Given the serious crisis of the European steel industry between 1974 and 1986, the Member States of the European Economic Community allocated a large amount of public resources to avoid the bankruptcy of major steel undertakings and to facilitate restructuring of the sector. In this regard, what the Spanish government did in relation to the steel aids was no exception. The main difference between the Spanish and European Community steel policies was not so much on the amount of the public resources but rather on the use of them in the restructuring process, especially since the 1980s. So while in the EEC steel aids were granted only in exchange for the elimination of surplus capacity, in Spain not adjustment was made until its accession to the European Communities on 1 January 1986.

Ante la grave crisis que atravesaba la siderurgia europea entre 1974 y 1986, los Estados miembros de la Comunidad Económica Europea destinaron una gran cantidad de recursos públicos para sostener económicamente a las grandes empresas que se hallaban al borde de la quiebra, y para facilitar la reestructuración del sector. A este respecto, la actuación de los Gobiernos españoles no fue una excepción. La principal diferencia entre las políticas siderúrgicas española y comunitaria estribó no tanto en el montante de las ayudas públicas destinadas al proceso de reestructuración como en el uso que se hizo de las mismas, especialmente desde los años ochenta. Así, mientras en la CEE las ayudas públicas estuvieron condicionadas a la eliminación de los excedentes de capacidad productiva, en España no se realizó ningún ajuste en este sentido hasta nuestra integración en la Comunidad en 1986.

The steel industry was one of sectors most severely affected by the crisis of the 1970s. From the end of 1974, the fall in demand for steel and the drop in prices, together with the increase in energy costs, wages and raw materials generated losses for all of the large steel-making companies in Western Europe. These difficult economic circumstances also coincided with the culmination of major plans for the modernisation and extension of the steel production facilities in an attempt to close the technological gap with Japan which generated a surplus production capacity and serious financial difficulties for the companies that had implemented these plans. This is why, from the mid 1970s, the European states dedicated vast amounts of public resources to the financial clean-up and the restructuring of the sector. After a brief respite between 1978 and 1979, with the second oil crisis it became evident that the sector had serious structural problems with extremely low levels of production facility use and with companies that were suffering from heavy losses and continued to require state aid. In view of this situation, the countries of the European Economic Community (EEC) accepted the need for a restructuring process, financed with public aid and sponsored by the European Commission with the aim of reducing the surplus production capacity. Therefore, from 1980, the national government subsidies granted to the sector were regulated and controlled be the EU institutions and conditioned by adjustment plans which required the permanent closure of some plants and the dismissal of thousands of workers.

The panorama for the Spanish steel sector was very similar to that of the rest of Europe. During the years immediately following the crisis, the Spanish companies began to implement ambitious extension and modernisation projects which received a high amount of state aid. The start-up of these new production facilities coincided with a dramatic contraction of demand for steel, giving rise to significant surpluses of production capacity. In spite of this, new investments were still required to modernise the sector and improve its competitiveness, particularly as Spain was preparing to become a member of the EEC.

The restructuring of the European steel industry in the 1980s has been analysed on the whole by specialists in the field of Political Science and Public Administration who have focused their studies on the role played by the different agents involved in the restructuring process (stakeholders), paying particular attention to the transformation of the institutional framework and the relationships between governments, trade unions and EC institutions.1 In the case of Spain, many studies have also been carried out which analyse the steel policy and the involvement of the different social agents. We can highlight the studies conducted by Saro (2000), which compares the steel policies of Spain and the UK; Marín Arce (1997), which analyses the changes in the attitudes of the trade unions in the restructuring processes during Spain's transition to democracy; and Navarro (1989a), which offers the best explanation of the motivations of all of the stakeholders of the restructuring process in the 1980s. Some of the studies in the field have tried to explain the behaviour of the social agents using economic models. For example, the study conducted by Viaña (1991) is based on the models of imperfect competition and workable competition theory; Simón (1997) uses the theory of pressure groups and Saro (2000) refers to policy networks. However, the complicated relationships between the social agents and the need to integrate political, economic, social and technological elements, limits the use of the economic models to explain an extremely complex reality.

Some of the above-mentioned studies address the role of national state aid and ECC aid in the restructuring processes, but, in general, this issue has remained in the background. This is in spite of the fact that during the 1980s, the strong increase in subsidies for industry, particularly the steel industry, decisively contributed to laying the foundations of competition policy, which is considered to be the first common policy of the EEC.2 Therefore, the few studies in the field of Political Science that have focused on the subsidies given to the steel industry mostly explain how the regulation of state aid carried out in the 1980s led to the design and implementation of the Community competition policy.3 However, there is a lack of comparative studies that examine the economic aspects of the state subsidies using a more quantitative methodology. In Spain however, studies have been conducted which, despite the enormous methodological difficulties in their calculation, have attempted to quantify the resources dedicated to industrial restructuring processes. For example, Navarro (1989b, 1989c) offers an estimate of all the public resources used for industrial restructuring until 1988, Edo Hernández and Paredes Gómez (1992) extend this calculation until 1992 and Simón (1997) provides an estimate of the subsidies granted to industry between 1978 and 1993.4 With respect to studies focusing on state aid for the restructuring of the steel industry, only two estimates have been conducted; one by Navarro (1989a) and one by the steel sector's employers’ association (Unesid, 1987b). However, there are no comparative studies that shed light onto whether the actions of the Spanish governments corresponded to the pattern followed by the EEC countries and if the amount of the subsidies and the instruments used to channel them were similar in Spain and the rest of Europe.

The main objective of this study is to provide a comparative analysis of state aid for the restructuring of the steel sector in Spain and in the EEC countries. More specifically, it will attempt to determine whether, as claimed by the entrepreneurs of the sector, the resources provided by the government for the restructuring process were lower than those received by the steel sectors of other EEC countries and whether the instruments through which they were channelled were similar. Furthermore, it seeks to contribute to a debate which remains open today: during the restructuring process were there regions that were favoured and others that were sacrificed? Or, more specifically: Did discrimination take place in favour of the public company (Ensidesa) and in detriment to the private sector (Altos Hornos de Vizcaya)?5 In this respect, it will also be interesting to determine to what extent the steel policies of the Spanish government coincided with the European guidelines. On the other hand, in the same way as Navarro (1989b), we will examine the real objectives sought by the restructuring policies and attempt to ascertain to what extent they were fulfilled. Similarly, we will study the role played by the European institutions in defining these objectives both for Spain and for the other EEC countries.

In order to respond to these questions, we have implicitly assumed the theoretical model proposed by Herrigel (2010). According to this model, each time a disruption occurs that challenges the institutional arrangements, as in the case of the crisis of the 1970s, the creative action of the social actors comes into play, generating changes in the regulatory practices and industrial policy. As we will see in the following pages, the new institutional arrangements after 1980 gave rise to a new framework for relations which, based on the agreements between national governments and the European institutions, made it possible to put the economic aspects before the social features in the restructuring processes which did not occur in Spain until it joined the EEC in 1986.

This paper will summarise the regulations relating to state aid and the restructuring plans of the steel industry in Spain and carries out an estimate of the total subsidies received by the sector between 1975 and 1988. The next section compares the state aid in Spain and that of the EEC countries. Bearing in mind the EC chronology, two periods are studied separately: 1975–1979, during which the European institutions did not exercise any control over national subsidies and 1980–1985 (until 1988 in the case of Spain), during which the subsidies were subjected to the supervision and authorisation of the European Commission. The conclusions of the study are summarised in the final section of the paper.

2Subsidies for the Spanish steel sectorDuring the 1970s and 1980s, there was no reconversion policy for the sector as a whole, rather specific restructuring plans were implemented for each of the three subsectors of which it was composed (integrated steel production, special steels and non-integrated common steel production), each of which had its own individual characteristics. At the beginning of the crisis, the integrated subsector was formed by two large groups, one public (Ensidesa) and one private, composed of two companies, Altos Hornos de Vizcaya (AHV) and Altos Hornos del Mediterráneo (AHM). The three companies operated with very high production costs compared to companies in other European countries and they became heavily indebted. On the other hand, the situation of the non-integrated common steel sub-sector, constituting 24 companies, was somewhat better. Many of these companies had highly competitive facilities, thanks to the investments made under the Second Concerted Action, which began in 1974. However, this action programme had two negative consequences: the debts incurred by the companies that implemented these projects, which contrasted with the healthy finances of those that did not modernise their facilities, and a surplus production capacity. The problems of surplus production were repeated in the special steels subsector, although there were large differences between the thirteen companies of which it was comprised in both production and financial terms.6

We can identify three stages in the restructuring process of the Spanish steel sector. The first, which began at the end of 1978 and continued until the end of 1980, was characterised by the absence of any sectoral plans and was restricted to providing public aid to those companies that were experiencing severe financial difficulties. In the second phase, which took place between 1980 and 1985, restructuring plans were designed for each subsector and a general framework was defined for the reconversion processes. The final phase began when Spain joined the EEC and lasted until the end of 1988, coinciding with the end of the transition period granted to the sector in order for it to fully integrate into the European Coal and Steel Community (ECSC) (ECSC, 1980). The next section will contemplate the restructuring measures adopted in each of the three phases and the subsidies received by each of the subsectors.7

2.1Subsidies for sustaining individual companies (1978–1980)The first phase of the industrial reconversion policies in Spain was characterised by measures to support companies with serious financial problems in order to prevent their closure. The first government action was Law 60/1978, of 23 December on urgent measures to support the integrated steel sector. This resulted in the nationalisation of AHM. The subsidies provided in the afore-mentioned Law consisted in loans from the Banco de Crédito Industrial (BCI) for a value of 23,500 million pesetas for the three companies in the subsector and capital contributions from the National Institute of Industry (INI) worth 11,000 million pesetas to rescue Ensidesa and 7450 million to purchase AHM from its owners. After being nationalised, AHM received a subsidy of 5000 million pesetas from the Ministry of Industry and Energy (Miner), a capital increase of 6000 million and a loan of 801 million from the INI.8

With respect to the non-integrated sectors, during this first phase, the support given to companies in crisis was provided through exceptional loans from the BCI subject to the presentation of feasibility studies. These aids were granted to four special steel companies which received 6950 million pesetas between December 1978 and January 1980, and two common steel producers, which received 3903 million between 1980 and 1982. It is important to note that the borrowers failed to comply with the obligations, so that at the end of 1985, the total debt with the BCI, resulting from outstanding interest and commissions and the failure to pay any of the principal amount, stood at 8122 million pesetas in the case of special steel companies and at 4152 million in the case of the common steel producers. These amounts were greater than those initially received.9

At the same time, from the mid 1980s, the companies of the non-integrated sectors which had participated in the Segunda Acción Concertada were able to access additional loans in order to heal their finances.10 These were aimed mostly at the common steel subsector in which eleven companies received BCI loans worth a total of 6390 million pesetas. Two special steel companies also received loans amounting to 600 million pesetas. In contrast to what happened with the loans granted to the companies in crisis, the default rate of these companies was lower. This did not mean that the financial situation of these companies had improved, rather that, as indicated by the Instituto de Crédito Oficial, the successive subsidies implied a continual refinancing of the debt owed.11

2.2Sectoral reconversion policies (1980–1986)The first regulation that established a series of general criteria for all of those sectors subject to reconversion was passed in June 1981 and was modified two years later after the victory of the Socialist Party in the general elections of 1982.12 With these measures, the individual subsidies given to companies were abandoned and the financial support was conditional on the existence of sector restructuring plans. Prior to these general regulations, the government had initiated sectoral restructuring processes with decrees directed at specific sectors including the steel sector.

Royal Decree 2206/1980, of 3 October, on the industrial reconversion of special steels, established that the restructuring process would be carried out by an association of companies in the sector (Aceriales), which would be responsible for adopting and executing the measures necessary for cleaning up the finances and the subsequent restructuring of the sector.13Aceriales was formed as a limited liability company with a capital of 10,000 million pesetas, of which only 2000 were provided by the companies, with the rest corresponding to aids from the Miner (7000 million) and the Autonomous Community of the Basque Region (1000 million).14 Subsequently, by way of Royal Decree 2046/1981, of 3 August, 350 million pesetas in bank guarantees were granted to Aceriales, to which a further 9000 million in BCI guarantees were added the following year. Once the financial reorganisation had been completed, the restructuring of the industry began, which required investments worth 21,191 million pesetas.15 After being approved by the government in February 1984, the subsector received 8678 million pesetas in ordinary loans from the BCI, a further 21,453 million in participatory loans and 16,656 million pesetas in subsidies for its restructuring.16

With regard to the integrated steel sector, on 8 May 1981, the central government approved a plan to increase its competitiveness by reducing financial costs and wages. In order to set the accounts between 1981 and 1985 the three companies of the subsector were to receive 72,875 million pesetas in new loans from the BCI and the INI. Furthermore, the INI was to grant AHV with bank guarantees worth 34,000 million for credit transactions arranged with private banks and AHM and Ensidesa were to receive 68,000 million pesetas in subsidies and capital injections. In addition, a further 7500 million euros in loans from the BCI was granted to partially finance investments to reduce production costs.17 As in the case of the special steels sector, the financial reorganisation was to be completed with a basic investment plan which would guarantee the viability of the companies in the medium and long term. However, due to the difficulties in reaching an agreement between the parties involved, the plan was not approved until the end of 1983. In broad terms, this plan comprised the modernisation of the facilities of Ensidesa in Avilés and those of AHV in Ansio and Sestao, together with the closure of the blast furnaces and steel mill of AHM in Sagunto.18 These investments were financed by a new aid package consisting in 327,727 million pesetas in subsidies, capital increases and participatory loans, 98,673 million in loans and 128,700 million pesetas in public guarantees for private loans.19

Finally, a reconversion programme for the non-integrated common steel sector was announced in 1982. In addition to the financial reorganisation of the companies, the programme sought to reduce the capacity installed by one million tonnes and to do this, subsidies were provided for the closure, dismantling or sale of plants to foreign investors or for a temporary reduction of capacity for a period of three years. The aid package also included tax benefits, loans and guarantees from the BCI and subsidies for early retirements.20 Under this legislation, six of the 24 companies comprising the subsector received loans from the BCI worth 10,950 million pesetas in addition to 6450 million pesetas in subsidies. This aid was insufficient to repair the financial situation, and in 1985 they received a new aid package which included subsidies amounting to 2500 million pesetas, 4925 million in ordinary loans from the BCI and 11,215 million in participatory loans.21

2.3State aid after joining the EEC (1986–1988)Article 52 of the Treaty of Accession of Spain to the European Communities (1985) established a period of three years after joining for Spain to complete the restructuring process of its steel industry. This implied that all of the public aid given to the sector had to stop on 31 December 1988 and on the same date the production capacity of hot-rolled steel could not exceed 18 million tonnes. After becoming a member of the EEC, the European Commission and the Miner conducted a feasibility study of the companies that had undergone a reconversion plan in 1984. The study, which was carried out by an independent consulting company, concluded that both the companies in the integrated steel sector and those in the special steel sector required additional aid in order to be viable before the end of the transition period. For this reason, the Spanish government informed the Commission of new measures to complement the restructuring plans at the end of 1986, which were approved in March 1987. In return, the Commission demanded that Spain reduce its hot-rolling capacity by a further 750,000tonnes.22

The total amount of aid received by the steel industry during this period was 189,362 million pesetas, distributed as follows: 43,922 million in subsidies for Ensidesa-Sidmed and AHV to cover the contributions that they had to make to the Fondos de Promoción de Empleo (Employment Promotion Funds), 57,700 million in subsidies for AHV and 27,740 million for Ensidesa, 50,000 million pesetas for the purchase of AHV bonds by BCI and 10,000 million in guarantees from the same bank for AHV bonds subscribed by other entities. With respect to the special steels sector, the total amount of aid amounted to 42,727 million pesetas, shared between the companies Acenor and Foarsa in the following way: 25,727 million in subsidies, a loan from BCI for 5000 million, 10.000 million for the purchase of Acenor bonds by BCI and 2000 million in guarantees from the same bank for the bonds distributed among other entities.23 In addition to this aid package, in 1988 AHV received a subsidy from Miner worth 6375 million pesetas to compensate for the financial costs derived from the delay in the subscription of the bonds by BCI and a loan from the same entity for 25,000 million pesetas.24

The last aid package approved by the Spanish government in the 1980s was motivated by the commitment to limit the hot-rolling capacity to 17.25 million tonnes, that is, the 18 million tonnes agreed in the Treaty of Accession less 0.75 million tonnes in exchange for the aid package of 1987. Therefore, between January 1986 and December 1988, the Spanish steel sector had to eliminate 4.05 million tonnes of hot-rolling capacity. To achieve this, the Miner designed a programme of incentives offering companies a subsidy of up to 15,000 pesetas per tonne of definitively scrapped hot-rolled capacity.25 Thirty companies, mainly from the non-integrated common steel sector, benefitted from the incentives that cost the public purse 40,265 million pesetas. The hot-rolling capacity was reduced by 4.3 million tonnes and that of crude steel by 2.64 million tonnes, which fulfilled the objectives set by the European Commission.26

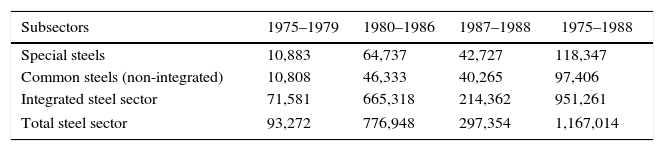

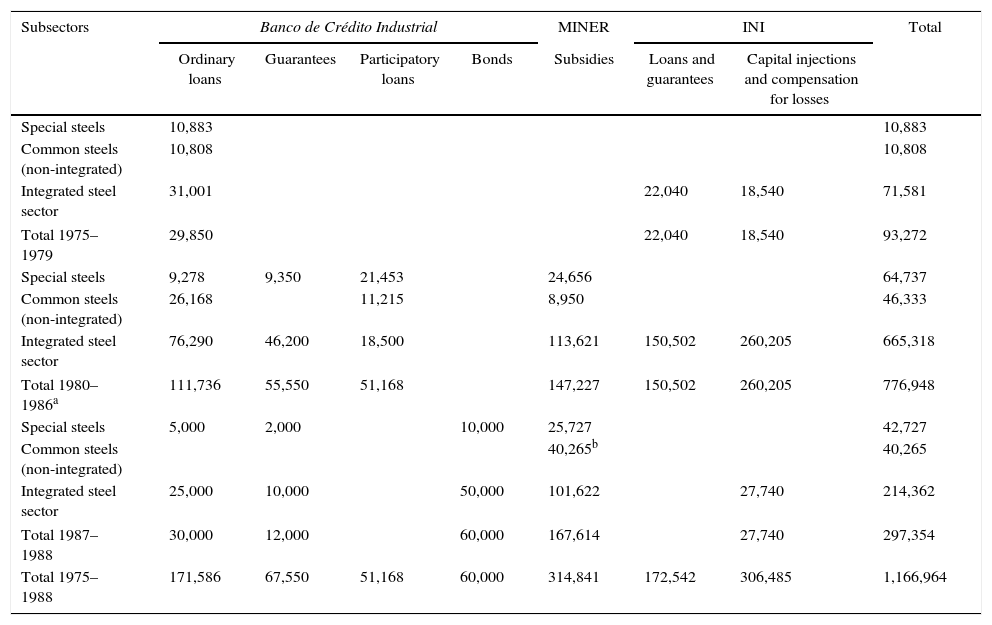

2.4An estimate of the aid provided to the steel companiesIt is highly complicated to provide an exact figure of the public resources dedicated to the sectors declared to be under reconversion due to the wide range of institutions involved and the numerous mechanisms of aid that were used. However, there are two estimates that have been made of the total public aid received by the steel sector between 1975 and 1988. The first was carried out by the Spanish Union of Steel Companies (Unesid) in 1987 estimating the total volume of resources provided by the state at 713,000 million pesetas, including the amounts that were to be received between 1987 and 1989.27 The second estimate was calculated by Navarro (1989a, p. 144) who gave a figure of 1500 thousand million pesetas for the aid received by the Spanish steel industry in the same period. Based on different sources, we have carried out our own estimate (Table 1), and the result is that the total amount of public aid received by the steel companies between 1975 and 1988 was 1167 thousand million pesetas (see Methodological appendix for a detailed explanation of the sources and calculation method). The large discrepancy between our estimate and that conducted by Navarro is, in fact, not so much if we take into account the different criteria followed in calculating the aid. If we subtract the tax and labour aids from Navarro's figures, which we have not included in our estimate, the state resources given to the steel companies stood at 1300 thousand million pesetas, a figure which is not so different from our estimate of 1167 thousand million.

State aid received by the Spanish steel sector, 1975–1988 (in millions of current pesetas).

| Subsectors | 1975–1979 | 1980–1986 | 1987–1988 | 1975–1988 |

|---|---|---|---|---|

| Special steels | 10,883 | 64,737 | 42,727 | 118,347 |

| Common steels (non-integrated) | 10,808 | 46,333 | 40,265 | 97,406 |

| Integrated steel sector | 71,581 | 665,318 | 214,362 | 951,261 |

| Total steel sector | 93,272 | 776,948 | 297,354 | 1,167,014 |

Sources: Annual reports of AHM (1980–1985), AHV (1978–1988), Ensidesa (1978–1987) and Sidmed (1985–1988); ICO (1986); Miner (1978–1987); Annual reports of Official Credit Institute (1988–1989); EC (1988), and Navarro (1989a).

Furthermore, Table 1 provides us with interesting information about the total volume of aid received by the Spanish steel industry. First, we can observe that, although the data is given in current peseta values, it is clear that the aid was much lower in the second half of the 1970s with an annual average of 18,650 million pesetas as opposed to more than 100,000 million after 1980. On the other hand, it should be noted that the integrated steel sector, was the sector that most benefitted from this aid by a long way, as it received around 80% of the total amount.

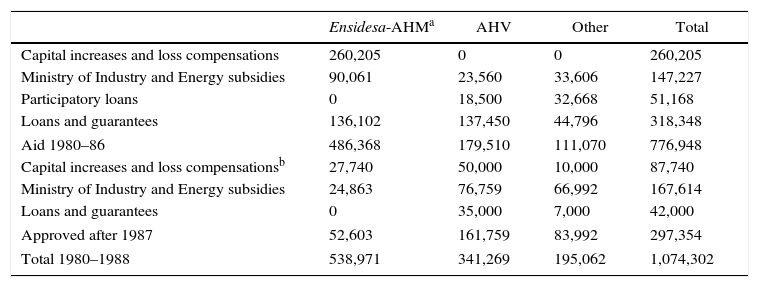

Limiting our analysis to the 1980s in order to facilitate its subsequent comparison with the EEC countries, we have created Table 2, differentiating between the aid received by the public group Ensidesa-AHM, AHV and the rest of the companies (non-integrated companies). We can observe that, until 1986, the state-owned companies were given 62.6% of the resources provided by the State; AHV was granted 23.1%, and the rest received 14.3%. With regard to the aid mechanisms used, 72% of the aid received by Ensidesa-AHM corresponded to capital injections, compensation of losses and subsidies. The private sector was very different where the principal aid mechanism used was loans and guarantees.

State aid received by the Spanish steel companies between 1980 and 1988 (in millions of current pesetas).

| Ensidesa-AHMa | AHV | Other | Total | |

|---|---|---|---|---|

| Capital increases and loss compensations | 260,205 | 0 | 0 | 260,205 |

| Ministry of Industry and Energy subsidies | 90,061 | 23,560 | 33,606 | 147,227 |

| Participatory loans | 0 | 18,500 | 32,668 | 51,168 |

| Loans and guarantees | 136,102 | 137,450 | 44,796 | 318,348 |

| Aid 1980–86 | 486,368 | 179,510 | 111,070 | 776,948 |

| Capital increases and loss compensationsb | 27,740 | 50,000 | 10,000 | 87,740 |

| Ministry of Industry and Energy subsidies | 24,863 | 76,759 | 66,992 | 167,614 |

| Loans and guarantees | 0 | 35,000 | 7,000 | 42,000 |

| Approved after 1987 | 52,603 | 161,759 | 83,992 | 297,354 |

| Total 1980–1988 | 538,971 | 341,269 | 195,062 | 1,074,302 |

Notes: a From 1986, the data correspond to Ensidesa-Sidmed. b In the case of AHV and the non-integrated companies, these figures correspond to the bonds purchased by the BCI.

The steel policy varied significantly after 1987, when the private sector began to benefit most from the state aid. AHV received three times the amount of resources than the public group and the non-integrated sector received 28% of the total, almost double that of Ensidesa. Furthermore, the traditional BCI loans were replaced by another kind of aid which implied lower financial costs for companies. Therefore, only 21.5% of the aid received by AHV between 1987 and 1988 were loans and guarantees, with 47.5% corresponding to subsidies and the rest to bonds purchased by the BCI. A similar situation can be observed in the non-integrated steel sector where only 14% of the aid received corresponded to loans and guarantees; 80% to subsidies and the rest to bonds bought by BCI. In the public steel sector, during this period the aid mechanisms were limited to subsidies (47.3%) and capital increases and compensation for losses (52.7%).

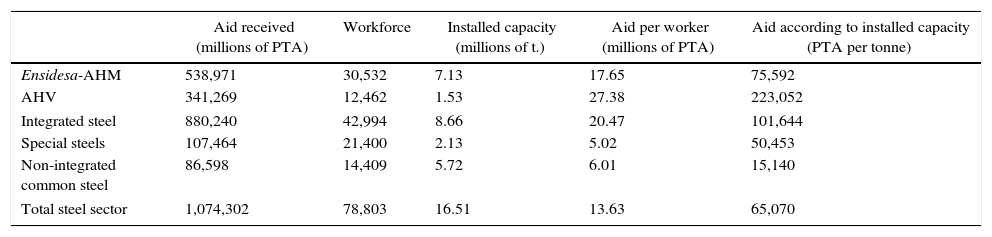

Table 3 compares the aid received with the workforces and installed capacity of each of the subsectors at the beginning of the restructuring process. The data confirm that the integrated steel sector was the main beneficiary of public aid, receiving up to four times more money per worker than the non-integrated subsectors and double that of the special steel subsector. In relation to the installed capacity it received 6.7 times more than the non-integrated common steel sector. With respect to the integrated companies, it is interesting to note that despite being a private company, AHV obtained much higher subsidies than Ensidesa and AHM: 55% more per worker and almost three times more in relation to the installed capacity.

State aid received by the Spanish steel sector per worker and installed capacity, 1980–1988 (in current pesetas).

| Aid received (millions of PTA) | Workforce | Installed capacity (millions of t.) | Aid per worker (millions of PTA) | Aid according to installed capacity (PTA per tonne) | |

|---|---|---|---|---|---|

| Ensidesa-AHM | 538,971 | 30,532 | 7.13 | 17.65 | 75,592 |

| AHV | 341,269 | 12,462 | 1.53 | 27.38 | 223,052 |

| Integrated steel | 880,240 | 42,994 | 8.66 | 20.47 | 101,644 |

| Special steels | 107,464 | 21,400 | 2.13 | 5.02 | 50,453 |

| Non-integrated common steel | 86,598 | 14,409 | 5.72 | 6.01 | 15,140 |

| Total steel sector | 1,074,302 | 78,803 | 16.51 | 13.63 | 65,070 |

Although Article 4 of the Treaty establishing the ECSC expressly prohibited national state aid, the ECSC had no choice but to accept the aid that, since the mid 1970s the member states had been granting the steel companies in order to prevent their bankruptcy.28 However, in response to pressure from the German government, whose steel sector had been suffering the effects of the crisis to a lesser degree, in May 1978 the Commission presented the European Council with a draft of a decision authorising the provision of national aid to the sector. Furthermore, the Commission appointed itself as the competent body to regulate and supervise the aid, pursuant to Article 95 of the Treaty which allowed it to extend its power in the case of “unforeseen difficulties” or “profound changes in the economic or technical conditions” in the market.29 Through the regulation and control of the aid, the Commission set itself an important objective: to promote the restructuring process of the European steel sector in order resolve the structural crisis which, due to its surplus production capacity, could not be denied.30 However, the strong opposition from Italy and Great Britain to the limitation of aids to their companies and the recovery experienced by the sector from the beginning of 1978 prevented any decision to regulate state aid from being approved and so the Commission was unable to control and condition the aid and to fulfil its objective.31

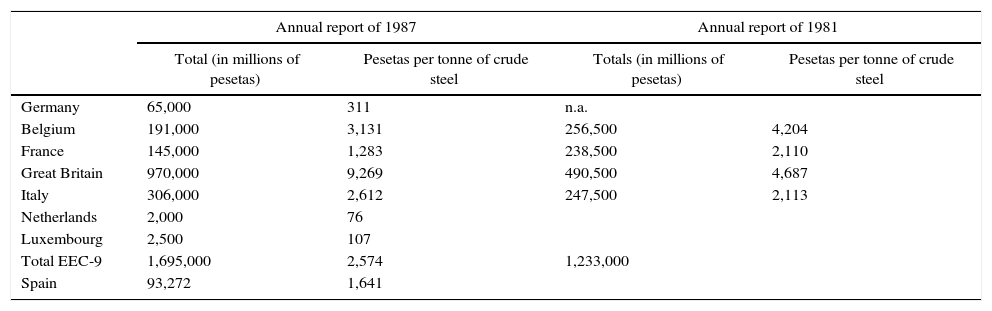

This lack of Community control is the reason why the information about state aid during this period is disperse and incomplete. However, there are two estimates of the total volume of national aid between 1975 and 1979, carried out by the federation of the German steel industry (Wirtschaftsvereinigung Eisen und Stahl). The first, published in 1981, gave a figure of 27,400 million German marks (1233 thousand million pesetas) for the public aid received by the steel industries in Belgium, France, Italy and The United Kingdom.32 The second, published by Unesid in 1987, produced a figure of 1695 thousand million pesetas for the total aid in the EEC-9 countries.33Table 4 compares the figures of both reports with the aid received by the Spanish steel companies during the same period.

State aid received by the European steel sector between 1975 and 1979 according to Wirtschaftsvereinigung Eisen und Stahl (in current pesetas).

| Annual report of 1987 | Annual report of 1981 | |||

|---|---|---|---|---|

| Total (in millions of pesetas) | Pesetas per tonne of crude steel | Totals (in millions of pesetas) | Pesetas per tonne of crude steel | |

| Germany | 65,000 | 311 | n.a. | |

| Belgium | 191,000 | 3,131 | 256,500 | 4,204 |

| France | 145,000 | 1,283 | 238,500 | 2,110 |

| Great Britain | 970,000 | 9,269 | 490,500 | 4,687 |

| Italy | 306,000 | 2,612 | 247,500 | 2,113 |

| Netherlands | 2,000 | 76 | ||

| Luxembourg | 2,500 | 107 | ||

| Total EEC-9 | 1,695,000 | 2,574 | 1,233,000 | |

| Spain | 93,272 | 1,641 | ||

Notes: The data for Spain correspond to our estimate, see Table 1.

Given the enormous difference between the European countries in terms of sector size, we have related the volume of the aid with the crude steel production in the period 1975–1979. The result shows that in those countries with a public steel sector (United Kingdom and Italy) or with a significant participation of the government in the steel sector (Belgium and France), the aid was a lot higher than in those with a predominant private sector (Germany, the Netherlands and Luxembourg).34 With regard to the Spanish steel sector, the aid per tonne was a lot lower than that obtained by the Belgian, British and Italian sectors and was fairly similar to the amount received by the French.35

While the quantification of the total public resources granted to the steel sector is important, it is more interesting to analyse to what extent they contributed to the restructuring of the sector. First, there is a large difference between Spain and the EEC in terms of the types of aid received by the sector. The national governments of the EEC notably improved the financial situations of the large steel undertakings through capital injections to compensate for losses, participatory loans, converting part of the debt into capital or by purchasing their shares at prices that were a lot higher than their market value.36 On the contrary, the Spanish government used these mechanisms to a much lesser degree and opted for the granting of loans through the BCI and the INI: only 20% of the total state aid granted between 1975 and 1979 was compensation for losses and capital injections, the rest corresponding to loans and guarantees.

Second, neither in Spain nor in the EEC countries did the aid have the ultimate aim of adapting the production capacity to the new market situation. In fact, between 1974 and 1977, the production capacity of steel, far from being reduced to adapt to the reduction in demand, increased by 12% as a consequence of the culmination of the modernisation plans that both the European steel sector and the Spanish sector had implemented at the beginning of the decade. The situation changed in the final years of the decade when the drastic reduction in investment led to the stagnation of the production capacity with only two exceptions, Italy and Spain, where it increased by 15% and 12% respectively.37

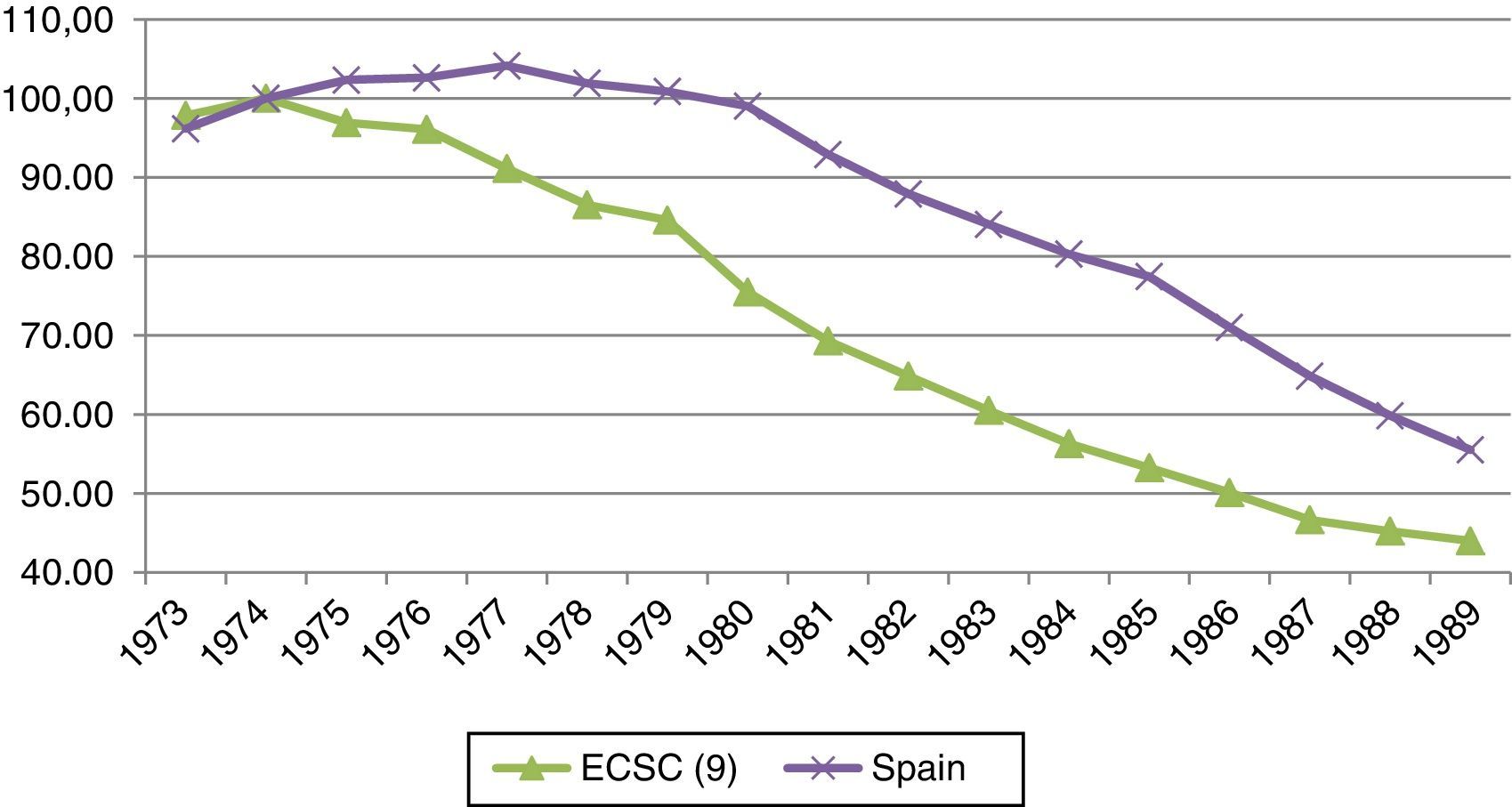

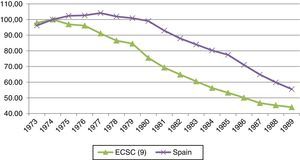

With respect to the evolution of employment, Graph 1 shows how the steel workforces in the EEC reduced by 15% between 1974 and 1979, while in Spain they continued to grow until 1977, experiencing a slight reduction until 1979. In the EEC countries, the workforce adjustments were facilitated by aid granted by the European institutions, particularly that provided by the ECSC. This aid consisted in reduced interest rate loans for the companies located in areas with serious social problems derived from the restructuring process of the steel industry and, on the other hand, in the so-called re-adaptation aid which comprised grants to fund retraining programmes and tide-over allowances for those workers affected by the job losses. Although this aid did not provide resources for the steel companies, it constituted a valuable instrument to facilitate the acceptance of the lay-offs by the workers, the trade unions and the affected regions.38 Spain, on the other hand, did not benefit from the European aid; neither did it have the mechanisms to facilitate the mobility or reduction of the surplus workforce and the instruments to promote investment and alternative employment in the areas affected by the restructuring processes.39

Evolution of the number of employees in the steel industry in the EEC-9 countries and Spain (1974=100).

In short, during the 1970s, the state aid given to the Spanish steel sector considered in proportion to the production, was lower than that provided by the governments of those countries where there was a large public steel sector (Italy and the United Kingdom) or in those where the nationalisation of the majority of the sector had been carried out (Belgium and France). However, it was a lot higher than that received by the steel sectors of countries in which the private sector was predominant (Germany, the Netherlands and Luxembourg). More than the amounts provided by the State, the main difference with the EEC countries resided in the fact that the public aid mainly consisted of loans and guarantees which did not contribute to reorganising the financial situation of the companies, so the financial burden at the end of the 1970s was much higher than that of the large European steel groups, with the exception of Italsider. On the other hand, the absence of workforce adjustment processes and wage increases meant that while the personnel costs in the European steel sector increased by 20% in real terms between 1972 and 1979, in Spain the increased by 55%.40 In this way, at the beginning of the 1980s, the Spanish steel sector was in worse shape to face the difficult years ahead.

In any event, the adjustment process of the European steel sector had been very limited and the main structural problem, the existence of over-capacity capacity in the sector, was still not resolved due to the lack of coordination of the national steel policies within the ECSC. The necessary adjustment clashed with the interests of the steel undertakings which were unwilling to eliminate production capacity or reach agreements that implied a loss of markets. Furthermore, the national governments, regional authorities and trade unions opposed the closure of facilities due to the impact that this would have on employment and on the economy of regions that strongly depended on this activity.41 In summary, until 1979, the European governments merely applied Keynesian policies of increasing public spending to avoid the bankruptcy of the large steel undertakings and to mitigate the social costs derived, paradoxically, from the increase in competitiveness generated by the strong investments carried out in the sector until the mid 1970s.

3.2The reconversion processes in the eightiesThe second oil crisis generated a change of attitude among the national governments as it highlighted the failure of the Keynesian policies and underlined the structural nature of the sector's problems. Faced with the continual fall in demand and prices and the need of the large steel undertakings for constant financial support from the State, some of the EEC governments, particularly those of France and Britain, willingly accepted a European regulation which they could use as an excuse to explain the high social costs derived from the inevitable restructuring of their steel industries.42 The European Commission assumed a leading role which it had not had until that time. Given the difficult financial situation of the sector, the contribution of public resources was considered as essential in order to carry out the adjustment, but under common rules and with EEC supervision in order to guarantee the objective set by the Commission which was to reduce the global hot-rolling capacity by 30–35 million tonnes of a total installed capacity of 172 million tonnes. The ultimate aim was, by the end of the process, for the European steel industry to become internationally competitive without continually resorting to financial support from the national governments.43

Therefore, with the unanimous support of the Council, on 1 February 1980, the first steel aid code came into force, which contemplated four types of aid: (a) investment aid; (b) aid for continued operation; (c) aid for closures, and (d) emergency aids for continued operation.44 The first two types of aid were conditioned by the implementation of a systematic and specific restructuring programme which contributed to reducing the over-capacity of the European steel sector. Although the aid code established the deadline for receiving the aid as the 31 December 1981, the worsening of the crisis and the limited progress in reducing the production capacity led the Commission to establishing a new aid code, extending the period of application of the aid until the end of 1985.45

After the period of application had expired, the Commission acknowledged that the restructuring process had increased the rate of capacity utilisation in the steel sector to 70% in 1985 (a level that had not been reached since 1974), but it expressed concern about the surplus production capacity that still existed which it estimated at around 30 million tonnes.46 For this reason, and despite the fact that the aid authorised until 1985 was sufficient to guarantee that companies were able to renew their production processes by themselves, the Commission decided to maintain the aid directed at closing inefficient plants in order to resolve the problem of over-capacity.47 During 1986, the adjustment plans that had been initiated in the final year of the aid code's validity were continued. However, for the rest of the decade the economic recovery paralysed the restructuring process and, it was not until the end of 1988 that Germany and Italy requested authorisation to provide aid for the closure of plants.48

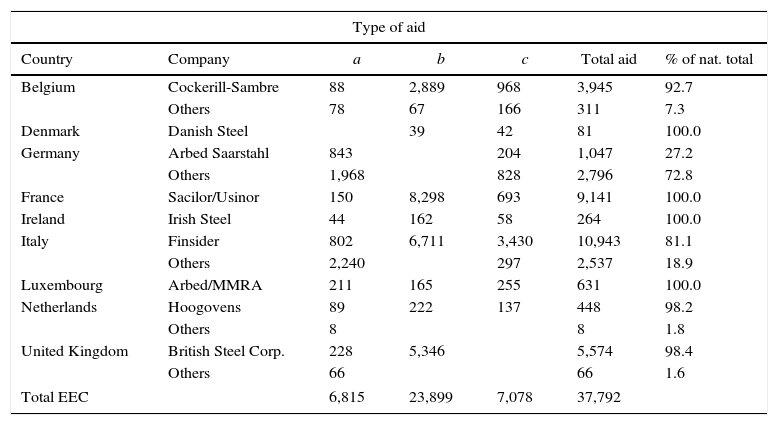

Table 5 shows the total amounts received by the steel companies in the EEC countries during the period of application of the aid codes (1980–1985). The main conclusion that can be drawn is that the large state-owned enterprises received most of the aid, with Cockerill-Sambre, Sacilor/Usinor, Finsider and British Steel Corporation accounting for 78% of the total. In Germany, the state aid was provided mainly to the main integrated company of the Saarland, Arbed Saarstahl, and the rest went to the large companies of the Ruhr, that were affected to a lesser degree by the crisis.49

State aid received by the European steel sector by company and type of aid (in millions of ecus) and the percentage that they represent of the total of each country, 1980–1985.

| Type of aid | ||||||

|---|---|---|---|---|---|---|

| Country | Company | a | b | c | Total aid | % of nat. total |

| Belgium | Cockerill-Sambre | 88 | 2,889 | 968 | 3,945 | 92.7 |

| Others | 78 | 67 | 166 | 311 | 7.3 | |

| Denmark | Danish Steel | 39 | 42 | 81 | 100.0 | |

| Germany | Arbed Saarstahl | 843 | 204 | 1,047 | 27.2 | |

| Others | 1,968 | 828 | 2,796 | 72.8 | ||

| France | Sacilor/Usinor | 150 | 8,298 | 693 | 9,141 | 100.0 |

| Ireland | Irish Steel | 44 | 162 | 58 | 264 | 100.0 |

| Italy | Finsider | 802 | 6,711 | 3,430 | 10,943 | 81.1 |

| Others | 2,240 | 297 | 2,537 | 18.9 | ||

| Luxembourg | Arbed/MMRA | 211 | 165 | 255 | 631 | 100.0 |

| Netherlands | Hoogovens | 89 | 222 | 137 | 448 | 98.2 |

| Others | 8 | 8 | 1.8 | |||

| United Kingdom | British Steel Corp. | 228 | 5,346 | 5,574 | 98.4 | |

| Others | 66 | 66 | 1.6 | |||

| Total EEC | 6,815 | 23,899 | 7,078 | 37,792 | ||

Notes: The data of the columns correspond to the following types of aid:

(a) Grants and interest relief grants.

(b) Capital and participatory loans and conversion of debts into capital.

(c) Loans, guarantees and others.

The comparison of these figures with those included in Table 2 reveals that there was an important difference between Spain and the EEC countries with respect to the distribution of the aid between the public and private sectors, as the public group Ensidesa-AHM received 51.6% while AHV received 30.8% and the non-integrated companies received 17.7%. This distribution implied that, compared to what was occurring in the main EEC countries, the private sector received a much higher percentage of the state aid provided to the sector. The French public companies received 100% of the government aids: the British BSC received 98.4% and the Italian Finsider received 81%. In these three countries the state-owned enterprises accounted for the whole of the integrated steel industry and there were no private groups as large as AHV. Therefore, the most relevant comparison that we can make is with Belgium, where two large steel groups operated, the public group Cockerill-Sambre, which included practically all of the Walloon industry, and Sidmar which was owned by the Luxembourg undertaking Arbed, and controlled the large coastal integrated plant of Ghent. The state-owned enterprise received 93% of the total aid granted between 1980 and 1985.50 Therefore, the private sector in Spain received, at least in terms of the volume of aid, a privileged treatment compared to those in other European countries where there were large state-owned undertakings.

With respect to the aid mechanisms used, no large differences can be observed between Spain and the EEC with regard to the public companies. 75% of the aid received by Ensidesa-AHM between 1980 and 1988 corresponded to capital increases, loss compensation and subsidies. This was the same as in Europe, where the majority of public funds dedicated to state-owned companies consisted in capital injections. This was not the case in the private sector. In the EEC countries subsidies constituted the main mechanism to financially support the companies. In Germany they represented 80% of the total aid received by Arbed Saarstahl and in the rest of the companies they represented 70%. These percentages were even higher in the case of the non-integrated private Italian companies where subsidies represented up to 88% of the total aid received. In contrast, between 1980 and 1986, the majority of the aid received by AHV (76.5%) consisted in loans and guarantees, while in the non-integrated steel sector they represented 40.3%.

In short, in the EEC there does not seem to have been any discrimination between public and private companies with respect to the type of aid provided as the public companies reduced the losses that they had accumulated through an injection of share capital and the private companies did the same thanks to the subsidies received. In Spain, on the other hand, only after 1987 did the state aid for the private steel sector resemble the European standard. Of the total received by AHV between 1987 and 1988 almost half corresponded to subsides and 31% to the bonds purchased by the BCI, while in the non-integrated steel sector, the subsidies represented 80% of the total and bonds 12%.

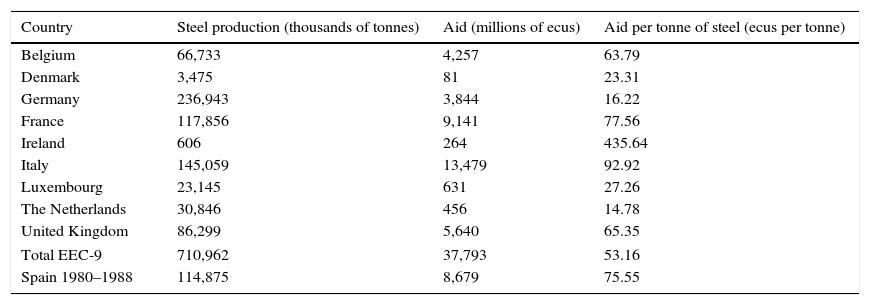

Table 6 compares the state aid in Spain and that in the EEC during the 1980s. Our first observation is that the Spanish companies received aid worth 8679 million ecus. This was a much higher amount than that provided by the majority of the EEC member states (including Belgium, Germany and the United Kingdom) and was fairly similar to the amount received by the French steel sector and was only exceeded clearly by the aid received by the Italian steel industry. We have also compared the crude steel production with state aid. In other words, we have examined the subsidies incorporated in each tonne of steel produced in the EEC countries during the validity of the aid codes. In the case of Spain, we have also included the period 1986–1988, because, as mentioned earlier, the restructuring process lasted for three more years in this country. If we exclude the aid received by Irish Steel, which was absolutely disproportionate with respect to the size of the company, we can observe that the aid received by the Spanish steel exceeded the EEC average by 40%, placing it on a similar level to the aid received by the French steel sector, but quite a lot lower than that granted by the Italian government. In general terms, we can say that, in the same way as during the 1970s, the aid received was lower than the average in those countries where the private sector was predominant: Germany, the Netherlands and Luxembourg: while in those countries with large state-owned companies, the aid exceeded the EEC average.

Aid received with respect to the production of crude steel, 1980–1985 (ecus per tonne).

| Country | Steel production (thousands of tonnes) | Aid (millions of ecus) | Aid per tonne of steel (ecus per tonne) |

|---|---|---|---|

| Belgium | 66,733 | 4,257 | 63.79 |

| Denmark | 3,475 | 81 | 23.31 |

| Germany | 236,943 | 3,844 | 16.22 |

| France | 117,856 | 9,141 | 77.56 |

| Ireland | 606 | 264 | 435.64 |

| Italy | 145,059 | 13,479 | 92.92 |

| Luxembourg | 23,145 | 631 | 27.26 |

| The Netherlands | 30,846 | 456 | 14.78 |

| United Kingdom | 86,299 | 5,640 | 65.35 |

| Total EEC-9 | 710,962 | 37,793 | 53.16 |

| Spain 1980–1988 | 114,875 | 8,679 | 75.55 |

Notes: The aid received by the Spanish steel sector has been calculated using the data from Table 1, taking the average annual peseta/ecu exchange rate of 1980–1986: 1 ecu=118.671 pesetas, and of 1987–1988: 1 ecu=139.9 pesetas.

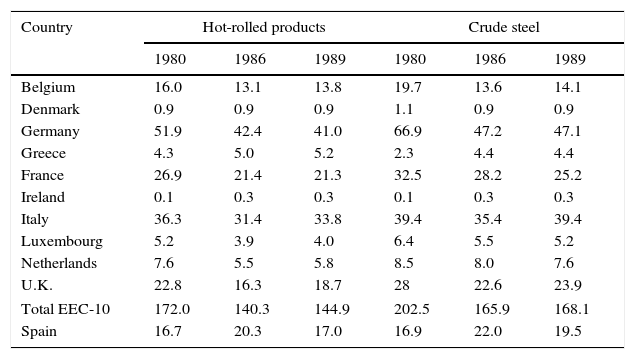

On the other hand, Table 7 shows how the objectives of reducing hot-rolling capacity established by the Commission were amply fulfilled, eliminating 31.7 million tonnes (18.5% of the total) between the beginning of 1980 and the end of 1986. Although the commitment to eliminate capacity was limited to hot-rolling facilities, this was coupled with the reduction, almost in the same proportion, of the crude steel production capacity which decreased from a maximum possible production of 202.5 million tonnes in 1980 to 165.9 million tonnes in 1986.

Evolution of Maximum Possible Production of hot rolled steel and crude steel (millions of tonnes per year).

| Country | Hot-rolled products | Crude steel | ||||

|---|---|---|---|---|---|---|

| 1980 | 1986 | 1989 | 1980 | 1986 | 1989 | |

| Belgium | 16.0 | 13.1 | 13.8 | 19.7 | 13.6 | 14.1 |

| Denmark | 0.9 | 0.9 | 0.9 | 1.1 | 0.9 | 0.9 |

| Germany | 51.9 | 42.4 | 41.0 | 66.9 | 47.2 | 47.1 |

| Greece | 4.3 | 5.0 | 5.2 | 2.3 | 4.4 | 4.4 |

| France | 26.9 | 21.4 | 21.3 | 32.5 | 28.2 | 25.2 |

| Ireland | 0.1 | 0.3 | 0.3 | 0.1 | 0.3 | 0.3 |

| Italy | 36.3 | 31.4 | 33.8 | 39.4 | 35.4 | 39.4 |

| Luxembourg | 5.2 | 3.9 | 4.0 | 6.4 | 5.5 | 5.2 |

| Netherlands | 7.6 | 5.5 | 5.8 | 8.5 | 8.0 | 7.6 |

| U.K. | 22.8 | 16.3 | 18.7 | 28 | 22.6 | 23.9 |

| Total EEC-10 | 172.0 | 140.3 | 144.9 | 202.5 | 165.9 | 168.1 |

| Spain | 16.7 | 20.3 | 17.0 | 16.9 | 22.0 | 19.5 |

In contrast with the situation in the EEC, in Spain the production capacity between 1980 and 1986 was not reduced, in fact it increased notably: by 22% for hot rolled products and by 30% for crude steel. This should not be surprising given that until 1986 the adjustment of the production capacity was not an objective of the steel policy of the Spanish governments who were convinced that the low level of steel consumption in the country compared to that of other developed countries justified the continued expansion of the production capacity of the sector.51 Therefore, although in theory the Treaty of Accession required Spain to make a sacrifice similar to that made by the European steel sector, establishing a production potential for hot-rolled products of 18 million tonnes, in practice, at the end of the decade it had increased its production capacity. So we could say that, until 1986, the restructuring process was focused on the financial reorganisation of the companies, while the adjustment of the production capacity was postponed until after Spain had joined the EEC. Only then was the sector required to take measures to fulfil the commitments of the Treaty of Accession and those acquired with the complementary aid approved in 1987. As a result, the production potential for steel dropped from 22 million tonnes in 1986 to 19.5 million in 1989 (a reduction of 11%) and the hot-rolling production capacity fell from 20.3 million to 17 million (14% less). Obviously, the adjustment that the Commission demanded of Spain in terms of hot-rolling capacity was very different to what the leading steel powers in the EEC had achieved in the first half of the 1980s.

With respect to job cutbacks, in Spain this did not have the same intensity as it had in the rest of Europe, which, obviously is related to the evolution of the production capacity which we have commented on above. As we can see in Graph 1, between 1980 and 1986, the job losses in the steel sector were much more intense in the EEC, where the number of workers fell by 41%, than in Spain where there was only a 30% reduction. It is noteworthy that, for the period 1986–1989, the job losses had a similar intensity in Spain (with a reduction of 22%) and in the EEC (18%), taking into account that Spain was immersed in a restructuring process whereas in the EEC this process had already been completed and no further reductions in production capacity were experienced.

4ConclusionsThe data provided in this study reveal that, contrary to what the Spanish steel producers association claimed at the time, the main difference between the restructuring process of the Spanish steel sector and that carried out by the EEC countries during the 1980s did not reside in the volume of public aid, but in the delay of the production capacity adjustment process which was necessary to adapt it to the new market conditions generated by the crisis. Similarly to other European countries, from the mid 1970s, the Spanish government provided loans to companies in crisis through the different public bodies. It nationalised part of the integrated steel sector and increased the capital share of the state-owned enterprises in order to address the problem of the losses accumulated. With respect to the public resources received by the Spanish companies, it seems that, until 1979, they were lower than those received by the Belgian, Italian, French and British companies and clearly higher than those received by the German companies. However, in the 1980s, when the subsidies given to the sector increased considerably in all countries, the public aid granted to the Spanish steel sector was no lower than that received by the sector in the other European countries: the aid per tonne produced was similar to that granted in the French steel sector and only less than that received by the Italian and Irish companies.

The main difference between the Spanish steel policy and the policy in the EEC countries resided in the use of the public resources during the 1980s. In Europe, the convergence of interests of the European Commission and the national governments after 1980 led to the use of state aid as a fundamental instrument for carrying out the adjustment process that reduced the production capacity by 18% in only six years. In Spain, on the other hand, until 1986, state aid did not contribute to reducing over-capacity but in fact increased the hot-rolling capacity by 22% and that of crude steel by 30%. Only the commitments acquired with the EEC in the Treaty of Accession and the subsequent agreements to offer complementary aid gave rise to a significant reduction in Spain's production capacity between 1986 and 1989, which, however, continued to be higher than the levels at the beginning of the decade.

Another important difference resides in the high percentage of aid received by the private sector. In those countries where the steel industry was dominated by the public sector, the state-owned companies received most of the aid; in Spain, however, the private sector received half of the public resources aimed at restructuring the sector in the 1980s (536,331 million pesetas as opposed to the 538,971 million received by the Ensidesa-AHM group). The economic support received from the State was particularly important in the case of AHV, which, in relation to its size, was the Spanish integrated company that received most aid in the 1980s.

The restructuring of the steel sector was a problem that was very difficult to manage in all European countries. The concentration of production in large integrated plants responsible for the majority of the direct and indirect employment of some regions, generated strong resistance in those regions where the closure of obsolete plants represented a high social cost. The worsening of the steel sector's situation with the second oil crisis enabled the European Commission to take over the control of the restructuring processes, conditioning the European aid (ECSC and FEDER funds and loans from the European Investment Bank) and state aid to the objectives of reducing capacity. The national governments, concerned about the growing amount of public resources required to sustain the sector, found a perfect excuse in the steel aid codes for overcoming the resistance from the social agents in each country which opposed the closure of facilities and the laying-off of workers.

The Spanish governments could not do the same until 1986. Although in theory they had a higher level of autonomy than the EEC countries when implementing measures to address the crisis as they did not have to fulfil the aid codes, in practice it was much more difficult for them to resist the pressure from the different interest groups (public and private companies, regions and trade unions), which gave rise to political and social factors taking precedence over the economic aspects.52 As a result, the integrated and special steel sectors were faced with new difficulties after 1991, which required the implementation of a new restructuring plan two years later which cost the public purse 573,000 million pesetas to respond to the EEC requirement of reducing hot-rolling capacity by 2.7 million tonnes. Of the countries forming the EEC at the beginning of the 1980s, only the Italian state company Ilva (created after the liquidation of Finsider) had to undergo a new restructuring process in the 1990s, receiving a total amount of aid of 2573 million ecus (409,000 million pesetas) and reducing its hot-rolling capacity by 1.2 million tonnes.53

The authors wish to record his thanks to Elena Laruelo Rueda for the facilities provided for the consultation of the funds of the Centre for Documentation and Archives of the Sociedad Estatal de Participaciones Industriales.

In order to study the state aid received by the steel industry in the EEC countries, we have used the information contained in the Official Journal of the European Union, the Reports on Competition Policy corresponding to the period 1976–1989, the first two Surveys on State Aid in the European Community (1989 and 1991) and, principally, the Reports on the Application of the Rules on Aid to the Steel Industry. These latter reports are internal documents that were sent by the Commission to the Council between 1981 and 1986 informing about the state aid authorised by the European Commission as from when the first aid code came into force (1980). The information provided by these sources for the first half of the 1980s contrasts with that available for the second half of the 1970s which is fragmentary and disperse. Although the European treaties required members to notify about state aid, the European bodies, in general were only informed of this aid after 1980.

With respect to Spain, there is no document issued by the government that provides a total amount of the public aid granted to the steel industry, or to any of the other sectors declared to be under reconversion. The governments sustained and restructured the steel sector using many different mechanisms ranging from tax aid to direct subsidies, including loans granted by the Banco de Crédito Industrial (BCI). The multiple aid mechanisms applied and the different institutions involved (Ministries of Industry and Employment, the National Institute of Industry (INI), the Official Credit Institute, etc.) make the calculation of the amount of public resources devoted to the industrial reconversion processes extremely difficult. For some types of aid we do not even know about how it was distributed among the different sectors or companies.5454 On the difficulties in obtaining data with which to conduct an estimate of public resources during the reconversion process, see Navarro (1989b) and Edo Hernández and Paredes Gómez (1992).

Comparing the state aid received by the Spanish steel sector and that received by the steel sector in other EEC countries is not an easy task. Our primary concern was to ensure that we included the same concepts and to quantify them in a similar way in both cases. So, first, in order to conduct our estimate we opted to use the total volume of the different types of aid without taking into account its intensity, in other words, the percentage of aid implicit in the mechanism used.5555 It is clear that while the percentage of aid of a subsidy that does not need to be returned equals 100% of the amount granted, in a loan with a reduced interest rate, the percentage of aid will be equivalent to the saving gained with respect to a loan taken under market conditions, which would therefore be much lower than the amount received by the borrower. Due to these differences, since the mid 1980s, the European Commission began to give more importance to the subject of aid, also called equivalent net aid, and proposed the division of state aid into four groups depending on the real aid received by the beneficiary. The classification of the different types of aid can be found in the First Survey on State Aid in the European Community (1989, pp. 5–7). Although the survey provides data by country of the aid granted to the steel sector, we have chosen not to use them because they only include the average aid received by the steel sector in the ECSC countries between 1981 and 1986 (there are no annual data). Therefore, as we will see in the following sections, they exclude a year (1980) when state aid was highly significant and include another (1986) when it was restricted by the European Commission, so the average for the period is not very useful for the objective of our study.

We are aware that this method of calculation does not allow us to carry out a precise estimate of the real amounts received by the steel companies. On the one hand, as indicated by Navarro (1989b, p. 59), some subsidies and loans did not represent new capital for the companies, but were aimed solely at covering the depreciation and the payment of the interest of loans granted in previous years, something which also would have occurred in the ECSC countries. On the other hand, the net aid component of the many loans granted by the BCI could have been much higher than their conditions may indicate, given that, in order to avoid liquidity problems, Article 4 of the Law 21/1982 of 9 June on industrial reconversion measures established the subsidiary liability of the State Treasury for losses incurred by the credit and guarantee operations agreed with the companies under reconversion. In fact, the State took responsibility for the outstanding payments delayed by more than one year without the borrower being declared insolvent. The subsidiarity of the State Treasury was not new, as since the mid 1970s the State assumed the losses arising from exceptional loans for companies in difficulties granted by the Government through the BCI under Law 13/1971, of 19 June, on the Official Credit System.5656 ICO (Official Credit Institute) (1986, pp. 7–14). It was common practice for the state to take responsibility for the unpaid loans of the steel companies in the 1970s and 1980s in France, Belgium, the UK and even Germany. See, for example, Howell et al. (1988, pp. 108-189).

The second aspect to take into account relates to the concepts considered as being state aid. In this respect we have quantified the amounts received by the sector and not the total cost that the restructuring process represented for the public purse, following the criteria established by the EEC which only supervised the aid received directly by the companies and not the social aid given to the workers or the areas affected by the reconversion process.5757 See, for example, what is said about the social aid of the ECSC in the European Commission (1989, pp. 40–41). A detailed analysis of the job and pension aid in the steel sector can be found in Navarro (1989a) with a global estimate provided in the table on page 144. With regard to the job and pension aid for sectors under reconversion and the regulatory changes that affected them during the 1980s, see Edo Hernández and Paredes Gómez (1992, pp. 274–276).

With respect to tax aid, despite being granted to all the companies under reconversion after the Royal Decree-Law of 5 June on industrial reconversion industrial was passed, we have decided not to include it in our estimate for two reasons. First, there is no detailed information available regarding the amount that they represented (the only data that we have found refer to the postponement of the payment of debts with the tax and social security authorities) and it is not linked exclusively to companies under reconversion.5959 The difficulties in calculating the tax aid in the industrial reconversion processes and the legislation governing it are addressed in Edo Hernández and Paredes Gómez (1992, pp. 270–271 and pp. 291–296). An estimate of the tax concessions granted to the Spanish steel sector in the 1980s can be found in Navarro (1989, p. 144).

The third issue to be taken into account relates to the units of measure. Given that the restructuring of the steel sector was carried out within a context of high inflation, especially in the case of Spain, it would be seem advisable to make the calculations in constant pesetas and not in current pesetas in order to appropriately quantify the effort made. However, we have decided to present the figures in current pesetas for two reasons; first, we know the moment when the aid was approved, but sometimes it is complicated to pinpoint the exact year in which the payment of the approved aid was made, and second, some sources (such as the Miner reports or the ICO (Official Credit Institute publications) only provide aggregated data for several years. Working with current currencies has a serious disadvantage given that, as pointed out by Navarro (1989b, p. 60), over time they accumulate non-homogeneous quantities, underestimating the importance of the quantities contributed during the first years. In our case, this is not such a great concern because the EEC also provides the data in current currencies and therefore the main question that we should address in order to compare the state aid given to the Spanish steel sector with that granted in other European countries is the exchange rate, as the continual depreciation of the peseta contrasts with the greater monetary stability of Europe.

Finally, although the loans granted by the BCI to the non-integrated steel sector between 1975 and 1977 under the second Concerted Action and the exceptional loan granted to AHM in 1977 in order to help finance its initial set-up cannot be considered as aid for the restructuring of the sector, we have included them. The is because for the EEC countries there is only aggregated data available for the period 1975–1979, although for some of them it is also questionable whether the subsidies prior to 1977 should be considered as aid for restructuring.

Based on the sources that we referred to at the beginning of the appendix, we have carried out an estimate of the state aid received by the Spanish steel sector between 1975 and 1988 (Table A.1). With respect to the information contained therein, it is necessary to clarify two points. First, in some cases, the amounts received by the companies did not coincide with the amount initially approved, which could generate discrepancies with the data presented in the estimates conducted by other authors. Second, the information is divided into three periods determined by the chronology of the European aid: the first covers the aid approved until 1 February 1980; the second refers to the aid approved between 1 February 1980 and December 1986 and the third includes the aid granted after Spain's adhesion to the CEE until December 1988.

State aid granted to the Spanish steel sector by subsector and type of aid, 1975–1988 (in millions of current pesetas).

| Subsectors | Banco de Crédito Industrial | MINER | INI | Total | ||||

|---|---|---|---|---|---|---|---|---|

| Ordinary loans | Guarantees | Participatory loans | Bonds | Subsidies | Loans and guarantees | Capital injections and compensation for losses | ||

| Special steels | 10,883 | 10,883 | ||||||

| Common steels (non-integrated) | 10,808 | 10,808 | ||||||

| Integrated steel sector | 31,001 | 22,040 | 18,540 | 71,581 | ||||

| Total 1975–1979 | 29,850 | 22,040 | 18,540 | 93,272 | ||||

| Special steels | 9,278 | 9,350 | 21,453 | 24,656 | 64,737 | |||

| Common steels (non-integrated) | 26,168 | 11,215 | 8,950 | 46,333 | ||||

| Integrated steel sector | 76,290 | 46,200 | 18,500 | 113,621 | 150,502 | 260,205 | 665,318 | |

| Total 1980–1986a | 111,736 | 55,550 | 51,168 | 147,227 | 150,502 | 260,205 | 776,948 | |

| Special steels | 5,000 | 2,000 | 10,000 | 25,727 | 42,727 | |||

| Common steels (non-integrated) | 40,265b | 40,265 | ||||||

| Integrated steel sector | 25,000 | 10,000 | 50,000 | 101,622 | 27,740 | 214,362 | ||

| Total 1987–1988 | 30,000 | 12,000 | 60,000 | 167,614 | 27,740 | 297,354 | ||

| Total 1975–1988 | 171,586 | 67,550 | 51,168 | 60,000 | 314,841 | 172,542 | 306,485 | 1,166,964 |

Annual Reports of Altos Hornos de Vizcaya, Altos Hornos del Mediterráneo, Ensidesa and Siderúrgica del Mediterráneo (Sidmed). Centro de Documentación y Archivo Histórico de la Sociedad Española de Participaciones Industriales.

COM and SEC documents of the European Commission. Historical Archive of the European Union (www.pittsburg.eua) and EUR-Lex (http://eur-lex.europa.eu/homepage.html).

Fondo Altos Hornos de Vizcaya. Archivo Histórico Foral de Bizkaia (AHFB).

For the restructuring of the steel sector in Western Europe, see the national studies included in the projects coordinated by Mény and Wright (1987) and Dudley and Richardson (2001). The studies conducted by Bain (1992) and Herrigel (2010) offer a comparison of the behaviour of the agents involved in the restructuring processes (unions, governments and companies) in several countries around the world, in the EEC and outside of Europe. See also, the national studies carried out by Daley (1996) and Godelier (2006) for France; Dudley and Richardson (1990) for the UK; and Balconi (1991) for Italy. The relations between the public companies British Steel Corporation and Finsider and their respective governments have been analysed by Ranieri (2011). A comparison between the restructuring process in Spain and in the EEC countries has been carried out by Díaz-Morlán et al. (2009).

See the articles by Dudley and Richardson (1997), Smith (1998), Conrad (2005) and Aydin and Thomas (2012).

We have preferred not to include the figures of the studies in the text because they are not comparable. While Simon's study includes all the subsidies granted to the industry, those of Navarro and Edo Hernández and Paredes Gómez limited their analyses to the specific subsidies directed at restructuring. The latter two studies use a different methodology and do not include the same concepts, therefore a comparison of the overall figures would not be significant.

The differences between the three consolidated companies (Ensidesa, Altos Hornos de Vizcaya and Altos Hornos del Mediterráneo) led to bitter regionalist disputes. However, the grievances persist today in the affected areas, as revealed in the recent study by Barrutia (2013), which claims that the closure of Altos Hornos de Vizcaya (AHB) at the beginning of the 1990s was a result of the lack of financial support from the Spanish government which led to the undercapitalisation of the company. The sense of grievance is also still evident in Asturias, as we can see, for example in the studies carried out by Agüera (1996) and Riβmann (1996). On the contrary, González-Polledo (2015) considered that Ensidesa was the “winner” of the conflict between the three integrated companies. Navarro (1989) and Sáez García and Díaz Morlán (2009) consider that the Basque company received favourable treatment due to social and political reasons.

A detailed description of the subsectors can be found in Navarro (1989).

A detailed analysis of the regulations regarding reconversion can be found in Navarro (1989b), and those specific to the steel sector in Navarro (1989a).

Sáez García and Díaz Morlán (2009, pp. 170–180). Between 1978 and 1980, Ensidesa received loans from the INI worth 28,739 million pesetas, so the debt of the company with the public holding company at the end of the period amounted to 60,000 million. Annual Reports of Ensidesa (1978–1980) and AHM (1979–1980).

Instituto de Crédito Oficial (Official Credit Institute) (ICO) (1986, pp. 7–8 and 18), Navarro (1989, pp. 165–166 and 288–289).

Order of 22/5/1980 (BOE 27/5/1980).

The first legislative measure was the Royal Decree-Law 9/1981, of 5 June on industrial reconversión, which was passed into Law 21/1982, of 9 June, which was replaced after the change of government with the Royal Decree Law 8/83, of 30 November on industrial reconversion and restructuring passed into Law 27/84, 26 June.

Initially, only seven of the thirteen companies comprising the subsector participated in the creation of Aceriales; however, they represented 80% of turnover and 85% of the workers of the subsector (Miner, 1981, p. 21).

The Autonomous Region participated because of the thirteen companies comprising the sector, ten were based in the Basque Country (Miner, 1980, p. 71).

Royal decree 878/1981 (BOE 20/5/1981) and Miner (1980, pp. 76–77).

After the closure of the Sagunto blast furnaces and steel mill, only the cold rolling mill remained in operation, which, at the end of 1985 was separated from AHM and was used to constitute a new company, Siderúrgica del Mediterráneo, S.A. (Sidmed), which became a subsidiary of Ensidesa (Sáez García and Díaz Morlán, 2009, pp. 223–224).

A list of the aids received can be found in the Annual Reports of Ensidesa (1984), AHM (1984) and AHV (1984–1985).

RD 917/1982 (BOE 12/05/1982).

Miner (1985, p. 20) and ICO (1986, pp. 12 and 18). A list of the aids given to each company can be found in Navarro (1989, pp. 204–205).

Annual reports of AHV (1988–1989) and Ensidesa (1988); Annual Report of Instituto de Crédito Oficial (1988–1989, pp. 20–21), and Navarro (1989), pp. 147 and 391.

Annual report of AHV (1988).

According to the same source, this meant that the aid received by Spanish steel industry was lower than that granted to the other EEC member countries, both in terms of capacity installed and per worker. Unesid (1987b, pp. 7–9).

Traité instituant la Communauté européene du charbon et de l’acier. 18/4/1951. Disponible en: http://eur-lex.europa.eu/legal-content/FR/TXT/PDF/?uri=CELEX:11951K/TXT&from=FR

Grunert (1987, p. 274); Annual report of AHV (1982, p. 31); Unesid (1982, p. 56).

Unesid (1987b, pp. 7–9). This estimate is quoted by Howell and others (1988, pp. 62–63) and is mentioned in Schenk (2001, p. 97).

The case of the leading Dutch firm of the sector, Hoogovens, is somewhat atypical in the European context as the State had a significant share in it (29%) as did the city of Amsterdam (17%). However, on the contrary to France or Belgium, this share was not rooted in the crisis of the 1970s, but dated back to the origins of the company in the years leading up to the Second World War. In fact, the state participation, far from increasing, decreased during the first half of the 1980s. Schenk (2001, pp. 92 and 104).

Our calculations largely coincide with those offered by Conrad (2005, p. 306), which claim that the aids received British steel industry amounted to 67.4 euros per tonne, as opposed to 23 in Italy and Belgium, 9.2 in France and much lower levels in Germany (2), the Netherlands (1) and Luxembourg (0.5). Schenk (2001, p. 97), based on the report of 1987, calculates the aid per installed capacity and the results are similar to ours.

On Finsider, see Eisenhammer and Rhodes (1986) and Balconi (1991); on the British Steel Corporation, Dudley and Richardson (1990) and Saro (2000); the nationalisation of the French steel sector in Hayward (1986), Daley (1996) and Godelier (2006), the nationalisation of the Belgian steel sector in Capron (1986).

Analyse Particulier de certains aspects de la politique de la restructuration sidérurgique. Archivo Histórico Foral de Bizkaia (AHFB). AHV Fund, leg. 776, pp. 29-36. On the aid granted by the ECSC for restructuring processes, see Mioche (2004, pp. 85–97).

Law 21/1982, of 9 June, established, for the first time, mechanisms to facilitate the elimination of labour surpluses in the sectors declared as being under reconversion, establishing improvements in unemployment benefits and the possibility of early retirement at the age of sixty. The reconversion law, approved by the socialist government in 1984, reinforced the social protection mechanisms (Employment Promotion Funds) and created Areas for Urgent Reindustrialisation in order to promote investment and alternative jobs. A detailed analysis of the reconversion policies can be found in Navarro (1989c).

The data correspond exclusively to the large integrated groups and have been drawn from the Miner, Programa de saneamiento y reconversión de la industria siderúrgica integral española, 9/7/1980. AHFB. Fondo AHV, leg. 575, p. 53 and Navarro (1989, pp. 16–17).

Analyse particulière…. AHFB. Fondo AHV, leg. 776, pp. 2-4.

Measures to be taken by the Community in 1980 to combat the crisis in the iron and steel industry COM(79) 640 final, pp. 23–25.

Decision of the Commission 257/80/ESCS, de 1/2/1980. Diario Oficial de las Comunidades Europeas (DO) of 6/2/1980.

Decisions of the Commission 2320/81/ESCS, of 7/8/1982 (DO, 13/8/1981), and 1018/85/ESCS, of 19/4/1985 (DO, 23/4/1985).

Howell and others (1988, p. 84), Steel Policy, COM(87) 388 final/2, 17 September 1987.