Employing stochastic frontier analysis, this paper explores whether there is trade-off between the number of borrowers per loan officer and microfinance institution (mfi) asset quality, represented by the portfolio value at risk. It uses a dataset with information from 1,575 mfis from 109 countries for the period 2006-2013. We find corroborative evidence that there is no trade-off between the number of borrowers per loan officer and mfi asset quality, which contravenes the conventional wisdom. We show that mfis have reaped the benefit of economies of scale without compromising asset quality. These findings remain significant across ownership types and regardless of deposit-taking status.

Empleando el análisis de fronteras estocásticas, este trabajo explora si existe un equilibrio entre el número de prestatarios por agente de crédito y la calidad de los activos de las instituciones microfinancieras (imf), representada por el valor de la cartera en riesgo. Usando un conjunto de datos con información de 1 575 imf de 109 países para el periodo 2006-2013, encontramos pruebas corroborantes de que no existe un equilibrio entre el número de prestatarios por agente de crédito y la calidad de los activos de las imf, lo que contraviene el saber convencional. Mostramos que las imf han obtenido el beneficio de las economías de escala sin comprometer la calidad de los activos. Estos hallazgos siguen siendo significativos en todos los tipos de propiedad y sin importar el estado de los depósitos.

Microfinance institutions (mfis) arrange for doorstep delivery of financial services to the poor, who do not have access to the formal banking system. mfis have been praised for their efforts to make financial services available to a wide spectrum of the unreached sections of society. mfis usually have their roots in development-focused entrepreneurial initiatives by socially oriented promoters, whom Yunus and Weber (2009) described as users of entrepreneurial acumen, providing some essential services to the poor to improve their livelihood. Surpluses from such entrepreneurship are not intended to make the promoters or investors richer but rather to be ploughed back into the business to solve the problems of the poor. Here, “profit” takes a back seat, while “purpose” serves as the prime motive for running the enterprise. Although the model is appreciated for its stand on offering financial services at a subsidized rate, its scalability is always an issue, as the viability of the model depends on the steady flow of soft loans or donors’ fund available at below-market interest rates.

With the drying up of such soft loans and funds from Western donors (Singh, Lal, and Bhat, 2010), mfis started exploring the possibility of accessing funds at the market rate from investors. To facilitate fund flow from investors while the existing not-for-profit mfis went through the process of changing their ownership status to for-profit commercial enterprises, a new set of mfis forayed into the microfinance arena to serve the poor on a purely commercial basis. Hence, in addition to financial inclusion, mfis focused on making the microfinance operations both operationally and financially self-sustainable in the shortest possible time.

The question that becomes pertinent here is whether and to what extent the motivation to be financially sustainable would affect the outreach and asset quality of an mfi. While outreach is measured as new members offered financial services during a particular period, asset quality is precisely judged by portfolio value at risk (pvar), which is expressed as the percentage of loans with one or more installments of principal a particular number of days past due, out of the total outstanding loan portfolio. Scholars like Cull, Demirgüç-Kunt, and Morduch (2007), Hermes, Lensink, and Meesters (2011), and Abate, Borzaga, and Getnet (2014) had investigated whether outreach was sacrificed to become cost-efficient. These studies established that trade-off occurs between outreach and efficiency. This seems plausible, as reaching new members with small ticket loans is more costly than offering high-value repeat loans to existing borrowers. This is because ex ante search costs and group development costs, and ex post monitoring costs, are all higher when an mfi focuses more on outreach (Mersland and Strom, 2010; Serrano-Cinca and Gutiérrez-Nieto, 2014). Nevertheless, there are dissent voices, as for example Sathye, Mukhopadhyay, and Sathye (2014), that from case studies of five mfis in eastern India, argue that competing objectives of efficiency and outreach can simultaneously be achieved following ethical practices.

More focus on financial sustainability and efficiency may also adversely affect the quality of the loan portfolio. In aiming to make its microfinance operation more cost-efficient, an mfi may add more clients per loan officer. In order to leverage economies of scale, the mfi may decide that its loan officers will make fortnightly visits to groups rather than weekly visits. Equitas, one of the fastest growing mfis in India, follows this arrangement. At Bandhan Financial Services Private Ltd., India's largest mfi, each loan officer attends on average weekly meetings of 25 groups comprising 600 members. Fortnightly group meetings would enhance the mfi's capacity to 50 groups or 1200 members per loan officer. This means the intervals at which a loan officer would come in contact with borrowers would move from one week to two weeks. As loan officers collect loan installments during these group meetings, this new mechanism would make loan repayments less frequent. As the borrower-loan officer interface is understood to have a considerable impact on the mfi's recovery, less frequent visits are expected to reduce borrower monitoring by the respective loan officer. Moreover, for poor borrowers, for whom saving is difficult, may find a repayment schedule with less frequent installments to be burdensome, as it requires them to keep aside surplus income for fortnightly repayments (Rutherford, 2009, p. 42).

In addition to peer selection (Wenner, 1995; Zeller, 1998; Ghatak, 1999, 2000), peer monitoring (Stiglitz, 1990; Wydick, 1999; Al-Azzam, Hill, and Sarangi, 2012), and joint liability (Besley and Coate, 1995) of the microfinance group members, close monitoring by loan officers is claimed to be a prime reason for the success of micro-lending (Dixon, Ritchie, and Siwale, 2007). Loan officers play a key role in successful microfinance operations, as they are involved throughout the loaning process, from borrower identification to loan closing. An extraordinary repayment in microfinance lending is also believed to be heavily relied on loan officers’ frequent contact at regular intervals with microcredit clients at group/center meetings (Armendariz de Aghion and Morduch, 2005, p. 131). If a borrower fails to turn up to his or her scheduled group meeting or fails to honor the repayment commitment, the loan officer takes immediate steps, such as inquiring of group members or visiting the borrower's house to assess whether the default is voluntary or non-voluntary in nature and how to regularize the account. Increasing the time gap between two meetings would lead to under-monitoring. As the deviation in repayment would be brought to the notice of the loan officer after a longer period, asset quality would be expected to be exposed to a higher risk.

Jain (1996) argued that the success of Grameen Bank's credit program was dependent on repeated supervision and field level crosschecking by loan officers. Gonzalez-Vega et al. (1997, p. 74), using borrowing data from Caja Los Andes and Bancosol, two Bolivian mfis, argued that frequent repayments played a critical role in ensuring high repayment performance. Silwal (2003), working with borrowing data from nine village banks in Nepal, found that delinquency in loans with weekly repayment schedules was nearly half that of loans repaid in a lump sum after three to four months. Nawai and Shariff (2012), working with a dataset of Malaysian microfinance clients, found that frequent visits by loan officers at business premises had a positive and significant effect on repayment performance. Berg, Lensink, and Servin (2015), working with microfinance borrower data from Mexico, found that men loan officers experienced higher loan repayment than women loan officers. For example, Field and Pande (2008), working with data from a field experiment in the West Bengal state of India, did not find any significant dampening effect on repayment performance from lower frequency repayment schedules. They even suggest that by following lower frequency repayments, that is, less frequent interactions through less frequent group meetings, mfis could improve outreach to four times its existing clients while maintaining high repayment performance.

The above-mentioned studies attribute a questionable role to less frequent visits and less frequent repayment installments, a direct outcome of more borrowers per loan officer, in explaining the repayment performance of the micro-lenders. As long as the financial self-sufficiency ratio is well above unity, any small deterioration in asset quality might not be very alarming. However, with the government-imposed cap on interest rates mfis can charge the final consumer and the increasing cost of funds mfis would have less of a cushion for provisioning of loan losses. From the lender's perspective, it is essential to know whether less frequent group meetings and less frequent repayment installments affect the asset quality of the mfi, from a scientific and scholarly perspective. We argue that the number of borrowers per loan officer stands as a good proxy for this, as the number of borrowers per loan officer can only increase if the mfi allows less frequent visits by loan officers. This less frequent visit schedule is a corollary to less frequent group meetings and less frequent repayment installments, as it is an established practice in the microfinance domain of compulsory visits by the loan officer during group meetings, where installments are also collected. Research work exploring such a relationship is very limited.

We aim to fill the gap in the existing empirical investigation. We offer an in-depth assessment of the potential impact of the number of borrowers per loan officer on the asset quality of mfis, using a larger dataset with information from 1,575 mfis from 109 countries spanning the period 2006-2013.

The contribution of this paper is two folds. First, and of more general nature, to the best of the authors’ knowledge, this paper is the first cross-country empirical investigation exploring the relationship between number of borrowers per loan officer and portfolio value at risk. Second, on the methodological front, we employ stochastic frontier analysis (sfa) of Battese and Coelli (1995) —a technique that can jointly estimate the stochastic frontier production function along with the technical inefficiency and has not been used earlier in exploring the factors responsible for the deterioration of asset quality of financial institutions, particularly in the context of microfinance—. We test the null hypothesis that there is no trade-off between the number of borrowers per loan officer and mfi asset quality. Our empirical inquiry suggests that there is no compelling evidence to reject the null.

The rest of the paper is arranged as follows. Section 2 lays out the methodology, followed by an explanation of the data in Section 3. In section 4, we present the results and discuss the findings. Section 5 concludes.

MODELTo analyze the repayment performance of mfis, we adopt the stochastic frontier analysis, sfa, model suggested by Battese and Coelli (1995), henceforth the bc-sfa model. The merits of the bc-sfa are as follows. First, unlike data envelopment analysis (dea), where the production frontier is deterministic and bounded by the non-stochastic quantity, in bc-sfa, the production frontier is probabilistic and accounts for measurement errors and other sources of random effects. Second, unlike the traditional two-step sfa model followed by Aigner, Lovell, and Schmidt (1977) and Meeusen and van den Broeck (1977), bc-sfa jointly estimates the production frontier and the coefficients of the inefficiency regressors.

Two basic models are prevalent for examining the functioning of a financial institution: production and intermediation (Athanassopoulos, 1997). Following the production approach, an mfi would be considered a producer of micro-loans and small deposits, with the number of employees and financial expenses as inputs. Under the intermediation approach, an mfi performs the role of financial intermediary between depositors as well as funding agencies and microcredit clients, where it transfers funds from a surplus economic agency to a deficit one. For the purpose of this paper, we hold that an mfi is the producer of a risky asset, represented in terms of portfolio value at risk >30 days, pvar, which is an output of three inputs: Borrowers per loan officer (bplo), loan amount per borrower (lapb), and gross loan portfolio of the mfi (glp). As explained, the number of borrowers per loan officer has been included as a proxy for the frequency of loan officer visits to groups. The higher the number of borrowers per loan officer, the less frequent the interactions between the loan officer and the group, which is expected to slacken monitoring and may adversely affect repayment performance. Alternatively, the number of borrowers per loan officer is expected to have a positive impact on pvar. The loan amount per borrower captures the level of a borrower's indebtedness. Following Vogelgesang (2003), we assume that with excess borrowing, a micro-borrower may utilize more funds for non-productive purposes, and, hence, the surplus generated out of the productive use of the funds may not be sufficient to meet the repayment obligations. Hence, we hypothesize that over-indebtedness would have a dampening effect on repayment performance. That is, a higher loan amount per borrower is expected to put more assets at risk. Further, following Despallier, Guerin, and Mersland (2011), we assume that with an increasing gross portfolio, the mfi would carry greater risk of poor asset quality. Thus, we hold that an mfi may have to accept more risky assets with an increasing gross portfolio.

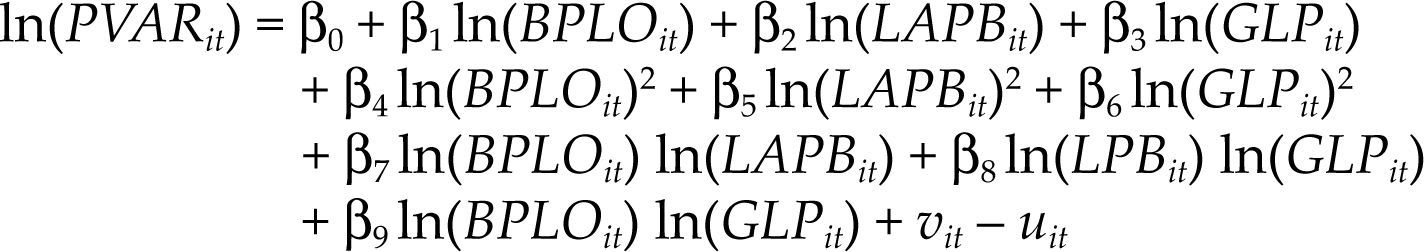

Following Battese and Coelli (1995), the translog specification of the stochastic frontier production function of the portfolio value at risk is as follows:

where the technical inefficiency effects are assumed to be defined by equation [2] as follows:In equation [1], ln(PVARit) represents the logarithmic function of portfolio value at risk for 30 days (in U.S. dollars) faced by the ithmfi at time t; ln(BPLOit) represents the logarithmic function of borrowers per loan officer of the ithmfi at time t; ln(LAPBit) is the logarithmic function of the loan amount per borrower (in U.S. dollars) of the ithmfi at time t, and ln(GLPit) refers to the logarithmic function of the gross loan portfolio (in U.S. dollars) of the ithmfi at time t.

Although for-profit mfis were found to be more technically efficient than their not-for-profit counterparts (Servin, Lensink, and van den Berg, 2012), for-profit mfis, (i.e., banks and non-banking financial institutions, nbfis) may attach more borrowers to one loan officer in an effort to grow faster, and thus repayment performance may be eventually decline owing to slackened monitoring. Hence, in order to control for the fact that the portfolio value at risk may vary with ownership status, in the model, we added a vector of dummies to capture the ownership status of the mfi (MFISTAT). In particular, we added dummy variables for banks, nbfis, and non-government organizations (ngos). Given that our model had an intercept term, cooperative mfi was considered the base to avoid multicollinearity.

Further, the literature (e.g., Godquin, 2004) has also documented the positive impact of “credit plus” services, which include savings, insurance, capacity building, and support for market linkage, on repayment performance. In order to control for the fact that an mfi's repayment performance may vary with the extent to which it can offer savings facilities to its borrowers, we included deposit-to-loan ratio (DLR) as additional control variable.

As the gross national income per capita (GNIPC) is a crude measure of a country's level of poverty, and as microfinance has historically flourished in economically backward nations as a tool for poverty alleviation, we added GNIPC as a control variable to capture the country effect.

Finally, we included YEAR as a dummy for the year, spanning from 1 to 8, as the inefficiency effect may vary linearly with time.

The term vit, which captures the random error of the ithmfi at time t, is assumed to be iidN0,σv2 and independently distributed of uit, which are non-negative random variables associated with production inefficiency of the ithmfi at time t. vit which explains measurement errors and random effects, is distributed as a standard normal variable. The term uit is obtained through truncation at 0 and assumed to be iidNzitδ,σu2 where zit is an (m×1) vector of the unknown coefficients of the mfi-specific variables that may vary over time, and δ is a (1×m) vector of the unknown coefficients of the mfi-specific inefficiency variables. The term wit in equation [2] is defined by the truncation of the normal distribution with 0 mean and variance, σw2, such that wit ≥ – zitδ.

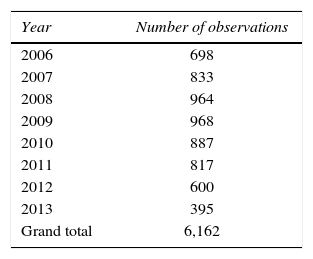

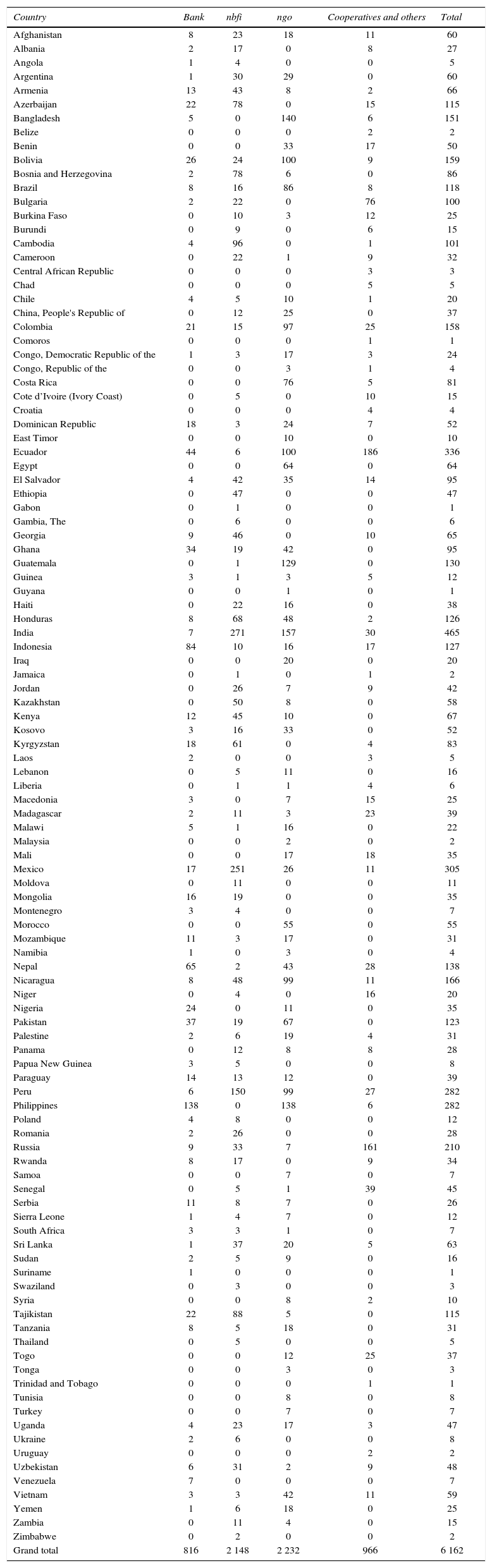

DATAThe data used for analysis in this study were sourced from the Microfinance Information Exchange Network (MixMarket), a Web portal that provides reliable information on mfis worldwide. Post-adjustments for missing data, the complete dataset consists of information for 1,575 mfis spanning the period 2006-2013. Our sample has 6,162 observations for the period 2006-2013 (refer Table 1).

We have constructed a panel set of operational and financial variables that are fairly representative of the types of mfis according to their ownership status globally. Appendix 1 reports the number of observations by ownership status. The highest number of observations (2,232) is from the non-profit ngo sector, followed by for-profit nbfi (2,148), cooperatives and others (966), and banks (816).

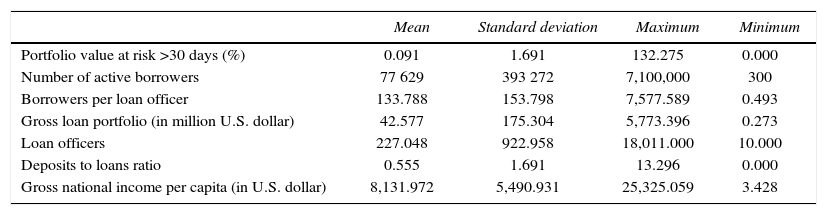

Table 2 presents a summary of the descriptive statistics of the basic variables. Those basic variables were used to develop the derived variables, namely portfolio value at risk (in U.S. dollars), which was derived by multiplying gross loan portfolio by portfolio value at risk >30 days (percent) and the loan amount per borrower, which was derived by dividing gross loan portfolio by the number of active borrowers. Those variables were used in the estimation of the production function given in equation [1].

Descriptive statistics of the variables used in the study.

| Mean | Standard deviation | Maximum | Minimum | |

|---|---|---|---|---|

| Portfolio value at risk >30 days (%) | 0.091 | 1.691 | 132.275 | 0.000 |

| Number of active borrowers | 77 629 | 393 272 | 7,100,000 | 300 |

| Borrowers per loan officer | 133.788 | 153.798 | 7,577.589 | 0.493 |

| Gross loan portfolio (in million U.S. dollar) | 42.577 | 175.304 | 5,773.396 | 0.273 |

| Loan officers | 227.048 | 922.958 | 18,011.000 | 10.000 |

| Deposits to loans ratio | 0.555 | 1.691 | 13.296 | 0.000 |

| Gross national income per capita (in U.S. dollar) | 8,131.972 | 5,490.931 | 25,325.059 | 3.428 |

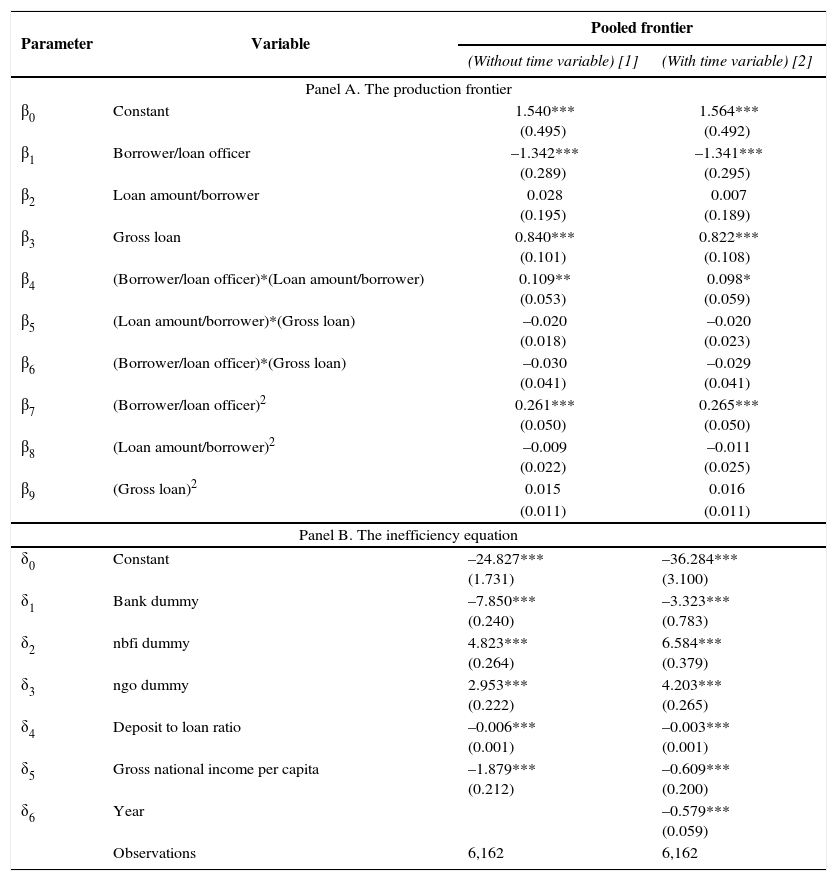

Table 3 provides the estimation results with respect to the value of the portfolio value at risk with the number of borrowers per loan officer, the loan amount per borrower, and the gross loan portfolio. Here, we have employed bc-sfa, which jointly estimates the production frontier along with the inefficiency equation. With reference to the production function, we estimate the translog specification following equation [1]. In Table 3, results without the year dummy are presented in column [1], and results with the year dummy are shown in column [2].

Pooled production frontier estimates of all mfis.

| Parameter | Variable | Pooled frontier | |

|---|---|---|---|

| (Without time variable) [1] | (With time variable) [2] | ||

| Panel A. The production frontier | |||

| β0 | Constant | 1.540*** (0.495) | 1.564*** (0.492) |

| β1 | Borrower/loan officer | –1.342*** (0.289) | –1.341*** (0.295) |

| β2 | Loan amount/borrower | 0.028 (0.195) | 0.007 (0.189) |

| β3 | Gross loan | 0.840*** (0.101) | 0.822*** (0.108) |

| β4 | (Borrower/loan officer)*(Loan amount/borrower) | 0.109** (0.053) | 0.098* (0.059) |

| β5 | (Loan amount/borrower)*(Gross loan) | –0.020 (0.018) | –0.020 (0.023) |

| β6 | (Borrower/loan officer)*(Gross loan) | –0.030 (0.041) | –0.029 (0.041) |

| β7 | (Borrower/loan officer)2 | 0.261*** (0.050) | 0.265*** (0.050) |

| β8 | (Loan amount/borrower)2 | –0.009 (0.022) | –0.011 (0.025) |

| β9 | (Gross loan)2 | 0.015 | 0.016 |

| (0.011) | (0.011) | ||

| Panel B. The inefficiency equation | |||

| δ0 | Constant | –24.827*** (1.731) | –36.284*** (3.100) |

| δ1 | Bank dummy | –7.850*** (0.240) | –3.323*** (0.783) |

| δ2 | nbfi dummy | 4.823*** (0.264) | 6.584*** (0.379) |

| δ3 | ngo dummy | 2.953*** (0.222) | 4.203*** (0.265) |

| δ4 | Deposit to loan ratio | –0.006*** (0.001) | –0.003*** (0.001) |

| δ5 | Gross national income per capita | –1.879*** (0.212) | –0.609*** (0.200) |

| δ6 | Year | –0.579*** (0.059) | |

| Observations | 6,162 | 6,162 | |

Note: Standard error in parantheses. ***, **, * indicate significant at a level of 1 percent; 5 percent and 10 percent, respectively.

The main focus of the paper is to identify any possible trade-off between the value of portfolio value at risk and the number of borrowers serviced by a loan officer. With reference to equation [1], as explained in Section 2, we expect that the coefficients of the variables borrower per loan officer (β1), loan amount per borrower (β2), and gross loans (β3) are expected to carry positive signs, as all the variables are assumed to yield poor quality assets, that is, adversely affect the asset quality of an mfi. With respect to the inefficiency equation under equation [1], we added the control variables —type of the mfis per their ownership status, deposit-to-loan ratio, net national product per capita, and a year dummy. Panel A of Table 3 refers to the estimation results of the production frontier. A positive coefficient indicates an outward shift of the production frontier, and therefore, ceteris paribus, higher output. While the coefficients associated with the loan amount per borrower and the gross loan portfolio, as expected, had positive signs, we found that the coefficient associated with borrowers per loan officer was negative and significant at the 1 percent level. This means that an increasing number of borrowers per loan officer did not add to the mfi's risky portfolio. In this study, borrowers per loan officer stands as a proxy for loan officers’ frequency of visits to microfinance borrowers. Following the established wisdom (e.g., Gonzalez-Vega et al., 1997, p. 74; Silwal, 2003; Armendariz de Aghion and Morduch, 2005, p. 131; Nawai and Shariff, 2012) it may be assumed that more borrowers per loan officer would result in less frequent interactions between the loan officer and the micro-borrower, and, hence, would reduce monitoring, which may have an adverse impact on repayment performance. Our results are in contrast to the established wisdom, and instead extend support to the findings from the field investigation conducted by Field and Pande (2008) in the West Bengal state of India. Field and Pande (2008) did not find any dampening effect of less frequent visits to borrowers but rather advocated that more borrowers attached to one loan officer would improve the outreach of the mfi at a lower cost.

Panel B of Table 3 presents the estimation results of the inefficiency frontier, defined in equation [2]. The year dummy in the inefficiency model (column [2]) accounts for the time-varying inefficiency effect. A positive coefficient in the inefficiency equation expresses inefficiency hindering maximization of production and is, hence, undesirable. As our output variable in the production function is the portfolio value at risk, the interpretation will be opposite. A positive value of the coefficients attached to the variables of the inefficiency equation is desirable, whereas a negative value of the coefficient indicates that the variable influences an increase of portfolio value at risk and is not desirable. The estimate for the coefficient associated with the bank dummy is negative, which indicates that the bank-mfis are more technically efficient in producing risky assets. Estimates for the coefficients associated with the nbfi dummy and the ngo dummy are positive, which shows that nbfi-mfis and ngo-mfis are more technically inefficient in producing risky assets, that is, they have healthier portfolio quality owing to better recovery performance. The estimate for the coefficient associated with deposit-to-loan ratio is negative and, hence, undesirable for the mfi, although the value of the coefficient is only 0.006. This implies that a 1 percent increase in the deposit-to-loan ratio would result in a 0.006 percent increase in the portfolio value at risk, ceteris paribus. That is, a change in the deposit-to-loan ratio would impact the asset quality of an mfi only to a limited extent. The estimate for the coefficient associated with gross national product per capita is negative, which indicates that mfis originating in countries with higher gross national product per capita are more technically inefficient in producing risky assets as compared to mfis originating in countries with a lower gross national product per capita. This implies that mfis from poorer and less developed nations show better repayment performance as compared to mfis from comparatively richer and developed nations. The negative sign associated with the coefficient of the Year variable suggests that the mfis’ technical inefficiency of yielding risky assets declined over the eight-year period of 2006-2013. This implies that over the study period, mfis experienced deterioration in their asset quality owing to poor repayment performance.

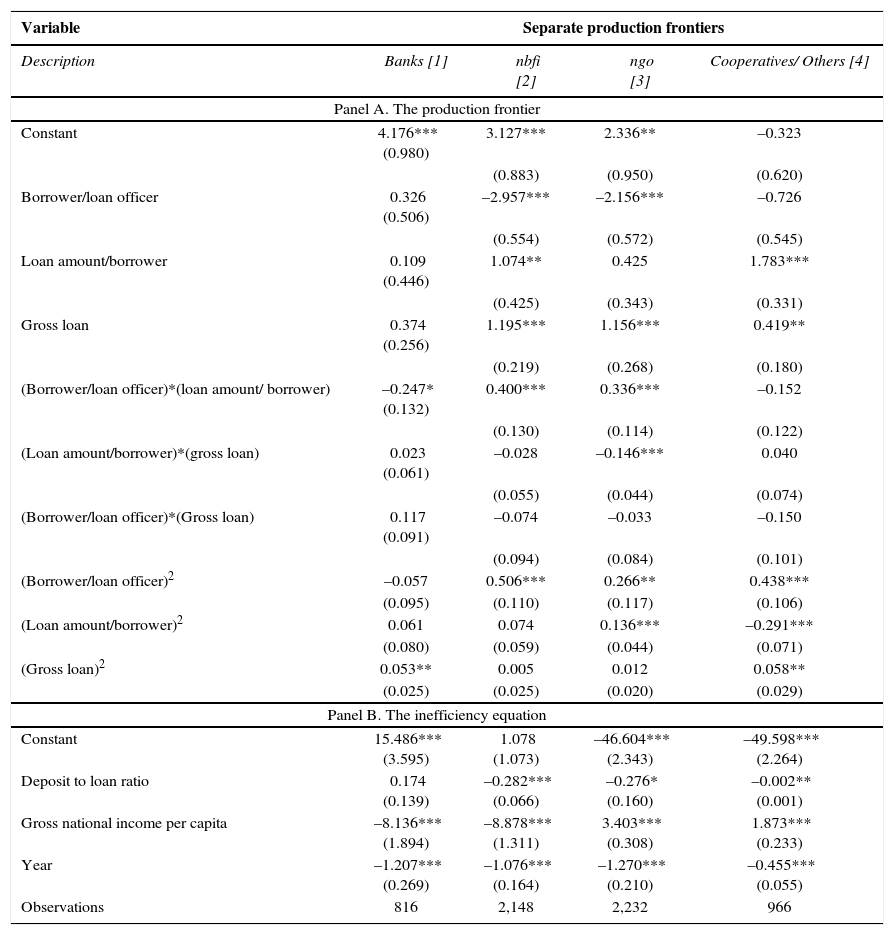

As the analysis of the pooled production frontier reveals a differential impact of ownership status on the portfolio value at risk, to probe further, we estimate separate production functions for each of the four types of ownership status. With reference to Table 4, for bank-mfis, borrowers per loan officer had a positive impact on the portfolio value at risk. However, the relationship is very weak, because the coefficient is highly insignificant. For mfis belonging to the other three ownership types, nbfis, ngos, and cooperatives/others, borrowers per loan officer was found to have a dampening effect on the portfolio value at risk. This implies that for mfis other than bank-mfis, increasing the number of borrowers per loan officer did not lead to deterioration in asset quality. Even for bank-mfis, this deterioration was insignificant. The result, again, is in contrast to the established wisdom that a trade-off exists between the number of borrowers per loan officer and portfolio quality. As expected, across ownership status, two other input variables —loan amounts per borrower and gross loans— were found to have positive impacts on portfolio value at risk.

Production frontier estimates of mfis by ownership status.

| Variable | Separate production frontiers | |||

|---|---|---|---|---|

| Description | Banks [1] | nbfi [2] | ngo [3] | Cooperatives/ Others [4] |

| Panel A. The production frontier | ||||

| Constant | 4.176*** (0.980) | 3.127*** | 2.336** | –0.323 |

| (0.883) | (0.950) | (0.620) | ||

| Borrower/loan officer | 0.326 (0.506) | –2.957*** | –2.156*** | –0.726 |

| (0.554) | (0.572) | (0.545) | ||

| Loan amount/borrower | 0.109 (0.446) | 1.074** | 0.425 | 1.783*** |

| (0.425) | (0.343) | (0.331) | ||

| Gross loan | 0.374 (0.256) | 1.195*** | 1.156*** | 0.419** |

| (0.219) | (0.268) | (0.180) | ||

| (Borrower/loan officer)*(loan amount/ borrower) | –0.247* (0.132) | 0.400*** | 0.336*** | –0.152 |

| (0.130) | (0.114) | (0.122) | ||

| (Loan amount/borrower)*(gross loan) | 0.023 (0.061) | –0.028 | –0.146*** | 0.040 |

| (0.055) | (0.044) | (0.074) | ||

| (Borrower/loan officer)*(Gross loan) | 0.117 (0.091) | –0.074 | –0.033 | –0.150 |

| (0.094) | (0.084) | (0.101) | ||

| (Borrower/loan officer)2 | –0.057 | 0.506*** | 0.266** | 0.438*** |

| (0.095) | (0.110) | (0.117) | (0.106) | |

| (Loan amount/borrower)2 | 0.061 | 0.074 | 0.136*** | –0.291*** |

| (0.080) | (0.059) | (0.044) | (0.071) | |

| (Gross loan)2 | 0.053** | 0.005 | 0.012 | 0.058** |

| (0.025) | (0.025) | (0.020) | (0.029) | |

| Panel B. The inefficiency equation | ||||

| Constant | 15.486*** (3.595) | 1.078 (1.073) | –46.604*** (2.343) | –49.598*** (2.264) |

| Deposit to loan ratio | 0.174 (0.139) | –0.282*** (0.066) | –0.276* (0.160) | –0.002** (0.001) |

| Gross national income per capita | –8.136*** (1.894) | –8.878*** (1.311) | 3.403*** (0.308) | 1.873*** (0.233) |

| Year | –1.207*** (0.269) | –1.076*** (0.164) | –1.270*** (0.210) | –0.455*** (0.055) |

| Observations | 816 | 2,148 | 2,232 | 966 |

Note: Standard error in parentheses. ***, **, * indicate significant at a level of 1 percent; 5 percent and 10 percent, respectively.

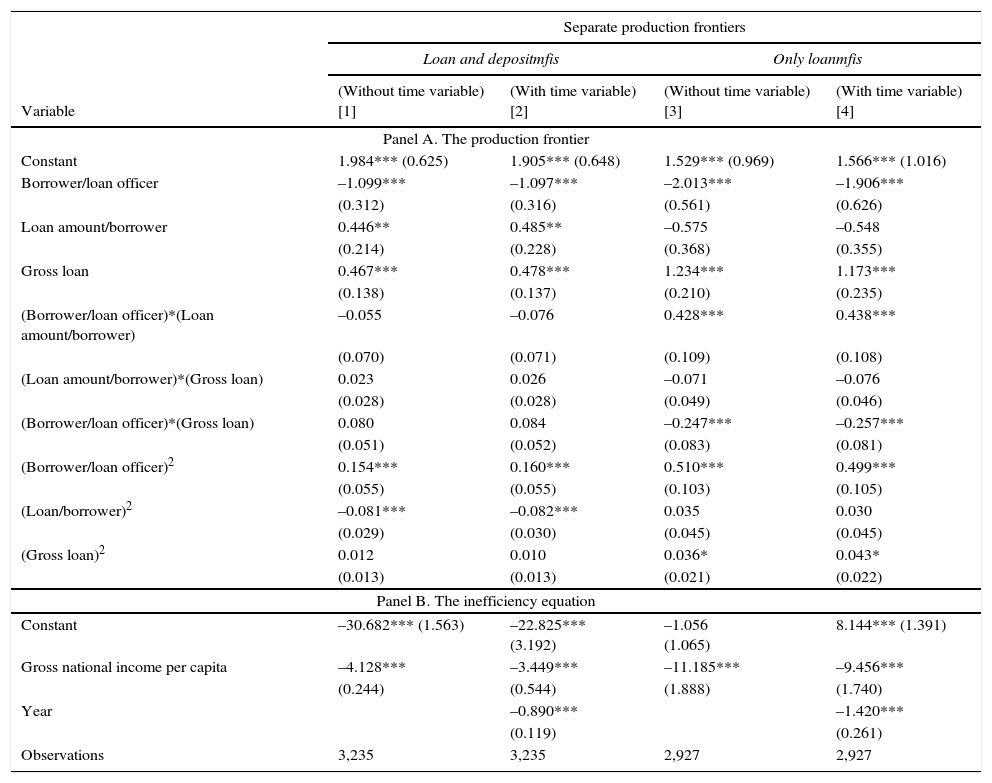

We further examined whether the impact of borrowers per loan officer on portfolio quality varies with the deposit-taking status of the mfi. With reference to Table 5, columns [1] and [2] show estimates for loan and deposit mfis, that is, mfis involved in both deposit mobilization and micro-lending, while columns [3] and [4] show estimates for loan-only mfis, that is, mfis involved only in extending loans to their microfinance borrowers. Across deposit-taking status, the estimates for the coefficients associated with borrowers per loan officer were negative. This implies that even if the mfi focuses only on lending activities, servicing more borrowers with one loan officer would not necessarily adversely affect repayment performance. The impact of other two input variables —loan amount per borrower and gross loan portfolio— were as expected to have a positive impact on portfolio value at risk. This shows that by attaching more number of borrowers to a loan officer mfis could reap the benefit of economies of scale without compromising asset quality. However, the positive sign attached to the coefficient corresponding to loan amount per borrower indicates that over-lending to individual borrowers would carry adverse impact on the asset quality. Hence, a cautious move is advisable as while our empirical results extended support for outreach it checked for over-lending.

Production frontier estimates of mfis by deposit-taking status.

| Variable | Separate production frontiers | |||

|---|---|---|---|---|

| Loan and depositmfis | Only loanmfis | |||

| (Without time variable) [1] | (With time variable) [2] | (Without time variable) [3] | (With time variable) [4] | |

| Panel A. The production frontier | ||||

| Constant | 1.984*** (0.625) | 1.905*** (0.648) | 1.529*** (0.969) | 1.566*** (1.016) |

| Borrower/loan officer | –1.099*** | –1.097*** | –2.013*** | –1.906*** |

| (0.312) | (0.316) | (0.561) | (0.626) | |

| Loan amount/borrower | 0.446** | 0.485** | –0.575 | –0.548 |

| (0.214) | (0.228) | (0.368) | (0.355) | |

| Gross loan | 0.467*** | 0.478*** | 1.234*** | 1.173*** |

| (0.138) | (0.137) | (0.210) | (0.235) | |

| (Borrower/loan officer)*(Loan amount/borrower) | –0.055 | –0.076 | 0.428*** | 0.438*** |

| (0.070) | (0.071) | (0.109) | (0.108) | |

| (Loan amount/borrower)*(Gross loan) | 0.023 | 0.026 | –0.071 | –0.076 |

| (0.028) | (0.028) | (0.049) | (0.046) | |

| (Borrower/loan officer)*(Gross loan) | 0.080 | 0.084 | –0.247*** | –0.257*** |

| (0.051) | (0.052) | (0.083) | (0.081) | |

| (Borrower/loan officer)2 | 0.154*** | 0.160*** | 0.510*** | 0.499*** |

| (0.055) | (0.055) | (0.103) | (0.105) | |

| (Loan/borrower)2 | –0.081*** | –0.082*** | 0.035 | 0.030 |

| (0.029) | (0.030) | (0.045) | (0.045) | |

| (Gross loan)2 | 0.012 | 0.010 | 0.036* | 0.043* |

| (0.013) | (0.013) | (0.021) | (0.022) | |

| Panel B. The inefficiency equation | ||||

| Constant | –30.682*** (1.563) | –22.825*** (3.192) | –1.056 (1.065) | 8.144*** (1.391) |

| Gross national income per capita | –4.128*** | –3.449*** | –11.185*** | –9.456*** |

| (0.244) | (0.544) | (1.888) | (1.740) | |

| Year | –0.890*** | –1.420*** | ||

| (0.119) | (0.261) | |||

| Observations | 3,235 | 3,235 | 2,927 | 2,927 |

Note: Standard error in parentheses. ***, **, * indicate significant at a level of 1 percent; 5 percent, and 10 percent, respectively.

Summarizing the results, we did not find support for the established wisdom that a higher number of borrowers serviced by one loan officer would create less frequent borrower-loan officer interaction and, hence, deteriorated asset quality owing to inadequate monitoring of the loan accounts. Rather, we found that the number of borrowers per loan officer had a negative impact on portfolio value at risk, which indicates that with an increasing number of borrowers per loan officer, mfis in our sample improved their asset quality through better repayment performance. These findings remain significant even with a number of control variables, as well as across ownership type and deposit-taking status. Our results do seem to support the findings of Field and Pande (2008), even though they focus only on borrower-level data from one mfi spread over a single Indian state.

The reason for absence of any such trade-off between number of borrowers per loan officer and microfinance institution asset quality may also be traced in peer selection, peer monitoring, and joint-liability mechanism followed by the microfinance groups. Because the group remains jointly liable for honoring debt obligations in group-based lending, it institutes appropriate methods of screening to minimize adverse selection, makes sure that every borrower utilizes the loan properly to control the moral hazard, is proactively involved in identifying the reason for any non-repayment, and even exerts due pressure on defaulting members to regularize the account. Living in close proximity or the same neighborhood means group members are well informed about the credit history of their neighbors, which may prevent entry to the group of a member carrying high default probability. This information is difficult for an outside formal lending agency to collect. Group homogeneity (in terms of default risk), an outcome of such a peer selection mechanism, improves the repayment behavior of the group. Evidence surfaced from the field level empirical investigation conducted by Wenner (1995) in Costa Rica, Zeller (1998) in Madagascar, Wydick (1999) in Guatemala, and Al-Azzam, Hill, and Sarangi (2012) in Jordon extends support to the positive role played by peer selection, peer monitoring, and joint liabi-lity to ensure good repayment in microfinance lending. In a more recent investigation, by applying stochastic cost frontier on a dataset of 162 mfis from 45 countries, Hartarska and Mersland (2012) found that mfis following prudent governance mechanisms could better balance the dual objective of maximizing client outreach while minimizing the cost including the cost of impairment represented by portfolio value at risk. Good governance was reflected by board comprising of nine members with more outsiders as well as creditors on the board and Chief Executive Officer not chairing the board. Thus, group level peer selection, peer monitoring, and joint liability followed by an mfi with good governance mechanism would have relaxed the need for stringent external monitoring and could continue to result good repayment even during less frequent interactions between the group and the credit officer.

CONCLUSIONSThis study draws its motivation from an inconclusive research question —whether for-profit mfis efforts to grow faster by adding more borrowers to each loan officer compromises their asset quality—. This paper employed bc-sfa, a non-traditional less-explored econometric technique that simultaneously estimates the stochastic frontier production function and the technical inefficiency, to explore the impact of the number of borrowers per loan officer on mfi repayment performance. The data pertaining to 1,575 mfis from 109 countries with 6,162 observations spanning the period 2006-2013 were sourced from MixMarket.

The results of this study go against the conventional wisdom that to ensure good repayment performance, an mfi has to maintain a strict vigil over its borrowers, and to do so, loan officers have to frequently interact with borrowers. Close monitoring through this mechanism was thought to be slackened if the mfi decided to service more borrowers through its existing loan officers. However, our results show that while excessive lending to individual borrowers/groups and a higher mfi gross loan portfolio were associated with greater portfolio value at risk, the number of borrowers per loan officer did not add to the mfi's risky assets.

These findings are important, as with the drying up of donor funds at the same time that a number of mfis are aiming to make their microfinance operations financially self-sustainable, adding more borrowers to one loan officer would help mfis to reap the benefit of economies of scale. On one hand, this would help mfis to reach more micro-borrowers without compromising their asset quality. On the other hand, more number of poor clients would also get access to the financial resources which would make them possible to come out of the poverty trap. Hence, it is recommended that: first, mfis, to reach financial self-sufficiency, may allow loan officers to serve more number of borrowers. However, the mfi should ensure that less frequent interactions between the group and the credit officer is adequately replaced by stringent practice of peer selection, peer monitoring, and adherence to joint liability mechanism by the group members. And secondly, mfis in the urge of building larger loan portfolio at a shortest possible time should not over-lend to the borrowers. As suggested by our empirical investigation this over-lending with every possibility would adversely affect the asset quality of an mfi.

The bc-sfa model helped us to jointly estimate the stochastic frontier production function along with the technical inefficiency that enabled to prove that by assigning more borrowers to one loan officer mfis could reap the benefit of economies of scale without compromising asset quality, and this insightful finding was possible due to the novelty of the model.

As no research has yet explored the relationship between the number of borrowers per loan officer and portfolio quality at the regional or national level, in the future, using the bc-sfa model, this research can be extended to regional or country-level mfis.

| Country | Bank | nbfi | ngo | Cooperatives and others | Total |

|---|---|---|---|---|---|

| Afghanistan | 8 | 23 | 18 | 11 | 60 |

| Albania | 2 | 17 | 0 | 8 | 27 |

| Angola | 1 | 4 | 0 | 0 | 5 |

| Argentina | 1 | 30 | 29 | 0 | 60 |

| Armenia | 13 | 43 | 8 | 2 | 66 |

| Azerbaijan | 22 | 78 | 0 | 15 | 115 |

| Bangladesh | 5 | 0 | 140 | 6 | 151 |

| Belize | 0 | 0 | 0 | 2 | 2 |

| Benin | 0 | 0 | 33 | 17 | 50 |

| Bolivia | 26 | 24 | 100 | 9 | 159 |

| Bosnia and Herzegovina | 2 | 78 | 6 | 0 | 86 |

| Brazil | 8 | 16 | 86 | 8 | 118 |

| Bulgaria | 2 | 22 | 0 | 76 | 100 |

| Burkina Faso | 0 | 10 | 3 | 12 | 25 |

| Burundi | 0 | 9 | 0 | 6 | 15 |

| Cambodia | 4 | 96 | 0 | 1 | 101 |

| Cameroon | 0 | 22 | 1 | 9 | 32 |

| Central African Republic | 0 | 0 | 0 | 3 | 3 |

| Chad | 0 | 0 | 0 | 5 | 5 |

| Chile | 4 | 5 | 10 | 1 | 20 |

| China, People's Republic of | 0 | 12 | 25 | 0 | 37 |

| Colombia | 21 | 15 | 97 | 25 | 158 |

| Comoros | 0 | 0 | 0 | 1 | 1 |

| Congo, Democratic Republic of the | 1 | 3 | 17 | 3 | 24 |

| Congo, Republic of the | 0 | 0 | 3 | 1 | 4 |

| Costa Rica | 0 | 0 | 76 | 5 | 81 |

| Cote d’Ivoire (Ivory Coast) | 0 | 5 | 0 | 10 | 15 |

| Croatia | 0 | 0 | 0 | 4 | 4 |

| Dominican Republic | 18 | 3 | 24 | 7 | 52 |

| East Timor | 0 | 0 | 10 | 0 | 10 |

| Ecuador | 44 | 6 | 100 | 186 | 336 |

| Egypt | 0 | 0 | 64 | 0 | 64 |

| El Salvador | 4 | 42 | 35 | 14 | 95 |

| Ethiopia | 0 | 47 | 0 | 0 | 47 |

| Gabon | 0 | 1 | 0 | 0 | 1 |

| Gambia, The | 0 | 6 | 0 | 0 | 6 |

| Georgia | 9 | 46 | 0 | 10 | 65 |

| Ghana | 34 | 19 | 42 | 0 | 95 |

| Guatemala | 0 | 1 | 129 | 0 | 130 |

| Guinea | 3 | 1 | 3 | 5 | 12 |

| Guyana | 0 | 0 | 1 | 0 | 1 |

| Haiti | 0 | 22 | 16 | 0 | 38 |

| Honduras | 8 | 68 | 48 | 2 | 126 |

| India | 7 | 271 | 157 | 30 | 465 |

| Indonesia | 84 | 10 | 16 | 17 | 127 |

| Iraq | 0 | 0 | 20 | 0 | 20 |

| Jamaica | 0 | 1 | 0 | 1 | 2 |

| Jordan | 0 | 26 | 7 | 9 | 42 |

| Kazakhstan | 0 | 50 | 8 | 0 | 58 |

| Kenya | 12 | 45 | 10 | 0 | 67 |

| Kosovo | 3 | 16 | 33 | 0 | 52 |

| Kyrgyzstan | 18 | 61 | 0 | 4 | 83 |

| Laos | 2 | 0 | 0 | 3 | 5 |

| Lebanon | 0 | 5 | 11 | 0 | 16 |

| Liberia | 0 | 1 | 1 | 4 | 6 |

| Macedonia | 3 | 0 | 7 | 15 | 25 |

| Madagascar | 2 | 11 | 3 | 23 | 39 |

| Malawi | 5 | 1 | 16 | 0 | 22 |

| Malaysia | 0 | 0 | 2 | 0 | 2 |

| Mali | 0 | 0 | 17 | 18 | 35 |

| Mexico | 17 | 251 | 26 | 11 | 305 |

| Moldova | 0 | 11 | 0 | 0 | 11 |

| Mongolia | 16 | 19 | 0 | 0 | 35 |

| Montenegro | 3 | 4 | 0 | 0 | 7 |

| Morocco | 0 | 0 | 55 | 0 | 55 |

| Mozambique | 11 | 3 | 17 | 0 | 31 |

| Namibia | 1 | 0 | 3 | 0 | 4 |

| Nepal | 65 | 2 | 43 | 28 | 138 |

| Nicaragua | 8 | 48 | 99 | 11 | 166 |

| Niger | 0 | 4 | 0 | 16 | 20 |

| Nigeria | 24 | 0 | 11 | 0 | 35 |

| Pakistan | 37 | 19 | 67 | 0 | 123 |

| Palestine | 2 | 6 | 19 | 4 | 31 |

| Panama | 0 | 12 | 8 | 8 | 28 |

| Papua New Guinea | 3 | 5 | 0 | 0 | 8 |

| Paraguay | 14 | 13 | 12 | 0 | 39 |

| Peru | 6 | 150 | 99 | 27 | 282 |

| Philippines | 138 | 0 | 138 | 6 | 282 |

| Poland | 4 | 8 | 0 | 0 | 12 |

| Romania | 2 | 26 | 0 | 0 | 28 |

| Russia | 9 | 33 | 7 | 161 | 210 |

| Rwanda | 8 | 17 | 0 | 9 | 34 |

| Samoa | 0 | 0 | 7 | 0 | 7 |

| Senegal | 0 | 5 | 1 | 39 | 45 |

| Serbia | 11 | 8 | 7 | 0 | 26 |

| Sierra Leone | 1 | 4 | 7 | 0 | 12 |

| South Africa | 3 | 3 | 1 | 0 | 7 |

| Sri Lanka | 1 | 37 | 20 | 5 | 63 |

| Sudan | 2 | 5 | 9 | 0 | 16 |

| Suriname | 1 | 0 | 0 | 0 | 1 |

| Swaziland | 0 | 3 | 0 | 0 | 3 |

| Syria | 0 | 0 | 8 | 2 | 10 |

| Tajikistan | 22 | 88 | 5 | 0 | 115 |

| Tanzania | 8 | 5 | 18 | 0 | 31 |

| Thailand | 0 | 5 | 0 | 0 | 5 |

| Togo | 0 | 0 | 12 | 25 | 37 |

| Tonga | 0 | 0 | 3 | 0 | 3 |

| Trinidad and Tobago | 0 | 0 | 0 | 1 | 1 |

| Tunisia | 0 | 0 | 8 | 0 | 8 |

| Turkey | 0 | 0 | 7 | 0 | 7 |

| Uganda | 4 | 23 | 17 | 3 | 47 |

| Ukraine | 2 | 6 | 0 | 0 | 8 |

| Uruguay | 0 | 0 | 0 | 2 | 2 |

| Uzbekistan | 6 | 31 | 2 | 9 | 48 |

| Venezuela | 7 | 0 | 0 | 0 | 7 |

| Vietnam | 3 | 3 | 42 | 11 | 59 |

| Yemen | 1 | 6 | 18 | 0 | 25 |

| Zambia | 0 | 11 | 4 | 0 | 15 |

| Zimbabwe | 0 | 2 | 0 | 0 | 2 |

| Grand total | 816 | 2 148 | 2 232 | 966 | 6 162 |