In the traditional retail industry, some supermarket chains and department stores have been maintaining strong positions as the market comes to maturity. They can make use of the strong positions to squeeze their suppliers and obtain extra earnings. This situation may be challenged by the rapid development of e-commerce. Consumers’ purchase habits have been changing and many manufacturers are starting to sell goods through electronic retailers, in addition to their traditional distribution channels. This paper analyzes price and service competition in the dual-channel supply chain with both pure play Internet and strong bricks-and mortar retailers, investigates the influence of retailer power and proposes some competitive strategies for traditional retailer under e-commerce environment. The demand model is proposed based on consumer utility theory, and Stackelberg theory is used to analyze the game process in which the manufacturer is the leader and the two retailers, acting simultaneously, are the followers. The equilibrium price and service decisions of the supply chain members are reached. The analysis of the competitive strategy is divided into two parts. Firstly, the influence of the retailer power on members of the supply chain is examined. We find that although the traditional retailer can use its power to depress the wholesale price, this strategy cannot help the traditional retailer increase its profit. Secondly, other competitive strategies of the traditional retailer are analyzed and the traditional retailer is found to be able to improve its operating status through adjusting prices and services via specific actions.

With the improvement of the concentration of the traditional retail industry, some large retail groups have emerged. The channel power switches from manufacturers to retailers, putting retailers in a stronger position within the supply chain with the help of retailers’ channel-controlling force [1]. However, motivated by the application of information technology and the rapid development of electronic commerce, greater numbers of manufacturers are building up dual-channel supply chains in order to sell goods through a traditional retailer and an electronic retailer at the same time. In fact, we can easily find a product currently sold at Wal-Mart stores and online at Amazon. Manufacturers have become less dependent on traditional retailers because of the emergence of electronic retailers. The competition from the electronic retailers in consumer markets has challenged the predominant position of traditional retailers. The ability to respond to continuous and unexpected changes is essential for success in the market [2].Therefore, it is quite important and significant to explore the effect of retailer power and formulate a resolution for traditional retailers under the evolving competitive environment.

The competitive environment of supply chain has been changing constantly and relevant researches have been paid general attention to [3]. There are a number of studies that concern the optimal decisions and competitive strategies in dual-channel supply chains composed of a traditional retailer and a dominant manufacturer with an established direct electronic channel. In terms of price competition, which is considered the most direct manifestation of channel conflict, Liu and Zhang (2006) found that personalized pricing is a useful strategy for a traditional retailer to deter a manufacturer from selling directly to consumers [4]. Cai et al. (2009) studied the impacts of different price discount contracts and pricing schemes on the dual-channel supply chain and found that simple price discount contracts can effectively improve the supplier’s and retailer’s performance [5]. Khouja et al. (2010) considered the existence of retail-captive consumers and found that the size of retail-captive consumer segment greatly influences the manufacturer in the channel selection process [6]. Huang et al. (2013) considered production cost disruptions in a dual-channel supply chain and derived optimal pricing decisions for the supply chain [7].

Some studies have also focused on channel competition with non-price factors. Dumrongsiri et al. (2008) conducted a numerical analysis and found that improving service quality is an efficient way for a traditional retailer to increase its profits [8]. In addition, Yan and Pei (2009) found that the higher service quality of the traditional retailer will be beneficial to the whole supply chain and can help to reduce channel conflict [9]. Dan et al. (2012) found that the service strategy of the traditional retailer will greatly influence the pricing decisions and final profits of both the manufacturer and the retailer [10]. Xu et al. (2012) analyzed the channel configuration strategy to be adopted when both price and delivery lead time in the online channel are endogenously determined and found that the choice of channel structure depends on customer acceptance of the online channel and the cost parameters [11]. Tsao and Su (2012) considered the influence of warranties and found that both the manufacturer and the retailer earn more profit in a cooperative game than in a non-cooperative game [12].

Liu et al. (2013) compared the traditional co-op advertising model with the dual-channel co-op advertising model and discussed the optimal co-op advertising strategy [13]. In these studies, manufacturers are usually considered to be in the dominant position in the supply chain and to determine wholesale prices to influence retailers. The downstream retailers in the supply chain decide their retail prices accordingly and often stay relatively passive positions. To some extent, manufacturers are the core enterprises in supply chain. This is not suitable to supply chain with strong retailer. A strong retailer usually has dominance over not only the retail price but also the wholesale price, which implies the use of more diversified competitive strategies. In fact, for a greater share of the total profit, traditional retailers often utilize their strong positions in the channel to depress wholesale prices [14].

The variety of electronic distribution channel gives manufacturers different choices. To satisfy the needs of online shopping, a manufacturer can not only establish its own electronic channel, but also distribute its products through electronic retailers. Some studies have also focused on the competition within a dual-channel supply chain in which a manufacturer distributes its products through a traditional retailer and an electronic retailer. Brynjolfsson et al. (2009) found that the competition between traditional and electronic retailers can be intense when consumers purchase popular products that have low search costs in both electronic and traditional channels [15]. Liao and Shi (2009) found that the easily accessible local market and the concern about risk in the virtual environment are influencing factors that can significantly affect consumers’ attitudes and behavioral intention to use electronic retail [16]. Yan (2010) developed a profit-maximization model to investigate the benefits of demand forecast information-sharing between the competitive traditional and electronic retailers and found that the two different retailers will benefit from information sharing [17].

Yan and Ghose (2010) developed a game-theoretic model to examine the value of forecast information about consumers’ willingness to pay and concluded that forecast accuracy has a greater effect on the performance of a traditional retailer than on the performance of an electronic retailer [18]. Tojo and Matsubayashi (2011) considered the presence of free-riding effect arising from the product information provided by the e-tailer and found that the optimal strategy of providing information depends mainly on the degree of free-riding and the consumers’ reservation price [19].The five aforementioned studies preset the unit costs of retailers and focus on price competition between the two types of retailers. By contrast, little attention has been paid to vertical competition in the supply chain and the influence of non-price factors. Considering the non-price factors and introducing a manufacturer to decision-making processes can help to make the literature more thorough and in-depth. Xu et al. (2013) examined the relationship between pricing and the risk of price competition brought by price comparison service, which is independent with all parties of the supply chain, and studied the pricing strategies of retailers and supplier [20].

In their research, supplier adjusts its wholesale price based on the signal of price comparison service. Liu and Liu (2013) analyzed the decision-making processes of supply chain members and found that channel acceptance plays a critical role in influencing equilibrium prices and profits [21]. They considered the decision-making of manufacturer and the influence of services.

However, the online sales market is considered to be perfectly competitive, and the online retailer cannot determine its retail price, which means that the influence of the electronic retailer is not fully included.

Also, all the above studies on supply chain with both traditional retailer and electronic retailer are not involved with retailer power. Since the influence of retailer power has been pretty common in traditional retail channel at present, researches on this are worth further attention.

Based on the analysis above, this paper aims to analyze competition in a dual-channel supply chain composed of a manufacturer, a traditional retailer and an electronic retailer. The traditional retailer retains a strong position. Equilibrium decisions will be reached with considering services. The influence of retailers’ power on channel members will be studied and the competitive strategies of traditional retailers will be explored.

The remainder of this paper is organized as follows: in Section 2, related parameters and assumptions are introduced and the basic model is presented. In Section 3, we study the equilibrium game of supply chain members to determine their optimal decisions.

The influence of retailer power and different competitive strategies of the traditional retailer are analyzed in Section 4. Finally, concluding remarks are presented in Section 5.

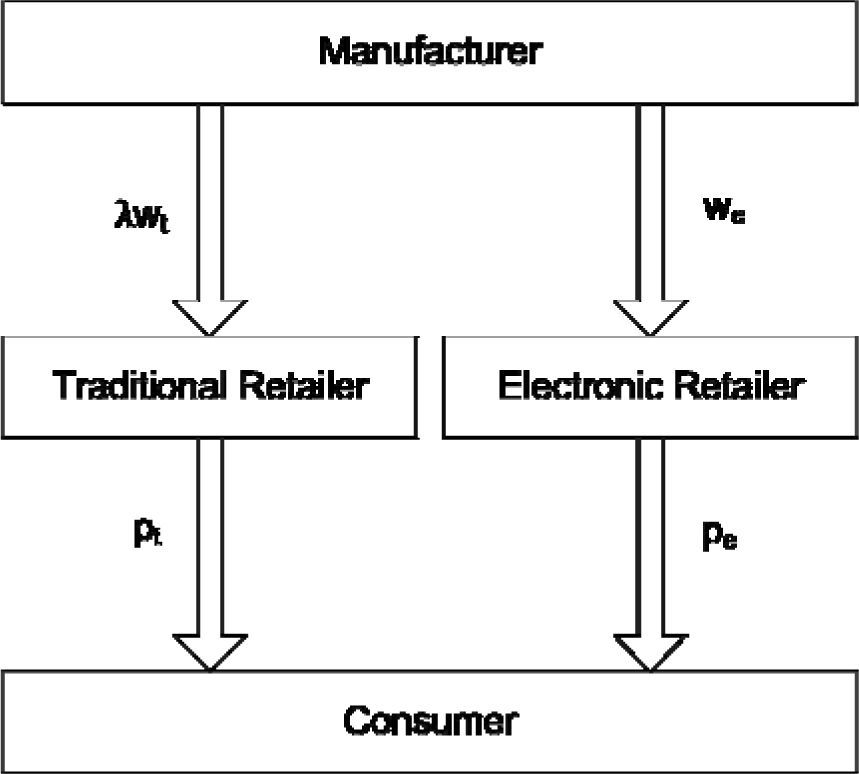

2The model2.1Consumer utility modelIn a dual-channel supply chain, a manufacturer distributes a single product through a traditional retailer and an electronic retailer at the same time (Fig.1). The traditional retailer holds a strong position within the supply chain, making the manufacturer unable to determine the wholesale price in the traditional channel. The manufacturer produces a single product at unit cost c and distributes through the traditional retailer at wholesale price Lwt. Let wt denote the benchmark wholesale price in the traditional retail channel, which is exogenous and determined by a long-term cooperation contract between the manufacturer and the traditional retailer, and let- denote the wholesale price-controlling coefficient of the traditional retailer, 0<λ≤1. At the same time, the manufacturer distributes the same product through the electronic retailer at wholesale price we. The traditional and electronic retailers resell the product to consumers at price pt and pe, respectively.

Let V be the ideal value of the product, which is consistent among various consumers. Consumers’ acceptance of the electronic channel is measured by θ. Considering the existence of risk in an electronic retail channel (e.g., differences between the real object and the description of the product, a complex return and exchange procedure, a delay in delivery, etc.), we assume 0<θ<1 [22]. The traditional retailer has competitive advantages in providing value-added services (e.g., field trials, professional shopping advice, etc.) that the electronic retailer cannot provide because of the restrictions of the channel mode. Let s denote the service level of the traditional retailer and 8 the service sensitivity of consumers. We assume that the marginal cost of service increases with the improvement of service level. The cost of providing services is 12ηS2 where η indicates the cost-benefit ratio of consumer services. This modelling approach is a common practice in the related areas of study [9,23,24]. In the traditional retail channel, convenience and time are really influencing factors when consumers make purchase decisions [25]. A consumer pays the cost of searching and purchasing goods (e.g., traffic cost, time cost, etc.), and we use t as the cost coefficient of buying from the traditional retailer and x to measure the distance between the consumer and the traditional retailer, 0≤x≤1. Let μ denote the cost of buying from the electronic retailer.

The assumptions of this model are as follows:

- 1.

The consumer market is linear. Consumers are uniformly distributed within the consumer population from 0 to 1, with a density of 1. Consumers make decisions of whether to purchase a product and which channel to purchase from. The traditional retailer is located at the original point of the market and consumers’ cost of buying from the traditional retailer is positively related to the distance between the consumer and the retailer, which means that the purchase cost of a consumer located at x is tx;

- 2

Supply chain members make decisions under circumstances of symmetric information. Retail prices are higher than wholesale prices, and wholesale prices are higher than manufacturing costs, i.e., ct, we) and max(λwt, we)t, pe).

In sum, we use Ut=V−pt−tX+δS to denote the consumer utility derived from the traditional retailer and Ue=θV−pe−μ to denote the consumer utility derived from the electronic retailer. Consumers purchase a product from the retailer that offers a higher level of utility.

2.2Demand and profit functionsA consumer will choose to purchase a product from the traditional retailer when Ut > max(0, Ue) or from the electronic retailer when Ue > max(0, Ut). Which retailer to choose is of no difference to a consumer when Ue = Ut ≥ 0.

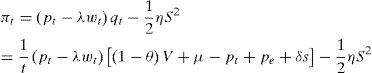

We can calculate the threshold X1=1t1−θV+μ−pt+pe+δs which indicates that Ut = Ue, and the threshold X2=1tV−pt+δS which indicates that Ut = 0. Taking the valid interval of x (i.e., 0 ≤ x ≤ 1) into consideration, we have Ut < 0 when x ∉ {0,min[max(0,x2),1]}, which means that a consumer whose distance from the traditional retailer exceeds {0,min[max(0,x2),1]} will not purchase from the traditional retailer because of its negative utility.

Similarly, a consumer will not purchase from the electronic retailer when Ue < 0.

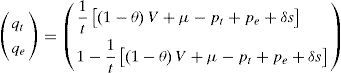

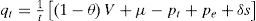

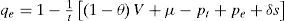

Let qt and qe denote the demands of the traditional retailer and the electronic retailer, respectively. qt and qe vary as the relationship between x1 and x2 changes.

If x1 > x2, then 1t1−θV+μ−pt+pe+δs>1tV−pt+δS.

Thisl inequality can be further —simplified- to θV−pe−μ<0, which means that qe = 0, and no demand is driven by the electronic channel.

If x1 ≤ x2, then θV−pe−μ≥0, and three cases can be found as follows:

- (i)

When 1−θV+μ−pt+pe+δs≤0,

- (ii)

When 0<1−θV+μ−pt+pe+δs

When 1−θV+μ−pt+pe+δs≥t,

In case (i), all consumers purchase products from the electronic retailer. In case (iii), all consumers purchase products from the traditional retailer. Because this paper analyzes the context of a dual-channel supply chain, the following sections will concentrate on case (ii), in which the two channels simultaneously generate demand. The demand functions of the traditional retailer and the electronic retailer are described as follows:

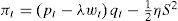

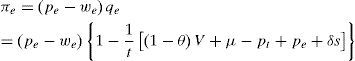

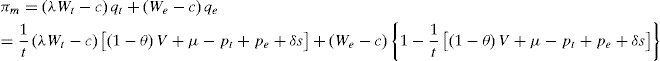

Accordingly, let πt, πe and πm denote the profits of the traditional retailer, the electronic retailer and the manufacturer, respectively, which can be established as follows:

3Optimal decisions of membersIn this section, we develop a Stackelberg decision-making model to illustrate the gaming process. In the first stage, the manufacturer sets the wholesale price of the electronic channel. In the second stage, the traditional retailer and the electronic retailer launch a Nash simultaneous movement game in which the former determines the traditional retail price and service level, and the latter determines the electronic retail price. As mutually independent operational entities, each participant in the game takes its own profit as the optimizing goal.

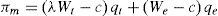

3.1Best responses of the retailers in the second stageThe profit functions of the traditional retailer and the electronic retailer are as follows:

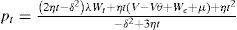

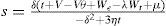

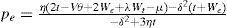

The traditional retailer makes decisions to realize maxπtpt,s, and the electronic retailer makes decisions to realize maxπepe. The first-order partial derivatives of πt are taken with respect to pt and s, and the first-order partial derivatives of πe are taken with respect to pe. Let the derivatives be zero, i.e., ∂πt∂pt=0,∂πt∂S=0 and ∂πe∂pe=0. We can obtain three reaction functions by solving the equation set:

3.2Decision-making of the manufacturer in the first stageThe profit function of the manufacturer is:

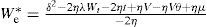

The manufacturer makes decision to realize maxπmWe. Substitute Eqs. 11, 12 and 13 into Eq. 14, let ∂πm∂We=0. We can obtain the optimal wholesale price charged by the manufacturer to the electronic retailer:

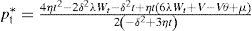

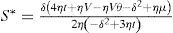

Substituting Eq. 15 into Eqs. 11, 12 and 13, we obtain the optimal retail price and service level of the traditional retailer and the optimal retail price of the electronic retailer:

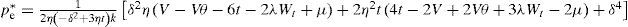

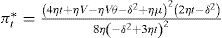

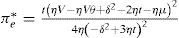

Substituting Eqs.16, 17 and 18 into Eqs. 6, 7 and 8, we obtain the equilibrium profits of the traditional retailer, the electronic retailer and the manufacturer:

4Competition analysisIn this section, the effect of depressing wholesale price will be examined and more competitive strategies for the strong retailer in dual-channel supply chain will be explored.

4.1Effect of depressing wholesale price by channel powerProposition 1 1∂We∗∂λ>0,∂πm∗∂λ>0,∂πe∗∂λ=0

Proposition 1 indicates that the traditional retailer can influence the equilibrium profit of the manufacturer and the wholesale price in the electronic channel. It can be proven that the wholesale price in the electronic channel is higher than the wholesale price in the traditional channel. If the wholesale price-controlling coefficient decreases, the traditional retailer achieves a lower wholesale price, and the manufacturer must therefore reduce the wholesale price in the electronic channel and receives a lower profit. However, it can be seen that the equilibrium profit of the electronic retailer will not be influenced by the controlling force of the traditional retailer; the influence of a retailer’s power is limited to its original channel and cannot expand to the retailer in the other channel. Since the effect of strong position is limited for the traditional retailers, they can’t exert enough influence on their horizontal competitors in e-commerce environment. This may explain the percussive development of electronic retailing in the past few years.

Proposition 2. ∂πt∗∂λ=0,∂qt∗∂λ=0

Proposition 2 indicates that the equilibrium profit and the demand of the traditional retailer are not related to the wholesale price-controlling coefficient. This phenomenon indicates that depressing the wholesale price is not an effective competitive strategy for the traditional retailer.

Although depressing the wholesale price guarantees the traditional retailer greater freedom in retail pricing, this freedom may be handled by the manufacturer, who can adjust the wholesale price in the electronic channel, and the change in wholesale price will also influence the electronic retailer’s retail price. These changes will finally influence the optimal price of the traditional retailer and offset the effect of the lower wholesale price. As e-commerce has become a long-term trend, a traditional retailer cannot achieve superior profit through a monopoly because of the invalidation of its original competitiveness. Despite the fact that depressing wholesale price is a common competitive strategy to a strong retailer in supply chain with single-retailer channel, this proposition shows us the invalidity of depressing wholesale price in a dual-channel supply chain. The strong retailer will have to find other effective ways to establish competitive advantages.

4.2Competitive strategies for the strong retailer in e-commerce environmentProposition 3. ∂qt∗∂V>0,∂πt∗∂V>0

Proposition 3 indicates that the demand and profit of the traditional retailer are positively related to the ideal value of the product. Strictly restricted by the specific transaction process, the electronic channel gives consumers more convenience and additional risk at the same time (e.g., the difference between the real object and the description, a complex return and exchange process, a delay in delivery, etc.). Consumers seem to be able to finish their purchase within one click, but the final results are not as guaranteed as those in the traditional channel. Such risks may compel consumers to prefer the traditional channel to the electronic channel when the value of a product is comparatively high. Therefore, higher-value products in the traditional channel have comparatively stronger resistance to channel competition and conflict than lower-value products do. For this reason, the traditional retailer can retain its competitive edge and resist the impact of the electronic retailer by selling higher-value products. Since higher-value often means higher-margin, this is also an advisable choice for the traditional retailers to offset the higher cost arising from their offline model.

Proposition 4∂πt∗∂θ<0,∂pt∗∂θ<0,∂S∗∂θ<0

Proposition 4 shows that the equilibrium profit, optimal traditional retail price and service level are negatively related to consumers’ acceptance of the electronic channel. When consumers’ acceptance of the electronic channel increases, which implies that consumers believe that the difference between the two channels is small, price competition becomes fiercer and the traditional retailer gains less profit. For example, in the book retail industry, electronic retailers can meet consumer demand at lower prices as efficiently as traditional retailers can, and therefore the traditional book retail industry experiences fierce competition from electronic retailers and must lower prices. In this case, the differentiated experience and services of traditional retailers do not function in a cost-effective way. On the contrary, the experience and services of traditional retailers may experience unreasonable cost pressure. The rise of Amazon and the simultaneous decline of traditional bookstores reflect this phenomenon to some degree.

Proposition 5∂pt∗∂δ>0,∂pt∗∂δ>0

Proposition 5 indicates positive correlations between the equilibrium price, the demand of the traditional retailer and the service sensitivity of consumers. This means that if the service sensitivity of consumers in the traditional channel is relatively high, the traditional retailer should concentrate on the services that highly reflect the channel mode and invest more in such services to expand its market share. To the traditional retailer, providing on-site service is a great advantage over electronic retailer. Such service does play an important role in consumers’ purchase decisions. Traditional retailers can better cope with the competition of electronic retailers through strengthening their own competitive advantage. For example, to address competition from electronic retailers, traditional mobile phone stores can provide more value-added services such as professional system updates, software installation and convenient after-sale services. These differentiated services may help consumers have a better understanding of the traditional channel and accept the price variance over electronic retailers.

Proposition 6∂qt∗∂t<0,∂S∗∂t<0

Proposition 6 shows that the equilibrium demand and service level of the traditional retailer are negatively related to the cost coefficient of buying from the traditional retailer. The higher the cost coefficient is, the lower the demand will be in the traditional channel. Thus, the traditional retailer must work to reduce the traffic cost in order to attract consumers. Purchasing cost is always an important consideration for the consumers to make purchase decisions. To some degree, customers choose electronic channel because of its convenience and usability. Traditional retailers should work to make their storefront more accessible to the consumers. Many similar situations exist in the real world. For example, in China, supermarket chains such as Carrefour attract consumers to their stores through providing free commuter transportation for consumers. Home appliance retail chains such as Suning and Gome continue to establish new shops to increase the convenience of shopping at their stores. Lower buying costs can encourage more consumers to visit traditional stores, while simultaneously, higher service levels can help increase consumer utility and stimulate customers to buy products.

5Conclusions and future researchIn this paper, we study a dual-channel supply chain composed of a manufacturer, a traditional retailer and an electronic retailer. The influence of retailers’ power and the competitive strategies of the traditional retailer are explored within the context of the traditional retailer holding a strong position in the supply chain. Our results indicate that the traditional retailer may control the wholesale price and influence the profit of the manufacturer; however, the equilibrium profit of the traditional retailer is not related to the wholesale price-controlling coefficient.

Therefore, depressing the wholesale price is no longer an effective competitive strategy for the traditional retailer in a dual-channel supply chain. The traditional retailer can cope with the “demand shock” of the electronic retailer by selling higher-value products, concentrating on the services that are better suited for the channel mode and reducing the traffic cost. The existence of channel differences also helps the traditional retailer remain competitive. With the increase in consumer acceptance of the electronic channel, the traditional retailer may have to reduce prices, but if the service sensitivity of consumers in the traditional channel remains relatively high, the traditional retailer can raise prices. When consumers believe that the difference between the two channels is small, providing many services would be uneconomical for the traditional retailer. However, if the buying cost is relatively low in the traditional channel, the competitiveness of the electronic retailer is comparatively weakened. In such a situation, the traditional retailer should improve its service level to strengthen the channel difference and spur profit growth.

This paper mainly focuses on the influence of retailer power and competitive strategies for a strong retailer, more attention can be paid to the strategies for manufacturers on how to cope with the strong retailers. Retailers and manufacturers may cooperate to weaken the competition and increase profits, which is a subject that warrants further research. Also future research may study the coordination of dual-channel supply chain with strong retailer.