This article studies the growth of the multinational Bunge in Brazil from 1905 until its fiftieth anniversary in 1955. The key question is how Bunge, in an economy of incipient industrialization, became an economic group. Initial investments in wheat milling—which spread to various other sectors—made this possible. Primary data from the Bunge Memory Center in Sao Paulo served as the main source of company data. We show Bunge's growth and transformation into an economic group as it bought competitors, increased the capacity of its mills, diversified products, and formed part of communities through its Foundation's activities. Bunge innovated by launching new merchandize. Its leaders were pioneers in several business areas, who occupied the country and reinvested the capital in new companies.

Este artículo estudia el crecimiento de la multinacional Bunge en Brasil desde 1905 hasta su quincuagésimo aniversario en 1955. La cuestión clave es cómo Bunge, en una economía de industrialización incipiente, se convirtió en un grupo económico. Las inversiones iniciales en la molienda de trigo, que se extendió a otros sectores, lo hicieron posible. Los datos primarios del Centro de Memoria Bunge en Sao Paulo sirvieron como principal fuente de datos de la empresa. Mostramos el crecimiento y la transformación de Bunge en un grupo económico, ya que compró competidores, incrementó la capacidad de sus molinos, diversificó productos, y formó parte de las comunidades a través de las actividades de su fundación. Bunge innovó con el lanzamiento de nuevos productos. Sus líderes fueron pioneros en varias áreas de negocio, que ocuparon el país y reinvirtieron el capital en nuevas empresas.

The purpose of this article is to study which elements favored the growth of Bunge in Brazil between 1905 and 1955 (at its fiftieth anniversary), enabling it to become one of the largest economic groups in the country. In 2007, Bunge had a net income of US $12 billion, placing it as the 14th largest Brazilian economic group and the second biggest food and drink company, following Companhia de Bebidas das Americas (AmBev) (Aldrighi and Postfali, 2010, pp. 355–357). In 2014, it was the fourth largest exporter in the country, with sales of $6.1 billion, surpassed by Vale (US $17.0 billion), Petrobras (US $11.1 billion), and Cargill (US $6.2 billion) (EXAME, 2015, p. 63).

According to its Sustainability Report (2012, p. 4), the Brazilian subsidiary of the company has about 150 operational units, including factories, mills, silos, distribution centers, and ports. It operates in 19 states, and the Federal District and its products are sold to 77% of Brazilian homes in more than 4600 municipalities. The company is organized into four business areas: Sugar & Bioenergy; Agribusiness & Logistics; Food & Ingredients; and Fertilizers. With more than 20,000 employees, it achieved gross revenues of $17 billion in 2012. The Brazilian subsidiary represented 27% of total sales of the international organization, demonstrating its strategic importance.

Bunge was already established in several European, African, American, and Asian countries, upon its 1905 entry into the Brazilian market, associating with the Mill Santista. It worked in different sectors: financial, industrial, international trade, and agricultural properties; it produced (rubber, cocoa), bred animals (cattle), financed farmers, and industrialized products (flour mills, oil mills). It has been operating in Argentina since 1880, where it was one of the largest exporters of grain and derivatives such as wheat flour, which was supplied to Brazil (Silva and Dalla Costa, 2014).

During the first fifty years of operation, Brazil has also grown and changed, and faced national egress of slavery in the early twentieth century. Around 1950, an agricultural exporting economy was industrialized by import substitution, which initiated the migration of the rural population to the cities.1

Bunge took advantage of the opportunities provided by this growth and urbanization. It initially grew its existing activities (flour mills) by increasing its plant capacity, incorporating other mills, and extending nationally. It then diversified into grain milling, oil production, grain exports, and production of cement, tissues, and fertilizers. It promoted its brands and products in radio advertisements and in the nascent Brazilian television, and consolidated its local presence through the Bunge Foundation.

Despite the existence of literature on the role of multinationals in Brazil,2 studies of the origin of these conglomerates and their business conformation as economic groups are limited; these processes occurred (as in the case of Bunge and others) during first half of the twentieth century.3 However, work has specifically been done on Bunge's training initiatives, its outstanding performance in Europe and Argentina, and its history in Brazil.4

This article contributes to the literature of Brazilian economic group history by discussing the Bunge growth factors in Brazil from 1905 to 1955, following 50 years of operations. It firstly reviews theoretical work on the basic elements of the formation of economic groups. This is followed by an analysis of Bunge's performance in the flour mill sector, a study of its history of product diversification and occupation of the national territory and, finally, the main conclusions.

2Bunge structured as economic group in BrazilIn the early twentieth century, Brazil's essentially agrarian economy was limited compared to major Latin American nations.5 During 1908–1912, when the country held 75% of the world coffee market, coffee exports accounted for 55% of Brazilian exports; agriculture accounted for 44.6% of GDP, while the industry totaled only 11.6% (Franco and Lago, 2012, p. 200).

The small weight of manufacturing was linked to industrial investment difficulties. For example, the great Brazilian territorial extension, coupled with the concentration of railroads in coastal and state capital areas, lead to excessive transport costs. For example, cotton transport cost between the states of Pernambuco and Rio de Janeiro was almost four times higher than its shipping cost to Liverpool (Franco and Lago, 2012, p. 205).

Possible industrial investments would have to overcome infrastructure bottlenecks generated by power supply fluctuations to factories. Brazilian coal was unsuitable for industrial use, and was offset by British coal imports. However, this could lead to cost increases due to sudden exchange rate devaluations. The establishment of power plants resolved this bottleneck from the 1910s onwards (Saes, 2010, p. 218). A single steel company for the production of pig iron until World War I posed another limitation, leading to imports of 83% of domestic iron consumption and all of steel and rolled consumption (Barros, 2015, p. 182).

In Sao Paulo where crops accounted for 70% of Brazil's coffee exports in 1900, the lack of access to credit serves as an example of the hardships faced by industrialists. Despite the existence of twenty banks in the state of Sao Paulo in 1901, neither national nor foreign banks prioritized long-term loans to preferred industries. However, the largest farmers and exporters financed the Sao Paulo public debt, and even took care of capital transfer of immigrants living in Brazil (Saes, 1986, p. 100).

Thus, low integration of the internal market, shortage of energy, and credit sources characterized the Brazilian economy in the early twentieth century. These characteristics were also present in other Latin American and Asian nations. However, large companies have been established in those countries, and market failures were overcame through organization into economic groups (Leff, 1974, p. 93).6

According to Colpan and Hikino (2010), economic groups were present as organizational form in (current) emerging economies, especially in the twentieth century. These groups took a leading role in the industrialization processes of countries such as Brazil, Argentina, Chile, South Korea, China, India, Mexico, and others.7

Although there is no single definition of economic groups,8 they are seen as groups of independent companies operating jointly, as in the adopted Khanna and Yafhe formulation: “These groups are usually composed of legally independent companies operating in various industries (often unrelated), which are connected by persistent formal (e.g., equity) and informal (e.g., family) ties” (Khanna and Yafeh, 2010, p. 576).

Economic groups could be constituted as business organizations of independent and diversified firms in related or unrelated sectors. Groups were articulated by a holding company, which would exercise control by, for example, the equity interest in these companies. In Brazil, important families—Matarazzo, Pereira Ignacio, Ermírio de Moraes, Klabin, and others—formed business groups that controlled most of the shares of the companies within the group, and that were present in their representative bodies such as the Board and/or Board Administration (Colpan and Hikino, 2010, p. 16; Valdaliso, 2002, p. 583; Fernandez-Perez and Casanova, 2012, p. 281).9

Some economic groups were multinationals entering a new market, such as Bunge in Brazil, who depended on the economic scenario organized by national states. They could generate attractiveness or repulsion to the entry of foreign conglomerates through their actions in the industrial sector, foreign trade, or the regulation of economic activities (Guillén, 2000, p. 366; Minella, 2006, p. 4; Goncalvez, 1991, p. 494).

The Brazilian state's economic role before 1930 tended to be non-interventionist, guided by the guarantor function of freedom of goods and capital flows, which generated a favorable scenario for the arrival of multinationals and, in some cases, resounded to economic groups (Baer et al., 1973, p. 887).10 This economic liberality corroborates the increase in foreign investment flows to Brazil, marked by the opening of 278 foreign-funded enterprises during 1903–1913. While British firms predominated, 15 firms were from Argentina and Uruguay (Castro, 1978, p. 122).11 In the wheat sector, the Brazilian government issued 17 decrees granting exemptions and credits to stimulate domestic production between 1889 and 1929; these proved ineffective at that time. However, there was recognition of the importance of cereal imports, which led the national government to establish the 8258 decree of September 29, 1910 and the 18,826 decree of June 28, 1929, both providing capital for the purchase of wheat spillways in the port of Santos (Bailly, 1930, pp. 105–127).

Bunge y Born, formed in Amsterdam in the year 1818 by Johann Bunge for the export of cereals, took advantage of this favorable scenario. In 1859, Bunge changed headquarters to Antwerp in Belgium while keeping the Dutch branch. In 1884, Ernest Bunge, Johann's grandson, joined brother Jorge Born and created the Argentinian Bunge y Born society, which was related to the European group (Bunge and Co.). The society would see the entry of German Alfredo Hirsch and George Oster as group members in 1897 (Barbero, 2013, p. 80).12

Supported by the bonds that united the group's directors in Europe (Bunge and Co.), Bunge y Born Ltd. had access to technology, trade agreements, and capital. This allowed Bunge to become one of the top five grain export firms in the world (Morgan, 2000), and to overcome performance challenges in backward economies, through expertise for the development of industrial projects or by the incipient formation of a capital market (Guillén, 2000, p. 365; Valdaliso, 2002, p. 587). Thus, Bunge y Born quickly became the largest Argentine economic group in the early 1920s; its main activity was the export of cereals, mainly wheat (Barbero and Lluch, 2015, p. 251).13

In the early twentieth century, Bunge y Born Argentine's process of internationalization entered productively into major Latin American markets such as Brazil. Binding policies were extremely important for the group's expansion in Argentina, and would be just as valuable to this new initiative (Barbero, 2013, p. 79; Chalmin, 1987, p. 200). The Argentine group directors—Alfredo Hirsch and George Oster—directed the Santista mill, and centering of Bunge's business in Brazil was essential, considering that the mill depended on wheat from Argentina for cereal crushing.

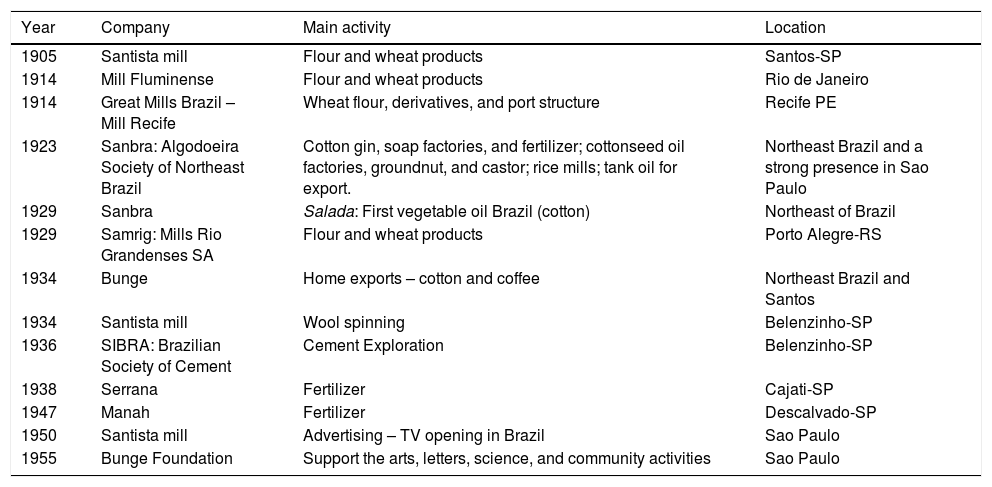

Bunge Brazil was an economic group of independent companies that, at first, focused its activities in the wheat milling industry, starting with the Santista mill located in Santos, Sao Paulo (see Table 1). The business was diversified in the 1920s, with the production of cotton oil, coffee, textiles, cement, and fertilizers.

Bunge Group in Brazil, 1905–1955.

| Year | Company | Main activity | Location |

|---|---|---|---|

| 1905 | Santista mill | Flour and wheat products | Santos-SP |

| 1914 | Mill Fluminense | Flour and wheat products | Rio de Janeiro |

| 1914 | Great Mills Brazil – Mill Recife | Wheat flour, derivatives, and port structure | Recife PE |

| 1923 | Sanbra: Algodoeira Society of Northeast Brazil | Cotton gin, soap factories, and fertilizer; cottonseed oil factories, groundnut, and castor; rice mills; tank oil for export. | Northeast Brazil and a strong presence in Sao Paulo |

| 1929 | Sanbra | Salada: First vegetable oil Brazil (cotton) | Northeast of Brazil |

| 1929 | Samrig: Mills Rio Grandenses SA | Flour and wheat products | Porto Alegre-RS |

| 1934 | Bunge | Home exports – cotton and coffee | Northeast Brazil and Santos |

| 1934 | Santista mill | Wool spinning | Belenzinho-SP |

| 1936 | SIBRA: Brazilian Society of Cement | Cement Exploration | Belenzinho-SP |

| 1938 | Serrana | Fertilizer | Cajati-SP |

| 1947 | Manah | Fertilizer | Descalvado-SP |

| 1950 | Santista mill | Advertising – TV opening in Brazil | Sao Paulo |

| 1955 | Bunge Foundation | Support the arts, letters, science, and community activities | Sao Paulo |

In the first decade of the twentieth century, the Brazilian economy was based on coffee exports. Due to the importance of manual labor, thousands of immigrants arrived from Europe, especially Italians, Spanish and Portuguese. They retained their eating habits, which included consumption of bread and pasta; this increased the demand for wheat flour.14 In 1903, domestic production supplied 50.9% of wheat flour consumption, increasing to 57.5% in 1909. Flour was sourced from foreign suppliers, namely the United States and Argentina (Suzigan, 2000, pp. 201–207).15

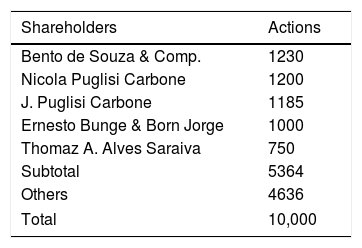

Bunge y Born of Argentina decided to settle in Brazil in 1905, with a strategy of union with Brazilian capitalists through membership in the Moinho Santista, a wheat procurement and milling company located in the port city of Santos (Sao Paulo) (Bunge's Memory Center, 2013, p. 10).16 The company was attracted by the expanding domestic market to which it was already exporting. This strategy was evidenced in 1907, when the names of Ernesto Bunge and Jorge Born were for the first time included as shareholders (Table 2) with a 10% shareholding. The Santista Mill was the third largest in Brazil,17 employing 153 workers.18

Santista Mill –Shareholders on December 31, 1907.

| Shareholders | Actions |

|---|---|

| Bento de Souza & Comp. | 1230 |

| Nicola Puglisi Carbone | 1200 |

| J. Puglisi Carbone | 1185 |

| Ernesto Bunge & Born Jorge | 1000 |

| Thomaz A. Alves Saraiva | 750 |

| Subtotal | 5364 |

| Others | 4636 |

| Total | 10,000 |

The Santos mill operated as wheat mill, mixer of plants, yeast, plant desserts, and exporter of wheat bran. Wheat came from Brazil, Argentina, Canada, Uruguay, Bulgaria, and the United States (SA Mill Santista, 1907, p. 4).

Barbero (2013) expands on the manner in which the array in Amsterdam helped the advancement of Bunge in Argentina; the Sao Paulo-Buenos Aires ratio was key to the Brazilian subsidiary, as Brazil did not produce all the necessary wheat. In Mill Santista's report for the year 1907, managers indicate the existence of a wheat supply agreement previously signed with the house of Ernesto Bunge & Born Buenos Aires, that is, Bunge y Born in Argentina.19 Considering wheat as basic mill input and the inconstancy of their offer in Brazil, this incorporation of more than a purely domestic firm as stakeholders in Bunge y Born solved the issue of the provision of raw materials to Mill Santista. The mobilization of resources and inputs, as described by Leff (1974, p. 96), presented an advantage that was made possible by the integration of business between companies in Brazil and Argentina, and featured the work of Bunge as an economic group. The minutes of the board and supervisory board indicated that Mill Santista had the services of Bunge y Born Argentine as supplier of raw material.

The description of the initial conditions at the plant gives an idea of the functioning of industries in the early twentieth century (see SA Mill Santista, 1907, p. 2). The first machines were imported from Amme Giesecke Koenegen in Germany, which later changed its name to Miag. The “mill” was driven by a 250HP generator, with a daily grinding capacity of 89 tons; it used coal or coke as fuel. The building was lit by kerosene lamps, imported from Belgium. Nine silos were built at the mill for the storage of grain, which was transported from the pier to the industrial plant by wagons with animal traction. “Mill B,” also using German machines, was added to this production unit in 1909.

Flours were classified as “first, second, and third grade,” which was met by the mill's brands “Sol, Santista, and Paulista.” As demand grew, the company increased its capital to 2000 contos as early as 1907. In addition, at the general meeting of October 17, 1908, the company resolved to move its headquarters from Santos to Sao Paulo (SA Mill Santista, p. 3).

Article 1 of the Statute describes the company's scope and goals: “buying and milling wheat and other domestic and foreign cereals; production of pasta and similar articles; participation in the formation of similar industries; making acquisitions, lease agreements; opening branches in the country and abroad” (Statutes Santista Mill, art. 1).

Three modes of product distribution are highlighted: road transport (for collection of products from the mill, moving 90–120 trucks per day); rail transport, through which the mill received their goods (achieved by building a railway siding with a capacity of 35 cars with seven simultaneous downloads); and finally, coastal shipping for the domestic line of products to Manaus, and for serving customers near the coast.20

In 1913, Brazilian mills accounted for 64% of the national wheat flour consumption, with most of the cereal coming from Argentina (Suzigan, 2000, p. 207).21 However, World War I affected the performance of the domestic mills because of their dependence on foreign wheat, in an environment marked by rising freight rates, a smaller wheat crop in Argentina, and government-imposed controls on wheat output amid conflict-related economic difficulties, such as avoidance of the British capital (Suzigan, 2000, p. 207; Rock, 2008, p. 571).

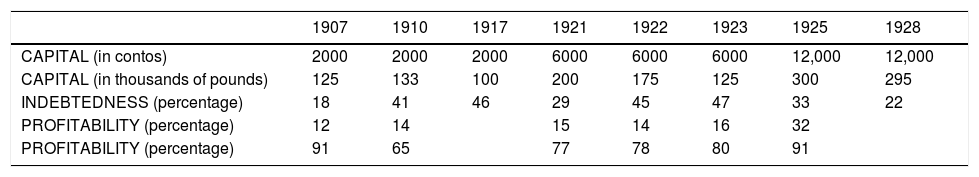

This adverse situation appears to have affected the Mill Santista. At the meeting of September 28, 1918, the board exposed the need to increase the capital of the company by 2000 contos 6 million escudos (Table 3) due to the construction of a new mill in the city port of Paranaguá (Paraná, Brazil) and the acquisition of four steamships to enlarge the arrival of raw material (wheat) and the flow of production (flour) (Official Diary of the Union, 1918, p. 13841).

Evolution of capital and economic indicators of SA Mill Santista, 1907–1928.

| 1907 | 1910 | 1917 | 1921 | 1922 | 1923 | 1925 | 1928 | |

|---|---|---|---|---|---|---|---|---|

| CAPITAL (in contos) | 2000 | 2000 | 2000 | 6000 | 6000 | 6000 | 12,000 | 12,000 |

| CAPITAL (in thousands of pounds) | 125 | 133 | 100 | 200 | 175 | 125 | 300 | 295 |

| INDEBTEDNESS (percentage) | 18 | 41 | 46 | 29 | 45 | 47 | 33 | 22 |

| PROFITABILITY (percentage) | 12 | 14 | 15 | 14 | 16 | 32 | ||

| PROFITABILITY (percentage) | 91 | 65 | 77 | 78 | 80 | 91 |

Note that Bunge y Born was not among the 36 subscribers of these ten new shares of Santista mill (which had its capital divided into 30,000 shares). However, Bossio & Camuyrano was the biggest buyer at 30% of the ten thousand new shares issued for subscription to capital. This Buenos Aires firm exported meat and other products to the Latin American market (Official Diary of the Union, 1918, p. 13842).

Bossio & Camuyrano seemed to hide the presence of members of Bunge y Born Argentina, whose participation would be more evident in the 1920s. The 1921 president was José da Silva Gomes de Sá and directors were John Ugliengo, Edmundo Metzger, and Alfredo Hirsch. The latter was one of the commanders of the Bunge y Born in Argentina who become the main director of Bunge y Born with the death of Eduardo Bunge in 1927. In 1929, George Oster, one of the leaders of Bunge y Born, was on the board of Sanista Mill alongside Alfredo Hirsch (Official Diary of Sao Paulo, 23/02/1922, p. 1463; 2/27/1929, p. 1943).

The 1920s marked the largest entry of Bunge's controlling families in Argentina, making the Santista mill in Brazil its affiliate through acquisition. This participation was extremely favorable for the Bunge y Born group, with a profitability of 15% between 1926 and 1932, a period in which its operations in Argentina comprised wheat exports (grain and flour) as well as industrial activities such as textiles (Cuesta and Newland, 2016, p. 212). However, as the company was expanding in Latin America, Perón22 came into power and they gained the business relevance of the group in Brazil (Green and Laurent, 1989, p. 97).

This greater integration is corroborated by the fact that the names of Bunge and Cia. Ltda and Bunge y Born in Argentina are among the 15 shareholders present, as contained in the October 10, 1931min of the Mill Santista Assembly (Official Diary of Sao Paulo, 10/10/1931, p. 12). This process would be completed in 1941, when a new meeting determined the composition of the Advisory Board of the mill—the body to which the board should refer for strategic decisions of the company, that had Alfredo Hirsch (principal leader of Bunge Argentina) as one of its three members (Official Diary of Sao Paulo, 06.07.1941, p. 44).

Bunge's businesses in Brazil, led by Santista Mill, stimulated stronger entry of Argentine representatives into the Brazilian market. The company's capital doubled between 1923 and 1925, from 6000 contos 12 million escudos, in a period when the average debt was low, accounting for 35% of the active investment between 1921 and 1928 (Table 3). In that decade, the mill had an average return of 19%, representing an even higher profitability than the 81% of the group in Argentina, which mainly came from the milling activities in Santos—in this case of one of the three largest firms of the branch in Brazil (Suzigan, 2000, p. 209).

Note: We mention the capital of Santista Mill in sterling due to the Brazilian government's use thereof as a basis for the exchange price of national currency until 1930 (the mil reis), as pointed out by Moura (2010).

Debt was obtained from the current liabilities ratio by total assets; profitability from the ratio of net income and earnings suspended by total assets; profitability by the ratio of net income by total revenues.

The positive results of the Santista mill were based on expansion of facilities in Singapore, and training and acquisition of other companies in Brazil. The 1925 balance sheet of the mill stated that 20% of assets were represented by buildings, machinery, and raw materials of Miscellaneous Industries (Official Diary of Sao Paulo, 26/02/1926, p. 1640). Such industries made up the parallel investments of Santista Mill, which represented Bunge y Born's Brazilian interests, leading to further expansion of the national wheat industry.

4The expansion of Bunge by the wheat industry in BrazilThe growing demand for wheat in the domestic market in the early twentieth century23 required higher imports of cereal and the expansion of grinding in Brazil, creating the opportunity for major cereal groups to integrate their investments. They did this by acquiring competitors and by creating new units, which were endowed with the capital, hand labor, and commercial expertise that, in the case of Bunge, could bridge the gap between a major supplier of raw material (the Argentine wheat) and companies benefiting from the product in Brazil. These combined units later made up the Bunge Group (Leff, 1974, p. 93; Colpan and Hikino, 2010, p. 41).

Bunge acquired the Fluminense Mill (which was established in 1887 in Rio de Janeiro) in 1914 through a decree granted by Princess Isabel (Bunge's Memory Center, 2013, p. 5).24 According to Article 2 of the Statute, this company was incorporated with the objective of exploring the large scale milling of wheat and other cereals, and to buy, sell, and stimulate wheat planting in Brazil.

Article 3 defines Rio de Janeiro as the company headquarters. Article 5 refers to the share capital, consisting of one thousand contos, of which the managing partner Carlos Gianelli committed an amount of 50,000 réis. The capital was divided into 1900 shares, worth 500 escudos each. Article 16 delegates to the managing partner the task of acquiring land by the sea where they can dock ships, build the necessary buildings, and purchase machines that allow the crushing of 80 tons of grain per day.

A new expansion phase started in the 1920s, following lifting of the World War 1 import constraints; machinery imports increased and production was concentrated by the three largest firms: River Flour Mills, Matarazzo, and Bunge & Born (Suzigan, 2000, p. 209). The Fluminense Mill expanded its activities significantly, with the Bunge Group setting up 16 branches in Brazil and abroad in the 1920s, located in: Sao Paulo, Juiz de Fora, Belo Horizonte, Bahia, Maceio, Ilheus, Itajaí, Vitória, Aracaju, Ceará, Barra do Pirai, Curitiba, Niterói, London, Alfenas, and Três Corações” (Fluminense Mill. agencies, p. 19).

These three groups were active in different sectors, with Rio Flour Mills dominating the market of Rio de Janeiro, while Matarazzo participated in the São Paulo and Paraná markets. The Bunge Group, operating in Sao Paulo (Santos Mill) and Rio de Janeiro (Mill Fluminense), took control of the South market in Brazil through Samrig (Suzigan, 2000, p. 209).

In February 1929, the Bunge Group formed the corporation Mills Rio Grande do – SAMRIG, the result of a merger between Widow Albino Cunha & Cia SA and Great South Mills (Bunge's Memory Center, 2013, p. 7). Before the purchase, they operated wheat mills in Porto Alegre and Pelotas.25 In the 1920s, imported equipment allowed production of 100 tons of flour per day. Cereal was imported from Argentina, unloaded in the warehouse, and transported to the plant by rail.26

On January 28, 1928, the then governor of Rio Grande do Sul, Getulio Vargas, expressed support for the company by saying that “… Wheat Mill Portoalegrense alia, a commercial interest, responded to the patriotic stimulus and contributed to the economic emancipation of Rio Grande do Sul …. Companies like this deserve the applause and the state government's support ….27”

In the decades of 1930–1940, the Samrig had mills in five cities: Erechim, Passo Fundo, Guaporé, Cruz Alta, Uruguaiana, and the newly participating mill of Joinville, Santa Catarina. It entered the field of commercial foods in 1950 by starting production in Porto Alegre and ushering in other industrial plants in Joinville (SC), Pelotas, Passo Fundo, and Cruz Alta (RS).

The history of the Joinvile mill started when the Boa Vista Mill was built on the banks of River Falls, near the pier Conde d’Eu, allowing receipt of sea wheat by barges pulled by tugboats from the port of Sao Francisco do Sul. The construction of the first industrial plant “began in 1910 with iron and steel imported from Germany. The building and its machines were made by Amme firm, Giesecke & Konegen, Braunschweig (Germany).28” Inaugurated on April 19, 1913, it was founded by Oscar Schneider & Co., whose partners were Oscar Antonio Schneider and Domingos da Nova Junior, Abdo Baptista, Eduardo Horn, and Commercio Bank of Porto Alegre.

Eleven steel silos with a capacity of 1100 tons of wheat were built. With an initial complement of 23 employees, it began producing 550–600 bags of flour with three brands—Cruzeiro, Surpresa, and Boavista—as well as 200 bags of bran. In 1923, the mill was purchased by the Brazilian Mercantile Group SA (UMBRA)—a company chaired by Alfredo Hirsch that had George Oster as one of its directors. On 27 May 1944, the Umbra transferred all industrial operations to Samrig (Bunge).29

After World War II, Samrig encouraged soybean cultivation and inaugurated the Industrial Park of Esteio-RS in 1958, then the largest soybean processor in Latin America and a milestone in the use of soy in Brazil, both as an incentive to grow this new crop and for the dissemination of its derivatives. He also launched the Primor soybean oil in 1958, Primor margarine in 1960, and built Esteio Park, the first protein isolate soy plant in Latin America, in 1969. This allowed its conversion into raw material for the food industry.

In addition to Samrig, of Santos and Fluminense mills, Bunge bought Mill Recife, with operations in the northeast, in 1914. The Company documents describe the process as follows: “The company Just Basto & Cia., which was from Hungary and the United States and operated in the export and import of wheat flour, joined the Bunge Group. It constituted on May 30, 1914, the Great Mills Brazil SA, which had its name changed in 1986 to Mill Recife SA Empreendimentos e Participaçoes, one of the largest units of Bunge in wheat industrialization port structure” (Bunge's Memory Center, 2013, p. 5).

Mill Recife was created to meet the needs for flour and other derivatives in the Northeast.30 Its initial capital was “a thousand contos.31” Its statutes were approved by the Federal Decree n. 10,946, published in the Official Gazette of June 26, 1914, and filed at the Board of Trade of Pernambuco, under n. 4053, on July 9, 1914.

War-related problems caused a delay in machinery and equipment imports and in the construction of industrial plants. Production therefore only commenced on December 11, 1919, with Recife, Olinda, and Northerner meal. For the start of activities “were hired six men to the house of the engines, four for cleaning, six for milling, six for stitching bags and stitchers, two for cables, and one in charge of transport control” (Historical Mill Recife, 2013, p. 4).

A new warehouse extended the facilities in 1921, leading to a production capacity of 80 tons per day. It opened a second unit (Mill B) as early as 1926.

As the region did not produce wheat, this was imported.32 For example, ten vapors were unloaded at the port of Recife and 30,000 tons at the mill in 1929. Due to the city's increasing importance, the headquarters of SA Brazil Great Mills was transferred to Recife on November 24, 1930.

Expanding its range of operations, the mill opened in 1945 to produce balanced feed. It inaugurated the third manufacturing plant (Mill C) in 1946, producing the Bovinovita rations, Equinovita, and Suinovita. The increase in units and renewal of the machine park lead to a crushing capacity of 536 tons per day with the opening of the new plant (Mill D) in 1952.

Bunge was similarly present in other countries in Latin America.33 We highlight the example of Peru, since it is similar in experience to the Brazilian subsidiary. Since the early twentieth century, the group invested in Peru, importing sunflower oil and lard from Argentina, and exporting grains and cotton fibers to England. In 1943, Bunge created the trade and finance company La Fabril in Peru, trading in agricultural products, textiles, and chemical and mineral products. It deployed Molinos Santos Rosa and created the Compañia oleaginous del Peru in 1946, intended to produce vegetable oil. Bunge followed a similar path in Uruguay, where it deployed the Uruguaya factory acceptances Comestibles in 1936, diversified its operations and founded the Sociedad Uruguaya Chemistry in 1941 (Green and Laurent, 1989, pp. 98–99).

The processes of internationalization and diversification were advantageous because they involved several companies with a wider range of profitability sources, which were made possible by subsidiaries (Colpan and Hikino, 2010, pp. 20–21). The economic benefits to Bunge are evident: “… This adaptability is enhanced by an important diversification of the group's activities. Since the early twentieth century, it operates in different sectors: agricultural production, trade, and initial processing of grain, cotton, oil, and finances various operations, such as the exploitation of Chinese mines or Leopold II companies in the Belgian Congo. Some of these activities promise a bright future and others end in failure. However, most allow substantial profits at some point, which finances the international growth of the group” (Green and Laurent, 1989, pp. 75–76).

Economic groups such as Bunge are characterized by diversification, which often originates from unrelated sectors. The growth opportunities stem from formation in markets with a reduced number of competitors. Economic groups access these markets easier, given the scale of capital required for efficiency (Cerutti, 2011, p. 4; Khanna and Yafeh, 2010, p. 580).

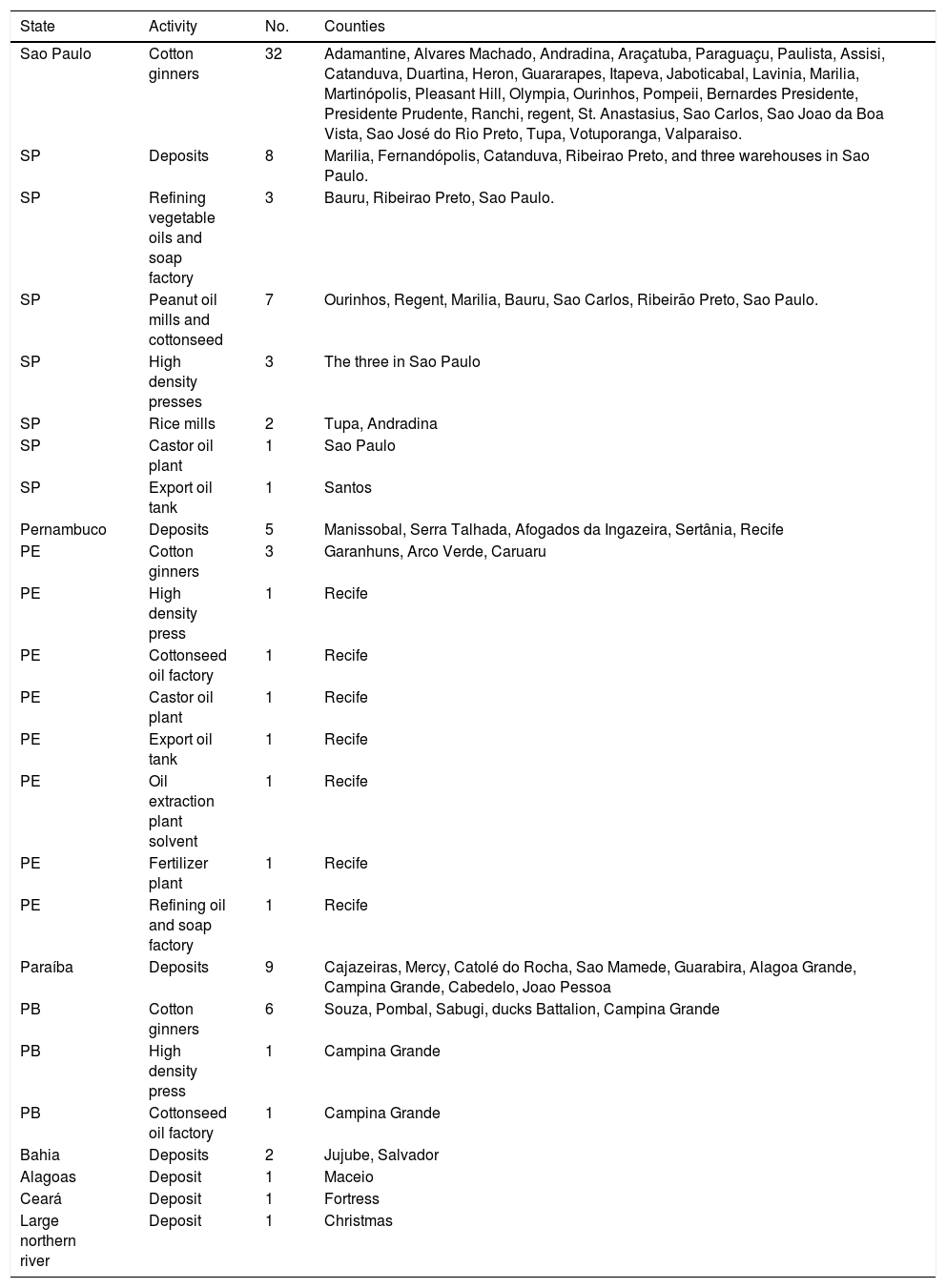

In this context, Bunge bought Cavalcanti & Co. in 1923, later to become the Sanbra: Society Algodoeira the Brazilian Northeast, Bunge's first company in the oil segment. This lead Bunge to broaden their occupation of the country, with operations in Sao Paulo, Pernambuco, Paraíba, Bahia, Alagoas, Ceará, and Rio Grande do Norte. Sanbra pioneered the launch of the first Brazilian edible vegetable oil derived from cotton, and thereafter from peanut and castor. It diversified into industrial plants (mills) for rice and cotton ginners.

In the 1920s, the State of Sao Paulo was the main agricultural and industrial strength of Brazil (Dean, 1971, p. 20).34 The government of Sao Paulo promoted research and improved the quality of the fibers and cottonseeds; these were distributed in large quantities, leading to significant increases in cotton production.35

Due to population growth and the agricultural and industrial development of Sao Paulo, Bunge also located in Santos, and then immediately transferred its headquarters to the capital. Sanbra's presence in this city was not surprising. According to the document of Sanbra, “the headquarters was in Sao Paulo, while branches were distributed in Rio de Janeiro, Salvador, Recife, Joao Pessoa, Campina Grande, Natal, and Fortaleza.36”

Sao Paulo's economic importance made it the key state, with “seven groundnut oil mills and cotton, one castor oil plant, two rice mills, 30 cotton gins, seven deposits, one oil tank for export, three high density presses, three refinements of vegetable oils, and soap mills” (Sanbra, s/d s/p).

While Sao Paulo's facilities stood out, Pernambuco took the lead toward diversification of activities, with “five deposits, three cotton ginners, one cotton oil mill, one castor oil plant, one tank oil for export, one high density press, one oil extraction solvent plant, one fertilizer plant, and one refining oil and soap factory” (Sanbra, s/d, s/w).

The document details the activities in other states, namely: Paraíba had “nine deposits, six cotton ginners, one high density press, one cottonseed oil factory.” Bahia had “two deposits,” while three northeastern states relied on only one activity, that is, “one deposit in Alagoas, Rio Grande do Norte, and Ceará” (Sanbra, s/d, s/w).

Campina Grande, Paraiba, stood out in the Northeast as the great polo cotton producer. It was based on this production that “Sanbra came to town in 1935, where it built a large structure, contributing to the economic development of the city and the state.37” It operated in a deposit site as a cotton gin, a high-density press, and a cotton seed oil factory.

According to Table 4, Sanbra originated in Recife in the 1940s, with the extraction of castor oil. It acquired an oil mill in the neighborhood of Boa Viagem that enabled the beginning of the activity, “… to the construction of a new plant in the industrial district of Sands, which opened in 1948.” Sanbra initiated in 1955 the construction of new castor oil plant in Salvador.38

Sanbra and its main activities in Brazil – 1923–1955.

| State | Activity | No. | Counties |

|---|---|---|---|

| Sao Paulo | Cotton ginners | 32 | Adamantine, Alvares Machado, Andradina, Araçatuba, Paraguaçu, Paulista, Assisi, Catanduva, Duartina, Heron, Guararapes, Itapeva, Jaboticabal, Lavinia, Marilia, Martinópolis, Pleasant Hill, Olympia, Ourinhos, Pompeii, Bernardes Presidente, Presidente Prudente, Ranchi, regent, St. Anastasius, Sao Carlos, Sao Joao da Boa Vista, Sao José do Rio Preto, Tupa, Votuporanga, Valparaiso. |

| SP | Deposits | 8 | Marilia, Fernandópolis, Catanduva, Ribeirao Preto, and three warehouses in Sao Paulo. |

| SP | Refining vegetable oils and soap factory | 3 | Bauru, Ribeirao Preto, Sao Paulo. |

| SP | Peanut oil mills and cottonseed | 7 | Ourinhos, Regent, Marilia, Bauru, Sao Carlos, Ribeirão Preto, Sao Paulo. |

| SP | High density presses | 3 | The three in Sao Paulo |

| SP | Rice mills | 2 | Tupa, Andradina |

| SP | Castor oil plant | 1 | Sao Paulo |

| SP | Export oil tank | 1 | Santos |

| Pernambuco | Deposits | 5 | Manissobal, Serra Talhada, Afogados da Ingazeira, Sertânia, Recife |

| PE | Cotton ginners | 3 | Garanhuns, Arco Verde, Caruaru |

| PE | High density press | 1 | Recife |

| PE | Cottonseed oil factory | 1 | Recife |

| PE | Castor oil plant | 1 | Recife |

| PE | Export oil tank | 1 | Recife |

| PE | Oil extraction plant solvent | 1 | Recife |

| PE | Fertilizer plant | 1 | Recife |

| PE | Refining oil and soap factory | 1 | Recife |

| Paraíba | Deposits | 9 | Cajazeiras, Mercy, Catolé do Rocha, Sao Mamede, Guarabira, Alagoa Grande, Campina Grande, Cabedelo, Joao Pessoa |

| PB | Cotton ginners | 6 | Souza, Pombal, Sabugi, ducks Battalion, Campina Grande |

| PB | High density press | 1 | Campina Grande |

| PB | Cottonseed oil factory | 1 | Campina Grande |

| Bahia | Deposits | 2 | Jujube, Salvador |

| Alagoas | Deposit | 1 | Maceio |

| Ceará | Deposit | 1 | Fortress |

| Large northern river | Deposit | 1 | Christmas |

Diversification continued with the launch of the Sanbra-pioneered salada first edible vegetable oil (cotton) in 1929. The oil contributed to changing in consumers eating habits from using lard.

The Bunge subsidiary in Brazil featured exports as activity in the middle of the second decade of this century, standing out in 2011 as the largest exporter of agribusiness and the third largest national exporter overall (BUNGE, Sustainability Report, 2012). This activity began in 1934, when Sanbra's Board undertook its first flight abroad, selling raw cotton to Europe.

The company's export data can be tracked in various ways. The Brazilian director, writing to the general maintainers in Buenos Aires on June 25, 1938, refer to exports in his letter to headquarters: “We communicate hereby to the Vv. Ss that we will make the following cottonseed cake shipments in the steam “RIGEL” to leave Santos for Copenhagen, more or less in 27 of fluent:. 1,694 bags with 601,140 Ks under the sale announced in letter n. 177, the price of sh/117/6 ….39”

Analysis of correspondence between the branch (Sao Paulo) and the headquarters (Buenos Aires) allows tracking of export details, as can be observed in the letter of November 26, 1938, when they report that “on the BRYNHLLD steam starting from Santos to Copenhagen will be shipped 1,694 bags of cottonseed cake, the sale of which was announced in the letter n. 207, worth Pounds 6.8.9.” The information is recurring in similar later correspondence.”

By analyzing correspondence, it is possible to follow the details of market fluctuations, as in the letter of 17 January 1939, which refers to the export of coffee. Those in charge of exports describe momentary difficulties, mentioning that: “… Under the adverse impacts of successive low of American terms and the Franco-Italian crisis, and before the large inflows that daily occur in the square—which already increased the ‘stock’ to almost 2.5 million bags—the operators (mainly our usual overseas buyers) are withdrawing and slowing their purchases. This fact is leading to some dismay among sellers, even the most optimistic, who are already disposing of their coffee at the prices offered by exporters.”

Attentive to higher value-adding activities, Sanbra diversified exports, contributing to a change in the country's sales. “Thus, Brazil, the largest exporter of raw materials, has become the largest exporter of castor oil retaining pie, by-product for use as fertilizer in many cultures, especially the tobacco in the Northeast” (News Sanbra, 1968).

From the mid-1930s, Bunge also diversified into wool. In 1934, the SA Mill Santista started construction and assembly of a large Wool Spinning plant in the district of Belenzinho, Sao Paulo, SA Mill Santista General Industries – LANIFICIO.40 Built on a farm, the factory occupied an area of 7000 square meters, known as Santista, which was divided into wool and cotton sections, making yarn for knitting. With an initial staff of 650 employees, Belenzinho went into operation in 1935 and was the first large factory in Brazil to produce top-notch wool yarn systematically. It launched the brands Siberia, Alaska, and Sams, also enhancing the production of woolen yarn (History Bunge Group, Bunge Memory Center, Sao Paulo, 2013, p. 8).

In this same field, Bunge bought the Textile Factory Tatuapé “registered with the Commercial Registry of São Paulo on August 23, 1929.41” The same document gives other company details such as the number of shares, consisting of “fifty thousand shares of two hundred thousand réis each.” At the time of the new company foundation, among the shareholders stood out: Fluminense Mill (Rio de Janeiro, 960,000 reis), SA Mills Riograndenses (Porto Alegre, 350,000 reis), SA Mill Santista (Sao Paulo, 200,000 reis), Great Mills Brazil SA (Recife, 100,000 reis), Commercial Union Brasileira SA (Joinville, 20,000 reis), John Ugliengo (Sao Paulo, 10,000 reis), Vicenzo Scancutta (Sao Paulo, 8000 reis), João Baptista Della Corsa (Sao Paulo), Armando Facade (Sao Paulo), and several (Sao Paulo, 2000 reis). Considering the amount of investment in the new firm, Bunge realized that its constitution depended essentially on reinvestment by the very same Bunge owned companies.

The new plant was constituted as follows: “Three large buildings where wiring and cotton weaving are installed; a building where one ginner and twister are installed; a building where the tissue measuring machines for packaging, as well as the equipment for sewing bags are installed on one side and, on the other, the warehouse of manufactured products and a storeroom; a building that serves on one hand as cotton warehouse and on the other contains machines for a waste treatment facility; a shed with the entrance and the dining room of the workers; a building for the machine shop, carpentry, and storage of materials; and a health pavilion for the workers” (Textile Factory Tatuapé, Daily n. 1, 2014).

The analysis of the machinery, described in the same document, gives a closer view of the size of the new company. The machines consisted of “a complete spinning of 16,000 spindles; 642 looms for weaving of different sizes with their ironing and auxiliary machinery; a complete mechanism for the treatment of waste; machinery for ginning cotton ….” In addition, there were “49 houses for workers—42 new and 7 old—built partly inside the factory at Celso Garcia Avenue, 680, and partly on the street André Vidal [Sao Paulo].”

Diversifying its activities further, the Bunge group created the Roseate Cement in Rua Sao Bento in Sao Paulo in 1936, which changed its name to Cibra – Brazilian Society of Cimentos SA in 1939, for the purpose of exploring the cement industry (Bunge Memory Center, Sao Paulo, 2013, p. 9).42

Bunge obtained the Serrana S/A Mining, founded in 1938 to “research and exploit a limestone reserve in the Serra do Mar, acting as associated with Cibra, a pozzolan cement producer, acquired by S/A Santista Mill in 1936.43” In 1942, the Serrana began to exploit a deposit of phosphatic rock (apatite) in Cajati, in the Ribeira Valley. In 1945, Cibra became Quimbrasil, manufacturing chemical products for veterinary and agricultural use as well as phosphate fertilizers.

Some new fertilizer brands, such as Manah, were produced in Descalvado, Sao Paulo in 1947. Along with the IAP and Serrana are the fertilizer brands of Bunge Brazil (Bunge's Memory Center, 2013, p. 11).

In addition to these activities, Bunge sought national market visibility, through innovation of own marketing. On September 18, 1950, at 22h, the first television program in the country aired on TV Tupi. Morais (1994, p. 499) describes: “On September 18 the function would start at five in the afternoon, with the transmission of the blessing ceremony and baptism of cameras and studios, and proceed with skits until ending at nine in the evening with a grand show. It was of course live, since the first videotape only appeared almost two decades later. For the celebration of the opening of Brazilian television, the fourth in the world, Chateaubriand had already booked a room at the Jockey Club, where a monitor would be installed so that its two hundred special guests (including David Sarnoff, president of RCA Victor-NBC, to whom you sold the material) could watch, at a banquet, the first regular presentation of what was called a legacy radio addiction, with the complicated prefix PRD-3-Tupi (and soon to become only “TV Tupi channel 3”).”

To fulfill the dream of deploying television, Assis Chateaubriand Bandeira de Melo achieved in 1947 “forward contracts advertising with SA Mill Santista and three companies: Sul America Seguros, Cia Antarctica Paulista, and Lamination of Pignatari. In the 1940s and 1950s, a time of radio gold, the Bunge Group started investing in media, promoting its products in radio programs” (Bunge's Memory Center, 2013, p. 11).

Finally, the Mill Foundation Santista (today Bunge Foundation) was created on September, 30, 1955—the year of the fiftieth anniversary of Bunge in Brazil—as a way to celebrate and settle permanently in the local society “in order to encourage production, scientific, artistic, and cultural development through the creation of the Bunge Foundation Award” (Bunge's Memory Center, 2013, p. 12). A ceremony is held yearly to recognize personalities who excel in the arts, letters, and sciences.

6Final considerationsBy analyzing this fifty-year period of Bunge in Brazil, it is clear that some of the authors’ ideas on the analysis of the formation of economic groups in developing countries were put into practice. The first finding is that the group took advantage of the opportunity and was not afraid to take risks. Bunge's growth can be attributed to performance in wheat milling, its initial focus in the country. Its growth here was due to some basic strategies: (i) incorporation of new mills into its industrial portfolio; (ii) permanent production capacity expansion by improving and expanding industrial plants in several places; and (iii) diversification of products.

Bunge grew and developed features of an economic group through industry diversification. Wheat mills expanded into cotton through Sanbra. A portfolio analysis shows that Bunge went far beyond cotton: it incorporated deposits; cotton ginners; soap plants and fertilizers; cottonseed oil factories, groundnut and castor; rice mills; oil tank for export.

Bunge diversified its activities by joining complementary fields such as wool spinning, production of cotton yarn, and cement production. It invested in industrial plants to produce fertilizers, a branch that has become one of the largest agribusiness suppliers.

Another way to be in economic group was the pioneer and permanent release of new products. Bunge pioneered by launching, for example, the “salada” in 1929—the first vegetable oil in Brazil, extracted from cottonseed, as well as lard, to enrich Industries Reunidas Matarazzo (Costa Couto, 2004a,b). It later suffered competition from soybean oil, “Primor” in this case, but it was again pioneered by Bunge and produced by the industrial plant Esteio-Rio Grande do Sul state, in 1958. In 1969, Bunge was also the first company to build a protein isolate soy plant in Latin America to provide raw materials to the food industry.

Another prominent activity from 1934 was its performance in international trade through exports—initially wheat bran from the Santista mill, followed by cotton and coffee (Sanbra), and then diversification into other products to become the largest exporter of Brazilian agribusiness in 2012. This activity contributed to the growth and formation of the Bunge economic group.

Bunge's early and extensive process of internationalization is noteworthy. It commenced operations in Amsterdam in 1818, and changed its headquarters by 1859 to Antwerp. Silva and Dalla Costa (2014) considered its trade with different continents and expansion to other countries in Europe, Asia, Africa, and the Americas as significant. For other authors, such as Green and Laurent (1989, p. 75) it was noticeable that in the early twentieth century, “at the time that most of the companies strive to consolidate positions in their domestic markets, if limited to the control circuit of the colonies of their country of reference, these societies involved Bunge & Born almost worldwide.” In Brazil, Bunge played the role of internationalization via exports through its subsidiary Sanbra.

The former director of Bunge's legal department points to more pragmatic reasons that led the company's growth into an economic group. “Bunge grew due to some specific factors, particularly: (i) leaders with appropriate view of the business that took every opportunity; (ii) engagement with the local communities where Bunge had units; (iii) quality of the people who ran the company; (iv) a pioneer in all areas of activity; (v) professionalism of the staff in all actions.44”

In resuming the initial key question of how Bunge, in the context of an economy of incipient industrialization became an economic group, we can say it did so by: (i) buying competitors; (ii) increasing the installed capacity of the mills; (iii) diversifying products; (iv) maintaining good relations with the Vargas government-encouraged industrialization from 1930; (v) inserting itself in the communities through the Bunge Foundation; (vi) innovating through the launch of new merchandize, non-existent in the market; (vii) leaders who pioneered areas of activity; (viii) occupying the country with industrial plants and distributors; (ix) implementing several modes of distribution (road, rail, maritime) for its products; (x) reinvesting the capital by forming new companies; (xi) initiating the export of cotton and coffee when they were essential to the Brazilian trade balance; and (xii) pioneering several of the business lines in which it served.

SourcesBorn, J., 2008. Interview with Jorge Born. Interviewed by Andrea Lluch, Buenos Aires, Argentina, August 21, 2008. Creating Emerging Markets Oral History Collection, Baker Library Historical Collections, Harvard Business School.

Bunge, 2012. Sustainability Report. Sao Paulo: Bunge 2012.

Charter of Bunge's directors in Sao Paulo, addressed to “Ilmos Messrs. Bunge & Born Ltda. Buenos Aires” (no. 368), dated June 25, 1938. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

History of Bunge Group, 2013. Document consulted in 2013, Bunge Memory Center, Sao Paulo.

Extract of the Minutes of the Joint Session Directory and Audit Committee. Santos, February 21, 1907. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

Factory Tatuapé fabrics. Daily no. 1. Document consulted in November 2014 in Bunge Memory Center, Sao Paulo.

History of Mill Recife. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

History of Fluminense Mill. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

History of Joinvile Mill. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.http://www.bunge.com.br/Bunge/Nossa_Historia.aspx. Accessed September 11, 2014.http://www.fundacaobunge.org.br/acervocmb/colecao/13/ Accessed February 12, 2015.

Interview 1. Interview with former director of the Legal Department of Bunge. Bunge Memory Center. Sao Paulo, November 14, 2014.

Journal News Sanbra. Bunge, Sao Paulo, no. 2, March-April 1968.

Letter of the Governor of Rio Grande do Sul in support of the Mills Rio Grandense. Porto Alegre, January 28, 1928. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

Mill Fluminense. Agencies. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

Minutes of the General Assembly of the “Textile Factory Tatuapé S/A.” August 5, 1929. Available from http://www.fundacaobunge.org.br/acervocmb/assets/documentos-historicos/constituicao-fab-tecido-tatuape-1929.pdf. Accessed February 24, 2015.

Minutes of the General Assembly Santista Mill. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

Minutes of Shareholders of Santista Mill. Data Diario Official 1244 of Friday, February 14, 1908.

Official Diary of the Union. Official Gazette, 1907-1935. Consulted the minutes of meetings of the Joint Stock Company Santista Mill and the Brazilian Mercantile Union (UMBRA).

Official Diary of Sao Paulo. Official Gazette of the State of Sao Paulo, 1907-1941. Consultation of balance sheets, profit and loss statements, and management reports of the Company Anonymous Mill Santista.

Permit of operation Fluminense Mill. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

Review Be News. Bunge Year I, no.1, Sao Paulo, July-August 1996.

Patchwork historical Campina Grande. Available from http://www.cgretalhos.blogspot.com.br/2009/11/Sanbra.html#.VNg68E10wdU. Accessed February 12, 2015.

SA Mill Santista Sociedad Anónima Santista Mill – General Industries. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

Sanbra – Algodoeira Society of Northeast Brazil. Book with history Sanbra, s/p, s/d. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

State of Sao Paulo. Official Gazette of the State of Sao Paulo, 1907-1941. Consultation of balance sheets, profit and loss statements, and management reports of the Company Anonymous Mill Santista.

Statues of Santista Mill. Document consulted in September 2014 in Bunge Memory Center, Sao Paulo.

Union. Official Gazette, 1907-1935. Consulted the minutes of meetings of the Joint Stock Company Santista Mill and the Brazilian Mercantile Union (UMBRA).

To understand the origins of the industrialization process by import substitution, see Tavares, M., 1977. The import substitution to financial capitalism. Zahar, Rio de Janeiro. For a review of this process see Fishlow, A, 2013. Origins and import substitution of consequences: 40 years later. In: Bacha, E., Bolle, M., 2013. The future of the industry in Brazil. Brazilian Civilization, Rio de Janeiro.

A first version of the text was presented in the XI Brazilian Congress of Economic History and the 12th International Conference on Business History. ABPHE-UFES, Vitoria, 14–16 September 2015. Thanks to text commentators and also the anonymous reviewers of the journal, for their valuable comments and suggestions. Possible errors and inaccuracies of the current version are our responsibility. We also thank the Bunge Memory Center, Sao Paulo, for access to primary sources.

Bresser and Perreira (1976), Doelinger and Cavalcanti (1975), Lacerda (2004), Suzigan and Szmrecsányi (2002), Castro (1978) and Suzigan (2000).

In 2007, the ten largest Brazilian economic groups were, in order of increasing gross revenues (in parentheses the year of foundation): Fiat (1899), Gerdau (1909), Votorantim (1892), Ambev (1999), Telefonica (1924), the Bank of Brazil (1808), Itaú (1945), Vale (1942), Bradesco (1943), and Petrobras (1953) (Aldrighi and Postfali, 2010, pp. 355–356). Some works outline a history of Brazilian economic groups, but do not analyze the first half of the twentieth century (see Bonelli, 1998 and Goncalvez, 1991).

Green and Laurent (1989), Schvarzer (1989), Barbero and Lluch (2015), Morgan (2000), Born (2008), and Silva and Dalla Costa (2014).

The Gross Domestic Product (GDP) of Brazil had an average growth of 2.3% between 1870 and 1913, while the average Argentinian GDP was 5.8% the Mexican 3.4%, and the Chilean 3.3% in the same period. Even though the Brazilian GDP per capita in absolute terms was second only to Argentina among Latin American nations, Brazil's GDP represented only 20% of GDP per capita of Argentina in 1900, 25% of Chile's and 40% of Mexico's GDP per capita (Bertola and Ocampo, 2012, pp. 100, 292).

Summary of recent contributions on economic groups: Guillén, M., 2000. Business Groups in Emerging Economies: The Resource-based View. The Academy of Management Journal 43(3), pp. 362–380. Granovetter, M., 2005. Business Group, in: Smelser, N., Swwedberg, R. (Eds.), The Handbook of Economic Sociology 2nd ed. Princeton University Press, Princeton, pp. 429–450. Fruin, M., 2007. Business Groups and Networks interfirm, in: Jones, G., Zeitlin, J. (Eds.), The Oxford Handbook of Business History. Oxford, Oxford University Press, pp. 244–267. Mork, R., Steier, L., 2007. The Global History of Corporate Governance. An Introduction, in: Mork, R. (Ed.), A History of Corporate Governance around the World. Family Business Groups to Professional Managers. University of Chicago Press, Chicago. Colpan, A., Hikino, T., 2010. Foundations of Business Groups: Toward an Integrated Framework, in: Colpan, A., Hikino, T., and Lincoln, J. (Eds.), The Oxford Handbook of Business Groups. Oxford University Press, Oxford, 2010.

The economic groups received different nomenclatures in emerging countries: chaebols in South Korea; business houses in India: holding companies in Turkey and economic groups in Latin America, including Brazil (Kim et al., 2004: 14).

In 2007, 15 of the 50 largest economic groups in the Brazilian market were led by national families, with 21 controlled by foreign firms (some were familiar, such as Bunge). Eight groups were run by private companies and/or were funded by national pension, five were state-owned, and one was jointly headed by a Brazilian family and a foreign company (Aldrighi and Postfali, 2010, p. 372).

The two main economic policy instruments used before 1930 in Brazil were the exchange rate and tariffs. However, the tax on imports was the main source of government revenue, and the consumption of Brazilian citizens depended largely on final goods and imports like wheat; there was therefore a limit to the use of these instruments. This linked to a lower weight of industrial and political force, helping to understand why an industrialization project was not formed before 1930 (Versiani and Suzigan, 1990, p. 10).

Between 1860–1902, 212 foreign-funded firms opened in Brazil, 127 British, with investments totaling 105 million pounds. Of these investments, 59% were into basic services (water, lighting, urban transport) and 34% into railways (Castro, 1978, pp. 80–81).

For historical analysis of the company and its internationalization see: Green and Laurent (1989), Schvarzer (1989), Silva and Dalla Costa (2014), Morgan (2000). The nomenclature suggested by Barbero (2013) was adopted to differentiate the global operations: Bunge and Co. for the original Netherlands-company; Bunge y Born Ltda. for the associate company in Argentina; and Bunge Brazil for the Brazilian investments.

On the eve of the First World War (1914–1918), the main export products from Argentina were (in millions of gold pesos) wheat (78.1) and corn (72.4), followed by frozen and chilled beef (54.0) (Glade, 2009, p. 32). Wheat exports in the Argentine economy were concentrated in the hands of strong exporting groups, the so-called “big four:” Bunge y Born, Huni and Wormser, Dreyfus, and Weil Brothers (Fausto and Devoto, 2004, pp. 165–167).

Coffee has become the main export product in the 1830s, and only lost that position in the second half of the twentieth century. Between 1901 and 1910, it accounted for almost 53% of Brazilian exports, with rubber in second place at 26% (Singer, 2006, p. 387).

Between 1926 and 1930, Brazil imported 72% of its wheat directly from Argentina (Sao Paulo, 1931, p. 70).

The Company's Constitution Assembly Ata Anonymous Mill Santista, of September 30, 1905, says that on September 30, 1905, at the provisional headquarters of the “Sociedad Anónima Mill Santista,” 16 shareholders representing 1000 shares and 200 votes were present. They presented the certificate for 10% of the capital cash deposit, deposited in the Commercial Italian Banco Santos Sao Paulo, and two copies of the Statutes (Acta Santista Mill, 1905). This should be the capital of the corporation Mill Santista, to the amount of R $ 1000 (i.e. 1.000:000$ 000thousand contos).

The largest mills in Brazil (1907, capital contos) were: The Rio de Janeiro Flour Mills & Granaries Ltda. (5634 contos) and Mill Fluminense (1000 contos) in the state of Rio de Janeiro; F. Matarazzo & Cia. (4000 contos) and Moinho Santista (2000 contos) in the state of Sao Paulo (Suzigan, 2000, p. 206).

The number of employees of Bunge Brazil is difficult to determine because “... until the mid-1990s, Bunge Brazil was formed by more than 120 companies, all acting independently and with their own brands and corporate identities” (Bunge's Memory Center, 2013, p. 31). Therefore, it would be necessary to search each of these 100 independent firms to determine the number of employees. We provide some numbers as an overview of the employees of Bunge Brazil. In Sanbra, one of its subsidiaries, employees reached a total of 7940 in 1967 (Sanbra: Management Report and Balance Sheet 1967, p. 6); they reached 18,353 in 2013 in the Bunge Brazil.

Extract of the Minutes of the session conjuncta the Directorate and the Fiscal Council. Santos, 21 February, 1907. Research on Bunge Memory Center.

Information contained in SA Santos mill. General Industries, p. 7; from the Bunge Memory Center. São Paulo, September, 2014.

The dependence on foreign wheat supplies continued, stocking 70% of the Brazilian market in 1960; 70% of this amount in Argentina, representing the l 70% of Brazilian cereal imports (Freitas and Delfim Netto, 1960, p. 80).

Juan Domingo Perón (08/10/1895–01/07/1974), exercised military career and ruled the country in two phases: between 1946 and 1955 (two terms) and, after 18 years of exile in Spain, returned to power between 1973 and 1974.

The per capita consumption of wheat increased from 18kg in 1920 to 30.3kg in 1929 (Freitas and Delfim Netto, 1960, p. 146).

The Fluminense mill operating license, in sheets 1 and 2, shows: “Mill Fluminense SA, based in this city [Rio de Janeiro] to Rua General Camara 45, his representative infra assigned, requires that VS should pass by the entire content of the decree. 9776 of 25 August 1887, published in Official Gazette of September 1, 1887, by certificate, which would authorize the work society in commandita by shares called Fluminense Mill.” Permit Fluminense mill operation. Retrieved September 2014 in the Bunge Memory Center, Sao Paulo.

Available at http://www.fundacaobunge.org.br/acervocmb/colecao/13/ (Accessed 12.02.15).

The state of Rio Grande do Sul produced 77% of wheat in Brazil in 1945. Recognizing the need to reduce dependence on imported wheat, the federal government undertook measures to stimulate the production of domestic wheat by providing credits for training at the Experimental Wheat Station in the gaucho towns of Conceicao do Arroio, Caxias do Sul, and Alfredo Chaves. However, these measures have proved fruitless, as Brazil imported 80% of its wheat consumption in 1930, mainly from Argentina (Bailly, 1930, p. 125; Bagé, 1951, p. 47–51).

Letter from the Rio Grande do Sul governor supporting the Mills Rio Grandenses. Porto Alegre, 01/28/1928. Found at Bunge Memory Center. Sao Paulo, November 2014.

Mill Joinville History. Bunge Memory Center. Sao Paulo: 2013, p. 1.

The minutes of the meeting of the Brazilian Mercantile Union (UMBRA) of 31 March 1930 contains the names of its shareholders – all present in SA Moinho Santista – and the number of their shares: Bunge y Born Ltda. (3200 shares), SA Moinho Santista (3125), John Ugliengo (100 shares), and Edmundo Metzger (100 shares) (Official Diary of the Union, 07.05.1930, p. 4221).

The poor integration of Brazil's transport system before 1930 forced companies to operate regionally, close to suppliers and consumers Bunge entered distant markets by acquiring local companies, such as Samrig and Mill Recife, allowing it to expand its income sources.

Historical information was extracted from Mill Recife History. Bunge Memory Center, Sao Paulo, p. 23 (accessed November 2014).

The main wheat producing area was the South of Brazil, Santa Catarina, Parana, and Rio Grande do Sul, collectively producing about 80% of Brazilian wheat (Freitas and Delfim Netto, 1960, p. 79).

For the performance of Bunge y Born in Latin America, see Green and Laurent (1989).

According to Dean (1971, p. 10), Santos exported 40 million dollars of coffee in 1892, and, its exports totaled 170 million in 1912. The population of Sao Paulo increased from 837,000 in 1872 to 2,283,000 in 1900, and to nearly 4 million by the beginning of the First World War. A village with 23,000 inhabitants in 1872 grew to 580,000 inhabitants in 1920.

According to Baer (1996, p. 52), “before 1933, Brazil produced less than 10 tons per year. In 1934, São Paulo reaped 90,000 tons. Between 1929 and 1940 the country's share of global cotton producing areas increased from 2% to 8.7%, and the share of cotton exports increased from an annual average of 2.1% at the end of the 1920s to 18.6% during the period of 1935–39.”

Sanbra: Algodoeira Society of Northeast Brazil. Historical book, undated, and without page numbers. Bunge Memory Center, Sao Paulo, November 2014.

Historic Patchwork Campina Grande. http://www.cgretalhos.blogspot.com.br/2009/11/sanbra.html#.VNg68E10wdU (accessed 12.02.15).

Data taken from the magazine “News Sanbra,” no. 2, March–April 1968. Bunge Memory Center. Sao Paulo, November 2014.

Charter of directors of Bunge in São Paulo, addressed to “Ilmos Messrs. Bunge & Born Ltda. Buenos Aires (no. 368),” dated June 25, 1938. Bunge Memory Center. Sao Paulo, November 2014. Note: this book contains the mailed copy of all letters, including some selected ones.

In 1940, the main sectors of the Brazilian industry were textiles and food, both accounting for 23% of industrial production (Baer, 1975, p. 13).

Textile Factory Tatuapé. Daily no. 1. Bunge Memory Center. Sao Paulo, November, 2014.

In 1935, 23% of the national cement consumption was imported, making it Brazil's fifth largest imported product (Brazil, 1931, p. 62; Prochnik, 1985, p. 434).