Editado por: Marcin W. Staniewski

Más datosThe impact of the sharing economy has become increasingly prominent in facilitating sustainable economic growth. The current study examined this relationship in the context of emerging markets. It addressed the influence of income inequality on restricting the expected benefits from activities associated with the sharing of assets or services. The study employed panel data from 20 developing countries across Africa and Asia from 2001 to 2020 and used dynamic models to mitigate the impact of endogeneity. The study utilised a proxy indicator for sharing economies developed in the literature, as well as three different measures for income inequality, in order to ensure robust findings. The study employed the generalised method of moments (GMM) as its primary methodology. The GMM results confirmed previous findings from developed countries in which the sharing economy tended to promote the sustainable growth of the economy. Income inequality was observed to have a negative relationship with sustainable economic growth, however, and this indicated that it hampered the ability of the sharing economy to stimulate sustainable growth. Interestingly, when the analysis included interaction terms to capture the moderating impact of income inequality there was more consistency with previous research. The interaction term had a negative coefficient, indicating that income inequality tended to act as an impediment in developing countries to the full capturing of the benefits of peer-to-peer transactions. These findings provided useful insights into collaborative consumption and the peer economy, given that the aim of the sharing of resources would be to capture rent from underused assets. The study suggested that the development of efficient and effective platforms would allow developing countries to capture the benefits of the sharing economy.

The adoption of various new technologies has arguably led to the exploitation of various natural resources, and this issue has been the focus of many governments across the world. This situation encouraged policy makers to introduce new policies that would promote sustainable economic growth, especially in developing countries. The consumption of natural resources by developing countries has resulted in negative influences on “traditional business activities” (Bai et al., 2020). The “environmental systems” of such countries were also found to be negatively influenced by such activities, and this resulted in the lowering of economic growth. To improve the economic growth of such countries, sustainable development was considered to be necessary (Dabbous & Tarhini, 2019), and new innovative methods were proposed to improve the information technology, as well as the communication technology, to prevent instability in the consumption of resources.

Innovative technologies can help to promote a sharing economy in developing countries and are thought to have a positive impact on sustainable economic growth in developing countries (Anglada & Lara, 2020; Batool et al., 2021; Dabbous & Tarhini, 2021; Hartl et al., 2018; Méndez-Picazo et al., 2021; Na et al., 2019). According to Liu et al. (2019), peer economy transactions on online platforms allow a shared access to goods and services. Thus, these transactions are thought to be a sustainable form of a sharing economy that effectively promotes the use of natural resources.

The observed income inequality in developing countries could limit the ability to share resources and result in a lower level of sustainable economic growth. Such an imbalance in incomes in these countries is due, in part, to political instability, social dysfunction and societal and governmental institutions that are less helpful than they could be (Mamun et al., 2021; Kolozsi & Lentner, 2020; Zvolska et al., 2019). Developing countries are unable to provide sufficient investments in human capital, and this leads to the improper distribution of wealth among people and influences people's contributions to the sustainable economic growth of the country. Such inequality also results in observed discrimination. Income inequality is basically the uneven distribution of income throughout a population. It is expected to impede growth in the initial stages of economic development, and this is the case in most developing countries.

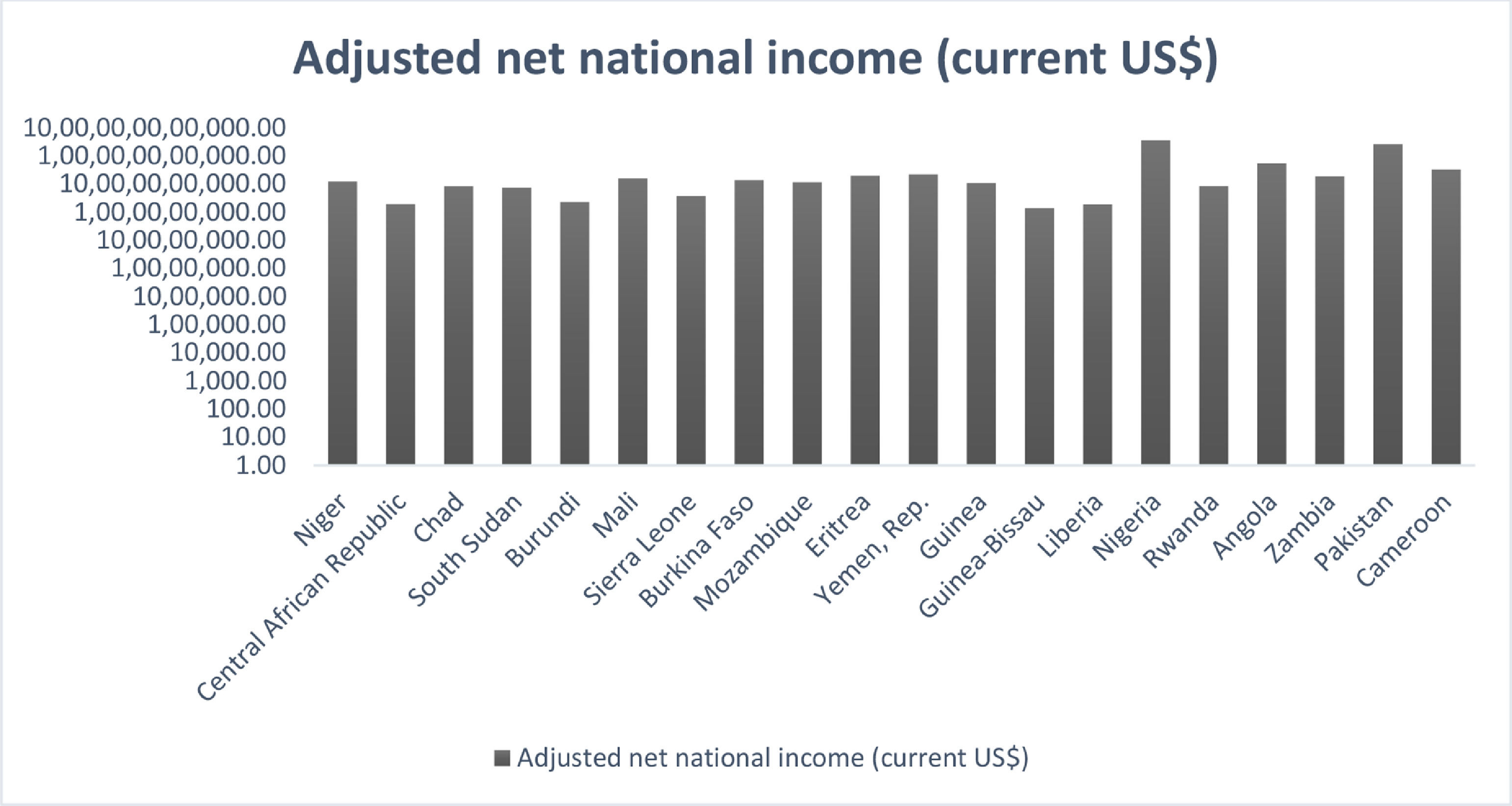

Developing countries are arguably less likely to have reduced poverty rates due to their poor economic growth opportunities. A potential solution could be to provide more equal opportunities, and this has been shown to promote sustainable economic growth in developing countries (Kryshtanovych et al., 2021; Tabeikyna et al., 2021; Tandon et al., 2020). The sharing economy phenomenon provides an equitable avenue for alleviating poverty via the sharing of resources; it offers access to those in need and facilitates exchanges in a peer-to-peer context. Its success is often restricted, however, due to a lack of awareness of the benefits of the sharing economy in the developing world and its benefits for sustainable economic growth (Qureshi et al., 2021). Fig. 1 shows the adjusted net national income (based on a logarithmic scale) of the developing countries considered in this study, retrieved from the World Bank for the year 2020.

Recent research on the sharing economy and economic sustainability has focused on developed parts of the world. The literature has largely ignored developing countries, which tend to have greater levels of income inequality (Dabbous & Tarhini, 2021; Menyelim et al., 2021). Given the significant rise in income inequality, it is important to assess the impact of the sharing economy on sustainable economic growth (Cheng, 2016; Cohen & Kietzmann, 2014). The importance of this study was further underlined by the fact that past studies have mostly focused on targeted evidence, with the relationships among identified factors remaining largely unexplored (Dabla-Norris et al., 2015; Dillahunt & Malone, 2015). Those previous studies have not taken developing countries into consideration when analysing the impact of the sharing economy on sustainable economic growth (Frenken & Schor, 2019; Heinrichs, 2013).

The findings of previous studies remain inconclusive, Some studies have proposed that the sharing economy disrupts the normal and standard patterns of consumption and production, whereas others have proposed that it significantly triggers sustainable economic growth in developing countries (Lee, 2016; Martin, 2016). It is therefore important to provide further insight into this issue and analyse the impact of the sharing economy on sustainable economic growth in the specific context of developing countries. It was expected that the findings would show that sustainable economic growth can be promoted and income inequality can be significantly decreased with a sharing economy. A lack of understanding and implementation of proper policies that would promote sustainable growth could potentially lead to instability and aggravate inequality, a phenomenon exacerbated by the influence of the global pandemic (Badulescu et al., 2021; Laskienė et al., 2020; Lydeka & Karaliute, 2021; Menyelim et al., 2021; Muñoz & Cohen, 2017; Quattrone et al., 2016; Zhang, 2021). We were motivated to analyze the impact of the sharing economy on sustainable growth whilst accounting for the moderating impact of income inequality with a focus on developing countries. The remaining sections of the paper include a literature review, research methodology, data analysis outcome and interpretation, discussion and conclusion, including research implications and limitations.

Literature reviewImpact of a sharing economy on sustainable developmentPrevious studies (Puschmann & Alt, 2016) showed that the sharing economy had been described as a monetary plan of action facilitated by digital platforms, with a focus on admittance to underutilised services and products rather than possession. This study added to the literature on the sharing economy and illustrated its significance for national economies in a rather turbulent time. Previous literature (Troisi et al., 2016) categorised the sharing economy as a unique entity that produces manageable value creation, lessening utilisation and asset and energy use, and that goes some way to support the accomplishment and improvement of sustainable development goals (hereinafter, SDGs).

In recent years, a number of definitions of the sharing economy have been suggested. From the scholastic perspective (Troisi et al., 2016), the sharing economy is predominantly depicted as a monetary biological system that is normally founded on transitory admittance to services and products utilising web-based platforms that connect various individuals through networks (i.e., purchasers and merchants or clients and suppliers). Schor and Fitzmaurice (2015) stated that the sharing economy diminished exchange costs and cultivated trust in sharing between unknown people to the extent that it rivaled the conventional business scene. More recent studies (Laukkanen & Tura, 2020) have contended that the sharing economy increases the use of underutilised things, usually for cash but sometimes for free (e.g., lounge chair surfing, or letting people stay in a home for free, and freecycling, or giving underutilised items to peers for free); this helps avoid overconsumption. This study viewed the sharing economy as a plan of action with the fundamental bases of (1) an access economy, (2) a platform economy, and (3) a local area‒based economy. Underutilised resources are shared (Schor, 2016), and the primary users of the sharing economy are suppliers of common items, clients who wish to purchase or obtain these items, and information technology platforms.

Recent literature (Pawlicz, 2019) discussed whether the sharing economy could yield maintainable and equitable advancement of the economy with a more maintainable monetary model (Hasan & Birgach, 2016). The sharing economy was perceived to be a driver for financial support during disruptive events, as it increased personal satisfaction by permitting the utilisation of existing assets. Furthermore, the sharing economy saved costs and diminished imbalances by providing a livelihood for individuals from all social classes and improved entrepreneurship, which in turn had a positive impact on economic growth (Pankov et al., 2021). The effect of the sharing economy became more significant during the Covid-19 pandemic, when enterprises within the sharing economy were better at coping with the crisis (Hossain, 2021) and helped improved economic growth.

The sharing economy allowed admittance to underutilised services and products (Ma et al., 2018). This meant that the sharing economy placed markets in a healthy ecosystem based on the socioeconomic environment of a region. This research clarified that the sharing economy is a financial framework that uses an innovation-based market and adds to more manageable consumption by utilising underutilised resources. Karobliene and Pilinkiene (2021) found that the sharing economy is a monetary benefit that empowers a more manageable utilisation of shared things and subsequently creates a path to a sound and practical economy. The connections of the sharing economy to the practical presentation and advancement of national economies has been observed to impact SDGs. There are 17 SDGs and 169 SDG subgoals, which aim to advance worldwide financial, social, and ecological events (Dalampira & Nastis, 2020). These goals are aligned with worldwide economic advancement and were embraced by the General Assembly of the United Nations in 2015 (Jaramillo et al., 2019).

The Stockholm Resilience Centre groups the objectives of the SDGs into three areas, financial, social, and ecological (Wood et al., 2019). The economic goals are SDGs 8 to 10 and 12; the social goals are SDGs 1 to 5, 7, 11, and 16, and the environmental goals are SDGs 6 and 13 to 15. The sharing economy offers opportunities for monetary development, a methodology that can provide a more manageable usage of assets, and the inclusion of unregulated business sectors; it thereby fortifies the neoliberal worldview and sustainable development (Martin, 2016).

In a conceptual view of the sharing economy, Schiel (2015) explored the connections among realist and postrealist values, the effect of environmentalism and manageability, and new ways of expanding material prosperity and giving a higher quality of life to more people. The sharing economy can be an umbrella covering novel ideas for new businesses, financial exercises, and ways of social cooperation. Because the sharing economy is expected to support financial and social developments, interdisciplinary and cross-disciplinary examinations of it should be made.

In light of these findings, the following hypothesis has been generated,

Hypothesis 1 The sharing economy has a significant impact on sustainable economic growth.

Feldstein (1998) showed that inequality is a social condition that has been present throughout history and that has always had a financial component. Differences in opportunity, wealth and freedom are long-standing, and efforts to alleviate them have done little over time.

Paukert (1973) showed that developed economies are characterised by big salaries and many opportunities compared with economies in nonindustrial countries and that developed economies have lower levels of inequality. As nonindustrial nations try to provide everyday comforts for their citizens, they face difficulties such as the concentration of wealth among a small group of individuals, the absence of opportunities for social mobility via education for the marginalised, and the fragility of young democracies. Household income has been rising over the past three decades in several nations belonging to the Organisation for Economic and Cooperative Development (OECD), although the increases slowed briefly during the Great Recession (Alderson & Nielsen, 2002). This prompted discussions about imbalances, especially in the United States, and was one of the reasons for the introduction of emergency monetary measures in 2008.

Lazar et al. (2020) found that the main debate centered on investments in which large expenditures were required to make basic advancements. Without established banks and a stock exchange that would allow for the assembling of enormous amounts of cash, a high centralization of wealth is required. Sadiku et al. (2015) showed the connection between financial development and pay imbalances for 45 nations from 1966 to 1995. Research revealed that the expansion in income inequality had a huge positive relationship with financial development in the short term and medium term and that there was a connection between income inequality and monetary development in 106 nations from 1965 to 2005 (Bravo-Ortega & Marín, 2011). The outcomes showed that pay imbalances affected the financial development in the short run but that the two were contrarily related over the long term. In other words, certain pay imbalances enhance economic development by increasing worker aspirations and motivating pioneers and entrepreneurs. Some researchers have speculated that inequality can influence development in either a positive or negative manner. Greater inequality may decrease development for the following reasons: (1) Large imbalances might cause electors to demand higher taxes or lose faith in and decrease support for the business sector; these changes might act as disincentives for entrepreneurial activities. In extreme cases, imbalances might prompt political insecurity and social agitation, with unsafe consequences for development (Keefer & Knack, 2002). (2) Financial market downturns might reduce growth potential for a society. For instance, families with low incomes might take their children out of school to avoid educational expenses, even though the intellectual and social costs of doing this are high for both the students and society. Therefore, actions of lower-income individuals may have detrimental results to society as a whole. The societal issues of economic downturns (Mol, 1995) have provided an impetus for discussions on the outcomes of rising U.S. financial imbalances (Castellano et al., 2016).

Brueckner & Lederman, 2015 evaluated the impact that income inequality had on the overall economy of a country. They looked at the impact that changes in income inequality had on the gross domestic product (GDP) per capita and its variability among rich and poorer nations. -Galor and Zeira (1993) proposed a model of credit market flaws and insuperabilities in investment to show that an imbalance influenced the GDP per capita in the short term and long term. Based on this discussion, the following hypothesis has been formed,

Hypothesis 2 Income inequality significantly moderates the relationship between a sharing economy and sustainable economic development.

The study used an independent variable (the sharing economy), a moderator (income inequality) and a dependent variable (sustainable economic growth), which are defined below. The data were from the years 2001 to 2020 in 20 developing countries, Niger, Central African Republic, Chad, South Sudan, Burundi, Mali, Sierra Leone, Burkina Faso, Mozambique, Eritrea, Yemen, Guinea, Guinea-Bissau, Liberia, Nigeria, Rwanda, Angola, Zambia, Pakistan and Cameroon. The data range allowed the researchers to have flexibility in modeling the differences present among the behaviors across different units.

Income inequality: The data for measuring income inequality were extracted with the Gini coefficient (GC), Atkinson index (AI) and Palma ratio (PR) from the Global Consumption and Income Project (GCIP) (Menyelim et al., 2021).

Sharing economy: The Composite Index was used to measure the sharing economy in the 20 countries, as adopted from Lee (2016).

Sustainable economic growth: The variable sustainable economic growth was measured by the growth of the per capita gross national income, as adopted from Menyelim et al. (2021). The data were taken from the World Development Indicators (WDI).

Model specifications and techniquesIn this study, the methodology used was the system Generalised Method of Moments (GMM). It combined the collected economic data with information on population movements for the production of estimates regarding unknown parameters in the econometric model (Stephany, 2015). There were a number of reasons for using the system GMM. (1) It deals well with cross-country variations, such as those in our sample. (2) It can handle simultaneity and works well when endogeneity issues are present. (3) The GMM system estimator fixes biases present in the difference GMM. (4) The GMM has small variances, and this makes it efficient and accurate in its estimators (Blundell & Bond, 1998). (5) One advantage of the system GMM over the simple GMM is that the system GMM provides original specifications in first and levels differences (Sundararajan, 2017). According to the criteria, the most suitable leg length for this study was 2, which was significant for the maintenance of the degrees of freedom and the extent of model stability. This was validated by a study applying leg length 4, the results of which were significantly similar to those obtained with leg length 2 (Sutherland & Jarrahi, 2018). The study avoided country-specific variables in order to exclude problems related to the endogeneity of the variables. (6) The application of the system GMM was significant for addressing the problems related to endogeneity because of the application of internal tools that were responsible for dealing with simultaneity and reverse causality (Martin, 2016). (7) Another important advantage of the system GMM was the control of any unnoticed heterogeneity with the help of time invariant absent indicators (Martin, 2016). The specific model for this study is illustrated in Eq. (1).EGi,t=β0+β1SEi,t1+β2IIi,t+∑ajXjit+β3γi+β4θt+εi,t (1)

In order to test the second hypothesis, the following model was proposed:

The model proposed in Eq. (2) engages the measure of the sharing economy with income inequality to evaluate the potential moderating effect of income inequality on the potential benefits offered by the sharing economy phenomenon.

The study used the cross-sectional dependence test, and as a result, p-values were obtained and the Q distribution and Friedman's test values were also applicable. The test was applied because panel data can be subject to pervasive cross-sectional dependence, whereas the involved units of a similar cross section can be correlated as well (Richardson, 2015; Schor, 2016). This was mostly related to the impact of the unobserved common factors, or factors that were common for all of the units and impacted all of the units in various ways (Menyelim et al., 2021). Further unit root and panel cointegration tests were also performed in order to evaluate the consistency of effects across time.

Furthermore, with the application and running of one panel of the GMM estimator, the results included the impact values, Hansen test results, Hansen probability findings, p-values and Sargan test results (Richardson, 2015; Schor, 2016). Stata software was used in the study.

ResultsTo investigate the impact of inequality on the sharing economy and economic growth, a battery of tests were employed. The analysis was initially done using descriptive and correlation testing, followed by diagnostics via cross-sectional dependence to examine the degree of slope homogeneity across the panel data, as well as the panel unit root tests. Finally, the analysis used dynamic panel data methods based on the implications of the diagnostics.

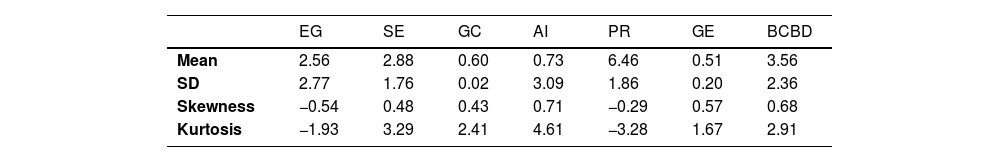

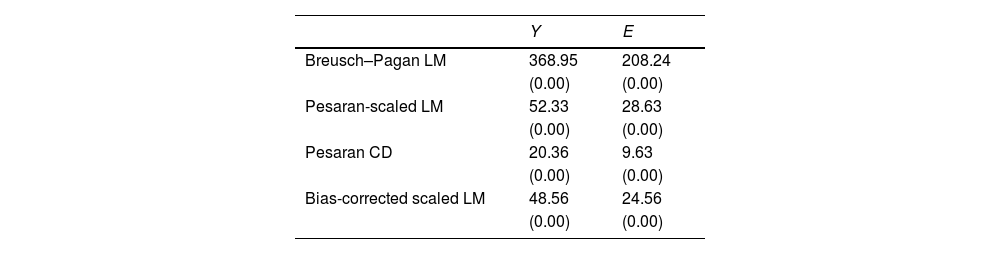

Descriptive analysis and correlationsThe results from the descriptive analysis are presented in Table 2. Table 1 depicts the values of the mean, standard deviation, skewness and kurtosis for the variables employed in the model. It can be seen from Table 1 that all of the variables were normal as indicated by the values of skewness and kurtosis.

Table 2 presents the coefficients of correlations among the variables, indicating the presence of low to moderate correlations among the factors. The results showed that there was a low correlation present between the dependent factor, sustainable economic growth as proxied through the gross national income and the proxy determined for the sharing economy, as well as the indicators of income inequality. The low correlation among all of the factors indicated that there was no issue of multicollinearity prevalent in the model. Only the different measures of income inequality had high levels of correlation because they were different proxies of the same measurement. The correlation matrix was unable to capture the potential dynamic association between factors deployed in the econometric model, however. Thus, the variable dependencies were studied through model diagnostics.

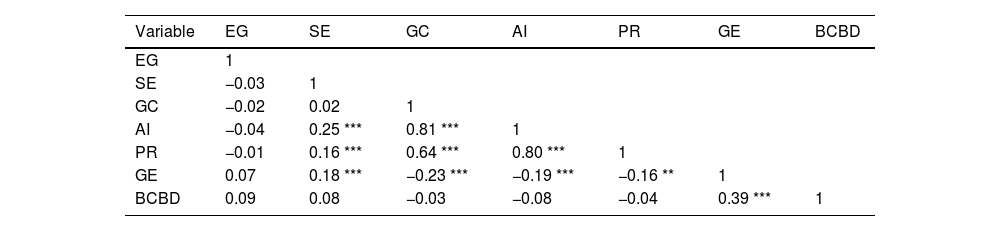

DiagnosticsA diagnostic was conducted with tests for cross-sectional dependence, as well as panel unit root tests. To examine the cross-sectional dependence, the study employed the Breusch and Pagan (1980) LM test, Pesaran (2004) scaled LM test, Pesaran (2004) CD test, and Baltagi et al. (2012) bias-corrected scaled LM test. Details on the specifics of each test can be found in the study by Tugcu and Tiwari (2016).

Table 3 depicts the results of cross-sectional dependency among the factors of the study. The results indicated that the null hypothesis for the slope homogeneity and cross-sectional dependence (i.e., absence of cross-sectional dependence) of the panel was rejected. The findings revealed that any changes or economic shocks occurring in one of the developing countries from the sample pool would be transferred to the other countries, and this suggested that contagion effects could be due to increasing economic and financial integration. The rejection of the slope homogeneity suggested that the causality analysis of the panel data showed that misrepresentative inferences occurred by inflicting a restriction on the homogeneity of the interest variables, leading to inefficient estimates as well as biased standard errors (Adams et al., 2018; De Hoyos & Sarafidis, 2006). The analysis therefore needed to proceed with techniques that could cater to cross-sectional dependence. As a result, the econometric model in this study employed a dynamic panel data method that accounted for this identified limitation.

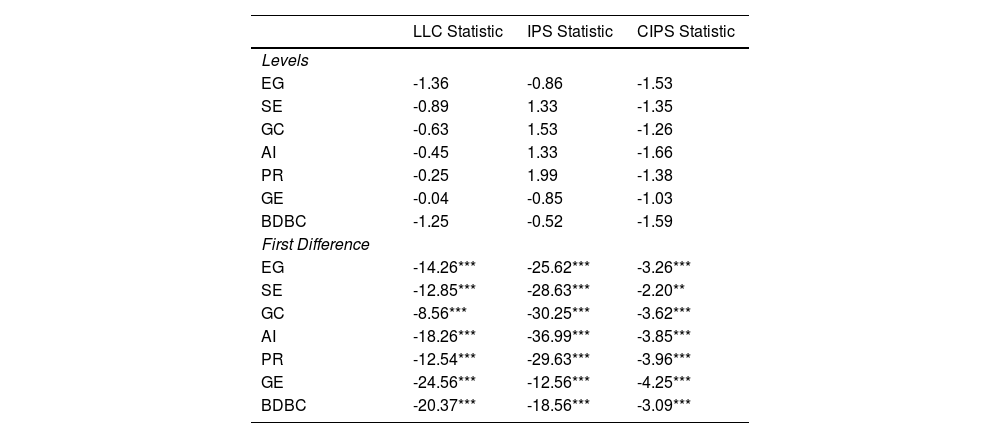

The unit roots and cointegration analysis was performed by an econometric analysis using panel data to overcome the power and size issues related to the time series data. The test aimed to ensure that the variables were stationary and integrated of the same order. Thus, several unit root tests widely used in the literature were employed (Hailemariam et al., 2020). Specifically, the tests employed were the Levin et al. (2002) (LLC) test and Im et al. (2003) (IPS) test, as well as the Pesaran (2007) (CIPS) test, all of which were unit root tests.

The LLC test made a homogeneous autoregressive coefficient assumption across the sample countries, where the null hypothesis was that each particular time series contained a unit root. The IPS test allowed for heterogeneous autoregressive parameters for the panel data, a relaxation of the homogeneity assumption. Thus, the null hypothesis was that all series in the sample had a common unit root. The CIPS test accounted for cross-dependence where the null hypothesis was that all series in the panel contained a unit root. The unit root test results are presented in Table 4 for the level and first differences for all variables utilised in the study.

Panel unit root.

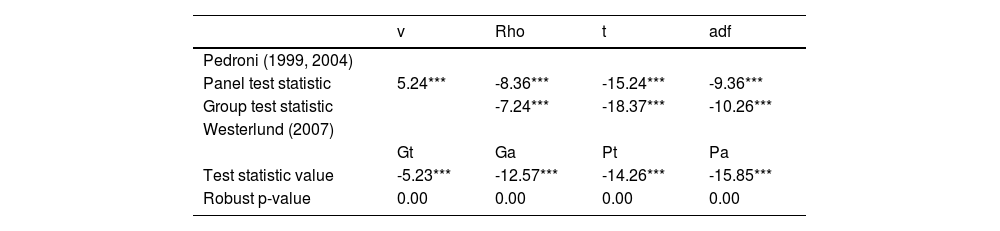

The first column indicates that all variables were likely to have a unit root at levels. In the second and third columns, which display the heterogeneity and cross-sectional dependence, the results were unable to reject the null hypothesis that each series had a unit root at levels. For the first difference, results across all three columns indicated a rejection of the null hypothesis. The results suggested an integration on the order of 1, I (1). This can be interpreted to mean that permanent changes in income inequality and the sharing economy were associated with permanent changes in the growth of the economy and thus led to sustainable economic growth. Finally, the diagnostic applied the cointegration and panel cointegration test in order to examine the cointegration among the variables of interest. It was performed via a two-step procedure, as proposed by Pedroni (1999, 2004), as well as via the error-correction approach suggested by Westerlund (2007). Results for the cointegration tests are reported in Table 5.

Panel cointegration.

| v | Rho | t | adf | |

|---|---|---|---|---|

| Pedroni (1999, 2004) | ||||

| Panel test statistic | 5.24*** | -8.36*** | -15.24*** | -9.36*** |

| Group test statistic | -7.24*** | -18.37*** | -10.26*** | |

| Westerlund (2007) | ||||

| Gt | Ga | Pt | Pa | |

| Test statistic value | -5.23*** | -12.57*** | -14.26*** | -15.85*** |

| Robust p-value | 0.00 | 0.00 | 0.00 | 0.00 |

The first approach indicated that the null hypothesis of no cointegration was rejected at the 1% level, and this validated the panel approach employed. The second approach, which allowed for common factors, also rejected the null hypothesis at 1%, further supporting the dynamic panel approach employed in the current study.

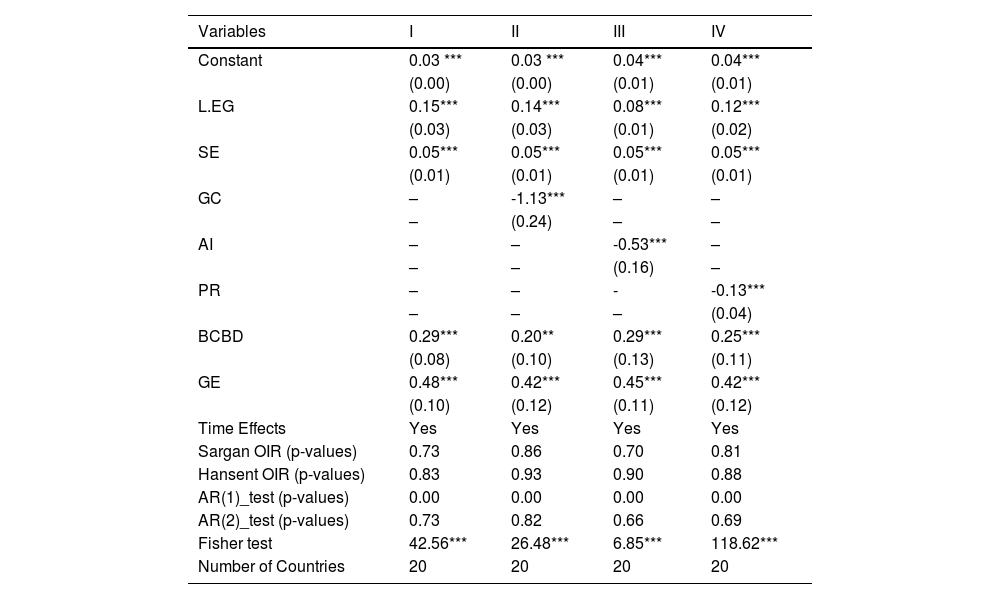

Estimation resultsThe study proposed a moderation of income inequality based on the association between the gross national income and the sharing economy of a pooled sample of developing countries. The employment of multiple indicators for income inequality was essential to ensure the robustness of the parameter. Table 6 presents the GMM results from the models run on the panel data.

Panel data results.

The first model considered only the independent factors of income inequality and the sharing economy, as well as the control variables of governmental effectiveness and the bank credit‒to‒bank deposit ratio. The columns show the effects of the variables on the dependent variable and sustainable economic growth as proxied through the gross national income (Menyelim et al., 2021).

Two criteria were used for the evaluation of the viability of the models for the study. Firstly, the null hypotheses of the second differential by Arellano and Bond (1991) exemplified the nonpresence of autocorrelation in the residuals of the study. Secondly, the OIR, Hansen over identification and Sargan tests were used. They should have been insignificant because the null hypotheses of the tests assumed that instruments were not correlated with their error terms (Odhiambo, 2020). The results from the analysis in Table 6 showed that the AR(2) was insignificant and suggested that there was no indication of autocorrelation in the model. Additionally, there was no evidence found for the correlation between the instrumental variables and error terms, as shown by the p-value of the Hansen J test. Finally, the model was considered valid based on the Fisher test for joint validity of coefficients.

The first column displays the model without a measure of income inequality to assess the impact of the sharing economy on sustainable economic growth. The results indicated that the sharing economy had a positive correlation and led to sustainable economic growth. The parameters of the estimates in the second column indicated that income inequality had a significant but negative association with sustainable economic growth, indicating that it reduced sustainable economic growth. The negative coefficient is seen in columns 2 to 4, indicating that the results were robust regardless of the measure of income inequality. These results showed that for the economy to grow sustainably, the level of inequality needed to be reduced. The results of the control variables were in line with expectations in the literature, in which governmental effectiveness and the bank credit‒to‒bank deposit ratio had a positive coefficient (Menyelim et al., 2021). Therefore, there was improved government effectiveness as well as financial inclusion, leading to greater levels of sustainable economic growth.

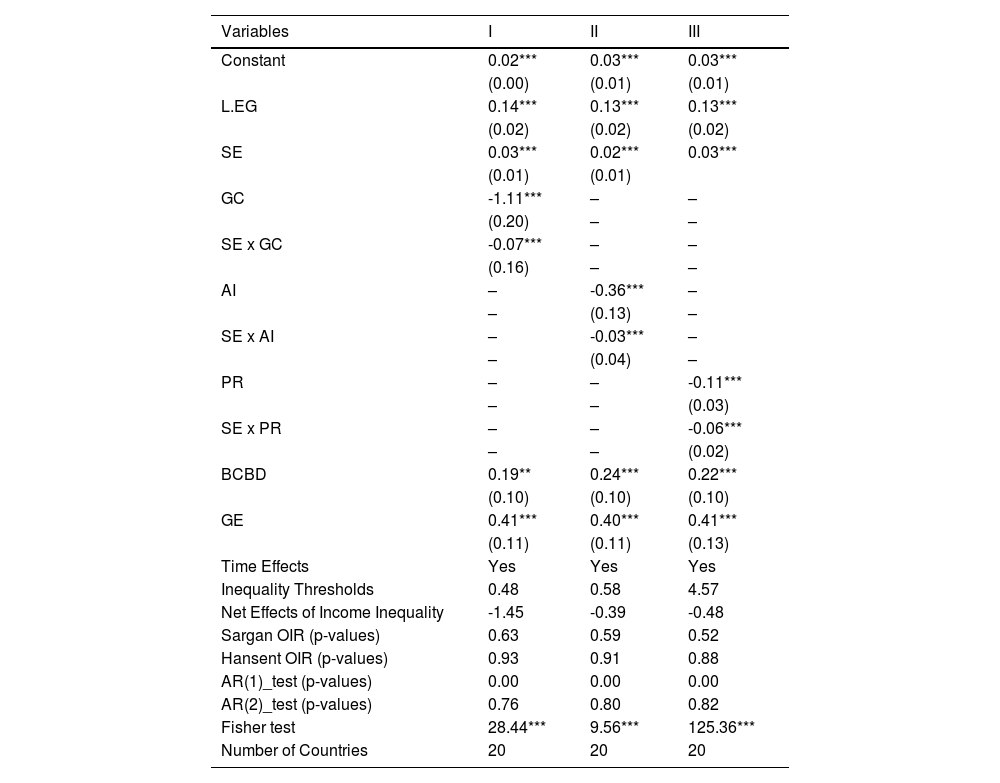

The results for Eq. (2) using the system GMM are reported in Table 7.

The impact of income inequality in moderating the relationship between sharing economy and sustainable growth.

Like the results in Table 6, all the diagnostics were in line with expectations that the model and the estimations were sound. Looking at the interaction term across all three columns, the coefficient is negative, indicating that income inequality dampened the benefit of the sharing economy on sustainable growth. For the interaction terms to be meaningfully interpreted, the net effect was estimated in line with developments in the empirical literature involving interaction terms (Agoba et al., 2020). The net effect was estimated by including the conditional and unconditional effects.

Like the results from the panel unit root tests, which showed that permanent changes in income inequality could lead to permanent changes in sustainable economic growth, the inequality thresholds were estimated (Asongu & Odhiambo, 2020). This provided a meaningful analysis and showed that developing countries could benefit from collaborative consumption.

DiscussionThe sharing economy phenomenon has the potential to have an important impact on sustainable economic growth. However, it is unclear whether the benefits can be harnessed in the presence of income inequality, because disparities in wealth could dilute the potential benefits arising from collaborative consumption. In order to partially address the relationship between the sharing economy and income inequality in developing countries, this study revealed that the sharing economy had a significant impact on the sustainable economic growth of the developing countries. Previous studies supported these findings and validated the research of Ahsan (2020), which showed that the sharing economy was an important model for sustainable economic growth. The results from this study offered a perspective on a macro level of developing countries that help to improve living standards by promoting the use of resources in the context of collaborative consumption. Promoting the use of resources via digital and online technologies can ensure maximum benefits from unused resources to aid a greater number of people. The results were supported by the literature, which showed that stable growth should be targeted in order to preserve resources for future generations (Michelini et al., 2018).

The literature has highlighted pitfalls that could develop from the sharing economy phenomenon because of inequalities in the digital divide being increased in sharing practices (Jin et al., 2018). The results of this study offered a macro-overview of 20 developing countries, showing the societal divide that can result from different levels of wealth arising from income inequality. The findings were supported by Eckhardt et al. (2019), who indicated that incompatibilities between individuals due to their financial status played an important role in affecting behavior. Leung et al. (2019) took this theme further, showing that income inequality made individuals more conscious of their social status as well as their financial status, making them less likely to participate in the collaborative utilisation of resources. This could result in a dampening of benefits because inequality could lead to risk averseness in the sharing of assets. In such situations, our findings supported the notion that people do not willingly take part in the sharing of resources and this provided an impetus for reducing income inequality given that it is one of the main obstacles to sustainable economic growth in developing countries (Ma et al., 2018). The estimation of thresholds validated the notion that reducing income inequality would change the nature of the relationship between the sharing economy and sustainable economic growth.

ConclusionLike the growing body of literature on measuring the determining factors of sustainable economic growth, the current study considered the role of the sharing economy in promoting sustainable development (Pouri & Hilty, 2018). The focus was to determine the impact of the sharing economy on sustainable economic growth whilst considering the moderating impact of income inequality in a group of developing countries. The countries were selected because the degree of inequality in them is great and inhibits efforts for promoting sustainable economic growth (Nguyen & Nasir, 2021).

The results obtained from this study showed that the sharing economy had a significant impact on the sustainable economic growth of the developing countries. The sharing of resources and assets promoted sustainable development by maintaining a proper balance between economic growth and the conservation of resources. The core aim of promoting growth through sharing economy activities was to maximize the utilisation of resources and thus shift the economy to a sustainable model based on increase efficiency, which would benefit society overall. The study found that the income inequality observed commonly in developing parts of the world lowered the impact of a sharing economy because it made individuals feel cautious and self-protective. However, there is potential for exploiting the benefits from the peer-to-peer economy since benefits have been seen in other parts of the world. Developing countries need to reduce the difference between perceived inequality and actual inequality in their societies since this perception was found to affect societal behavioural patterns (Weisstanner & Armingeon, 2022).

Limitations and future research indicationsPrevious studies have focused on the impact of different variables on sustainable economic growth, but there is still a gap in the literature on the impact of the sharing economy, as well as on the impact of income inequality on sustainable economic growth, in the same framework and across developing countries. This research addressed this gap but still has some limitations. The first is the cross-sectional nature of the study in determining the impact of different factors on sustainable economic growth in the sample countries. Although it was an appropriate approach, in future studies, a comparison between developing and developed countries could be conducted to determine the impact of such economic factors on sustainable economic growth. This would be motivated by findings that an inverse effect of income inequality on sustainable economic growth was observed in the literature in the era of globalization (Huh & Park, 2021). The second limitation is the number of variables examined; in further research, factors such as cultures and societal structures could also be considered to provide a more holistic understanding of the relationships (Hodgson, 2022).

ImplicationsThe study has both theoretical and practical implications. The theoretical contribution centers around the extension of knowledge in the area of the sharing economy, sustainable economic growth and income inequality, specifically in the context of developing countries. Regarding the practical contributions and given the importance of the sharing economy for sustainable economic growth, the findings of this study could assist practitioners in gaining a perspective about and motivation for promoting the concept of the sharing economy, in order to trigger sustainable economic growth whilst addressing the hampering effect of income inequality (Schor, 2017). Furthermore, policy makers could also focus on promoting sustainable economic growth through a sharing economy via a reduction in income inequality based on a targeted analysis, as well as implementation (Schor & Fitzmaurice, 2015; Schor et al., 2016).