The aim of this study is to estimate the probability of fraud and earnings management for a specific Spanish family business, Pescanova. In the context of financial statements, the Beneish model is used to detect fraudulent behavior. Our findings reveal that Pescanova presented propensity to commit fraud and carried out aggressive accounting practices before the disclosure of its financial problems. The manipulation index and the probability of manipulation are used as indicators of fraud and earnings management. Results also show that Pescanova made aggressive accounting practices, through the manipulation of Day's sales in receivables index and Total accruals to total assets. Next, we provided evidence that the Sales Growth index and Leverage index are aligned with the position of technical default shown by the pre-bankruptcy board of Pescanova. Our main contribution is demonstrating the validity of the model for the case of Pescanova. Therefore, the application of the Beneish model might have detected fraudulent behavior, in the years prior to Pescanova's collapse.

El objetivo de este estudio es estimar la probabilidad de fraude y de manipulación de beneficios para una empresa familiar española, Pescanova. En el contexto de los estados financieros, se utiliza el modelo Beneish para detectar el comportamiento fraudulento. Nuestros resultados revelan que Pescanova presentaba propensión a cometer fraude y que llevó a cabo prácticas contables agresivas, antes de revelar sus problemas financieros. El índice de manipulación y la probabilidad de manipulación, han sido usados como indicadores de fraude y de gestión de beneficios. Los resultados también muestran que Pescanova llevó a cabo prácticas contables agresivas a través de la manipulación de índices como, Ventas diarias sobre cuentas por cobrar y Devengos totales sobre activos totales. Además, se aporta evidencia empírica de que el índice de crecimiento de ventas y el índice de endeudamiento, están alineados con el informe reportado por la Administración concursal. Nuestra principal contribución es la demostración de la validez del modelo para el caso Pescanova. Por lo tanto, la aplicación del modelo Beneish podría haber detectado el comportamiento fraudulento de la empresa, en los años previos al colapso de Pescanova.

Financial statements fraud and earnings manipulation have probably existed since the beginning of commerce. Smith (1778) recognized the shortcomings of the modern corporation including the erosion of shareholder value due to losses from fraud and abuse (Dorminey, Scott Fleming, Kranacher, & Riley, 2012). Over the last 60 years, several studies have been developed to achieve a better understanding of the motivations and means of fraudulent behavior (e.g. Hogan, Rezaee, Riley, & Velury, 2008; Jones, Krishnan, & Melendrez, 2008).

Financial statements fraud is known for having dramatic consequences on corporations and their stakeholders. The 2016 Report to the Nations published by the Association of Certified Fraud Examiners (ACFE), 2016 estimated the cost of fraud to be around 5% of businesses’ annual revenues. Globally, this might well be translated as $3.7 trillion of economic losses due to fraud approximately. Thus, given the high costs associated with fraud, identifying models that accurately predict fraud is really important. In this vein, fraudulent financial statements involve the intentional misstatement of an organization's financial results of economic position (Anand, Tina Dacin, & Murphy, 2015).

The existing literature regarding earnings management is really extensive, with a recent evolution derived from the well-known cases of fraudulent companies (e.g. Enron, WorldCom, AIG, Parmalat, Bankia, among others). In the wake of such cases, a new research stream began to jointly appoint earnings management and aggressive earnings manipulation to detect extreme cases of earnings management – fraudulent earnings and non-fraudulent restatements of financial statements (Trompeter, Carpenter, Desai, Jones, & Riley, 2013). Therefore, a relationship between earnings management and fraud was established.

Although a number of studies have been conducted on fraud in disciplines as psychology, criminology, and sociology, much remains to be done on accounting research to offer insights and guidance to managers, policy-makers, and regulators in relation to fraud (Free, 2015). The screening of new models for fraud detection is perhaps one of the most critical accounting research activities, but it is often poorly performed. Also while some studies have been conducted on earnings management and fraud under the jurisdiction of USA, little empirical research has been developed in others jurisdictions (Abdul Aris, Maznah Mohd Arif, Arif, Othman, & Zain, 2015). Thereby, a gap still exists in analysing earnings management and fraud in the accounting research field and in other jurisdictions rather than in that of the USA.

Bearing in mind all the previous considerations, the aim of this study is to estimate the probability of fraud and earnings management, generated from a particular Spanish family business through the utilization of Beneish model. In this vein, we also advance in the family business field to the extent that to the best of our knowledge, this is the first study that applies the Beneish model to a Spanish family firm.

Using a ‘case-based’ research approach, we check whether the Beneish model fits the data presented by Pescanova before disclosing their financial problems and their accounting discrepancies.

Pescanova is an international Spanish food company that in 2013 made a public announcement of an existent discrepancy between the firm's accounting and the bank debt. Due to the successful investigation from the forensic accountants (KPMG), the pre-bankruptcy corporate board (Deloitte) demands a restatement of the 2011 financial statements of the company.

As De Massis and Kotlar (2014, p. 16) stated case study research is particularly appropriate to answer how and why questions or to describe a phenomenon and the real-life context in which it occurred. Thereby, our case study contributes to assess the validity of a fraud detection model in other jurisdictions rather than that of the United States, as we could assume, ex-post, that earnings were managed and fraud was committed. The model's utility is demonstrated since we had access to the bankruptcy management reports, whose results confirm those shown by the Beneish model.

Our findings reveal a significant propensity to commit fraud and aggressive accounting practices from Pescanova in the previous years to its collapse. Post-collapse bankruptcy corporate board reports reveal the same results than those offered by the Beneish model. These outcomes can be explained in the light of the agency theory (Jensen & Meckling, 1976) as to whether firms without separation of ownership and control are more likely to be involved in earnings management and fraudulent behaviors than their counterparts with separation of ownership and control (Ramdani & van Witteloostuijn, 2012).

The remainder of this article is organized as follows. The next section reviews the theoretical background regarding fraud and earnings management. In the third section, we describe the context of the particular firm under study. In the fourth section, we develop Beneish M-score model to identify the likelihood of fraud and earnings management. The results of the research are presented in section fifth. Finally, we conclude with the discussion and conclusions.

Theoretical backgroundEarnings management and fraudOne of the most cited definitions of earnings management is that provided by Healy and Wahlen (1999). These authors stated that ‘earnings management occurs when managers use judgment in financial reporting and in structuring transactions to alter financial reports to either mislead some stakeholders about the underlying economic performance of the company or to influence contractual outcomes that depend on reported accounting numbers’.

Parallel to the study of earnings management, different models were designed to detect this fraudulent practice over the years (Beneish, 1997, 1999; Dechow, Sloan, & Sweeney, 1995; Jones, 1991).

Earnings management has been a prevailing topic over the previous decades with a clear emphasis on the subject arising in the 1980s through various academic studies. At that time, there were several scholars examining broad measures of earnings management to investigate which were the motivations to manipulate earnings (Healy & Wahlen, 1999). To date, four categories of measures on earnings management are identified in the literature: (I) accruals, (II) earnings smoothing, (III) earnings predictability and, (IV) earnings conservatism. A distinction is made between non-discretionary accruals because in the absence of manipulation companies can generate a certain degree of accruals, and discretionary accruals, that added to make up to the total accruals practiced by the company (Badertscher, 2011). Then, studies have been conducted on firms that manage earnings to window-dress financial statements prior to public securities’ offerings (Alsharairi, Gleason, & Kannan, 2014; Bruegger & Dunbar, 2009; Jo, Kim, & Park, 2007; Lee, Xie, & Zhou, 2012; Marquardt & Wiedman, 2004), to increase corporate managers’ compensation and job security (Kumar, Ghicas, & Pastena, 1993; Meek, Rao, & Skousen, 2007; Moradi, Salehi, & Zamanirad, 2015; Weng, Tseng, Chen, & Hsu, 2014), to avoid lending contracts violating (Franz, HassabElnaby, & Lobo, 2014; Khalil & Simon, 2014; Valipour & Moradbeygi, 2010), or to investigate the board of directors’ characteristics and earnings management (Ebrahim, 2007; Jouber & Fakhfakh, 2012; Man, Seng, & Wong, 2013; Niu, 2006; Rahman & Ali, 2006). In addition, there are also studies in which earnings management techniques are modeled. For estimate non-discretionary accruals, the following models have been used: the DeAngelo model, the Healy model, the Jones model and the modified Jones model. In object to know discretionary accruals, the discretionary accrual models firstly evaluate the ability of various non-discretionary accrual models and total accruals, and then discretionary accruals can be derived. Finally, the extended multiple regression models are another statistical technique used to measure earnings management.

While earnings management is generally restricted to reporting practices considered to be within the bounds of GAAP, fraud does not (Dechow et al., 1995). There is a connection between earnings management and fraud since both earnings management and fraud involve discretionary accruals management. Therefore, discretionary accruals management has been considered to be out GAAP whether it does not materially misstate the financial statements (Zhaohui Xu, Taylor, & Dugan, 2007).

Nevertheless, there is also a thick line between both concepts, since fraud such as falsification/alteration of accounting records or documents are clearly not within GAAP (AICPA, 1988, 1997). Rosner (2003) stated that ‘financial statement users are more concerned about fraud than earnings management because they are likely to incur greater monetary losses by acting on materially misstated information’. Research in the last two decades of the twentieth century began to focus more on detection of fraudulent financial statements. Various models were created focused on fraud detection and qualitative aspects of managerial decision-making. One of the most common techniques for detecting fraudulent financial reporting is financial statement analysis, but the objective analysis of financial figures falls short in the process of fraud detection. Another method described to detect fraud is the digital analysis based on Benford's Law. Benford's research focused on the comparison of the actual frequency of some digits in different positions in a data set to the expected frequency (Roxas, 2011).

A preliminary model, seeking to combine accrual research and adding numerical values to the previous qualitative studies, was designed by Beneish in 1997 ‘based on variables intended to capture incentives which may prompt firms to violate GAAP,’ thus, predicting the probability of manipulation at the hands of the directors (Beneish, 1997). The aim of this model, known as M-score, was to differentiate between companies whose directors illegally managed earnings and those that made aggressive, yet legal, accounting practices. Unlike the discretionary accrual methods, this model emphasized that in addition to total accruals, more existing factors or variables indicate the presence of fraudulent activity. In other words, accrual models focused on the existence of earnings management, whether legal or not, while the Beneish model predicted the likelihood that management's decisions violate the GAAP.

Building upon previous models and theories related to earnings management, the M-score takes into account a wide variety of variables to assess financial health and motivating areas to commit fraud.

Maybe its enhanced predictive ability is a result of the five variables that are not associated with accruals. These indices give the M-score an edge over traditional accrual methods as those models already incorporated the three other variables used in the M-score along with other ratios related to the use of accruals. Although not all of the eight variables may be individually important, they collectively provide a general profile of the company (Beneish, Lee, & Nichols, 2013).

Earnings manipulation in family firmsStockmans, Lybaert, and Voordeckers (2010) highlighted that although earnings management is a major research topic in the accounting field, not many researchers have studied this issue from a family business perspective. Sousa Paiva, Costa Lourenço, and Castelo Branco (2016) also emphasized the little attention given to family firms with respect to earnings management in comparison with their nonfamily counterparts.

In the last years, and due to the fact that the vast majority of firms around the world are family firms (Rojo Ramírez et al., 2015), many researchers have centered their attention in analysing these issues focusing on family businesses. For example, Prencipe, Bar-Yosef, and Dekker (2014) highlighted the empirical and theoretical challenges that scholars have to address when they investigate issues related to accounting and reporting in family businesses. By providing a ‘state of art’ these authors, identified for each of the analyzed articles, its topic, main theoretical framework, scope and principal findings. Moreover, Sousa Paiva et al. (2016) centered their attention on earnings management in family firms and gave a synthesis of the extant research on this topic. These authors distinguish between studies that analyze earnings management in family firms by comparison with earnings management in their nonfamily counterparts and studies that analyze earnings management in different types of family firms. Even though, the latter has received less attention than the former.

In any case, the existent empirical literature shows that family and nonfamily firms differ with respect to their financial reporting decisions (Gómez-Mejia, Cruz, & Imperatore, 2014), but results are inconclusive. On the one hand, most of the studies highlight that family firms incur in lower earnings management practices than their nonfamily counterparts (e.g. Achleitner, Günther, Kaserer, & Siciliano, 2014; Ali, Chen, & Radhakrishnan, 2007; Wang, 2006). On the other hand, some studies reveal opposite outcomes (Chi, Hung, Cheng, & Tien Lieu, 2014; Ding, Qu, & Zhuang, 2011). And, Prencipe, Markarian, and Pozza (2008) go beyond by distinguishing different earnings management practices and stated that although family firms are less prone to engage in earnings smoothing, they manage earnings to avoid debt-covenant violations.

Regarding the theoretical framework used in explaining earnings management in family firms, agency theory (Jensen & Meckling, 1976) has been identified as the dominant paradigm (Prencipe et al., 2014; Sousa Paiva et al., 2016). Nevertheless, the stewardship theory (Anderson & Reeb, 2003; Miller & Breton-Miller, 2006; Miller, Breton-Miller, & Scholnick, 2008) and the socioemotional wealth theory (Gómez-Mejia, Haynes, Núñez Nickel, Jacobson, & Moyano Fuentes, 2007) also appeared as main theoretical frameworks in these studies, taking the latter special relevance in recent articles (Martin, Campbell, & Gomez-Mejia, 2016; Pazzaglia, Mengoli, & Sapienza, 2013; Stockmans et al., 2010).

In this vein, Gómez-Mejia et al. (2014) stated that financial reporting decisions in family firms, that is earnings management and voluntary disclosure, are determined by the socioemotional wealth (SEW) (Berrone, Cruz, & Gómez-Mejia, 2012; Gómez-Mejia et al., 2007; Gómez-Mejia, Cruz, Berrone, & De Castro, 2011; Martínez Romero & Rojo Ramírez, 2016) presented in this type of firms. These authors argued that, when contemplating earnings management as a gamble, family shareholders would use SEW protection as their main reference point. Namely, they established that depending on which of the SEW dimensions (i.e. ‘Family Control and Influence’ and ‘Family Identification’) prevail in the family business, the family owners’ evaluation of benefits and costs of accounting strategies would be different.

Pazzaglia et al. (2013) developed an explanation to describe the difference in earnings quality between different types of family firms based on the SEW theory.

Finally, Stockmans et al. (2010) stated that SEW might play a decisive role as a motive for upward earnings management when firm performance is poor. These authors argued that family firms with a higher emotional endowment, as first-generation and founder-led private family firms, have greater incentive to engage in upward earnings management.

How to detect earnings manipulation? The Beneish modelWith respect to the analysis of fraudulent financial statement detection in particular firms, one of the most commonly used methods has been the ‘case-based’ research approach. In this vein, Wiedman (1999) wrote an instructional case for detecting earnings manipulation by using financial statement analysis. Goel (2014) examined the magnitude of earnings management in Indian corporate businesses. And, Abdul Aris et al. (2015) analyzed the possibility of a fraudulent financial statement in an automotive company in Malaysia by using different statistical techniques.

What these studies have in common is that all of them used the M-score model (Beneish, 1997, 1999) in addition to other types of analysis to detect earnings manipulation. Thereby, it seems that M-score is one of the most commonly applied models to detect this fraudulent behavior.

Earnings manipulation is defined as an instance in which a company's managers violate generally accepted accounting principles (GAAP) to favorably represent the company's financial performance (Beneish, 1999).

Beneish (1997) designed a model to detect earnings management among firms experiencing extreme financial performance. To develop his model, he examined 64 firms that had violated GAAP (GAAP violators) and compared them with 1989 that had supposedly not violated GAAP (control firms), during the period 1987–1993. Although GAAP violators were well identified, as they had appeared in the media as manipulators or were subject to accounting enforcement by the SEC (Wiedman, 1999), this was not the case for control firms. The fact is that the control sample might well have contained GAAP violators that had not been detected, biasing the Beneish model in detecting GAAP violators and making his tests more conservative (Barsky, Catanach, & Rhoades-Catanach, 2003).

Beneish (1999) also presented a model to detect manipulation. This model (Beneish, 1999) differs from Beneish's (1997) in the following characteristics. First, it was estimated using 74 companies, instead of the 64 companies that contained the previous model. Second, it used Compustat companies in the same industry, instead of Compustat companies with the largest unexpected accruals. Third, the set of explanatory variables used in Beneish (1999) provided a more parsimonious model than the previous model.

Beneish concluded arguing that the proposed model (Beneish, 1999) allows researchers and investment professionals for detecting manipulation. Moreover, he added that the model is cost-effectively related to a naive strategy that treats all businesses as if they were no manipulators.

A case study – the family business PescanovaThe business sector where the company deals are the fishery industry (capture and aquaculture), transformation and frozen fish trading. Capture consists on fishing in a natural environment, while aquaculture consists on the farming of marine species within controlled conditions. Capture and aquaculture meant a total of 148 million of tons of fish in 2010 worldwide (FAO, 2016). From this total, 128 million of tons were for human consumption. In 2011, the production raised to 154 tons, 131 million of which were destined to the food industry. The world supply of fishery products has risen in the last five decades with an annual average tax of growth of the 3.2% from 1961 to 2009 (FAO, 2016).

Extracting captures in maritime waters have been relatively steady around 90 million of tons during the period 2006–2011. Aquaculture has evolved from being hardly noticeable to equal capture production in terms of the international food industry and it reaches 60 million of tons in 2010. In terms of aquatic species, Aquaculture produces worldwide a total of 600 species within different systems and farming facilities. In Europe, the production quota has raised from 55% in 1990 to 81% in 2010, although some important producers’ quota has stopped growing or even diminished recently, especially within bivalves. In a European Union framework, Spain goes second in terms of aquaculture production, with 252,351 tons in 2010, which represents 10% of the whole.

In connection with the current state of fishery resources, the consumption of fish has grown exponentially in the last 50 years. It has caused that many aquatic species are fully exploited, 57%, there is no scope for improvement the capture production. About 30% of the aquatic species are overexploitation (FAO, 2016). Regarding the average consumption of fish at a global level, the most recent data show an annual average consumption of 18.7kg per capita in 2011, even reaching 28.7 in industrialized countries (FAO, 2016). In Spain, fish consumption within the whole food expenses of households represented a 13.1% in 2012, although the volume only represents a 4% of the whole of food consumption.

Pescanova is a well-established group based on the vertical integration, whose activities involve from fishing to manufacturing and selling the final products in European, American and Japanese markets. The company takes in completely the pairing resource-market; their first access to their resources is made either by its fishery fleet or by cultivating fishes in their factory farms (aquaculture). Pescanova was founded as a family-owned company in 1960 in Galicia (Spain). It was the first company to build the first refrigeration device in the world for storing tons of frozen fish. The developing of freezers, high investments in low-temperature refrigeration chambers and the non-defrosting packaging system for hake filets emerged the Project Pescanova. In 1963, the first Galician mixed fishery company was founded, and it is the beginning of a new era for Pescanova's business. Ten years after its foundation, Pescanova was the first fishery company in Europe and had more than 60 gross tonnages refrigerated trucks whose distributions channels go from Vigo's headquarters to all its provincial delegations. Besides, it also has 100 isothermal trucks covering many areas that drive Pescanova's products all across the country. The 1980s decade was a step ahead to the next generation with the founder's son, who becomes the head of the company. The founder's son places Pescanova almost at the top at an international level and leads its coming out on the Spanish official stock market in 1985.

In the nineties, last century, the firm proved its commitment with aquaculture by building factories in Chile (salmon), Southern Spain (king prawn) and Northern Spain (turbot).

Since 2000, Pescanova has been developing a remarkable business expansion by taken control of companies whose wholesale areas were focused on cephalopods, seafood manufacturers, as well as widely-projected commercial companies in their own countries. In the meantime, new commercial companies were founded in Japan (2006), Greece (2004), and Poland (2006). Regarding aquaculture, they developed the greatest projects in the world by building two factories in Mira (Portugal) and Xove (Lugo, Spain). The area of vannamei king shrimp is also promoted by the acquisition of some producer societies in countries such as Nicaragua, Honduras, Guatemala, and Ecuador.

Within Pescanova's assets, there are over 50 aquaculture facilities, more than 30 processing factories and a fleet of more than 100 ships. They process more than 70 marine species through 16 commercial brands of their own. The Company is present in the five continents and in more than 20 countries employing almost 10,000 people.

The company's main activity consists of the wholesaling of frozen fish, whereas the rest of the societies of the group develop a great number of activities related to the fishery (capture and aquaculture), transformation and trading. Pescanova associated companies take capture activities in Africa: wild king prawn (Mozambique), hake (Namibia and South Africa), white and red prawn (Angola). South America (South Cone), hake (Chile), king prawn (Argentina), hake, sea robin and cuttlefish (Uruguay). Australia: king prawn and cod from deep waters. Aquaculture activity is developed in the main farm: Vannamei king prawn (Central America and Ecuador); Salmon (Chile); Turbot (Spain and Portugal); Tilapia (Brazil); King Prawn (Spain).

Processing and industrial manufacturing include activities as cooking and freezing vannamei king prawn; processing, freezing and packaging of hake; pre-frying fish and cephalopods, breading, coating in batter and ultra-freezing; manufacturing of frozen and semi-tinned products; manufacturing of surimi products; logistics and goods storing; production of flours and grated bread; manufacturing of cuttlefish pasta. After the product is processed, Pescanova commercializes and manufactures products, basically with their own brand and fish trading business. Pescanova also develops other activities, at a minor level, such as port services, lifeguard ships adaptation.

The headline figures displayed strong growth for the period 2007–2011. The turnover increased 8.7%, the EBITDA raised 15.8% and the consolidated profit after taxes increased 21.5%. Pescanova's business expansion meant a total amount of investments over € 830 million since 2007, half of which belong to the period 2007–2010 and the other half to 2011 and 2012. Its investments were mainly destined to aquaculture business and € 379 million to develop vannemi king shrimp production in Ecuador and Central America; € 186 million invested in breeding and nurturing salmons in the South Cone; and € 230 million invested in breeding and nurturing turbots in Portuguese and Spanish factories. According to the analysts, the share price on the stock market reflected the high growth expectations.

But the situation became increasingly difficult. On 28 February 2013, the Spanish regulator of the stock market (CNMV), according to the article 85 of the Law of Stock Market, requested Pescanova their 2012 financial statements as soon as possible. The regulator also required from the company additional information on its balance sheets, debt conditions and the overcome and not paid debts. Pescanova, aware of the impossibility to submit this information to the regulator in the short term, acknowledged the CNMV that some differences between their accounting and their banking debts had just come up. These differences could be significant and were already being double-checked, for supervision and settlement, by their auditor BDO Auditores S. L. in order to correct them as soon as possible.

The CNMV and the auditors take investigations that allow clarifying the true situation of the company. In April 2013 CEOs of Pescanova publicly announce that the company has filed voluntary bankruptcy. These trigger a suspension of the trading of its securities.

In December 2013, due to a successful investigation carried out by forensic accountants (KPMG), the new Pescanova bankruptcy administration (Deloitte) requested the restatement of the 2011 financial statements.

Henceforth, the bankruptcy administrator of Pescanova, Deloitte, revealed that the accounting of the Galician company presents a series of errors and accounting irregularities such as concealment of financial debt, purchase, and sale with instrumental companies or non-accounting of financial expenses.

In particular, accounting adjustments in current assets were conducted as increasing the intangible assets and the equity and liabilities. The company capitalized financial investments by means of an increase of the indirect ownership in the stocks of the aquaculture companies. The noncurrent assets adjustments were done in the reclassifications of provisions, instrumental companies, customer advances and financial debt compensation that were not real.

On the hand of liabilities, the company increased suppliers’ accounts transactions, which did not have repercussions in increasing stocks, fictitious sales were done with shell companies, factoring lines were increased through the discounted of the same invoice to different institutions. Moreover, an important volume of finance expenses related to working capital was paid but was not registered in the accounting books.

In this vein, a critical contribution to our case study reveals that bankruptcy occurred due to a mixture of an internal decision-making, relative to company's growth through new investment projects, when external events were not favorable, i.e., the decreasing of credits bank due to global financial crisis. Among the causes, the following are highlighted (Deloitte, 2013): (1) funding for the aquaculture business. (2) Funding for negative cash flow position in the aquaculture business plan and a slower process of development. (3) Funding needs for finance expenses related to working capital. (4) Lack of bank financing due to global financial crisis.

At the same time, the judicial complaints of Pescanova case increase. In a judicial order, the examining magistrate of the Pescanova case has charged Manuel Fernández de Sousa-Faro, president of Pescanova at the time of suspension of the company's quota and other company executives, with the imposition of guaranties of more than 1.2 million euros to cover their possible civil responsibilities.

In addition, a judicial complaint is also presented by Cartasian Capital Group, an Investment Fund, against BDO audit, auditor firm at the time of suspension of the company's quota. The complaint was admitted against BDO audit for an alleged offense of falsification of economic-financial information. Also, it was admitted against the audit partner of the firm for alleged participation in an offense of misrepresentation of annual accounts and a crime of falsification of economic and financial information.

Finally, the loss of credibility of the company and its CEOs, the audit firm, and the securities regulator has been an unwanted consequence for all of them which should lead to better fight against financial statement fraud.

MethodsThis section presents how to apply the M-score model (Beneish, 1999) to the financial statements of Pescanova in order to check whether the fraud committed by this company could have been detected before its collapse. A case-based research approach has been followed here.

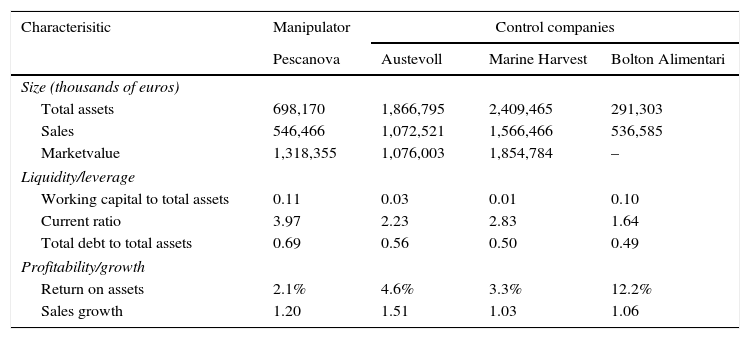

The present study is focused on a particular company, Pescanova. Nevertheless, we also analyzed three more companies, i.e. Austevoll Seafood, Marine Harvest, and Bolton Alimentari, that might well be considered the main competitors of Pescanova (Graña, 2016). We took these firms as control companies because compete in the same industry than Pescanova and due to they were not implicated in any recognized case of fraud. Then, we compared their financial outcomes with that of Pescanova.

The main financial characteristics of the analyzed companies are summarized in Table 1.

Characteristics of Pescanova and control companies: mean 2008–2011 data.

| Characterisitic | Manipulator | Control companies | ||

|---|---|---|---|---|

| Pescanova | Austevoll | Marine Harvest | Bolton Alimentari | |

| Size (thousands of euros) | ||||

| Total assets | 698,170 | 1,866,795 | 2,409,465 | 291,303 |

| Sales | 546,466 | 1,072,521 | 1,566,466 | 536,585 |

| Marketvalue | 1,318,355 | 1,076,003 | 1,854,784 | – |

| Liquidity/leverage | ||||

| Working capital to total assets | 0.11 | 0.03 | 0.01 | 0.10 |

| Current ratio | 3.97 | 2.23 | 2.83 | 1.64 |

| Total debt to total assets | 0.69 | 0.56 | 0.50 | 0.49 |

| Profitability/growth | ||||

| Return on assets | 2.1% | 4.6% | 3.3% | 12.2% |

| Sales growth | 1.20 | 1.51 | 1.03 | 1.06 |

Note: This information is based on data from S&P Capital IQ and from the firms’ Financial Statements.

The period covered in the present study is of four years, ranging from 2008 to 2011. This period has been considered to be meaningful enough, to reveal the manipulation practices of Pescanova various periods before the disclosure of earnings management in 2012.

This study uses both accounting and market data. Both of them were obtained from the annual reports of the companies and other such records for the relevant period from S&P Capital IQ and from the firms’ financial statements.

The Beneish probit model, specifically developed for testing aggressive accounting practices and detecting propensity to fraud, has been used in the present study. This model yields an earnings manipulation index as a linear combination of financial variables to be converted to a ‘probability manipulation’.

The model in Beneish (1999) contained the following variables, that were designed to capture either the financial statement distortions that can result from manipulation or preconditions that might prompt companies to engage in such activity:

- 1.

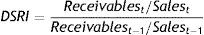

Day's sales in receivables index (DSRI): measures whether changes in receivables are consistent with changes in sales.

- 2.

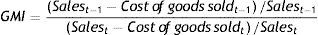

Gross margin index (GMI): measures if gross margins, that is, sales less cost of goods sold, have deteriorated and thus, gives a negative signal about future firms’ prospects.

- 3.

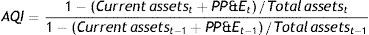

Asset quality index (AQI): measures changes, and thereby risks, in the quality of businesses’ assets. Increases in this index imply a growing propensity to capitalize and defer costs.

- 4.

Sales growth index (SGI): this ratio relates sales in year t to sales in year t−1. Although growth per se does not imply manipulation, growth businesses are perceived as more likely than other businesses to commit fraud due to pressure exerted on their managers to reach financial goals.

- 5.

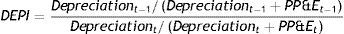

Depreciation index (DEPI): measures variations in the rate of depreciation. An increase in this measure reflects business efforts to reduce depreciation for increasing earnings.

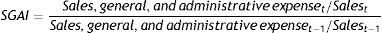

- 6.

Sales, general and administrative expenses index (SGAI): is the ratio of sales, general and administrative expenses relative to sales. A disproportionate increase in this index can be interpreted as a negative signal about the company's future prospects.

- 7.

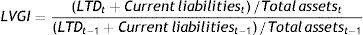

Leverage index (LVGI): indicates the business’ total debt with respect to assets. It is supposed that high values of this measure reveal an incentive of business’ managers to manipulate earnings, not to violated debt covenant.

- 8.

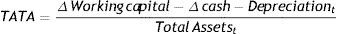

Total accruals to total assets (TATA): measures the extent to which earnings are cash based. Higher positive accruals, and thereby less cash might well be associated with earnings manipulation.

The eight financial statement variables designed to capture distortions in the financial statement data to assess the probability of detection are calculated as follow:

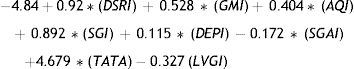

To estimate the model, Beneish (1999) used either weighted exogenous sample maximum likelihood (WESML) probit and unweighted probit. The final results of Beneish (1999)’s unweighted probit estimations conducted to the following model:

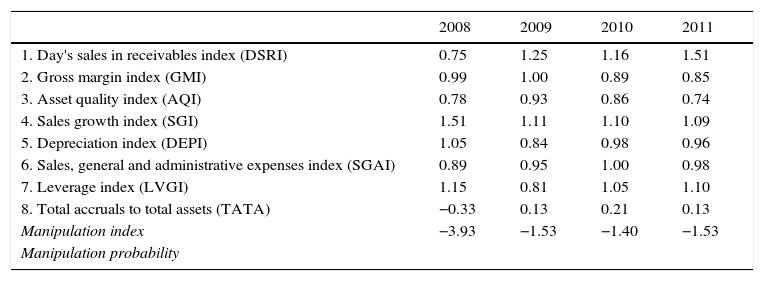

ResultsTable 2 reports the M-score variables for Pescanova, its manipulation index and its probability of manipulation.

Earnings manipulation predictive indicators from Beneish (1999).

| 2008 | 2009 | 2010 | 2011 | |

|---|---|---|---|---|

| 1. Day's sales in receivables index (DSRI) | 0.75 | 1.25 | 1.16 | 1.51 |

| 2. Gross margin index (GMI) | 0.99 | 1.00 | 0.89 | 0.85 |

| 3. Asset quality index (AQI) | 0.78 | 0.93 | 0.86 | 0.74 |

| 4. Sales growth index (SGI) | 1.51 | 1.11 | 1.10 | 1.09 |

| 5. Depreciation index (DEPI) | 1.05 | 0.84 | 0.98 | 0.96 |

| 6. Sales, general and administrative expenses index (SGAI) | 0.89 | 0.95 | 1.00 | 0.98 |

| 7. Leverage index (LVGI) | 1.15 | 0.81 | 1.05 | 1.10 |

| 8. Total accruals to total assets (TATA) | −0.33 | 0.13 | 0.21 | 0.13 |

| Manipulation index | −3.93 | −1.53 | −1.40 | −1.53 |

| Manipulation probability |

Note: Data based on S&P Capital IQ. McGraw Hill Financial.

The Day's sales in receivables index (DSRI) of Pescanova increased its value during the analyzed period, reaching values higher than 1, till 1.51 in the prior year to disclosure financial problems and accounting discrepancies. Such increase might suggest that Pescanova carried out revenue inflation practices.

The deterioration of gross margin, as observed in Pescanova between 2009 and 2011, is a negative signal about the company's prospects. Companies with poor prospects are more likely to engage in earnings manipulation.

The asset quality index experimented to an increase in 2009, but it showed a declining trend for the following years and took the value of 0.744 in the last year of the study.

The Sales growth index showed a value of 1.51 the first year of the study. Although the trend of this ratio has decreased over the period of study, it always has remained greater than 1.

A Depreciation Index's value greater than 1 means that the depreciation rate has decreased and, consequently earnings have increased. Pescanova has the highest value of DEPI in 2008. An increase in this index suggests efforts of the company to achieve a lower depreciation and thus increase earnings.

Analysts interpret a noticeable increase in the Sales, general and administrative expenses index as a negative signal about company's future prospects. Increases suggest a loss of managerial control of costs or unusual sales efforts. Pescanova shows a negative signal about the future prospects of the company in 2010.

When the Leverage index (LVGI) has a value higher than 1, it indicates an increase in debt. Higher values might identify companies whose managers have incentives to manipulate earnings and avoid violations of debt covenants. Table 2 shows that the increase in debt produces incentives for manipulating earnings in three years (2008, 2010 and 2011).

Total accruals to total assets index (TATA) is used as a proxy to evaluate the extent to which cash underlies reported earnings. A significant positive TATA coefficient is consistent with manipulators who have less cash behind their incomes. High increases in non-cash working capital may reflect possible manipulation. In 2010, Pescanova exhibited a rise from a value that was negative suggesting that earnings manipulation exists.

The relative high value of the variable Day's sales in receivables index (DSRI) indicates that this is the most important determinant of earnings manipulation by Pescanova. By order of importance, the next variable for detecting the earnings manipulation in Pescanova is the Leverage index (LVGI) that might be capturing the impact on violations of debt covenants. It should be noted that a growth tendency in Sales Growth index (SGI) does not imply manipulation, but nevertheless, some companies might feel pressured by the market to present some specific values of their earnings. Pescanova also appears to have a preference for higher positive accruals in 2010, as measured by TATA.

An Assets Quality index (AQI) positive and lower than 1 contradicts the conventional references. So, this result indicates not much of a cost deferral by the company. Neither the Depreciation index (DEPI) nor Sales, general and administrative expenses index (SGAI) nor Gross margin index (GMI) suggest manipulation to raise earnings.

Beneish et al. (2013) distinguish two categories of ratios. Category practicing aggressive accounting include three ratios (DSRI, DEPI, TATA) while the category of propensity to commit fraud include five ratios (SGI, AQI, GMI, SGAI, and LVGI). So, Pescanova presents aggressive accounting in Day's sales in receivables index (DSRI) and Total accruals to total assets (TATA). Moreover, this company presents propensity to commit fraud in Sales Growth index (SGI) and Leverage index (LVGI).

Finally, at the end of Table 2, we offer the results of applying the M-score model (Eq. (1)) to Pescanova. The manipulation index took the value −3.93 in 2008, which implies a probability of manipulation of 0.10%. As explained in “Theoretical background” section, we obtained the probability of manipulation by looking up the manipulation index in a standard normal distribution table. The manipulation index took values of −1.53, −1.40 and −1.53 in 2009, 2010 and 2011, respectively. These values imply a probability of manipulation of 6.3% in 2009 and 2011 and 8.1% in 2010. There are different criteria to establish the probability cut-offs associated with different costs of making classification errors (Beneish, 1999). In this vein, Wiedman (1999) postulated that an estimated probability between 5.99% and 11.72%, as Pescanova has in the 2009–2011 period, implies a serious risk of earnings manipulation and that further analysis is necessary to confirm or dispel this negative signal.

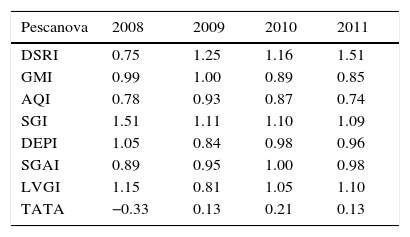

The measurements of the eight ratios for Pescanova and for the three control companies are shown in Table 3.

Variables from Pescanova and control companies.

| Pescanova | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|

| DSRI | 0.75 | 1.25 | 1.16 | 1.51 |

| GMI | 0.99 | 1.00 | 0.89 | 0.85 |

| AQI | 0.78 | 0.93 | 0.87 | 0.74 |

| SGI | 1.51 | 1.11 | 1.10 | 1.09 |

| DEPI | 1.05 | 0.84 | 0.98 | 0.96 |

| SGAI | 0.89 | 0.95 | 1.00 | 0.98 |

| LVGI | 1.15 | 0.81 | 1.05 | 1.10 |

| TATA | −0.33 | 0.13 | 0.21 | 0.13 |

| Austevoll Seafood | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|

| DSRI | 2.78 | 0.00 | – | – |

| GMI | 0.80 | 2.62 | 0.79 | 0.67 |

| AQI | 0.89 | 0.00 | 0.00 | 3556 |

| SGI | 1.16 | 2.82 | 1.13 | 0.94 |

| DEPI | 1.34 | 1.20 | 0.93 | 0.43 |

| SGAI | 1.19 | 0.00 | – | – |

| LVGI | 1.25 | 0.87 | 0.92 | 0.97 |

| TATA | 0.14 | −0.09 | −0.06 | −0.04 |

| Marine Harvest | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|

| DSRI | 1.06 | 0.75 | 1.08 | 0.97 |

| GMI | 0.99 | 0.79 | 0.74 | 1.69 |

| AQI | 0.93 | 1.04 | 0.86 | 1.08 |

| SGI | 0.93 | 1.11 | 1.04 | 1.04 |

| DEPI | 1.22 | 0.85 | 1.14 | 1.04 |

| SGAI | 1.06 | 0.89 | 1.06 | 1.00 |

| LVGI | 1.25 | 0.76 | 1.05 | 1.14 |

| TATA | −0.11 | 0.08 | 0.08 | −0.10 |

| Bolton Alimentari | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|

| DSRI | 1.05 | 0.96 | 1.13 | 1.06 |

| GMI | 0.93 | 0.95 | 0.94 | 1.09 |

| AQI | 0.87 | 0.89 | 0.92 | 0.96 |

| SGI | 1.18 | 1.01 | 1.00 | 1.05 |

| DEPI | 0.45 | 2.07 | 1.42 | 0.97 |

| SGAI | 0.90 | 1.00 | 1.10 | 1.03 |

| LVGI | 0.94 | 0.81 | 0.86 | 0.94 |

| TATA | 0.04 | 0.14 | 0.07 | 0.07 |

Notes: Prepared based on data from S&P Capital IQ. McGraw Hill Financial.

The DSRI of Austevoll Seafood in the first year, 2008, has increased to 2.78. Such an increase of this ratio can be interpreted as revenue inflation. GMI increased from 0.80 in 2008 to 2.62 in 2009, but from the third year onwards, it has been on a decreasing trend. Its value is 0.67 for 2011. AQI has shown values under 1, but in the last year, this ratio shows a large change (increase) that might be a liquidation of PP&E. SGI shows values higher than 1, during the whole period except for the last year. DEPI decreased from 1.34 in 2008 to 1.20 in 2009, following a downward trend in the remaining years, taking its lowest value in 2011. SGAI lacks values the last two years. While the first two years decreases from 1.19 to 0.00. LVGI ratio appears not to have a preference for debt. TATA Index has indicated a negative variable trend. This signifies a decrease in non-cash working capital of the firm. Thus, it is assumed that manipulation of financial information does not take place.

In the case of Marine Harvest, its DSRI could be interpreted as if it does not have revenue inflation. GMI increased during the period from 0.99 in the first year to 1.69 in 2011. Increases in this index point margin decline. AQI values correspond to a company that is not deferring costs. SGI has been more or less constant, around 1, during the period, except in 2008. Its index was lower than 1 in that year. Any increase in the index reflects a rise in sales, which may or may not be real. DEPI and SGAI have followed quite a fluctuating trend during the period, although it stayed around 1. LVGI ratio appears to have a preference for debt. TATA Index has indicated a very fluctuating trend: from −0.11 in 2008, it increased its value to 0.08 in 2009–2010. This is a high increase in non-cash working capital. For the last years, it was negative. It implies a large decrease in non-cash working capital of the firm. The chance of aggressive accounting corresponds to the years of increase in non-cash working capital.

Finally, the DSRI of Bolton Alimentari shows an increase in 2010 that can be interpreted that is more likely that revenues and earnings are overrated. Gross margin shows values lower than 1, except the last year, thus, it does not appear to be deteriorated. Throughout the period AQI values are lower than 1, indicating that the company is not deferred costs. SGI indicates increases in sales. However, this growth does not have to involve manipulation. DEPI has followed quite a fluctuating trend during the period, presents an increase higher than 1 in 2009–2010. The opportunity of aggressive accounting corresponds to the years of highest increase. SGAI indicates an increasing trend. In 2010, the variable reaches its maximum value (1.10), which could be interpreted as a negative signal about the future prospects of the company, but the value decreased again in 2011. LVGI ratio does not appear to have a preference for debt. TATA Index has shown a positive variable trend. In 2009, it increased significantly to 0.14. TATA reflects increases in aggressive accounting practices of Bolton Alimentari.

In fact, the control companies’ indexes show that none of them seem to carry out practices likely to fraud. While some of these companies have carried out some aggressive accounting practices.

Finally, the manipulation and probability indices for control firms have not been calculated. The reason is that none of them have presented a bankruptcy and/or fraud situations that justify it. However, the manipulation index can be easily calculated by applying Eq. (1).

Discussion and conclusionsThis study presented an experimental evaluation of fraudulent financial statements in an international food company, Pescanova. The ratios, the manipulation index and the manipulation probability of the company under study and of the control companies were computed using the Beneish model.

Our findings revealed that Pescanova manipulated its financial statements prior to the year of its disclosure of financial difficulties and accounting discrepancies. In particular, the variables manipulated were Day's sales in receivables index, Leverage index, Sales Growth index, and Total accruals to total assets. These results had a link with the Pre-bankruptcy Report of Corporate Board in 2013 (Deloitte, 2013). The report of the Pre-bankruptcy Corporate Board noted that part of the sales was not made. Namely, the report highlighted “In 2011, a 77% of the sales recorded by the insolvent (Pescanova) correspond to sales to instrumentality companies without economic content”(Deloitte, 2013, 124). This circumstance is consistent with the manipulation of the Sales Growth index, the Day's sales in receivables index and Total accruals to total Assets. The Pre-bankruptcy Corporate Board carried out a detailed analysis on the positions of risky corporate debt. Not only bank debt, but also five bond issues executed in the previous years to the firm's financial problems, of which three have not yet been canceled. In this sense, our results concerning Leverage index are aligned with the position of technical default shown by the Pre-bankruptcy Corporate Board of Pescanova.

With the support of the research reported by Beneish et al. (2013) our results suggest that Pescanova made aggressive accounting practices (through the manipulation of Day's sales in receivables index and Total accruals to total assets) and has had a propensity to commit fraud (through the manipulation of Sales Growth index and Leverage index).

In line with the mainstream in the domain (Prencipe et al., 2014; Salvato & Moores, 2010; Sousa Paiva et al., 2016), our findings can be explained using the agency theory (Jensen & Meckling, 1976) as the theoretical framework by arguing that firms with owners also acting as managers are more likely to engage in earnings management than their counterparts with separation of ownership and control (Ramdani & van Witteloostuijn, 2012). In fact, the aim of the owner is to maximize the value of the firm (Rojo Ramírez & Martínez Romero, 2017).

Considering that the Pre-bankruptcy Corporate Board did not use models such as Beneish's in its report, this article contributes to demonstrating the validity of the model in the case of Pescanova. Therefore, the application of M-score model to a family firm in Spain could have detected and prevented fraudulent financial statements, prior to the year of the Pescanova's collapse.

Despite the interesting results that can be derived from our study, we nevertheless must note a few shortcomings of this article. First, there is a lack of empirical research that relates family businesses’ cases studies to the variables used in this paper. In fact, to the best of our knowledge, this is the first study that applies the Beneish model to a Spanish family firm to detect earnings management and fraudulent practices. Therefore, although our study is exploratory, it constitutes an initial approach to determine the variables that might affect fraud and earnings manipulation. Second, the nature of the data implies that these results should not be interpreted in a casual manner, although our analysis suggests that these relationships do seem to exist among manipulators companies and the background variables used. Finally, we have to mention the inherent limitations of the Beneish model: first, the model was estimated using financial information for publicly traded firms so it might not be reliably for privately held firms; and second, the model was designed for earnings overstatement rather than understatement, so it might not be reliably for businesses that conduct decreasing earnings

This study also suggests directions for future research. Concerning to the diverse stakeholders, a complete understanding of the data from fraud examples is necessary, and a lack of research exists in case studies of this kind. The need for the regulators in Spain approves laws focused on the prevention of many of the corporate governance and oversight failures that have characterized financial reported fraud in the past. Another area for future research involves the development of causal models concerning to a sample of family businesses, taking into account some variables of control such as size, industry or country.

In spite of the abovementioned limitations, the research findings demonstrate that the role of accounting-based models has impacts in corporate credibility as well as in the measures of prevention fraud. By assessing the role both of these sources of credibility plays in the cases of fraud, auditors and other stakeholders can gain a complete understanding of the effect from multiple credibility sources have on capitals markets and thus may be able to develop more effective control strategies.

Conflict of interestsThe authors declare that they have no conflicts of interest.

María J. Martínez Romero acknowledges the contract grant sponsor of the Spanish Ministry of Education, Culture and Sport (MECD) for the predoctoral grant FPU-15/03393.