The introduction of Category Management in operational resources purchasing helps to improve logistics service levels and increase the profitability of industrial enterprises. There are two main purposes of the provided article. The first purpose is to develop a methodological framework for category management of operational resources supply for large industrial enterprises. Secondly, it aims to offer a mechanism for inter-organizational collaboration with suppliers and contractors in supply chains. This study is based on the methods of forecasting of the uncertain stock demand. Time-series and correlation-regression models are used for forecasting. The first finding of the research is the systematization and classification of the operational resources purchased by industrial enterprises. Modified models of operational resources inventory management and a methodology for assessing tied-up losses are offered in this article and, they are based on category management. A developed methodology allows one to make strategic decisions in the field of procurement. According to the preliminary estimates, implementation of the proposed approaches increases net profit in large industrial companies by 4–5 % in relative periods.

A large number of the publications (Arkader & Ferreira, 2004; Buzukova, 2009; Castaldo et al., 2009; Desrochers & Nelson, 2006; Dussart, 1998; Gerasimova et al., 2021; Gruen & Shah, 2000; Han et al., 2014; Hübner & Kuhn, 2012; Mao et al., 2021; Mitchell & Balabanis, 2021; Nakkas et al., 2014; Shestak & Tsyplakova, 2023; Snegireva, 2007; Vellhoff & Masson, 2004) is devoted to the methods of assortment category management in retail companies, supplemented by a considerable practical experience of using these methods in business. The introduction of Category Management in operational resources purchasing helps to improve logistics service levels and increase the profitability of industrial enterprises.

Methods of improving procurement activities are discussed by Boutellir and Korsten (2006), Lajsons and Dzhillingem (2005), and Linders et al. (2007) in detail. However, issues related to the provision of supplementary resources to industrial enterprises that aren't a part of a finished product, but vary significantly in the breadth of the assortment and unit value, have not been the subject of a separate study to date. Accordingly, modifications and classical models of planning (forecasting) stocks of operational resources are no longer relevant (Schreibfeder, 2006; Sigel, 2002). The consumption of these resources is stochastic, while the degree of consumption variability does not allow the use of traditional methods based on the analysis of time series characteristics.

Therefore, the analysis of the mentioned works and the available practical experience of applying category management in business indicates the use of these principles primarily in the sales sector and relates primarily to assortment management in retail companies. At the same time, there are significantly fewer examples of using category management in industrial production. While the business in the retail sector has been able to develop certain industry standards over many years, such universal principles and approaches are almost absent in production companies. A similar situation is observed in the procurement sector for raw materials, components, and operational resources.

Currently, there is no established terminology for determining the resources, purchased by companies to support their activities. For example, many companies use concepts such as "Indirect Procurement" which can also refer to indirect business communications established through several dealers, or "Maintenance, Repairs, and Operations" which refers only to resources for maintenance, repair, and maintenance of fixed assets. To clarify and systematize the concepts used, the authors propose to use the broader term “operational resources” which will include any materials (auxiliary, consumables) that are not part of the finished products produced by enterprises but are necessary to ensure the continuity of production processes.

Thus, operational resources are not sold to the customers of the downstream demand chain but they are objects of internal consumption. The customers of these objects are the production divisions of companies (“internal customers”). The operational resources purchased by industrial companies are a wide range of stocks - on average from 10 to 15 thousand categories. The market of operational resources suppliers is characterized by a higher level of competition, compared with purchases of primary raw materials and materials where long-term economic ties are established with a sufficiently limited number of participants. When purchasing raw and other materials and components, the supply chain focuses mainly on working with suppliers, and the most challenging aspect is building relationships with internal customers.

Therefore, this article is dedicated to the development of principles for category management in large industrial companies, as well as the modification of approaches to planning (forecasting) the need for operational resource inventory. Considering the specificity of life support resource consumption, traditional planning methods and models may be less accurate, which will negatively affect the volume of finished product production and the fulfillment of production companies' obligations to their clients.

Moreover, the article developers introduce a new concept of "Supply Service Level", which can be used to assess the effectiveness of procurement function in companies. The methodology for calculating this indicator, which the authors of the article are developing, takes into account the losses from the immobilization of the company's working capital in inventory. At the same time, an original approach is proposed to evaluate the discount rate, the determination of which is currently a matter of debate, as confirmed by the analysis of the literature sources cited above.

The article presents the main principles of forming organizational structures for managing companies, which should become matrix-based, when implementing category management in procurement. This approach should raise the status of operational resources, which will contribute to a better understanding by employees of the company's activities as a whole and increase responsibility for their actions.

These proposals will contribute to increasing the efficiency of the production business by integrating inventory management processes for raw materials in procurement and finished products in sales. Under a comprehensive material flow management approach, managers responsible for specific categories will handle all tasks related to inventory needs planning, supplier selection, procurement, supply monitoring, resource acceptance, and release to production. Operational resources will also become the responsibility of designated managers, who will interact with the company's internal customers, leaving only the planning of overall needs and transferring plans to category managers in their sphere of responsibility. It can be stated that the proposals formulated in this article serve as the basis for the reengineering of procurement and inventory management business processes.

Furthermore, the authors demonstrate that traditional methods of planning inventory needs for operational resources do not always produce the desired results, especially for material categories whose consumption statistics are random and predominantly lack formalizable trends.

In addition, the disadvantages of using traditional approaches are associated with the need to exclude random fluctuations that distort formalizable parameters, the results of which directly depend on the experts' experience and intuition. The process of selecting weighting coefficients in models based on long retrospective series (e.g., 3–5 years) such as weighted moving average or weighted exponential average can also be challenging. Selecting weighting coefficients, which take into account the relative importance of different periods to each other, is subjective since it relies on expert opinions.

Correlation-regression models, which can be used in this case as an alternative to time series extrapolation methods, require significant time and financial resources due to their labor-intensive nature. However, they do not always produce the expected results due to the need to propose a series of statistical hypotheses that are not always confirmed in practice. One way to overcome these problems could be to use harmonic analysis, in which statistics are represented as a sum of "harmonics" (Fourier series terms).

This is due to the fact that the expenditure of the majority of operational resources includes periodic (quasi-periodic) processes. Harmonic analysis, widely used in natural sciences such as meteorology, and in social sciences such as economics and management, is almost never used. In the article, the authors present a modified approach to conducting harmonic analysis in the procurement activities of industrial companies, which can be successfully used in other business areas as well.

MethodologyThe research methodology is based on the data analysis connected with the procurement and consumption of operational resources. The authors collected data from open-source statistics and identified specific relationships between suppliers, intermediate dealers, and industrial enterprises from corporate reports of mining companies. The main hypothesis is that operational resource supply and consumption are stochastic.

The authors investigated the statistics of usage (issuance of materials into the production process) of the following categories, which make up about 90 % of all the nomenclature of operational resources purchased by mining companies in Russia: drill bits and rods; excavator bucket teeth; steel cables; rails; wooden sleepers; rolled steel of black and non-ferrous metals; steel pipes; welding electrodes; cable and wire products; timber; lubricants; explosives and detonators. The mining industry in Russia is dynamically changing in accordance with global trends. The industry leaders' stocks are traded on global exchanges. The goods produced by mining companies are also objects of exchange trading, the prices of which depend on demand in global markets.

The statistics analyzed by the authors cover the period from 2015 to 2022. Tested hypotheses have been analyzed on the basis of data from approximately 100 key industry enterprises engaged in coal extraction and ferrous mining in Russia. Analysis of the selected statistics by categories of operational resources showed its compliance with the normal (Gaussian) distribution, which made it possible to apply methods of linear extrapolation and correlation-regression models when planning inventory needs.

Authors argue that the category management application to the operational resources purchasing process reduces operational costs and increases the profitability of an industrial enterprise.

The above-mentioned assumptions are based on the nature of providing industrial enterprises with auxiliary items that are not considered components of the finished goods. These features are reflected in the procedures of supply organization, the width of the materials range, and the product unit cost. That is why supply/purchasing logistics for industrial companies requires additional research on supply market characteristics for operational resources, limits of the purchasing budget for these purposes, and complexity of demand planning (forecasting) for this type of resource.

The researchers have compiled statistics on the supply and consumption of operational resources by volume. The range of operational resources in some industrial enterprises has exceeded 11 thousand items. In addition to the shreds of evidence mentioned, both direct costs of companies dealing with procurement, delivery, and storage of operational resources and indirect losses from working capital tie-ups and shortage of necessary stocks in warehouses are included. The main sources of information are the Federal State Statistics Service of the Russian Federation and corporate reports of mining enterprises with profit and loss accounts published on the Internet.

Methods of system-oriented, technical, economic, and financial analysis as well as mathematical statistics have been used to process the received data. In order to assess tied-up losses of working capital, the authors have modified the Capital Assets Pricing Model (CAPM). The expanded CAPM includes components reflecting inflationary pressures, opportunity costs, changes in share exchange quotations of mining companies, and the cost of mineral extraction.

In processing time series data, the authors further divided all analyzed operational resources into 9 groups using the following principles. The first 3 groups were obtained using ABC-analysis according to the 80/20 rule (Pareto principle), where losses (losses) of the company from the absence of necessary stocks in warehouses located directly at the places of mineral extraction were used as a segmentation criterion. The results of this analysis allowed for a differentiated approach to determining the Supply Service Level (SSL). For the most critical positions, the absence of which leads to maximum losses (for example, spare parts for production equipment), SSL is recommended to be maintained at a level close to 100 %. That is, inventory of such positions should always be available in sufficient quantities, with a focus on rare statistical cases of simultaneous failure of several units of equipment and, accordingly, stopping the production process.

The next 3 groups were obtained by dividing the analyzed inventory of operational resources according to the degree of variability of the demand relative to the average chronological value (XYZ-analysis). For resource positions with stable demand trends and minimal variability, extrapolation methods were considered in planning warehouse stocks. Similar recommendations were given for seasonal stocks, but with an additional assessment of seasonality coefficients in statistics. Finally, for resources with chaotic demand, the use of correlation regression models was recommended. However, for positions where the share of random fluctuations is dominant, harmonic analysis was proposed.

Thus, the overlapping results of ABC and XYZ analysis made it possible to form 9 inventory groups with the development of a differentiated approach to calculating SSL and choosing a method for forecasting the demand of warehouse inventory for operational resources.

ResultsIn management theory, a fairly large number of approaches to classifying material resources that companies in various business spheres work with are considered. For example, in Kraljic's work (Kraljic, 1983), the entire range of purchased inventory is proposed to be divided into 4 categories, using two criteria - the impact of a particular item on the company's profit and the degree of competition in the market where the inventory is purchased (procurement risks). In our opinion, this approach segments the assortment too broadly and does not take into account many specific characteristics for individual categories and inventory items, such as procurement cost, sales volume, batch sizes, etc. Therefore, it can be used at the preliminary stage when dividing purchased resources into classes that group inventory by the main directions of the company's activity.

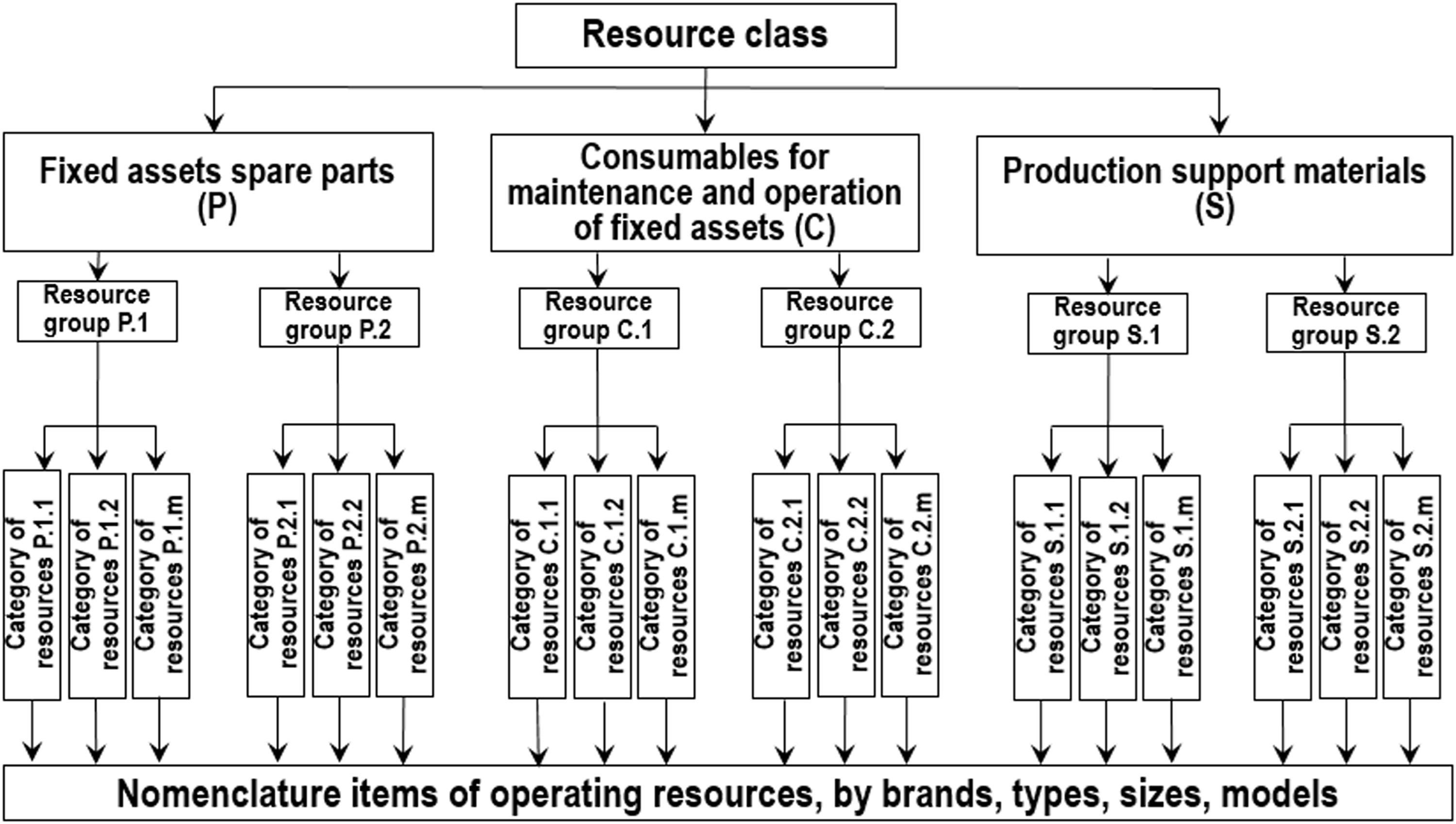

Category management of purchases should be based on grouping of stocks according to the purposes of their acquisition, and usage and consumption parameters. The consumption planning should be performed based on a resource classifier representing a full list of all items necessary for production and economic activity. To separate the entire range of operational resources, it is necessary to diversify stocks into several levels in the classifier in accordance with their common characteristics or properties (see Fig. 1):

- 1.

Resource classes group procurement items into the main areas of activity, among which are spare parts, consumables for the repair and operation of fixed assets, and support materials for the implementation of production processes.

- 2.

Resource groups are aggregations of stocks combined with some common features. If the material characteristic is the way of production or usage, then the stock is divided into spare parts for production, lifting and transport equipment, fuel, etc.

- 3.

Resource categories are inventory aggregations grouped by functional purpose similar to their consumer properties. They are interrelated (partly interchangeable) and have similar storage and transportation conditions, for example, metal sheet, grade metal, cable, wire, cut board, etc.

- 4.

Material groups divide resources by brands, and models and represent individual inventory items in the accounting system.

It is expedient to classify purchased resources using ABC analysis, which is based on the Pareto rule - 80/20 (Aktunc et al., 2019; Pandya & Thakkar, 2016; Scholz-Reiter et al., 2012; Shestak & Savenkova, 2023; Veresha, 2016). ABC analysis can be conducted using multiple criteria, allowing for the creation of a larger number of resource categories, sufficient for developing individual approaches to inventory management for each. For example, for operational resources, the temporary absence of which can lead to serious losses for the company, it is advisable to use models in which the inventory level is constantly monitored using a threshold level.

Conversely, for non-critical positions, inventory management models can be recommended, in which checking the inventory level is discrete, by a schedule.

In the subsequent development of diversified approaches to inventory planning, in addition to ABC analysis, XYZ analysis can be used. The only criterion for classification in XYZ analysis is the coefficient of variation of sales relative to their mean chronological value (Gonzalez & González, 2010). As a result, we can segment the available assortment into several nomenclature groups (AX, AY, AZ, BX, BY, BZ, CX, CY, CZ) and group operational resources according to similar consumption trends.

Positions of resources with a coefficient of variation in shipment not exceeding 10 % can be classified as an "X" group and recommended for the simplest approaches in planning inventory needs based on extrapolation of identified trends, such as trend forecasting, simple average, etc. For such positions, supplied by the most reliable suppliers, "Just-in-Time" purchasing can also be organized. For resource positions with a coefficient of variation in the range of 10 to 25 % (group "Y"), modified extrapolation methods with additional evaluation of seasonal coefficients can be recommended for inventory planning.

Finally, for resources with coefficients of variation exceeding 25 % (group "Z"), it is advisable to use correlation regression models. However, for resources in which random fluctuations dominate in statistics, the authors propose using harmonic analysis.

When making purchases, it is advisable to allocate each of the presented categories of operational resources into a separate channel of supply, with the appointment of managers by category, who should be delegated the functions of planning the need, establishing business relationships with suppliers, finding ways to optimize the cost of acquisition and delivery, as well as inventory management.

Grouping the need for interchangeable (similar) resources at the category level will allow suppliers to place bulk orders, thereby achieving savings on procurement without increasing the overall requirement for reserves and eliminating additional losses from capital mobilization. The management of a specific category should be administered by a category manager and cover the full cycle of work, ranging from demand planning, procurement, and leave to production, regardless of the subordination of internal customers to companies. Category managers will accumulate information about the operational resource requirements for the next period, with the information received from internal customers according to the following algorithm:

- 1.

Collection of requests for requirements for the next planning period.

- 2.

Consolidation of the need for operational resources from all consumers.

- 3.

Checking the stock in the storage being in place as part of the rolling stock.

- 4.

Calculation of the net purchase requirement.

- 5.

Creating and placing a replenishment order from the supplier.

In addition, the category manager must organize the supply process, monitor and evaluate suppliers’ performance, as well as storage and release (issuance) from the expendable warehouse resources by material responsible persons for the needs of the production process. A category manager's function includes duties traditionally performed by purchasing specialists, marketers, and logistics. Allocation of managers by category will make it possible to achieve a reduction in the volume of stocks stored in warehouses, by reducing the number of errors by representatives of related services of industrial companies that arise when duplicating orders. On the other hand, the activities of category managers will prevent overstating order sizes to receive wholesale discounts or place orders earlier than necessary. It is assumed that the collection of demand requests and the verification of stock availability will be conducted by representatives of the company's internal customers, while category managers will handle the remaining activities.

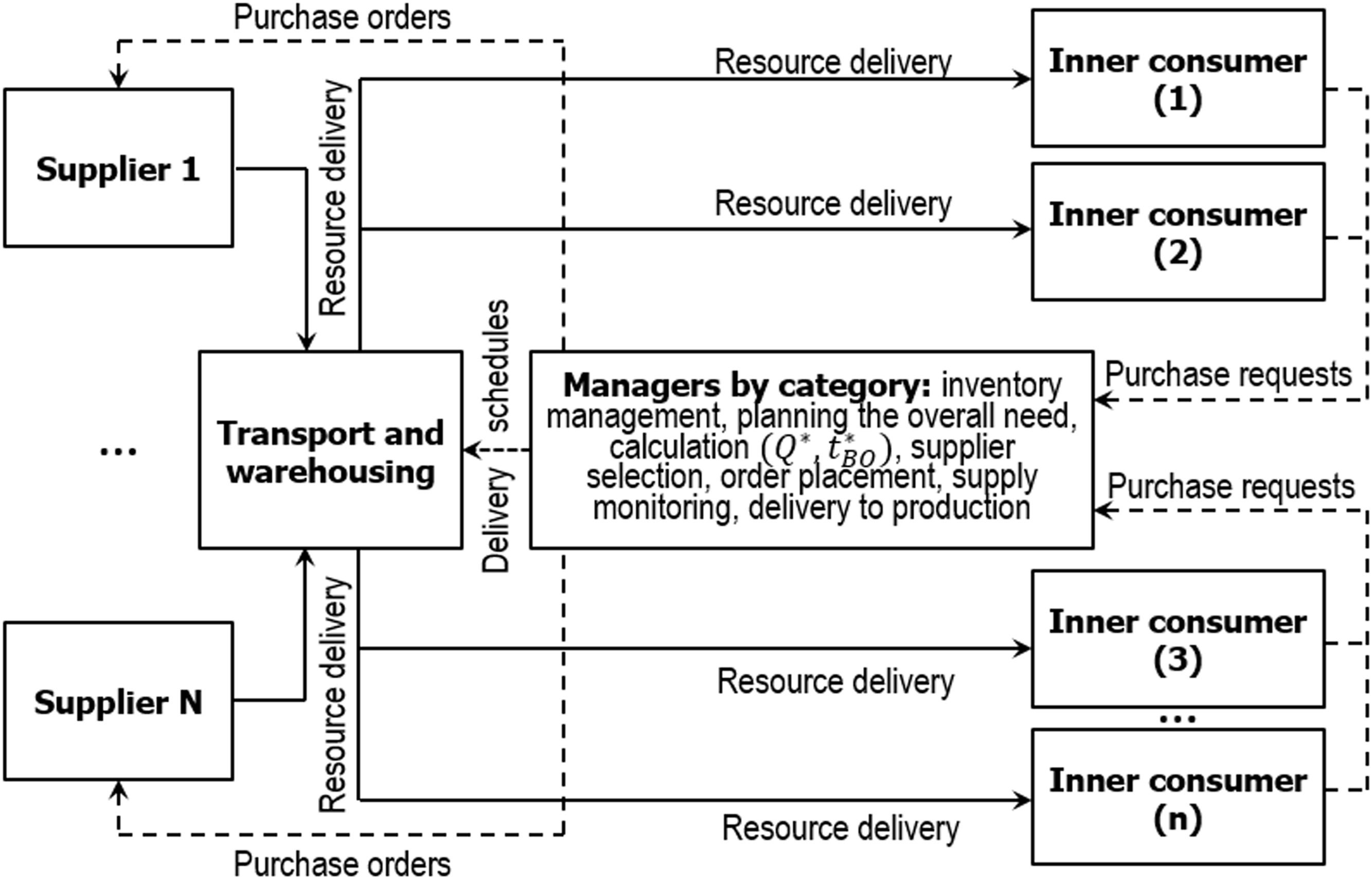

Organizational and functional scheme of interaction of industrial companies with operational resources suppliersFig. 2 shows the perspective scheme of industrial companies' interaction with suppliers involving the integration of procurement and inventory management functions within category management.

In this case, internal operational resource customers pre-submit to managers by category purchase requisitions that determine the overall need, as well as the optimal order Quantity (EOQ/Q*) and the time intervals between related orders (tBO*) according to the minimum total cost of the supply chain.

Thus, preliminary delivery schedules are developed to aid in the selection of suppliers and in negotiations regarding the terms of purchase contracts. These schedules are utilized alongside traditional commercial criteria such as price and payment terms. In other words, the best source of supply from all available on the market will not necessarily be suppliers offering minimum selling prices or maximum quality. Such suppliers will be the companies that can make deliveries in the mode closest to the optimal conditions of the industrial company. That is when selecting suppliers, it is necessary to additionally take into account the logistic criteria used in inventory management.

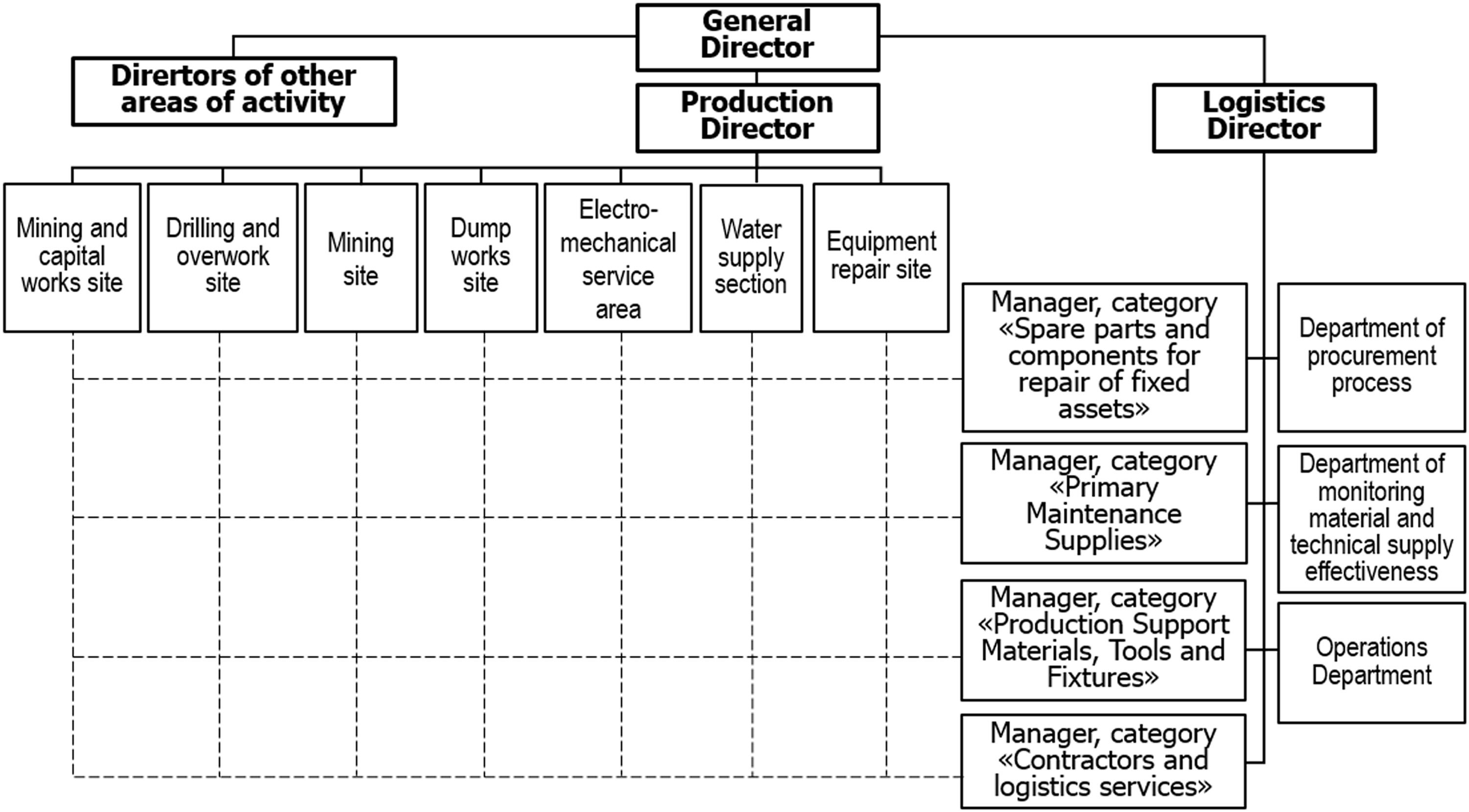

Since the supply chain intersects several activities, inter-functional coordination is advisable through the Logistics Department, transferring inventory management to it and setting the goal of minimizing the total (aggregate) costs arising in related areas of the company's activities. Logistics managers should be cross-functional category teams responsible for the accuracy of demand planning and the speed of inventory turnover. The proposals on the organizational structure of supply management in industrial companies are presented in Fig. 3.

In order to increase the level of objectivity in the selection of operational resources and service providers, it is necessary to involve representatives of internal customers to participate in the competitive procedures, in the development of lists of criteria, and the evaluation of their importance. For instance, beyond the traditional business metrics for proposal assessment, engineering services can establish requirements for procurement items, focusing on their specifications and their applicability in the maintenance of fixed assets. Production units must determine the quality of support materials and the reliability of supplies. Transportation and storage facilities may recommend the geographical location of the suppliers and the level of logistics infrastructure development in the regions to maintain the time of execution of the order at an acceptable level.

Extrapolation methods for calculating the need for operational resourcesExtrapolation methods for planning (forecasting) the demand for operational resources' inventory can be effectively used for positions that have stable and seasonal consumption trends. In mining companies, spare parts for production equipment that are used for planned maintenance and repairs (MRO) are consistently consumed.

Materials with seasonal consumption can be attributed to items whose demand is predominantly dependent on climatic conditions. For example, during the winter-spring period, the extraction of minerals occurs in more challenging conditions due to the freezing of rock, resulting in an increased demand for certain positions of operational resources. Typical examples of such positions for mining companies are excavator bucket teeth and steel cables for their rigging.

Since long-term and periodic (seasonal) components in the consumption statistics of such positions are the dominant components, inventory demand planning results based on time series extrapolation methods will be accurate. Such methods will be sufficiently effective, with minimal labor and financial resources, in terms of finding an economic compromise between the availability of inventory in the company's warehouse (SSL) and the costs of their acquisition and storage.

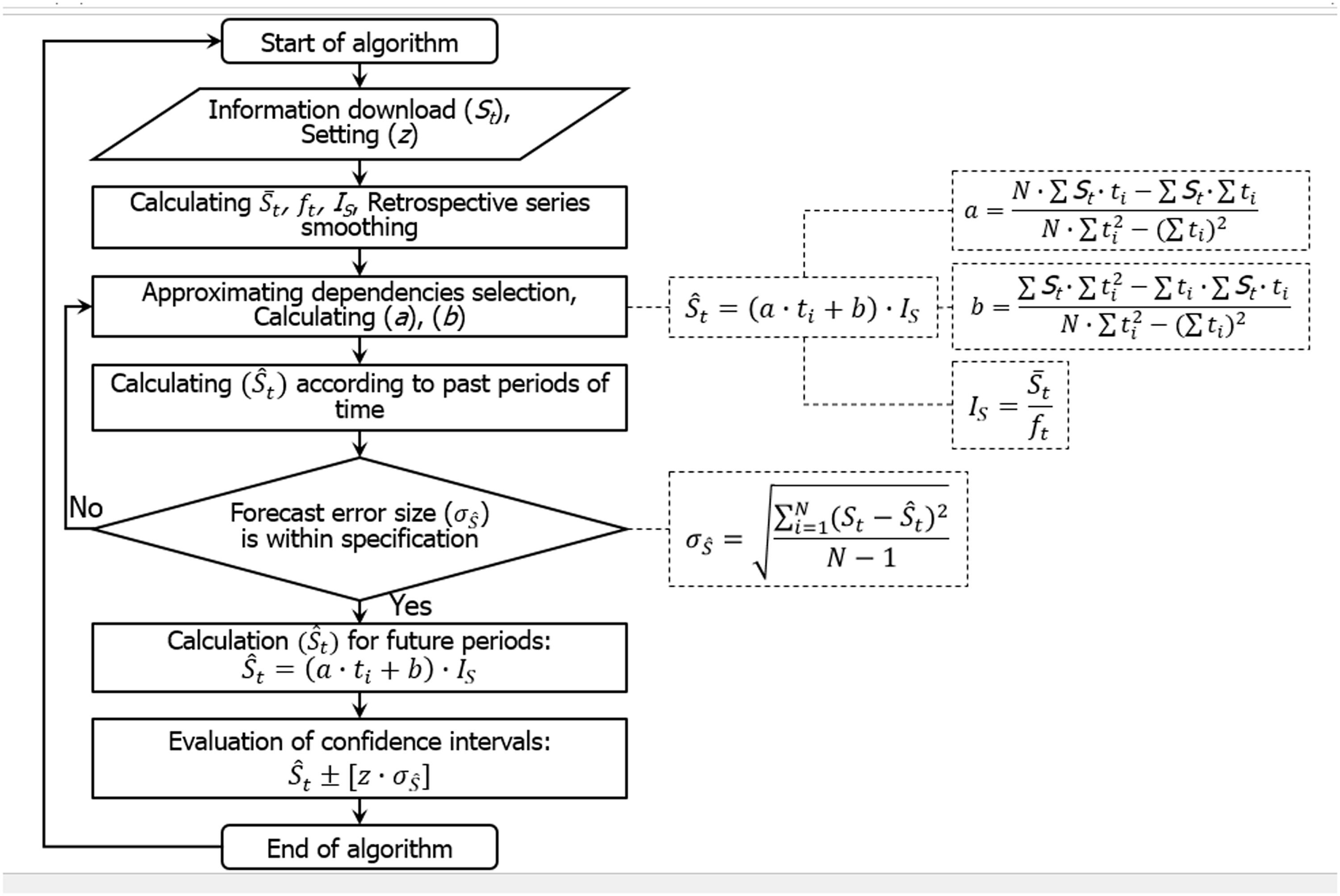

Operational resource consumption and the vendor's lead time are the main parameters of inventory management models that require forecasting (Sigel, 2002). Time-series extrapolations based on the dissemination of past trends for the future can be used for the purpose of demand forecasting needs. The flow of operational resources at the time (t) can be formalized by the following formula:

where a – factor reflecting the angle of the trend line to the OX axis;b – factor representing the distance from the origin to the intersection point of the trend line with the OY axis;

St – number of resources released at a time (t);

z – normal distribution law parameter that corresponds to the defined (optimal) level of the supply service;

ft – operational resource consumption trend value;

S¯t – average operational resource consumption for the reporting period;

S¯0 – average historical expenditure of operational resources over a long period;

S^t– estimated operational resource consumption at a time (t);

N – number of members of the time series of operational resource consumption.

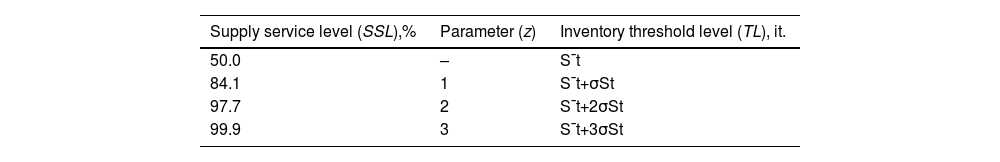

If your vendor's operational resources and lead times are normally allocated, using the standard quadratic rate deviation of lead time (σSt), you can determine the insurance reserve levels corresponding to the optimal level of the supply service (Table 1).

Supply service level (SSL) is the proportion of the needs of domestic customers of industrial companies, which can be satisfied with the available operational resources in the inventory between the next supplies. For logistics services and repair and construction works, the level of service is the share of applications executed in time, in the total number of applications received from internal customers. The actual level of procurement service with which the purchasing department meets the current need can be determined by the formula:

where ∑i=1NSi – total need of the internal customers of the industrial company in the stock of operational resources;∑i=1kSifact – total number of operational resources that have been met with available supplies in the inventory;

N,k – number of units of operational resources required and issued to the production process (k

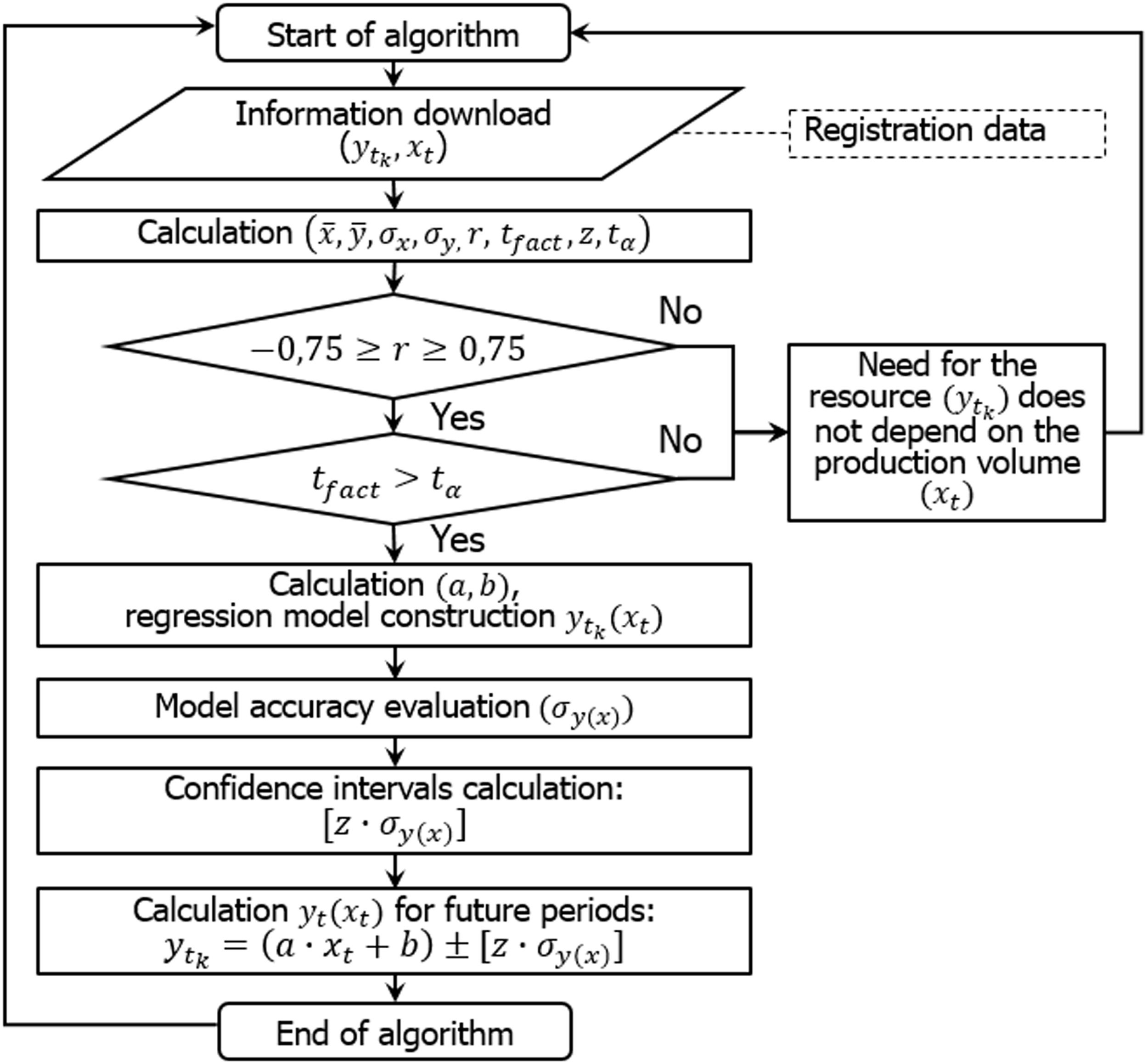

As can be seen from the formula (4), at close to each other values ∑i=1NSi and ∑i=1kSifact, SL→1.0 and the more complete the supply service satisfies the need for the necessary operational resources. A block diagram of the proposed algorithm for calculating the predicted operational resource consumption values by time series is indicated in Fig. 4.

The task of managers by category is to define parameter (z) for calculation of insurance stock in order to minimize losses from deficit on the one hand, and on the other, to prevent sharp increase of costs related to immobilization of working capital. The search for a balance between these unavoidable losses is to determine the optimal level of supply service (SLopt), which for the resource category (k) is proposed by the following formula:

where Hi – loss from the stock deficit by position (i);ci – specific cost of operational resources purchased from the supplier by position (i); i – rate of loss from the immobilization of working capital in the value of the unit of operational resources by position (i).

In this formula, storage costs are assumed to be zero, since industrial companies and their suppliers, representing large manufacturing enterprises, use their infrastructure as a rule. In this case, the cost of keeping stocks refers to conventionally constant costs which do not depend on the level of inventory. Losses from the immobilization of working capital are understood as losses in an implicit form (not reflected in the accounting records) related to the formation of reserves of operational resources and the diversion of financial resources to the company. On the one hand, the losses from immobilization can be calculated on the basis that the money invested in the inventory of operational resources does not generate income, losing its value as a result of inflation. On the other hand, when buying excessive stocks, companies refuse the possibility of receiving interest, when investing money in "risk-free" assets, such as government bonds (lost profits). Therefore, as a basis for calculating the rate (i) in industrial companies, it is proposed to use the Capital Assets Pricing Model (CAPM), taking into account inflation and alternative costs:

where I – Consumer Price Index – CPI;ra – alternative costs identified as the potential return on investment in risk-free assets;

rkt – profitability of the industrial company's shares, at short time intervals;

r¯k – the average return of shares of an industrial company, for the entire period of calculation of losses from immobilization;

rmt – change of stock index corresponding to the industry of the company under consideration at short time intervals;

rm – changes in the stock index corresponding to the industry of the company under consideration for the entire period of calculation of losses from immobilization;

σrm– standard quadratic deviation of the industry index corresponding to the industry of the company under consideration;

n – number of pairs of values of the series of returns of shares of the considered industrial company and the stock market as a whole.

The Moscow Stock Exchange Index (RTS Index), a market capitalization-weighted (free-float) composite index of the Russian stock market, exemplifies the aforementioned stock indexes in Russia. It includes the most liquid shares of the largest and most dynamically developing Russian companies. To take into account the specifics of the industry to which the company in question belongs, in the calculations it is advisable to use industry indices included in the structure of the RTS Index. For example, for mining companies, the Metals and Mining Index can be used as an industry RTS Index.

Thus, the authors have proposed modified extrapolation methods for time series taking into account losses from immobilization of working capital in the company. The authors' developments can be used in planning the demand for warehouse stocks that have stable and seasonal consumption trends, as well as being the most critical positions in terms of losses that a mining company may incur in their temporary absence (deficit).

Correlation-regression models for calculating the need for operational resourcesThese methods are expedient to use for operational resources with consumption statistics dominated by local (random) factors, complicating the formalization of trends and seasonal patterns. The inventory of randomly consumed items in mining companies includes a wide range of auxiliary materials used in the extraction of minerals, such as lumber, black metal rolling, cable and wire products, explosives, etc.

It is not always possible to link certain costs to certain inventory items, especially when operating our own logistics infrastructure. In addition, most management operations and functions, which include procurement activities, do not lend themselves to rationing, in contrast to the work on the warehouse processing of goods. In order to study the causal relationships between variables and conventionally constant costs, it is advisable to apply correlation-regression models which can also be used to assess the need for operational resources and associated costs based on production plans. The most suitable mathematical model that uses the close relationship between the two parameters being investigated is the linear regression of the two variables (Schreibfeder, 2006):

where ytk – costs (direct/variable) for purchasing category (k) operational resources at time (t);xt– volume of production of finished products by the industrial company at the time (t);

a and b – constant coefficients representing the angle of inclination of the regression line to the OX axis and the distance from the origin to the intersection point of the regression line with the OY axis, respectively:

r – Pearson's pair correlation coefficient:

x¯,y¯,σx,σy – average values and standard quadratic deviations of statistical series of output volumes of finished products and the costs of purchasing operational resources, respectively;

N – length of statistical series of volumes of output and procurement costs.

The validity of the Eq. (10) values of correlation coefficients is estimated using Student's t-statistics, the actual value of which is determined by the formula:

The obtained value (tfact) is compared to the critical value of t-statistics (tα), determined at a given significance level (α), and the number of degrees of freedom (υ=N−2). If (tfact>tα), then the obtained value of the correlation coefficient is recognized as significant. Accordingly, it is possible to conclude that there is a sufficiently close statistical relationship between the parameters under study, which makes it possible to construct adequate correlation-regression models and perform with their help the necessary calculations. As a criterion for the accuracy of the regression equation, a standard quadratic deviation between the actual cost of purchasing operational resources (ytfact), that occurred in the past and calculated according to the proposed method can be used (ytcalc):

The obtained value σy(x) can be used to determine the boundaries of the cost forecast intervals, taking into account the planned volumes of output of finished products: [yt±z·σy(x)]. However, for cost planning purposes, industrial companies will be interested only in the upper limit of the interval as a level of costs that will not be exceeded with a given probability, namely [yt+z·σy(x)]. This amount must be budgeted for the company's planned period. Fig. 5 shows a block diagram of the algorithm for calculating the forecast values of operational resource consumption based on the plans for the release of finished products.

Thus, for the most complex positions of operational resources in terms of calculating demand, the authors suggest using correlation-regression methods to assess causal relationships between inventory usage and other factors in the internal and external environment. Among these factors, production process failures caused by accidents, incidents, explosions, or fires during the extraction process can be particularly noted. Random factors often include delivery delays caused by natural disasters, transportation congestion, and other issues that hinder suppliers' ability to fulfill their contractual obligations.

The use of harmonic analysis in operational resource inventory planningSince periodic or quasi-periodic processes are present in the consumption statistics of most operational inventories, harmonic analysis can be used as an alternative to the traditional correlation-regression methods. In this approach, the statistics are represented as a sum of "harmonics." If we have a function S(t), then on the time interval [t;t+2π], it can be represented as a Fourier series as follows (Granger & Hatanaka, 1972; Murphy, 1996):

where S¯ - arithmetic mean of the function S(t);N - number of elements in the time series of inventory sales; n - harmonic number;

an and bn - equation coefficients determined as:

Thus, the approximation of the statistical series of inventory expenditure is carried out using trigonometric polynomials with the method of least squares. By using harmonic analysis, we can obtain a mathematical model that formalizes the original time series, based on which we can make predictions for future periods. The terms of the Fourier series, S^n=an·cos(n·t)+bn·sin(n·t),wheren=1,2,3,… are called "harmonics." For example, the formulas for calculating the values of the first two individual harmonics are as follows:

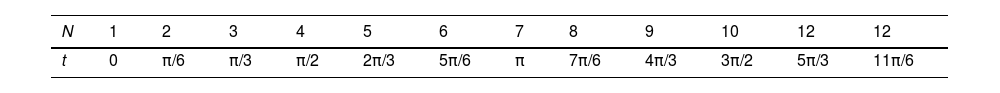

The formula for the sum of the first two harmonics can be represented as follows: S^t2=S¯+a1·cost+b1·sint+a2·cos2t+b2·sin2t. The values of time (t) in the above formulas are given in the interval [t=0,…,N] with a period equal to (2·πN). Time (t) takes the following values [0;2·πN;2·2·πN;3·2·πN;…;(N−1)·2·πN] (Table 2).

The Fourier decomposition more accurately represents the values of the given function the longer the original time series of inventory expenditure is. However, in this case, the number of harmonics that participate in the Fourier decomposition increases. If the number of values in the time series is (N), then the number of harmonics will be equal to (N2). For example, when examining the annual inventory expenditure series (N = 12 months), the first harmonic will have a period equal to the length of the main series (12 months), the second will have a period equal to half the length of the main series (6 months), the third will have a period equal to 1/3 of the main series (4 months), and the sixth harmonic will have a period equal to 2 months. For seasonal or semi-seasonal inventories, the length of the fluctuations may have an annual or semi-annual period. Therefore, when examining the statistics of such inventories, some of the identified harmonics will have quite real analogies with seasonal changes in product sales.

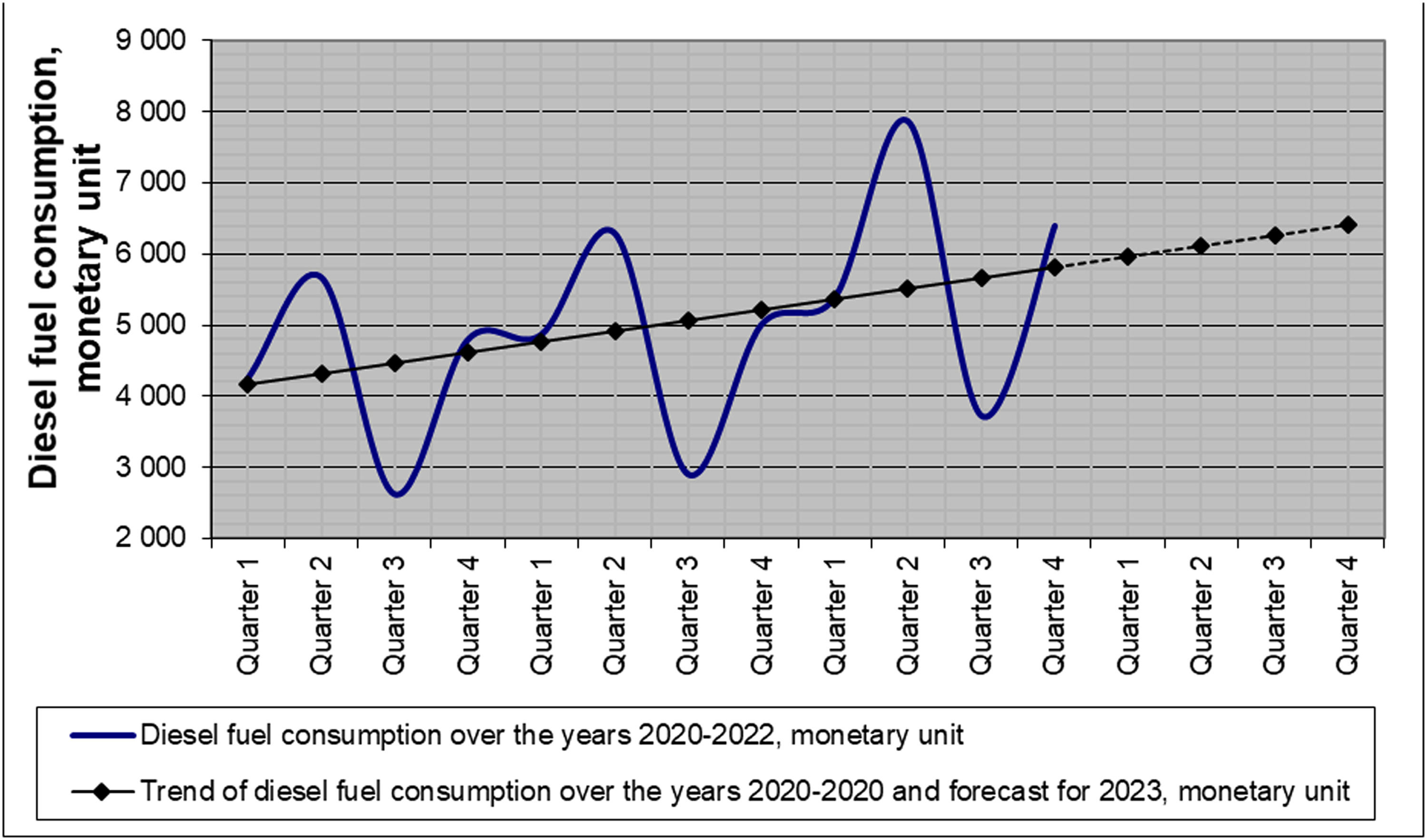

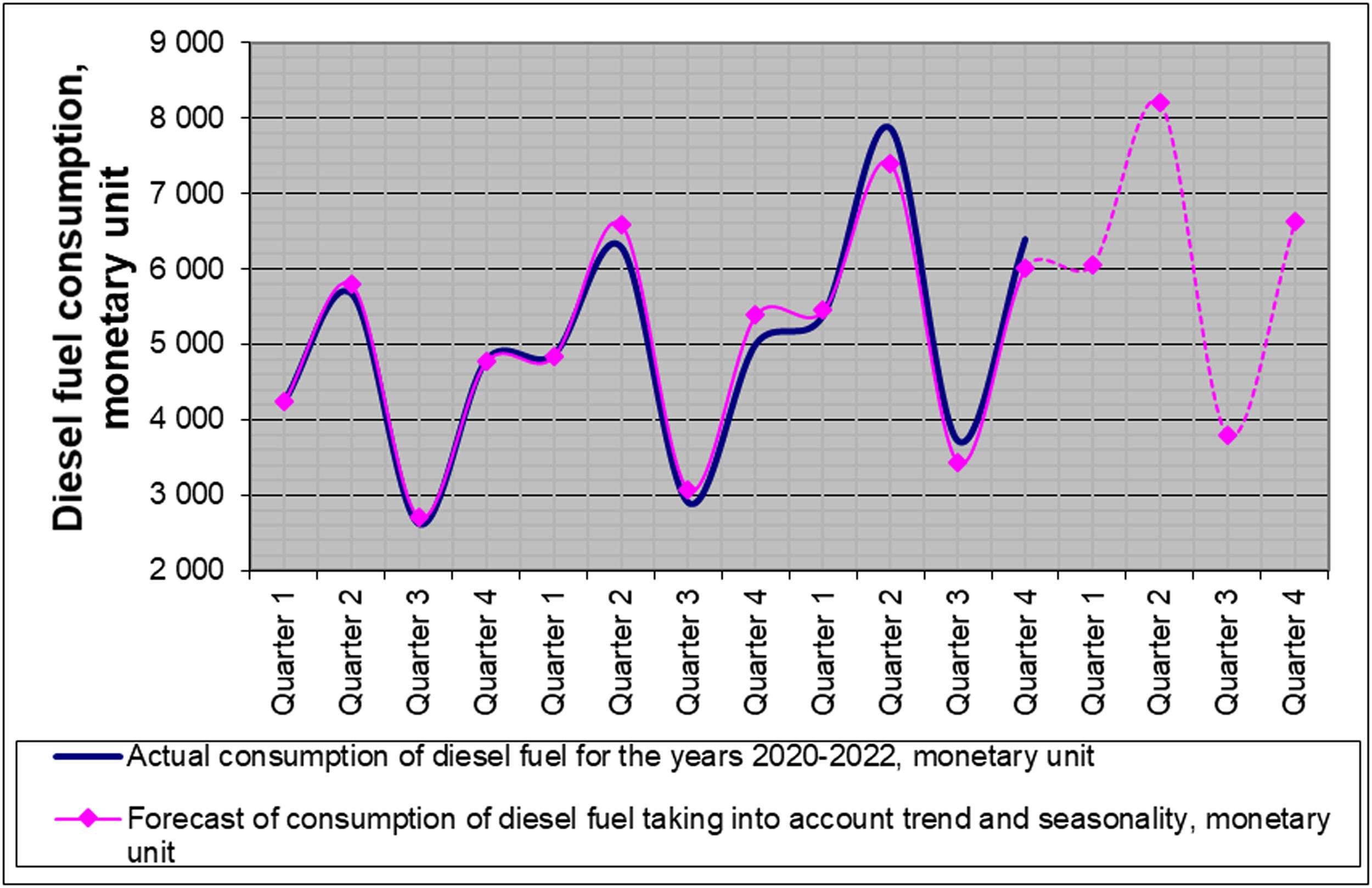

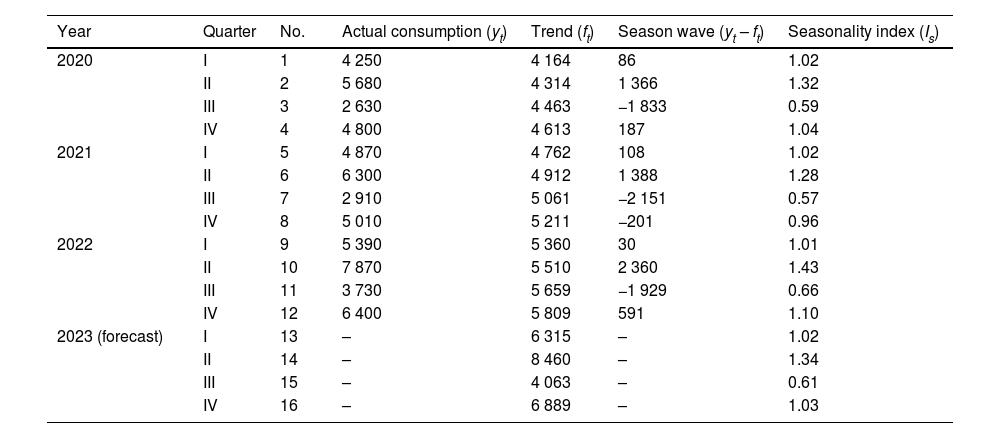

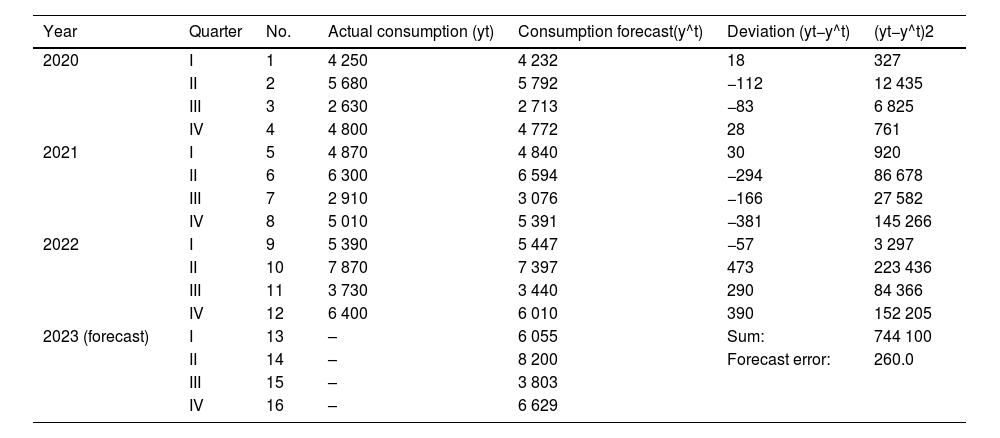

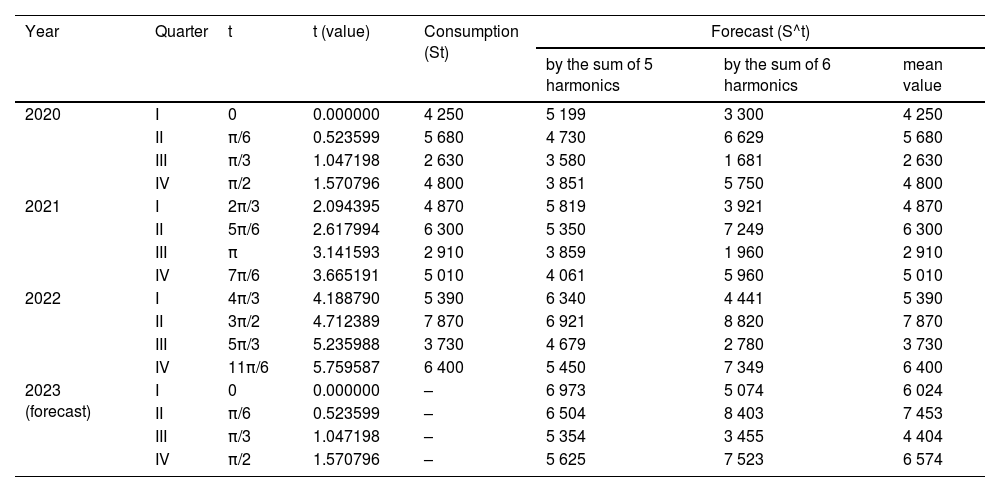

An example of the calculation of a company's operational resources need to be used in the natural raw materials productionThe coal mining company plans the demand for diesel fuel for production needs based on its consumption statistics for the previous three years (2020–2022) and coal production plans for 2023. The level of supply service (the probability of meeting the internal needs of the company) for this type of operational resource is 84.1 %. The results of the calculations are given in Table 3 and Table 4 and Figs. 6 and 7.

Statistics of consumption of diesel fuel from the warehouse of the coal mining company taking into account trend and seasonality, monetary unit.

| Year | Quarter | No. | Actual consumption (yt) | Trend (ft) | Season wave (yt – ft) | Seasonality index (Is) |

|---|---|---|---|---|---|---|

| 2020 | I | 1 | 4 250 | 4 164 | 86 | 1.02 |

| II | 2 | 5 680 | 4 314 | 1 366 | 1.32 | |

| III | 3 | 2 630 | 4 463 | −1 833 | 0.59 | |

| IV | 4 | 4 800 | 4 613 | 187 | 1.04 | |

| 2021 | I | 5 | 4 870 | 4 762 | 108 | 1.02 |

| II | 6 | 6 300 | 4 912 | 1 388 | 1.28 | |

| III | 7 | 2 910 | 5 061 | −2 151 | 0.57 | |

| IV | 8 | 5 010 | 5 211 | −201 | 0.96 | |

| 2022 | I | 9 | 5 390 | 5 360 | 30 | 1.01 |

| II | 10 | 7 870 | 5 510 | 2 360 | 1.43 | |

| III | 11 | 3 730 | 5 659 | −1 929 | 0.66 | |

| IV | 12 | 6 400 | 5 809 | 591 | 1.10 | |

| 2023 (forecast) | I | 13 | – | 6 315 | – | 1.02 |

| II | 14 | – | 8 460 | – | 1.34 | |

| III | 15 | – | 4 063 | – | 0.61 | |

| IV | 16 | – | 6 889 | – | 1.03 |

Estimation of forecast error and calculation of demand for diesel fuel for needs of coal mining company for 2023 (monetary units).

| Year | Quarter | No. | Actual consumption (yt) | Consumption forecast(y^t) | Deviation (yt−y^t) | (yt−y^t)2 |

|---|---|---|---|---|---|---|

| 2020 | I | 1 | 4 250 | 4 232 | 18 | 327 |

| II | 2 | 5 680 | 5 792 | −112 | 12 435 | |

| III | 3 | 2 630 | 2 713 | −83 | 6 825 | |

| IV | 4 | 4 800 | 4 772 | 28 | 761 | |

| 2021 | I | 5 | 4 870 | 4 840 | 30 | 920 |

| II | 6 | 6 300 | 6 594 | −294 | 86 678 | |

| III | 7 | 2 910 | 3 076 | −166 | 27 582 | |

| IV | 8 | 5 010 | 5 391 | −381 | 145 266 | |

| 2022 | I | 9 | 5 390 | 5 447 | −57 | 3 297 |

| II | 10 | 7 870 | 7 397 | 473 | 223 436 | |

| III | 11 | 3 730 | 3 440 | 290 | 84 366 | |

| IV | 12 | 6 400 | 6 010 | 390 | 152 205 | |

| 2023 (forecast) | I | 13 | – | 6 055 | Sum: | 744 100 |

| II | 14 | – | 8 200 | Forecast error: | 260.0 | |

| III | 15 | – | 3 803 | |||

| IV | 16 | – | 6 629 |

Forecast model in general form: yt=(a·t+b)·IS+z·σy. For the example conditions, the forecast model will look like the following: yt=(149.51·t+4014.8)·IS+260.0.

The example calculation of inventory requirements presented shows a fairly good accuracy of the forecasting model developed by the authors. The safety stock that will need to be formed in the warehouse in case of consumption and supply failures, for a given reliability level of 84.1 %, will be 260 monetary units, and for a reliability level of 99.9 % (the "three-sigma" rule) – 780 monetary units. Thus, the safety stock will account for about 12 % of the total volume of the overall inventory for this group of operational resources.

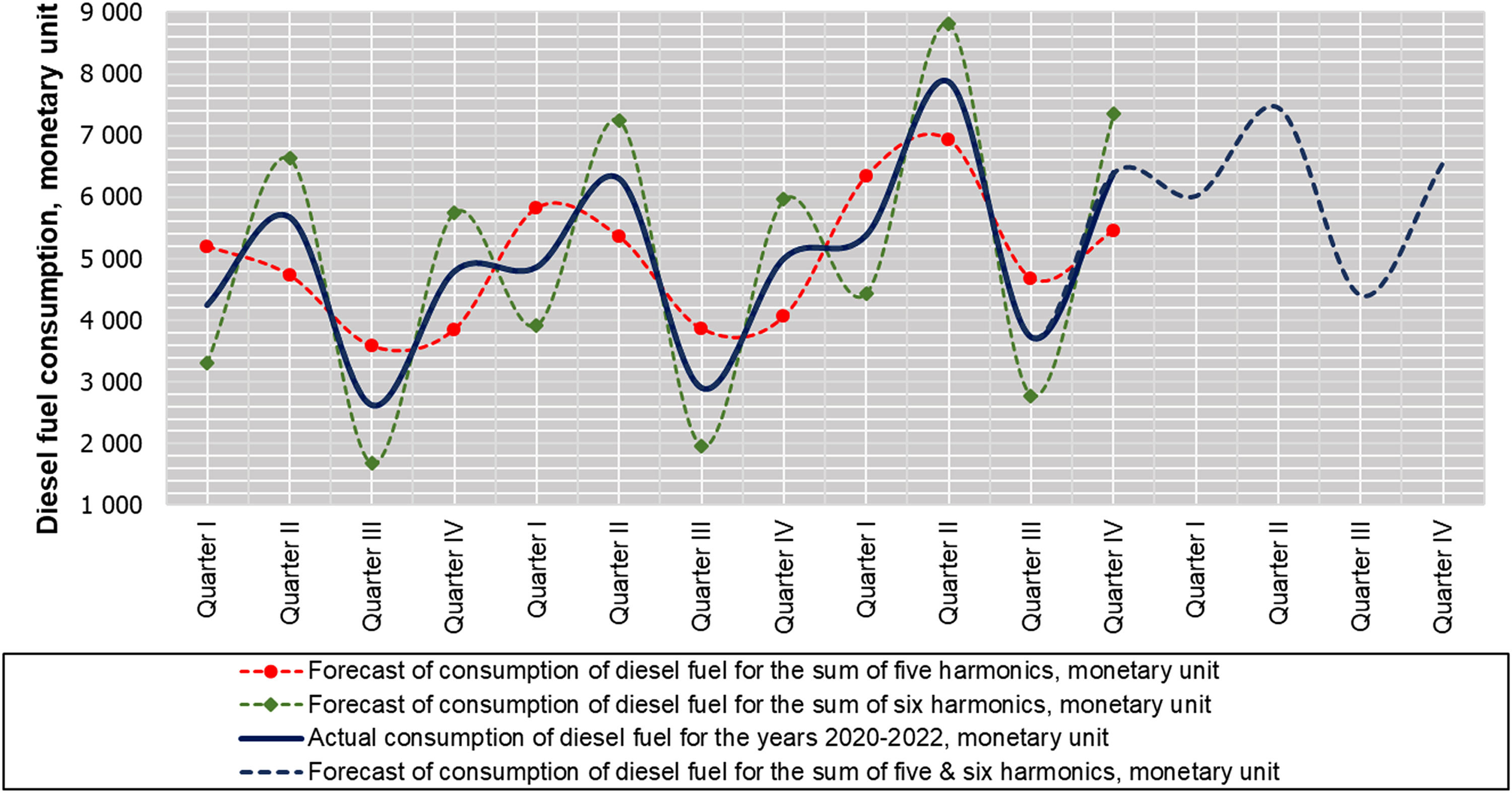

However, upon visual inspection of the graph (Fig. 6), it is evident that the demand dynamics have a pronounced periodic component, the formalization of which using harmonic analysis could provide greater accuracy in forecasting. To confirm this assumption, the inventory requirement is calculated using the original data from the previous example (Table 2). The forecast equation for the sum of six harmonics was obtained using formulas (13) - (15). Further examination of the 7th and 8th harmonics showed that the forecasted values of inventory consumption from the warehouse are almost identical to the forecast based on the 6th harmonic (Table 5 and Fig. 8).

Results of prediction of diesel fuel consumption using harmonic analysis, (monetary units).

| Year | Quarter | t | t (value) | Consumption (St) | Forecast (S^t) | ||

|---|---|---|---|---|---|---|---|

| by the sum of 5 harmonics | by the sum of 6 harmonics | mean value | |||||

| 2020 | I | 0 | 0.000000 | 4 250 | 5 199 | 3 300 | 4 250 |

| II | π/6 | 0.523599 | 5 680 | 4 730 | 6 629 | 5 680 | |

| III | π/3 | 1.047198 | 2 630 | 3 580 | 1 681 | 2 630 | |

| IV | π/2 | 1.570796 | 4 800 | 3 851 | 5 750 | 4 800 | |

| 2021 | I | 2π/3 | 2.094395 | 4 870 | 5 819 | 3 921 | 4 870 |

| II | 5π/6 | 2.617994 | 6 300 | 5 350 | 7 249 | 6 300 | |

| III | π | 3.141593 | 2 910 | 3 859 | 1 960 | 2 910 | |

| IV | 7π/6 | 3.665191 | 5 010 | 4 061 | 5 960 | 5 010 | |

| 2022 | I | 4π/3 | 4.188790 | 5 390 | 6 340 | 4 441 | 5 390 |

| II | 3π/2 | 4.712389 | 7 870 | 6 921 | 8 820 | 7 870 | |

| III | 5π/3 | 5.235988 | 3 730 | 4 679 | 2 780 | 3 730 | |

| IV | 11π/6 | 5.759587 | 6 400 | 5 450 | 7 349 | 6 400 | |

| 2023 (forecast) | I | 0 | 0.000000 | – | 6 973 | 5 074 | 6 024 |

| II | π/6 | 0.523599 | – | 6 504 | 8 403 | 7 453 | |

| III | π/3 | 1.047198 | – | 5 354 | 3 455 | 4 404 | |

| IV | π/2 | 1.570796 | – | 5 625 | 7 523 | 6 574 | |

In Fig. 8, it can be seen that the forecasted values obtained by summing the fifth and sixth harmonics are almost symmetric regarding the mean values. Therefore, when planning inventory requirements, it is advisable to use the average forecasted values as a basis to minimize forecast error – 30 monetary units. Then, when planning warehouse inventory corresponding to a reliability level of 99.9 %, the safety stock will be about 2 % of the total volume of operational resources for this group. This indicates greater accuracy of harmonic analysis methods compared to traditional methods of time series extrapolation for operational resources with predominantly periodic or quasi-periodic processes.

The main results of the conducted research are the following:

- 1)

systematization and classification of supplies purchased by industrial enterprises and clarification of the terms “operational resources” and “material and technical supply level of service”;

- 2)

modification of the models of operational resources inventory management and development of a methodology for assessing tied-up working capital losses;

- 3)

determination of methodological foundations for operational resources category management;

- 4)

development of a mechanism for inter-organizational coordination of industrial enterprises with operational resources suppliers and a methodology for collaboration between counterparties in supply chains.

The results of the study are relevant for large industrial enterprises, particularly, mining companies that own a wide range of production and logistics infrastructure facilities. The implementation of the developed methodology does not fit wholesale and retail companies due to other cost structures of the purchasing process within these enterprises. Trade enterprises based on outsourcing counterparties perform various operations and functions that reflect not only on financial but also on operational processes.

DiscussionThe author's contribution to the theory and practice of procurement and logistics lies in the clarification of the terminological apparatus of category management and the development of modified planning (forecasting) models for the need for inventory of operational resources. In addition, the authors have proposed methodological approaches to optimizing inter-organizational interaction in the supply chains of mining companies, as well as principles for building organizational management structures. Scientific and practical work in the field of category management, on which the authors relied, mainly considers activities related to assortment management in retail or finished products in the sales of industrial companies. The possibilities of category management in the procurement activities of production companies have been studied to a lesser extent. This especially applies to the procurement of operational resources, the importance of which is traditionally lower than that of raw materials, materials, and components for the production of finished products.

As a result of the conducted research, the authors systematized and classified material resources that are objects of internal consumption and not directly used in the production of finished products. The article clarified the concept of "operational resources," which, in addition, to spare parts for the repair and operation of infrastructure facilities (MRO), included auxiliary and consumable materials for production processes, as well as resources for administrative and managerial activities. A methodological basis for category management of operational resource procurement in supply chains has been developed, which includes the consolidation of supply plans, supplier search, contract conclusion, and supply monitoring. It has been shown that when introducing category management in procurement, organizational management structures of companies should be transformed into matrix structures, with managers by categories being assigned as the sole centers of responsibility for the entire supply cycle.

The proposed organizational structure for industrial enterprise management suggests a clear functional delineation between category managers and production managers. Category managers are responsible for the entire process of managing operational resources, from planning the need for inventory to issuance to production. Production units are internal customers (consumers) of operational resources, carrying out technical maintenance and repair of production and logistics infrastructure. Their functional responsibilities include planning the overall need for operational resources and forming schedules for planned repair work. Such functional division allows for a more flexible response to any changes in the need for operational resources, quickly adjusting procurement and supply processes.

Inter-organizational coordination of supply chains with a matrix organizational management structure allows for the formation of cross-functional teams that provide industrial companies with a wide range of necessary resources. Such an organizational management structure reduces labor costs and the level of uncertainty in the supply chains of operational resources. Cost reduction occurs by reducing the number of management levels and the number of administrative staff. This is possible due to the expansion of the powers and responsibilities of categorical managers. It is expected that the counterparts of companies will have closer interaction with the focus company, providing information about the state of resources and reducing the risk of the "bullwhip effect".

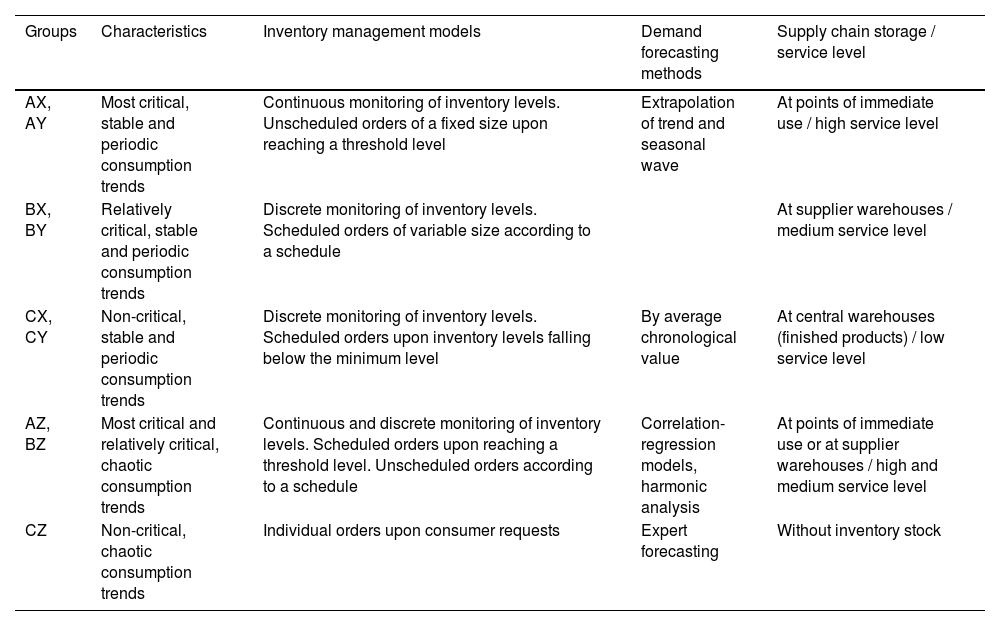

A new concept of "supply service level (SSL)" has been introduced, and a methodology for its calculation has been proposed. Based on this indicator, the authors have proposed a diversified approach to planning the demand for operational resources in the warehouses of mining companies, depending on the criticality of the inventory position and the variability of its consumption. The essence of this approach, based on the results of combined ABC-XYZ analysis, is as follows (Table 6).

Recommendations for working with operational resources of mining companies, depending on classification groups.

| Groups | Characteristics | Inventory management models | Demand forecasting methods | Supply chain storage / service level |

|---|---|---|---|---|

| AX, AY | Most critical, stable and periodic consumption trends | Continuous monitoring of inventory levels. Unscheduled orders of a fixed size upon reaching a threshold level | Extrapolation of trend and seasonal wave | At points of immediate use / high service level |

| BX, BY | Relatively critical, stable and periodic consumption trends | Discrete monitoring of inventory levels. Scheduled orders of variable size according to a schedule | At supplier warehouses / medium service level | |

| CX, CY | Non-critical, stable and periodic consumption trends | Discrete monitoring of inventory levels. Scheduled orders upon inventory levels falling below the minimum level | By average chronological value | At central warehouses (finished products) / low service level |

| AZ, BZ | Most critical and relatively critical, chaotic consumption trends | Continuous and discrete monitoring of inventory levels. Scheduled orders upon reaching a threshold level. Unscheduled orders according to a schedule | Correlation-regression models, harmonic analysis | At points of immediate use or at supplier warehouses / high and medium service level |

| CZ | Non-critical, chaotic consumption trends | Individual orders upon consumer requests | Expert forecasting | Without inventory stock |

An analysis of the studies used in the research shows that currently there is no unified methodology for assessing financial losses from immobilizing funds in inventories. To reduce the financial burden on companies, the authors have modified the classical model of optimal order size for the most critical and expensive inventories of operational resources. When determining alternative costs, the authors have proposed a methodology for calculating the rate of losses from immobilizing working capital, which takes into account market trends in which the company operates. Based on the proposed methodology, inventories can be additionally divided according to the "cost" criterion, and the approaches to managing the cash balance of inventories in the warehouse can be accordingly adjusted.

In the works on mathematical statistics examined by the authors, the methods and models considered are universal, without being tied to any specific industry, type of business activity, or material resources. However, questions regarding the specificity of using these methods in the mining industry are fragmented and not related to each other. The study confirmed the authors' hypothesis about the stochastic nature of the consumption of operational resources in the mining industry and the delivery times of suppliers, which are mostly distributed according to the normal law. This fact allowed for the modification of traditional models for extrapolating time series for the needs of mining companies, which provided sufficiently accurate results in forecasting demand (Table 6).

Reducing uncertainty positively affects the accuracy of forecasting the demand for operational resources, as suppliers can better fulfill their contractual obligations. This creates the opportunity to reduce safety stocks at all levels of the supply chains of mining companies, as well as reduce costs for storage and associated losses from the immobilization of working capital.

The algorithms proposed by the authors should serve as the basis for programming in corporate information systems of companies and automating the processes of managing stocks of operational resources and forecasting the demand for inventory.

Thus, the proposed methodological framework for category management of procurement by the authors significantly complements existing theoretical developments and practices of inventory management in companies, taking into account the specificity of the mining industry. It has been shown that the temporary absence of operational resources in storage can lead to the same losses as a shortage of basic raw materials and components. At the same time, the share of costs for purchasing operational resources in the mining industry can reach 50 % of the company's total costs, which significantly increases the importance of operational resources in procurement activities.

ConclusionsThe main conclusions of the research results and calculations carried out in the article are indicated below:

- –

the purchase of reserves of operational resources in large industrial companies is advisable to form on the category principle, with its allocation into a separate supply channel. The companies’ senior management should understand the importance of this purchasing channel and should provide financing for this channel taking into account all business priorities;

- –

due to the territorial isolation of divisions, organizational structures for managing companies should be built on a matrix principle, transferring the functions of inventory management to the logistics service;

- –

periodic shortage of operational resources in warehouses can lead to production process stoppages. Losses from the lack of operational resources can be comparable in size to losses that occur due to a shortage of basic raw materials, materials, and components used for the production of finished products;

- –

the need for operational resources may be irregular, so you need to use mathematical statistics and probability theory when planning;

- –

you must take into account losses from the immobilization of working capital when determining the level of availability for the domestic divisions of large industrial companies. These losses should be determined considering the share's profitability on the stock exchange.

Consumption of operational resources in large industrial enterprises is stochastic. At the same time, the distribution of a random variable moves to normal probability law when the sample size (for N > 35–40) is rising. That is why a normal distribution of the operational resources stock characteristics is the basis for the modifications of the theoretical methods and the models for demand planning in the provided research. Since the industrial companies have the data of each item inventory consumption over several years, the above-mentioned conditions prevail, and the sample size of separate operational resources has a distribution close to the normal law.

However, when the industrial enterprise upgrades the structure or configuration of industrial equipment during the production modernization, the statistics of the spare parts consumption may be absent or not in sufficient volume. Specialists who calculate the demand for the operational resources inventory may face distributions that differ from normal in such a situation. Nevertheless, these cases are not widespread and long-term. Therefore, further research on this topic should focus on the modification of the forecasting methods and models for random variables with the other distribution laws.

CRediT authorship contribution statementIvan Elyashevich: Conceptualization, Methodology, Supervision, Writing – original draft. Victor Sergeev: Conceptualization, Formal analysis, Investigation, Resources, Writing – review & editing. Valentina Dybskaya: Formal analysis, Funding acquisition, Investigation, Methodology, Writing – original draft. Anastasia Ivanova: Funding acquisition, Resources, Supervision, Writing – review & editing.

CRediT authorship contribution statementIvan Elyashevich: Conceptualization, Methodology, Supervision, Writing – original draft. Victor Sergeev: Conceptualization, Formal analysis, Investigation, Resources, Writing – review & editing. Valentina Dybskaya: Formal analysis, Funding acquisition, Investigation, Methodology, Writing – original draft. Anastasia Ivanova: Funding acquisition, Resources, Supervision, Writing – review & editing.