From a sample of Spanish manufacturing businesses, extracted from the 2005 Technological Innovation Panel (PITEC 2005), we suggest a lineal regression model in which we relate the exporting intensity with the product innovation, the process innovation, the sectorial technological intensity, the business extent and the membership to a pool of businesses. In the descriptive and statistical analysis, we obtained that all of these variables have a positive and significant influence on the exporting intensity. Regarding this matter, we have checked that the main influence corresponds to businesses that develop product innovation strategies, are of medium extent, are assigned to sectors of medium‐high technological intensity and belong to a foreign corporate group.

A partir de una muestra de empresas manufactureras españolas, extraída del Panel de Innovación Tecnológica 2005 (PITEC 2005), planteamos un modelo de regresión lineal en el que relacionamos la intensidad exportadora con la innovación de producto, la innovación de proceso, la intensidad tecnológica sectorial, el tamaño empresarial y la pertenencia a un grupo de empresas. En el análisis descriptivo y estadístico obtuvimos que todas estas variables exhiben una influencia positiva y significativa sobre la intensidad exportadora. Al respecto, hemos constatado que la mayor influencia corresponde a las empresas que desarrollan estrategias de innovación de producto, son de tamaño medio, están adscritas a los sectores de intensidad tecnológica media‐alta y pertenecen a un grupo de empresas extranjero.

The economy of developed countries has been characterised in the last years by the globalisation of the markets and the internationalisation of managerial activity. This internationalisation bears important risks (financial, logistic, commercial, etc.). Therefore, many authors argue that this process must be realised in a sequential and tidy way, beginning with forms of entry into the simple foreign markets and of scarce commitment of resources to finish implementing other much more complex forms of entry and of major commitment of resources, and thus of major risk (Bilkey & Tesar, 1977; Cavusgil & Nevin, 1981; Guisado, 2002; Wind, Douglas, & Perlmutter, 1973). Consequently, this current thought conceives of internationalisation as a learning process, since it passes from the simple to the complex, and of risk control, since it considers that only when certain experience has been acquired can one assume larger scales of commitment of resources in the internationalisation activities. Such current thinking points out that, in general, the first internationalisation experiences usually materialise by means of exports with intermediaries carried out to geographical or culturally close foreign markets. Subsequently, just as the company is acquiring experience, it may try to internalise the commercial roles that the intermediaries execute, creating to this end the so‐called sales subsidiaries. This form of entry is more evolved and facilitates the attainment of more intense and rapid learning; in return, it increases the expenses of fixed nature and with it the risk that the company assumes. Finally, when the company has acquired enough international experience and believes that manufacture in the target country provides it with advantages, it can choose the implementation of production subsidiaries. In this case, not only is the resources commitment maximum, but also the possibilities of learning and growth (Giacomozzi, 2005). Between the indicated extreme positions – exportation by means of intermediaries and production subsidiaries – intermediate forms of entry exist when the possibilities of learning and commitment of resources are concerned. It is a question of different cooperation agreements with other companies, such as agreements of exemption, agreements of subcontracting and the joint ventures, fundamentally. That said, of all the mentioned forms of entry, exportation, whether with intermediaries or subsidiaries of sales, is by far the most common (García & Avella, 2008). Therefore, in the present study, we focus exclusively on this form of entry in the foreign markets.

The high heterogeneity of the different foreign markets implies that it is not easy to succeed in exports (Walters & Samiee, 1990). Consequently, the specialised literature has placed special emphasis on trying to identify the factors that secure effective and appropriate exporting development. Also, it has focused on analysing the design and effectiveness of the different programmes of exterior promotion which different government agencies have implemented (Baldauf, Cravens, & Wagner, 2000).

In this regard, the literature associated with exports has identified a certain number of variables that have influence on the innovative performance of the companies; variables significantly related to external aspects, such as the sector or the peculiarities of the market of exportation, as with internal aspects, such as the size or the exporting experience of the companies.

As previously stated, the objective of this work was to analyse how some of these factors affect exports, for example, the size and sector which the analysed companies belong to, the innovation of product and the process innovation, the technological intensity and belonging or not belonging to some corporative group.

The structure of the article is as follows. In the next section a review of the literature is carried out, in order to establish the theoretical frame within which to base the election of the variables that are used in the corresponding empirical analysis and to formulate the hypotheses that we try to confirm. In Section 3, we describe the sample, discuss the internal structure that adopts the variables that we use and consider the statistical method. In Section 4, we present the obtained results. Finally, in Section 5, we provide the main conclusions reached.

2Theoretical frame and hypothesis of investigationThe economic literature points out that exportation is important for the success and growth of companies (Álvarez & García, 2008; Bigsten & Gebreeyesus, 2009; Dejo‐Oricain & Ramírez‐Alesón, 2009; Donoso & Alonso, 2000; Fariñas & Martín‐Marcos, 2007; Flor & Oltra, 2010; García & Avella, 2008; López, 2007; López & Hernández, 2000; Suárez, Olivares, & Galván, 2002).

Also, review of the literature reveals that in the relation between productivity and exportation, two important alternative hypotheses exist. On the one hand, many authors defend that the companies of larger productivity are those that exhibit a larger exporting propensity (Álvarez & García, 2008). This causal relation of productivity to exportation, called the hypothesis of auto selection, would explain that only the companies that improve their performance, especially in terms of productivity, are capable of exporting (Melitz, 2003; Bernard, Eaton, Bradford, & Kortun, 2003). Nevertheless, there are other authors who defend the so‐called hypothesis of learning, which supports that the sense of the causal relation between these two variables is exactly the opposite. For these authors, it is the exporting process that induces an increase in productivity (Delgado, Fariñas, & Ruano, 2002). Nevertheless, it is necessary to underline that the realised empirical studies support in a more conclusive way the so‐called hypothesis of auto selection (Barac, Rochina, & Sanchis, 2009).

On the other hand, it is important to underline that there are multiple options or routes by means of which the companies can try to increase productivity. One of the most important is the internal I+D and the development of other complementary strategies of innovation (Cassiman & Golovko, 2007). Authors such as Hirsch and Bijaoui (1985) determined that innovative companies had a greater exporting propensity than the average of the corresponding sector of which they were part. Also, several studies of the European Commission points out that, generally, in all the countries of the EU and in all the industries, the probability of innovative companies exporting is determined by respective levels of productivity and the innovations of product that they carry out. Therefore, it is necessary to infer that the companies that innovate generate greater average productivity than those that do not innovate, increasing also in this way respective exportation probabilities.

In this sense, there are numerous empirical evidences showing a positive relation between innovation and propensity to export, such as the works of Labeaga and Martínez‐Ros (1994), Martin and Velázquez (1993), Rodil and Vence (2008) and Rodríguez (1999).

In terms of innovation, different categorisations exist. The one commonly used distinguishes between innovation of product and process innovation (Cassiman, Golovko, & Martínez‐Ros, 2010; Velando & Crespo, 1994). With regard to the latter, it is necessary to expect that any innovation or progress that should take place in a productive process or in management will contribute to making the abovementioned process more effective and/or efficient and, hence, to the corresponding increase in company productivity. Obviously, according to the causality relation previously discussed, this increase in productivity must bring with it an increase in corresponding exports, since the cost reduction that the biggest productivity conveys allows the company more resources to face the barriers of entry and the costs that all exporting activity incurs.

The same exposition can be realised with regard to product innovation. When a radical or incremental innovation takes place in a product, it becomes possible to satisfy a larger number of customers, with whom sales will increase, thus producing an increase in the results of the company. Therefore, product innovation also influences, in a positive way, productivity, and likewise in reference to the process innovation, this will affect the exporting intensity of the company (García & Avella, 2008).

On this matter, in the empirical literature we find multiple contributions on how the innovation of product and process produces a larger exporting result (Hoang, 1998; Kirpalani & Macintosh, 1980; Nassimbeni, 2001; Ong & Pearson, 1982; Piercy, Kaleka, & Katsikeas, 1998). Nevertheless, it is necessary to underline that certain studies exist that try to value which innovation category has larger influence on the propensity to export. As regards this topic, Rodil and Vence (2008) note that of all the forms of innovation they analysed, those which influence the exporting propensity the most are categorised as product innovation. Also, Cassiman and Martínez‐Ros (2007) come to the conclusion that for the small Spanish enterprises to export influences more the innovation of product than the process innovation. Besides, Cassiman and Golovko (2007) and Cassiman et al. (2010), in their studies on the relation between innovation, exports and productivity, find evidence that product innovation, and not process innovation, leads to larger productivity levels, influencing that nonexporting companies enter the market of exportation. The empirical evidence on this influence is vast. Nevertheless, it is necessary to review that there exist some studies that do not corroborate the abovementioned relation. For example, in the work by Damijan, Kostevc, and Polanec (2008) on companies in Slovenia, they did not find any significant relation between the innovation of product and the propensity to export.

Also, there exist empirical studies that underline the influence of the process innovations on the propensity of the companies to export. For example, Van Beveren and Vandenbussche (2009), in their study of the Belgian economy, found indications that the simultaneous use of innovations of product and process has a positive influence on the probability of the companies exporting. Furthermore, according to Caldera (2009) process innovation influences positively and significantly the propensity of companies to export. Nevertheless, in the study by Becker and Egger (2007), there was no evidence that process innovation increases the propensity of the companies to export.

Since in most of the empirical studies there exists a positive and significant relation of the innovations of process and product with companies’ productivity and the propensity to export, we raise the following hypotheses:Hypothesis 1 The product innovation determines positively and significantly the exporting intensity of the manufacturing companies. The process innovation determines positively and significantly the exporting intensity of the manufacturing companies.

Another variable often analysed in the field of propensity to export is that of the technological intensity of the companies. With regard to this variable, it is necessary to point out that although in the literature a unanimous agreement seems to exist on stating its existence and importance, there seems to be an absence of unanimity in defining, and measuring what is considered technological intensity. As noted by Cuadrado, Guardia, Iglesias, and Ortíz (1999), it is important to emphasise that a sole indicator of technological intensity does not exist, but a whole series of them, question that it affects decisively the potential relation between the abovementioned variable and the exporting behaviour of the companies. In this sense, the literature pays special attention to two warning types especially (Sáez, 1991): the so‐called indicators of technological content and the so‐called indicators of input.

The indicators of technological content focus on the expenses realised by the companies in R&D (Research and Development), using measurements of direct expense in R&D, technical and scientific personnel, patents or material and resources in the activities of R&D. According to this definition, the companies of high technological intensity are those that devote themselves mainly to basic and applied research, that is to say, to the generation of new ideas and knowledge capable of generating some type of invention and/or radical innovation of product and/or process. Also, in terms of the companies of upper intermediate technological intensity, there are those which devote themselves to generate new products/processes with a lesser radical grade in innovation, as well as those which adapt the abovementioned innovations to the needs of specific markets, though perhaps limited to the level of a medium‐low technological intensity. Bearing this in mind, it is probable that only the companies that have a level of upper intermediate or medium low technological intensity develop a larger exporting behaviour, since the process of technological innovation seems more adapted to the needs of markets of products at a significant demand level. In this approach, it would be necessary to raise the exception of those companies that are developing entirely the process of technological innovation; they are carrying out basic, applied research and the process of design and development of new products and/or processes.

Nevertheless, these indicators of technological content against which the technological intensity measures itself have the disadvantage of measuring this variable from the point of view of the production of technological change, omitting that the technological intensity can also be evaluated through company users of the abovementioned technology. In this respect, some authors have used the so‐called input indicators. Thus, technological intensity is defined as a consequence of the results that the use of innovative technologies generates at the heart of the companies. Therefore, this new definition of technological intensity requires previous knowledge of what technologies are more innovative, and which sectors use them in larger proportion. Therefore, it will be possible to define clearly a typology of sectors of high, medium and low technological intensity.

Within the framework of this second definition, it is possible to argue that company users of more technological intensity have greater capacities for learning and innovation. For this reason, they will be more competitive and will obtain better results, which will allow them to face the exporting challenge with probability of greater success.

In any case, whether it is one or the other approach, the empirical evidence does not allow us to come to a conclusion on the influence of the technological intensity of the companies on the probability of exporting. For instance, studies by Cavusgil and Nevin (1981), Cooper and Kleinschmidt (1985) and Gemunden (1991) find a positive relation, while the studies by Cavusgil and Naor (1987) and Alonso and Donoso (1994) do not find statistical evidence as regards this relation.

Consequently, it is possible to argue both in favour and against the existence of a positive relation between technological intensity and exporting behaviour. Nevertheless, assuming that a greater technological intensity implies a greater innovation capacity, and that this one bears, in accordance with Hypotheses 1 and 2, a greater exporting propensity, in what follows we support the following hypothesis with regard to technological intensity:Hypothesis 3 The manufacturing companies belonging to sectors of greater technological intensity have a greater significant influence on exporting intensity than those which belong to sectors of lesser technological intensity.

Although there are many variables that have been considered to be determinants in the exporting behaviour of the companies, none has received as much attention as the managerial size. In fact, this variable is undoubtedly one of the internal characteristics of the company that has been analysed more in this type of study (Arteaga & Medina, 2006).

Alonso and Donoso (1994) go further in their discussion of managerial size, since they think that this feature of the company is a variable synthesis, related to technical activities, economic and financial capacities and the exporting propensity. In the literature on exporting behaviour of the companies, the most frequent opinion about the managerial size and its exporting activity tends to suppose a relation of positive sign between these two variables. In other words, the positive sense of the relation usually refers as much to the probability of exporting of the companies as to the intensity of corresponding exporting effort.

As usually the companies of larger size are those which possess larger capacities and resources, almost always the dimension of the company is considered to be a fundamental requirement to enter foreign markets. Therefore, the big company is generally assigned the advantage of a wider and intense commercial activity in the exterior.

However, it also underlines that other reasons exist in favour of the big company, such as the technological factors related to the aptitude to make use of economies of scale, and its greatest advantage, which is to gain access to the manufacture of differentiated products (Ethier, 1982; Helpman, 1981; Krugman, 1979, 1980; Lancaster, 1980). Also, it is necessary to bear in mind the greater capacity that the companies of large size have to absorb the costs that stem from the exporting activity. Finally, it is also possible to indicate as a favourable factor of the big company its negotiating power in the markets.

That said, although most of the arguments offered by economic theory endorse the high exporting capacity of the big company, reasons also exist to suggest certain advantages of the Small and Medium sized Enterprises (Camisón & De Lucio Fernández, 2010; Joffre, 1986). The existence of new tendencies, such as the advances in the technologies of production, communication and information, the deregulation of many sectors and the demand of customised products on behalf of the consumers globally (Acs & Audretsch, 1990; Loveman & Sengenberger, 1992), provokes the understanding that flexible organisations are needed and with capacity of adaptation that they can face the abovementioned challenges. The organisational and managerial structure of the small and medium sized enterprises helps comply with these requirements; this class of companies is considered to be generative of economic wealth, employment and social welfare (Storey, 1982; Reynolds, 1997).

Consequently, it might be suggested that the capacity that the small and medium sized enterprises have to reach a high specialisation in the production of a differentiated good and its larger geographical and organisational flexibility facilitates adaptation to the forms of expansion of the company. These are the main arguments that support the foundation of a positive relation between the small and medium sized enterprises and the exporting behaviour. Nevertheless, in spite of the previous arguments, in the specialist literature, the majority of opinion defends the advantages of the big company in comparison with the small and medium sized enterprises facing the challenge of internationalisation.

Several studies have attempted to corroborate these arguments from the empirical point of view. In this sense, Barac, Máñez, Rochina, and Sanchis (2008) find a positive relation between the size of the companies and its participation in the exportation; they also point out that this relation increases with time. On the contrary, Máñez, Rochina, and Sanchis (2009) consider the size of the companies and the sector to which they belong as offering a vision of the evolution of participation rate and exporting intensity of the manufacturing companies in the 1990s. They come to the conclusion that both variables are important to explain the abovementioned evolution. In this analysis, the bigger the company, the bigger the exporting intensity.

Nevertheless, this relation is not so clear, since there are diverse studies that show a certain ambiguity grade. While a few studies find the existence of a linear relation between the size of the enterprise and its exporting capacity (Calof, 1994; Donoso & Alonso, 2000), other studies question this relation, indicating that the linearity of the relation is not so clear (Verwaal & Donkers, 2002; Wolff & Pett, 2000). Also, according to another group of studies, the relation between size and exporting intensity was not significant as per statistics (Bilkey & Tesar, 1977).

For Alonso and Donoso (1998), the reasons that justify the absence of consensus in the results of the different empirical works analysing the relation between managerial size and exporting behaviour concern the variety of criteria of methodological design of the different studies. This diversity focuses, fundamentally, on two criteria: the form in which it measures itself both the size and the exporting behaviour and the characteristics of the analysed sample.

Since most of the arguments and analysis support the existence of a positive relation between the size and the exporting behaviour, as the economies of scale which the big companies enjoy favour the availability of resources that allow them to face export with greater confidence, we raise the following hypothesis:Hypothesis 4 The manufacturing companies of larger size exhibit a larger exporting intensity than those of lesser size.

To conclude, we analyse the influence that a company which belongs to a managerial group has on exporting behaviour, as opposed to the results obtained by companies which realise activity in the exterior as independent and autonomous units.

It is clear that the presence of foreign capital or the belonging to a managerial group can bring with it inconveniences, such as the loss of autonomy at the time of taking strategic decisions (Guisado Tato, Vila Alonso, & Guisado González, 2010). Nevertheless, it also has advantages. In fact, when considering export behaviour, it seems clear that belonging to a managerial group provides very relevant advantages. For instance, the companies that belong to foreign groups, as a result of the repeated interaction with other agents of the group belonging to other countries, are exposed to knowledge which autonomous companies cannot gain access to. Also, the diffusion of knowledge among the group enterprises usually occurs at larger innovation levels, which, as we have already indicated, facilitates the exporting process. In addition, many other advantages exist, such as the possibility of making profitable specific knowledge that facilitates the adaptation process to the needs of the foreign markets, the probability of generating larger economies of scale that increase the productivity and the competitiveness of the integral companies of the group. This allows a larger generation of resources that can increase the corresponding exporting effort, increase the power of market and of negotiation, etc.

All these arguments seem to support, at theoretical level, that the companies which belong to a managerial group or that are informed by foreign capital have a larger potential to gain access to the international markets than the companies that develop the exporting effort in an autonomous way.

The existing empirical literature seems to support this idea. Durán and Lamothe (1986), Maravall and Torres (1986) and Bajo (1987) state that the companies in Spain with presence of foreign capital have a larger exporting propensity. Also, according to Alonso and Donoso (1994), in their sample of companies at the ICEX‐92, the probability of the company exporting seems larger among those which have foreign capital than among those with solely domestic capital. However, they argue that this presence of foreign capital varies significantly according to the sector to which a company belongs and its size. Nevertheless, these results are not conclusive, since in this work, although it is observed that a company with foreign capital has a larger probability of exporting than the company with national capital, if the exporting propensity is borne in mind, the results change, and there is obtained a scarcely defined relation between the exporting intensity and the foreign capital.

On the other hand, according to the study of the internationalisation of Spanish companies by the Cámara de Comercio (2007), their international trajectory is determined by their belonging to a group or by the presence of foreign capital. In general, from their study is derived the idea that both the companies that belong to a group and those which are provided with foreign capital have a larger exporting propensity than the rest.

In short, after a review of the literature, in which most of the studies maintain a positive relation between belonging to a managerial group and the exporting propensity, we raise the following hypothesis:Hypothesis 5 The manufacturing companies that belong to a corporative group have a greater significant influence on the exporting intensity than the independent companies.

The information we use in the empirical analysis comes from the Panel of Technological Innovation 2005 (PITEC 2005), concerning the Spanish economy. From this database, we extract the companies that comprise the manufacturing sector, obtaining a sample of 6334 companies.

With the objective of evaluating the exporting behaviour of the Spanish manufacturing companies, we use corresponding exporting intensity (exportation/sales) as a dependent variable.

The explanatory variables that we use in the analysis, and internal structures from the perspective of the statistical treatment of the information, are the following:

Product innovation: when the company realises product innovation, this variable takes the value one; when product innovation is not realised, it takes null value.

Process innovation: the variable takes the value one if the company realises process innovation and null value if it does not realise process innovation.

Technological intensity: in this study, we use as a measurement of the technological intensity of the companies the unified international industrial classification (CIIU) proposed by the Organisation of United Nations (UNO) and adopted by the OECD/EUROSTAT. This classification allows us to catalogue the manufacturing companies in four categories of technological complexity, represented in the database, for statistical treatment, with the digits 1, 2, 3 and 4 in the following way: low technological intensity (1), medium–low (2), upper intermediate (3) and high (4).

Size: we consider three categories of managerial size as regards the number of personnel. In this way, there will be small enterprises that have up to 49 workers, assigning them to the sample value 1; medium‐sized companies that have between 50 and 249 workers, assigned to the value 2; finally, big companies with more than 249 workers, assigned to value 3.

Belonging to groups of companies: if the company does not belong to any group, the variable takes the value zero; if it belongs to a group with head office in Spain, it takes the value 1; finally, if it belongs to a foreign group, the variable takes the value 2.

With the objective of confirming the formulated hypotheses, we regress the exporting intensity on the correspondent explanatory variables (innovation of product, process innovation, technological intensity, size and belonging to groups of companies). We use the linear regression as a statistical technique, since the dependent variable is continuous.

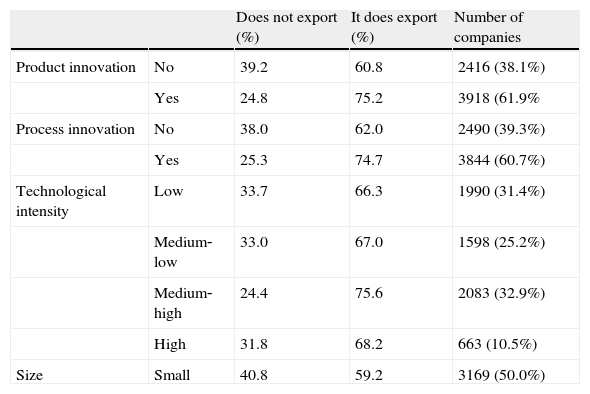

4Results and discussionTable 1 shows some descriptive information of the variables used in the empirical analysis. The companies that innovate in product are 61.9% of the whole of manufacturing companies, a number very similar to those which innovate in process (60.7%). Also, we can catalogue the Spanish manufacturing sector as of low and medium innovative intensity, since 89.5% of the companies belong to these categories. Furthermore, the companies of the manufacturing sector are of small and medium size, as both categories represent 84.8% of the companies of the sector. It should also be noted that most of the companies are not assigned to any group (65.5%), and that inside those which belong to any group, the majority belong to Spanish groups (22.3%) (Table 1).

Descriptive values of the variables.

| Does not export (%) | It does export (%) | Number of companies | ||

| Product innovation | No | 39.2 | 60.8 | 2416 (38.1%) |

| Yes | 24.8 | 75.2 | 3918 (61.9% | |

| Process innovation | No | 38.0 | 62.0 | 2490 (39.3%) |

| Yes | 25.3 | 74.7 | 3844 (60.7%) | |

| Technological intensity | Low | 33.7 | 66.3 | 1990 (31.4%) |

| Medium‐low | 33.0 | 67.0 | 1598 (25.2%) | |

| Medium‐high | 24.4 | 75.6 | 2083 (32.9%) | |

| High | 31.8 | 68.2 | 663 (10.5%) | |

| Size | Small | 40.8 | 59.2 | 3169 (50.0%) |

As regards exports, 75.2% of the companies that innovate in product and 74.7% of those which innovate in process are exporting companies. Therefore, in this case, both classes of innovation have a very similar behaviour. Nevertheless, as regards size, the same does not already happen, since the least abundant companies (the big ones) export the most. In total, 81.6% of the big companies are exporting companies, while in terms of the small enterprises, this number is 59.2%. With regard to the innovative intensity, the exporting behaviour is quite similar in three of four existing categories. The category that shows a larger exporting propensity is that of upper intermediate intensity, since 75.6% of this class are exporting companies. Finally, it is possible to prove that the companies that belong to corporative groups have a major exporting activity, principally those assigned to foreign groups, since 85.9% are exporting companies.

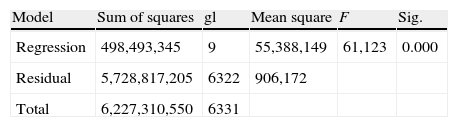

Next, before the analysis of the relevance of the coefficients of linear retrogression, we evaluate the adjustment of the model to the corresponding information distribution. To this end, we use the analysis of the variance (Table 2). From the above analysis, it is concluded that the model, as a whole, realises a good adjustment, since its relevance is full (0.000) (Table 2).

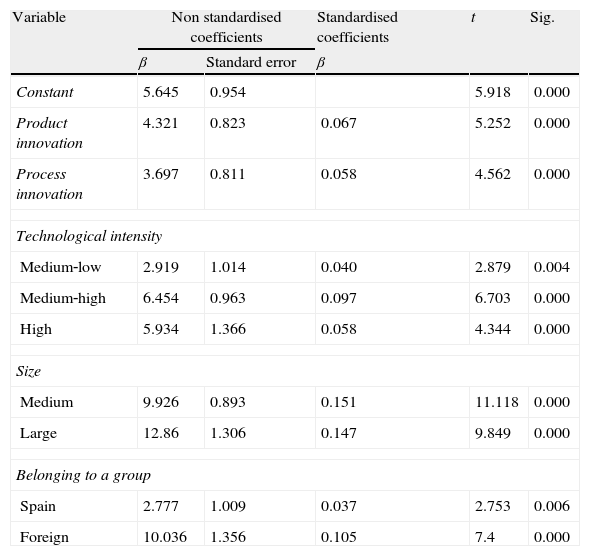

Finally, in Table 3, there are the coefficients of the linear regression. We argue that the product innovation influences in a positive and significant way the exporting intensity of the companies. This result is similar to the one obtained by many other studies; when the companies realise some type of innovation in their products, they are in a better position to satisfy a larger number of clients, thus increasing sales, improving the results and increasing productivity. All these issues help to improve possibilities of penetrating successfully the foreign markets. Consequently, we can affirm that Hypothesis 1 is fulfilled.

Coefficients of the linear regression of the exporting intensity.

| Variable | Non standardised coefficients | Standardised coefficients | t | Sig. | |

| β | Standard error | β | |||

| Constant | 5.645 | 0.954 | 5.918 | 0.000 | |

| Product innovation | 4.321 | 0.823 | 0.067 | 5.252 | 0.000 |

| Process innovation | 3.697 | 0.811 | 0.058 | 4.562 | 0.000 |

| Technological intensity | |||||

| Medium‐low | 2.919 | 1.014 | 0.040 | 2.879 | 0.004 |

| Medium‐high | 6.454 | 0.963 | 0.097 | 6.703 | 0.000 |

| High | 5.934 | 1.366 | 0.058 | 4.344 | 0.000 |

| Size | |||||

| Medium | 9.926 | 0.893 | 0.151 | 11.118 | 0.000 |

| Large | 12.86 | 1.306 | 0.147 | 9.849 | 0.000 |

| Belonging to a group | |||||

| Spain | 2.777 | 1.009 | 0.037 | 2.753 | 0.006 |

| Foreign | 10.036 | 1.356 | 0.105 | 7.4 | 0.000 |

As regards the process innovation, it is also stated that the relation between this variable and the exporting intensity is positive and entirely significant. Consequently, we can point out that Hypothesis 2 is fulfilled. Nevertheless, it is necessary to underline that the influence of the innovation of product on the exporting intensity is larger than the one that applies to the process innovation. It constitutes a clear indicator that public policies of promotion of innovation must place larger emphasis on product innovations, since these facilitate greater penetration into foreign markets.

As for the technological intensity, it is necessary to highlight that each of the categories of this variable has a positive regression coefficient and is statistically significant. Nevertheless, the quantity of the coefficients of regression does not increase as the category of considered technological intensity does, since the coefficient of the companies of high technological intensity is lesser than that of the companies of upper intermediate technological intensity. This result is coherent with the argument that the most exporting companies are those which have an upper intermediate technological intensity; they possess a technological process of innovation more adapted to the needs for the exporting process of companies. This is because the products made in industries of low technological intensity and medium–low must bear a high competitive intensity, as many suppliers exist in all the international markets. On the other hand, the lower impact on the exporting intensity of products made in sectors with high technological intensity – as regards those of upper intermediate intensity – is due to the fact that the novelty for the market that usually these products have does that a voluminous international demand still does not exist, from what it derives, obviously, a lesser influence on the variable exporting intensity (Table 3).

In relation to size, it is observed that medium and large companies have a positive regression coefficient and significant in comparison with small enterprises. Also, we verify that the influence on the exporting intensity of the companies of larger size is superior to the remaining analysed categories. Nevertheless, if we correct the coefficients of the influence of the different used scales of measurement,1 and we calculate the so‐called typified coefficients (column 4 of Table 3), we find that the companies of average size have greater influence on the exporting intensity. Therefore, we can confirm that Hypothesis 4 is not fulfilled.

Finally, the influence of belonging to a corporative group on the exporting intensity is positive and statistically significant in all the considered categories of the variable compared with not belonging to any group. Therefore, Hypothesis 5 that we raised is fulfilled. It is necessary to emphasise that belonging to a foreign group has an influence much greater than belonging to a Spanish group. In any case, we state that belonging to a corporative group contributes to the progress of the exporting behaviour of the companies, since they have access to excellent information about trends of consumption in certain international markets that result from interest, as well as practical knowledge of the whole regulation and the processes, and administration, such as management, which normally bears the exporting activity. Finally, it is necessary to emphasise that the companies that belong to a group benefit from the exporting culture that other group enterprises could possess. As the foreign companies of advanced countries usually have a larger exporting culture than corresponding Spanish rivals, belonging to a group of foreign companies tends to favour the propensity of the Spanish companies incorporated within this class. Hence, the biggest influence of this class of companies on the exporting intensity may be noted.

5ConclusionsIn this study we have raised an explanatory model of the exporting activity of companies, based on a sample of the Spanish manufacturing companies extracted from the Panel of Technological Innovation 2005.

We have carried out a review of the specialist literature, which has allowed us to identify a set of variables that have some type of influence on the exporting intensity of the companies. These variables include both external aspects, such as the sector or the peculiarities of the market of exportation, and internal aspects, that is, the size, the exporting experience, etc. (Alonso and Donoso, 1994, 1998, 2000; Delgado, Espitia, & Ramírez, 2006; García & Avella, 2008).

Among all the variables that the review of the literature provides, we have placed special attention on the influence that innovation strategy has as regards both its typology (product innovation versus process innovation) and intensity (considering the existence of four categories separated from sectors in which it refers to the technological intensity).

We also have incorporated into the explanatory model two additional variables to which the specialist literature attaches large moderating importance, so much of the strategies of innovation as of the corresponding exporting behaviour: on the one hand, the size of the companies, measured in terms of the number of personnel; on the other hand, belonging to a corporative group, differing between national groups and foreign groups.

From the empirical analysis carried out, we have verified that all the variables were significant and had a positive influence on the exporting intensity of the companies.

Nevertheless, it is necessary to point out that our empirical analysis has provided four results that deserve some type of additional comment. First of all, the influence of the strategy of innovation of product is superior to that of process innovation. Therefore, everything seems to indicate that the attainment of larger rates of exportation happens for a larger promotion of the strategy of innovation of product, not neglecting, obviously, the process innovation.

Secondly, we have also verified that the coefficient of regression of the companies that belong to sectors of high technology is less than that of the companies that belong to sectors of upper intermediate technology. Such a result can be due to the fact that the developed products are more easily marketable and that, therefore, they enjoy consolidated and increasing international demand. This facilitates their penetration in more permeable international markets to the exporting share.

Third, there are no companies of larger size, but those of medium size which have major influence on the exporting intensity of the companies. This fact, together with the importance of the sectors of upper intermediate technology previously mentioned, reveals that the public policies of promotion of innovation and exports must place special emphasis on the companies of medium size belonging to this class of sectors.

Fourth, the coefficient of regression of the companies that belong to a foreign managerial group is also much larger than that of the companies which belong to a national group. In this case, the explanation can be given that either belonging to a foreign group favours the knowledge exchange between domestic and non‐national enterprises, which will allow the company to develop more efficient and more adapted process of exportation to the needs of the exterior market, or the existence of a strong exporting culture that traditionally has been considered to be that of non‐national companies is exhibited. Nevertheless, given the explanatory character of these two conclusions, we believe additional studies are necessary to provide them with greater empirical consistency.

In conclusion, it is necessary to bear in mind that many of the variables that we have used can be studied from other perspectives, or the study can even be deepened. For example, it has been indicated that process innovation influences exporting intensity, but, in our opinion, the study of all the typologies of process innovations that might be included in this generic category will need to be tackled in future.

It must be taken into account that the large companies take value 3, while the medium and small ones take values 2 and 1, respectively. Therefore, the coefficients of every representative class of variable size are influenced by the value of its respective scales of measurement. Consequently, and with the objective of measuring the corresponding coefficients in the same scale to be able to realise homogeneous comparisons, it turns out to be habitual to transform the original coefficients into typified coefficients, since the abovementioned reflect the relation between the independent variable and clerk in units of respective typical deviations.