This research aims to shed light on the formulation of returns management strategies and to identify key returns management components in developing more effective returns management strategies. Anchored in supply chain orientation and supply chain alignment research, we use a multiple confirmatory case study of six retailers operating in online commerce. Interviews with fifteen managers provided the primary empirical data source for the study. The results confirm the presence of alignment in establishing effective strategies for managing product returns and suggest a return policy. The findings provide detailed insights into seven existing misalignments that curb the strength of alignment. These serve as strategic elements for managers to consider in formulating returns management strategies and goals. The results may assist retail and supply chain professionals in their quest to develop effective strategies for managing product returns. Research on returns management strategy is scarce. This study offers a conceptual framework and provides new empirical insights into returns management strategy formulation and, in particular, potential misalignments.

Online sales, a critical but challenging growth driver for retailers, roughly represent 25% of retail sales in the US (NRF, 2022). As sales figures continue to rise, especially during and after the COVID-19 pandemic, return rates follow the same pattern. During 2020, $428bn of goods were returned by US consumers (NRF & Appriss Retail, 2021) and, in 2023, online returns are expected to reach $7 bn (Ambikar et al., 2021). While retail return rates have grown from nearly 11% to 17% over the last two years, e-commerce return rates are reported to be at an all-time high of 25% (Ader et al., 2022). In 2020, returns were estimated to generate 16 million metric tons of CO2 emission and 5.8 billion pounds of waste (Optoro, 2020). Furthermore, the cost to the internet retailer of handling the return of a 50-dollar item was estimated at $33. The impact of consumer returns on industry and society are significant.

Given that e-commerce returns represent about a quarter of total return rates, global retail CEOs point out that product returns are the most expensive aspect of omnichannel fulfilment (PwC, 2015). Returns impose a substantial economic cost that is borne entirely by retailers, not only from the direct result of lost sales but also from additional costs of shipping, handling, restocking, and repackaging products (Guide et al., 2006). Customers expect lenient return policies and a hassle-free return process experience as the price of their continuing patronage of, and future spending at, that retailer. Yet consumers may experience disquiet and express increased concern about the environmental impact of retailers’ return practices. These trends suggest the need for retailers to align competing customer preferences into a coherent whole and to understand fully the strategic implications of managing product returns. In this context, the alignment of the returns management process, policy, and overall business goals are essential to ensure a high level of business performance.

Given its high relevance, research on product returns and returns management has gained a prominent role in the literature on logistics and supply chain management (SCM) – for a review, see Abdulla et al. (2019) and Ambilkar et al. (2022). Despite the many contributions in this area, literature that maintains an explicit strategic focus is limited. Dapiran and Kam (2017) specifically call for an investigation of strategies to manage product returns and to further explore the existing trade-offs between customer returns in terms of operating costs and returns as an essential element of customer service. More recently, Ren et al. (2021) examined strategic choices relating to return insurance, and Chen et al. (2019) studied employee development as an antecedent to effective returns management. Earlier studies by Mollenkopf et al. (2007, 2011) suggest that functional integration at the marketing and operations interfaces would enable firms to better meet customer return requirements. Moreover, Abdulla et al. (2019) concluded that there is a lack of research on the decision making relating to returns policy and the policy's impact on the returns process.

While the existing literature presents many insights that inform and shape the returns management process, we still do not fully understand the strategic links between key components in the return process and the route to a successful returns management strategy. We first explore this issue by conceptualizing adequate returns management strategies. Drawing on the supply chain orientation (SCO) literature, we propose that firms seek to achieve a level of alignment between the return process, the return policy, and the business goal designed to manage effective product return strategies. Then, using qualitative data from internet retailers, we explore strategy formulations on the presence of alignment and misalignment. The research corroborates the existence of misalignments in returns management and examines the interdependencies amongst the components involved and their potential business impact.

This research seeks to contribute in the following ways. Specifically, the results extend the previous work that addresses process alignment in returns management (Dapiran & Kam, 2017; Larsen et al., 2018; Mollenkopf et al., 2007) by identifying and categorizing potential misalignments. Our study on returns management strategy formulation represents a previously unexplored perspective and adds, both theoretically and empirically, to the many aspects of the supply chain management process that are of growing importance. Equally, the findings inform retailers, as part of their strategy development, how best to manage their consumer returns. Finally, we add to previous studies that address the relatively limited research stream on SCO (Esper et al., 2010) through our extended investigation of returns management.

The remainder of the paper is organized as follows. The next section introduces the theoretical background related to managing product returns and presents a conceptual framework. This is followed by a section that describes the research methodology and the empirical findings, and discusses misalignments in establishing effective returns management strategies. We conclude by addressing the research's implications and by offering further research suggestions.

Theoretical background and research frameworkThis section reviews three streams of literature, The first concerns the returns management process and returns policy as key interdependent components in managing product returns. The second stream presents the SCO and alignment literature as a strategic viewpoint on developing strategies for supply chain processes. The third stream discusses returns management strategy alignment as a theoretical grounding for a conceptual framework.

Returns management and policyReturns management deals with the reverse flow of goods, organizational design, and workflow within and between the business functions that handle returned items in several firms. From a process-orientated viewpoint, Rogers et al. (2002) define returns management as a core supply chain process in which all activities associated with product returns (i.e., reverse logistics, gatekeeping, and restocking) are organized. Research in reverse logistics has dominated scholarly interest in the logistics and SCM fields. Rogers and Tibben-Lembke (1999) focus on the efficiency of logistics activities, stating that reverse logistics encompass all reverse material and information flows. To define reverse logistics and its components, Stock and Mulki (2009) identified several operational steps in reverse logistics: providing authorization and labelling; receiving and unloading; processing the data entry and issuing customer credits; inspecting and routing to the defined destination; and disposition.

Gatekeeping is a key activity when managing the flow of returns. It concerns reviewing information on the returned items and the reasons for their return to decide how best to capture value in the returned goods. Rightly used, the activity should guarantee that unwanted returns do not enter the returns flow. For example, these returns could fall outside the stipulated return time. Unwanted returns can also relate to circumstances where the handling and processing costs are higher than the value that can be captured. In e-retail practice, there is a clear difference between consumer gatekeeping and warehouse gatekeeping. Gatekeeping at the warehouse is often paper based using a pre-printed return note whereas the decision to capture the value of the returned items occurs at the processing stage, which may be too late to ensure efficient handling of the return. Consumer gatekeeping allows for an earlier decision point, providing an enhanced opportunity to prevent undesirable returns from entering the return flow.

Reverse logistics and gatekeeping activities focus on the actual physical implementation of the reverse flow of goods, while avoidance focuses on lowering the flow of returns. There are numerous initiatives and practices to minimize the likelihood of product returns in the first place (Bernon et al., 2016). Some examples are improved product quality, precise information and detailed images to ensure that the products correspond to customer expectations, and correct product delivery and on time. The importance and range of avoidance initiatives serve to emphasize returns management as a supply chain process that goes beyond a single business function, such as logistics and a firm's marketing department. To strengthen returns management as a supply chain process, Hjort et al. (2019) empirically identified a fifth interlinked activity for e-retailers to manage product returns: service. Service can take different forms, such as providing speedy reimbursement, and convenient and flexible procedures for collecting returns. However, it is more important that returns are viewed as a service offer or a service recovery and, therefore, need to be managed accordingly. As a service offer, returns are an integral part of the customer experience from the beginning to the end. As a service recovery, returns are the unintended consequence of customer dissatisfaction. The need for technical support is reinforced by Albors-Garrigos (2020) who concludes that technology can serve as a supporting tool in communicating with consumers.

To manage product returns, it is necessary to go beyond the return process to include the returns policy. For internet retailers, the returns policy constitutes the interface with the customers and communicates the rules and mutual agreement between them. Janakiraman et al. (2016) defined the returns policy in terms of the time frame within which the customer can return goods, at what cost, and whether the product can be returned. If not, how will the product be replaced or how will the customer be compensated? Research shows that the return policy impacts the customer's purchase intention and return behaviour (Abdulla et al., 2022; Bechwati & Siegal, 2005; Lantz & Hjort, 2013; Mollenkopf et al., 2007) and, thus, bottom line sales and profitability. In a recent study, Son et al. (2019) showed that return amounts had no negative impact on order amounts, indicating that high returns do not necessarily mean lower profitability. The return policy can impact consumers’ willingness to buy since they can choose other vendors with more generous return policies.

Research over the years has shown that a generous policy signals quality and confidence (Bonifield et al., 2010; Rokonuzzaman et al., 2021; Shao et al., 2021). By applying a lenient return policy, e-retailers can reduce the customers’ risk: the customers will opt for the product offering with return shipping insurance, which they will view as a sign of quality and credibility (Shao et al., 2013). Moreover, a generous return policy can lead to a positive purchase decision and, rightly used, can result in increased demand (Oghazi et al., 2018). Wood (2001) found that a more lenient return policy increases the probability of the customer placing an order. An experimental study by Kim and Wansink (2012) showed that a more lenient return policy makes the customer evaluate the products more favourably. More recently, Abdulla et al. (2022) found that money was the most effective lever, with exchange as the second most important, when consumers make a purchase decision. Existing research shows that return policy decisions clearly impact customer buying and return behaviours and, thus, a firm's back-end return process of handling the reverse flow of products is a matter of considerable consequence.

Supply chain orientation as a strategic lensThe concept of SCO was developed during the late 1990s and reflected in the SCM literature. As a research topic, though, SCO has remained largely unexamined (Dhaigude et al., 2015) despite the growing body of SCM research. In the salient work by Mentzer et al. (2001), SCM is defined as: “the systemic, strategic coordination of the traditional business functions within a particular company and across businesses within the supply chain, for the purposes of improving the long-term performance of the individual companies and the supply chain as a whole” (p.18), whilst SCO is defined as: “the recognition by an organisation of the systemic, strategic implications of the activities and processes involved in managing the various flows in a supply chain” (p.11). This means that SCM focuses on managing interactions between the supply chain members while SCO describes and visualizes a firm's understanding of its SCM strategy. This suggests that an organization must understand and agree on an SCO before it can create an effective strategy for its supply chain processes (Min & Mentzer, 2004). In other words, SCO represents a shared value and belief system that helps a firm to understand how it should strategically manage its supply chain, and it embodies the behavioural norms needed inside the organization (Deshpande & Webster, 1989).

To operationalize SCO and make it a more tangible formulation of effective strategies to manage supply chains, Esper et al. (2010) classified SCO into four structural key elements: organizational design, human resources, information technology, and organizational measurement. The organisational design element is the assessment of how to communicate, divide the workload, and coordinate and control the workflow to achieve the goals of the supply chain and of the company. This is particularly important because tighter integration is essential in SCM, and effective process coordination depends on it (Mollenkopf et al., 2000). The human resource element requires having the right people in the organization with the relevant skillsets. Factors impacting supply chain activities and process implementation often come from outside the actual supply chain. It is, therefore, highly important to have a staff who possess a fully rounded view of the company's decisions and goals and can transform them into efficient activities and processes in the supply chain. In the information technology element, factors to consider include information sharing and using systems for planning, replenishment, and ordering. Having a seamless flow of information is a well-understood and pervasive means of improving decision making in the supply chain. The right performance measurements and measuring systems constitute the fourth element, organizational measurement. Measurement systems enable fact-based decision making, but they also work as the means that management can deploy to direct company focus and create change.

Esper et al. (2010) further extended the notion of SCO to place it firmly between the firm's supply chain strategy and its structural support for managing supply chains. An understanding of fit or level of alignment is a central notion that members of organizations must grasp in endeavouring to align strategies in pursuit of common goals (Defee & Stank, 2009). When supply chain members fail to pull in the same direction, competitive advantage cannot be achieved. Alignment is closely tied to effectiveness in strategic SCM (Ketchen & Hult, 2007) and is defined by Lee (2004) as consistency in the interests of all participants in the supply chain. Many firms fail to achieve their targets mainly due to an inability to agree and develop consistent strategies, joint processes, and plans that cross firms and business functions.

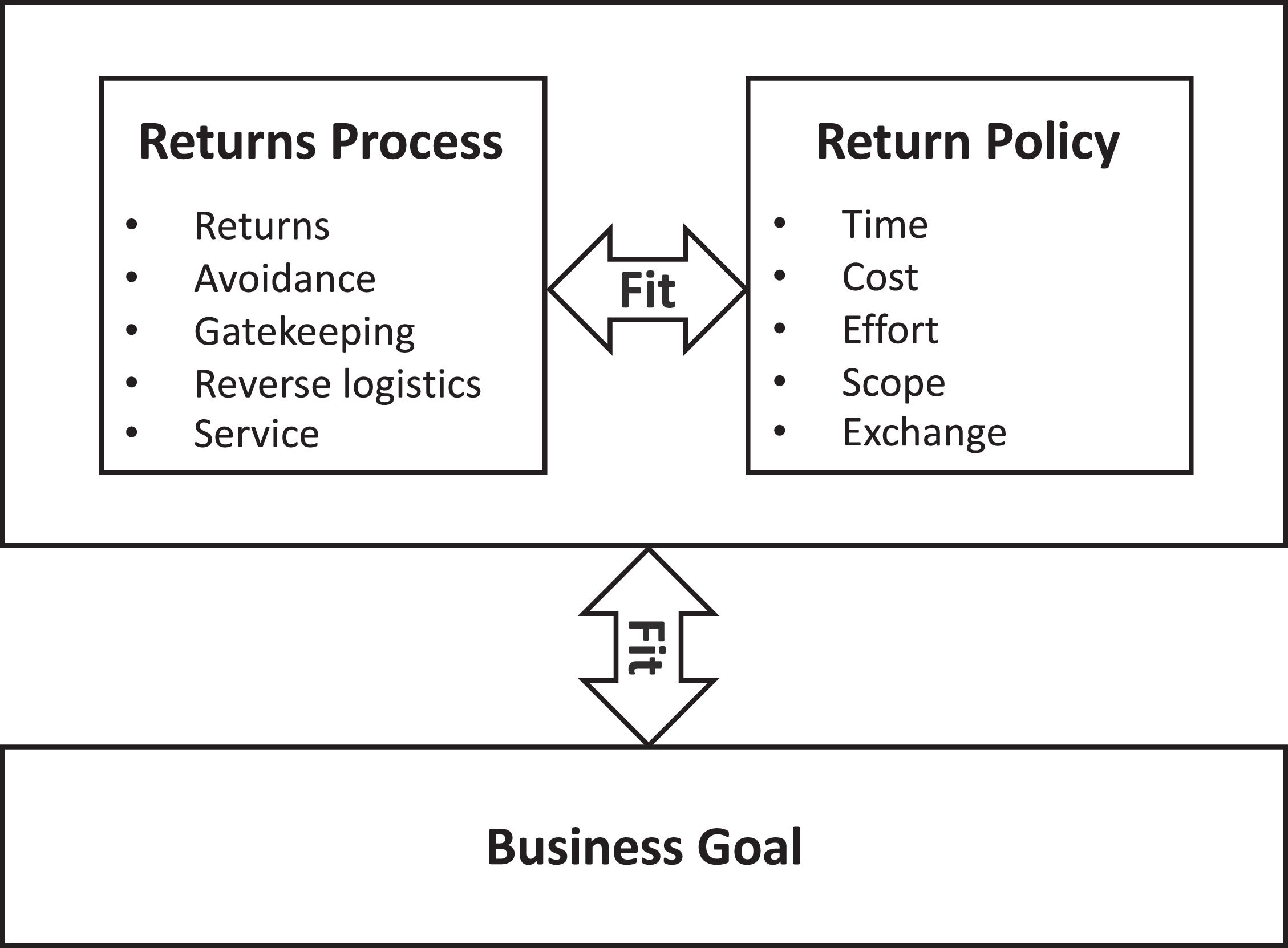

Returns management strategy alignmentIn this section, we present a conceptual framework to guide our research on developing effective returns management strategies. The framework (Fig. 1) captures the managerial issues associated with designing an effective returns management strategy for e-retailers. The framework proposes that effective returns management strategies are concerned with achieving a level of alignment, or “fit”, between the business goal, the return process, and the return policy.

Returns management has held a strategic connotation since its origin in scholarly research. As early as 2002, Rogers et al. (2002, p. 6) stated: “A firm's returns management capabilities can be used strategically to enhance the overall performance of the company”. More recent research has attempted to study returns management from a strategic perspective with an impact on overall company performance. Russo et al. (2018) identified combinations of return practices that constitute customer satisfaction and, thereby, support overall business goals. Moreover, they presented options where customer satisfaction was high, even though high return rates were equally high. Röllecke et al. (2018) distinguished three broad risks and gain-sharing practices in returns management programs: firms take most of the return costs and focus on the long-term customer lifetime value; share and balance the price with the customer; and shift the price towards the customer. They argued that an aligned strategy – where the returns management strategy fully supports the overall business strategy – drives the organization to continue improvement regarding returns management. Therefore, it is a key lever in developing an effective returns management strategy. In line with previous research, we put forward the following proposition:

RP1: Firms establishing effective strategies to manage returns need to achieve a level of alignment between returns management and the overall business goal.

Lack of alignment between functions,such as marketing and operations, is seen as the underlying reason why firms do not achieve their strategic objectives (Berry et al., 1999). Here, alignment is defined as the ability to jointly develop consistent strategies, whilst Calantone et al. (2002) referred to alignment as cross-functional harmony. Mollenkopf et al. (2007) showed that the returns management process is genuinely cross-functional and that firms with higher levels of functional integration were more adaptive and proactive in effectively managing returns. In a B2B context, Mollenkopf et al. (2010) went on to further identify alignment of those functions as a requisite to create value in the returns management process – correctly aligned returns management can utilize operational capabilities and proactively respond to marketing and the overall business goals of generating sales. Accordingly, Rogers and Tibben-Lembke (1999) and Rogers et al. (2002) emphasized the importance of first agreeing on goals and strategy before developing a coordinated returns management process. However, Hjort et al. (2019) found that e-retailers do not have clear goals and strategies when establishing their return processes, and they argued that this is the product of disjointed policies and practices. Based on the paradoxical fact that the return policy (a powerful marketing instrument) is a strategic driver that generates sales and revenue whilst the return process (operations intensive) is more readily associated with costs, it is reasonable to expect e-retailers to face challenges in aligning these two in a consistent strategy pulling in the same direction. Based on the discussion above, we put forward the following proposition:

RP2: Firms establishing effective strategies to manage returns need to achieve a level of alignment between return policy and process.

In our research, we employed a confirmatory case study approach – that is to say, we used primarily case studies to test the theory under consideration rather than to develop one. Every confirmatory case study must rest on a priori theory-based hypotheses or frameworks that drive the research (Barratt et al., 2011; Voss et al., 2002). Unlike correlational hypotheses found in surveys, case study hypotheses are suited to positing the existence of a phenomenon, or the presence or absence of a phenomenon under certain conditions (Johnston et al., 1999). Our research aimed to assess a returns management strategy alignment framework in an online and omnichannel retail context. To shed light on this issue, we found case research to be particularly useful since returns management strategies are emerging as contemporary empirical phenomena that cannot be readily quantified. Furthermore, case research is appropriate because the phenomenon of interest cannot be studied outside its natural setting – that is, its rich context (McCutcheon & Meredith, 1993).

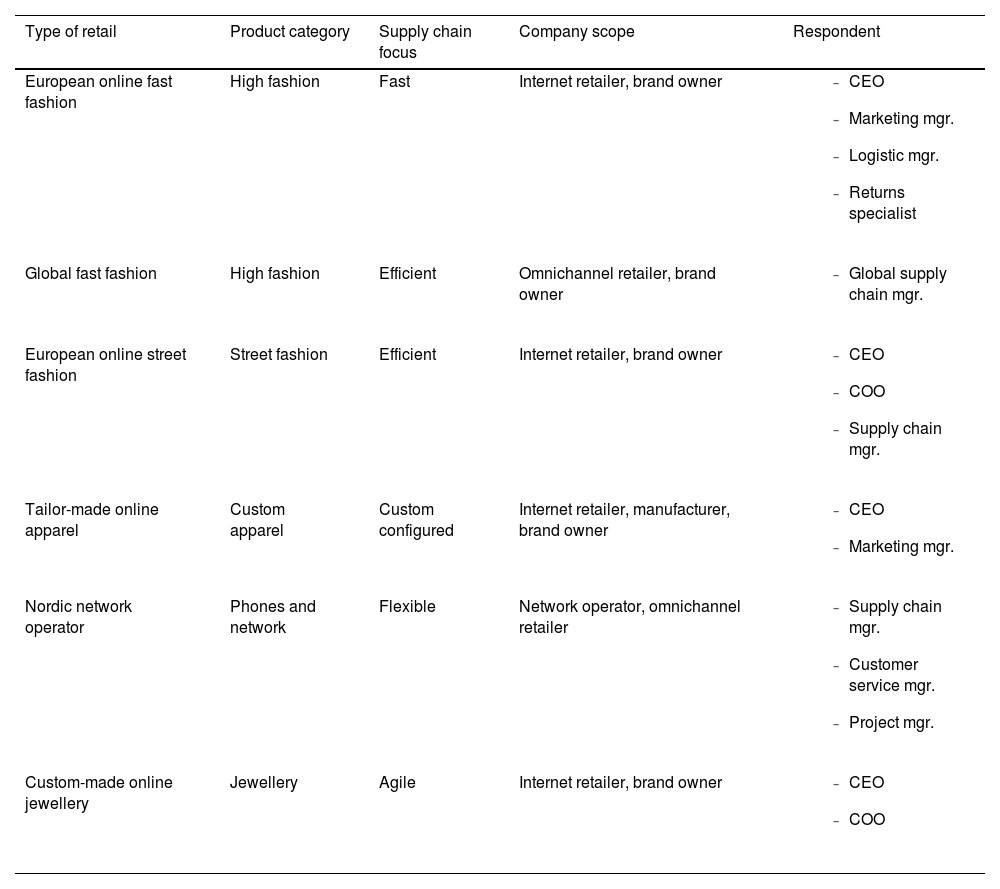

Case study design and selectionA multiple case study research design was adopted, comprising six retail companies. A combination of purposive and convenience sampling was used in selecting the cases. The retailers were chosen purposively based principally on their status as channel leader ensuring the integration of customer experience strategies in the supply chain. Moreover, the retailers contended that returns management is important, regarding it as a strategic source of value. The retailers were also selected as heterogeneous cases to provide contrasting situations – operational setups, return policy leniency, return rates, and SCO all served to enhance the external validity of the findings (Yin, 2014). Moreover, the cases were selected based on data access and availability. All the companies have head offices in Sweden. They agreed to share data and experience openly, and they were willing to participate in interview sessions on returns management strategies. Business volume of the case companies ranges from 150 million for a channel leader with turnover of 250 billion SÉK with a share of online revenue ranging from 15% to 100%. Three case companies operate an omnichannel business model and three case company a direct-to-consumer internet retailing business model.

The overall rationale for using the multiple case study design and selection was the potential of the cases included to provide revelatory evidence of the phenomenon under study (Yin, 2014).

Data collection and analysisThe primary data were collected through a series of interviews. This offered appropriate media for gaining insights into the challenges and experiences encountered in setting goals and strategies for the design of returns management programs. In addition, documentation and direct observations through field and site visits (warehouses, headquarters, websites, etc.) were used to complement the richness obtained from the interviews. Studying the return policy facing customers on each internet retailer's website and matching it against activities found in the warehouse processes from site visits revealed misalignments. Internal documentation for customer service instructions gave valuable input communication flow and areas of misalignment when managing returns. In total, 15 key management staff involved in product returns were interviewed. Respondents were selected through open dialogue with each retailer, resulting in a variation of respondents in each case, often depending on the size of the company. The interview guide contained three sections covering return policy, return process, and company goals and strategy, with open-ended questions in which respondents were asked to reflect critically on company practices and their experiences. This provided opportunities for respondents to describe their everyday interactions and challenges in managing product returns. The interviews, all face-to-face, lasted between 92 and 125 min. They were recorded, transcribed, and validated by the respondents. The transcribed material consisted of 53 pages that was open coded using NVivo 12. All transcribed material was uploaded to one place with easy access, enabling tracking of the progress of the coding with comments easily inserted. Nvivo12 is a multiple-user software allowing co-authors to annotate coding and offer comments. By identifying respondents’ answers and creating nodes, the software supports a systematic approach, with insight and replicability ensuring reliable results. The coded material in each node was categorized into a set of misalignments. The misalignments were reviewed and discussed amongst all investigators. The main investigator performed the initial coding, and discussions with the co-investigators took place continuously during the entire process through reflective feedback from each investigator. An overview of the characteristics of the companies and respondents is presented in Table 1.

Overview of case companies and respondents.

| Type of retail | Product category | Supply chain focus | Company scope | Respondent |

|---|---|---|---|---|

| European online fast fashion | High fashion | Fast | Internet retailer, brand owner |

|

| Global fast fashion | High fashion | Efficient | Omnichannel retailer, brand owner |

|

| European online street fashion | Street fashion | Efficient | Internet retailer, brand owner |

|

| Tailor-made online apparel | Custom apparel | Custom configured | Internet retailer, manufacturer, brand owner |

|

| Nordic network operator | Phones and network | Flexible | Network operator, omnichannel retailer |

|

| Custom-made online jewellery | Jewellery | Agile | Internet retailer, brand owner |

|

The analysis of the empirical data provided several insights into how the investigated retailers formulated their returns management strategies. Even though the retailers view returns management as a strategic source of value, our case evidence indicates that retailers have adopted a somewhat ad hoc approach to their returns management process rather than being guided by clear strategic thinking. As the global supply chain manager for the fast-fashion retailer explained: “We don't have a return strategy. We see returns as a necessary evil of doing business.” Moreover, the manager asserted: “The whole return process is just one big compromise.” The absence of a coherent and comprehensive strategy in managing product returns is evident in all case companies. The lack of clear strategic goals suggests that the retailers have not yet fully understood the strategic implications of the returns management process.

Another pattern found across all the retailers was the challenge of agreeing and making holistic trade-off decisions. It can be argued that an effective formulation of returns strategies requires the management team to consider all the components involved in combination and not in isolation. The supply chain manager at the Nordic network operator exemplified this point: “The sales manager decides the return policy as part of our customer offer; the supply chain just has to follow.” The outcome is that returns management, in the context of retailing, must seek to align a set of components, such as return process activities, return policy aspects, and overall business goals, into a coherent process.

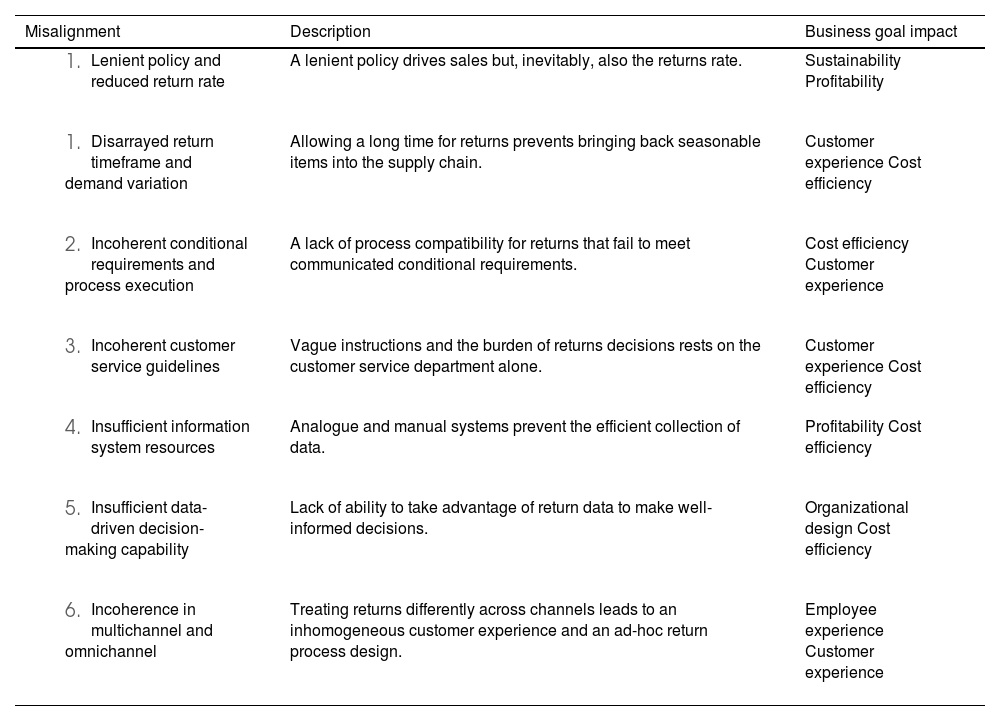

The research results suggest that there is a set of misalignments that affect the level of fit between the returns management components involved: return process, return policy, and which business goal is impacted by each misalignment. The structured discussions with senior managers provided insights into seven misalignments that inhibit the organisations from developing effective returns management strategies. Each misalignment is presented in Table 2 and is described in the sub-sections that follow with examples from the case companies. To assist supply chain managers in developing strategies for managing product returns, the key learning points are classified into the four structural elements of SCO in the discussion section.

Seven misalignments in returns management.

| Misalignment | Description | Business goal impact |

|---|---|---|

| A lenient policy drives sales but, inevitably, also the returns rate. | Sustainability Profitability |

| Allowing a long time for returns prevents bringing back seasonable items into the supply chain. | Customer experience Cost efficiency |

| A lack of process compatibility for returns that fail to meet communicated conditional requirements. | Cost efficiency Customer experience |

| Vague instructions and the burden of returns decisions rests on the customer service department alone. | Customer experience Cost efficiency |

| Analogue and manual systems prevent the efficient collection of data. | Profitability Cost efficiency |

| Lack of ability to take advantage of return data to make well-informed decisions. | Organizational design Cost efficiency |

| Treating returns differently across channels leads to an inhomogeneous customer experience and an ad-hoc return process design. | Employee experience Customer experience |

Each of the six case companies is struggling to harmonise a lenient return policy with its effect on the return rate and overall business goals. All organisations prioritised lenient return policies to boost sales and a hassle-free return process experience for the customers, such as pre-printed return documents accompanying every order, and free-of-charge returns if your order is above a certain amount. Policies presented in recent research are effective levers in influencing purchase intentions (Abdulla et al., 2022), shaping the magnitude of returns and exchanges and impacting the company's business goals. Thus, there is a need to balance return policy effects on sales with the return rate.

The misalignment between a lenient return policy and a reduced return rate has different characteristics from company to company in our case study. For instance, the supply chain manager of the global fashion retailer explains that their push model, which advises their customers to buy 7 to 8 items of various sizes and colours in every order and “try at home”, inevitably drives high return rates. Regardless, the supply chain manager concluded: “Often, we see that customers who do a lot of returning are good customers.” Paradoxically, the same case company strives to be environmentally sustainable, but it also recognizes the conflict between increased transportation and environmental sustainability. The customers notice this paradox and are critical. This is an apparent misalignment between the company's return policy and its business goal of being environmentally sustainable.

The CEO of the custom-made online jewellery company aims for zero returns. Its average selling price is very high and individualized products result in high return and redisposition costs. Nevertheless, the company applies a lenient return policy to maintain its service to customers. Consequently, there is a constant struggle to try to square its return policy with the overall business goal. At the other extreme, the supply chain manager for the Nordic mobile operator explains its (unusual) ambition of 100% returns to ensure full ownership of the total supply chain, from manufacturing through sales and consumer usage to disposal and reuse of parts and components. This is a circular ambition, albeit one that has not yet been fully deployed by the company. Indeed, having such a lenient return policy does harmonize with its overall ambition, yet the company is struggling to formulate a policy that matches its business intensions.

This misalignment is further confirmed by the CEO of the European online street fashion company. He points to a lack of harmony in that marketing and operations do not join forces to balance policy and company goals. Evidence from the interviews indicates that aligning leniency with its reduced return rate policy in pursuit of the company's overall business goal is vital. Whereas the competitive landscape often demands lenient return policies, its implication for business goals poses a trade-off situation for companies.

Disarrayed return timeframe and demand variationOffering a wide timeframe for returns, which allows customers to delay the process, does not sit well with products that have a limited sales window. Variation in demand in the case companies comes from, seasonal variation, sales campaigns, and new product launches, amongst others. Higher or lower demand from customers is derived from company activities and market specifics. This misalignment was particularly evident in three of the case companies. For these companies, an expansive timeframe for returns is seen as a competitive advantage and yet, no real effort was expended on analysing optimal time. None of the case companies adjusted the return time for products that needed fast re-entry into the supply chain, such as seasonal products. The global supply chain manager of the fast-fashion company stated: “We have applied 100 days return time by looking at what the competition does, but we need the products back faster.” He claimed that: “The most expensive for us is an unsold item at the regular price”, suggesting that managing returns quickly impacts overall profitability.

The COO of the European online street fashion company explained that they have come to acknowledge the inconsistency and, in order to overcome the mismatch, actions have been taken to achieve a speedier return, such as a faster refund if the products are returned before the stipulated time. Furthermore, the company has launched free returns if the returned item is exchanged for a replacement product, in the belief that this will drive down customer return time. Although this is applied to the full range of products, no differentiation is made for items with varying demands. The jewellery company has managed to strike a balance by offering fast processing of returns for a fee of up to 10% of the purchase price. Despite its relatively high cost, customers often used this service. This has led the company to believe that charging for return services is possible so long as it adds value for customers.

Incoherent conditional requirements and process executionAll case companies communicated specific requirements concerning the condition of the product before they will accept a return, such as an unbroken box and an intact price tag. Yet, they all accept returns that fail to meet these requirements. In other words, there is a discrepancy between what the organizations communicate and what they do. Demanding specific conditions for returned items exerts pressure on both sides of the process – the customer's endeavour to return and the company's execution of the return process. For the company, this can mean gatekeeping decisions, the inspection process, and the subsequent operational steps needed for the reverse flow. Thus, there is a surprising discrepancy between the return conditions that are communicated and those that are applied. This generates a lack of processing compatibility for the items that fail to meet those requirements.

According to the Nordic mobile operator, the product must be in its original box. However, the supply chain manager explained that the company had moved away from demanding unbroken parcels many years ago because customers objected. The company accepts returns even if boxes are torn and unusable, requiring extra work at the recovery centre. In a similar way, the supply chain manager at the global fast fashion retailer admitted that returns are accepted even though the conditions stipulated are not met: “Even if a return is six months old, we still accept it. It should be hassle-free for the customer.” The jewellery company's CEO stated: “All returns have to be in mint condition.” This resonates with the price tag of their products. Such high requirements force the company to operate, to a large extent, an individualized return process for each customer. This is time-consuming, but it isa trade-off for the retailer that has been thought through. Most respondents argue for information technology, which enables early gatekeeping, as a prerequisite for adjusting the process to fully match the actual condition of items being returned. Surprisingly, none of the respondents mentioned changing the conditions or applying existing ones.

Incoherent customer service guidelinesIn all case companies, the heart of returns handling is the customer service department. Its instructions are often broad and vague with a core message such as “solve the problem with returns”. The highly generalized instructions that exist often lead to idiosyncratic decisions that do not always correspond with what customers expect or need; nor do they necessarily accord with the return process intended. This situation undermines effective returns management.

The global fashion retailer admitted that all returns go through its customer service department, and it accepts returns even if they are six months old regardless of the reason given. This is considerably more lenient than what is communicated to customers when purchasing. The marketing manager of the European online fashion retailer stated that an unhappy customer has potentially a higher negative impact than the cost of resolving a return issue. Therefore, it delegates the return decision to customer service. Interestingly, none of the case companies measure the effect or cost of these instructions on the customer service staff. It makes no differentiation between an uncomplicated product exchange and a return due to customer dissatisfaction with quality or service. This makes a well-informed trade-off decision impossible.

The interviews show there is no interest in communicating the company's factual leniency because the contact between the customer service department and customers gives room for manoeuvre. To take a case in point, the CEO of the tailor-made internet retailer marketing individualized fashion apparel directed the customer service department to be more generous than the conditions stated in customer communications. This was done to use the occasion for negotiation and make disposal decisions when the returns were approved: “We don't want to have any physical returns. That should be solved by customer service.” Customer service is clearly a focal point in the return process, and business-relevant trade-off decisions are the product of customer service action, misguided or otherwise.

Insufficient information system resourcesAll case companies share the view that communication with customers over returns must be digitalized. Even though return data are often collected by mail or printed forms, the quality and makeup of the data do not result in helpful analytics. Effectively managing returns is limited by inadequate information system resources.

The European street fashion retailer has come the furthest of the case companies. It has a digital module in its sales system to collect return data. However, communication with customers is still maintained through e-mail and telephone. The apparent purpose of digitalizing the return flow is to communicate with the customer before the item is returned and to decide how, and in some cases, whether it should be returned. The global fashion retailers stated that the cost of handling returns sometimes exceeded the value of the product and, thus, it would be cheaper for the customer to dispose of the item instead of returning it. The lack of an information system to support early dialogue with customers prohibits that trade-off decision. The customer service manager from the Nordic network company claimed its connected products should be able to generate better knowledge from usage, thereby reducing return rates: “With all our connected products, we should be able to avoid returns by knowing the reasons for returns better.” The global fast fashion company described how it asked customers to fill in printed forms. However, the data is not used or analysed mainly because of time constraints in processing printed data material. The tailor-made internet retailer has a custom-fit return process. This means that the customer has mail contact with customer service who requests information about the return claim for a fully flexible solution. The marketing manager stated: “Nothing is more expensive than an unhappy customer”. This shows that striking a balance in the return process depends to a large extent on the accessibility of return data.

Insufficient data-driven decision-making capabilityAnother pattern found in all case companies concerns the analysis of return data and its use in decision-making processes. According to the respondents, the actual data collected by the company sales systems on returns is not analysed or used when managing returns. Not using available return data in the decision-making process impacts a company's ability to develop an appropriate return process and limits harmonization of the return process with the overall business goal.

Several respondents argued that the ability to measure and use total return costs from the profit-and-loss account would help them guide their efforts. The actual cost of returns is not measured separately in any of the case companies; it is an element in supply chain costs. This lack of transparency inhibits meaningful trade-off decisions. In addition, fulfilment excellence is precluded by not considering what is being returned. The supply chain manager at the global fashion retailer stated: “How can we plan our supply when 30%−40% of the goods are coming the other way?”, claiming that the inability to use the return data for sourcing and fulfilment decisions impacted SC costs and, consequently, overall profitability. On the other hand, even though the street fashion retailer is the only case company to gather return data digitally, it does not analyse the data. They freely admit that this is a lost opportunity, but they lack both the resources and the capabilities to do so. In addition, the tailor-made retailer identified the need for return data when developing and launching new products or categories but, as its data consists of e-mail correspondence with customers, it is far too complicated to analyse. The CEO acknowledged that return data would help to manage price points, margins, and the return process.

Multichannel and omnichannel incoherenceInternet retailers’ evolving business models across channels pose a challenge to effective returns management. The internet retailer who expands into physical stores struggles with harmonizing consumer returns across channels, as do the bricks and mortar retailers who begin to digitalize their businesses. To succeed, it is necessary to create a seamless experience across channels and communication tools (Mostaghel et al., 2022; Palmié et al., 2022; Grewal et al., 2017).

Three of the six case companies confirmed they apply the same return process in physical stores as online, and they have yet to organize returns of online purchases to physical stores. Case companies admit that it can be confusing for customers and staff to manage returns in a physical store setting that were initially designed for internet retailing The global fast fashion retailer claimed there are almost no returns from sales generated in its physical stores. This has resulted in a process mismatch when online sales, with their exponential growth and different returns procedure, are returned to the retailer's physical stores. The street fashion retailer accepts returns from orders made online to its physical stores, but it uses a manual process. The supply chain manager stated: “No return process is developed yet, so cashiers handle the returns manually.” The company is investigating new solutions, such as pick-up points for returns. They foresee this as a natural part of the omnichannel return process.

The Nordic mobile operator with half of its business in stores and half online has struggled to develop a coordinated approach for an online business that also retains physical stores. But, as the supply chain manager stated: “Call us. We will solve it!”. This opens up flexibility in returns handling both online and offline. Today, it only allows some items bought online to be returned in physical stores, which can then be dispatched to the return point in a designated warehouse. The three companies acknowledge shortcomings in being unable to manage returns in a coordinated manner across sales channels, with staff experiencing difficulty in handling online orders returned to physical outlets. This creates confusion in staff members who may feel compelled to invent a return process at a moment's notice. It makes for a disparate customer experience and higher supply chain costs.

DiscussionMisalignment in returns management is a multi-faceted phenomenon that occurs as technology advances and as customer attitudes, behaviours, and purchasing habits change as new practices emerge and myriad other causes dynamically change organizations’ operating environment. There is no silver bullet that can overcome the misalignments identified in this study of returns management. Put more simply, a misalignment typically stems from several systemic breakdowns resulting from poor coordination in whatever form. Establishing and sustaining alignment in managing returns requires focused action and ongoing attention from supply chain managers. Respondents are generally aware that applying a holistic approach when establishing returns management strategies is beneficial but, equally, they are unaware of what prevents them from making it a reality. This corroborates the results of Chen et al. (2019) who recognized the importance of returns management as an essential step towards establishing effective strategies. Rather than chasing silver bullets, supply chain managers need to acknowledge the return process as a key business activity – as they do with the forward flow (i.e., the source, make, and deliver process) – and adopt a holistic view of managing returns in order to develop beneficial strategies. Based on the results of this study, we suggest there are several learning points that can assist supply chain managers in developing effective strategies. The following sub-sections cover common managerial themes and practices that span the previously described misalignments. These learning points are categorized into the four strategic elements of SCO outlined by Min et al. (2007). They support organisations that view supply chain management strategically.

Organizational designReturns management needs to be a natural and integral part of the organizational design. SC organizations need to move away from focusing solely on return prevention and cost reduction. They should apply a more customer-centric approach, offering a differentiated service and actively working with functional integration, in which returns are managed and not just prevented.

Towards a product and customer-centric approachThere is a scholarly argument for the revival of a consumer-centric approach to supply-chain management, (Esper et al., 2020). Consumer returns are no longer only a product-centric but also a customer-centric puzzle, where customer service plays a central role in handling the returns and dealing with the returnee (Baldauf et al., 2021; Oghazi et al., 2021). The approach centring the return process on products must focus on the individual customer by measuring relevant data that covers the customer journey from purchasing to returning. This is a journey involving interaction in a variety of channels over time leading to an expected increase in customer lifetime value. While the aim of reducing returns to save costs has been dominant amongst internet retailers, they must also consider the customer experience concerning returns.

Combining service recovery and service offersAll returns are not complaints and, therefore, the old service recovery approach is not applicable to the vast number of consumer returns where the product is returned (and often re-sold) in exchange for a new size. Customer service needs to make decisions on separating returns on whether interaction with the returnee is needed or not. If a customer orders more than one size of a product, then it is easy to make a prognosis that a product will be returned. In this case, there is no reason to interact with the returnee on service recovery issues. All that is needed is a communication that a return has been received and approved, and refunding is scheduled.

However, a customer using the returns process to register a complaint for any reason should be treated differently. On this occasion, the company's reputation, the customer journey, and the lifetime value-creation process are all involved and require a more interventionist approach. In online retailing, this is luckily not the most common return reason, and so a more decentralized approach is appropriate, in which customer returns are brought to closure simply.

Functional integrationFor any given return reason, be it regret, exchange, or product recall, the physical handling of the goods returned must have a reverse flow with coordinated physical actions and often a monetary process before closure. This means a workload covering different functional areas within the organization and the SC. A customer-centric organisation will not benefit from taking the easy route where the logistics function solves all returns in the same way using a standard pipeline. Different return reasons need a differentiated approach to reverse logistics. Managers need to understand the boundaries and functional areas to correctly balance customer demands on service and products.

The lack of internal integration witnessed in many organizations often results in a poorly coordinated SC. Similarly, failing to incorporate returns in today's business goals results in internal inefficiency where poor control and increasing return costs are apparent. To assert control, managers need to develop measures that connect policies and practice, in order to achieve the overall business goal. Johnston and Mera (2002) found that excellent complaint management systems require both centralized and decentralized approaches. Complaints are similar to returns, or at least that part that refers to service recovery. A centralized system would separate out returns that relate to regrets from dissatisfied customers.

Information technologyMany firms see that there are inherent risks in doing the same thing tomorrow as they did yesterday. Generally, they seek change to bring competitiveness, improve profits, and enter new markets. Much of this change requires information technology to underpin this transformation. Whether it is digitization providing a better online experience, transforming business with AI, or implementing new technology, such as the Internet of things, 3D printing, and AR/V, an essential transformation is from a “silo-based” organization to a cross-functional process-driven supply chain that excels in managing complex flows of information and decision making. However, it is rarely used in the returns process.

Digitization of returns informationIntegrating all necessary functional areas and SC partners begins with an IT system that has been developed for the particular purpose of returns. As explained above, different return reasons require a differentiated approach to make the returns process effective. Managing expressly the exchange of goods initiated by the returnee is likely to be very different from a product recall, where the retailer controls and initiates the recall. Similar logic will fit any other given return reason, and this should not be handled by the customer service personnel individually. Using IT to connect back to the returnee allows not only for proper gatekeeping and synchronization of the return activities but also for using organisationally designed return decision engines to execute diverse disposal decisions. Furthermore, real-time information sharing within and across organizations facilitates returns avoidance because of a better understanding of returns reasons.

Organizational measurementsOnce returns have become a part of the overall business in online sales, organizations need measures that capture operational performance and fit with strategic intent. Integration is key for an aligned and effective process and, therefore, common goals and cross-functional measures are fitting.

Managerial key performance indicators (KPIs)As discussed above, measuring returns within an organization begins with a proper returns information system. However, the measurements must include costs, be service focused, and be able to portray the fit between returns policy and process, as well as the overall strategic intent. Adopting lenient return policies might fit certain products, customers, and markets depending on demand and buying/returning patterns. However, with proper measurements and a returns information system to support proper gatekeeping, managers can follow up on both efficiency and responsiveness. Furthermore, inconsistent goals prevent successful integration. Having divergent objectives foster a silo mentality where managers take decisions that run counter to other goals in the organization and that suboptimize the business. Therefore, companies need to measure returns and develop KPIs: for successful business development, profit and loss analysis is needed to understand what activities carry which financial implications.

Service offer and service recovery KPIsTo ensure efficiency measures that ensure that returns are handled in accordance with the type of service, service recovery, or service offering as explained in 5.1.2, both financial and non-financial objectives need to be considered when defining KPIs. Measures that focus on responsiveness to different types of returns as defined by the reported customer reason code need to be developed. For example, when customers express dissatisfaction, they may need interaction with customer service (decentralized) to achieve proper closure (Johnston & Mehra, 2002). To this end, the internet retailer will need internal integration where the returnee, the product, its demand pattern, and the financial and non-financial potential of value recovery are recognized before making business decisions.

For the service offering, new KPIs are needed, reflecting sound and relevant targets. For the service to provide value to customers, it should focus on customer value-added attributes, such as speedy service and fast cash refund. A short timeframe set as a KPI when replacing a size change return or a maximum timeframe for money refund to facilitate repurchase is desirable. Potential negative consequences need a follow-up strategy to monitor and mitigate abusive behaviours. A customer-centric approach is required when developing service KPIs.

Human resourcesReturns management has evolved into an essential part of the supply chain process of an internet retailer. Consequently, staff and managers need to acquire the necessary set of skills. There is no doubt that SC managers need a diverse group of skills to steer and manage internal and external integrations (Esper et al., 2010) and that supply chain professionals must acquire new knowledge enabling them to make a positive impact on the development of returns management (Chen et al., 2019). Furthermore, developing both measures and systems to support the SCs is mandatory because over 90% of all logistics activities take place outside direct supervision (Bowersox et al., 2000). The manager skills that are needed to mitigate misalignments in returns management are a relatively new phenomenon. They require not only logistics and SC skills but also learning capabilities and transformational leadership styles to facilitate and embrace new logistical wonders and SC ideas (Esper et al., 2010). Returns management is a cross-functional process in which professionals from, for example, operations and marketing need to work together and deploy common goals that support cross-functional coordination. Focusing staff and management attention on the benefits of a well-functioning return process should lead to more educated decisions. Customer service often handles the return process unsupervised but, as the central cog in returns management, it needs to be aware of the cause and effect of returns decisions.

Conclusion and future researchDespite increased scholarly attention, research focusing on the strategy in returns management is scarce. This study embarked on the task of shedding light on the formulation of returns management strategies. Based on a theoretical framework and a series of case studies with a diverse set of retailers, we confirm the need to achieve a level of alignment between returns management components and the overall business goal in order to establish effective strategies. Specifically, the research results provide insights into seven multi-faceted misalignments that inhibit organizations from developing adequate returns management strategies.

To overcome these misalignments and support supply chain managers in developing effective strategies, we suggest several learning points.

Research implicationsOur results extend the previous research addressing strategies on the returns management process (Rogers et al., 2002) by identifying and characterizing misalignments between returns management components. Our results complement and extend previous research on strategizing returns management (e.g., Dapiran & Kam, 2017; Hjort et al., 2019; Rölleke et al., 2018). Our conceptualization of the components of returns management and its interrelation adds to the literature and the role of alignment in returns management strategy formation. It confirms and extends the research and the relevance of alignment (Mollenkopf et al., 2010) when creating effective supply chain strategies. Moreover, we draw on the SCO literature (e.g., Esper et al., 2010) and extend the relatively limited research stream on SCO into the area of returns management. The notion of SCO and its relevance for strategy formation in returns management contribute to the SCO literature. We contribute by providing a broad and rich empirical study of strategy development in internet retailing, with several practical implications emerging from our case study findings.

Managerial implicationsThe results indicate that internet retailing does not have a healthy returns management strategy that is thought through. Rather, it is a patchwork derived from policies and processes designed over time. This is a material fact for managers to contemplate. An understanding of the components in returns management that need to be considered can assist companies in their quest to establish adequate returns management strategies. Our study supports the conception that policy and process are undoubtedly interlinked. Cross-functional cooperation is crucial when deciding the return policy. Equally, designing the return process is a vital element in developing an effective returns management strategy. The relationship of these components to each other in a returns management context and the identified misalignments can be used as a foundation to explore how to achieve a higher level of alignment. Finally, the misalignments that run counter to a general business goal can support managers in developing more coordinated strategies. A returns management strategy, or the lack thereof, can impact company performance and reputation, whether in numbers or customer promises.

Limitations and suggestions for further researchThere are several limitations to the research. The case companies were carefully selected based on their understanding of the importance of the return process, but the sample size was limited as were industry representatives. Although varied in geographical footprint, the case companies were based in northern Europe. This means the results do not represent a broader population encapsulating differences in operating environments, marketing constraints, organisational infrastructure, and culture. There are several routes that future research could consider. Extending the research to a more comprehensive set of retailers in different geographical settings can verify misalignments in returns management. With the identified set of misalignments presented, an interesting step would be to understand how internet retailers manage and overcome the misalignments to achieve a more effective returns management strategy. Finally, having introduced the notion of SCO into returns management, it would be valuable to explore differences in returns management depending on the SCO.