The concept of the global production network expressively covers the spatial interrelationships characteristic of the economy due to the existence of worldwide flows of information, raw materials, components, and finished products. Recent geographical analyses of global production networks in different economic sectors demonstrate that little attention has been paid to the logistical and transport systems through which networks are fully integrated. Nevertheless efficient logistics and transport services are essential to an understanding of their organisational and geographical structure. The supply chains of big fashion retailers provide a good example because the choice of global or local supply depends on whether suppliers rely on efficient transport and logistics systems that let them compensate for higher relative costs compared with developing countries —in the case of local supply— or the costs deriving from their greater distance to the market —in the case of global supply. In addition the challenges presented by the functional and geographical integration of fashion production networks can only be overcome if global retailers manage their logistics efficiently and leverage the differentiated advantages of the modes of transport in relation to time.

This paper on Inditex, a Spanish leading group in the fashion sector, analyses how transport and logistics fit into the production network and provide the firm with one of its most notable competitive advantages. We first discuss the dilemmas that fashion retailers face when organising the supply chain and the contribution of logistics and transport to its functional and geographical integration. We then open the study of Inditex by describing the network of shops and manufacturing, presenting the principles of the logistical model, and providing details of the procedures applied for the functional and geographical integration of the chain of production of Zara, the best known of the company’s 11 brands. The analysis, based on recent and previously unpublished data on the brand’s logistics hub in Zaragoza (northeast Spain), sheds light on the modus operandi of the group and confirms the crucial importance of logistics in all facets of the production model. First, efficient logistics and sufficiently fast transport, allow the company to enjoy short lead times and be present in economically and geographically very disparate markets. Second, the productive structure, combining nearby and distant manufacturing, and both dispersion and concentration spatially and in production, also relies on the effectiveness of the logistical model. On the one hand, better internal and external communication and greater productivity compensate for the company’s higher costs of manufacturing in nearby areas. On the other, the vigour of the four clusters of suppliers in Asia (China, Pakistan, Bangladesh, and India) rests on the availability of efficient logistics and transport services, including air transport, which ameliorate the costs of their distance to the company’s distribution centres in Spain and other markets. Finally, we offer details of how the Inditex group completely centralises the distribution of its products to shops. The data for the Zara logistics hub in Zaragoza (North East of Spain) illustrate the value given to time in the company’s activities and how this consideration influences the organisation of the flows in and out of the hub. Air transport is used to send garments to distant markets and also for the reception of high-fashion-content garments from the Asian clusters and for their quick delivery to various markets despite the distance.

The results provide evidence for considering logistics and transport as key facilitators for the Inditex expansion, but we understand that the effects described in the paper can extend to the fast fashion sector as a whole in that the geographical configuration of global networks increasingly depends on the organisational and logistical strategies that the firms adopt in order to meet the needs of time-sensitive customers. At the conclusion we remind that a heavy dependence on energy and the likelihood of fuel price increases threaten the future viability of a logistic model based on the present unrealistic cheapness of fast transport. As establishing the scope and reach of these aspects would require complementary analysis, we finish the paper whith tuh hope of having stimulate interest for a better understanding of the logistical and transport systems within the global production networks in a possible new economic and environmental context.

El análisis geográfico de las cadenas globales de producción en diferentes sectores económicos ha prestado poca atención a los sistemas logísticos y de transporte que permiten la integración espacial completa de dichas cadenas. Este artículo sobre Inditex, empresa líder en el sector de la moda rápida, sale al paso de dicha carencia, analizando cómo el encaje del transporte y la logística en sus redes de producción otorgan a dicha compañía una de sus principales ventajas competitivas. El texto describe la red de tiendas y fábricas, presenta los principios del modelo logístico y ofrece algunos detalles sobre los procedimientos aplicados para lograr la integración geográfica y funcional de la cadena de producción de Zara, la más conocida de las once marcas de la compañía. Entre otros aspectos, se resalta el creciente uso del transporte aéreo en las cadenas de suministro de productos con alto contenido en moda fabricados en países distantes, así como en la distribución de prendas a los mercados más alejados. También queda patente la importancia de la variable tiempo en la configuración geográfica de las redes globales de este sector rápida. Por ello el artículo concluye señalando la necesidad de prestar una mayor atención a las estrategias organizativas y logísticas que adoptan las empresas para mantener y aumentar su competitividad global en este ámbito.

One of the most characteristic features of the global economy and its geography is the configuration of complex and extensive trans-national networks, through which information, raw materials, components, and finished products flow from production to consumption centres. This phenomenon is the basis of the global production network concept, understood as the network whose “interconnected functions, operations, and transactions —through which a specific product or service is produced, distributed, and consumed— extend spatially across national boundaries” (Coe et al., 2008:274). The heuristic advantages of the concept have led to its application in different sectors and contexts and to greater understanding of how global sourcing and offshore manufacturing have altered the economic landscape (Hess and Yeung, 2006; Christopher et al., 2006). However, recent reviews of the state of the subject note that very little attention has been paid to the logistical and transport systems through which production chains are geographically and functionally integrated that enable firms to respond to the market appropriately (Rodrigue, 2006).

With this paper on the Spanish group Inditex, a world leader in the fast fashion sector, we aim to illustrate how transport and logistics procedures fit into the firm’s global production network and provide the company its recognised competitiveness. We first discuss the dilemmas that fashion retailers face when organising the supply chain and the contribution of logistics and transport to its functional and geographical integration. We then open the study of Inditex by describing the network of shops and manufacturing. Next, we present the principles of the logistical model and describe details of the procedures applied for the functional and geographical integration of the chain of production of Zara, the best known of the company’s 11 brands. This section offers previously unpublished data on the brand’s logistics hub in Zaragoza (northeast Spain).

The results provide evidence for considering logistics and transport as key facilitators for the group global expansion, but we understand that the effects described in the paper can extend to the fast fashion sector as a whole. The article concludes with a reflection on the theoretical and methodological implications of the results and their contributions to a better understanding and analysis of the global production networks.

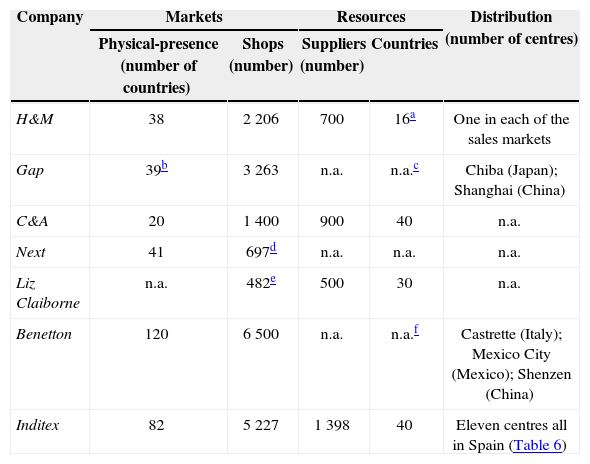

Spatial organisation and integration within the global fashion production networks: some issuesFactors and elements of the production chains of global fast fashion distributorsThe contemporary evolution of traditional industrial sectors, such as clothes manufacturing, can be viewed as a pioneering case of the technical and spatial fragmentation of the production process and the appearance of global production and distribution networks. The production is divided into specialised activities, and each activity is located where it can contribute most to the value of the end product. When the location decision of each activity is being made, costs, quality, reliability of delivery, access to quality inputs, and transport and transaction costs are important variables (Nordås, 2004). The data gathered in Table 1 present the resulting geographical dispersion typical of the production chains of leading companies.

Comparative data for geographical configuration of production circuits (selection of global retailers)

| Company | Markets | Resources | Distribution (number of centres) | ||

|---|---|---|---|---|---|

| Physical-presence (number of countries) | Shops (number) | Suppliers (number) | Countries | ||

| H&M | 38 | 2 206 | 700 | 16a | One in each of the sales markets |

| Gap | 39b | 3 263 | n.a. | n.a.c | Chiba (Japan); Shanghai (China) |

| C&A | 20 | 1 400 | 900 | 40 | n.a. |

| Next | 41 | 697d | n.a. | n.a. | n.a. |

| Liz Claiborne | n.a. | 482e | 500 | 30 | n.a. |

| Benetton | 120 | 6 500 | n.a. | n.a.f | Castrette (Italy); Mexico City (Mexico); Shenzen (China) |

| Inditex | 82 | 5 227 | 1 398 | 40 | Eleven centres all in Spain (Table 6) |

n.a.: data not available.

Notes:

Such companies as the American Gap, Banana Republic, and Liz Claiborne, the British Next, the Swedish H&M, the Italian Benetton, and the Spanish Inditex group do not manufacture their goods; instead, they manufacture only a part of the products they sell and thus have large networks of external suppliers. The spread of lean and agile production systems has led to changes in companies’ sourcing strategies as they find themselves facing a dilemma between the global supply chain, which lets them benefit from the economic advantages of different suppliers anywhere in the world, and a local supply chain consisting of suppliers near the markets, facilitating a fast response to the same markets but at a higher cost (Guercini and Runfola, 2004).1

When the manufactured products are basic or predictable and restocked only once a season, the production chain spreads more or less around the world, with China, India, and Bangladesh serving as the main suppliers due to their advantage in the quality/price ratio. For product categories of unpredictable demand, such as those with a high fashion content, the need for quick replenishment enabling quicker responses to the market, makes it more profitable for buyers to source their products from countries with close proximities, even if the products cost more initially (Guercini and Runfola, 2004; Bruce et al., 2004; Evans and Harrigan, 2004; Abernathy et al., 2006; Christopher et al., 2006). In these cases, the place of manufacture is not determined by cost but by opportunity, punctuality, and the quality of the service provided. “Transport time”, a location factor other than the “transport cost” factor traditionally considered in Economic Geography models, allows for comparative advantages to be reassigned in favour of countries in Eastern Europe, Turkey, Mexico, and the Dominican Republic, among others, due to a common border with importers from the European and North American markets or the quality of their logistics and transport services. In addition, those countries are likely to remain important exporters because of preferential access to the aforementioned markets through regional trade agreements (Evans and Harrigan 2005; Guercini and Runfola 2004; Nordås, 2004; Nordås et al., 2006).

Shop network is other essential element of a global fashion retailer’s strategy that is clearly focused on ensuring the growth of the companies by increasing their sales (Dawson, 2007:383). Emerging countries in East and South Asia, Latin America, and Eastern Europe have been the preferred destinations in recent years, creating new challenges for companies to provide a rapid response to the demands of their markets, especially the most distant ones (Table 1).

Logistics and transport in the framework of global production chains in the fast fashion sectorAccording to Rodrigue (2006), the organisational and spatial model described in the previous section appears paradoxical if we consider the risks underlying this dispersion, including uncertainty and delayed deliveries. Christopher et al. even predict that “low-cost off-shore sourcing strategies can end up as high-cost supply chain outcomes” (2006: 278). For those reasons, a suitable integration, both functional and geographical, of all elements of the chain of production is required. Functional integration is achieved when the delivery cost, dimension, and time of the goods supplied by each productive establishment —external workshop or manufacturer, supplier, distribution centre, and shops— meet the requirements of the destination establishment. Functional integration has been favoured by the generalised adoption of lean retailing systems, electronic data interchange (edi) between establishments, or computerised systems for recording sales.

Global fashion distributors tend to concentrate diverse operations and activities in logistics platforms and distribution centres with the intention of optimising product deliveries in different parts of the world. Their spatial requirements include a good location between the respective clusters of suppliers and clients to minimise the distance covered by transport, especially lorries. Most global fashion retailers prefer centres to support stores in their geographic vicinity (see Table 1) and locate them in their different sales markets (e.g., Europe, East Asia). However, in other cases, the companies keep some or all of their distribution centres in their country of origin.

Geographical integration within the production chain is achieved when the goods sent from each establishment arrive at the destination establishment quickly. Geographical integration has been favoured by improvements in global goods transport systems, although such improvements has occurred at the expense of substantially higher energy consumption, reinforced by the fact that energy costs are still relatively very low (Rodrigue, 2006). Elsewhere, air transport has been experiencing an increased market share. The price reduction, especially of the ad valorem rates, is a key factor, as it means that speed and shorter lead and travel times become less expensive, especially for products with a higher value-to-weight ratio, where the ability to respond quickly to market demands is an important advantage for companies. In these cases, air transport provides real coverage against the volatility and uncertainty of the market (Hummels, 2007) while avoiding other delays not directly caused by distance, such as border crossings.

Indeed, as discussed above, using air transport improves the competitive position of semi-peripheral and peripheral territories, as it permits exporting higher-value garments to distant markets. Exports from Bulgaria to the East Coast of the United States (Nordås et al., 2006) and the flows with clothing for the Spanish group Inditex from China or Korea are only two of many possible examples. If, in addition, firms have centralised distribution systems, air transport is increasingly important for delivering garments to distant markets. Once again, the group Inditex is a good example because it transports much of the clothing sold in shops outside Europe by plane, as we discuss in the next section.

Global production networks, logistics, and transport: the inditex groupInditex (acronym for Industria de Diseño Textil, S. A.) is a group of companies whose main activity is the distribution of fashion articles, including clothes, footwear, accessories, and household textile products. Its activity takes place through different commercial formats, including Zara, Pull & Bear, Massimo Dutti, Bershka, Stradivarius, Oysho, Zara Home, and Uterqüe, and its trajectory has attracted attention since 1975, the year the first Zara shop opened in the Galician city of La Coruña, Northwest Spain. Significant recent figures include sales, which grew by 10% in 2011 and 17% in 2012, reaching 11 362 million euros; 6 000 shops in 86 markets; 116 110 employees in October 2012; and the 12% increase in net profits between 2010 and 2011 despite the complicated economic situation (Inditex, 2012), among other data.

Inditex meets all of the requirements of the leading companies in the fashion sector (Tokatli, 2008; Rohwedder and Johnson, 2008; Tokatly and Kizilgün, 2010) with interesting peculiarities, such as the control and integration of all operations in the production chain, a renewal of supply in shops more frequent that its competitors, a reduced design-to-retail cycle, a location in the vicinity of many business functions, or the complete centralisation of distribution. Many studies suggest that Inditex is mainly a design-led company and assert the importance of market research as a key facilitator of the success of the firm (Dutta, 2002 and 2004). Our aim is not to challenge that view but to provide empirical evidence of how logistics enable the international expansion of the firm to demonstrate that it is also a logistics-led company.

Globalising trends of the commercial functionThe growing number of shops indicates how the group reaches the markets with an increasing “convergent middle class”,2 such as Eastern Europe markets, where 50 and 49 new shops opened in Russia and Poland, respectively, in 2011 (Table 2).

Aspects of interest of the Inditex commercial network

| Geographical area | 2012 | |||

|---|---|---|---|---|

| Shops | Countries | Selected market examples (new shops) | % sales | |

| Europe | 4 237 | 38 | Poland (50) | 70 |

| Russia (49) | ||||

| Americas | 425 | 17 | Mexico (21) | 12 |

| Asia | 838 | 22 | China (132) | 18 |

| Africa & rest of the world | 27 | 5 | South Africa (1) Australia (1) | |

| Total | 5 527 | 82 | 100 | |

Note: Data on 31 January.

A presence in Asia was also consolidated with the 2010 opening of the first Zara shop in India. The opening of 75 shops in China in 2010 and 132 shops in 2011 confirms the trend to expand in that country, where the group expected to have a presence in 40 cities at the end of 2011. In 2011, Inditex entered the Australian and South African markets, thus expanding the area for which Inditex designs specific collections due to the different seasons. Data from Table 2 indicate an increase in the number of American markets and shops (16 and 395, respectively, in 2011), with growth clearly concentrated in Mexico (Inditex, 2011 and 2012).

Shops in old and new markets receive goods twice a week. Each delivery includes new items adapted to local demand in terms of models, sizes, seasons, and other requirements. If we consider that lean retailers in the United States typically replenish their stores on a weekly basis (Nordås, 2004), the Inditex replenishment rhythm doubles that of competitors. Delivery include garments manufactured in the previous 30 days and moved from the distribution centre to shops in Europe in an average of 24 hours and to shops in the Americas or Asia in 48 hours (Inditex 2012). Maintaining both short lead times and short transport times presents complex challenges for the logistical system, which must ensure a constant renewal of the offerings in the stores and maintain a competitive advantage in markets that differ commercially and geographically. As short lead times are related to the supply chain strategy, we develop that aspect in the following chapter.

Aspects of design and manufacturing: location and function within the firm’s global networkDesign and manufacturing demonstrate the Inditex group’s commitment to the vertical integration model in its operations. It is well known that the more capital-intensive and value-added intensive stages of group production (purchasing raw materials, designing, cutting, dyeing, quality control, ironing, packaging, labelling, distribution, logistics) are performed internally and that sewing and more labour-intensive and less value-added intensive tasks are outsourced (Alonso, 2000; Martínez, 2008; Martínez-Senra et al., 2012). To appreciate how logistical and transport challenges are overcome, it is necessary to know where the different stages of production are performed. Approximately 1 000 people based at the La Coruña company headquarters and in Barcelona carry out the design and development tasks (Inditex, 2011). They receive constant information from the stores, allowing the firm to react very quickly to changes in demand and to design many more models than the competitors. Their specifications can quickly be put into practice because the Inditex facilities, where manufacturing begins, are located in the same or another very proximal industrial park. The facilities consist of 11 small establishments, with all but one having less than 100 employees. They are equipped with the latest equipment for fabric dyeing and processing, cutting, and garment finishing (Dutta, 2002; Martínez et al., 2012).

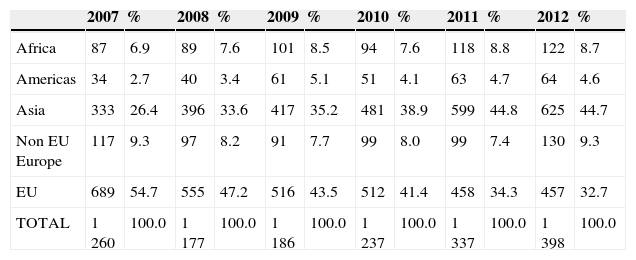

Labour-intensive tasks, such as sewing, are subcontracted to firms in a wide-ranging supply chain, currently present in 60 countries (Inditex, 2012).3 The nearest supplier companies are situated along the La Coruña-Vigo axis and the North of Portugal, where a very strong sector of dressmaking manufacturing has developed competitive production capabilities by means of cooperatives and non-cooperative workshops and by contracting to domestic producers (Revilla, 2002). The spatial distribution and evolution of all suppliers forming the first line of the production chains appear in Table 3.4

Evolution of the number of suppliers by geographical areas (on 31 January)a

| 2007 | % | 2008 | % | 2009 | % | 2010 | % | 2011 | % | 2012 | % | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Africa | 87 | 6.9 | 89 | 7.6 | 101 | 8.5 | 94 | 7.6 | 118 | 8.8 | 122 | 8.7 |

| Americas | 34 | 2.7 | 40 | 3.4 | 61 | 5.1 | 51 | 4.1 | 63 | 4.7 | 64 | 4.6 |

| Asia | 333 | 26.4 | 396 | 33.6 | 417 | 35.2 | 481 | 38.9 | 599 | 44.8 | 625 | 44.7 |

| Non EU Europe | 117 | 9.3 | 97 | 8.2 | 91 | 7.7 | 99 | 8.0 | 99 | 7.4 | 130 | 9.3 |

| EU | 689 | 54.7 | 555 | 47.2 | 516 | 43.5 | 512 | 41.4 | 458 | 34.3 | 457 | 32.7 |

| TOTAL | 1 260 | 100.0 | 1 177 | 100.0 | 1 186 | 100.0 | 1 237 | 100.0 | 1 337 | 100.0 | 1 398 | 100.0 |

Notes:

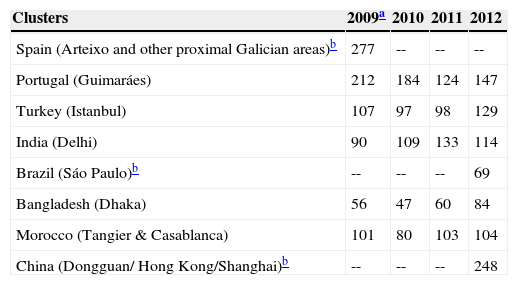

Alongside the geographical diversification of the supply chain, Inditex maintains a clear strategy of concentrating the production because more than 87% is obtained in the seven countries where the group has established clusters of suppliers from 2006 on (Table 4). The data provided in Tables 3 and 4 illustrate the absolute and relative increase in the number of non-European suppliers, especially the Asian suppliers. Nevertheless, corporative information indicates that proximity is still a hallmark of the group because 50% of production is manufactured in areas much closer than Asia, such as the rest of Galicia, the North of Portugal, Morocco, or even some non-EU European countries, such as Turkey (Ibid.:9). Furthermore, the proximity trend could even recover in the near future due to the recent transfer of some of the group’s current production in China to Turkey, Morocco, or Portugal (Gómez, 2012). Our data do not allow us to confirm the first part of that statement, but we can confirm the second part because of the increasing number of suppliers in Turkey, Portugal, and even Morocco.

Evolution of the number of suppliers in the corresponding clusters (on 31 January)

| Clusters | 2009a | 2010 | 2011 | 2012 |

|---|---|---|---|---|

| Spain (Arteixo and other proximal Galician areas)b | 277 | -- | -- | -- |

| Portugal (Guimaráes) | 212 | 184 | 124 | 147 |

| Turkey (Istanbul) | 107 | 97 | 98 | 129 |

| India (Delhi) | 90 | 109 | 133 | 114 |

| Brazil (Sáo Paulo)b | -- | -- | -- | 69 |

| Bangladesh (Dhaka) | 56 | 47 | 60 | 84 |

| Morocco (Tangier & Casablanca) | 101 | 80 | 103 | 104 |

| China (Dongguan/ Hong Kong/Shanghai)b | -- | -- | -- | 248 |

Notes:

Clusters of suppliers are important for the goods-in and goods-out flows through the logistics system and for understanding the production process. With the cluster strategy, the firm selected a smaller number of productive scenarios to stimulate collaboration among the different agents involved, increase the productivity of local manufacturers, and share technology with them as a source of competitive advantage (Inditex, 2007). Stable commercial relationships allow the companies to increase the level of integration of their own processes with the group dynamic. Thus, the conditions are in place to get a garment to market very quickly. Sometimes, this rapid time to market is achieved because undyed fabrics and trims are already at the firm’s warehouses in Arteixo after been sourced from East Spain, India, or Morocco and because the pieces cut at the neighbouring group facilities are distributed for assembly to the Galicia and North of Portugal suppliers.

On other occasions, local suppliers merely personalise or provide a “basic product”, previously manufactured by a low-cost supplier, a different finish according with the market tendencies. Customisation or after-treatment makes it possible to create 10 “new” final products from one “basic” one (Martínez et al., 2012). Although manufacturing in Spain and Portugal is two and a half times more expensive than in Eastern Europe due to higher salary costs, the group has maintained its competitiveness because it compensates for this increased cost with higher productivity, better quality products, and faster access to its markets (Gavidia and Martínez, 2007; Tokatli, 2008).

In addition to the local supply strategy, Inditex has an overseas or global supply chain. In four of the global supplier countries —China, Pakistan, Bangladesh, and India— there are clusters of suppliers, from which we may conclude that, as explained above, their contribution to production, which could represent over 30% of the total, includes products with a high fashion content. It can also be inferred that in addition to the advantageous quality/price ratio typical of these countries, we can add the availability of efficient logistics and transport services, including air transport, which would attenuate the costs of their distance to the Spanish distribution centres, as we explain below.

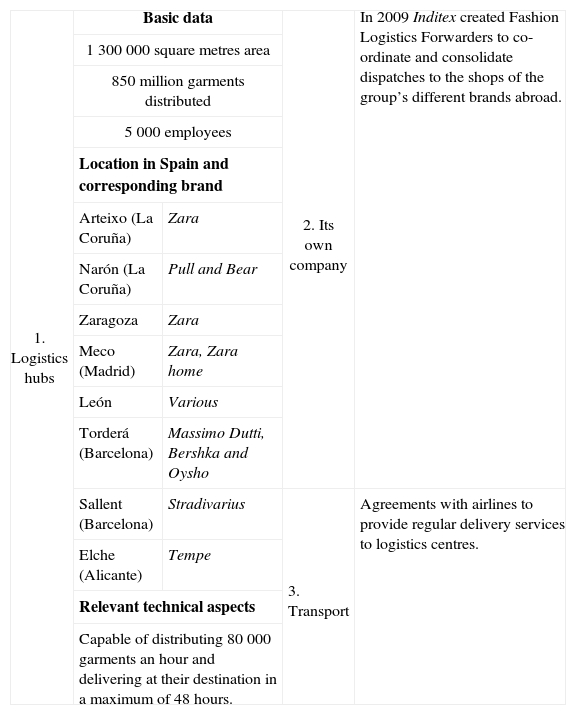

Geographical integration of the supply chain: logistics and transportThe basic characteristics of the Inditex transport and logistics system are summarised in Table 5. Efficiency is achieved due to economies of scale, simplified communications, and the coordination of production in establishments on all five continents (Gavidia and Martínez, 2007). The activity of the group’s own company, Fashion Logistics Forwarders, focuses on improving its brands’ deliveries to destinations where they do not have a large presence, as the containers carrying the garments of these brands were often not full, and occasionally, two brands would send half-empty containers to the same destinations (Farto, 2008). The company optimises the transport methods and redefines the routes established by the logistics departments of each of the group’s brands to make distribution costs for the goods as inexpensive as possible.

Elements of the Inditex logistical model (on 31 January 2012)

| 1. Logistics hubs | Basic data | 2. Its own company | In 2009 Inditex created Fashion Logistics Forwarders to co-ordinate and consolidate dispatches to the shops of the group’s different brands abroad. | |

| 1 300 000 square metres area | ||||

| 850 million garments distributed | ||||

| 5 000 employees | ||||

| Location in Spain and corresponding brand | ||||

| Arteixo (La Coruña) | Zara | |||

| Narón (La Coruña) | Pull and Bear | |||

| Zaragoza | Zara | |||

| Meco (Madrid) | Zara, Zara home | |||

| León | Various | |||

| Torderá (Barcelona) | Massimo Dutti, Bershka and Oysho | |||

| Sallent (Barcelona) | Stradivarius | 3. Transport | Agreements with airlines to provide regular delivery services to logistics centres. | |

| Elche (Alicante) | Tempe | |||

| Relevant technical aspects | ||||

| Capable of distributing 80 000 garments an hour and delivering at their destination in a maximum of 48 hours. | ||||

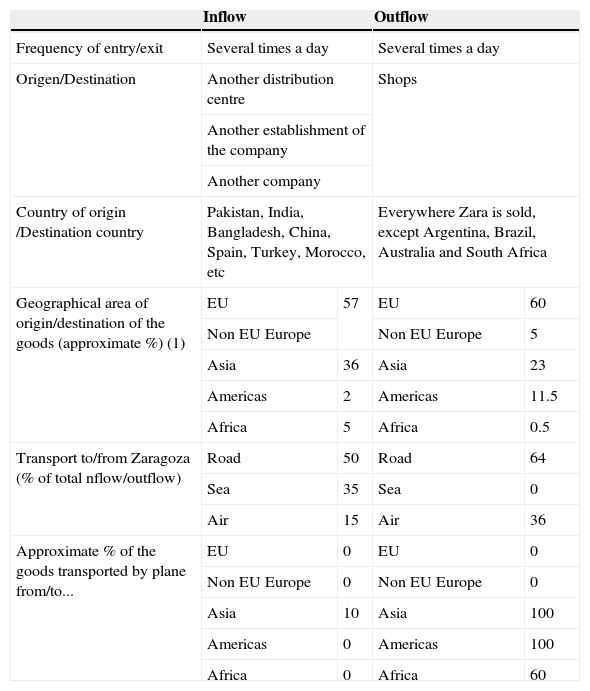

The data in Table 6 summarise the activity of the Zara logistics hub in Zaragoza (Northeast Spain), opened in 2003, in addition to the existing Zara hub in Arteixo (Galicia). The centre is in the city’s logistics platform and enjoys a high accessibility and potential for intermodality due to the presence at the site itself or nearby of railway, roads, and an airport and of good road connections to the Mediterranean ports of Valencia and Barcelona and the port of Pasajes on the Bay of Biscay (Cambra and Ruiz, 2009; Sheffi, 2012). This facility can store 34 million garments, distribute 360 million garments, and have more than 900 people operating at a time. The data in the table illustrate what has already been discussed regarding how logistics hubs work as part of global chains of production. The inflows come from supplier factories everywhere and from other distribution centres in Spain, whereas outflows are exclusively towards the Zara shops. As remarked above, the radius of action of the hub has increased, and the destination shops are now on every continent except Australia. However, European shops are the destination of more than half the garments, followed by shops in Asia. Although our source did not provide information about the geographical origin of inflows, the fact that 50% are road flows indicates that the origin is European. Fifteen percent of inflows arrive by air from Asia, confirming the use of air transport to compensate for the disadvantage of some manufacturers due to their distance and thus make it possible to maintain the manufacture of high-fashion garments in these territories. Nevertheless, most of the goods from the Asian continent use sea transport until the Barcelona port. The explained intermodal distribution of the goods coming in has been stable for several years (Escalona and Ramos, 2010).

Basic data on operations in the Zara logistics hub (Zaragoza, NE Spain)

| Inflow | Outflow | |||

|---|---|---|---|---|

| Frequency of entry/exit | Several times a day | Several times a day | ||

| Origen/Destination | Another distribution centre | Shops | ||

| Another establishment of the company | ||||

| Another company | ||||

| Country of origin /Destination country | Pakistan, India, Bangladesh, China, Spain, Turkey, Morocco, etc | Everywhere Zara is sold, except Argentina, Brazil, Australia and South Africa | ||

| Geographical area of origin/destination of the goods (approximate %) (1) | EU | 57 | EU | 60 |

| Non EU Europe | Non EU Europe | 5 | ||

| Asia | 36 | Asia | 23 | |

| Americas | 2 | Americas | 11.5 | |

| Africa | 5 | Africa | 0.5 | |

| Transport to/from Zaragoza (% of total nflow/outflow) | Road | 50 | Road | 64 |

| Sea | 35 | Sea | 0 | |

| Air | 15 | Air | 36 | |

| Approximate % of the goods transported by plane from/to... | EU | 0 | EU | 0 |

| Non EU Europe | 0 | Non EU Europe | 0 | |

| Asia | 10 | Asia | 100 | |

| Americas | 0 | Americas | 100 | |

| Africa | 0 | Africa | 60 | |

Note: (1) The data thus marked were not provided by the source, but entered by the authors on the basis of corporate information, which was considered close to the real data.

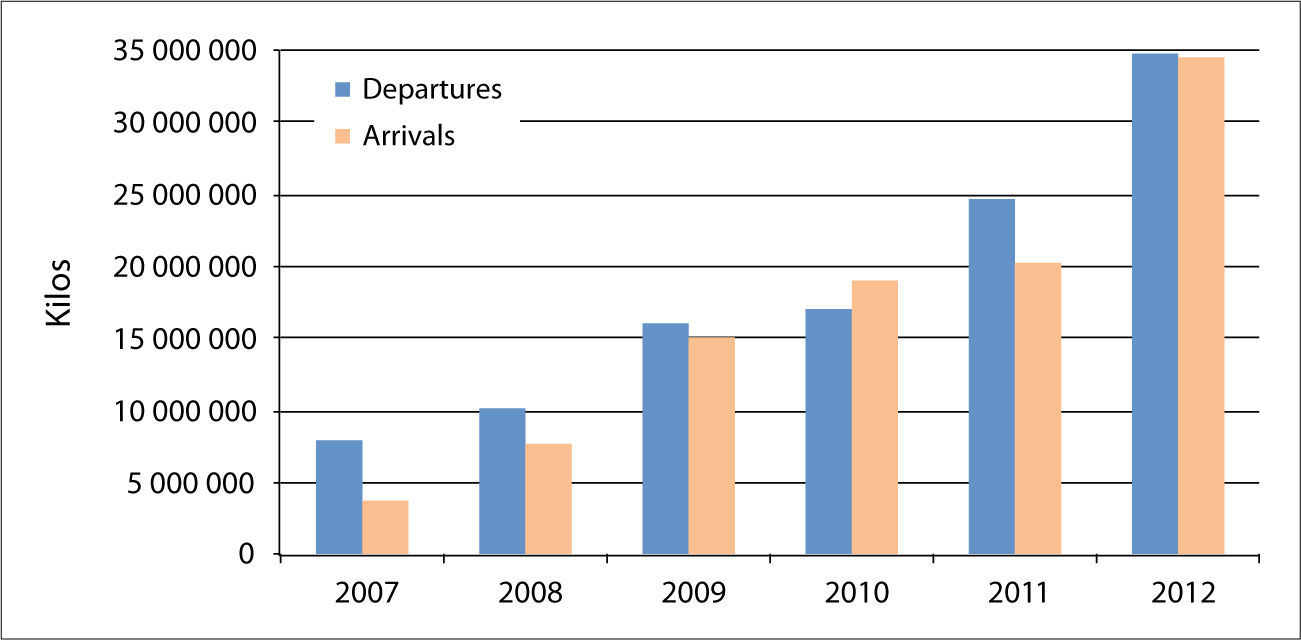

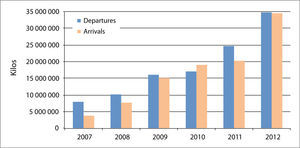

Concerning the outflows, the intermodal distribution is related to the achievement of delivering to shops in Europe in an average of 24 hours and to the Americas and Asia in 48 hours. Air transport is used for 36% of the outflows, a figure that is 20% higher than in 2010 and appears to be an effect of the growing importance of non-European markets, which are served only (Asia and America) or mostly (Africa) by plane. A local effect of the greater use of air transport for logistics flows is the increased use of the neighbouring airport of Zaragoza (see Figure 1). For that reason, the airport ranks third of all of the Spanish airports for freight transport, just after Madrid and Barcelona, and freight for Inditex represents more than 80% of the total freight.

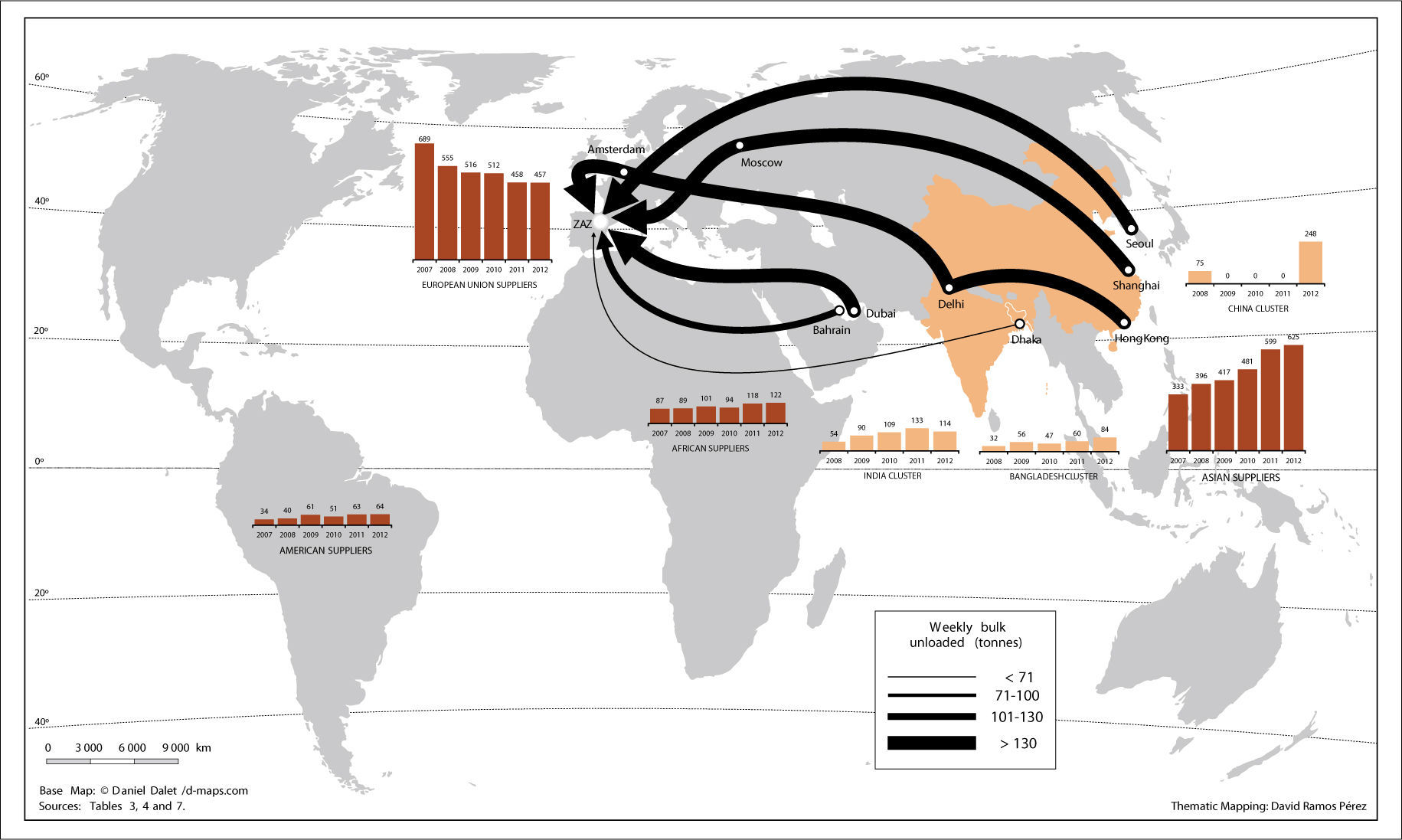

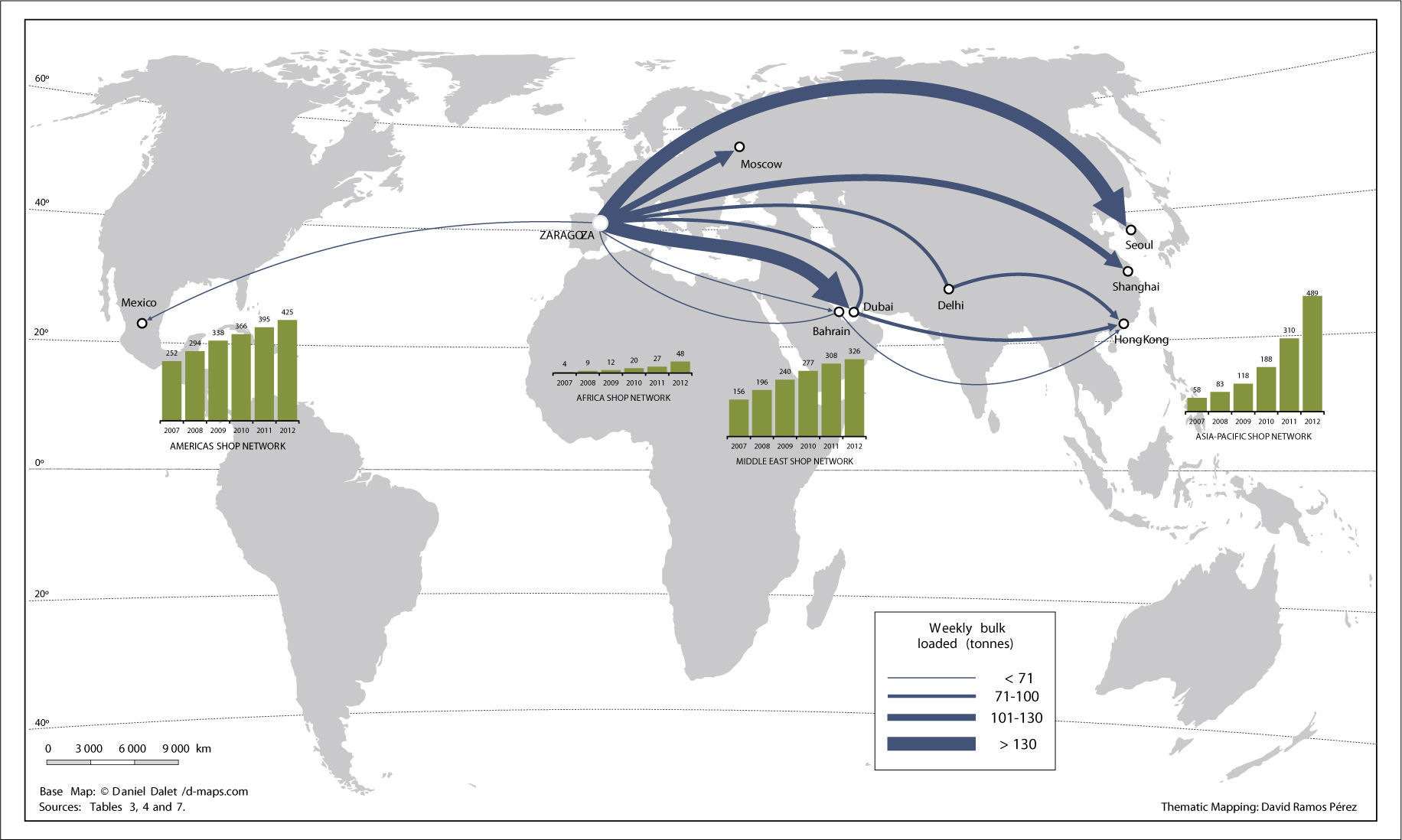

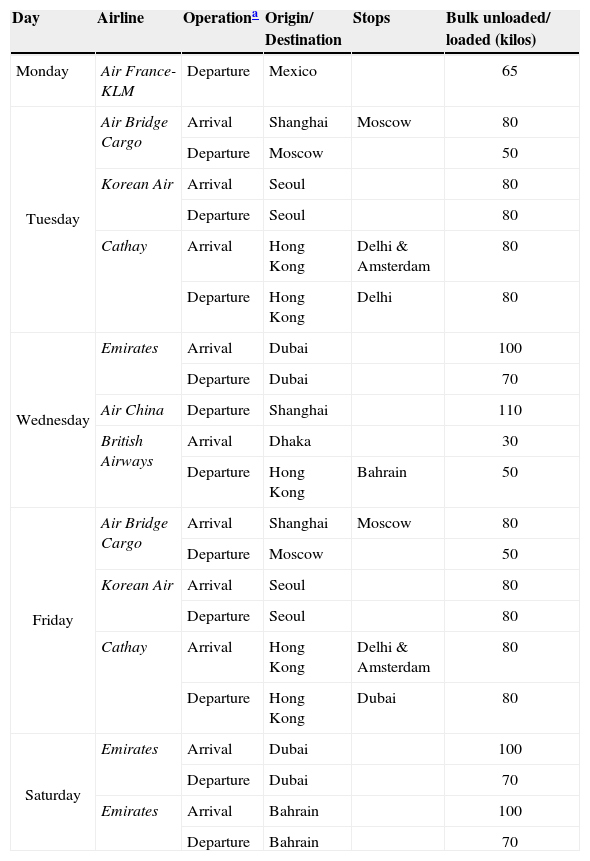

Due to the increase in air inflows and outflows, the relative importance of Zaragoza Airport for the company’s operations in the platform has grown, accounting for 10% of all air inflows and 22% of all air outflows. Table 7 and Figures 2 and 3 present aspects of the recent activity.

List of flights per week for Inditex via Zaragoza Airport (in January 2013)

| Day | Airline | Operationa | Origin/ Destination | Stops | Bulk unloaded/ loaded (kilos) |

|---|---|---|---|---|---|

| Monday | Air France-KLM | Departure | Mexico | 65 | |

| Tuesday | Air Bridge Cargo | Arrival | Shanghai | Moscow | 80 |

| Departure | Moscow | 50 | |||

| Korean Air | Arrival | Seoul | 80 | ||

| Departure | Seoul | 80 | |||

| Cathay | Arrival | Hong Kong | Delhi & Amsterdam | 80 | |

| Departure | Hong Kong | Delhi | 80 | ||

| Wednesday | Emirates | Arrival | Dubai | 100 | |

| Departure | Dubai | 70 | |||

| Air China | Departure | Shanghai | 110 | ||

| British Airways | Arrival | Dhaka | 30 | ||

| Departure | Hong Kong | Bahrain | 50 | ||

| Friday | Air Bridge Cargo | Arrival | Shanghai | Moscow | 80 |

| Departure | Moscow | 50 | |||

| Korean Air | Arrival | Seoul | 80 | ||

| Departure | Seoul | 80 | |||

| Cathay | Arrival | Hong Kong | Delhi & Amsterdam | 80 | |

| Departure | Hong Kong | Dubai | 80 | ||

| Saturday | Emirates | Arrival | Dubai | 100 | |

| Departure | Dubai | 70 | |||

| Emirates | Arrival | Bahrain | 100 | ||

| Departure | Bahrain | 70 |

Note

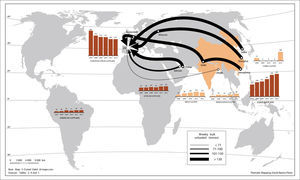

Cargo flights for Inditex arrive at Zaragoza Airport from Asia and the Middle East carrying garments made in the Asian supplier clusters and factories. The use of air transport indicates that these can be high-fashion-content products and that air transport facilitates bringing them to the market quickly (Figure 2).

Outgoing flights take the finished garments to the shops in the Asian and Middle Eastern markets. Additionally, in August 2012, a regular service to Mexico began to deliver to the Central and North American markets. Mexico is one of the countries that has leveraged its proximity to the North American market to develop competitive advantages in transport and logistics services. All of the routes developed go to highly dynamic markets in emerging countries (Figure 3).

ConclusionThe concept of the global production network expressively covers the spatial interrelationships characteristic of the economy due to the existence of worldwide flows of information, raw materials, components, and finished products. The starting point of this article is that efficient logistics and transport services are what make production chains truly global and are essential to an understanding of their organisational and geographical structure. The configuration of the supply chain of global retailers is a good example because the choice of global or local supply depends on whether suppliers rely on efficient transport and logistics systems that let them compensate for higher relative costs compared with developing countries —in the case of local supply— or the costs deriving from their greater distance to the market —in the case of global supply— (Tokatli, 2008; Tokatli and Kizilgün, 2010; Christopher et al., 2006).

Meanwhile, a review of the theory also demonstrates that the challenges presented by the functional and geographical integration of fashion production networks can only be overcome if global retailers manage their logistics efficiently and leverage the differentiated advantages of the modes of transport in relation to time, the value of which is confirmed as a new key variable for understanding the geography of the major global fast fashion industry and similar companies (Evans and Harrigan 2004).

The Spanish group Inditex, a world leader in fashion distribution, provides a clear example of how the logistics system forms part of the organisation of production, giving it a global reach and, in this case, a notable competitiveness. The analysis, based on recent data that are not often discussed and in some cases are previously unpublished, sheds light on the modus operandi of the group global network and confirms the crucial importance of logistics in all facets of the production model. First, without efficient logistics and sufficiently fast transport, the company could not enjoy such short lead times and be present in economically and geographically very disparate markets, continuously renewing the offerings available in its shops, in less than 48 hours when necessary. The organisational structure, combining nearby and distant manufacturing, and both dispersion and concentration spatially and in production, also relies on the effectiveness of the logistical model. We know that better internal and external communication and greater productivity has compensated for the company’s higher costs of manufacturing in nearby areas. However, in this article, we demonstrate how the vigour of the four clusters of suppliers in Asia (China, Pakistan, Bangladesh, and India) and the advantageous quality/ price ratio typical of these countries rests on the availability of efficient logistics and transport services, including air transport, which ameliorate the costs of their distance to the company’s distribution centres in Spain and other markets.

Finally, we have provided details of how the Inditex group completely centralises the distribution of its products to shops. The data for the Zara logistics hub in Zaragoza illustrate and highlight the value given to time in the company’s activities and how this consideration influences the organisation of the flows in and out of the hub. Air transport is used to send garments to distant markets and also for the reception of high-fashion-content garments from the Asian clusters and for their quick delivery to various markets despite the distance.

We understand the Inditex case, despite its uniqueness, to be sufficiently representative and the conclusions of the analysis to be valuable because they refer to aspects of global production networks that should be considered more often to provide a more accurate account of the situation. Nevertheless, we agree with Rodrigue (2006) that a heavy dependence on energy and the likelihood of fuel price increases threaten the future viability of the logistics models described here. Inditex, the company which is the focus of this study, has been adopting different energy saving measures as part of its sustainability programmes, notably including measures to reduce greenhouse gas emissions (GGEs) in its logistics activity by 20% until 2020, taking 2005 as a reference (Inditex 2012). However, the overall economic impact of a scenario of high energy costs on the organisation and functioning of global production chains whose rapid response to the market is based on the present unrealistic cheapness of fast transport is still unclear. Establishing the scope and reach of these aspects will require complementary analysis. However, we are confident that we have contributed to stimulating interest in a better understanding of the relationship between logistical and transport systems and global production networks whose future formulation and configuration in a possible new economic and environmental context will undoubtedly pose an interesting challenge to research.

The impact of lean production systems on the labour conditions of workers in supplier companies and countries has been criticised. Although various large distributors, including Inditex, have established systems to protect workers’ rights in the subcontracted companies, ensuring they are complied with is very difficult; furthermore, their purchasing policies undermine the labour principles they are trying to protect (Raworth and Kidder, 2009).

According to its creator, professor José Luis Nueno, the convergent middle class concept refers to the set of Europeans, Americans, and Asians that have the same purchasing power (Noguería, 2013).

Leading the Asian and African suppliers are those from Morocco, Egypt, Tunisia, China, India, Bangladesh, Syria, Indonesia, Malaysia, Pakistan, Taiwan, and Thailand; among the Europeans, we can mention, aside from the Spanish suppliers, those in Portugal, Italy, Bulgaria, Romania, Albania, Serbia, Moldavia, and Turkey. Finally, in the Americas, companies in Argentina, Brazil, Mexico, and Uruguay manufacture goods for Inditex (Inditex, 2011 and 2012; Tokatli, 2008 and 2010; Rohwedder and Johnson, 2008).