Innovation remains a complex phenomenon and the task of managing it at the Regional Innovation Systems (RIS) architecture level is discussed herein, namely involving joint initiatives, close to organizational realities and their competitive advantages, up and beyond the uncertainty that surrounds Governmental R&D Investment (GRI) effectiveness, either due to misuse or ineffective, application of resources. Artificial Neural Networks (ANN) modelling was applied to the study of RIS structure, aiming to identify the ‘hidden’ mediating variables that may influence the overall effect of GRI on economic and employment growth. In general, Absorptive Capacity, is the most rapid and balanced development strategy for regions characterised by environments, which are adverse to change and innovation, and characterized by low industrialization and income levels.

La innovación sigue siendo un fenómeno de gran complejidad, particularmente cuando es gestionada a escala regional, inherente a la existencia de Sistemas Regionales de Innovación (SRI). La estructura de los SRI intenta optimizar el porfolio de recursos endógenos que forman parte de un territorio, encaminando la inversión a los activos con mejor relación ‘riesgo-retorno’. La adopción de lógicas de cocreación, la innovación abierta y el reparto de riesgos, gestionan una mayor proximidad con el tejido económico local, la cual permite controlar la incertidumbre de la inversión pública en I&D (IPI) que resulta de la inoportuna o ineficaz afectación de los recursos financieros disponibles. La modelación de redes neuronales ha sido administrada al mapeo de la estructura de los SRI, identificando las variables mediadoras ‘ocultas’ que son susceptibles de influir en el impacto de la IPI sobre el crecimiento económico y la creación de empleo. En síntesis, los resultados del modelo empírico indican que la capacidad de absorción es la estrategia de desarrollo más equilibrada para territorios periféricos, adversos a la innovación y al progreso tecnológico, como aquellos que se caracterizan por una reducida industrialización y por un bajo valor acrecentado de los bienes y servicios prestados.

Our research herein was performed in order to contribute to the publications related to the improvement of innovation output, albeit when considering a large scale, namely the scale of regions, and not at the level of individual firms. We thus, with this study, discuss what changes can be made, at the regional level, in Europe, to Regional Innovation Systems (RIS), regarding the management of innovation based on knowledge, technology, and R&D, and with stakeholders that include higher education institutions, government, as well as individual firms, as regions seek to become more competitive. In a scenario of ever scarcer resources, in view of what has to be achieved with them, by both the public and private sectors, capital outlays must be aimed, where possible, at the most effective investments, where natural selection (Dawkins, 1989), left to its own devices, in an industrial setting, might not succeed. In reality, balanced ecosystems suffer when any even seemingly minor element is removed, and so we have developed a new process for research involving such complex systems, in which we combine Factor Analysis with Artificial Neural Networks (ANN) modelling. Policy makers will want to learn from successful ecosystems, in order to replicate them, but also to improve their current output capacities. To do this, the ingredients and subcomponents will have to be understood, in order to not risk spoiling the balance irrevocably.

The aim of this study then is to demonstrate empirically how a RIS is made up by a series of elements, each with different impacts at the macro or aggregate regional level. As an example, consider a luxury hotel resort in the middle of a centuries-old rainforest. Naturally, guests would not be happy to stumble upon snakes on a regular basis. So, senior management decides to eliminate the snakes, to take them out of the habitat entirely. Unfortunately, though the hotel guests are now happy, farmers in the region now complain that their crops are being damaged by an excess of rodents. So, cats are introduced into the habitat, to diminish the population of rodents and again establish an equilibrium. However, rare species of birds have now started to disappear from the rainforest, as cats seemingly have ‘no respect’ for rare species, wanting only to secure a meal for themselves. This example shows how nature knows best and how it is indeed difficult to manipulate and ‘out-think’ nature. Nations and RIS are much the same. Remove certain support systems, of seemingly little value, and the whole balance may be spoiled —any subsequent action nothing more than patchwork, or a series of ‘band aids’, in a maize of industrial connections now amiss.

Innovation, and all that it involves, is still somewhat a mystery to us, but according to evolutionary theory it involves a multitude of dimensions (Furman, Porter, and Stern, 2002; Leydesdorff and Fritsch, 2006). Going back to the rainforest example, we will witness antecedents and consequents in innovative environments (i.e., the rainforest has been innovating for thousands of years) whereby some investments will have greater impact than others (Landabaso, 2013; OECD, 2013; Ranga and Etzkowitz, 2013). What we contend is that managing closer to the effects, at the RIS level rather than at the national level, will reap the most benefits, in industrial environments. The research questions addressed herein are as follows:

- •

What innovation drivers merit the closest attention for economic and employment growth?

How are current perspectives of economic theory helping us to solve serious economic problems, in view of necessary increased growth and employment, within regions, and what new theory can aid the mapping out of RIS?

- •

Do ‘hidden’ but relevant mediating variables need to be made evident to policy makers and, if so, how can they be given credibility at the macro-economic level (i.e., Gross Domestic Product, Gross Value Added, Unemployment and Youth-Unemployment)?

So, ANN modelling was applied to the study of RIS structure, with the objective of identifying the ‘hidden’ mediating variables that may influence the overall effect of Governmental R&D Investment (GRI) on economic and employment growth. In effect, Absorptive Capacity (i.e., companies having the knowledge necessary to be able to understand advances in technology occurring outside the company, in order to be able to benefit from those advances), a hidden node in the ANN network, is the most rapid and balanced development strategy for regions, characterised by environments which are adverse to change and innovation and characterized by low industrialization and income levels. Such a contribution emphasizes the importance of the knowledge economy and the information society, where innovation is uncertain but its success will determine how competitive firms and economies will be (Tolda, 2014). Firms must open up and be equipped to benefit from their external environment.

What we are in fact saying is that our empirical model suggests that developing technology and innovation is difficult, risky and expensive, and that following rather than leading successful innovation is a more secure way to growth and development (e.g., launching generic medicine rather than patented medicine). Absorptive Capacity has an impact on economic growth. Let patents expire and then copy those technologies. As a result of these findings, clusters able to detect relevant technologies and benefit from them, and specialized in creating effective business models, should be a focus of policy makers. Notably, even the prominent company Apple, Inc., is very effective at capitalizing on technologies it has not invented, the case, for example, of personal computers, smartphones and tablets. Apple has, over the years, known how to create its own specialized cluster, and is very effective at creating superior business models (i.e., iTunes), much of it based on incremental innovation rather than radical innovation. A core concept is that of business model innovation.

The following sections of the paper include a literature review (Section 2), a description of the methodology and dataset used (Section 3), overall results and proposed RIS neural model (Section 4), a theoretical and policy-driven discussion as a consequence of the study (Section 5), with the final section (Section 6) including remarks to wrap-up the study.

LITERATURE REVIEWKnowledge is seen as a source of competitive advantage for nations, and, as observed by David and Foray (2002, pp. 9-10), “Economic historians point out that nowadays disparities in the productivity and growth of different countries have far less to do with their abundance (or lack) of natural resources than with the capacity to improve the quality of human capital and factors of production: in other words, to create new knowledge and ideas and incorporate them in equipment and people.” If so, what are the mechanisms through which knowledge and ideas can be converted into economic activity in measurable, sustained and sustainable ways? New product development success, for example, will depend on conditions existing in what has been called the “front end of innovation” (Poskela and Martinsuo, 2009, p. 671).

The literature on the “fuzzy” front end of innovation states that “one of the key problems in managing innovation is that we need to make sense of a complex, uncertain and highly risky set of phenomena. Inevitably we try and simplify these through the use of mental models —often reverting to the simplest linear models to help us” (Tidd and Bessant, 2013, p. 76)—. Our research herein intends to contribute to the literature on improving innovation output, on a large scale, the scale of regions rather than of individual enterprises, by providing a novel framework, while recognising that “the balance needs to be struck between simplifications and representations which help thinking —but just as the map is not the same as the territory it represents so they need to be seen as frameworks for thinking” (Tidd and Bessant, 2013, p. 76).

R&D intensity generates new ideas and expands the technological opportunity set; “the front end should result in a well-defined product concept and a business plan aligned with the corporate strategy” (Poskela and Martinsuo, 2009, p. 671); the increased knowledge endowment in turn enhances the profitability of entrepreneurial activity by facilitating recognition and exploitation of new business opportunities (Acs et al., 2009; Auerswald, 2010; Fritsch, 2008; Wersching, 2010). Hence, the industrial sectors with a greater share of R&D employment tend to host more new fast-growing companies (Eckhardt and Shane, 2011), while firms with high “technological-competence-enhancing capability” can translate knowledge accumulation into sustained growth when knowledge is leveraged by the initial scale of such firms’ technological endowments (Lee, 2010).

China is an example of how an innovation system can change quite dramatically (Chen and Guan, 2011), which it has done in recent decades, now centering itself more on private firms, following economic reform and “far-reaching deregulation and the creation of new framework conditions” (OECD, 2007, p. 11), such as efficient markets and financial institutions and intellectual property rights protection (OECD, 2007). Furthermore, in China, “there is a strikingly driving or supporting role of universities, government S&T [scientific and technological] programs, industry specification and public research institutes in improving China's regional innovative capacity. This to some extent, reflects the well-performing functions of China's public policies and cluster-specific environment in regional innovation process” (Chen and Guan, 2011, p. 26). Since 1978, China has had an “open-door” policy and, in 2001, China accessed the World Trade Organization (WTO), factors which have led to what is now “the most open of the large developing economies” (OECD, 2007, p. 11). Indeed, incentives for innovation in China are quite significant, in what has become a very competitive market. One has much to learn from China and its commitment to accelerating human capital creation, while increasingly investing in technology and innovation, based on science, in an “enterprise-based innovation system” (OECD, 2007, p. 16).

Another significant example, where considerable effort is being expended to improve competitiveness, is the state of Mexico, where the aim “is to foster innovation through the increase of private sector investments in R&D and the improvement of the links among firms, research organizations, universities and government” (Solleiro and Gaona, 2012, p. 110). Nonetheless, the program has been criticized for not supplying sufficient innovation and collaboration-related funding to SMEs, and the “high-level training on innovation policies and management (…) for staff of firms, universities, R&D centers and government institutions” (Solleiro and Gaona, 2012, p. 118), in order to reap its expected benefits, will have to continue and be more widespread (Solleiro and Gaona, 2012). In the state of Mexico, realizing the importance of innovation as a strategy for growth, as well as the need for increased collaboration in the process, need to become more embedded in the corporate culture of firms as well as with regards to policy makers (Solleiro and Gaona, 2012).

What needs to be emphasized is that different types of failures —which can be linked to “market, capabilities, and interaction” (Bach, Matt, and Wolff, 2014, p. 335)— motivate different policy responses which will vary from region to region and from industry to industry. China has been seen to differ, for example, with regards to the United States of American (USA) in the smart grid industry, as it has preferred to use “supply-side policy” which focuses on “public enterprise, scientific and technical development and legal regulation”. The USA has preferred to use “environmental-side policy” which focuses on “scientific and technical development, financial, political and public enterprise” (Lin, Yang, and Shyua, 2013, p. 119). However, for example, even in the European Union (EU), much as in China, Mexico and the USA, “universities could be considered as relevant partners to companies and compatible with the needs of firms” (Bach, Matt, and Wolff, 2014, p. 335), and the focus may well have to be on “keeping the [policy] instruments simple and stable over time [which] should also save on the high costs of public administration via learning effects” (Bach, Matt, and Wolff, 2014, p. 335), calling attention, in turn, to budget constraints, all the more significant in times of crises.

We are now at major cross-roads as we are at a time when Euro scepticism is a topic of discussion, involving the EU and its institutions (Bongiovanni, 2012). The search for solutions to the most recent EU crisis has gained added importance. It is imperative that the EU find new ways to increase quality of life in the EU, which will be linked to new ways of making the EU more innovative and competitive, in order to grow faster (Bach, Matt, and Wolff, 2014), in what is now known as the innovation economy (Tolda, 2014). The EU has to make better use of its scarce resources, beyond its industrial restructuring —involving decentralization and flexibility— and needs to further enhance its ability to leverage technology and global markets (Audretsch, Grilo, and Thurik, 2012). The above considerations bring us to the concept of RIS, which are important with regards, in particular, to new technologies which promote more effective business models, such as with software and e-commerce (Carlsson, 1989; Zenger, 1994). The vast majority of firms in the EU are Small and Medium Enterprises (SME), which rely on efficient RIS to remain competitive in fast-changing environments. SME have unique needs, linked to networks, which are specialized knowledge sources for effective technology transfer, to create high value-added market offerings which capture the interest of consumers (Audretsch, Lehmann, and Warning, 2005; Audretsch and Lehmann, 2005a, 2005b; Gilbert, McDougall, and Audretsch, 2008; Lindic, Bavdaz, and Kovacic, 2012).

R&D activity is a specific way to provide for additional competitiveness but it may come in many forms and involves many decisions, at different levels, which need to be addressed (Audretsch and Thurik, 2001; Eckhardt and Shane, 2011; Gilbert, McDougall, and Audretsch, 2008), to contribute to innovative capacity at the systems level (Asheim and Coenen, 2005; Audretsch and Lehmann, 2005a; Audretsch and Keilbach, 2008). It is to these topics that we turn our attention, in this study, involving, as in Furman and Hayes's approach (2004), the following:

- •

The core ideas-driven endogenous growth theory (e.g., Griliches, 1979; Pires, 2005; Romer, 1990; Rosenberg, 1982);

- •

the competitive advantages perspective (e.g., Furman, Porter, and Stern, 2002);

- •

the Triple Helix dynamics (e.g., Leydesdorff and Fritsch, 2006; Ranga and Etzkowitz, 2013; Herliana, 2015), and

- •

the concept of RIS (e.g., Asheim and Coenen, 2005; Cooke, 2001; Doloreux and Parto, 2005).

Previous studies have determined that certain effective ecosystems, at the regional level, need to be promoted and which involve successful enterprises, higher education institutions and research bodies (Acs et al., 2009; Fritsch and Mueller, 2004; Sternberg and Litzenberger, 2004). Additionally, regions that include highly qualified personnel and knowledge intensive services are an important basis on which industries may develop (Eckhardt and Shane, 2011; Gilbert, McDougall, and Audretsch, 2008; Leydesdorff and Fritsch, 2006; Tappeiner, Hauser, and Walde, 2008).

In essence, we are talking about highly inter-connected dynamic systems, where development occurs but where distinguishing between antecedents and consequents, that is, what comes first and what follows, is no easy task (Cooke, 2001; Pessoa, 2010; Rosenberg, 1982; Teixeira and Fortuna, 2010; Thurik et al., 2008; Uyarra, 2010). For example, Arocena, Goransson, and Sutz (2015) call attention to the fact that very significant differences exist between regions regarding development, even regions within the same country, and such development cannot be disassociated from innovation —which is a way to attain competitive advantage, though the innovation in itself may vary in its degree of novelty (Souto, 2015). “Innovation leading to increased productivity is the fundamental source of increasing wealth in an economy” (Akcali and Sismanoglu, 2015, p. 768). In particular, evidence suggests that firms located in research-driven clusters tend to produce greater innovation output, while being linked also to higher growth and survival rates than counterparts not located within such geographical clusters (Gilbert, McDougall, and Audretsch, 2008). Successful development policies which involve universities and other innovation systems (Arocena, Goransson, and Sutz, 2015) suggest that University-Industry-Government channels positively affect their regions (e.g., Arocena, Goransson, and Sutz, 2015; Sternberg and Litzenberger, 2004). Collaboration between institutions is essential when considering innovation systems.

The above is also related to the Knowledge Spillover Theory of Entrepreneurship literature. Higher R&D investment in regions also tends to lead to greater knowledge spillover as well as economic growth (e.g., Akcali and Sismanoglu, 2015; Audretsch and Feldman, 1996; Audretsch and Keilbach, 2004, 2008; Audretsch and Lehmann, 2005b). On the other hand, enterprise sustainability is influenced by Market Potential (MKP) (e.g., Pires, 2005), including market size and purchasing power, and also by Demand Sophistication (DES) (e.g., Buesa, Heijs, and Baumert, 2010; Lindic, Bavdaz, and Kovacic, 2012), linked to the appreciation of quality, for example, which are traditional economic factors. Additionally, enterprise sustainability is proven to be influenced by the proximity of universities and the possibility to access their knowledge and technology (Audretsch, Lehmann, and Warning, 2005). Thus, knowledge availability, a form of human capital (Lubango, 2015), can be a source of competitive advantage (Porter, 1980) at the regional level (e.g., Fritsch, 2008; Pe’er and Vertinsky, 2008; Tappeiner, Hauser, and Walde, 2008).

Globalization, and easy access to markets and information, means that the ‘comparative advantage’ of advanced economies is no longer based on traditional inputs of production, but rather is based on knowledge (e.g., brands, intellectual property rights, patents and trademarks) (Ejermo, Kander, and Henning, 2011; Furman and Hayes, 2004; Maassen and Stensaker, 2011). Additionally, the emergence of new perspectives has led to a shift from national and international focuses (Goel, Payne, and Ram, 2008; Lubango, 2015; Radu, 2015) towards regions and clusters at the regional level (Bourletidis, 2014; European Commission, 2012; Landabaso, 2013; OECD, 2013). As a consequence, for example, the RIS framework perceives regions (e.g., Silicon Valley, in the USA, as well as the Chinese Zhongguancun technology hub), and not countries, as the unit of economic interest meriting attention (Kilpatrick and Wilson, 2013), especially when these regions present distinct administrative innovation-enhancing structures and industrial clusters. It is significant that innovation takes place at the enterprise level, but also across the interfaces among institutional agents —including universities, sectors in industry, government entities and agencies dedicated to regional development (Cooke, 2001; Furman, Porter, and Stern, 2002)— linked to the Triple Helix concept (Herliana, 2015). The RIS structure introduces novelty with regards to the fluxes produced —networks are an essential part of society and the heterogeneous fluxes of knowledge generated provide synergy opportunities (Bollingtoft and Ulhoi, 2005; Fritsch, 2008; Klepper, 1996; Klepper and Sleeper, 2005; Pe’er and Vertinsky, 2008). Networks— including their relational and intellectual capital, as well as their supporting institutional environment (Sarvan et al., 2011) —provide a basic knowledge infrastructure—. The knowledge base of an innovation system, on the other hand, when looked at holistically, is carved out by a division of innovative human capital at the regional level, in view of such a knowledge infrastructure and web (Eckhardt and Shane, 2011; Gilbert, McDougall, and Audretsch, 2008; Lee, 2010; Sarvan et al., 2011).

An innovation system at the national level is seen to have a significant impact on science and technology in those countries where it is present (Cavdar and Aydin, 2015), and so also at the regional level. Within regions how industrial clusters, spatial location and R&D installed capacity establish linkages determines how strong an innovation system is (Asheim and Coenen, 2005; Tappeiner, Hauser, and Walde, 2008). At the country level as well as at the regional level we will witness different growth dynamics between differing geographies (Cavdar and Aydin, 2015), and institutional effectiveness will have a bearing on this also. The concept of RIS described herein maintains that differences registered on an economic and technological plain, across countries or regions, need additional explanations beyond enterprises and their performance and subsequent —more or less advantageous— market positions. Accumulation of capital, knowledge and technology assume particular importance in a process where institutions combine and interact in key ways (Brown and Petersen, 2010; Ciftci and Cready, 2011; Harhoff, 2000; Ranga and Etzkowitz, 2013). The capability of firms to find financing is positively influenced by the scale and depth of their R&D practices (Brown and Petersen, 2010; Ciftci and Cready, 2011; Eckhardt, Shane, and Delmar, 2006), true even in the case of SME. Indeed, SME may benefit from better access to financing as compared with larger firms in industries which are less knowledge-intensive (Audretsch and Weigand, 2005). This clearly shows how R&D is seen to be linked to innovation output, and how knowledge is the asset on which innovation stands. The role of technology, in the environment, beyond the simple automation of tasks, but considering the management of knowledge which technology permits (i.e., in an era of excess information), and its ability to improve quality of life of citizens, is also associated with enhanced market positions and reach of firms (Cavdar and Aydin, 2015; Wersching, 2010).

Auerswald (2010) noted that complex production processes, in certain industries, lead to more consistent profits, over time, in the case of those firms that prevail. Albeit, the aforementioned profits are highest during the initial stages of those industries where technology is neither too complex nor too simple, but rather is of intermediate complexity (Auerswald, 2010). In such an environment, learning will occur quickly so as to provide an advantage to pioneering firms; and, on the other hand, imitation will be undesirable in so far as it will be deemed uncertain (i.e., ‘me too’ firms, or late entrants, will be deterred) (Auerswald, 2010). Disruptive innovation, for example, is a path for the creation of growth based on technological progress, whereby smaller rivals selling cheaper and simpler products end up beating more powerful competitors, which sell better quality products, but that customers are not able to use to the fullest, as the technology is too good even for the most demanding customers (Christensen and Raynor, 2003). Products with room to improve over time and that attract a market satisfied with sub-optimum quality (i.e., customers who are not the most demanding) is how whole industries move forward in terms of innovation-driven dynamics. This is, also, how we witness leaps forward in quality of life, as lower prices enable more people to benefit from technological progress, progress which customers are able to use (Moutinho et al., 2015). Considering the goal of improving RIS innovation output, technology of medium complexity best capitalises on local synergies (i.e., Triple Helix interactions between University-Industry-Government), within a certain geography. This is because high-tech production is unable to mobilize local environments, as it tends to be small scale and occur in multinational firms with focused global objectives. That is to say, local environments lack the necessary Absorptive Capacity —i.e., the ability to leverage something novel made available by external industry partners, in a collaborative innovation process (Tsai, 2009)— to benefit from high-tech processes. On the other hand, technology- and knowledge-transfer occur more easily with medium-tech manufacturing (Doloreux, 2003; Doloreux and Parto, 2005; Leydesdorff and Fritsch, 2006; Pessoa, 2010; Teixeira and Fortuna, 2010).

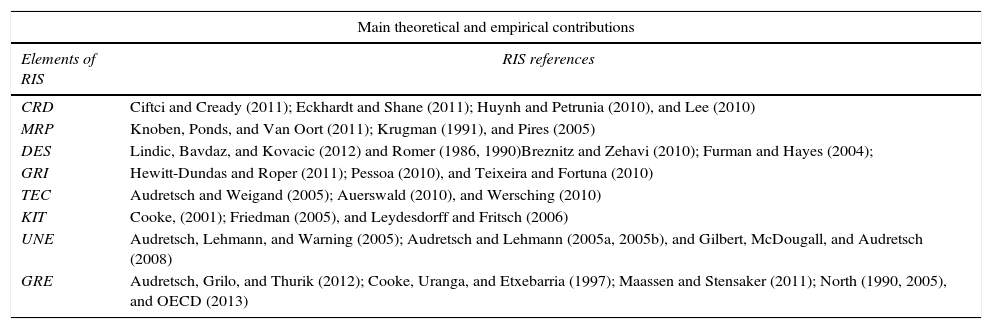

The present research effort suggests that the allocation of resources is what counts, for regional innovation capacity enhancement (Audretsch and Lehmann, 2005b; Furman and Hayes, 2004; Tappeiner, Hauser, and Walde, 2008). Table 1 emphasizes which RIS elements receive the most attention in the literature. These eight core RIS elements, are what shall be used as the Independent or input variables in our model —as they probably will be the cause of the outcomes, being the predictor variables (Creswell, 2014).

Substantiation of the RIS concept.

Source: Own preparation.

For Europe, in certain promising markets (i.e., MKP) where customers are, to a certain degree, sophisticated (i.e., DES), antecedents of innovation capacity (i.e., the basis for economic development and growth) are technology (i.e., Technological Capacity, TEC) and various forms of R&D —linked to corporate (Corporate R&D, CRD), scientific and governmental activity, as in the Triple Helix model— which work together with knowledge (i.e., Knowledge Intensity, KIT). Thus, knowledge seems to be information we can act on and leverage and which leads to better decision-making (Jashapara, 2004) towards improved overall RIS quality (Moutinho et al., 2015).

We included in our model the inputs or innovative efforts of the corporate sector (i.e., firms) both in terms of expenditure and of human resources. On the other hand, the R&D infrastructure refers to the group of agents and actions which impinge on the development of regional scientific and innovatory activity. We gathered data on human resources —share of total employment and number— and distinguish two different analytical areas: University R&D Employment (URE) and Governmental R&D Employment (GRE).

FORMULATION OF THE DATASET AND METHODOLOGYIn an era of ever-more complex realities (e.g., more globalized competition; greater interconnectedness; a greater number of countries having come into existence over the last fifty years, but where cross-border travel is mostly simplified; and with certain developing countries soon to dominate the changing economic landscape), new and more precise mathematical models are necessary to calculate with more precision what outputs (i.e., dependent variables) will result from, or be affected by, certain inputs (i.e., Independent variables) (Marôco, 2014). In other words, we need better predictors, or a better knowledge of influencers, of economic behaviour.

This study thus applies the ANN methodology, an advanced mathematical technique which goes beyond traditional models, such as regression analysis (e.g., Ordinary Least Squares, OLS) and even Structural Equation Modelling (SEM), to supply hidden predictors of economic behaviour. The OLS approach, under specific assumptions, “has some very attractive statistical properties that have made it one of the most powerful and popular methods of regression analysis” (Gujarati, 2003, p. 58). However, OLS estimation in the presence of, and allowing for heteroscedasticity —“unequal spread or variance [where] the variance of the γ population is no longer constant” (Gujarati, 2003, p. 69); for example, the case of richer families’ consumption having more variable consumption patterns than poorer families— may yield t and F tests with inaccurate results (Gujarati, 2003). On the other hand, OLS estimation in the presence of, but disregarding heteroscedasticity, may lead to over- or underestimation (e.g., misleading inferences) where “we can no longer rely on the conventionally computed confidence intervals and the conventionally employed t and F tests” (Gujarati, 2003, p. 399). Kline (2011, p. 20) goes on further to state that “the method of OLS estimation is a partial-information method or a limited-information method because it analyses the equation for only one criterion at a time”. OLS, by capitalizing on chance, for example, will tend to “overestimate the population proportion of explained variance” (Kline, 2011, p. 20), giving rise to the possibility that similar values “may not be found in a replication sample” (Kline, 2011, p. 20).

SEM, also known as covariance structure analysis, is in fact a family of procedures, which are related (Kline, 2011). Let it be noted, that “the results of an SEM analysis cannot generally be taken as evidence for causation” (Kline, 2011, p. 8), that is, a limitation which ANN attempts to overcome, by supplying hidden nodes, which help to explain outcomes. Furthermore, SEM is seen to be a confirmatory procedure, as “your model is a given at the start of the analysis, and one of the main questions to be answered is whether it is supported by the data. But as often happens, the data may be inconsistent with your model, which means that you must either abandon your model or modify the hypotheses on which it is based” (Kline, 2011, p. 8). Model acceptance or rejection, based on the data, occurs with SEM, and even when we have more than one model (i.e., there being different alternatives) only one will be retained, based on acceptable data correspondence (Kline, 2011). Models can be generated with SEM, if the researchers are prepared to modify models until they fit the data, following serial testing procedures with the same data. Another limitation of SEM is that it only deals with continuous latent —that is, not directly measurable (Marôco, 2014)— variables, such as intelligence, occurring on a continuum (i.e., not categorical, or ‘0’ or ‘1’ valued, or ‘have’ or ‘have not’, latent variables) (Kline, 2011). Also, whereas OLS can be used on smaller samples, SEM requires large samples in order to be accurate, which can be a limitation for certain research designs (Kline, 2011). Of note is that theory is the engine of analysis, whether with OLS, SEM or ANN techniques, and contrary to what happens with qualitative research, whereby knowledge of the literature, prior to data collection, may be limited (Corbin and Strauss, 2008).

Certain studies have in general compared ANN to more traditional statistical methods (e.g., OLS, SEM) in terms of predictive accuracy, finding neural networks to be superior in this respect (Davies et al., 1999; Detienne, Detienne, and Joshi, 2003; Swingler, 1996), although it is interesting to note that little is known about ANN's applications to innovation systems and their relationship with macro-economic dynamics. In addition, we extend the findings of previous innovation process management studies by identifying the key dimensions through which innovation is converted into economic and employment growth in the RIS.

From the outset, and based on the theoretical dimensions in Table 1, it was an objective to include in our model the highest number of RIS elements possible. To this end we processed the contents of existing sources of data (i.e., Eurostat, Organisation for Economic Co-operation and Development, United Nations, United Nations Educational, Scientific and Cultural Organization, and World Bank). A decision was made to select, for each nation, comparable administrative levels as concerns policy making competences and with regards to R&D and innovation policies (European Commission, 2012; OECD, 2013).

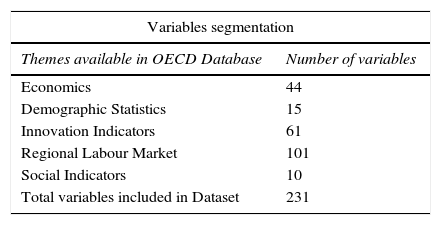

Additionally, we had to make sure that the necessary statistical data was available, to make the study viable. To this end, we collected statistical information comprised of a total of 231 variables, regionally standardised, from the OECD Regional Statistics Database (OECD, 2014), as our initial dataset (Table 2). The geographical scope selected for analysis is the OECD Territorial Level II (TL II). The sample is as follows:

- •

Selection from a dataset of 396 regions;

- •

involving 34 OECD countries;

- •

consisting of a total of 158 regions;

- •

forming parts of 18 countries in Europe.

Themes available on OECD Regional Statistics Database.

| Variables segmentation | |

|---|---|

| Themes available in OECD Database | Number of variables |

| Economics | 44 |

| Demographic Statistics | 15 |

| Innovation Indicators | 61 |

| Regional Labour Market | 101 |

| Social Indicators | 10 |

| Total variables included in Dataset | 231 |

Source: Own preparation and OECD (2014).

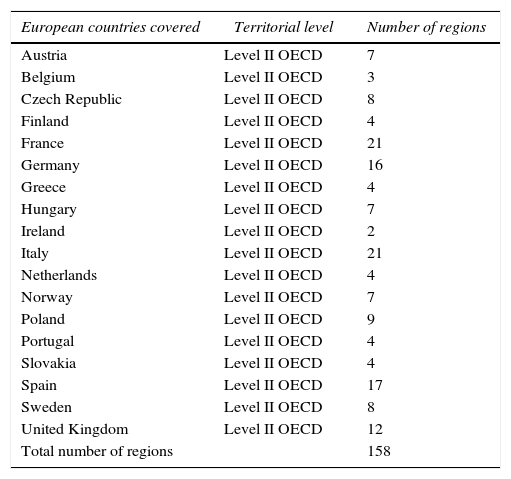

The sample thus has data from all European countries available in the OECD Regional Statistics Database (OECD, 2014). Only European countries were considered (Table 3), all of which are a part of the EU, except Norway.

European countries covered: Territorial level and number of regions.

| European countries covered | Territorial level | Number of regions |

|---|---|---|

| Austria | Level II OECD | 7 |

| Belgium | Level II OECD | 3 |

| Czech Republic | Level II OECD | 8 |

| Finland | Level II OECD | 4 |

| France | Level II OECD | 21 |

| Germany | Level II OECD | 16 |

| Greece | Level II OECD | 4 |

| Hungary | Level II OECD | 7 |

| Ireland | Level II OECD | 2 |

| Italy | Level II OECD | 21 |

| Netherlands | Level II OECD | 4 |

| Norway | Level II OECD | 7 |

| Poland | Level II OECD | 9 |

| Portugal | Level II OECD | 4 |

| Slovakia | Level II OECD | 4 |

| Spain | Level II OECD | 17 |

| Sweden | Level II OECD | 8 |

| United Kingdom | Level II OECD | 12 |

| Total number of regions | 158 |

Source: Own preparation and OCED (2014).

The decade, from 1998-2008 —ending approximately when the most recent international crisis began— is the period to which the regional variables pertain. This was done in order to ensure the best fit of the series to the data which was available. Not all regions in the OECD Regional Statistics Database (OECD, 2014) for Territorial Level II (TL II) were included in the sample as a concern was to only include series with an acceptable number of original values, spanning at least five years. Yearly variation rates are required to exclude bias from geometrical averages, per region, for the time span under analysis.

A number of methodologies were used to fill in the remaining missing values, according to each situation and where appropriate:

- •

The arithmetical mean was used to calculate single intermediate missing values —the two nearest years were used—;

- •

in the case of more than one missing value in intermediate years, estimates were calculated for the annual rate of variation —the gap was filled by corresponding previous and subsequent values that we had—;

- •

In the case of a missing value being situated at the beginning or end of the series we then used a geometrical average of the rates of variation —in relation to the value sequences we had.

In actual fact, all variables being studied had missing values, so these procedures were used whenever necessary and for each of the 231 variables in the OECD Regional Statistics Database (OECD, 2014). When all estimations had been made to make up for all of the missing values, annual variation rates were calculated as were the corresponding geometrical averages —for every region contemplated and for 1998-2008.

Factor Analysis (i.e., a statistical method that reduces the original large group of variables to a relatively small number of factors while maintaining the explanatory power of the original dataset) was applied, so that a specific group of composite dimensions, which make up the layer of inputs to the RIS was identified. The extracted factors better reflect the core components of the RIS, than each of the individual variables could independently, as they not only group together all related variables but also reflect interactions between factors, as the model correlates each variable to all factors, not just the one in which it is included. Furthermore, single variables are more sensitive than extracted factors to data recording errors, which may potentially occur, as in the latter case existing bias is dispersed into a larger, full set of original variables, in representation by each factor. Multicollinearity —i.e., when there is a linear association between exogenous variables, instead of them being linearly independent (Pestana and Gageiro, 2014)— would normally cause serious difficulties, but as we are actually looking for groups of interrelated variables, in this study, multicollinearity is positive. Please note that the main elements of a RIS are not directly observable, thus we applied the ANN approach, as mentioned above.

Typically, ANN modelling has been found to offer various advantages — many of them addressed by Detienne, Detienne, and Joshi (2003)— over conventional statistical methods such as regression. Two advantages are most relevant to the present study. First, neural networks are capable of learning an approximation to any functional form, provided their complexity (i.e., number of hidden nodes) is sufficiently increased (White, 1989). This means that there is no need for the researcher to specify underlying directional paths prior to analysis (Bejou, Wray, and Ingram, 1996). Second, there is significant value to scholars in the hidden layer nodes, which can be regarded as latent or unobserved variables related to the process by which R&D outlays are converted into economic activity.

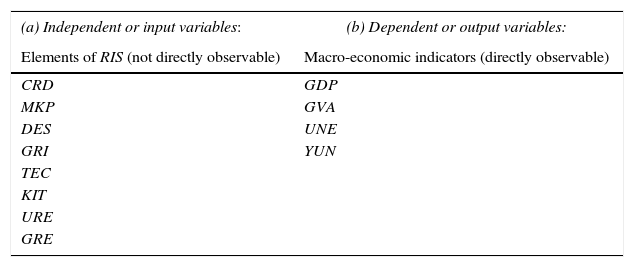

An important part of productive growth in advanced nations —as measured in terms of Gross Domestic Product (GDP), Gross Value Added (GVA), Unemployment (UNE), and Youth-Unemployment (YUN)— corresponds to innovation (European Commission, 2012; Furman and Hayes, 2004; Landabaso, 2013; OECD, 2013). The reference level of analysis is regional and the source database is the same as the elements of RIS, more precisely, the OECD Regional Statistics Database (OECD, 2014).

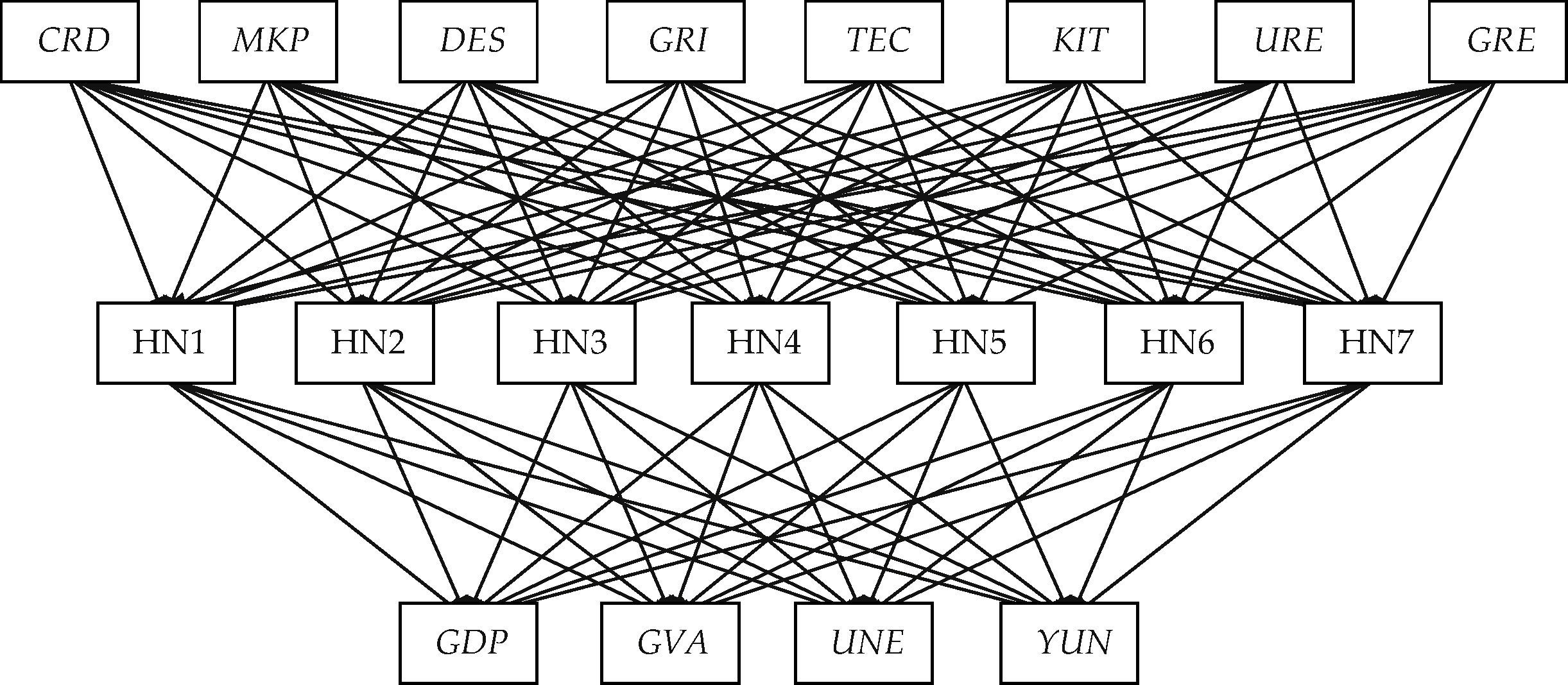

Before computing the Neural Network (NN), the four macro-economic and directly observable indicators GDP, GVA, UNE and YUN are designated dependent or output variables, while the other RIS elements (i.e., not directly observable) arrived at by Factor Analysis are taken to be Independent or input variables (Table 4).

Theoretical model.

| (a) Independent or input variables: | (b) Dependent or output variables: |

|---|---|

| Elements of RIS (not directly observable) | Macro-economic indicators (directly observable) |

| CRD | GDP |

| MKP | GVA |

| DES | UNE |

| GRI | YUN |

| TEC | |

| KIT | |

| URE | |

| GRE |

Source: Own preparation. Statistical data from the OECD (2014).

Thus, the output variables are the original macro-economic indicators of each region and are expressed in yearly variation-rates. Additionally, we assume that there remains a group of latent or mediating variables, conceptualised as hidden nodes that entail at least one intermediate layer between the independent (i.e., Elements of RIS) and dependent variables (i.e., Macro-economic Indicators). This intermediate layer is expected to determine RIS effectiveness, generating significant macro-economic outputs. Neural networks modelling thus reproduces innovative ecosystems and the existing non-linear relationships between the RIS elements, inputs and outcomes, providing insights towards what composes innovation's “Black Box” (Rosenberg, 1982; Tappeiner, Hauser, and Walde, 2008).

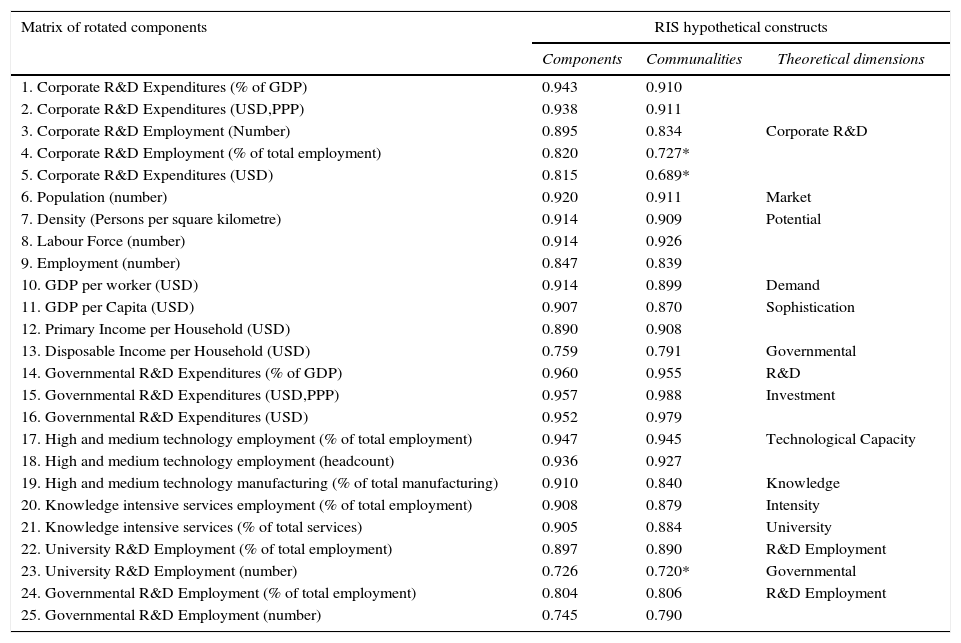

We used Factor Analysis, a set of statistical techniques, in order to explain the correlation between the variables being observed —thus simplifying the data by reducing the amount of variables necessary to describe them (Pestana and Gageiro, 2014). Using Factor Analysis, 25 variables were arrived at (Table 5), from the original dataset (Table 2) of 231 variables— 231 variables is too many variables and is too complex to deal with. The simplification process, to a lower number of more representative variables (i.e., 25 original variables), was a systematic process of variable consolidation. Eight factors were finally generated —from the lot of 25 variables— non-observable and expressing what exists in common in the original variables. The constructs —CRD, MKP, DES, GRI, TEC, KIT, URE, and GRE— are consistent with the RIS theoretical framework. Dealing with only eight common factors, or latent variables, is simpler, and we can now explain the communalities between the observed variables. The communalities, most of which higher than 0.750, ensure that the findings are reliable.

Hypothetical components: Components, communalities and theoretical dimensions.

| Matrix of rotated components | RIS hypothetical constructs | ||

|---|---|---|---|

| Components | Communalities | Theoretical dimensions | |

| 1. Corporate R&D Expenditures (% of GDP) | 0.943 | 0.910 | |

| 2. Corporate R&D Expenditures (USD,PPP) | 0.938 | 0.911 | |

| 3. Corporate R&D Employment (Number) | 0.895 | 0.834 | Corporate R&D |

| 4. Corporate R&D Employment (% of total employment) | 0.820 | 0.727* | |

| 5. Corporate R&D Expenditures (USD) | 0.815 | 0.689* | |

| 6. Population (number) | 0.920 | 0.911 | Market |

| 7. Density (Persons per square kilometre) | 0.914 | 0.909 | Potential |

| 8. Labour Force (number) | 0.914 | 0.926 | |

| 9. Employment (number) | 0.847 | 0.839 | |

| 10. GDP per worker (USD) | 0.914 | 0.899 | Demand |

| 11. GDP per Capita (USD) | 0.907 | 0.870 | Sophistication |

| 12. Primary Income per Household (USD) | 0.890 | 0.908 | |

| 13. Disposable Income per Household (USD) | 0.759 | 0.791 | Governmental |

| 14. Governmental R&D Expenditures (% of GDP) | 0.960 | 0.955 | R&D |

| 15. Governmental R&D Expenditures (USD,PPP) | 0.957 | 0.988 | Investment |

| 16. Governmental R&D Expenditures (USD) | 0.952 | 0.979 | |

| 17. High and medium technology employment (% of total employment) | 0.947 | 0.945 | Technological Capacity |

| 18. High and medium technology employment (headcount) | 0.936 | 0.927 | |

| 19. High and medium technology manufacturing (% of total manufacturing) | 0.910 | 0.840 | Knowledge |

| 20. Knowledge intensive services employment (% of total employment) | 0.908 | 0.879 | Intensity |

| 21. Knowledge intensive services (% of total services) | 0.905 | 0.884 | University |

| 22. University R&D Employment (% of total employment) | 0.897 | 0.890 | R&D Employment |

| 23. University R&D Employment (number) | 0.726 | 0.720* | Governmental |

| 24. Governmental R&D Employment (% of total employment) | 0.804 | 0.806 | R&D Employment |

| 25. Governmental R&D Employment (number) | 0.745 | 0.790 | |

Source: Own preparation. Asterisks* indicate communalities that are less than 0.750.

Factor Analysis and its outcome can be further assessed by qualitative validation (Manso and Simões, 2009). This process involves considering the following dimensions:

- •

Parsimony. With the objective herein of aiding policy decisions, Factor Analysis was used to simplify the identification and subsequent explanation of correlations, between the variables in the original grouping. This is done by way of using the minimum amount of factors possible, while in the meantime maintaining as much of the variability as is possible. Thus, theoretical constructs will be more easily interpretable and measurable. Of essence is that simpler models which are theoretically acceptable are preferred over more complex ones with more variables than can be intuitively grasped by decision-makers (Kline, 2011).

- •

Interpretability. Care should be taken to only use Factor Analysis if the results are coherent with the theory defined for the study and if they are also coherent with empirical results from previous studies. A specific research domain needs to be considered. Thus, much will be gained in terms of interpretability and consistency, but also with regards to transparency, an objective of studies of this kind (Kline, 2011).

Furthermore, while adhering to the principles of Parsimony and Interpretability, for superior qualitative validation (Manso and Simões, 2009), the eight theoretical dimensions only register a 13 per cent variability loss. With the Factor Analysis we used VARIMAX rotation and KAISER normalization, for the purposes of interpretability and robustness (Pestana and Gageiro, 2014).

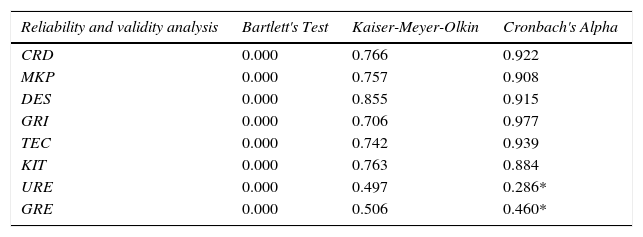

To examine reliability and validity (Table 6), and to test the null hypothesis (i.e., in fact rejected) of uncorrelated variables, Bartlett's test of sphericity was used. The Kaiser-Meyer-Olkin (KMO) statistic tests partial correlations, measuring the adequacy of the sampling, and have to be greater than 0.5 for a satisfactory Factor Analysis to be able to go ahead. Our results revealed that URE should be discarded from our model. ‘Multicollinearity’ and Cronbach's Alpha coefficient resulted in the majority of the factors showing strong internal consistency, with Alphas above 0.9. (i.e., the only exceptions are KIT, which is quite close to the 0.9 level, at 0.884, and URE and GRE, with much lower values, below the acceptable 0.7 level).

Reliability and validity analysis.

| Reliability and validity analysis | Bartlett's Test | Kaiser-Meyer-Olkin | Cronbach's Alpha |

|---|---|---|---|

| CRD | 0.000 | 0.766 | 0.922 |

| MKP | 0.000 | 0.757 | 0.908 |

| DES | 0.000 | 0.855 | 0.915 |

| GRI | 0.000 | 0.706 | 0.977 |

| TEC | 0.000 | 0.742 | 0.939 |

| KIT | 0.000 | 0.763 | 0.884 |

| URE | 0.000 | 0.497 | 0.286* |

| GRE | 0.000 | 0.506 | 0.460* |

Source: Own preparation. Asterisks* indicate Cronbach's Alpha scores that indicate variables are not suitable for further analysis.

However, given the importance of the constructs involved, and taking into account the RIS empirical model, it was decided to leave them in the study, replacing in the NN by the most representative items in their corresponding groupings, namely, URE (% of total employment) and GRE (% of total employment). As seen in Table 5, these original variables show greater representativeness within the extracted factors, retaining more information than the other variables, which have lower communalities.

Additionally, we modelled the two original variables, URE and GRE, and the 6 other dimensions shown by the Factor Analysis to have ‘excellent’ (i.e., higher than a value of 0.9) or at least ‘good’ (i.e., higher than a value of 0.8) internal consistency, CRD, MKP, DES, GRI, TEC and KIT. As Dependent variables, we considered GDP, GVA, UNE and YUN.

RIS ARCHITECTURE AND MACRO-ECONOMIC DYNAMICSThere has been a steady increase in the number of refereed research articles reporting the use of the ANN methodology. Early applications of ANN in a business context have focused on areas such as accounting and finance, manufacturing and marketing. In accounting and finance, for example, much research has focused on bankruptcy risk prediction (Wilson and Sharda, 1994). However, many applications of ANN to marketing have also been reported, including the modelling of consumer responses to market stimuli, evaluating the effect of gender on car buyer satisfaction and loyalty (Moutinho, 1996), predicting consumer choice (West, Brockett, and Golden, 1997), and modelling the effect of market orientation on firm performance (Silva et al., 2009).

The studies cited above have in general compared ANN to more traditional statistical methods (e.g., multiple regression), finding neural networks to be superior, in terms of predictive accuracy (Davies et al., 1999; Detienne, Detienne, and Joshi, 2003; Swingler, 1996). Recent studies have extended this optimism to problems that involve predictions of the continuous criterion, from which nonlinear relationships were expected. In this stream of the literature, Somers and Casal (2009) used neural networks to examine the relationship between work attitudes and job performance.

It should be noted that, although several studies using ANN have been developed in recent years, this modelling approach remains wide open, and its applicability to some domains is still unknown. The benefits it offers relative to traditional statistical methods and the increased enthusiasm shown by researchers in using it to predict and explain problems in the management domain are most remarkable, although it is interesting to note that little is known about ANN's applications to innovation systems and their relationship with macro-economic dynamics. In addition, we extend the findings of previous innovation management studies by identifying the key dimensions that shape the overall RIS structure and by mapping the mediating flows through which innovation is converted into economic and employment growth.

ANN are massively parallel interconnected networks of simple processing units also designated by cells, neurons or nodes, which are intended to interact with the objects of the real world in the same way as do biological systems (Kohonen, 1988).

The NN reproduces the Network of Neurons, which carry out the lower level computational actions (i.e., as opposed to the high level cognitive operations) in the human brain. More specifically, ANN are pattern recognition algorithms that capture salient features from a set of inputs and map them to outputs (Bishop, 1995; Swingler, 1996). In this regard, neural networks do not require a knowledge base to be constructed, nor do they need an explicit inference procedure to be developed and subsequently encoded.

In each computing cell, we can identify three fundamental elements: a set of connecting links, each one characterized by a weight Wkj where k and j indicate the receiving and the emitting neuron, respectively; an adder for summing the input signals x1,x2,…,xn and an activation function f in order to limit the amplitude range of the output of the neuron. Note that a neuron model can also include an external constant input x0=1 known by the bias term, that is added to the sum of the weighted inputs and that plays a similar role to the intercept term in multiple regressions. As such, each unit of a NN performs a weighted sum on the inputs received from many other nodes and applies the function f to the resultant value of the previous operation, generating a single scalar output that depends only on locally-available information, either stored internally or arriving via the weighted connections. The output is distributed to, and acts as an input to, other processing nodes.

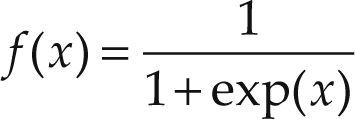

The activation functions can be classified into three basic types: threshold or Heaviside functions, piecewise linear function, and sigmoid (S-shaped) function. In this study we use the sigmoid function because it is by far the most common form of activation function used in the construction of a NN (Davies et al., 1999; Mitchell et al., 1999; Phillips, Davies, and Moutinho, 2001), and it is a bounded no decreasing and nonlinear function that exhibits smoothness and asymptotic properties. Specifically, this function is able to find patterns of nonlinearity that linear statistics such as regression analysis cannot model (Detienne, Detienne, and Joshi, 2003). An example of sigmoid is the logistic function defined by:

A NN is composed of an input layer, hidden layer(s), and an output layer (Figure 1). As illustrated in Figure 1, each layer comprises a predetermined number of neurons, which in general, define the topology of a NN. An input layer is used to represent the predictor or independent variables in the study (i.e., Elements of RIS) and an output layer is used to represent the dependent or criterion variables (i.e., Macro-economic indicators). Nevertheless, mapping occurs in the intermediary layers (i.e., hidden layers), where the number of neurons is discretionary (Detienne, Detienne, and Joshi, 2003; Somers and Casal, 2009).

These interior layers of neurons are not directly observable from the inputs and outputs system. Each hidden node is linked to each input node and to each output node, with the network computing values for each processing unit as a weighted sum of the neurons in the preceding layer, according to the connection weights. And, by adding hidden layers, the network is enabled to extract high-order statistics because it acquires a global perspective, in spite of the extra set of links and the extra dimension of neural interactions. The ANN with this architecture are usually designated by multi-layer feed-forward networks (MLF). In fact, MLF using arbitrary activation functions are universal approximators (Hornik, 1989).

Given the purpose of our study, mapping the mediating variables, which influence the effects of RIS inputs on economic and employment growth, we used MLF networks in our NN model selection (Svozil, Kvasnicka, and Pospichal, 1997). Specifically, this is because MLF are by far the most universally used neural networks in management and economics research (Davies et al., 1999; Swingler, 1996). Furthermore, as argued before, these neural networks use S-shaped functions to find patterns of nonlinearities in data that linear statistical tools such as regression analysis cannot model. In this context, the sigmoid function was employed for the hidden and output nodes.

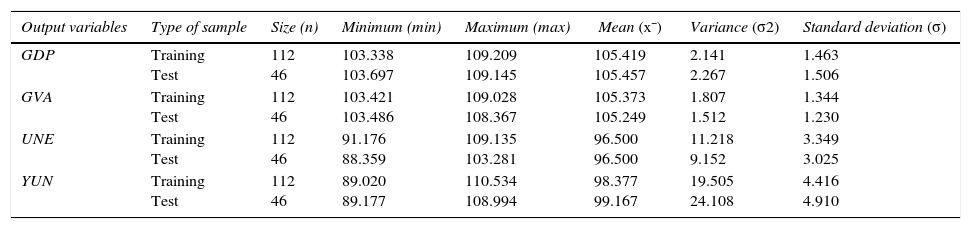

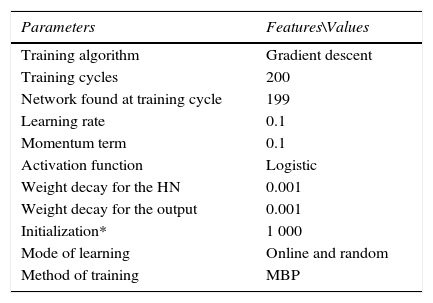

Contrary to previous studies, we used Multiple Back-propagation Algorithms (MBP) because they perform significantly better than does back-propagation (Lopes and Ribeiro, 2003), and the additional parameterizations are presented in Table 8. Data were divided into training and test subsets (Table 7). Training data were used to estimate weights used by the neural network to subsequently generate predicted outcomes, and the presentation of the training patterns was online mode and random. Test data represented a holdout sample. Weights derived from training were applied to test validation and the predictions compared to known outputs, and a significant decrement in performance indicated that the network was over-trained and uncovered patterns unique to the data set (Bishop, 1995). The training data comprised 70.9% of the sample (112 cases) and the remaining 29.1% was used for test set (46 cases).

Parameterizations.

| Parameters | Features\Values |

|---|---|

| Training algorithm | Gradient descent |

| Training cycles | 200 |

| Network found at training cycle | 199 |

| Learning rate | 0.1 |

| Momentum term | 0.1 |

| Activation function | Logistic |

| Weight decay for the HN | 0.001 |

| Weight decay for the output | 0.001 |

| Initialization* | 1 000 |

| Mode of learning | Online and random |

| Method of training | MBP |

Source: Own preparation. * Equal to “used fixed seed” and “seed value”.

Descriptive statistics: Real and forecasted data.

| Output variables | Type of sample | Size (n) | Minimum (min) | Maximum (max) | Mean (x¯) | Variance (σ2) | Standard deviation (σ) |

|---|---|---|---|---|---|---|---|

| GDP | Training Test | 112 46 | 103.338 103.697 | 109.209 109.145 | 105.419 105.457 | 2.141 2.267 | 1.463 1.506 |

| GVA | Training Test | 112 46 | 103.421 103.486 | 109.028 108.367 | 105.373 105.249 | 1.807 1.512 | 1.344 1.230 |

| UNE | Training Test | 112 46 | 91.176 88.359 | 109.135 103.281 | 96.500 96.500 | 11.218 9.152 | 3.349 3.025 |

| YUN | Training Test | 112 46 | 89.020 89.177 | 110.534 108.994 | 98.377 99.167 | 19.505 24.108 | 4.416 4.910 |

Source: Own preparation.

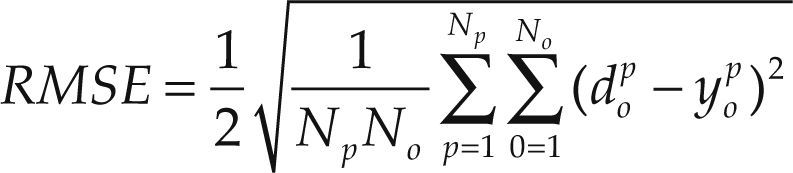

This study adopts a connectionist framework, where the processing elements that define the topology of the model are examined in a relatively unstructured manner. The focus is on the interactions between input and output layers. The links between Independent and Dependent variables occur through an intermediate layer termed the hidden layer, where the number of elements is discretionary (Detienne, Detienne, and Joshi, 2003; Somers and Casal, 2009). These nodes are assumed to be latent variables, and the neural network can be used to cast light on these variables through their links, identifying communal processes that are labelled by their connections to the input variables (Moutinho, 1996, p. 135). In this way, different architectures were tried, and it was found that the optimal fit between inputs and outputs was achieved through a network with a single intermediate layer, integrating 7 hidden nodes. This was thought to be an ‘interpretable’ number of latent variables that could be identified and labelled, and the network did not produce significantly better results when the number of nodes composing the hidden layer was increased. The Root Mean Square Error (RMSE) defined by:

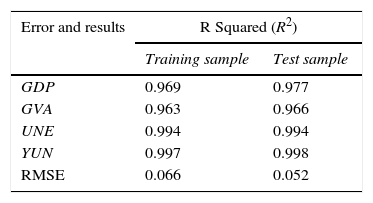

where Np represents the number of patterns, was used in an attempt to minimize the discrepancy between the predicted and observed values. The network modelling was conducted through a trial-and-error process in order to gradually narrow the RMSE. Moreover, the goodness-of-fit value (R2) was calculated to evaluate the performance of the network model. The R2 values (Table 9) are calculated by comparing the RMSE between desired output and actual output divided by the variance of desired output and are similar to R2 coefficients provided in multiple regression analysis.

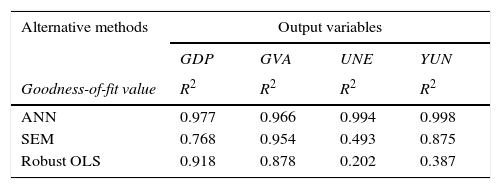

As measured by R2, a relatively high share of macro-economic variance is explained by the network architecture, ensuring the representativeness of the overall NN and adding to current state-of-the-art knowledge in this research field. In addition, two alternative methods were run for the macro-economic outputs (i.e., SEM and OLS), using the same 8 independent or input variables used in the NN model (Figure 1).

As expected, the NN outperformed the other models in terms of predictive accuracy (Table 10), a result consistent with previous studies (e.g., Somers and Casal, 2009; Wilson and Sharda, 1994). ANN modelling takes into account nonlinear relationships between RIS components and macro-economic outcomes, achieving greater explanatory power than equivalent empirical models.

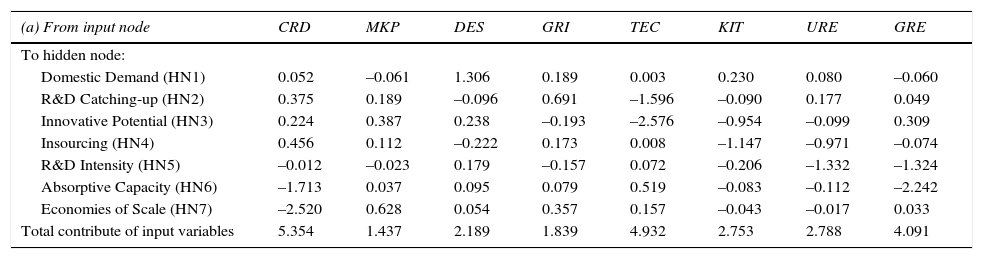

DISCUSSIONWe examined the links between the variables in each layer of the neural network (Table 11). The overall contributions of the independent variables to the hidden nodes reveal that CRD (5.354) is the most significant contributor, followed closely by TEC (4.932) and GRE (4.091).

ANN: Network layers and weights.

| (a) From input node | CRD | MKP | DES | GRI | TEC | KIT | URE | GRE |

|---|---|---|---|---|---|---|---|---|

| To hidden node: | ||||||||

| Domestic Demand (HN1) | 0.052 | –0.061 | 1.306 | 0.189 | 0.003 | 0.230 | 0.080 | –0.060 |

| R&D Catching-up (HN2) | 0.375 | 0.189 | –0.096 | 0.691 | –1.596 | –0.090 | 0.177 | 0.049 |

| Innovative Potential (HN3) | 0.224 | 0.387 | 0.238 | –0.193 | –2.576 | –0.954 | –0.099 | 0.309 |

| Insourcing (HN4) | 0.456 | 0.112 | –0.222 | 0.173 | 0.008 | –1.147 | –0.971 | –0.074 |

| R&D Intensity (HN5) | –0.012 | –0.023 | 0.179 | –0.157 | 0.072 | –0.206 | –1.332 | –1.324 |

| Absorptive Capacity (HN6) | –1.713 | 0.037 | 0.095 | 0.079 | 0.519 | –0.083 | –0.112 | –2.242 |

| Economies of Scale (HN7) | –2.520 | 0.628 | 0.054 | 0.357 | 0.157 | –0.043 | –0.017 | 0.033 |

| Total contribute of input variables | 5.354 | 1.437 | 2.189 | 1.839 | 4.932 | 2.753 | 2.788 | 4.091 |

| (b) From hidden node | HN1 | HN2 | HN3 | HN4 | HN5 | HN6 | HN7 |

|---|---|---|---|---|---|---|---|

| To output: | |||||||

| GDP | –1.091 | 0.736 | –1.651 | –2.002 | –0.015 | –0.146 | –0.653 |

| GVA | –1.874 | –2.249 | –2.027 | –0.928 | –0.356 | 0.250 | –0.571 |

| UNE | –2.337 | –0.965 | 1.244 | –0.072 | 0.248 | –0.807 | 0.856 |

| YUN | 1.450 | –0.980 | 0.626 | 0.058 | 0.190 | –0.645 | 0.097 |

| Total contribution of hidden node | 6.752 | 4.930 | 5.548 | 3.060 | 0.809 | 1.848 | 2.177 |

Source: Own preparation.

The independent contributions to hidden node HN1, show more positive than negative effects. For instance, the findings show that DES (+1.306) has by far the most significant contributory weight followed by the much smaller weights of KIT (+0.230) and GRI (+0.189). In the particular case of HN1, inhibitory effects have very low weights and, considering all of the remaining contributory and inhibitory contributions, we labelled this node Domestic Demand, due to the structuring impact of DES. It is interesting to note that Domestic Demand has generally a very meaningful impact on the output layer (6.752). In examining the individual neuronal outputs, we find that the GVA (–1.874) and GDP (–1.091) growth rates are both negatively influenced by Domestic Demand, as international markets and a focus on these leads to better results than focusing on domestic markets, some in a crisis and of smaller size, in Europe, when compared, for example, to the USA (Bento, 2011). The non-tradable sectors are, in fact protected against external competitors, giving rise to a tendency for oligopolistic consolidation and thus the empowering of large utility firms through ‘pricing-power’. This adjustment process may operate positively (i.e., reducing uncertainty) or negatively because it reinforces globalization in a previously more predictable system (Leydesdorff and Fritsch, 2006; Ranga and Etzkowitz, 2013).

In other words, the network of relations may turn into a configuration that can be entrepreneurial, but not all networks can be expected to do so all the time. Despite their RIS architecture, regions may suffer from deindustrialization, because of the globalizing dynamics in the appropriation of the profits and the advantages of regional economies (Bach, Matt, and Wolff, 2014). HN1 or Domestic Demand generates additional YUN because ‘consumption-driven’ economies rely primarily on non-tradable services, which are not exposed to international competition for more productive technologies and human capital and thus generate lower wage jobs compared with tradable sectors. The younger segments of the population possess, on average, high-quality human capital, which is why Domestic Demand leads to rising YUN (+1.450). Despite its positive effect on YUN, Domestic Demand has a significant and quite meaningful role in reducing overall UNE (–2.337) —note that the importance of regions and local domestic demand, being linked to reducing UNE, is all the more true in particular in Europe, due to greater diversity amongst regions; meaning that there is less mobility than in the USA, as in Europe there is more cultural diversity and there are more languages, making travel more complex, for example the difference between moving from Spain to Germany, to work, versus moving from New York to Florida, in North America; younger individuals, however, adapt better to different cultures and tend to speak more languages, so they are more mobile; albeit, within regions, YUN may still continue to be high, even in view of increased domestic demand, due to the difficulty in employing younger individuals with no work experience but who, being more qualified than older counterparts, expect higher pay due to this reason; furthermore, older individuals already in the job market are very expensive or even impossible to replace, as over time they have accumulated rights, Europe being a social welfare society where entrance by new employees is thus difficult; this difficulty does, though, ensure jobs for older individuals, who might otherwise be an even greater burden to society, if terminated prematurely— by creating ‘mass-market’ opportunities with lower qualification standards for the active population. In this sense, the non-tradable services have an important and indispensable role to play in generating job opportunities for average segments of the population, replacing the relocation of manufacturing facilities to countries with lower labour and social costs and maintaining regional MKP (Friedman, 2005; Norman, 2002; Pires, 2005).

The effects of the contributory and inhibitory weights in hidden node HN2 are more positive than negative. However, the stronger impact, by far, is inhibitory, owing especially to the effects of TEC (–1.596). We named HN2 R&D Catching-up. In regional economies with weak TEC, governmental investment in R&D plays an indispensable role (+0.691) in creating the necessary conditions for the establishment of a medium-tech manufacturing base. Such ‘public leverage’ increases both employment of qualified personnel and R&D expenditures by corporations due to risk-sharing and spill-over effects between public and private agents (Caragliu and Bo, 2011; Hewit-Dundas and Roper, 2011; Leydesdorff and Fritsch, 2006). R&D Catching-up has a significant effect (4.930) on the overall output layer, particularly in its positive effect on GDP (+0.736) growth rate. The ‘emerging innovator’ regions show a tendency to increase R&D investment to ‘catch-up’ with more developed regions or countries (e.g., Furman and Hayes, 2004), and such expenditures lead to increased GDP growth rate and help sustain demand for qualified human capital, thus reducing both YUN (–0.980) and overall UNE (0.965). Despite the priming effect both on GDP growth rate and on ‘mass-market’ employment, the R&D Catching-up approach is adopted precisely to overcome a lack of TEC (Bento, 2011; Furman and Hayes, 2004; Pe’er and Vertinsky, 2008), which impairs GVA growth rate. For this reason, an R&D Catching-up policy tends to be applied in technologically underdeveloped regions, as seen clearly in the negative association between TEC and GVA growth rate (–2.249).

HN3 shows an equal number of positive and negative contributions, the most significant effects, namely, TEC (–2.576) and KIT (–0.954), being inhibitory. These negative weights are balanced by MKP (+0.387), GRE (+0.309), DES (+0.238) and CRD (+0.224). The label attached to HN3 is Innovative Potential, due to that node's overall structural impairment induced by the combined effects of weak TEC and low KIT. In this context, the role of MKP is to expand the size of the market, increasing economies of scale and making each region a more attractive destination for capital investment. These results are congruent with the previous empirical findings of Gilbert, McDougall, and Audretsch (2008) and Pires (2005), reinforcing the idea that MKP has a double-role (assuring demand and building critical mass). The economy's ability to cope with economic downturns could be enhanced by improving flexible access to highly qualified human capital, allowing companies to convert fixed costs into variable costs and thus decrease the marginal cost of production (Auerswald, 2010; Friedman, 2005). As expected, a lack of Innovative Potential has a constraining effect (5.548) on economic growth rates both in terms of GVA (–2.027) and GDP (–1.651). Contrary to R&D Catching-up, Innovative Potential is characterised by a quite weak TEC combined with significant impairment in knowledge-intensive services, and this restriction on the qualified services ‘supply side’ disproportionately affects experienced workers, as seen in the specific impact of Innovative Potential on UNE (+1.244), which is almost double its impact on YUN (+0.626).

Additionally, in node HN4 the most relevant effects are negative —in particular, KIT (–1.147) and URE (–0.971)— while the most significant positive contribution is provided by CRD (+0.456). The lack of a qualified outsourcing pool induces firms to incorporate all related know-how, including knowledge that is not ‘critical’ or pertains to activities outside their core business. This adjustment helps firms overcome higher outsourcing costs and cope with the absence of a necessary pool of specialised human capital and know-how. Accordingly, we labelled HN4 Insourcing because, when outsourcing economies of scale are not available within a given region, firms replace them by incorporating those skills and competences into their own production processes to overcome the ‘supply-side’ deficit. Furthermore, an increased availability of knowledge-intensive and technological transference services within a given region creates an incentive for companies to outsource and thereby replace non-core regular employment. Given the availability of economies of scale and researcher mobility within regional boundaries, companies tend to increase their level of outsourcing (Leydesdorff and Fritsch, 2006). Reinforcement of KIT and URE (i.e., the outsourcing pool) contributes to price competitiveness and firms’ abilities to cope with bullish environments, generating more sales and thus leading to a higher GDP growth rate. Also, replacing non-core regular employment with flexible service providers allows companies to reduce overhead costs and improve their profit margins by converting fixed costs into variable costs (Norman, 2002), leading to further GVA growth. The overall impact of Insourcing is 3.060, and a discriminant analysis of the node's outcomes indicates, as expected, an inhibitory effect on regional competitiveness expressed either in terms of GDP (–2.002) or GVA (–0.928) growth rates. However, contrary to expectations, Insourcing does not generate significant employment (–0.072) or youth-employment (0.058) gains. This could be because when companies incorporate certain skills and competences, they also enlarge their organizational structures, creating additional overhead costs with no proportional effect on sales or value-added. This ‘forced’ conversion of variable costs into ‘structural’ costs, by increasing operational costs and decreasing price competitiveness and thus profit margins, appears to impair firms’ abilities to cope with market volatility, as shown by the negative impact of Insourcing on economic growth rates (i.e., GDP and GVA). Thus, firms create much fewer jobs than expected because, at some point, Insourcing restricts sales and growth of value-added potential.

HN5 is mainly subject to negative effects. The most important weights are URE (–1.332) and GRE (–1.324), while the remaining effects are not especially meaningful. As URE and GRE measure the relative prevalence of R&D employment in both kinds of organizations, we labelled HN5 R&D Intensity. A weak R&D Intensity both in universities and in governmental organizations restricts economic development (0.809), as expressed in the inhibitory effects on GVA (–0.356) and on GDP (–0.015) growth rates. At the same time, a weak R&D Intensity generates additional UNE (+0.248) and YUN (+0.190). This means that reinforcing R&D Intensity tends to significantly increase GVA growth rate and ‘mass-market’ UNE reduction potential, although universities and governmental institutions —e.g., research institutes— do not always produce economically useful knowledge, leading to a clogging of the so called “Knowledge Filter”. Although industries with a greater share of R&D employment tend to be characterised by more new high-growth companies (Eckhardt and Shane, 2011), there are other factors involved in this process, such as the “technological competence enhancing capability” that allow firms to translate knowledge accumulation into sustained growth, if leveraged by the initial size of their technological stock endowment (Lee, 2010). That is, R&D Intensity widens the technological opportunity set, but to unclog the “Knowledge Filter”, an ability to effectively translate new knowledge and ideas into marketable products and services is also needed (Audretsch and Keilbach, 2004, 2008; Fritsch, 2008).

Regarding HN6, the most relevant inhibitory effects were GRE (–2.242) and CRD (–1.713), inducing a significant response from TEC (+0.519). According to the node's structure, if engagement in innovation —both by governmental institutions and market players— is low, regional economies tend to be increasingly driven by TEC. This dimension basically consists of high or medium-technology employment and manufacturing, variables associated with the Absorptive Capacity construct (Teixeira and Fortuna, 2010). The negative effects of weak R&D intensity on TEC have the same mitigating effects on the productivity of productive factors and consequently on the attractiveness of investment, effects usually attributed to Absorptive Capacity (Fritsch, 2008; Fritsch and Mueller, 2008; Leydesdorff and Fritsch, 2006; Pe’er and Vertinsky, 2008; Pires, 2005). HN6 has an overall impact of 1.848, overlapping with the respective theoretical construct, this node thus labelled Absorptive Capacity. When there remains a significant gap in R&D intensity, the Absorptive Capacity role is empowered, so that knowledge and technologies developed elsewhere can be more readily understood and incorporated into local production factors and applied as a seedbed for technological (Leydesdorff and Fritsch, 2006; Tappeiner, Hauser, and Walde, 2008) and productivity upgrades (Choudhary and Gabriel, 2009; Pe’er and Vertinsky, 2008). This implies that Absorptive Capacity can overcome an organizational environment averse to innovation, generating value-added even under such conditions, as seen in GVA growth rate (+0.250). If human capital development is combined with local R&D efforts, economically peripheral regions can improve their ability to identify, evaluate, assimilate and benefit from the knowledge that is produced in the most technologically developed regions. However, we must be aware that this is a ‘catching-up’ process because Absorptive Capacity works as an engine of growth primarily in regions characterised by low industrialization and income (Krugman, 1991; Tappeiner, Hauser, and Walde 2008; Teixeira and Fortuna, 2010), as seen in the negative association between Absorptive Capacity and GDP growth rate (–0.146). In general terms, the overall results suggest that Absorptive Capacity is the most effective short-term policy for overcoming UNE (–0.807) and YUN (–0.645), after R&D Catching-up.

The final node, HN7, has more positive weights than negative ones, although the most important one, CRD (–2.520), is inhibitory. The responsiveness to CRD limitation is assured by MKP (0.628) and by GRI (0.357). HN7 was labelled Economies of Scale, where such economies of scale result from growth of the market, manifested by increases in potential consumers and in overall R&D expenditures within a given region. The node's overall impact on independent variables (2.177) reinforces the notion that merely increasing market size and the scale of public expenditures to stimulate economic growth is not sufficient to compensate for the restrictive effects of a ‘low-quality’ economic productive capacity, as expressed in GDP (–0.653) and GVA (–0.571) growth rates. Such a conjuncture is also associated with additional UNE (+0.856) and with a negligible effect on YUN (+0.097). It is important to note that the R&D labour market is not strongly linked to mass-market employment. As shown in HN1 (i.e., Domestic Demand) and HN6 (i.e., Absorptive Capacity), the need for job opportunities directed to the portion of the population with average qualifications should be addressed primarily by the service and manufacturing sectors. This is also congruent with the insight provided by HN2 (i.e., R&D Catching-up) that GRI must be coupled with CRD to have a significant effect on UNE and YUN. Despite this, we must be aware that additional job opportunities generated by GRI itself are more suitable to the younger and, on average, most qualified segments of the population, neutralizing the effects of growth in the labour market on YUN.