The integration of emerging economies in world financial markets allowed these countries to import foreign capital. In some cases, however, the capital inflows have been interrupted by sudden reversals and severe financial crises. Although excessive borrowing is a necessary condition for a financial crisis, the dynamics leading to excessive borrowing and subsequent reversal can also be connected to external factors, that is, changes that take place in the rest of the world and are not under the control of the borrowing country (external risks). In this article I discuss some of these risks. In particular, I show how the growth of the financial sector in advanced economies can lead to the build up of imbalances that increase the financial fragility of emerging countries. I also discuss how the origin of the imbalances can sometimes be connected to the business cycle in industrialized countries.

La integración de las economías emergentes en los mercados financieros internacionales ha permitido que estos países importen capital externo. No obstante, en algunos casos la afluencia de capitales se ha visto interrumpida por retornos repentinos y crisis financieras importantes. Si bien el préstamo excesivo es una condición necesaria para una crisis financiera, las dinámicas que conducen al préstamo excesivo y posterior retorno del capital podrían estar conectadas con factores externos, esto es, cambios que tienen lugar en otros lugares del mundo y se escapan del control del país prestatario (riesgos externos). En el presente artículo se debaten algunos de estos riesgos. En concreto se muestra cómo el crecimiento del sector financiero en las economías avanzadas podría generar desbalances que aumenten la fragilidad financiera de los países emergentes. También se debate acerca de cómo el origen de los desbalances podría estar vinculado al ciclo económico en los países industrializados.

The last 30 years have been characterized by a dramatic increase in the international integration of financial markets. The process of financial integration involved not only industrialized countries but also emerging economies. For many of these countries financial integration has been associated with an acceleration of economic growth, sometimes interrupted by severe financial crises. Because of the sudden stops, the benevolent view about the benefits of financial integration has been severely questioned. In this article I discuss some of the risks that an economy faces when it becomes integrated in international financial markets. In particular, I discuss the ‘external’ risks to which the country would be exposed once it liberalizes its capital account. For external risks I mean changes that, although they take place outside the integrated country, they are at the origin of a dynamic process that could culminate in a crisis in the integrated country.

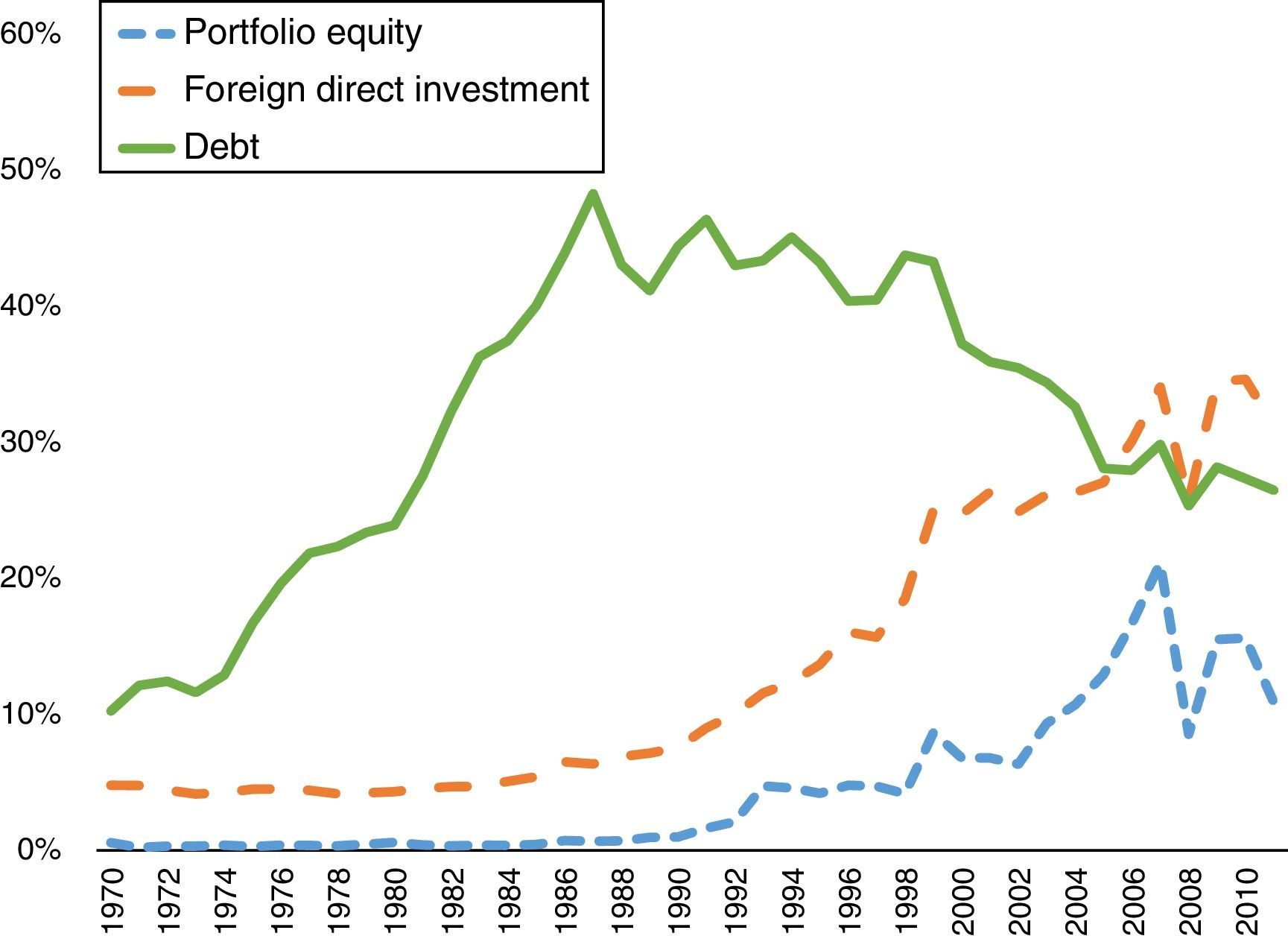

In order to understand how external changes affect the economy of integrated countries, we have to understand the implications of financial integration for the functioning of global financial markets. The first implication of financial integration is that it allows a country to ‘export’ their liabilities, that is, to borrow from foreign countries. Fig. 1 plots the foreign liabilities of emerging countries in percentage of their GDP since 1970. Three types of liabilities are plotted: portfolio equity, foreign direct investment and debt instruments. As can be seen from the figure, the sum of the three instruments has grown substantially during the last 40 year. The composition has also changed: during the 1980s the growth was mostly in debt instruments which include government debt while the subsequent growth is mostly driven by portfolio equity and foreign direct investments. Still, debt instruments remain an important component of the foreign liabilities for emerging countries in recent years.

Foreign liabilities of emerging countries as a percentage of GDP. Emerging countries include Argentina, Brazil, Bulgaria, Chile, China, Hong Kong, Colombia, Estonia, Hungary, India, Indonesia, South Korea, Latvia, Lithuania, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Romania, Russia, South Africa, Thailand, Turkey, Ukraine, Venezuela. Sources: World Development Indicators (World Bank) and External Wealth of Nations Mark II database (Lane & Milesi-Ferretti, 2007).

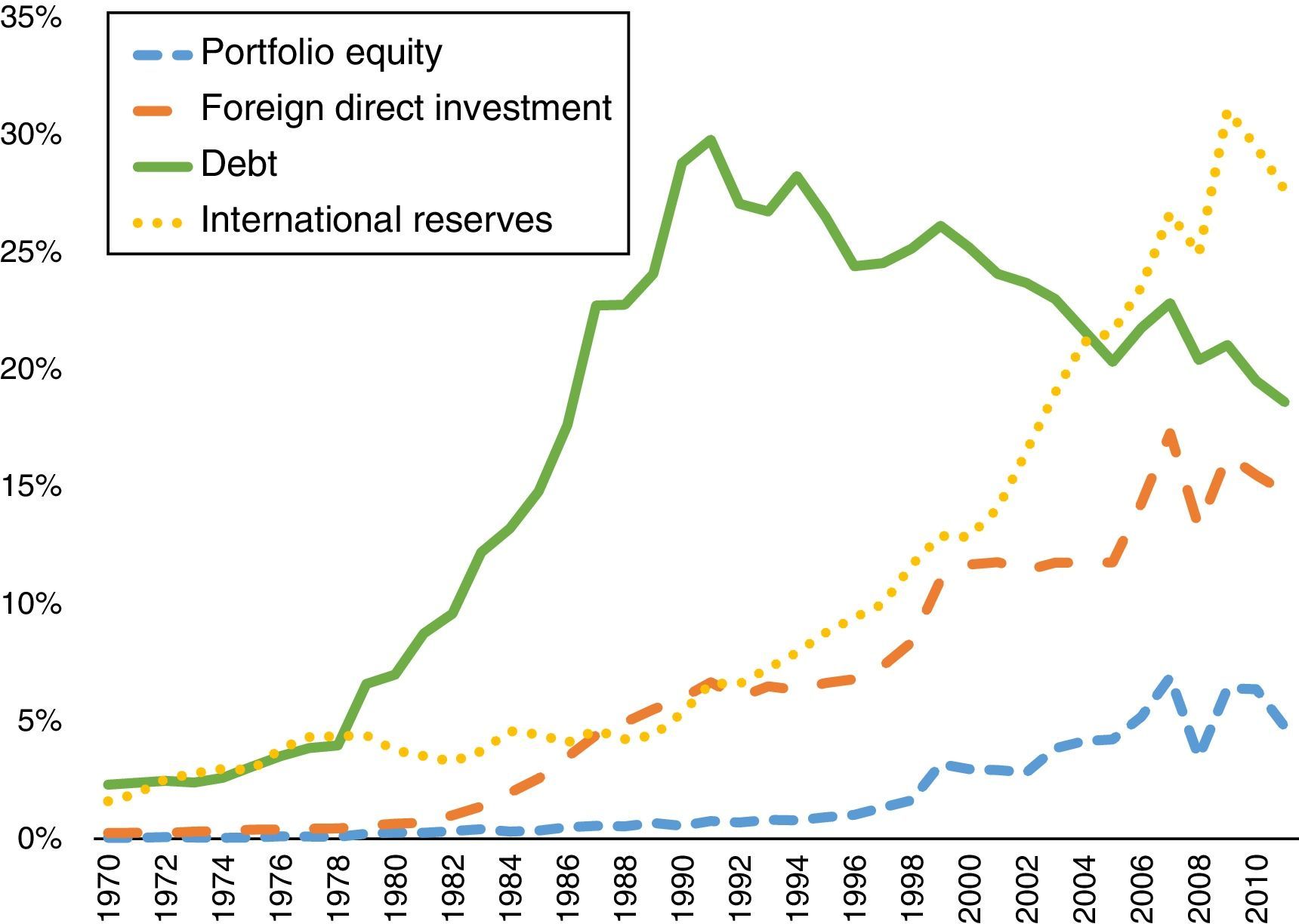

Financial integration also allows countries to ‘import’ foreign assets as domestic residents increase the holding of securities issued by foreign countries. Fig. 2 plots the emerging countries ownership of foreign assets since 1970. Four types of assets are plotted: portfolio equity, foreign direct investments, debt instruments and international reserves. As can be seen from the figure, the ownership of foreign assets has increased dramatically since the early 1980s. Also for foreign assets we observe that the early growth was mostly driven by debt instruments while in the 1990s and 2000s the other classes of foreign assets played a dominant role. The growth of international reserves was especially important.

Foreign assets of emerging countries as a percentage of GDP. Emerging countries include Argentina, Brazil, Bulgaria, Chile, China, Hong Kong, Colombia, Estonia, Hungary, India, Indonesia, South Korea, Latvia, Lithuania, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Romania, Russia, South Africa, Thailand, Turkey, Ukraine, Venezuela. Sources: World Development Indicators (World Bank) and External Wealth of Nations Mark II database (Lane & Milesi-Ferretti, 2007).

The two figures illustrate an important trend in global financial markets, which is a natural implication of financial integration: the cross-country diversification of financial portfolios. This article shows how international diversification of portfolios affects the vulnerability of emerging countries to changes that take place outside these countries (external risk).

2Sovereign defaultAlthough financial crises do not always involve difficulties in the refinancing of sovereign debt, in many cases government liabilities, directly or indirectly, play a central role. Sometimes because a large portion of government debt is held by foreigners. In other cases because there is the expectation that the government has to increase its liabilities to alleviate the consequences of a crisis. It is then natural to ask how the international diversification of portfolios affects: (i) the incentive of governments to default on sovereign debt; (ii) the international transmission of the macroeconomic costs of default (spillover); (iii) the benefits (ex-post and ex-ante) for the creditor countries to bail-out defaulting countries. These questions are addressed in Azzimonti and Quadrini (2016).1 Here I illustrate and summarize the main findings with a stylized model starting with the impact of portfolio diversification on government default.

2.1Incentive to defaultFinancial globalization allows also the government to export its sovereign debt, that is, to sell it to foreign investors. Of course, if a larger share of sovereign debt is held by foreigners, the government's incentive to default increases since it redistributes wealth from foreign residents to domestic residents. This mechanism is well recognized in the literature although Broner, Martin, and Ventura (2010) challenge its relevance. Azzimonti and Quadrini (2016), however, explores a different mechanism through which financial diversification increases the incentive of a country to default: in addition to redistributing wealth, the domestic ‘macroeconomic cost’ of default is smaller when domestic agents are internationally diversified.

Why is the macroeconomic cost of default smaller when the country is financially diversified? The central mechanism is the disruption of financial markets induced by default. When a government defaults on its debt, the holders of government debt incur capital losses. Since the financial wealth held by domestic agents affects their economic decisions, capital losses have negative effects on aggregate economic activity.

To illustrates this mechanism I outline a simple one-period model with two countries: ‘home’ country and ‘foreign’ country. In each country there are three sectors: the household sector, the producer sector and the government. The home country starts with public debt Bh and the foreign country starts with debt Bf. The public debt is held by the producer sector. To repay the debt the governments of the two countries raise taxes from households. The government then chooses how much to repay and, given the repayment, the taxes to collect from households.

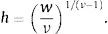

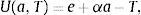

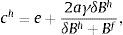

Household sector: Households are the supplier of labor to producers with utility c−hν, where c is consumption and h is the working time that earns the equilibrium wage w. Consumption is determined by the budget constraint c=e+hw−T, where e is the household's endowment and T are lump-sum taxes charged by the government to repay the public debt. The taxes will be determined by the optimal choice of the government which will be characterized below. The only choice made by households is the supply of labor. Using the first order condition the labor supply is

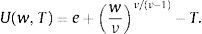

Therefore, higher is the wage rate and higher is the supply of labor. Substituting the supply of labor in the utility function, the indirect utility of households can be written as

This shows that the welfare of households increases with wages but decreases with taxes.

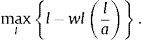

Producer sector: There is a continuum of entrepreneurs who produce with the input of labor using the production function y=l, where l is the input of labor. A special feature of this model is that the cost of production decreases with the financial wealth of the entrepreneur. To capture this idea I assume that the cost of labor decreases with the entrepreneur's wealth a. More specifically, the effective cost of labor is wl(l/a). The term wl is the direct cost of labor (workers’ payout), while l/a captures the indirect financial cost of hiring labor.

The entrepreneur maximizes profits by solving

The first order condition for this problem allows us to derive the demand of labor,which is linear in the financial wealth of entrepreneurs.Azzimonti and Quadrini (2016) provides a micro-foundation for this property of the labor demand which derives from the riskiness of production and market incompleteness: Since the input of labor is risky, higher is the scale of production and higher is the risk incurred by entrepreneurs (in terms of consumption smoothing). The uninsurability of these risks then implies that entrepreneurs with lower wealth will hire fewer workers. In this article, however, I abstract from the micro-foundation in order to keep the analysis simple and I will work directly with a reduced form of this mechanism.

Substituting the labor demand in the objective of the entrepreneur we obtain the profit a/4w. Thus the indirect utility of entrepreneurs, equal to consumption, is

This shows that the welfare of entrepreneurs increases with financial wealth and decreases with the wage rate.

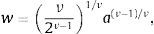

Labor market equilibrium: The equilibrium in the labor market is derived by combining the supply of labor, Eq. (1), with the demand of labor, Eq. (3). Imposing that the supply of labor is equal to the demand, h=l, we derive the equilibrium wage

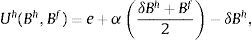

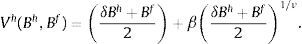

which is increasing in the wealth of entrepreneurs. Finally, using Eq. (5) to eliminate the wage rate w in the indirect utilities of workers and entrepreneurs, Eqs. (2) and (4), we can write the welfare for households and entrepreneurs, respectively, aswhere α=(ν−1)/2ν and β=1/[ν1/ν2(1+ν)/ν] are functions of parameters.These expressions make clear that the welfare of households is decreasing in taxes but increasing in the wealth of entrepreneurs. The positive dependence from the entrepreneurs’ wealth is because this increases the demand of labor and, therefore, households earn higher wages. The welfare of entrepreneurs is strictly increasing in their wealth which is intuitive.

Government objective: The dependence of the utilities of households and entrepreneurs from the wealth of entrepreneurs a plays an important role in the choice of the optimal government policies. In the model the only assets that entrepreneurs can hold are government liabilities, Bh and Bf, and for the optimal government policies it matters whether these liabilities are held by home or foreign entrepreneurs.

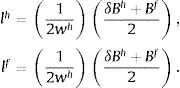

Suppose that entrepreneurs in home and foreign countries are perfectly diversified, that is, a=(Bh+Bf)/2. Furthermore suppose that the foreign country f commits to repay its debt while the home country h can choose to default and repay less than Bh. Denoting by δ the fraction repaid by the home country, the taxes that home households have to pay are Th=δBh. Then the welfare of households and producers in the home country can be rewritten as

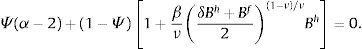

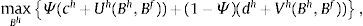

The government maximizes the weighted utility of households and entrepreneurs with Ψ the weight assigned to households, that is,

The first order condition for the unconstrained problem, that is, without the constraint δ≤1 is

This condition shows that higher is the foreign debt Bf and lower is the optimal repayment δ. If the optimal δ is smaller than 1, the government defaults and repays only part of the debt.

When financial markets are not integrated, the home country would not hold any foreign debt, that is, Bf=0 for the home country. In this case, if the government defaults, it redistributes wealth between domestic agents. Still, heterogeneity within a country implies that redistribution is not neutral for economic activity and aggregate welfare. This is similar to the study of D’Erasmo and Mendoza (2013). When financial markets are integrated (and portfolios diversified), domestic residents hold a smaller share of wealth in domestic assets and a larger share in foreign assets. This implies that, when the domestic government defaults, the wealth losses of domestic residents (and, therefore, domestic redistribution) are smaller. This causes a smaller macroeconomic contraction. Being the macroeconomic cost smaller, the incentive of the government to default increases.

The mechanism described above points out that it is not only the quantity of domestic debt held by foreigners that matters for the choice of a country to default but also the debt issued by foreign countries and held by domestic agents matters. Of course, the quantity of foreign debt held by domestic agents depends on the external supply of foreign debt. This introduces a channel through which the supply of foreign debt affects the incentive of a country to default: an increase in the issuance of debt by foreign countries implies that in equilibrium domestic agents will hold more of the foreign debt and they are more diversified. Higher diversification then implies that the macroeconomic cost of default is lower, which in turn increases the government incentive to default even if the quantity of domestic debt held by foreigners remains unchanged. Here it is important to emphasize that a similar mechanism would be at work if the debt is issued by the private sector. To the extent that the debt issued by the foreign countries represents a safe asset, domestic agents will be more diversified.

This mechanism introduces our first ‘external risk’ for emerging countries: financial expansions in advanced economies—either by the public sector or the private sector—increase the supply of financial assets purchased by emerging countries. Although this allows for greater macroeconomic efficiency (foreign assets provide additional liquidity that emerging countries may find difficult to produce internally), it also makes the macroeconomic cost of sovereign default smaller for these countries. This increases their governments’ incentive to default. Paradoxically, greater efficiency in the private sector (due to their diversification) could create the conditions for greater instability of the public sector.

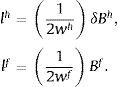

2.2Macroeconomic spillover and bailoutsGreater financial diversification also implies that the macroeconomic consequences of default spills to other countries. In fact, with greater financial diversification, all countries hold more external debt. Then, when the issuing country defaults, the domestic agents of the countries that hold the debt experience financial losses that generate a macroeconomic contraction in their countries. To see this more explicitly, consider the demand of labor (3). Since the entrepreneurs’ wealth in both countries is a=(Bh+Bf)/2, the demands of labor in the home and foreign countries are, respectively,

This makes clear that when the home country defaults (δ<1), the demand of labor falls not only in the home country but also in the foreign country. Without financial integration, instead, the demands of labor in home and foreign countries would be, respectively,

Therefore, the default of the home country would generate a larger macroeconomic recession in the home country but it would not have any consequences for the foreign country. This shows that financial diversification creates the conditions for real macroeconomic spillover across countries, which brings us to the second question addressed in this section, that is, how portfolio diversification affects the transmission of sovereign default to the real sector of other countries.

The macroeconomic spillover has important implications for bailouts: when a country defaults, the other countries may have an incentive to bailout the defaulting country in order to guarantee a higher repayment of the debt.

Bailouts can be thought as transfers that creditor countries negotiate with defaulting countries in compensation for a higher repayment of the debt. But expected future bailouts affect the choice of debt today, which introduces another external risk: anticipating bailouts, a country may have higher incentive to borrow which ex-post could trigger the crisis. This is the typical moral hazard problem frequently emphasized in academic and policy circles, which motivates the recommendation of ex-ante commitment against bailouts. But are bailouts always inefficient?

To answer this question we have to distinguish ex-ante (before a sovereign default materializes) and ex-post (after the crisis materializes and a country would default with certainty in absence of a bailout).

From an ex-post prospective bailouts are likely to be efficient, that is, all countries could benefit from reaching an agreement that avoids default or guarantees a higher partial repayment. This is especially true in the environment considered here where default in the home country generates macroeconomic costs also in the foreign country. The question, however, is whether bailouts are also efficient ex-ante, that is, before a country ends up in a default state. Azzimonti and Quadrini (2016) show that bailouts could be welfare improving also ex-ante. This is because they correct for an externality that emerges from the uncoordinated governments’ choice of public debt.

2.3Issuance of public debtTo understand the source of the externality, I now extend the model by adding an earlier period when the debt is issued. So now we have two periods: period 1 and period 2. Period 2 is exactly as described in the previous subsection. In period 1, the government of the home country chooses its debt Bh. For simplicity the debt issued by the foreign country is exogenous. The revenues from issuing the debt are transferred to households. The entrepreneurs will choose how much to save out of their endowment in period 1 and allocate the savings between home and foreign bonds.

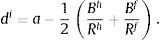

To keep the analysis simple, I assume that entrepreneurs save a constant fraction γ of their endowment in period 1. Furthermore, home and foreign entrepreneurs choose the same allocation of savings in home and foreign bonds. Under these assumptions, the consumption of households and entrepreneurs in period 1 are

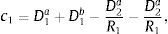

The superscript i denotes the country (home or foreign); Ri is the gross interest rate paid on the debt issued by country i; e is the endowment of households and a is the endowment of entrepreneurs. The consumption of households is equal to their endowment plus the transfer from their government. The consumption of entrepreneurs is equal to their endowment minus their purchases of government bonds. Since I assumed that home and foreign entrepreneurs choose the same composition of portfolio, bond holdings are equal to the global issuance of debt divided by 2. Therefore, in equilibrium we must have

The left-hand-side is the worldwide issuance of bonds. The right-hand-side is the worldwide demand of bonds which is equal to the sum of savings of home and foreign entrepreneurs. Since the home government could default in period 2 and this is fully anticipated in period 1, the home and foreign interest rates must satisfyThe fraction repaid in period 2 δ is determined by solving the optimization problem in period 2 as characterized earlier. As we have seen, the default decision depends on the debt of both countries. Given Bh and Bf and the anticipated repayment δ, conditions (12) and (13) determine the equilibrium interest rate R.

The above equations allows me to rewrite the consumption of households and entrepreneurs in the home country in period 1 as

Therefore, the consumption of home households in period 1 increases in Bh (given the debt Bf issued by the foreign country) while the consumption of home entrepreneurs is independent of it.

We are now ready to construct the objective function of the home government in period 1. Given the weight Ψ assigned to households, the home government solves the problem

where ch and dh are defined in (14) and (15), while Uh(Bh, Bf) and Vh(Bh, Bf) are defined in (8) and (9).From the prospective of the home government, issuing more debt δBh in period 1 has positive and negative welfare effects. Let us start with period 2 welfare. Higher debt allows for higher wages earned by households (positive effect) but also higher repayment from households (negative effect). This is shown by the two terms in Eq. (8). The next period utility of entrepreneurs, instead, increases unambiguously (see Eq. (9)). Notice, however, that the positive effects of δBh on workers and entrepreneurs in period 2 is multiplied by 1/2. Instead, the repayment cost for workers is multiplied by 1. This is because half of the debt is purchased by foreigners and, therefore, the positive macroeconomic effect of higher government debt is shared with the foreign country. The repayment of the debt, instead, must be incurred in full by home households. This shows that, in an integrated economy, the future benefits from issuing debt declines when the economy is financially integrated.

Let us consider now the welfare effects in period 1. Entrepreneurs's consumption in period 1 is unaffected by the issuance of debt. However, workers do benefits from higher issuance of debt. Even if global savings from entrepreneurs do not change, when δBh increases, a larger fraction of these savings are allocated to the bonds issued by the home country (and a lower fraction is allocated to foreign bonds). This allows the home country to make more transfers to domestic households which increases their consumption. The positive effect on households does not arise in a closed economy.

Placing together the welfare effects in period 1 and period 2, we conclude that in an integrated economy the future net benefits from issuing debt are lower but the immediate benefits are higher. Therefore, whether financial integration leads to more or less issuance of debt depends on the parameters of the model. Azzimonti and Quadrini (2016) provides an example in which financial integration reduces the equilibrium debt. This implies that worldwide financial assets are inefficiently low. But then, the anticipation of bailouts could provide the incentive to issue more debt which could compensate, at least in part, for the scarce supply of financial assets.

3Seeking for yieldsFinancial markets are extremely fluid. In absence of capital controls, funds move quickly from one type of investment to another type and across countries. The facility with which funds can be transferred poses important risks for emerging countries that takes the form of a sudden reversal. But why do funds move to emerging countries for then suddenly moving away from these countries? Here I describe some typical patterns or mechanisms.

When the economies of industrialized countries slow down, it becomes more difficult for these economies to generate satisfactory returns to financial investments. Investors, then, start looking for alternatives which in some cases seem to be located in emerging economies. For example, the oil crisis of the 1970s and the consequent economic difficulties faced by industrialized countries created the conditions for a flow of investments in Latin America. To some extent, a similar pattern took place after the 2008–2009 crisis.

The inflow of funds to emerging countries tend to have beneficial effects at first. It generates an economic boom that positions the receiving countries on a higher growth trend. This reinforces the interest of foreign investors in a spiral that could feature self-fulfilling prophecies: expectations of high yields induce higher investments which cause the yields to raise (at least temporarily) which in turn increases the inflow of capital in emerging countries and so on.

Few would disagree that the inflows of capital have positive macroeconomic effects at first (although some would disagree on the distributional equity of the benefits). However, as the inflows continue, some negative consequences or imbalances start to build. The first is the appreciation of the exchange rate (provided that the country is in a regime of flexible exchange rates). The second is a mis-allocation of investments that in the long run reduces their return. Both trends create the conditions, in the medium term, for the unsustainability of the inflows.

The problem with an appreciated currency is that it eventually leads to trade deficits. But persistent trade deficits may signal the limited ability of a country to repay the foreign investors. After all, in an international context, foreign repayments will eventually require trade surpluses, that is, the country must export more than it imports. But when the market does not see a reversal in the trade accounts from deficits to surpluses, it starts to worry about repayment and this could stop the inflow of funds that at this point are badly needed to finance the trade deficits. This mechanism may have played a significant role in the 2001 crisis in Argentina.

The second trend (mis-allocation) could also trigger a crisis. When the cost of funding is low, it becomes optimal to invest in marginal projects, that is, projects with lower returns. In some instances, governments play a central role. For example, before the 1997 Asian crisis, the governments of certain Asian countries provided guarantees for loans made by banks to the private sector. The effect was to reduce the financing cost with subsequent over-investments funded by foreign money. A similar story took place in Ireland before the 2008 crisis. In other cases foreign capital finances directly government spending. Political cycle tends to induce myopia in policy making. Because of the imminence of elections, the focus of policies tilts toward the short-run. As a result, long-term projects are postponed and spending is tilted toward consumption. Easy foreign borrowing facilitates this process. But as long-term projects are postponed, the fundamentals of the country do not improve and, eventually, it becomes evident to foreign investors. Again, the effect is a sudden reversal with all the consequences that we are accustomed to see during financial crisis.

The mechanism described above suggests that the fundamental factors leading a country to experience financial problems reside in some internal deficiencies, specifically, problems with internal policies. However, these problems become especially important when advanced economies turn their interest in emerging economies in search of yields. This is the sense in which the economic cycle of advanced economies could be a major risk for emerging countries.

4ContagionContagion is today recognized as a major external risk for countries that are financially integrated. For example, this was a major concern in the discussion on how to address the debt crisis in Europe. But the idea that contagion could be a major risk for countries integrated in world financial markets is relatively new and it became apparent only after the 1997 Asian crisis. What are the mechanisms through which difficulties encountered by one or few countries spread to other countries? Is this the result of self-fulfilling prophecies where investors conjecture that difficulties observed in one country signal difficulties in other countries even if there are not strong direct cross-country links? Or are there more fundamental reasons for contagion? The view that contagion could be the result of self-fulfilling expectations is prominent in the literature. In this article, however, I would like to emphasize mechanisms that are based on more fundamental channels.

One idea is that emerging countries borrow in international market and their debt is priced by common investors in industrialized countries. But these investors are not perfectly diversified and, therefore, the lack of repayment of one single emerging country affects the price charged to other emerging countries. Thus, the default of one country generates a higher borrowing cost for other countries which could make the debt unsustainable in these other countries. See Lizarazo (2012, 2013) and Volkan (2008).

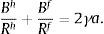

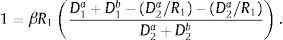

To illustrate this mechanism, consider an economy with two emerging countries (country a and country b) that borrow from an international investor who values consumption according to the utility log(c1)+log(c2).

The economy lasts for only two periods and the two emerging countries enter period 1 with debt D1a and D1b. In period 1 they issue new debt D2a/R1 and D2b/R1, where R1 is the gross interest rate. Here I assume that D2a and D2b are fixed. Therefore, an increase in the interest rate R1 implies lower consumption today. By fixing the debt that the two countries need to issue in period 1 (specifically, D2a and D2b), I abstract from the optimization problem solved by the two emerging countries.

The consumption of international investors is

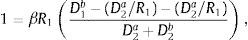

Since the debt is priced by international investors, the interest rate satisfies the Euler equation 1=βc1/c2. Replacing c1 and c2 using (17) and (18), the euler equation can be written as

Now suppose that the two emerging countries could default in period 1. However, they can credibly commit to repay in period 2. If country a chooses to default in period 1, that is, D1a=0, the consumption of the international investors in period 1 will fall. Therefore, the euler equation for the international investors changes to

which implies an increase in the interest rate R1. But the higher interest rate now means that country b has to pay a higher interest rate which implies lower consumption today (since D2b is assumed to be fixed by assumption, the funds raised in period 1, D2b/R1, decline with the interest rate). This could induce country b to also default.In this example contagion arises from the pricing of the debt. But the pricing could also change for reasons that are external to emerging countries. Monetary policy in industrialized countries could be an important factor. Loose monetary policy, like the one conducted by industrialized countries in the aftermath of the 2008 crisis, decreases the interest rate and could generate the search for higher yields in emerging countries. This is similar to the mechanism discussed in the previous subsection. But when monetary policy reverts its action and becomes contractionary, the interest rate in industrialized countries increases which would make the cost of heavily indebted countries unsustainable. Although it is the excessive borrowing that makes the debt unsustainable, the interest jump induced by external factors is what triggers the crisis.

Arellano and Bai (2014) proposes another mechanism through which the default of one country could trigger default in another country. Countries are linked by sharing the same lenders. By defaulting together, countries can renegotiate better conditions with the lender. With this mechanism, however, contagion plays more a role of external opportunity than external risk.

5ConclusionIn this article I have discussed several external factors and mechanisms that could induce a financial crisis in emerging countries when they are integrated in world financial markets. It becomes then natural to ask whether emerging countries could be better off limiting the degree of financial integration. Of course, if countries do not liberalize their capital account, they remain insulated from the external risks discussed in this article. This may suggest that financial liberalization is not the best option for these countries.

Before jumping to this conclusion, however, we also need to recognize that countries also benefit from financial integration. Although these benefits have not been formalize in this article, they could be very substantial. For example, Caballero, Farhi, and Gourinchas (2008) argue that emerging countries may lack the ability to create financial assets that can be held by savers. Then, access to international financial markets allows savers to hold more financial wealth. This improves the efficiency of these economies along the lines illustrated with the model presented in the first part of this article. Financial integration also allows for the inflow of certain type of capital that could facilitate growth more directly as in the case of FDI. Finally, access to foreign financial markets allows for international risk sharing.

When all the potential benefits are taken into consideration, financial liberation may still remain the preferred option but managing the external risks with appropriate regulatory measures may be desirable. In practise, however, strict regulatory provisions may have the effect of reducing the effective degree of capital market integration. Therefore, although the management of external risks may be desirable, its practical implementation might be extremely challenging.

Conflict of interestsThe author declares that they have no conflict of interest.

Invited Article.

This paper extends the model developed in Azzimonti, de Francisco, and Quadrini (2014) by allowing for endogenous aggregate production and equilibrium default. The extension with endogenous aggregate production allows to study the macroeconomic effects of default and its international spillover.