In recent years, companies in the pharmaceutical industry have been confronted with a turbulent environment characterized by dynamism, complexity and uncertainty. To cope with these changes and achieve improved performance, these companies must generate the ability to make appropriate changes in their organizations. For that reason, we use a quantitative methodology linear regression model to investigate the multilevel resources, capacities and institutional aspects that influence the level of exports of companies in Colombia's pharmaceutical sector. The main findings that are highlighted include the significant role of the variables of supply costs, logistics, preview experience and the institutional environment in improving exports in the sector.

In recent years, companies have experienced a complex, dynamic environment. Permanent changes in customers’ needs and preferences have appeared, new products have been introduced, competition has increased, uncertainty has become marked at the time of decision making, and new agents have appeared. The pharmaceutical sector is no stranger to this situation: it is a sector in which it is very difficult to predict the behavior of the environment. For this reason, companies have been forced to work intensively to keep up with the market's changes. One of the pharmaceutical sector's primary characteristics is that its environment contains a large number of agents and components, and new products have been developed as a result of technological progress (Rivera, Avila, López, Garzón, & Flores, 2010).

The pharmaceutical sector is also characterized by its requirement of large investments in research and development (R&D), its products’ high renewal and differentiation rates, and the generation of benefits for companies and patients, the latter through reduced treatment costs and hospitalization days.

These characteristics encourage interactions between supply and demand in a market environment that differs from other industries. On the consumer side, the participation of various agents in the acquisition of goods is noteworthy; on the retailer side, the market power that companies acquire through the establishment of legal monopolies, brand loyalty, and adverse selection is noteworthy. These features allow us to place the pharmaceutical industry in a complex market scenario with multiple failures, creating incentives for state intervention.

In Colombia, the pharmaceutical market features strong interactions between private producers and public-sector distributors because of the existence of a list of generic and essential medicines to which those affiliated with social security are entitled, multiple distribution channels, and a price regulation and market concentration policy that often ignores the particularities of the sector. In addition, the health care reform contained in Law 100 of 1993 modified some of the sector's rules without considering the impact of that change on the overall performance and achievement of the healthcare system.

Sixty-seven percent of the Colombian pharmaceutical sector is in the hands of national companies; international laboratories compose the remaining 33% (ANDI, 2014). The trade balance of the Colombian pharmaceutical market is characterized by a greater number of imports than exports because the sector relies on imports from raw materials to finished products. Therefore, Colombia's pharmaceutical sector has very strong international dynamics that are determined by this combination of exports and imports. Colombian companies in this sector must compete with foreign companies. To do so, Colombian companies attempt to cut costs by buying foreign raw materials and supplies.

In this paper, we present the dynamics of the Colombian pharmaceutical sector's export activity. Factors that Colombian companies confront in the pharmaceutical sector are identified, along with their influence in export growth. In addition, we identify resources, capabilities and institutional factors that influence the growth of exports in a quantitative study that achieves a close approximation of the sector's reality. According to the results of the Joint Survey of Industrial Opinions (Encuesta de Opinión Industrial Conjunta—EOIC) conducted by the National Businessmen's Association of Colombia (Asociación Nacional de Empresarios de Colombia—ANDI) among businessmen in the pharmaceutical sector during the third quarter of 2013, numerous problems affect the Colombian pharmaceutical sector. Based on that survey, this study aims to verify whether variables such as productive resources, logistic capacity, previous experience on the international market and the institutional environment influence the sector's export growth. Our hypotheses are supported by resource-based theory. Moreover, institutional theory and the regulatory function of institutions are incorporated as the theoretical basis to support our hypothesis that the institutional environment affects the growth of the sector's exports. This study finds that input costs, logistic costs, previous experience and institutional environment affect the Colombian pharmaceutical sector's exports, highlighting the sector's high dependence on imports of raw materials because of the advantages that other countries offer with respect to prices, leading to the domestic industry's lack of initiative to increase domestic production of raw materials.

The context of the Colombian pharmaceutical sectorThe Colombian pharmaceutical industry is made up of national companies, which control 67% of the domestic market, with international laboratories or subsidiaries controlling the remainder. Nevertheless, these foreign industries have developed production and distribution strategies that have enabled them to reach regions that previously had a minimal industry presence, resulting in increased productive activity.

The Colombian pharmaceutical market is characterized by strong interaction between private producers and public-sector distributors; there is a list of generic and essential medicines to which those affiliated with social security are entitled; there are only two distribution channels, and there is a price-regulation and market-concentration policy that often ignores the sector's particularities (SENA, 2008).

In 1993, the National Health System (Sistema Nacional de Salud) was restructured, creating the General System of Social Security in Health (Sistema General de Seguridad Social en Salud) and incorporating two instruments of drug policy: (1) essential drugs, as the mechanism to select the best drugs for the most common diseases; and (2) generic drugs, as the mechanism to introduce market competition. Therefore, the Colombian drug market is composed of two markets derived from the two drug-distribution channels: (1) institutional, for the members of the social security system; and (2) private. In both cases, there are critical differences in the distribution channels to the final consumer and there are substitution possibilities.

The Colombian pharmaceutical industry has undergone major changes in recent years, particularly after the issuance of Law 100 of 1993. The social-security policy with respect to health that contains this law has increased demand in the sector, especially for generics. This law also defined the role of state regulators in drug-related issues. One of the highest-impact standards for producers is Decree 549 of 2001, which implements Manufacturing Best Practices (Buenas Prácticas de Manufactura—BPM) in all of the laboratories in Colombia, thus enabling the sector to be more competitive and productive (Bustamante, 2007).

Overall, the market for drugs has various classification criteria—e.g., mode of sale, type of products, therapeutic class, and place of manufacture. In Colombia, the pharmaceutical industry is very heterogeneous. It includes the production and import of semi-elaborated pharmaceutical goods for final consumption by humans and animals. The industry directs a very small percentage of its expenditure to R&D expenses both because foreign companies perform their research abroad and because domestic companies can be considered small and medium sized; they do not have enough resources to develop research programs to create new drugs (Bustamante, 2007).

Moreover, the presence of multinational companies in Colombia has declined in recent years. Several have taken their production to other countries that offer greater tax incentives and fewer quality and procedural regulations. This situation has encouraged national laboratories to develop new products that meet domestic demand for medicine (Stepanian & Tirado, 2013), thus transforming the sector into a strong exporter of drugs and an importer of raw materials (Angulo & Mosquera, 2008). Exports of pharmaceutical products have shown a growth trend since 2005, with a slight decrease during 2010 and 2011. In the last two years, although exports have continued to increase, there remains a trade-balance deficit. The sector's strengths are its regulations in line with international standards, freedom of prices, skilled labor, competitiveness, and high-quality products; its weaknesses are instabilities in the health system, counterfeiting and smuggling, and control and surveillance deficiencies (Angulo & Mosquera, 2008).

In recent years, Colombia has been characterized by a turbulent business environment, with continuous changes in customer needs and a resulting emergence of new products, increased price competition and new players in the market. The pharmaceutical sector has been affected by this dynamic; the behavior of its environment has become more unpredictable and companies must not only learn new skills to stay in business but also improve their performance in developing skills and managing their resources to adapt to new environmental conditions (Rivera et al., 2010). This series of problems is reflected in the Joint Survey of Industrial Opinions (Encuesta de Opinión Industrial Conjunta—EOIC) conducted by the National Businessmen's Association of Colombia (Asociación Nacional de Empresarios de Colombia—ANDI) among businessmen in the pharmaceutical sector during the fourth quarter of 2014. The survey results showed a series of problems that affect Colombia's pharmaceutical sector. The primary obstacles perceived by businessmen include high levels of market competition, low demand, the exchange rate, the cost and supply of raw materials, smuggling and unfair competition, and infrastructure and logistics costs. The survey results also showed the presence of positive levels of production and sales, stable inventories and a relatively favorable business climate. One of the major topics of concern is the tax reform being discussed in Congress because a higher income tax represents a substantial burden on companies whose tax capacity is at its limit. Another concern for entrepreneurs involves proposed labor initiatives that could result in slower growth, less investment, less employment and more informality (ANDI, 2014).

Starting with problems specific to the pharmaceutical sector, this study analyzes the effects of the resources available for production, logistics costs, previous experience and institutional environment on the sector's export growth. The following section thus presents the theoretical framework focused on resource-based theory and institutional theory, along with the hypothesis to be tested.

Theoretical frameworkOne of the most notable aspects of today's economy is the new world order of international competition, trade blocs and globalism, which requires companies to participate in international trade, regardless of a company's size. This theoretical framework focuses on analyzing the influence of particular resources, capacities and the institutional environment on export growth.

Resource-based theory and internationalizationVarious business characteristics—typically, the possession of certain resources and capabilities that can be exploited in other geographical markets at low costs (Buckley & Casson, 1976)—have a determining effect on export performance. Tallman (1992) states that a company decides to enter a foreign market based on an analysis of its resources and capabilities that identifies its competitive advantage.

Resource-based theory is drawn from the work of Penrose (1959), focusing on the theory of the growth of the firm, which argues that the main function of business is to acquire resources and organize for the purpose of producing goods and services that create profitability. Among these resources, Penrose (1959) highlights the need for personnel with experience and knowledge of the use of other resources. Authors that followed Penrose (1959) defined these resources as either tangible or intangible assets that companies control; these assets can be physical, technological, human, etc. Therefore, companies’ competitive advantage will depend on the existence of such assets (Teece, 1980; Wernerfelt, 1984; Barney, 1986, 1991; Peteraf, 1993; among others).

Overall, resource-based theory suggests not only that companies have heterogeneous resources and capabilities but also that the extra benefits obtained by companies are the result either of the possession of valuable resources that constitute their competitive advantage or of the creation of specific capabilities that allow companies to compete more successfully (Fong, 1998). Therefore, this theory assumes that it is necessary to possess distinctive resources that are also “strategic”—that is, resources that are either valuable or rare and difficult to imitate or substitute (Barney, 1991; Peteraf, 1993; Teece, Pisano, & Shuen, 1997)—because if a company possesses these types of resources, it is difficult to find other companies with similar strategies for taking advantage of market opportunities.

When a company's various resources are broken down into categories, Weston and Brigham (1994) indicate that those categories include physical resources (technology, plant, equipment, access to raw materials, infrastructure and other factors that may affect production costs), financial resources (internal or external funding sources) and human-capital resources (classifying employees by their respective competencies, including but not limited to education level, experience, ability to make decisions, ability to adapt, and job skills) (Barney, 1991; Grant, 2006). Similarly, reference is made to organizational resources, organizational structure, levels of authority, planning and control systems, and organizational culture (Barney, 1991; Grant, 2006).

In terms of capabilities, according to Cardona (2011), these organizational routines enable resources to be organized, integrated and complemented. Cardona draws on Grant (2006) to indicate that these routines are fundamental processes to transform operational and administrative practices into capabilities. Hamel and Prahalad (1990) argue that organizational capabilities not only are distinctive competencies of companies that are important for the achievement of company objectives but also comprise different individual tasks that often require the integration of specialized knowledge.

Wang, Boateng, and Hong (2009) attempt to explain the process of the internationalization of companies from three perspectives, including resource-based theory, suggesting that international expansion can occur when companies possess specific competitive resources that can offset the additional costs associated with entry into a foreign market. Therefore, the overseas expansion of a business is seen as a means of appropriating income from foreign markets using valuable resources, which help reduce the costs and risks incurred by the foreign market's novelty and other differences from the domestic market (Tseng, Tansuhaj, Hallagan, & McCullough, 2007).

Another perspective used by Wang et al. (2009) to explain the internationalization of companies is based on institutions; those authors note that strategic decisions are not only promoted by industry conditions and specific company resources but also reflect the formal and informal constraints that result from a company's institutional framework (Scott, 1995). This viewpoint suggests that every strategic decision is limited by various institutional forces that can either promote or hinder the improvement of resources and capabilities (Dunning & Lundan, 2008, cited by Wang et al., 2009). Even strategies such as internationalization are developed based on the institutional framework of the company's country of origin (Wan & Hoskisson, 2003). Below, the resources and capabilities analyzed in this work are described.

Productive resourcesAccording to Leonidou, Katsikeas, and Samiee (2002), companies must optimally allocate their resources so that they can achieve higher export performance because resource availability enables companies to exploit their opportunities and confront threats from their environment. The determinants of export growth are seen as external and internal influences, and the studies that examine the internal factors are grounded upon resource-based theory (Beleska-Spasova, Glaister, & Stride, 2012). Within these internal influences are operative, financial, and human capital resources (Beleska-Spasova et al., 2012). Operative resources include inputs used to develop organizational processes. Therefore, the possession or lack of material resources affects export activity. Without production resources, companies cannot satisfy the demand of international markets, thus hampering export growth (Arteaga-Ortiz & Fernández-Ortiz, 2010). In general, when the requirements for export activities are incompatible with existing productive resources, companies may experience poor export activity. In addition, the high cost of required inputs can hamper business participation in the international market, thus affecting the implementation of an export strategy (Beleska-Spasova et al., 2012). As a result, the following hypothesis is proposed:Hypothesis 1a

The high cost of productive resources negatively influences the growth of exports.

Logistic resources and capabilitiesLogistics represent a portion of the commercial costs of international business activity and are critical for the volume of bilateral trade (Anderson & Van Wincoop, 2004). When referring to logistic costs, freight costs, customs, transaction costs, and documentation (among other things) are included. According to Chang, Kaltani, and Loayza (2009) and Hoekman and Nicita (2008), a country's infrastructure affects trade and export growth. The real costs of trade can be substantially reduced by improvements in physical and logistical infrastructure that increase the volume of international trade. When a country has many suppliers, adequate transportation, a high-quality logistic infrastructure, several specialized logistic operators, and a suitable cost and time requirement for companies to cross borders, international trade is facilitated because these resources are a major determinant of import and export volume (Hausman, Lee, & Subramanian, 2013). Accordingly, the following hypothesis is presented:Hypothesis 1b

High logistic costs negatively influence the growth of exports.

Previous experienceHuman capital resources arise through training, experience and management vision (Theingi & Purchase, 2011). Thus, managers with higher educational levels, knowledge of foreign markets and experience in international activities contribute to boosting exports (Ibeh & Wheeler, 2005; Maurel, 2009; Stoian, Rialp, & Rialp, 2011). In this sense, Millington and Bayliss (1990) note the role of strategic planning in the process of internationalization and conclude that during the first wave of international participation, companies rely on their market experience and therefore make incremental adjustments. However, as their degree of international experience increases, companies’ planning systems formalize their strategic analysis and information search. The growth of international activity continues to the extent that experience can be translated across different markets and among various product groups, enabling companies to use an incremental process within markets (Morgan & Katsikeas, 1997). Therefore, the following hypothesis is presented:Hypothesis 1c

Previous experience positively influences the growth of exports.

We started with resource-based theory to show the influence of the presence of valuable resources and specific organizational capabilities on companies’ internationalization decisions. However, there are also environmental conditions that affect that decision. According to Wang et al. (2009), those environmental conditions are related to the institutional forces that are present in companies. For that reason, institutional theory and its influence on internationalization are described below.

Institutional theory and its influence on internationalizationInstitutionalism considers that institutions are operating rules for society and therefore have the ability to guide social processes in all spheres: society, state and the market (Vargas, 2008). Institutional theory states that institutions are created that are capable of guaranteeing trust relationships among parties in conflict, solving problems of collective action, reducing transaction costs, and reducing incentives for corruption, among other tasks that ultimately seek to maintain societal stability (Vargas, 2008).

According to Zucker (1987), institutional theory provides a vision for organizations because organizations are influenced by regulations, usually originating from external sources such as the government but sometimes originating within the organization. Through institutional theory, various perspectives are presented in which the institution is the unit of analysis of economic and political reality. Among these perspectives, we present the most outstanding. Economic institutionalism focuses on studying institutions as a mechanism to make decisions that allow a match between individuals’ preferences; therefore, institutions are rules and regulations that enable and constrain the behavior of social actors (North, 1990; Scott, 2001). Economic institutionalism identifies institutions’ influence on countries’ economic and social performance, where those countries’ preferences are explained according to institutional guidelines (Vargas, 2008). The new economic institutionalism does not consider institutions’ social character; therefore, it is recognized that individuals’ rationality is determined by their own limits to know all of the possible options for decision-making (Hennings, 2007). Institutional political economy provides a basis for governance because it holds that the institutional norms that act on the behavior of individuals and their decisions are the mechanisms that allow institutions to control those individuals’ behaviors, thus generating the logic through which organizations must change (Weimer, 1995). In contrast, the new institutional political economy analyzes the failures and deficiencies that occur in state mechanisms and substantiates economic principles that lead to efficiency.

This study is based on the approaches of the neo-institutionalists, who express the need to study the existing legal system and the means under which individuals’ actions are restricted (Laurent, Ochoa, & Urbano, 2004). Government activities can help companies develop competitive advantages to develop in foreign markets those organizational capabilities that they possess in their domestic markets (Westhead, Wright, & Ucbasaran, 2002), which is why all government export-promoting policies and industry regulations are considered external factors that determine companies’ export behavior.

The institutional environment that influences the pharmaceutical sector's international trade is analyzed in this paper, leading us to frame this variable within institutional theory when considering the foreign-trade rules established by the State and conditions imposed for foreign trade's development. Moreover, institutional theory suggests that to the extent that a company sees itself as part of the world, it should progressively adopt rules and procedures that give it legitimacy within its field, so that companies that decide to export or import can expand their organizational field, adapting to each country's institutional environment to facilitate their legitimacy in both local and global markets (Hessels & Terjesen, 2007).

The institutional environmentAccording to Araujo, Mion, and Ornelas (2012), export growth depends on the quality of a country's institutions of a country: a good institutional environment can advance a distributor's reputation, especially because institutions impose strict restrictions on its behavior. A country's institutional characteristics reflect various dimensions of the national environment framed in laws, rules and regulations that either approve or restrict certain behaviors, which is why institutions determine a company's behavior, including its internationalization activities (Novikov, 2014).

In Colombia, the issue of comprehensive quality control of medicines (whether produced domestically or entering the county) has become a matter of great importance because of the opening of the international market. The group that seeks control includes associations such as Afidro (with its framework for intellectual property protection) and Asocoldro (which advocates for harsher criminal punishment for those who commit smuggling and counterfeiting). State organizations include the INVIMA (with its Drug Surveillance Program) and DIAN (with its policy on the eradication of smuggling). The regulatory framework is based on constitutional principles and the right to enjoy a healthy environment. Other important policies include the following: drug-price regulation; health records; criminal sanctions for product adulteration; and intellectual property protections. However, Colombia's institutions suffer from certain limitations, including a lack of infrastructure to perform monitoring and control functions and to ensure compliance with bioequivalence and bioavailability studies, a requirement that in practice has not been implemented (Valbuena, 2006).Hypothesis 2

A favorable institutional environment positively influences the growth of exports.

MethodologyThis quantitative research uses a database from a 2014 survey of a group of 400 exporting companies in Colombia. All of the pharmaceutical-industry companies were filtered, resulting in a sample of 163 companies. With these data, we intend to analyze some of the variables presented in the Joint Survey of Industrial Opinion (Encuesta de Opinión Industrial Conjunta—EOIC), which is conducted annually by the ANDI. Through a multiple linear-regression model, the influence of these variables on the growth of exports in the sector is established.

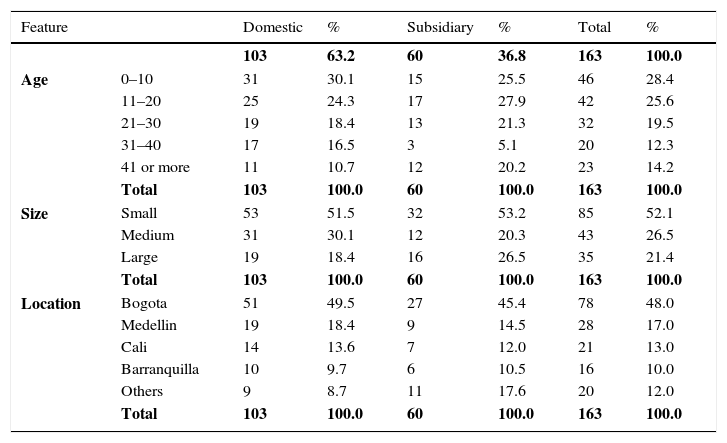

The sample is composed of 103 domestic companies and 60 international companies with subsidiaries in Colombia. According to their size, they were classified as small, medium or large depending on the number of workers. Thus, small businesses have 1–50 employees, medium-sized businesses have between 50 and 200 employees and large businesses have more than 200 employees. In the sample, 52.1% are small, 26.5% are medium and 21.4% are large. Most of these companies are located in Bogota (58%), followed by Medellin (17%), Cali (13%), Barranquilla (10%) and other cities (12%, including Cartagena and Bucaramanga). With respect to the age of these companies, 28.4% are between 0 and 10 years of age, 25.6% are between 11 and 20 years of age, 19.5% are between 21 and 30 years of age, 12.3% are between 31 and 40 years of age, and the remaining 14.2% are more than 41 years of age (Table 1).

Sample characterization.

| Feature | Domestic | % | Subsidiary | % | Total | % | |

|---|---|---|---|---|---|---|---|

| 103 | 63.2 | 60 | 36.8 | 163 | 100.0 | ||

| Age | 0–10 | 31 | 30.1 | 15 | 25.5 | 46 | 28.4 |

| 11–20 | 25 | 24.3 | 17 | 27.9 | 42 | 25.6 | |

| 21–30 | 19 | 18.4 | 13 | 21.3 | 32 | 19.5 | |

| 31–40 | 17 | 16.5 | 3 | 5.1 | 20 | 12.3 | |

| 41 or more | 11 | 10.7 | 12 | 20.2 | 23 | 14.2 | |

| Total | 103 | 100.0 | 60 | 100.0 | 163 | 100.0 | |

| Size | Small | 53 | 51.5 | 32 | 53.2 | 85 | 52.1 |

| Medium | 31 | 30.1 | 12 | 20.3 | 43 | 26.5 | |

| Large | 19 | 18.4 | 16 | 26.5 | 35 | 21.4 | |

| Total | 103 | 100.0 | 60 | 100.0 | 163 | 100.0 | |

| Location | Bogota | 51 | 49.5 | 27 | 45.4 | 78 | 48.0 |

| Medellin | 19 | 18.4 | 9 | 14.5 | 28 | 17.0 | |

| Cali | 14 | 13.6 | 7 | 12.0 | 21 | 13.0 | |

| Barranquilla | 10 | 9.7 | 6 | 10.5 | 16 | 10.0 | |

| Others | 9 | 8.7 | 11 | 17.6 | 20 | 12.0 | |

| Total | 103 | 100.0 | 60 | 100.0 | 163 | 100.0 |

Source: Own preparation, based on sample data.

The research question and the assumptions made in this study generate the need to establish a model that enables us to include business and industry variables. Therefore, a multilevel or hierarchical analysis is performed that allows us to include various groups engaging in the individual behavior, an approach that is characteristic of traditional models (Liu & Gupta, 2007). This aggregation of various groups leads to better estimates of standard errors and differentiates the effects at the micro level (in this company research) or the macro level (i.e., the sector), along with the relationships between levels, that is, in this research, the top-down processes approach (Klein, Dansereau, & Foti, 1994; Klein & Kozlowski, 2000) is used to analyze influences generated from a higher level to a lower level (i.e., sector to company).

Multilevel models have primarily been used in the social sciences and education because it is clear that society is organized in nested hierarchies (Wu, 1999). This type of social order and the benefits of this type of model are recognized; there has been a sharp increase in the use of this model in the last decade, although it remains limited (….).

Therefore, multilevel models are used in this research because of the existence of possible differences in firm performance caused by variables related to their economic sectors whose influence is not directly revealed by traditional techniques (Snijders, 2011). In other words, such models can identify differences associated with individuals and the groups to which they belong while avoiding a simple statistical aggregation of individuals and subsequent generalizations that assume that all individuals interact with their context in a similar manner (Draper, 1995).

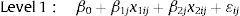

In mathematical terms, it is proposed that the multilevel model can be seen as an extension of the linear model, which explains a dependent variable in response to a group of independent variables as follows:

Where

Y=(y1+y2+y3+…yn) is a vector of random answers.

yn: is the nth observation of the dependent variable. This variable has the dimension (n×1).

Moreover, Xn is the nth observation of the independent variable in the model.

Thus, x=(x1+x2+x3……xn) is a matrix of size n*p that includes zeros, ones or existing independent variables in the model.

¿=(¿1+¿2+¿3+⋯+¿n) is the error vector containing the unexplained with the independent variables included in the model; in other words, these random errors result in the difference between the observed and estimated values. Additionally, homoskedasticity (equal variance for all values of X) is assumed.

Finally, β=(β1+β2+β3+⋯+βn) is the vector of the parameters that reveal the weight of the variable in the equation and the parameters to be estimated.

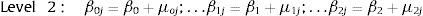

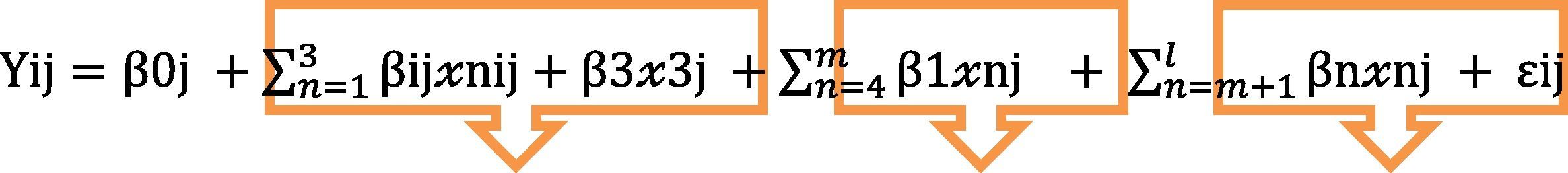

However, if the existence of the hierarchy or level within the model is established and it is recognized that the individuals at the micro level are clustered at the macro level, then the i-th individual in the j-th group is expressed as follows:

Where:

Yij: is the response of individual i in group j.

xij: is the explanatory variable in the individual i in group j.

¿ij: is the normally distributed error with constant variance.

β0j: is the average of y and the j-th group.

β0: is the average of the population.

μoj: is the random effect on the j-th group with variance σμ02.

Additionally, if the possibility of having different slopes for each existing group is presented, the following equation is obtained:

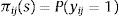

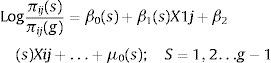

with the column vector μ: μ=(μoj+μ1j+μ2j)∼N(0,Ωμ): Ωμ=σ2μ0 σμ10σ2μ1 σμ20σμ21σ2μ2(eoij)∼N(0,Ωe): Ωe=(σe02).It is important to note that because the dependent variable is not continuous, a multinomial logistic multilevel analysis is used to capture the response options and the structure of the two levels in the model. In general, if the reference category of the dependent variable is g, it is specified that

For this research, we seek to find the model with the best fit based on a theoretical model that contains the relationships that we seek to contrast (Murillo, 2004). For this purpose, 4 steps are proposed:

Model 1: A model is generated with the control variables.

Model 2: A model with variables related to the companies’ resources and capabilities is created.

Model 3: A model with the institutional variable associated with the environment is created. In mathematical terms, the final model is expressed as follows:

Control Variables Resource V. Institutional V.

Measurement of variablesTo measure the dependent variable Growth of Exports, the survey question that asks whether the company has increased its level of exports in the last 3 years is used. The responses are measured using the Likert scale from 1 to 7, in which 1 is strongly disagree and 7 is strongly agree.

To test the model, control variables such as the following are proposed:

AGE=Number of years the company has been in the market.

SIZE=Size of the company (small, medium or large).

OWNERSHIP=Ownership type (1=national or 2=international).

DSIQUI=Distance in kilometers to its main foreign market.

For independent variables, the following questions were selected. These responses were also measured on a Likert scale from 1 to 7, in which 1 is strongly disagree and 7 is strongly agree.

The resources and capabilities variables are as follows:

RPROD=Productive resources are measured using the following question: Do you consider that the production costs of the sector are high?

RLOG=Logistic resources are measured using the following question: Do you consider the sector's logistic costs to be high?

PREVEX=Previous experience is measured by the average number of years that entrepreneurs in each sector claim to have performed export activities.

The following institutional variable is proposed:

INSTE=Institutional environment is measured using the following question: Do you consider the institutional environment to be favorable for businesses?

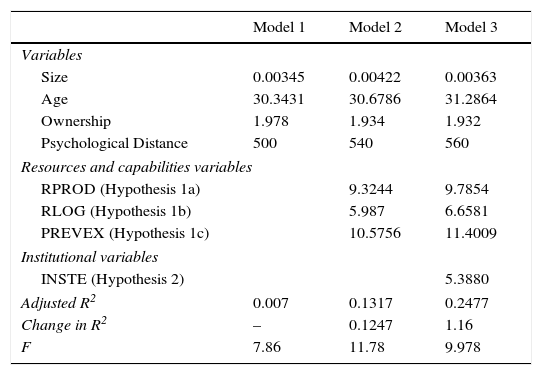

The estimated multilevel regression model yields the results in Table 2. It should be clarified that before estimating the model, the statistical assumptions of the linear regression are verified, thus validating the absence of distortions in the estimated relationships in a linear regression model and confirming the quality and reliability of the model results (Hair, Anderson, Tatham, & Black, 1999). First, the independence assumption is validated, which estimates either the absence of a relationship between residuals in the evolution of the data or a no-correlation assumption. To this end, we analyze the Durbin–Watson statistic, which provides information about the degree of independence between the residuals, where the residuals must not show any systematic pattern with respect to either the predictions or the independent variables. If the value of the Durbin–Watson statistic is close to 2 (approximately 1.5–2.5), the residuals are independent; if it approaches 4, the residuals will be negatively autocorrelated; and if it approaches 0, the residuals will be positively autocorrelated (Hair et al., 1999). The statistic has a value of 1.444, so the residuals’ independence is assumed.

Regression analysis results.

| Model 1 | Model 2 | Model 3 | |

|---|---|---|---|

| Variables | |||

| Size | 0.00345 | 0.00422 | 0.00363 |

| Age | 30.3431 | 30.6786 | 31.2864 |

| Ownership | 1.978 | 1.934 | 1.932 |

| Psychological Distance | 500 | 540 | 560 |

| Resources and capabilities variables | |||

| RPROD (Hypothesis 1a) | 9.3244 | 9.7854 | |

| RLOG (Hypothesis 1b) | 5.987 | 6.6581 | |

| PREVEX (Hypothesis 1c) | 10.5756 | 11.4009 | |

| Institutional variables | |||

| INSTE (Hypothesis 2) | 5.3880 | ||

| Adjusted R2 | 0.007 | 0.1317 | 0.2477 |

| Change in R2 | – | 0.1247 | 1.16 |

| F | 7.86 | 11.78 | 9.978 |

Source: Self-made.

Model 2 enables us to test the first group of hypotheses. A positive relationship between Production Resources and Export Growth in the companies is perceived (Beta: 9.3244; sig.=0.001), which corroborates those hypotheses. Similarly, Hypothesis 1b is proved, showing that the availability of Logistic Resources positively influences the growth of exports of Colombian companies (Beta: 5.987; sig.=0.005). Finally, the positive relationship established in the literature between the Previous Experience and Export Growth is shown (Beta: 10.5756; sig.=0.005). After evaluating model 2 and before evaluating model 3, the regression indicators obtained from model 2 are analyzed to corroborate the explanation based on the variables of the firm within Export Growth, concluding that the variables are significant and relevant within the investigation. Subsequently, model 3 is tested, the institutional variable is incorporated and the hypothesis proposed at this level of analysis is evidenced. Hypothesis 2 is confirmed, indicating that the institutional environment positively influences Export Growth (Beta: 5.3880; sig.=0.001).

In summary, these results find that although reports state that the Institutional Environment is a problem that affects the pharmaceutical sector, for the surveyed companies, it is not possible to validate this result, particularly because this sector often must address counterfeiting issues (for example, drugs may contain the incorrect active ingredient or the correct ingredient in incorrect quantities) instead of smuggling (drugs entering illegally). This is because of government regulations of the sector controlling the entry of smuggled drugs.

Export growth is adversely affected by the availability of Production and Logistic resources. For both variables, we find that the higher the costs, the lower the studied companies’ export growth. When companies in the Colombian manufacturing sector must purchase expensive supplies, their products became less competitive in foreign markets because the selling price must also be high to recover the seller's costs. For such companies, it therefore will not be profitable to export their products because their competitors’ supply costs are low, enabling them to offer low prices. The same is true for logistical costs; if Colombian pharmaceutical companies’ cost of placing their products in foreign markets is very high, they lose competitiveness in those markets, that is, it will be unfavorable to export to other countries, especially countries in which the pharmaceutical sector benefits from supplies and logistical costs at competitive prices. Therefore, if pharmaceutical companies have insufficient resources to fulfill their most important needs—e.g., purchasing inputs, labor, acquisition of new assets or replacement of obsolete assets—they cannot continue to engage in export activities because it is probable not only that they will be unable to meet a certain level of production but also that they will not have the capital to bear the additional costs associated with commercialization in other markets.

ConclusionsThe Colombian pharmaceutical market is the fourth-largest market in Latin America. In recent years, the trend in this market has been to import and export products and/or raw materials. The amendment to Law 100 of 1993 was one of the factors that led to a more dynamic market and boosted domestic demand, resulting in higher revenues for companies. The social security system's increased drug coverage has resulted in a boost to the market for generic products; consequently, there has been an annual increase in the import of inputs for manufacturing generic drugs. Similarly, national companies have been making inroads into foreign markets, especially in neighboring countries, because of their level of competitiveness, production processes and sales strategies.

The results of this study support the conclusion that although logistical costs are high in Colombia, it is still advantageous for companies to continue to import raw materials; the benefits of importing still outweigh the costs of internal production. In addition, Colombia primarily produces drugs of low complexity; for this reason, the market trend is weighted heavily toward importation either of raw materials or of drugs that are not manufactured locally. In this sense, exchange-rate fluctuation is one of the primary factors that can cause changes in supply and therefore would have a negative effect on the exports because as a market importer of raw materials, the Colombian pharmaceutical industry will be limited by economic changes in the countries that export supplies to the Colombian market.

In general, the reason for the high production costs associated with supplies and logistics that affect the export growth of the Colombian pharmaceutical sector is that the value of the drugs is the sum of the costs and margins that comprise the price paid by the final consumer. In addition, a long chain of intermediaries adds costs. Moreover, the pharmaceutical industry must employ qualified professionals given the need to provide products with high quality standards that guarantee individuals’ health, thus increasing production costs.

Nevertheless, the sector's high costs—whether caused by imported supplies, skilled labor, or logistics chains—result in the sector's companies prioritizing the ability to cover those costs to reach a level of production that will, at minimum, allow them to remain in the local market. Thus, exports are conditioned to specific products that have a competitive cost advantage, such as natural products (which have boomed because of Colombia's significant biological diversity) or generic pharmaceuticals.

Overall, Colombia lacks advantageous resources and capabilities in the pharmaceutical sector. Despite the industry's technological modernization, it does not attract the investment levels needed to produce highly complex drugs. Because the government must ensure the supply of drugs for the health system, Colombia is forced to become an import-heavy market, dependent on countries with valuable resources and capabilities.

From an institutional point of view, health policies seek to provide greater coverage regardless of product quality, devoting their efforts to increase coverage at any cost instead of investing in knowledge and research to generate a range of drugs. However, at the level of market regulation policies, notable positive results are evident because medicine smuggling controls have increased. The problem that companies often experience in the sector is the growing threat of counterfeiting, which is exacerbated by networks that introduce counterfeit products to the health system through pharmacies, hospitals, distributors or the EPS, which are attracted by the low prices offered. Thus, greater controls and special measures to counteract this problem are required, including continuous inspections of distributors and industry customers to ensure that drugs are stored in compliance with the sanitary conditions and other provisions defined by the Invima, from the composition of the products to the packaging. These controls are necessary not only because of the high level of drug adulteration and counterfeiting but also because of the incorrect usage of legitimate drugs that are sold irregularly or after their expiration, putting at users’ health at risk.

Finally, this work enables us to consider some impacts on business, government, academia and even consumers. In the business sector, relevant aspects to assess the advantages and disadvantages of the pharmaceutical sector have been identified, thus enabling it to directly confront the issue of internationalization. Although the focus of this study is some variables that affect international trade, it is important for future studies to consider other variables involved in the export growth of Colombia's pharmaceutical sector. This need is obvious in the results of goodness of fit, which recognizes that the omission of other variables in the model could explain the export behavior of companies in the pharmaceutical sector.

Next, we issue a call to the academy to continue its research work to address the needs and concerns of the economic sector and to support business success. The disclosure of all of these studies is an opportunity for companies to learn more about their environment and their industry and to identify opportunities, threats, and potential.

The government is another important player because it determines public policy. Therefore, the results of this study enable the identification of the shortcomings and merits of the government's economic policy, thereby boosting the sector and attempting to encourage more export activity to improve the trade balance.

Finally, this study points to the importance of the consumer because the pharmaceutical industry is responsible for providing drugs. For that reason, proper import and export activity involves access to quality medicines at reasonable costs.

Among the primary limitations of this study is its use of a cross-sectional model that belies the long-term evolution of the proposed relationships. That said, this study does facilitate an understanding of this sector's behavior and weaknesses. Moreover, we find that the sample, even though it is representative, is highly limited because of the size of the sector in Colombia. Nevertheless, the sample allows us to establish the main conclusions provided in this section.

This article is the product of draft Networks and Innovation internationalization of enterprises funded by the Pontificia Universidad Javeriana Cali (Colombia).