We investigate the relationship between the capital structure and the economic conditions in Korean market. To find the adjustment behavior on capital structure depending on macroeconomic conditions, we use dynamic partial adjustment model to estimate adjustment speeds toward targets. As the data analyzed in the study, we use non-financial firms listed in the Korean stock exchange. Through the empirical test, we find evidence that is consistent with Hackbarth, Miao and Morellec (2006) and Cook and Tang (2010)’s arguments that firms tend to adjust faster their leverage toward target level in economic expansion. Thus, our findings support to the pecking order and market timing theories in terms of corporate finance theories on capital structure. In addition, our test results are re-confirmed with robust consistency even though we include year dummy variable in the empirical test model for controlling global financial crisis in contrast with Kim (2013).

En este trabajo investigamos la relación entre la estructura de capital y las condiciones económicas en el mercado coreano. Para conocer el comportamiento de ajuste de la estructura de capital respecto a las condiciones macroeconómicas, utilizamos un modelo de ajuste parcial dinámico que estima las velocidades de ajuste hacia los objetivos. Los datos analizados en el estudio corresponden a las empresas no financieras que cotizan en la bolsa de valores de Corea. Empíricamente encontramos evidencia que es consistente con los argumentos de Hackbarth, Miao y Morellec (2006) y Cook y Tang (2010), respecto a que las empresas tienden a ajustar más rápidamente su apalancamiento respecto al nivel objetivo durante la expansión económica. Por lo tanto, nuestros resultados apoyan las teorías de pecking order y de market timing en términos de las teorías de finanzas corporativas relativas a la estructura de capital. Además, los resultados de nuestras pruebas son consistentemente robustos a pesar de que incluimos en nuestro modelo una variable ficticia ligada al tiempo como mecanismo de control de la crisis financiera global, en contraste con Kim (2013).

Korajczyk and Levy (2003) have suggested target capital structure as the function of economic conditions and firm characteristics. Based on the results from Korajczyk and Levy (2003), we postulate that economic conditions have a significant effect on debt and equity issuance in firms with financial constraints rather than in firms without financial constraints. Thus, we infer that economic conditions and a firm's characteristics may result in variability, and that also this variability differentially affects capital structure. Even though there are some studies on the relationship between security issuing and economic condition like Hackbarth, Miao and Morellec (2006) and Cook and Tang (2010) for North America firms, it is hard to find the previous studies analyzed with the sample data of Korean firms.

Especially, Korea is one of core countries among many emerging countries and we think that the empirical result on Korean firms plays a benchmark role in inferring from the debt financing behavior of other emerging countries. As the reason why we study on Korean firms’ debt financing behavior, we can suggest that Korean firms have experienced rapidly growth and undergone bailout for Asian financial crisis in 1997 as a typical economic cataclysm case to understand the mechanism between debt financing behavior and economic condition.

In domestic research with the sample data of Korean firms, our paper is relatively similarity to Kim and Shin (2011) in terms of research theme. Kim and Shin (2011) analyze the effects of macroeconomic conditions on the adjustment speed of capital structure without any manager's behavior of debt financing like over and under leverage depending on macroeconomic conditions. However, we use different model and control variables. As the other previous studies dealt with the relationship between economic factor and capital structure, there are Choe, Masulis, and Nanda (1993) and Lee et al. (2010). Choe, Masulis, and Nanda (1993) suggest the positive association between equity issues and various business cycles, and Lee et al. (2010) provide the persistence behavior of capital structure determinants.

Meanwhile, this study based on the conceptual ideas of Kim (2013), unpublished dissertation, is tested mainly on the relationship between economic conditions and financial decisions on capital structure using Korean firms. Unlike the research methodology of Kim (2013), we re-analyze the theme with regression model including year dummy variables for controlling global financial crisis to confirm robustness of test results of Kim (2013).

The remainder of this paper is organized as follows. Section 2 presents theoretical backgrounds on traditional capital structure theories and the recently related literatures, and Section 3 contains a description of the empirical test model through derivation procedure. In section 4, the basic statistic and the description of used data are discussed, and in section 5, empirical test results are shown. Finally, the conclusion is provided in section 6.

Theoretical backgroundsTraditionally, some theories on capital structure in the field of finance include trade-off theory, pecking order theory, and market timing theory. To analyze the impact of a determinant factor on capital structure, we have to review the concept of introduced theories.

First, trade-off theory focuses on financing selection depending on trade-off between benefits and costs, and this trade-off leads to target leverage as suggested by Jensen and Meckling (1976), Stulz (1990), and Hart and Moore (1995). Adjustment behavior toward target leverage may continue to quickly adjust deviation from target leverage if adjustment cost does not occur. Recently, Graham and Harvey (2001) is line with trade-off theory by suggesting that most firms have a rigid debt-to-equity ratio as their target capital structure.

Second, pecking order theory argues that firms invest with internal funds, and then tend to use debt and equity sequentially as suggested by Myers and Majluf (1984). According to pecking order theory, the adjustment speed to target leverage is very slow, or there is no target leverage because a firm does not have incentive to adjust to target leverage. Like the studies of Shyam-Sunder and Myers (1999), Fama and French (2002), Baker and Wurgler (2002), Welch (2004), Hovakimian (2006), and Flannery and Rangan (2006), they suggest that pecking order theory is much better than trade-off theory in terms of explaining capital structures with time-series patterns.

Third, market timing theory in capital structures, suggested by Baker and Wurgler (2002), indicates the accumulated result from previous forecasts on market. There is no optimal structure, and market evaluation continuously affects capital structure.

However, the research trends that economic conditions play a pivotal role in determining capital structure is frequently introduced in that it can be changed with time and a firm's characteristics follows.

Leary and Roberts (2005) provide the evidence to show that firms try to adjust the gap between target leverage and real one. Alti (2006) asserts that market timing shock related with initial public offerings (IPO) activity on leverage disappears after two. As recent study for the South African market, Ezeoha and Botha (2012) investigate debt issues for firms with varying ages and collateral value. Especially, Hackbarth, Miao and Morellec (2006) suggest models to analyze the affect of economic conditions on capital structure selection in terms of dynamic perspective. Under dynamic adjustment of capital structure, firms tend to quickly adjust their capital structure toward target one during expansion rather than recession. The suggestion of Hackbarth, Miao and Morellec (2006) was reconfirmed by Cook and Tang (2010) who asserts that there are positive relationships between business cycles and the adjustment speed of capital structure. Erel et al. (2012) also suggest that economic conditions encourage firms to issue equity. Thus, firms that are reluctant to issue securities are susceptible to information if a recession does not abate; instead, firms tend to issue convertible bonds when equity is issued leading to increasing debt.

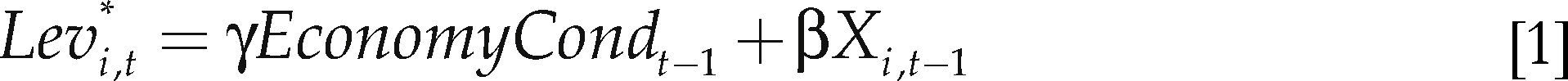

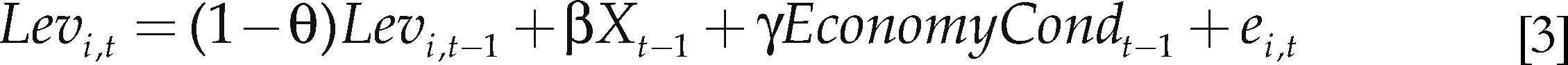

The framework of empirical modelWe use empirical test model derived by two partial adjustment models which are the second stage partial adjustment model and integrated dynamic partial adjustment model. Based on Hovakimian, Opler, and Titman (2001), the second stage partial adjustment model is to analyze capital structure issues. One advantage of this model is that target leverage changes can be gleaned because they occur over time and can be based on a firm's characteristics. We suggest the estimation of the speed of adjustment as follows.

Considering the methodology of Cook and Tang (2010), we estimated target leverage through regression using equation [1]. During the second stage, we estimated the speed of adjustment using target leverage through the first stage by considering Kayhan and Titman (2007) and Cook and Tang (2010). The following equation [1] is set up as the first stage for the estimation of target leverage. In equation [1], EconomyCond is economy condition, and we estimate target leverage (Lev*) using the quasi-maximum likelihood estimator method (QMLE) by Papke and Wooldridge (1996). The method is to solve bias, which occurs in linear model estimation, with a fractional dependent variable. In equation [1], we expect that firms would quickly adjust their capital structure to target one in the perfect market with no adjustment cost as suggested by Hovakimian, Opler, and Titman (2001). Thus, we postulate that firms would partially re-adjust their capital structure toward the level they want if there is adjustment cost.

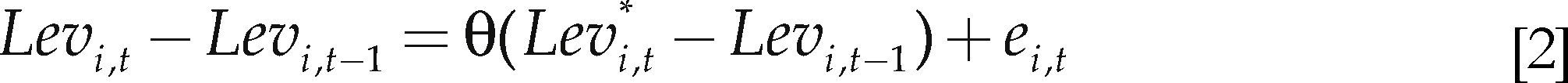

In the second stage, we use the standardized partial adjustment model by Hovakimian, Opler, and Titman (2001), which is as follows. In equation [2], θ is the ratio deviated from the target leverage from t-1 to t. The meaning that θ equals 1 indicates that firms perfectly adjust their capital structure toward their target level. However, adjustment cost exists if θ is below 1. Flannery and Rangan (2006) find that the speed of adjustment is abnormally smaller than expected if the target leverage derived from the first stage equation is used in the second stage. We include the partial adjustment effect and fixed effects into the integrated dynamic partial adjustment model to catch the affect of economic conditions on the speed of adjustment.

Equation [3] is designed for integrated dynamic partial adjustment model. In equation [3], the leverage of i firm at time t can be presented as the linear function of a set of economic conditions with time lag 1, EconomyCondt–1, and firm characteristics Xt–1. To derive equation [3], we included equation [1] into equation [2]. We estimate the speed of adjustment for economic conditions by separating them into expansion and recession periods without including time effects because economic variables have time-varying effects.

Basic statistic and description of dataWe use the sample data of non-financial firms listed in the Korean stock exchange from 1990 to 2010. To consider manufacturing firms in private sectors, we exclude firms in the public sector, including electricity and gas firms. We also exclude workout firms and firms with an impaired capital. Our data sources were FnGuide and KisValue, Korean financial databases.

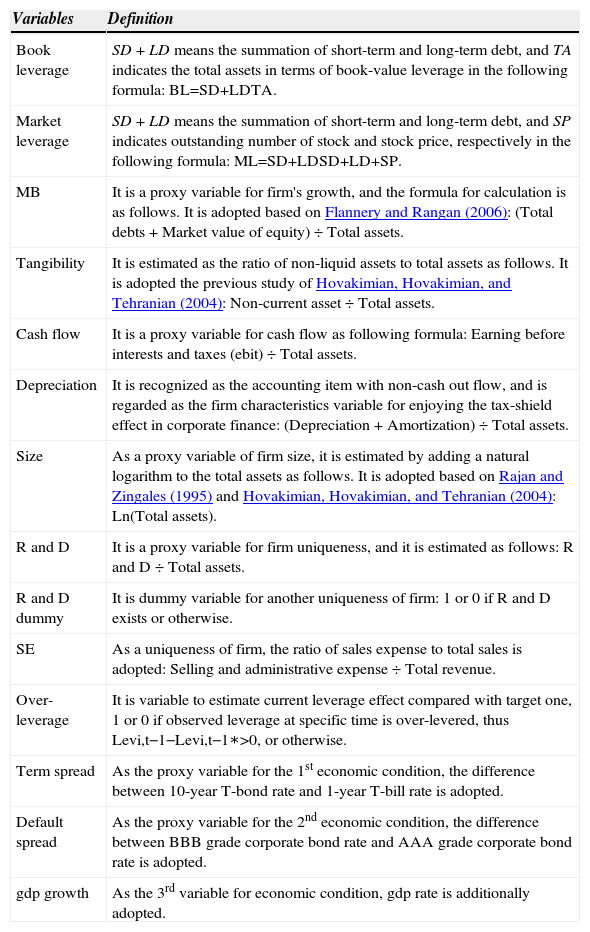

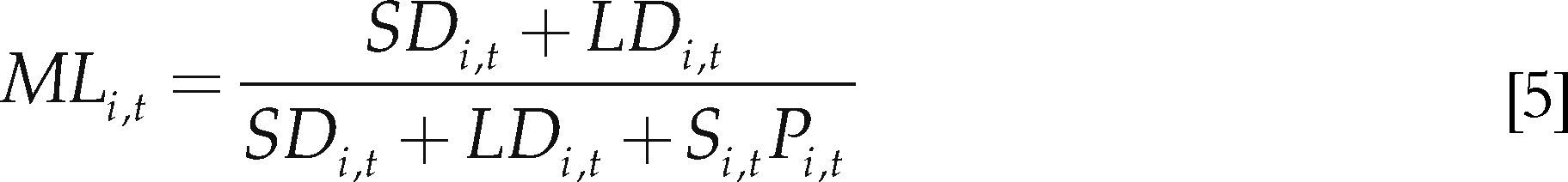

Table 1 shows the definitions of used variables. We use two types of leverage. Book-value leverage (Book leverage) is calculated as equation [4]. In equation [4], SD + LD is the summation of short-term and long-term debt at time t, and TA means the total assets in terms of Book-value leverage. Meanwhile, Market-value leverage (Market leverage) is estimated using equation [5]. In equation [5], SD + LD is the summation of short-term and long-term debt. S and P indicate outstanding numbers of stock and stock price, respectively, which is used to calculate the market value of equity.

Definition of variables.

| Variables | Definition |

|---|---|

| Book leverage | SD + LD means the summation of short-term and long-term debt, and TA indicates the total assets in terms of book-value leverage in the following formula: BL=SD+LDTA. |

| Market leverage | SD + LD means the summation of short-term and long-term debt, and SP indicates outstanding number of stock and stock price, respectively in the following formula: ML=SD+LDSD+LD+SP. |

| MB | It is a proxy variable for firm's growth, and the formula for calculation is as follows. It is adopted based on Flannery and Rangan (2006): (Total debts + Market value of equity) ÷ Total assets. |

| Tangibility | It is estimated as the ratio of non-liquid assets to total assets as follows. It is adopted the previous study of Hovakimian, Hovakimian, and Tehranian (2004): Non-current asset ÷ Total assets. |

| Cash flow | It is a proxy variable for cash flow as following formula: Earning before interests and taxes (ebit) ÷ Total assets. |

| Depreciation | It is recognized as the accounting item with non-cash out flow, and is regarded as the firm characteristics variable for enjoying the tax-shield effect in corporate finance: (Depreciation + Amortization) ÷ Total assets. |

| Size | As a proxy variable of firm size, it is estimated by adding a natural logarithm to the total assets as follows. It is adopted based on Rajan and Zingales (1995) and Hovakimian, Hovakimian, and Tehranian (2004): Ln(Total assets). |

| R and D | It is a proxy variable for firm uniqueness, and it is estimated as follows: R and D ÷ Total assets. |

| R and D dummy | It is dummy variable for another uniqueness of firm: 1 or 0 if R and D exists or otherwise. |

| SE | As a uniqueness of firm, the ratio of sales expense to total sales is adopted: Selling and administrative expense ÷ Total revenue. |

| Over-leverage | It is variable to estimate current leverage effect compared with target one, 1 or 0 if observed leverage at specific time is over-levered, thus Levi,t−1−Levi,t−1∗>0, or otherwise. |

| Term spread | As the proxy variable for the 1st economic condition, the difference between 10-year T-bond rate and 1-year T-bill rate is adopted. |

| Default spread | As the proxy variable for the 2nd economic condition, the difference between BBB grade corporate bond rate and AAA grade corporate bond rate is adopted. |

| gdp growth | As the 3rd variable for economic condition, gdp rate is additionally adopted. |

As plausible firm characteristic determinants, we adopt variables used in the studies of Hovakimian, Opler, and Titman (2001), Fama and French (2002), and Flannery and Rangan (2006). As previous studies suggested, the determinants are market-to-book ratio (MB), asset tangibility (Tangibility), earnings before interests and taxes (Cash flow), depreciation and amortization (Depreciation), firm size (Size), research and development (R and D), research and development dummy (R and D dummy), and sales and expense (SE).

MB is the ratio of market value for the total assets that represent a firm's growth. In terms of pecking order theory, Flannery and Rangan (2006) suggested that a high MB limits leverage and increases investment opportunities.

Tangibility is a firm's tangible assets, and is estimated as the ratio of non-liquid assets to total assets. According to Hovakimian, Hovakimian, and Tehranian (2004), we expect that firms with higher tangibility have the security capacity to borrow funds, and have low cost of bankruptcy.

Cash flow is estimated as the ratio of earnings before interests and taxes to total assets. It is used as the proxy variable for cash flow. It is expected that firms with high cash flow tend to have low leverage.

Depreciation is the ratio of depreciation to total assets. It is not for out-cash flow, and it is expected that firms with high depreciation and amortization tend to have less leverage to enjoy the tax-shield.

Size is estimated by adding a natural logarithm to the total assets that represent firm size. According to Rajan and Zingales (1995) and Hovakimian, Hovakimian, and Tehranian (2004), firms tend to increase leverage because of high accessibility to the financial market. It is expected that firms with a high firm size have low-cash flow volatility and financial distress.

Considering Titman (1984) and Hovakimian, Hovakimian, and Tehranian (2004), we adopt the proxy variables for firm uniqueness, such as R and D, SE, and R and D dummy. R and D is calculated as the ratio of research and development to total assets, and R and D dummy is 1, or 0, if R and D is available within a firm. SE is calculated as the ratio of sales expense to total sales. Based on previous research results, we expected that firms with a high R and D and SE would tend to maintain low leverage to protect them from financial distress.

To control industry characteristics, which cannot be observed by independent variables, we use the median industry debt from Korean Standard Industrial Classification (KSIC) and Korean Stock Exchange Classification (KSEC) to classify each industry. Furthermore, we add the Over-leverage into the model to confirm current leverage levels compared with target leverage. Over-leverage is a dummy variable, which represents 1, or 0, when a firm is over-levered at a specific time.

Meanwhile, we use some economic variables like Term spread, Default spread, and Gross Domestic Product growth (GDP growth) rate to find out the affect of economic factors on the speed of adjustment on capital structure.

First of all, Term spread is calculated as the difference between 10-year T-bond rate and 1-year T-bill rate. Based on Dotsey (1998), high spread indicates that economic conditions may be booming. Thus, we expect that the speed of adjustment on capital structure might progress quickly when there is an economic boom.

Default spread is defined as the difference between the average rate of return on BBB-grade corporate bonds and average rate of return on AAA-grade corporate bonds according to Korajczyk and Levy (2003) and Cook and Tang (2010). We expect that default spread would be high at the recession period, and vice versa. Thus, it is expected that firms would quickly adjust their capital structure when default spread was low rather than high.

We also adopt the GDP growth rate as the proxy variable for economy conditions. We expect that the speed of adjustment on capital structure would be quicker in economic expansion than in economic recession.

Additionally, we need to consider a current leverage level compared with the target leverage. Thus, we analyze over-levered, or un-levered, effects. In terms of pecking order theory, we consider a possibility that firms with low leverage will quickly adjust their capital structure more than over-levered firms because the former prefers to issue new debts rather than issue new equity. In addition, we need to check the plausible argument of Baker and Wurgler (2002) in terms of market timing theory that firms are reluctant to issue equity when the stock-price is low. However, firms can issue new debt to adjust capital structure to target one when a firm has low leverage.

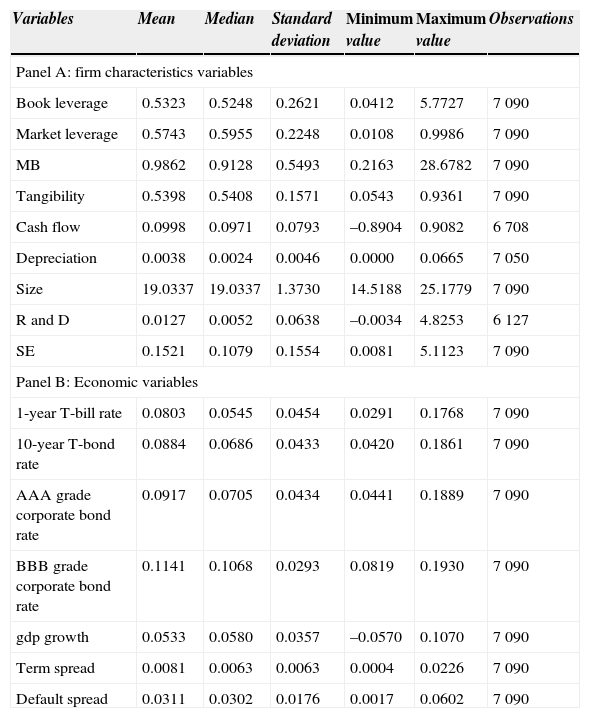

Table 2 shows a basic statistic for firm characteristics and economy variables. According to the Table 2, the means of book-value leverage and market-value leverage among firm characteristics variables are 0.5323 and 0.5743, respectively. In addition, the means of term spread and default spread in the economic variables are 0.0081 and 0.0311, respectively.

Basic statistic of firm characteristics and economic variables.

| Variables | Mean | Median | Standard deviation | Minimum value | Maximum value | Observations |

|---|---|---|---|---|---|---|

| Panel A: firm characteristics variables | ||||||

| Book leverage | 0.5323 | 0.5248 | 0.2621 | 0.0412 | 5.7727 | 7 090 |

| Market leverage | 0.5743 | 0.5955 | 0.2248 | 0.0108 | 0.9986 | 7 090 |

| MB | 0.9862 | 0.9128 | 0.5493 | 0.2163 | 28.6782 | 7 090 |

| Tangibility | 0.5398 | 0.5408 | 0.1571 | 0.0543 | 0.9361 | 7 090 |

| Cash flow | 0.0998 | 0.0971 | 0.0793 | –0.8904 | 0.9082 | 6 708 |

| Depreciation | 0.0038 | 0.0024 | 0.0046 | 0.0000 | 0.0665 | 7 050 |

| Size | 19.0337 | 19.0337 | 1.3730 | 14.5188 | 25.1779 | 7 090 |

| R and D | 0.0127 | 0.0052 | 0.0638 | –0.0034 | 4.8253 | 6 127 |

| SE | 0.1521 | 0.1079 | 0.1554 | 0.0081 | 5.1123 | 7 090 |

| Panel B: Economic variables | ||||||

| 1-year T-bill rate | 0.0803 | 0.0545 | 0.0454 | 0.0291 | 0.1768 | 7 090 |

| 10-year T-bond rate | 0.0884 | 0.0686 | 0.0433 | 0.0420 | 0.1861 | 7 090 |

| AAA grade corporate bond rate | 0.0917 | 0.0705 | 0.0434 | 0.0441 | 0.1889 | 7 090 |

| BBB grade corporate bond rate | 0.1141 | 0.1068 | 0.0293 | 0.0819 | 0.1930 | 7 090 |

| gdp growth | 0.0533 | 0.0580 | 0.0357 | –0.0570 | 0.1070 | 7 090 |

| Term spread | 0.0081 | 0.0063 | 0.0063 | 0.0004 | 0.0226 | 7 090 |

| Default spread | 0.0311 | 0.0302 | 0.0176 | 0.0017 | 0.0602 | 7 090 |

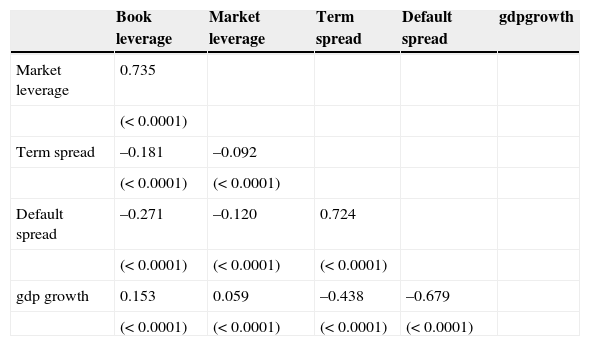

Table 3 suggests the Pearson correlation between leverage and economy variables. The relation between leverage and GDP growth is significantly positive at 1% regardless of book-value or market-value leverage. However, the relation between leverage and spread (i.e., term spread and default spread) is negatively significant at 1% regardless of book-value or market-value leverage.

Correlation between leverage and economic condition.

| Book leverage | Market leverage | Term spread | Default spread | gdpgrowth | |

|---|---|---|---|---|---|

| Market leverage | 0.735 | ||||

| (< 0.0001) | |||||

| Term spread | –0.181 | –0.092 | |||

| (< 0.0001) | (< 0.0001) | ||||

| Default spread | –0.271 | –0.120 | 0.724 | ||

| (< 0.0001) | (< 0.0001) | (< 0.0001) | |||

| gdp growth | 0.153 | 0.059 | –0.438 | –0.679 | |

| (< 0.0001) | (< 0.0001) | (< 0.0001) | (< 0.0001) |

Note: () indicates p-value.

We estimate how the speed of adjustment on capital structure was different depending on the economic conditions.

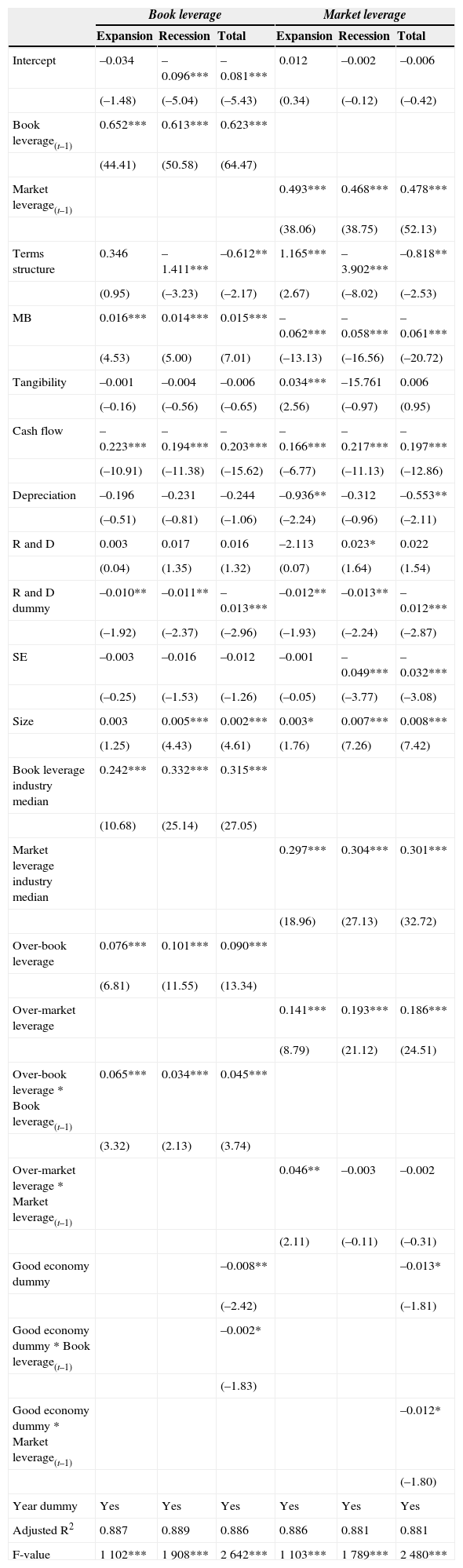

Table 4 shows the result of the speed of adjustment on capital structure depending on term spread. At the booming period, the speeds of adjustment are 0.348 (=1 – 0.652) and 0.507 (= 1 – 0.493) for book-value leverage and market-value leverage, respectively. The speeds of adjustment in book-value leverage and market-value leverage are 0.387 (= 1 – 0.613) and 0.532 (= 1 – 0.468) during the recession period. We know that the speed of adjustment during the recession period was faster than that at the booming period. These results do not align with our expectations, which were based on Korajczyk and Levy (2003) that the speed of adjustment would be faster in the economy expansion than in the economy recession.

Regression results according to economic condition based on Term Spread.

| Book leverage | Market leverage | |||||

|---|---|---|---|---|---|---|

| Expansion | Recession | Total | Expansion | Recession | Total | |

| Intercept | –0.034 | –0.096*** | –0.081*** | 0.012 | –0.002 | –0.006 |

| (–1.48) | (–5.04) | (–5.43) | (0.34) | (–0.12) | (–0.42) | |

| Book leverage(t–1) | 0.652*** | 0.613*** | 0.623*** | |||

| (44.41) | (50.58) | (64.47) | ||||

| Market leverage(t–1) | 0.493*** | 0.468*** | 0.478*** | |||

| (38.06) | (38.75) | (52.13) | ||||

| Terms structure | 0.346 | –1.411*** | –0.612** | 1.165*** | –3.902*** | –0.818** |

| (0.95) | (–3.23) | (–2.17) | (2.67) | (–8.02) | (–2.53) | |

| MB | 0.016*** | 0.014*** | 0.015*** | –0.062*** | –0.058*** | –0.061*** |

| (4.53) | (5.00) | (7.01) | (–13.13) | (–16.56) | (–20.72) | |

| Tangibility | –0.001 | –0.004 | –0.006 | 0.034*** | –15.761 | 0.006 |

| (–0.16) | (–0.56) | (–0.65) | (2.56) | (–0.97) | (0.95) | |

| Cash flow | –0.223*** | –0.194*** | –0.203*** | –0.166*** | –0.217*** | –0.197*** |

| (–10.91) | (–11.38) | (–15.62) | (–6.77) | (–11.13) | (–12.86) | |

| Depreciation | –0.196 | –0.231 | –0.244 | –0.936** | –0.312 | –0.553** |

| (–0.51) | (–0.81) | (–1.06) | (–2.24) | (–0.96) | (–2.11) | |

| R and D | 0.003 | 0.017 | 0.016 | –2.113 | 0.023* | 0.022 |

| (0.04) | (1.35) | (1.32) | (0.07) | (1.64) | (1.54) | |

| R and D dummy | –0.010** | –0.011** | –0.013*** | –0.012** | –0.013** | –0.012*** |

| (–1.92) | (–2.37) | (–2.96) | (–1.93) | (–2.24) | (–2.87) | |

| SE | –0.003 | –0.016 | –0.012 | –0.001 | –0.049*** | –0.032*** |

| (–0.25) | (–1.53) | (–1.26) | (–0.05) | (–3.77) | (–3.08) | |

| Size | 0.003 | 0.005*** | 0.002*** | 0.003* | 0.007*** | 0.008*** |

| (1.25) | (4.43) | (4.61) | (1.76) | (7.26) | (7.42) | |

| Book leverage industry median | 0.242*** | 0.332*** | 0.315*** | |||

| (10.68) | (25.14) | (27.05) | ||||

| Market leverage industry median | 0.297*** | 0.304*** | 0.301*** | |||

| (18.96) | (27.13) | (32.72) | ||||

| Over-book leverage | 0.076*** | 0.101*** | 0.090*** | |||

| (6.81) | (11.55) | (13.34) | ||||

| Over-market leverage | 0.141*** | 0.193*** | 0.186*** | |||

| (8.79) | (21.12) | (24.51) | ||||

| Over-book leverage * Book leverage(t–1) | 0.065*** | 0.034*** | 0.045*** | |||

| (3.32) | (2.13) | (3.74) | ||||

| Over-market leverage * Market leverage(t–1) | 0.046** | –0.003 | –0.002 | |||

| (2.11) | (–0.11) | (–0.31) | ||||

| Good economy dummy | –0.008** | –0.013* | ||||

| (–2.42) | (–1.81) | |||||

| Good economy dummy * Book leverage(t–1) | –0.002* | |||||

| (–1.83) | ||||||

| Good economy dummy * Market leverage(t–1) | –0.012* | |||||

| (–1.80) | ||||||

| Year dummy | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.887 | 0.889 | 0.886 | 0.886 | 0.881 | 0.881 |

| F-value | 1 102*** | 1 908*** | 2 642*** | 1 103*** | 1 789*** | 2 480*** |

Note: ***, **, and * are significant at 1%, 5%, and 10% level, respectively.

We note on firm characteristic determinants, Cash flow and R and D dummy. The coefficient values of Cash flow are all significantly negative regardless of using book-value leverage and market-value leverage. As we expected, it confirms that firms with a high profitability per 1 unit of asset maintains a lowleverage level because of increasing retained earnings. The coefficient values of R and D dummy are all significantly negative regardless of the type of leverage and economic condition. As we expected, the firms with R and D dummy tend to lower their leverage to protect themselves from financial distress. This evidence is aligned with the results of Titman (1984) and Hovakimian, Hovakimian, and Tehranian (2004).

In Over-book leverage and Over-market leverage current leverage effects, all the coefficient values are significantly positive. However, we suggest that all speeds of adjustment were faster than those of Book leverage(t–1) and Market leverage(t–1). In the light of this evidence, we understand that firms tend to adjust capital structure with faster speed because of over-levered conditions.

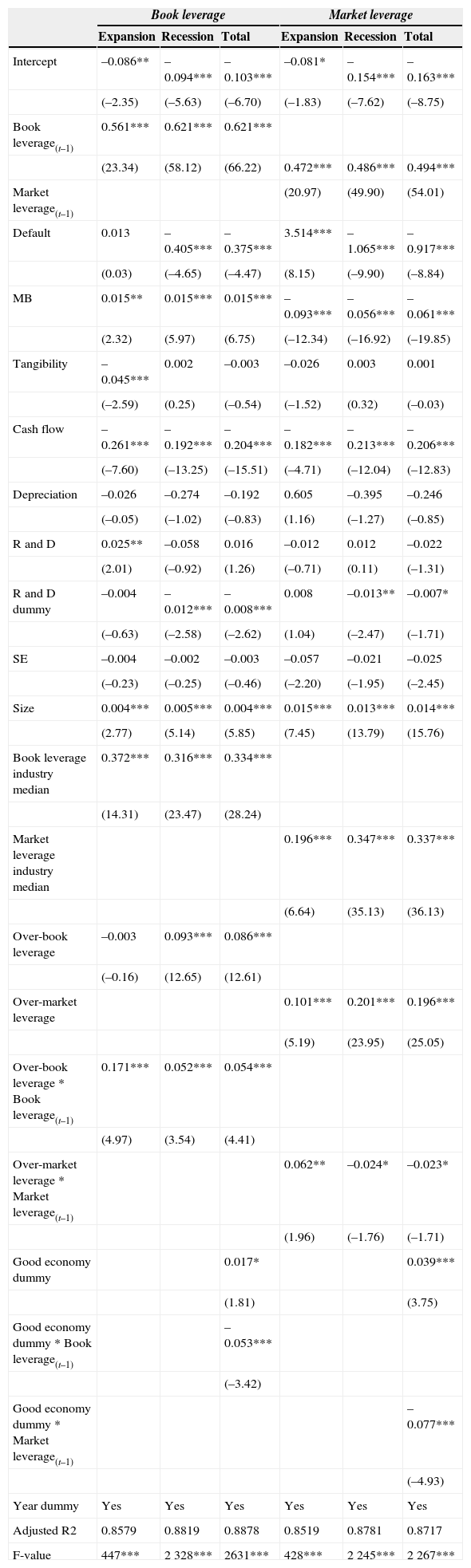

Table 5 shows the result of speed of adjustment depending on default spread instead of term spread. However, the speeds of adjustment are 0.439 (= 1 – 0.561) and 0.528 (= 1 – 0.472) in the economy expansion period using book-value leverage and market-value leverage. The speeds of adjustment for book-value leverage and market-value leverage are 0.379 (= 1 – 0.621) and 0.514 (= 1 – 0.486) in the economic recession period. The speed of adjustment in the economic expansion is faster than in the recession period. These results are in line with our expectations. Therefore, default spread is suitable as a proxy variable for the economic condition.

Regression results according to economic condition based on Default Spread.

| Book leverage | Market leverage | |||||

|---|---|---|---|---|---|---|

| Expansion | Recession | Total | Expansion | Recession | Total | |

| Intercept | –0.086** | –0.094*** | –0.103*** | –0.081* | –0.154*** | –0.163*** |

| (–2.35) | (–5.63) | (–6.70) | (–1.83) | (–7.62) | (–8.75) | |

| Book leverage(t–1) | 0.561*** | 0.621*** | 0.621*** | |||

| (23.34) | (58.12) | (66.22) | 0.472*** | 0.486*** | 0.494*** | |

| Market leverage(t–1) | (20.97) | (49.90) | (54.01) | |||

| Default | 0.013 | –0.405*** | –0.375*** | 3.514*** | –1.065*** | –0.917*** |

| (0.03) | (–4.65) | (–4.47) | (8.15) | (–9.90) | (–8.84) | |

| MB | 0.015** | 0.015*** | 0.015*** | –0.093*** | –0.056*** | –0.061*** |

| (2.32) | (5.97) | (6.75) | (–12.34) | (–16.92) | (–19.85) | |

| Tangibility | –0.045*** | 0.002 | –0.003 | –0.026 | 0.003 | 0.001 |

| (–2.59) | (0.25) | (–0.54) | (–1.52) | (0.32) | (–0.03) | |

| Cash flow | –0.261*** | –0.192*** | –0.204*** | –0.182*** | –0.213*** | –0.206*** |

| (–7.60) | (–13.25) | (–15.51) | (–4.71) | (–12.04) | (–12.83) | |

| Depreciation | –0.026 | –0.274 | –0.192 | 0.605 | –0.395 | –0.246 |

| (–0.05) | (–1.02) | (–0.83) | (1.16) | (–1.27) | (–0.85) | |

| R and D | 0.025** | –0.058 | 0.016 | –0.012 | 0.012 | –0.022 |

| (2.01) | (–0.92) | (1.26) | (–0.71) | (0.11) | (–1.31) | |

| R and D dummy | –0.004 | –0.012*** | –0.008*** | 0.008 | –0.013** | –0.007* |

| (–0.63) | (–2.58) | (–2.62) | (1.04) | (–2.47) | (–1.71) | |

| SE | –0.004 | –0.002 | –0.003 | –0.057 | –0.021 | –0.025 |

| (–0.23) | (–0.25) | (–0.46) | (–2.20) | (–1.95) | (–2.45) | |

| Size | 0.004*** | 0.005*** | 0.004*** | 0.015*** | 0.013*** | 0.014*** |

| (2.77) | (5.14) | (5.85) | (7.45) | (13.79) | (15.76) | |

| Book leverage industry median | 0.372*** | 0.316*** | 0.334*** | |||

| (14.31) | (23.47) | (28.24) | ||||

| Market leverage industry median | 0.196*** | 0.347*** | 0.337*** | |||

| (6.64) | (35.13) | (36.13) | ||||

| Over-book leverage | –0.003 | 0.093*** | 0.086*** | |||

| (–0.16) | (12.65) | (12.61) | ||||

| Over-market leverage | 0.101*** | 0.201*** | 0.196*** | |||

| (5.19) | (23.95) | (25.05) | ||||

| Over-book leverage * Book leverage(t–1) | 0.171*** | 0.052*** | 0.054*** | |||

| (4.97) | (3.54) | (4.41) | ||||

| Over-market leverage * Market leverage(t–1) | 0.062** | –0.024* | –0.023* | |||

| (1.96) | (–1.76) | (–1.71) | ||||

| Good economy dummy | 0.017* | 0.039*** | ||||

| (1.81) | (3.75) | |||||

| Good economy dummy * Book leverage(t–1) | –0.053*** | |||||

| (–3.42) | ||||||

| Good economy dummy * Market leverage(t–1) | –0.077*** | |||||

| (–4.93) | ||||||

| Year dummy | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.8579 | 0.8819 | 0.8878 | 0.8519 | 0.8781 | 0.8717 |

| F-value | 447*** | 2 328*** | 2631*** | 428*** | 2 245*** | 2 267*** |

Note: ***, **, and * are significant at 1%, 5%, and 10% level, respectively.

Regarding firm characteristics determinants, the variables that show consistency for significance and coefficients regardless of type of leverage and economic condition are Cash flow and Size. The coefficient values of firm size are all significantly positive regardless of the type of leverage and economy condition, which was as we expected. It is line with Rajan and Zingales (1995) and Hovakimian, Hovakimian, and Tehranian (2004). Therefore, we confirm that bigger firms tend to increase leverage levels because of low-cash flow volatility and high accessibility to capital market.

Meanwhile, as far as Over-market leverage is concerned, its coefficient value is significantly positive. Therefore, we confirm that the speeds of adjustment are faster than that of Market leverage(t–1) in cases using market-value leverage. Firms tend to adjust capital structure with faster speeds because of over-levered conditions when market-value leverage is used.

Throughout the above test results, our major findings are consistent with those of Hackbarth, Miao and Morellec (2006) and Cook and Tang (2010) analyzing with the data of North America firms.

ConclusionWe examine how the speed of adjustment on capital structure depends on economic conditions for nonfinancial firms listed in the Korean stock exchange. Even though the results on the speed of adjustment according to the type of economy conditions are different, we can suggest that the evidence obtained from default spread aligns with our expectations based on the previous studies. Therefore, we think that default spread is a suitable proxy variable for economic conditions.

Our academic contributions through this research are to confirm that the speed of adjustment on capital structure is different depending on the type of economy condition, and to suggest suitable proxy variables for economy conditions. Our study posits significant evidence on the speed of adjustment on capital structure, supporting the result of Hackbarth, Miao and Morellec (2006) that the speed of adjustment is faster in economic expansions than in economic recessions. Even though our study includes the year dummy variable for controlling global financial crisis, the test result is re-confirmed because of robust consistency in terms of significances and directions of coefficients in comparison with Kim (2013). As a result, we can assert that this study supports pecking order and market timing theories.

However, our paper has some limitations which are needed to extend time series. In addition, we need to compare the evidences from domestic market data with those of international market to make our main findings generalized. Thus, we leave it as new research topic.

This paper is the re-tested with year dummy variable for controlling global financial crisis and revised manuscript based on conceptual idea of the unpublished master's dissertation of Hyun Jung Kim (2013) in Dona-A University. We, authors, thank the 1st author, Hyun Jung Kim, for providing her conceptual idea in writing this article. In addition, the authors wish to express their gratitude to the anonymous referees who provided valuable comments to improve the quality of this paper. This study was supported by research funds from Dong-A University. Professor Sohn and Professor Seo are corresponding author and co-author of this paper, respectively. Professor Sohn is responsible for retesting and revising on unpublished dissertation of Kim, and Professor Seo made an original draft in Korean into a completed manuscript in English including proofreading, submitting the manuscript to journal, and communicating with journal editor.