El Instituto para el Depósito de Valores (INDEVAL) es el Depositario Central de Valores de México. Es la única institución mexicana autorizada para ejecutar, de manera integrada, las actividades de guarda, custodia, administración, compensación, liquidación y transferencia de valores. En este artículo se reporta el modelado, simulación y análisis de un nuevo sistema de liquidación de valores (SLV) implantado por INDEVAL, como parte de un proyecto para la construcción de un sistema de operación más seguro y eficiente. El objetivo principal de esta investigación fue el de utilizar cantidades menores de efectivo y de valores en el proceso de liquidación del mercado mexicano, dentro de un período adecuado, empleando para ello un modelo de programación lineal para la compensación de valores y efectivo. El desempeño del nuevo SLV se evaluó conduciendo experimentos, utilizando un modelo de simulación determinística, bajo diferentes parámetros de operación, los cuales incluyen el número y monto de las transacciones y el lapso que determinan los ciclos de compensación, así como de reglas usadas en una operación de pre-liquidación. Los resultados generados en esta investigación pueden ser utilizados como referencia por otros SLV para tomar decisiones relacionadas con la eficiencia y la seguridad en el uso de sus recursos. La implementación del modelo llevó más de tres años. Actualmente, muchas operaciones que quedarían pendientes de liquidar si se hiciesen en forma individual, son liquidadas en grupo, por compensación, reduciendo dramáticamente los requerimientos de liquidez: en 52% en el caso del efectivo y en 26% en el caso de valores.

The Instituto para el Depósito de Valores (INDEVAL) is the Central Securities Depository of Mexico. It is the only Mexican institution authorized to perform, in an integrated manner, the activities of safe-keeping, custody, management, clearing, settlement and transfer of securities. In this article, we report the modeling, simulation and analysis of a new Securities Settlement System (SSS) implemented by INDEVAL, as part of a project for the implementation of a safer and more efficient operating system. The main objective of this research was to use reduced amounts of cash and securities, within reasonable periods of time, for the settlement of securities of the Mexican market. A linear programming model for the netting and clearing of operations was used. The performance of the new SSS was evaluated by performing experiments using a deterministic simulation model under different operation parameters, such as the number and monetary value of transactions, the time between clearing cycles and also under a new set of rules for pre-settlement operations. The results presented may be used by other Central Securities Depositories to make decisions related to the efficient and safer use of their resources. The implementation of the model took more than three years. Now many transactions that would remain pending if processed individually are settled together, thus reducing liquidity requirements dramatically —by 52% in cash and 26% in securities.

1. Introduction

In Mexico, the public ser vices of safe-keeping, custody, management, clearing, settlement and transfer of securities can only be offered by institutions authorized by the Federal Government. These services are offered by the Central Securities Depository (CSD), which was created on April 28, 1978, as a government agency. In 1987, the agency was privatized and legally constituted as the "S.D. INDEVAL, S.A. de C.V." (from here on, INDEVAL), starting operations October 1st of that year and also serving as a Securities Settlement System (SSS).

To improve the quality of their services, INDEVAL developed a project to re-design their business processes which included the implementation of a new system that takes advantage of the existing technology, increases the security and reliability of their operations and incorporates better industry practices. The implementation of the new system (named Dali) obtained the "2010 Edelman Award" as an outstanding example of the application of Operations Research tools (see Horner, 2010, for details). In this article we report the details on the modeling and simulation of the clearing system that are not reported in Muñoz et al. (2011).

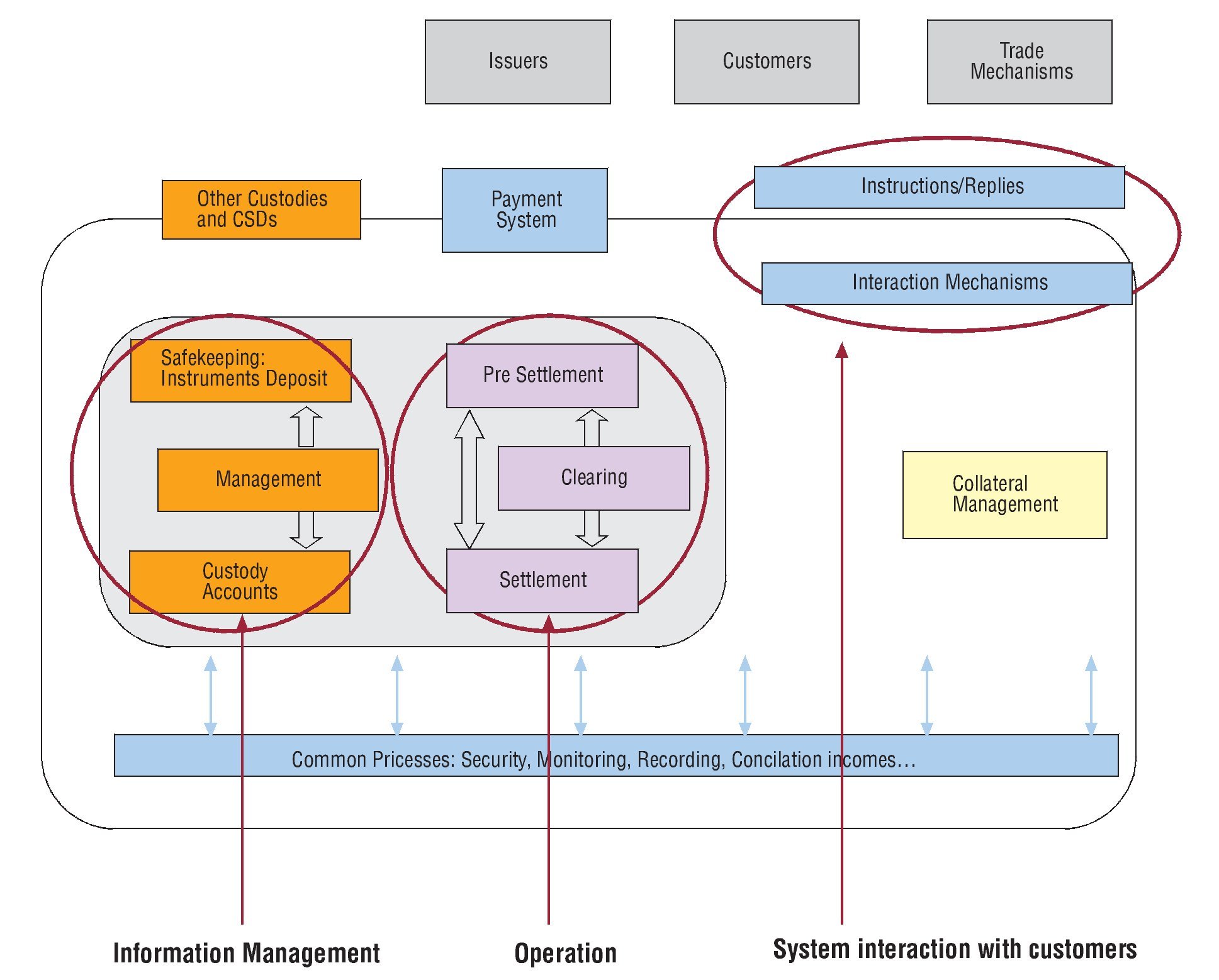

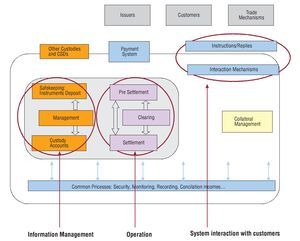

The functional model that was proposed for this project has the following three areas:

• System interaction. This area includes functions that allow the system to communicate with customers, as well as to manage its access security.

• Information management. This area provides the services that INDEVAL offers as a CSD, and directly involves the areas of safe-keeping, custody and management of securities.

• Operations. This functional area constitutes the SSS, which is responsible for processing all the transactions for settlement received by INDEVAL from its clients in the financial system. The SSS is responsible for concluding transactions through transfers of titles and/or cash in the accounts of the clients involved in the operation. For this, the SSS may use support functions such as the clearing of securities and cash.

The problem that constitutes the main object of study for this investigation originates in the functional area of Operations. For a more detailed description of the scope of the first two areas of this project see Romero et al. (2008).

The performance of many of the innovations proposed for the Operations area are not easy to predict since they depend upon a set of operation parameters that must be adjusted empirically. For example, the implementation of a linear programming model (which is described in the INDEVAL's Settlement System section) is proposed for the clearing of securities and cash; whereas, the performance of this model is highly dependent upon both the duration of the cycles between clearings as well as the number and monetary value of the transactions to clear. For this reason, a simulation model was also implemented to determine the settlement instructions that will allow the system to process transactions quickly and efficiently, without the need to insert large amounts of cash into the system. After developing a simulation model for the SSS, the performance of the system was analyzed to determine the values of the operation parameters that work best for the settlement system.

Applying simulation to a SSS may offer several advantages, such as:

• A given SSS becomes increasingly complex due to the adoption of new technology, infrastructure modifications or changes in the behavior of financial markets, increasing the need to study the systems under new operational conditions. This situation highlights the importance of simulation, since it is an effective method to study these complex systems in a reasonable time (Bank for International Settlements, 2005).

• Simulation is capable of replicating a SSS with great precision, using real historic information from the previously processed transactions and incorporating specif ic operational circumstances in the generated models. On the other hand, simulation also enables us to measure the impact of changing important system characteristics without actually altering the current system. Furthermore, using simulation we can measure and compare different SSS performances, originated by varying several parameters and decision variables that determine its processes (Leinonen & Soramäki, 2003).

• In general, transactions processing is based on a data transfer and management approach, which, in many occasions, does not take into account certain critical factors such as the order in which settlement instructions are executed, the prevalence of certain operations depending on their monetary value in titles and/or cash and the risks associated to their processing, among others. For this reason, simulation may be useful to help in the design and development of strategies for the SSS that integrate data availability as well as specific business criteria and rules, reducing operating costs and risks.

• Simulation models may be used to obtain relevant information regarding risks associated to SSSs, which are usually not reported in the system's operation statistics. Examples of these risks are the effect of flaws in important clients of the financial market, the consequences of credit defaults from the parties involved in the transaction or the impact of rare events such as system malfunction. These incidents are very difficult to analyze without the use of simulation (Bedford et al., 2005).

The advantages previously mentioned justify the use of a simulation model for the SSS to measure the impact on the level of liquidity and the time taken to settle the operations when varying certain parameters of the SSS.

After this introduction, the components of the SSS system for INDEVAL are described in the section on INDEVAL's Security Settlement System. In the section on Simulation of a Securities Settlement System, we describe the relevant characteristics of the developed simulator and then, in the Results Analysis section, we discuss the main results obtained from experimenting with the simulation model. Finally, the paper ends with a presentation of the conclusions obtained in this research.

2. INDEVAL's security settlement system

INDEVAL is a private institution whose stockholders include brokerage firms, banks, insurance and bond companies, Banco de México (The Central Bank of Mexico), the Mexican Stock Market (BMV) and Nacional Financiera (NAFINSA). As the only CSD in Mexico, INDEVAL keeps a deposit of all settlements registered in the Registro Nacional de Valores that are negotiated in the financial markets (Centro de Estudios Monetarios Latinoamericanos and World Bank, 2003).

In Figure 1, we may observe both INDEVAL's functions (encircled in the larger rectangle) as well as the company's interactions with external agents (elements outside the rectangle), which include different institutions (issuers, clients, other custodians and CSDs), trade mechanisms (BMV, trade-floor positions) and payment systems.

Figure 1 INDEVAL's functions and interactions with external agents.

The institutions that may interact with INDEVAL include: Banco de México, the Contraparte Central de Valores (CCV), credit institutions, brokers, international custodians, stock markets, bond institutions, stock market specialists, issuers, insurance companies and investment funds.

Trade mechanisms are places in which certain f inancial operations, such as transactions, stock loans, repurchase agreements (repos) may be arranged. Since these transactions involve the titles deposited in the INDEVAL, it is necessary to have them registered at this institution.

The distinct elements that are part of INDEVAL's interactions (institutions, trade mechanisms and payment systems) generate instructions that must be processed by INDEVAL. An instruction is a service request associated with a business process through which INDEVAL generates value. Furthermore, settlements of transactions that take place in the financial market are especially important instructions. As a SSS, the INDEVAL processes settlement instructions using one or several of the following operations:

i) Settlement: the settlement of securities involves the finalization of a financial transaction by transferring titles and/or cash in the accounts of the clients involved in the operations.

ii) Clearing: clearing is an auxiliary function for settlements, which calculates the mutual obligations of securities and/or cash, generally in net terms, which must be delivered by the agents involved in one or more financial operations.

iii) Securities transfer: this function involves securities transfers among accounts of the CSD clients, and makes the physical delivery of titles unnecessary.

2.1. INDEVAL'S previous settlement model

One of the main motivations to start a project of re-design and implementation of a new system was the need to improve the performance and safety of its functions as a SSS. To accomplish this objective, it is necessary to have a strict control over the accounts, which is an important element in the operation of the SSS.

Modifications in the securities and cash accounts kept by INDEVAL were previously performed in a decentralized manner. In other words, there were several ways of modifying the contents of an account (which consists of title positions and cash balances). For example, it is possible to alter an account's title position using a withdrawal, a transfer operation or a stock loan, and depending on the instrument and the type of operation that was performed, the change in balances and positions could be done through different modules, according to the operational area that processed the instruction and the type of settlement mode that was used.

The internationally approved settlement mechanisms are:

i) Delivery versus Payment: refers to the operations that guarantee the delivery of securities if and only if the corresponding payment is made.

ii) Delivery versus Delivery: refers to the settlements that guarantee the delivery of securities if and only if other previously negotiated securities are delivered.

iii) Delivery Free of Payment: refers to a delivery of securities with no corresponding payment of funds.

iv) Payment: refers to the transfer of funds from one client to another in order to satisfy a specific obligation.

v) Payment versus Payment: refers to a settlement operation of currencies that guarantees that a funds transfer of a certain currency will only be made if another transfer of equivalent value is made in one or more currencies (Bank for International Settlements, 2003).

Under its previous operating model, INDEVAL possessed nine modules, each operated within different areas of the institution and capable of modifying the accounting records in titles or cash. Some of the modules settled both operations of Delivery versus Payment (DvP) as well as Delivery Free of Payment; others, however, only settled operations under the DvP mechanism. The modules were, in several occasions, executed manually by systems operators that worked in a coordinated manner, although intermittently, following specific operating functions.

Modifying an account through the use of different modules hinders the implementation of control mechanisms for the settlement of transactions, reducing the SSS's security and increasing the operational risks, defined as the "risk that functional factors, such as technical breakdowns or operation faults, will cause or aggravate credit and liquidity risks" (Bank for International Settlements, 2001).

Since a SSS is the core of a financial system, inefficiencies in its functional processes have serious consequences. In particular, when settlements become too complex or expensive, f inancial transactions are discouraged (The Giovannini Group, 2003).

2.2. Proposed model for settlements in INDEVAL

The proposed model for INDEVAL's SSS incorporates elements that allow the system to operate continuously, improve performance and efficiency. Furthermore, using Clearing and Pre-settlement tools, the system has a better control of the titles and cash used in settlements and is able to conclude transactions faster. Contrary to INDEVAL's previous settlement system, the proposed model relies on only one mechanism for modifying accounts.

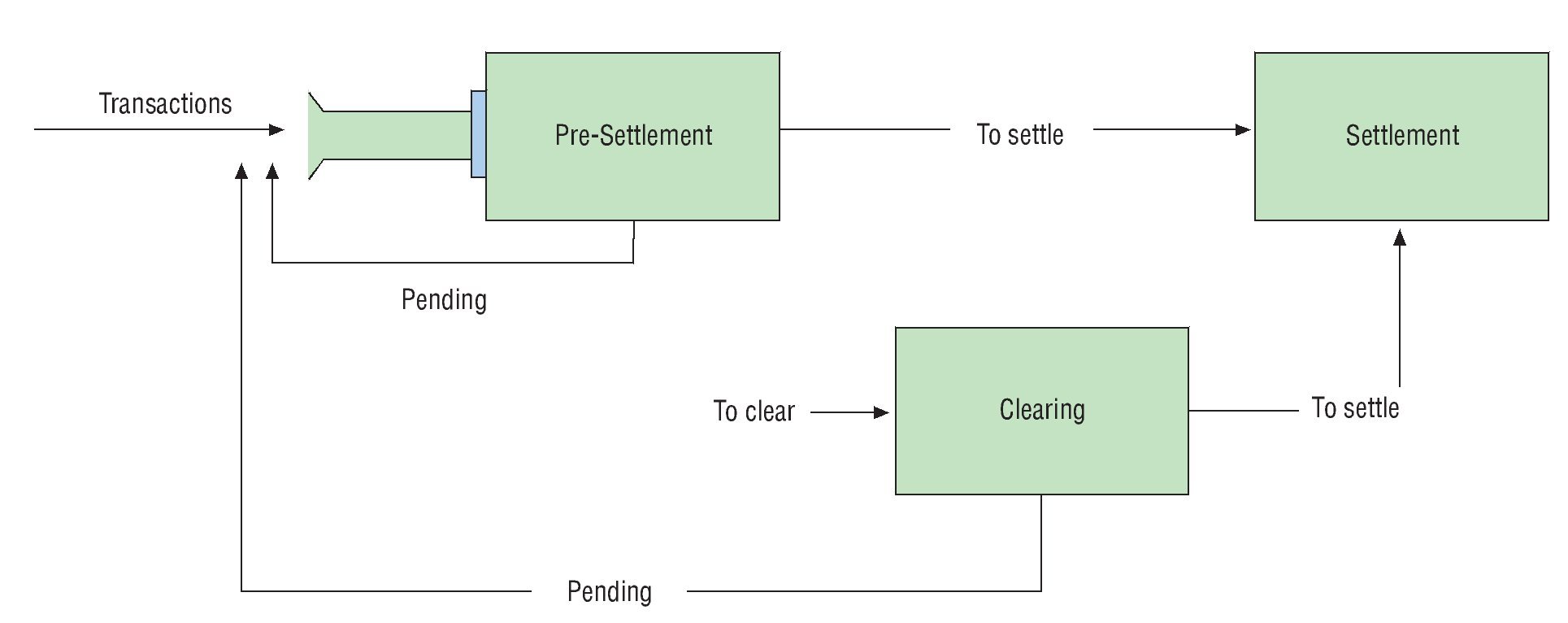

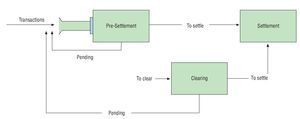

The proposed settlement model begins by admitting transactional instructions into the Operations functional area from the Distribution Module. These instructions may include several operations, which are queued in the Pre-settlement Module. The Pre-settlement Module is in charge of deciding whether the operation must be settled immediately, go through a clearing process, or stay in the queue with a "pending" status. Once the settlement has been completed, a message is sent to the client (through a module that manages the messages) to confirm that the transaction (and their corresponding operations) has been settled. Through this mechanism, all clients are made aware of the status and completion of every instruction in which they are involved. The proposed settlement process is shown in Figure 2 along with each of its components, which we will now proceed to discuss.

Figure 2 Flow of operations in the settlement process.

Pre-settlement is an auxiliary function within the SSS that has the objective of managing and helping the proper execution of the clearing and settlement functions. The main task of this module is to decide, according to certain business rules, if an operation must be cleared, immediately settled or be held on a "pending" status. Furthermore, this process decides when to invoke the clearing procedure, depending on certain pre-established criteria.

The pre-settlement module receives a queue of operations to be processed according to their arrival order (first-come, first-served). For each operation that is part of a transactional instruction, there is a set of specific rules that apply to them depending on the types of operations to be settled in INDEVAL. These business rules take into account both the monetary value of the transactions as well as the balances and positions of the accounts involved in the operations.

Applying the pre-settlement business rules to an operation produce one of the following results:

1. The operation is sent to settlement immediately, where the corresponding balances and positions are modified.

2. The operation is sent to the clearing procedure, where it will be cleared at some point. The operations that are sent to the clearing cycle may be settled afterwards or sent back to the operations queue in case they cannot be partially or totally cleared.

3. The operation is kept on hold with a "pending" status until the conditions necessary for its immediate settlement or clearing are fulfilled.

4. The operation may be rejected whenever the pre-settlement rules so dictate, in which case, the reasons justifying this result are reported.

Based on the decisions made in the pre-settlement module, an operation may advance to the clearing or settlement modules.

The clearing process, as an auxiliary function for the SSS, is responsible for calculating the obligations in securities and/or cash that each party involved in the financial transaction must deliver. The main objective of this module is to reduce the amount of cash and titles that each involved party must deliver in order to settle transactions in the SSS. In other words, instead of using the resources necessary to settle each transactional instruction one by one, only the equivalent net balances resulting from executing all operations are calculated and used. Therefore, some operations that cannot be settled individually due to a lack of cash and/or titles might be settled through clearing, since this procedure only requires the net transfer of obligations among clients.

The Clearing Module that was implemented is based on a linear programming formulation (called Procoval2) proposed by the Banco de México (Muñoz et al., 2011). This algorithm determines the numbers of titles that can be settled in a set of pending operations without the need of further titles or cash in the clients' accounts.

The clearing process may be activated using different criteria, whose parameters may be changed according to the specific needs of the SSS. Some of these criteria are that a certain amount of time has passed since the last clearing, a certain number of operations on hold has been reached or a limit value for the number of operations waiting for clearing has been exceeded. Furthermore, there is also the possibility that the clearing may be executed manually whenever required.

When the clearing module is activated, it is necessary to halt the settlement and pre-settlement functions in order to immobilize balances and positions. This condition must be met for Procoval2 to function properly, since its calculations are based on the account balances at a specific point of time.

Procoval2 determines the set of operations that will be cleared by solving two linear programming (LP) problems sequentially (both formulations are included in Appendix A). An exact solution for this problem can also be obtained through an integer linear programming (ILP) formulation that is also included in Appendix A. Unfortunately, implementing this alternative is not feasible since the time required to solve the ILP problem is too long compared to the time required to solve the two LP models proposed by Procoval2. We should mention that the Bank Clearing Problem is shown to be an NP-complete problem (see Güntzer et al., 1998 for further details), and it is clearly an instance of the ILP formulation of Appendix A.

Procoval2's first model is a relaxation of the ILP formulation, and its solution may indicate the settlement of a proper fraction of title. The second model takes the solution from the first model and adjusts it to find a solution that ensures the settlement of integer numbers of titles. The solution from the last model may cause some clients to incur a lack of funds to cover slight adjustments that allow the solution to consider only integer numbers. To deal with this issue, there is a trusteeship, constituted from client resources, that is used to grant small credits that avoid overdraws when the clearing algorithm's solution is implemented. It is worth mentioning that Procoval2 may propose the partial settlement of one or more operations, keeping the remainders of these operations in a pending status.

Procoval2 processes mainly two types of operations: those that involve DvP mechanisms and those that correspond to amortizations of financial titles. When settling a DvP, the following elements must be specified: the operation to settle, the client that acts as the seller, the titles to be sold, the account from which these will be sold, the client that acts as the buyer and the account which will receive the titles. Likewise, when handling amortization operations, the client in charge of the payment, the title subject to the amortization and the client receiving the funds must be also specified.

Parameters for the clearing process are the operations awaiting clearing, the balances and positions of the clients and the effective balance of the trusteeship. Using these parameters, Procoval2 solves the two LP problems and returns the titles and cash that may be settled, as well as payments received by the trusteeship and credits granted by this mechanism to clients that require it. However, this algorithm might not clear all operations received and must send them back to the pre-settlement module queue. The net transfers calculated in this module are sent to the settlement procedure to modify the client's accounts and finalize the transactions within the SSS.

The operations received in the settlement module may arrive from the pre-settlement or the clearing procedures. There are two types of settlements used to process operations: gross settlement and net settlement. The first one settles operations one-by-one; on the other hand, net settlement makes security and/or cash exchanges for the net obligations involved in several operations (Bank for International Settlements, 1997). The operations arriving from clearing are settled using net settlements.

After an operation has been settled, a message confirming the settlement is sent to the client using the Concentration Module. This concludes the description of the operating model proposed for the SSS of INDEVAL. In order to determine if the described model is feasible, a simulation model was developed and used to make decisions related to the operational framework proposed for the SSS. The section on Simulation of a Securities Settlement System describes this simulation model in detail.

3. Simulation of a securities settlement system

In order to fulfill the objectives of the present research, a simulation model for the SSS was developed, that allows us to:

• Find a balance between the liquidity in the system and the time taken to settle operations.

• Analyze the advantages or limitations of using the rules of pre-settlement as parameters.

• Measure the performance of the SSS under these and other operational parameters defined in the Simulation Experiments section.

• Determine the set of values for the parameters that allow the SSS to work adequately according to specific performance measurements.

The simulation model intends to replicate the operations of INDEVAL's SSS if the proposed model was implemented. We will proceed to detail the general characteristics, the performance measurements used to evaluate the system, the parameters considered and the different simulated scenarios.

3.1. General characteristics of the simulation model

The simulation model of the SSS was developed using Visual Basic. NET and all three of its basic functions were implemented: pre-settlement, clearing and settlement. The LP problems for the clearing procedure were solved using the Cplex 10.0 solver, through a procedure that was exported to an executable DLL to facilitate its call from the simulator.

Inputs to the model include the relevant data from real transactions registered by INDEVAL in one day (one of the busiest transaction-wise days was taken) and title positions of each client's account at the beginning of the same day. We assume that the cash balances of all clients are zero except those of Banco de Mexico, whose account is used to fund those of the clients through repurchase operations.

The simulator processes the operations one by one, according to their arrival time. According to the model proposed for the SSS, different pre-settlement rules are applied to each operation, depending to its type, and settlement decisions are based on the balances calculated for each of the clients involved. An operation may be settled immediately, may be cleared or may keep its "pending" status awaiting for the conditions necessary for its immediate settlement or clearing.

The different types of operations considered in the simulation model, which make up for 99.9% of the operations settled in INDEVAL are: DvP, Delivery Free of Payment, Cash Deposit, Cash Withdrawal, Cash Transfer, and Amortizations (a principal is paid to the holders of a title).

Only DvPs and amortizations may be cleared. The clearing procedure used in the simulator is based on Procoval2 and is initiated by the same events suggested for the proposed SSS described in the section on Proposed Model for Settlements in INDEVAL.

3.2. Performance measures

As mentioned previously, the objective of developing a simulation model for the SSS is to find a balance between the levels of liquidity and the time required to perform the settlement of operations. To accomplish this objective, it is necessary to define performance measures that adequately monitor these variables when simulating the system under different conditions and operation parameters. In this section, we proceed to describe the performance measures used.

The first performance measure reported by the SSS simulator is the average settlement time of all the operations defined as:

where Tj is the time (in minutes) since the arrival of operation j until it is settled, and N is the number of operations settled on the day. The average settlement time is also reported for three additional cases: for operations settled in only one pass (a settlement or a clearing), for operations settled after several passes and for operations that never reach a complete settlement (partial settlements). These variants arise from the need to carefully study the settlement times of operations that undergo different settlement modalities.

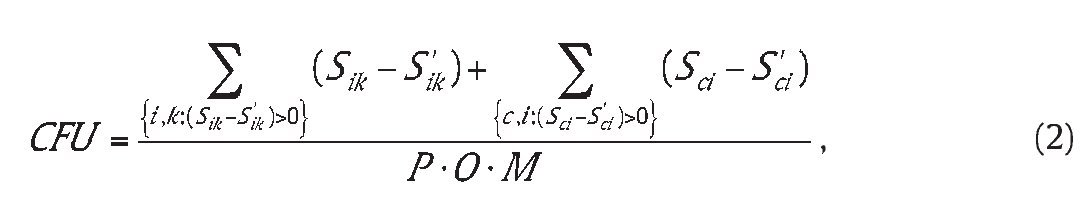

The second performance measure is used to study the liquidity of the SSS, and represents the amount of money required to settle operations in the system. This index is the amount of cash that is withdrawn from the account of every client for all operations per minute and is calculated according to:

where Sik is the balance of client i before settling operation k using a gross settlement, S´ik is the balance of client i after the settlement of operation k using a gross settlement, Sci is the balance of client i before the clearing process c settles an operation either partially or completely, S´ci is the balance of client i after clearing process c is completed, P is the number of clients that are involved in some operation throughout the day, O is the number of settled operations that involved cash and M is the number of operation minutes in a day at INDEVAL.

To study the system adequately, two variants of this liquidity measurement were considered: the first one takes into account all settled operations that involved cash (cash transfers, cash withdrawals, DvPs and amortizations) and the second one is used to measure the amount of cash used in settlement operations that may be incorporated into the clearing procedure, i.e., that are amortizations or DvPs. This last variant is useful to study the effect of clearings on the liquidity of the SSS.

As can be observed from the results of our experiments, there is a trade-off between the index of cash (2) and the average settlement time (1). For example, when the time between settlements decreases, we expect that the average settlement time (1) decreases but the index of cash (2) increases. Because of this trade-off, we decided to include a global performance index that considers both the amount of cash and the average operations settlement time. The value of this index is obtained by multiplying the amount of cash used in all operations that involve cash by the average settlement time of all operations:

where T and CFU are as defined in (1) and (2), respectively. It is worth mentioning that lower values for this index correspond to higher performances.

3.3. Simulation experiments

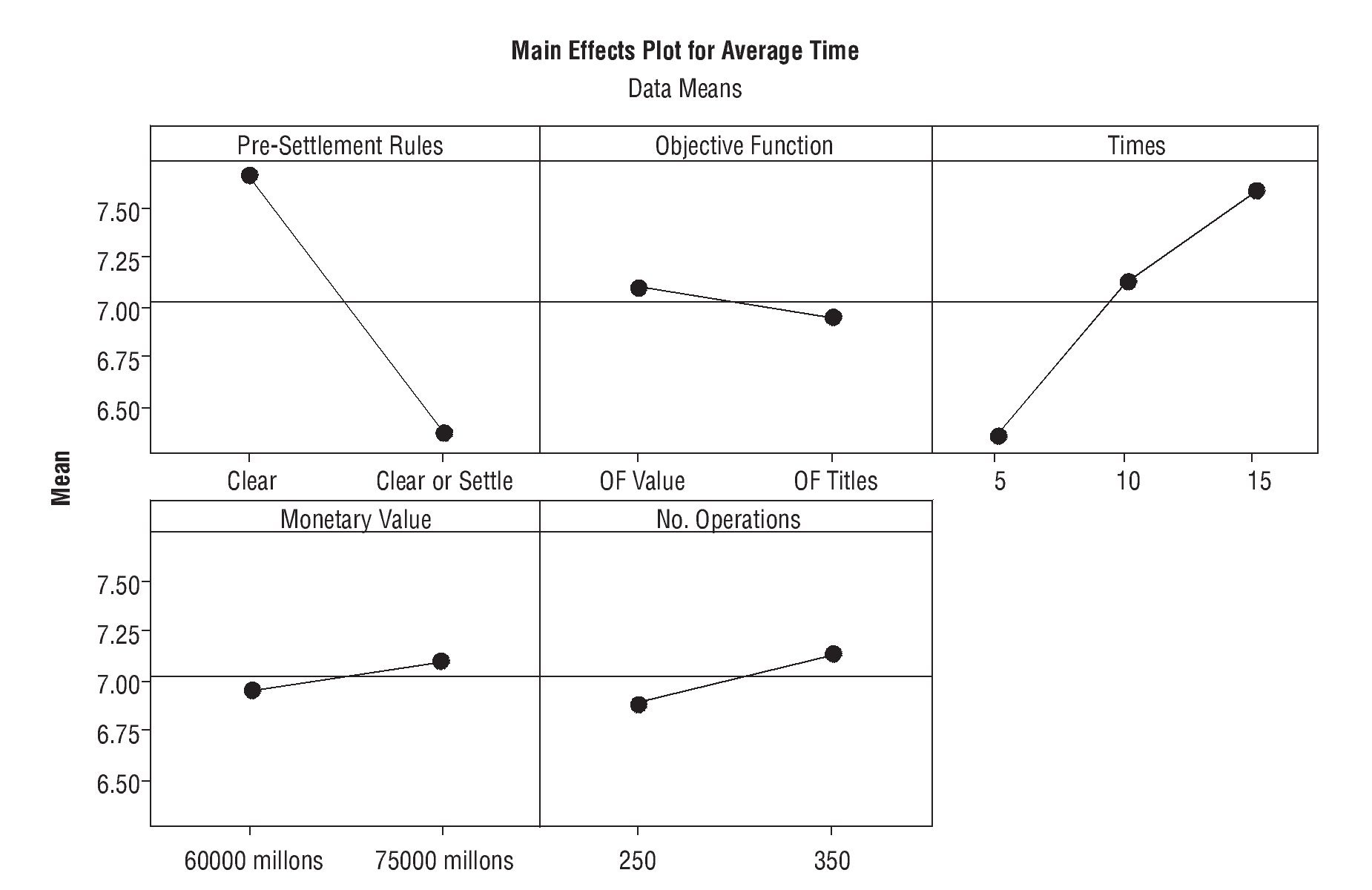

To analyze the impact of the operation parameters for the SSS, a series of experiments were designed to test hypotheses, analyze results and establish valid and objective conclusions. It is worth mentioning that the particular values considered for these parameters have been suggested by the experts of INDEVAL, whose input is based on their extensive knowledge, experience and historical data. The different parameter options considered in our simulation experiments were:

1. For pre-settlement rules regarding the clearing process, we considered two possible scenarios: one in which all DvPs and amortizations are sent to the clearing procedure and another in which all of these operations are settled immediately if the clients have enough funds (titles and cash) in their accounts or sent to the clearing procedure otherwise.

2. For the objective function used in the clearing procedure, we considered two possible variants. The first one corresponds to minimization of the amount of cash used in the cleared operations and the second to minimization of the number of titles to be settled after each clearing. Detailed specifications of both objective functions may be found in Appendix A.

3. The maximum monetary value of the operations waiting for clearing has two possible values: $60,000 million pesos and $75,000 million pesos.

4. The maximum number of operations waiting for clearing has 2 possible values: 250 and 350 operations.

5. Finally, the maximum time between clearings may be 5, 10 or 15 minutes.

By considering all possible combinations, we have 24 · 3 = 48 different scenarios.

4. Analysis of results

It is worth mentioning that the input data for each simulation experiment is not random, since it consisted of the arrival times and settlement instructions observed from a particularly busy workday, and only the rules or parameter values were different among experiments, as described previously. Although the alternative of generating random arrivals (e.g. Poisson processes) for the settlement instructions was considered, INDEVAL's experts strongly discouraged this idea arguing that the arrival patterns for transactions are not random, but rather highly dependent upon the information possessed by the clients, including information generated by the SSS itself. Also, as discussed in Martin and McAndrews (2008), the design of a liquidity-saving mechanism has important implications in participants' behavior. For these reasons, it is more adequate to consider the arrival data of a particularly hectic day -a worst case scenario- instead of attempting to model the arrival patterns. We proceed to discuss the results obtained for each of the three performance measurements considered.

4.1. Performance evaluation from average settlement time

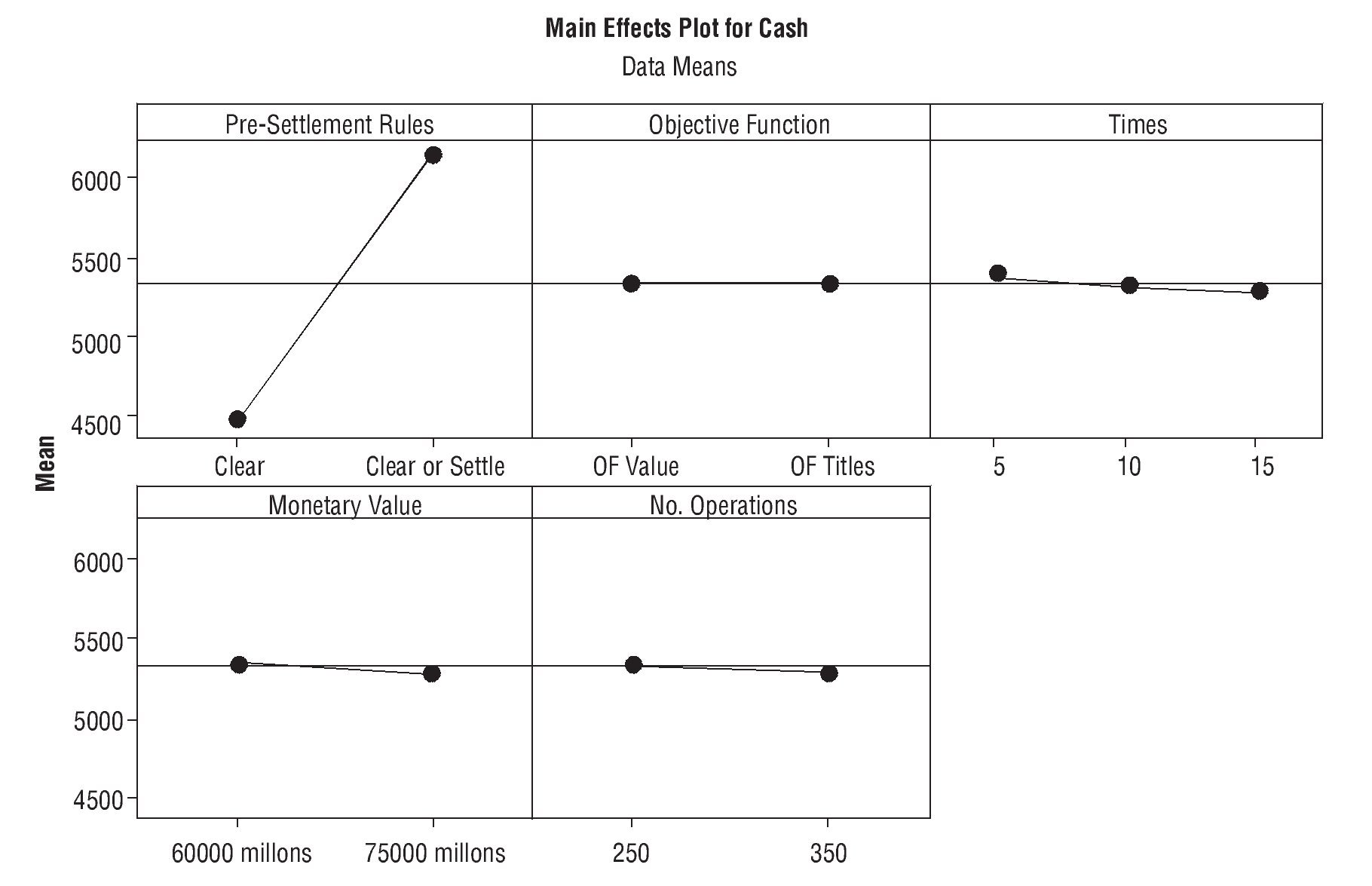

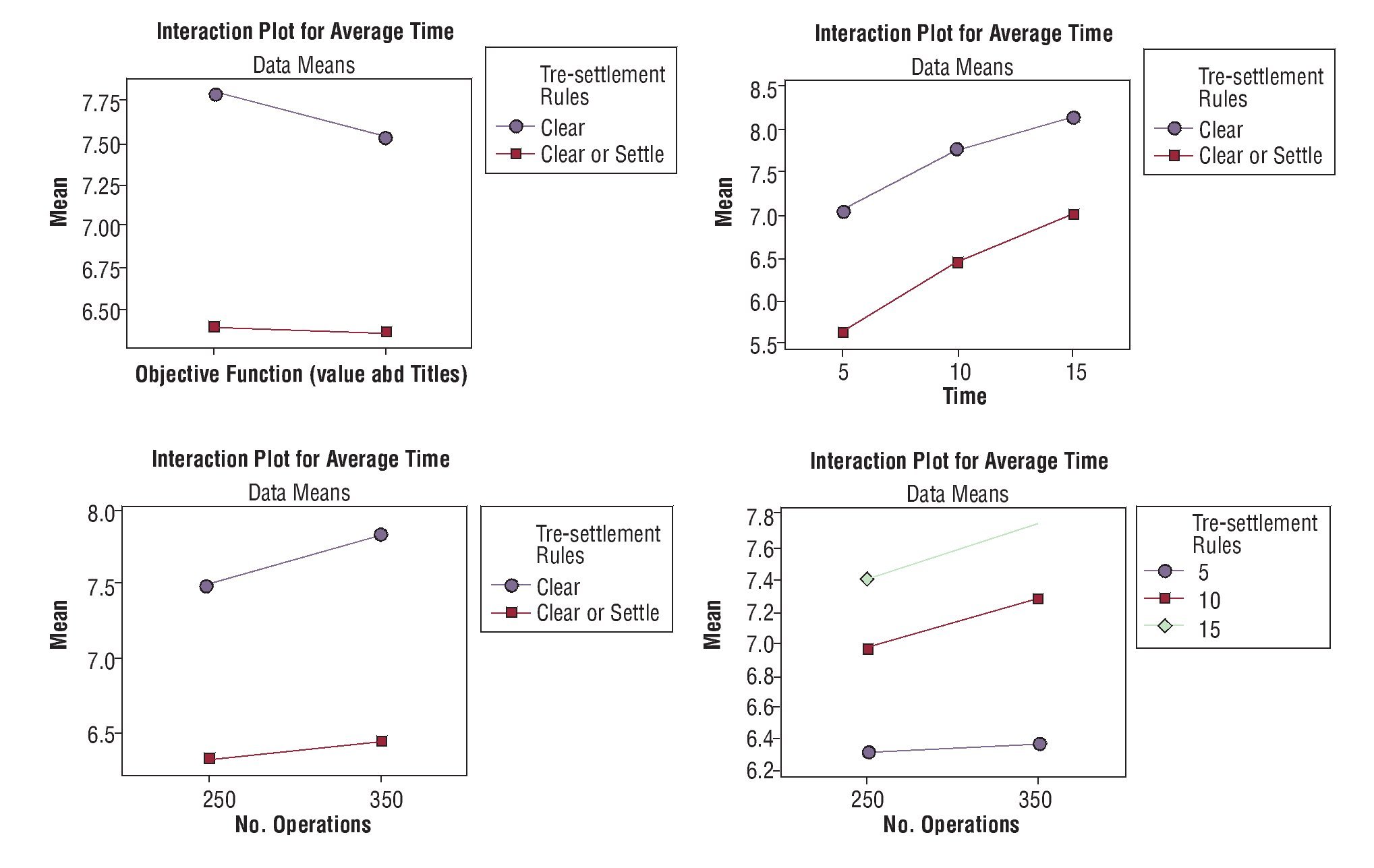

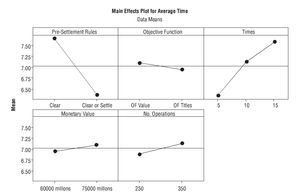

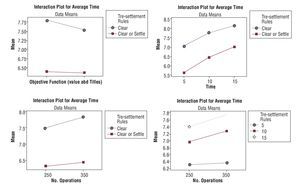

As can be seen from Figure 3, the optimal combination of factor levels, from a settlement time point of view, corresponds to: clearings and gross settlements for amortizations and DvP operations, an objective function minimizing the number of titles and maxima of 5 minutes between clearing, $60,000 million pesos for operations awaiting clearing and 250 transactions in queue for clearing.

Figure 3 Graphs of the main effects for the average settlement time.

On the other hand, as can be observed from the graphs of the interaction effects (Appendix B), the interactions do not change the optimal levels of each factor (the corresponding lines have no intersection).

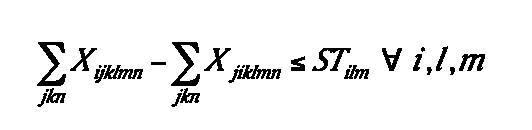

4.2. Performance evaluation from amount of cash used

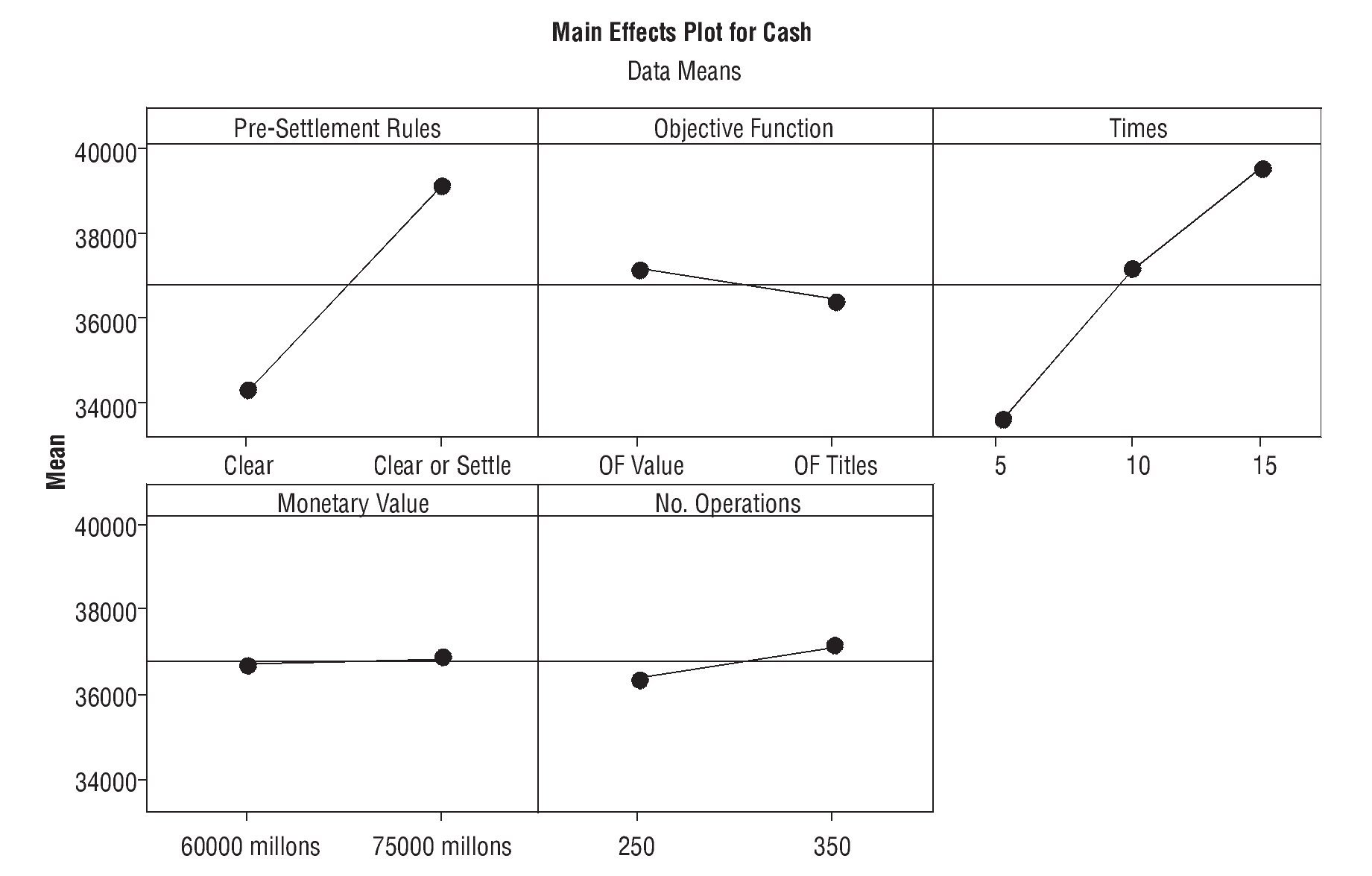

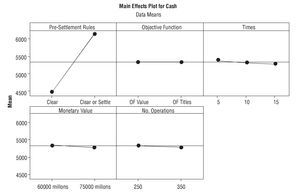

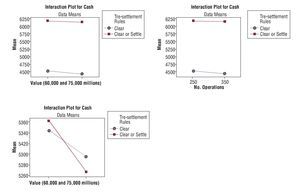

As we see from the interaction graphs in Appendix B, the interaction graph of only one combination (objective function × monetary value) has an intersection with its corresponding lines (see Appendix B) indicating that the combination of larger monetary values for operations waiting clearing with an objective function minimizing the cash for clearing operations generates a smaller amount of cash used.

As can be observed from the interaction graphs in Appendix B and the main effects graphs of Figure 4, from an amount of cash used point of view, the optimal combination of factor levels corresponds to the use of: clearings for all amortizations and DvP operations, an objective function optimizing the amount of cash used and maximums of 15 minutes between clearings, $75,000 million pesos for operations awaiting clearing and 350 transactions in queue for clearing. It should be noted that the optimal combination of factor levels for this case is the exact opposite of those that minimize the average settlement time, suggesting that there is a trade-off between reducing settlement times and using larger amounts of cash in the system.

Figure 4 Graphs of the main effects for amount of cash used.

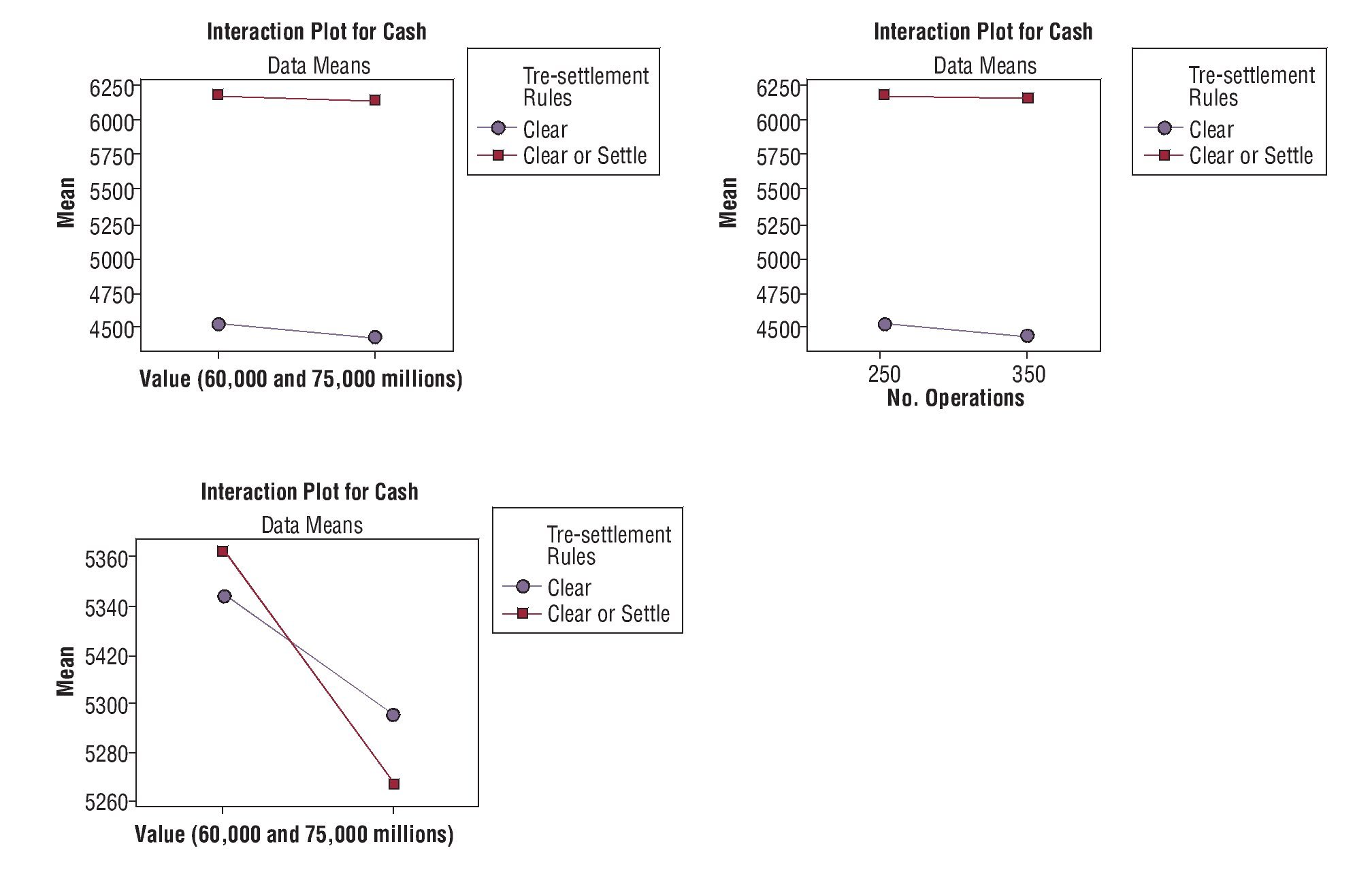

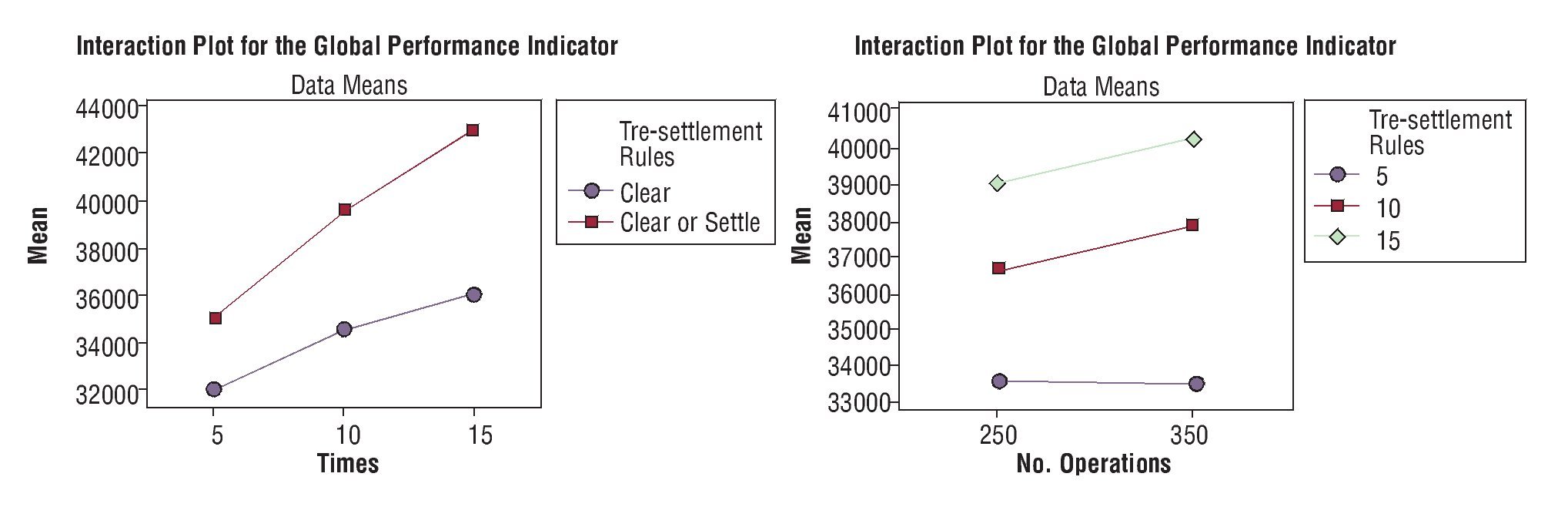

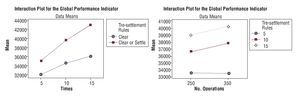

4.3. Results for the global performance index

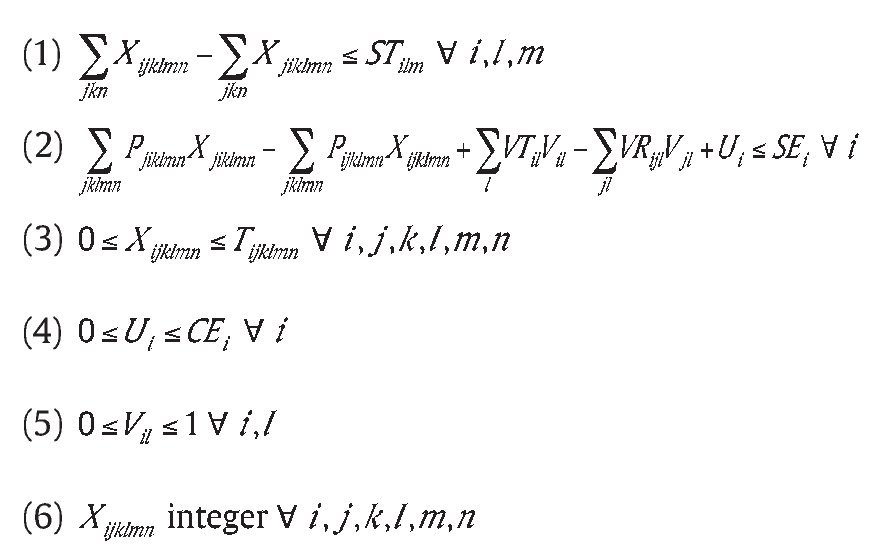

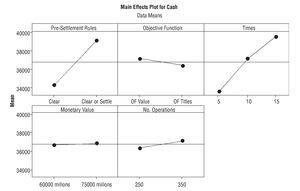

As can be observed from the interaction graphs of Appendix B and the main effects graphs of Figure 5, from a global performance index point of view, the optimal combination of factors corresponds to the use of: clearings for all DvP and amortization operations, an objective function optimizing the number of titles and maximums of 5 minutes between clearings, $60,000 million pesos for operations awaiting clearing and 250 transactions in queue for clearing.

Figure 5 Graphs of the main effects for the global performance index.

5. Conclusions

INDEVAL's new system was successfully launched on November 14, 2008 after three years of business process design and complex software programming, and after nine months of exhaustive daily tests. It is worth mentioning that its final version, approved by all stakeholders, incorporated several of the features presented in the SSS simulation developed in this project, including the ones stated below:

• The integration of gross and deferred net settlement in a single engine, offering a flexible and hybrid settlement structure.

• The enhanced version of the clearing algorithm.

• The execution parameters for the clearing process.

• The objective functions used in the LP problems of Procoval2.

• The handling of pending transactions considering the application of pre-settlement rules.

In addition, INDEVAL's new system has been operating daily using some of the values suggested in this research for the parameters that determine the activation of the clearing process and for the pre-settlement rules, e.g. five minutes between clearings and sending all DvP's and amortizations to clearance, presenting a great performance in terms of liquidity usage (between 1,426 and 2,192 pesos withdrawn from the account of every client for all operations per minute) and average settlement time (between 5.1 and 5.9 minutes, as experienced in the real system after the implementation). These results show that INDEVAL's new SSS works efficiently, combining a high settlement speed and an effective use of the cash and securities held in the CSD accounts.

The measurements used to analyze the performance of the SSS were defined to study both the liquidity of the system as well as the average time to settle operations. The results obtained for these measurements and for the operation of the SSS in general yielded the following benefits (see Muñoz et al., 2011 for detailed explanation):

• A sophisticated clearing and settlement engine that operates in a secure, reliable, automatic, and continuous process, handling efficiently all the transactions that INDEVAL receives from its clients.

• An intelligent pre-settlement function that controls the execution of clearance and settlement using few operation parameters, offering great flexibility and the possibility of adjusting these parameters to turn INDEVAL's hybrid SSS into a Real-Time Gross Settlement (RTGS) system when needed.

• Clearing and settlement cycles with accumulated settlement cash amounts of more than 500,000 million pesos per cycle; settlement amounts that would have been impossible for INDEVAL's old SSS to reach in a single cycle.

• An exceptionally efficient and enhanced clearing algorithm that is able to generate an accumulated settlement amount of more than 200,000 million pesos in a single settlement cycle with zero cash balances, except for 90,000 pesos (contained in the trusteeship's account) used for granting small credits that avoid overdraws. Finding an optimal solution takes no more than five tenths of a second. In regard to the size of the problems, they are large since there are 75 clients with over 50 accounts per client. In a typical day there may be 350 different issues being traded. In a five-minute interval we have observed around 2,500 decision variables being handled by the model.

• A reduction of 65% in the number of incoming phone call complaints related to INDEVAL's system, due to the better performance and reliability of the new SSS.

All the benefits stated above confirm that this project played an important role in the successful design and implementation of INDEVAL's new Securities Settlement System, and demonstrated that simulation and operations research can be very valuable tools for this kind of systems.

Acknowledgements

Support provided by the Asociación Mexicana de Cultura A.C. is highly appreciated. The authors would like to express their gratitude to the Associate Editor and an anonymous Referee for their valuable hints and suggestions.

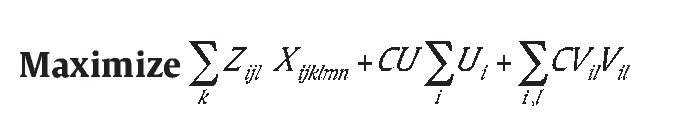

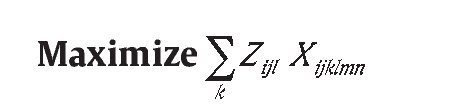

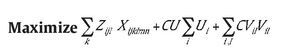

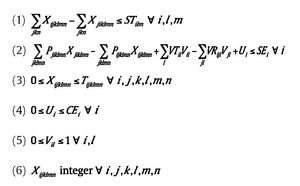

Appendix A. Linear programming models for clearing

Decision variables

Xijklmn: Number of titles l to be settled in (DvP) operation k, where client i intends to sell from his account m to the account n of buyer j.

Vil: Fraction that client i may pay from a pending amortization that corresponds to title l.

Ui: Total cash that client i pays in return for the special credit received in the previous clearing.

Model parameters

STilm: Initial balance of titles l in the account m of client i.

SEi: Cash balance of client i.

CEi: Special credit received by client i in the previous clearing.

Tijklmn: Number of titles l that client i intends to sell from his/her account m to the account n of client j in the (DvP) pending operation k.

Pijklmn: Price of titles l that client i intends to sell from his/her account m to the account n of client j, corresponding to the (DvP) pending operation k.

VTil: Total sum corresponding to the amortizations from title l that client i has still not paid.

VRijl: Total sum of the amortizations from title l that client i has yet to receive from client j.

SF: Balance of the trusteeship.

Zijl: Coefficient of variable Xijklmnin the objective functions.

CU: Coefficient of variables Ui in the objective function of the relaxed model.

CVil: Coefficient of the variable Vil in the objective function of the relaxed model.

The corresponding values for the parameters Zijl, CU and CVil determine the objective that is to be maximized. The values of these parameters for both objective functions considered are as follows:

Parameters for the objective function that maximizes the amount of cash of the cleared operations: Zijklmn = Pijklmn, CU = 100, CVil = VTil.

Parameters for the objective function that maximizes the number of titles suggested for clearing: Zijklmn = 1, CU = 100, CVil = VTil.

The coefficients CU and CVil must be relatively large since the initial amount used from the trusteeship must be totally paid, and the amortizations are obligations that must be paid during the day.

ILP Formulation: This model corresponds to a formulation for finding an exact solution to the clearing problem.

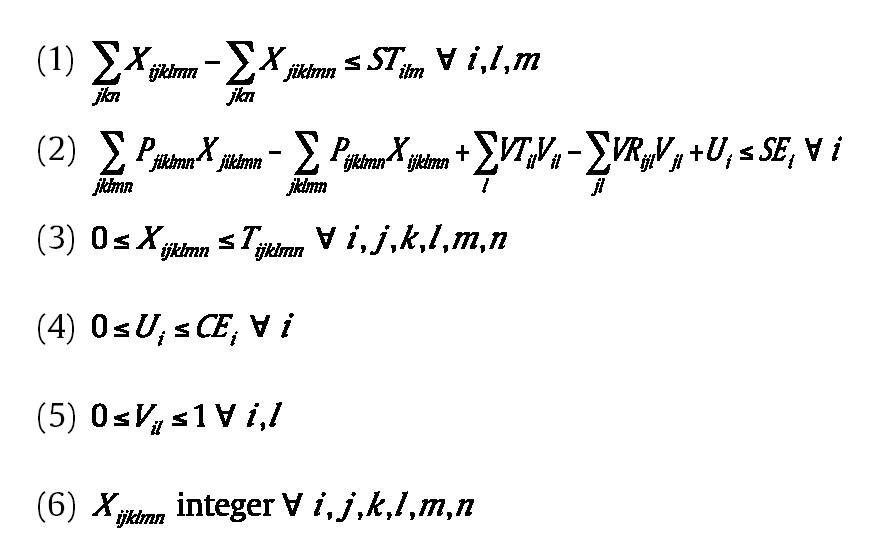

Subject to:

The purposes of each set of constraints are:

• Constraints (1) avoid overdraws in the balance of titles at any account of every client.

• Constraints (2) ensure all the client's cash balances are non-negative.

• Constraints (3) ensure the number of titles settled do not exceed those that are pending for each operation.

• Constraints (4) prevent clients from paying the trusteeship more than the amount they owe.

• Constraints (5) ensure all fractions of an amortization do not exceed the value of 1.

• Constraints (6) ensure the number of titles settled in each operation is integer.

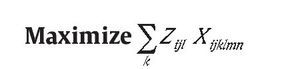

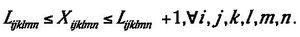

Formulation of the models used by Procoval2

Model 1: Relaxed Model

This model is the same as the one previously described without the last set of Constraints (6), so that its solution may provide fractional values for the variables Xijklmn.

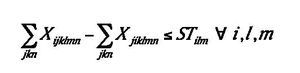

Model 2: Rounded Solution Model

This model starts from a solution obtained from the relaxed model, and requires the following additional parameters: Lijklmn: Integer part of the optimal value of Xijklmn in the relaxed model.

The formulation of this second model is:

Subject to:

Xijklmn = Lijklmn if the optimal resolution in the relaxed problem is Lijklmn, otherwise .

Note that the matrix of coefficients corresponding to this model is unimodular, so that the corresponding optimal solution is integer. The solution obtained from this model may require new credits from the trusteeship to fund the settlement of a rounded up title, therefore, all trusteeship credits must be recalculated. Since the optimal solution for model 1 is feasible for model 2, the optimal solution for model 2 can not be worse than the optimal solution for the original ILP model. This is because model 2 does not have a constraint on cash, and we are using the trusteeship to cover any cash requirement.

Appendix B. Interaction graphs

In this Appendix, we present the most significant interaction graphs for each performance measure.

Interaction Graphs for the amount of cash used

Interaction Graphs for the average settlement time

Interaction Graphs for the global performance index

Article history:

Recibido el 29 de marzo de 2012 Aceptado el 21 de agosto de 2012

* Autor para correspondencia.

Correo electrónico:

davidm@itam.mx (D.F. Muñoz).

References

Bank for International Settlements, 1997. Real-time gross settlement systems. Committee on Payment and Settlement Systems Publications, Basel.

Bank for International Settlements, 2001. core principles for systemically important payment systems. Committee on Payment and Settlement Systems Publications, Basel.

Bank for International Settlements, 2003. Glossary of terms used in payments and settlement systems. Committee on Payment and Settlement Systems Publications, Basel.

Bank for International Settlements, 2005. New developments in large-value payment systems. Committee on Payment and Settlement Systems Publications, Basel.

Bedford, P., Millard, J., Yang, J., 2005. Analysing the impact of operational incidents in large-value payment systems: A simulation approach. In: Leinonen, H., (Ed.), Liquidity, risks and speed in payment and settlement systems-A simulation approach. Bank of Finland Studies, Helsinki, pp. 247-274.

Centro de Estudios Monetarios Latinoamericanos and World Bank, 2003. Sistemas de compensación y liquidación de pagos y valores en México. Iniciativa de compensación y liquidación de pagos y valores del hemisferio occidental. World Bank, Mexico City.

Güntzer, M.M., Jungnickel, D., Leclerc, M., 1998. Efficient algorithms for the clearing of interbank payments. European Journal of Operational Research 106 (1), 212-219.

Horner, P., 2010. Safe, secure securities settlement. ORMS Today 37 (3), 48-52. Leinonen, H., Soramäki, K., 2003. Simulating interbank payment and securities settlement mechanisms with the BoF-PSS2 simulator. Bank of Finland Discussion Papers, Helsinki.

Martin, A., McAndrews, J., 2008. Liquidity-saving mechanisms. Journal of Monetary Economics 55 (3), 554-567.

Muñoz, D.F., De Lascurain, M., Romero-Hernández, O., Solis, F., De los Santos, L., Palacios-Brun, A., et al., 2011. Indeval develops a new operating and settlement system using operations research. Interfaces 41 (1), 8-17.

Romero O., De Lascurain, M., Muñoz, D.F., Romero, S., Muñoz, D.G., Palacios, A., et al., 2008. Business process modeling for a central securities depository. Business Process Management Journal 14 (3), 419-431.

The Giovannini Group, 2003. Second report on EU clearing and settlement arrangements. Giovannini Group, Brussels.