In Latin America, company ownership is typically concentrated in the hands of controlling families, who build powerful business groups which facilitate interlocking practices. The purpose of this study is to examine how President interlocking relates with financial performance in Latin American firms, under uncertainty circumstances. Using regression analysis (panel least squares), the association between return on assets and President interlocking during turbulent times is analyzed. For the latter, annual data (2009–2010) from non-financial publicly traded companies in Chile (243 firms) and Mexico (89 firms) is employed. It is documented that President interlocking in Latin American firms is positively associated with financial performance. However, this effect is higher in Chile than in Mexico, where minority shareholders and other stakeholders are better protected against expropriation. This study increases the understanding of the strengths of President interlocks in stormy times, by introducing the Latin American context.

En Latinoamérica, la propiedad de una empresa normalmente se concentra en las manos de las familias dominantes, que construyen poderosos grupos empresariales que facilitan las prácticas de interlocking. El propósito de este estudio es analizar cómo se relaciona el interlocking de presidentes con los resultados económicos de las empresas de Latinoamérica en circunstancias de incertidumbre. Mediante el análisis de regresión (panel de mínimos cuadrados) se analizó la asociación entre el retorno sobre los activos y el interlocking de presidentes en tiempos turbulentos. Para estos últimos, se han utilizado los datos anuales (2009-2010) de las empresas no financieras que cotizan en bolsa en Chile (243 empresas) y México (89 empresas). Está documentado que el interlocking de presidentes en las empresas de Latinoamérica está asociado positivamente con los resultados económicos. Sin embargo, este impacto es mayor en Chile que en México, donde los accionistas minoritarios y otras partes interesadas están mejor protegidos contra la expropiación. Este estudio aumenta la comprensión de los puntos fuertes del interlocking de presidentes en momentos tempestuosos, introduciendo el contexto latinoamericano.

Social networks can be viewed as “the pattern of ties linking a defined set of persons or social actors” (Seibert, Kraimer, & Liden, 2001, p. 220), enabling collaborative work and facilitating the sharing of ideas, information, and knowledge among network members (Fliaster & Spiess, 2008).

Social interaction can take a lot of forms; this study will center particularly in Presidents’ interlocks to study their relationship with performance. Most studies deal with general Directors’ interlocking; in our case, we give special emphasis to Board Chairs’ interlocks, as they represent very powerful ties for Latin American organizations. In fact, Board Chairs tend to be one of the main shareholders and in many cases they also act as firms’ CEOs. Mizruchi and Galaskiewicz (1993) observed that a firm's executive, especially its leading officer or CEO, often sits on the boards of other firms; the same applies among board members, predominantly regarding the President of the board of directors. Pfeffer and Salancik (1978) describe directors’ interlocks as a form of inter-organizational linkage that facilitates interaction between the organizations over time. The increasing relevance of these networks has even resulted in specific regulations in few countries and/or particular industries; for example, in the electric industry in the US. Numerous studies have suggested that interlocking directorate ties help firms to generate valuable social capital through connectivity to other directors and executives (Kor & Sundaramurthy, 2009). The latter suggests that Presidents’ interlocks can aid in the performance because a board chair linking a firm to its external environment can foster access to critical information and valuable resources that help adapt or reduce uncertainty for strategic actions (Beckman, Haunschild, & Phillips, 2004; Boyd, 1990; Pfeffer, 1972; Podolny, 1993; Tsai & Ghoshal, 1998). However, prior research also shows a broad debate on the negative consequences of director interlocks, generally calling attention to the potential conflict of interest of the directors involved (Bazerman & Schoorman, 1983) and the scarce time directors invest in each board. Galaskiewicz, Wasserman, Raushenbach, Bielefeld, and Mulaney (1985) found that where the CEO was also a member of the social elite, members of this elite were most likely to be represented on local boards and tended to choose one another to sit on their own boards. These connections allow a specific group of company owners, managers, chairs of the boards, and other directors to unify corporate policy and concentrate power, which facilitates not the interests of the institution itself, but rather the interests of particular directors (Valenti & Horner, 2010). In brief, studies have presented contradictory arguments regarding the influence of director interlocks on corporate performance, strategy, and change (Combe & Botschen, 2004).

These arguments are even more confused in turbulent times because the “rules of the game” change. In these circumstances, strong networks seem to facilitate adaptation that enhances performance when confronted with environmental uncertainty (Haynes & Hillman, 2010; Fernández-Pérez, Llorens Montes, & García-Morales, 2014). “Drawing upon resource dependence theory (Pfeffer & Salancik, 1978), empirical research in strategy and organization theory shows that firms respond to uncertainty by developing or reinforcing networks, such as directorate interlocks (i.e., the network of firms a director is appointed by), in order to avoid uncertainty's potential negative performance effects” (Martin, Gözübüyük, & Becerra, 2015. p. 235). Thus is, firms may form linkages through strategically adding directors (especially powerful directors such as board chairs) to improve their capacity to deal with uncertainty by sharing information, experiences, and resources. Resource dependence theory states that a firm's corporate strategic orientation is linked to the opportunities that are available to access the required resources and protect from external threats (Huse, 2005; Pfeffer & Salancik, 1978), which is particularly important in uncertain environments. However, it is also evident that during turbulent episodes agency costs rise, increasing the odds of entrenchment by interlocked managers, board chairs, and other directors. The fulfillment of private benefits is detrimental to other stakeholders’ interests, and generally harms companies’ performance (di Donato & Tiscini, 2009; Mitton, 2002). Class hegemony theory arguments that board chairs and other directors are chosen according to their positions within a dominant social class (Palmer, 1983); therefore, President interlocks constitute social networks between people with important positions in society – not among companies themselves – which increases their power and expropriation opportunities, above all during volatile times (Caswell, 1984; Drago, Millo, Ricciuti, & Santella, 2015).

In emerging markets, specifically in Latin American countries, corporate governance practices and ownership structure of firms are quite different from that prevailing in Anglo-Saxon countries. In these emerging economies, ownership concentration is greater and a larger percentage of corporations are controlled by so called business groups. Such groups exhibit the following three characteristics (Leff, 1978): A shared administration of diverse companies in several economic sectors (conglomeration), their integration in the financial sector, and the relationship among companies through a common family ownership. Thus, a business group differs from a loose collection of companies united by financial ties, like the conglomerates in the United States, by the presence of a well-established social structure among participating firms (Granovetter, 1994). Hence, Presidents’ interlocks tend to be more frequent and powerful, as suggested by Dyck and Zingales (2004), Berglof and Claessens (2006), and Uddin and Choudhury (2008). In spite of the above, there are few specific studies on Latin American interlocking directorates. So, this study focuses on Presidents’ interlocks in Mexican and Chilean companies, and how their structural links relate with financial performance, particularly during turbulent times.

This study offers three key contributions. First, the analysis adds to the literature partly favoring Presidents’ interlocks presence in Latin American organizations, during uncertain times. For it, results are framed on the well-established resource dependence theory. Second, in weak institutional settings, as are more commonly found in Latin America in general, where there tends to be a predominance of family businesses with a high concentration of ownership, current accepted theories may be questioned. Particularly for volatile times, interlocks can heighten the power of those involved, enabling them to take advantage of the opportunity to achieve the family's socio-emotional goals to the detriment of business interests, thus reducing the advantages of interlocks as exposed by the resource dependence theory. Third, the study provides insights supportive of the class hegemony theory, by differentiating the positive relationship between performance and President interlocking among firms in Latin America. By doing so, it appears that the favorable performance association with President interlocking is greater in Chile than in Mexico. According to OECD (2011) and McKinsey and Company (2007), Chilean governance practices and regulations are better than those present at other emerging markets. Therefore, expropriation opportunities by elitist director circles are greater in Mexico, which constraints the beneficial link of President interlocking and firm performance during volatile periods. The above opens an interesting ethical debate.

The paper is organized as follows. The second section deals with the literature review and hypotheses formulation. The third section refers to the data and variables employed. The fourth section presents the methodology and results. The last section discusses and concludes.

Literature review and hypothesesDirectors’ interlocks and performance under uncertainty: resource dependence frameworkDifferent types of network studies have shown a positive relationship between a favorable position in inter-organizational networks and firm performance (Baum & Oliver, 1992; Collins & Clark, 2003; Dyer, 1996; McEvily & Marcus, 2005; Podolny, 1993; Powell, Koput, Smith-Doerr, & Owen-Smith, 1999; Zaheer & Bell, 2005), which extends to alliance networks (Ahuja, 2000), and interpersonal managerial networks (Fernández-Pérez, García-Morales, & Bustinza-Sánchez, 2012; Uzzi, 1997), among others examples. Theoretical arguments and empirical findings regarding the performance effects of networks also apply to directors’ interlocks, as they constitute a device for social interaction. Carrington (1981), in a study for Canadian firms, found positive associations among concentration, interlocking, and profitability. Other studies on the performance effects of interlocks have shown the relationship to be small, yet positive (Burt, 1983; Pennings, 1980).

Resource dependence theory asserts that interlocking directorates (particularly regarding powerful directors such as board chairs) are a tool used to manage environmental uncertainty (Boyd, 1990), by reducing risk through cooperation, information revelation, and sharing different resources and knowledge among companies. Research in strategic management and organizational sociology argues that interlocking directorates offer valuable social capital to the companies, due to three main reasons: (1) it is a mechanism for cooperation and monitoring between connected companies, reducing uncertainties and transaction costs (Carrington, 1981; Mizruchi, 1996); (2) it allows more personal contacts and increases information flows through companies’ top directors and managers, providing data for decision making and disseminating successful strategies; (3) interlocking could reflect a situation of social cohesion, in which only a restricted group of highly talented professionals participate. As such, busy boards could be an indication of the quality of the directors, who can make use of their network, knowledge, experience, and information in order to achieve high company value (Deloof & Vermoesen, 2015).

Environmental uncertainty affects how firms manage their strategy and activities to remain competitive (Nadkarni & Narayanan, 2007; Sirmon, Hitt, & Ireland, 2007). Uncertainty is related to managerial perceptions that the general business environment or one of its components (technology, consumers’ expectations, demand, legislation, etc.) is unpredictable (Milliken, 1987). During turbulent periods, CEOs, board chairs, and other directors may turn to those they trust to exchange resources and reduce uncertainty. In highly volatile periods, companies become more conservative and interlocked firms tend to standardize their policies (Fernández-Pérez et al., 2014). Homogenization may stabilize performance and provide security (Geletknaycz & Hambrick, 1997), although in certain contexts it can also lead to harmful consequences, such as the continuation of previous poor performance. Nevertheless, Boyd (1990) observes that, among firms who face bigger uncertainty in the economic environment, those with greater connections with other companies through common directors display better performance – measured through sales’ increase and return on equity. Nicholson, Alexander, and Kiel (2004) highlight that board interlocking is especially advantageous for companies facing organizational complexity, uncertainty, and interdependence, since this mechanism would act against possible disadvantages of these factors through directors’ social connections and their influence in the market. Martin et al. (2015) find strong support for the moderating effect of uncertainty in the director network-performance relationship; these networks appear to enhance firm outcomes when uncertainty is high.

Directors’ interlocks and performance under uncertainty: class hegemony frameworkClass hegemony theory suggests that President interlocking constitutes a control device for the social elite. These networks facilitate upper-class participation in business, permit coordination of corporate policy, and contribute to elite's unity through common life experiences-like board membership (Sonquist & Koenig, 1984). Authors such as Palmer (1983) argue that company directors are chosen according to their positions within a dominant social class, instead of due to characteristics such as knowledge and talent. Social relationships provide power; then, interlocks correspond to networks between influential people, not among firms themselves, which serves their own interests in maintaining friendship ties and social status (Caswell, 1984; Koenig & Gogel, 1981; Valenti & Horner, 2010). Excess power limits effective firms’ regulation by minority shareholders, financial markets, and other control devices (Drago et al., 2015).

President interlocking can set in motion mutual entrenchment actions against stakeholders. Through these networks, the accomplishment of collective interests of the corporate elite is facilitated (Useem, 1984). Majority shareholders influence the composition of the board of directors, and tend to appoint friendly board chairs and other directors. New directors are then selected through interlocks (Davis, 1993); those directors serve the interests of companies’ main owners, and eventually belong to a bigger director network with the same characteristics. Due to this loyalty, directors are able to obtain several privileges (such as high compensation levels) and at the same time their independence is jeopardized (Fich & Shivdasani, 2006; Fich & White, 2003; Jiraporn, Manohar, & Lee, 2009).

Several authors sustain that interlocks can be used to exploit private benefits in favor of entrenched managers or controlling shareholders, which is prejudicial for companies’ value (di Donato & Tiscini, 2009; Fich & White, 2003). This situation is worse under uncertainty periods and in scenarios of high ownership concentration, where corporate crossholdings are common and elitist managerial circles more easily prevail (Piccardi, Calatroni, & Bertoni, 2010). Turbulent times on average reduce companies’ performance. During firm value destruction circumstances, it becomes more attractive to expropriate minority shareholders and other stakeholders. And, if external governance mechanisms (legal system, labor markets, and markets for corporate control) do not function properly, the odds for these types of actions increase, pushing firm performance further down (Baek, Kang, & Park, 2004).

Directors’ interlocks and performance under uncertainty: the Latin American contextMost research on board interlocks is based on developed economies. There have been relatively few studies for emerging countries such as Malaysia, Thailand, Singapore, Chile, and Mexico (Farías, 2014; Lim & Porpora, 1987; Ong, Wan, & Ong, 2003; Peng, Au, & Wang, 2001; Salas-Porras, 2006; Santos & da Silveira, 2007; Silva, Majluf, & Paredes, 2006). This study aims to contribute to the literature on President interlocking in emerging economies, particularly regarding Latin American firms during turbulent times.

Latin American firms’ ownership structure and corporate governance mechanisms differ from those observed in developed countries, mainly when considering Anglo-Saxon nations: (a) there is a greater probability that boards of directors in Latin America are under the influence of controlling shareholders, who might not perform their legitimate fiduciary duty to safeguard minority shareholders’ and other stakeholders’ interests; (b) the ownership structure is concentrated in the hands of the controlling family or families, who tend to appoint family members as board chairs and CEOs. They build powerful business groups which facilitate interlocking directorate practices (Cárdenas, 2014; Santiago, Brown, & Baez, 2009); and (c) formal institutional protection is often lacking, corrupted, or not enforced (Santiago & Brown, 2009).

Latin America is a hotbed of family business groups, in which families typically control firms and family ties among directors are strong (Lefort, 2005; Schneider, 2008; Silva et al., 2006). In the Latin American context, the concept of social cohesion, which according to Mizruchi (1996) is associated with members sharing similar interests and with an extensive network of social contacts (allowing a large flow of relevant information), is particularly robust. President interlocking can improve communication routes and information exchange, which reduces transaction costs and risk. These networks support intra-group trading and financing, and can ensure close monitoring of management. The latter is particularly relevant during turbulent times when sales and access to formal financial markets decline (Castañeda, 2005; Claessens, Djankov, & Xu, 2000; Khanna & Palepu, 2000).

Resource dependence theory asserts that the board is a tool used to manage environmental uncertainty (Boyd, 1990). In the Latin American context, President interlocking could also reduce the negative impact of uncertainty on firm performance. This leads to the following hypothesis:H1 President interlocking is positively related to firms’ financial performance during Latin American turbulent times.

Nevertheless, President interlocking practices might have negative effects on performance, when majority shareholders take advantage of their condition to expropriate minority shareholders and other stakeholders, at the expense of overall efficiency (Carlin & Mayer, 2000; Fich & Shivdasani, 2006; Fich & White, 2005; Loderer & Peyer, 2002; Shleifer & Vishny, 1997). In this context, Silva et al. (2006) show that interlocks improve performance only in 26% of the cases, while Santos and da Silveira (2007) suggest that this practice negatively influences firm value measured by Tobin's Q and price-to-book-value ratio.

According to Santiago et al. (2009), in Latin American firms there is little stakeholder protection through appropriate corporate governance schemes. Families represent the greatest shareholders in 58% of the analyzed firms. The authors observed that majority shareholders dominate the boards through interlocks and appointment of family members and friends as board chairs and other directors, while independent directors correspond to less than one fourth of board members. The former reflects the amount of power and control that these actors possess. Regarding external governance mechanisms, the general view is that in this sense stakeholders are better protected in developed markets than in emerging economies. Legal systems, labor markets, and markets for corporate control are comparatively weaker in Latin America than in developed nations (Boubakri, Cosset, & Guedhami, 2005).

Baek et al. (2004) sustain that during turbulent episodes high ownership concentration (mainly in family hands) shrinks firm performance. Under these firm value damage settings, it becomes more attractive to expropriate minority shareholders and other stakeholders. And, if external governance mechanisms are deficient, the chances for these types of actions rise, reducing even more companies’ value. Through President interlocking expropriation possibilities expand. The appointment of board chairs from the social elite reciprocally protects the interests of network members, without ensuring that other company stakeholders’ rights are not violated (Valenti & Horner, 2010).

Class hegemony theory manifests that interlocking directorates correspond to a control mechanism, which can be used for mutual management entrenchment actions against stakeholders. With environmental uncertainty, the odds for expropriation increase, especially when firms operate in weak corporate governance and high ownership concentration settings. In the Latin American context, the positive influence of President interlocking on firm value due to cooperation, resource sharing, and information disclosure could be mitigated through expropriation actions. However, on this regard there is heterogeneity among countries. This leads to the following hypothesis:H2 The positive relationship between performance and President interlocking in Latin American companies (during turbulent times) is mitigated in countries where expropriation odds are higher.

Although some papers have analyzed the association between financial performance and President interlocks during turbulent times, there are very few studies concentrating on companies operating in emerging markets, and to the authors’ knowledge none related to the Latin American context. This is probably due to the lack of detailed publicly available company information.

A comparative database was constructed for pursuing the present research. The authors have built a unique database containing annual (for 2009 and 2010) corporate governance and financial information, for all non-financial companies quoted both in Chile and Mexico. Most of these companies are family firms. The data comes from the firms’ annual reports, which are electronically available at Superintendencia de Valores y Seguros in Chile (SVS) and Bolsa Mexicana de Valores in Mexico (BMV). Information was manually captured for a total of 243 companies in Chile and 89 firms in Mexico.

Chile and Mexico under a corporate governance and ownership structure portrayalChile and Mexico are two of the main economic players at the emerging market – Latin American context. Together with Brazil, they possess the biggest capital markets in the Latin American region; nevertheless, they are considered relatively illiquid in the international context. One explanation for the former is that in both nations firms’ ownership is highly concentrated, particularly in family hands and business groups (Castañeda, 2005; Lefort & González, 2008). These groups refer to legally independent entities, controlled by the same leader through a chain of property relationships. Under these circumstances, it is quite normal for board chairs to participate in several firms’ boards.

According to the data, 44% of companies in Chile are family owned. In Mexico, this corresponds to 78% of the firms under study. Family firms are determined as those where at least two of the main shareholders hold the same last names. If a control trust, private investment fund, or company limited by shares has more than 30% of the stocks, its shareholders are identified in order to verify if the company is family owned, according to the present definition. This classification is even stricter than the European Union definition (2009) which considers a family business when a family possesses at least 25% of voting rights. Regarding business groups, in Chile 70% of listed corporates belong to these networks, vs. 40% in Mexico. Following Self-identifying reference (2013), in this study a company is considered to be part of a business group when it possesses at least 30% of the shares of another firm (or vice versa). Both in Chile and Mexico it is quite common to observe family firms which at the same time belong to business groups. This is the case for 36% of listed companies in Chile, and 30% of listed firms in Mexico. On the contrary, just a few corporates present disperse ownership (12% in Mexico and 21% in Chile).

Due to this entrepreneurial environment, it is more difficult for corporates to finance their operations through capital markets, as there are higher expropriation threats from majority stockholders (expropriation dealing with the generation of private benefits by large shareholders that are not shared by others). Yet, this effect might be lessened as Chile and Mexico are the only Latin American countries members of the Organization for Economic Cooperation and Development (OECD), so they have faithfully adopted its recommendations regarding good corporate governance. One of the main commendations on this regard is to protect minority shareholders’ rights and treat equitably all shareholders (OECD, 2004). These points have been included in the stock market legislations, both in the Ley de Gobiernos Corporativos de Empresas Privadas (2010) in Chile and in the Ley del Mercado de Valores (2006) in Mexico.

In spite of the above similarities, when comparing Chilean and Mexican capital markets, Chile appears more dynamic with respect to the number of listed companies (2.7 Chilean firms for 1 Mexican company) and market capitalization (in relation to GDP). Chong, Guillén, and López-de-Silanes (2009) suggest that these differences relate to the fact that in Chile minority shareholders are better protected than in Mexico. Firstly, investment funds represent the main minority stockholders in Chile. They play a predominant role as monitors and firms’ advisors, and possess the power to designate independent board members (this contributes to interlocking activity of independent directors). Secondly, compliance with stakeholders’ rights is more effective in Chile than in Mexico. According to a report by Centro de Excelencia en Gobierno Corporativo (2008) and the study by Chong et al. (2009), in Mexico the judicial process is more corrupt, slow, and inefficient than in Chile.

Turbulent years for Chile and MexicoBoth in Chile and Mexico, 2009 and 2010 constitute turbulent years. First of all, there was the contagion effect from the global financial crisis that initiated in the US. Being the US Mexico's main commercial partner – 82% of Mexican exports are driven to this market – it is not surprising that this incident deeply wounded its economy. According to the Bank of Mexico, Mexican real GDP declined 6.1% during 2009; the most injured sectors were industrial production (in particular mining, petroleum, construction, and manufacturing) and financial services. The Mexican economy started to recover during the second quarter of 2010, due to the betterment of the world economy (particularly the US’), reaching 5.5% annual growth.

In Chile, real GDP dropped 1.7% during 2009, also as a reaction to the global financial crisis. The worst performing sectors were fishing, manufacturing, and construction. In spite that Chile had lower contagion repercussions from this event, which can be partly explained by its greater commercial diversification and financial strengths, its economic activity was also susceptible to the February 27th, 2010 earthquake. According to the Chilean Central Bank, industrial and fishing sectors decayed considerably, especially during the initial quarter of 2010; overall, Chile's real GDP declined almost 2 per cent during this first quarter, and afterwards recovered attaining 5% annual growth.

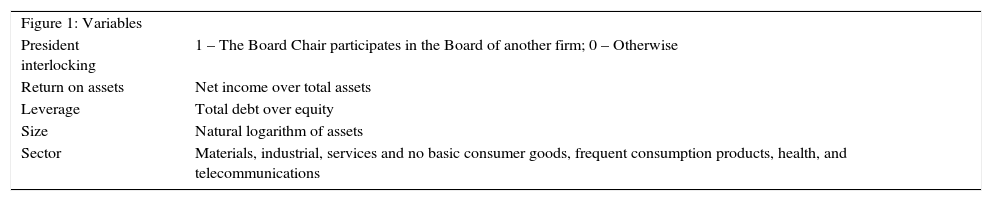

VariablesThe objective of this paper is to determine the association between financial performance and President interlocking during turbulent times, under a Latin American context. For this purpose, information on board chairs’ appointments to other boards has been obtained both for Chile and Mexico, during the period 2009 till 2010. The President interlocking variable is then constructed as a dummy variable, which is 0 if the chair of a particular board does not participate as proprietary director at other companies’ boards (during 2009 or 2010), and 1 if that is not the case.

The performance variable corresponds to return on assets, calculated as net income over total assets. As such, it reflects book value. It was chosen to alternative market value measures such as Tobin's Q, as these may not be adequate performance indicators in countries with relatively incipient capital markets.

Control variables for performance such as leverage, firm size, and sector are used. Leverage is defined as total debt over equity. As it increases, so does the exposure to shocks and the amount of agency costs of debt (Berger & Bonaccorsi di Patti, 2006). The natural logarithm of assets is employed to capture size effects. Former evidence manifests a direct size influence on return on assets. There are several explanations for it: First of all, large companies are able to take advantage of economies of scale. Second, big firms have comparatively better access to financial markets and lower financial costs, above all during turbulent times. Third, large enterprises possess more resources to compete for the best CEOs (Harford & Li, 2007). Lastly, as performance fluctuates according to companies’ sector (sector effects usually predict between 17% and 20% of financial performance – Coles, McWilliams, & Sen, 2001), companies have been grouped through dummy variables into six sectors: materials, industrial, services and no basic consumer goods, frequent consumption products, health, and telecommunications.

Variables are summarized in the following figure:

| Figure 1: Variables | |

| President interlocking | 1 – The Board Chair participates in the Board of another firm; 0 – Otherwise |

| Return on assets | Net income over total assets |

| Leverage | Total debt over equity |

| Size | Natural logarithm of assets |

| Sector | Materials, industrial, services and no basic consumer goods, frequent consumption products, health, and telecommunications |

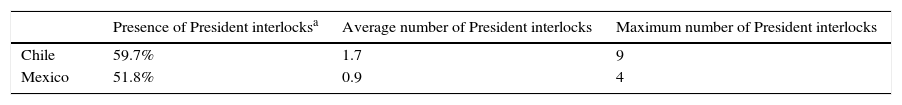

President interlocks are quite common both in Chile and Mexico. During 2009 and 2010, more than half of all boards’ chairs participated as proprietary directors in other listed companies’ boards. Nonetheless, statistically speaking (at 10% significance level), Chilean listed non-financial firms show comparatively higher presence of President interlocks with respect to analogous companies operating in Mexico. On average, 59.7% of board chairs in Chilean companies take part in other firms’ boards; this percentage is 51.8% in Mexican corporates.

In addition to the above, President interlocks in Chile occur between more firms than in Mexico (average of 1.7 in Chile vs. 0.9 in Mexico). While in Chile boards’ chairs appear as proprietary directors of up to 9 other boards, in Mexico this number is limited to 4. Table 1 shows these characteristics.

President interlocking in Chile and Mexico during 2009–2010.

| Presence of President interlocksa | Average number of President interlocks | Maximum number of President interlocks | |

|---|---|---|---|

| Chile | 59.7% | 1.7 | 9 |

| Mexico | 51.8% | 0.9 | 4 |

Values differ significantly at 10% level for Chilean and Mexican companies.

President Interlocking is constructed as a dummy variable, which is 0 if the President of a particular board does not participate as proprietary director at other companies’ boards (during 2009 or 2010), and 1 if that is not the case.

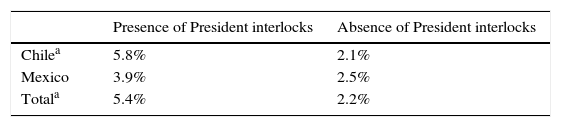

When comparing average ROA for the entire sample (Chilean and Mexican companies during 2009 and 2010), according to the presence or absence of President interlocks, it drives to attention that business performance is significantly higher (at 1% significance level) in cases where President interlocks are present: 5.4% vs. 2.2%. This effect is further analyzed separating the sample for each country. In Chilean firms, where boards’ chairs participate also in other boards, mean return on assets is 5.8%. This value is statistically lower (at 1% level) for Chilean corporates lacking President interlocks – 2.1%. Although President interlocks are also related with higher average ROA in Mexican firms (3.9% vs. 2.5%), these differences are not statistically significant. Table 2 presents these relationships.

Average ROA (2009–2010) according to the presence or absence of President interlocking.

| Presence of President interlocks | Absence of President interlocks | |

|---|---|---|

| Chilea | 5.8% | 2.1% |

| Mexico | 3.9% | 2.5% |

| Totala | 5.4% | 2.2% |

Values differ significantly at 1% level.

President Interlocking is constructed as a dummy variable, which is 0 if the President of a particular board does not participate as proprietary director at other companies’ boards (during 2009 or 2010), and 1 if that is not the case.

Return on assets is calculated as net income over total assets.

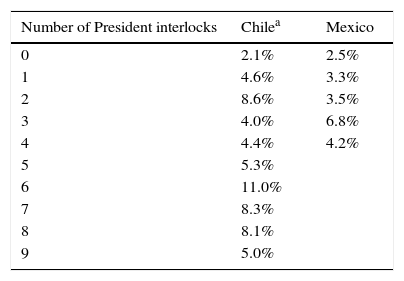

Going further into President interlocking, data for Chilean companies evidences substantial ROA increments when Presidents of the boards participate in 6 or more boards. In these circumstances, average return on assets corresponds to 8.0%, which is considerably greater compared to 4.1% mean ROA for firms involved in less President interlocks. For Mexican corporates, as the number of entities involved in President interlocks increase, so does average ROA (although this is not a statistically significant outcome). The latter evidence is exposed in Table 3.

Average ROA (2009–2010) according to the number of President interlocks.

| Number of President interlocks | Chilea | Mexico |

|---|---|---|

| 0 | 2.1% | 2.5% |

| 1 | 4.6% | 3.3% |

| 2 | 8.6% | 3.5% |

| 3 | 4.0% | 6.8% |

| 4 | 4.4% | 4.2% |

| 5 | 5.3% | |

| 6 | 11.0% | |

| 7 | 8.3% | |

| 8 | 8.1% | |

| 9 | 5.0% |

ROA values differ significantly at 1% level.

President Interlocking is constructed as a dummy variable, which is 0 if the President of a particular board does not participate as proprietary director at other companies’ boards (during 2009 or 2010), and 1 if that is not the case.

Return on assets is calculated as net income over total assets.

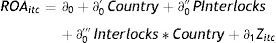

This section presents econometric results for the relationship between President interlocking and firm performance during turbulent times, under a Latin American context. For all non-financial companies quoted both in Chile and Mexico during 2009 and 2010 (243 companies in Chile and 89 firms in Mexico, for a total of 664 observations), the following equation is estimated through panel least squares:

where itc refers to firm, time, and country; Country is a dummy variable that takes the value of 0 for Chile and 1 for Mexico; ∂0 is a parameter that indicates ROA's mean value for Chilean companies where President interlocks are absent; ∂0+∂′0 is a parameter that indicates ROA's mean value for Mexican companies where President interlocks are absent; PInterlocks is a dummy variable, which is 0 if the President of a particular board does not participate as proprietary director at other companies’ boards (during 2009 or 2010), and 1 if that is not the case; ∂″0 shows the President interlocks’ effect on ROA, for Chilean corporates; ∂″0+∂‴0 indicates the President interlocks’ effect on ROA, for Mexican firms; ∂1 is a vector of parameters, associated with each of the control variables; Zitc is a vector of control variables; particularly, leverage, firm size, and sector.In the regression potential biases due to endogeneity are accepted, as there are not enough observations to run a Generalized Method of Moments (GMM) model, nor strong instrumental variables (particularly not lagged on time) that allow including all relevant regressors. Therefore, a two-stage least squares estimation is not performed either and causality is not addressed.

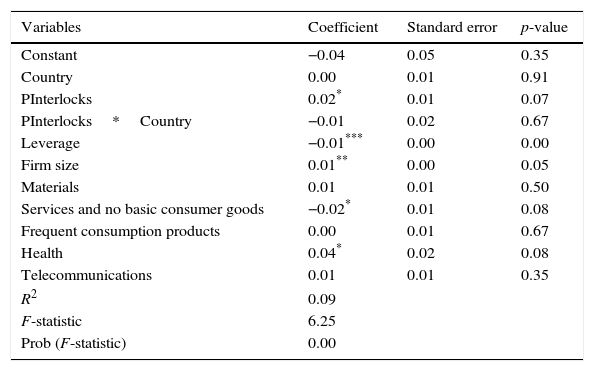

ResultsTable 4 presents econometric results from estimating Eq. (1):

Econometric results – panel least squares.

| Variables | Coefficient | Standard error | p-value |

|---|---|---|---|

| Constant | −0.04 | 0.05 | 0.35 |

| Country | 0.00 | 0.01 | 0.91 |

| PInterlocks | 0.02* | 0.01 | 0.07 |

| PInterlocks*Country | −0.01 | 0.02 | 0.67 |

| Leverage | −0.01*** | 0.00 | 0.00 |

| Firm size | 0.01** | 0.00 | 0.05 |

| Materials | 0.01 | 0.01 | 0.50 |

| Services and no basic consumer goods | −0.02* | 0.01 | 0.08 |

| Frequent consumption products | 0.00 | 0.01 | 0.67 |

| Health | 0.04* | 0.02 | 0.08 |

| Telecommunications | 0.01 | 0.01 | 0.35 |

| R2 | 0.09 | ||

| F-statistic | 6.25 | ||

| Prob (F-statistic) | 0.00 | ||

Significant at 1%.

Country is a dummy variable that takes the value of 0 for Chile and 1 for Mexico.

PInterlocks is a dummy variable, which is 0 if the President of a particular board does not participate as proprietary director at other companies’ boards (during 2009 or 2010), and 1 if that is not the case.

Dependent variable is ROA. It is calculated as net income over total assets.

Results show that the relationship between President interlocking and Chilean companies’ performance is positive and significant at 10% level (∂″0=0.02,p=0.07). Experience on other boards can enhance Presidents’ abilities to contribute to strategy, in order to overcome turbulent periods of time (as in 2009 and 2010). The additional information regarding business practices that board chairs receive from participating in different boards can be crucial in order to survive stormy episodes. The latter, together with the fact that President interlocks facilitate cooperation (and even monitoring) within participating firms, positively relates with corporates’ outcomes during volatile times. From a capital markets perspective, during turbulent periods investors are more cautious and invest primarily in prestigious companies, including those who legitimate their boards by appropriate interlocks with the leading firms.

In order to determine if President interlocks are also associated with return on assets of listed Mexican companies (during 2009 and 2010), H0: ∂″0+∂‴0=0 is examined through a Wald test. Although the value for the test is positive (0.01), suggesting that President interlocks’ relationship with Mexican firms’ outcomes is positive, the null hypothesis cannot be rejected at 10% significance level (p=0.47). Therefore, there are no statistical performance divergences among Mexican companies where President interlocking is present or absent.

There are two possible explanations for the differences between President interlocks’ relationship with financial performance in Chile and Mexico. First of all, President interlocks in Chile occur between more companies than in Mexico (average of 1.7 in Chile vs. 0.9 in Mexico), which allows Chilean corporates to further exploit interlocks’ advantages. Second, Chilean governance practices and regulations are stronger than Mexican, which reduces the odds of expropriation by interlocked board chairs. During turbulent periods of time, there is more incentive to expropriate minority shareholders and other parties and to address alternative goals such as the family's socio-emotional wealth. And if external governance mechanisms (the legal system, labor markets, corporate control markets, etc.) do not function properly, the probability of this type of action being taken by majority shareholders, reducing corporate performance, will increase.

With respect to control variables, both firm size and leverage are significant and show the expected signs. Larger companies are able to take advantage of economies of scale, which favor firm performance. In addition, bigger firms have comparatively better access to financial markets and lower financial costs, above all during turbulent times. Finally, large enterprises possess more resources to compete for the best CEOs. Regarding leverage, it implies higher risk levels and vulnerability during difficult periods, which pushes performance further down. Concerning sectors, compared with industrial (which groups most corporates in Chile and Mexico, and is one of the most affected during the turmoil), health displays better outcomes and in contrast services and no basic consumer goods present lower ROA. This is an expected result, since during turbulent times demand for non-basic goods and services decline; on the contrary, consumption of relatively more important products and services (such as health) does not change considerably, as they possess lower price elasticity.

Discussion and conclusionsThis study investigates whether Presidents’ interlocks, the connection of firms through board chairs simultaneously serving in two or more boards, actually happens in Latin American companies and how it relates with financial performance. The latter is analyzed taking into account environmental uncertainty, which was present during the period 2009 and 2010. It is proposed that the peculiarities of Latin American ownership and corporate governance schemes may explain the configuration of business organizational structures, conditioning the relationship of Presidents’ interlocks and performance under uncertainty. As such, this opens an ethical debate and adds to the lacking literature for Latin American markets.

Financial scandals at the beginning of the XXI century revealed that boards must become more involved in the strategic decisions of their organizations. Efforts in this regard are reflected in the increased proliferation of codes of good governance in most countries (Aguilera & Cuervo-Cazurra, 2009; Tricker, 2009). However, the literature has only partially examined how board characteristics can contribute to this role, predominantly in developing economies (Carpenter & Westphal, 2001; Golden & Zajac, 2001). As such, this study responds to calls in the literature (Golden & Zajac, 2001; McNulty & Pettigrew, 1999; Ravasi & Zattoni, 2006) for a better understanding of how Latin American Presidents’ interlocks relate with organizations’ performance in turbulent periods.

President interlocking tend to enhance efficiency and profitability in affiliated firms, for reasons such as better coordination, improved communication, and deeper trust, which reduces risk during turbulent periods (Beckman et al., 2004; Podolny, 1993; Tsai & Ghoshal, 1998). The analysis is based on the well-established resource dependence theory, by stating that facilitation of resource acquisition by the board can have a positive result from a strategic point of view, under uncertain environmental conditions. Nevertheless, the positive effect of President interlocking on firm performance can dilute through unethical behaviors of the business elite (Valenti & Horner, 2010), whose excessive power allows them to look after their own objectives instead of those of the companies themselves. In Latin American countries, where there is relatively weak investor protection, lack of transparency, and consequently more possibilities for expropriation, control through Presidents’ interlocks becomes very valuable. In volatile periods, due to the destruction of firm value and greater uncertainty, it becomes more attractive to expropriate minority shareholders and other stakeholders. According to the class hegemony theory, President interlocking can set in motion mutual entrenchment actions against stakeholders, with negative consequences on overall corporates’ performance.

This study offers some evidence in favor of Presidents’ interlocks during Latin American turbulent times. The positive association between financial performance and these networks is related both to the number of firms involved and corporate governance schemes. When comparing Chilean and Mexican companies, it drives to attention that Presidents’ interlocks in Chile have a comparatively higher positive relationship with financial performance. Board chairs in Chile simultaneously participate in more boards than in Mexico; in addition, Chile possesses better corporate governance mechanisms (both internal and external) than Mexico. On the latter, even though in both nations there is high company's ownership concentration, stakeholders’ rights are better protected in Chile. The judicial system is faster, more efficient and transparent than in Mexico (Chong et al., 2009); in addition, minority shareholders are better represented by independent board members appointed by the influence of investment funds. Directors’ interlocking activity in Chile is stimulated through the activism of these actors, being designated in several boards. In contrast, in Mexico most interlocking activity takes place between directors who represent majority shareholders. The odds of expropriation due to the tempestuous circumstances are therefore lessened in Chile, which explains the comparatively higher positive association of President interlocking and firm performance.

These findings have several important implications for academics and practitioners. First, even though in the international literature there is contradictory evidence on the effects of directorate interlocks on firm performance, these are a reality both in developed and emerging markets. This study increases the understanding of the strengths of Presidents’ interlocks in stormy times, in line with resource dependence theory, by introducing the Latin American context. The analysis of President interlocks and their connection with firms’ performance is very useful for nominating committees for the board itself and for a company in general. The members of the board of directors are important from the strategic standpoint, as they have access to resources that the business needs. Empirical evidence suggests that the participation of powerful directors in different boards leads to increased financial performance during volatile periods. Turbulent environments require rapid action and sufficient resources, and board chairs’ power combined with board capital can fulfill such requirements. Accordingly, innovative firms may benefit from such directors’ interlocks to a greater extent than other firms, because powerful directors can facilitate efficient decision making based on the advice and resources provided throughout the network. However, firms must keep in mind the balance between the access to resources and the loss of autonomy, as the search to decrease environmental uncertainty in turbulent periods imply more coordinated and challenging organizational changes.

Second, the potential conflict between majority shareholders and other stakeholders should be addressed when considering Presidents’ interlocks. When main shareholders sit in the boards of several firms, it is easier to benefit from the expropriation of other stakeholders’ rights through nepotism and corruption all over the network (Santiago & Brown, 2009). In an entrepreneurial environment dominated by family firms, where ownership concentration is particularly high even for quoted companies (the Latin American case), this latent conflict naturally arises and deepens as the legal system fails to efficiently protect stakeholders (Gomes, 2000). These circumstances incentivize majority shareholders to maintain control of the corporations, dominate senior management and board positions, and sit on several boards of directors, which can deteriorate firm value and act against minority shareholders and other stakeholders (Santiago & Brown, 2009). But, when interlocking activity takes place mainly through independent board members, its positive influence on single companies can be extended to several firms of the network. The presence of independent board members reduces agency costs between managers and shareholders (Coles, Daniel, & Naveen, 2008), and between majority and minority shareholders (Santiago & Brown, 2009).

Finally, this research has important policy implications. Some boards seem to exist solely for fulfilling a legal requirement rather than being a professional group fully engaged in managing the firm. This research analyzes specific, relevant features that may be useful in the development of good governance guidelines and policymakers’ regulations regarding the controversial topic of President interlocking. For example, the regulation of director interlocks must be oriented to encourage greater transparency rather than to impose limitations on their frequency, as in specific situations (such as turbulent times) President interlocking can help businesses to achieve their goals.

Several limitations to this study must be acknowledged. First, the subjective problem inherent to the compilation and evaluation of information published in the annual reports of the companies analyzed cannot be excluded. Second, the analysis is subject to geographical restriction, being limited to firms listed on the Mexican and Chilean Stock Exchanges. Third, the study sample was restricted to large businesses, due to lack of information for those not quoted. In any case, company size might introduce bias into the analysis, and these restrictions will need to be addressed in later studies. Fourth, the research deals only with turbulent periods of time. Results are interesting and they justify extending this research to other countries, periods, and to smaller companies.

Conflicts of interestThe authors declare that they have no conflicts of interest.