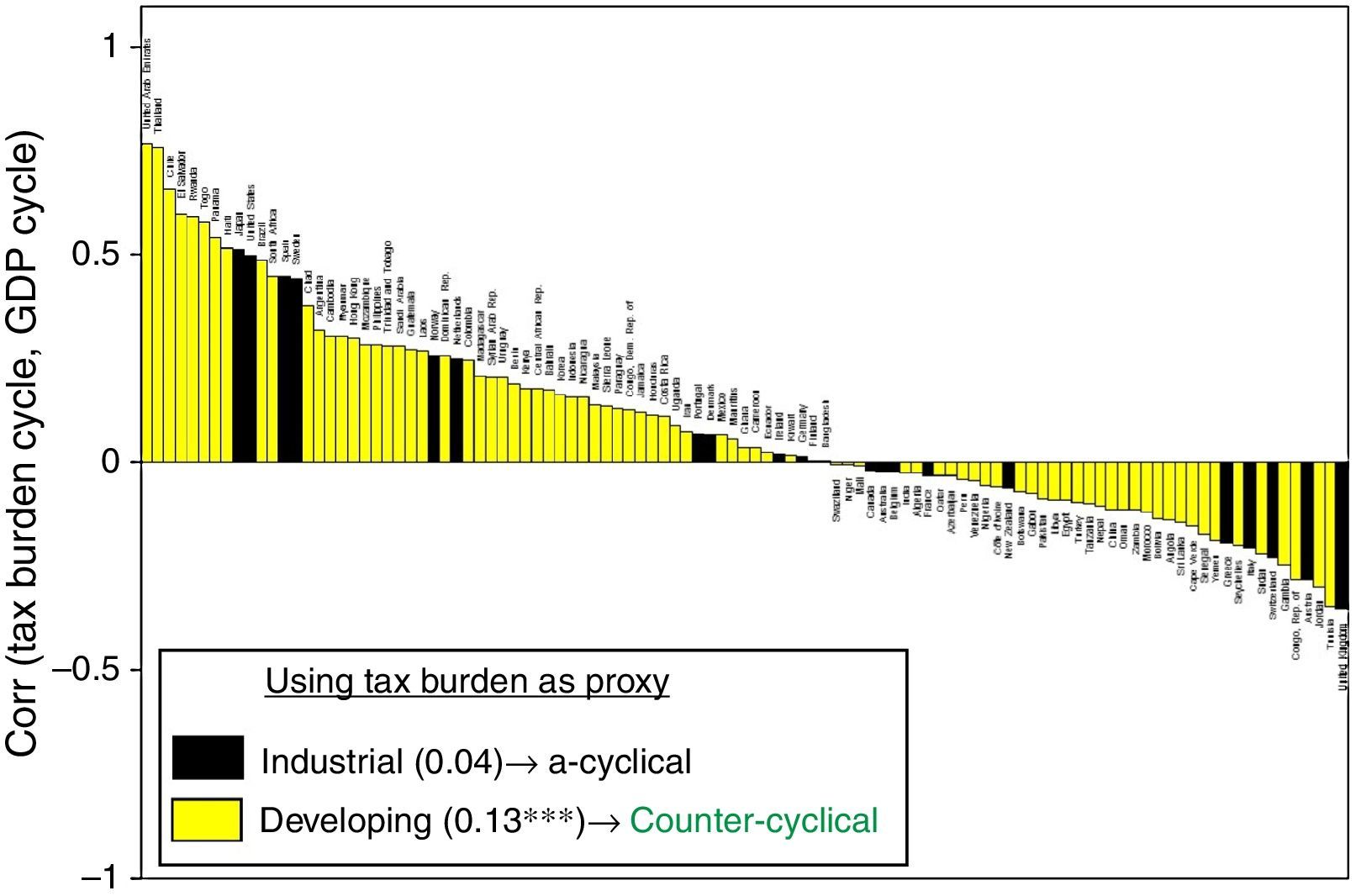

2.3Average tax rateIn an attempt to correct for the fact that tax revenues are dominated by fluctuations in the tax base, some researchers have used tax revenues as a proportion of GDP as the measure for tax policy. This correction, however, does little to solve the problem of the undue influence of the tax base, particularly for the case of developing countries. Since the output-elasticity of the tax base is very high, the tax base will increase proportionately more in good times than GDP and hence the “average” tax rate will increase, conveying the misleading impression of countercyclical tax policy. Indeed, as Fig. 3 illustrates, based on the average tax rate, we would erroneously conclude that developing countries are, on average, countercyclical.

2.4Cyclically adjusted revenuesCyclically adjusted revenues (CAR) are, by far, the most commonly used measure of tax policy.

2.4.1Theoretical ideaThe idea is conceptually simple and attractive. By removing the effects of the business cycle on tax revenues, we would be left with a measure that would presumably be capturing “discretionary tax policy.”

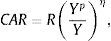

To illustrate this idea, define CAR as

where R are tax revenues, Yp is potential output, Y is output, and η is, as defined below, the output elasticity of the tax base.8 Assuming that Yp is constant and using “hats” to denote proportional changes, it follows thatThis is a commonly used measure of cyclically adjusted revenues. The value of η is often assumed to be one.9

To show the relation between CARˆ and changes in the tax rate, define

where TB is the tax base and τ is the tax rate and assume that the link between the tax base and output is given byTaking proportional changes in Eqs. (2) and (3) and substituting into (1) yields

In other words, the proportional change in cyclically adjusted revenues is equal to the proportional change in the tax rate. This provides a nice example of the theoretical underpinnings of using cyclically adjusted revenues.

2.4.2CAR in practiceUnfortunately, the practical use of CAR provides the quintessential example of a good theoretical idea gone awry. The main problem is that, in practice, the world is not neatly divided between changes in taxes that result from business cycle fluctuations and changes that are policy-driven. In practice, tax revenues can change due to a myriad of non-policy changes such as structural breaks, changes in tax evasion, changes in income distribution, changes in the output elasticity of taxes, and so forth. The CAR methodology will (erroneously) attribute any changes not systematically related to the business cycle to discretionary policy.

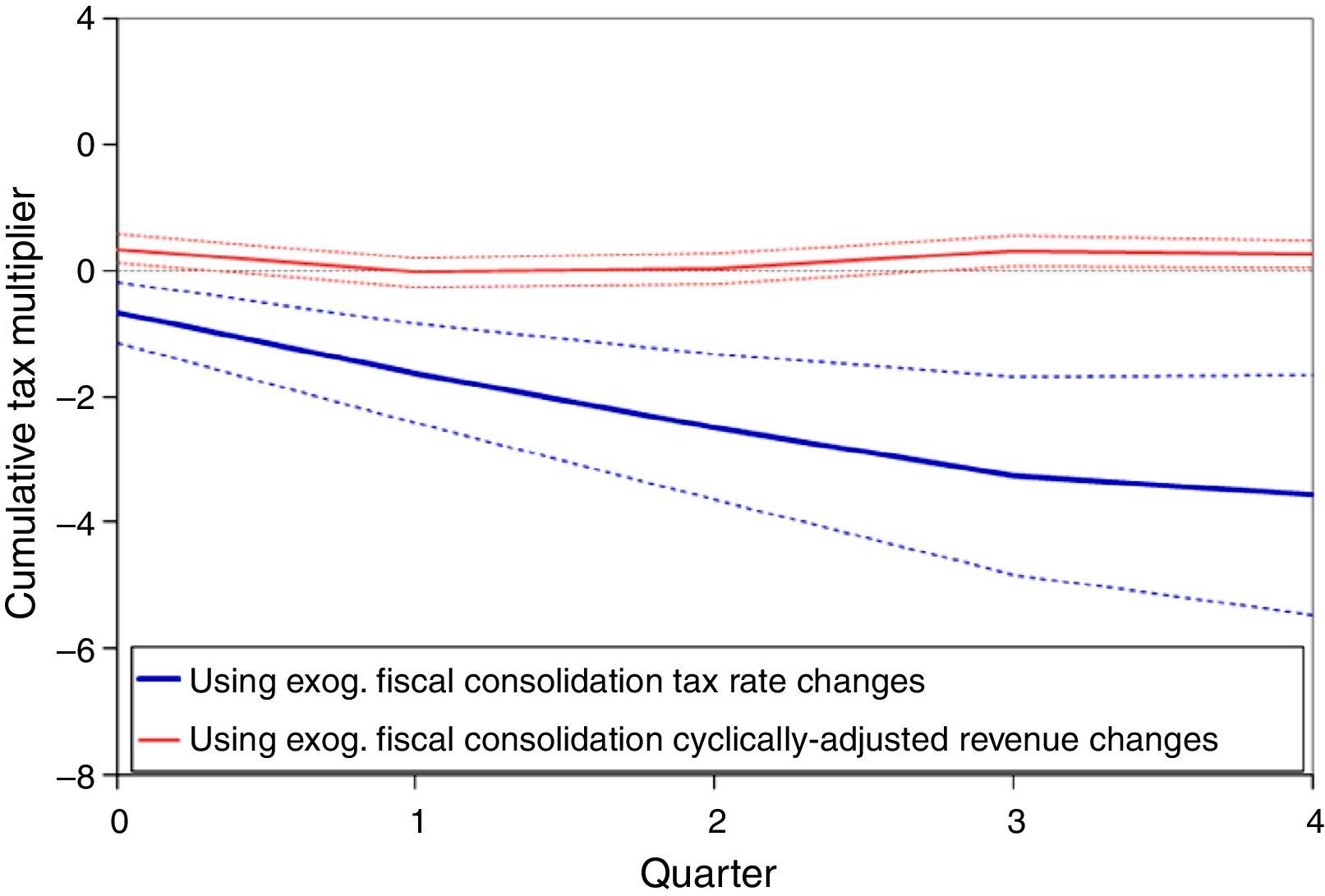

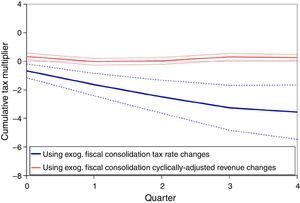

Fig. 4 provides a striking illustration of the differences between using CAR and tax rates changes. In theory – and as suggested by Eq. (4) – these two measures should provide a similar estimate of the tax multipliers. In practice, however, the resulting estimates are dramatically different. For a sample of 14 OECD countries, the tax multiplier based on CAR is not significantly different from zero whereas the one based on tax rate changes is significantly negative throughout.10

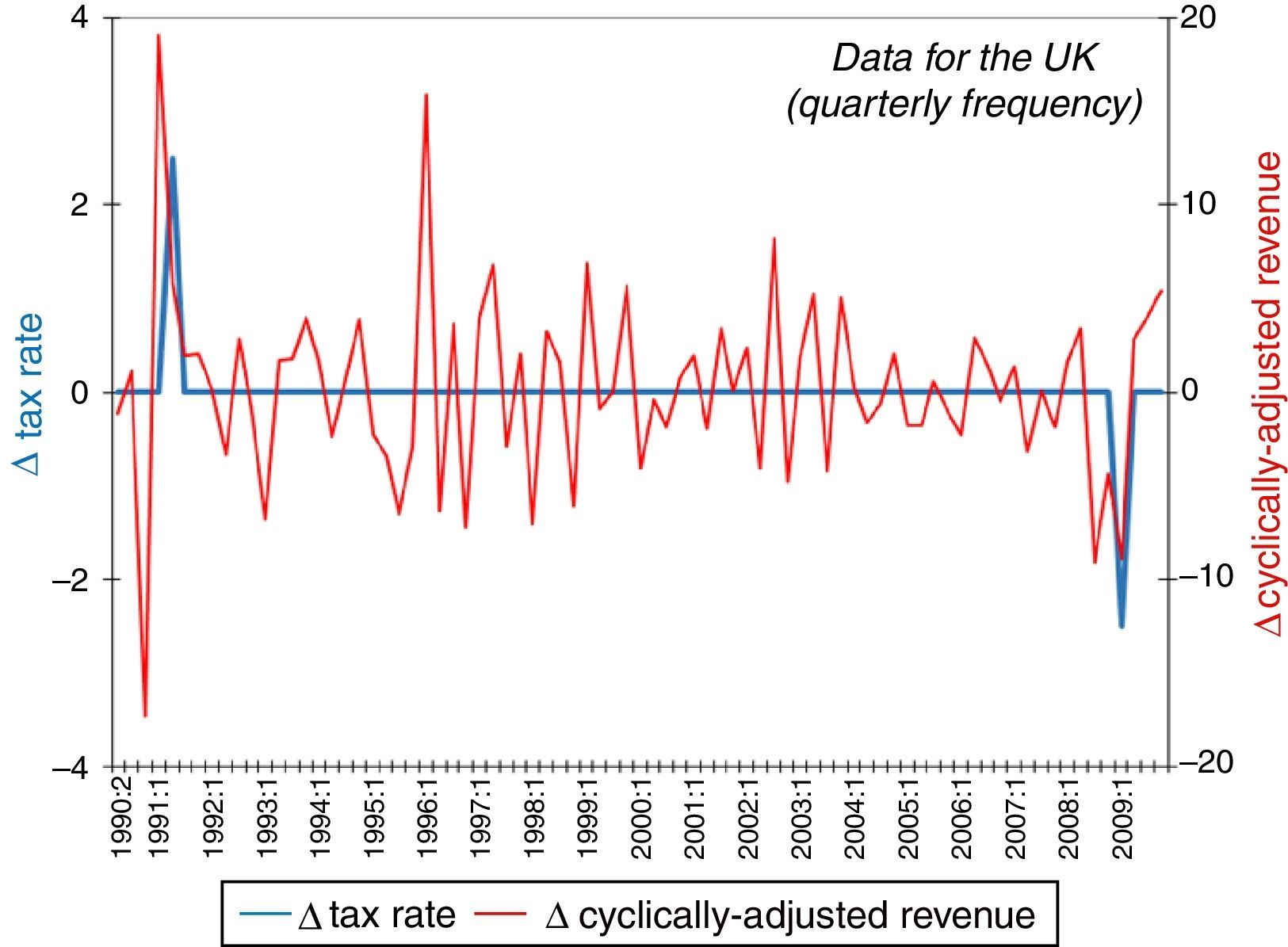

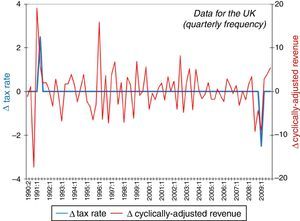

Fig. 5 hints at some of the problems with CAR measures that may lie behind the misleading results just illustrated. As an example (time series for other countries would look roughly similar), Fig. 5 shows the CAR series for the UK from 1990 to 2009, together with the actual series for the VAT tax rate. Notice that during this 20-year period, there were only two changes in the VAT rate. The figure calls attention to some obvious problems:

- •

While the time series capturing tax rate changes is “discrete” in the sense that changes take place only occasionally, CAR is a “continuous” variable in the sense that, by construction, it changes all the time.

- •

The contemporaneous correlation between changes in CAR and the tax rate is not significantly different from zero.

- •

The change in CAR is negatively autocorrelated at the quarterly frequency in more than 70% (10 out of 14) of the countries in our sample. Under the standard interpretation that changes in CAR capture changes in discretionary tax policy, this finding would imply that policymakers's discretionary policy changes are reversed essentially every quarter! Since this is clearly implausible, it calls into question the validity of CAR as a proxy for discretionary tax policy.

In sum, in our view, the use of CAR as a proxy for discretionary tax policy is, at best, highly problematic and, at worst, simply yields misleading results.

2.5Tax ratesBy definition, tax rates are under the direct control of policymakers and hence constitute the tax policy instrument par excellence. Given all the problems described above with alternative measures of tax policy, we believe that there is simply no good substitute for tax rates as the measure of tax policy. To this effect, in Vegh and Vuletin (2015), we built a novel dataset on tax rates for 62 countries (20 industrial and 42 developing) for the period 1960–2015 that comprises (i) standard value-added tax (VAT) rates, (ii) highest personal income tax rates, and (iii) highest corporate income tax rates.

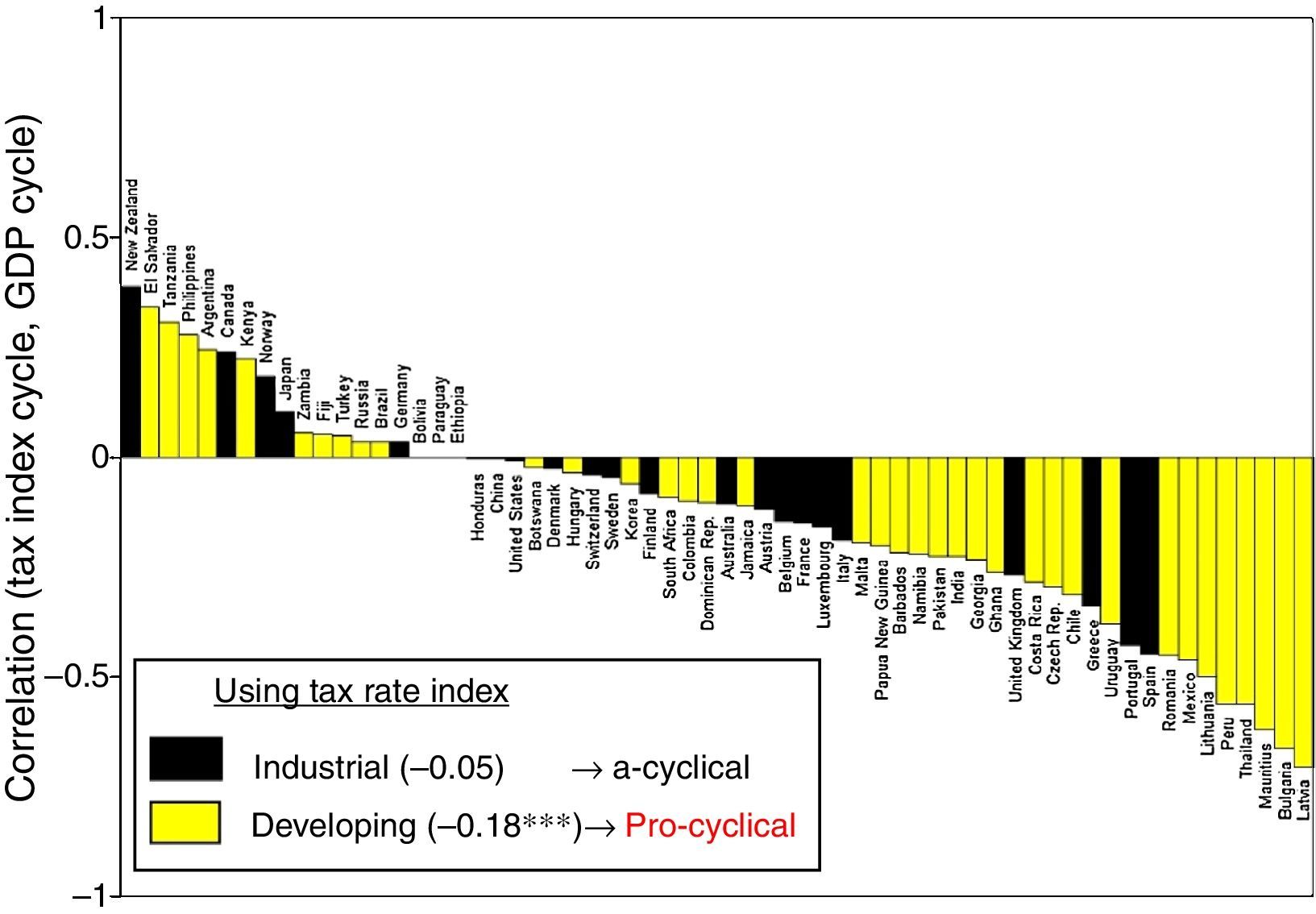

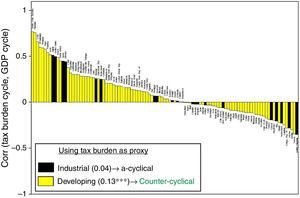

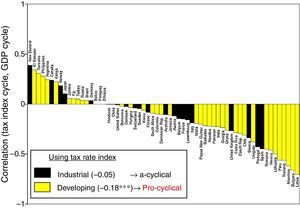

Using this dataset, we constructed a tax rate index by weighing each tax rate by its share in total tax revenues. Fig. 6 shows the correlation between the cyclical components of this tax rate index and real GDP. We can see that a very different picture emerges compared to other measures reviewed above. While industrial countries are acyclical (i.e., the average correlation is not significantly different from zero), the average correlation for developing countries is -0.18 and significantly different from zero, indicating procyclical tax policy. This is, of course, consistent with the fact that developing countries have also been shown to be procyclical on the spending side.11

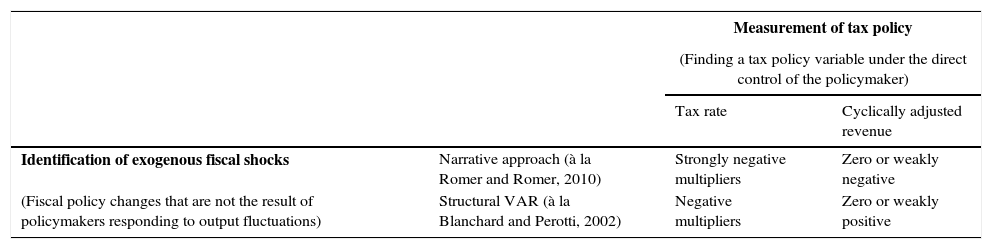

In Riera-Crichton, Vegh, and Vuletin (2016), we show that measurement matters a lot when it comes to the size of tax multipliers, almost irrespective of the identification technique (discussed below). As illustrated in Table 1 – and consistent of course with Fig. 4 – tax multipliers estimated based on CAR are typically zero or very small in absolute value. In sharp contrast, multipliers estimated using tax rates are negative – and often strongly so. The policy implications thus vary dramatically depending on how we measure tax policy.

Identification of exogenous fiscal shocks vs. measurement of tax policy.

| Measurement of tax policy | |||

|---|---|---|---|

| (Finding a tax policy variable under the direct control of the policymaker) | |||

| Tax rate | Cyclically adjusted revenue | ||

| Identification of exogenous fiscal shocks | Narrative approach (à la Romer and Romer, 2010) | Strongly negative multipliers | Zero or weakly negative |

| (Fiscal policy changes that are not the result of policymakers responding to output fluctuations) | Structural VAR (à la Blanchard and Perotti, 2002) | Negative multipliers | Zero or weakly positive |

We should close this section by clearly stating that, for all its good qualities as a proxy for tax policy, tax rates are certainly not a panacea. The reason is that, in practice, tax policy comprises not only setting a standard rate for some tax category (say, VAT or personal income taxation) but often setting multiple rates as well as different thresholds and coverages for each rate. VAT taxation, for example, often includes reduced and/or zero rates (i.e., exempted goods), in addition to the standard rate. Personal income taxation typically includes several tax rates with corresponding thresholds. Clearly, varying the coverage of each rate in the case of VAT or changing thresholds in the case of personal income taxation amounts to a change in tax policy that does not involve tax rates.

To get a sense of the potential magnitude of this problem, in Vegh and Vuletin (2015), we constructed an effective VAT rate for 10 European countries using the different value-added statutory tax rates weighted by the share of transactions as a percentage of the taxable base.12 Since the standard VAT rate accounts, on average, for 70% of the taxable base, the standard rate (the one we use for all of our calculations) accounts for 85% of the effective rate. Further, we cannot reject the hypothesis that the linear regression coefficient is not different from one, indicating that a one percentage point increase in the standard rate would be associated, on average, with a one percentage point increase in the effective rate.

In sum, while further work is clearly warranted to check that tax rates are a good enough indicator (statistically speaking) of tax policy, our work so far tends to suggest that this is indeed the case.

3IdentificationHaving good measures of tax policy is just one of the two key ingredients needed to estimate reliable tax multipliers. The second is, of course, being able to identify changes in tax policy that are exogenous to the business cycle. The two main methods for doing so are Blanchard–Perotti and the narrative approach.

3.1Blanchard–PerottiThe identification method based on Blanchard and Perotti (2002) is the workhorse of the profession, mainly due to its ease of implementation. In the context of an SVAR, the critical identifying assumption is that tax policy can react to GDP only with a one-period lag. In other words, all contemporaneous correlation between tax policy and output will be attributed to tax policy affecting output.

This identifying assumption is at least plausible with quarterly data, since one could argue that just getting a tax policy change through the legislature may require at least a quarter. With annual data, however, this key identification assumption makes little sense. But perhaps the most damaging critique of the Blanchard–Perotti identification assumption is that most changes in government spending or tax policy are actually anticipated by agents.13

3.2Narrative approachThe narrative approach, based on the pathbreaking contribution by Romer and Romer (2010), uses contemporaneous economic records to classify tax changes into exogenous or endogenous to the business cycle.

In Gunter, Riera-Crichton, Vegh, and Vuletin (2016), we apply the narrative approach to a worldwide sample. Specifically, we look at VAT rates for 51 countries (21 industrial and 30 developing) for the period 1970–2014. We identify 96 changes in VAT rates.14 Based on contemporaneous economic records, both domestic and IMF-based, we classify every change into exogenous and endogenous to the business cycle. Specifically, of the 96 changes in VAT rates, we classify 52 as endogenous and 44 as exogenous.

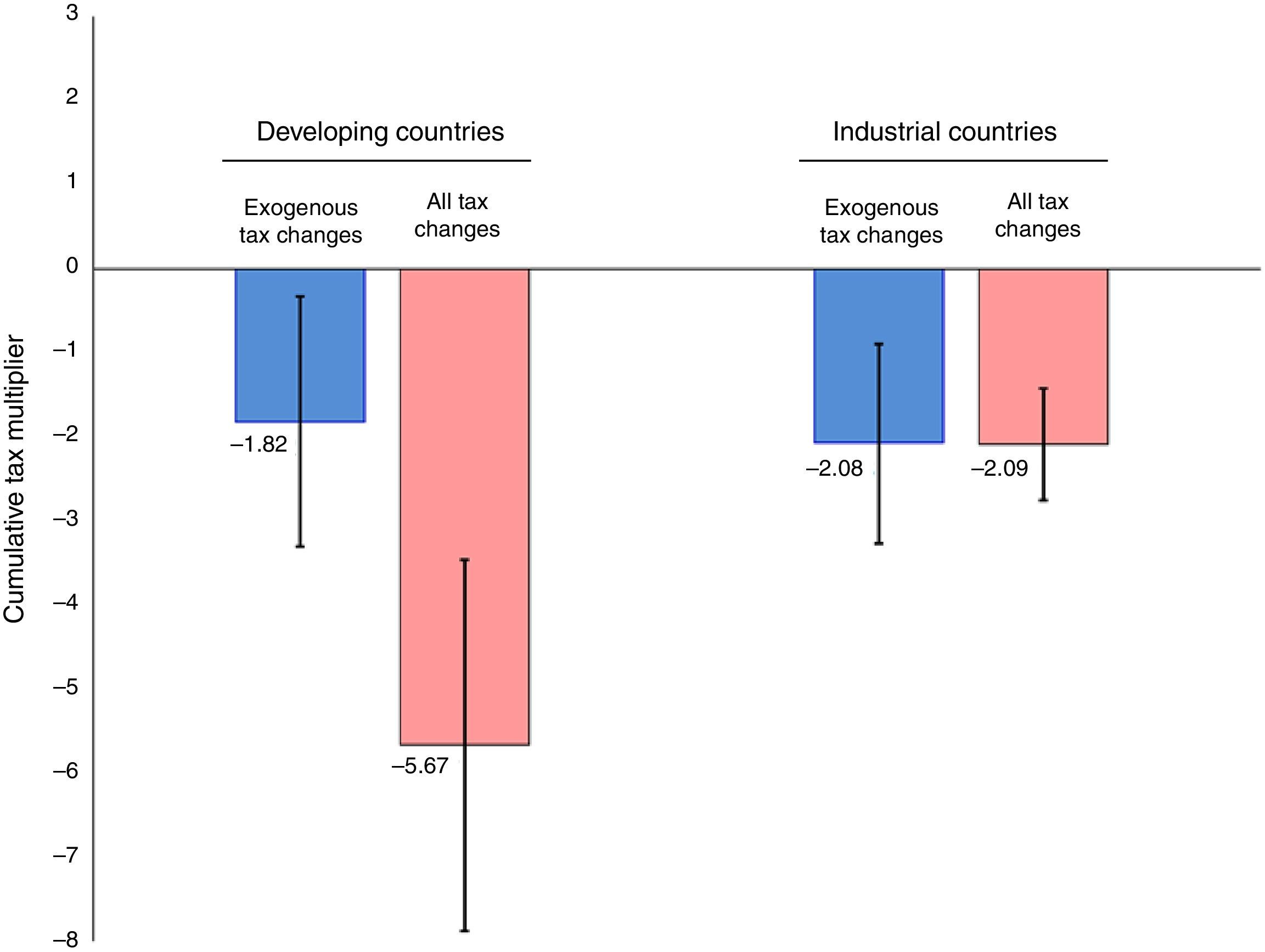

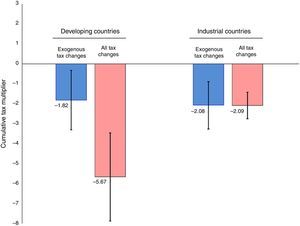

Fig. 7 illustrates the bias introduced by using the Blanchard–Perotti methodology compared to the narrative approach. The light grey/red bars indicate the value of the cumulative tax multipliers after two years when all tax changes are included and the Blanchard–Perotti timing assumption is used for identification purposes. The dark grey/blue bars show the multipliers when only exogenous tax changes are included in the estimation. Interestingly enough, the value of the tax multipliers for industrial countries in both cases is virtually identical. In sharp contrast, in the case of developing countries, the tax multiplier is much larger (in absolute value) when all tax changes are used (with the Banchard-Perotti methodology) compared to the value obtained when only exogenous tax changes are used. In fact, when only exogenous changes are used, the tax multiplier is very similar to that of industrial countries (i.e., around -2).

The bias observed for the case of developing countries is due to the fact that developing countries follow, on average, a procyclical fiscal policy. In other words, in bad times developing countries often raise tax rates in an attempt to close the fiscal gap. The causality in this case clearly goes from the business cycle (a recession that drastically reduces revenues) to higher taxes. But if not properly identified, the estimation will attribute such correlation to higher taxes provoking a recession and hence overestimate the tax multiplier (in absolute value).

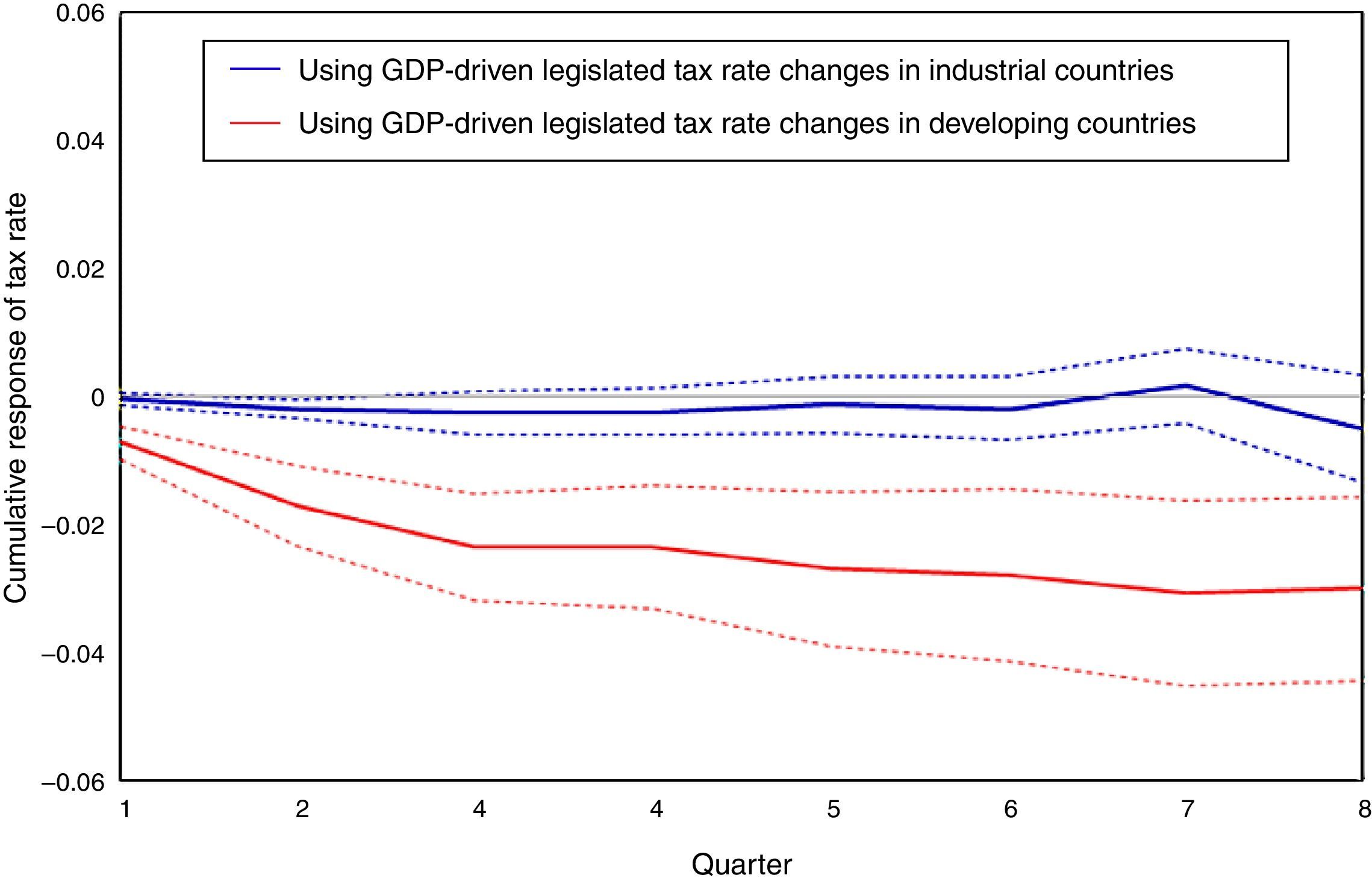

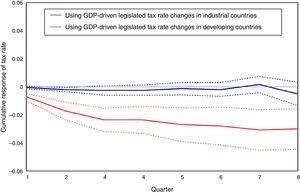

The procyclicality of fiscal policy in developing countries is illustrated in Fig. 8. This figure considers those changes in VAT rates that we have classified as endogenous to the business cycle and shows the response of tax rates to shocks to GDP. We can see that while the response of tax rates to output shocks in industrial countries is acyclical, in developing countries that response is significantly procyclical. This is thus the source of the bias when using the Blanchard–Perotti identification assumption to estimate tax multipliers in developing countries.

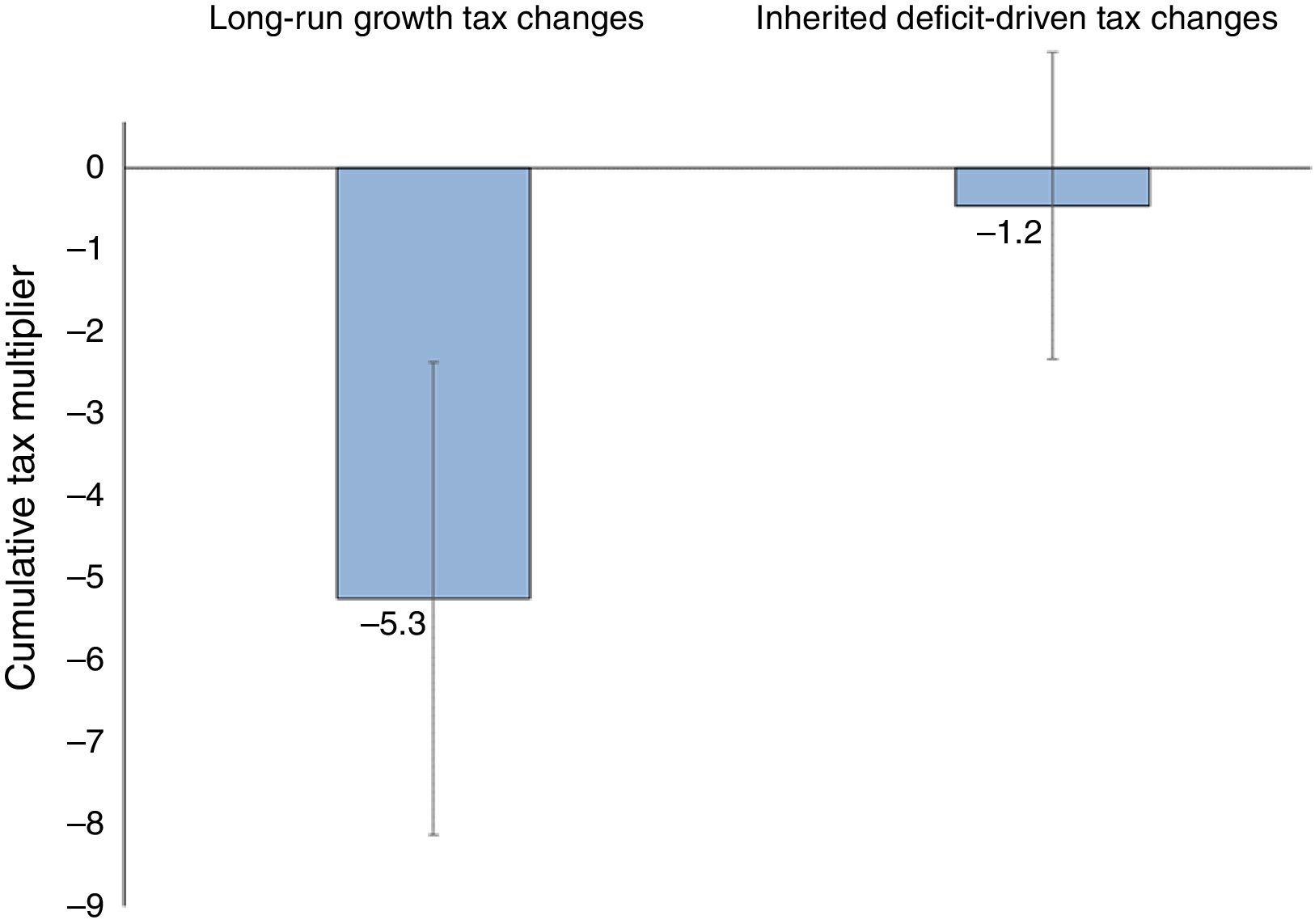

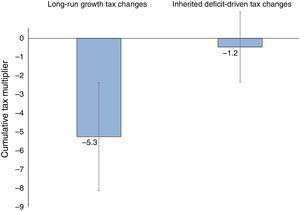

4Non-linearitiesIn their work, Romer and Romer raised a puzzle, which they left basically unexplained. Specifically, they found for the United States that tax multipliers based on tax changes that were motivated by long-run growth considerations (i.e., supply side arguments) were not only highly significant but as high as 3 (in absolute value). In contrast, tax multipliers based on tax changes aimed at closing inherited fiscal deficits had no significant effect on economic activity. They offered no real explanation as to why this may be so.

As illustrated in Fig. 9, we also find differential effects on output of tax changes motivated by different considerations. In line with Romer and Romer's findings for the United States, we can see that the multiplier based on long-run growth tax changes is considerably larger (in absolute value) than the ones based on inherited deficit-driven factors.

Why might this be the case? A possible explanation is that the mechanism involved in the transmission of tax shocks differs from case to case. While we certainly cannot rule out this possibility, we put forward a simpler explanation: the effects of tax changes on output are highly non-linear. This is, by the way, in line with recent theoretical research by Jaimovich and Rebelo (2012) who show that while for low/moderate levels of initial tax rates the output effect of tax increases is very small, for higher levels of tax rates the impact is much larger. This occurs because the distortion imposed by taxes increases with the level of taxes.

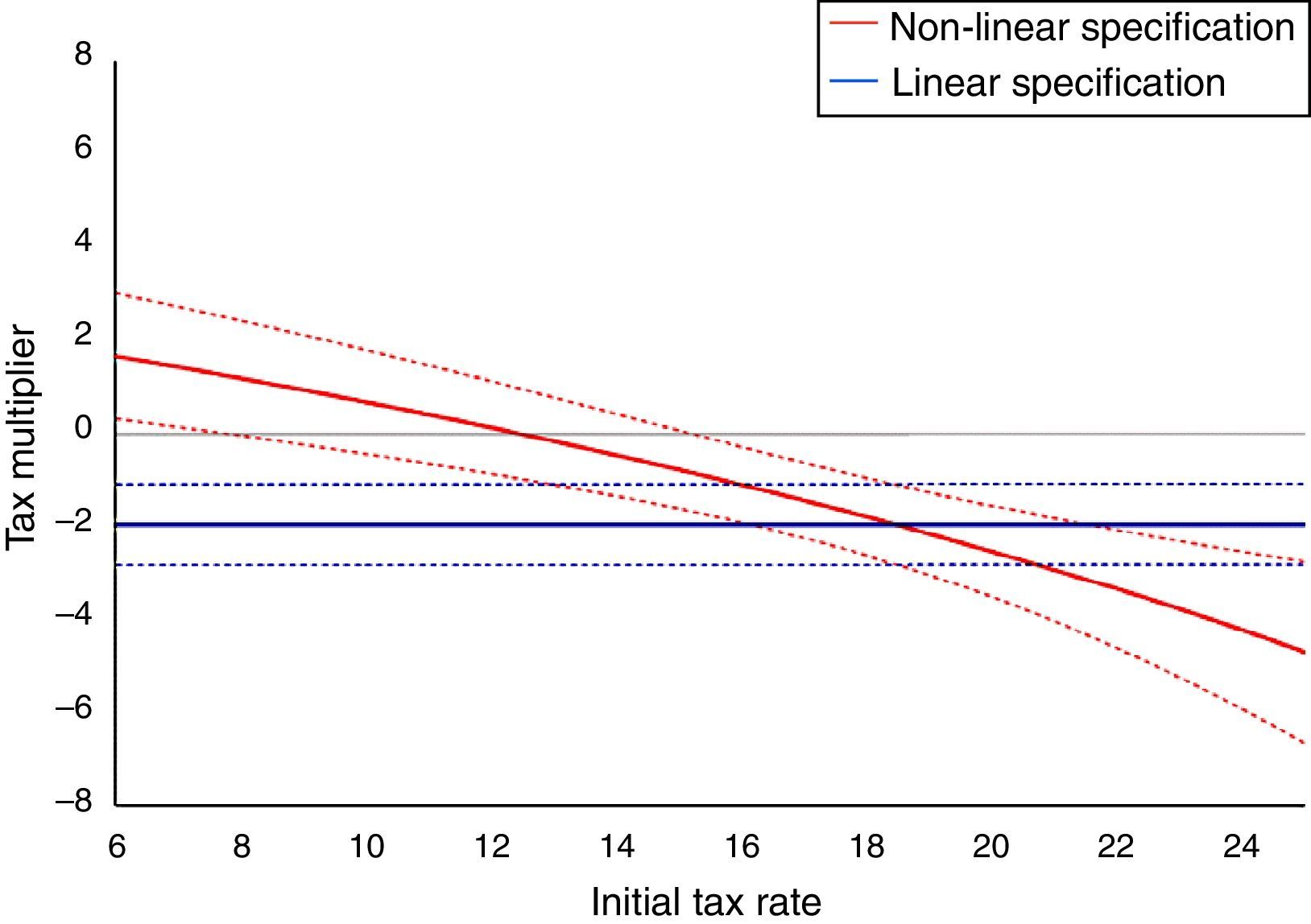

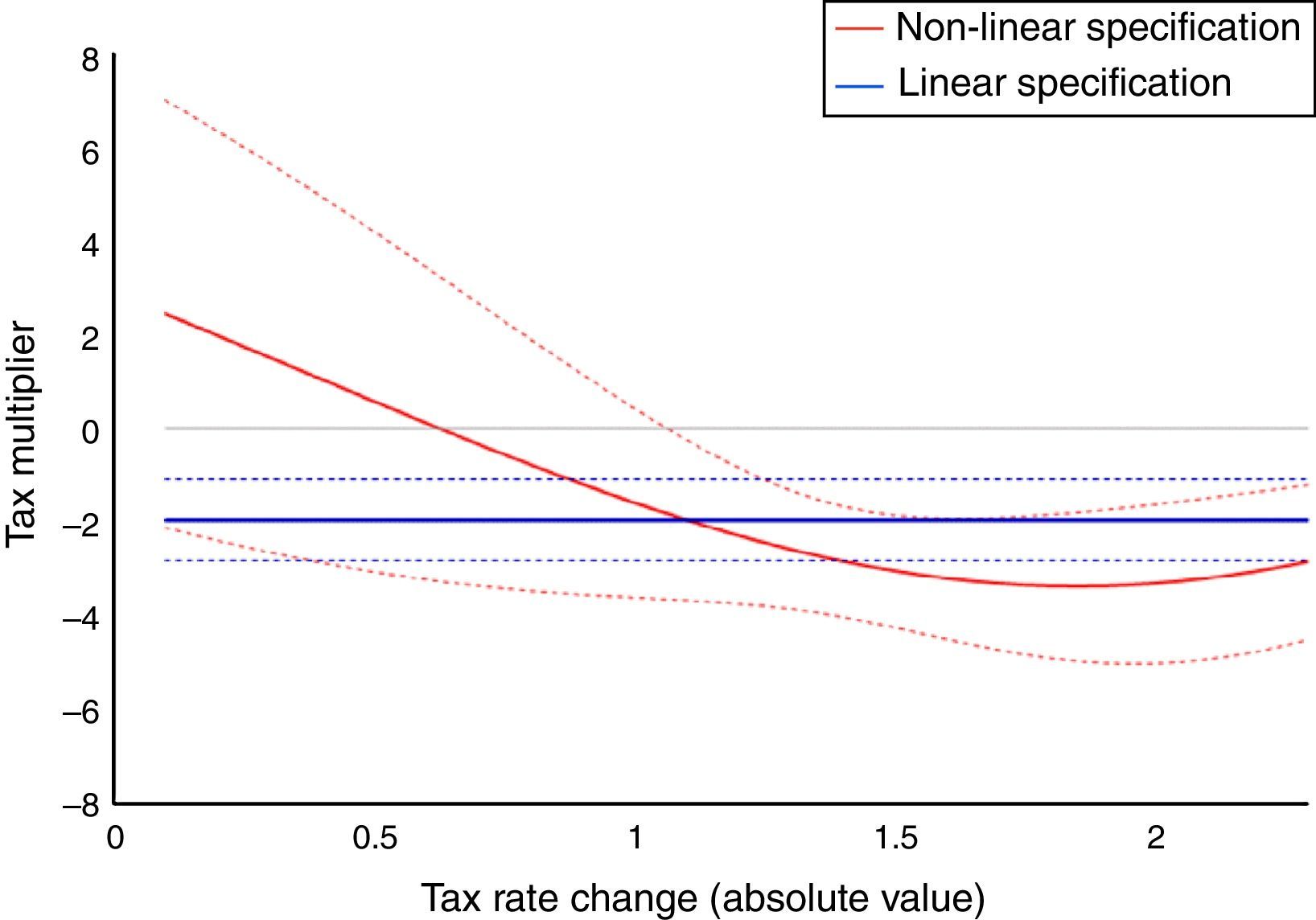

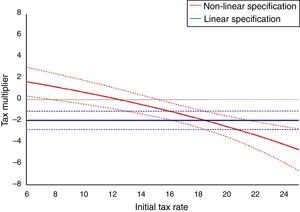

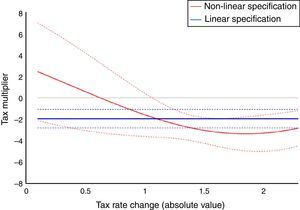

Figs. 10 through 12 show the non-linearities in our estimates based on exogenous tax rate changes. Specifically, Fig. 10 shows the estimates for the long-run multipliers as a function of the initial tax rate, with the linear estimate as a reference. We can see how the size of the multiplier falls (i.e., increases in absolute value) reaching a maximum (in absolute value) of 4.2 when the initial tax rate is 24%. A similar point emerges from Fig. 11, which depicts the tax multiplier as a function the size of the tax rate change (in absolute value). For small values of tax rate changes, the multiplier is not significantly different from zero but for large values (a 2 percentage point change), the multiplier becomes significantly different from zero.

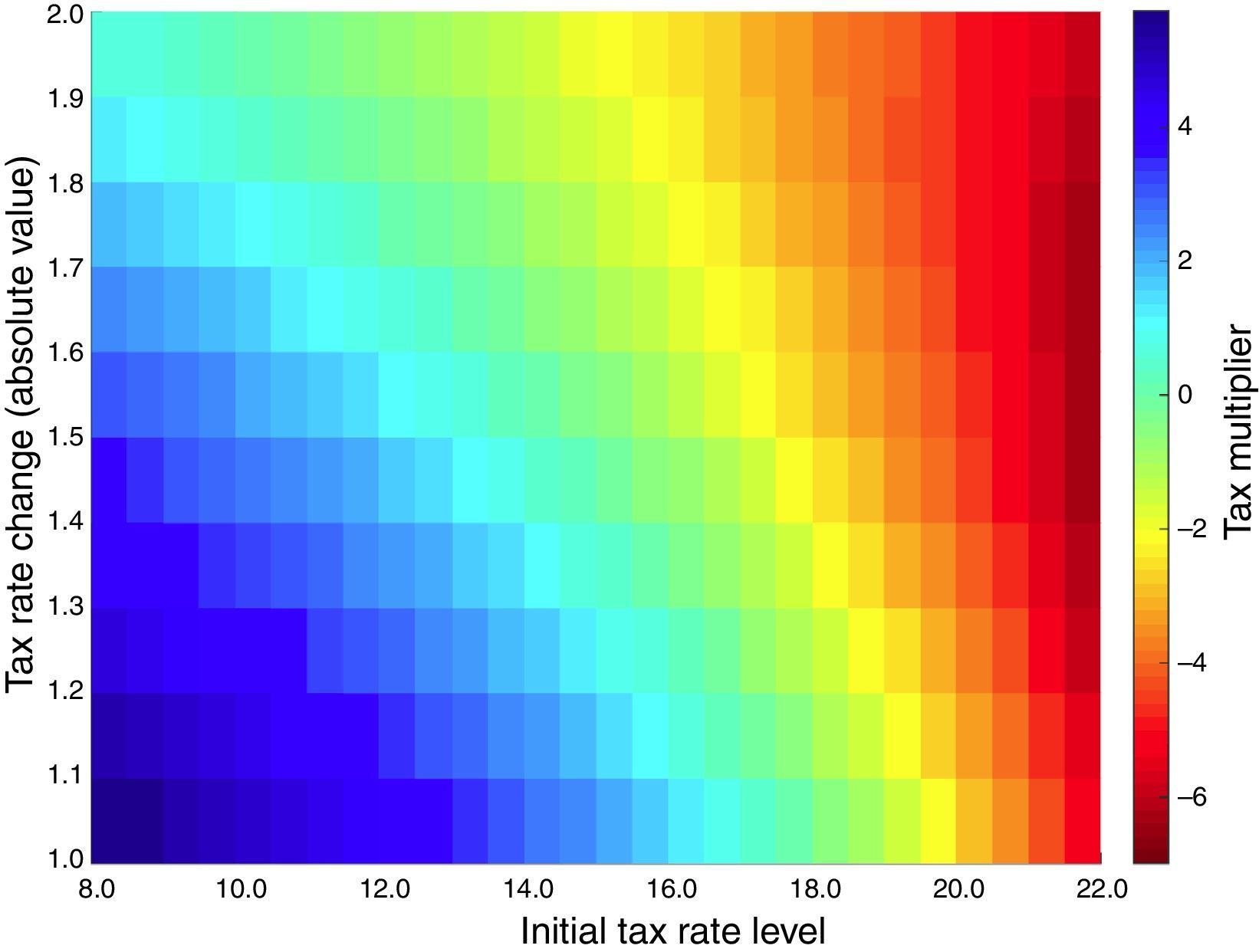

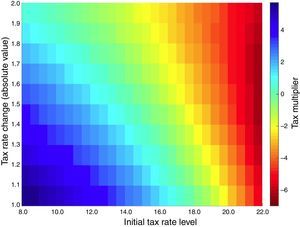

Finally, Fig. 12 shows what is essentially a 3D graph (but with the vertical dimension being captured by different colors), which depicts the size of the tax multiplier as a function of both the initial tax rate and the size of the tax rate change. The size of the tax multipliers is given by the color scale pictured in the plot with blue capturing the lowest values and red the highest. The plot speaks for itself, as we can clearly see that the largest multipliers result when initial tax rate levels are high and tax rate changes are large.

5ConclusionsOur paper contributes to the empirical literature on tax multipliers. First, we examine the issue of how to measure tax policy (i.e., obtaining a tax policy variable that is under the direct control of policymakers). Our results strongly support the use of tax rates as a true measure of tax policy, as opposed to widely used revenue-based measures. In particular, we argue that the most commonly used measure of tax policy – cyclically adjusted revenues – is actually a poor proxy for tax policy and yields misleading results. Second, we re-examine the issue of the identification of exogenous fiscal policy shocks (i.e., fiscal policy changes that are not the result of policymakers responding to output fluctuations). Based on a global sample of 35 countries, our findings support Romer and Romer's (2010) narrative approach as a more convincing strategy than SVARs à la Blanchard–Perotti to truly identify exogenous fiscal shocks. When properly measured and identified, tax rate increases are always contractionary, with a multiplier of about 2 (in absolute value) in both industrial and developing countries. In contrast, if cyclically adjusted revenues are used, multipliers turn out to be essentially zero.

Conflicts of interestThe authors declare that they have no conflict of interest.

See, among many others, Auerbach and Gorodnichenko (2013), Barro and Redlick (2011), Hall (2009), Ilzetzki et al. (2013), IMF (2010), Perotti (2011), and Ramey (2011).

Paper prepared for the conference on “Policy lessons and challenges for emerging economies in a context of global uncertainty,” held in Cartagena, October 3-4, 2016, organized by the Banco de la Republica (Colombia), the Bilateral Assistance and Capacity Building for Central Banks Program at the Graduate Institute (Geneva) and the Swiss Secretariat for Economic Affairs.

Invited article.

Unless otherwise noticed, this review is based on Vegh and Vuletin (2015), Gunter, Riera-Crichton, Vegh, and Vuletin (2016) and Riera-Crichton et al. (2016).

See, for instance, Gavin and Perotti (1997), Kaminsky, Reinhart, and Vegh (2004), and Talvi and Vegh (2005).

See, for example, Roubini and Sachs (1989), Poterba and Rotemberg (1990), and Edwards and Tabellini (1991).

The inflation tax is computed as π/(1+π), where π is the inflation rate.

Throughout this paper, a positive (negative) correlation between the cyclical components of tax policy and real GDP is defined as countercyclical (procycical) tax policy.

It would not be farfetched to speculate, also, that the countercyclicality of the inflation tax in industrial countries is not due to discretionary policy but rather to “Keynesian” inflation (i.e., aggregate demand hitting capacity constraints pushes inflation up in good times and lack of aggregate demand brings inflation down in bad times).

See van den Noord (2000) for a detailed analysis of the methodology associated with computing cyclically adjusted fiscal accounts.

The parameter η can, of course, be estimated from the data. For example, based on indirect taxation, van den Noord (2000) estimates values of η for 14 European countries (with an average of 0.9).

In both cases, tax shocks were identified using the IMF's (2010) fiscal consolidation narrative, supplemented by our own.

See, for example, Frankel et al. (2013), and the references therein.

Data limitations on the share of transactions covered by each VAT rate prevented us from doing this for more countries.

See, in particular, Ramey and Shapiro (1998) and Ramey (2011).