Small and medium-sized firms (SMEs) face serious challenges in order to be competitive, and they need to develop strategies enabling them to control their costs. This work aims to analyze and evaluate the impact, penetration and characteristics of Activity-Based Costs (ABC). This research is of a quantitative type descriptive design, with a sample of 180 SMEs. The results show low penetration of the ABC in SMEs using traditional systems, due to the lack of knowledge, and that there are enterprises that do not use any costing system at all. Finally the Mexican SMEs recognize the compatibility and usefulness of ABC, and that the most important fact is to understand the possible application of different costing methodologies for different purposes.

Las pequeñas y medianas empresas (Pymes) enfrentan grandes retos en materia de competitividad, siendo necesario desarrollar estrategias que les permitan controlar sus costes. Este trabajo tiene por objetivo analizar y evaluar el impacto, penetración y características de los costes basados en actividades (ABC). Esta investigación responde a un diseño descriptivo de carácter cuantitativo, con una muestra de 180 empresas. Los resultados muestran la baja penetración del ABC por desconocimiento de las Pymes que utilizan sistemas tradicionales y que hay empresas que no utilizan sistemas de costeo. Por último, las Pymes mexicanas reconocen la compatibilidad y utilidad del ABC y que lo más importante es la necesidad de entender la posible aplicación de diferentes metodologías de costeo para diferentes propósitos.

As pequenas e médias empresas (PMEs) enfrentam grandes desafios em matéria de competitividade, sendo necessário desenvolver estratégias que lhes permitam controlar os seus custos. Este trabalho tem como objectivo analisar e avaliar o impacto, penetração e características dos custos baseados em actividades (ABC). Esta investigação responde a um plano descritivo de carácter quantitativo, com uma amostra de 180 empresas. Os resultados mostram a baixa penetração do ABC por desconhecimento das PMEs que utilizam sistemas tradicionais e que há empresas que não utilizam sistemas de poupanças. Por último as PMEs mexicanas reconhecem a compatibilidade e utilidade do ABC e que o mais importante é a necessidade de entender a possível aplicação de diferentes metodologias de poupança para diferentes propósitos.

The activity-based costing system began as a response to the lack of information regarding companies’ needs to achieve competitive costs and their inability to do so with traditional cost systems. The new system, created and spread by Kaplan & Cooper since mid-1980 (Kaplan & Cooper, 1988, 1991), changed the way of thinking about the usefulness of the cost system for decision making. From the academic viewpoint, it has represented an advance in knowledge. As such, it has been recognized by various authors in their research works and in their published work they have given evidence of the advantages of this system to manage costs (Baykasoğlu & Kaplanoğlu, 2008; Camaleño, 1997; Cárdenas, 2006; Carmona, 1993; Castellanos, 2003; Cavero & Trigueros, 2001; Cuevas, Chávez, Castillo, Caicedo & Solarte, 2004; Garbey, 2003; Granof, Platt & Vaysman, 2000; Hansen & Mowen, 2003; Hernández, Alfaro & Zamudio, 2006; Horngren, Sundem & Selto, 1994; Ittner, 1999; Muñoz & Cano, 2004; Ríos, 2011; Shank & Govindarajan, 1995; Stapleton, Sanghamitra, Beach & Poomipak, 2004; Stefano, 2011, etc.). Likewise, company managers have been interested in this philosophy and have sought to implement its methodology as an efficient help in increasing their competitiveness and developing strategies enabling them to control costs.

However, implementing it has led to a much more limited success than expected, with many failing in the attempt due to coming up against internal and external problems which could be as follows: (a) the system not properly fitting in with the organizational structure; (b) the firm's management has doubts as to whether the system can provide information for decision-making; (c) compatibility problems between financial accounting, analytical accounting and administrative control; (d) problems of rising indirect costs; and (e) problems of a fiscal nature or with auditing, etc. This situation has occurred even more in small and medium-sized firms (SMEs) since they have fewer resources than big firms, while facing the same competitive challenges in a globalized business world. For this reason, the authors of the work wished to ascertain whether, a quarter of a century after ABC was circulated on a worldwide basis, this methodology has been consolidated in business practice and especially in SMEs. This would make it possible to ascertain that ABC has become aligned with this social framework and has had a social repercussion.

Therefore, the aim of this work is to analyze to what extent the cost system according to activities has been implanted in SMEs and what has brought this about. For this purpose the small and medium firms of Mexico have been chosen for study where these firms account for more than 90% of the business fabric, a percentage comparable to that of many countries. Moreover, existing studies have previously been published on this topic in this country, and this leads us to think that the topic is a relevant one and can be taken as a point of reference for a comparison of the results obtained.

The analysis has been carried out with a sample of 180 firms, from which the greatest number of replies came from the industrial sector (46%), followed by the service sector (36%) and the commercial one (18%). The number of small companies taking part was the same percentage as that for medium-sized ones (50%), and the analysis was sent to directors, both managing directors and managers and those responsible for cost and accounting processes.

An analysis was performed of the characteristics of the production systems used by Mexican SMEs in terms of both their production volume and product range, the cost systems they adopted and what they were used for. Also analyzed were the use of information technologies in cost calculating, the reasons for implementing ABC, and the problems they had had in adopting it.

The findings from the work show that only 7.22% of the Mexican SMEs have put this methodology into practice and 54% of them are small firms, unlike what could be assumed with regard to the availability of resources and the view of the business held by the medium-sized firms. Another important aspect is that 66% of the SMEs using traditional systems were unaware of ABC methodology, even though all those questioned had knowledge of accounting and costs. This indicates that knowhow has not been updated as far as adopting methodology to improve the business is concerned. When asked why they did not use the ABC, there were many different replies, among the most significant of which are the loss of importance of the cost structure; the difficulty involved in fitting the activity-based costing and activity-based management (ABC/ABM) into their organizational structure; high costs involved in implementing ABC; problems in adapting to the firm's information system and accounting problems with the general accounting system.

Among difficulties encountered in putting it into practice it is important to mention problems in choosing activities and interpreting results; and complexity in acquiring data and problems related to auditing and fiscal aspects. However, in spite of these difficulties Mexican SMEs consider that applying ABC in combination with methods based on organic centres is compatible and useful. This shows us that in cost methodology, the usefulness lies not in the alternative methods but in understanding that it is possible to apply different cost methods for different purposes.

This research responds to a descriptive and quantitative design, and the main goal is to determine whether the ABC system has been accepted in firms, and the proportion of its use compared to the traditional systems. Likewise it aims to ascertain whether there exists unawareness of the ACB/ABM system among Mexican SMEs, and also whether its adoption is related to the increase in indirect costs.

This work is structured as follows: Section 2 reviews opinions on the ABC/ABM systems in the academic field and publications on ABC systems in Mexican SMEs; Section 3 is devoted to the methodology applied and Section 4 analyses data and findings, ending with conclusions.

2Theoretical frameworkThe theoretical framework utilized in this study is composed of the most relevant international academic publications on this subject and practical experiences resulting from applying activity-based costing in Mexican small and medium enterprises. Both are described in the following sections.

2.1System of activity-based costing and activity-based management in the academic worldThe methodology of the ABC system was created in the U.S. by Kaplan and Cooper (1988, 1991) and developed by Miller and Vollman (1985). This philosophy changed the way academics and managers thought about the usefulness of cost information systems in both private and public organizations. Furthermore, company directors saw the need to discover a new way of managing organizations to make them more competitive and focus on the concept of the chain of value as a valid instrument for customers and users. Thus, the philosophy of the ABC system has been shown to be a valid instrument since it identifies the processes in the chain of value and assigns costs by specific activities related to the product, the service, the customer, programme or project. This helps in analyzing profitability, efficiency and cost control of the firm as a yardstick for comparison with competitors. Based on the method established by Kaplan and Cooper, several authors have established the steps to be taken in the methodology needed for putting it into practice in organizations, according to size and/or sector (Adams, 1996; Fernandes, Vilarinho, Euclen de Carvalho & Euclen de Carvalho, 2008; González & Morini, 2007; Granof et al., 2000; Lin, Collins & Su, 2001; Mallo & Jiménez, 1997; Millán & Muñoz, 2005; Muñoz & Cano, 2004; Muñoz, Cano & Chamizo, 2011; Prieto, Santidrián & Valladares, 2007; Ríos & Rodríguez-Vilariño, 2010; Ríos, Rodríguez-Vilariño & Ferrer, 2012; Robleda & Prieto, 2006). However when implemented, this cost management system has come up against a series of difficulties, which have reduced the optimistic expectations established by this methodology (Banker, Bardhan & Chen, 2008; Baykasoğlu & Kaplanoğlu, 2008; Camaleño, 1997; Carmona, 1993; Cavero & Trigueros, 2001; Cokins, 1996; Del Río, 2004; Garbey, 2003; Granof et al., 2000; Gunasekaran, 1999; Hernández et al., 2006; Stapleton et al., 2004). The fact is that ABC methodology establishes the basis for working in large corporations, although micro, small and medium-sized firms in Mexico, as in many other countries, accounting for more than 90% of Gross Domestic Product have found more difficulties when developing or implementing them. An attempt has been made to tackle this problem through researchers, who have developed and applied an ABC methodology for SMEs (Baxendale, 2001; Fladkjaer & Jensen, 2011; Gecevska & Anisic, 2006; Gunasekaran & Sing, 1999; Gunasekaran, Marri & Grieve, 1999; Hicks, 1999; Kostovska, Gecevska & Jovanoski, 2006; Majid & Sulaiman, 2008; Needy, Nachtmann, Roztocki, Warner & Bidanda, 2003; Roztocki, Valenzuela, Porter, Monk & Needy, 1999; Stefano, 2011), and also by firms specializing in ABC software which have designed an ABC system for SMEs as 3Com Technology (Vázquez, 2004) or by implementing the ABC model from SAS (OROS System) (Januszewski, 2008).

2.2Experiences in applying activity-based costing in Mexican small and medium enterprisesIn Mexico several studies have been published on firms which have adopted ABC methodology for SMEs in different sectors, such as printing firms (Mendiola & Peralta, 1999), small manufacturers of metal, aluminium and ironwork structures (Flores, 2002) or the polyvinyl chloride industry (Ruiz, 2003). Studies have also been carried out on small and medium-sized firms in commerce, services and transformation, outstandingly those published by Ruiz and Escobedo (1996) and García, Marín and Martínez (2006). The first was developed in the metropolitan area of Mexico City aimed at determining the use of cost systems by centering upon whether cost systems were applied and whether software was used for it. A total of 69 firms were contacted and the results indicated that 43% had a real or historic cost system, 37% had estimated or standard ones and only 6% were activity-based costs; 14% did not reply. The second (García et al., 2006), carried out in the state of Veracruz, Mexico, showed that cost accounting was scarcely used in microfirms since only 12.2% calculated their costs, whereas 24.3% of small firms and 38.1% of medium-sized firms adopted cost systems. It was centred on questions similar to the previous one. Another interesting result is that 36% of firms use hi-tech cost accounting systems extensively, whilst the percentage of firms with no sustainable technology in use is 49.2%. Finally it analyses how the cost accounting system impacts on the performance of the SME but does not differentiate as to whether the system is a traditional or management one. The findings obtained in both works are relevant, albeit limited in their field of study and in questions for research.

Subsequently, Prieto et al. (2007) made a study of the Mexican logistics sector and how it implemented activity-based costs. From a 27-firm sample, 22.25% were microfirms, 22.25% medium-sized ones of similar proportion, 25.9% small and 29.6% large enterprises. The adoption rate of ABC was as high as 22.2%, a decision taken by top management (60%) for the following reasons: reduction and administration of costs; to establish the price of the product/service; measuring and improving the performance by activity, cost modelling; budgets; client profitability analysis; product/service decisions; new product/service design; and inventory evaluation. Another significant finding is that the main reason why it was not implemented is unawareness of ABC (51.9%). This finding coincides with that presented here. In a similar fashion we agree with the fact that the main cause is ignorance of the methodology even though in this paper problems involved in its implementation are determined both from the viewpoint of users of traditional systems and those adopting ABC/ABM. What is more, both works agree that there is no relationship between firm size and adopting ABC, although, as can be seen in subsequent pages, small firms adopt ABC in greater proportion than medium-sized ones.

So, taking as reference the findings obtained in previous works, in this study we have analyzed the evolution of cost systems used in Mexican SMEs, describing competitive activity, adoption of cost management and administrative systems in this type of firm, as well as activity-based costs (ABM) by means of activity-based costs (ABC), and replying to the following questions: what are the cost systems that Mexican firms adopt in order to be competitive? Is there any relationship between level of adoption and firm size? What reasons lead Mexican firms to adopt the ABC/ABM system? Can the ABC system be a key instrument in the decision making of the Mexican businessman? Do they have enough technical and economic capacity to maintain the ABC system if they adopt it? What is the level of adoption of the system in Mexico?

3Research methodologyIn this section, specific topics related with the research are detailed. In this way we explain research type, sample determination, hypothesis, investigation subjects and instrument of data collection.

3.1Type of researchThis paper follows a descriptive design of quantitative behaviour, since it validates its hypothesis using the field work results from surveys applied to Mexican small and medium size enterprises.

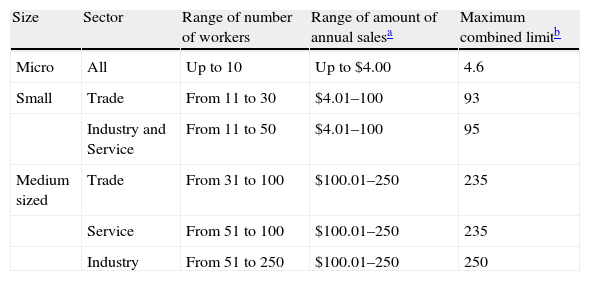

3.2Sample determinationThe survey was applied to SMEs established in Mexico, following the criteria published at the Diario Oficial de la Federación Mexicana (2009) that differentiate the size of an enterprise as a function of the employees and their activity, which could either be manufacturing, commerce or services. Table 1 shows the classification of micro, small and medium enterprises, by size, sector, number of employees, annual sales and combined maximum ceiling.

Classification of the micro, small and medium enterprises.

| Size | Sector | Range of number of workers | Range of amount of annual salesa | Maximum combined limitb |

| Micro | All | Up to 10 | Up to $4.00 | 4.6 |

| Small | Trade | From 11 to 30 | $4.01–100 | 93 |

| Industry and Service | From 11 to 50 | $4.01–100 | 95 | |

| Medium sized | Trade | From 31 to 100 | $100.01–250 | 235 |

| Service | From 51 to 100 | $100.01–250 | 235 | |

| Industry | From 51 to 250 | $100.01–250 | 250 |

The population was obtained from firms registered in the database of the Mexican business system (SIEM, 2009), excluding those SMEs with no email or the ones containing errors. A population of 8659 firms was obtained, determining a sample of 263 firms with an error margin of 5% and 90% of confidence level. Invitation to participate was sent by email. The percentage of replies was 68.44% (180 acceptable answers); of these, 167 have not adopted the activity-based costing system, while the other 13 have adopted the ABC system.

The results of this study represent the same distribution in the number of assessed companies: the biggest percentage of the companies have between 11 and 50 employees with a total of 50% of the sample, 39% have 51–100 employees, and the other 11%, fewer than 250 employees.

In order to characterize the sample as a function of the companies that have implemented the ABC and that have not, 50% of the companies using traditional systems belong to the 11–50 employees range, 40% to the 51–100 and the last 10% to the companies with 101–250 employees. For the companies that have adopted the ABC/ABM systems, 54% belong to the 11–50 employees range, 31% to the 51–100 employees and 15% to the 250 or less employees range. If we classify the enterprises according to their size, of those that use traditional systems, 49.7% are small and 50.30% are medium-sized; of those that have adopted the ABC, the percentage of small-sized enterprises is bigger (53.85%) than the medium-sized ones (46.15%).

To clarify its structure, the sample was classified depending on its sector: industrial, commercial or service. The results obtained for the enterprises using traditional systems indicate that the largest number of answers is from the industrial sector with 47%, followed by the service sector with 36% and finally the commercial sector with 17%. However, for the companies using the ABC system, the biggest number of answers came from the service sector, while it was 31% each from the industrial and commercial sectors.

3.3HypothesesFollowing are presented the hypotheses for this study:

- •

H1: the characteristics of the production systems used in the firms adopting ABC systems are different from that in those rejecting this methodology.

- •

H2: the proportion of firms using real or historic cost systems is higher than those using the standard cost.

- •

H3: the adoption of the ABC/ABM is related to the increase in indirect expenditure.

- •

H4: SMEs have the economic and technical capacity to maintain the ABC system.

- •

H5: there is unawareness of the ABC/ABM system among Mexican SMEs.

- •

H6: the proportion of firms adopting the ABC/ABM on a regular basis is higher than that of those using it occasionally.

- •

H7: the information generated by the ABC is used to prepare the financial statements.

- •

H8: the number of activities the ABC methodology needs to have, to use it in a simple way, must be within the 20–60 activities range.

- •

H9: most of the SMEs adopting it record the data from their present system in order to use them in the ABC/ABM system.

- •

H10: the ABC/ABM system is adopted by SMEs to reduce costs.

The surveys were directed to executives, business owners, managers or those responsible for the costing process area or accounting area, in every analyzed enterprise. In the case of the enterprises that use traditional systems, 82% are in the executive level and 18% in lower ranks, emphasizing that 71.86% were accounting specialists in auditing and in costs. In the case of the ABC users, 100% were said to be at management level, and all with accounting and costs knowledge.

3.5Instrument for data collectionTwo different types of instruments were applied, depending on whether or not the respondents had implemented the ABC system. The survey's shipment method was exclusively by email, sending first a pilot survey to five entrepreneurs in order to adapt it to a Mexican context. Also, it was put into a thorough analysis of the Mexican Institute of Public Accountants and the Mexican stock market of values. The surveys used in the research are an adoption of some applied in other countries, given by the “Asociación Española de Contabilidad y Administración de Empresas (AECA)”.

4Analysis and resultsThe outcomes of the study are described next. The order in which they are presented is as follows: characteristics of the production systems used at the small and medium enterprises; costing computer systems used and their relationship with SME’ goals; costing distribution in Mexican small and medium enterprises; technological information systems used in SMEs in order to obtain costs; the activity-based costing and activity-based management knowledge; scope and use of activity-based costing and activity-based management in Mexican small and medium enterprises; use of information from activity-based costing; identification of the activities in the activity-based costing and activity-based management; integration process and start up of the activity-based costing and activity-based management; and implementation of the activity-based costing and activity-based management systems.

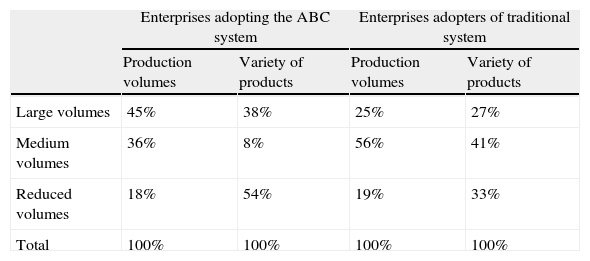

4.1The characteristics of the production systems used at the small and medium enterprisesAn aspect to consider for the adoption of the ABC system is the need for this methodology which is based on the complexity of their operation volumes classified into large, medium and reduced; and on the second variety of products and services. In this regard, the first hypothesis (H1) was posited: the characteristics of the production system used in the firm adopting ABC systems are different from that in those rejecting this methodology. This hypothesis is accepted since when analyzing the results for the users and non-users of the ABC system, it was observed that the enterprises adopting ABC system give rise to bigger production volumes (45%), in comparison to the traditional systems users which have medium production volume (56%). With regard to the main characteristics of the production systems, the variety of principal products and/or services offered by the SMEs is significant. From those using the ABC system, 54% provide their products in reduced volumes of production, and the traditional users maintain a medium variety of products and services (41%) (Table 2).

Distribution by production volumes and product variety and services from the ABC system users and non-users.

| Enterprises adopting the ABC system | Enterprises adopters of traditional system | |||

| Production volumes | Variety of products | Production volumes | Variety of products | |

| Large volumes | 45% | 38% | 25% | 27% |

| Medium volumes | 36% | 8% | 56% | 41% |

| Reduced volumes | 18% | 54% | 19% | 33% |

| Total | 100% | 100% | 100% | 100% |

In regard of the relationship between the production and sale of goods and services, the SMEs that haven’t implemented the ABC system report that most of their production is done at the time of the order with a total of 65%, while only 29% start their production in order to store them and then to formalize its sale. The same happens to the SMEs that have adopted the ABC system, the production when the order is made 60%, 30% of the enterprises produce for their later storage and sale, and only 10% represents the production of the product components with prior storage and assembling after being sold. In both cases the situation is similar, and there are no clear differences between the ABC users or non-users.

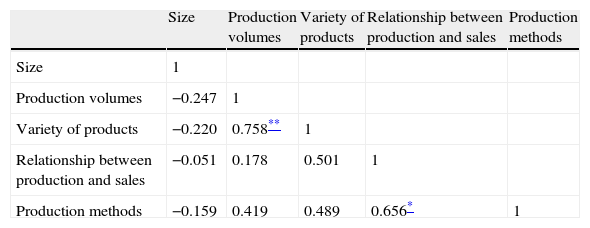

After studying the first results of the sample, it was analyzed to ascertain whether there is a correlation between production volumes, variety of products, relationship between production and sales, production methods and the size of the enterprises. Using the correlation of the Pearson function, it can be observed that among the SMEs adopting the ABC there is an inverse relationship between the size and variety of the products and/or the service benefits; nevertheless there is a strong correlation between the production volumes and the variety of the products and/or services (p=0.758). Moreover, it can be highlighted that the correlation between the production methods and the relationship between productions and sale (p=0.656) means that the ABC system users have a direct role in productivity and the product organizational methods, changing their organizational culture to an approach to good management, prepared to invest all types of resources to its success (Table 3).

Correlation between the size of the company and the characteristic variables of the production system in the SMEs using ABC.

| Size | Production volumes | Variety of products | Relationship between production and sales | Production methods | |

| Size | 1 | ||||

| Production volumes | −0.247 | 1 | |||

| Variety of products | −0.220 | 0.758** | 1 | ||

| Relationship between production and sales | −0.051 | 0.178 | 0.501 | 1 | |

| Production methods | −0.159 | 0.419 | 0.489 | 0.656* | 1 |

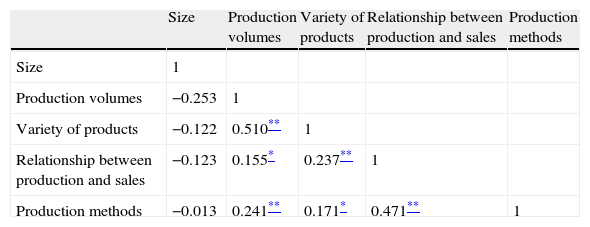

However, in the SMEs that have implemented traditional costing systems, lower correlations have been observed with respect to size of the company and the different characteristics of the production system (Table 4).

Correlation between the size of the company and the different characteristics of the production system in the SMEs using traditional systems.

| Size | Production volumes | Variety of products | Relationship between production and sales | Production methods | |

| Size | 1 | ||||

| Production volumes | −0.253 | 1 | |||

| Variety of products | −0.122 | 0.510** | 1 | ||

| Relationship between production and sales | −0.123 | 0.155* | 0.237** | 1 | |

| Production methods | −0.013 | 0.241** | 0.171* | 0.471** | 1 |

There is a correlation which is inversely proportional to the size of the enterprise and the production volumes (p=−0.253). It can be highlighted that the correlation between the methods of production and the production volume and/or services (p=0.241) and the relation between the sales and production (p=0.471) represent that the interviewed companies have a direct relationship between the production volume and its relation with the sales and the organizational methods. Finally, a correlation is found between the product variety and production volumes (p=0.510), which seems a little different taking into account the characteristics of both possibilities, as the result of the enterprises that handle a bigger portfolio of products and services, generating a higher volume.

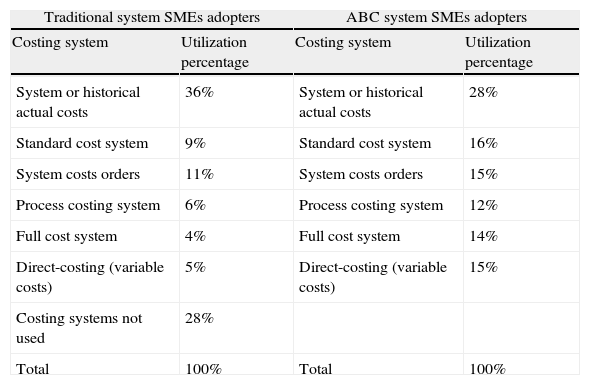

4.2Types of computing systems of costing and their relationship with the small and medium enterprises’ goalsA key aspect in the costing system of an organization is precisely the use given to it positing the second hypothesis (H2): the proportion of firms using real or historic cost systems is higher than those using the standard costing. In this case it was questioned in the survey whether they were using any costing system and what they were trying to get from it, and what the options in this survey were if their results were used for the elaboration of financial statements, the costing management of the enterprise, margin management, as an adoption base or for the decision-making process.

It was observed that 36% of the enterprises using traditional systems use a real or historical costing system, followed by a standard costing system with 9%, and the variable costing system with 5%. In the case of their production, 11% use an order based costing system, and the process costing system is used by 6%. Another important aspect is the fact that the 28% do not use a costing system; of this last category, 73% are commercial enterprises, 19% service enterprises and 8% industrial enterprises (basing their management method on the production supervisors’ experience, and the accounting department on general accountability and Microsoft Excel). Among the companies using the ABC system, 28% use the historic costing system, followed by the standard costing system with 16%; with regard to their way of production, 15% use the costing system by order and 12% use the costing system by process. Thus the hypothesis is accepted (Table 5).

Distribution of the costing systems by the SMEs using traditional system and the ABC system.

| Traditional system SMEs adopters | ABC system SMEs adopters | ||

| Costing system | Utilization percentage | Costing system | Utilization percentage |

| System or historical actual costs | 36% | System or historical actual costs | 28% |

| Standard cost system | 9% | Standard cost system | 16% |

| System costs orders | 11% | System costs orders | 15% |

| Process costing system | 6% | Process costing system | 12% |

| Full cost system | 4% | Full cost system | 14% |

| Direct-costing (variable costs) | 5% | Direct-costing (variable costs) | 15% |

| Costing systems not used | 28% | ||

| Total | 100% | Total | 100% |

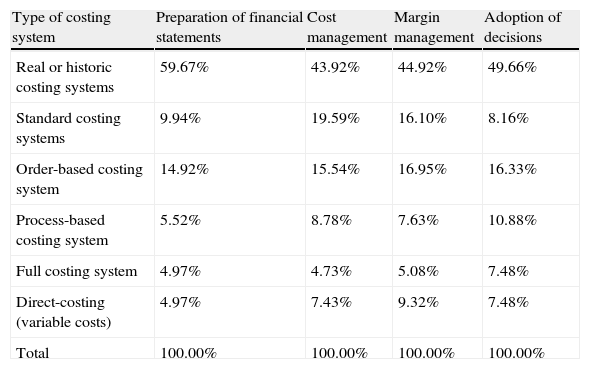

The SMEs that use traditional systems gave greater importance to their costing systems on the basis of their financial statement elaboration and they mostly use the historic costing system to achieve this. Along this same line, it can be observed that those using a variable costing system and the costing by order give more importance to their margin management, while those using the standard costing system give priority to management costing and those who use the full costing system give priority to the decision-making process (Table 6).

Distribution of the objectives for which the costing systems are used in the SMEs that use traditional costing.

| Type of costing system | Preparation of financial statements | Cost management | Margin management | Adoption of decisions |

| Real or historic costing systems | 59.67% | 43.92% | 44.92% | 49.66% |

| Standard costing systems | 9.94% | 19.59% | 16.10% | 8.16% |

| Order-based costing system | 14.92% | 15.54% | 16.95% | 16.33% |

| Process-based costing system | 5.52% | 8.78% | 7.63% | 10.88% |

| Full costing system | 4.97% | 4.73% | 5.08% | 7.48% |

| Direct-costing (variable costs) | 4.97% | 7.43% | 9.32% | 7.48% |

| Total | 100.00% | 100.00% | 100.00% | 100.00% |

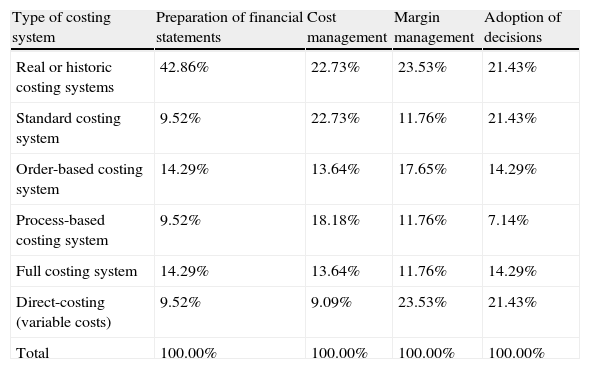

In Table 7, we can see which of the objectives are used for each of the costing system from the ABC users, and the type of costing system most used in the historic costing system for decision taking, margin management and preparation of financial statements. The users that have direct costing give priority to decision and margin management.

Distribution of the objectives for which the costing systems are used in the SMEs that use ABC.

| Type of costing system | Preparation of financial statements | Cost management | Margin management | Adoption of decisions |

| Real or historic costing systems | 42.86% | 22.73% | 23.53% | 21.43% |

| Standard costing system | 9.52% | 22.73% | 11.76% | 21.43% |

| Order-based costing system | 14.29% | 13.64% | 17.65% | 14.29% |

| Process-based costing system | 9.52% | 18.18% | 11.76% | 7.14% |

| Full costing system | 14.29% | 13.64% | 11.76% | 14.29% |

| Direct-costing (variable costs) | 9.52% | 9.09% | 23.53% | 21.43% |

| Total | 100.00% | 100.00% | 100.00% | 100.00% |

The hypothesis (H3): the adoption of the ABC/ABM is related to the increase in indirect expenditure, is rejected, because the cost is found to be correlated principally with raw materials in the Mexican SMEs, for both the ABC users (47%) and the traditional system users (46%), followed by manpower costs, which represent 26% for the ABC users and 31% for the traditional systems users. The SMEs that adopt the ABC system have a higher indirect expenses index (26%) than the users of traditional systems (19%).

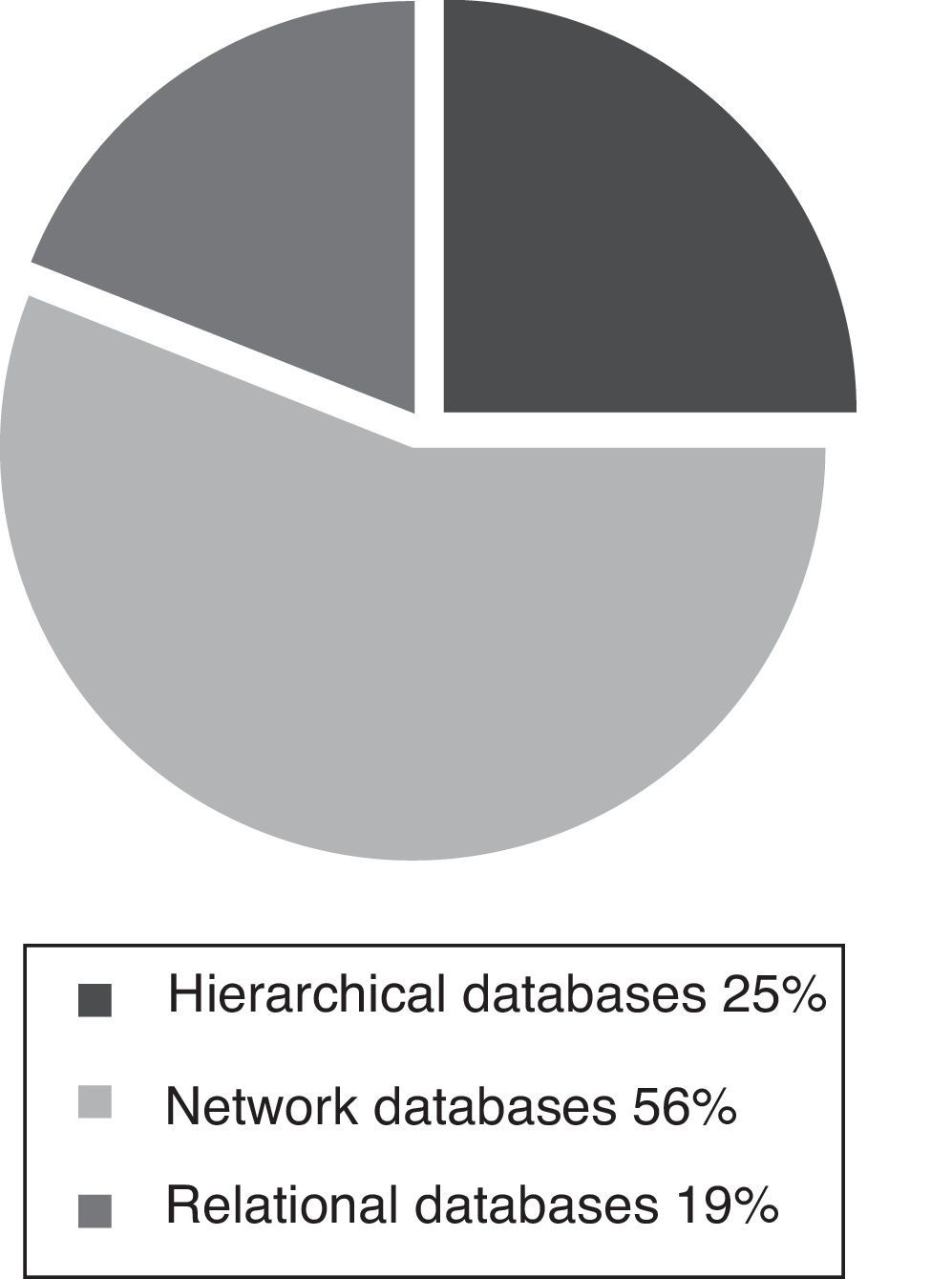

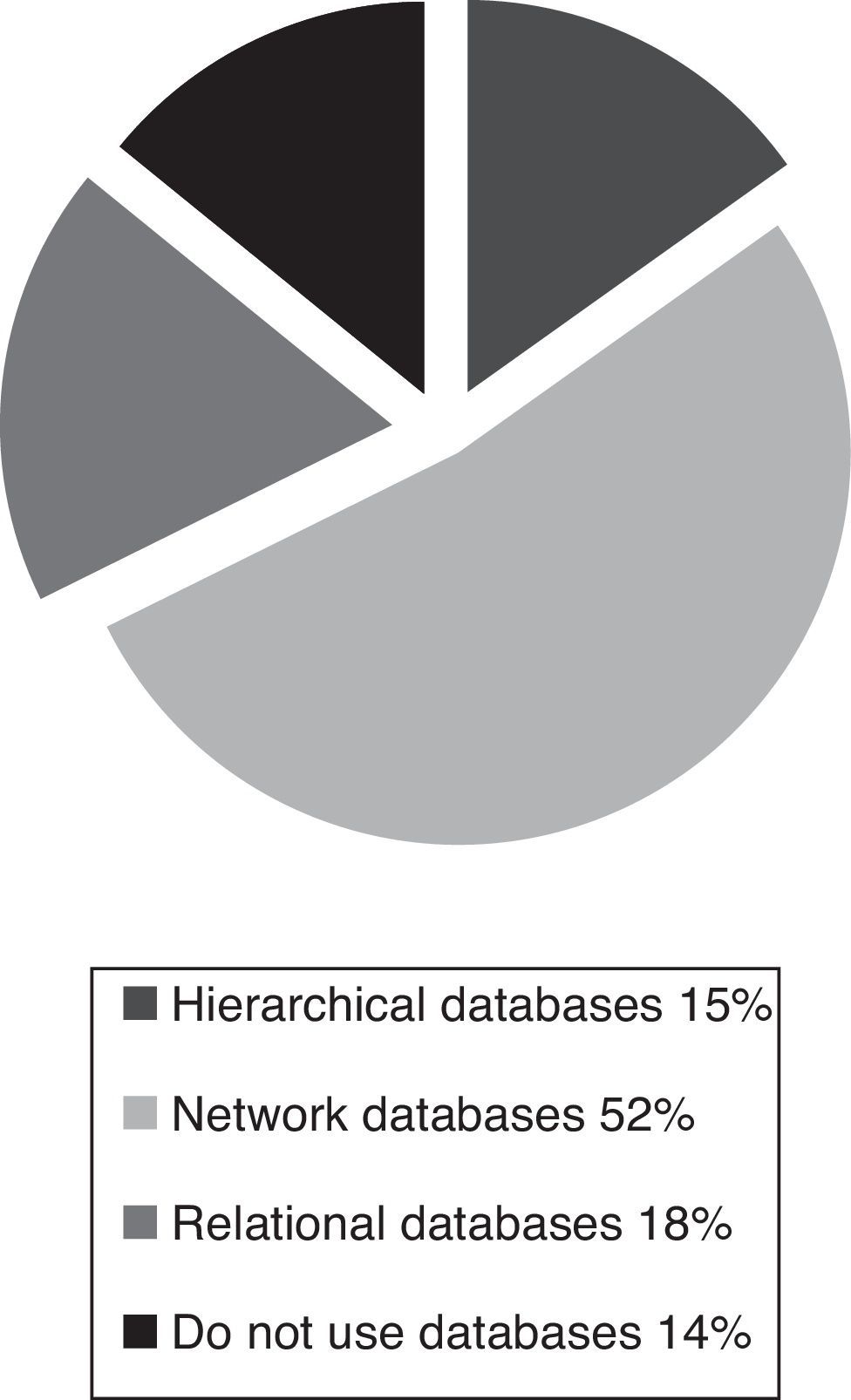

4.4Use of technological information systems of the small and medium enterprises in order to obtain costingsThe hypothesis (H4): SMEs have the economic and technical capacity to maintain the ABC system, is accepted. Among the enterprises that have implemented the ABC/ABM system, 100% could identify the use of databases in the processes followed by the costing calculus, whereas of the users of traditional systems 14% claimed not to use any of these systems, using an Excel spreadsheet in some cases and in others the reasons why they did not use these technological information (TI) tools were not specified. In all, 56% of the assessed companies use network-based systems, 25% use hierarchy database and 19% use relational database. Comparing the ABC SMEs and the rest, both tend to use network database; nevertheless, in the non-ABC users relational data bases are used more than hierarchy databases (Figs. 1 and 2).

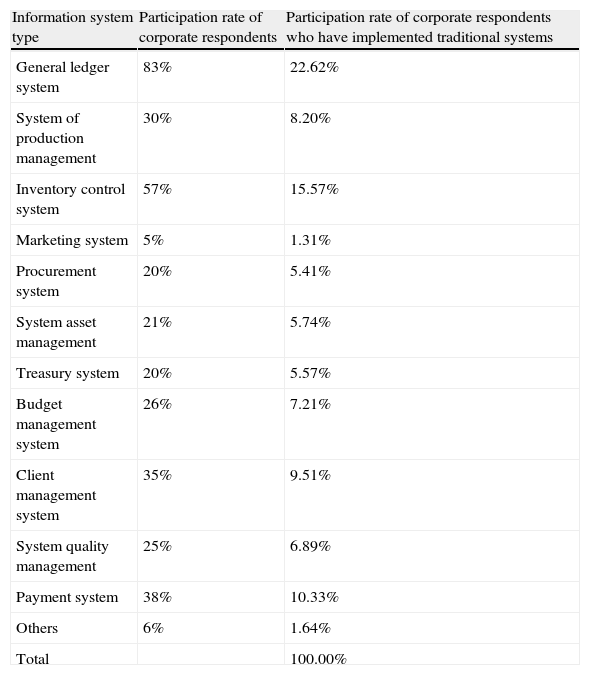

The costing subsystem is a key element of the organizational information system, which is why it is important to know how the costing information is shared among the rest of the systems within a company. For the enterprises that have not implemented the ABC system, 83% consider that the costing system is part of the accounting system, but 6% do not use any costing system; therefore there is no information sharing.

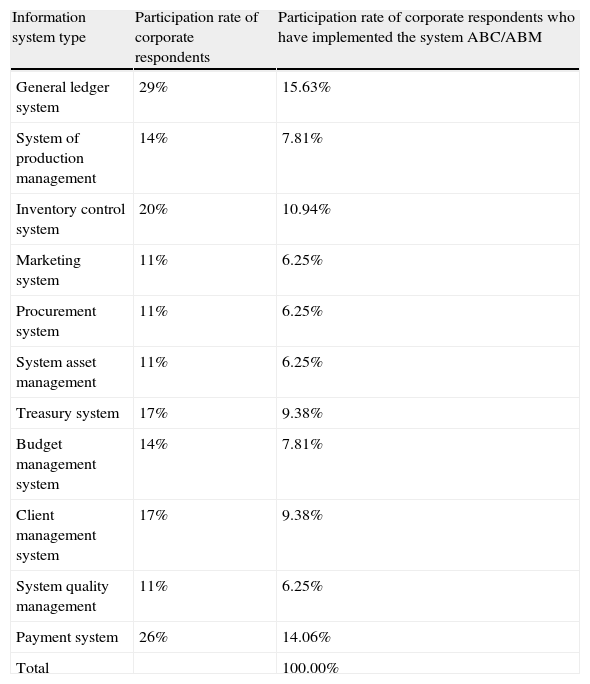

The SMEs that have the ABC system believe that it is very important to share information in the accounting system (29%). They also consider that the least important departments to share information with are the marketing, supply, management of fixed assets, quality management systems, and administration of fixed assets (11%) (Tables 8 and 9). It is important to mention that in Mexico the activity-based systems are not regulated by the Mexican Institute of Public Accountants and not even by the rules of the Secretariat of Property and Public Credit; this is why it is imperative for the enterprises that have the ABC system to share the information on general accounting and different costing systems that are accepted by the rules of the country.

Type of information systems that share data with the costing system adopters SMEs.

| Information system type | Participation rate of corporate respondents | Participation rate of corporate respondents who have implemented the system ABC/ABM |

| General ledger system | 29% | 15.63% |

| System of production management | 14% | 7.81% |

| Inventory control system | 20% | 10.94% |

| Marketing system | 11% | 6.25% |

| Procurement system | 11% | 6.25% |

| System asset management | 11% | 6.25% |

| Treasury system | 17% | 9.38% |

| Budget management system | 14% | 7.81% |

| Client management system | 17% | 9.38% |

| System quality management | 11% | 6.25% |

| Payment system | 26% | 14.06% |

| Total | 100.00% |

Type of information systems that share data with the costing system of nonadopters SMEs.

| Information system type | Participation rate of corporate respondents | Participation rate of corporate respondents who have implemented traditional systems |

| General ledger system | 83% | 22.62% |

| System of production management | 30% | 8.20% |

| Inventory control system | 57% | 15.57% |

| Marketing system | 5% | 1.31% |

| Procurement system | 20% | 5.41% |

| System asset management | 21% | 5.74% |

| Treasury system | 20% | 5.57% |

| Budget management system | 26% | 7.21% |

| Client management system | 35% | 9.51% |

| System quality management | 25% | 6.89% |

| Payment system | 38% | 10.33% |

| Others | 6% | 1.64% |

| Total | 100.00% |

An important measurement of the broadcasting and adoption level and of the system depends on the knowledge that the assessed companies could have about it. In this respect the hypothesis (H5): there is unawareness of the ABC/ABM system among Mexican SMEs, is accepted. Analyzing the SMEs’ traditional systems, 66% of the sample do not know about the existence of the ABC/ABM system, and only 34% have this knowledge. Analyzing these enterprises by size, 50.90% of the small enterprises do not know the ABC, while 1.20% know but have not implemented it; in the medium-sized enterprises, 28.14% do not know about it and only 19.76% know about it but have not implemented it.

At first sight, the answers show that 17% of the enterprises have made some sort of analysis related to the system, even if they have not used it. From this percentage, and the total of answers given by those who follow traditional systems, 11% have made enough progress that might make possible the ABC implementation, 2% have opted to reject the possibility of the implementation of this system and 4% were found to be in an analysis process. On the other hand, most of them do not have the intention or have not even thought about implementing this system (83%). The most representative answer in the sample (74%) was that the enterprises have not considered the possibility of ABC/ABM implementation. The main reason for this is the executives’ lack of knowledge of the system. This leads to an important conclusion: broadcasting of the information among the executives of an enterprise is required for the implementation of the system.

After asking the reasons for not adopting the ABC/ABM systems, the results show that the principal difficulty is the lack of knowledge of the organizations, since 71% claimed not to know this system, even though 65% of the interviewed are public accountants and 9% are accountant assistants, which means that 74% have knowledge of cost accounting that may allow them to update to newer costing tendencies. In all, 6% mentioned the complexity in the identification and selection of activities; and the same ratio of firms considered the assigning of activity cost to the products and services really hard; 5% mentioned the difficulty in the costing drivers and the activity units selection; 4% mentioned the lack of knowledge of the fiscal authorities or auditors, 2% considered it hard to localize or distribute the costs between the activities and 6% mentioned that there is no problem but they did not implement it.

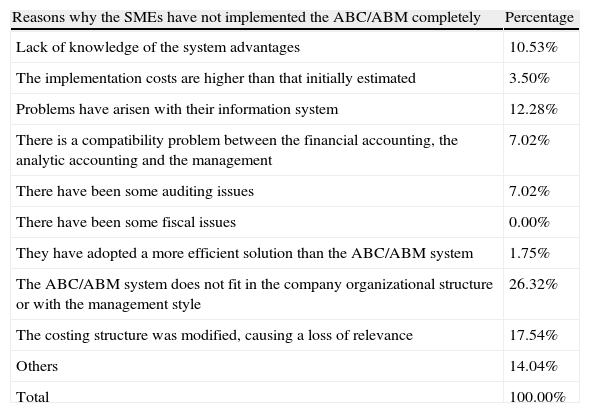

In the survey, the motives for the enterprises not having completed the implementation of the ABC/ABM system (11%) are as follows: 26.32% considered that the ABC does not fit in with the organizational structure of the company, 17.54% mentioned that their company has changed its costing structure originating a loss of relevance and only 1.75% had adopted a more efficient approach than the ABC/ABM (Table 10).

Reasons why the SMEs have not implemented the ABC/ABM completely.

| Reasons why the SMEs have not implemented the ABC/ABM completely | Percentage |

| Lack of knowledge of the system advantages | 10.53% |

| The implementation costs are higher than that initially estimated | 3.50% |

| Problems have arisen with their information system | 12.28% |

| There is a compatibility problem between the financial accounting, the analytic accounting and the management | 7.02% |

| There have been some auditing issues | 7.02% |

| There have been some fiscal issues | 0.00% |

| They have adopted a more efficient solution than the ABC/ABM system | 1.75% |

| The ABC/ABM system does not fit in the company organizational structure or with the management style | 26.32% |

| The costing structure was modified, causing a loss of relevance | 17.54% |

| Others | 14.04% |

| Total | 100.00% |

It is important to establish the scope of the utilization of the ABC/ABM because as was determined, in both the framework and the different investigations, the level of penetration of the ABC/M ranges from adoption in a specific area (human resources, finances, management or production) to all the companies. Positing the hypothesis (H6): the proportion of firms adopting the ABC/ABM on a regular basis is higher than those using it occasionally, from the results obtained the hypothesis is accepted, since it can be said that a regular utilization is found in the enterprises that adopted the system (68%) and in an occasional one by 32%. Among the enterprises with a regular implementation of the activity-based costing and the activity-based management, it was determined that the biggest index of utilization is in the whole company with 62%, 8% is used in every single area and 15% in a specific department or area (15%). Finally, the enterprises that use it occasionally have applied it to all the companies in 33.33% and 16.67% is used in all the areas, and the same ratio for a particular area, a specific department or a particular product or service. These cases are enterprises that are in the implementation process, so they used it occasionally.

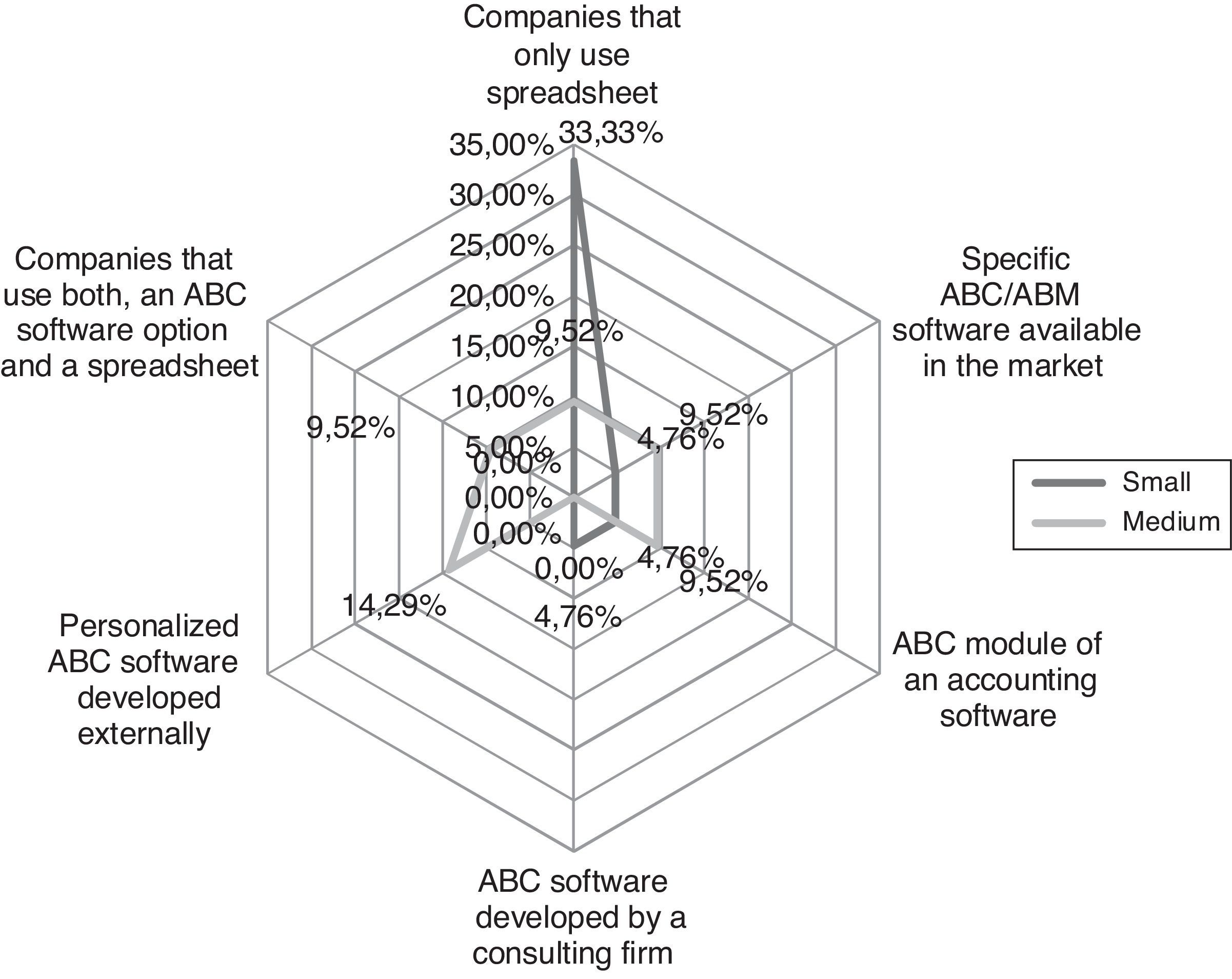

The use of information technologies is an important tool since it reduces waiting time in every information process, facilitating and improving the tasks in each area of the enterprise by reducing errors if the correct software is chosen in order to achieve the desired goals. To achieve success goals with the ABC system, it is necessary to have a custom design or the purchase of specific software, because the level of information needed is high and its implementation is a complicated task. For most of the enterprises, it is clear that the ABC system is linked directly with the software systems and information technologies. This is proved by the assessed companies and is the reason why the type of software that was evaluated by them in order to implement the system is first questioned. The companies manifested that they analyzed the possibility of the acquisition of personalized software, developed inside the company, and in the same ratio an ABC module of accounting software (14.29%), followed by an ABC software developed by a consultant. However, most of the SMEs use a spreadsheet, because of the lack of financial resources to access an ABC software (Fig. 3). This is also one of the reasons why the ABC system is not implemented in some enterprises.

4.7Use of information from activity-based costing by the small and medium enterprisesAn important part of the use of the information produced by the ABC/ABM system is to analyze if the enterprises use it to present financial statements to the managers of the company in order to make decisions. For this reason hypothesis (H7) is posited: the information generated by the ABC is used to prepare financial statements, and it is accepted, since most of the assessed companies are in favour of using the information generated by the ABC system to create the financial statements with an index of 45%, 18% have the intention of using the information generated by the system and 36% do not use the information generated by the ABC to create financial statements. After these results, the next step was to analyze the reasons why the Mexican SMEs do not use or are thinking of using the information generated by the ABC system to create financial statements, obtaining the following results: 43% stated that the ABC system was specifically designed for internal affairs, 29% that the information generated by the ABC system does not follow the auditing rules and 14% mentioned that the information is not valid to create the financial statements. Another observation is that despite it being established that the system does not follow the tax regulation requirements by the authors at the framework, it does not mean that they cannot be used to generate any sort of financial information.

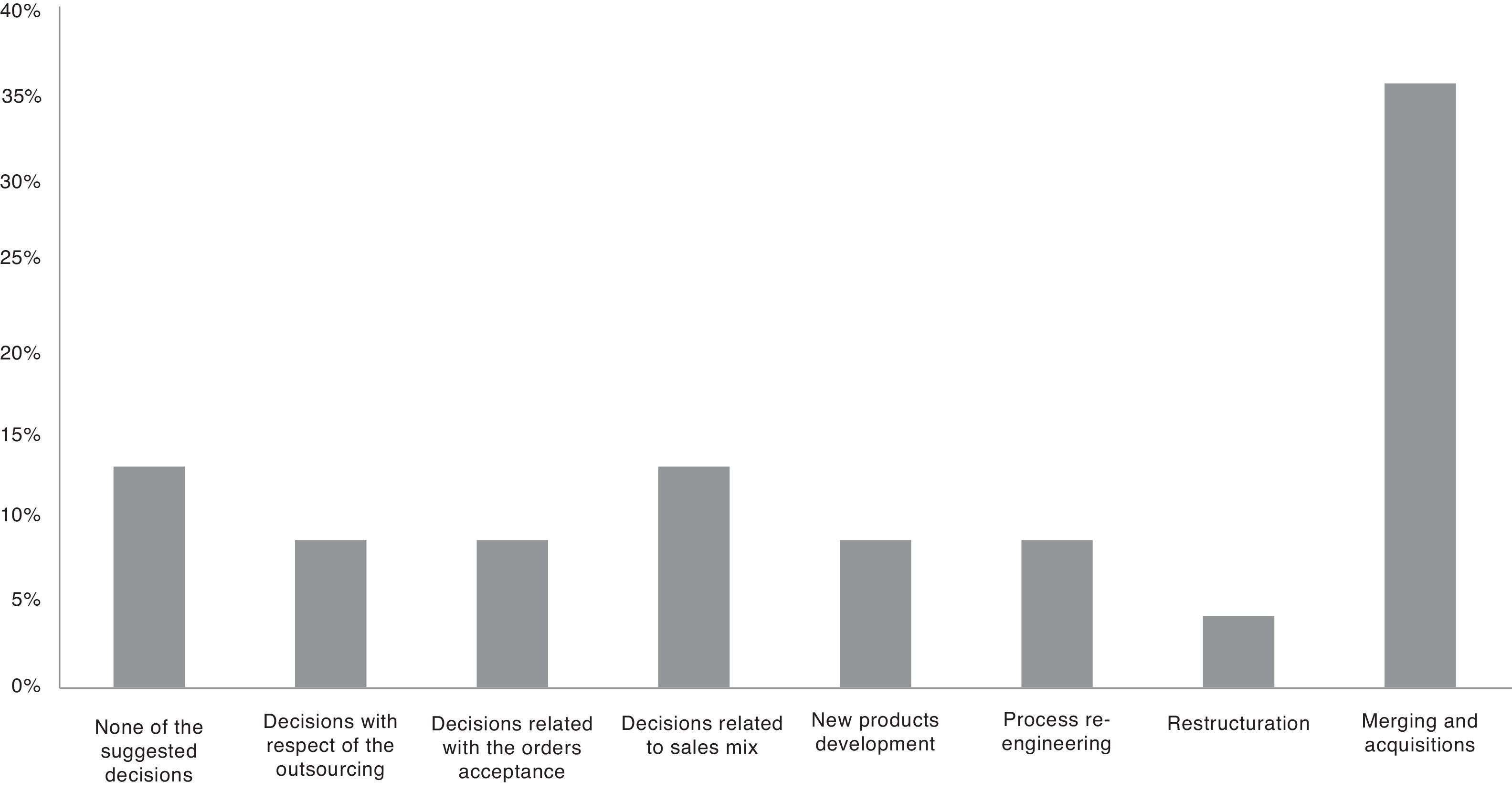

Since it is important to determine decisions made by SMEs with the information generated by the ABC/ABM, we found that 35% of the enterprises in the surveys consider that it helps them to take decisions for mergers and acquisitions, 13% of the decisions are related to the sale combinations, 9% for decisions relative to the outsourcing, acceptance of orders, development of new products, re-engineering of processes, and 4% pointed out that this system helps them to take restructuring decisions. Finally, 13% did not use it for any of the proposed decisions (Fig. 4), which means that the system is valid as a support for the improvement of the enterprise management, proving once more the validity of the philosophy, and that the difficulty found for its applications is derived from the initial methodology proposal for its implementation.

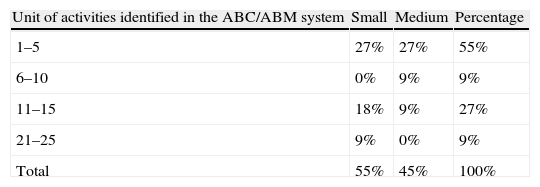

4.8Identification of the activities in the activity-based costing and activity-based management in the small and medium enterprisesWith regard to the volume of activities that the ABC methodology needs to include, the following hypothesis (H8) is posited: the number of activities that the ABC methodology needs to have, to use it in a simple way, must be within the 20–60 activities range, and the results show that it is rejected because most of the enterprises (67%) define their activities by the centre of responsibilities or the departments that exist, 25% define it by processes, 8% define the activities independent of the centres of responsibilities or departments. Experts in the ABC methodology (Kaplan & Cooper, 2003) suggest that to take this system in a simple way it must include around 30–50 activities; meanwhile for Cooper and Slagmulder (1999) the system must contain at least 20 activities and rarely 60, among its primary objects are products, channels and clients (Fig. 5).

Lastly, they were asked about the number of grouping centres that the SMEs establish in the chosen ABC system, observing that 70% use 1–5 grouping cost centres and 10% use 6–10, 16–20 or 11–15 grouping cost centres.

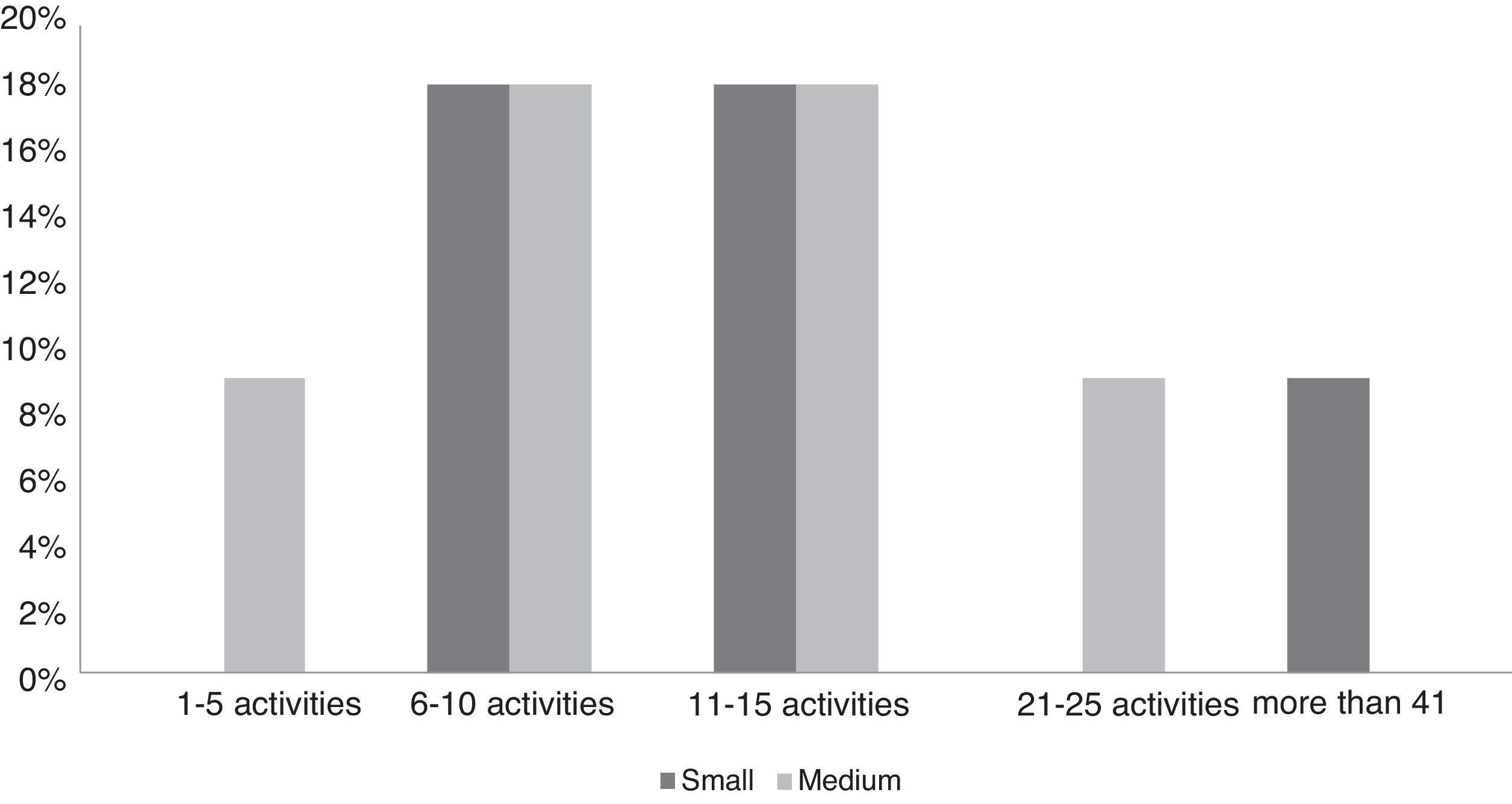

Another substantial element in the ABC/ABM system is the activity units which can be associated with one or more activities. Table 11 shows that 55% of the assessed companies claimed to have between 1 and 5 activity units, followed by 11 and 15 activities and only 9% handle between 21 and 25 activity units in their ABC/ABM system. Analyzing the results by company size, it was observed that the SMEs are in equal circumstances in number of activity units between 1 and 5 activities; of these enterprises, the medium-sized tend to have more activity units (9%).

4.9Integration process and start-up of the activity-based costing and activity-based managementIt is well known that success in integrating the system can be influenced by the process of recording previous data, and the following hypothesis (H9) has been posited: most of SMEs adopting it record data from their present system in order to use them in the ABC/ABM system. This hypothesis is accepted, since 73% of those surveyed record data from their present system to use in the ABC/M, 18% use a new system to record data and a mere 9% mark “others” but do not state which ones. In turn, of the previous 73%, 80% claimed to record data on real costs, whereas only 20% use standard costs. This is in line with the situation displayed by Kaplan and Cooper (2003).

Furthermore, during the integration and start-up process, SMEs face problems in allocating costs to activities since 32% of firms claim that there are no suitable cost drivers for assigning some activities, 17% claim the cost distribution is complex; 12% indicate that it is difficult to assign resource costs to activities; 17% of those surveyed had occasional problems without mentioning what type, and only 22% had no problem in allocating costs to activities.

Another important aspect of the implementation process is to ascertain the cost objectives of the ABC/ABM system. According to the experience of many enterprises, it is important to focus on the way to perform the activities and create efficient processes, but it is also necessary that these companies link their activity costing to the cost objects, such as products, clients, processes, distribution channels and markets. For the Mexican SMEs, 29% have as the main goal the “activities”, 24% the “products or services”, 18% the “projects” and the “processes” and 12% the “clients”.

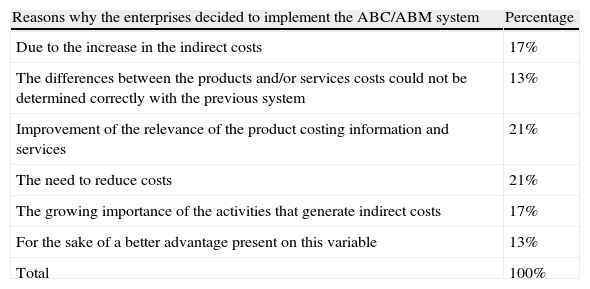

4.10Implementation of the activity-based costing and activity-based management systemAmong the various reasons that Mexican firms may have for implementing the ABC system, we thought that cost reduction is the most important and, for that reason, Hypothesis (H10) was set up: the ABC/ABM system is adopted by SMEs to reduce costs. However, this hypothesis is rejected since, albeit 21% consider the need for reducing costs, a similar percentage mentioned the improvement of relevance of the goods and services costing information as well. Also it is significant necessity in cost reduction at the same percent 17% were motivated by the increase of indirect costs, 13% by the differences among their product portfolio and/or the fact that the benefits were not reflected in an adequate way in the costs obtained with the system used before the ABC/ABM adoption; with the same percentage, the enterprises were driven by the need to revise their pricing policy due to an increase in the amount of competitors (Table 12).

Reasons why the enterprises decided to implement the ABC/ABM system.

| Reasons why the enterprises decided to implement the ABC/ABM system | Percentage |

| Due to the increase in the indirect costs | 17% |

| The differences between the products and/or services costs could not be determined correctly with the previous system | 13% |

| Improvement of the relevance of the product costing information and services | 21% |

| The need to reduce costs | 21% |

| The growing importance of the activities that generate indirect costs | 17% |

| For the sake of a better advantage present on this variable | 13% |

| Total | 100% |

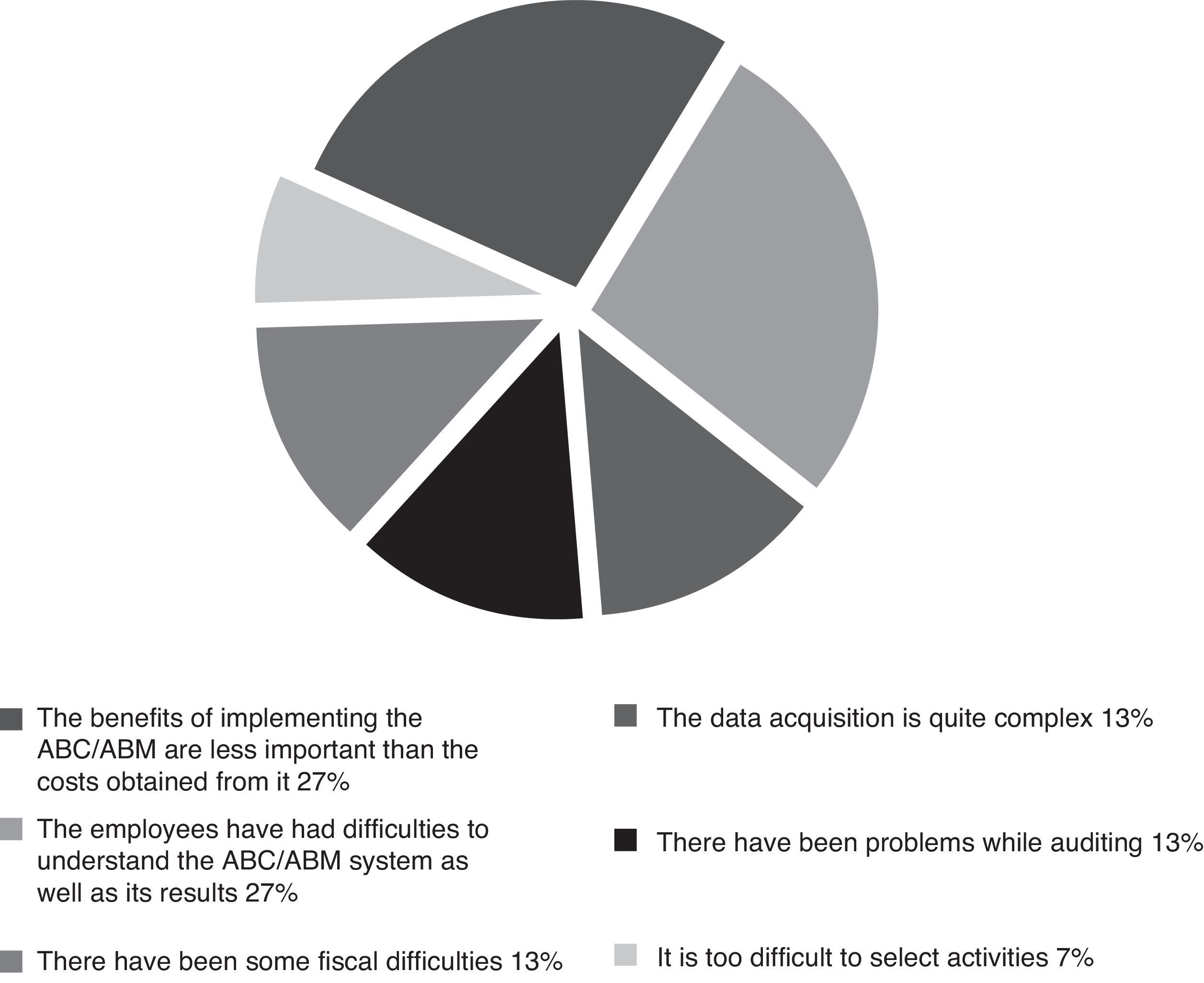

Moreover, when investigating whether firms have experienced difficulties in the process of implementing the ABC/ABM system, the replies indicated that the main problems lay in the difficulties staff suffered in understanding the model and the results (27%) and in the implementation cost, since 27% think the cost is higher than the benefits it provides. What is more, obtaining data is complex (13%) and firms have encountered problems related to auditing and of a fiscal nature (Fig. 6). All in all, this confirms the opinion of the authors, who gave notice of the difficulties of the model being consolidated and substituting the traditional ones based on volumes of production.

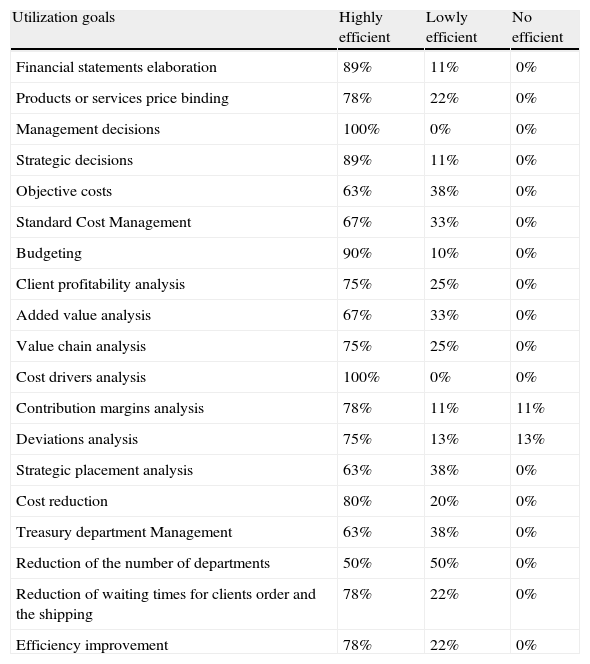

Finally it is important to evaluate the efficiency of the implementation of the ABC/ABM according to their different use purposes. As can be observed, the enterprises considered it efficient in general. Only 11% manifested that it is slightly ineffective in the analysis of contribution margins and 13% considered that it is totally inefficient in the deviation analysis, showing, from the assessed companies’ perspective, their satisfaction with the ABC/ABM system and considering it efficient towards their use goals (Table 13).

Evaluation of the ABC/ABM system in each of the use goals.

| Utilization goals | Highly efficient | Lowly efficient | No efficient |

| Financial statements elaboration | 89% | 11% | 0% |

| Products or services price binding | 78% | 22% | 0% |

| Management decisions | 100% | 0% | 0% |

| Strategic decisions | 89% | 11% | 0% |

| Objective costs | 63% | 38% | 0% |

| Standard Cost Management | 67% | 33% | 0% |

| Budgeting | 90% | 10% | 0% |

| Client profitability analysis | 75% | 25% | 0% |

| Added value analysis | 67% | 33% | 0% |

| Value chain analysis | 75% | 25% | 0% |

| Cost drivers analysis | 100% | 0% | 0% |

| Contribution margins analysis | 78% | 11% | 11% |

| Deviations analysis | 75% | 13% | 13% |

| Strategic placement analysis | 63% | 38% | 0% |

| Cost reduction | 80% | 20% | 0% |

| Treasury department Management | 63% | 38% | 0% |

| Reduction of the number of departments | 50% | 50% | 0% |

| Reduction of waiting times for clients order and the shipping | 78% | 22% | 0% |

| Efficiency improvement | 78% | 22% | 0% |

This work has made it possible to reveal the degree of social repercussion caused by the ABC/ABM cost system to the Mexican SMEs. There is evidence that their theoretical foundations have managed to change the business culture regarding the vision and structure of organizations. It also contributes to explaining the problems encountered in its adoption by the SMEs, mainly the difficulties found by employees when trying to understand the system, the high cost of setting it up, problems of a fiscal and auditing nature. It also analyzes the suggestions for its implementation made by different authors, and how Mexican businessmen have their own expectations and how they evaluate the effectiveness of the information provided by the ABC/ABM system. In this way it provides results for obtaining knowhow for the SMEs in a particular country, in the development stage facing the challenge of growing and positioning themselves to deal with foreign competitors by finding a place against foreign competitors.

In Mexican SMEs, the ABC/ABM impact is only 7.22%. However, the small enterprises see this methodology as an information tool that is useful in their decision-making process; but they only use the comparison between their current costing system and the ABC results in order to obtain information that might help them to correct errors or failures in traditional systems and to eliminate activities that do not add value.

With this analysis, the following important points about the adoption of the ABC/ABM system are evident:

- •

In all, 66% of the SMEs using traditional systems do not have any knowledge of the ABC system, despite the fact that all the people who answered the survey have accounts and costing knowledge. This is why it is imperative to publicize the ABC/ABM system in the Mexican entrepreneurial environment.

- •

Given the competitive environment where the Mexican SMEs are, it is a matter of concern that 7% of the industrial enterprises and 19% of the service enterprises in Mexico do not use any costing system, and the industrial ones do not have any knowledge of which production method is being used in their company.

- •

The SMEs share information with their accounting department in 29% and 20% of the medium-sized enterprises use activity-based costing, because they have accounting software which makes the adoption easier.

- •

Even though the Activity Based Budgeting (ABB) gives enough information to facilitate their long-term goals, only 12% of the SMEs use this tool, considering that the main concern of the SME entrepreneur is to solve current problems.

- •

The SMEs using the ABC system have changed their organizational culture in regard to the ideology that the improvements in the company's management came from all the subsystems and all the resources that participated in its achievement.

- •

For the SMEs, the information obtained from the ABC/ABM system is valid as the support for the company's management improvement, ensuring that its philosophy and the difficulties found in its implementation are derived from the initial implementation methodology.

- •

The Mexican SMEs consider the application of the ABC system with other methods based on organic centres to be compatible and useful. This means that the usefulness of the costing methodology is not present in the alternative methods, but in the understanding of the possible application of different costing methods for different purposes.

- •

A key factor in the impact of the ABC/ABM system adoption is the publicizing of its methodology. This is why it is really important to start spreading a proposal to update the head of accounting and create government supported programmes with the universities, in order to foment the growth of these sectors that are very important for the Mexican economy.

- •

In Mexican SMEs the traditional cost systems are still a valid tool for their decision-making processes.

- •

For Mexican SMEs that have adopted the ABC/ABM, having experience in standard costs is not an important factor since 80% feed the system with data based on real costs, as proposed by Kaplan and Cooper (2003).

Finally, there arises the need to deepen the study as to whether Mexican SMEs follow other trends in cost management which make up for difficulties in traditional systems, and also to ascertain to what extent the use of information and communication technologies would contribute to reducing difficulties found in its successful implementation.

Conflict of interestThe authors declare not to have any conflict of interest.