Editado por: Abbas Mardari

Más datosFor developing countries with advanced societies and growing economies, it is essential to accurately assess the technological innovation effect of capital goods imports on regional development quality. This study explores the path of high-quality urban development from the perspective of international trade. Examining city-level panel data on China from 2003 to 2013, the study applies various econometric analysis methods, including fixed effects, quantile regression, two-stage least squares regression and mediating and moderating effects models, to investigate the impact of capital goods imports on regional development quality and the mechanism of action. The findings demonstrate that capital goods imports have an inverted U-shaped, non-linear effect on high-quality urban development, whereas the effect on regional development is characterised by urban heterogeneity. Regarding technological innovation, the primary reason for the inverted U-shaped relationship is the combined effects of technology dependence and technology upgrading. In terms of institutional economics, policymakers can transform the pressure of economic growth into a driving force through initiatives to enhance the economic development effect of capital goods imports. Transitioning this pressure can mitigate the hindering effect of excessive capital goods imports on improving the quality of regional development.

The United Nations (UN) has proposed a comprehensive joint declaration on social development, highlighting the environment, social responsibility, and economy as the three main pillars of sustainable development (Dabbous & Tarhini, 2021; Li & Yi., 2020; Nodehi, Arani & Taghvaee, 2021; Taghvaee, Arani, Soretz & Agheli, 2023). This concept offers important guidance for improving the level of economic and social development and technological innovation (Cumming & von Cramon-Taubadel, 2018). The US evaluation system of the 'new economy' (Atkinson & Wu, 2017), the EU's evaluation system of sustainable development (Bolcárová & Kološta, 2015), Germany's national welfare evaluation system (Held, Rodenhäuser, Diefenbacher & Zieschank, 2018), and China's construction and improvement of a high-quality development path based on the new development concept1 have made sustainable urban development and improved regional quality key goals in national economic policies (Wang, Zhang & Liao, 2022).

International trade and global cooperation are key to promoting quality development in all regions (Arora & Siddiqui, 2022; Zhao et al., 2022). The role of imports in the link between international trade and sustained economic growth as a driver of sustainable economic development and a key driver for optimizing industrial structure, transforming economic growth patterns, and thus achieving quality economic development has become increasingly prominent (Caselli & Wilson, 2004). Due to the complex composition and technological content of certain technological equipment, developing countries, which generally have low levels of technology and high costs derived from independent production, tend to import capital goods to enhance their technological development and the quality of their economic and social development (Eaton & Kortum, 2001).

Capital goods, known for their higher technological content, play a crucial role in facilitating technological diffusion through international trade (Grossman & Helpman, 1991; Rivera-Batiz & Romer, 1991). This aspect has had a profound impact on the economic development quality of trading countries during the fifth industrial technological revolution. The effects of capital goods imports on economic development are particularly notable in developing countries that are catching up in terms of technology (Carrasco & Tovar-García, 2021; Herrerias & Orts, 2013). In these countries, the productivity gains from domestic capital goods primarily stem from technological spillovers originating from imported capital goods (Hasan, 2002). As the demand for skill upgrading rises in a trading country, there is a significant increase in the importation of technologically advanced capital goods (Li, Li & Ma, 2022). This is because capital goods from abroad exhibit more pronounced technological improvement characteristics than intermediate goods (Caselli, 2018; Mo, Qiu, Zhang & Dong, 2021). Overall, imported capital goods can substantially enhance firm productivity through the mechanisms of "import-learning" and "embodied technological progress." Domestic firms can bridge the technological gap by absorbing, copying, and imitating the knowledge embedded in imported capital goods, thereby boosting their technological capacity. As a result, domestic firms narrow the technological gap, improve productivity (Bempong Nyantakyi & Munemo, 2017; Gonchar & Kuznetsov, 2018), and achieve significant enhancements in the quality of regional economic and social development.

However, do capital goods imports necessarily have a positive effect on social development?

On the one hand, national technology embargoes and protection measures in the global competition for innovation and industrial dominance discourage trade in capital goods with high technological content, indicating that their borderlessness is theoretical rather than practical. However, we find that even in the face of rising trade barriers and technological embargoes, the technological innovation capacity of certain developing countries, represented by China, has increased significantly. Additionally, technological progress has continued to advance, and the passive reduction in imports of high-end equipment and products with higher technological content has not slowed the pace of improvement in the quality of economic and social development in these countries. These changes reflect the impact of imports of capital goods with higher technological content on regions. This suggests that the impact of imports of capital goods with higher technology content on the quality of regional development is not necessarily one way. Various studies have explored this topic. Goldberg, Khandelwal, Pavcnik and Topalova (2009) argue that the integration of new and valuable capital goods from abroad with domestic products can generate secondary innovation, thereby contributing to regional development. Conversely, Damijan and Kostevc (2015) argue that importing capital goods, such as advanced production equipment hinders firms' innovative activities, undermines industrial development, and has a negative impact on regional economic growth.

The impact of imported capital goods on importing countries can be multifaceted. First, capital goods with technology spillovers complement different skill levels of labor, and the effect on regional industrial development depends on the innovation level of the capital goods. This can result in a situation where R&D-intensive capital goods increase the skill premium, while imports of less innovative capital equipment decrease it (Raveh & Reshef, 2016). Second, at the micro level, the economic effects of imported capital goods depend on the importing firm's capacity to absorb, transform, and utilize knowledge (Augier, Cadot & Dovis, 2013; Coe, Helpman & Hoffmaister, 1997). Additionally, the spillover and economic development effects of imported capital goods are influenced by the social environment of the importing country, where cooperation within the industrial sector and a sufficient market size ensure the realization of economic value (Jia & Cheng, 2019). Therefore, what is the impact of capital goods imports on the regional quality of development, and what is the mechanism of this impact? This is the topic of this study.

This paper examines the impact of capital goods imports on the quality of regional development using panel data on Chinese cities. The main reasons for choosing China as the study subject are as follows. First, China, as the largest developing country, has experienced rapid economic growth and import trade since joining the World Trade Organization (WTO) in 2001. The import scale exceeded US $2 trillion in 2018, expanding the import of high-tech products, capital goods, and intermediate goods2. Like other developing countries, China's development strategy prioritizes economic growth, resulting in various development problems. With the increasing level of openness to the outside world and the fiercely competitive environment of the new industrial and technological revolution, China's industrial chain and commodity development face significant challenges. The Chinese government and countries worldwide have begun to focus on gathering and effectively utilizing global high-end factors for regional development. Second, as a major commodity trading country and a major importer of capital goods, trade in capital goods occupies an important position in China's foreign trade and makes an important contribution to China's capital accumulation and total factor productivity (TFP) growth (Yang, 2015). In the recent trade dispute, the issue of import and export trade in capital goods with strong technological innovation effects and the negative impact of international trade on regional development provide realistic conditions for our study (Cooray & Palanivel, 2022). Third, as with other developing countries, China's current imperfect foreign trade regime and the path of international trade's impact on high-quality economic development have not been clearly elucidated, and the government faces contradictions inherent in its high level of opening up to the outside world and its own relatively backward level of development. Therefore, a study using a sample of Chinese cities can not only enrich the theoretical study of the economic and social effects of capital goods imports but can also provide general insights into international trade strategies and high-quality economic and social development in other developing countries.

Three considerations characterize the innovation and novelty of this study. First, previous research lacks exploration of the impact of capital goods imports from developing countries on the quality of regional development. Considering the emergence of a new industrial technology revolution and the uncertainties confronting global trade, it is both opportune and necessary to develop appropriate trade strategies to advance the progress of developing countries. This study combines the challenges of international trade and regional economic development to explore the relationship between capital goods imports and the quality of regional economic development, enriching the research regarding the economic and social effects of capital goods imports. Second, existing studies place a greater focus on the technology spillover effect of imported products; however, the impact of capital goods imports on the high-quality development of the importing country's economy is not yet conclusively investigated. The findings of this study complement related research on the economic effects of capital goods imports. The results show that the positive impact of capital goods imports on regional development exhibits non-linear characteristics, which are predominantly influenced by the facilitating effect of technology upgrading and the hindering effect of technology dependence. Third, considering the pressure to advance economic growth faced by local governments under the centralised system and the potential for intergovernmental competition to impact the economic and social effects of capital goods imports, this study further examines the influence of capital goods imports on the quality of urban development under this pressure. The findings enrich the theoretical examination of the economic and social effects of capital goods imports from the perspective of institutional economics.

Theoretical analysis and hypothesis developmentUnder the impetus of the new industrial technology revolution, high-quality economic development should follow a comprehensive development model based on innovation, coordination, greenness, openness and sharing3. High-quality development cannot be achieved without a high-quality supply of production factors. In recent years, as China's opening-up policy has shifted from a combination of import substitution and export orientation to a combination of imports and exports. The characteristics of the supply of imported goods have gradually changed from labor-intensive to capital-intensive and technology-intensive, while the role of import trade in China's high-quality development is receiving increasing attention. As a key product of import trade, capital goods are also an important factor that influences the structure and quality of a region's factor supply. Developing countries are able to obtain knowledge spillovers from developed countries through capital goods imports (Coe & Helpman, 1995), which inevitably influences the quality of regional development.

On the one hand, technologically innovative imported capital goods can influence the economic development of the importing region through technology upgrading effects. First, as an important means of optimizing the allocation of production factors across borders, capital goods imports can lead to a redistribution of resources (Lu & Yu, 2015). At the microenterprise level, capital goods with technological advantages can increase the productivity of the production chain, which leads to a flow of labor and capital factors to the higher-productivity chains, and enterprises then focus on the production chain displaying exhibiting advantages to achieve higher quality development through the optimization of resource allocation, production and operation structures. From the perspective of the sectoral shift in resource allocation, the specialization of production promoted by capital goods imports leads to the free movement of labor and capital as production sectors adjust and concentrate in more productive sectors or industries, which improves resource allocation efficiency. The resource allocation function of capital goods imports promotes changes in factor endowments and optimizes the efficiency of factor allocation and the structure of industrial sectors, thus achieving sustained improvement in the quality of regional economic development. Second, imports of capital goods can improve innovation capacity, and increase the level of improvement and optimization of the industrial chain through the effect of technological upgrading. First, after acquiring advanced technology and other capital goods through foreign imports, domestic economic agents imitate or use "secondary innovation" based on these imported products, which further promotes the accumulation of knowledge and increased innovation capacity (Akamatsu, 1962). Second, the use of technologically advanced capital goods requires complementary technologies in the upstream and downstream production chain. This further promotes the continuous upgrading and improvement of the production chain in the region, thus contributing to the continuous improvement of regional development. Third, the competitive pressure brought by imported capital goods is the main impetus for R&D investment by local economic agents, who have to enhance their competitiveness by improving their innovation capacity and overall strength to gain market share in a highly competitive environment (Bloom, Draca & Van Reenen, 2016; Lu & Ng, 2012).

On the other hand, some scholars have argued that the competitive effects of capital goods imports may inhibit the innovation activities of importing agents (Dixit & Stiglitz, 1977), thus affecting the quality of regional economic development. Liu and Qiu (2016) argue that imports of capital goods with high technological levels can substitute for local internal innovation, as the cost advantage of supplying products with high-technology content reduces the incentives for technological innovation on the demand side. Thus, faced with lower-priced, higher-technology products from abroad, economic agents with shortsighted motivation will choose to buy them outright rather than innovate on their own. Moreover, imported capital goods that do not complement domestic R&D activities can dampen effect on regional innovation (Zhang, 2015). In addition, imported capital goods can have adverse competitive effects, with fierce import competition seizing the market share of local firms, reducing the demand for local firms' products and their profit levels. This reduces the capital investment needed for regional development and thus hinders the level of basic innovation and development in the region (Parameswaran, 2010). Therefore, based on the above analysis, this paper proposes the following hypotheses:

Hypothesis 1 There is a non-linear effect of capital goods imports on high-quality urban development.

Hypothesis 2a Imports of capital goods drive high-quality regional development through technology upgrading effects.

Hypothesis 2b Imports of capital goods hinder regional development quality through technology dependence effects.

The technology upgrading effect of imported capital goods may be influenced by factors such as the geographical location and industrial structure of the production chain Chen (2021), the regional capacity to absorb and transform technology (Xie & Zhou, 2009) and the size of the market (Wei & Lin, 2017). This could regionally differentiate the economic and social effects of imported capital goods.

First, the import of capital goods changes the competitive market environment in the importing region, affecting regional development through incentive effects (Zhou & Hong, 2021). The pressure engendered by the import of capital goods with advanced technology is an important driver of R&D investment by importing agents, and the effectiveness of this incentive effect mainly depends on the initial state of competition in the importing region. For regions with better industrial structure, the importing agents form a more complete industrial system, and they enhance their overall strength and achieve lower innovation costs by means of independent innovation and promoting valuable complementarities between high-quality imported inputs and domestic products to regain the lost market share of capital goods imports (Fieler, Eslava & Xu, 2018). This improves the quality of regional development. Therefore, cities with certain strengths can significantly increase the quality of urban development due to the incentive effect of imported capital goods. For marginal regions with low initial industrial competitiveness and industrial chains that are not well structured, the import of capital goods disadvantages the development of relevant local industries, and this disincentive effect instead leads to further reductions in the profit margins of manufacturing industries in low-competitive cities and a lack of financial support for independent innovation. The hinders the pace of economic and social development in these regions in the short term.

Second, the impact of imported capital goods on the quality of development may vary across regions due to differences in technology absorption and transformation capabilities. Generally, the import trade of capital goods can promote regional industrial development through the learning effect. Regions with a certain level of industrial strength can gradually master the production technology of key products through the assembly and processing of imported key components, thus enhancing the level of regional industrial production. Imported machinery and equipment and other capital goods are introduced into the industrial production sector, which continues to accumulate knowledge and technology in the production process and conducts secondary innovation on this basis, thus upgrading of industrial structure and improving the quality of regional economic development (Liao, Yang, Ma & Zheng, 2020). For regions with poor technology absorption and transformation capabilities, the technology spillover from imported capital goods may not translate into the region's own innovation capabilities, as the spillover effect of capital goods proceeds in with the resource endowment and decision-making behavior of the importing region (Tao, 2011). Although regions with lower technology levels can reduce their R&D costs and obtain diversified quality factors through the import of capital goods, the marginal costs of technology transformation and secondary innovation inputs may still exceed the marginal benefits, making it difficult to exploit the technology effects of imported capital goods (Li & Shi, 2020). This complicates the effective use of imported capital goods in the short term. The actual take-up capacity of capital goods imports is low due to a lack of demand in the markets of regions with insufficient technology levels and technological transformation capabilities, which makes engendering a catalytic effect on the economy and society difficult.

Hypothesis 3a The contribution of capital goods imports to high-quality urban development is heterogeneous across different types of cities.

Hypothesis 3b The contribution of capital goods imports to high-quality urban development is heterogeneous across cities at different levels of development.

Achieving high-quality and sustainable economic development requires strong institutional support (Petrakis, Valsamis & Kafka, 2017; Yang, Li & Li, 2020). As the strategic planner of high-quality regional economic development, the leader of modernization efforts and the designer of the foreign trade system, governments play an important role in improving the quality of regional development and optimizing trade strategies. In the face of economic growth pressures, the decision-making behavior and behavioral preferences of local governments may be an important factor influencing technological spillover and the economic and social effects of capital goods. On the one hand, there is a significant positive relationship between government growth pressure and fiscal expenditure; the higher that the growth pressure is, the higher the fiscal pressure (Sun, Di, Yuan & Li, 2022). To alleviate fiscal pressure, the government improves the efficiency of investment use, e.g., by widening the use channels and guiding industrial chain alignment and tax incentives to improve the efficiency of imported capital goods use with state-owned capital, thus achieving higher marginal returns. On the other hand, local governments face pressure to grow economically, and to achieve their economic goals, they have strong incentives to expand local investment, attract external capital inflows and increase the level of utilization of products with technological content (Wu, Yang & Yang, 2021). This incentive behavior can enhance the degree of matching of imported capital goods, build an efficient market for capital goods demand, and thus improve the level of regional economic development. Therefore, this paper proposes the following hypothesis.

Hypothesis 4 Government economic growth pressures can enhance the contribution of capital goods imports to the improvement of regional development quality while mitigating the impeding effect of excessive capital goods imports on the improvement of regional development quality.

This paper uses the RESET test (specification test) before the base regression to check whether there are omitted high-subordinate terms in the model setting, and the results are shown in Table 3, Column (1). The test results indicate that the p-value is 0, rejecting the original hypothesis that the coefficient of the fitted value is 0. This indicates that there is a non-linear component of the main explanatory variables, and it is necessary to add the high-subordinate term. Therefore, it is reasonable for us to use capital and its square. To test the effect of capital goods imports on the quality of urban development, that is, to test Hypothesis 1, the basic regression model is as follows.

where hqd represents the level of regional quality development and capital represents the level of capital goods imports, which is expressed as the ratio of capital goods imports to GDP. In this paper, we obtained the capital goods import data from the Chinese import and export customs database according to the United Nations BEC classification, combined with the BECHS correspondence table. control is the set of relevant control variables used in this paper, where internet is internet penetration, measured by the number of international internet users; proad is the degree of infrastructure construction, measured by paved roads; gov is the degree of government support, measured by the amount of local budgetary expenditure; fdi is the degree of openness to the outside world, measured by the amount of actual foreign investment; and finance is the level of regional financial development, expressed as the ratio of the balance of deposits and loans of financial institutions to GDP at the end of the year. i denotes city-level indicators, t denotes year-level indicators, β is the regression coefficient, and ε is the error term.To analyze the reasons for the non-linear relationship between the impact of capital imports on regional development quality, this paper explores the transmission paths through which capital imports affect the technology upgrading effect, the technological dependence effect and hence the regional quality development from the perspective of technological innovation. This paper investigates the impact of capital goods imports on regional development quality and the mechanism of the effect of the level of capital goods imports on regional development quality using a stepwise regression model based on Baron and Kenny's (1986) approach. Regression models (2) and (3) are used to investigate the influence of the level of capital goods imports on the development quality of a region and the mechanism of the effect.

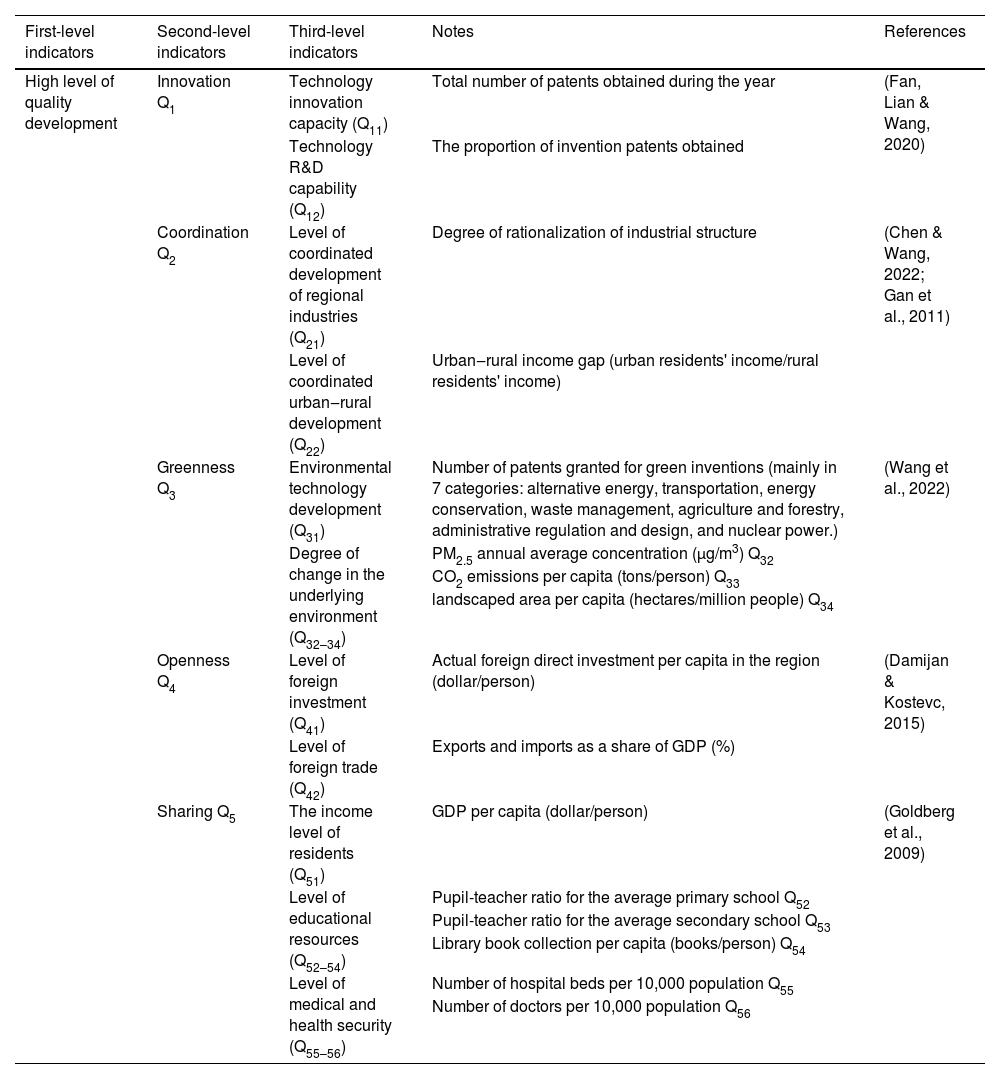

Variable descriptionThe indicators of the level of high-quality development of citiesExisting research generally uses TFP to measure the quality of regional development(Liao, Wang, Zhu & Zhao, 2022), which does not fully reflect the United Nations Sustainable Development Goals (SDGs) or China's high-quality development goals. Based on the principles of feasibility and simplicity in the construction of high-quality evaluation indicators and drawing on the construction approach of Wang et al. (2022), this paper constructs an indicator evaluation system from five dimensions, namely, innovation, coordination, greenness, openness and sharing. Moreover, the entropy-weighted TOPSIS method is used to calculate the high-quality development index of 265 cities from 2003 to 2013 by weighting the objective weights. Among them, the degree of rationalization of regional industrial structure is based on algorithm of Gan et al. (2011). In addition, among the third-level indicators, Q21, Q22, Q32, Q33, Q52 and Q53 are negative indicators, while the rest are positive indicators. The specific indicators are shown in Table 1.

System of indicators for high-quality development levels.

| First-level indicators | Second-level indicators | Third-level indicators | Notes | References |

|---|---|---|---|---|

| High level of quality development | Innovation Q1 | Technology innovation capacity (Q11) | Total number of patents obtained during the year | (Fan, Lian & Wang, 2020) |

| Technology R&D capability (Q12) | The proportion of invention patents obtained | |||

| Coordination Q2 | Level of coordinated development of regional industries (Q21) | Degree of rationalization of industrial structure | (Chen & Wang, 2022; Gan et al., 2011) | |

| Level of coordinated urban‒rural development (Q22) | Urban‒rural income gap (urban residents' income/rural residents' income) | |||

| Greenness Q3 | Environmental technology development (Q31) | Number of patents granted for green inventions (mainly in 7 categories: alternative energy, transportation, energy conservation, waste management, agriculture and forestry, administrative regulation and design, and nuclear power.) | (Wang et al., 2022) | |

| Degree of change in the underlying environment (Q32–34) | PM2.5 annual average concentration (μg/m3) Q32 | |||

| CO2 emissions per capita (tons/person) Q33 | ||||

| landscaped area per capita (hectares/million people) Q34 | ||||

| Openness Q4 | Level of foreign investment (Q41) | Actual foreign direct investment per capita in the region (dollar/person) | (Damijan & Kostevc, 2015) | |

| Level of foreign trade (Q42) | Exports and imports as a share of GDP (%) | |||

| Sharing Q5 | The income level of residents (Q51) | GDP per capita (dollar/person) | (Goldberg et al., 2009) | |

| Level of educational resources (Q52–54) | Pupil-teacher ratio for the average primary school Q52 | |||

| Pupil-teacher ratio for the average secondary school Q53 | ||||

| Library book collection per capita (books/person) Q54 | ||||

| Level of medical and health security (Q55–56) | Number of hospital beds per 10,000 population Q55 | |||

| Number of doctors per 10,000 population Q56 |

In addition to the level of regional quality development (hqd) and capital imports (capital), the mediating variables of manufacturing and research are measured by the complexity of manufacturing and the number of people employed in the research and technology services sector per 10,000 people in the region, respectively. For manufacturing technological sophistication in cities, this paper constructs the following indicators.

where prodyj,2002 represents the technical complexity of each segment j within the manufacturing industry in 2002, and the technical complexity of industry j can be obtained by averaging the product-level technical complexity within the industry. Product complexity is calculated with the export fit method, drawing on Tacchella, Cristelli, Caldarelli, Gabrielli and Pietronero (2013) and Zhou and Hong (2023). The reason for fixing the technical complexity of industry j in 2002 is to exclude the interference of natural variation in product technical complexity at the global level on the change in technical complexity of the industry at the city level to better identify the upgrading of the industrial structure due to the restsructuring of production within the city-level manufacturing industry. outputcjt denotes the sum of the output value of all firms in industry j in city c in year t and its relationship with manufacturing. The proportional relationship with the total output value of manufacturing can indicate the production structure within the city-level manufacturing industry. The higher the technological complexity of the city is, the higher the proportion of industries with higher technological complexity in the industrial structure of that city. This is in line with the connotation regarding the shift in industrial structure from labor-intensive industries with relatively low technological complexity to capital-intensive and technology-intensive industries with relatively high technological complexity under the upgrading of manufacturing industries.This paper employs economic growth pressure (egp) as the moderating variable. In China, the political system characterized by centralized political power and the incentive model of local governments being accountable to their superiors is responsible for economic growth pressure at all levels of government (Liu, Xu, Yu, Rong & Zhang, 2020). This economic growth pressure may be able to activate the government through incentive effects. This paper uses the economic growth targets of prefectural and provincial governments to measure economic growth pressure (Li & Liu, 2022). In addition, control variables are included in the empirical analysis, including internet penetration (internet), the degree of infrastructure construction (proad), government support (gov), openness to the outside world (fdi), and the level of regional financial development (finance).

Data sourcesThis paper uses panel data for prefecture-level cities in China, with a sample period of 2003–2013. The year 2003 was chosen as the starting year mainly because after 2001, China formally joined the WTO, which led to increasingly close import and export trade links between China and the rest of the world. However, in 2002, China's import and export trade activities were severely affected by the SARS coronavirus, which caused infectious atypical pneumonia. It was only after 2003 that China's regions were gradually integrated into the global industrial system, and regional import trade and economic development thus entered a phase of rapid growth. The data sources for this paper mainly include the China Customs Import and Export Database, the China Industrial Enterprises Database, and the China City Statistical Yearbook. The China Industrial Enterprise Database is the main database used by most researchers to study the business conditions and problems of Chinese enterprises, and it is the largest and most comprehensive corporate-level database available to study China's current import volume and indicators. To ensure the reliability of the research results in calculating the technological upgrading effect of capital goods, matched data of industrial enterprises and the corresponding cities are necessary, and the relevant raw data from the China Industrial Enterprise Database used are updated up to 2013. Like most studies, this paper uses 2013 as the end date of the sample data. Therefore, to ensure the scientific validity of the study sample period as well as the integrity and reliability of the data, relevant data for 265 cities from 2003 to 2013 are uesd for the empirical analysis.

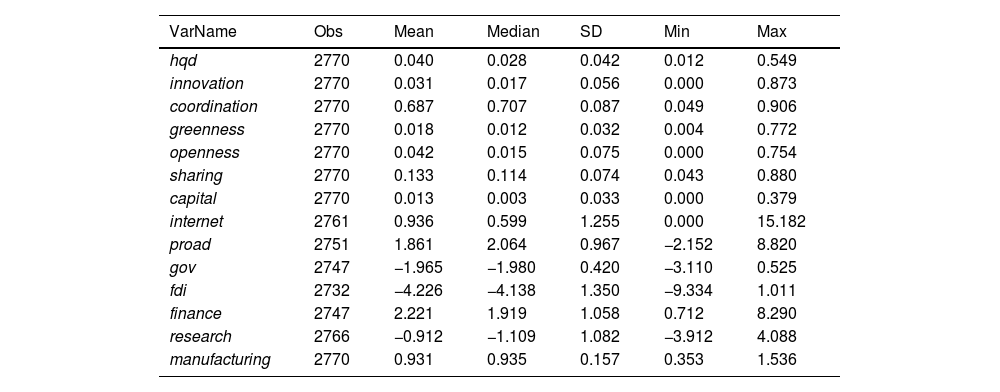

There are several main sources of data used in the study. The first is the China Customs Import and Export Database, from which this paper identifies the import information for different years in the same city by using the company name, address, location and postal code to obtain the import amounts for each year in each city. The second is the China Industrial Enterprises Database, from which the data used in the calculation of the technical complexity of the manufacturing industry are mainly derived. The third is the China City Statistical Yearbook, from which the majority of the raw data for the control variables involved in our empirical analysis and for the indicators of high-quality development can be found. The fourth is the Patent Database of the China Patent and Intellectual Property Office, from which the data on the number of patents granted and other data on the explanatory variables are obtained. The fifth is the urban PM 2.5 emissions data, with the raw data sourced from the global raster data on the Washington University in St. Lewis website. Based on data availability, 2770 observation units are selected. Descriptive statistics for the relevant variables are shown in Table 2. The data are double-sided with a 0.5% tailing.

Descriptive statistics of relevant variables.

In addition, collinearity and smoothness tests are performed on the variables. First, since we have unbalanced panel data, the Fisher test is used to test for robustness, and the results are shown in Appendix A. The statistics of each variable reject the original hypothesis of a panel unit root and the corresponding p-values are less than 0.1 and close to 0. Second, a correlation matrix is considered to identify multicollinearity, and the results are shown in Appendix B. The correlation between the dependent variable and the explanatory variables is significant and the correlation coefficient between the explanatory variables is less than the mean of 0.8, which indicates that there is no multicollinearity between the variables.

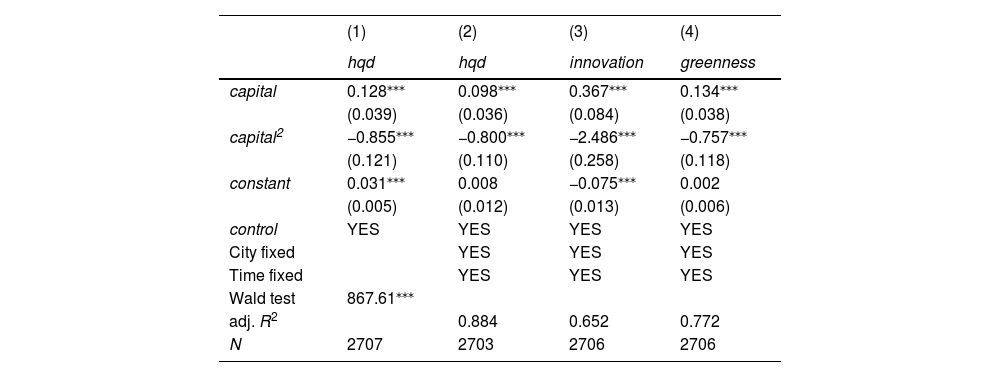

Regression analysisBaseline regression analysisTo test Hypothesis 1, this paper estimates Eq. (1) using a random effects model, a mixed effects model, a time fixed effects model and a two-way fixed effects model, and the regression results are shown in Table 3. Moreover, this paper conducts the Hausman test. The estimated statistic is significant at the 1% level, rejecting the null hypothesis of a random fixed effects model. The results show that the regression coefficients of the primary and secondary terms of the level of capital goods imports on urban high-quality development are positive and negative, respectively, and that they are statistically significant at the 1% level. This indicates that the impact of capital goods imports on urban high-quality development is non-linear exhibiting an inverted U-shaped relationship. This finding diffes from those of studies that conclude that imports of capital goods are positively associated with the quality of regional development (Eaton & Kortum, 2001; Fieler et al., 2018). Within a certain range, an increase in the level of capital goods imports can significantly promote the high-quality development of cities, and when the import of capital goods exceeds a certain level, capital goods imports will have a negative effect on the high-quality development of cities.

Baseline regression result.

Notes: The values in brackets "[]" are the p- values of the corresponding test statistics. The values in brackets are standard deviations. ***, ** and * indicate that the estimated coefficients are significant at the confidence 1%, 5% and 10% levels, respectively. In addition, the result of the Wald test in the Column (2) is significant at the 1% level, which indicates that the parameters of the explanatory variables in the random effects model are significant and important for the explanation of the model and implies that the model exhibits strong explanatory power.

Regarding the control variables, the coefficients of internet penetration (internet) and the degree of construction of basic transport facilities (proad) on a city's high-quality development are both positive and statistically significant at the 1% level, indicating that the penetration of digital networks and the improvement in basic transport facilities help enhance a city's high-quality development. Government support (gov) has a negative coefficient after using time fixed effects and two-way fixed effects and is statistically significant at the 1% level, suggesting that excessive government intervention may be detrimental to the quality development of cities, and therefore, local governments should be careful to control their level of financial support. The degree of openness to foreign investment (fdi) is significantly positive in the mixed and time fixed effects models and statistically significant at the 1% level, suggesting that obtaining foreign investment is an important step in a city's quality development and that attention should be given to guiding foreign investment. The coefficients on the level of regional financial development (finance) on the quality development of cities are all significantly positive, indicating that the healthy development of financial markets can effectively promote the quality development of cities.

To test the robustness of the effect of capital goods imports on quality urban development, this paper adopts methods such as replacing the regression model, adding control variables and replacing the explanatory variables, and the results are shown in Table 4. First, the dependent variable has a significant tail on the left-hand side with zero as the critical value, and this paper uses the Tobit model for robustness testing. Column (1) in Table 4 shows the results of employing the Tobit model, and capital goods imports continue to display an inverted U-shaped relationship with quality urban development. Second, this paper does not include the level of residential consumption as a control variable in the baseline regression, while regional high-quality development is closely related to the level of residential consumption. An increase in the level of residential consumption can promote the transformation and upgrading of related enterprises through the demand effect, which in turn can better match the changes in the quality and level of consumer demand. This helps modernize and transform the industrial system and thus promotes high-quality urban development. Therefore, this paper further introduces the level of residential consumption as a control variable for robustness testing. The regression results are shown in Column (2) of Table 4. After controlling for regional residential consumption levels, capital goods imports still show an inverted U-shaped relationship with high-quality urban development, and the basic conclusions of this paper still hold. Finally, we know that innovation is the first driver of economic development and that high-quality development should also be green and sustainable. Therefore, this paper replaces the regional quality development index with the level of innovation development and the level of green development of a city for robustness tests, and the regression results are shown in Columns (3) and (4) in Table 4. Clearly, the inverted U-shaped relationship between capital goods imports and urban high-quality development remains robust and that the coefficient of capital goods imports on innovation development is greater than that of the other coefficients.

Robustness checks.

Notes: The values in brackets are standard deviations. ***, ** and * indicate that the estimated coefficients are significant at the 1%, 5% and 10% level, respectively. The result of the Wald test in the Column (1) is significant at the 1% level, which indicates that the parameters of the explanatory variables in the Tobit model are significant and important for the explanation of the model, and implies that the model is constructed with strong explanatory power.

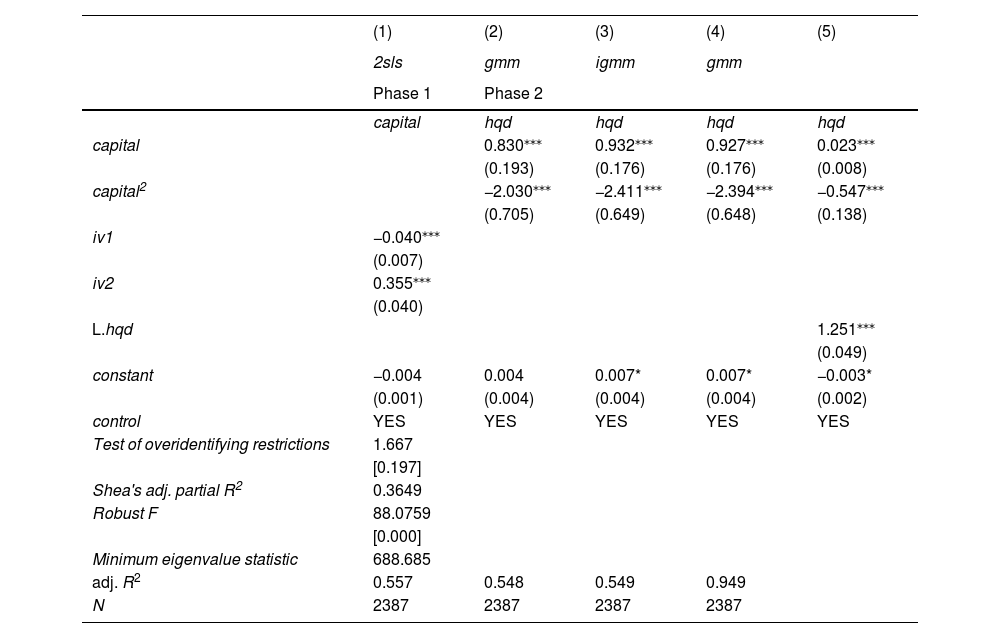

To further eliminate the endogeneity problem in the regression model, this paper uses the instrumental variables method for regression analysis. Specifically, this paper uses the distance of the prefecture-level city from the nearest port (iv1) and the one-period lagged capital goods import level (iv2) as instrumental variables and uses the two-stage least squares (2SLS), optimal GMM and iterative GMM methods to solve the potential endogeneity problem of the model. The results of the analysis are shown in Table 5. The p value of the F test is 0.000, and the minimum eigenvalue statistic of 688.685 is much greater than 10, indicating that there is no problem of weak instrumental variables. Since two instrumental variables are chosen, further overidentification tests are needed. From the results, the p value of 0.197 is greater than 0.1, which indicates that the hypothesis that the instrumental variables are exogenous cannot be rejected, and therefore, there is no overidentification problem. The results of the 2SLS, optimal GMM and iterative GMM estimations show that the regression coefficients of the primary and secondary terms of the capital goods import level are still statistically significant at the 1% level. The results of the optimal GMM estimation and iterative GMM estimation are basically consistent with those of the IV-2SLS, which indicates that the inverted U-shaped relationship between the capital goods import level and regional high-quality development has been further verified. Because hdq may persist in different periods and spill over into future periods, a lagged term of hqd is added to the GMM model, and the results are shown in Column (5) in Table 5, indicate that the hypothesis still holds. In summary, the inverted U-shaped relationship between the level of capital goods imports and regional high-quality development is robust. That is, there is a non-linear characteristic of the contribution of the level of capital goods imports to regional high-quality development. Thus, Hypothesis 1 is verified.

Endogeneity test.

Notes: The values in parentheses "()" are standard deviations. The values in brackets "[]" are the p- values of the corresponding test statistics. ***, ** and * indicate that the estimated coefficients are significant at the of 1%, 5% and 10% level, respectively.

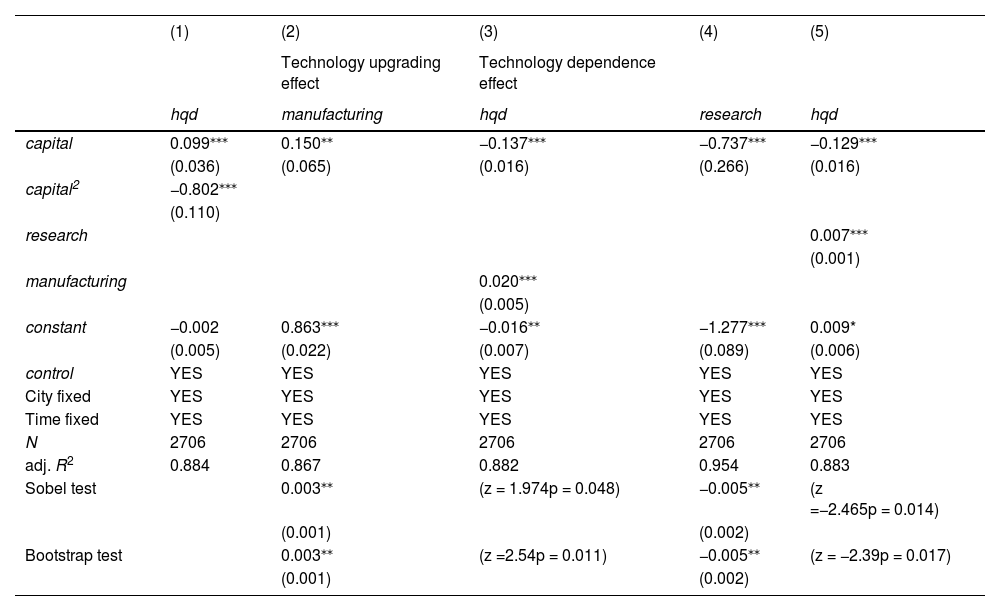

From the previous analysis, it is clear that the level of capital goods imports has a non-linear relationship with regional high-quality development, showing an inverted U-shaped trend. The reason for this non-linear relationship needs further verification. Therefore, this paper adopts a step-by-step analysis of the mediating effect to regress Eq. (2) with Eq. (3), and the results of the analysis are shown in Table 6. First, the results of the regression of the mediating effect of the technology upgrading effect show that the estimated coefficient of the level of capital goods imports on the level of technological sophistication of regional manufacturing is positive and statistically significant at the 5% level. This indicates that capital goods imports can generate a technology upgrading effect by enhancing the technological sophistication of urban manufacturing (Goldberg et al., 2009), thus promoting regional high-quality development. Its mediating effect is 0.003 (0.150×0.020). This is consistent with studies concluding that domestic productivity gains in capital goods arise mainly from technology spillovers from capital goods imports (Eaton & Kortum, 1996; Hasan, 2002). In addition, this paper uses the Bootstrap test and Sobel test, which are able to effectively test the results of Baron's (1986) three-step method of transmission mechanism analysis. The purpose of these two tests is to ensure the robustness of the results in the analysis of mediating effects. The mediating effect test results show that the results of the Sobel test and the Bootstrap test are consistent and statistically significant at the 5% level. Hypothesis 2a is verified; that is, the imports of capital goods promote regional quality development through a technology upgrading effect. Second, the regression results of the mediating effect of technology dependence show that the regression coefficient on the level of capital goods imports on the importance of regional technological R&D investment is negative and statistically significant at the 1% level. This indicates that capital goods imports generate the technology dependence effect by suppressing the importance of regional technological R&D investment, thus slowing the process of high-quality urban development. The mediating effect is −0.005 (−0.737×0.007). This is similar to the conclusion of Zhang (2015) and Damijan and Kostevc (2015) that capital goods imports may have a dampening effect on endogenous innovation. The results of the mediating effect test show that there is consistency between the Sobel test and the Bootstrap test results, both of which are statistically significant at the 5% level. Hypothesis 2b is verified. The imports of capital goods can hinder regional quality development through a technology dependence effect. Therefore, capital goods imports can have a technology upgrading effect that promotes high-quality urban development, and a technological dependency effect that dampens the process of high-quality regional development, which leads to a non-linear effect of capital goods imports on high-quality urban development.

Regression results for the mechanism analysis.

Notes: The values in brackets are standard deviations. ***, ** and * indicate that the estimated coefficients are significant at the 1%, 5% and 10% level, respectively.

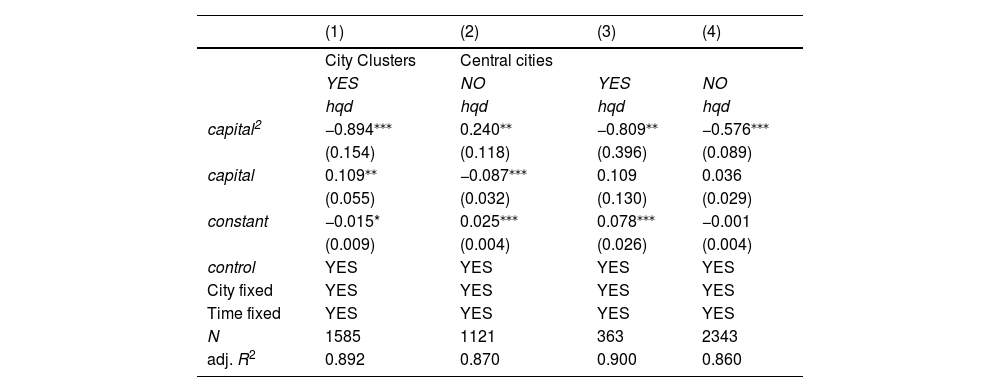

Regional heterogeneity is analyzed to verify whether the non-linear impact of capital goods imports on the high-quality development of cities is heterogeneous across regions. First, this paper classifies the sample into urban and nonurban clusters and central and noncentral cities according to the different categories of cities. The division of urban clusters is based on documents such as the Opinions of the Central Committee of the Communist Party of China and the State Council on Establishing a New Mechanism for More Effective Coordinated Regional Development, issued by the Chinese government on 18 November 20184. Urban agglomerations are the inevitable product of urbanization and industrialization at a certain stage of development. Compared with nonurban agglomerations, cities within urban agglomerations have complete industrial systems, more mature technological innovation chains and a greater scope of market demand. The difference between central cities and noncentral cities is mainly based on their level of economic development, and the degree of completeness of the industrial system and technological innovation capability are not their main differentiating factors. Second, the paper categorizes the city sample into cities at the 10%, 25%, 50%, 75% and 90% development levels and uses quantile regression analysis to test this categorization.

The estimation results regarding regional heterogeneity are shown in Table 7. For the regression results of urban and nonurban clusters, the coefficients of the primary and secondary terms of capital goods imports of urban clusters on the high-quality development of cities are positive and negative, respectively, and both are statistically significant at the 1% level. This indicates the non-linear characteristics of the positive effect of capital goods imports on the quality of economic development in urban clusters. At the initial stage, the technology upgrading effect of the introduction of capital goods exceeds the technological dependency effect, and when the amount of capital goods imports surpasses a certain level, the resulting technological dependency effect exceeds the technology upgrading effect, thus adversely affecting the quality of urban economic development. The regression coefficients of the primary and secondary terms of capital goods imports for nonurban clusters on the high-quality development of cities are negative and positive, respectively, which indicates that the effect of capital goods imports on cities with weak industrial bases and weak technological transformation and innovation capabilities has a suppressive and then a promotional effect. For the regression results of central and noncentral cities, the estimated coefficients of the primary and secondary coefficients of capital goods imports on regional quality development for central and noncentral cities are positive and negative, respectively. This indicates that the regression results for city categories differentiated by their economic development levels exhibit non-linear characteristics. Thus, there is heterogeneity in the contribution of capital goods imports to quality urban development across different categories of cities. This may result form the effect of knowledge spillovers related to the variability of a region's resource endowment (Hobday & Perini, 2005). Hypothesis 3a is tested. However, it is worth further exploring whether there is heterogeneity in the effect of capital goods imports on economic development in these cities.

Analysis of regional heterogeneity.

Notes: The values in brackets are standard deviations. ***, ** and * indicate that the estimated coefficients are significant at the 1%, 5% and 10% level, respectively.

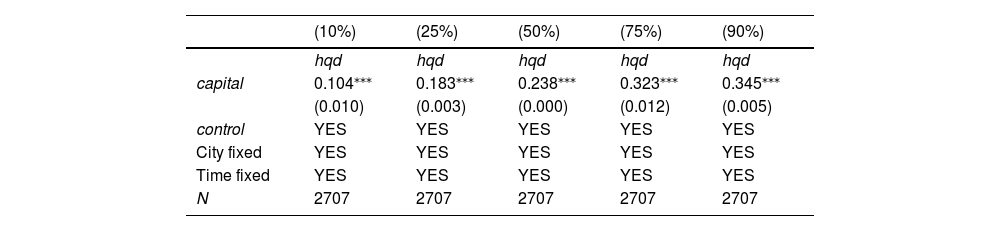

To further explore the regional variability of the impact of capital goods imports on the high-quality development of cities at different levels of economic development, this paper applies quantile regression methods, and the estimation results are shown in Table 8. On the one hand, for cities at all levels of economic development, the estimated coefficients of capital goods imports on high-quality urban development are positive and statistically significant at the 1% level, indicating that capital goods imports can contribute to the quality of urban development for cities at different stages of development. On the other hand, as the level of urban development increases, the estimated coefficient of capital goods imports on high-quality urban development increases, indicating that the higher the level of regional development is, the greater the economic and social effects of capital goods. Thus, for cities at different levels of development, there is heterogeneity in the contribution of capital goods imports to high-quality urban development. Hypothesis 3b is tested.

Analysis of heterogeneity in levels of development.

Notes: The values in brackets are standard deviations. ***, ** and * indicate that the estimated coefficients are significant at the 1%, 5% and 10% level, respectively.

Under a centralized government but a decentralized fiscal system, economic growth pressure and horizontal competition among local governments in China may affect the economic and social effects of capital goods imports. To verify whether the effect of capital goods imports on quality urban development is affected by the economic growth pressure on local governments, this paper uses the difference between the economic growth targets of prefectural and provincial governments as a proxy variable for government economic growth pressure and introduces an interaction term between government economic growth pressure and the level of capital goods imports. The estimated results are shown in Table 9. The extreme value of the inverted U-shaped relationship between capital goods imports and urban quality development is (0.057, 0.005) before government economic growth pressure was considered. The extreme value of the inverted U-shaped relationship between capital goods imports and urban quality development is (0.084, 0.017) after introducing the interaction term between government economic growth pressure and capital goods imports. The economic development effect of capital goods imports, moderated by the government's growth pressure, undergoes the following changes. On the one hand, the highest level of quality development in the city increases, which means that the contribution of capital goods imports to the quality of urban development is significantly enhanced. On the other hand, the optimal value of capital goods imports increases, which means that excessive capital goods imports are less of an obstacle to the improvement of urban development quality. Therefore, Hypothesis 4 is tested.

Moderating effects of government pressure for economic growth.

Notes: The values in brackets are standard deviations. ***, ** and * indicate that the estimated coefficients are significant at the 1%, 5% and 10% level, respectively.

In the face of the fifth industrial revolution, a central aim of which is sustainable development, economies need to develop import trade with specific technological content in line with their development goals to improve social productivity to achieve high-quality economic and social development. Unlike previous studies that focused on the economic and social effects of intermediate goods imports, this paper is more concerned with the economic development effects engendered by imports of capital goods with a higher level of imbedded technology and their possible underlying mechanisms. The study is important for countries seeking to reexamine their foreign trade policies to improve the quality of their economic and social development in light of increasing global economic and trade frictions, prevailing trade protectionism and increasing trade uncertainty. Specifically, this study has general value for developing countries seeking to balance capital goods imports with long-term quality economic development in an era of heightened trade uncertainty. In addition, the incentive effects of government economic growth pressures are further explored from an institutional economics perspective, thus enriching the study of the economic development effects of capital goods imports.

Using China as the research object, the economic development effects of capital goods imports are explored using Chinese customs import and export data, Chinese industrial enterprise data and Chinese city statistical yearbooks covering the period from 2003 to 2013. It is found that the impact of capital goods imports on the high-quality development of cities presents a non-linear relationship that takes an overall inverted U-shape. From the results of the mechanism analysis, this paper finds that capital goods imports can be seen to influence the quality of urban development through the technology spillover effect. This influence mainly includes the promotion effect engendered by the technology upgrading effect and the hindering effect caused by the technology dependence effect. From the results of the regional heterogeneity analysis, the economic and social effects of capital goods imports show an inverted U-shape for city clusters with complete industrial systems, more mature technological innovation chains and larger market demand space. These results indicate that the technology upgrading effect of capital imports is greater than the technological dependence effect at the initial stage. However, the technological dependence effect exceeds the technology upgrading effect after the import volume reaches a certain threshold, making the impact of capital goods imports on the quality of regional development moderate. For regions with different levels of economic development, the higher the economic development level of the region is, the better the economic and social effects of capital goods. In addition, the economic growth pressure of local governments can strengthen the positive effect of capital goods imports on the quality of regional development and simultaneously reduce the inhibiting effect of excessive capital goods imports on the quality of regional development.

Policy implicationsBased on the results of the research, the following implications are obtained. First, the technological spillover effect of capital goods imports should be approached rationally. While indulging in the technology upgrading effect of capital imports on high-quality sustainable regional development in an environment of increased trade uncertainty, the technological dependency effect it brings must be recognized. While the important role played by capital goods in promoting regional technological innovation, green development and thus high-quality sustainable economic and social development cannot be denied, measures must also be taken to prevent local economic agents from losing the dynamism of independent innovation and the incentive to construct key links in the industrial and innovation chains. Second, in a country with a centralized political system and a decentralized fiscal system such as China, the central government should focus on fully mobilizing local governments to develop the economy and reshape the incentive and constraint mechanisms of local governments while optimizing import and trade policies. It should be clearly understood that, based on the definition of high-quality SDGs and the improvement of the performance evaluation system of officials, the incentives and pressures exerted by horizontal competition and the holding of promotion "tournaments" represented by the pressure of economic growth can effectively push local governments to play the role of the a "visible hand". Local officials are motivated to enhance the technological spillover effect of capital goods imports and reduce the technological dependency effect by encouraging capital goods imports, building resource platforms and providing various preferential policies, which would enable the economic and social effects of imported capital goods to be fully utilized, thus promoting high-quality sustainable regional development.

Limitations and future research directionsThis paper examines the impact of capital goods imports on regional development quality and government actions, providing insights for regional development and trade policy. The paper also presents future research directions. First, it highlights the crucial role of innovation in enhancing regional development quality and international competitiveness. While considering the technology upgrading and dependence effects of capital goods imports, it calls for further investigation into their influence on innovation quality and continuous progress. Second, the paper explores the external effects driven by government actions but neglects the role and impact of digital factors in the market-based mechanism. Investigating the synergistic effects of digital factors on the economic and social outcomes of capital goods imports will offer valuable policy insights for trade policy formulation in the digital economy era.

http://www.gov.cn/xinwen/2022-10/25/content_5721685.htm