Using panel data of 196 cities in 19 urban agglomerations in China from 2012 to 2021, this study analyzes the impact of digital finance on the innovation capacity of urban agglomerations and the underlying mechanisms. The level of digital finance development is measured using Peking University's Digital Financial Inclusion Index. Meanwhile, by manually sorting the relevant evaluation indicators in CSSCI journal papers, creating frequency statistics, and combining the total and average indices, innovation capacity is measured from five aspects: innovation resources, knowledge creation, innovation performance, innovation environment, and innovation collaboration. The results show that digital finance promotes the innovation capacity of urban agglomerations. This effect is stronger for small-scale, highly marketized, and polycentric urban agglomerations. Mechanism analysis shows that, first, via the agglomeration of innovation capital, digital finance provides financial support for improving the innovation capacity of urban agglomerations. Second, by improving entrepreneurial activity, digital finance promotes the formation of an innovation ecosystem. Third, by enhancing credit resource allocation, digital finance encourages more innovation funds to flow into innovative enterprises and promotes innovation capacity in urban agglomerations. Finally, economic policy uncertainty plays an “inverted N-type,” nonlinear moderating role in the relationship between digital finance and innovation capacity. In summary, by introducing digital finance as a key variable into urban agglomeration innovation research, this study expands the theory of financial and regional innovation systems. Next, demonstrating the heterogeneous impact of digital finance on different types of urban agglomerations, the findings can serve as a benchmark against which urban agglomerations can be compared to develop differentiated digital finance development strategies. Finally, the insights can inspire managers to re-examine the complex influence of economic policy uncertainty in the innovation process, which may help them make sound economic decisions.

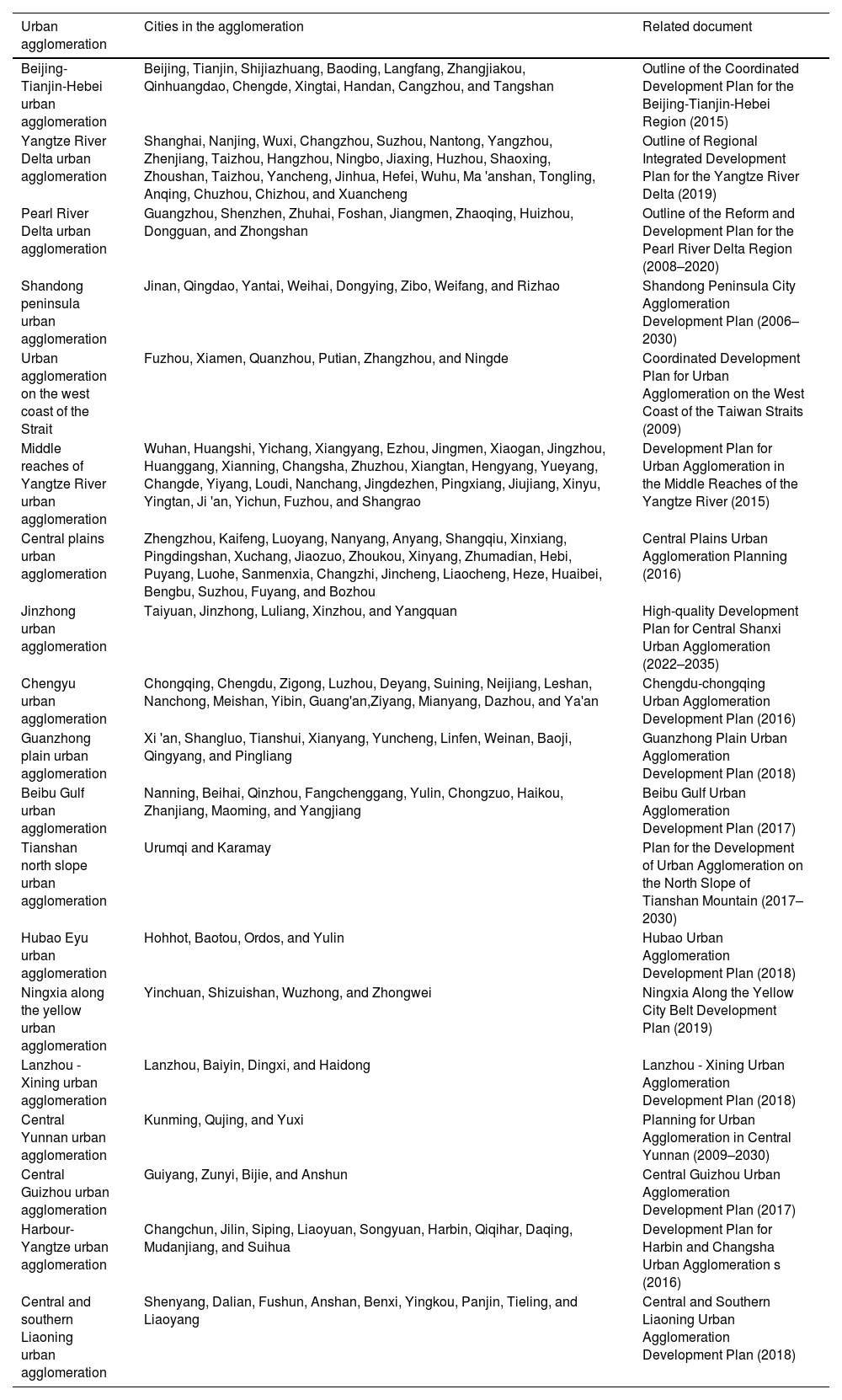

Improving the innovation capacity of urban agglomerations is crucial for ensuring steady and long-term economic development in China. China has introduced several policies to improve the creative and coordinated development of urban agglomerations. For example, in the Central Plains Urban Agglomeration Development Plan (2016), it proposed building the “innovation and entrepreneurship pilot zone in the Central and Western regions.” The Chengdu-Chongqing Urban Agglomeration Development Plan (2016) emphasizes the creation of a “Chengdu-Chongqing Urban Agglomeration Innovation Community.” Another proposal in the Development Plan for Urban Agglomeration in the Middle Reaches of the Yangtze River (2022) is to “build a scientific and technological innovation highland with core competitiveness”. These policies have provided significant support for improving the innovation capacity of urban agglomerations. However, a gap remains between the innovation level of urban agglomerations in China and the global average. This may be due to problems such as poor flow of innovation factors, difficulty in gathering innovation resources, and imperfect collaborative innovation mechanisms among urban agglomerations. As such, understanding ways to further enhance the innovation capacity of urban agglomerations is crucial to achieve high-quality regional economic development.

Digital finance can be one such factor for enhancing innovation capacity, ushering in rapid development in China. Technologies such as artificial intelligence, big data, cloud computing, and blockchain have accelerated the generation, collection, processing, and sharing of data (Manyika et al., 2016). The framework of traditional finance based on “credit” has gradually changed to one based on “data,” transforming the business model of traditional financial institutions (Li et al., 2020). Indeed, digital finance is developing rapidly in China. According to the 2018 Global Fintech 100 jointly released by KPMG and H2 Ventures, Chinese fintech companies make up three-fifths of the “Leading 50” list. Among them, Ant Financial, JD Finance, and Baidu are ranked among the top five. The development and scale of digital finance in the 19 Chinese urban agglomerations has also been excellent. Digital financial services such as mobile payments, online banking, and digital currency pilots have been widely. According to the “China Digital Financial Inclusion Development Report (2024),” as of June 2024, the outstanding loan balance of banking financial institutions for small and micro enterprises reached 78 trillion yuan, while the penetration rate of mobile payments was the highest in the world at 86%. However, digital finance in urban agglomerations in China is characterized by differences and convergence (Sun, et al., 2021; Li et al., 2020). On the one hand, the overall development level of digital finance is high in the east and low in the west. Specifically, the development of digital finance in the eastern urban agglomerations (such as the Yangtze River Delta and Pearl River Delta city clusters) is significantly ahead of that in the central and western regions. Meanwhile, the development level of the central urban agglomerations (such as the Central Plains and Guanzhong Plain city clusters) is better than that of the western urban agglomerations (e.g., the as Lanzhou-Xining and Hubao Eyu city clusters). On the other hand, these differences between regions are gradually narrowing and exhibiting spatial convergence.

The rapid development of digital finance has opened up a new path for improving innovation capacity and advancing high-quality economic development in urban agglomerations. Compared to traditional finance, digital finance has many advantages such as low cost, high efficiency, omni-directionality, stronger customer reach ability, and geographical penetration (Gomber et al., 2017). Meanwhile, compared with other investment avenues, innovation projects have large investments, high risk, long cycles, and large uncertainty. As such, continuous and stable funding is particularly important for innovation activities (Dasgupta & Stiglitz, 1980). Digital finance can provide “convenient, efficient, sustainable and all-round” financial services to more economic entities, thereby providing the necessary financial support for innovative activities (Lin & Ma, 2022). However, the digital financial market and transmission mechanisms in China are not perfect. Further, the coverage of financial services is insufficient, and their development is unbalanced and insufficient (Li et al., 2020; Hasan et al., 2022). These problems make it difficult for to fully leverage digital finance and improve the innovation capacity of urban agglomerations.

Addressing these gaps, we analyze the impact of digital finance on the innovation capacity of urban agglomerations and the underlying mechanisms. Specifically, we posit the following research questions: What will be impact of the overall acceleration of digital financial development on the innovation capacity of urban agglomerations in China? What are the rules and characteristics? What are the underlying mechanisms? Will there be heterogenous impacts of digital finance on the innovation capacity? Answering these above questions not only deepens or understanding of the leading role of digital finance in improving the innovation capacity of urban agglomerations, but also provides rigorous evidence for the formulation and implementation of relevant supporting policies.

Literature reviewConnotation and evaluation measure of innovation capacityNumerous studies have examined national, regional, and other innovative capabilities. Cooke (2001) believed that regional innovation capacity is a type of integration capacity produced by the effective integration of innovation elements in the cooperation of innovation subjects. Furman et al. (2002) argued that the core of national innovation capacity is not limited to the level of innovation output, but more focused on the whole innovation process. Hu and Mathews (2008) held the view that national innovation capacity is closely related to innovation resources and is the power source for a country's economic performance. The China Regional Innovation Capacity Report (2019) stated that regional innovation capacity refers to a region's capacity to transform new knowledge into new products, processes, and services. Different perspectives on innovation capacity lead to different definitions, but its essence remains the same. Essentially, innovation capacity is the balance accumulated through past innovation activities. Innovation input, resources, output, the environment, and so on play important roles in the formation and promotion of innovation capacity.

To evaluate innovation capacity, we need a set of better indicators. At present, extensive research has been conducted on the evaluation measure of innovation capacity. However, there are differences in evaluation indicators. Many scholars advocate the use of multiple indicators to comprehensively evaluate innovation capacity. For example, the China Regional Innovation Capacity Report (2019) measured regional innovation capacity from four perspectives: knowledge creation, knowledge acquisition, enterprise innovation, and innovation environment. Hu et al. (2019) discussed regional innovation capacity from the two aspects of technology and systems, and measure regional institutional innovation capacity from seven aspects. The National Innovation Index Report (2015) constructed a national innovation capacity index system based on five pillars of innovation resources, knowledge creation, enterprise innovation, innovation performance, and innovation environment. Despite their differing methodologies, studies mostly believe that innovation capacity is a comprehensive measure that needs to be analyzed from many aspects. However, many scholars use a single index to reflect regional innovation capacity. One of the most commonly used ones is the number of patents (for example,. granted, patent applications, invention patents, and the number of invention patent applications) (Hamidi et al., 2019; Zhang et al. 2023; Geng et al., 2023; He et al., 2020). Another commonly used method is R&D funding, and its intensity (for example. R&D expenditures, number of high-tech employees, and enterprises’ R&D expenditures) (Shen et al., 2020; Liu et al., 2023).

The effect of digital financeDigital finance, supported by digital technologies such as big data and inclusive features, can reduce barriers to financial services, significantly expand the scope of financial services, and positively affect all aspects of the economy and society (Hui et al., 2023).

First, digital finance plays an important role in easing the financing constraints. Using digital technology, valuable information can be mined from big data and applied to corporate financing, which is significant for easing financing constraints, improving financial inclusion, and developing the real economy (Sarma & Pais, 2011; Kapoor, 2014). Specifically, digital finance expands the scope of loans through digital financial models, such as peer-to-peer lending and crowdfunding, reduces the difficulty of obtaining financial services, and improves the convenience and availability of loans (Bollaert et al., 2021; Aziz & Naima, 2021).

Second, digital financing promotes consumption and employment. On the one hand, digital finance promotes the development of online credit, making it possible to match the supply side's financial demands (Pierrakis & Collins, 2013). Simultaneously, the easing of liquidity constraints and reduction in financial service transaction costs will improve the ability and efficiency of household consumption payments and transfers (Li et al., 2020). On the other hand, digital finance has significantly boosted sustainable employment by empowering small, medium, and micro enterprises (MSMEs), providing them with broader and more effective financial support (Geng & He, 2021).

Third, digital finance plays a positive role in improving the level of industrial structure and quality of innovation. Through digital technology, each demand end of the industrial chain can be accurately matched to promote the rational allocation of resources and industrial structure upgrading (Wang & Wang, 2021). Next, studies show that digital finance can positively affect innovation quality (Li et al., 2023). Digital finance can overcome the geographical and spatial limitations of traditional financial channels and compensate for the shortcomings of traditional finance (Cao et al., 2021; Pal et al., 2021), effectively improve the efficiency of the connection between capital supply and demand (Calantone et al., 2002), and provide financial support for innovative and entrepreneurial activities.

Underlying mechanismsMost studies have demonstrated the positive effect of digital finance on innovation capacity, and the underlying mechanisms at the macro and micro levels.

First, studies reveal the theoretical mechanism by which new models, such as digital finance, affect economic innovation behavior at the macro level. Digital finance can significantly promote the innovation quality or performance of a city or region (Hui et al, 2023; Li et al., 2023). This promotion effect is mainly achieved by improving the allocation of credit resources, promoting consumer consumption, upgrading the industrial structure (Li & Li, 2022), and increasing regional R&D investment (Shao & Chen, 2023). In addition, traditional financial supply (Li et al., 2023), financial agglomeration, and environmental regulation (Shao & Chen, 2023), etc., play important roles. Further, digital finance can have heterogenous impacts on regional innovation capacity from the aspects of business attraction degree (Li et al., 2023), geographical location (Yang et al., 2022), and regional hierarchy (core areas and non-core areas) (Sun & You, 2023).

Second, studies are also exploring the impact of digital finance on the innovation activities of micro-economic entities at the micro level. In terms of the mechanism, digital transformation, government subsidies (Jiang et al.2022), external bank competition (Xiong et al., 2023), easing financing constraints, financing costs, etc., have mediated the influence of digital finance on the innovation capacity of enterprises. Some particular important aspects are digital transformation and easing financing constraints. Digital finance broadens innovative financing channels for enterprises (Li et al., 2022; Xiong et al., 2023), lays a solid financial foundation for enterprises' digital transformation, and helps them quickly achieve digital transformation. Additionally, fiscal constraints, the shareholding of the largest shareholder, and the asset-liability ratio (Jiang et al., 2022) can play a moderating role in this process.

The impact of economic policy uncertainty on innovationEconomic policy uncertainty refers to uncertainty related to whether, when, and how the government will change the current economic policies (Gulen & Ion, 2016). It negatively affects macroeconomic development and micro-enterprise behavior. At the macro level, the rise of economic policy uncertainty not only intensifies the fluctuation of key macroeconomic variables of output and employment but also affects the economic cycle and hinders economic recovery (Fernández-Villaverde et al., 2015; Pastor & Veronesi, 2012; Baker et al., 2016). At the micro level, economic policy uncertainty affects microenterprises’ economic activities. Economic policy uncertainties changes the cost of business activities and inhibits enterprises’ investment activities. This inhibitory effect may be related to factors such as financial constraints, degree of competition among firms, and industry characteristics (Julio & Yook, 2012; Gulen & Ion, 2016; Kang et al., 2014).

However, innovation is an important link and a fundamental driving force of economic activities. Yet, few studies have explored the impact of economic policy uncertainty on innovation. Owing to the differences in adjustment cost characteristics, economic policy uncertainty has different impacts depending on the types of business activities (especially R&D activities) (Bloom, 2007; Gu et al., 2018). The few studies on the impact of economic policy uncertainty on innovation present two opposing views. Some scholars believe that economic policy uncertainty positively affects scientific and technological innovation activities, leading to an increase in enterprises’ R&D levels and promoting innovation (Atanassov et al., 2024; Marcus, 1981). Other scholars hold the opposite view, arguing that economic policy uncertainty causes enterprises to delay R&D investment decisions, damaging the driving force of a country's economic innovation and hindering innovation, especially in industries with high R&D intensity and politically connected enterprises (Bhattacharya et al., 2017; Wang et al., 2017). Therefore, understanding the complex mechanisms of policy uncertainty in the innovation process is important.

Summary and study contributionsExtant studies provide useful guidance for exploring the relationship between digital finance and innovation. However, there are still research deficiencies. (1) In terms of research objects, owing to the dispersion and disorder of data, the literature mainly studies innovation capacity based on provinces, cities, or single urban agglomerations. Few studies have focused on the 19 urban agglomerations in China. (2) Regarding the evaluation index system, although there have been few studies on the innovation capacity of urban agglomerations, most are based on research on regional innovation capacity in terms of definition and measurement. Few focus on the urban agglomeration. Urban agglomeration innovation is quite different from urban, regional, and enterprise innovations. An urban agglomeration is a unique spatial form that transcends administrative divisions, and has different scales and functions (Tang et al., 2024). It has its own internal development and change laws, and should not be confused with the city or provincial level. Therefore, it is necessary to establish a unique evaluation index system for the UA innovation capacity of urban agglomeration. (3) Few studies consider the mediating factors of innovation capital agglomeration, entrepreneurial activity, credit resource allocation, and moderating moderating effect of economic policy uncertainty. While studies considered these factors, they have not focused on these factors’ mechanism roles.

Our contributions to the literature are fourfold. (1) In terms of research objects, this study focuses on 196 cities in 19 urban agglomerations in China to explore the impact of digital finance on the innovation capacity of urban agglomerations. This broader selection can reveal the nuances of digital finance's impact on innovation capacity at the urban agglomeration level from a comprehensive, macro perspective. (2) To construct the innovation capacity index system of urban agglomerations, the evaluation indicators have been sorted related to the innovation capacity of urban agglomerations in CSSCI journal papers from 2012 to 2022, and frequency statistics have been conducted. Finally, we create an indicator system for the innovation capacity of urban agglomerations, which includes 25 indicators from five dimensions: innovation resources, knowledge creation, innovation performance, innovation environment, and innovation collaboration. This index system provides a more accurate and comprehensive measurement tool for examining the urban agglomeration innovation capacity and improving innovation capacity evaluation. (3) Third, we provide evidence on three mechanisms mediating the main effect: innovation capital agglomeration, entrepreneurial activity, and credit resource allocation. Simultaneously, this study explores the moderating effect of economic policy uncertainty. Revealing these internal action paths provides a theoretical basis for understanding how digital finance promotes innovation in urban agglomerations and improves the theoretical understanding of the impact mechanism of digital finance on regional innovation. (4) Finally, we examine the heterogeneous impact of digital finance on the innovation capacity of urban agglomerations from three perspectives: scale, marketization level, and spatial structure. This analysis helps us to better understand the effects of digital finance in different contexts and can provide a scientific basis for formulating regional innovation policies according to local conditions. (5) Finally, our findings can hold relevance for other countries or regions, despite its focus on urban agglomerations in China. As an important spatial carrier of economic development on a global scale, any urban agglomeration faces similar innovation challenges and opportunities. Other countries or regions can learn from the methods and conclusions of this study, combined with their actual conditions, to explore local digital finance and urban agglomeration innovation development paths.

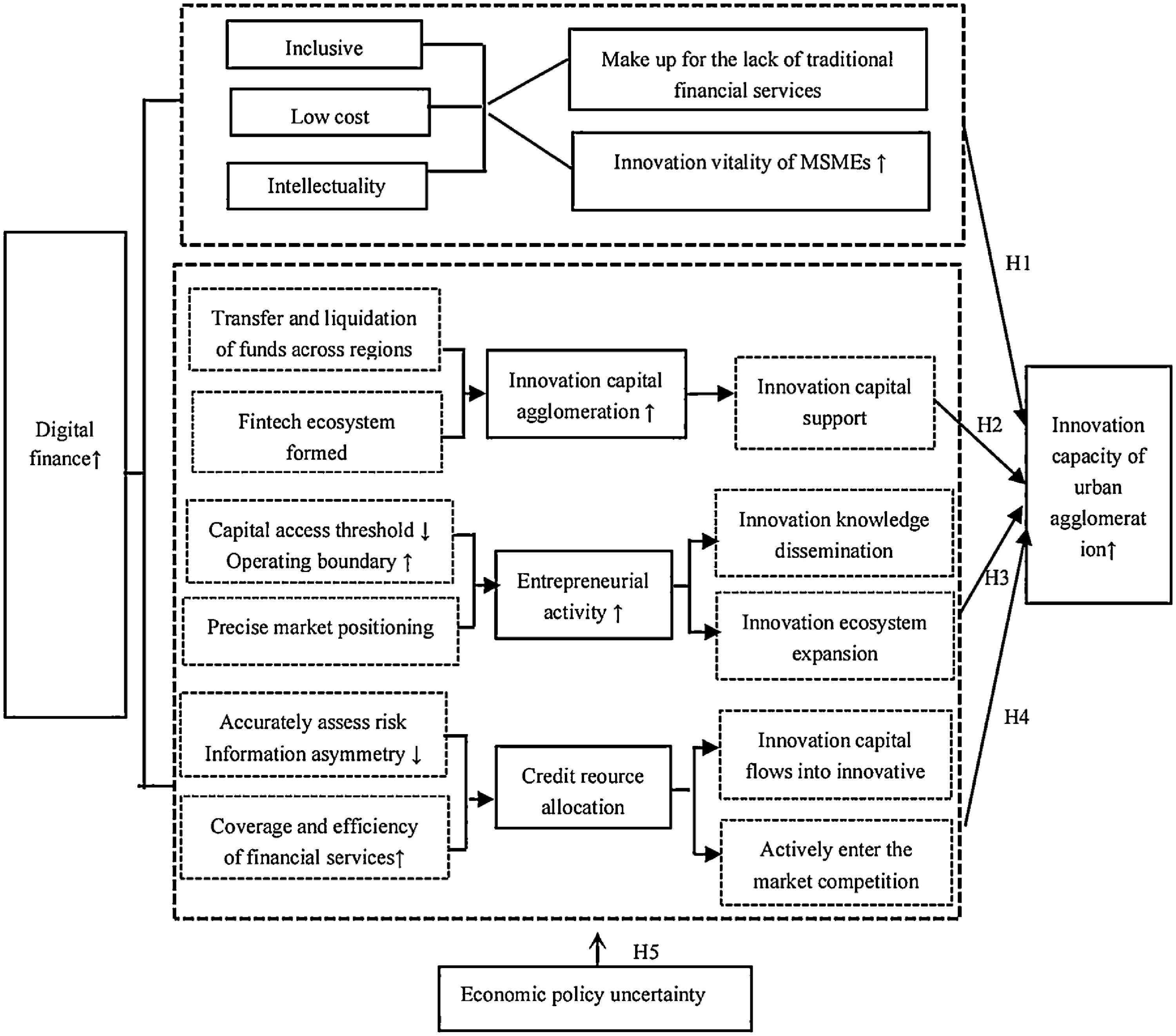

Theoretical background and hypotheses developmentDigital finance and urban agglomeration innovation capacityFinance is an important part of the innovation and entrepreneurship environment. Financial institutions’ decision to finance MSMEs directly affects the development of innovation and entrepreneurship activities (Hoskisson et al., 2000; Ahlstrom & Bruton, 2010). Many studies shows that the degree of friendliness of a country's or region's financial system toward innovative banks affects the extent of entrepreneurial activity in a country or region (Welter & Smallbone, 2011; Lim et al., 2010). Digital finance is the product of a combination of financial services and digital technology, such as mobile payments, digital insurance, Internet credit, and so on (Gomber et al., 2017), and provides inclusive and accurate financial services as its core attribute (Teng & Ma, 2020). Innovative activities are characterized by high risk, long cycles, and high input, and require the support of large and stable cash flows (Wang, 2022). The universality, low cost, and intelligence of digital finance make it feasible to optimize its development of digital finance to promote the improvement of regional innovation capacity.

Studies provide different definitions of innovation capacity from various perspectives. Cooke (2001) believed that innovation capacity is a type of integration capacity. Furman et al. (2002) believed that the core of innovation capacity should focus on the innovation process. Hu and Mathews (2008) attached great importance to the role of innovation resources in terms of innovation capacity. According to this definition of innovation capacity, this study holds that innovation capacity is a complex concept. Innovation resources, knowledge creation, innovation output, and innovation environment are important components of a country's or region's innovation capacity. As an urban complex formed by the combination of multiple spatial entities, the innovation capacity of an urban agglomeration can be defined as “the ability of an urban agglomeration to rely on its internal and external innovation environment, use the innovation resources within the group for knowledge creation, and form innovative performance through the collaborative innovation of various entities within the group”.

As a new form of finance, digital finance has significantly compensated for the shortcomings of traditional finance. It provides portable financial support for MSMEs in urban agglomerations and plays a direct role in promoting their innovation capacity of urban agglomerations.

On the one hand, digital finance can effectively overcome many restrictions on traditional financial services and compensate for the shortcomings of traditional financial services. Technological innovation activities have a long investment cycle, large capital investment, high risk, and often face serious financing constraints (Nie et al., 2021). However, the shortcomings of traditional financial services make it difficult to provide sufficient and effective financial support for innovation activities. Innovation activities are mainly reflected in the narrow financial coverage, resource mismatch, and financing discrimination. Traditional financial institutions are often reluctant to serve remote and poor people (De Aghion & Morduch, 2005). Simultaneously, it is difficult for traditional financial intermediaries to alleviate the information asymmetry between supply and demand, and resource mismatches (Stiglitz & Weiss, 1981; Li et al., 2023). As a new financial model, digital inclusive finance applies digital technology and other financial technologies to the field of inclusive finance (Hasan et al., 2020). This effectively compensates for the shortcomings of traditional financial services, promotes the improvement of service efficiency and quality of financial institutions (Yang et al., 2022), and encourages innovation and entrepreneurship activities in urban agglomerations.

On the other hand, digital finance can provide portable financial support for MSMEs in urban agglomerations, thus stimulating their innovation vitality and internal motivation. As the most active and potential innovation subjects in urban agglomerations, MSMEs are excluded from the traditional financial system owing to many restrictions (Lin et al., 2022). MSMEs’ external financing is limited by imperfect information disclosure mechanisms, non-standard financial statements, and poor management abilities (John Mathis & Cavinato, 2010; Xie et al., 2018; Booyens, 2011). This makes it difficult for traditional financial institutions to judge their integrity and economy (Yang & Zhang, 2020; Faherty & Stephens, 2016), and provide effective and appropriate financial services. The “inclusive” concept and “grassroots” characteristics of digital finance (Durai & Stella, 2019) coincide with the characteristics of innovative financing needs of MSMEs. Digital financing lowers the cost and threshold of financial services, increases MSMEs’ capital source channels, and stimulates their innovation impetus to promote the innovation capacity of urban agglomerations. Therefore, we propose the following hypothesis:

Hypothesis 1

Digital finance can improve the innovation capacity of urban agglomeration.

Digital finance, innovation capital agglomeration, and urban agglomeration innovation capacityNext, we argue that digital finance promotes innovation capital agglomeration, thus improving the innovation capacity of urban agglomerations.

On the one hand, digital finance is conducive for promoting innovative capital agglomeration in urban agglomerations. Digital finance, as a new financial model driven by the advancement of digital technology, is characterized by wide accessibility and high efficiency (Hasan et al., 2022). This has the potential to influence the allocation of financial resources and information flows, enhancing the agglomeration and circulation of funds within urban agglomerations. Through electronic payments, blockchain, and other technologies, digital finance can quickly realize cross-regional transfer and clearing of funds, and promote a more efficient concentration of funds into innovation (Rao et al., 2022). Meanwhile, digital finance promotes the formation of fin-tech ecosystems in urban agglomerations. Digital technology upgrades can promote greater financial resource flow between underdeveloped and developed regions, enhance capital spillover and resource radiation, promote financial industry agglomeration, and ensure financial stability (Risman et al., 2021). Through cooperation among innovation subjects, innovation funds gather and flow in urban agglomerations, forming a benign capital cycle and innovation ecology, and effectively promoting the capital agglomeration of urban agglomerations.

On the other hand, innovation capital agglomeration has injected vitality into improving the innovation capacity in urban agglomerations. Many studies confirm that economic agglomeration can produce various spillover effects and economies of scale (Martin & Ottaviano, 2001; Rosenthal & Strange, 2006). The agglomerated innovation capital can be directly invested in scientific research, technological innovation, transformation of scientific and technological achievements, and other innovative activities (Mention, 2012). Innovation capital agglomeration provides the necessary financial support and guarantees to improve the innovation capacity of urban agglomerations. Meanwhile, the concentration of innovation funds is conducive to promoting high-tech industry agglomeration, promoting the technological upgrading and industrial structure optimization of key industries within the urban agglomeration, and enhancing the innovation level of urban agglomerations (Xu & Jiao, 2021). Thus, we hypothesize:

Hypothesis 2

Digital financing can improve the innovation capacity of urban agglomerations by enhancing the innovative capital agglomeration.

Digital finance, entrepreneurial activity, and urban agglomeration innovation capacityNext, we argue that digital finance promotes the innovation capacity of urban agglomerations by improving entrepreneurial activity. Financial development can promote entrepreneurial activities by easing liquidity constraints of entrepreneurs (Bianchi, 2010), while financial constraints affect the level and scale of entrepreneurship (Hurst & Lusardi, 2004). On the supply side, digital finance lowers the threshold for entrepreneurs to obtain funds by providing diversified financing channels and tools (Wang, 2022; Qin et al., 2022), making “mass entrepreneurship and innovation” possible. Simultaneously, the increasing technological revolution in finance and banking, and the increasing efficiency and creativity of digital finance are driving the prosperity of the financial sector (Alkhwaldi et al., 2022), greatly reducing the operating costs of financial services (Ketterer, 2017). The reduction in costs encourages enterprises to realize product and service innovation with more abundant funds (Luo, 2022). From the demand side, digital financial technologies can help entrepreneurs better understand and respond to market changes and business risks (Wang, 2022). Entrepreneurs can better understand market needs in a modern and innovative way, quickly adjust business strategies to meet diverse customer wishes, and enhance market adaptability and competitive advantage (Chen et al., 2019; Singh & Del Giudice, 2019).

The improvement in entrepreneurial activity further injects vitality into improving the innovation capacity of urban agglomerations. First, it can improve the dissemination of innovative knowledge and technology. Regions with high levels of entrepreneurial activity tend to become hubs for knowledge and technology exchange. Entrepreneurs share and exchange innovative ideas here. Expertise in different fields can gather and interact (Amaghouss & Ibourk, 2013; Szirmai et al., 2011), thereby promoting the cross-border integration of urban agglomeration innovation. The second aspect is the formation and expansion of innovative ecosystems. Entrepreneurship plays an important role in innovation activities (Acs & Audretsch, 2005; Veeraraghavan, 2009; Szirmai et al., 2011). An increase in entrepreneurial activity contributes to the cultivation and development of entrepreneurship, thus forming a more active and diversified innovation ecosystem in urban agglomerations (Zahra & Nambisan, 2011; Nambisan & Baron, 2013; Beliaeva et al., 2020). This promotes the generation and development of innovation capacity in urban agglomerations (Zahra & Nambisan, 2011). Therefore, we propose the following hypothesis:

Hypothesis 3

Digital finance can improve the innovation capacity of urban agglomerations by promoting entrepreneurial activity.

Digital finance, credit resource allocation, and urban agglomeration innovation capacityFirst, we argue that digital finance improves the innovation capacity of urban agglomerations by improving the allocation of credit resources. First, the development of digital finance can improve information transparency and market efficiency. The relevant literature on resource allocation shows that a reasonable allocation of financial resources can guide the optimal allocation of social resources and improve the efficiency of resource utilization (Wang et al., 2022). Improving the efficiency of financial institutions can improve the efficiency of resource allocation (Jie et al., 2021). Digital finance is a new business model that combines finance and digital technology (Huang & Huang, 2018), which can more accurately assess borrowers' credit risk and reduce information asymmetry (Kong et al., 2022). This promotes financial resources to flow more effectively to borrowers who really need them. Second, there has been an improvement in the coverage and efficiency of financial services. Faced with challenges such as information asymmetry and financing difficulties, MSMEs have significant demand for credit financing. Digital financial technology can overcome the geographical limitations and high operating costs of traditional financial institutions (Yang et al., 2022; Ketterer, 2017). By providing online financing channels, financing difficulties can be reduced (Guo et al., 2023) to expand financial services to more areas and groups within urban agglomerations and improve the balanced allocation of credit resources (Hasan et al., 2020).

Meanwhile, the improvements in the allocation of credit resources improve the innovation capacity of urban agglomerations. As the most extensive external financing channel, bank credit plays a crucial role in upgrading enterprises’ investment and innovation activities (Hall, 2002; Atanassov, 2016; Chiu & Lee; 2020), especially in countries in transition with inadequate capital markets. Firms without access to bank credit tend to be less productive (Cao & Leung, 2020). Improved credit resources imply that more money can flow into innovative enterprises and projects. In urban agglomerations, with sufficient credit resource support, innovative enterprises can more easily obtain startup and expansion funds to increase investment in R&D and undertake innovative activities (Shi et al., 2019). Simultaneously, through a better allocation of credit resources, enterprises in a group can be more actively involved in market competition (Dell'Ariccia & Marquez, 2004). Improvements in market competitiveness are also an important embodiment of the enhanced innovation capacity of urban agglomerations. Hence, we hypothesize the following:

Hypothesis 4

Digital finance helps improve the allocation of credit resources, thereby promoting the innovation capacity of urban agglomerations.

Moderating effect: economic policy uncertaintyUnder the influence of many factors, different economic policy factors lead to uncertainties (Al-Thaqeb & Algharabali, 2019; Baker et al., 2016). The first is the diversity of policy adjustments. To meet the needs of the economic development, different cities have formulated and implemented diverse economic policies (Siegel et al., 1995). These policies include industrial development, fiscal taxation and financial supervision. The diversity of policies makes it difficult for enterprises and markets to accurately predict the direction of future policies (Abel, 1983; Baker & Bloom, 2013), thus creating uncertainty in economic policy. The second is the complexity of the policy objectives. Each city's economic policies tend to have multiple objectives that may be interrelated and mutually restrictive (Bhattacharya et al., 2017). Moreover, cities have different priorities in achieving these goals at different times. This makes it difficult for enterprises and the market to grasp the specific direction and focus of policies, and further aggravates the uncertainty of economic policies (Turner, 2012; Bekaert et al., 2013; Atanassov et al., 2024). The third factor is the difference in policy implementation. Although different cities have similar economic policies, their implementation processes may differ. This is because each city has different administrative efficiencies, local interests, and regulatory capacities. These differences make it difficult for enterprises to accurately judge the actual effect and impact of policies (Bloom, 2009; Balcilar et al., 2016), thus increasing the uncertainty of economic policy.

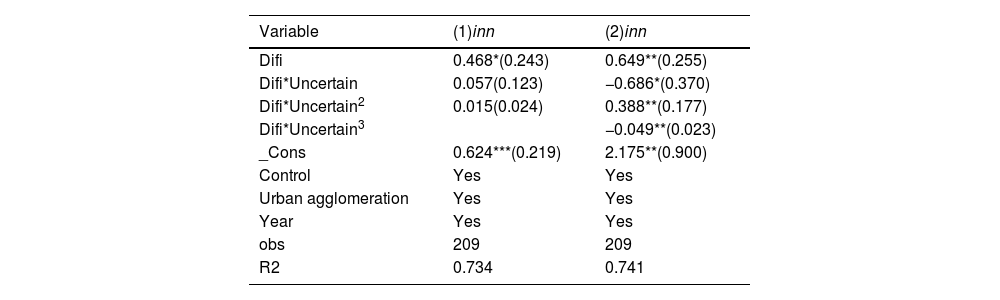

To regulate the market economy and improve the efficiency of resource allocation, the government promotes economic development by adjusting economic policies. Repeated updates of economic development policies can increase the policy uncertainty of the external environment (Gulen & Ion, 2016; He & Shen, 2021). Economic policy uncertainty is an important environmental factor influencing the impact of digital finance with the innovation capacity of urban agglomerations (Wang et al., 2024). Due to the complexity of the economic system and behavior of market agents, economic policy uncertainty may have different impacts, resulting in a dynamic trade-off between risk aversion, innovation incentives, and survival pressure.

First, when economic policy uncertainty is low, the innovation decisions of firms and urban agglomerations are typically based on stable policy expectations. On the one hand, based on real options theory, market agents tend to be risk-averse by postponing risky investments under low uncertainty (Myers, 1977). Under low uncertainty, market players tend to rely on existing policy dividends and deterministic paths. Enterprises choose to delay investments to wait for more information, and have little incentive to invest in high-risk, long-cycle innovations. This leads to difficulties in fully transforming digital economic resources (e.g., data elements and digital technologies) into innovation capabilities, thus generating negative shock effects. On the other hand, institutional theory emphasizes that path dependence may be reinforced when institutions are stable (North, 1990). A stable policy environment may encourage urban agglomerations and firms to entrench their established business models and technological routes, thereby inhibiting disruptive innovation. For example, firms may be more inclined to optimize their existing digital technology applications rather than breakthrough R&D.

Second, when economic policy uncertainty rises to a moderate level, its inhibitory effect on innovation capacity diminishes or even turns into a positive incentive. On the one hand, when economic policy uncertainty rises to a moderate level, it pushes back the innovation mechanism. Schumpeter's theory of innovation emphasizes creative destruction as the driving force of economic progress (Schumpeter & Swedberg, 2021). Policy volatility forces firms to innovate to cope with market risks and enhance their market power (Tajaddini & Gholipour, 2021; Peng et al., 2023; Geng et al., 2023). For example, in response to potential policy adjustments (e.g., increased data regulation), firms may accelerate the development of compliant technologies or explore new markets. On the other hand, based on dynamic capabilities theory, uncertainty motivates urban agglomerations to reorganize their resources to cope with environmental changes (Teece et al., 1997). Uncertainty forces an accelerated flow of factors (capital, talent, and technology) within urban agglomerations (Cheng & Masron, 2023), promoting the optimal allocation of innovation resources and facilitating cross-regional collaborative innovation (Lin & Ma, 2022). For example, local governments may attract firms and talent to the digital economy through differentiated policies that form innovation networks.

Third, when economic policy uncertainty exceeds another threshold, its negative impact once again dominates. On the one hand, according to the expected return theory, frequent policy fluctuations make it difficult for market players to accurately judge future market demand, cost changes, etc., and the expected return on investment and innovation becomes highly unstable (Ilmanen, 2022), inhibiting long-term R&D investment. For example, uncertainty regarding the direction of digital tax policy may discourage firms from investing in big data. On the other hand, according to the theory of market failure, excessive policy uncertainty can undermine the normal operation of the market mechanism (Nair & Howlett, 2020; Stiglitz, 1989). This can lead to distorted market signals, ineffective functioning of the price mechanisms, and serious distortions in resource allocation. For example, funds in the financial market may flow to safe assets in large quantities. Digital economy enterprises may then find it difficult to obtain sufficient financial support, and talent will be lost due to market instability, thus negatively affecting the innovation capacity of urban agglomerations. Based on the above analysis, Hypothesis 5 is proposed.

Hypothesis 5

Economic policy uncertainty has an “inverted N-type” nonlinear moderating effect on the impact of digital finance on the innovation capacity of urban agglomerations.

Fig. 1 outlines the theoretical framework with our hypotheses.

This study advances extant theory and knowledge. (1) Regarding the direct relationship between digital finance and the innovation capacity of urban agglomerations, previous studies have mostly focused on innovation in provincial, municipal, or single urban agglomerations. This study considers many urban agglomerations and systematically analyzes the impact of digital finance on their innovation capacity. (2) This study proposes three mechanisms mediating the main effect: innovation capital agglomeration, entrepreneurial activity, and credit resource allocation. Compared with extant studies which consider a single or small number of perspectives, this study provides a more in-depth and systematic theoretical explanation, enriching the theoretical framework of the impact mechanism. (3) Regarding the moderating effect of economic policy uncertainty, most studies argue that economic policy uncertainty hinders innovation. Meanwhile, this study paints a more complex picture, challenging the conventional wisdom and promoting an in-depth discussion of the innovation-promoting role of digital finance in complex policy environments.

MethodologyDefinition of urban agglomerationAn urban agglomeration refers to an urban complex with a relatively compact space and close economic connections (Yu et al., 2019; Yu et al., 2020). With the acceleration of the construction of urban agglomerations and metropolitan areas in China, the country has established the pattern of “19+2” urban agglomerations. Considering data availability and development planning of various urban agglomerations, we select 196 cities in 19 urban agglomerations defined in the “13th Five-Year Plan” as the research sample1. The regional definitions of specific urban agglomerations and relevant documents are provided in the Appendix.

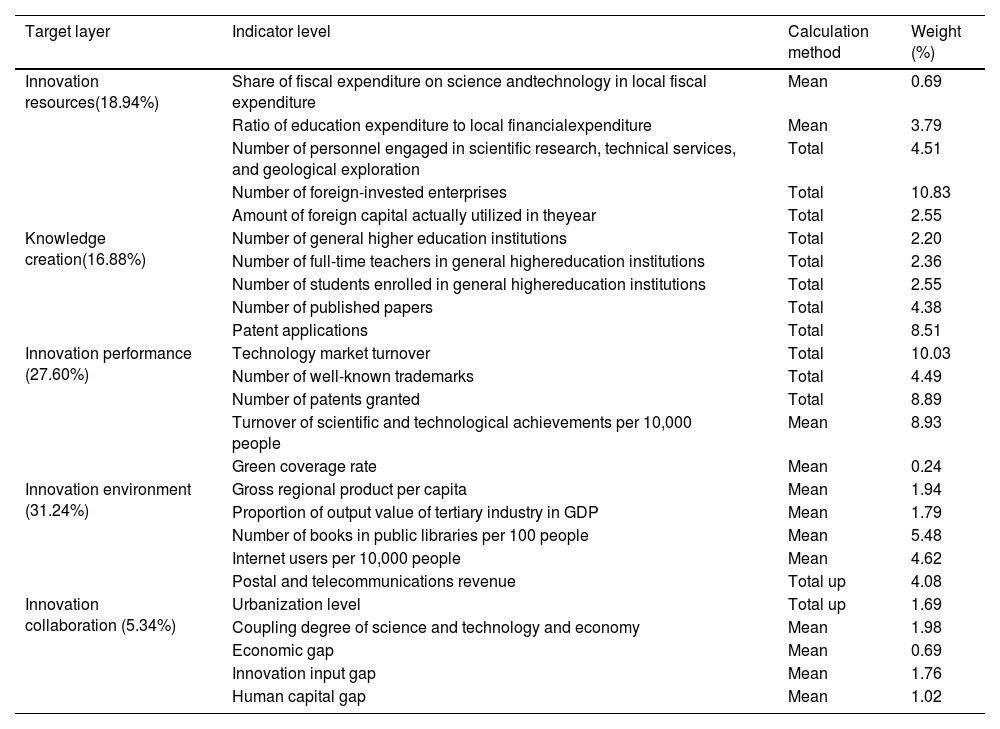

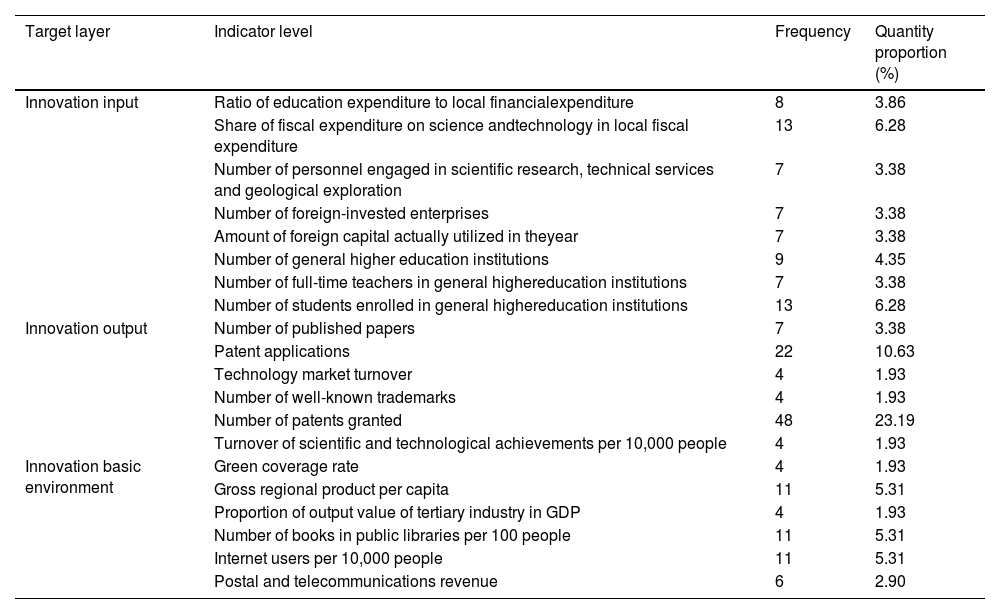

Variable selectionOur dependent variable is the innovation capacity of urban agglomerations (Inn). It refers to the capacity of an urban agglomeration to rely on innovation environment to transform innovation inputs into social productivity, and to promote knowledge creation through the synergy of industry, academia and research within the cluster, ultimately leading to the formation of innovation output. In recent years, scholars have conducted extensive research on the indicators of regional innovation capacity. However, to our knowledge, no unified and comprehensive index system exists for evaluating the innovation capacity of urban agglomerations. Therefore, this study manually collects the literature related to the innovation capacity of urban agglomerations from CSSCI journal papers from 2012 to 2022. Among them are authoritative Chinese economic journals such as Economic Research, Industrial Economics of China, Quantitative and Technical Economics Research, and Economic Management. While selecting empirical literature on the innovation capacity of urban agglomerations, we exclude irrelevant literature2. Through manual sorting, we finally select 108 papers on the measurement indicators of innovation capacity of urban agglomerations and obtain 183 variables to measure innovation capacity of urban agglomerations.

Among the papers that use comprehensive indicators to measure innovation capacity, the highest number of papers (11) use the three broad levels of “innovation input,” “innovation output,” and “innovation environment”. Therefore, the 183 variables collected are classified according to these three levels. This yields 47 variables of innovation input, 45 variables of innovation output, and 29 variables of innovation environment. The innovation input variables have been used a total of 81 times, innovation output variables have been used 107 times, and innovation environment variables have been used 45 times. However, considering that it is impossible to include all the variables into the econometric model in the following analysis, this study preliminarily screens the above measurement factors as follows: the selection criteria for the innovation input variables were used seven or more times, and for the innovation output and innovation environment variables were used four or more times. Combined with the availability of data, the main indicators and usage frequencies of the innovation capacity of Chinese urban agglomerations selected from the 108 papers are shown in the Appendix.

Next, we compare authoritative domestic and foreign reports3 on the innovation capacity of urban agglomerations. Most reports construct an index system of regional innovation capacity from the perspectives of “innovation resources,” “knowledge creation,” “enterprise innovation,” “innovation performance” and “innovation environment.” Innovation resources reflect the input intensity and supply capacity of regional innovation factors, as well as the degree of improvement in innovation infrastructure. Knowledge creation reflects the output capacity of regional scientific research inputs, and the ability of knowledge dissemination and spillover. Enterprise innovation is primarily used to reflect the intensity, efficiency, and level of innovation activities at the micro-enterprise level. Innovation performance reflects the effects and influence of regional innovation. The innovation environment reflects the external hardware and software environment on which regional innovation activities depend. This index system can more comprehensively reflect the innovation capacity of urban agglomeration. Therefore, based on the main indicators of the innovation capacity of urban agglomerations obtained using the frequency statistics method, we classify and reorganize them according to four levels: “innovation resources,” “knowledge creation,” “innovation performance,” and “innovation environment”4. We also add an index of “innovation synergy”5.

In addition, market openness, as an important factor affecting the innovation activities of a country or region, is usually measured by indicators such as trade openness (Fankem & Oumarou, 2020; Fröidh & Nelldal, 2015; González & Ferencz, 2018). On the one hand, market openness attracts external resources such as capital and labor, which affect innovation resources. On the other hand, it also affect the innovation environment by promoting competition and increasing market diversity. However, according to Can et al. (2017) and Huang et al. (2016), most studies divide market openness into innovation resources. To avoid duplication, we divide the indicators related to market openness (number of foreign-invested enterprises and amount of foreign capital utilized in the year) into innovation resources. Similarly, international exchanges reflect the exchanges and interactions between countries or regions in politics, economy, culture, science, and technology. In economic terms, it can be measured by indicators such as trade and investment (Wang & Bu, 2019; Wang & Zhang, 2021). International exchanges play an important role in the acquisition, integration, and utilization of innovative resources. They also help spread knowledge and transfer technology, create a good innovation environment, and provide strong support for regional innovation and development. However, to avoid duplication, we refer to existing studies (Guanghu, 2015; Peng et al., 2023) and divide the relevant indicators of international exchanges (number of foreign-invested enterprises and amount of foreign capital actually utilized in the year) into innovation resources.

In summary, this study constructs an innovation capacity index system for urban agglomerations from five dimensions: innovation resources, knowledge creation, innovation performance, innovation environment, and innovation collaboration. Finally, we get 25 secondary indicators, with 5 indicators for each dimension. Next, we use the entropy weight method to determine the index weight of urban agglomeration innovation capacity. Notice that factors such as the development stage, jurisdictional area, and scale of different urban agglomerations should be considered. If we simply use the aggregate index value, there is no comparability among national, regional, and regional urban agglomerations. Similarly, simply using the mean values cannot reflect the scale and agglomeration effects of urban agglomerations. Hence, we consider both aggregate and mean values for the indices. Specifically, among the 25 indicators used here, 11 are use aggregate values, while the remaining 14 indicators use mean values. Table 1 summarizes the index system.

Innovation capacity index.

| Target layer | Indicator level | Calculation method | Weight (%) |

|---|---|---|---|

| Innovation resources(18.94%) | Share of fiscal expenditure on science andtechnology in local fiscal expenditure | Mean | 0.69 |

| Ratio of education expenditure to local financialexpenditure | Mean | 3.79 | |

| Number of personnel engaged in scientific research, technical services, and geological exploration | Total | 4.51 | |

| Number of foreign-invested enterprises | Total | 10.83 | |

| Amount of foreign capital actually utilized in theyear | Total | 2.55 | |

| Knowledge creation(16.88%) | Number of general higher education institutions | Total | 2.20 |

| Number of full-time teachers in general highereducation institutions | Total | 2.36 | |

| Number of students enrolled in general highereducation institutions | Total | 2.55 | |

| Number of published papers | Total | 4.38 | |

| Patent applications | Total | 8.51 | |

| Innovation performance (27.60%) | Technology market turnover | Total | 10.03 |

| Number of well-known trademarks | Total | 4.49 | |

| Number of patents granted | Total | 8.89 | |

| Turnover of scientific and technological achievements per 10,000 people | Mean | 8.93 | |

| Green coverage rate | Mean | 0.24 | |

| Innovation environment (31.24%) | Gross regional product per capita | Mean | 1.94 |

| Proportion of output value of tertiary industry in GDP | Mean | 1.79 | |

| Number of books in public libraries per 100 people | Mean | 5.48 | |

| Internet users per 10,000 people | Mean | 4.62 | |

| Postal and telecommunications revenue | Total up | 4.08 | |

| Innovation collaboration (5.34%) | Urbanization level | Total up | 1.69 |

| Coupling degree of science and technology and economy | Mean | 1.98 | |

| Economic gap | Mean | 0.69 | |

| Innovation input gap | Mean | 1.76 | |

| Human capital gap | Mean | 1.02 |

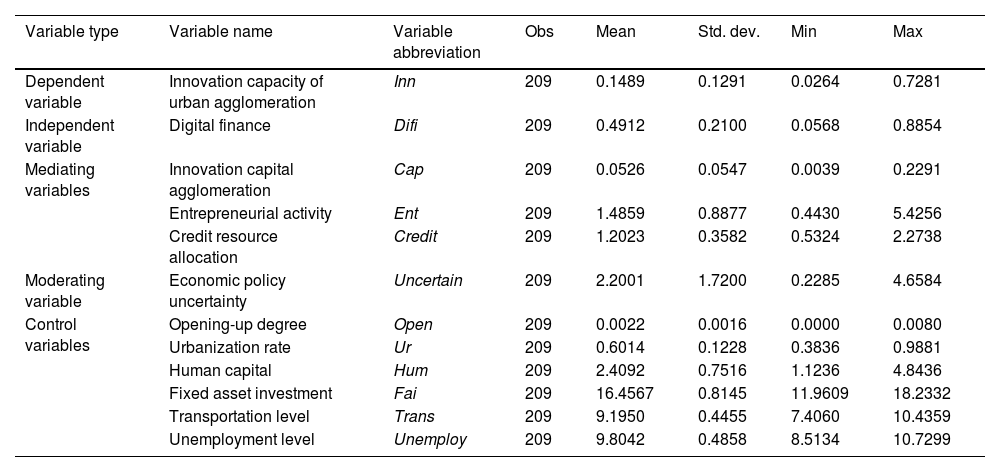

Next, our independent variable is digital finance (Difi), measured using the Peking University digital financial inclusion index of China (PKU-DFIIC). The digital financial index is constructed from three aspects: coverage breadth (Breadth), usage depth (Depth), and digitization level (Digi). The specific measurement method of this indicator can be found in Peking University Digital Financial Inclusion Index (2011–2018). We use the arithmetic average of the digital financial inclusion index and its sub-indicators to obtain the digital financial level of urban agglomeration.

Many other factors affect the innovation capacities of urban agglomerations. To ensure the accuracy and reliability of the empirical results, the following control variables are selected based on Tao et al. (2022) and Li et al. (2023). ① Opening-up degree (Open): It is expressed by the arithmetic mean of the logarithm of the amount of foreign capital actually utilized in the year in the year as a share of GDP. A higher degree of openness to the outside world often creates more opportunities for international cooperation and introduction of advanced technologies. This may improve the ability of urban agglomerations to obtain external resources, and promote innovation and efficiency (Cheung & Ping, 2004; Lu et al., 2017; Zhang, 2017). ② Urbanization rate (Ur): It is measured by the arithmetic mean of the logarithm of urban population as a share of the resident population at the end of the year. A higher level of urbanization may lead to a narrowing of the wealth gap and improved infrastructure. Simultaneously, it may promote the optimal allocation of resources and population agglomeration, thus promoting innovation (Andersson et al., 2009; Chen et al., 2020). ③ Human capital (Hum): It is measured by the arithmetic mean of the logarithm of the population with a general college degree or higher as a percentage of the city's resident population. Human capital is an engine of economic development and innovation. Human capital stock can enhance a country's or region's ability to develop local technological innovation and disseminate knowledge (World Development Report, 1998), thus providing intellectual support for innovation activities (Nelson & Phelps, 1966; Danquah & Amankwah-Amoah; 2017). ④ Fixed asset investment (Fai): This is the arithmetic mean of the logarithmic value of total urban fixed asset investment. Investment in fixed assets reflects the strength of economic development and the foundation of industrial development in a region. Investment in fixed assets is conducive to increasing employment, improving the production efficiency and profitability of enterprises, promoting industrial structure upgrading, and positivley affects economic vitality and innovation capacity (Olatunji & Adegbite, 2014; Eriotis et al., 2002). ⑤ Transportation level (Trans): It is measured by the arithmetic mean of the logarithm of the road freight volume. Improvements in transportation infrastructure affect the efficiency of resource circulation within and between urban agglomerations. Good transportation conditions can promote the flow of innovation factors, increase innovation opportunities, narrow regional innovation gaps, and positively affect regional innovation (Garrison & Souleyrette, 1996; Bian et al., 2019). ⑥ Unemployment level (Unemploy): This is represented by the arithmetic mean of the logarithm of registered unemployed persons in urban areas. The unemployment rate reflects the employment situation and economic vitality of the region. A high unemployment rate may lead to brain drain and decreased consumption power, which in turn adversely affects innovation input and atmosphere, and thus, regional innovation (Stiglitz, 2014; Majewska & Rawińska, 2018).

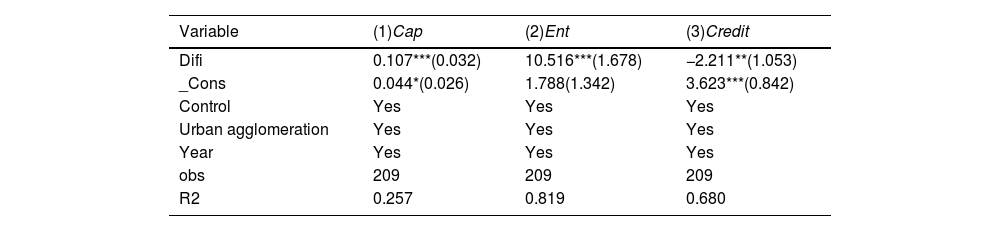

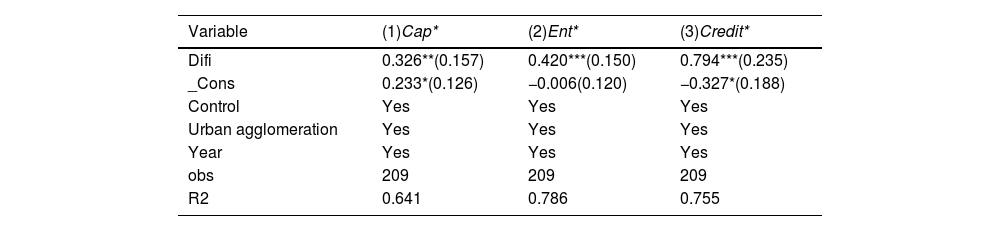

We adopt three mediating variables: ① Innovation capital agglomeration (Cap): It is measured as the proportion of urban agglomeration R&D expenditure to national R&D expenditure. ② Entrepreneurial activity (Ent): It is measured as the arithmetic average of the number of new businesses per 100 people in a city. ③ Credit resource allocation (Credit): The regional credit constraint is measured by the traditional financial development level index of each city to reflect the regional credit resource allocation. The higher the level of traditional financial development in urban agglomerations, the better the credit resource allocation. This implies that enterprises in urban agglomerations face fewer credit constraints.

Finally, we use economic policy uncertainty (Uncertain) as the moderating variable. It is measured using the Economic Policy Uncertainty index compiled by Baker et al. (2016). Since this index is a monthly indicator, we take the arithmetic average of the economic policy uncertainty index to obtain the annual index and divide it by 100 for empirical estimation. The higher the index, the higher the uncertainty of economic policy in the current year.

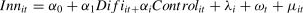

Model constructionThis study uses panel data from 19 urban agglomerations in China from 2012 to 2021. Panel data refer to data obtained by repeated measurements of the same group of individuals over a period and have been widely used by scholars in various studies (Bai et al., 2024; Li et al., 2023; Hui et al., 2023; Ren et al., 2023; Cheng et al., 2024). This study uses data from multiple urban agglomerations at multiple time points. The level of digital finance in each urban agglomeration changes with time. Further, its impact on innovation capacity can also change. From a spatial perspective, the level of digital finance in different urban agglomerations is different. Additionally, its impact on innovation capacity can also be different. The panel data model can simultaneously consider the influence of individual differences and time changes. We use the following empirical specification:

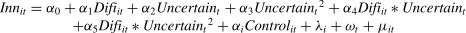

where Difiit is digital finance; Innit is the innovation capacity of urban agglomeration; i represents the 19 urban agglomerations in China; t represents time (year); Controlit is a series of control variables that include opening-up degree (Open), urbanization rate (Ur), human capital (Hum), fixed asset investment (Fai), transportation level (Trans), and unemployment level (Unemploy); λi is the urban agglomeration-fixed effect; ωt is the year-fixed effect; and μit is the random error term.Next, we consider three mediating variables: innovative capital agglomeration, entrepreneurial activity, and credit resource allocation. We use the following specification to test the mediating effects:

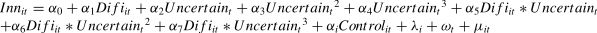

where Medit represents the mediating variables, including innovation capital agglomeration (Cap), entrepreneurial activity (Ent), and credit resource allocation (Credit). First, innovation capital agglomeration (Cap) is measured by the ratio of urban agglomeration R&D expenditure to national R&D expenditure. Second, entrepreneurial activity (Ent) is measured as the arithmetic average of the number of new businesses per 100 people in a city. Third, as an inverse proxy for credit resource allocation, regional credit constraint is measured using the traditional financial development level index of each city (Credit). The higher the level of traditional financial development in urban agglomerations, the better the credit resource allocation and the fewer credit constraints enterprises face to innovate.Next, we examine whether economic policy uncertainty has a nonlinear moderating effect on the relationship between digital finance and innovation capacity, as it is an important environmental factor affecting the digital economy and regional innovation (Zhou et al., 2023; Xu, 2020; He et al., 2020; Nguyen & Nguyen, 2023; Cheng & Masron, 2023). We construct the following nonlinear moderating model. First, based on model (1), the squared term of economic policy uncertainty (Uncertaint2) and its cross-multiplier with digital finance (Difiit*Uncertaint2) are added to construct model (3). This model is used to test whether there is a “U-type” or “inverted U-type” nonlinear moderation effect of economic policy uncertainty. Then, the cubic term of economic policy uncertainty (Uncertaint3) and its cross-multiplier with digital finance (Difiit*Uncertaint3) are added to model (3), yielding model (4) which examines whether there is an “N-type” or “inverse N-type” nonlinear moderating effect of economic policy uncertainty.

where Uncertaint indicates economic policy uncertainty and is measured using the Economic Policy Uncertainty index compiled by Baker et al. (2016). If the coefficients of Difiit*Uncertaint2 and Difiit*Uncertaint3 in the model are significantly non-zero, this indicates that economic policy uncertainty has a nonlinear moderating effect in the influence of digital finance on the innovation capacity of urban agglomerations.Data sources and descriptive statisticsBased on the availability of data, consistency of statistical caliber, and integrity of data samples, we exclude cities with missing data in the urban agglomeration. Finally, we select panel data of 196 cities in 19 urban agglomerations in China from 2008 to 2021. Basic data are obtained from the China City Statistical Yearbook. We use the PKU-DFIIC to measure digital finance development levels. Data such as the turnover of scientific and technological achievements, turnover of the technology market, and number of well-known trademarks are collected from the CSMAR and WIND databases, the National Bureau of Statistics, and local statistics bureaus. The number of patent applications for each city in the past year comes from the “China Patent Database” of the State Intellectual Property Office of the People's Republic of China. Economic policy uncertainty comes from Baker et al. (2016). The descriptive statistics of the variables are presented in Table 2.

Descriptive statistics.

| Variable type | Variable name | Variable abbreviation | Obs | Mean | Std. dev. | Min | Max |

|---|---|---|---|---|---|---|---|

| Dependent variable | Innovation capacity of urban agglomeration | Inn | 209 | 0.1489 | 0.1291 | 0.0264 | 0.7281 |

| Independent variable | Digital finance | Difi | 209 | 0.4912 | 0.2100 | 0.0568 | 0.8854 |

| Mediating variables | Innovation capital agglomeration | Cap | 209 | 0.0526 | 0.0547 | 0.0039 | 0.2291 |

| Entrepreneurial activity | Ent | 209 | 1.4859 | 0.8877 | 0.4430 | 5.4256 | |

| Credit resource allocation | Credit | 209 | 1.2023 | 0.3582 | 0.5324 | 2.2738 | |

| Moderating variable | Economic policy uncertainty | Uncertain | 209 | 2.2001 | 1.7200 | 0.2285 | 4.6584 |

| Control variables | Opening-up degree | Open | 209 | 0.0022 | 0.0016 | 0.0000 | 0.0080 |

| Urbanization rate | Ur | 209 | 0.6014 | 0.1228 | 0.3836 | 0.9881 | |

| Human capital | Hum | 209 | 2.4092 | 0.7516 | 1.1236 | 4.8436 | |

| Fixed asset investment | Fai | 209 | 16.4567 | 0.8145 | 11.9609 | 18.2332 | |

| Transportation level | Trans | 209 | 9.1950 | 0.4455 | 7.4060 | 10.4359 | |

| Unemployment level | Unemploy | 209 | 9.8042 | 0.4858 | 8.5134 | 10.7299 |

The mean value of innovation capacity (Inn) of urban agglomerations is 0.15, the minimum value is 0.03, and the maximum value is 0.73. Thus, the innovation capacity of urban agglomerations exhibits substantial differences. Similarly, the level of digital finance development differs, with an average value of digital finance (Difi) being 0.49, the minimum value is 0.06, and the maximum value is 0.89. In addition, control variables, such as the degree of openness to the outside world (Open), urbanization (Ur), human capital (Hum), fixed asset investment (Fai), transportation level (Trans), and unemployment level (Unemploy) vary considerably across urban agglomerations.

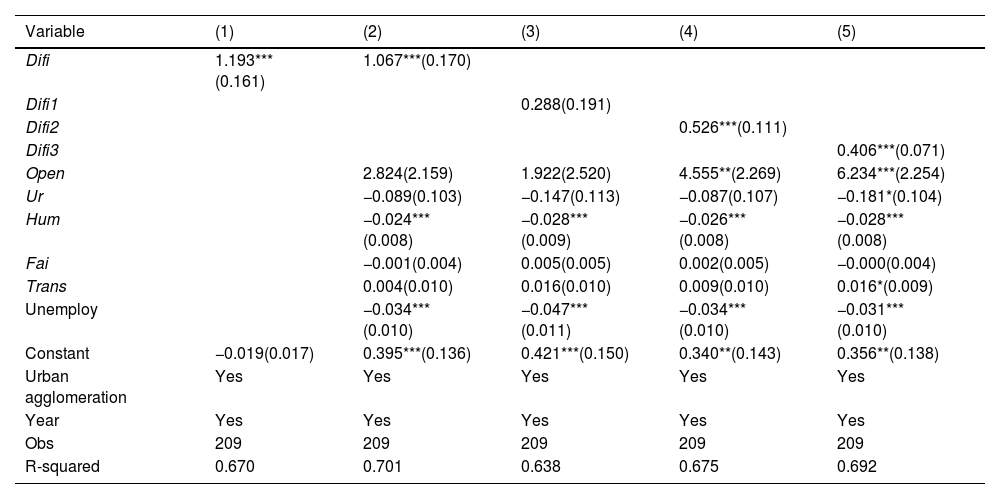

Empirical resultsBenchmark regression resultsTable 3 reports the benchmark regression results for digital finance on the innovation capacity of urban agglomerations. The Hausman test is a statistical tool commonly used in empirical research to select fixed- and random-effects models (Bai et al., 2024). The Hausman test result shows that the p-value is 0.000, and the fixed-effects model should be used. The fixed effects model can effectively deal with individual differences, allowing us to accurately assess the impact of digital finance on the innovation capacity of urban agglomerations while controlling for their inherent characteristics. Column (1) shows the regression results without control variables. Digital finance has a significant positive impact on the innovation capacity of urban agglomerations (coefficient = 1.205; passes the significance level test at the 1% level). Column (2) adds the control variables to the regression model. Again, the main effect holds (coefficient = 1.064; passes the significance level test of 1%), supporting Hypothesis 1. At its core, digital finance involves providing inclusive and accurate financial services (Teng & Ma, 2020) by applying digital technology and other fintech technologies (Hasan et al., 2020). It can effectively overcome many restrictions on traditional financial services, promote the service efficiency and quality improvement of financial institutions (Yang et al., 2022), and encourage innovative and entrepreneurial activities. Meanwhile, the characteristics of “inclusiveness” and the “grassroots” of digital finance (Durai & Stella, 2019) coincide with the innovative financing needs of MSMSEs. The development of digital finance lowers the cost and threshold of financial services, and increases the sources of capital for MSMEs. With artificial intelligence, big data, and other digital technologies, digital finance can speed up the approval process, reduce the financing costs of MSMEs, and ensure the smooth progress of innovation activities.

Benchmark results.

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Difi | 1.193***(0.161) | 1.067***(0.170) | |||

| Difi1 | 0.288(0.191) | ||||

| Difi2 | 0.526***(0.111) | ||||

| Difi3 | 0.406***(0.071) | ||||

| Open | 2.824(2.159) | 1.922(2.520) | 4.555**(2.269) | 6.234***(2.254) | |

| Ur | −0.089(0.103) | −0.147(0.113) | −0.087(0.107) | −0.181*(0.104) | |

| Hum | −0.024***(0.008) | −0.028***(0.009) | −0.026***(0.008) | −0.028***(0.008) | |

| Fai | −0.001(0.004) | 0.005(0.005) | 0.002(0.005) | −0.000(0.004) | |

| Trans | 0.004(0.010) | 0.016(0.010) | 0.009(0.010) | 0.016*(0.009) | |

| Unemploy | −0.034***(0.010) | −0.047***(0.011) | −0.034***(0.010) | −0.031***(0.010) | |

| Constant | −0.019(0.017) | 0.395***(0.136) | 0.421***(0.150) | 0.340**(0.143) | 0.356**(0.138) |

| Urban agglomeration | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes |

| Obs | 209 | 209 | 209 | 209 | 209 |

| R-squared | 0.670 | 0.701 | 0.638 | 0.675 | 0.692 |

Note: ***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively; robust standard errors are in parentheses.

The Digital Finance Index comprises three sub-indicators: coverage, depth of use, and digitization level. The results in columns (3)–(5) of Table 5 show the impact of the three dimensions on the innovation capacity of urban agglomerations. The depth of use of digital finance has the greatest and most significant impact on the innovation capacity (coefficient = 0.526; passes the significance test at the 1% level). Digitization level also has a significant positive impact on the innovation capacity (coefficient = 0.046; passes the significance test at the 1% level). Although the regression coefficient of digital financial coverage breadth on the innovation capacity of urban agglomerations is positive, it does not pass the significance test. Thus, the main effect is mainly driven by the depth of use of digital finance and digitization level. Although the coverage of digital finance can expand the beneficiary groups of financial services so that more groups can reach it, its direct correlation with the improvement of innovation capacity of urban agglomeration is weak (Nie et al., 2021). The breadth of coverage does not guarantee the quality and depth of service. Innovative activities are uncertain and require significant capital, long-term investments, and professional risk assessment. Therefore, the quality and depth of service are more critical to innovation activities. High-quality financial services can accurately assess risks and rationally allocate resources (Tao et al., 2022; Xie et al., 2018), whereas in-depth services can provide customized solutions that are critical elements for stimulating innovation vitality and improving the innovation capacity of urban agglomerations.

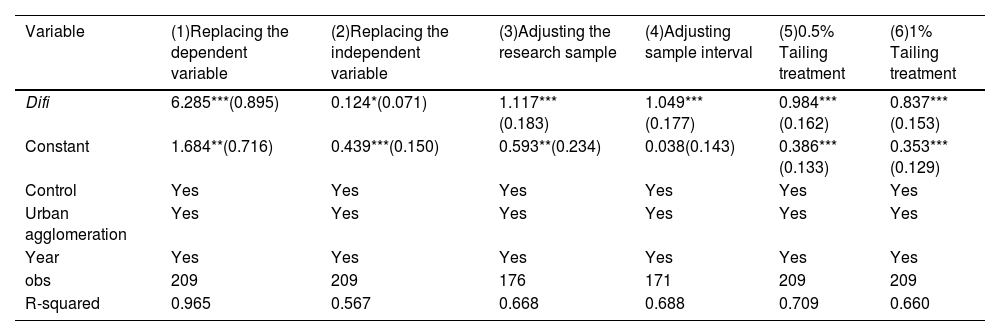

Robustness test and endogenous problem handlingTo ensure the accuracy of the conclusions, five robustness tests are conducted: replacing the dependent variable, replacing the independent variable, adjusting the research sample, adjusting the sample interval, and mitigating the influence of outliers. First, we replace the dependent variables. The Urban Innovation Index published by Kou and Liu (2017) has been widely adopted by scholars as a measure of urban innovation capacity. Therefore, we use this index as a proxy variable for the innovation capacity of urban agglomerations. The results shown in Column (1) of Table 4 are consistent with the benchmark results. Second, we use the “text mining method” to construct the Internet finance index as a substitute variable for digital finance. The regression results in Column (2) of Table 4 are consistent with the main results. Third, we adjust the research sample by excluding urban agglomerations with fewer than three cities, such as the north slope of Tianshan Mountain, central Guizhou Urban agglomeration, and central Yunnan Urban agglomeration. This is because the number of cities in China's urban agglomerations differ, which may affect the accuracy of the estimation results. Column (3) of Table 4 shows the results, which is qualitatively similar to the main results. Next, to avoid the excessive policy confusion effect caused by an excessively long sample interval, this study shortens the sample interval and selects the samples from 2013 to 2021. The results in Column (4) of Table 4 are consistent with the main results. Finally, to avoid the influence of possible outliers given the large differences between the maximum and minimum values for each variable, we winsorize the 0.5% and 1% outliers of the dependent, independent, and control variables. The results in Columns (5) and (6) of Table 4 yield the same conclusions as the benchmark results. Thus, our main conclusions hold under these robustness tests.

Robustness test results.

| Variable | (1)Replacing the dependent variable | (2)Replacing the independent variable | (3)Adjusting the research sample | (4)Adjusting sample interval | (5)0.5% Tailing treatment | (6)1% Tailing treatment |

|---|---|---|---|---|---|---|

| Difi | 6.285***(0.895) | 0.124*(0.071) | 1.117***(0.183) | 1.049***(0.177) | 0.984***(0.162) | 0.837***(0.153) |

| Constant | 1.684**(0.716) | 0.439***(0.150) | 0.593**(0.234) | 0.038(0.143) | 0.386***(0.133) | 0.353***(0.129) |

| Control | Yes | Yes | Yes | Yes | Yes | Yes |

| Urban agglomeration | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| obs | 209 | 209 | 176 | 171 | 209 | 209 |

| R-squared | 0.965 | 0.567 | 0.668 | 0.688 | 0.709 | 0.660 |

Note: ***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively; robust standard errors are in parentheses.

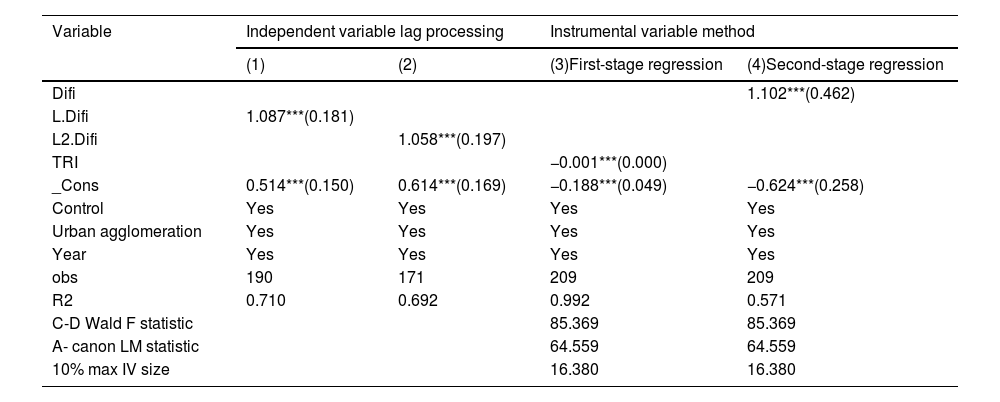

Next, we address endogeneity concerns. First, we lag the core explanatory and control variables by one and two periods to mitigate reverse causality between digital finance and the innovation capacity of urban agglomerations (Wooldridge, 2010). The results shown in Columns (1) and (2) of Table 5, respectively, are consistent with the main conclusions. Next, we employ the instrumental variable approach. Geographical location is an exogenous variable that is separate from the economic system. Referring to Nunn and Qian (2014), the average distance between prefecture-level cities and ports in urban agglomerations is used as an instrumental variable for digital finance. Considering that the research sample consists of balanced panel data and selected instrumental variable has cross-sectional data, it cannot meet the requirements of the panel data regression model. Therefore, the selected instrumental variable is interacted with the number of Internet broadband users at the national level in the current period, which is used as the instrumental variable for digital finance. The regression results shown in Columns (3) and (4) of Table 5 reveal that in the first-stage regression, the instrumental variable coefficient is significantly negative. The Wald F statistic is 85.37, which is much higher than 10, and the LM statistic is 64.56 (p=0.000). Thus, there is no weak variable problem in the selected instrumental variables and the over-recognition constraint is effective. Column (4) presents the second-stage regression results. After considering possible endogeneity problems, the influence coefficient of digital finance on the innovation capacity of urban agglomerations is still significantly positive.

Endogeneity test results.

| Variable | Independent variable lag processing | Instrumental variable method | ||

|---|---|---|---|---|

| (1) | (2) | (3)First-stage regression | (4)Second-stage regression | |

| Difi | 1.102***(0.462) | |||

| L.Difi | 1.087***(0.181) | |||

| L2.Difi | 1.058***(0.197) | |||

| TRI | −0.001***(0.000) | |||

| _Cons | 0.514***(0.150) | 0.614***(0.169) | −0.188***(0.049) | −0.624***(0.258) |

| Control | Yes | Yes | Yes | Yes |

| Urban agglomeration | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| obs | 190 | 171 | 209 | 209 |

| R2 | 0.710 | 0.692 | 0.992 | 0.571 |

| C-D Wald F statistic | 85.369 | 85.369 | ||

| A- canon LM statistic | 64.559 | 64.559 | ||

| 10% max IV size | 16.380 | 16.380 | ||

Note: ***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively; robust standard errors are in parentheses.

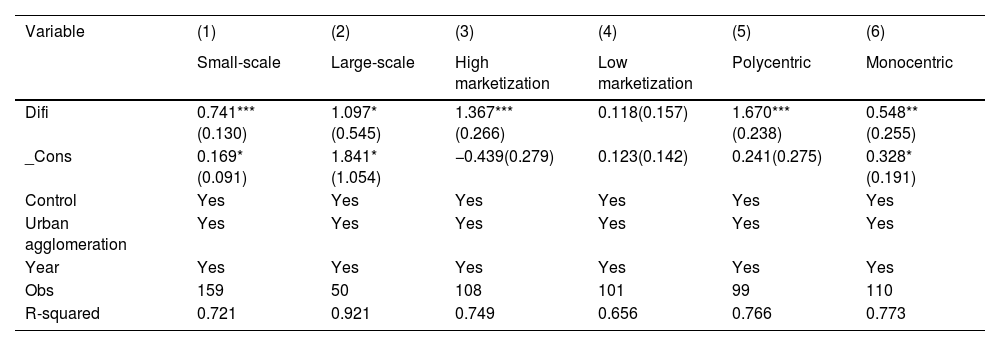

First, we perform heterogeneity analysis by urban agglomeration size. We consider the average sum of the registered populations of urban agglomerations as the measure of size. We define urban agglomerations that are greater than the average population as “large-scale urban agglomerations” and those that are less than the average as “small-scale urban agglomerations.” The regression results are shown in Columns (1) and (2) of Table 6, respectively. Digital finance has a significant positive promoting effect on the innovation capacity of both large- and small-scale urban agglomerations, with stronger effects for the latter. These differences may be because of the difference in the access to financial resources. Small-scale urban agglomerations lack financial resources and traditional financial coverage, making it difficult for innovative MSMEs to obtain sufficient funds through traditional financial channels. Digital finance can overcome these geographical limitations, use big data to accurately match the supply and demand of funds, quickly provide funds for innovative subjects, and provide timely assistance to technology start-ups. By contrast, large-scale urban agglomerations are rich in financial resources, and innovative firms have more access to capital and are less dependent on digital finance. The second factor is the innovation cost. Digital finance reduces transaction costs and information asymmetry. This can particularly help in small-scale urban agglomerations, helping enterprises and talent reduce costs, such as those related financing and research. While large-scale urban agglomerations have also benefited, the promotion of innovation through digital finance has been relatively limited owing to complex economic structures and dispersed effect of cost reductions. The third factor is policy flexibility. Small urban agglomerations are relatively simple in terms of their administrative hierarchy because of their small geographical scope. Policymakers can capture information more keenly in the face of market changes and innovation needs. When digital finance brings new development opportunities and innovation needs, smaller agglomerations can react quickly and introduce policies to support the integration of digital finance and innovation to adjust the policy direction in a timely manner. In contrast, large-scale urban agglomerations have complex administrative systems, where policymaking needs to consider the interests of many parties, and the decision-making process is complicated. Therefore, it is difficult to adjust policies quickly to market changes, resulting in a slower response in the use of digital finance to drive innovation.

Heterogeneity analysis results.

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Small-scale | Large-scale | High marketization | Low marketization | Polycentric | Monocentric | |

| Difi | 0.741***(0.130) | 1.097*(0.545) | 1.367***(0.266) | 0.118(0.157) | 1.670***(0.238) | 0.548**(0.255) |

| _Cons | 0.169*(0.091) | 1.841*(1.054) | −0.439(0.279) | 0.123(0.142) | 0.241(0.275) | 0.328*(0.191) |

| Control | Yes | Yes | Yes | Yes | Yes | Yes |

| Urban agglomeration | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs | 159 | 50 | 108 | 101 | 99 | 110 |

| R-squared | 0.721 | 0.921 | 0.749 | 0.656 | 0.766 | 0.773 |

Note: ***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively; robust standard errors are in parentheses.