This paper studies an online retail supply chain that includes one referral infomediary and one retailer, in which the infomediary provides demand referral service to retailers and incentive rebates to customers. A linear dual-channel demand with the effect of customer incentive and horizontal service cooperation model was established, and then the optimal policies of infomediary and retailers in centralized and decentralized supply chain were analyzed. Moreover, a horizontal cooperation contract based on customer incentive cost as well as referral service price was developed to coordinate the supply chain. The results revealed that the contract contributed to profit optimization of online retail supply chain and effective win-win cooperation. Finally, we analyze the impact of rebate sensitivity and market share on these optimal policies and illustrate the results by some numerical examples.

The rapid development of Information technology and Internet presents the retailers with the opportunities for expansion to new online segments. According to the recent report of China Internet Network Information Center (CNNIC), the number of online shopping users reached 242 million and utilization ratio of online shopping rose to 42.9% by the end of December 2012[1]. The increase of users’ purchase power and the combination of online consumption habit and the forms of mobile and social online shopping promote the growth of online retail market.

The Internet market structure is in a rapid optimization stage while the online shopping users rapidly increase in number. Firms are increasingly embracing integrated Internet-based supply chains because such chains are believed to enhance efficiency and competitiveness [2, 3]. The Internet has opened up opportunities for firms to share information and efficiently collaborate their activities with other entities in the supply chain [4].

E-commerce has given rise to a new breed of intermediaries, the so-called information intermediaries or infomediaries [5, 6]. An infomediary plays an expanded role in brokering prospect information in product categories, such as automobiles, insurance, and real estate, where the purchase decisions that consumers face are complex and frequently require direct interactions with salespeople [7]. The lowering of search costs with the advent of the Internet has changed the shopping way of consumers. With the help of online infomediary, consumers can get the information they need to make more informed choices [8]. For example, http://www.Shopping.com collects the consumers’ comments and offers online comparison shopping, and is currently one of the fastest growing shopping destinations for a comprehensive set of products. It recommends interested customers to some trusted online stores, such as http://www.Ebay.com, http://www.Amazon.com and http://www.Buy.com.

Several recent studies have elaborated on the referral service, price of segments and other marketing problems. Chen et al. (2002) analyze the effect of referral infomediary on retail markets and examines the contractual arrangements that they should use in selling their services [9]. The infomediary helps consumers to costlessly get an additional retail price quote before purchase and endows enrolled retailers with a price discrimination mechanism. Viswanathan et al. (2007) investigate the role of online infomediaries in market segmentation and price discrimination in the automotive retailing context based on three online buying service (OBS) pattern [7].

The result shows that consumers who obtain price information pay lower prices (for the same product), whereas consumers who obtain product information pay higher prices. Chen and Yao (2012) study the optimal decisions of infomediary’s effort and retailer’s order quantity in centralized and decentralized supply chain, and propose a horizontal cooperation contract based on sharing marketing effort cost [10].

Furthermore, the quantity and quality of information about companies, products, brands or services via online media, in the form of scores or comments, becomes the core competitive advantage of infomediary [11-13]. Recent evidence suggests that consumer reviews have become very important for online purchase decisions and product sales [14]. According to real data on firm security prices, Luo (2009) finds that negative WOM (Word of Mouth) of customers has significant direct short- and long-term effects on firm cash flows and stock prices [15].

Cheung and Lee (2012) focus on the factors that drive consumers to spread positive digital WOM in online consumer-opinion platforms and present the positive relationship between the perception of the opportunity to enhance consumers’ own reputations and their eWOM (electronic Word of Mouth) intentions [16]. Consumers are considered as co-providers in the online consumption process and intimately involved in the transition from selling the product to selling the experience [17].

In addition to these internal factors, customers incentive plan of infomediary becomes the external induce to encourage customers to write and disseminate their reviews and comments. Some online shopping platforms and virtual communities provides many kinds of customer incentives, such as price discount, coupon, cash rebate et al, to encourage customers to share their shopping experience and record their comments. But researchers have not yet studied the customer incentive plans provided by infomediary, even though understanding these mechanisms could enhance customers’ behavior of reviews dissemination and infomediary ability to recommendation of products and services.

Our primary interests of this research focus on the effect of customer incentive mechanism and the demand referral service cooperation between infomediary and retailer.

The aforesaid literature usually does not explicitly consider the impact of customer incentive on the final online demand, the service cooperation and supply chain coordination. We will characterize supply chain demands, equilibrium prices, and incentive commission paid by infomediary. The coordination mechanisms of the online retail supply chain are also to be investigated.

The rest of the paper is organized as follows. Section 2 outlines the model framework and the necessary assumptions and notations. Section 3 proposes the optimal policies in Stackelberg decentralized supply chain. Service contract of supply chain is discussed in Section 4. And some numerical examples are given in Section 5 and the paper concludes with some remarks in Section 6.

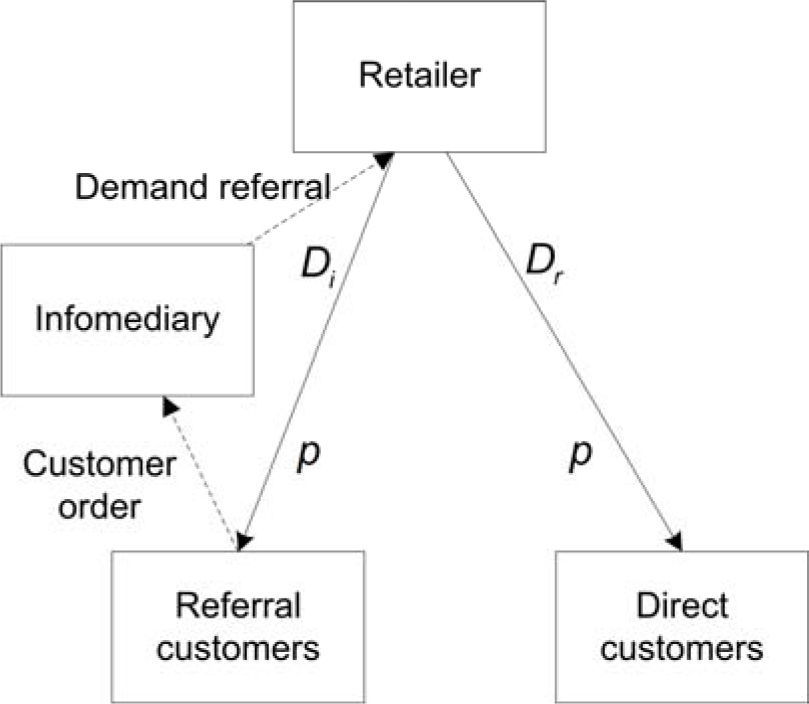

2Model formulationIn an online retail supply chain, a retailer sells the product through self-owned channel as well as through an infomediary website. The retailer pays the infomediary for the referral service at t per unit. The infomediary only provides the customers with product and price information and recommends the potential customers to the retailer.

Thus, the retailer orders the products from upstream supplier, sells to his direct customers from self marketing effort and indirect customers from the demand referral (Figure 1). It is reasonable to expect that the infomediary gets the compensation from the retailer for demand referral service. Furthermore a rebate r will be given to the customers as an incentive to for recording their experiences and comments on the products and services in detail.

The linear rebate function kr represents the customer incentive plan and parameter k (k>0) denotes the positive effect of rebate. Moreover the rebate r indicates the quantity and quality of customer eWOM, and the parameter k represents the recommendation effectiveness for the referral potential customers. As in Liu et al. (2013) [18], we suppose the retailer and infomediary both face independent demand and the retailer declares the same price p to both two customer segments.

Assume that all the potential customers influenced by the price and the referral customers are also dependent on the amount of rebate.

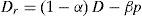

Let Di and Dr be the market demand share of the infomediary and the retailer respectively. Assume that (1-α) D proportion potential customers will buy the product from the retailer, while the other αD proportion will come from the infomediary (0 < α < 1).

The similar linear demand functions are frequently used in supply chains research [19-21]. The common concave function ηr2/2 denotes the customer incentive cost (η > 0) [22].

Assume that the purchase cost, sales cost and transportation cost of retailer is zero and unfulfilled demand is lost. See Table 1 for summary of notation.

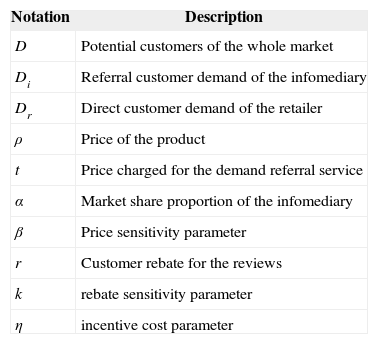

Notation.

| Notation | Description |

|---|---|

| D | Potential customers of the whole market |

| Di | Referral customer demand of the infomediary |

| Dr | Direct customer demand of the retailer |

| ρ | Price of the product |

| t | Price charged for the demand referral service |

| α | Market share proportion of the infomediary |

| β | Price sensitivity parameter |

| r | Customer rebate for the reviews |

| k | rebate sensitivity parameter |

| η | incentive cost parameter |

Therefore, the following Eqs. 1 and 2 capture the direct demand of the retailer and the referral demand of the infomediary respectively.

Where β > 0 represents the price effect and k > 0 enotes the positive effect of incentive rebate. They are both constants during the whole horizon.

3The optimal service and sales polices in a retailer Stackelberg gameAssume that retailer is the leader of Stackelberg game. The firms’ objectives can be divided into the following two-stage problem: in stage one, the retailer determines the service price t of the referral demand before the sales horizon; in stage two, the infomediary determines the customer rebate r in accordance with the referral price t. Infomediary provides all the referral demand to the retailer and gets the paid service fee, and the retailer undertakes the customer’s order fulfillment and gets the retailing price.

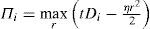

For fixed referral service t, the infomediary’s purpose is to choose the customer rebate r to maximize the profit Πi

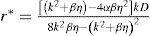

Substituting Eq. 2 into Eq. 3 and solving the first derivate of Eq. 3 according to r, we can get the ptimal customer rebate r *

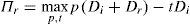

The superscript * denotes the optimal decision variables in Stackelberg scenario. Next, considering the retailer determines the optimal retailing and referral service price the profit function of retailer can be written as

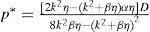

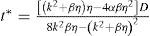

Substituting Eqs. 1, 2 and 4 into Eq. 5 and solving the first derivate according to p, t respectively, we ave the optimal retailing price p* and service price t*

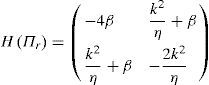

Since the optimal solution of Eq. 5, the Hessian Matrix H(Π r) must be negative definite matrix. We can derive H(Π r)

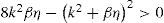

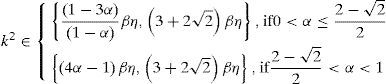

If parameters k and β satisfy

The objective function Π r must be jointly concave in (p, t). Hence, we prove that policies p and t are optimal. Substituting Eqs. 6 and 7 to Eq. 4 the optimal customer rebate r* can be described as

Consequently rational infomediary and retailer will commit to participate in the referral demand cooperation only if the retailing price p* is higher than the price of referral service t*. And we can obtain

From Eqs. 9 and 11 the feasible region of parameters k can be described as following

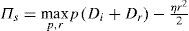

4Service contract coordinating the online retail supply chainIf the whole online retail supply chain acts as a centralized system, the profit of supply chain can be described as

The subscript s denotes the optimal decision variables in centralized scenario. To maximize the system profit the retailing price ρs and customer rebate rs are chosen according to the following

Based on Eqs. 14 and 15, parameters k must satisfy k

It is obvious that the system optimal price is higher than the retailer optimal price. Therefore, it reveals that the service price-only contract can not coordinate the supply chain system. The separation of marketing and sales operation between infomediary and retailer will result in inefficiency in the supply chain.

The customer incentive activities result in considerable costs. When the demand is affected by infomediary effort, such as buy-back, rebate and returns contract alone can not achieve channel coordination [22, 23]. But the marketing cost sharing mechanism can help supply chain attain a win-win goal [24, 25].

We assume the retailer provides γ (γ∈ [0,1]) percent of customers’ rebate cost as well as referral price t.

The superscript ~ denotes the variables in this scenario with customer rebate cost sharing contract.

Let Π~i, be the profit of infomediary and Π~r the profit of retailer. We can get

According to r we can get the optimal customer rebate

If the supply chains achieve coordination, the customer rebate of infomediary in decentralized scenario equals to that in centralized scenario.

Substituting Eq. 15 into Eq. 17 we can obtain

So when the online infomediary provides demand referral service to the retailer, the retailer must share γ=4βη−k2tηD percent of the customer incentive cost in addition to unit t service fee.

This customer incentive cost sharing contract can achieve coordination of the online retail supply chain.

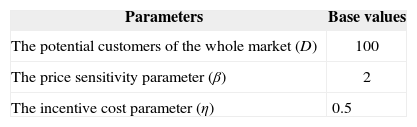

5Numerical examplesTo explore the effects of the referral service and customer rebate of the decentralized and centralized supply chains, we give some numerical examples in this section.

The basic settings with respect to the parameters are summarized in Table 2.

Parameters setting in the numerical examples.

| Parameters | Base values |

|---|---|

| The potential customers of the whole market (D) | 100 |

| The price sensitivity parameter (β) | 2 |

| The incentive cost parameter (η) | 0.5 |

| Parameters | Base values |

|---|---|

| The potential customers of the whole market (D) | 100 |

| The price sensitivity parameter (β) | 2 |

| The incentive cost parameter (η) | 0.5 |

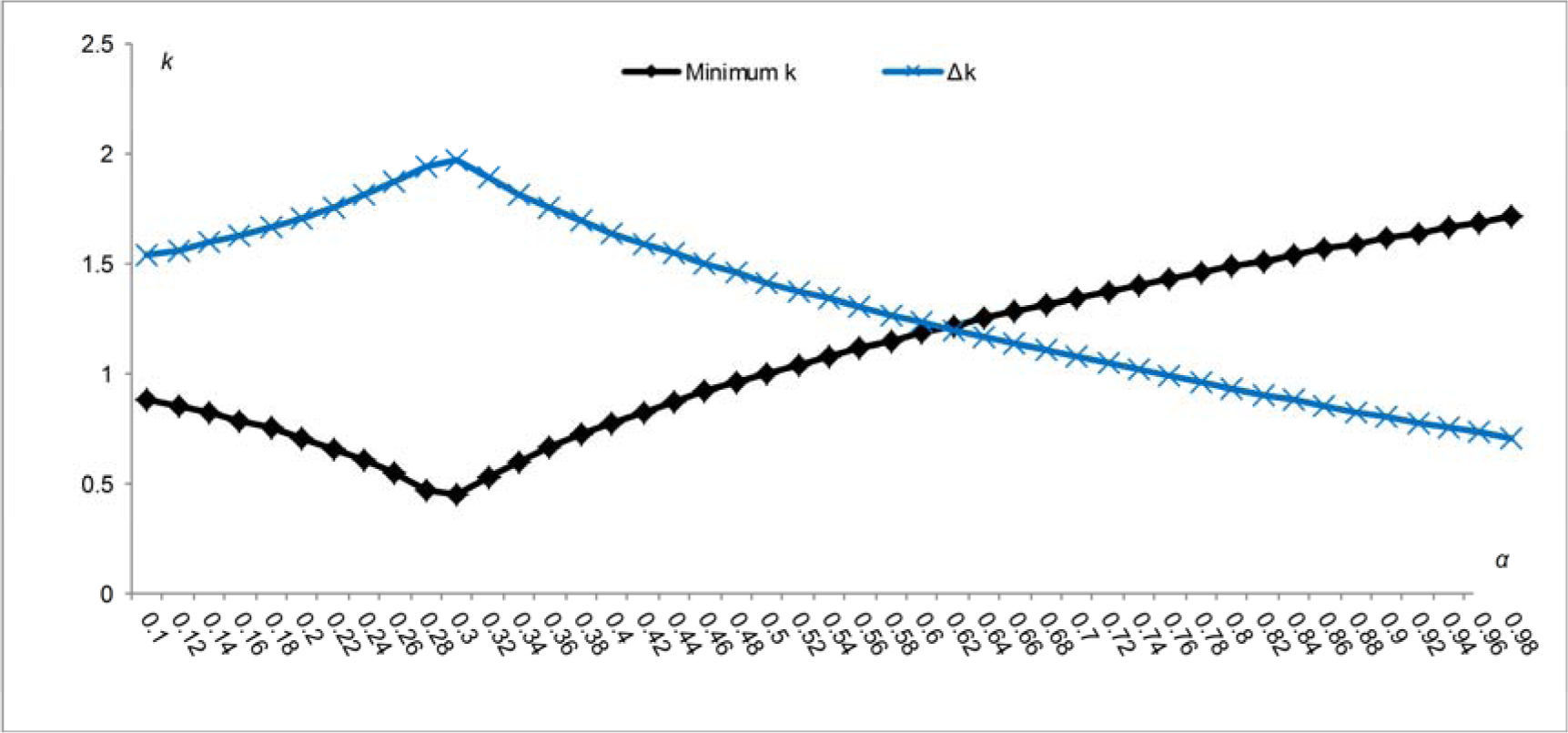

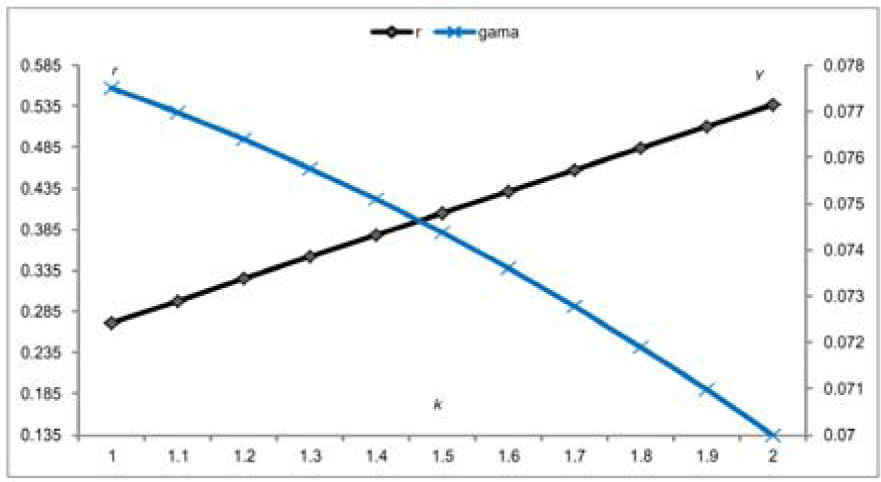

For a given market share proportion α, we can get the minimum lower k_; and fixed upper k¯. An interesting observation from Fig. 2 is that as α increases, the range of parameter kΔk=k¯−k_; increases firstly and decreases subsequently, where Δk indicates the feasible range of rebate sensitivity or customer referral effectiveness. Therefore, it reveals that when the proportion of online referral demand accounts for a small market share (From Eq. 12 parameter α is assumed smaller than 0.293), the possible variance of customer rebate sensitivity or referral effectiveness increases with the growth of referral segment. But if the market share of online referral demand exceeds 0.293, the opposite change will happen.

Thus, infomediary should continuously improve the features of eWOM to help shoppers make quick, easy and informed shopping decisions, thereby increasing its efficiency of potential customer conversion.

Considering the direct demand of retailer is dominant to the referral demand of infomediary or vice versa, we assume α = 0.1 or α = 0.6 respectively on condition that the numerical example of α must satisfy Eqs. 9 and 11.

Furthermore, the feasible region of parameters k is (0.881, 2.414) while α = 0.1 and (1.183, 2.414) while α = 0.6.

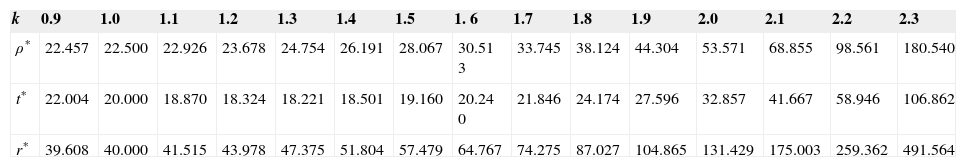

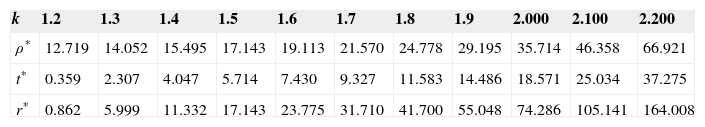

The optimal solutions of retailing price, referral service price and customer rebate are listed in Table 3-1 and Table 3-2.

Optimal solutions in the numerical examples (α = 0.1).

| k | 0.9 | 1.0 | 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1. 6 | 1.7 | 1.8 | 1.9 | 2.0 | 2.1 | 2.2 | 2.3 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ρ* | 22.457 | 22.500 | 22.926 | 23.678 | 24.754 | 26.191 | 28.067 | 30.51 3 | 33.745 | 38.124 | 44.304 | 53.571 | 68.855 | 98.561 | 180.540 |

| t* | 22.004 | 20.000 | 18.870 | 18.324 | 18.221 | 18.501 | 19.160 | 20.24 0 | 21.846 | 24.174 | 27.596 | 32.857 | 41.667 | 58.946 | 106.862 |

| r* | 39.608 | 40.000 | 41.515 | 43.978 | 47.375 | 51.804 | 57.479 | 64.767 | 74.275 | 87.027 | 104.865 | 131.429 | 175.003 | 259.362 | 491.564 |

Optimal solutions in the numerical examples (α = 0.6).

| k | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 | 1.7 | 1.8 | 1.9 | 2.000 | 2.100 | 2.200 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ρ* | 12.719 | 14.052 | 15.495 | 17.143 | 19.113 | 21.570 | 24.778 | 29.195 | 35.714 | 46.358 | 66.921 |

| t* | 0.359 | 2.307 | 4.047 | 5.714 | 7.430 | 9.327 | 11.583 | 14.486 | 18.571 | 25.034 | 37.275 |

| r* | 0.862 | 5.999 | 11.332 | 17.143 | 23.775 | 31.710 | 41.700 | 55.048 | 74.286 | 105.141 | 164.008 |

From Table 3-1 and Table 3-2, we can see that the segments of direct and referral demand have important influence on feasible rebate sensitivity k and optimal decisions of retailing price, referral service price and customer rebate.

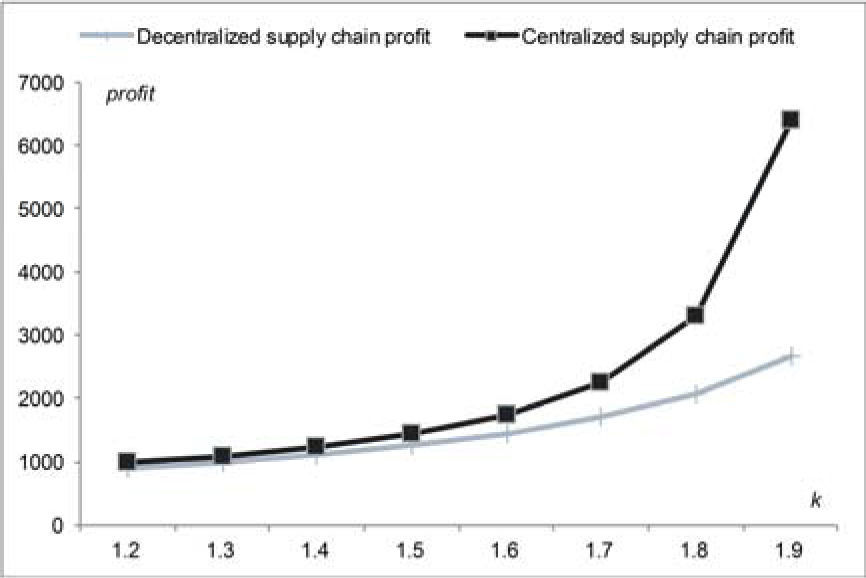

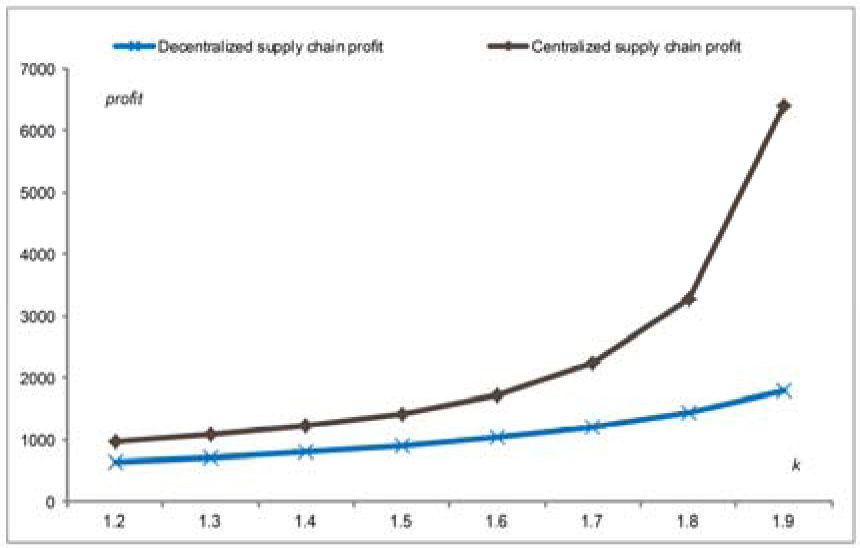

Figure 3-1 and 3-2 illustrate how the profits of the supply chain in decentralized and centralized scenarios depend on the different parameter k.

The total supply chain profit increases with the rebate sensitivity or the recommendation effectiveness under any condition of dual-market segments.

We denote η = 4 and t = 1.

The retailer provides customer incentive cost sharing contract to encourage infomediary to recommend customers.

Figure. 4 presents the sharing percentage of customer incentive cost and optimal customer rebate for different values of rebate sensitivity k.

6ConclusionsWe elaborate on the problem of demand referral service of infomediary, customer incentive effect and coordination contract in this article. With the sharing of customers’ comments and experiences the infomediary helps to meet and match the common needs between the numerous and rapidly growing consumers and suppliers. The online retail supply chain benefits from the horizontal referral service. The higher referral service price paid by the retailer will activate the infomediary to exert its customer incentive. But the service price contract alone can not achieve supply chain coordination. The customer incentive cost sharing contract besides service price is proved to coordinate the Internet supply chain. We show that efficient referral decision brings about more opportunity for supply chain cooperation. We believe that these insights will be useful for managers in dual-channel supply chain strategy.

The demand referral and channel cooperation in the supply chain is a meaningful and interesting field. This research helps us to understand how online retailer and infomediary interact with each other with respect to the customers recommendation conduct. As stated in the basic model settings, only one retailer and sole contract of incentive cost sharing is considered. In our futurestudy, we will explore the different mechanisms of servic recommendation and various structures of supply chain coordination contract.

This research was partially supported by the Zhejiang Provincial Natural Science Foundation of China under Grant No. LY12G02006, the Humanity and Social Science Youth Foundation of the Ministry of Education of the Republic of China under Grand No. 11YJC630028 and 13YJC630203, and the Philosophy and Social Science Research Project of Zhejiang Province under Grant No. 13NDJC054YB. This work was also supported by the Key Soft Science Research Project of Zhejiang Province under Grant No. 2013C25045 and the National Natural Science Foundation of China under Grant No. 51375429 and 71271188.