Merger and acquisitions (M&As) strategies have been growingly deployed by firms for their domestic and international expansion, in order to redefine their business scope or take advantage of emerging opportunities. In this paper we conduct a bibliometric study of the extant strategy research on M&As, assessed by the articles published in the main journal for strategic management studies over the period 1984–2010. Results reveal the highest impact works (articles and books), the intellectual ties among authors and theories that form five main clusters of research, and the topics delved into. Performance effects, M&As as diversification strategies, and resource- and capabilities-based topics have dominated the extant research. The study contributes to the existing knowledge on M&As by taking stock of the accumulated knowledge and research direction, complementing other literature reviews with a strategic management perspective. Thus, we provide a rear view of the field, which facilitates detecting untapped gaps that may provide generous avenues for future research.

Mergers and acquisitions (M&As) are among the most frequently used growth strategies firms deploy both for domestic and international expansion, and are CEOs’ favorite strategy (Peng, 2012). The literature on M&As is rather extensive, and scholars have uncovered multiple motivations, process issues, hazards, and outcomes of M&As. For instance, firms may deploy M&A for a variety of reasons, such as enlarging their product scope and geographical reach, to learn (Barkema & Vermeulen, 1998; Morosini, Shane, & Singh, 1998; Zollo & Singh, 2004), to improve competitive capacity (Hitt, Harrison, & Ireland, 2001), acquire resources and knowledge (Barney, 1988; Phene, Tallman, & Almeida, 2012; Ranft, 2006), obtain synergies (Bradley, Desai, & Kim, 1988), overcome shortcomings in the financial markets (Brouthers & Brouthers, 2000), reduce competition (Bradley et al., 1988), and access valuable strategic resources that are essential for a competitive advantage (Barney, 1991).

In this study we examine the stock of accumulated knowledge on M&As in strategic management research. Albeit scholars have researched M&As employing a variety of theoretical and disciplinary lenses, from international business to economics, finance, and organizational culture, in this paper we take a narrower focus in examining specifically the path that extant M&A-related research has taken in strategic management. Methodologically, we conducted a bibliometric study on the entire track record of publications in the leading journal for strategic management research – the Strategic Management Journal (SMJ). This involved examining over 1400 articles published over the period from 1984 to 2010. In a sample of 85 articles, we delve into a structural analysis of the most cited works, a co-citation examination to infer the intellectual structure binding works and the main themes emphasized – using cluster analysis complemented with multidimensional scaling (MDS) techniques –, and co-occurrence of author-supplied keywords to grasp what have been the main topics researched.

The main results denote that M&As have been examined from several theoretical foundations, and although a focus using the Resource-Based View (RBV) has gained some momentum in the last decade (Ferreira, Santos, Almeida, & Reis, 2014), we identified contributions of the agency theory, institutional theory, and transaction cost theory. The cluster analysis identified five main areas of concentration of research: strategic relatedness, post-M&A integration, competence-based, value creation in diversification, and cross-fertilization of finance theory and corporate strategy. Nonetheless, although M&As are a preferred CEOs’ strategy, M&A-related research has not been thus far the preferred scholars’ phenomenon for endeavoring research efforts in strategic management. Hence, more research is needed, not only to help in establishing guidelines for practitioners but also to deepen our theoretical and empirical understanding on M&As.

This study offers a number of contributions. First, it contributes to gaining a broad understanding of the accumulated knowledge on the topic of M&As as researched by strategic management scholars, complementing other literature reviews (e.g., Datta, Pinches, & Narayanan, 1992; Ferreira et al., 2014; Reddy, 2015; Shimizu, Hitt, Vaidyanath, & Pisano, 2004). Specifically, it complements Ferreira et al.’s (2014) bibliometric study by narrowing the focus to strategic management research, using a single and dedicated outlet to strategic management studies. We further complement by conducting a more in-depth study on M&As and delving more into the content of what M&A research has been about. Further, this study is a complement to Werner's (2002) review of international management literature that did not include cross-border M&As among the 12 topics identified, and to Shimizu et al. (2004) and Reddy (2015), who described cross-border M&As in international business literature. Taking a narrow disciplinary lens, we are better able to distinguish discipline-specific advancements and emphasis. It is likely that a phenomenon such as M&As will be subject to idiosyncratic theoretical lenses representing the concerns of a community of scholars. In strategy, for instance, the core concern is on firms’ performance compared to their competitors’. Hence, to this end, scholars will seek to examine strategic issues and structural forms in M&As that will likely impact firms’ performance.

Moreover, this study uses standard bibliometric procedures examining citations, co-citations, and keywords co-occurrences. We specifically focus on the main works (articles and books) on M&As in strategic management, the intellectual structure as depicted by co-citation analysis, and delve into the topics scholars have examined in studying M&As. The bibliometric techniques permit an objective assessment of the stock of accumulated knowledge in a certain field of study, overcoming potential subjective evaluations that could arise from alternative methods based on a discretionary selection of the literature. This is how we position this study: taking a rear view on the extant research to summarize and identify the core works and how they are intellectually connected.

Thus, this study is possibly of particular relevance to doctoral students and newcomers to the topic of M&As that may grasp a quick overview of the field, identify the core articles, the intellectual structure and main themes, and the core research topics that have been delved into (Ramos-Rodriguez & Ruiz-Navarro, 2004). Moreover, by examining an extended timespan – 31 years, from 1980 to 2010 – including the origin of strategy as a discipline (the SMJ was founded in 1980), we are able to provide a clear picture on the stock of M&A-related strategy research. In any instance, it is worth noting that bibliometric studies scrutinize past records (Ramos-Rodriguez & Ruiz-Navarro, 2004; White & McCain, 1998), from which researchers may identify untapped gaps and possible future research directions capable of moving the field forward.

The paper is organized in four main sections. First, we briefly review the literature on mergers and acquisitions in strategy. In the second section we present the method, including the procedures for data collection, sample, and analyses conducted. The third section concerns the results. The paper concludes with a broad discussion pointing out the main areas where knowledge has accumulated, as well as identifying some gaps for future inquiry.

Literature reviewThe number of M&As, both domestic and international, has increased substantially over the last decades (Shimizu et al., 2004). However, the growth of M&As by firms has not been accompanied by an equal growth on M&A research and many doubts remain, namely concerning the performance effects for acquired and acquiring firms, integration hazards, economic rationality for undertaking an acquisition, the managerial hubris, and so forth. Nonetheless, in strategy research scholars have looked into M&As using several conceptual lenses, from a transaction costs view (Hennart & Reddy, 1997), Resource-Based View (Anand & Singh, 1997; Capron, Dussauge, & Mitchell, 1998; Zollo & Singh, 2004), organization learning (Hayward, 2002), agency theory (Amihud & Lev, 1999; Jensen & Ruback, 1983), and finance or finance-related concepts (Chatterjee, 1986, 1992) pertaining to M&As.

Despite being a frequently used strategy, M&As are risky deals and the reports in the media account of poorly succeeded M&As, or of their dissolutions. A majority of the studies has focused on the pre- and post-acquisition performance of the firms involved. However, the results have not been conclusive on whether M&As contribute to the destruction of value or to improve firms’ competitive capacity and market or financial performance (Agrawal & Jaffe, 2000; Hitt et al., 2001; King, Dalton, Daily, & Covin, 2004). Rao and Sanker (1997) found that M&A had a positive impact on selected financial performance measures of the acquirer firms. Other studies have also showed a positive impact on firms’ performance (Hitt, Harrison, & Best, 1998), but a majority of studies found that M&As by and large have no effect or are detrimental to firms’ post-acquisition performance (e.g., Agrawal & Jaffe, 2000; Agrawal, Jaffe, & Mandelker, 1992; Cartwright & Schoenberg, 2006; Datta et al., 1992). Many acquisitions have a negative impact on performance for reasons such as managers’ self-interest or an incorrect assessment of the potential synergies (Roll, 1986; Seth, Song, & Pettit, 2000), inadequate integration of the acquired firm (Hitt et al., 2001), excessive debt resulting from the acquisition effort (Haspeslagh & Jemison, 1991; Hitt et al., 2001), and cultural differences (Haspeslagh & Jemison, 1991; Morosini et al., 1998). In sum, the performance impact of M&As is not conclusive; nonetheless, in strategy research has examined M&As due to the potential for firms to reconfigure their businesses, altering their pool of resources and capabilities and thus affecting their performance (Karim & Mitchell, 2000; Vermeulen & Barkema, 2001).

In strategic management, M&As have often been examined looking at post-acquisition integration of the acquired firm (Zollo & Singh, 2004). A successful post-M&A integration is deemed paramount to the success of the M&A (Haspeslagh & Jemison, 1991). However, there are a number of obstacles that hinder successful post-M&A integration, such as proper target selection (Haspeslagh & Jemison, 1991), the cultural hazards in integrating firms with different institutional and cultural backgrounds (Chatterjee, Lubatkin, Schweiger, & Weber, 1992; Clougherty, 2005), the impact of resource relatedness (Chatterjee, 1986; Chatterjee et al., 1992; Singh & Montgomery, 1987), the loss of value post-acquisition (Dyer, Kale, & Singh, 2004; King et al., 2004), the top management team turnover (Walsh, 1988), and so forth. Thus, firms often face poor performance after undertaking an M&A deal (Dyer et al., 2004; King et al., 2004) and may fail to achieve other strategic objectives, such as tapping into and leveraging the target firm's pool of resources, such as the top managers’ knowledge and experience (Walsh, 1988). Nevertheless, the hazards, challenges, and potential benefits of the post-M&A integration are not yet fully understood (Zollo & Singh, 2004).

Research on M&As has also taken an international strategy view, especially examining cross-border M&A as an entry mode into foreign markets (Harzing, 2002; Hennart & Reddy, 1997; Kogut & Singh, 1988), often contrasting M&As with alternative foreign entry modes such as greenfield investments (Harzing, 2002; Isobe, Makino, & Montgomery, 2000) and joint ventures (Hennart & Reddy, 1997). This stream of literature has often contrasted entry modes in terms of equity and non-equity entries, noting how equity entries provide greater control over the foreign subsidiaries but also greater risk (Hennart & Reddy, 1997; Isobe et al., 2000; Kogut & Singh, 1988), and are better to transfer knowledge internally (Phene et al., 2012). This stream has identified several factors that influence the M&A outcome such as multinational experience (Harzing, 2002), local experience (Barkema & Vermeulen, 1998), product diversity (Brouthers & Brouthers, 2000), internal knowledge transfer (Phene et al., 2012), the selection of the target firms (Haspeslagh & Jemison, 1991), and post-M&A cross-border integration (Shimizu et al., 2004), but also industry and even country-level (Hennart & Reddy, 1997; Kogut & Singh, 1988) factors such as technological intensity, host country market attractiveness, internal isomorphic pressures, and legal constraints. The cultural dimension in M&As has been one of the most frequently studied variables (Stahl & Voigt, 2005) in international strategy. Cultural differences may generate distrust, integration hazards, and be a source of the high failure rates in M&A (Datta et al., 1992; King et al., 2004). Integrating different firms may be especially difficult (Barkema, Bell, & Pennings, 1996), requiring “double-layered acculturation” skills at the organization and national level. Other streams have examined, for instance, the factors that have a positive effect on the likelihood of entering a foreign country by acquisition, such as a low cultural distance between home and host countries (Kogut & Singh, 1988), larger product diversification (Brouthers & Brouthers, 2000), and larger multinational experience (Harzing, 2002).

Cross-border M&As have been argued to overcome the transaction costs upon new market entry by internalizing an activity or transaction (Brouthers & Brouthers, 2000). The TCT and the internalization perspective (see the ownership–location–internalization framework – OLI) have supported much of the traditional research on M&As. Cross-border M&As help overcome, or minimize, the risks and hazards associated to the uncertainties of entering foreign markets, with different cultures and institutional milieus by acquiring a locally embedded firm (Eden & Miller, 2004). The institutional theory has also been used in this context complementing the transaction costs approach, positing that when entering a foreign market, firms face liabilities of foreignness which hinder their success (Eden & Miller, 2004), for instance, due to the differences in institutional environment (Xu & Shenkar, 2002). Therefore, performing a cross-border M&A may allow foreign firms to gain organizational legitimacy and knowledge of the local institutional milieus.

Another stream of thought on M&As has involved managerial choices, discretion, and hubris. There is some anecdotal evidence that CEOs benefit financially from acquisitions. However, there is no clear evidence that they are being rewarded by the shareholders, since the shareholders of the acquiring firms do not seem to capture significant returns from the acquisitions (Jensen & Ruback, 1983). Moreover, the acquisitions often involve paying a premium as high as over 20 percent of the value of the acquired firms. Thus, questions are raised concerning the alignment of CEOs and shareholders’ objectives and the value of paying CEOs for undertaking acquisitions (Amihud & Lev, 1981). In addition to self-serving objectives, CEOs may be moved by a managerial hubris (Hayward, 2002; Morck, Shleifer, & Vishny, 1990; Roll, 1986), which is possible since they have the power to influence the composition of the board and select directors (Bebchuk & Fried, 2003).

Recent research on M&As has had a Resource-Based View (RBV) and organizational learning theoretical focus (Barkema & Vermeulen, 1998; Vermeulen & Barkema, 2001; Zollo & Singh, 2004). M&As are mechanisms to access critical resources (Vermeulen & Barkema, 2001), knowledge not yet held, and to develop novel capabilities (Karim & Mitchell, 2000). The theoretical developments on M&As as vehicles for the acquiring firm to access resources, knowledge, and technologies have been conceptually interesting. Karim and Mitchell (2000) referred to the opportunity that M&As may provide firms to reconfigure their businesses, altering the pool of resources and capabilities held. To some extent, this research has a theoretical emphasis on the RBV. M&As have also been conceptualized for their learning potential (Hayward, 2002; Phene et al., 2012; Vermeulen & Barkema, 2001; Zollo & Singh, 2004), although this may depend on a complex – and hazardous – integration process (Haleblian & Finkelstein, 1999). Learning from a target firm and building new capabilities is one of the reasons why firms acquire others (Zollo & Singh, 2004). Acquired firms may have singular employee skills, technologies, and knowledge that are not available in the factor market and can only be accessed through acquisitions. Thus, there may be capability-building motivations presiding over M&As (Gammelgaard, 2004).

Finally, M&A research in strategy has further focused on the process (see Haspeslagh & Jemison, 1991; Larsson & Finkelstein, 1999). Understanding the process helps to comprehend the M&A outcome (Jemison & Sitkin, 1986). Especially relevant was not only the strategic fit between acquired and acquiring firms, but also the realization that simply acquiring the equity of another firm does not generate value by itself, nor does it contribute to the gestation of the potential synergies. Hence, scholars have developed models for coordinating across firms, systems to align objectives and incentives, and to promote communication and the transfer of knowledge (Ranft, 2006; Zollo & Singh, 2004). In other words, the creation of value in M&A requires skillful management (Jensen & Ruback, 1983; Kitching, 1967, 1974) by the top managers to really generate corporate renewal (Capron et al., 1998; Haspeslagh & Jemison, 1991).

MethodA bibliometric study relies on examining existing documents, such as published articles, books, theses and dissertations, papers presented at conferences, and other source documents to examine a variety of issues such as trends, authors, institutions, journals and theories. The core purpose is helping to make sense, organize, and explore what has been done in a certain topic, subject of study, or discipline (Ferreira, 2011; Ferreira et al., 2014; Shafique, 2013). Bibliometric techniques are particularly useful in dealing with large volumes of information that render content analysis techniques or in-depth literature reviews unviable. By employing bibliometric techniques, scholars may gain a view on what research has been about and where the current frontiers of the field or topic are situated. Moreover, using published articles is especially relevant, since these are certified knowledge that overcame the hurdle of the peer-review process.

Bibliometric studies assessing research developments using the publication records are not novel in business/management disciplines and sub-fields. For instance, bibliometric studies have focused on identifying the main authors in a field (Willett, 2007), the impact of a scholar in the discipline (Ferreira, 2011), the impact of a journal (Tahai & Meyer, 1999), the stock of knowledge in one domain (Ferreira et al., 2014), and the intellectual structure of a discipline such as strategic management (Ramos-Rodriguez & Ruiz-Navarro, 2004) and knowledge management (Ponzi, 2002). All these studies rely on different forms of examining citations and co-citations as primary inputs from a bibliographic dataset.

Procedures for sample selectionWe followed four steps to collect the sample. First, we defined the source documents. We specifically delimited the study to the top journal for publishing strategic management research – the Strategic Management Journal (SMJ). The SMJ is the most influential journal for strategy research (Franke, Timothy, & Frederick, 1990; Ramos-Rodriguez & Ruiz-Navarro, 2004; Tahai & Meyer, 1999), with the highest SSCI impact factor – 3.783 (2012 data, based on the Journal Citation Reports) – among all strategy journals. The impact factor is often used as a measure of quality and influence (Franke et al., 1990). The SMJ is also one of the official journals of the Strategic Management Society, whose mission comprises contributing to developing the theory and practice of strategic management. Moreover, by using SMJ we are able to scrutinize its entire track record from the 1980s onwards without incurring in possible hazards that using different outlets could entail, such as different editorial policies or journals’ missions.

Despite the high stature of the SMJ, we should note that other lower-impact journals also publish strategy research and are thus likely to also publish research on M&As. However, we should make clear that our goal is neither to be exhaustive in constructing a sample of published papers to perform sophisticated empirical tests nor to be exhaustive in identifying all possible publications on M&As; rather, we simply aim to understand the stock of accumulated knowledge concerning leading works, authors, themes, and topics (content). Finally, in selecting only the top journal we overcome doubts pertaining to journal selection criteria.

The second step involved defining the time period. We specified the timespan to the period from 1980 to 2010. The SMJ was founded in 1980, and data collection was conducted in mid-2011. The first article published in SMJ identified in our sample dates from 1984. The third step involved defining the keywords to identify the sample of articles. After a literature review, we defined the following set of keywords: “mergers & acquisitions”, “mergers and acquisitions”, “M&A”, “mergers”, “acquisitions”, and “consolidation & merger”. Although we tried additional keywords post hoc, they did not add to the final sample. Finally, we retrieved the empirical data from the Institute for Scientific Information's (ISI) Web of Knowledge (available at isiknowledge.com) by searching the database following the previous criteria and using the software Bibexcel. We retrieved all relevant bibliographical data from the articles (authors, year, author-supplied keywords, abstract, and references) to perform the bibliometric analyses. ISI has been recognized as the primary source to analyze scientific output (Ferreira, 2011; Ferreira et al., 2014; Ramos-Rodriguez & Ruiz-Navarro, 2004). To ensure that the sample was comprehensive and the papers dealt with M&As, two researchers and co-authors in this study manually screened all the articles published in SMJ, reading, at the minimum, the title, abstract, and author-supplied keywords of all papers published.

With these procedures, out of the nearly 1500 articles published in SMJ from 1980 to 2010, we obtained a sample of 85 articles addressing M&As, which is just short of six percent of all articles. Although this is a seemingly a small number of articles on M&As, the SMJ has published more articles on M&As than other 15 top-ranked management journals identified in Ferreira et al. (2014) – more than the Journal of Business, Long Range Planning, and Journal of Management combined. The data on the 85 papers was processed using the following software: Bibexcel to generate citation lists and co-citation matrixes, SPSS to transform the co-citation matrix into a correlation matrix, run the cluster analysis, and plot the MDS map, and the social networks software Ucinet to draw the visual displays of the network of co-occurrences.

The relevance of M&A-related research published in SMJ is further evidenced by two considerations. First, Furrer et al.’s (2008) content analysis of 26 years of strategic management research, from 1980 to 2005, using the articles published in four journals – the majority of which were from the SMJ – identified the main research topics and trends, and M&As was the eighth most studied topic, though M&As were included within the broader themes of corporate restructuring. Second, we conducted an analysis of the author-supplied keywords in all articles published in SMJ from 1991 to 2010, and M&As was the 11th most explored topic, coming after topics such as firm performance, innovation, strategic alliances and global strategy, and after theories such as the RBV, transaction costs, and organizational learning.

Procedures of analysisThe analysis conducted entailed examining citations, co-citations (or clusters of works), and topics investigated in the existing published articles. Bibliometric studies may employ different procedures with different purposes, and there is no unique, undisputed best procedure (Zupic & Čater, 2014). We followed the method put forth by Ramos-Rodriguez and Ruiz-Navarro (2004) and by Charvet, Cooper, and Gardner (2008) for the citations and co-citations analyses, and Furrer et al.’s (2008) methods and procedures to identify the major research topics.

Citation analysis assesses the frequency with which a certain work (article or book), an author, an institution, or a journal is referenced in other documents. When writing a paper, authors cite other works that are relevant to their own research to build upon a theory or an argument or to contrast findings. Citing existing works is a norm in scientific writing, and we may assume that citation data is a measure of impact, such that the more a work is cited, the higher its impact (Ramos-Rodriguez & Ruiz-Navarro, 2004; Tahai & Meyer, 1999).

Co-citation analysis is based on identifying pairs of articles that are jointly cited in a third document and have been used to uncover the intellectual ties binding works (Ramos-Rodriguez & Ruiz-Navarro, 2004; Shafique, 2013); that is, performing a co-citation analysis requires that we explore the list of references to identify the frequency with which given pairs of articles are used (Zupic & Čater, 2014) to identify the intellectual pillars (Ponzi, 2002). We may assume that papers that are more often jointly cited are likely to be intellectually intertwined (White & McCain, 1998) concerning either theories or the phenomena studied. We have selected co-citation over coupling analysis, as it is arguably more adequate for the analysis over a long period (Zupic & Čater, 2014). Additionally, since we sought to understand the knowledge base of M&A research in the SMJ, a coupling analysis would not be suitable (Dagnino, Levanti, Minà, & Picone, 2015; Zupic & Čater, 2014). Using this data, we constructed the co-citation matrix and replaced the undefined diagonal cells by the sum of the three highest co-citation scores divided by two (cfr. Charvet et al., 2008). Using the raw co-citation matrix, we computed the Pearson correlation matrix, which standardizes the data and prevents distortions from differences between older and more recent works (Acedo, Barroso, & Galan, 2006; Charvet et al., 2008). Using the correlation matrix, we then conducted a cluster analysis with a two-dimensional MDS map depicting the clusters in order to identify bundles of works that are somehow related (White & McCain, 1998). Observing the papers in each cluster, it is possible to interpret the thematic content of each cluster (Chen, Ibekwe-SanJuan, & Hou, 2010).

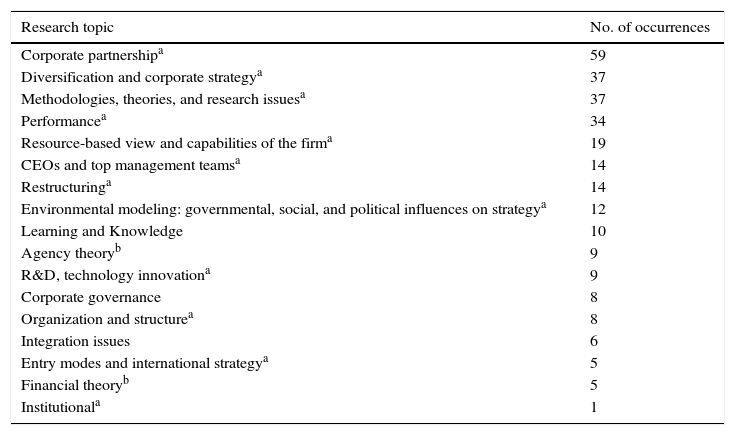

The third analysis involved examining the main research topics and determining how they are interconnected. To identify the topics we followed Furrer et al.’s (2008) procedure of coding and grouping the author-supplied keywords. This appears to be a reasonable approach to infer the specific topical content of an article, since authors select the keywords that best identify the topics of their paper. This involved two procedures. First, we collected the author-supplied keywords from every article, and second, two coders jointly attributed each keyword to one of the pre-defined major research themes. Any inconsistencies were resolved by the principal investigator. This procedure of classifying keywords into major themes is important, as observing a large number of different keywords does not produce meaningful information. Moreover, a paper may be classified according to the theoretical lens, but also according to the geographic context and the methodology used. We made some adjustments to Furrer et al.’s (2008) list of topics because their work examined the entire strategy literature, while we only examined M&A-related research (see also Ferreira et al., 2014). This involved first allocating the keywords to Furrer et al.’s (2008) themes and then finding coherent groups for the non-assigned keywords. The procedure of grouping keywords resulted in 17 topics (Table 1).

Main research topics.

| Research topic | No. of occurrences |

|---|---|

| Corporate partnershipa | 59 |

| Diversification and corporate strategya | 37 |

| Methodologies, theories, and research issuesa | 37 |

| Performancea | 34 |

| Resource-based view and capabilities of the firma | 19 |

| CEOs and top management teamsa | 14 |

| Restructuringa | 14 |

| Environmental modeling: governmental, social, and political influences on strategya | 12 |

| Learning and Knowledge | 10 |

| Agency theoryb | 9 |

| R&D, technology innovationa | 9 |

| Corporate governance | 8 |

| Organization and structurea | 8 |

| Integration issues | 6 |

| Entry modes and international strategya | 5 |

| Financial theoryb | 5 |

| Institutionala | 1 |

In Furrer et al. (2008) there was one grouping on “Financial theory and strategic management” that included agency theory.

The bibliometric data was then depicted as a social network to permit the visualization of the structure underlying the works (Borner, Chen, & Boyack, 2003). The network was drawn using Ucinet, and is based on the co-occurrences from which we infer the proximity, or similarity, among works (Rafols, Porter, & Leydesdorff, 2010).

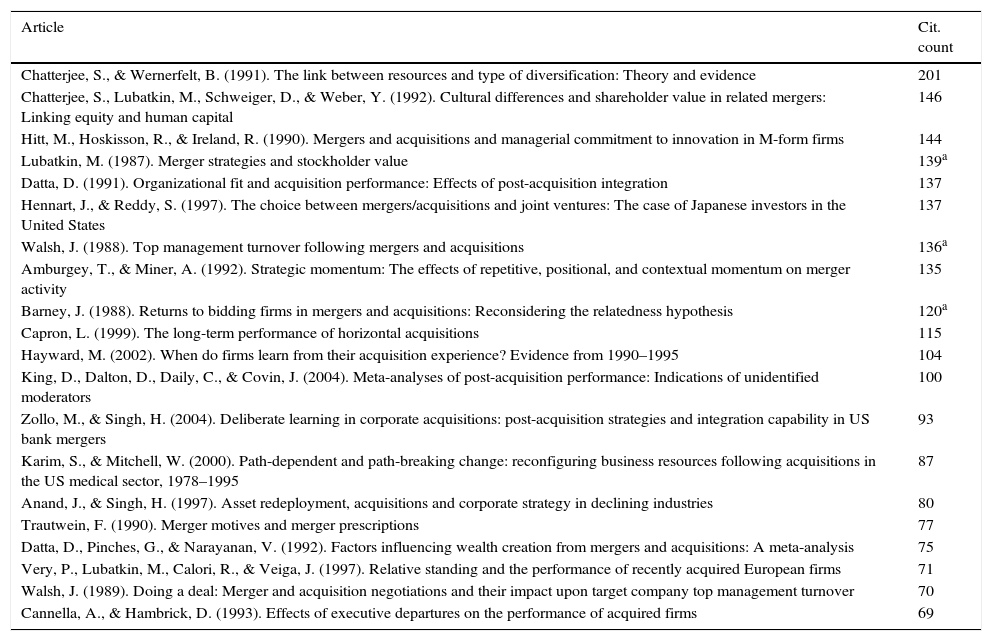

ResultsThe first analysis entailed observing the impact of the articles on M&A published in the SMJ. The citation counts for the most cited articles is shown in Table 2, with data collected from ISI Web of Knowledge, on the citation counts of each of the 85 articles up to 2010. This data allows us to observe the impact of these studies.

The most influential articles in the sample.

| Article | Cit. count |

|---|---|

| Chatterjee, S., & Wernerfelt, B. (1991). The link between resources and type of diversification: Theory and evidence | 201 |

| Chatterjee, S., Lubatkin, M., Schweiger, D., & Weber, Y. (1992). Cultural differences and shareholder value in related mergers: Linking equity and human capital | 146 |

| Hitt, M., Hoskisson, R., & Ireland, R. (1990). Mergers and acquisitions and managerial commitment to innovation in M-form firms | 144 |

| Lubatkin, M. (1987). Merger strategies and stockholder value | 139a |

| Datta, D. (1991). Organizational fit and acquisition performance: Effects of post-acquisition integration | 137 |

| Hennart, J., & Reddy, S. (1997). The choice between mergers/acquisitions and joint ventures: The case of Japanese investors in the United States | 137 |

| Walsh, J. (1988). Top management turnover following mergers and acquisitions | 136a |

| Amburgey, T., & Miner, A. (1992). Strategic momentum: The effects of repetitive, positional, and contextual momentum on merger activity | 135 |

| Barney, J. (1988). Returns to bidding firms in mergers and acquisitions: Reconsidering the relatedness hypothesis | 120a |

| Capron, L. (1999). The long-term performance of horizontal acquisitions | 115 |

| Hayward, M. (2002). When do firms learn from their acquisition experience? Evidence from 1990–1995 | 104 |

| King, D., Dalton, D., Daily, C., & Covin, J. (2004). Meta-analyses of post-acquisition performance: Indications of unidentified moderators | 100 |

| Zollo, M., & Singh, H. (2004). Deliberate learning in corporate acquisitions: post-acquisition strategies and integration capability in US bank mergers | 93 |

| Karim, S., & Mitchell, W. (2000). Path-dependent and path-breaking change: reconfiguring business resources following acquisitions in the US medical sector, 1978–1995 | 87 |

| Anand, J., & Singh, H. (1997). Asset redeployment, acquisitions and corporate strategy in declining industries | 80 |

| Trautwein, F. (1990). Merger motives and merger prescriptions | 77 |

| Datta, D., Pinches, G., & Narayanan, V. (1992). Factors influencing wealth creation from mergers and acquisitions: A meta-analysis | 75 |

| Very, P., Lubatkin, M., Calori, R., & Veiga, J. (1997). Relative standing and the performance of recently acquired European firms | 71 |

| Walsh, J. (1989). Doing a deal: Merger and acquisition negotiations and their impact upon target company top management turnover | 70 |

| Cannella, A., & Hambrick, D. (1993). Effects of executive departures on the performance of acquired firms | 69 |

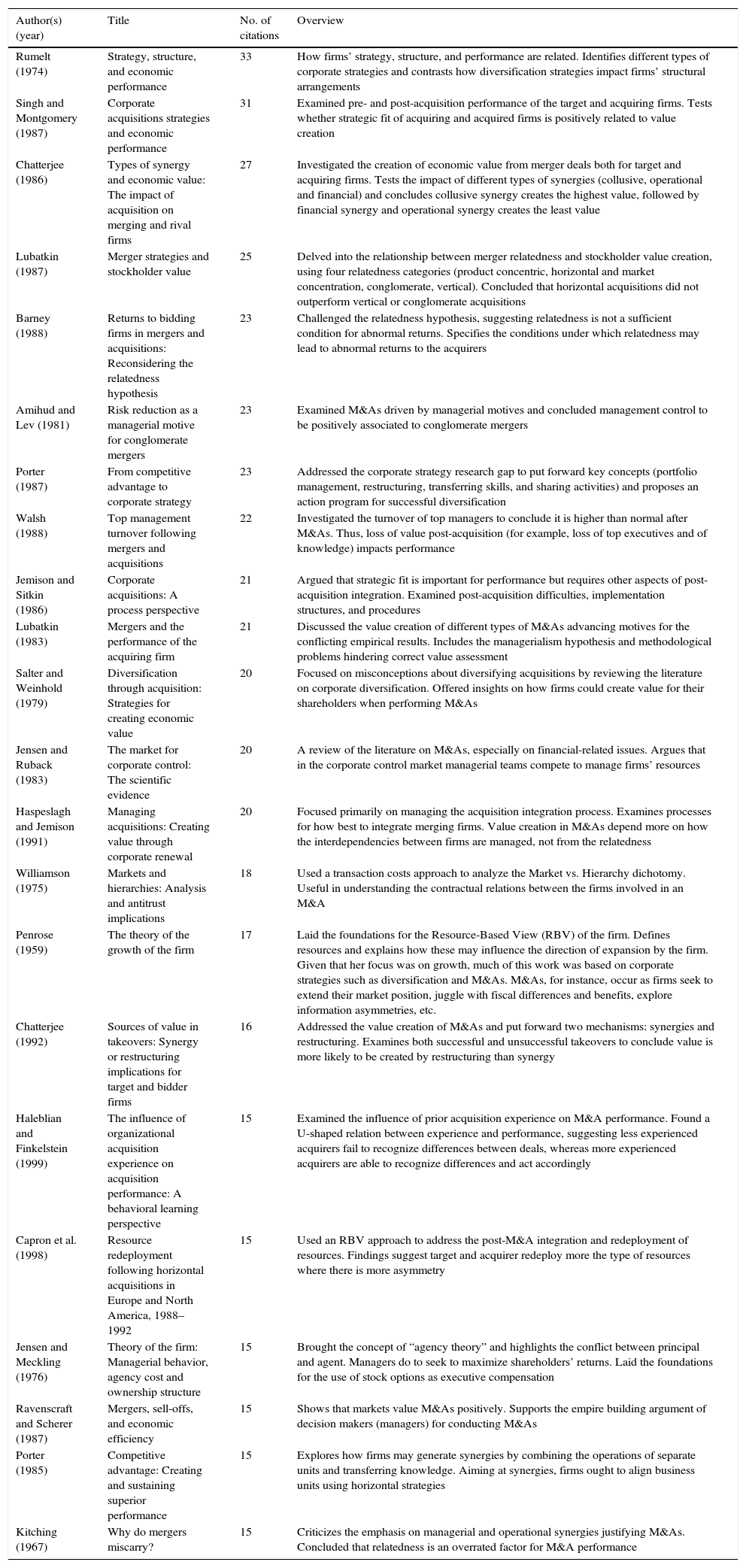

The second analysis entailed examining the reference list of the works on M&As to identify those works that have been more cited by M&A researchers. This citation analysis refers to the works referenced by the 85 articles in our sample, and we thus unveil the conceptual foundations over which M&A research has built. By analyzing the number of citations of each work that was referenced, we identified those that hold larger impact on M&A research published in the SMJ. The 85 articles have used 5557 references, and in Table 3 we include only the 22 most referenced.

Most cited works by M&A articles published in the SMJ.

| Author(s) (year) | Title | No. of citations | Overview |

|---|---|---|---|

| Rumelt (1974) | Strategy, structure, and economic performance | 33 | How firms’ strategy, structure, and performance are related. Identifies different types of corporate strategies and contrasts how diversification strategies impact firms’ structural arrangements |

| Singh and Montgomery (1987) | Corporate acquisitions strategies and economic performance | 31 | Examined pre- and post-acquisition performance of the target and acquiring firms. Tests whether strategic fit of acquiring and acquired firms is positively related to value creation |

| Chatterjee (1986) | Types of synergy and economic value: The impact of acquisition on merging and rival firms | 27 | Investigated the creation of economic value from merger deals both for target and acquiring firms. Tests the impact of different types of synergies (collusive, operational and financial) and concludes collusive synergy creates the highest value, followed by financial synergy and operational synergy creates the least value |

| Lubatkin (1987) | Merger strategies and stockholder value | 25 | Delved into the relationship between merger relatedness and stockholder value creation, using four relatedness categories (product concentric, horizontal and market concentration, conglomerate, vertical). Concluded that horizontal acquisitions did not outperform vertical or conglomerate acquisitions |

| Barney (1988) | Returns to bidding firms in mergers and acquisitions: Reconsidering the relatedness hypothesis | 23 | Challenged the relatedness hypothesis, suggesting relatedness is not a sufficient condition for abnormal returns. Specifies the conditions under which relatedness may lead to abnormal returns to the acquirers |

| Amihud and Lev (1981) | Risk reduction as a managerial motive for conglomerate mergers | 23 | Examined M&As driven by managerial motives and concluded management control to be positively associated to conglomerate mergers |

| Porter (1987) | From competitive advantage to corporate strategy | 23 | Addressed the corporate strategy research gap to put forward key concepts (portfolio management, restructuring, transferring skills, and sharing activities) and proposes an action program for successful diversification |

| Walsh (1988) | Top management turnover following mergers and acquisitions | 22 | Investigated the turnover of top managers to conclude it is higher than normal after M&As. Thus, loss of value post-acquisition (for example, loss of top executives and of knowledge) impacts performance |

| Jemison and Sitkin (1986) | Corporate acquisitions: A process perspective | 21 | Argued that strategic fit is important for performance but requires other aspects of post-acquisition integration. Examined post-acquisition difficulties, implementation structures, and procedures |

| Lubatkin (1983) | Mergers and the performance of the acquiring firm | 21 | Discussed the value creation of different types of M&As advancing motives for the conflicting empirical results. Includes the managerialism hypothesis and methodological problems hindering correct value assessment |

| Salter and Weinhold (1979) | Diversification through acquisition: Strategies for creating economic value | 20 | Focused on misconceptions about diversifying acquisitions by reviewing the literature on corporate diversification. Offered insights on how firms could create value for their shareholders when performing M&As |

| Jensen and Ruback (1983) | The market for corporate control: The scientific evidence | 20 | A review of the literature on M&As, especially on financial-related issues. Argues that in the corporate control market managerial teams compete to manage firms’ resources |

| Haspeslagh and Jemison (1991) | Managing acquisitions: Creating value through corporate renewal | 20 | Focused primarily on managing the acquisition integration process. Examines processes for how best to integrate merging firms. Value creation in M&As depend more on how the interdependencies between firms are managed, not from the relatedness |

| Williamson (1975) | Markets and hierarchies: Analysis and antitrust implications | 18 | Used a transaction costs approach to analyze the Market vs. Hierarchy dichotomy. Useful in understanding the contractual relations between the firms involved in an M&A |

| Penrose (1959) | The theory of the growth of the firm | 17 | Laid the foundations for the Resource-Based View (RBV) of the firm. Defines resources and explains how these may influence the direction of expansion by the firm. Given that her focus was on growth, much of this work was based on corporate strategies such as diversification and M&As. M&As, for instance, occur as firms seek to extend their market position, juggle with fiscal differences and benefits, explore information asymmetries, etc. |

| Chatterjee (1992) | Sources of value in takeovers: Synergy or restructuring implications for target and bidder firms | 16 | Addressed the value creation of M&As and put forward two mechanisms: synergies and restructuring. Examines both successful and unsuccessful takeovers to conclude value is more likely to be created by restructuring than synergy |

| Haleblian and Finkelstein (1999) | The influence of organizational acquisition experience on acquisition performance: A behavioral learning perspective | 15 | Examined the influence of prior acquisition experience on M&A performance. Found a U-shaped relation between experience and performance, suggesting less experienced acquirers fail to recognize differences between deals, whereas more experienced acquirers are able to recognize differences and act accordingly |

| Capron et al. (1998) | Resource redeployment following horizontal acquisitions in Europe and North America, 1988–1992 | 15 | Used an RBV approach to address the post-M&A integration and redeployment of resources. Findings suggest target and acquirer redeploy more the type of resources where there is more asymmetry |

| Jensen and Meckling (1976) | Theory of the firm: Managerial behavior, agency cost and ownership structure | 15 | Brought the concept of “agency theory” and highlights the conflict between principal and agent. Managers do to seek to maximize shareholders’ returns. Laid the foundations for the use of stock options as executive compensation |

| Ravenscraft and Scherer (1987) | Mergers, sell-offs, and economic efficiency | 15 | Shows that markets value M&As positively. Supports the empire building argument of decision makers (managers) for conducting M&As |

| Porter (1985) | Competitive advantage: Creating and sustaining superior performance | 15 | Explores how firms may generate synergies by combining the operations of separate units and transferring knowledge. Aiming at synergies, firms ought to align business units using horizontal strategies |

| Kitching (1967) | Why do mergers miscarry? | 15 | Criticizes the emphasis on managerial and operational synergies justifying M&As. Concluded that relatedness is an overrated factor for M&A performance |

Note: the works included in this table are those most cited among the 85 articles in our sample.

The works listed in Table 3 provide an initial insight into the intellectual roots and the many angles from which M&A research has drawn its theoretical foundations. For instance, we find several advocates of the Resource-Based View (such as Capron, Chatterjee, Barney, Penrose), which has been claimed as the dominant strategic management paradigm of the 1990s. Other perspectives to M&A are revealed in the transaction costs (Williamson) that bear proximity to M&A issues such as the boundaries of the firm, vertical integration and contracting, organizational, environmental and cultural fit (Datta), agency theory, property rights theory, and nexus of contracts (Jensen, Fama, Ruback, Meckling). Lubatkin's (1987) work appears in the top cited for the contribution to M&A performance and especially the relationship between shareholder gains and firms’ relatedness. Ravenscraft and Scherer (1987) held a finance view on game theory, anti-trust, and vertical integration. Somewhat complementary are the works by Porter and Chatterjee delving into the impact of M&A on corporate strategy and decision making. A different stance by Walsh (1988) and Amihud and Lev's (1981) focuses on the managerial aspects of M&A, top management teams, and CEOs.

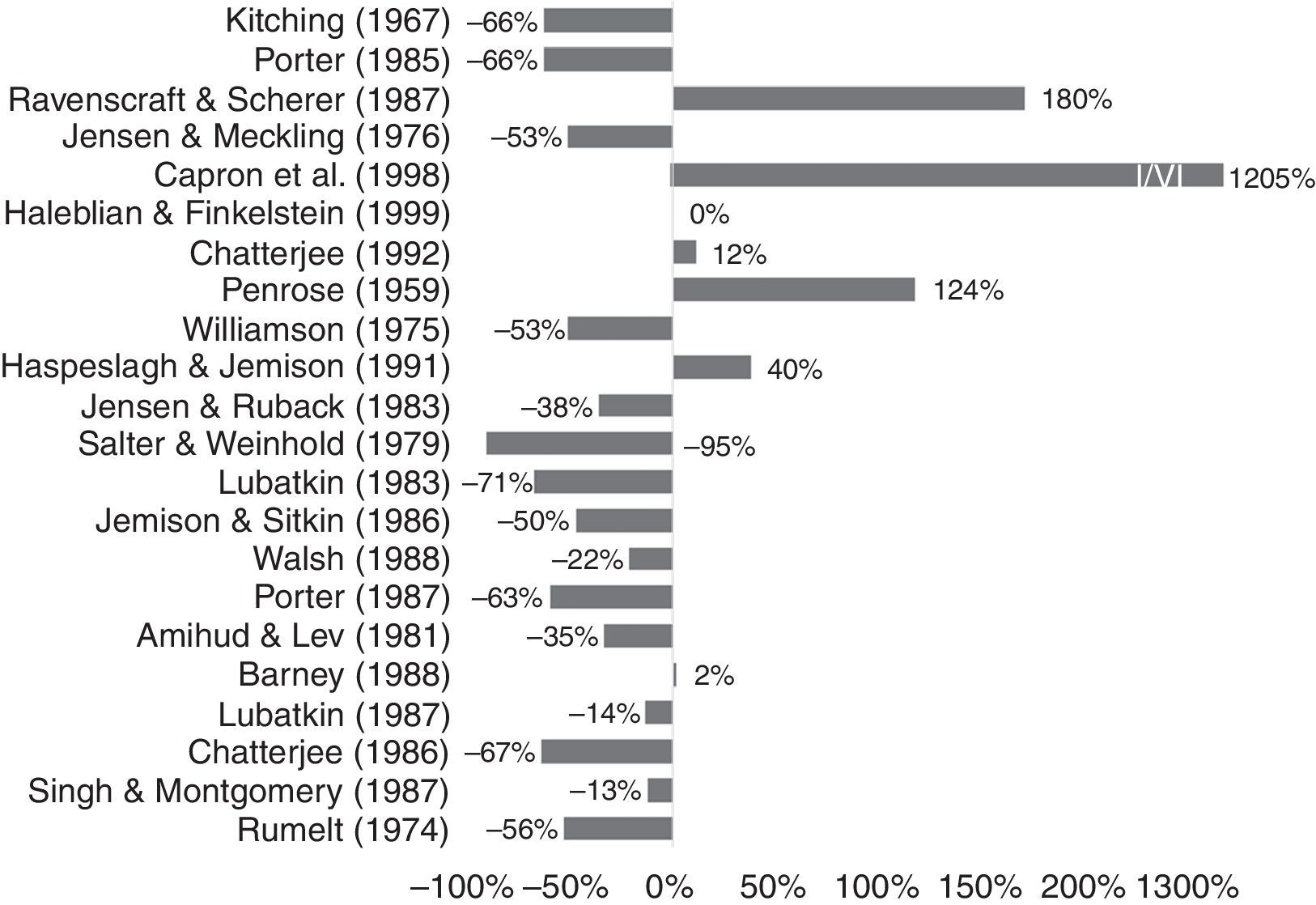

Fig. 1 depicts the time-adjusted impact of the most cited references in M&A research. Specifically, we examined what were the changes in influence (measured by citation counts) between the two periods 1980–1999 and 2000–2010. Although we could observe an increase in the influence of RBV-related works (e.g., Capron et al., 1998; Penrose, 1959) and the use of the M&A process perspective (Haspeslagh & Jemison, 1991) suggesting more attention be given to target selection and post-deal integration issues, other theoretical perspectives such as TCT (Williamson, 1975), agency theory (Jensen & Meckling, 1976; Jensen & Ruback, 1983) and industrial organization (Porter, 1985) have a decreasing influence.

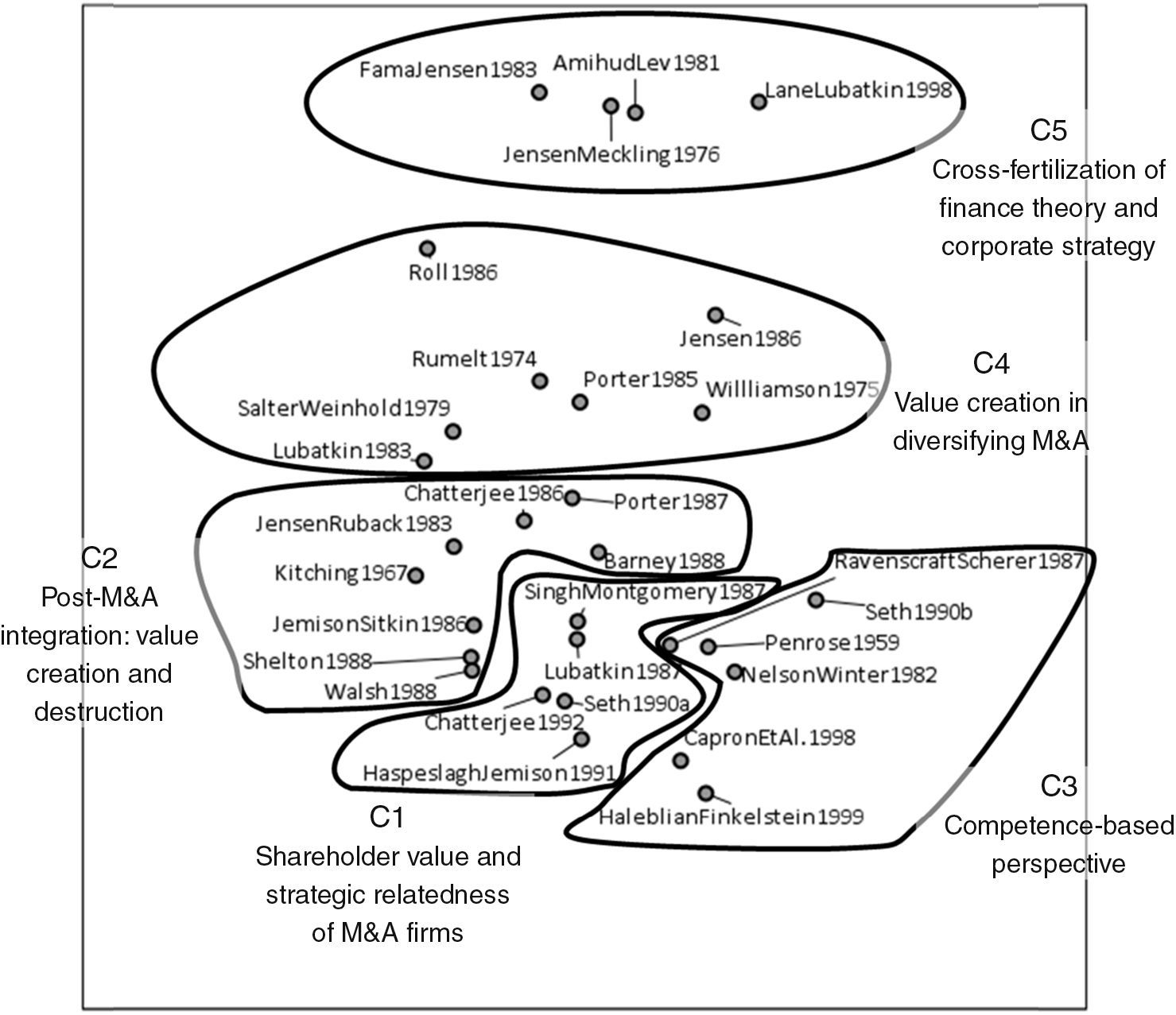

Co-citation analysis and main themesExamining co-citation ties reveals the intellectual structure underlying a field (Ramos-Rodriguez & Ruiz-Navarro, 2004); that is, by doing so we find conceptual or thematic proximity between works, and through examining the content of those works we are able to identify the themes and theories that are more salient and how they are related. We analyzed the co-citation data of the articles in the sample with a cluster analysis to detect patterns in the extant research. Fig. 2 depicts the MDS map, which renders a visual representation of the intellectual structure of the field and aids in uncovering the hidden structure of the data (Ramos-Rodriguez & Ruiz-Navarro, 2004; Shafique, 2013). The MDS map represents the proximity between works; that is, the similarity based on the co-citation frequency. The MDS was built with two dimensions, since the stress measures (Stress I=0.123) and dispersion accounted for (D.A.F.=0.984) were acceptable and did not improve substantially with a higher number of dimensions (Charvet et al., 2008). The clusters identified (and confirmed with a Dendogram of hierarchical cluster analysis) were superimposed in the MDS map for better visualization of the proximity between works. We were able to identify five clusters. The rationale in this analysis is that works (articles, books) that are conceptually similar tend to cluster together, and shorter linkage distances between works and clusters denote stronger relationships (Charvet et al., 2008).

Cluster 1 includes five works delving into value creation, and specifically shareholder value outcomes from strategic relatedness between the firms involved in the M&A (Chatterjee et al., 1992; Lubatkin, 1987; Seth, 1990a; Singh & Montgomery, 1987). Strategic relatedness was found to influence performance and shareholder gains (e.g., Singh & Montgomery, 1987) by improving economic efficiency and the generation of economies of scope (Seth, 1990a). Nevertheless, the effect is not undisputed, as value may also be generated in unrelated acquisitions (Lubatkin, 1987) and the relatedness gains are arguably moderated by other factors such as cultural differences or cultural compatibility (e.g., Chatterjee et al., 1992). This cluster also includes a key work on the process perspective of M&As (Haspeslagh & Jemison, 1991), exploring integration and highlighting the importance of selecting which M&A deals to pursue and which not to pursue. Haspeslagh and Jemison (1991) provided a view on M&A as a value-creation mechanism, advocating a process perspective to M&A that is conceptually rooted on the resource-based theory of the firm.

Cluster 2 comprises eight works tied by post-M&A integration concerns and value creation or destruction. Integrating an acquired firm and being able to achieve synergies are paramount for the success of an M&A (Chatterjee, 1986; Jemison & Sitkin, 1986), and failing to achieve synergies is pointed as a crucial motive for M&A failure (Kitching, 1967). While many M&A deals are expected to create value through synergies and leverage the existing resources and knowledge, evidence suggests that top managers are likely to abandon the acquired firm after the M&A (Walsh, 1988), destroying value. Synergies may also emerge from resource combination of acquired and target firms, and integration will arguably be more successful if there is a strategic fit between the acquirer and the target (Shelton, 1988). Thus, having inimitable and synergistic resources (Chatterjee, 1986), or how firms are strategically related, is posited to be a condition for post-deal value creation, especially for shareholders (Barney, 1988). Kitching (1967) attempted to find a statistically significant relation between various firms’ characteristics and their performance and profitability. Integrating acquired firms and arranging them to create value requires strong competences on corporate strategy (Jensen & Ruback, 1983; Porter, 1987). In sum, relatedness between activities – or the synergies that may arise from appropriate portfolio management, sharing of activities, and the transfer of resources (Porter, 1987) – is a major aspect driving successful integration and value creation in M&A.

Cluster 3 contains six works on a resource-, capabilities-, competence-based perspective. Two of the foundational pieces of the RBV are found in evolutionary economics (Nelson & Winter, 1982) and on Penrose's (1959) view of firms as bundles of resources. Nelson and Winter (1982) theoretical approach emphasizes the corporate routines (that is, capabilities), and therefore is somewhat related to the RBV (Ramos-Rodriguez & Ruiz-Navarro, 2004). Nelson and Winter (1982) identified the need for firms to constantly develop new skills to exploit opportunities. Haleblian and Finkelstein (1999) also referred to learning and examined how organizations may learn from their M&A. Firms often seek to acquire other firms to tap into their resource pool, especially when the acquired resources complement the resources already held and when these resources may be internally deployed post-M&A (Capron et al., 1998). Therefore, creating value requires “the combination of specific characteristics of both firms involved in the acquisition” (Seth, 1990b, p. 106). Ravenscraft and Scherer (1987) book on ‘Mergers, selloffs and economic efficiency’ noted the inefficiencies and profitability declines of the US conglomerate merger wave of the 1960s and 1970s, highlighting the importance of resources and competences for creating and sustaining firms’ performance.

Cluster 4 contains seven works examining value creation in diversification. However, this cluster is rather eclectic and brings about several theoretical lenses: an early competence-based theory of the firm perspective to corporate strategy (Rumelt, 1974), principal–agent conflicts (Jensen, 1986), transaction costs and the governance choice of using the market or the hierarchy (Williamson, 1975), and industrial organization (Porter, 1985). Diversifying M&A (Salter & Weinhold, 1979) takes place as firms seek to lessen the business risks and grow and enter new markets to hold their competitive advantage (Porter, 1985). However, not all types of diversification are successful in improving firms’ performance, and Rumelt (1974) found that large firms that were unrelated diversified had lower performance than firms with related activities. Taking over a competitor or expanding in the same business line is more efficient than diversifying (Jensen, 1986; Salter & Weinhold, 1979). Diversification may also fail to create value when managers misjudge the value of the target by overestimating the synergy creation – the hubris hypothesis – or engage in empire-building M&A (Roll, 1986). Value creation of diversified M&A has also been analyzed from a transaction costs approach, since the market-hierarchy dichotomy may help establish the boundaries of successful diversification (Williamson, 1975). In later studies, Williamson (1985) would refer to “hybrid” governance forms that are intermediate (between the market and the hierarchy) modes of contracting.

Cluster 5 comprehends four works that seem to comprise a cross-fertilization between corporate finance (or finance theory) and corporate strategy. Separation between a firm's management and ownership leads to principal-agent potential conflict of interests, as put forth by agency theory (Fama & Jensen, 1983; Jensen & Meckling, 1976). In sum, agency theory focuses on the conflicts of goals between the principal and the agent, thus seeking to uncover the governance mechanism that may limit the agent's opportunistic behavior. Fama and Jensen (1983) introduced the concepts of “outcome-based contracts” and “behavior-based contracts” to the governance rationale, tying incentive structures and contracting as an agency problem. Jensen and Meckling (1976) noted that the form of incentive used, in an agency scenario, influences the best governance form. Amihud and Lev (1981) applied agency theory to M&A and explained that managers may pursue the actions that maximize their own interests instead of the shareholders’, hence engaging in M&A deals to reduce their employment risk and not the business risk (Amihud & Lev, 1981). Thus, unrelated, value-decreasing diversification may be explained as an agency problem.

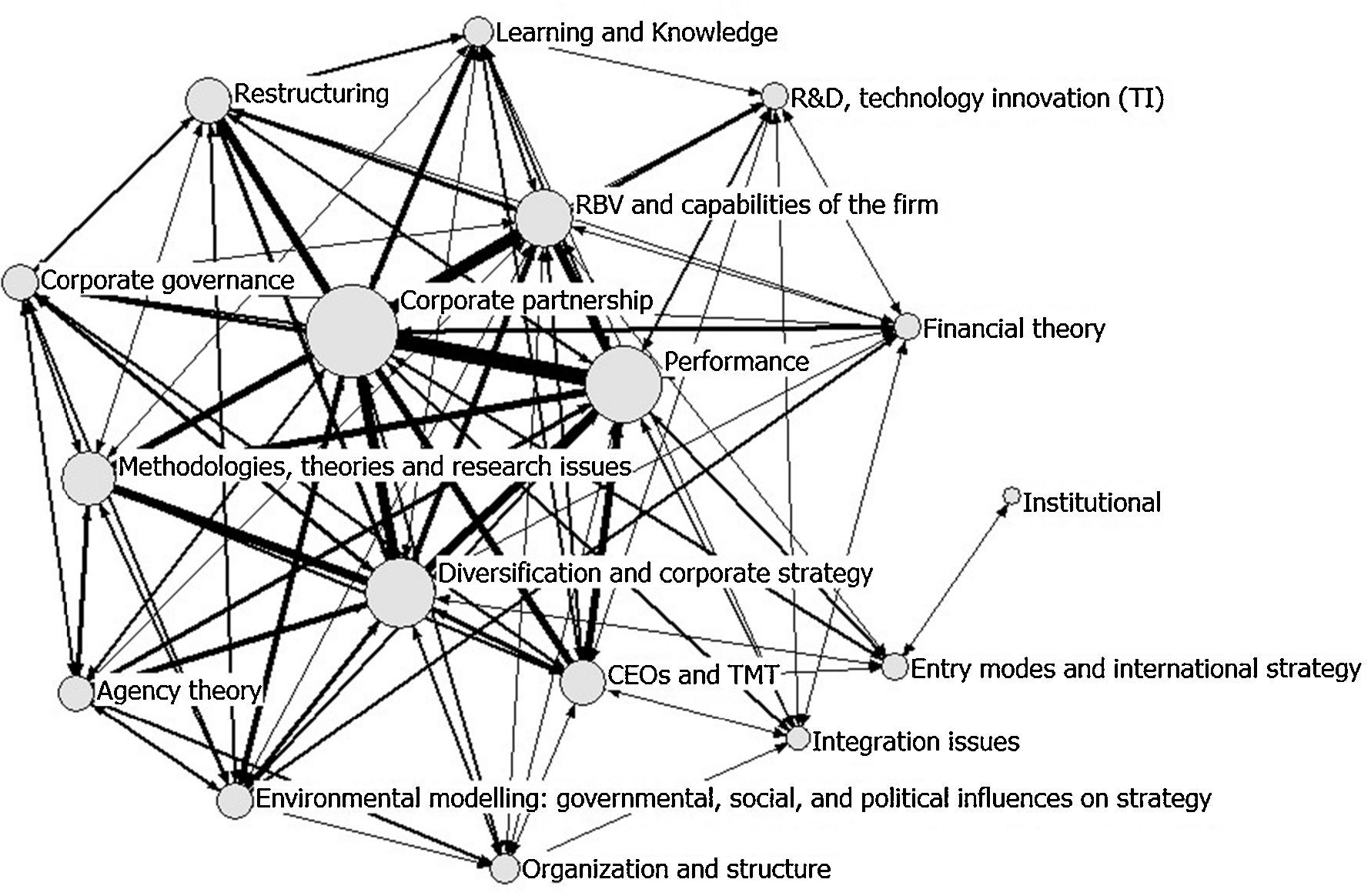

What has M&A research been about: main topicsIn assessing the extant M&A research, it is useful to identify the core research topics. This analysis complements our previously identified clusters, providing finer-grained detail. Fig. 3 reveals the topics and how they interconnect. In reading the figure, note that the thickness of the line is a measure of the strength of the relation between two topics (meaning that they were used more often together). For instance, an article may deal with firms’ resources and their impact on post-acquisition performance. The size of the circles indicates the frequency with which the topic has been delved into. The more central topics, and thus the most researched, were: “Corporate partnership”, “performance”, “diversification and corporate strategy”, and “RBV and capabilities of the firm”. Conversely, issues related to “organization and structure”, “agency theory”, “environmental modeling” that drive M&As, and even “learning and knowledge”, among others, were less often focused upon.

It is worth noting that while some of the themes pertain to theory, others involve specific issues. This analysis is not surprising, since we have used author-supplied keywords to code the topics and authors will likely select a set of keywords that simultaneously point to the prevailing theory but also to contextual components. Thus, we may grasp both the theories that were used in studying M&As as well as the specific phenomenon of those studies.

DiscussionIn this study we sought to understand the extant strategy research on M&As. The bibliometric study, with data collected on the published articles in SMJ, allows several observations. Perhaps the first is the relative scarcity of M&A research. We identified only 85 articles (of a total of over 1500 articles published in SMJ over 31 years, representing just under six percent) dealing with M&As. Ferreira et al. (2014) had already noted that M&A research has not accompanied the M&A practice by firms. This small number of papers is prima facie evidence that M&A research has not followed practice, at least not in volume, considering that M&As are such a frequently deployed strategy utilized by firms for both domestic and international expansion (Hitt et al., 2001; Stahl & Voigt, 2005).

From the data we are able to extract some guidelines on what future research directions may entail. First, the last 30 years have seen a significant number of studies on the antecedents and performance of M&As. Although this research has identified important variables, many facets remain poorly understood, and the impact of M&As on firms’ performance is not yet a closed debate, with empirical results remaining inconclusive in such fundamental aspects such as the performance impact of M&As, the true learning that is realized post-M&A, or the integration hazards of pooling together two different firms. Kitching (1974), examining European acquisitions, reported failure rates of nearly 50 percent, and Agrawal and Jaffe (2000) reported that, on average, acquisitions returns for acquirers were negative. This evidence could have led researchers to look for alternative explanations and for those pieces that have been missing on other motives leading firms to acquire that are not value maximizers. King et al. (2004) noted that the usual antecedents of post-M&A performance – degree of diversification, relatedness between acquiring and acquired firms, prior M&A experience – were significant. An important variable seems to be the impact of cultural differences on M&A performance, although the actual effects arguably vary according to the integration approach, the extent and nature of the cultural differences, and the performance measures (Shimizu et al., 2004). Hence, researchers ought to look beyond the more commonly used measures and variables in explaining M&A performance. Hence, it is plausible that future studies may assess multiple performance measures to better understand how M&As impact both acquirer and acquired firms’ performance.

Consistent with Ferreira et al. (2014), we observe some articles focusing on the CEO and top management teams. In fact, this research by and large considers other motives, beyond the economic rationale, for undertaking M&As. Hayward and Hambrick (1997) and Morck et al. (1990) suggested managerial hubris when explaining the premiums paid in large acquisitions, and Seth et al. (2000) noted that about one quarter of all acquisitions were driven by managers’ utility. This line of inquiry is interesting and we now understand that not all decisions are based on economic or strategic rationales. Additionally, Walsh (1988) and Dyer et al. (2004) focused on how there may be a loss of the top management team post-acquisition, but it is less clear how much this loss of the TMT impacts the acquired firm's loss of value. What is the value of the architectural knowledge that is lost due to key employees exiting a firm post-acquisition? While we understand that these exits occur, we do not have actual measurements of the true impact.

Although there is extensive research on the performance implications of M&As, more research is needed. In this respect, the work by King et al. (2004) on the determinants of M&As performance, including the analysis of the most frequently used variables in strategy and finance research, noted that “post-acquisition performance is moderated by variables unspecified in existing research” (p. 188). Perhaps some of those unspecified variables may be found in institutional factors that have been largely ignored, beyond those pertaining to post-M&A integration. Institutional distance between acquirer and target firms may be further explored, as well as – perhaps more interestingly – exploring into the expansion from and into emerging economies. In this regard, the institutional environment of the home and host countries is likely to drive many of the decisions pertaining to cross-border M&A (Peng, 2012; Pinto, Falaster, Canela, Fleury, & Fleury, 2015). We also failed to identify a clear focus on other behavioral approaches to studying M&As beyond those classified under the topic on “CEO and TMT”.

We noted the emergence of the RBV on the study of M&As over the past two decades, in a trend that really follows the broader trend in strategic management of focusing on the firms’ internal resources and capabilities for competitive advantage (for an overview, see Acedo et al., 2006). This general trend has shifted research attention away from the relationship between the firm and its surrounding environment that was the dominant paradigm during the 1980s (Porter, 1980). According to Michael Porter (1980), the strategic management process begins with asserting firms’ relative position in the industry and only then setting a strategy that may lead to a competitive advantage. Thus, research attention started to be placed on the firm and on its resources and capabilities as potential generators of sustainable competitive advantage (Barney, 1991). Firms are now seen as bundles of resources that are interconnected and that augment the firm's ability to create economic value. Note, however, the difficulties of actually measuring the tangible and intangible resources involved in M&As. Thus, future studies may seek to conceptualize the types of resources sought in M&A deals and how to actually measure them. On the study of M&As, according to the basic postulate of the RBV, performance differences across firms arise from differences on the pool of resources and capabilities held (Barney, 1991) and how they can be (re)combined to improve profit margins and create wealth for shareholders (Sirmon, Hitt, & Ireland, 2007). This rationale may at least in part sustain the synergy argument, but we still lack empirical efforts at measuring those synergies, and more importantly, on understanding whether complementary resources may be combined to generate a benefit or an advantage.

Managing the pool of resources/capabilities forces firms to continuously assess and change their portfolio of resources and capabilities (Sirmon et al., 2007). M&As are mechanisms to access critical resources (Barkema & Vermeulen, 1998; Hitt et al., 1998; Karim & Mitchell, 2000; Vermeulen & Barkema, 2001), and acquisitions may render access to knowledge not yet held and allow the development of novel capabilities (Karim & Mitchell, 2000). Learning from a target firm and building new capabilities is a reason for firms acquiring others (Zollo & Singh, 2004), as acquired firms may have singular employee skills, technologies, and knowledge that are available only through acquisitions. Thus, there may be capability-building motivations behind M&As (Gammelgaard, 2004). Notwithstanding, while this argument is compelling, a large amount of research has mostly measured the access to novelty (assuming that entering a new industry or a new country, a firm accesses new knowledge), but not the actual learning that occurs post-M&A.

Although M&As are one entry mode into foreign markets that firms may use, there is a surprisingly small number of papers on the topic in strategy research. Perhaps a possible explanation for this is that such studies may also be published in international business-specific journals. These will be studies contrasting M&As with other entry modes, especially greenfield start-up investments and joint ventures (Brouthers & Brouthers, 2000; Harzing, 2002). These studies are relevant, but their quest is essentially identifying the factors that drive firms’ choices on mode of entry, often delving more into the characteristics of the locations – which is a concern in IB studies – than into other firm-specific factors. As such, although we noted that research using an RBV perspective is growing, it is still reasonably lacking an understanding of how firms’ resources and capabilities truly play a role on M&A. In fact, we are still lacking better measures of those strategic resources, capabilities, and how firms augment their resource base in related and unrelated acquisitions.

Our analyses also reveal that M&A research is notably scant on process studies. One such less studied process is how firms select targets. In some respect, this line of future inquiry may help us better understand how to evaluate a target firm's resources, including physical, knowledge-based and human capital, capabilities, and employees’ skills. The line of inquiry entailed here may also complement the extant research on learning. Although learning from acquisitions is currently considered one of the core reasons to acquire in the first place, our analyses reveal that research on learning is still rather limited, and in some instances inconclusive (see, for instance, Hayward, 2002). How do firms actually learn? What are the knowledge-transfer mechanisms that need to be created? How is novel knowledge absorbed? How is the potential knowledge accessed in an M&A truly valued?

LimitationsThis study has some noteworthy limitations. First, while the choice of a single outlet may raise doubts as to the generalizability of our findings, we suggest that the papers published in the SMJ are illustrative of the strategic management research efforts on M&As. The SMJ is the highest stature for publishing strategy research, and according to Hoskisson, Hitt, Wan, and Yiu (1999), the SMJ defines the development of the strategic management discipline. Moreover, it is likely that top-ranked journals set the pace, and arguably the focus, of research. In fact, the need to publish, or as put forth by Harzing, the “publish or perish” dilemma, leads scholars to seek publication in the top journals. The articles published in these journals tend to be more cited and influential than articles in lower stature journals. Moreover, the impact of highly reputed journals surpasses national and disciplinary boundaries. Thus, it is reasonable to argue that the articles published in top journals drive the discipline and the research attention of the community. Although using only one journal may seem restrictive, we avoid all the variations that including different journals would bring to our study, namely editorial guidelines, differences in focus (for instance, some journals value empirical works while others prefer theoretical) and in audience (for example, academic- or practitioners-oriented). Thus, to state it simply, we aimed at understanding high-quality strategic management research on M&As. Future studies may extend on our sample (see also Ferreira et al., 2014) and perhaps delve specifically into disciplinary journals to observe what is the theoretical focus of different disciplines.

Another limitation concerns the depth of our analysis. The bibliometric techniques used do not permit content analysis. In fact, bibliometric techniques seek to eliminate, or at least reduce, subjective bias that the researcher may introduce by dealing mathematically with the body of works. For instance, while we dealt with citations, we cannot know the context of the citation, and an article may be cited for many reasons – to build upon the conceptual arguments, to contrast with prior findings, or to criticize. While a content analysis was not our goal, future research might gain additional insights by carrying out in-depth content analysis, possibly using specific software and techniques to truly understand a variety of other issues, such as the methodologies used, samples, theories, and arguments scrutinized. These analyses will have greater value if they include a large timeframe. Moreover, older papers will tend to have greater citation counts than papers published more recently.

Concluding remarksWith this study we gained a better awareness of the extant knowledge on M&A-related research as published in the top journal of the field. Different scholars will look into our analyses to detect novel ways to explore many gaps that warrant additional research. For instance, the scarcity of research on M&A using an institutional focus is remarkable, and it is even more notable once we distinguish the internal isomorphic pressures – which could impede an M&A to occur or lead firms to develop complete manuals on how to integrate an acquired firm – and the external pressures of the surrounding agents and institutions. Other conceptual perspectives, namely the sociological views on networks, also have made little inroads into the study of M&As, although concepts such as trust to mitigate possible transactional hazards are better known. Moreover, there are many gaps left untapped, such as the impact on the firm's network of an additional acquisition; how the network structure evolves as additional ties are added; how prior experience helps to build a capability to expand with M&A into emerging economies (see Isobe et al., 2000), and more. These concerns and others could be even more salient for firms that are frequent acquirers.

M&A research is a field of interest for both scholars and practitioners. As firms expand nationally and internationally through M&As or simply use M&As for diversifying their technological, product, or business portfolio, it is likely that research will follow supporting and clarifying the many fundamental doubts that remain pertaining to firms’ immediate performance impact and the future strategic advantages that may arise from M&A.