In this article we aim to analyze the relationship between a set of organizational extrinsic and intrinsic factors and the adoption of the Balanced Scorecard (BSC) by privately-owned Portuguese organizations (large companies and small and medium enterprises). These factors are related to companies age, the diversity of products and services, the nature of the ownership structure, the internationalization, and the organizational size. As a primary means of data collection was carried out a postal survey through a questionnaire sent to 549 privately-owned Portuguese organizations, with an overall response rate of 28.2%. The results indicate that the degree of diversity of the products/services of the organization, the ownership of foreign groups, and the organizational size are positively associated with the implementation of the BSC. Thus, we conclude that the BSC increases with the degree of diversity of the products/services of the organization, that the Portuguese organizations that use the BSC are mainly owned by foreign groups; and larger organizations are most likely to use this tool.

The current environment is characterized by economic globalization and internationalization of markets, uncertainty and risk, increased competitiveness, the increase in the range of goods and services offered by companies to their customers, technological development and its impact on shortening the life cycle of products and the introduction of new organizational forms.

All these aspects have led to major changes within companies, as in order to cope with the changes taking place in the environment, they need to make all the processes related to formulation, planning, implementation and strategy control more flexible, facilitating the maintenance and development of competitive advantages (Burns & Vaivio, 2001; Giralt, 2001). Thus, in recent decades, with the aim of improving the link between the strategy and performance measurement, new models and tools for management control have been developed, that combine financial and non-financial measures among which is the Balanced Scorecard (BSC).

The literature on the BSC is very extensive, and there is a lot of work on the analysis of cases or its use in certain activity sectors (Ferreira, Caldeira, Asseiceiro, Vieira, & Vicente, 2014; Hoque, 2014). The fact is that as in the case of any other management control innovation, the implementation of the BSC is usually associated with the presence of certain organizational environmental characteristics, which make some companies more likely to adopt it than others. However, the vast majority of empirical studies have focused on the generic analysis of the implementation of the BSC, its characteristics and the results of its application (Hoque, 2014), while identifying the factors influencing the adoption of the BSC in organizations is an issue that has been less dealt with. On the other hand, despite the large number of books, articles, etc. which have dealt with the BSC from different perspectives and for different areas and the wide range of Information Technology (IT) solutions that have been developed in recent years, there is a lack of theoretical and empirical studies in Portugal on factors influencing the adoption of the BSC. These findings have led us to ask the following question: What are the factors influencing the implementation of the BSC in private Portuguese companies?

In light of the above, this article aims to analyze the relationship between various extrinsic and intrinsic factors for organizations and the adoption of the BSC. These factors have been identified within the literature review and are related to the age of the enterprises, the degree of diversity of the products/services offered, the nature of the ownership structure, the degree of internationalization and the organizational size.

In accordance with the objective proposed, the work is structured as follows: initially the theoretical framework is collected and the research hypotheses are defined. On this basis, the methodology and the sample under study are presented, as well as the results obtained and a discussion thereof. Finally, the main conclusions, as well as the limitations of the study and some suggestions for future research are discussed.

The Balanced Scoreboard: determining factors for its adoptionIn the early nineties of the last century, Kaplan and Norton (1992, 1993) conducted a multi-business study motivated by the observation that to evaluate business performance, companies relied mainly on traditional financial measures such as return on investment and payback, and that performance measurement systems did not explain the impact of intangible assets on the performance of enterprises, especially on those technology-intensive ones, suggesting that the financial measures were inadequate in a complex and constantly changing environment and should be supplemented by additional indicators reflecting customer satisfaction, internal business processes and the capacity of the organization to learn and grow.

Therefore, there was the need to develop a tool that incorporated a wide range of more generic and integrated measures, capable of linking long-term financial success to performance achieved from the perspective of customers, internal processes and employees and systems (Kaplan & Norton, 2001). Consequently, the BSC has been proposed as a management tool capable of improving the information system of the company and responding to changes in the environment, providing managers with relevant and necessary information to evaluate the development of the strategy and take decisions, identifying four key areas for any type of organization: learning and growth, internal processes, customers and financial results (Ferreira et al., 2014; Zizlavsky, 2014).

Numerous papers refer to the advantages, strengths and contributions of the BSC for organizations. In the opinion of its creators (Kaplan & Norton, 1992, 1993, 1996, 2001, 2004, 2006, 2007, 2008), the most innovative aspect of the BSC is it capacity to produce strategic learning, providing a global vision of organizational performance and improving the understanding of the objectives as a prior requirement for their achievement.

For Kaplan and Norton (1993), the BSC is not a standard model applicable in the same way to all organizations, but should otherwise be adapted to the particular requirements of their mission, strategy, technology and culture. Therefore, different market situations, product strategies and conditions of competitive environments will involve different applications of this model. Similar statements were made by Leite (2001), who considers that the cause–effect model of Kaplan and Norton is a dynamic system that cannot be indifferent to internal and external contingent factors, and Olve, Roy, and Wetter (2002), who claim that the design and characteristics of the BSC and the process for its implementation will depend on many factors, intrinsic or extrinsic to the organization, whose degree of influence may vary.

Taking into account the objective of this work, we consider that the Contingency Theory provides the adequate framework to base our empirical study, since it is one of the main theoretical approaches that support studies that try to explain the determinants of the use of different Management Accounting practices (Chenhall, 2003).1 Thus, applying the assumptions of the Contingency Theory, it can be said that the propensity by an organization to adopt the BSC is contingent regarding its characteristics and the environment in which it operates.

In fact, with the aim of identifying the different factors which influence and condition the implementation and use of the BSC and explain the range of models observed in practice, some authors (Galas & Ponte, 2005; Garengo & Bititci, 2007; Hoque & James, 2000; Speckbacher, Bischof, & Pfeiffer, 2003) have adopted a contingent approach as a reference theoretical framework to deal with this study. In the development of this line of research, possible variables have gradually been identified, denominated contingent or contextual factors that seem to explain the decision of a company on whether to adopt or not the BSC.

While there is no general consensus on what the contextual factors that make certain companies more likely than others to implement the BSC are, in a first approach, and without being exhaustive, we can point out that among the most analyzed factors, there are organizational characteristics such as company size (Hoque & James, 2000; Olve et al., 2002; Sharma, 2002; Silk, 1998; Speckbacher et al., 2003); the strategy (Ittner, Larcker, & Meyer, 2003; Olson & Slater, 2002); the organizational structure (Sharma, 2002) or business culture (Olve et al., 2002), factors related with the characteristics of the industry/market and uncertainty of the environment (Banker, Janakiraman, & Konstans, 2001; Kraus & Lind, 2010; Olve et al., 2002; Sharma, 2002; Speckbacher et al., 2003) and variables linked to the leadership style and personality of management (Wiersma, 2009).

In our case, we tried to combine firstly the interest in seeing whether within Portuguese companies, the results obtained in other countries regarding the influence of certain contextual factors in the adoption of the BSC are confirmed and secondly, the possibility of extending this research to analyze new variables, whose influence has been analyzed in the general framework of systems of management control and performance evaluation, but not in the particular case of the BSC. For this reason, in this work the influence of the following six characteristics are analyzed: (1) the age of enterprises; (2) the degree of diversity of the products/services offered; (3) type of control (family/non-family); (4) the importance of foreign capital in the ownership structure; (5) the degree of internationalization and (6) organizational size (considered this last one a control variable).

The development of the research hypothesis was based on the existing literature on determining factors of management control systems (Chenhall, 2003).

In relation to the first variable under study, the association between the age of the company and its use of accounting/management control systems has been studied by various authors (Dávila, 2005; Gomes, 2007; O’Connor, Chow, & Wu, 2004; Olve et al., 2002).

The main finding of these studies is that the oldest organizations are more likely to adopt management accounting techniques, due to the existence of higher learning (background) of management. Applying these ideas to the degree of adoption of the BSC, it is expected to be higher in older organizations. In this regard, the following hypothesis arises:H1 The implementation of the BSC is positively associated with the age of organizations.

Regarding the diversity of products and services offered, different authors like Merchant (1981), Govindarajan (1988), Fisher (1995), Malmi (1999) and Drury and Tayles (2005) consider that the accounting/management control system will become more complex, the greater the number and variety of products/services offered by the company, due to the higher complexity of its operations. Besides, Bjornenak (1997), Malmi (1999), Abdel-Kader and Luther (2008) and Ahamadzadeh, Etemadi, and Pifeh (2011) have observed that the use of management accounting tools, in particular the Activity-Based Costing (ABC) system, is greater in organizations with a higher diversity of products/services. In the particular case of the BSC, Hoque and James (2000) verified a positive relationship between the use of the BSC by the company and the lifecycle stage of its products, so companies that had tendency to use the BSC more, were those that had a higher percentage of new products, that is, the most innovative ones in this field. In accordance with these ideas, the following hypothesis arises:H2 The implementation of the BSC is positively associated with the degree of diversity of the products and services offered by the organization.

The form of ownership and the management structure of the enterprise are contingent factors which affect the use of performance control and management systems by the enterprise, formalized as the BSC (Speckbacher & Wentges, 2012). Thus, in general, family businesses tend to make less use of formal systems of performance measurement and management, prioritizing informal control, intuition and personal contacts as opposed to formal plans (Merchant, 1984; Perera & Baker, 2007). In this regard, Speckbacher and Wentges (2012) found that family ownership greatly influences the behavior of small and medium enterprises (SMEs). In particular, these authors argue that the management of enterprises exclusively by their owners is more centralized and is characterized by less use of formal systems of performance management, as owners-managers of small businesses tend to have more informal and personalized management styles. Consequently, they are more likely to supervise their employees’ activities and evaluate their performance without using formal measurement procedures (Perera & Baker, 2007).

Therefore, we considered that it would be interesting to see whether family businesses use the BSC less than the rest of enterprises or vice versa, if the BSC is used more in enterprises with non-family control. Thus, the following hypothesis was defined:H3 The BSC is used more in Portuguese enterprises with non-family control.

Regarding the importance of foreign capital in the ownership structure, according to Dávila (2005), the existence of foreign investors in the capital of a company is a determining factor in the adoption of management control systems by organizations. In the same vein, Malmi (1999) states that when a company is owned by a foreign group, this will be reflected in the adoption of new accounting and management control techniques by the company. Therefore, we believe that the growth in direct foreign investment can be an additional incentive for Portuguese managers to adopt new strategic management tools.

On the other hand, Jones (1985) refers to the influence of multinational companies on their subsidiary companies as a contingent variable that affects the design and characteristics of the management systems adopted, to the extent that the transfer of cultural values, people and accounting techniques from the parent to subsidiaries often takes place. This idea is shared by Blanco, Maside, and Aibar (2000), who believe that because of their needs in terms of integration and standardization, it is common for the parent company to transfer their accounting and management control practices to their subsidiaries. Thus, it is expected for the adoption of the BSC to be greater in Portuguese subsidiaries of multinational companies and therefore the following hypothesis has been defined:H4 Portuguese organizations that use the BSC are mainly property of foreign groups (multinational companies).

In relation to the degree of internationalization, Cooke (1989) and Lopes and Rodrigues (2007) argue that due to the increased complexity of their operations, companies that are more oriented to international markets tend to have more developed management control systems. In the particular case of the BSC, Banker et al. (2001) observed a greater tendency to use the BSC by companies operating in more competitive markets and facing greater competitive pressures, elements that in our view, characterize companies operating in international markets. On the other hand, in the context of a study on the 250 largest Portuguese companies, Quesado and Rodrigues (2009) found empirically that with regard to the internationalization variable, the difference between companies using and not using the BSC and those that knew and did not know about that tool is not statistically significant.

Thus, we consider that it would be interesting to see whether Portuguese companies that have implemented the BSC are more oriented to international markets. This results in the following hypothesis:H5 The implementation of the BSC is positively associated with the internationalization of the organization.

Finally, the size of the organization is a classic contingent variable that affects the design and use of management control and performance evaluation systems. In fact, the relationship between the size and adoption of performance measurement and management systems has received numerous attention in the literature on management accounting (Abdel-Kader & Luther, 2008; Chenhall & Langfield-Smith, 1998; Chenhall, 2003; Dávila & Foster, 2005, 2007; Dávila, 2005; Elmore, 1990; Ezzamel, 1990; Giannopoulos, Hotlt, Khansalar, & Cleanthous, 2013; Hendricks, Menor, & Wiedman, 2004; Hendricks, Hora, Menor, & Wiedman, 2012; Huerta, Contreras, Almodóvar, & Navas, 2010; Kaplan & Atkinson, 1998; Kimberly, 1976; Langfield-Smith, 1997; Libby & Waterhouse, 1996; Machado, 2013; Merchant, 1981, 1984; Otley, 1999; Simon, 2007; Speckbacher & Wentges, 2012; Wenisch, 2004). In this regard, Dávila (2005) states that the larger the company, the greater the implementation of Management Accounting systems. Moreover, previous empirical studies show the positive effect of size on the probability of the company using new management tools. In this sense, most authors believe that when the size increases, coordination and communication problems are higher and therefore management control systems tend to be more formal, complete and sophisticated. In addition, larger companies have more resources available (material and human) for the implementation of management innovations.

As mentioned above, several authors have analyzed the influence of company size on the adoption of the BSC. However, different results were obtained. Some authors found that the adoption of the BSC is significantly and positively associated with the size of organizations (Bedford, Brown, Malmi, & Sivabalan, 2008; Braam & Nijssen, 2004; Hendricks et al., 2004, 2012; Hoque & James, 2000; Pineno, 2004; Speckbacher et al., 2003; Tapinos, Dyson, & Meadows, 2011; Wagner & Kaufmann, 2004), while other studies corroborated that the organization size does not affect the use of the BSC (Hoque, Mia, & Alam, 2001; Quesado & Rodrigues, 2009).

Taking into account these arguments, there was an attempt to verify whether in fact in private Portuguese enterprises there is a positive relationship between the organization size and the adoption of the BSC. Thus, the following research hypothesis was defined:H6 The implementation of the BSC was positively associated with the organization size.

To achieve the objective established, the positivist research paradigm has been used. Thus, a quantitative methodology has been used and we proceeded to survey, by sending a postal questionnaire to a sample of 549 private companies operating in Portugal (the 388 largest Portuguese companies and 161 SMEs classified as excellence-industry SMEs).

In the case of large companies, the database of the 500 largest and best Portuguese companies was used for their identification, which are classified according to their turnover, published in the special edition of “Exame Magazine” and referred to 2007 (Exame, 2008). Regarding SMEs, only those belonging to the industrial sector were selected, which were classified as excellent in 2000 and 2001 (the last two years in which this classification was made). This choice was necessary due to the large number of SMEs in Portugal and their heterogeneity in terms of capacity, size and location. We opted for industrial companies because as Machado (2009) points out, they have more tradition in the use of management accounting systems compared with service companies. In addition, the fact that they have been classified as excellent, allows us to focus the analysis on those that stand out more for their economic-financial management and performance.

The questionnaires were essentially composed of closed questions, mostly dichotomous and/or multiple choice, with the application of nominal and ordinal scales (for example, Likert scales). The questions were grouped into blocks depending on the subject to which they referred. Although to a lesser extent, some open questions were also included to identify the perception of respondents regarding the BSC.

In March 2009, the questionnaire was tested by elements belonging to the study target population and by academic experts on the subject and with extensive experience in designing and conducting research, with the aim of assessing the coherence and relevance of the questions, ensuring that they were not confusing but easy to read and respond. In addition, it was sought to obtain their opinion regarding the submission and interest of the questionnaire, its size, response time and to correct errors in the interpretation of questions, reviewing the language used. This stage proved to be very useful, as the suggestions received were used to improve the clarity, comprehensibility and relevance of the questionnaire.2

We decided to send the questionnaires to the controller, financial manager or the person responsible for the accounting in the company, as they are considered the most appropriate because of their role at the decision-making level on the strategy and management of organizations as well as their knowledge of the information on which we want evidence.3 The first questionnaire was first sent in April 2009 and it was necessary for it to be sent several times, so the data reception period was extended until March 2010.

The questionnaires received were reviewed with the aim of identifying missing values resulting from the errors when filling out the questionnaire or not having answered a/some question/s. The data collected were processed statistically with the SPSS program (Statistical Package for the Social Sciences: version 17).

The response rate was 28.2% of the total population, that is, 155 responses: 107 large companies (27.6% response rate) and 48 SMEs (29.8% response rate).

In order to analyze if the conclusions obtained in our study can be applied to all private Portuguese organizations, we have carried out an analysis of the representation of the sample4 based on known values for the total population, such as the activity sector, total assets and number of employees. However, it is important to note that this analysis was more detailed in the case of large companies, as there was information available for the entire sample (both for the responsive sample as for the non-responsive sample). The results showed that there were no significant differences among the companies that replied to the questionnaire and those which did not.

As to the variables, taking into account the hypothesis defined previously, the following proxies have been defined:

Adoption of the BSC: according to Malmi (2001), it is difficult to determine whether an enterprise has or not implemented the BSC due to the evolving nature of the BSC. Consequently, following the approach taken by Speckbacher et al. (2003) and Kraus and Lind (2010), we considered the broadest possible definition of the BSC and to evaluate this variable we asked enterprises whether they used some type of measurement system of multidimensional performance in which the indicators were grouped into at least three of the original perspectives of the model proposed by Kaplan and Norton. In this regard, it is important to note that: (1) due to the small number of organizations in the sample that used the BSC and (2) because some of the organizations that stated that they were expecting to implement the BSC in the future indicated that they were already taking the first steps in the process of implementation of the tool at the time of the survey, the data from organizations using the BSC or expecting to implement it in the future (41.7% of organizations) were grouped. Therefore, the dependent variable “BSC” refers to the use of the BSC by the organizations of the sample, taking the value 1, in the case that the organization uses the BSC and otherwise the value 0.

Age: the age variable was measured through the age of the organization, i.e., the number of years since the constitution or beginning of its activity. Based on this data, companies were grouped into five age groups: (a) less than 10 years; (b) between 10 and 20 years; (c) between 20 and 30 years; (d) between 30 and 40 years; and (e) more than 40 years.

Degree of diversity of products and/or services: it was measured using a 4-point Likert scale in which the companies were asked to classify the number and variety of products/services offered into the following four categories: (a) very high; (b) high; (C) average; and (d) low.

Type of control (family/non-family): dichotomous variable (dummy) that takes the value 1 if the owner of the enterprise is also the manager and 0 otherwise.

Importance of foreign capital in the ownership structure: dichotomous variable (dummy) that takes the value 1 if the percentage of foreign participation is higher than 50% and 0 otherwise.

Degree of internationalization: it was measured based on the turnover in foreign markets, the number of foreign subsidiaries and the percentage of foreign participation in the capital of the company. Based on these data, a new variable “internationalization” was defined, through the use of principal component factor analysis – PCFA5 (for more information on how this variable was obtained, see the annex).

Size: although the literature suggests several variables to measure the organizational size, in our study the most used variables were turnover, total assets and number of employees. In this case, due to the small number of SMEs using or intending to use the BSC, it was necessary to incorporate the two types of enterprises (large and SMEs). Thus, companies that had previously been grouped under the category of large companies were rearranged in terms of size.

As the three reference variables to calculate the size of the organization are asymmetrical, the respective Naperian logarithms (NapLog) were calculated, and as they are nominal variables, a new representative variable of the organizational size has been defined, denominated “dimension”, by using PCFA6 (for more information on how this variable was obtained, see the annex).

ResultsThis section is intended to test research hypotheses defined according to the appropriate statistical criteria and procedures and present a discussion of the results obtained.

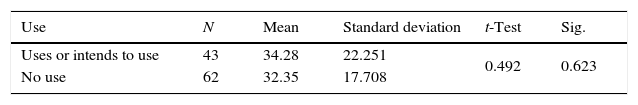

Regarding the first research hypothesis on the influence of the age of the organization on adopting the BSC (H1), the analysis of the normality for the group of organizations that use the BSC was carried out using the K–S test, whose value has led to the acceptance thereof. The t-test is not significant (p-value=0.623). Consequently, the research hypothesis defined regarding the existence of a positive association between the variables must be rejected. Thus, according to the results, the age of the organization is not, from a statistical point of view, related to the use of the BSC (Table 1).

In this case, our results, referring to the particular case of the BSC, are in contradiction with those generally obtained for management control systems by Dávila (2005), who observed that the older the enterprise, the greater the use of these systems.

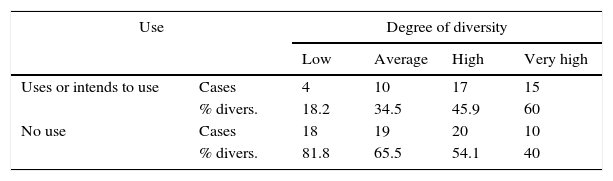

With respect to the hypothesis on the association between the degree of diversity of the products/services offered by the organization and implementation of BSC (H2), the results obtained through the test of independence chi-square (p-value=0.025) indicate that one cannot reject the hypothesis as it stands. That is, the implementation of the BSC increases depending on the degree of diversity of the products/services of the organization. Furthermore, Cramer's V test (p-value=0.288) shows a correlation between the variables (Table 2).

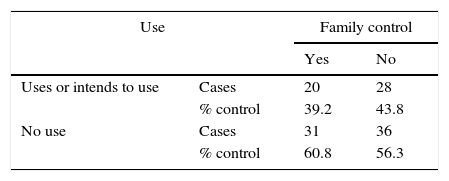

To test the third hypothesis, in which it was stated that the BSC is used in Portuguese companies with no family control (H3), the test of independence chi-square was used. The results, which are shown in Table 3 lead us to reject this hypothesis, as the significance level is greater than 0.05. Thus, no association between the type of control (family/non-family) and the use of the BSC is observed.

In this case, our results do not match those of the study by Campa and Sánchez (2007), who concluded that family and/or single-owner organizations do not value the BSC, as the management and ownership of the company are the same person. However, according to our results, this does not mean that these organizations do not need to increase the planning and implementation of their strategy by adopting formal systems of performance measurement and management, such as the BSC.

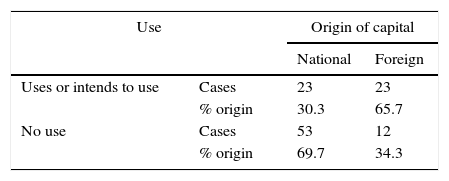

To check the fourth hypothesis regarding the relationship between the implementation of the BSC and the importance of foreign capital in the ownership structure (H4), the test of independence chi-square was used, which showed a (p-value <0.01), verifying the association between the origin of capital and the use of the BSC (Table 4). That is, Portuguese companies in which capital of foreign origin has considerable importance in the ownership structure show a higher degree of the use of the BSC.

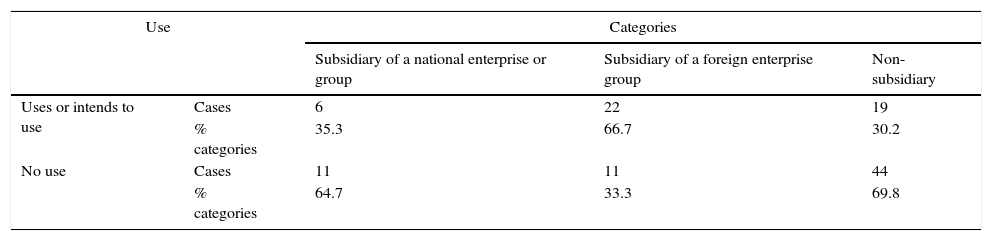

Furthermore, this result has been confirmed by analyzing the categories to which the company belongs (Table 5), where it was observed that it is precisely subsidiaries of a foreign group that use the BSC the most. In both cases, Cramer's V reveals a strong correlation between the variables (p-value=0.334 and p-value=0.329, respectively). Thus, the proposed research hypothesis cannot be rejected.

Implementation of BSC vs categories where enterprise is included.

| Use | Categories | |||

|---|---|---|---|---|

| Subsidiary of a national enterprise or group | Subsidiary of a foreign enterprise group | Non-subsidiary | ||

| Uses or intends to use | Cases | 6 | 22 | 19 |

| % categories | 35.3 | 66.7 | 30.2 | |

| No use | Cases | 11 | 11 | 44 |

| % categories | 64.7 | 33.3 | 69.8 | |

p-Value=0.002; χ2=12.208; Cramer's V=0.329.

This result is in line with those results obtained in studies by Malmi (1999), Wanderley, Meira, Souza, and Miranda (2004), Dávila (2005) and Bocci and Mojoli (2006). In our opinion, the results confirm what was stated by Queirós (2004), for whom in Portugal the BSC has been “imported”, especially by multinational companies.

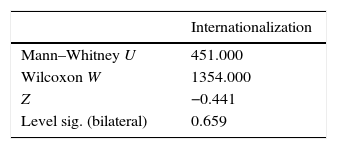

In order to check the relationship between the use of the BSC and the degree of internationalization of the organization (H5), a normality test was performed. Adherence tests to normality, K–S with correction of Lilliefors or Shapiro–Wilk reveal that for a significance level of 5% normality is not met (p-value <0.05). Thus, for the analysis it was necessary to use an alternative to the t-test for two independent samples. Specifically, the nonparametric Mann–Whitney test was used.

The results presented in Table 6 allow us to conclude that the two distributions do not differ in central tendency (Mann–Whitney test with a bilateral significance level of 0.659). That is, the difference between the use and non-use of the BSC regarding internationalization is not statistically significant, similar to the results in the study by Quesado and Rodrigues (2009).

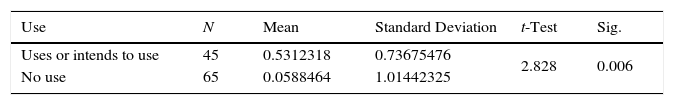

Finally, with respect to the hypothesis regarding the existence of a positive association between the size of the organization and implementation of the BSC (H6), the t-test was used, which showed a significant value (p-value=0.006), which does not allow to reject the hypothesis defined, i.e., there is an association between the size of the organization and implementation of the BSC (Table 7).

This statistical result leads us to state that as the size of the organizations of the sample increase, so does the use of the BSC.

Even though some authors have proved that the use of a sophisticated measurement system, such as the BSC does not depend on the size of the enterprise (Hoque et al., 2001; Quesado & Rodrigues, 2009), our results are in line with those obtained by the majority of authors who have analyzed the influence of this variable, by observing that the use of BSC is greater in larger companies (Bedford et al., 2008; Braam & Nijssen, 2004; Hendricks et al., 2004, 2012; Hoque & James, 2000; Pineno, 2004; Speckbacher et al., 2003; Tapinos et al., 2011; Wagner & Kaufmann, 2004).

In fact, company size affects the way in which companies design and use management systems because as size increases, their operations become more complex and communication and control problems require greater attention, promoting the use of more specialized, formal and sophisticated accounting management control tools (Ezzamel, 1990; Libby & Waterhouse, 1996; Merchant, 1984), such as the case of the BSC.

In this sense, the empirical evidence that the contingent variable size positively influences the implementation of the BSC can be attributed to increased needs and demands of communication, coordination, control and expertise in these types of enterprises (Andersen, Cobbold, & Lawrie, 2001). Consequently, larger companies need to control a broader set of issues compared to smaller companies, so they require more sophisticated management control systems.

ConclusionsEmpirical evidence obtained from work carried out regarding this subject has shown that the BSC dissociates from traditional systems of performance evaluation and control, considering the alignment between management indicators and the organization strategy, one of the keys to successful implementation (Hoque, 2014).

Despite the theoretical and practical consolidation of the BSC, there is still no widely disseminated work on the determinant factors of the adoption of the BSC in Portuguese companies. In this sense, the main objective of this study was to analyze the relationship between a set of contextual factors and the adoption of the BSC in a sample of Portuguese companies in the private sector. To do so, six research hypotheses were established which posed the existence of a positive relationship between the adoption of the BSC and six organizational characteristics.

In line with that indicated in the analysis of the results, we have obtained empirical evidence that confirms the association between the implementation of the BSC and three of the analyzed characteristics: the degree of diversity of the products/services of the organization, the ownership of the company by foreign groups and the organizational size. Thus, it is possible to conclude that: (1) implementation of the BSC increases with a greater degree of diversity of the products/services of the organization; (2) Portuguese companies using the BSC are especially those in which a large percentage of their capital is owned by foreign groups; and (3) larger Portuguese companies are more likely to use this tool.

However, we did not obtain empirical evidence that would allow us to corroborate the possible relationship between the adoption of the BSC and the age of the organizations, the type of control (family/non-family) and the degree of internationalization. In our opinion, this result could be due to the characteristics of the sample under study and the research methodology chosen, in the sense that both aspects can distort the results.

On the basis of the results, the research conducted and the results obtained in the study are considered to contribute to knowledge about the implementation of the BSC in companies, which may be interesting for managers who are considering its adoption. On the other hand, some variables referred to in the literature as determinants of the use of other management control tools have been confirmed as such in the specific case of the BSC, while others showed the opposite results within the Portuguese scope.

However, the results of this study should be evaluated based on a set of limitations. The fact that the empirical study has been limited to private Portuguese companies and the small sample size have made the analysis and generalization of the results difficult for the universe of study. Furthermore, we must point out the limitations inherent to conducting a quantitative research through questionnaires, in particular problems of interpretation of questions, and the fact that the data were collected in 2009 and 2010 may not reflect the current reality.

The results obtained and the limitations encourage us to propose some future research lines. So, for example, it might be interesting to extend the analysis to SMEs from other sectors or expand the analysis by including other variables that could also have some influence. In addition, longitudinal studies could enable to identify evolution trends regarding the determinants of the implementation of the BSC in private Portuguese organizations.

On the other hand, the underlying limitations to a study conducted by a postal questionnaire could be overcome through interviews/case studies, which would enable to obtain more objective and detailed data and enrich the exchange of experiences and individual perceptions on this issue. So, it would be interesting to conduct case studies that would enable to compare cases of success and failure in implementing the BSC, helping to better understand the existing connections between different organizational and environmental variables. In addition, considering the limitation related to the time horizon associated with the collection of data, it would be important to update the empirical study we have conducted, in the sense of checking whether the results remain valid in the current environment.

Finally, in this paper a bivariate analysis was conducted to see whether the adoption of the BSC is conditioned by various contingent factors analyzed considered individually. However, we are aware that the use of the BSC is a complex phenomenon influenced by a wide range of contingent factors, which in turn, influence and condition each other, in such a way that a contextual variable can indirectly influence the adoption of the BSC through its relationship with another variable. In this regard, in order to corroborate and make the results more solid, the relationship between the use of the BSC and potential contextual factors should be checked by performing a multivariate analysis using either hierarchical regressions or structural equation models that enable to contrast different hypotheses simultaneously facilitating their global analysis.7

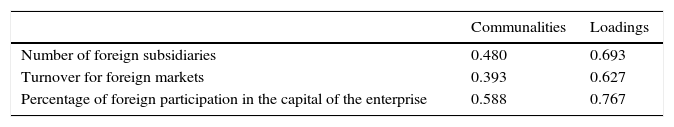

“Internacionalización” variable: The appropriateness test KMO was 0.577, indicating that factor analysis is relevant to obtain a factor representing the scale (although the value is not very high). In addition, the Bartlett test took a high value (13.824) and an almost full (0.003) significance level, which indicates a high correlation between the elements that make up the scale. Therefore, the previous values indicate that applying factor analysis is adequate.

Table 8 shows the part of each variable that has remained or is present in the components that were retained (commonalities), the number of factors to retain (total variance explained) and the correlation between each variable and the component (loadings). Thus, a relationship between the variables and the retained factor is observed (although this relationship is not very strong, because the values are not very high for all the variables).

With respect to the total variance explained by the Kaiser criterion, only one factor can be retained, considering that there is only one own value (eigenvalue) greater than 1. The retained component accounts for about 50% of the variation of the original variables, i.e., 50% is represented in the “internationalization” variable.

The weight of each variable, according to the loadings obtained in the factor analysis provides an appropriate measure of the relevance of the factor in each case, reducing the isolated incidence of specific variables. All variables are positively correlated, i.e., the higher the number of foreign subsidiaries, sales to foreign markets and the percentage of foreign participation in the capital of the company, the greater the internationalization of the organization.

Based on the above, it is verified that the PCFA provides a good measure of the level of internationalization of companies, creating a new variable (“internationalization”) consisting of ratings (scores) of these components, which allow to relate the responses provided by each respondent to the variables involved and the component itself.

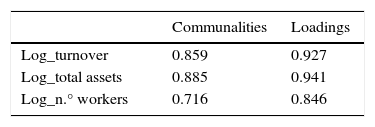

“Dimension” variable: the appropriateness test of the factor analysis of the variables of the study was reasonable (KMO of 0.698). In turn, the Bartlett sphericity test showed a significant statistic (p-value <0.01), indicating the rejection of the hypothesis that the correlation matrix is the identity matrix. That is, there is significant correlation between the variables for a significance level of 5%, which allows us to continue with the factor analysis.

In Table 9 high values are observed for all variables, reflecting a very strong relationship with the retained factor, i.e., these items are satisfactorily explained by the solution factor.

With respect to the total variance explained, by the Kaiser criterion, only one factor can be retained (eigenvalue >1). The retained component explains 82% of the variation of the original variables, that is, 82% is represented in the “dimension” variables.

Regarding the loadings, it is observed that all the variables are correlated positively, that is, the higher the turnover, total assets and number of employees, the higher the dimension of the enterprise. Nevertheless, it is important to highlight that as was foreseen, the lowest recorded value corresponded to the number of employees (0.846) variable.

Based on the above, it is verified that PCFA provides a good measurement of the size of the enterprises, creating a new variable (“dimension”) made up of the ratings (scores) of these components.

To validate the measures, the reliability of the scales (Cronbach's Alpha) was verified. It is worth mentioning how high Cronbach's alpha of the factor (0.890) is, which is more than adequate to ensure internal consistency of the factor.

The Contingency Theory allowed to introduce in the management accounting research, the study of the influence of the context (external and internal) on the design and use of several techniques and tools of management accounting, becoming due to its great intuitive attraction one of the dominant paradigms for the study of the design of accounting and management control systems (Chenhall, 2003).

It is important to note that the answers of interviewees in the pretest were omitted in the subsequent data analysis.

However, in all cases it was requested for the questionnaire to be given to the most suitable person of the organization to respond to the questions.

In this regard, the possibility of a bias in the sample that does not respond should be considered. That is, the organizations that decide not to respond may be significantly different from those that do decide to do so. This fact could pose a problem to extrapolate the results of the test sample to the entire population.

The correlation coefficients of Pearson and Spearman revealed a positive correlation between the variables number of subsidiaries, turnover of foreign markets and percentage of foreign participation in the capital of the company. Thus, the reduction of variables through the PCFA can be considered. Each scale has undergone the process of sample appropriateness of factor analysis and the corresponding reliability analysis (which showed a very low value due to very low correlations between variables).