Currently, the rapid pace of digitalization is creating many challenges regarding new ventures’ survival and development. Improvisation, the occurrence of spontaneous and creative behavior (Magni, Proserpio, Hoegl & Provera, 2009), is increasingly important in today's changeable and unpredictable business environment (Hughes, Morgan, Hodgkinson, Kouropalatis & Lindgreen, 2020), such as responding to unusual demands on the part of stakeholders, including customers, suppliers, and governments, and responding to unexpected events. As shown in practice, companies use improvisation as a critical strategy in dealing with emergencies (Best & Gooderham, 2015; Hu, Gu, Wu, & Lado, 2018). As start-ups may not have the specialized coordination routines or capabilities needed to handle unexpected events, they regularly improvise in this situation (O'Toole, Gong, Baker, Eesley, & Miner, 2021). Research also shows that new ventures must improvise when resources are insufficient or there is time pressure or uncertainty (Hmieleski & Corbett, 2008). Thus, improvisation in entrepreneurship has received increasing attention.

Several studies have established the relevance of improvisation to firm performance (Adomako, Opoku, & Frimpong, 2018; Hughes, Hodgkinson, Arshad, Hughes, & Leone, 2018; Fultz & Hmieleski, 2021), but in previous studies, how improvisation affects performance has been a controversial issue. Some studies posit improvisation as a means of exploiting opportunities that directly contribute to venture survival and performance (Hughes et al., 2018). Other studies suggest that the potency of improvisation in driving performance is contingent on various factors, such as environmental dynamism (Hmieleski, Corbett, & Baron, 2013) and institutional support (Adomako et al., 2018). The results show that improvisation can harm, help, or have little impact on performance by supporting a contingency model which explains how moderating factors work in the improvisation-performance link (Vera & Crossan, 2005; Ciuchta, O'Toole, & Miner, 2021). With this in mind, some scholars agree that there is likely a mediating mechanism or intervening factors between improvisation and performance (Nemkova, Souchon, & Hughes, 2012; Fultz & Hmieleski, 2021; Xiong, 2020). They call for scholars to examine the process or intermediate steps through which improvisation delivers firm performance rather than examining the direct effect(s) or moderating effect(s) alone.

Therefore, this leads to the following research question: how and due to what mechanisms does organizational improvisation affect firm performance for new ventures? The failure of researchers to address this issue has led to lingering skepticism concerning the practical value of organizational improvisation, despite its importance in the literature (e.g., Hughes et al., 2020; Ciuchta et al., 2021).

Some studies have shown that improvisation–performance relationships can connect to broader learning-related processes (Xiong, 2020; Macpherson, Breslin & Akinci, 2022). It has been proven that improvisational processes can lead to organizational learning (Miner, Bassof & Moorman, 2001; Crossan, Pina-e-Cunha, Vera & Cunha, 2005; Ciuchta et al., 2021). Learning from improvisation is a process that involves the selective retention of lessons learned from the improvisation event and a process in which analysis of the event occurs over an extended period, allowing for the assessment of effectiveness, refinement, and experimentation with options (Fisher & Barrett, 2019; Macpherson et al., 2022). It is improvisation that provides the conditions for learning (Prashantham & Floyd, 2019), and a context of improvisation leads to expansive learning (Macpherson et al., 2022). Xiong (2020) also indicates that new ventures that learn faster and better from improvisation than others are likely to dominate the competition.

Based on the knowledge-based view of the firm, firms are viewed as entities that create, store, and deploy knowledge (Grant, 1996). The result of the learning process is essential, as it ultimately determines whether improvisation positively impacts performance. Studies have proven that accumulating knowledge regarding improvisation is vital to firms (Vera & Crossan, 2005; Hmieleski et al., 2013; Adomako et al., 2018). New ventures should routinize the knowledge derived from improvisation because they, being new to the marketplace, lack routines (McKnight & Bontis, 2002), and a lack of routines and predictability constitutes uncertainty in organizational operations (Cunha Neves, Clegg & Rego, 2015). Routines, defined as “repetitive, recognizable patterns of interdependent actions (that are) carried out by multiple actors” (Feldman & Pentland, 2003; Pentland, Feldman, Becker & Liu, 2012), represent a type of knowledge resource within a firm (Winter & Nelson, 1985; Vromen, 2011). Evolutionary theory posits that routines are the DNA of a firm and determine what it can and cannot do and that they are thus primarily responsible for performance outcomes (Winter & Nelson, 1985). Thus, quickly and effectively promoting the establishment of routines in new ventures is essential in encouraging entrepreneurial success and managerial effectiveness (Lin, Murphree & Li, 2017).

The argument that routines are essential in the improvisation–performance relationship is congruent with the learning literature. Learning from improvisation in entrepreneurship seems to be a common way for start-ups to establish or update their routines. Previous studies have emphasized the role of existing routines in organizations but ignored how routines are formed (Bapuji, Hora & Saeed, 2012; Lin et al., 2017). As a complement, some scholars explain where routines begin in new ventures by adopting genealogical theory. They posit that new ventures’ routines are transferred from “parent” firms because it is usually the former employees of these parents who found the “progeny” ventures (Basu, Sahaym, Howard & Boeker, 2015). However, this is not sufficient to fully illustrate how new ventures make up for the deficiencies of the routines inherited from their parent companies, nor is it sufficient to explain all the routines in new ventures entirely. Because routines learned from a “parent” firm are only a tiny part of the whole, as new venture firms grow, these routines may fail in a new organizational context.

In other studies, scholars have suggested that some improvisations or improvisation outcomes can evolve into routines and promote the development of new routines (Cunha et al., 2015; Parida, Wincent & Kohtamäki, 2013); however, they do not explain how this link is established. In addition, the literature on learning has shown that routines result from an organization's learning process (Gross, 2014). The use of coding and sharing practices within the entrepreneurial learning process will support the routinization of behaviors (El-Awad, 2019). Through learning, firms can update and refine their routines (Ben Arfi & Hikkerova, 2021). These views help further our understanding of the potential link between improvisation, routine, and performance.

Therefore, this study proposes a new mediation link between improvisation and performance through entrepreneurial learning and routines. Facilitating post-improvisational processes, such as learning and routinizing processes, is vital for the growth of new ventures. As discussed above, improvisation is a means of solving new problems in a new way, accompanied by the generation of new knowledge. Through entrepreneurial learning, companies can interpret and evaluate the improvised actions, and the knowledge developed via firm improvisation can be identified, articulated, codified, and shared within the organization. This learning process also promotes the formation of new venture routines, ensuring the smooth daily operation of the organization, which, in turn, positively affects organizational performance.

We test this model empirically using a sample of 243 new ventures in China. The results show that improvisation positively affects entrepreneurial learning, which, in turn, positively influences routines and, thus, performance.

This paper makes two important contributions. First, this paper expands improvisation theory by understanding how improvisation translates into performance outcomes in the new-venture context. In previous studies, scholars have emphasized the critical role of contingency factors, such as environmental dynamics, in the link between improvisation and performance. However, they overlook the underlying mechanisms via which improvisation affects performance. To fill this gap, we propose and explore a mediating mechanism in the form of two intermediary variables: entrepreneurial learning and routines. In sum, developing routines is a driver of firm performance in new ventures, so learning from improvisation to develop routines is a critical path via which improvisation can play an influential role in new ventures. This result explains that the effectiveness of improvisation is based on the actions taken by the organization beyond improvisation and the knowledge absorbed in the improvising process, which can contribute a different perspective on improvisation as compared to ongoing theoretical developments in the field.

Second, this paper contributes to our understanding of how routines develop in new ventures. In entrepreneurship, the theory of how new ventures develop routines from practice must still be improved (Lin et al., 2017). This paper explains how improvisation, through entrepreneurial learning, improves new ventures’ ability to create and update their routines. Learning from improvisation is a common way for new ventures to establish and develop routines because improvisation often occurs in start-ups due to a lack of relevant guidance. Indeed, new ventures learn through entrepreneurial practice, gradually routinize the valuable parts of such practice, and take advantage of them to continuously improve and optimize processes. Therefore, this article, in theorizing about the role of improvisation and entrepreneurial learning in developing new-venture routines, opens a door for future research on the theory of the emergence and evolution of routines in entrepreneurship.

Background and hypothesesNew venture improvisationMany of the earliest theory-building papers on improvisation relied on the jazz metaphor to conceptualize improvisation in organizations (Ciuchta et al., 2021). Today, improvisation research seeks to move beyond the conceptualization of improvisation as a metaphor and focus on analyzing organizational context and entrepreneurial scenarios. Today, improvisation has been widely researched in various disciplinary fields (Hughes et al., 2020), such as corporate strategy, organizational learning, and entrepreneurship management. Many studies have drawn attention to the importance of improvisation for entrepreneurship (O'Toole et al., 2021; Fultz & Hmieleski, 2021).

After Baker, Miner and Eesley (2003) extended improvisation into entrepreneurship, scholars mainly focused on entrepreneur improvisation. They explored its influencing factors, such as regulatory focus (Hu et al., 2018), or its effect on performance depending on some contingency factors, such as self-efficacy (Hmieleski & Corbett, 2008). Research on improvisation at the organizational level in entrepreneurship has recently emerged. Gojny-Zbierowska and Zbierowski (2021) studied the positive effect of organizational improvisation on entrepreneurial orientation; Fultz and Hmieleski (2021) explored the roles of organizational improvisation and serendipity in new-venture performance. However, there is no consensus on the understanding of improvisation at the organizational level in entrepreneurship, and studies must still generate a unified and integrated view.

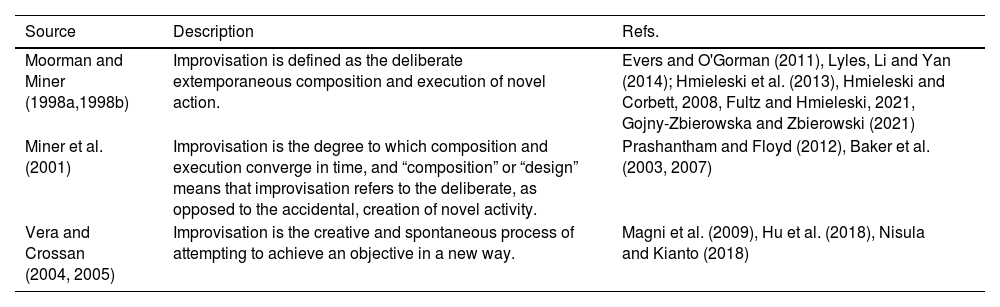

In terms of a definition, Moorman and Miner (1998a,1998b), Miner et al. (2001), and Vera and Crossan (2005) have contributed a great deal to the research on improvisation in entrepreneurship (as shown in Table 1). For example, Hmieleski et al. (2013) and Hmieleski and Corbett (2008) focused on entrepreneurs’ improvisation and, following the view of Moorman and Miner (1998a), defined improvisation as the deliberate extemporaneous composition and execution of novel action, as does the study of Fultz and Hmieleski (2021), which examines the organizational improvisation of new ventures. Hu et al. (2018), according to Vera and Crossan (2004; 2005) and Magni et al. (2009), consider entrepreneur improvisation to be the spontaneous and creative behavior of entrepreneurs in the face of an emerging event.

Concept of improvisation.

| Source | Description | Refs. |

|---|---|---|

| Moorman and Miner (1998a,1998b) | Improvisation is defined as the deliberate extemporaneous composition and execution of novel action. | Evers and O'Gorman (2011), Lyles, Li and Yan (2014); Hmieleski et al. (2013), Hmieleski and Corbett, 2008, Fultz and Hmieleski, 2021, Gojny-Zbierowska and Zbierowski (2021) |

| Miner et al. (2001) | Improvisation is the degree to which composition and execution converge in time, and “composition” or “design” means that improvisation refers to the deliberate, as opposed to the accidental, creation of novel activity. | Prashantham and Floyd (2012), Baker et al. (2003, 2007) |

| Vera and Crossan (2004, 2005) | Improvisation is the creative and spontaneous process of attempting to achieve an objective in a new way. | Magni et al. (2009), Hu et al. (2018), Nisula and Kianto (2018) |

There are certain differences between improvisation in entrepreneurship and that within the context of larger or more established organizations. Because new ventures are “small and new,” entrepreneurs or entrepreneurial teams can play most of the roles in new ventures. Larger or more established organizations emphasize improvisation for the top management team, work team, or employee.

In addition, we also emphasize that new-venture improvisation is the convergence of two main theoretical frameworks, spontaneity and creativity, which encompass the factors other studies have mentioned, such as intuition, flexibility, and the use of the materials at hand (Vera & Crossan, 2004). Following the view of Vera and Crossan (2004; 2005), we define new venture improvisation as start-ups’ spontaneous and creative process of attempting to achieve an objective in a new way. As a spontaneous process, improvisation is temporary and without a plan; as a creative process, improvisation attempts to develop something new for a given situation.

Routines in entrepreneurshipSince Stene put forward the concept of organizational routines in the 1940s, organizational routines have been widely considered an organization's essential attribute and fundamental means of achieving goals (Lin et al., 2017). The knowledge attributes of routines, especially the fact that they contain inexpressible tacit knowledge, make routines challenging to imitate (Winter & Nelson, 1985; Vromen, 2011); as a result, routines provide firms with the basis for sustained competitive advantage. Thus, routines have attracted increasing attention.

In previous studies, most scholars have focused on the role of routines in medium and large enterprises or mature companies. They have proven that routines have pros and cons. Some studies show that routines are closely associated with organizational capability (Teece, 2012; Heimeriks, Schijven & Gates, 2012; Hilliard & Goldstein, 2019). Some studies explore the notion that the existing routines in an organization can hinder (Kelley, 2011) or promote (Yi, Knudsen & Becker, 2016) organizational adaptation. Nevertheless, these studies only focus on existing routines. The existing routines never emerge out of the void. We point out that, within an organization, the routines accumulate from few to many as the company grows with time. As Deken, Carlile, Berends and Lauche (2016) mention, routines evolve. However, limited studies (Basu et al., 2015; Okhmatovskiy, Suhomlinova & Tihanyi, 2020) have explored how routines emerge; more theories are still needed to explain how new-venture routines develop.

Regarding the definition of routines, earlier scholars used routines as a metaphor for skills, mainly emphasizing that routine corporate behaviors, in terms of autonomy, are similar to skilled personal behaviors (Winter & Nelson, 1985). Some also see routines as replication factors, which shows that routines are similar to genes in terms of lifespan and transmission accuracy (Hodgson & Knudsen, 2004). Unlike the view of Winter and Nelson (1985), Vromen (2011) believes that routinized organizational behavior will be impossible if there is no skilled personal behavior. Thus, he believes that routinized organizational behavior and skilled personal behavior are not metaphorical but, rather, ontological.

In addition, scholars have also defined routines from behavioral and cognitive perspectives. From a behavioral perspective, routines are considered a behavior, a highly automated, repetitive, interactive mode (Zollo & Winter, 2002; Deken et al., 2016). From a cognitive perspective, some scholars believe that a routine is a cognitive rule, procedure, or method for a specific activity (Davies, Frederiksen, Cacciatori & Hartmann, 2018). However, Feldman and Pentland (2003) believe that routines are a duality of structure and agency or object and subject; they consider routines to be “repetitive, recognizable patterns of interdependent actions (that are) carried out by multiple actors” that consist of two parts. One includes abstract descriptive parts, such as organizational rules and techniques, and the other consists of the actual action patterns produced by a specific person at a specific time and place (Pentland et al., 2012). In this paper, following Feldman and Pentland (2003), we define routines as “repetitive, recognizable patterns of interdependent actions (that are) carried out by multiple actors.”

Mediating effects of entrepreneurial learningEntrepreneurial learning is a process via which start-ups acquire and develop the entrepreneurial knowledge, skills, and abilities to create a new venture or promote its growth (Hamilton, 2011). Organizational learning can bring about organizational behavioral change and adaptation, via which companies can respond to dynamic challenges (Levinthal & March 1993). Therefore, in a rapidly changing external environment, start-ups must create a learning process via which to adapt to changes constantly. The knowledge-based view also emphasizes the need for superior coordination and integration of the learning process within the organization (Nelson & Winter, 1982).

According to the knowledge-based view, firms are viewed as entities that create, store, and deploy knowledge (Grant, 1996), which supports the argument that entrepreneurial learning mediates the improvisation–routines relationship. As a creative process, improvisation represents an attempt to develop something new (Vera & Crossan, 2004; 2005), something that would be considered new knowledge for the organization (Crossan et al., 2005). As Miner et al. (2001) state, improvisation is a creative process, and each instance of improvisation can produce something new, such as new behaviors or interpretive frameworks.

In addition, a routine is a type of knowledge resource within a firm (Winter & Nelson, 1985; Vromen, 2011). However, new knowledge is not equal to routines. Only knowledge that is fully absorbed and applied to existing business activity can be stored as routines in companies. Entrepreneurial learning thus acts as a bridge between improvisation and routines by facilitating the progress of encoding, sharing, and utilizing knowledge. As previous studies show, coding and sharing practices are the key learning processes that support the routinization of behaviors (El-Awad, 2019). These indicate a mediatory role on the part of entrepreneurial learning in the improvisation–routines relationship. That is, new ventures drive entrepreneurial learning via improvising so as to better understand and assimilate the new knowledge generated and routinize this knowledge into management practices.

More specifically, entrepreneurial learning can function as a filtering mechanism for new ventures to use in assimilating and retaining knowledge deemed relevant to the lessons the organization has learned from improvisation. Because new ventures have flexible organizational structures and face resource constraints, they must improvise to deal with the ubiquity of unexpected events (O'Toole et al., 2021; Fultz & Hmieleski, 2021). However, these improvisational actions are only sometimes beneficial (Cunha et al., 2015). Improvisation can either solve the problem or exacerbate the problem (Hmieleski et al., 2013), and a vast amount of new knowledge generated by frequent improvisation may overwhelm start-ups that fail to respond to knowledge creation in an orderly fashion. Thus, regardless of whether an improvising event is successful, how it affects subsequent management practices is worth addressing.

The key to revealing how improvisation affects subsequent management practices lies in using entrepreneurial learning as an intermediary mechanism to transform relevant experiences into routines after improvisation events. Through the learning process, new start-ups can reflect on whether the solution is appropriate and how to improve it in the future. They can also code and share the valuable results of improvisation to further routinize them and thus improve organization efficiency. As explained by Feldman and Pentland (2003), new organizational routines are created by reflection on improvisation. Therefore, we hypothesize as follows:

Hypothesis 1: Entrepreneurial learning mediates the relationship between improvisation and the development of routines in new ventures.

Mediating effects of routinesBased on the knowledge-based view, knowledge is vital for firm survival, growth, and success (Grant, 1996). Routines are an essential knowledge resource within a firm (Winter & Nelson, 1985; Vromen, 2011). However, a new venture—a newborn in the marketplace—has a limited repository of routines with which to cover the full range of business activities (McKnight & Bontis, 2002). As Aldrich and Yang (2014) point out, large companies’ managers usually continue or modify existing routines, but they differ from entrepreneurs in this regard. Routines are mostly blank at the beginning of a new venture, so entrepreneurs must propose rules or principles and experiment with them until they determine the most effective or appropriate rules or principles for the operation. Thus, in entrepreneurial practice, new companies typically begin with chaotic processes and gradually become more efficient and streamline production activities to improve efficiency. Developing routines in new ventures can also be viewed as a learning process.

In addition, scholars have proven, in previous studies, that routines are the result of organizational learning (Gross, 2014); learning can lead to changes in organizational behavior, action patterns, and organizational rules and techniques. Through collective learning activities that involve sharing individual experiences and comparing opinions, the routines from the original capability set will undergo synergistic mutation (Weerawardena, Mort & Liesch, 2019). Thus, entrepreneurial learning can positively impact the development of routines in new ventures.

Routines enable companies to put the learned knowledge into organizational practice in a form that improves performance. Evidence has shown that routines can positively impact enterprises: organizations use routines to improve their work processes, maximize efficiency and legitimacy, and minimize conflict and ontological insecurity (Feldman & Pentland, 2003). By using routines, enterprises can guide the standards and norms of organizational members’ behavior, reduce communication barriers, improve corporate relationships, and enhance organizational coordination, which, in turn, helps to improve corporate performance. For instance, as the internationalization literature suggests, the liabilities of newness and foreignness may be less constraining in new firms when founders can build new and beneficial routines to ensure operational effectiveness (Zhou, Barnes, & Lu, 2010; Weerawardena et al., 2019).

It also indicates that routines are preferred when facing simple threats (Manfield & Newey, 2018) and can help firms to adapt to changes (Yi et al., 2016). In entrepreneurship, new startups face more challenges based on the uncertainties of the external environment. It is important to develop routines via which to stabilize enterprises’ production and operational activities (Winter & Nelson, 1985). This stability on the part of routines is essential in the entrepreneurial context. It enables organizations to increase the controllable time needed to respond to changes in an uncertain environment and reduce operational risks. As evidenced by Yi et al. (2016), routines are the source of organizational changes, which can help organizations adapt to changes in uncertain environments, enabling them to survive and have outstanding performance.

Thus, routines are a critical path via which entrepreneurial learning can impact performance. Continuous learning to adopt new modes of action or organizational best practices and thus form new routines or update them promptly in real-time according to external environment changes is a meaningful way to improve corporate performance. Thus, we hypothesize as follows:

H2: The development of routines mediates the relationship between entrepreneurial learning and performance in new ventures.

Research methodsData collection and sample characteristicsThis study employed a questionnaire to collect data for testing the research hypotheses. The sample of new ventures was drawn in China. China represents a meaningful context in which to test the study's hypotheses because China is the most prominent emerging economy and, therefore, fertile ground for entrepreneurship (Zheng & Mai, 2013). Therefore, investigating new ventures’ improvisational behavior in China offers a critical emerging-economy perspective on firm-level outcomes.

To ensure the validity of the data and avoid any ambiguity caused by professional terms and expressions, we first selected 20 individuals—entrepreneurs, members of senior management, and EMBA or MBA students—to complete preliminary questionnaire tests. This process allowed us to ensure that respondents fully understood the meaning of each item. The pre-survey data were removed from the final data.

According to Cardon and Kirk (2015), this research targets new ventures that are eight years old or less because this age helps capture firms at various stages of development, including those at the early and growth stages. We collected data in two phases to mitigate the potential standard method bias issues associated with single-informant or self-reported data (Podsakoff, MacKenzie & Podsakoff, 2012). With the help of alumni and fellow entrepreneurship researchers, as well as the coordination of relevant government departments, we connected with 300 new companies. In the first phase, we collected data other than the dependent variable from the entrepreneurs or entrepreneurial team members. A year later, we contacted the firms that took part in the first phase to capture data on the dependent variable, new venture performance. During this phase, we received only 276 responses. After matching the two-stage data, some data were omitted due to apparent randomness or missing values in the main study variables, so we used the conditional mean imputation method to input a few remaining missing values. Ultimately, we received 243 valid questionnaires over 18 months.

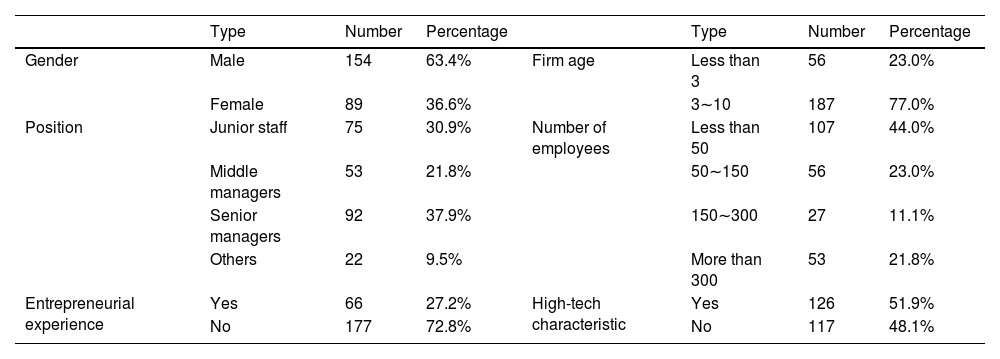

Among the 243 respondents, the majority were male (63.4%), 36.6% were senior managers, and 21.8% were middle managers. Most participants (72.8%) did not have prior entrepreneurial experience. Of the firms in this survey, 23.0% were established in less than three years, 44.0% had fewer than 50 employees, and about half were high-tech enterprises. The respondents are shown in Appendix 1.

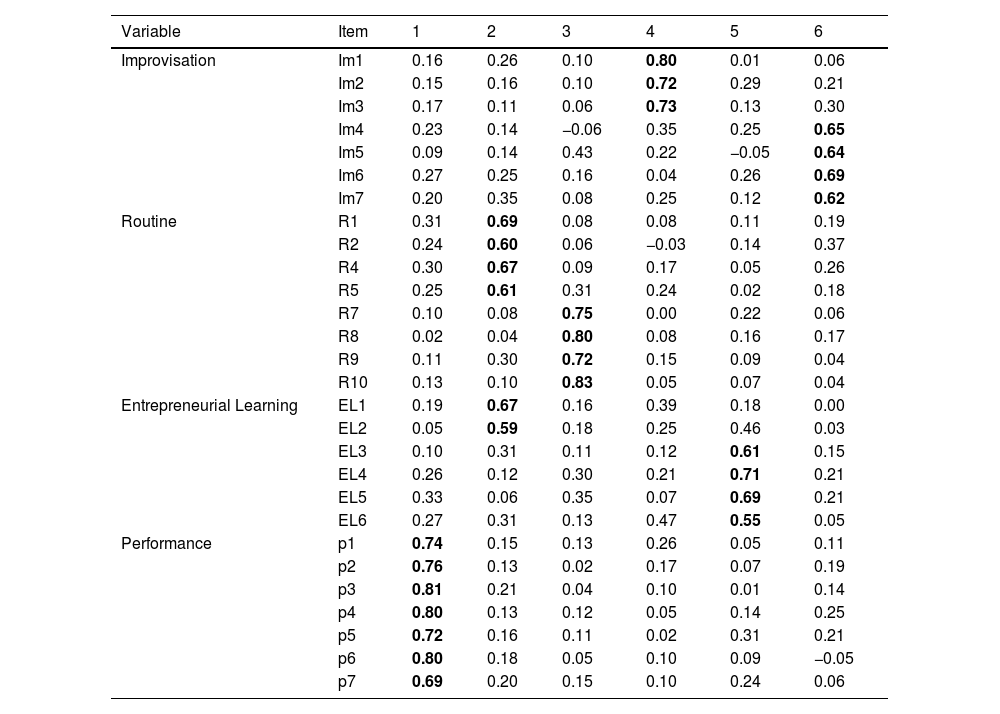

MeasuresIn this study, the main variables were measured using a maturity scale taken from existing studies. All scales were based on a five-point Likert indicator (i.e., 1: strongly disagree to 5: strongly agree). After data collection, we ran an exploratory factor analysis to confirm the scales. The result is shown in Table 2. Thus, we adjusted the scale for entrepreneurial learning.

Result of exploratory factor analysis.

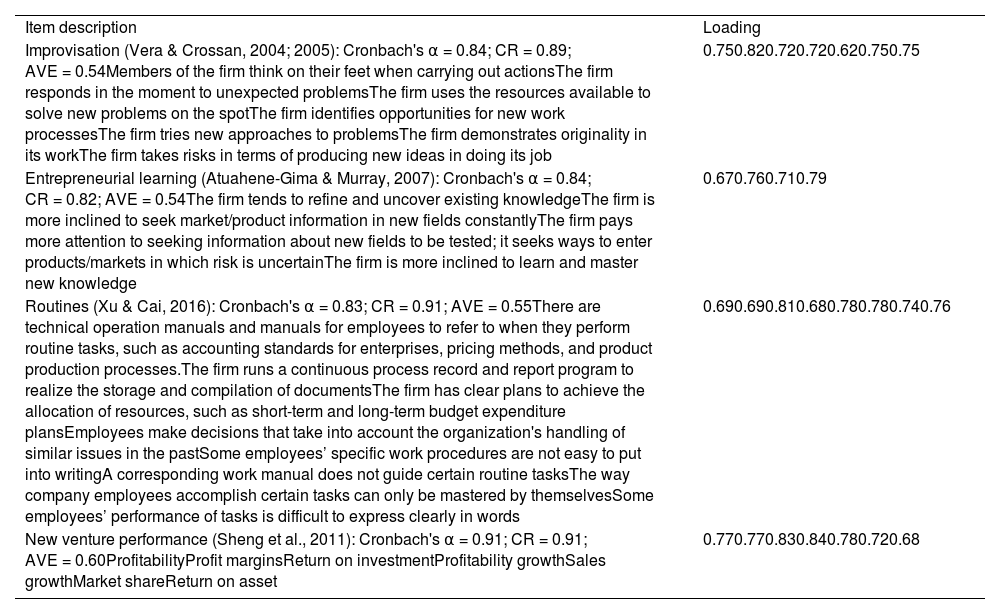

Then, we conducted the reliability and validity analyses to ensure that the measurement was sufficiently effective and reliable. Details on specific items measuring the constructs, including their respective factor loadings, are presented in Table 3.

Constructs, measurement items, and reliability and validity tests.

| Item description | Loading |

| Improvisation (Vera & Crossan, 2004; 2005): Cronbach's α = 0.84; CR = 0.89; AVE = 0.54Members of the firm think on their feet when carrying out actionsThe firm responds in the moment to unexpected problemsThe firm uses the resources available to solve new problems on the spotThe firm identifies opportunities for new work processesThe firm tries new approaches to problemsThe firm demonstrates originality in its workThe firm takes risks in terms of producing new ideas in doing its job | 0.750.820.720.720.620.750.75 |

| Entrepreneurial learning (Atuahene-Gima & Murray, 2007): Cronbach's α = 0.84; CR = 0.82; AVE = 0.54The firm tends to refine and uncover existing knowledgeThe firm is more inclined to seek market/product information in new fields constantlyThe firm pays more attention to seeking information about new fields to be tested; it seeks ways to enter products/markets in which risk is uncertainThe firm is more inclined to learn and master new knowledge | 0.670.760.710.79 |

| Routines (Xu & Cai, 2016): Cronbach's α = 0.83; CR = 0.91; AVE = 0.55There are technical operation manuals and manuals for employees to refer to when they perform routine tasks, such as accounting standards for enterprises, pricing methods, and product production processes.The firm runs a continuous process record and report program to realize the storage and compilation of documentsThe firm has clear plans to achieve the allocation of resources, such as short-term and long-term budget expenditure plansEmployees make decisions that take into account the organization's handling of similar issues in the pastSome employees’ specific work procedures are not easy to put into writingA corresponding work manual does not guide certain routine tasksThe way company employees accomplish certain tasks can only be mastered by themselvesSome employees’ performance of tasks is difficult to express clearly in words | 0.690.690.810.680.780.780.740.76 |

| New venture performance (Sheng et al., 2011): Cronbach's α = 0.91; CR = 0.91; AVE = 0.60ProfitabilityProfit marginsReturn on investmentProfitability growthSales growthMarket shareReturn on asset | 0.770.770.830.840.780.720.68 |

N = 243; CR is composite reliability; AVE is average variance extracted.

This study used a scale derived from Vera and Crossan (2004, 2005) to measure new ventures’ improvisation. Seven items were obtained for improvisation (α = 0.84). The improvisation thus appears as a second-order reflective construct made up of two first-order reflective constructs: spontaneity and creativity.

Entrepreneurial learningEntrepreneurial learning is operationalized regarding the learning degree of existing and new knowledge in the entrepreneurial process. Atuahene-Gima and Murray's (2007) instrument was adopted to measure this variable. The value of Cronbach's alpha is 0.84.

RoutineFor the measurement of routines, there is no accepted scale in the existing research. Xu and Cai (2016) developed a measurement scale for routines in the context of China that measured both explicit and tacit routines. It includes the measurement of abstract descriptive parts of rules, such as organizational rules, techniques, and specific action patterns within an enterprise; thus, this scale is consistent with this study's eight items that were used to measure new ventures’ routines (α = 0.83).

New-venture performanceNew-venture performance was measured using seven items taken from previous studies (e.g., Sheng, Zhou & Li, 2011). Entrepreneurs compared their firms with their main industry competitors on a five-point Likert scale with anchors ranging from 1 = much worse than the competitors to 5 = much better than the competitors (α = 0.91).

Control variablesFour sets of controls were included. Firm size and age may affect routines and performance because larger and older firms usually have more extensive knowledge bases. This paper included firm scale, represented by the logarithm of the number of firm employees, and firm age in the analyses. The paper also controlled for high-tech characteristics (1 = yes, 0 = no).

Validity and reliability testsWe used multiple methods to verify the reliability and validity of the measures; the results are shown in Table 3. Firstly, according to the suggestion of Podsakoff et al. (2012), the data were collected in two phases. During the data collection process, we emphasized the confidentiality and anonymity of the data and the fact that the data would be used only for academic research. However, we are still concerned about potential common method bias. Thus, we statistically tested for common method bias in the data, following the procedures recommended by Podsakoff, MacKenzie, Lee, and Podsakoff (2003); Podsakoff, MacKenzie, and Podsakoff (2012) using the method of “controlling for the effects of an unmeasured latent methods factor.” We conducted one additional CFA (Confirmatory Factor Analysis) with common method variance factor added to the overall measurement model. Specifically, all measured items were loaded on their theoretical construct and the common method variance factor to compare this model with a model in which there is no common method variance factor. The results show that the changes in each index are less than 0.05 (∆RMR = 0.012, ∆CFI = 0.01, ∆GFI = 0.007, ∆RMSEA = −0.004). The results indicate that common method bias did not influence the study's data.

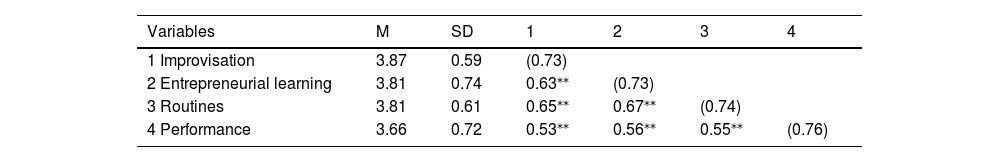

The Cronbach's alpha reliability, composite reliability, and discriminant validity of the measures were deemed acceptable (Bagozzi & Yi, 2012). A CFA shows each item's loading is more than 0.5, with values ranging from 0.62 to 0.84, indicating the convergent validity of the scales. Moreover, the average variance extracted (AVE) is higher than 0.50 (Fornell & Larcker, 1981) and more than the squared correlation between each pair of variables (see Table 4) (Bagozzi & Yi, 2012). Then, the study assessed the reliability of the measurement instrument by using the value of Cronbach's alpha (α) and composite reliability (CR). The Cronbach's α of all variables’ items ranges from 0.83 to 0.91, all of which are greater than the recommended 0.70. The CR values of this study range from 0.84 to 0.91, which are all greater than the minimum standard of 0.6. Accordingly, both indicators show that the reliability of our measurement instrument is suitable.

Descriptive statistics and correlations of the constructs.

N = 243; M=Mean; S.D. = standard deviation; two-tailed tests; values in parentheses represent the square root of the average variance extracted; ⁎⁎P < 0.01.

Following the assessment of the psychometric properties of all the multi-item scales, the fit of the measurement model using many fit heuristics is assessed. The overall fit of the CFA measurement model is considered acceptable given the following output: χ2/df = 1.90; RMSEA = 0.06; CFI = 0.94, and RMR = 0.05. Thus, the model supports the measurement items’ robustness (Ping, 2004).

ResultsHypothesis testingUsing Amos 22.0 to test the hypothesized model, a structural equation model was created. This model specified improvisation as an exogenous variable with a direct path to entrepreneurial learning. Next, entrepreneurial learning was specified as a mediator transmitting the effect of improvisation to routines, and routines were included as a mediator between entrepreneurial learning and performance. Along with these hypothesized paths, the structural model included additional paths from the three control variables to attendance frequency. Moreover, improvisation and routines are included as the second-order factors. The analysis yielded the following goodness-of-fit indices, χ2/df = 1.90, CFI = 0.91, RMSEA = 0.06, and SRMR = 0.07, indicating a good model fit (MacKenzie, Podsakoff & Podsakoff, 2011).

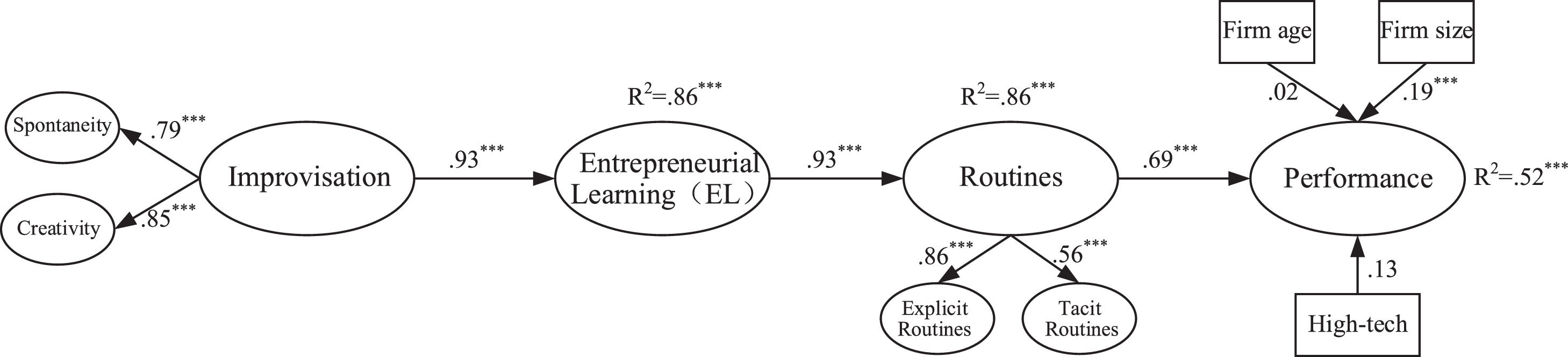

Fig. 1 shows the hypothesized model with standardized path coefficients. Overall, this model explains a significant amount of the variance in entrepreneurial learning (R2 = 0.86, p < 0.001), routines (R2 = 0.86, p < 0.001), and performance (R2 = 0.52, p < 0.001). The controller variables of firm age (β = 0.02, p >0.05), firm size (β = 0.19, p <0.001), and high-tech characteristics (β = 0.13, p >0.05) have no significant effects on performance.

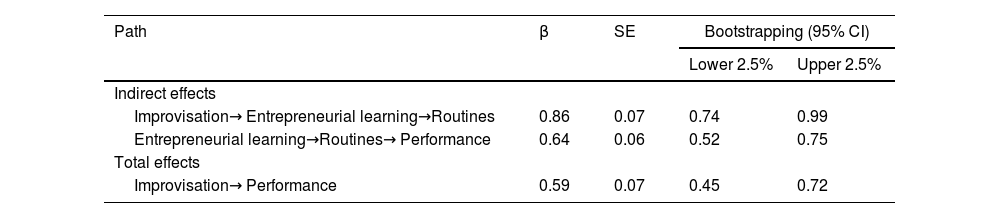

The results also show that improvisation has a significant positive effect on entrepreneurial learning (β = 0.93, p < 0.001), which, in turn, positively predicts routines in new ventures (β = 0.93, p < 0.001), and routines are positively associated with performance (β = 0.69, p < 0.001). Regarding the hypothesized paths, consistent with H1, the path coefficient yields a significant indirect positive effect on the part of improvisation on routines (β = 0.86) through entrepreneurial learning, as shown in Table 5. The bias-corrected 95% confidence interval (CI) for the indirect effect based on 1000 bootstrap samples does not exclude zero [0.74, 0.99], providing robust support for the mediating effect of entrepreneurial learning (Zhao, Lynch Jr, & Chen, 2010).

Bootstrap test of indirect effects and total effect.

Note: β = Standardized coefficient; SE = Standard error; CI = Confidence interval.

Regarding the mediation of routines between entrepreneurial learning and performance, the coefficient produces a positive indirect effect (β = 0.64), with the bias-corrected 95% CI of this effect excluding zero [0.52, 0.75], which supports H2. The results also indicate that improvisation, in total, contributed to improved new-venture performance (β = 0.59, 95%CI = [0.45, 0.72]).

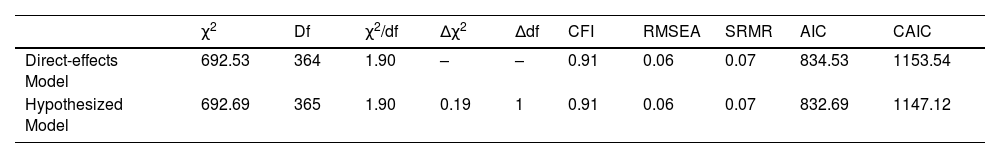

Follow-up analysesOne additional analysis was performed to ensure the robustness of the hypothesis testing reported above. First, to achieve model parsimony, the hypothesized model did not consider the direct effects of improvisation on performance. Although improvisation, which focuses on the creative process and not on the creative outcome, does not make any judgments about performance (Hmieleski et al., 2013; Vera & Crossan, 2005), some studies show a positive relationship between improvisation and performance (Adomako et al., 2018; Hughes et al., 2018). Therefore, we conducted an additional analysis to verify the hypothesized model's appropriateness by creating an alternative direct effects model that included the direct paths from improvisation to performance and then comparing these two models.

As shown in Table 6, the direct effects model provided goodness-of-fit indices very similar to those of the hypothesized model. Moreover, a Chi-square difference test indicated that the inclusion of the direct paths does not improve the model's overall fit: Δχ2 (Δdf =1) = 0.16, p > 0.05. It also shows that the hypothesized model's AIC and CAIC are better than those of the direct-effect model. These results indicate that, because of its greater parsimony, the hypothesized model represents a more appropriate solution than the alternative direct effects model (Inoue, Funk, & McDonald, 2017). Additionally, the direct effect of improvisation on performance is β = 0.10 (p > 0.05), which proves that improvisation does not make any judgment about performance (Hmieleski et al., 2013; Vera & Crossan, 2005).

Comparison of model fit indices between direct effects model and hypothesized model.

| χ2 | Df | χ2/df | Δχ2 | Δdf | CFI | RMSEA | SRMR | AIC | CAIC | |

|---|---|---|---|---|---|---|---|---|---|---|

| Direct-effects Model | 692.53 | 364 | 1.90 | – | – | 0.91 | 0.06 | 0.07 | 834.53 | 1153.54 |

| Hypothesized Model | 692.69 | 365 | 1.90 | 0.19 | 1 | 0.91 | 0.06 | 0.07 | 832.69 | 1147.12 |

N = 243; χ2 = Chi-square; df = Degrees of freedom; Δχ2 = Difference in chi-square values; Δdf = Difference in degrees of freedom; CFI = Comparative Fit Index; RMSEA = Root Mean Square Error of Approximation; SRMR = Standardized Root Mean Square Residual; AIC=Akaike Information Criterion; CAIC= Consistent Akaike information criterion.

This study sought to answer one primary research question: How does improvisation affect the performance of new ventures? Entrepreneurial learning and routines are the critical paths via which improvisation can affect the performance of new enterprises. The results contribute to the entrepreneurship literature in several ways.

First, from the perspective of process, this paper explores the indirect effect of improvisation on the performance of new enterprises, revealing that frequent improvisation in entrepreneurship is uncertain. However, improvisation can indirectly influence performance through entrepreneurial learning and routines. It provides a new perspective on the relationship between improvisation and new venture performance by focusing on the mediating effect of improvisation on performance rather than its moderating effects. This result contributes to the development of improvisation theory by further opening the black box of new-venture performance in entrepreneurship and makes a theoretical contribution that can be used in follow-up studies.

Second, the positive effects of entrepreneurial learning on routines and the mediating effect of entrepreneurial learning in the relationship between improvisation and routines in new ventures contribute to the formation theory of routines in entrepreneurship. Previous analyses have focused on studying existing routines in organizations. In contrast, only a few have verified the emergence of routines (Bapuji et al., 2012) and studied how entrepreneurial firms form routines (Lin et al., 2017). The results of this study confirmed that improvisation and entrepreneurial learning in start-ups can contribute to the formation of routines.

Finally, this paper illustrates the mediating effect of routines in the relationship between entrepreneurial learning and performance, as well as the positive influence of routines on new venture performance. These results prove the importance of routines as a resource within organizations. They also enrich the study of routines and the resource-based view in entrepreneurship.

The high failure rate of new ventures has always been an important issue, particularly in emerging economies. Improvisation helps start-ups survive by allowing them to respond effectively to unexpected events, and routines help businesses remain stable and adapt to change. Thus, this paper's conclusions are also of great value for the survival and development of new enterprises in emerging economies.

First, improvisation and planning are considered two approaches to strategic development (Hughes et al., 2018). Improvisation cannot be ignored in management practice. As Baker et al. (2003) and Hu et al. (2018) put it, improvisation effectively solves sudden problems and is crucial to enterprises’ long-term survival and development. Therefore, this paper, exploring the indirect effect of new ventures’ improvisation on performance through entrepreneurial learning and routines, helps inspire managers of new ventures to identify and manage effective improvisation. At the same time, managers are responsible for standardizing, reinforcing, and adjusting the individual behaviors of employees within the organization to align them with organizational goals and encourage learning. This will optimize improvisation, which may affect organizational routines over time, thereby improving corporate performance.

Second, this study helps to inspire managers to establish appropriate learning mechanisms within the enterprise. Translating effective improvisation into routines is inseparable from setting collective norms and good communication within organizations. It will be an essential strategy for new ventures to consider long-term development and learn from improvisation in an uncertain environment. Selectively retaining the results of improvisation within enterprises and collecting the response mechanisms based on previous improvisation experiences can help new ventures deal with accidents more quickly. In addition, when the retention process occurs in an organization with rich and coherent information, it can be better translated into enhanced innovation capability (Baker et al., 2003). Accordingly, establishing appropriate learning mechanisms can help new ventures better use improvisation, develop routines, and enhance corporate innovation and creativity in practice.

Third, exploring the formation mechanism of new-venture routines helps inspire entrepreneurs and entrepreneurial teams to think about the survival and development of the enterprise from the perspective of routines during the process of entrepreneurship. These individuals form routines that are suitable for helping new ventures to improve their operational and management efficiency and establish and manage competitive advantage in a targeted way.

Limitations and future research directionsThis study has certain limitations but also provides opportunities for future research. First, based on the knowledge-based view, this paper confirms that entrepreneurial learning and routines are critical intermediate paths through which improvisation affects the performance of new ventures. However, our research model does not include any contingency factors. This study's conclusions do not conflict with those of previous studies exploring the moderators of the relationship between improvisation and performance based on contingency theory. In future research, it is recommended that scholars combine these viewpoints to gain a more comprehensive understanding of the influence path and context of improvisation in new firms.

In addition, other theories may support the existence of other pathways in the relationship between new venture improvisation and performance. Second, our research data are only a sample of respondents from one country, China, which may lead to an inability to generalize the results to other countries or cultural backgrounds. Future researchers should extend our study into other cultural or cross-cultural contexts. Finally, our research uses cross-sectional data, so causality could not be determined. Future research should further explore the causal relationships between and interaction among the variables involved in this study through a case analysis or longitudinal data; in particular, the growth of new ventures is a complicated and continuous evolutionary process. dummy citation Appendix 1

Breakdown of respondents (N = 243).

This study proposed that entrepreneurial learning and routines mediate the link between new ventures’ improvisation and performance. Furthermore, this study argued that the relationship between improvisation and routines is mediated by entrepreneurial learning and that routines mediate the relationship between entrepreneurial learning and new-venture performance. Improvisation indirectly affects new business performance through entrepreneurial learning and routines. Overall, the findings of this study provide a more nuanced explanation of how improvisational behavior drives new ventures’ growth and success.

This research was supported by the National Natural Science Foundation of China (NSFC) under the Grants numbers of 71972084, supported by Project 1 of the major project of the National Natural Science Foundation of China (NSFC), under the Grants numbers of 72091315, and supported by the project of innovation team for the Jilin University under the Grants numbers of 2022CXTD10