This article aims at contributing to the study of the factors conducive to a successful intergenerational transfer within a family business, understood as that which favors the longevity of the family firms. The literature has pointed out how such transmissions tend to generate tensions that can threaten the survival of the family firms and business family cohesion.

An analysis is made of how a long-lived family business made use of accounting information during a process of inter-generational transfer. The case studied presents evidence on how the trust in accounting information was used to facilitate this process. It is concluded that trust in accounting information contributed to the longevity of family firm and family cohesion. In other words, it guaranteed the preservation of its socio-emotional wealth.

Este artículo pretende contribuir al estudio de los factores que conducen a una exitosa transferencia intergeneracional en una familia empresaria, entendida como aquella que favorece la longevidad de las empresas familiares. La literatura ha señalado que estas transmisiones suelen generar tensiones que pueden amenazar la supervivencia de la empresa familiar y de la cohesión de la familia empresaria.

Se analiza cómo una familia empresaria de larga duración hizo uso de la información contable durante un proceso de transferencia intergeneracional. El caso presentado pone de manifiesto el modo en que la familia empresaria usó la información contable para facilitar dicho proceso. Se concluye que la confianza en la información contable contribuyó a la longevidad de la empresa familiar y a la cohesión de la familia. Es decir, garantizó la preservación de su riqueza socioemocional.

This article deals with the use that business families make of accounting reports to achieve successful intergenerational transfers, understood as those that contribute to the longevity of the family business. Such transfers usually generate stress regarding the survival of the family business and can even jeopardize the continuity of the family firms when they engender conflict within the family (De Massis et al., 2008, p. 188). The literature has shown how intergenerational change is one of the most decisive processes within a family business and how it may lead to its disappearance (Rose, 1993, p. 133; Colli and Rose, 2008; Songini et al., 2013; Fernández and Lluch, 2016). This work aims at contributing to the literature on this topic with the idea that accounting information facilitates intergenerational transfers by preventing conflicts within the business family, thus increasing the probability of success.

This research adopts the theoretical approach of the socio-emotional wealth (SEW) of the family (Gómez-Mejía et al., 2007, 2010, 2011; Berrone et al., 2010). The SEW theoretical framework has a great potential to be used in studies dealing with the accounting issues of family businesses (Prencipe et al., 2014, p. 379), given that the performance of this kind of businesses is evaluated not only in financial terms (profit maximization, profitability, stakeholder value or cash flow), but also in non-financial terms, including the family's and firm's reputation with stakeholders, long-term survival as a family business, preservation of unity within the family and accumulation of social capital (Carney, 2005; Miller and Le Breton-Miller, 2005). In short, Songini et al. (2013) underline how family succession, an especially delicate process in relation to the preservation of SEW, introduces accounting research into the field of family business studies.

The literature that links SEW and accounting research has mainly dealt with the role of accounting choices related to management, earnings and quality information in family business (Stockmans et al., 2010; Pazzaglia et al., 2013; Achleitner et al., 2014; Gomez-Mejia et al., 2014), focusing on the first two dimensions of SEW: family control and influence, and identification of the family members with the firm. In addition, Pazzaglia et al. (2013) insist on the need to explore the other three dimensions and, together with Songini et al. (2013), draw attention to the role of accounting information in the preservation of SEW during the renewal of family ties through dynastic succession.

Thus, accounting history is used as tool for business history in this work. In this sense, we follow McWatters (2002), who pointed out that: “Accounting records are prepared within a specific organizational context. Their analysis and interpretation provide insights into actions of individual firms. It is at this level that choices and decisions were made in terms of the environmental context”. Along the same lines, Hernández Esteve (2010, p. 165) remarked: “Accounting history scope is to extract all possible knowledge from the analysis and interpretation of books of accounts and other accounting documents of the past.” More specifically, the literature on accounting in relation to family wealth suggests greater prominence of the accounting practice during key and critical events in the family life (Walker and Llewellyn, 2000; Ezzamel, 2002; Carnegie and Walker, 2007a, 2007b), such as, for example, the death of the patriarch and the subsequent division of the inheritance.

This article focuses on one specific case in order to analyze in detail the use given by business families to accounting reports during intergenerational transfer processes (Salvato and Moores, 2010; Berrone et al., 2012; Songini et al., 2013). It is the case of a long-lived business family that has successfully outlived various intergenerational transfers and is presently in its fifth generation. In addition, the family owns several firms that are relevant in their respective sectors: their naval company was ranked among the top three in Spain (Valdaliso, 1997, 1999) and their olive oil company became the most important exporter to Argentina and among the top three to New York (Ramón, 2012).

The sources used in this research are located in the Notary Protocol Section of the Historical Archives of the Province of Seville and in the Ybarra Archive. As a result, several deeds have been analyzed, such as that of the extinction of the pro indiviso (Deed of clarification or explanation of the distribution of goods left in the pro indiviso after the company José María Ybarra e Hijos was liquidated) and the wills of members of the first and second generation in the family, together with the deeds of constitution and dissolution of the different companies. The information provided by the works of Sierra (1992, 2000) and Ybarra Hidalgo (1985, 1987) has also been considered.

The rest of this article is structured as follows. The next section analyzes the business family through the various SEW dimensions. The third one studies the use given to accounting reports during intergenerational transfers with the purpose of preserving the family's SEW. The work ends with a conclusions section.

2The Ybarra family through the SEW dimensionsThe SEW approach analyzes the non-economic factors that condition the decisions and behaviors of family businesses aiming to preserve their SEW (Songini et al., 2013; Prencipe et al., 2014). In general terms, this theory focuses on the impact that the family's values, ties and objectives have on business aspects such as its firm's corporate vision, strategic objectives, organizational dynamics, time horizon for decisions, intangible resources and stakeholders (Berrone et al., 2010; Gómez-Mejía et al., 2007, 2010).

In fact, SEW is the most important characteristic of a family business, that which differentiates it from other types of organizations (Berrone et al., 2012, p. 260). This is why preserving SEW in a family that is closely linked to an organization is a fundamental objective in itself (Gómez-Mejía et al., 2007, p. 108), and makes business families tackle their problems by considering how their decisions will affect their SEW (Berrone et al., 2012, p. 259). These authors define five dimensions that should be considered regarding the SEW of families: (i) family control and influence, (ii) identification of the family members with the firm, (iii) social ties, (iv) emotional attachment, and (v) the renewal of family ties through dynastic succession, which constitutes the central aspect of intergenerational sustainability (Zellweger and Astrachan, 2008; Zellweger et al., 2012). The latter dimension is the main aim of this article, which analyzes the specific case of the Ybarra family.

The Ybarra family was already an important business family in its hometown, Bilbao (Spain), when, in 1840, one of its members, José María Ybarra Gutiérrez de Cabiedes (Bilbao, 1816–Seville, 1878), the fifth child of the family's founder, José Antonio Ybarra, established himself in Seville (Spain). Once in town, he married Dolores González Álvarez in 1843 and had five sons: José María (1844–1898), Eduardo (1846–1911), Tomás (1847–1916), Luis (1849–1916) and Ramón (1851–1925).

Ever since, in 1844, the family's patriarch, José María Ybarra Gutiérrez de Cabiedes, started its first commercial enterprise (José María Ybarra Gutiérrez), the subsequent generations preserved the family's control over the property and management of its firms, thus complying with the first SEW dimension and the theory of conservation (Zellweger et al., 2012). In order to guarantee the family's control in the long term, the patriarch reproduced the usual behavior of British and Spanish family dynasties: as soon as their age and training allowed it, he gradually incorporated his sons into the family business (Díaz Morlán, 2002, 2013a,b). As the new members entered the family business the firms’ names were modified. Thus, in 1870, coinciding with the incorporation of the patriarch's two eldest sons (José María and Eduardo) to the business activities, a new company was created, called José María Ybarra e Hijos.

In the same way, when the transfer from the second to the third generation was initiated in 1908, and the first members of the third generation (José María Ybarra Menchacatorre, Tomás Ybarra Lasso de la Vega and José María Ybarra Gómez) joined in along with two members of the second generation (Tomás and Luis Ybarra González), a new company was founded: Hijos de Ybarra.

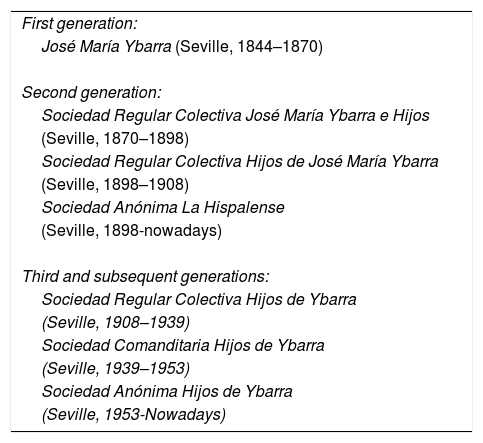

The successive generations of the Ybarra family also complied with the second dimension of SEW: the identification of the members of the family with its firms. The family's name survived as company name through generations (Table 1). Thus, the firms came to be seen, both within and outside the family, as an extension of the latter, and the family members were sensitive to the image they projected. In the case of the Ybarra family, this connection was reinforced through the structure that linked the family, the different firms and the family's property. This structure was known as Casa Ybarra and it behaved similarly to other Spanish business dynasties (Torres, 1998; Valdaliso, 2013; Díaz Morlán, 1999, 2002).

Firms and generations.

| First generation: |

| José María Ybarra (Seville, 1844–1870) |

| Second generation: |

| Sociedad Regular Colectiva José María Ybarra e Hijos |

| (Seville, 1870–1898) |

| Sociedad Regular Colectiva Hijos de José María Ybarra |

| (Seville, 1898–1908) |

| Sociedad Anónima La Hispalense |

| (Seville, 1898-nowadays) |

| Third and subsequent generations: |

| Sociedad Regular Colectiva Hijos de Ybarra |

| (Seville, 1908–1939) |

| Sociedad Comanditaria Hijos de Ybarra |

| (Seville, 1939–1953) |

| Sociedad Anónima Hijos de Ybarra |

| (Seville, 1953-Nowadays) |

In the third place, the Ybarra family created, through its members’ marriages, a dense and extensive family network with its socioeconomic environment, thus attending to the third dimension of SEW: social ties. This intricate network of patronage, stretching throughout the Lower Andalusia region, was not only fruitful in the field of business but also became a pillar for the political activities of the family (Sierra, 1992, 2000; Díaz Morlán, 2002). Thus, for instance, the family began to produce and export olive oil following a strategy designed after a market analysis performed shortly before, in 1904, when they were considering the possibility of building a fertilizer factory (which in the end never happened) because “living in Seville and having connections among farmers in this and the surrounding provinces [who would have been their natural partners in this enterprise] must prove somehow useful” (Sierra, 2000, p. 8).

In the construction of this social network, the marriage strategy of the second generation, through which the family became related to various important Andalusian dynasties, was decisive. The marriage of four of the Ybarra González brothers created strong family and economic ties with some of the most relevant agrarian families in Seville, while the eldest son's marriage aimed to reinforce the original Basque connection. Thus, Eduardo and Tomás married two daughters of Felipe Pablo Romero, one of the main landowners in Seville (Florencio, 1993, pp. 506–507). After his first wife's death, Tomás married Concepción Lasso de la Vega y Zayas–heiress to two of the most important agrarian families in Seville and niece of the leader of the conservative party in the city. Soon again a widower, Tomás married Emilia Osborne Guezala, a representative of the wine-producing community of Jerez de la Frontera. Luis Ybarra González married Concepción Gómez Rull, daughter of the mayor of the city of Huelva, and Ramón Ybarra González married Dolores Llorente González, daughter of another important landowning family (Ybarra Hidalgo, 1985; Sierra, 1992, 2000). The third generation also married into important agrarian families in the area: the Lasso de la Vega, Parladé, Atienza Benjumea, Dávila Garvey, Gamero, Medina Garvey, Llosent and Fernández Palacios (Florencio, 1994).

The fourth dimension of SEW is the bond that connects the emotional values of the business family with the business aspects of its companies (Eddleston and Kellermanns, 2007), blurring the lines between family and firms (Berrone et al., 2010) and reinforcing the feeling of family heritage, because losing the firms would be an emotional event for the owners (Sharma and Manikuti, 2005). This possibility, in the period before the generalization of public limited companies, could not only hurt the family's feelings but cause its ruin, because the firms’ activities were backed by the family's property. Well into the 20th century, business families – British, Italian, Spanish – acted within a legal framework that favored the adoption of unlimited liability legal entities (Rose, 1977; Colli, 2013; Colli et al., 2003, pp. 35–36). Unlimited liability made firms or rather business families live under the permanent fear of bankruptcy, because firm and family were actually synonyms in this context. In the case of Spain, the most common legal entity at the time was the sociedad regular colectiva (general partnership), in which a reduced number of stakeholders compromised their property under the principle of unlimited liability through short-term extendable contracts.

It has recently been revealed that Spanish limited liability firms, i.e. those in which the family property is not compromised by the company's debts, were first established after the passing of the Code of Commerce of 1885. This Code allowed the constitution of trading companies whose legal form was not specified on the text.1 This lack of typification allowed adopting in Spain certain legal and business developments through practice, use and experience in the style of common law countries (Martínez-Rodríguez, 2016). However, as Hansmann et al. (2007) understand it, the establishment of limited liability companies requires accounting innovations and adequate monitoring techniques so that the potential creditors can trust the data, given that business assets are the only guarantee for their investment. These authors thus state that accounting development is a precondition for the extension of the limited liability company form to small and medium-sized enterprises.

The emotional dimension of SEW is relevant to explain the altruistic behavior of the members of the Ybarra family (Schulze et al., 2003), who, as shown below, helped the Ybarra family cope during the difficult periods of intergenerational change. With this purpose, the patriarch had molded the next generation from a technical, intellectual and emotional point of view. Thus, his five sons received both theoretical and practical training and learned discipline and hard work, like other young men belonging to business families, and he often insisted on the “union between the five brothers”, which should remain unbroken under any circumstances and which actually influenced very positively the development of Casa Ybarra (Torres, 1998; Díaz Morlán, 2002; Valdaliso, 2013; Fernández-Roca et al., 2014).

Finally, the fifth dimension of SEW, which refers to the transfer of the firm to the next generation (dynastic succession), is commonly accepted in all family businesses to the point that some authors consider it to be the core of SEW (Zellweger and Astrachan, 2008; Zellweger et al., 2012), especially in the case of family businesses with a strong dynastic character (Casson, 1999). For the consecution of longevity in the long term, there was a need to develop the right mechanisms to make the transition automatic and provide stability for both the firms and the family. This way, in family firms, and most often in those with a strong dynastic character, the founders did not let go the management of their firms until they died. In addition, their financial strategy was cautious to avoid taking financial risks that could lead to the closure of the firms. This led to conservative decisions in business strategies and a high resistance to change (Casson, 1999). The firms of the Ybarra family shared the characteristic of being family businesses with a strong dynamic component and, for this reason, to guarantee business longevity was one of the main objectives of the family.

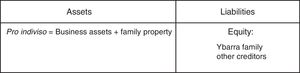

José María Ybarra Gutiérrez de Cabiedes considered that the legal form of the pro indiviso or community of goods would guarantee the survival of the patrimonial unity of Casa Ybarra. This community of goods comprised both the firms’ assets and the family's patrimony. The bequests received by the sons while still minors, especially from their mother but also from their maternal grandparents, granduncles and aunts, were also included. José María Ybarra Gutiérrez de Cabiedes did not differentiate between his personal property, that of his wife and his companies’ assets, with the exception of the naval company, the capital of which he shared with his partners.

With the pro indiviso, the legal difficulties that challenged the survival of the heritage of Casa Ybarra were overcome. However, this was a necessary but insufficient measure. The legal obligation to divide the heritage was avoided, but in order to preserve its unity it was also necessary that the heirs agreed to it: should any dissension arise between them, the property would easily be dissolved. In this sense, the main lesson that the father left upon his death, and which was part of the SEW accumulated by the Ybarra family, was that the “union between the five brothers” should not be broken under any circumstances. As shown below, this principle clearly determined the development of Casa Ybarra.

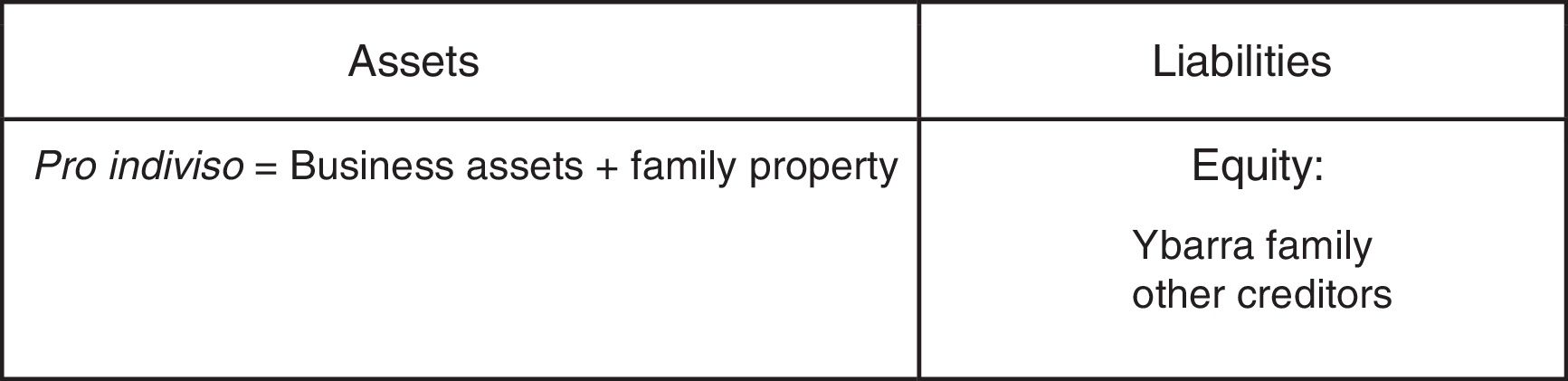

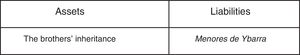

The pro indiviso created an economic-financial network that tied the family, its property and its various firms together. This legal structure reinforced two of the SEW characteristics of family businesses (Berrone et al., 2012): (i) the family's control and influence and (ii) the identification of the family members with the firms. Therefore, in practice, the firms’ assets and the family's property formed a single estate that bound their destiny. Also, if the unlimited liability of the family's firms is considered, it is easy to see how failure in the management of the business could entail the ruin of the family. From an accounting point of view, José María Ybarra Gutiérrez de Cabiedes behaved as was customary during that period, that is, without differentiating his family's patrimony from his firms’ assets. This can be schematically summarized as follows (see Fig. 1):

In 1870, at the time of the incorporation to the firms of his first two sons, the founder carried out a business transfer by creating a new general partnership (José María Ybarra e Hijos), which became the foundations of the long-term success of Casa Ybarra. In other words, all assets, whether business or family-related, were transferred from one firm to the other, favoring the continuation of business and the preservation of the family's unity.

The sixth clause of the deed of foundation of this new firm made the annual financial statement (profits) compulsory. The ninth clause established that, in case of death of a partner during the firm's validity period, the company would be dissolved at the end of the year in which the death took place. The process of closing down the firm and distributing its assets should be managed by the surviving partners together with the deceased's heirs “without, in any case, the intervention of the legal authorities”. This way, the first of the SEW dimensions, the family's control over its firms, was safeguarded in the face of a possible intervention of the legal authorities as external stakeholders.

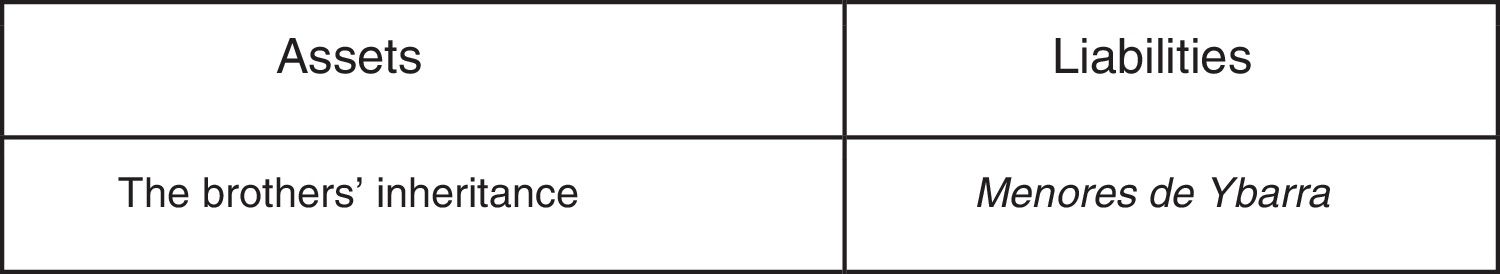

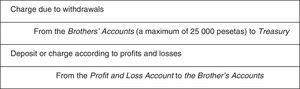

After the death of José María Ybarra Gutiérrez de Cabiedes in 1878, his five sons’ inheritance was integrated into the family's pro indiviso. These goods became part of the firm's assets and a new account called “Menores de Ybarra” was created as part of the firm's liabilities (see Fig. 2). The annual interest rate with which the firm remunerated its partners’ contributions was fixed at 3 percent. This way, the firm generated wealth for the family and the family became a financing source for the firm, and family unity was reinforced.

The five brothers of the family's second generation “meant to improve the management” of their firms (deed of partition of property, dated June 28, 1898, Ybarra Archive). But when they began making decisions autonomously, they chose to respect their father's wishes and code of conduct. Thus, they kept the family's control over the firms and reinforced the mutual influence between the companies’ development and the preservation of the family's unity. This decision is a proof of the heirs’ emotional attachment to the family firms and to the code of conduct established by their father, the founder of Casa Ybarra. In other words, the members of the second generation chose to maintain and reinforce the family's SEW in what concerned the family's control and influence, the identification of the family members with the firms and their emotional attachment to them.2

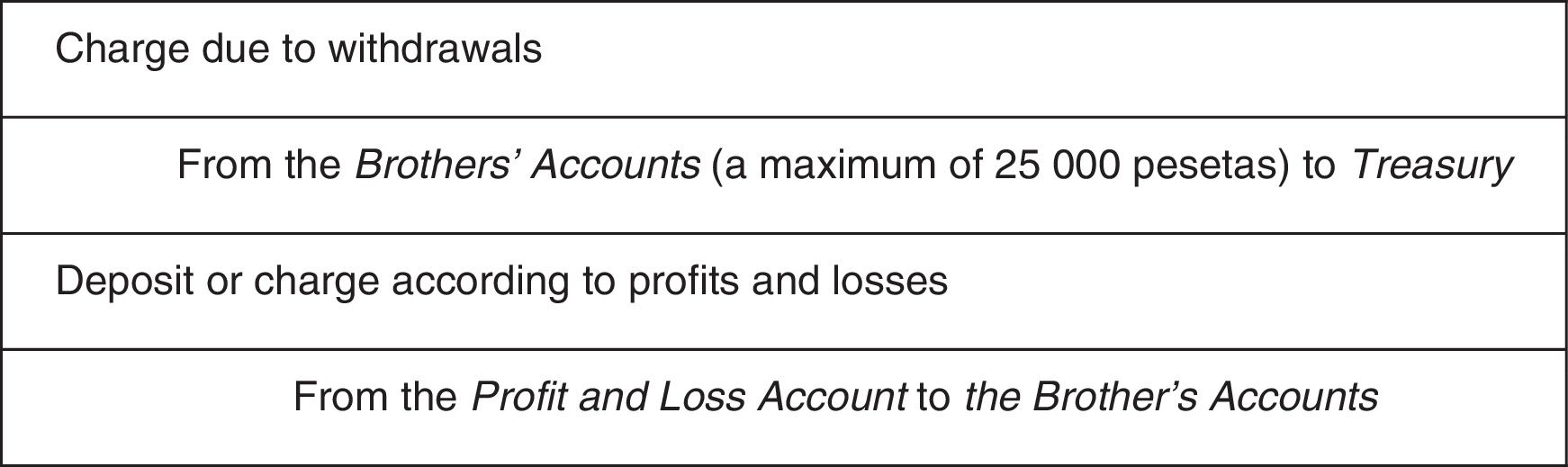

The fourth clause of the deed of foundation of the general partnership José María Ybarra e Hijos (1878) fixed the company's capital stock at 500,000 pesetas, to be deposited in cash and in equal shares by the five brothers and partners, so that the distribution of profits or losses would later on also be equal. Thus, the evolution of business affected each brother in the same way. As for other contributions to their common fund, the fifth clause established that a personal account was to be opened for each partner, where profits or losses would be respectively deposited or charged. According to the sixth clause, a maximum of 25,000 pesetas could be withdrawn by the brothers from these accounts each year. The seventh clause stated that, at the end of the year, these accounts would be settled against the profit and loss account (see Fig. 3).

3Accounting reports as a tool to preserve SEWThe Code of Commerce of 1885 forced individual traders and companies to keep their books updated to prepare annual accounts and balance sheets. The Code did not mention the need to prepare income statements or to apply any registration or valuation methods. In addition, it established the secret nature of accounting information. Only by court injunction requested by an interested party, was access possible to the content of accounting documents. On the other hand, Spanish tax regulations were based on indirect calculations. Until 1920, Spanish tax laws did not include a profit-based tax, which required the regulation of the companies’ profit calculation (Beltrán Pérez, 1999).

The deed of January 23, 1896, which was the first one to divide the inheritance, shows that these founding dispositions were not put into practice. The brothers manifested that there was an “expenditure” account where the amounts withdrawn by them were being charged, thus reflecting each brother's debts with the partnership, and where their contributions for items not related to the partnership's business were deposited. It was, therefore, the expenditure account the one settled against the profit and loss account at the end of the year. Therefore, in line with the SEW approach, the members of the business family were not as interested in the annual result of the firms, which was relevant according to short-term criteria, as in their long-term continuity and in their preservation as the family's main source of income, in other words, in the sustainability of the family's socioemotional wealth in the long term.

Contrary to what was originally intended, the balance thus established did not represent each partner's net profit, but the alterations and actual differences between each brother's assets at that specific time. This was due to the fact that the accounts were opened on June 30, 1878, and the first item recorded in them was each brother's balance. The sums they had withdrawn or deposited were all registered in them, as were the profits made or the losses suffered in business operations or in relation to the goods included in the inventories and balance sheets of Casa Ybarra and which affected the profit and loss account.

After the death of José María Ybarra Gutiérrez de Cabiedes in 1878, the transition from one generation to the next was so easy that the firms did not even change their names, legal structures or accounting books. Thus, the main company was still known as Sociedad Regular Colectiva José María Ybarra e Hijos, although it was in fact a renewal of the previous one of the same name, and it had a new validity period of twenty years, which was to last until 1898. Everything took place as in similar cases before: the business and family assets were transferred from the old company to the new one, and the profits accrued in the capital account were liquidated.

In 1898, at the end of the validity period of the Sociedad Regular Colectiva José María Ybarra e Hijos, the five Ybarra brothers had to dissolve the pro indiviso in order to calculate the inheritance of Tomás Ybarra Lasso de la Vega.3 The fact that the measure was imposed can be felt in the deed of dissolution of the company.4

The need to calculate the inheritance of Tomás Ybarra Lasso de la Vega brought the family's pro indiviso to an end. In addition, given that the validity period of the company José María Ybarra e Hijos was over, there was a need to dissolve it and to calculate the community property assets belonging to Concepción Lasso de la Vega and, subsequently, the part that corresponded to her son Tomás Ybarra Lasso de la Vega. This fact is reflected in the deed of dissolution of the company.5

This deed already made clear that the brothers trusted the data drawn from the accounting reports and that these data could be useful to clarify any doubts they might have, thus helping to maintain their unity. In order to establish the inheritance, the first thing was to dissolve the pro indiviso and calculate Tomás Ybarra González's property at the moment of his marriage. Once this information was obtained, the balance resulting from the dissolution of the community property of Tomás Ybarra González and Concepción Lasso de la Vega could be estimated, as well as the part that corresponded exclusively to Tomás Ybarra Lasso de la Vega.

The complexity of the process led the heirs to register, in 1902 and before a notary public, a deed that explained it and described the trials that the family's firms and patrimony had gone through. The objective was to put on record the nature and amount of inherited goods integrated in the pro indiviso. First of all, the valuation of the pro indiviso, including the paternal inheritance and all bequests received from other relatives, which presented fewer difficulties, was undertaken. When calculating the paternal inheritance they had to confront the fact that the community property of José María Ybarra Gutiérrez de Cabiedes and his wife had not been settled at the time of her death. Consequently, the mother's inheritance was included together with the father's in the community of goods and, given that it was impossible to determine what belonged to each, the date of valuation had to be that of José María Ybarra Gutiérrez de Cabiedes’ death in 1878.

Soon the brothers had to face another challenge: that of calculating the capital and goods belonging to their father, a difficult task given that there was a strong imbrication between his personal property and his firms’ assets. In order to make the valuation, the brothers had access to three sources of information, but their contents and their description and valuation of the goods did not match. The documents used were: (i) a deed of inventory formalized on December 31, 1878 and slightly modified by a series of new deeds that registered all changes in the goods belonging to the father's property; (ii) a list presented to the liquidator of real rights on March 22, 1890, and (iii) the corporate records of the company José María Ybarra e Hijos.

Under these circumstances, it was decided that the most reliable valuation was that of the accounting books. Consequently, the task now was to identify the capital and profits of the firm José María Ybarra e Hijos that corresponded to the late José María Ybarra Gutiérrez de Cabiedes. After adding their personal property and the sums of other inheritances to which the brothers had equal rights, the value of the pro indiviso was estimated at 3,614,034.44 pesetas. The following step was to dissolve the company José María Ybarra e Hijos.

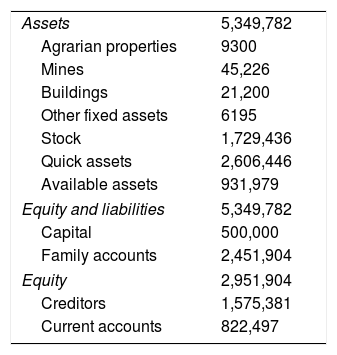

Table 2 presents the company's liquidation balance sheet, from which the Ybarra González Brothers segregated cash, assets and goods (urban and rural estates, mines and mining concessions) in an amount equivalent to the value of the inheritances previously calculated. With this decision, they separated, for the first time in the family's history, the family's property from its business assets.

Liquidation balance sheet of the company José María Ybarra e Hijos (end of 1898) (Pesetas).

| Assets | 5,349,782 |

| Agrarian properties | 9300 |

| Mines | 45,226 |

| Buildings | 21,200 |

| Other fixed assets | 6195 |

| Stock | 1,729,436 |

| Quick assets | 2,606,446 |

| Available assets | 931,979 |

| Equity and liabilities | 5,349,782 |

| Capital | 500,000 |

| Family accounts | 2,451,904 |

| Equity | 2,951,904 |

| Creditors | 1,575,381 |

| Current accounts | 822,497 |

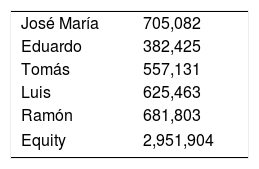

Considering the above-mentioned balance sheet (Table 2), the company was liquidated by distributing the equity (capital and family accounts) to the five sons. The different dates on which each son joined the business, the death of José María Ybarra González before the liquidation was accomplished and the different amounts withdrawn and deposited through the application of an accounting tool, the Menores de Ybarra account, explain the fact that the brothers received different shares from the distribution (see Table 3). Accounting criteria were therefore used to perform this distribution.

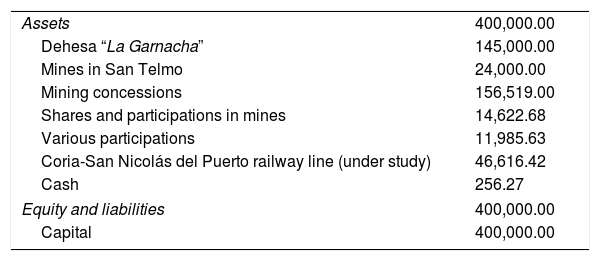

Once the company José María Ybarra e Hijos was liquidated, the brothers proceeded to reorganize the firms. On the one hand, a new general partnership was created, Hijos de José María Ybarra, the capital of which (500,000 pesetas), divided into five equal shares, came from the distribution of the previous firm's equity (see Table 3). On the other hand, in June 1899 they founded a public limited company, Sociedad Anónima La Hispalense, in which all the mining-related assets were allocated.6 Their details are reflected in the opening balance of the new company, dated in 1900 (see Table 4).

Opening balance of the company S.A. La Hispalense (1900) (Pesetas).

| Assets | 400,000.00 |

| Dehesa “La Garnacha” | 145,000.00 |

| Mines in San Telmo | 24,000.00 |

| Mining concessions | 156,519.00 |

| Shares and participations in mines | 14,622.68 |

| Various participations | 11,985.63 |

| Coria-San Nicolás del Puerto railway line (under study) | 46,616.42 |

| Cash | 256.27 |

| Equity and liabilities | 400,000.00 |

| Capital | 400,000.00 |

From 1899 onwards a separate accounting system called “Ybarra Hermanos” was set up, where the property segregated from the business assets was registered. Although these goods and rights were not anymore subject to commercial legislation, the brothers’ trust in the use of accounting information led them to resort to it also for the management of the patrimony that was already the exclusive property of the family. This new asset register differed from previous lists, because it included assets that did not appear in the inventories anymore (because they had been sold or realized), others whose valuation had changed (“not on a whim”, as the document literally stated), and new ones (acquired pro indiviso, but not derived from inheritances). Among these differences, it is worth underlining the lesser value of the mines in San Telmo and the Huerta de Espantaperrillos, which was lower now that some “lease and sales income” had been included in the assets accounts, transforming its balances into credit balances. When the company José María Ybarra e Hijos was dissolved, these deviations were transferred to the profit and loss account, so that, in practice, a one-account-only speculative criterion had been applied to those estates, which was replaced only during this process of property distribution. The accounting criteria used to elaborate the corresponding liquidation and opening balance sheets were thus different than the ones applied while the company was still operating. In fact, the choice of accounting options was more rigorous when the objective was to guarantee the equity of the distribution and, therefore, the preservation of the family's unity and SEW, than when the purpose was to comply with legal accounting obligations and/or to draw up useful accounting reports for the economic management of the family firms.

At this stage of the process, the olive-producing estates were still to be divided. This delay was justified by the excessive oscillation of the market price of gordal olives. The division was finally undertaken making sure that each of the five brothers received a part of the olive-producing business. It was also then that the brothers decided that, on January 1, 1901, the goods to be divided, with the exception of the shares and participations in the mining business, would be sublet to the company Hijos de José María Ybarra.

Once this point was reached, it proved necessary to make new changes in the inventories and balance sheets due to the detection of errors and the need to substitute leased-out assets for the amounts received. In order not to delay the distribution process, it was decided that the leased-out assets would be segregated and an approximate amount would be calculated: “and, as available cash, a provisional amount will be fixed, which will obviously be smaller than the one meant to result in the end” (1902 deed). The need to complete the distribution without any more delay led to these accounting choices.

Finally, this explanatory deed included an accounting statement “which, in columns, showed the evolution of the whole fund from 1863 to December 31, 1900”. The first column had a narrative-descriptive character. The second one reflected the amounts invested in purchases and transformations. The third one registered the cash derived from inheritances and the total or partial realization of some of those assets. This accounting statement proved that the amounts invested always came from what was obtained from the goods belonging to the pro indiviso and that there was always enough cash available when an investment was made. An accounting statement was thus drawn up to prove the fairness and equity of the distribution of this property, destined to the heirs’ private use, among the brothers.

4ConclusionsThis article discusses the use that a business family made of accounting reports to achieve a successful intergenerational transfer, understood as one that is instrumental to the longevity of the family's firms. Its main contribution is the idea that accounting information can facilitate intergenerational transfers because it helps preventing conflicts within the business family, thus increasing the possibility of success. The case here studied shows the owners’ trust in accounting data as a tool to clarify the patrimonial situation of the firms and of the different members of the business family. This way, the business family successfully overcame the process of intergenerational transfer and laid the foundations for future successes. In this line, the paper fits in the line of research that uses accounting history as a helpful tool to obtain data to improve the analysis of business history.

In the second place, after analyzing the case from the point of view of the theoretical approach selected, this article evidences the role played by accounting information in the preservation of the family's SEW during the renewal of family ties through dynastic succession, given that intergenerational sustainability is considered a central aspect of SEW. Along the process of distribution of the pro indiviso and the reorganization of business, the data provided by accounting reports were used to facilitate the preservation of the family's unity, guaranteeing equal treatment to all the heirs and to their bond to the family businesses. In other words, this work presents the use of accounting information in relation to the SEW dimension that has been least studied from an accounting perspective.

In addition, this work demonstrates how the criteria used for the valuation and classification/presentation of assets and liabilities in the liquidation and opening balance sheets elaborated during the process of business reorganization were different than those applied when the objective was to comply with commercial requirements, to help managing the firms or to determine their profits. In other words, accounting choices were made with the specific purpose of facilitating the transfer of property and the preservation of the family's SEW. In this sense, it is remarkable that neither tax nor trade regulations made compulsory the preparation of annual income statements.

FundingArchivo Histórico Provincial de Sevilla (Historical Archives of the Province of Seville).

Archivo Ybarra (Ybarra Archives).

The authors thank the finance support of Research Projects: (HAR2014-52079-C2-1-P): “Persistence and Longevity of the Family Business” (Spanish Ministry of Science and Innovation) and SEJ 2678: “Andalusia Crossing cultures. A view from accounting” (Andalusia Regional Government) as well as the comments received at conferences and workshops in which earlier drafts of the manuscript were presented.

The law was completed with the passing of the Companies Registry Regulations in 1919.

When José María Ybarra Gutiérrez de Cabiedes died in 1878, the inheritance payment scheme in force was the one approved as part of Echegaray's Reform in 1872. The subsequent reforms of this tax did not lead to major changes, other than little adjustments on the tax lien. In fact, when the dissolution of the pro indiviso was undertaken, the tax lien was still at a rate of 20 percent (García de Pablos, 2010). Therefore, the decision to proceed with the division of the inheritance was not motivated by changes in the tax system but by other considerations reflected on the text.

In 1884, Tomás Ybarra González's second wife, Concepción Lasso de la Vega y Zayas, died leaving her only son, Tomás Ybarra Lasso de la Vega, as heir. Tomás Ybarra González should have then settled their community property in order to calculate and settle the legitimate inheritance of their son, but he postponed the decision and integrated the goods of both father and child in the family's pro indiviso.

“pero en la necesidad que tiene el don Tomás de Ybarra de fijar el capital que por todos los conceptos le correspondía en el día 5 de octubre de 1879 en que contrajo matrimonio (…) y la importancia de ese mismo capital al fallecimiento de la susodicha [su esposa] ocurrido el 9 de 9 de 1884 para determinar si hubo o no gananciales en la sociedad conyugal y fijar lo que en concepto de herencia corresponda al único hijo…”

“(…) in the need of Mr. Tomás de Ybarra to determine the capital that by all means corresponded to him on October 5, 1879, the date of his marriage […] and the importance of this same capital at the death of the above-mentioned [second wife], which took place on September 9, 1884, to determine whether there was a community property or not in their marital union and to establish the amount that corresponds to their only son in terms of inheritance…”.

Deed of dissolution of the company J.M. Ybarra e Hijos, June 28, 1898, AY.

“… que para la perfecta armonía y completa uniformidad de pareceres que siempre ha existido entre los expresados cinco señores hermanos (…) para la dirección de todos los asuntos de su casa, inversión de capitales, distribución de utilidades y todo en fin cuanto se relaciona con las múltiples operaciones y negocios de aquella excusarían aclaraciones que no necesitan entre sí porque si alguna duda pudiera ocurrírseles pronto desaparecería sin más que consultar los libros y antecedentes respectivos”.

[…] due to the perfect harmony and complete uniformity of opinions that have always existed among the above-mentioned five brothers […] on the management of all matters in the house, capital investment, profit sharing and, finally, everything related to its multiple operations and businesses, they do not need to make any clarifications, because, should they have any doubts, these would immediately disappear after consulting the corresponding books and precedents […].”

Deed of dissolution of the company J.M. Ybarra e Hijos, June 28, 1898, AY.

While not specified in the primary sources, low taxation on mining companies (Escudero Gutiérrez, 1999) must have been one of the reasons for establishing this firm.